Research Article: 2019 Vol: 22 Issue: 4

Board composition, diversity index and performance: Evidence from four major nigerian banks

ONUORAH A. C, Delta State University

Osuji C.C., Delta State University

Ozurumba, B.A, Federal University of Technology Owerri

Abstract

This study examined how corporate board composition (CBC) measures and diversity index affect the performance of some Nigerian Deposit Money Banks (NDMBs). It covered four banks within a 20 year period (1999-2017) using both time series and cross sectional data of audited reports of the banks understudied. In a bid to answer the research question posed on how CBC measures and diversity index affect the banks performance, nine hypotheses were postulated. Panel data was sourced from the Nigeria Stock Exchange fact book. Data obtained was also regressed via the use of E-views statistical tool. The study revealed a linear relationship between CBC measures and performance of the banks studied. Furthermore, it showed that Directors' Competence was a paramount determinant of board effectiveness. This implied that; knowledge, skills, and abilities acquired by directors are critical for board effectiveness in the Nigerian banking industry. It was found that the board diversity measures adopted in this study had a significant impact on the Return on Owners' Equity (ROE). This study is a relatively new concept in Nigeria and hence, was intended to be exploratory. Further studies, using quantitative approach to support some of the findings in the present study is recommended.

Keywords

Board Effectiveness, Corporate Board Composition, Board Age Index; Board Expertise Index, Shareholders’ Value

Introduction

The concepts of board composition is derived from the attribute or incentive variables that play a significant role in monitoring and controlling managers and can be described as a bridge between company management and shareholders (Dalton et al., 1998). Increased demands of shareholders for answerableness and transparency of a corporate firm, scandals of corporate firms and making financial markets less strict, brought the functions and characteristics of corporate board composition to the forefront of corporate governance deliberation (Ingley & Van der Walt, 2003). According to Mohamed et al. (2016), the most important part of a corporate firm is the board of directors (CBC). CBC plays an essential and very necessary role in every corporate firm in terms of corporate performance (Eluyela et al., 2019). Thus, corporate board set-ups have been established to be of immense importance to the total efficiency and effectiveness of every corporate organization. Kakanda et al. (2016a) stated that corporate performance of a firm can be determined based on its growth rate. However, there are contrary views as regards the assessment of corporate firm performance. Corporate firm performance is seen as the utilization of limited resources effectively and efficiently to achieve the overall objective of the institution (Marn & Romauld, 2012). Firm performance can be assessed when shareholders gain adequate compensation at the end of a financial year.

In measuring the performance of a corporate firm, the variables mostly used are return on capital employed (ROCE), return on asset (ROA) and return on equity (ROE). For a good corporate firm performance, it is supposed that agency cost is limited by board composition. But in reality, that is not the case (Mohamed et al., 2016). Similarly, board diversity can be regarded as board composition in terms of different variables such as age, gender, ethnicity, nationality, experience and educational background (Coffey & Wang, 1998; Erhardt et al., 2003). It has become a major debate within corporate firm governance of late. Struggles (2011) stated that nearly one in four board members of European boards is non-national, reflecting the search for international expertise. Also, the role of females on boards is gaining increasing attention. Previous research on gender differences shows that even though there are no much difference in effectiveness between men and women in corporate boards, there are some differences related to gender in terms of behavior and skills in certain situations (Yukl, 2002). Although ethnic and gender diversity has developed into a subject of necessary policymaking in several countries, with certain governments establishing certain elements of it, while others are simply providing tips for diversity. However, it is not yet obvious whether or not these policies can gain the required results. Theories from organization behavior, economic science and psychological science provide some link between board variety and company/firm monetary performance (Carter et al., 2010). Resource dependence theory proposes that board diversity holds the possibility of the knowledge provided by the company board to managers because of the special information controlled by numerous boards of administrators. Board diversity in terms of nationality and gender are probably likely to produce distinctive sets of knowledge that are out there to management for good decision-making (Berger & Neugart, 2012). Contrarily, a psychological science theory suggests that decision-making is also hampered with numerous boards of directors. Thus, numerous scholars see board diversity as a ‘‘two-edged sword’’ (Milliken & Martins, 1996), specifically decreasing cohesion and all too often disrupting group processes on one hand while also improving processes of the group on certain tasks, leading to higher-quality solutions. In this regard, academic research has not been able to show a clear relationship between effective board performance and board diversity.

