Research Article: 2021 Vol: 25 Issue: 6

Bank Capital and Credit Risk Relationship in Islamic Banks: Comparative Analysis between Mena Region and Non-Mena Region

Suganthi Ramasamy, Multimedia University

Jothee Sinnakannu, Monash University Malaysia

Sockalingam Ramasamy, Monash University Malaysia

Citation Information: Ramasamy, S., Sinnakannu, J., & Ramasamy, S. (2021). Bank Capital and Credit Risk Relationship in Islamic Banks: Comparative Analysis between Mena Region and Non-Mena Region. Academy of Accounting and Financial Studies Journal, 25(6), 1-13.

Abstract

Using ten years’ financial statements data, this study empirically determines the relationships between bank capital and credit risk in a selected sample of MENA region and non-MENA region Islamic banks. Evidence shows a negative impact of bank capital on the credit risk in MENA region Islamic banks supporting the moral hazard theory. Findings also indicates that non-MENA region Islamic banks with higher credit risk hold smaller capital. Moreover, highly profitable Islamic banks in the MENA region take less credit risk. This study also found that bank size also negatively affects credit risk of both MENA and non-MENA region Islamic banks. This implies that as the size of the MENA and non-MENA region Islamic banks increases, the credit risk decreases.

Keywords

Credit risk, Bank capital, MENA.

Introduction

Institutions that provide Islamic banking and financial services have proliferated to almost all countries in the world now. Islamic banking or the Shariah - compliant banking has become a viable alternative to conventional banking, providing a wide range of financial intermediary services. Though it was originally initiated to meet the requirements of Muslims, Islamic banking has now gained universal acceptance and is recognized as one of the fastest growing areas in Islamic finance employing Islamic religious principles into capitalism. Since 1963, when the first Islamic financial institution was established in Egypt, Islamic banking has grown rapidly and significantly over the past four decades. While the Shariah - compliant banking assets represents a small portion of the global banking assets, these Islamic financial institutions are reported to be growing at an average annual growth rate of over 20% per annum and set to exceed US$3.4 trillion by 2018 (John, 2014). According to the Islamic Financial Services Board (IFSB) in its 2014 report; the total Islamic finance assets grew to an estimated USD1.8 trillion by the end of 2013. Islamic banking remains the dominant sector within the Islamic financial services industry (IFSI) with approximately 80% of the total Islamic financial assets. The industry is estimated to have charted a compound annual growth rate (CAGR) of 17.04% between 2009 and 2013. This momentum of growth in Islamic banks is expected to continue at a higher pace in coming years.

In terms of capitalisation, the top ten Islamic banks worldwide command a market capitalisation of only 4.1% of the market capitalisation of the top ten conventional banks at the end of 2010. The IFSB in 2011 reported that Islamic banks in general, remained strongly resilient during the 2007/08 global financial crisis (GFC). Islamic banks managed to record profits while conventional banks recorded losses during the crisis and at the height of the GFC in 2008, the net profit of Islamic banks totaled US$4.74 billion in contrast to a total loss of US$4.2 billion incurred by the conventional banks (Grewal, 2011). Pursuant to this dynamics in the banking industry, the total assets of the top ten Islamic banks as a percentage of the top ten conventional banks increased from 0.8% in 2008 to 1.0% in 2010.

The essential feature that differentiates Islamic banking model from its conventional counterpart is the practice of distributive justice in financial intermediation, which is achieved through the profit and loss sharing arrangement with its depositors and borrowers. Islamic banking is governed by Shariah - compliant mechanism, which is an alternative to conventional interest based financial intermediation. Unlike that practiced in the conventional banking system, Islamic banks are prohibited from offering and charging fixed predetermined interest rate (riba) on deposits, loans and other financial products. Shariah scholars relate interest based conventional banking system as an imbalanced sharing of wealth in society which is considered exploitative. The notion of including any fixed interest rate which is agreed prior to the actual performance of the underlying asset completely disconnects the benefits of the outcome, which is prohibited in Islamic finance. Alternatively, the distribution of returns between depositors and Islamic financial intermediaries is based on a Profit and Loss Sharing (PLS) principle depicting an equator system of risk-return distribution between counterparties. Besides considering interest (riba) as impermissible, Islamic banks are also prohibited from investing in activities featuring extreme uncertainties and risks (gharar), activities that resembles gambling (maisir) and allocating wealth in activities that is religiously impermissible (haram) such as trading in alcohol, tobacco and other demoralizing instruments.

