Research Article: 2019 Vol: 23 Issue: 3

Audit Quality Report: A Conceptual Review of Perceived Effects of Selected Factors

Hendrik Elisa Sutejo Samosir, Universitas HKBP Nommensen

Abstract

This study conceptually explores the influence of firm internal characteristics in presenting timely audited report which is one of the parameters for quantifying a quality audited report. The reviewed studies reveal that although longer audit tenure might reduce the auditor independence and influence negatively quality of audited reports. However, considering audit report timeliness, longer audit tenure significantly reduce audit report lag, therefore positively have significant contribution to the quality of audited report. With this, the author suggests empirical investigation into the argument of elongated audit tenure on quality audit report in terms of impaired quality and timeliness.

Keywords

Audit Quality, Audit Tenure, Audit Timeliness.

Introduction

In recent times, quality audit reports have been used in securing investors, shareholder and stakeholders’ interest and confidence. However, the extent to which this statement is true and effective has continued to raise some concerns for editors and scholars (Gray et al., 2011). The issue of quality audit report has been one of the major concerns of investors, shareholders and stakeholders as well as key considerations for auditors across the globe. Audit as a profession was argued to have suffered a lot because it is believed to be the pancreas that cure all ills. For example, executing high quality audit task implies reduced audit risk and minimal chances of issuing biased audit option (Francis, 2004). Meanwhile, reality has it that audit process has limitation of what is included in the auditing exercise. As such, the audit users’ expectations differ from the reality of what auditors can accomplished (Du & Roohani, 2007; Gold et al., 2012). Nevertheless, audit practitioners and scholars had devoted attention on improving public confidence via close calls in devising means of enhancing the quality of audit report produced (Hoag et al., 2017; International Auditing and Assurance Standards Board, 2014).

One of the major pitfalls of achieving audit quality report is that audit scholars find it difficult to explain what a quality audit report should entail. Rather, audit quality reports are proxied based on the authors’ interest (Abdullah, 2006; Afify, 2008; Al-Tahat, 2015; Ika & Ghazali, 2012). Hence, an audit report which is assumed to be of high quality might just be another normal report in another context. Since there is no agreed scholarly definition of what audit quality entails, it is therefore a difficult task for scholars to conclude the optimal level of audit quality (Francis, 2004).

Despite this, insights into prior studies reveals that even though there is no agreed definition of what audit quality entails, nor what firm characteristics should be audited, in earlier studies present that some similar characteristics does exist among the proxies of audit quality investigations. These are not limited to audit committee, auditor partners’ rotation, audit tenure and audit report timing. These factors, according to earlier scholars are highly important in achieving audit quality report (Mansi et al., 2004; Sultana et al., 2015).

Theoretically, as observed by Francis (2004) and Hoag et al. (2017), measures to improve audit quality reports is yielding significant positive results. Hence, the question is if these theoretical findings are real, why did high profile companies defunct? The reality in this sense reveals that the accounting profession is witnessing credibility issues (Krishnan, 2005). Insights into earlier studies on the quality of audit reports several studies reveals the contributions of different factors not limited to demography, audit report time lag, firm internal characteristics and auditor tenure contributes to the inconclusive arguments reported by earlier studies.

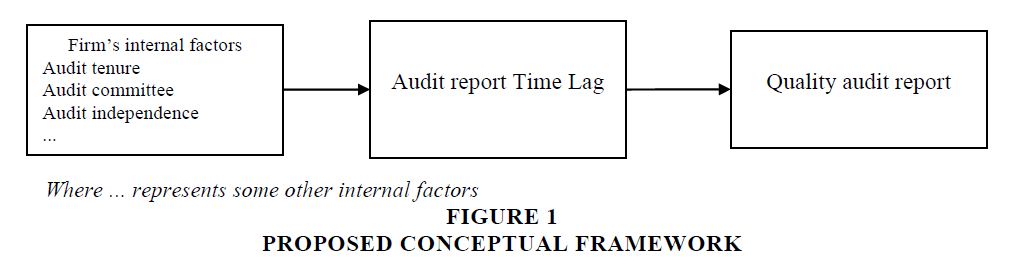

Focusing on Indonesia, this study aims to examine conceptually, the relationship between audit report time lag or audit timeliness and quality audit report. Not only this, the objective of this study is to identify the contribution of firm internal factors such as the audit committee, audit tenure and audit independence on audit timeliness that technically influence the perceived audit report quality. With this, some of the primary causes of audit quality issues and mix evidences and perhaps are unearthed, suggest a framework that has the potential to mitigate these recurring issues in audit quality reports.

