Research Article: 2018 Vol: 22 Issue: 5

Auditor Tenure and Auditor Industry Specialization as a Signal to Detect Fraudulent Financial Reporting

Mukhlasin Mukhlasin, Atma Jaya Catholic University of Indonesia

Abstract

As a result of investor distrust of management, competent independent parties are needed to detect management's opportunistic attitudes and reduce information asymmetry. Audit ownership reflects independence which in the context of government is a signal whether there is fraudulent financial reporting or not. Furthermore, audit industry specialization shows audit competencies in certain industries, so auditors of industrial specialization have more ability to detect material misstatements as a result of fraudulent financial reporting. This study aims to examine the potentiality of auditor tenure and industry specialization as a signal to detect fraudulent financial reporting. The research was conducted in companies listed on the Indonesia Stock Exchange for the period 2012 to 2015. Logistic regression with paired sampling techniques was used to prove the research objectives. The sample consisted of 46 fraudulents and 46 non-fraudulent. The test results failed to prove that the longer tenure audit can reduce independence so that it becomes fatigue for the company to commit financial reporting fraud. Meanwhile, the specialization industry audit has been successfully proven in this study. Industry specialization auditors are able to detect fraudulent financial reporting.

Keywords

Auditor Tenure, Auditor Industry Specialization, Fraudulent Financial Reporting, Signaling Theory.

Introduction

Signaling theory arises because of information asymmetry. This theory shows how asymmetry can be reduced by giving information signals to other parties (Morris, 1987). Asymmetry of information and personal interests that arise in the context of agency relations is the reason for principals not to trust agents, this distrust can be reduced by good external governance through quality audits that can align the interests of agents and principals (Jensen and Meckling, 1976). Audits quality can increase investor confidence and can strengthen investor confidence in financial information. The role of quality external audit in ensuring the quality of financial reports is a serious concern due to the emergence of several published financial reporting fraud cases (e.g., Enron, Tyco International, and WorldCom). Romanus et al. (2008) state that trust in the capital market depends on the level of confidence investors place on financial statements when making investment decisions. The ability of audits to detect misstatements and fraud in financial reporting is highly questionable due to recent corporate scandals (Badawi, 2008; Enofe, 2010). This is due to differences in audit quality that results in differences in auditor credibility and reliability of the company's earnings report. Okolie (2014) stated that the company's accounting scandal recently posed a major challenge to the truth, credibility, utility or relevance of the value of the audit results.

A wide understanding of audit quality is recognized as the most important monitoring mechanism that can minimize agency costs and reduce conflicts of interest between management and owners. The audit quality of external auditors creates distrust of audit results because of threats to objectivity and independence. This concern arises because the quality of monitoring depends on its ability to reduce the likelihood of fraudulent company financial statements (Zgarni et al., 2016) and auditor independence to determine whether or not to report material misstatements (Jorjani and Gerayeli, 2018) In the perspective of information asymmetry, good governance is needed so that the auditor remains independent by limiting the length of the client-auditor relationship (Audit Tenure). Overly long tenure audits tend to reduce auditor professional skepticism, thereby reducing the ability to detect fraudulent financial reporting. This shows that the duration of the audit tenure can be a signal to detect fraudulent financial reporting. Meanwhile, auditors of industrial specialization are auditors who have experience, skills, and competencies both general and specific from the industry so that they can detect the possibility of fraudulent financial reporting. This shows that the use of industry specialization auditors in companies is a signal that there is no fraudulent financial reporting

The general aim of this study is to test the audit quality of signals to detect fraudulent financial reporting. This general objective is outlined in the following two specific objectives: first, audit tenure as a signal to detect fraudulent financial reporting. Audit tenure is important to learn because of two opposing perspectives. Practitioners argue that the possibility of accounting fraud occurs in the outset years of client-auditor relations, whereas in the longer tenure audit period, the possibility of fraudulent financial reporting will be lower. Meanwhile, based on the perspective of corporate governance the threat to the auditor's objectivity arises because the length of audit tenure will affect auditor independence so that the auditor is unable to detect fraudulent financial reporting or ignore fraudulent financial reporting (Carcello and Nagy, 2004). Regulators and professional accounting bodies are of the opinion that a long audit period is likely to reduce auditor independence, and therefore produce a lower quality audit (Monroe & Hossain, 2013). In addition, audit tenure is interesting to study because of the gap between the regulations of the Indonesian finance ministry and the results of previous studies. Decree of the Minister of Finance of the Republic of Indonesia No: 17/PMK.01/2008 mandates a three-year rotation for partner audits and a sixyear rotation for companies which means limiting the audit period. While the results of research by Carcello and Nagy (2004) prove that financial fraud occurs in short tenure audits while fraud does not occur in a long tenure audit. Research results that are contrary to the regulation of the Indonesian finance minister were also obtained for audit report lag (Dao & Pham, 2014), earnings management (Jennifer et al., 2010), and accounting conservatism (Rickett et al., 2016)