Only just recently have studies on board diversity given some insight on the impacts of board diversity within management group on company’s performance. Similarly, the attention of research literature has also been on various board characteristics and their impact on firm performance (Dalton & Dalton, 2011; Nanka-Bruce, 2011; Rebeiz, 2015; Saibaba & Ansari, 2011; Uwuigbe et al., 2018). These board characteristics examined by previous researchers include board size, board meeting and board independence (Eluyela et al., 2019). Thus, the realization that board composition and board diversity are source of competitive advantage (Richard, 2000), calls for additional analysis into the relationship between them among company’s board members and firms performance. Thus, this paper analyses the effects of certain board compositions (board size, board enterprise, board equity holding, board meeting and board committees) and board diversity (gender, expertise and age) on the performance of some selected banking institutions in Nigeria.

Literature Review

As stated previously in the introductory section, there are lots of scholastic papers which have researched the connection between board composition measures, board variety and corporate performance. Corporate administration and performance of a bank has been considered by Oyerinde (2014), where he evaluated the extent corporate firm administration contributed to the financial crisis experienced in Nigeria particularly in the banking industry from 2000 to 2010. Panel data set was used by him to examine the pre and post Nigeria banks consolidation reforms, net interest income (NII) and return on equity (ROE) as indicators of bank performance and using variables such as related insider loan and number of board members as indicators to measure corporate governance. Findings from the study showed that insider loan had a negative relationship to bank performance while number of board members had a significant positive relationship to firm performance.

Gompers et al. (2003) has also studied corporate governance influence on firm performance. Governance index to proxy for the level of shareholder rights was constructed by the authors using the twenty-four (24) governance rule. The study revealed that firms with better shareholder rights had stronger performance, higher firm value and stronger sales growth than companies with weak shareholder rights. Similarly, many conceptual and empirical research works are in the literature on board diversity composition and firm performance. Anderson & Wallgren (2018) submitted that the involvement of at least a single woman director has a positive impact on shareholders’ value. Higher gender diversity on boards was also noted to have positive influence on shareholders’ value. For the purpose of this article, Board Gender Index (BGI) is denoted by the ratio of women directors to the sum total numbers of directors of the firms under in a given financial year. In recent times, the issue of women on board has gained much scholarly attention globally (Gordini & Rancati, 2017). Conyon & Mallin (1997) argued resiliently that, Board Gender diversity affects board’s effectiveness and performance, which as a result influences the company's financial prowess. Consequently, scholars suggest that females should be incorporated in companies' board-room. This later resulted to ethical and Economic school of thought (Isidro & Sobral, 2015). From the ethical viewpoint, proponents submitted that, it is unethical, injustice, and unconscionable for a board composition to be devoid of women directors on the basis of gender consciousness and lack of respect for diversity. They further added that, companies should add to their gender diversity so as to attain a more equitable, peaceable, and productive society (Isidro & Sobral, 2015). While the economic proponents suggest that companies with respect to the level of gender diversity within the board. Based on this, one may conclude that this be the reason why companies have heterogeneous boards composed of males and females, old and young, experienced and inexperienced board members and in some instance performs much better than companies with none (Gordini & Rancati, 2017). This study therefore focuses on the economic school of thought.

Prior studies have maintained that the number of women directors cannot be overemphasized, however such relationship tend to be either positive, negative or no relationship at all. Consequently, empirical studies view on this matter is divergent and inconsistent, and mixed (Upadhyaya & Puthenpyrackal, 2013; Gordini & Rancati, 2017). Specifically, Azmi & Barrett (2013) and Joecks et al. (2013) argued tenaciously that, women are meticulous, risk averse, skilled in accounting and finance, and good decision-makers. Hence, this has necessitated series of scholarly attention on the impact of Corporate Board Diversity and shareholders’ value. Furthermore, they explained that those boards with women are related to higher financial performance. They also emphasized that women are better supervisors than male counterpart because they attend board meetings more frequently, encourage their male counterparts to board meetings, and are more predispose to work on surveillance committees. These authors also concluded that, women directors' intense monitoring influences shareholder's value positively.