Literature Review

One of the factors that were found by earlier scholars to influence the quality of the audit report is audit timeliness. Audit timeliness or audit time lag is the time frame needed for the auditors to complete and present the findings from the audit process (Ika & Ghazali, 2012). This construct has been investigated extensively and was believed to be a major factor that influence audit quality report as it translates to corporate transparency and value (Abdullah, 2006; Almilia, 2015; Ika & Ghazali, 2012). For example, the study of Ika & Ghazali (2012) concludes that audit timeliness contributes to audit quality report achievement however through audit committee effectiveness. The authors remarked that the effectiveness of audit committee can drastically cut the report lead time. Contrary to the timeliness significance in predicting the quality of audited report, the study by Rahmawati (2018) argues that in Indonesia, the audit timeliness report has no significant effect on its quality.

On the account of Almilia (2015), audit reporting via the internet has improved the quality of the audit reports in Indonesia based on its timeliness. Despite this claim, evidences from literatures shows that audit reporting in Indonesia is at its infancy stage and needs improvement. Attempt to reduce audit report time lag via the engagement of information communication technology apparatus births the study of Budisusetyo & Almilia (2011), from the intention of these authors, it could be seen that they wish to explore innovative ways of prompt financial reporting. However, they found that technology usage among the firms surveyed contribute less innovativeness in financial reporting techniques and the time required.

Meanwhile, the study of Nuryanto & Afiah (2013) tends to examine why the level of innovativeness and timeliness of audit reporting among government parastatals that is, local government officials in Indonesia. It was discovered by these authors that technology competence among audit committees contribute significantly in ensuring timeliness in audit reporting and presentation.

In a similar study, Afify (2008) conducted a regression analysis to examine the significance and as well measure the extent of audit report lag in Egypt. It was revealed that from the 85 companies examined, audit report lag ranges from 19 days to 115 days. The author concludes factors such as the audit committee, board of independence and CEO duality significantly influence audit report lag or timeliness in these firms. Concerning the study of Hussin et al. (2018) and Lee et al. (2009), suggests that late timing of reporting financial audit can be leveraged through elongated audit tenure.

Therefore, the issue of auditors’ tenure comes into play. Similar to the discussion above, there are ongoing inconclusive arguments among scholars. Some believed that elongated audit tenure enhances audit quality report via acclimatization and deeper knowledge of firms’ practices (Dao & Pham, 2014; Hussin et al., 2018; Lee et al., 2009; Rusmin, & Evans, 2017; Walker & Hay, 2013). The study from Malik et al. (2017) argues that elongated audit tenure has better implication for the firm than reducing the quality of audited reports. In their study, they found that during the early years of auditors, there is a considerable increase of discretionary accruals because these auditors are less equipped with client specific knowledge. However, as times goes on, these discretionary magnitude decreases, hence, the quality of audited reports is enhanced. While, Carcello & Nagy (2004) mandatory rotation of audit firm so as not to have elongated audit tenure could have an adverse effect on the firm’s audited report.

Findings from scholars such as Walker and Hay (2013) and Wan Hussin et al. (2018) supports the notion that elongated audit tenure significantly and positively contributes to reduced audit report lag. The authors conclude that longer audit tenure mitigates the adverse effect of impaired quality of presenting the audit report on time.

On a contrary, González-Díaz et al. (2015) argues that audited reports begin to lose its quality precisely after six years of elongated audit tenure. This is consistent with the conclusion of the study of Azizkhani et al. (2018) contending that frequent audit rotation enhances quality of audited reports.

Meanwhile, in Australia, Sulatana et al. (2015) concluded that companies who tends to present their audit report in due time, that is, shorter Audit Report Lag (ADL) are those firms with experienced audit committee members with prior financial expertise. In view of this, legislation or policy mandating financial expertise of audit committees as well as independence of these committees was recommended by these authors. While, Armanda and Adi (2018) in their study argue that firm’s size predict the timelines in presenting the audited report. Further, findings from these authors shows that leverage and audit opinion does not influence the audited report timeliness. On a different note, the findings from the study of Al-Tahat (2015) contends the argument of Armanda and Adi (2018) Al-Tahat in the Jordanian context argues no significant influence of firm size on audit report timeliness.

On the other hand, scholars such as Abedalqader Al-Thuneibat et al. (2011); Knechel & Vanstraelen (2007) believed that elongated audit tenure creates unprofessional familiarity between the auditors and the managers thus, causing under reporting or non-issuance of ongoing concern. Other primary sources of arguments of quality audit report is the contribution of audit firms on the audit reports itself. There have been ongoing debates between the “Big-Four” and “non-big four,” with several scholars (Brown et al., 2016; Kumar & Lim, 2015) arguing in favor of the notion that the quality of audit reports produced by Big Four is high.

