Research Article: 2021 Vol: 25 Issue: 6

Blue Chip Stocks Valuation and Risk Prediction on the Indonesia Stock Exchange

Endang Tri Widyarti, Diponegoro University

Di Asih I Maruddani, Diponegoro University

T Trimono, UPN Veteran Jawa Timur

H Hersugondo*, Diponegoro University

Citation Information: Widyarti, E.T., Maruddani, D.A., Trimono, T., & Hersugondo, H. (2021). Blue chip stocks valuation and risk prediction on the indonesia stock exchange. Academy of Accounting and Financial Studies Journal, 25(6), 1- 14.

Abstract

Investment in the financial sector, especially stocks, is a type of investment that is increasingly in demand by investors in Indonesia. Stock trading in Indonesia is centered on the capital market called the Indonesia Stock Exchange (IDX). Every year, IDX issues an official release of stocks that fall into the Blue Chip category stocks. These stocks have consistent profit growth and established financial capabilities in paying dividends; therefore, Blue Chip stocks are perceived as the best option to invest in. However, as price movements are difficult to predict, investing in Blue Chip stocks is not without risk. To find out price movements and to predict the risk of possible losses, the Geometric Brownian Motion and Value at Risk methods were used. This study aims to forecast the price and measure the loss risk of Blue Chip stocks in IDX. The results of the empirical study on the 5 Blue Chip stock period 07/30/20 - 04/14/21 showed that the GBM model was very accurate in predicting stock prices. At the 99% confidence level, the possible losses for Blue Chip were in the range of 4.66%-5.96%.

Keywords

Valuation, IDX Blue Chip Stocks, Geometric Brownian Motion, Value at Risk.

Introduction

The financial sector is a sector that plays an essential role in spurring the economic growth of a country. According to World Bank (2021), a growing financial sector can encourage economic growth, reduce poverty, and reduce macroeconomic volatility. In Indonesia, in the last five years, the investment and financial services sector has become a significant driver of Indonesia's economic growth, as this sector stands in fourth place under agriculture, industry, and trade (Bank Indonesia, 2021). This significant influence is affected by the increasing number of Indonesian people who invest their funds to buy financial assets. In general, this decision is motivated by several factors, including financial assets that are generally liquid can be easily converted into cash, some financial assets can provide higher interest rates than real assets, financial assets are relatively safe even though there is a crisis (for example bonds), and financial assets are the best investment way to get a high Return on Income in a short time (Kuchancur, 2015).

According to Joseph (2018), financial assets are intangible assets of which buying and selling transaction processes are centered on the capital market. In Indonesia, the capital market, as a trading center for financial assets, is located on the Indonesia Stock Exchange (IDX). Based on the data released by IDX Indonesia, as of October 2020, there were 709 public companies listed on IDX, and the most traded financial asset on IDX was stock. Based on the financial reports published by IDX, the total value of stock trading in 2020 was 9,555.73 trillion IDR, an increase of 4.12% from 2019 (IDX Indonesia, 2020a). The tendency of people who prefers investing in stocks over other financial assets is because stocks offer higher potential returns, although the risk is also higher.

In one trading year, each company listed on IDX has various conditions. Some earn high profits with substantial market capitalization value, while others do not make a profit at all, even they go bankrupt (Sorongan, 2017). Every year, IDX categorizes and ranks each company's stock based on their achievements obtained. The highest classification is given by IDX stocks with the Blue Chip category. According to Hendarsih & Harjunawati (2020), Blue Chip is categories for stocks of big companies that have consistent profit growth and established financial capabilities in paying dividends. Thus, investing in Blue Chip stocks is the most appropriate and safe choice.

Based on Islam and Nguyen (2020), stock price movements (including Blue Chip stocks) for each period are difficult to predict; as a result, it is difficult to determine whether the stock price will decrease or increase. This unpredictable movement of stock prices also causes the value of the returns to be received to be uncertain. One of the models used for modeling and predicting stock prices based on past prices is Geometric Brownian Motion (GBM). Based on Azizah et al. (2020), GBM is one of the stochastic models in Black Scholes Merton, which is built on the assumption that the data follows a normal distribution. The GBM model is generally used to predict stock price movements for a short time.

Although the profit growth of Blue Chip stocks tended to be constant, this did not mean that this investment was risk-free. This risk is uncertain, it can occur at any time, and if it occurs, it can cause losses (Yuniningsih et al., 2017). Stock investment risks include the opportunity to get a lower return than the initial investment. The higher the possible return to being obtained, the higher the risk of loss that can be received (Tahir et al., 2020). Because of its nature that could cause losses, it was important to know the estimated value of the risk of loss that might occur. One of the models that could be used to predict the value of the risk of loss was Value at Risk (VaR). According to Likitratcharoen et al. (2018), VaR is used to predict the maximum possible loss value that will be obtained in a certain period and a certain level of confidence (significance level).