Similarly, Masulis & Mobbs (2010) in their study concluded female directors help to reduce the level of managerial conflicts on the board of firms, and they easily make use of board development activities, such as work instructions, evaluations, and development programs to improve board effectiveness and firms’ performance. However, Ahren & Dittmar (2012) gave a contrary view, concluding a negative relationship. In addition, Carter et al. (2010), Isidro & Sobral (2015) and Haslam et al. (2010) found no relationship between board gender diversity and shareholders’ value. Similarly, the antecedent empirical studies reveal that board dynamism influences shareholders’ value. According to the study, heterogeneous board composition leads to better and informed decision in comparison to homogenous board composition because board gender diversity increases the size of alternatives considered. This may in turn positively affect the quality of decision making and at the same time increase board independence (Hillman, 2015). Conversely, this more of a theoretical approach than been pragmatic approach (that is to say, it may not be true in its entirety in that homogenous board composition reduces the complication resulting from poor decision-making process and increase board efficacy and performance.

From the foregoing empirical analysis, the various empirical findings reported that the nature of relationship between women directors and shareholders’ value are not consistent. While some empirical studies hold a positive view on such relationship, others believe that such relationship tends to be negatively correlated.

Corporate Board Diversity guarantees a solid diverse affairs and foundation dependent on the board. It is the essential duty of the board to give quality help and guidance to the CEO and top administrators. The viability of these help and administrative jobs of the board will rely upon the boards' combined human capital that is regularly connected to foundation, experience and expertise of the board members. Various investigations argue that board variety in terms of directors’ professional experiences should prompt increasingly productive administration/skill/vital jobs of the board and, accordingly, to better performance.

The study of Petri & Soublin (2010) emphasized that board of directors should have some endearing experiences in order to gain the respect and confidence of the owners. According to Ujunwa (2012), board members with Ph.D. qualifications positively affected the performance in quoted firms in Nigeria. However, the issue of experience is a matter of how long a director have been with the company, which in reality, has no significant effect on firm’ shareholder value. Similarly, Torea et al. (2016) conducted a study on Board of directors’ effectiveness and the shareholder perspective of corporate board composition. The study measured board effectiveness from shareholders viewpoint using board independence, women director index, directors’ experience, board meetings attended; board committees as the corporate composition measures. The research indicated that board effectiveness positively influences the transparency of sustainability reports. The study concludes that board effectiveness under the shareholder viewpoint of board dynamism is also a valid construct under the stakeholder viewpoint. This connotes that board’s effectiveness may safeguard and guarantee shareholder value while satisfying other shareholders in the firm. Thus, this perspective, gave a broad view of the firm.

Theoretical Perspective

The theoretical perspective of this study revolves around the shareholders’ theory, the resource dependency theory and the theoretical stance for this article focused on the stewardship, and political theories. The Stewardship theory postulates that directors are considered as good and faithful stewards whose activities are in the best interest of the owners (Donaldson & Davis 1991).

Stakeholder's theory

Stakeholder theory holds that there should a symbiotic relationship between the company and its external and internal shareholders and that the company's value depends on the company’s ability to fulfill the need of its stakeholder (Cornell & Shapiro, 1987). In other words, the directors of firms are saddled with the responsibility of ensuring that both the internal and shareholders of the firm, their needs are met. These persons are affected directly or indirectly in one way or the other and that meeting their needs is meeting the need of the firm since they are the reason for the business. In other words, stakeholder theory states that the board of directors owes a responsibility to a wider group of shareholders other than just the shareholders of the company. A stakeholder in this case is any person or group persons which are affected directly or indirectly by the business activities. They include the company's employees, creditors, suppliers, community and even competitors. In more recent business models, the board of a corporate firm is viewed as a group of specialist appointed to convert the inputs of shareholders and other shareholders such as company's employees, creditors and suppliers into forms that are marketable, hence, earns rupees and other forms of returns back to its shareholders. This means that, the directors are expected to apply their expertise in pursuing the interest of the shareholders because that is the reason for their appointments. This is why this theory addresses the interests of the shareholders and the need for the directors to be intellectually capable of achieving the objectives of the shareholders and other shareholders, most important of which is to achieve higher firm value. Effective and efficient stakeholder is necessary for the company’s growth, sustainability and long-run success. The company has to take into cognizance shareholders to increase shareholder value. The company must ensure that its activities are in consonance with the different shareholders’ interests to avoid loss of profit and reputation (Harjoto et al., 2015).