On a contrary, Kumar & Lim, 2015 and Semba & Kato (2019) argues that the services provided by non-big four firm differs not from that of the big four. Examining audit quality indicators from junior auditors, the result from the study from Brown et al. (2016) presents that factors such as demography ‘gender and auditors’ experience level’, and firm size summing up to be audit characteristics significantly influence certain audit quality indicators. In, summary, the study of Brown et al. (2016) exposes some fantastic source of audit discrepancies. Similar study by Hoag et al. (2017) investigates the effects of audit characteristics on financial audit quality before and after implementation of Sarbanes-Oxley (SOX) Act 2002. The findings indicate a no difference in audit firm size in post SOX implementation between Big four and non-big four audit firms indicating that there is an optimal compliance comparing to pre-SOX, where there is a significant difference between the Big N and no Big N audit firms. A recent study by Agyei-Mensah (2019) conclude that audit committee plays a significant role among Big Four in ensuring quality audit report.

Similarly, the findings from the studies by Houmes et al. (2013) and Zgarni et al. (2016) also notes the significant influence of audit committee in reducing earning accruals which enhance quality of reported financial audits over time. As such, this study concludes a no significant difference between audit quality report presented by Big four and not big four auditing firms. But concur with the notion that factors such as audit firm internal factors have significant influence on audit report time lag/audit report timeliness which automatically influence audit report users’ perception on the quality of audit report produced. In the wake of this, the below framework which is to be empirically verified is proposed(Figure 1).

Summary Of Findings

As observed from the pieces of reviewed literatures, one of the issues audit report users have is the time lag in presenting audit findings. The faster it is, the higher the quality they perceived. While, the longer it takes, the lower they perceived the quality of the reports.

More so, evidence from earlier studies present that elongated audit tenure is beneficial in reducing the timeliness of presenting audited reports. However, the elongated audit tenure can be as well not a good idea for the firm in the sense that the auditor has the tendencies of compromising his auditing task therefore leveraging the intended quality audit report. However, this problem can be solved by the solution provided by Abbott et al.(2000) suggesting a close monitoring of auditors. In spite of the significant findings in this study, the author acknowledges some lapses during the course of conceptual investigations. These include human bias in the selected literatures used in this study.

Meanwhile, no difference in quality of audit report between big four auditing firms and non-big four auditing firms.

References

- Abedalqader Al-Thuneibat, A., Tawfiq Ibrahim Al Issa, R., & Ata Baker, R.A. (2011). Do audit tenure and firm size contribute to audit quality? Empirical evidence from Jordan.Managerial Auditing Journal,26(4), 317-334.

- Knechel, W.R., & Vanstraelen, A. (2007). The relationship between auditor tenure and audit quality implied by going concern opinions.AUDITING: A journal of Practice & Theory,26(1), 113-131.

- Abbott, L.J., Park, Y., & Parker, S. (2000). The effects of audit committee activity and independence on corporate fraud.Managerial Finance,26(11), 55-68.

- Abdullah, S.N. (2006). Board composition, audit committee and timeliness of corporate financial reports in Malaysia.Corporate Ownership and Control,4(2), 33-45.

- Afify, H.A.E. (2009). Determinants of audit report lag: Does implementing corporate governance have any impact? Empirical evidence from Egypt.Journal of Applied Accounting Research,10(1), 56-86.

- Agyei-Mensah, B.K. (2019). The effect of audit committee effectiveness and audit quality on corporate voluntary disclosure quality.African Journal of Economic and Management Studies,10(1), 17-31.

- Almilia, L.S. (2015). Comparing internet financial reporting practices: Indonesia, Malaysia, Singapore, Japan and Australia.International Journal of Business Information Systems,20(4), 477-495.

- Al-tahat, S.S.Y. (2015). Timeliness of audited financial reports of Jordanian listed companies.International Journal of Management,3(2), 39-47.

- Armanda, M.D., & Adi, S.W. (2018).Determinasi Faktor-Faktor Waktu Penyampaian Pelaporan Keuangan (Studi Empiris Pada Perusahaan LQ45 Yang Terdaftar Di Bursa Efek Indonesia Periode 2014-2016)(Doctoral dissertation, Universitas Muhammadiyah Surakarta).

- Azizkhani, M., Daghani, R., & Shailer, G. (2018). Audit firm tenure and audit quality in a constrained market.The International Journal of Accounting,53(3), 167-182.