Second, to examine the influence of auditor industry specialization in detecting fraudulent financial reporting. The phenomenon of the failure of large public accountants in detecting material misstatements (such as the cases of Enron, WorldCom, HIH Insurance Company Group, PT. Indofarma Tbk, PT Bank Global International Tbk, and PT Indosat Tbk) raises criticism of the quality audit (Sarwoko & Agoes, 2014). Industry audit specialists are interesting to study because of the failure of large public accounting firms as a representation of audit quality, so that other required approaches can represent audit quality. In addition, previous studies that place auditor industry specialization as a signal to detect fraudulent financial reporting have not been studied. In addition, research on specialist industry audits also produces inconsistent results. Carcello and Nagy (2004) prove that auditor industry specialization has a negative effect on financial reporting fraud. This result is supported by Hegazy et al. (2015); Ittonen et al. (2015); Havasi and Darabi (2016); Jaggiet et al. (2012). Different results were obtained by Zuo & Guan, (2014) for earnings management research, and Karami et al. (2017) for lag reporting audits.

Literatur Review And Hypothesis

Signaling theory arises because of information asymmetry, there is a separation between agent and principal. This theory explains how asymmetry can be reduced by giving signals or information to other parties. Signals can be given either by means of financial statements or financial reports through corporate policy. One policy signal is the selection of auditors, because the auditor influences the quality of financial statements. From the perspective of agency theory, increased demand for high-quality audits is increased, it will be tempered by increased agency costs (Watts and Zimmerman, 1986). Zuo and Guan (2014) say that audits are one way to reduce information asymmetry and associated agency costs. Since higher quality audits are more likely to detect and avoid accounting errors and misstatements than lower quality audits, higher quality audits should reduce information asymmetry more than lower quality audits. Audit quality is importance in protecting and strengthening its market share, companies with unique demands will employ credible auditors to ensure management integrity to all interested parties and to reduce agency costs. Auditors as independent parties are expected to reduce information asymmetry so that everything related to the auditor can be a signal to investors. Information asymmetry arises because the separation of agents by principals requires good corporate governance, where long audit engagements lead to a decrease in audit quality (Carcello and Nagy, 2004). Without realizing it, a long tenure auditor can encourage audit team members to be complacent, skepticism and independence. Regulators have concerns about the company's audit period because auditors are skeptical of client accounting can be decreased and high intimacy between auditees and auditors can reduce independence (Chen et al., 2008). Karami et al. (2017) states that as the auditor's tenure is extended, auditor independence has experienced a fall that can, in the long run, cause auditors to lose motivation and see their goals diluted. Long auditor tenure is a red flag which shows less skepticism and the emergence of compromise on auditor independence, so accounting fraud is more likely to occur.

Previous research has discussed the effects of tenurial corporate audits on earnings management, earnings quality, and accounting fraud aim to achieve personal incentives. Carey & Simnett (2006) show that for companies in Australia, the auditing period is longer associated with a lower tendency to issue going concern opinions and a higher tendency to simply beat the revenue target. Rickett et al. (2016) prove that long-term auditors have a negative effect on audit quality in countries with poor accounting quality. Furthermore, Vanstraelen (2000) found that unqualified audit opinions are more likely to occur when the auditor-client relationship is too long, thereby reducing the tendency of the auditor to issue a modified audit opinion. Meyers et al. (2003) which measured accruals with the Jones model in companies in the United States between 1988 and 2000 found that earnings management tended to decrease with longer company audit periods as their results showed a decrease in income and fewer accruals in income, while for the firm’s longer periods audit-proof is not proven to reduce earnings quality. Statistical data analysis Al-Thuneibat et al. (2011) show that corporate audits engagement affect audit quality negatively. Audit quality deteriorates when expanded corporate audits tenure increases the amounts of discretionary accruals. Meanwhile, Johnson et al. (2002) finding that a period of 9 years or longer does not have a negative effect on the quality of financial statements. Mande and Son (2013) found that auditor-client changes were more likely after the company announced reappointment, especially for severe restatements, and they also found evidence of positive market reactions to auditor changes.Based on the description above can be prepared hypothesis as follows:

Hypothesis 1: The length of audit tenure has a positive influence on fraudulent financial reporting.