Islamic banking, governed by Shariah rules and regulations presents specific challenges in the allocation and distribution of funds, therefore their capital and balance sheet structure is different from those of the conventional banks. Essentially, the Islamic bank’s capital structure is configured based on the shareholders equity and Investment Account Holder’s (IAH) funds. Specifically, Islamic banks operational system can be differentiated from their conventional peers in the way the former allocate funds based on interest free basis and distribute profits and losses. Islamic bank’s depositors holding Profit Sharing Investments Accounts (PSIA) are subjected to profit and loss sharing of the actual returns. Investment account holder’s funds are invested transparently (with depositor’s consent) in projects that have inherent risks without any possible guarantees on their deposits and returns.

Understanding the basic differences in the financial intermediation system is the key to differentiate the risk exposures between Islamic banks and conventional banks. Islamic banking system that operates on non-interest basis, PLS arrangements and trade financing with price mark-up techniques, has been generally perceived to be less risky (Akkizidis & Khandelwal, 2008; El-Hawary, Grais & Iqbal, 2007; Fiennes, 2007; Greuning & Iqbal, 2007; Khan & Bhatti, 2008; Sundararjan & Erico, 2002). However, Islamic banks are also subjected to the list of risks faced by conventional banks. These risks could have a magnified effect in Islamic banks as the financial instruments used are new (Fiennes, 2007). Besides that, the capital and balance sheet structure of Islamic banking exposes them to certain unique risks that are not found in conventional banking (El-Hawary et al., 2007; Fiennes, 2007; Khan & Ahmed, 2001; Sundararajan, 2007; Sundararajan & Errico, 2002). Islamic banking that manages PSIA funds for the Investment Account Holders are faced with unique risks such as fiduciary risk and displaced commercial risk (AAOIFI, 1999). Fiduciary risk means breaching of investment contract or mismanagement of funds by the bank (Anjum, 2014). According to IFSB, (2005), displaced commercial risk is the risk arising from assets managed on behalf of Investment Account Holders which is effectively transferred to the Islamic Financial Institution’s own capital because the Institution forgoes part or all of its Mudarib’s share on such fund, when it considers this necessary as a result of commercial pressure in order to increase the return that would otherwise be payable to the Investment Account Holder.

Bank Capital And Credit Risk Relationship

Banking institutions are highly regulated organizations as their core business is to borrow and lend public’s money. They must be supervised by regulatory authorities to maintain ongoing ability to meet obligations on a daily basis, instill public confidence and meet regulatory requirements. Bank’s capital is the key factor that indicates the level of credit risk that a bank can take on. Bank capital is a sustainable source of stable funding and a buffer to absorb expected and unexpected losses due to loan defaults. Every loan loss in a banking institution will be a loss in bank capital. The ratio between total bank capital and the risk weighted assets gives the capital adequacy ratio (CAR). CAR is an important indicator used by banking regulators to assess the soundness of bank operations. CAR plays a vital role in helping both conventional and Islamic banks to manage the level of credit risk in proportionate to the capital requirement. The central feature of the Basel Accord is the computation and meeting the minimum standard of CAR. Basel Accord II stipulates that banks with international presence are required to hold capital equal to eight per cent of the risk-weighted assets. The denominator in the CAR computation is the total risk-weighted assets.

The Islamic Financial Services Board (IFSB) had also published a similar Capital Adequacy Standard for IIFS (institutions, other than insurance institutions, offering only Islamic finance services) based on the Basel II guidelines. According to IFSB, the minimum capital adequacy requirements for IIFS shall be a CAR of not lower than 8% for total capital (IFBS, 2005).

However, the framework developed for IIFS does not require regulatory capital for risk-weighted assets that are funded by profit – sharing investment accounts. The CAR framework for Islamic banks addresses the different nature of risks faced by Islamic banks and duly assigns adequate risk weights to different Islamic financing assets.

