Research Article: 2022 Vol: 25 Issue: 4

Blockchain-based solutions for tackling difficulties in an industrial sustainability engineering

Nguyen Van Nguyen, Tra Vinh University

Luong Thi Thu, Vietnam joint-stock commercial bank for industry and trade, Vietnam

Citation Information: Nguyen, N.V., & Thu, L.T. (2022). Blockchain-based solutions for tackling difficulties in an industrial sustainability engineering. Journal of Management Information and Decision Sciences, 25(4), 1-11.

Abstract

Industrial engineering is highly concentrated on the creation of values and developing a bridge between management and technology. Cleaner production is a major concern in such systems that aims at effective utilization of resources and reduce emission and waste generation through efficient practices. Such practices involving supply chain management reverse the adverse effects of industry and to improve the portability of business. In this paper, we formulate a block chain mechanism in addressing the issues associated with the sustainability of the manufacturing and production industry from economic point of view. The study contributes mainly with the management of supply chain in developing the economy of the nation. The block chain based management ensures better supply and tracking of products to the end users via e-commerce platform. The simulation is conducted to test the viability of the model against various state-of-art bloc kchain models. The results of simulation show that the proposed method achieves higher rate of accuracy in delivering the products to end-user thereby creating a sustainable management of business.

Keywords

Sustainable Industrial Engineering; Supply Chain; Industrial Symbiosis; Cleaner Production Strategies.

Introduction

In recent years, the rise in bitcoin popularity, usage, and price has increased public awareness of block chain technology (Agrawal et al., 2021). The introduction of a new crypto currency or an Initial Coin Offering (ico) is becoming more common, as is the introduction of new crypto currencies, icos, and crypto currency exchanges (Reddy et al., 2021). Btc and other crypto currencies can be created on the foundations of block chain technology, which has been shown to be a secure, efficient, and dependable method of exchanging currency in the past. As a result of its extensive use in crypto currency transactions, block chain has gained in popularity, motivating researchers to investigate the technology possible applications (Esmaeilian et al., 2020). Furthermore, block chain technology has the potential to disrupt a wide range of businesses, in addition to the financial services industry (Rusinek et al., 2018).

For quite some time, there has been discussion about the potential benefits of block chain technology for supply chain management and logistics. According to the findings of this research, block chain technology might be used to manage supply chains in a variety of industries, including manufacturing, agriculture, food, and medicine, as well as e-commerce, airlines, hotels, and retail. Because of the concept of smart contracts, block chain technology can now be used in a variety of fields other than banking (Lim et al., 2021).

Since decades, technological advancements have kept pace with the rise of new applications in a diverse spectrum of fields. Suppliers, manufacturers, retailers, and financial service providers can all reap significant benefits from a supply chain network built on block chain technology (Varriale et al., 2021). However, it is possible that supply chain theories and supply chain management practices are to blame for the slow adoption of new technology in this industry (Manupati et al., 2020).

Because of its revolutionary nature, block chain has had a huge impact on society, law, and governance, among other things. Political repercussions can be found in some of its implementations, such as block chain-based voting, for example. Thanks to block chain technology, even the structure of organizations has been altered as a result of the emergence of decentralized autonomous groups (dags) (Kayikci et al., 2020). Diverse countries have embraced a variety of viewpoints on the application of block chain technology in crypto currencies, such as bitcoin, initial coin offerings (icos), and other related projects. A positive aspect of the block chain is that it is not merely one network, but rather a collection of varied networks, each with its own consensus method and set of additional criteria (Sarkis, 2020).

Many levels of tokenization are feasible in block chain networks; consequently, certain networks may be prohibited in conservative or risk-averse countries. An increase in liquidity, a reduction in transaction costs, and an increase in transparency are just a few of the advantages of tokenization for both investors and sellers (Ronaghi, 2021). Some block chain-based applications, such as crypto currency exchanges, may not require the use of tokenization. The fact is that it is the driving force behind the vast majority of financial sector upheavals, and it serves as the foundation for initial coin offerings (icos) (Duan, 2020).

Block chain technology applications in supply chain management have been expanded thanks to smart contracts, low-energy consensus mechanisms, and tokenization, among other developments (scm). Using an examination of the existing literature on the issue, this paper evaluates the benefits and applications of block chain technology in supply chain management (scm) (Hannah et al., 2022).