Audit quality is important to ensure management integrity for all interested parties so as to reduce agency costs. High quality audits if the auditor has special expertise and competencies related to the audited industry, so that it can detect opportunistic behavior of management to cheat or misstatement of financial statements (Havasi and Darabi, 2016) Auditors of Industry Specialization can have an effective role in corporate governance and can improve the quality of financial statements. Krishnan (2003) states that auditor specialists are more likely to verify the credibility of financial reporting. Auditor specialists, compared to non-specialists, can guarantee higher level audits. Karami, et al. (2017) stated that auditor industry expertise includes the development of constructive ideas to help clients create added value and provide new perspectives/solutions to several problems that clients may face in their industry. For auditors who are known as industry experts, they must recognize and understand certain issues from related industries, identify key organizations operating in the industry, and know how certain industrial issues can affect various sectors throughout the industry (Kend, 2008). Audit companies tend to recruit more specialized audit staff and provide advanced training in information technology and audit technology to specialist auditors rather than non-specialist (Dopuch and Simunic, 1982), so industry-specific auditors have superior performance than their peers (Solomon et al., 1999; Owhoso et al., 2002; Gul et al., 2009; Hegazy et al., 2015), industry experts are better able to detect fraudulent financial reporting because they have better expertise, both on the audit team. level and at the audit company level.

Previous research conducted by Hegazy et al. (2015) proved that industry specialist auditors performed significantly better than non-specialists in detecting fraud and misstatements. This shows that industry specialist auditors will be more competent than nonspecialists in detecting and reporting audited accounting practices. Carcello and Nagy (2010) found a significant negative relationship between audit specialist and financial reporting deficiencies. Rusmin (2010) which proves that the number of earnings managements in companies that use specialist audit services is significantly lower than companies that use the services of non-specialist auditors. Meanwhile, Karami et al. (2017) failed to prove that auditors have a shorter lag if the company is audited by specialist industry auditors than nonspecialists. Based on the above description, the following hypotheses can be prepared:

Hypothesis 2: The auditor industry specialization has a positive influence on fraudulent financial reporting.

Research Methodology

Sample Description and Data Collection

Referring to the research objectives, this research can be dated as field research to examine causality relationships. The analytical tool used to prove the research objective is the logistic regression. This regression is chosen because the dependent variable is financial reporting fraud is a variable with a nominal measurement scale. The periods considered in this study are 2012-2015. The statistical population of this study includes all non-financial companies listed on the Indonesia Stock Exchange (ISX). The sample consists of 46 companies that fraudulent financial reporting in the period 2012-2015 and 46 companies that do not commit fraudulent financial reporting. 46 samples of non-fraudulent companies were selected randomly and proportionally based on the observation years of all non-financial companies listed on the Indonesia Stock Exchange. The research data is financial reporting data of listed companies in Indonesia Stock Exchange downloaded through www.idx.co.id and Indonesian Capital Market Directory. In addition, research data is also obtained from the financial services authority (OJK), particularly data on fraudulent financial reporting.

Measurement

Fraudulent Financial Reporting (FFR) is measured on a nominal scale as a dummy variable (Kedia and Philippon, 2009; Rezaee, 2005; Chakrabarty, 2015). FFR data is obtained from the list of issuers listed on the Indonesian Stock Exchanges obtained from the authority of financial services (OJK). value 1 given to company-related year is listed in case list (accounting) and value 0 for company-year not listed in the list of OJK issuer case. Auditor Tenure (AT) is measured by the number of years a public accounting firm consecutively audits a client's financial statements (Jorjani and Gerayli, 2018). Auditor Industry Specialization (AIS) are measured by dummy variables by assigning a score of 1 for a specialist industry audit and 0 for non-specialist industry audits. The determination of specialists and non-specialists shall be carried out by the following stages: the first classification of industrial samples having at least 30 companies in a study in accordance with the industrial classification according to the Indonesia Stock Exchange. The second step, identifying auditors who conduct audits on companies in an industry conducted under the name of an audit partner. The last step that needs to be done is to do the analysis. The public accounting firm is designated as a specialist auditor in a particular industry field when conducting an audit of 15% of the total company contained within an industry. Independent Commissioners (IC) measured by the proportion of independent board of commissioners is performed using the indicator of the number of members of the board of commissioners who come from outside the company compared to the total number of members of the board of commissioners owned by the company. Discretionary Accruals (DA) is measured using the Modified Jones Model which is expressed by Dechow et al. (1995). Return on Assets (ROA) is derived from net profit after tax divided by total assets. The leverage (LEV) is measured by total debt divided by total assets.