For potential investors, stock price movements and the predictive value of the risk of loss were imperative because the results obtained could be taken into consideration before deciding which blue-chip stock to invest in. The obtained results of price and risk prediction are highly dependent on the existing historical data (Jishag et al., 2020). Trimono et al. (2017) modeled the stock price of Ciputra Development. Ltd with the GBM model, using 261 historical data from the period 31/01/2016 – 31/01/2017. After the normality test results show that the stock returns are normally distributed, the prediction results gained are very accurate, with a MAPE value of 1.98%. In developing countries, economic conditions and the stock market often experienced ups and downs, as happened in India in 2018-2019, causing the stock market to become more volatile, and stock prices were difficult to predict. Under this circumstance, Si & Bishi (2020) modeled stock prices on the Indian stock market using Geometric Brownian Motion to help provide better judgment to investors and predict stock prices for a short period. The prediction results obtained give a MAPE value of 5.41%, which means that the prediction accuracy is very accurate.

In practice, there are always risks involved in the stock trading process caused by the stock price, which value fluctuates from time to time. Stock price fluctuations occur because the position of the previous stock affects the current stock price and the stock's response to the problems that are currently taking place Based on these factors, changes in stock prices are included in a Markov Chain stochastic process. As it is a stochastic process, Agustini et al. (2018) modeled IDX using the Geometric Brownian Motion (GBM) method as one of the stochastic models. Measurement of risk was very important concerning large investment funds. Saputri et al. (2019) carried out risk measurements using Value at Risk with the Copula approach on two stocks that were included in the Blue Chip category, namely Bank Negara Indonesia Ltd and Telekomunikasi Indonesia Ltd. This research concluded that Gumbel's copula modeling is the best copula model because it can capture heavy tail better based on the resulting VaR value. Pratama et al. (2015) researched to quantify the value of the risk of loss on the JCI by combining the GBM method with the Leap and the Value at Risk method. This research was motivated by the condition that in price predictions and the risk of loss on the JCI, sometimes there were jump times. Consequently, a model was needed to see the jump times by using the GBM model with Leap. As a result, the predicted VaR values for the GBM model with Leaps at the 95% and 99% confidence levels were -0.0580 and -0.0818.

Based on several previous research, this research will focused to analyze valuation of Blue Chip IDX stocks. In 2020, there were 20 Blue Chip IDX stocks (IDX Indonesia, 2020b), from which the top 5 stocks were chosen to be evaluated. The valuation covered the prediction of stock prices in the future using the GBM model and the prediction of the risk of loss using the VaR method. The RMSE (Root Mean Square Error) and MAE (Mean Absolute Error) methods were used to test the accuracy of stock price predictions obtained. Meanwhile, the valuation was used to empirically test that although Blue Chip stocks could provide constant profits, investing in Blue Chip stocks still contained an element of risk in the form of losses.

Methodology

Asset Return

Return is one of the factors that motivates investors to interact in the investment world and is also a reward for their courage to take risks with their investments (Widagdo et al., 2019). Based on Miskolczi (2017), return is defined as the result obtained from an investment activity (can be in the form of profit or loss) for a certain period. If St and St-1 are asset prices in periods t and t-1, the return value for period-t can be obtained through the following equation

.........(1)

.........(1)

To make it easier to interpret the value obtained, the return value obtained from equation (1) is usually written in percentage.

Geometric Brownian Motion Model

Geometric Brownian Motion (GBM) is a derivative of the Brownian motion process, used as a model for stock price predictions based on stock return values (Reddy & Clinton, 2017). The most important assumption that must be met from this model is that the stock return value must be normally distributed. The initial equation for the GBM model is as follows

dSt = μ St dt + σ St dWt ........(2)

To get the final equation of the GBM model derived from equation (2) Lemma Ito is used. According to Lemma Ito, for an F which is a function of S (stock price) and t (time), the following equation applies:

.............(3)

.............(3)

where μ is the risk-free rate and σ is the volatility parameter. Then, the function F is defined as

F = ln (St) ...........(4)

By substituting equation (4) into equation (3), the new equation is

..........(5)

..........(5)

Next, by integrating both sides of equation (5) with a limit ti up to ti-1 , the yield is

.............(6)