- Brown, V.L., Gissel, J.L., & Neely, D.G. (2016). Audit quality indicators: Perceptions of junior-level auditors.Managerial Auditing Journal,31(8/9), 949-980.

- Budisusetyo, S., & Almilia, L.S. (2011). Internet financial reporting on the web in Indonesian: Not just technical problem.International Journal of Business Information Systems,8(4), 380-395.

- Carcello, J.V., & Nagy, A.L. (2004). Audit firm tenure and fraudulent financial reporting.Auditing: A Journal of Practice & Theory,23(2), 55-69.

- Dao, M., & Pham, T. (2014). Audit tenure, auditor specialization and audit report lag.Managerial Auditing Journal, 29(6), 490-512.

- Du, H., & Roohani, S. (2007). Meeting challenges and expectations of continuous auditing in the context of independent audits of financial statements.International Journal of Auditing,11(2), 133-146.

- Francis, J.R. (2004). What do we know about audit quality?The British Accounting Review,36(4), 345-368.

- Gold, A., Gronewold, U., & Pott, C. (2012). The ISA 700 auditor's report and the audit expectation gap do explanations matter?International Journal of Auditing,16(3), 286-307.

- González-Díaz, B., García-Fernández, R., & López-Díaz, A. (2015). Auditor tenure and audit quality in Spanish state-owned foundations.Revista de Contabilidad,18(2), 115-126.

- Gray, G.L., Turner, J.L., Coram, P.J., & Mock, T.J. (2011). Perceptions and misperceptions regarding the unqualified auditor's report by financial statement preparers, users, and auditors. Accounting Horizons, 25(4), 659-684.

- Hoag, M., Myring, M., & Schroeder, J. (2017). Has Sarbanes-Oxley standardized audit quality?American Journal of Business,32(1), 2-23.

- Houmes, R., Foley, M., & Cebula, R. J. (2013). Audit quality and overvalued equity.Accounting Research Journal,26(1), 56-74.

- Ika, S.R., & Ghazali, M.N.A. (2012). Audit committee effectiveness and timeliness of reporting: Indonesian evidence.Managerial Auditing Journal,27(4), 403-424.

- Krishnan, G.V. (2005). The association between Big 6 auditor industry expertise and the asymmetric timeliness of earnings.Journal of Accounting, Auditing & Finance,20(3), 209-228.

- Kumar, K., & Lim, L. (2015). Was Andersen’s audit quality lower than its peers? A comparative analysis of audit quality.Managerial Auditing Journal,30(8/9), 911-962.

- Lee, H.Y., Mande, V., & Son, M. (2009). Do lengthy auditor tenure and the provision of non-audit services by the external auditor reduce audit report lags?International Journal of Auditing,13(2), 87-104.

- Malik, Z.F., Arshed, N., Hassan, M.S., Rasheed, B., Kazmi, S.T.F.H., & Gulzar, M. (2017). The Impact of Auditor Tenure on Audit Quality: Evidence from Pakistan.Paradigms,11(2), 202-209.

- Nuryanto, M., & Afiah, N.N. (2013). The impact of apparatus competence, information technology utilization and internal control on financial statement quality (study on local government of Jakarta province-Indonesia).World Review of Business Research,3(4), 157-171.

- Rahmawati, E. (2018). Information content and determinants of timeliness financial reporting: evidence from an emerging market.Academy of Accounting and Financial Studies Journal,22(4).

- Rusmin, R., & Evans, J. (2017). Audit quality and audit report lag: case of Indonesian listed companies.Asian Review of Accounting,25(2), 191-210.

- Semba, H.D., & Kato, R. (2019). Does Big N matter for audit quality? Evidence from Japan.Asian Review of Accounting,27(1), 2-28.

- Sultana, N., Singh, H., & Van der Zahn, J.L.M. (2015). Audit committee characteristics and audit report lag.International Journal of Auditing,19(2), 72-87.

- Walker, A., & Hay, D. (2013). Non-audit services and knowledge spillovers: an investigation of the audit report lag.Meditari Accountancy Research,21(1), 32-51.

- Wan Hussin, W.N., Bamahros, H.M., & Shukeri, S.N. (2018). Lead engagement partner workload, partner-client tenure and audit reporting lag: Evidence from Malaysia.Managerial Auditing Journal,33(3), 246-266.

- Wan Hussin, W. N., Bamahros, H. M., & Shukeri, S. N. (2018). Lead engagement partner workload, partner-client

- Zgarni, I., Hlioui, K., & Zehri, F. (2016). Effective audit committee, audit quality and earnings management: Evidence from Tunisia.Journal of Accounting in Emerging Economies, 6(2), 138-155.