Those three pillars of sustainability are depicted as follows: the economic, social, and environmental dimensions. When it comes to following environmental and financial best practices at the same time, it can be challenging for businesses (Elhidaoui et al., 2022). In order to attain a high level of social performance, it is necessary to safeguard the rights and needs of all stakeholders. Promoting sustainable development goals has the potential to yield long-term benefits. It has been demonstrated that the ability of a corporation to strengthen its competitive advantage while also generating positive environmental and social consequences has been demonstrated (Öztürk & Yildizba?i, 2020).

It is necessary to investigate supply chain operations in order to gain a better understanding of this problem. It is important to remember that teamwork is critical to increasing the flow of commodities, information, and financial transactions, and that should not be disregarded in this context (Alawi et al., 2022). Participants in the supply chain frequently have goals and objectives that conflict with one another. A further technological barrier exists in the form of incompatible tracking systems that are being used by diverse stakeholders. To deal with these difficulties, it is possible to include sustainability in a company overall strategy.

In this paper, we develop an innovative block chain-based solution is proposed to ensure the long-term viability of the manufacturing and production industries. According to the authors, the management of the supply chain is the study most important contribution to the development of the nation economy. A block chain-based management system has been introduced to provide improved supply and tracking of items to clients who purchase goods through an e-commerce platform. The simulation is used to evaluate the model viability against other current block chain model state-of-art and to determine whether or not the model is viable. Using simulation, it is demonstrated that the proposed technique delivers products to end users with more precision, resulting in improved long-term financial management.

Literature Review

Dai & Vasarhelyi (2017) state that there is still a great deal to learn about block chain-enabled accounting systems. In theory, a system that is real-time, verifiable, and transparent like this should function properly. There is a look at how block chain technology can be used to transform the auditing industry. Accounting is still based on notions that have been around for centuries, despite the fact that technology has revolutionized the world dramatically in the last decade and during the last century. Practices in the auditing field are the same as they are everywhere else. Block chain technology, on the other hand, has the potential to completely transform this. There has been a significant shift in the development of technology, and its difficult application should not be disregarded. New algorithms and approaches being developed on the technological side will have a significant impact on the development of block chain technology accounting and assurance applications, among other things.

According to Tapscott and Tapscott (2017), block chain will have a significant impact on the way businesses operate. As a result, they expect the block chain to have a substantial impact on a wide range of business processes and activities. Personnel management and procurement finance and accounting, sales and marketing, legal affairs, and capital rising are just a few examples of the tasks and duties that organizations have.

Ghobakhloo (2018) block chain is critical to the transition to Industry 4.0. Financial transactions made possible by block chain-enabled coins are frictionless. These transactions can also be automated through the use of smart contracts. In nature, these transactions are considered to be safe, secure, swift, and hassle-free in their execution. With the advent of Industry 4.0, the application of block chain technology can be expanded to include any type of digital information flow, allowing for trusted and autonomous interactions between its various components.

According to Werbach (2018), block chain technology requires legal regulation, as he discusses in detail. In the process of resolving the age-old problem of trust, using block chain-enabled applications outside of the legal framework might be counterproductive, if not downright dangerous. In a variety of instances, the use of block chain technology to supplement, complement, or completely replace legal enforcement is an unavoidable requirement. Beware of technology-related legal requirements that are too rigid, as they might hinder innovation and lead to missed opportunities. It is now more important than ever for block chain architects and developers to engage with legal organizations in order to achieve their goals.

Casey & Wong (2017) investigate the possibility of improving global supply networks by utilizing the emerging technology of block chain. The fundamental advantages of block chain technology are being investigated by both established organizations and start-ups in a range of application areas. But perhaps more importantly, it provides a solution to the problem of transparency and responsibility among parties whose commercial interests are at odds with one another.

Proposed Method

By applying theory to case studies, we examined the usefulness and sufficiency of block chain-based supply chains in terms of establishing a dependable, transparent, authentic, and safe system. It is easier to identify and understand the complexities and idiosyncrasies of a block chain-based supply chain when working with real-world scenarios than when working with hypothetical ones. In order to validate the theoretical study, it is necessary to have a complete grasp of the practical and real-world applications of block chain in a supply chain ecosystem. The term theoretical studies refer to research that has not been undertaken on a large scale.