Result And Discussion

The AT variables in Table 1 show the minimum values of 1 and maximum 11. The maximum value of 11 indicates that a company is audited by a certain public accounting firm exceeding the maximum rotation limit of 5 years. The mean of 4,870 and the median 4 describes that most firms will replace their auditors before 5 years. Auditor Industry Specialization (AIS) denotes mode 0 means that most companies are audited by public accounting firms that are not auditor industry specialization. A minimum value of 0 in the ICOM control variable indicates that there are still companies that do not comply with government policies on corporate governance. however, based on a mean of 0.4200 and a median of 4.00 proves that most companies adhere to good corporate governance.

| Table 1 DESCRIPTIVE STATISTIC |

|||||

| Variable | Minimum | Maximum | Mean | Median | Std. Deviation |

| AT | 1.0 | 11.0 | 4.870 | 4.000 | 3.3355 |

| ICOM | 0.0000 | 1.0000 | 0.4200 | 0.4000 | 0.1564 |

| DA | -1.2736 | 0.7398 | -0.0888 | -0.0336 | 0.2859 |

| TA | 6,816 | 236,029,000 | 10,208,686 | 1,276,078 | 29,817,473 |

| ROA | -1.72905 | 0.57433 | 0.03938 | 0.04240 | 0.21095 |

| LEV | 0.03269 | 8.30772 | 0.69538 | 0.46499 | 1.32159 |

DA in Table 1 shows the minimum value of -1.2736, the mean of -0.0888 and the median of -0.0336 which means that the accrual policy taken by most companies is to lower the profit. The minimum and maximum value of TA is 6,816 and 236,029,000 with deviation standard 29,817,473 and mean of 10,208,686 illustrate that the sample in this study represents the population of non-financial companies listed in Indonesia stock exchange. Mean and median for ROA of 0.03938 and 0.04240 and minimum value of -1.72905 indicates that most companies ability to generate low profits. The LEV projected with the Debt to Equity ratio has a minimum value of 0.03269 with the mean and median of 0.69538 and 0.46499 which means that the company still has the ability to repay the debt.

In relation to the correlation between independent variables, independent variables with control variables, and among the control variables themselves, significant correlations were reported in the correlation matrix (Table 2). The highest correlation is between ROA and LEV, with a correlation coefficient of 0.479. While the correlation between AT and AIS is 0.418. The highest correlation value and the correlation between the independent variables are carried by the critical limit of 0.80 indicating that there is no multicollinearity (Cooper and Schindler, 2003).