.............(6)

where Wt(i-1) is Brownian motion in the period -ti+1 , and Wt(i) is Brownian motion in the period -ti . Suppose ti+1- ti = Δt applies to every i, ΔWi+1 = Wt(i+1)- Wt(i)and applies to i = 0, 1, 2, …, N-1. Note that ΔWi+1 is normally distributed (0, Δt), then ΔWi+1 = Wt(i+1)- Wt(i) can be replaced by  with Zi+1 is a random variable with a Standard Normal distribution for each i = 0, 1, 2, …, N–1. So, equation (6) can be reduced to

with Zi+1 is a random variable with a Standard Normal distribution for each i = 0, 1, 2, …, N–1. So, equation (6) can be reduced to

..........(7)

..........(7)

where,

St(i+1) : stock price in period to - ti+1

St(i) : stock price in period to - ti

μ : stock return mean ( -1 < μ < 1)

σ : stock return volatility ( 0 < σ < ∞)

σ2 : stock return variance ( 0 < σ2 < ∞)

Accuracy Test for Prediction Results

The accuracy of the prediction results is the most important indicator used to assess the performance of a model. A model is said to be accurate if the prediction value obtained is closer to the actual value. In this study, the prediction resulted from the GBM model were tested for its accuracy using 2 methods, namely RMSE (Root Mean Square Error) and MAE (Mean Absolute Error).

RMSE (Root Mean Square Error)

Root mean square error (RMSE) is a commonly used method to measure the performance of predictive models. The accuracy value is measured by quantifying the average squared value of the difference between the predicted value and the actual value (Chai & Draxler, 2015). The equation to obtain the RMSE value is as follows:

............(8)

............(8)

with, n is the number of samples, Yiis the actual value, and  is the prediction value at period i. The value of RMSE is between 0 and ∞.

is the prediction value at period i. The value of RMSE is between 0 and ∞.

MAE (Mean Absolute Error)

According to Wang and Lu (2018), MAE measures the average value of the error in prediction data without considering whether the error is positive or negative. It is the average over the test sample of the absolute difference between predicted and actual observations where all individual differences have the same weight. The size of the MAE value is defined as

...........(9)

...........(9)

with, n is the number of samples, Yi is the actual value, and  is the prediction value at period i. The value of MAE is between 0 and ∞.

is the prediction value at period i. The value of MAE is between 0 and ∞.

Value at Risk

The risk of loss was the main problem that often causes an investment activity difficult to develop until it experienced bankruptcy. Therefore, it was important to quantify the risk to obtain an estimated value of the risk of loss that may occur. Value at Risk (VaR) is a risk measure that can be used to quantify and predict risk (Ahadiat & Kesumah, 2021). VaR is also defined as the estimated maximum loss value that will occur in a certain period with a certain level of confidence (Alhammouri & Alkhadli, 2017). Reffering to Ogwa, Costa, & Moralles (2018) VaR is calculated through the quantiles of the distribution of the historical returns of the related assets. Mathematically, VaR is formulated as:

............(10)

............(10)

where, X is a random variable that represents the return value of the asset, and  is the inverse of the distribution function of X at the α. According to Suwarno and Mahadwartha (2017), calculating loss predictions using VaR can be done through 2 approaches; parametric and nonparametric.

is the inverse of the distribution function of X at the α. According to Suwarno and Mahadwartha (2017), calculating loss predictions using VaR can be done through 2 approaches; parametric and nonparametric.

The parametric approach of VaR value is based on the assumption that stock returns follow a normal distribution. The advantage of the parametric approach is that it can provide many possible risk predictions obtained from regenerated return data (Maruddani & Trimono, 2020). The parametric approach method used in this research was the Standard Deviation Premium Principle (SDPP). The equation for measuring the value of risk using VaR with the SDPP approach was conducted through the following equation

............(11)

............(11)

where μ and σ are the mean and standard deviation of the asset return, Zα is the value of the α-th quantile of the Standard Normal distribution.

The nonparametric approach measures VaR without regard to the assumption of normality of stock return data, so it could be used on all data returns (Maruddani, 2019). The non-parametric method used in this study was Historical Simulation (HS). The following equation is the formula for determining VaR using the HS approach

.............(12)

.............(12)

where X is the return on assets, 1-α is the value of the confidence level, t is the length of the holding period, and φα is the α-th quantile of the sorted stock return data. The use of SDPP and HS method were intended to compare which method gave the best measurement results.