The stakeholder theory has become more prominent in recent times because many researchers have now recognized that the activities and contributions of each director to the board are dependent on their expertise. Therefore, there is need to emphasize on the expertise of directors on the board. Hence, in this study, we also try to determine the effect of directors’ expertise Index on the firm value of selected firms in Nigeria.

Resources dependency theory (RDT)

RDT emphasizes that assets required by firms should be procured through a system of contacts and that the effectiveness in crossing over system holes will decide the nature of corporate performance. RDT depicts organization accomplishment as the capacity to amplify control by accessing scarce and fundamental assets. Corporate board can help firms in accessing vital assets that may some way or another be beyond their scope. Board members are viewed as critical limit spanners that safe important assets. Diversity of corporate board individuals has been observed to be an essential component in this hypothesis since it can prompt more extensive corporate systems and an improved investor’s value.

Stewardship theory

The fundamentals of the stewardship theory are based on social psychology, which focuses on the disposition and attitudes of executives. Hence, following the stewardship theory, directors, as good and faithful stewards are expected to improve the firm's performance and successfully satisfy the stakeholder groups in the organization. This means that more directors on the board can be regarded to be at a greater tendency of achieving higher financial performance.

This theory does not encourage a relatively small board size because it believes that when the board size is few, then the fate of the firm and the power to determine strategy would become the responsibility of a few persons. Thus, stewardship theory focuses on control rather than monitor. Attempts were made in this study to determine the influence of large board size on some Nigeria deposit money banks performance. Furthermore, Donaldson and Davis, cited in Akingunola et al. (2013), submitted that managers at the helm of affairs are good and faithful stewards who circumspectly work to attain a high level of profit and shareholders' returns. Hence, more directors on the board would encourage higher achievements.

On the other hand, political theory focuses on developing voting-support-approach from shareholders rather than by buying voting rights (power). Hence, having a politically-influenced board of directors is capable of affecting the firms ‘performance and shifting emphases from shareholders’ interests to directors' self-interest. This theory dwells more on the ownership structure of firms, such that people gain political influence in organizations through their share of ownership of the organization. When ownership is concentrated, then there are few shareholders with large shareholdings in the organization, significant enough to gain power and influence over the decisions of the board and management. This is because such Shareholders can buy the voting power of other shareholders and even members of the board, hence, resulting in managerial entrenchment. However, where ownership is dispersed, then there are many shareholders holding very few and an insignificant number of share. Hence, there is no tendency for them to influence the board or management and therefore, nobody can effectively buy voting power or control management or the board. In this study, we wish to determine if directors' equity holding is capable of contributing significantly to Nigerian’s deposit money banks performance and in what direction.

Based on the foregoing, the following nine hypotheses were proposed to guide the study:

Ho1: Large board size does not contribute to Nigerian’s deposit money banks performance

Ho2: Independent directors do not contribute to Nigerian’s deposit money banks performance

Ho3: Directors' equity holding does not contribute to Nigerian’s deposit money banks performance

Ho4: Board experience has no effect on selected banks performance in Nigeria

Ho5: Board committees have no significant effect on Nigerian’s deposit money banks performance

HO6: Presence of at least a single woman director (PWI) has no significant impact on shareholders’ value of selected banks in Nigeria.

HO7: Board Gender Index has no significant impact on shareholders’ value of selected banks in Nigeria.

HO8: Board Age Index has no significant impact on shareholders’ value of selected banks in Nigeria.

HO9: Board Expertise Index has no significant impact on shareholders’ value of selected banks in Nigeria.

Research Methodologies

In order to answer the research questions and hypothesis, four deposit money banks (Zenith Bank Plc, Access Bank Plc, Guarantee Trust Bank Plc and First Bank Plc) were chosen for the study. Sample period adopted for the study was 1999-2018 (20 years). These banks were chosen for the study because they were established around 1997 and still exist. Data were generated from the audited, annual financial statements/reports of the sampled banks as quoted on the Nigeria Stock Exchange (NSE). The choice of the study period was based on the availability of data that would permit the examination of the supposed impact.