| Table 2 PEARSON CORRELATION |

|||||||

| AT | AIS | ICOM | DA | TA | ROA | LEV | |

| AT | 0.418** | 0.232* | 0.160 | 0.152 | 0.135 | -0.160 | |

| AIS | 0.418** | 0.156 | 0.104 | 0.219* | 0.168 | -0.146 | |

| ICOM | 0.232* | 0.156 | -0.016 | -0.026 | -0.047 | 0.085 | |

| DA | 0.160 | 0.104 | -0.016 | 0.040 | -0.014 | 0.101 | |

| TA | 0.152 | 0.219* | -0.026 | 0.040 | 0.074 | -0.058 | |

| ROA | 0.135 | 0.168 | -0.047 | -0.014 | 0.074 | -0.479** | |

| LEV | -0.160 | -0.146 | 0.085 | 0.101 | -0.058 | -0.479** | |

**: Correlation is significant at the 0.01 level (2-tailed). *: Correlation is significant at the 0.05 level (2-tailed).

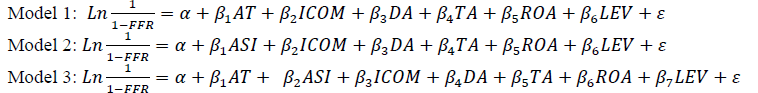

The results of hypothesis testing using logistic regression in Table 3 show that the wald value for tenure audit variables in Model 1 AT is significant at the 5% and 10% levels. In addition, the regression coefficients for audit mastery variables have no confirmation with the expected sign, which is negative. This result is shown by various models, hypothesis 1 in this study was not accepted. This proves that audited companies with longer audit tenure periods are less likely to be opportunistic than fraudulent financial reporting than audited companies with shorter audit periods. This study fails to prove that limiting the audit of audit engagement period is part of the company's external governance through auditor objectivity and independence. Concerns about the length of a company's audit engagement that results in auditor skepticism about client accounting can reduce auditor independence so that the auditor loses motivation and audit objectives to be diluted (Chen et al., 2008 and Karami et al., 2017) are not proven. The rejection of this hypothesis can be explained by two approaches. First, the low balling hypothesis states that auditors charge lower costs in the early years of the engagement to attract clients and because they need to keep clients long enough to recover their initial losses this can threaten the independence and quality of income in the early years of the engagement. Second, the learning effect hypothesis argues that the auditor gets more specific client knowledge through time and, therefore, audit quality increases over time, the length of involvement in the audit will improve audit quality due to increased knowledge and skills (El Guindy & Basuony, 2018) The auditor will better understand the client's specific risk profile, rely less on managerial estimates, and become more independent of management, which in turn results in higher audit quality (Johnson et al., 2002; Ghosh and Moon, 2005) so that fraud financial reporting can easily detected by the auditor. This shows that the duration of the audit engagement improves audit quality so that it can be a good signal for investors that the company does not commit fraudulent financial reporting.

| Table 3 LOGISTIC REGRESSION WITH FRAUDULENT FINANCIAL REPORTING AS DEPENDENT VARIABLE |

||||||||||||

| Independent Variables | Model 1 | Model 2 | Model 3 | |||||||||

| B | Wald | Sig. | B | Wald | Sig. | B | Wald | Sig. | ||||

| AT | -0.234 | 7.992 | 0.005 | -0.168 | 3.615 | 0.057 | ||||||

| AIS | -1.981 | 13.282 | 0.000 | -1.734 | 9.337 | 0.002 | ||||||

| Control Variable | ||||||||||||

| ICOM | -4.339 | 4.507 | 0.034 | -5.281 | 5.527 | 0.019 | -4.491 | 3.795 | 0.051 | |||

| DA | 0.097 | 0.011 | 0.915 | 0.058 | 0.004 | 0.951 | 0.283 | 0.086 | 0.769 | |||

| TA | 0.000 | 1.589 | 0.207 | 0.000 | 0.947 | 0.330 | 0.000 | 0.732 | 0.392 | |||

| ROA | -3.582 | 1.606 | 0.205 | -3.353 | 1.135 | 0.287 | -2.060 | 0.505 | 0.477 | |||

| LEV | -1.114 | 2.577 | 0.108 | -1.082 | 2.074 | 0.150 | -0.847 | 1.641 | 0.200 | |||

| Constant | 3.898 | 13.161 | 0.000 | 3.951 | 10.894 | 0.001 | 4.164 | 12.948 | 0.000 | |||

| Chisquare | Sig. | Chisquare | Sig. | Chisquare | Sig. | |||||||

| Hosmer and Lemeshow Test | 12.173 | 0.144 | 7.567 | 0.477 | 9.128 | 0.332 | ||||||

| Omnibus Tests of Model Coefficients | 30.717 | 0.000 | 36.855 | 0.000 | 40.521 | 0.000 | ||||||

| Nagelkerke R Square | 0.378 | 0.440 | 0.475 | |||||||||

The results of this study differ from the research by Al-Thuneibat et al. (2011) which examined the Amman Stock Exchange for many years (2002-2006) showed that the length of corporate audit-client involvement proved to affect the quality of audit of public companies in Jordan. Long client-auditor relationships that create trust learned by clients that endanger the auditor's independence and objectivity. Trust relationships can produce biased behaviors when the auditor is bound to personal and non-professional loyalty with the client, so that he will lose the motive for conducting an audit process with professional care and in accordance with the latest and best practices in the industry (Al-Thuneibat et al., 2011). The results in line with Guindy and Basuony (2018) which shows that a longer working period than an audit company does not depend on independence but in reality improves audit quality. Dao and Pham (2014) document that the audit firm's short tenure is related to a longer audit report delay which means that the auditor needs more time to understand the client and industry during the first few years of the audit engagement. Furthermore, the results of this study are also in line with Hohensfel (2016) which proves that earnings quality is considered the highest when the auditor's tenure is 8-9 years. Geiger and Raghunandan (2002) found greater failure of audit reporting in the early years of client-audit relationships than when audit firms had served these clients for a longer period of time. Fairchild (2008) argues that the longer the auditor's tenure, the more auditors detect fraud in the client's financial statements and also improve the quality of financial reporting.