Banks regularly adjust their balance sheet in order to comply with the CAR requirement. Generally, during the GFC, just the core capital of banks was insufficient to absorb the losses created by significant impairment in the value of loan and security portfolios. This prompted banks to increase their capital level and reduce credit risk exposure. In efforts to enhance the resilience of banking sector in general and to avoid crisis like GFC in the future, the Basel committee drafted a new regulatory framework called Basel III which requires a more stringent capital in financial institutions (Basel Committee, 2010). Normally banks maintain capital ratios above the requirement and buffered with time-varying capital (ECB, 2007). Coupling this with the regulatory capital, banks form an internal target capital ratio. During capital crunch situations, banks reconcile their balance sheet gaps by increasing their internal target capital level. This can be achieved through an increase in core capital, adjustment in security portfolio and a reduction in lending to lessen their risk exposure. In extreme economic conditions, adding capital to absorb losses will be costly and any attempt to adjust capital upwards will eventually increase the cost of financing thus adversely impacting the general economy (Kashyap et al., 2010; Miles et al., 2010, Otker-Robe & Pazarbasioglu, 2010). However, studies by Ahmad (2005), Kahane (1977) and Koehn & Santomero, (1980) found that increase in capital ratio may actually result in more bank risk – taking in the Malaysian and the U.S. conventional banks respectively.

The existing literature in conventional banking has documented two hypotheses surrounding the relationship between bank capital and credit risk. These hypotheses are (i) the regulatory hypothesis; and (ii) the moral hazard hypothesis. The regulatory hypothesis and moral hazard hypothesis were introduced by Sinkey Jr. & Carter, (1997). The regulatory hypothesis suggests that regulators constantly encourage banks to adjust their capital proportionately with the amount of credit risk taken (Altunbas et al., 2007). The moral hazard hypothesis, however notes a negative relationship between bank capital and credit risk. Moral hazard hypothesis predicts that banks with low capitalization will take on higher risks as they have less to lose in case of default (Horiuchi & Shimizu, 2001; Williams, 2004). A large part of the existing literature (both conventional and Islamic banks) which confines to theoretical perspective in discussing the relationship between bank’s capital and risk positions, have often yield conflicting results. A positive relation between bank capital and credit risk would reflect the unintended consequences of a higher capital requirement, the risk preference of bank managers and shareholders (Shrieves & Dahl, 1992). While a negative relation between bank capital and credit risk can be explained by the moral hazard behavior of the managers of thinly capitalized banks.

Ahmad & Ahmad, (2004) examined and compared the factors affecting credit risk in both Islamic and conventional banks in Malaysia. These authors found that bank capital is significantly negatively related to credit risk in conventional banks. This is consistent with Berger & DeYoung’s, (1997) moral hazard theory. However, there was a stark contrast in the results for Islamic banks. The results for Islamic banking showed that bank capital was positively associated with credit risk. This condition could possibly be explained by the PLS arrangement and the PSIA in Islamic banks that reduces the need to have large capital base to absorb losses created by loan defaults or increase in credit risk. This raises an investigative question as to whether bank capital and credit risk relationship is different for Islamic banks.

As discussed earlier, the key difference between conventional banks and Islamic banks is the profit and loss sharing (mudarabah) operation. The relationship between bank capital and credit risk in Islamic banks would therefore be different due to the difference in the mode of operations between Islamic banks and conventional banks. Thus far, majority of the studies on Islamic bank performances were done solely either on MENA countries or non-MENA countries. Thus far, majority of the studies on Islamic bank performances were done solely either on MENA countries or non-MENA countries. Several studies have compared the performance of Islamic banks in the MENA region and the Asian region on efficiency (Noor & Ahmad, 2012; Sufian et al., 2008, Sufian et al., 2007; Sufian & Noor, 2009), and on profitability and efficiency (Akbar et al., 2011). None of these studies have compared Islamic banks in MENA and non-MENA countries on the relationships between bank capital and credit risk.

Based on the problem statement discussed above, the main objective of this study is to empirically determine the relationships between bank capital and credit risk in a selected sample of MENA region and non-MENA region Islamic banks for the years between 2003 and 2012.

Methodology

Bank-specific data for the Islamic banks were obtained from the Bureau Van Dijk’s Bankscope (Bankscope) database that includes financial statements (balance sheet and income statement) information on selected Islamic banking institutions for a period of 10 years between 2003 and 2012. All monetary values in the bank specific data are converted into U.S. dollars based on each year’s average exchange rate to maintain uniformity in the data value. Bankscope database defines Islamic banks a specialization category which includes about 30 national and multi-lateral governmental banks that are members of the "International Association of Islamic Banks" (Heliopolis, EG) plus 20 non-member banks that are considered to be "Islamic" by Fitch Ratings.