Block chain in this paper tends to solve the problems related to supply chain and it hence improves the sustainability of environment. The block chain adoption is hence suitable for large organizations and the companies tends to have resources, distributed operations, greater transaction volume in various workplaces with several partners in supply chain for managing the information than smaller organizations. The influence of smaller organization is not overlooked and it plays a major role inside the supply chain for achieving transparency. The inclusion of players in network ensures better collaboration among the companies for increasing the profitability. The adoption of block chain creates collaborative market that helps in trading and avoids fraudulent behaviour. The companies enabling block chain verifies the data with suppliers and monitors the participants to adopt sustainability practices

To gain a deeper understanding of the block chain supply chain ecosystem, it initially understands the tracking system and how the block chain is incorporated into their respective platforms. It will be explored how their block chain-based supply chain operates and whether or not it is sufficient.

Simulation Model

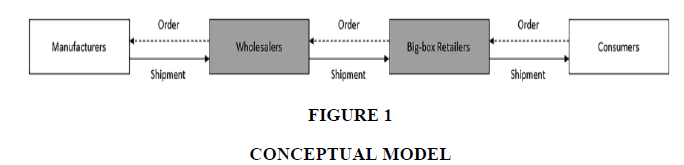

It is feasible to quantify the benefits organizations by implementing a supply chain that is enabled with block chains by utilizing a simulation model (Figure 1). Inventory management, demand forecasting, and procurement, as well as the arrival and delivery of client orders, are all included in the network of carriers, suppliers, retailers and wholesalers, as is the goods movement and entity information. Here, the supply chain processes are first theorized and then realized in a Java-based simulation model that was created from the ground up in order to demonstrate their effectiveness. It is proposed that models for data forecasting and inventory management be developed since the quality and authenticity of the data communicated between supply chain players, as well as the consequences of this data on business performance, are both considered essential by these mathematical models(Figure 1).

Blockchain Costs

The first time a block chain member tries to complete a transaction; they will be charged a transaction fee. The majority of the system participants verify each transaction on the public ledger using a consensus process, which is implemented in the Ethereum programming language. To complete the transaction, it is necessary for miners, or computers connected to the network that search for the correct hashes, to complete the task. In terms of computing difficulty, this is a demanding challenge. As previously said, the greater the number of people who participate in the block chain, the more stable and successful the network will be. As a result, miners must be compensated for their efforts.

The crypto currency fee for the block chain and each block chain has its own method of determining the fee structure. On the Bitcoin block chain, the amount of space taken up by a transaction is used to calculate the cost of the transaction. The Ethereum block chain estimates transaction cost based on the number of blocks that are processed during the transaction. The difficulty of the method is directly proportional to the number of blocks that must be dealt with during the procedure. Additional costs are associated with the number of blocks processed in order to store data on the block chain. When a transaction is submitted, a matching number of blocks are processed in the background. The transaction cost is defined as below:

Where,

G -Amount of Blocks and

P -Block Price.

However, the number of blocks required to save a hash on the block chain is fixed, although the participants on the block chain is variable. The cost of processing a block has an impact on the amount of time it takes for a mined transaction. In the end, the miner reward value on a block chain is determined by the value of the block as well as the sum of the transaction charges associated with it.

Demand Forecasting

Following the conceptualization of the supply chain described above, a multi-paradigm was developed for simulation of the supply chain. A unique Java class has been created and allocated for each supply chain agent. Purchase orders can also be expressed as a Java class, as shown below. In response to events generated by event generator objects, simulated demand estimations and inventory levels can be changed in database tables using specific approaches that are defined in the documentation. By employing this strategy, we were able to construct a simulation model that was adaptable, parametric, and time-efficient.

The negative exponential function is used to determine the distribution of order arrival times at each big box store j, j =1,20 is the number of stores. Single Exponential Smoothing (SES) is used to control their inventory, and a Reorder Level-Target Level policy is used to regulate their reorder levels (r,R). The order quantities placed by clients of a big-box store are meant to follow a triangle-shaped probability distribution.

Every wholesaler i, i=1,2,3, has a policy associated with Dynamic Safety Stock (DSS) forecasting approach. Listed below are the inventory control and demand forecasting rules that were implemented in our simulation model for this study, which were necessary to demonstrate the types of information that are shared between wholesalers and retailers, as well as how this information affects the enterprise performance.