Auditor industry auditor specialization in Table 2 has a significance value less than 0.01 with Wald 13.282 and 9.337. Regression coefficients for all negative models. This result proves that hypothesis 2 is accepted, which means that the auditor has a lower likelihood of financial reporting than the company audited by non-auditor industry specialists. Acceptance of hypothesis 3 can state that the use of industrial specialization auditors in a company can be a signal that the company is not doing fraudulent financial reporting. Industry specialization auditors have a better understanding of industry characteristics, better understand accounting standards and audit standards and regulations related to other industries, understand the risks and problems in the audited industry (Romanus et al., 2008), so that they have the ability to detect fraud. Industry specialists are able to verify and guarantee financial reports because they understand related industry issues, organizations that affect industry, and understand the impact of certain industry issues on various sectors throughout the industry (Kend, 2008; Krishnan 2003; Karami et al., 2017) Experience, expertise and specific skills are the main factors of the auditor's ability to detect fraud and misstatement of financial statements. On the other hand, companies with good financial report quality will tend to choose qualified specific auditors who have the expertise to maintain their reputation, so fraudulent financial reporting is detected from auditors chosen by the company (Gul et al., 2009; Hegazy et al., 2015).

Negative results on regression coefficients indicate that companies audited by public accounting firms with industry specialties tend to be able to detect fraudulent financial reporting. This result consistence with the research of Carcello and Nagy (2004) which proves that auditor industry specialization has a negative effect on financial reporting fraud. Hegazy et al. (2015) states in the conclusion that industry specialist auditors perform significantly better than non-specialists in detecting fraud and misstatements. In addition, industry specialist auditors will be more competent to report questionable accounting practices. In the signal theory perspective, Balsam et al. (2003) that specialist auditor clients have a higher ERC than non-specialist clients. Similar results with this study were also obtained by Almutairi et al. (2009); Jaggi et el. (2012); Robin and Zang (2015) which make industry auditors specialization as a positive signal. Meanwhile, several previous studies have failed to prove the influence of industry auditor specialization. Havasi and Darabi (2016) tested companies listed on the Tehran Stock Exchange failed to prove the influence of auditor expertise in the industry on the quality of corporate financial reporting. This insignificant result was also obtained by Mascarenhas et al. (2010). Similar results were also obtained by Zuo and Guan (2014) indicating that the correlation was negative but not significant. This means that industry-specific auditors can improve audit quality and help reduce abnormal accruals. A possible explanation is that the Chinese audit market is more dispersed, and industry specialization is still in its early stages.

Conclussion

The role of the auditor in reducing the information asymmetry through audit quality signals the financial reporting policy. Quality audits serve as a basis for increasing trust and strengthening confidence in generating financial information. The auditor's ability to detect fraudulent financial reporting depends on the competence and independence of the auditor. This study can not prove that in the context of corporate governance, a long tenure audit will reduce the independence and professional skepticism of auditors in detecting fraudulent financial reporting. However, this study proves that the use of services auditor industry specialization can be a signal that the company does not commit fraudulent financial reporting.

The limitation of the study is not able to explain the length of time the audit service is provided by the ideal public accounting firm in order to maintain independence and objectivity. In addition, the audit is only studied from the length of the public accounting firm to audit a company regardless of the length of the public accountant (partner) in auditing an entity. This study contributes to the development of signaling theory, that the selection of auditors can be a sign of fraudulent financial reporting by managers. Substitution public accountant firm that is relatively short can be a sign of the occurrence of fraudulent financial reporting, as well as auditors non-audit industry. The results of this study indicate that the regulator should make a policy without limiting the period of audit service delivery by the public accounting firm and there should be a policy that regulates the specialization of public accountants and/or public accounting firms. Researchers can then develop audit tenure measurements that combine audit periods by public accounting firms and public accountants. In addition, further research can also prove that audit tenure and Auditor industry specialization can be a good signal for investors.

References

- Abbott, L.J., & Parker, S. (2000). Auditor Selection and Audit Committee Characteristics. Auditing: A Journal of Practice & Theory, 19(2), 47-66.

- Almutairi, A.R., Dunn, K., & Skantz, T. (2009). Auditor tenure, auditor specialization, and information asymmetry. Managerial Auditing Journal, 24(7), 600-623.