Out of these 85 Islamic banks, 48 are from Middle East and North African (MENA) countries, while 37 are from non-MENA countries. However, due to incomplete and unavailability of data, the dataset was unbalanced. As such, a total of only 650 Islamic bank year observations were finally used in the analysis of this study (of which 395 are from MENA region and 255 are from non-MENA region).

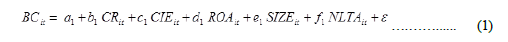

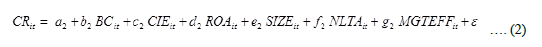

Listed below are the equations tested to determine the relationship between bank capital and credit risk in MENA and non-MENA region Islamic banks.

Bank capital as the dependent variable

Credit risk as the dependent variable

where:

BCit - Bank capital for bank i at time t (Equity to assets ratio)

CRit - Credit risk for bank i at time t (Loan loss reserves as a fraction of total assets)

CIEit - Cost inefficiency for bank i at time t (derived from stochastic cost frontier estimates)

ROAit - Profitability for bank i at time t (Net income to total asset ratio)

SIZEit - Size of bank i at time t (Natural log of total assets)

NLTAit - Net loans to total assets for bank i at time t (Loans to total assets ratio)

MGTEFFit - Management efficiency for bank i at time t (Earning assets to total assets ratio)

Equation (1) explains Islamic banks’ capital levels and it uses average annual bank capital as the dependent variable (BC). Bank capital is measured using the equity to total assets ratio.

Equation (2) explains Islamic bank credit risk based on annual loan - loss reserves as a proxy for banking risk as the dependent variable (CR). Loan loss reserves as a fraction to total assets is used as a measure of credit risk. Higher levels of loan - loss reserves are suggestive of greater credit risk.

Besides the two main dependent variables, there are other bank specific variables which are also included in the analysis of this study. Individual banks’ cost inefficiency (CIE) is obtained using the stochastic frontier approach which is a widely used parametric approach in estimating bank cost efficiency. Return on average assets (ROA) is measured using annual net income to total assets ratio. Net loans to total assets (NLTA) is used to measure loan growth. The Islamic banks’ asset size will be controlled by using natural log of total assets (SIZE). Management efficiency (MGTEFF) will be measured using the earning assets to total assets ratio.

As the observations of this study combines cross sectional and times series, panel data analysis deemed to be the most appropriate. The data is tested using pooled least square (PLS) technique. fixed effect (FE) model, random effect (RE) model and two-stage least square (TSLS) model.

Findings

The PLS, FE, RE and TSLS results on bank capital and credit risk in MENA region and non-MENA region Islamic banks are presented below Table 1a.

| Table 1a Results of the Pooled Least Square (Pls) Analysis on Islamic Banks in Mena Region for the Overall Period of 10 Years (2003 To 2012) | ||

| Pooled OLS, using 395 bank year observations Robust (HAC) standard errors |

||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 52.882*** (16.532) |

1.048 (2.175) |

| BC | 0.002 (0.011) |

|

| CR | 0.085 (0.464) |

|

| CInE | -7.674 (8.785) |

-0.572 (0.698) |

| ROA | 0.511** (0.230) |

-0.097*** (0.031) |

| NLTA | -0.019 (0.028) |

0.004 (0.004) |

| SIZE | -2.982*** (1.042) |

0.042 (0.138) |

| MGT_EFF | -0.000 (0.017) |

|

| Adjusted R-squared | 0.138 | 0.035 |

| F-statistics | 13.586*** | 3.403*** |

| Table 1b Results of the Fixed Effect (Fe) Analysis on Islamic Banks In Mena Region Over the 10 Year Period (2003 To 2012) | ||

| Fixed-effects, using 395 bank year observations Robust (HAC) standard errors |

||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 55.398*** (14.307) |

10.819*** (3.972) |

| BC | -0.047*** (0.017) |

|

| CR | -0.638* (0.332) |

|

| CInE | -2.678 (3.057) |

-0.327 (0.652) |

| ROA | 0.186 (0.222) |

-0.104*** (0.031) |

| NLTA | 0.004 (0.011) |

0.004 (0.003) |

| SIZE | -4.028** (1.493) |

-0.622* (0.335) |

| MGT_EFF | -0.028* (0.016) |

|

| Adjusted R-squared | 0.818 | 0.421 |

| F-test statistic | 34.970 *** | 6.395*** |

| Table 1c Results of the Random Effect (Re) Analysis on Islamic Banks in Mena Region for the Overall Period Of 10 Years (2003 To 2012) | ||

| Random-effects (GLS), using 395 bank year observations | ||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 54.260*** (5.038) |