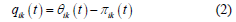

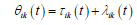

Retailers and wholesalers use a review policy (r,R) to decide when and how many purchases are needed to maintain inventory control. If the level of target θik(t)and the position of inventory πik(t), the amount of item k that should be ordered at time t is determined by a network node i, qik(t) depends on the θik(t) and πik(t), respectively

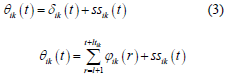

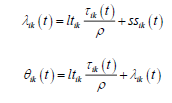

The target level θik(t) is the total number of safety stock for an item k at time t on the node i. ssk(t) is considered as the lead time demand, δik(t) is therefore formulated using a exponential smoothing as below:

Where

φik(t) is the demand forecast at time r for item k at i and

ltik - lead time of the item k at i.

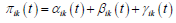

The position of inventory, τik(t), is hence defined in terms of inventory (on-hand), αik(t), product (on order), βik(t), and the shipped quantity, γik(t):

The purchase order time is thus estimated using the following condition.

Where γik(t) - re-order level and

ssk(t) - safety stock and

δik(t) - lead time demand.

The γik(t), the θik(t) and the ssk(t) are assumed as constant over the period of review ρ. Upon forecasting the demand over the review period ρ id given at time t as τik(t) and it is defined as below:

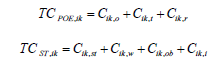

The overall cost of the total storage cost and purchase order emission is given as below:

Where:

Cik,o -cost of order placed

Cik,t -cost of transportation

Cik,r -cost of order reception

Cik,st -cost of storage

Cik,w -worsening cost

Cik,ob -obsolescence cost

Cik,i -interest cost

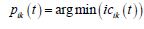

Therefore the review period optimized, pik(t) is estimated as the minimization of argument based on demand forecast and hence the inventory cost icik(t) is estimated as below:

Upon indicating the Τik(t) over pik(t), the θik(t) is reformulated as:

Where,

τik(t) - optimal size of lot that is estimated through demand forecast.

Results and Discussion

Big-box stores and Wholesalers can keep supply chain data off-chain by utilizing the Unical Coin block chain as a safe, reliable, and decentralized ledger on the Unical Coin block chain.

As a result, the simulations were performed for 60 days and three times each in both situations in order to reduce the impact of chance and stochasticity on the outcomes. This section displays and statistically analyses the averages of the three replications of supply chain performance measurements that were used in the previous section.

Cost and Performance

It was found that transaction waiting times on the Unical Coin block chain were incredibly short during the course of the experimentation. In order to determine how long it will take for transactions to be processed on the Unical Coin block chain, it is necessary to know how long they will take to process on the Ethereum block chain. According to the estimates, the average time is 16.3 seconds, with the longest time being 146 seconds and the smallest time being 2 seconds at the extremes. Each store in the block chain-enabled supply chain generates 60 transactions every day. Table 1 summarizes the total lowest and maximum expenses associated with block chain transactions in terms of dollars.

| Table 1 Parameters |

||

|---|---|---|

| Parameters | Minimum | Maximum |

| Transaction time (node/day/second) | 1.4 | 8.6512 |

| Retailer block chain cost ($) | 0.852 | 11.2365 |

| Wholesaler block chain cost ($) | 5.7 | 11.842 |

| Total block chain cost ($) | 30.2185 | 72.0514 |

When compared with B-IS scenario, we find that wholesaler average revenues increase by 17.44% on average. As indicated by the absence of revenue data in the B-IS situation, wholesalers execute all orders. Because of the increased costs, there is little difference in the profit margin between the block chain installations. The Mann-Whitney test, which is non-parametric, was used to determine whether or not their profits had changed significantly.

| Table 2 Indicators On Economic Performance |

||||

|---|---|---|---|---|

| Scenario | R | MR | TIC | Max BC |

| B-IS | 88.956 | 1.024 | 38.2564 | 12.266 |

| No-IS | 75.2654 | 18.264 | 25.2646 | 1.5934 |

Although the B-IS scenario has larger average revenue per wholesaler than the No-IS scenario, there isn't enough evidence to rule out the null hypothesis, as seen in Table 3. As a result, it is necessary to conduct a more thorough investigation of inventory expenses (IP). This means that wholesalers never run out of inventory and can fulfill all orders placed by retailers thanks to the latter sharing of reliable information on lead time demand via the block chain, which makes it possible for wholesalers to never run out of inventory. When comparing the graphs illustrating the location and cost of inventory, there is a significant difference between the two situations.

| Table 3 Wholesaler Profit |

||||

|---|---|---|---|---|

| Score | Median | N | Difference | P-value |

| B-IS | 52.1514 | 4 | -23.1854 | 0.5968 |

| No-IS | 52.154 | |||

Economic performance measurements for big-box retailers follow a similar pattern to those used for tracking the performance of other businesses. A review of the specifications for each big-box retailer and a breakdown is provided in Table 4.