Board Composition Measures Study

Data collection and analysis

The study employed the judgmental sampling technique which was ultimately used in drawing up the sample. Regression analysis to examine the relationship between the independent variable and the dependent variables of collected data was done using the E-view statistical software [version 7.0]. The test statistics estimation was done using Ordinary Least Square (OLS), Diagnostic Check, Unit root, Co-integration, and Granger Causality Test.

Variable Specification

The dependent variable in this study is financial performance while the independent variable is corporate board composition. The Financial Performance of the DMBs can be measured with Return on Asset (ROA), Return on Equity (ROE), Return on Investment (ROI), and Return on Capital Employee (ROC) or Profit after tax. This study however, used the Return on Equity (ROE) as the Financial Performance indicator. Some recent studies have also used the ROE for the determination of the performance of financial institutions (Edem, 2015; Abu et al., 2016). ROE as used in this study is the ratio of Profit after tax to total shareholder funds.

The independent variable corporate board was represented by the following measures:-

BRDS=Board Size; BRDX=Board Expertise; BRDE=Board Equity; BRDM=Board Meetings; BRDC=Board Committees

Although the Central Bank of Nigeria (CBN) Code of Corporate board composition addresses all corporate issues relating to the various parties to a firm such as shareholders, directors and management and other investors. However, we have selected the above listed corporate board composition measures related to board effectiveness because these indicators are geared towards ensuring that board of directors are effective at pursuing the interest of the owners which is to maximize profit.

Model Specification

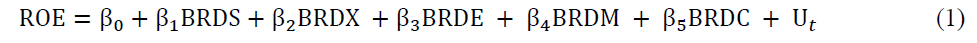

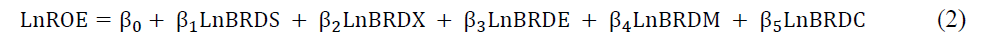

This study adopted an econometric model as shown in Eq. (1)

where:

ROE=Bank Performance; Return on Equity; BRDS=Board Size: Number of board members; BRDX=Board Expertise: Percentage of youthful board members between the age of 25 and 50 years; BRDE=Board Equity: Proportion of the Number of shares held by directors to the total shares in the company; BRDM=Board Meeting: The number of the meeting held by the directors during the period; BRDC=Board Committee: Board that checks the activities of directors

Apriori expectation

The apriori expectation is such that β1BRDS, β2BRDX, β3BRDE, β4BRDM, β5BRDC, β6WBRD>0. The implication of this is that a positive relationship is expected between explanatory variables (Board Size, Board Expertise, Board Equity, Board Meetings, and Board Committees) and the explained variable-Return on Equity (ROE). The size of the coefficient of regression helps in explaining various levels of relationship between the explanatory variables. For the sake of usage convenience, Eq. (1) was transformed into Eq. (2).

Corporate Board Diversity Study

Data collection and analysis

The data sourced are panel data (being a type of longitudinal data) in consonance with the findings of Gordini & Rancati (2017). The choice of this is because panel data unlike cross-sectional data examine data which are gotten from the same chosen cross-sectional units over a period of time. Moreover, panel data analysis ensures that heterogeneity problems (which tends to be inherent in the company's sample but are unobservable) are cancelled and thus provide a more reliable, up-to-date picture than cross-sectional data (Gordini & Rancati, 2017).

The Ordinary Least Square (OLS) regression analysis was used to analyze the data. Regression analysis was carried out to generate a report that shows clearly the relationship between both the dependent and independent variable. The OLS regression analysis was adopted in pari-pasu with other econometric tests such as the Augmented Dickey Fuller (ADF) test.

The ADF test is employed to test whether or not the data set are spurious or inconsistent. Co-integration test was used to check the presence of long-run connection among the data set or determine disparity from a data set.

Variable specification

Firms’ performance (dependent variable) was measured using Return on Equity (ROE) and it was calculated by dividing the company’s annual net income with its market value of equity for the year. The corporate board diversity (independent variable) considered includes P-Woman Index, Board gender index (BGI), Board Age Index (BAI), and Board Expertise Index (BEI). These variables were regressed against shareholders’ value measure- Return on Equity (ROE). The data on the selected variables were sourced from the Nigerian Stock Exchange Fact book (NSE, 2018) covering a period of 5 years (2014-2018).