5.573*** (1.829) |

| BC | -0.023** (0.011) |

|

| CR | -0.585*** (0.203) |

|

| CInE | -2.842* (1.708) |

0.026 (0.479) |

| ROA | 0.205** (0.089) |

-0.099*** (0.023) |

| NLTA | 0.003 (0.011) |

0.004 (0.003) |

| SIZE | -3.847*** (0.518) |

-0.239** (0.116) |

| MGT_EFF | -0.013 (0.011) |

|

| Breusch-Pagan test (Chi-square) | 996.593*** | 184.635*** |

| Hausman test (Chi-square) | 10.445* | 14.688** |

| Table 1d Results of the Two Stage Least Square Panel Data Analysis on Islamic Banks in Mena Region for the Overall Period of 10 Years (2003 To 2012) | ||

| TSLS, using 395 bank year observations Instruments: const., NLTA, SIZE, MGT_EFF Robust (HAC) standard errors |

||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 14.535 (11.994) |

1.933 (4.252) |

| BC | 0.125 (0.125) |

|

| CR | 6.569 (6.858) |

|

| CInE | 14.210 (10.673) |

-3.002 (4.518) |

| ROA | 1.507*** (0.457) |

-0.232 (0.208) |

| NLTA | -0.013 (0.037) |

0.002 (0.005) |

| SIZE | -3.891*** (0.993) |

0.529 (0.486) |

| MGT_EFF | -0.024 (0.033) |

|

| Instrumented | CR CInE ROA | BC CInE ROA |

| Hausman test (Chi-square) | 55.267*** | 3.784 |

| Sargan over-identification test statistic | 2.534 | |

| Weak instrument test - Cragg-Donald minimum eigenvalue |

0.420** | 0.626** |

Based on the findings from Table 1a, 1b, 1c and 1d, TSLS model was found to be more appropriate in estimating Equation 1 for MENA region Islamic banks. Thus, based on Table 1d, profitability is significantly positively related to bank capital at 1% significance level. The table also shows that bank size is negatively related to bank capital at 1% level of significance.

Fixed effect model was found to be more appropriate to examine Equation 2 for the MENA region Islamic banks. Thus based on Table 1b, bank capital and profitability are found to be significantly negatively related to credit risk at 1% significance level. The result also reveals that bank size and management efficiency are significantly negatively related to credit risk at 10% significance level. On the other hand, cost inefficiency and loan growth are not significantly related to credit risk.

| TABLE 2a Results of the Pooled Least Square (Pls) Analysis on Islamic Banks in Non-Mena Region for the Overall Period of 10 Years (2003 To 2012) | ||

| Pooled OLS, using 255 bank year observations Robust (HAC) standard errors |

||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 62.820*** (19.543) |

15.799** (7.831) |

| BC | -0.110* (0.060) |

|

| CR | -2.334*** (0.602) |

|

| CInE | -19.782** (8.993) |

-4.934** (2.337) |

| ROA | -2.200*** (0.711) |

-0.748*** (0.254) |

| NLTA | -0.129 (0.138) |

0.052* (0.027) |

| SIZE | -1.022 (1.149) |

-0.346 (0.369) |

| MGT_EFF | -0.057 (0.037) |

|

| Adjusted R-squared | 0.388 | 0.475 |

| F-statistics | 33.245*** | 39.278*** |

| TABLE 2b Results of the Fixed Effect (Fe) Analysis on Islamic Banks in Non-Mena Region for the Overall Period of 10 Years (2003 To 2012) | ||

| Fixed-effects, using 255 bank year observations Robust (HAC) standard errors |

||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 66.171*** (15.734) |

13.240** (5.391) |

| BC | -0.122** (0.049) |

|

| CR | -2.030*** (0.513) |

|

| CInE | -9.984** (4.465) |

-2.053* (1.196) |

| ROA | -1.400*** (0.441) |

-0.319*** (0.115) |

| NLTA | -0.185* (0.096) |

-0.001 (0.022) |

| SIZE | -3.116*** (1.152) |

-0.431 (0.263) |

| MGT_EFF | -0.033 (0.022) |

|

| Adjusted R-squared | 0.851 | 0.843 |

| F-test statistic | 22.540*** | 17.181*** |

| Table 2c Results of the Random Effect (Re) Analysis on Islamic Banks in Non-Mena Region for the Overall Period Of 10 Years (2003 To 2012) | ||

| Random-effects (GLS), using 255 bank year observations | ||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 66.008*** (6.546) |