| Table 4 Key Outcomes Of Wholesaler Inventory |

||||

|---|---|---|---|---|

| Scenario | FR (%) | IP | TIC($) | AIC($) |

| B-IS | 1.0254 | 13.0514 | 35.12564 | 114.154 |

| No-IS | 0.81254 | 10.12564 | 31.0541 | 101.154 |

As a result of the information sharing allowed by block chain technology, big-box merchants see an increase in sales and a decrease in lost revenues in the B-IS scenario. This is because the parties have mutual trust in the information shared. Big-box stores will earn far more money under the B-IS scenario.

Inventory management data is studied to gain an understanding of where the company increased revenue is coming from. Both retailers and wholesalers have experienced significant increases in their average fill rate, which is defined as the ratio of fulfilled orders to the total number of orders. Due to a lack of trust between companies in the No-IS scenario, forecasts can only be made using historical data from wholesalers who have purchased goods from retailers in the past. Due to the fact that they are based on information provided by big-box retailers, wholesaler estimates under the B-IS scenario are more accurate.

This was made feasible due to the fact that the block chain serves as a certification agent and verifies the accuracy and reliability of the information supplied. Retailers are better equipped to meet market demand as a result of the improved service level provided by wholesalers, which is made possible by information exchange using block chain and this increased trust via data shared. Improved forecasting and planning result in an increase in revenues, while higher inventory for wholesaler results in an increase in expenses.

Interestingly, wholesalers acquire more from manufacturers and maintain more inventory in the B-IS scenario than they do in the No-IS scenario, but they also sell more in the former. Because expanding sales outpace rising inventory costs, wholesaler profit margins have been relatively stable in recent years. Block chain verifies the integrity, origin, and data invariability by retailers has a substantial influence on wholesaler operational performance, it has no major impact on the economic benefits that wholesalers could realize as a result of this technology.

In spite of the fact that big-box retailers are doing a better job of meeting market demand than they did in the past, their inventory levels are largely unchanged in both scenarios. Despite the fact that the use of block chain has resulted in significant improvements in profit margins, the average increase in inventory costs is just 17.18%, keeping merchant profit margins unaffected. This has resulted in the polar opposite effect for big-box retailers, who report that while their operational effectiveness in terms of inventory position does not change dramatically, the greater fill rate results in significantly higher margins.

As a result, organizations with supply chain lack trust in one another or where confidential information cannot be shared with all parties involved, block chain technology is a helpful technology that creates the circumstances for improved overall supply chain performance. In order to convince merchants to use block chain technology, they must first demonstrate that they will benefit financially from doing so. It would also benefit suppliers by lessening the impact of the bullwhip, allowing them to plan more effectively and achieve higher levels of operational efficiency. A study conducted by IBM found that distributed ledger technology can be a cost-effective tool for resolving supply chain collaboration and trust issues while also decreasing the negative consequences of supply chain information asymmetry.

Conclusion

In this paper, we formulate a block chain mechanism in addressing the issues associated with the sustainability of the manufacturing and production industry from economic point of view. The study contributes mainly with the management of supply chain in developing the economy of the nation. The block chain based management ensures better supply and tracking of products to the end-users via e-commerce platform. The simulation is conducted to test the viability of the model against various state-of-art block chain models. The results of the simulation show that the proposed method achieves higher rate of accuracy in delivering the products to end users thereby creating sustainable management of the business.

References

Agrawal, T.K., Kumar, V., Pal, R., Wang, L., & Chen, Y. (2021). Blockchain-based framework for supply chain traceability: A case example of textile and clothing industry. Computers & industrial engineering, 154, 107130.

Indexed at, Google Scholar, Cross ref

Alawi, B., Al Mubarak, M.M.S., & Hamdan, A. (2022). Blockchain evaluation framework for supply chain management: a decision-making approach. In Supply Chain Forum: An International Journal, 1-15.

Indexed at, Google Scholar, Cross ref

Casey, M.J., & Wong, P. (2017). Global supply chains are about to get better, thanks to blockchain. Harvard business review, 13, 1-6.

Dai, J., & Vasarhelyi, M.A. (2017). Toward blockchain-based accounting and assurance. Journal of Information Systems, 31(3), 5-21.