Analysis Procedures

The steps for valuing Blue Chip stocks using the GBM and VaR methods are as follows

1. Collecting Blue Chip stocks price data

2. Calculating the value of stock returns

3. Dividing the return data into two parts, namely in-sample and out-sample

4. Conducting in-sample data normality test

5. Calculating the parameter values of the GBM model, which include μ, σ, and σ2

6. Modeling and predicting stock prices using the Geometric Brownian Motion method

7. Testing the prediction accuracy using the RMSE and MAE methods

8. Calculating the value at risk of predictive stock prices using the HS and SDPP approaches.

Results and Discussion

In this study, the data consisted of 5 stock prices from 5 limited companies that were ranked in the top 5 for the IDX Blue Chip 2020 category. According to IDX Indonesia (IDX Indonesia, 2020b), the top 5 companies were Astra Agro Lestari (ASII.JK), Bank Central Asia (BBCA.JK), Bank Rakyat Indonesia (BBRI.JK), Jasa Marga (JSMR.JK), and United Tractor (UNTR.JK). AALI.JK is a public company in Indonesia with its business fields covering agriculture and plantations. In 2020, AALI.JK earned a net profit of IDR. 833.1 billion, the highest among all shares of agricultural and plantation companies listed on the IDX. The profit increased 7.8% from the previous year. Then, BBCA.JK and BBRI.JK are public banking companies owned by the Djarum Group (private sector) and the Indonesian government, respectively. BBCA.JK is the largest private bank in Indonesia with a net profit in 2020 of IDR 27.13 trillion. BBRI. JK is an Indonesian government-owned bank with the largest number of customers, namely 2,880,916 people in 2020 with total assets of IDR 177.31 trillion. The last 2 companies, JSMR.JK and UNTR.JK, are companies that engaged in toll road operations and industrial construction. The existence of an industrialization program in Indonesia, causing the progress of these 2 companies to increase. In 2020, the net profit earned by JSMR.JK and UNTRK.JK was IDR 501 billion and IDR 6 trillion, respectively. With the good progress of the company, many investors finally decided to invest in the company's shares.

The stock price data of the five companies to be analyzed was obtained from the website www.financeyahoo. co.id, with the period used was 07/30/2020 to 04/14/2021 (170 data). The descriptive statistical values for each stock price are shown in the following table:

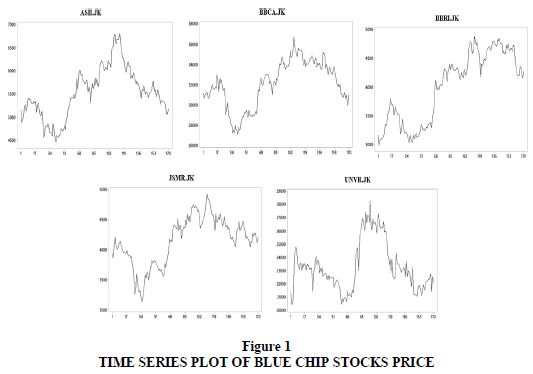

Based on Table 1, the stock with the highest standard deviation is BBRI.JK. This means that the changes of BBRI.JK prices are are the most volatile compared to other stocks. Furthermore, the following figure presents a plot of stock price movements in the period 07/30/2020 to 04/14/2021:

| Table 1 Descriptive Statistics of Stock Prices | |||||

| Variable | Obs | Mean | St.Dev | Min | Max |

| ASII.JK | 170 | 5,531.6 | 545 | 4,460 | 6,800 |

| BBCA.JK | 170 | 32,076.2 | 228.4 | 27,100 | 36,725 |

| BBRI.JK | 170 | 4,008.6 | 602.5 | 2,990 | 4,890 |

| JSMR.JK | 170 | 4,145.9 | 401.6 | 3,130 | 4,920 |

| UNTR.JK | 170 | 2,330.7 | 183.5 | 20,450 | 28,275 |

Based on Figure 1, the stock price movements are fluctuated. The lowest price happened around September 2020, when COVID-19 pandemic in Indonesia which is in a critical phase. But in general, there are no stocks that experience extreme price changes, so it can be said that the stock price is quite stable.

Blue Chip stocks valuation includes stock price predictions and predictions of the risk of loss starting by dividing the sample data into in-sample and out-sample data. In this study, 145 in-sample data were determined from 07/30/2020 – 03/08/2021, and 25 data from 03/09/21 – 04/14/21 became out-sample data. After the data in sample and out sample are determined, the return value for the data in a sample is measured. The following is the descriptive statistical value of stock return data in the sample Table 2:

| Table 2 Descriptive Statistics of Stock Returns in Sample | |||||

| Return of | Obs | Mean | St.Dev | Min | Max |

| ASII.JK | 144 | 0.00052 | 0.02308 | -0.07191 | 0.05741 |

| BBCA.JK | 144 | 0.00051 | 0.01782 | -0.07220 | 0.05515 |

| BBRI.JK | 144 | 0.00280 | 0.02405 | -0.06983 | 0.08067 |

| JSMR.JK | 144 | 0.00062 | 0.02452 | -0.07104 | 0.08097 |

| UNVR.JK | 144 | 0.00061 | 0.02742 | -0.07232 | 0.09942 |

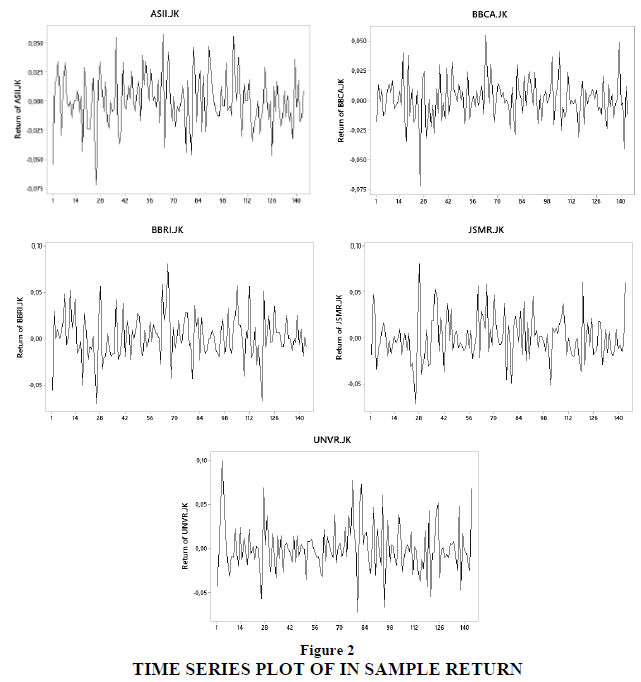

It is known that the average historical return value for each stock is positive, which indicates that, in general, the movement of stock returns and profits tends to be stable. The movement of the stock return value as a whole can be seen in the following Figure 2:

For each stock, the movement of the return value is stationary, meaning that there is no significant change in value or there are outliers. Modeling and predicting stock prices using the GBM method requires that stock return data follow the Normal distribution. The normality test of stock returns was carried out using the Kolmogorov-Smirnov test, and the test results obtained are in Table 3:

| Table 3 In Sample Return Normality Test Output | |||

| Return of | D | P-Value | Decision |

| ASII.JK | 1.107 | 0.172 | H0 accepted |

| BBCA.JK | 0.073 | 0.061 | H0 accepted |

| BBRI.JK | 0.878 | 0.424 | H0 accepted |

| JSMR.JK | 0.933 | 0.349 | H0 accepted |

| UNVR.JK | 1.225 | 0.099 | H0 accepted |

The Kolmogorov-Smirnov test in this research were used significance level α = 5%. Because of the p-value for every stock return > α, then H0 accepted (stock return are normally distributed). As the data are normally distributed, the analysis is continued to estimate the parameters of the GBM model. There are two parameters in GBM model, μ as mean value, and σ as volatility value. The parameter estimation results for each stock are as follows Table 4:

| Table 4 GBM Model Parameter Estimation | ||

| µ | s | |

| ASII.JK | 0.00052 | 0.02308 |

| BBCA.JK | 0.00051 | 0.01782 |

| BBRI.JK | 0.00280 | 0.02405 |

| JSMR.JK | 0.00062 | 0.02452 |

| UNVR.JK | 0.00061 | 0.02742 |

The parameter values of μ and σ are substituted into the GMB model in equation (7) to obtain the predicted value of each stock.

1. GBM model for ASII.JK stock price prediction

2. GBM model for BBCA.JK stock price prediction

3. GBM model for BBRI.JK stock price prediction

4. GBM model for stock price prediction JSMR.JK

5. GBM model for stock price prediction UNVR.JK

For each stock, stock price predictions were made for 26 periods, starting from 03/09/21 – 04/15/21. 03/09/21 – 04/14/21 is a prediction for out sample data. While 04/15/21 is a real prediction outside the out sample data. The following are the results of stock price predictions for out-sample data Table 5:

| Table 5 Blue Chip Stocks Prediction Results | |||||

| Date | ASII.JK | BBCA.JK | BBRI.JK | JSMR.JK | UNVR.JK |

| 03/09/21 | 5,495.47 | 33,847.67 | 4,705.08 | 4,337.05 | 23,589.97 |

| 03/10/21 | 5,321.29 | 33,396.01 | 4,756.99 | 4,418.85 | 23,393.78 |

| 03/12/21 | 5,275.15 | 33,273.95 | 4,785.38 | 4,499.94 | 22,132.34 |

| 03/15/21 | 5,351.93 | 32,502.79 | 4,673.46 | 4,591.82 | 21,384.79 |

| 03/16/21 | 5,591.24 | 32,490.49 | 4,749.44 | 4,708.70 | 21,035.65 |

| 03/17/21 | 5,531.43 | 32,008.93 | 4,658.11 | 4,385.20 | 21,413.26 |

| 03/18/21 | 5,639.95 | 31,187.23 | 4,690.11 | 4,123.48 | 22,346.41 |

| 03/19/21 | 5,814.11 | 31,473.29 | 4,713.22 | 4,430.73 | 22,300.33 |

| 03/22/21 | 5,685.46 | 31,698.35 | 4,737.88 | 4,381.16 | 22,289.66 |

| 03/23/21 | 5,558.37 | 31,601.29 | 4,720.30 | 4,074.46 | 21,663.73 |

| 03/24/21 | 5,706.55 | 31,900.48 | 4,717.18 | 4,086.87 | 20,820.81 |

| 03/25/21 | 5,723.95 | 31,510.84 | 4,743.86 | 3,962.96 | 20,741.66 |

| 03/26/21 | 5,601.68 | 31,529.69 | 4,610.05 | 3,854.52 | 20,773.30 |

| 03/29/21 | 5,649.60 | 31,393.99 | 4,590.55 | 3,982.54 | 20,854.80 |

| 03/30/21 | 5,715.29 | 31,625.25 | 4,519.86 | 4,117.18 | 21,943.36 |

| 03/31/21 | 5,550.19 | 31,260.45 | 4,471.02 | 3,932.15 | 22,297.42 |

| 04/01/21 | 5,541.39 | 31,971.60 | 4,349.33 | 4,012.43 | 22,144.20 |

| 04/05/21 | 5,478.76 | 32,168.87 | 4,387.62 | 3,969.47 | 21,948.50 |

| 04/06/21 | 5,494.58 | 31,191.68 | 4,191.35 | 4,151.12 | 22,604.42 |

| 04/07/21 | 5,636.42 | 30,262.86 | 4,199.05 | 4,155.25 | 22,184.16 |

| 04/08/21 | 5,210.55 | 30,349.65 | 4,159.55 | 4,243.51 | 22,318.00 |

| 04/09/21 | 5,208.73 | 30,042.31 | 4,037.71 | 4,184.81 | 22,414.18 |

| 04/12/21 | 5,129.63 | 29,977.95 | 3,994.58 | 4,123.17 | 21,935.31 |

| 04/13/21 | 5,030.18 | 29,565.57 | 4,047.11 | 4,117.08 | 22,207.91 |

The prediction result for each stock shows that the value tends to be stable and there are no extreme price changes. This condition is a very good opportunity for investors. because with a stable price, the investment will be safer from the risk of loss. Then, MAE and RMSE values were used as a reference to measure prediction accuracy. The MAE and RMSE values obtained based on the prediction data are Table 6:

| Table 6 Prediction Accuracy Test Using MAE And RMSE | |||||

| ASII.JK | BBCA.JK | BBRI.JK | JSMR.JK | UNVR.JK | |

| MAE | 130.28 | 816.37 | 102.61 | 120.86 | 510.56 |

| RMSE | 160.62 | 1,004.13 | 126.61 | 162.97 | 682.55 |

A prediction result is declared accurate if the value is close to the actual value. In addition, if the results of the accuracy measurement using MAE and RMSE will produce a small value. The results of stock price predictions on the five blue-chip stocks showed that the MAE and RMSE values obtained were small; therefore, in general, the stock price prediction results using the GBM model are accurate. The results of the accurate GBM test were in line with several previous studies. Syahriah and Pratiwi (2020), and Reddy and Clinton (2016), who conducted research on stock prices in Australia using GBM, obtained the results that the GBM model is very accurate with a MAPE value of 2.49%. The following table are the results of stock price predictions for the period 14-20 April 2021 Table 7:

| Table 7 Blue Chip Stock Price Prediction In 04/14/21 – 04/20/21 | |||||

| Date | ASII.JK | BBCA.JK | BBRI.JK | JSMR.JK | UNVR.JK |

| 04/14/21 | 5,038.69 | 29,640.02 | 4,167.23 | 4,153.78 | 22,337.34 |

| 04/15/21 | 5,035.72 | 29,680.82 | 4,130.24 | 4,190.23 | 22,350.21 |

| 04/16/21 | 5,123.78 | 29,703.41 | 4,204.28 | 4,142.22 | 22,401.82 |

| 04/19/21 | 5,090.23 | 29,903.52 | 4,220.22 | 4,209.56 | 22,359.09 |

| 04/20/21 | 5,007.21 | 29,805.32 | 4,170.73 | 4,192.87 | 22,387.92 |

Furthermore, the risk prediction of blue-chip stocks for the period 04/15/2021 is done by using VaR method. The result of risk prediction with the Historical Simulation and SDPP approaches at various confidence levels is represented in Tables 8 and 9.