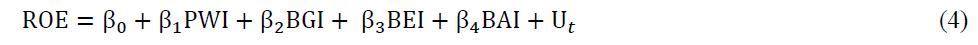

Model specification

In an attempt to answer the research questions, the study adopted the Ordinary Least Square (OLS) multiple regression analysis in line with the findings of Gordini & Rancati (2017). The model is mathematically represented as follows:

It is further represented as:

Where:

ROE=Return on Equity; PWI=Presence of at least one Woman director; BGI=Board Gender Index; BEI=Board Expertise Index; BAI=Board Age Index; β1-βn=Regression coefficients; β0=Constant; Ut=Stochastic Variable

Apriori expectation

On apriori, it is expected that 1PWI, 2BGI, 3BEI, 4BAI>0. This connotes a positive relationship expected between independent variables (PWI, Board Gender Index, Board Expertise Index, and Board Age Index) and shareholders’ value (Return on owners’' equity-ROE) (Table 1). The coefficient of correlation was used to explain various levels of relationship between the independent variables and the dependent variable.

| Table 1: Description Of The Dependent and Independent Variables | |||

| Denotation | Variable | Measurement | Reference |

|---|---|---|---|

| BGI | Board Gender Index | Ratio of women directors to the sum total numbers of directors | Upadhyaya & Puthenpyrackal, 2013; Gordini & Rancati, 2017; Azmi & Barrett, 2013 and Joecks et al., 2013 |

| PWI | Dummy variable for woman director | Presence of at least one woman director. | Gordini & Rancati, 2017 |

| BAI | Board Age Index | Percentage of young directors between the age of 25 and 50 years on the board. | Akpan and Rima, 2012 |

| BEI | Board Expertise Index | Ratio of board members with Ph.D qualification over board members with non | Ujunwa, 2012 |

| ROE | Return on Equity | Ratio of average asset to owners’ equity | Gordini & Rancati, 2017 |

Source: Researcher Computation, 2018.

Autocorrelation: This was used to analyze the presence of auto/serial-correlation in the data set. It was verified using D-Watson Statistics (DWS). If DWs is closer to 2, it would signify weak/no auto-correlation. Where it is 0 or close to 0 signifies perfect positive auto-correlation, and 4 or 3.5 connote perfect negative auto-correlation. Table 1 shows the description of the dependent and independent variables.

Variable measurement

Following subsequent empirical studies, various board diversity and shareholders’ value measures had been employed by empiricists (Gordini & Rancati, 2017). However, this study specifically adopted five variables in order to measure board diversity and one variable to measure shareholders’ value. This included a control variable (PWI), Board gender index, board age index and Board Expertise Index.

Result and Discussion

OLS Results of the Banks

The OLS results for the four banks studied are shown in Tables 2 to 5.

| Table 2: Access Bank Nigeria Plc Ols Results For Specific Variables | ||||

| Variables | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Dependent: ROE (C) | 13217.57 | 1308.585 | 10.10066 | 0.0000 |

| Independents: BRDS | 1.092949 | 0.387878 | 2.817768 | 0.0145 |

| BRDX | 5993.003 | 2697.104 | 2.222014 | 0.0476 |

| BRDE | 37.32572 | 17.43217 | 2.141198 | 0.0432 |

| BRDM | 32.42165 | 11.27524 | 2.875473 | 0.0312 |

| BRDC | 262.1695 | 26.23359 | 9.993658 | 0.0000 |

OLS Results for Overall Variables: R2=0.993385 AdjR2=0.990332 F-stat =325.3858 Prob. (F-Stat)=0.000 Dw=2.02. Source: Output Results Computed from E-view 7.0 (2018).

| Table 3: Ols Results For Specific Variables For First Bank Nigeria Plc | ||||

| Variables | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Dependent: ROE (C) | 13354.84 | 52708.89 | 0.253370 | 0.8039 |

| Independents: BRDS | 31.40671 | 12.87250 | 2.439829 | 0.0461 |

| BRDX | 81.96115 | 29.66306 | 2.763072 | 0.0161 |

| BRDE | 100.0141 | 48.11724 | 2.078550 | 0.0411 |

| BRDM | 93.65972 | 40.66145 | 2.303403 | 0.0481 |

| BRDC | 9485.981 | 3794.601 | 2.499862 | 0.0266 |

OLS Results for Overall Variables: R2 = 0.963740 AdjR2 = 0.930081 F-stat =16.46966 Prob. (F-stat) = 0.002 Dw = 1.72: Source: Output Results Computed from E-view 7.0 (2018).