12.981*** (2.256) |

| BC | -0.117*** (0.013) |

|

| CR | -2.042*** (0.233) |

|

| CInE | -10.598*** (2.528) |

-2.333*** (0.711) |

| ROA | -1.461*** (0.228) |

-0.370*** (0.057) |

| NLTA | -0.173*** (0.053) |

0.013 (0.013) |

| SIZE | -2.986*** (0.615) |

-0.445*** (0.151) |

| MGT_EFF | -0.034** (0.015) |

|

| Breusch-Pagan test (Chi-square) | 305.905*** | 285.517*** |

| Hausman test (Chi-square) | 4.899 | 17.427*** |

| Table 2d Results of the Two Stage Least Square Panel Data Analysis on Islamic Banks in Non-Mena Region for The Overall Period Of 10 Years (2003 To 2012) | ||

| TSLS, using 255 bank year observations Instruments: const., NLTA, SIZE, MGT_EFF, OBSTA, ASSUTI, OHEADTOTA Robust (HAC) standard errors |

||

| Bank Capital as dependent variable (1) |

Credit Risk as dependent variable (2) |

|

| Const. | 59.122** (30.135) |

-18.835 (38.811) |

| BC | -0.088 (0.144) |

|

| CR | 6.631 (14.438) |

|

| CInE | -36.171 (42.850) |

11.803 (18.386) |

| ROA | -0.548 (1.894) |

0.227 (0.780) |

| NLTA | -0.751 (1.028) |

0.014 (0.089) |

| SIZE | 3.584 (8.907) |

-0.551* (0.330) |

| MGT_EFF | 0.118 (0.216) |

|

| Instrumented | CR CInE ROA | BC CInE ROA |

| Hausman test (Chi-square) | 3.787 | 46.093*** |

| Sargan over-identification test statistic | 0.830 | |

| Weak instrument test - Cragg-Donald minimum eigenvalue |

0.035** | 0.097** |

Based on the findings from Table 2a, 2b, 2c and 2d, random effect model was found to be more appropriate in estimating Equation 1 for non-MENA region Islamic banks. Thus the random effect result (Table 2c) shows that all the independent variables used (credit risk, cost inefficiency, profitability, loan growth and bank size) are significantly negatively related to bank capital.

Meanwhile, TSLS was found to be more appropriate in estimating Equation 2 for non-MENA region Islamic banks. Thus, based on Table 2d, it can be noted that bank size is negatively related to credit risk at 10% level of significance.

Conclusion

From the findings, it can be noted that MENA region Islamic banks’ capital are significantly affected by profitability and bank size. Profitability significantly positively affects bank capital, while, bank size significantly negatively affects bank capital. This implies that, small and profitable banks in the MENA region tend to hold more capital.

Non-MENA region Islamic banks’ capital are significantly negatively affected by credit risk, cost inefficiency, profitability, loan growth, and bank size. This implies that non-MENA Islamic banks with higher credit risk hold smaller capital. The finding generally indicates that cost inefficient (less cost efficient) non-MENA region Islamic banks hold less capital. In other words, cost efficient Islamic banks in the non-MENA region are better capitalized. Higher profitable Islamic banks in the non-MENA region reduces bank capital holdings. The negative relationship between loan growth and credit risk indicates that generally Islamic banks in the non-MENA region are holding lesser bank capital to cover the risk incurred by the increase in loan value. Negative association between bank size and credit risk implies the generalization that larger banks hold less capital because from a safety net perspective (systemic risk), larger banks can be viewed as ‘Too-Big-To-Fail’ or ‘Too-Big-To-Discipline-Adequately’ (Kane, 2000; Mishkin, 2006).