| Table 8 Measurement Of VAR With Historical Simulation Approach | ||||

| Confidence Level (%) | ||||

| 90% | 95% | 97.50% | 99% | |

| ASII.JK | -0.02432 | -0.03221 | -0.05539 | -0.07856 |

| BBCA.JK | -0.02384 | -0.03023 | -0.03054 | -0.03085 |

| BBRI.JK | -0.02591 | -0.02973 | -0.03775 | -0.04576 |

| JSMR.JK | -0.06458 | -0.07118 | -0.07188 | -0.07258 |

| UNVR.JK | -0.03362 | -0.03969 | -0.04756 | -0.05543 |

| Table 9 Measurement Of VAR With SDPP Approach | ||||

| Confidence Level (%) | ||||

| 90% | 95% | 97.5% | 99% | |

| ASII.JK | -0.0249 | -0.03244 | -0.03899 | -0.0466 |

| BBCA.JK | -0.02375 | -0.03038 | -0.03614 | -0.04283 |

| BBRI.JK | -0.03391 | -0.04299 | -0.05086 | -0.06001 |

| JSMR.JK | -0.0306 | -0.04066 | -0.04939 | -0.05953 |

| UNTR.JK | -0.03027 | -0.04047 | -0.04932 | -0.05961 |

The results showed that the possible risk predictions were relatively small, with all risk predictions being less than 10%. This proved that investing in blue-chip stocks was relatively safe when assessed in terms of the risk of loss. As an additional interpretation, the SDPP VaR value of ASII.JK stock at the 95% confidence level was -0.03244. This means that the maximum amount of loss that may occur for the next period (04/15/2021) was 3.244% of the total invested funds.

Conclusion

In this article, a stock price valuation has been carried out which includes stock price prediction and loss risk prediction using the Geometric Brownian Motion and Value at Risk methods. Stock price predictions through the GBM method provide accurate results with relatively small RMSE and MAE values. Then, risk prediction using VaR with Historical Simulation and SDPP approaches at various confidence levels gives the result that the maximum possible loss for the next period (04/15/2021) is in the range of 2% to 6% of the total invested funds. This relatively small loss prediction value can at the same time justify that investment in the five stocks is quite safe.

Acknowledgement

This article is the output of Research and Development Research (RPP) funded from non-APBN sources at Diponegoro University for the 2021 Fiscal Year.

References

- Ahadiat, A., & Kesumah, F.S.D. (2021). Risk Measurement and Stock Prices during the COVID-19 Pandemic: An Empirical Study of State-Owned Banks in Indonesia. Journal of Asian Finance, Economics and Business, 8(6), 819–828.

- Agustini, F., Affianti, I.R., & Putri, E. (2018). Stock Price Prediction Using Geometric Brownian Motion. IOP Conf. Series: Journal of Physics: Conf. Series. 974 (012047), 1-11. Access: https://iopscience.iop.org/article/10.1088/1742-6596/974/1/012047

- Alhammouri, B., & Alkhadli, F. (2017). Risk Determinants and Investment Decisions: An Explanatory Study. Research Journal of Finance and Accounting, 8(20), 104-111.

- Azizah, M., Irawan, M.I., & Putri, E.R.M. (2020). Comparison of stock price prediction using geometric Brownian motion and multilayer perceptron. AIP Conference Proceedings, 2242, 1-16.

- Bank Indonesia. (2021). Statistik Ekonomi dan Keuangan Indonesia - April 2021. Retrieved June 7, 2021, from https://www .bi .go.id/id/ statistik/ekonomi-keuangan/seki/Pages/SEKI-APRIL-2021.aspx.

- Chai, T., & Draxler, R.R. (2015). Root Mean Square Error (RMSE) or Mean Absolute Error (MAE)? Arguments Against Avoiding RMSE in The Literature. Geoscientific Model Development, 7(2), 1247-1250.

- Hendarsih, I., & Harjunawati, S. (2020). Penggolongan Saham Blue Chip Berdasarkan Kapitalisasi Pasar Pada Bursa Efek Indonesia Tahun 2017-2020. Jurnal Akrab Juara, 5(2), 115-133.

- IDX Indonesia. (2020a). Annual Report Book 2020. Jakarta: PT Bursa Efek Indonesia Press.

- IDX Indonesia. (2020b). Daftar Saham Blue Chip Periode Maret 2021. Retrieved June 7, 2021, from https://www.idx.co.id/data-pasar/data-saham/daftar-saham-blue-chip-desember-2020/.

- Islam, M.R., & Nguyen, N. (2020). Comparison of Financial Models for Stock Price Prediction. Journal of Risk and Financial Management, 13(181), 1-19.