- Al-Thuneibat, A.A., Al Issa, R.T., & Ata Baker, R.A. (2011). Do audit tenure and firm size contribute to audit quality? Empirical evidence from Jordan. Managerial Auditing Journal, 26(4), 317-334.

- Azizkhani, M., Gary S.M., & Greg S. (2013). Audit partner tenure and cost of equity capital. Auditing: A Journal of Practice & Theory, 32(1), 183-202.

- Badawi, I. M. (2008). Motives and consequences of fraudulent financial reporting. Paper presented at the 17th annual convention of the global awareness society international, May, (2008), San Fracisco, USA.

- Balsam, S., Krishnan, J., & Yang, J.S. (2003). Auditor industry specialization and earnings quality. Auditing: A Journal of Practice & Theory, 22(2), 71-97.

- Carcello, J.V., & Nagy, A.L. (2004). Audit firm tenure and fraudulent financial reporting. Auditing: A Journal of Practice & Theory, 23(2), 55-59.

- Carcello, J.V., & Nagy, A.L. (2004b). Client size, auditor specialization, and fraudulent financial reporting. Managerial Auditing Journal, 19(5), 651-668.

- Carey, P., & Simnett, R. (2006). Audit partner tenure and audit quality. The Accounting Review, 81(3), 653-676.

- Chakrabarty, S. (2015). The influence of unrelated and related diversification on fraudulent reporting. Journal of Business Ethics, 131(4), 815-832.

- Chen, C., Lin, C., & Lin, Y. (2008). Audit partner tenure, auditor tenure, and discretionary accruals: Does long auditor tenure impair earnings quality? Contemporary Accounting Research, 25, 415-445.

- Cooper, D.R., & Schindler, P.S. (2003). Business Research Methods (Eighth Edition). Boston: 15 McGraw-Hill Irwin

- Craswell, A.T., Francis, J.R., & Taylor. S.L. (1995). Auditor brand name reputations and industry specializations. Journal of Accounting and Economics, 20(3), 297-322.

- Dao, M., & Pham, T. (2014). Audit tenure, auditor specialization and audit report lag. Managerial Auditing Journal, 29(6).

- Dao, M., Mishra, S., & Raghunandan, K. (2008). Auditor tenure and shareholder ratification of the auditor. Accounting Horizons, 22(3), 297-314.

- Darabi, R., & Roya, H. (2016). The effect of auditor’s industry specialization on the quality of financial reporting of the listed companies in tehran stock exchange. Asian Social Science, 12(8), 92-103.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193-225.

- Dopuch, N., & Simunic, D. (1982). Competition in auditing: An Assessment. Fourth Symposium on Auditing Research.

- El Guindy, M.N., & Basuony, M.A. (2018). Audit firm tenure and earning management: The impact of changing accounting standars in UK firm. The Journal of Developing Areas, 52(4), 167-181.

- Enofe, A. (2010). Reaping the fruits of evils: How scandals help reshape the accounting profession. International Journal of Business, Accounting and Finance, 4(2), 53-69.

- Fairchild, R. (2008). Auditor tenure, managerial fraud and report qualification: A behavioural gametheoretic approach. International Journal of Behavioural Accounting and Finance, 1(1), 23-37.

- Geiger, M.A., & Raghunandan, K. (2002). Auditor tenure and audit reporting failure Auditing: A Journal of Practice and Theory, 21(1), 67-78.

- Ghosh, A., & Moon, D. (2005). Auditor tenure and perceptions of audit quality. The Accounting Review, 80(2), 585-612.

- Gul, F.A., Fung, S.Y.K., & Jaggi, B. (2009). Earnings quality: Some evidence on the role of auditor tenure and auditors’ industry expertise. Journal of Accounting and Economics, 47(3), 265-287.

- Havasi, R., & Darabi, R. (2016). The effect of auditor’s industry specialization on the quality of financial reporting of the listed companies in tehran stock exchange. Asian Social Science, 12(8), 92-103.

- Hegazy, M., Al Sabagh, A., & Hamdy, R. (2015). The effect of audit firm specialization on earnings management and quality of audit work. Journal of Accounting and Finance, 15(4), 143-165.

- Ho, J.L.C., Liu, C.S., & Schaefer, T. (2010). Audit tenure and earnings surprise management. Review of Accounting and Finance, 9(2), 116-138.

- Ittonen, K., Johnstone, K., & Myllymäki, E. (2015). Audit partner public-client specialization and client abnormal accruals. European Accounting Review, 24(1), 607-633.