MENA region Islamic banks’ credit risk are significantly negatively affected by bank capital, profitability, bank size and management efficiency. Evidence of negative impact of bank capital on credit risk is consistent with the moral hazard theory postulated by Berger & DeYoung, (1997) where smaller capitalized banks assume higher risk. Evidence of moral hazard in conventional banks was also noted by Ahmad & Ariff, (2007), Bahrini, (2011), Chortareas et al., (2011), Deechand et al., (2009), Gambacorta & Mistrulli, (2004), Guillen, (2006), Hussain, (2007), Konishi & Yasuda, (2004), Lee & Hsieh, (2013), Lindquist, (2004), Staikouras et al., (2008), Suhartono, (2012) and Van Roy, (2005). Similar moral hazard evidence was also found in Islamic banks by Abedifar et al., (2011), Abedifar et al., (2012), Alam, (2013), Gustina, (2011) and Taktak et al., (2010). Weill (2011) too noted that Islamic banks have incentives to charge lower return rates than conventional banks and face higher exposure to moral hazard behavior of borrowers. Cihak & Hesse, (2010) noted that, given Islamic banks’ limitations on standardization in credit risk management, monitoring the various PLS arrangements becomes rapidly much more complex as the scale of the banking operation grows, resulting in problems relating to adverse selection and moral hazard becoming more prominent.

Negative impact of profitability on credit risk indicates that Islamic banks in the MENA region with higher profitability take less credit risk. Moreover, bank size also negatively affects credit risk of both MENA and non-MENA region Islamic banks. This 12 1528-2635-25-6-842 implies that as the size of the MENA and non-MENA region Islamic banks increases, the credit risk decreases. A significant negative relationship between management efficiency and credit risk shows that MENA region Islamic banks with low earning assets take more credit risk.

This study contributes newer evidences on Islamic banking resilience and its managerial efficiency. As the Islamic banking system operates on an asset based intermediation, the underlying assets should provide profitable returns without much uncertainty. Besides adding to the existing literature on Islamic banking performance measures, the findings of this study contributes useful indicators in determining the tradeoff between the level of credit risk and capital that an efficient Islamic bank should take. This would enable the Islamic banking industry and its regulators, to make better decisions in terms of risk management practices on extreme economic events in the future. This study also contributes useful implications in determining the impact of financial crisis on the relationships among bank capital, credit risk, cost inefficiency and profitability in Islamic banks besides extending the linkages among these four factors on the overall performance of the banks.

Generally, the findings of this study contribute towards the management of the risk by Islamic banks in its financial intermediation. Specifically, the findings of this study, highlights the existence of moral hazard in Islamic banks that operate in MENA and non-MENA regions. This finding suggests that Islamic banks need to be more prudent in their cost management practices while monitoring their credit risk appetite.

Region wise, it is noted that highly profitable MENA region Islamic banks take less credit risk, while highly profitable non-MENA region Islamic banks take on more credit risk. Another important contribution of this study to the Islamic banking sector is that, well capitalized Islamic banks attained higher profits both in MENA and non-MENA regions.

References

- Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI). (1999). Statement on the purpose and calculation of the capital adequacy ratio for Islamic banks. Bahrain.

- Ahmad, N., & Ahmad, S. (2004). Key factors influencing credit risk of Islamic bank: A Malaysian case. The Journal of Muamalat and Islamic Finance Research, 1(1), 65-80.

- Ahmad, R. (2005). Bank capital, risk and performance: Malaysia evidence. (Unpublished Doctoral dissertation). Monash University, Australia.

- Akkizidis, I., & Khandelwal, S. K. (2008). Financial risk management for Islamic banking and finance (1st Edition). New York: Palgrave Macmillan.

- Altunbas, Y., Carbo, S., Gardener, E. P. M., & Molyneux, P. (2007). Examining the relationships between capital, risk and efficiency in European banking. European Financial Management, 13, 49-70.

- Anjum, S. (2014). Quantification of fiduciary risks: Islamic sources of funds, neo-institutionalism and SARWAR Bank. Journal of Islamic Banking and Finance, 2(1), 31-57.

- Basel Committee. (2010). Basel III: A global regulatory framework for more resilient banks and banking systems. Basel Committee on Banking Supervision, Basel.

- Berger, A. N., & DeYoung, R. (1997). Problem loans and cost efficiency in commercial banking. Journal of Banking and Finance, 21, 849-870.

- El-Hawary, D., Grais, W., & Iqbal, Z. (2007). Diversity in the regulation of Islamic financial institutions. The Quarterly Review of Economics and Finance, 46, 778-800.

- European Central Bank (ECB). (2007). EU Banking Structures, October.

- Fiennes, T. (2007). Supervisory implications of Islamic banking: A supervisor’s perspective. In Archer, S. & Karim, R. A. A. (Eds.), Islamic Finance: Regulatory Challenges (pp. 247-256). Singapore: Wiley.