Indexed at, Google Scholar, Cross ref

Duan, J., Zhang, C., Gong, Y., Brown, S., & Li, Z. (2020). A content-analysis based literature review in blockchain adoption within food supply chain. International journal of environmental research and public health, 17(5), 1784.-1793.

Indexed at, Google Scholar, Cross ref

Elhidaoui, S., Benhida, K., El Fezazi, S., Kota, S., & Lamalem, A. (2022). Critical Success Factors of Blockchain adoption inGreen Supply Chain Management: Contribution through an Interpretive Structural Model. Production & Manufacturing Research, 10(1), 1-23.

Indexed at, Google Scholar, Cross ref

Esmaeilian, B., Sarkis, J., Lewis, K., & Behdad, S. (2020). Blockchain for the future of sustainable supply chain management in Industry 4.0. Resources, Conservation and Recycling, 163, 105064.

Indexed at, Google Scholar, Cross ref

Ghobakhloo, M. (2018). The future of manufacturing industry: a strategic roadmap toward Industry 4.0. Journal of Manufacturing Technology Management., 29(6), 910-936.

Indexed at, Google Scholar, Cross ref

Hannah, S., Deepa, A.J., Chooralil, V.S., BrillySangeetha, S., Yuvaraj, N., Arshath Raja, R, Alene, A. (2022). Blockchain-Based Deep Learning to Process IoT Data Acquisition in Cognitive Data. BioMed Research International, 2022, 1-7.

Indexed at, Google Scholar, Cross ref

Kayikci, Y, Subramanian, N, Dora, M, Bhatia M.S. (2020). “Food supply chain in the era of Industry 4.0: Blockchain technology implementation opportunities and impediments from the perspective of people, process, performance, and technology.” Production Planning & Control, 33(2-3), 301-321.

Indexed at, Google scholar, Cross ref

Lim, M. K., Li, Y., Wang, C., & Tseng, M.L. (2021). A literature review of blockchain technology applications in supply chains: A comprehensive analysis of themes, methodologies and industries. Computers & Industrial Engineering, 154, 107133.

Indexed at, Google Scholar, Cross ref

Manupati, V.K., Schoenherr, T., Ramkumar, M., Wagner, S.M., Pabba, S.K., & Inder Raj Singh, R. (2020). A blockchain-based approach for a multi-echelon sustainable supply chain. International Journal of Production Research, 58(7), 2222-2241.

Indexed at, Google Scholar, Cross ref

Öztürk, C., & Yildizba?i, A. (2020). Barriers to implementation of blockchain into supply chain management using an integrated multi-criteria decision-making method: a numerical example. Soft Computing, 24(19), 14771-14789.

Reddy, K.R.K., Gunasekaran, A., Kalpana, P., Sreedharan, V.R., & Kumar, S.A. (2021). Developing a blockchain framework for the automotive supply chain: A systematic review. Computers & Industrial Engineering, 157, 107334.

Indexed at, Google Scholar, Cross ref

Ronaghi, M.H. (2021). A blockchain maturity model in agricultural supply chain. Information Processing in Agriculture, 8(3), 398-408.

Indexed at, Google Scholar, Cross ref

Rusinek, M. J., Zhang, H., & Radziwill, N. (2018). Blockchain for a Traceable, Circular Textile Supply Chain: A Requirements Approach. Software Quality Professional, 21(1), 1-14.

Sarkis, J. (2020). Supply chain sustainability: learning from the COVID-19 pandemic. International Journal of Operations & Production Management, 41(1), 63-73.

Indexed at, Google Scholar, Cross ref

Tapscott, D., & Tapscott, A. (2017). How blockchain will change organizations. MIT Sloan Management Review, 58(2), 1-10.

Varriale, V., Cammarano, A., Michelino, F., & Caputo, M. (2021). New organizational changes with blockchain: A focus on the supply chain. Journal of Organizational Change Management, 34(2), 420-438.

Indexed at, Google Scholar, Cross ref

Werbach, K. (2018). Trust, but verify: Why the blockchain needs the law. Berkeley Technology Law Journal, 33(2), 487-550.

Indexed at, Google Scholar, Cross ref

Received: 12-Apr-2022, Manuscript No. JMIDS-22-11740; Editor assigned: 15-Apr-2022, PreQC No. JMIDS-22-11740(PQ); Reviewed: 22-Apr-2022, QC No. JMIDS-22-11740; Revised: 27-Apr-2022, Manuscript No. JMIDS-22-11740(R); Published: 30-Apr-2022