- Jaggi, B., Gul, F.A., & Lau, T.S. (2012). Auditor industry specialization, political economy and earnings quality: Some cross-country evidence. Journal of International Financial Management & Accounting, 23(1), 23-61.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Johnson, E., Khurana, I.K., & Reynolds, J.K. (2002). Audit?firm tenure and the quality of financial reports. Contemporary Accounting Research, 19(4), 637-660.

- Jorjani, M., & Gerayeli, M.S. (2018). Auditor tenure and stock price volatility: The moderating role of auditor industry specialization. Australasian Accounting, Business and Finance Journal, 12(1), 65-76.

- Karami, G., Karimiyan, T., & Salati, S. (2017). Auditor tenure, auditor industry expertise, and audit report lag: Evidences of Iran. Iranian Journal of Management Studies, 10(3), 641-666.

- Kend, M. (2008). Client industry audit expertise: Towards a better understanding. Pacific Accounting Review, 20(1), 49-62

- Krishnan, G.V. (2003). Audit quality and the pricing of discretionary accruals. Auditing: A Journal of Practice & Theory, 22(1), 109-126.

- Mande, V., & Son, M. (2013). Do financial restatements lead to auditor changes?. Auditing: A Journal of Practice & Theory, 32(2), 119-145.

- Marshall A. G., &Raghunandan, K. (2002). Auditor tenure and audit reporting failures. Auditing: A Journal of Practice & Theory, 21(1) 67-78.

- Mascarenhas, D., Cahan S.F., & Naiker V. (2010). The effect of audit specialists on the informativeness of discretionary accruals. Journal of Accounting, Auditing and Finance, 25(1), 53-84.

- Meyers, J., Meyers, L., & Omer, T. (2003). Exploring the term of the auditor-client relationship and the quality of earnings: A case for mandatory auditor rotation? The Accounting Review, 78(3), 779-799.

- Monroe, G., & Hossain, S. (2013). Does audit quality improve after the implementation of mandatory audit partner rotation? Journal of Accounting and Management Information Systems, 12(2), 264-280.

- Okolie, A.O. (2014). Auditor tenure, auditor independence and accrual-based earnings management of quoted companies in Nigeria. European Journal of Accounting, Auditing and Finance Research, 2(2), 63-90.

- Owhoso, V.E., Messier, W.F., & Lynch, J. (2002). Error detection by industry-specialized teams during the sequential audit review. Journal of Accounting, 40(3), 883-900.

- Rahman, R.A., Sulaiman, S., Fadel, E.S., & Kazemian., S. (2016). Earnings management and fraudulent financial reporting: The Malaysian story. Journal of Modern Accounting and Auditing, 12(2), 91-101.

- Rickett, L.K., Maggina, A., & Alam, P. (2016). Auditor tenure and accounting conservatism: Evidence from Greece. Managerial Auditing Journal, 538-565.

- Robin, A. J., & Zhang, H. (2015). Do industry-specialist auditors influence stock price crash risk? Auditing: A Journal of Practice & Theory, 34(3), 47-79.

- Romanus, Robin N., Maher, John J., & Fleming, Damon M. (2008). Auditor industry specialization, auditor changes, and accounting restatements. Accounting Horizons, 22(4), 389-413.

- Rusmin, R. (2010). Auditor quality and earnings management: Singaporean evidence. Managerial Auditing Journal, 25(7), 618-638.

- Sarwoko, I., & Agoes, S. (2014). An empirical analysis of auditor’s industry specialization, auditor’s independence and audit procedures on audit quality: Evidence from Indonesia. Procedia-Social and Behavioral Sciences, 164, 271-281.

- Solomon, I., Shields, M., & Whittington, O. (1999). What do industry-specialist auditors know? Journal of Accounting Research, 37, 191-208.

- Vanstraelen, A. (2000). Impact of renewable long-term audit mandates on audit quality. European Accounting Review, 9(3), 419-442.

- Zgarni, I.I, Hlioui, K., & Zehri, F. (2016). Effective audit committee, audit quality and earnings management: Evidence from Tunisia. Journal of Accounting in Emerging Economies, 6(2), 138-155.

- Zuo, L., & Guan, X. (2014). The Association of Audit Firm Size and Industry Specialization on Earnings Management: Evidence in China. The Macrotheme Review A Multidisciplinary Journal of Global Macro Trends, 3(1), 1-21.