- Greuning, H. V., & Iqbal, Z. (2007). Banking and risk environment. In Archer, S. & Karim, R. A. A. (Eds), Islamic Finance: The Regulatory Challenge. New York: Wiley Finance.

- Grewal, B. K. (2011). Constraints on growth in Islamic finance. IFSB 4th Public Lecture on Financial Policy and Stability.

- Horiuchi, A., & Shimizu, K. (2001). Did Amakudari undermine the effectiveness of regulator monitoring in Japan? Journal of Banking & Finance, 25, 573?596.

- IFSB (2005), Capital Adequacy Standard for Institutions (Other Than Insurance Institutions) Offering Only Islamic Financial Services, Islamic Financial Services Board, available at: http://ifsb.org/standard/ifsb2.pdf.

- John, I. (2014, May 24). Islamic banks’ profits hit record $10 billion. Khaleej Times. Retrieved from http://www.khaleejtimes.com

- Kahane, Y. (1977). Capital adequacy and the regulation of financial intermediaries. Journal of Banking and Finance, 1, 207?218.

- Kashyap, A.K., Stein, J.C., & Hanson, S. (2010). An analysis of the impact of ‘substantially heightened’ capital requirements on large financial institutions. (Working paper), University of Chicago, Chicago, IL.

- Khan, M. M., & Bhatti, M. I. (2008). Development in Islamic banking: A financial risk-allocation approach. The Journal of Risk Finance, 9(1), 40?51.

- Khan, T., & Ahmed, H. (2001). Risk management: An analysis of issues in Islamic financial industry. (Occasional paper no. 5), Islamic Research and Training Institute, Islamic Development Bank.

- Koehn, M., & Santomero, A. M. (1980). Regulation of bank capital and portfolio risk. Journal of Finance, 35, 1235-1244.

- Miles, M., Feulner, M., & O’Grady, (2010). 2008 index of economic freedom. Washington, DC: The Heritage Foundation and Wall Street Journal.

- Noor, M. A. N. M., & Ahmad, N. H. B. (2012). The determinants of Islamic banks’ efficiency changes: Empirical evidence from the world banking sectors. Global Business Review, 13(2), 179?200. doi:10.1177/097215091201300201

- Otker-Robe, I., & Pazarbasioglu, C. (2010). Impact of regulatory reforms on large and complex financial institutions. IMF Staff Position Note, No.SPN/10/16, International Monetary Fund (IMF), Washington, D.C.

- Shrieves, R. E., & Dahl, D. (1992). The relationship between risk and capital in commercial banks. Journal of Banking and Finance, 16, 439?457.

- Sinkey, J. F., & Carter, D. (1997). Derivatives in U.S. banking: Theory, practice and empirical evidence. In Schachter, B. (Eds.), Derivatives, Regulation and Banking, Elsevier Science, 41-77.

- Sufian, F., & Noor, M. A. N. M. (2009). The determinants of Islamic banks efficiency evidence: Empirical evidence from MENA and ASIAN banking sectors. International Journal of Islamic and Middle Eastern Finance and Management, 2(2), 120-138.

- Sufian, F., Mohamad, A., & Muhamed-Zulkhibri, A. (2008). The efficiency of Islamic banks: Empirical evidence from the MENA and Asian countries Islamic banking sectors. (MPRA Paper, No. 19072). Retrieved from http://mpra.ub.uni-muenchen.de/19072/

- Sufian, F., Noor, M. A. N. M., & Majid, M. A. (2007). The efficiency of Islamic banks: Empirical evidence from the MENA and Asian countries Islamic banking sectors. In 5th International Islamic Finance Conference 2007 (pp. 1?19).

- Sundararajan, V. (2007). Risk characteristics of Islamic product: Implications for risk measurements and supervision. In Archer, S., & Karim, R. A. A. (Eds.), Islamic Finance: The Regulatory Challenges (pp. 40-68). Singapore: Wiley.

- Sundararajan, V. & Errico, L. (2002). Islamic financial institutions and products in the global financial system: Key issues in risk management and challenges ahead. IMF working paper, IMF/02/192. (Washington: International Monetary Fund, November, 2002).

- Williams, J. (2004). Determining management behaviour in European banking. Journal of Banking and Finance, 28(10), 2427-2460.