- Jishag, A.C., et al. (2020). Predicting the Stock Market Behavior Using Historic Data Analysis and News Sentiment Analysis in R. First International Conference on Sustainable Technologies for Computational Intelligence, 717-728

- Joseph, J.M. (2018). A study on the Information seeking and Investment Behaviour of Equity Investors. International Journal of Multidisciplinary Research Review, 3(9), 370-375.

- Kuchancur, A.B. (2015). Analysis of Investment in Financial and Physical Assets: A Comparative Study. International Journal of Research in Management, Economics & Commerce, 5(4), 61-76.

- Kusumawardani, R.A. (2019). Analisis Ukuran Risiko Expected Shortfall pada Indeks Pasar Saham. e-Proceeding of Engineering, 2046-2416.

- Likitratcharoen, D. et al. (2018). Value at Risk Performance In Cryptocurrencies. The Journal of Risk Management and Insurance, 22(1), 11-28.

- Maruddani, D.A.I. (2019). Value at Risk untuk Pengukuran Risiko Investasi Saham. Ponorogo: Wade Grup.

- Maruddani, D.A.I., & Trimono. (2020). Microsoft Excel untuk Pengukuran Value at Risk. Semarang: Undip Press.

- Miskolczi, P. (2017). Note on Simple and Logarithmic Return. Applied Studies in Agribusiness and Commerce. 11(1), 127-136.

- Ogawa, M.A., Costa, N.J., & Moralles, H.F. (2018). Value-at-Risk (VaR) Brazilian Real and currencies of emerging and developing markets. Gestao Producao, 25(3), 485-499.

- Pratama, I., Dharmawan, W., & Harini. (2015). Penentuan Nilai Value at Risk Pada Saham IHSG Menggunakan Model Geometric Brownian Motion Dengan Lompatan. E-Jurnal Matematika, 4(2), 67-73.

- Reddy, K., & Clinton, V. (2016). Simulation Stock Prices Using Geometric Brownian Motion: Evidence from Australian Companies. Australasian Accounting, Business and Finance Journal, 10(3), 23-47.

- Saputri, G.A., Suharsono, A., & Haryono. (2019). Analisis Value at Risk (VaR) pada Investasi Saham Blue Chips dengan Pendekatan Copula. Jurnal Sains dan Seni ITS, 8(2), 200-205.

- Si, R.K., & Bishi, B. (2020). Forecasting Short Term Return Distribution of S&P BSE Stock Index Using Geometric Brownian Motion: An Evidence from Bombay Stock Exchange. International Journal Of Statistics And Systems, 15(1), 29-45.

- Sorongan, F.A. (2017). Factors Affecting The Return Stock Company In Indonesia Stock Exchange (IDX) LQ45 In Years 2012-2015. Journal The Winners, 17(1), 37-45.

- Suwarno, A., & Mahadwartha, P.A. (2017). The Analysis of Portfolio Risk Management using VaR Approach Based on Investor Risk Preference. KINERJA, 21(2), 129-144.

- Syariah & Pratiwi, N. (2020). Pengukuran Value at Risk (VaR) Portofolio Optimal Pada Investasi Saham Bank Badan Usaha Milik Negara (BUMN) Menggunakan Metode Varian Covarian dan Metode Simulasi Monte Carlo. Jurnal Statistika Industri dan Komputasi, 5(1), 1-10.

- Tahir, S.H., Moazzam, M.M., & Sultana, N. (2020). Firm’s Risk and Capital Structure: An Empirical Analysis of Seasonal and Non-Seasonal Businesses. Journal of Asian Finance, Economics and Business, 7(12), 627–633.

- Trimono, Maruddani, D.A.I., & Ispriyanti, D. (2017). Pemodelan Harga Saham dengan Geometric Brownian Motion dan Value at Risk PT. Ciputra Development Tbk. Jurnal Gaussian, 6(2), 261-270.

- Wang, W., & Lu, Y. (2018). Analysis of the Mean Absolute Error (MAE) and the Root Mean Square Error (RMSE) in Assessing Rounding Model. . Proceedings of Materials Science and Engineering. 1-12.

- Widagdo, B. et al. (2019). Financial Ratio, Macro Economy, and Investment Risk on Sharia Stock Return. Journal of Asian Finance, Economics and Business, 7(12), 919 – 926.

- World Bank. (2021). Financial Sector. Retrieved June 7, 2021, from https://www.worldbank.org / en/ topic /financial sector/overview.

- Yuniningsih., Widodo, S., & Wajdi, M.B.N. (2017). An analysis of Decision Making in the Stock Investment. Jurnal Ekonomi & Hukum Islam, 8(2), 122-129.