| Table 4: Ols Results For Specific Variables For Guarantee Trust Bank | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Dependent: ROE (C) | 2.426754 | 0.307745 | 7.885595 | 0.0000 |

| Independents: BRDS | -0.184168 | 0.037313 | -4.935823 | 0.0003 |

| BRDX | 0.199351 | 0.100912 | 1.975486 | 0.0717 |

| BRDE | -0.035802 | 0.112928 | -0.317032 | 0.7567 |

| BRDM | -0.229998 | 0.142258 | -1.616760 | 0.1319 |

| BRDC | -0.244244 | 0.117677 | -2.075548 | 0.0601 |

OLS Results for Overall Variables: R2 = 0.840242 AdjR2 = 0.810362 F-stat = 31.46807 Prob. (F-stat) = 0.001 Dw = 1.45; Source: Output Results Computed from E-view 7.0 (2018).

| Table 5: Ols Results For Specific Variables Zenith Bank Nigeria Plc | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Dependent: ROE (C) | 77745.16 | 13014.50 | 5.973734 | 0.0000 |

| Independent: BRDS | 60.34156 | 20.67812 | 2.918136 | 0.0310 |

| BRDX | 59124.00 | 29514.00 | 2.003253 | 0.0424 |

| BRDE | 76248.10 | 13462.30 | 5.663824 | 0.0101 |

| BRDM | 34900.20 | 12500.80 | 2.791837 | 0.0401 |

| BRDC | 47582.40 | 11428.60 | 4.163449 | 0.0006 |

OLS Results for Overall Variables: R2=0.989000 AdjR2=0.985000 F-stat=4.222229 Prob. (F-stat)=0.000 Dw=2.21; Source: Output Results Computed from E-view 7.0 (2018).

The coefficient of the specific independent variables has the values shown in Tables 2-5 for Access, First, Guarantee Trust and Zenith Banks respectively. Tables 2 to 5 show that there is a positive significant relationship between ROE and each of BRDS, BRDX, BRDC, BRDE and BRDM in the four banks. The R2 which measures the magnitude of the relationship between the overall independent variables (BRDS, BRDX, BRDE, BRDM, BRDC, WBRD), and the dependent variable ROE is 0.9934, 0.964, 0.840 and 0.989 for Access, First, Guarantee Trust and Zenith Bank respectively. These indicate that the independent variables had a strong positive relationship to the dependent variable (ROE). This was also confirmed by the P-values of F-stat of the different banks as shown in Table 2. AdjR2 value of 0.9903, 0.9301, 0.8104, 0.9850 were obtained for Access, First, Guarantee Trust and Zenith Bank respectively and showed that the degree of variation to which the independent variables could explain the dependent variable was 99%, 93%, 81% and 99% for Access, First, Guarantee Trust and Zenith Bank respectively. The Durbin Watson stat used to test the presence of autocorrelation in the series had value of 2.02, 1.72, 1.45, 2.21 2.21 for Access, First, Guarantee Trust and Zenith Bank respectively and showed that the series was a good model fit for prediction.

Diagnostic Test Result

The summary of the diagnostic test results of selected banks is shown in Table 6.

| Table 6: Summarized Diagnostic Test Results Of The Banks | ||||||||||||

| Banks | Jarque-Bera Stat. (JB) Normality test | Breusch Godfrey (BGS) Serial correlation | Breusch Pagan Codfrey (BPC) Heteroskedasticity | Ramsey Reset test Stability | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jarque-Bera | p-Value | F-Stat | p-value | R2 | p-value | F-Stat | p-value | R2 | p-value | F-stat | p-value | |

| Access | 1.71 | 0.43 | 1.29 | 0.31 | 3.80 | 0.150 | 0.95 | 0.49 | 6.09 | 0.41 | 15.197 | 0.002 |

| First bank | 1.45 | 0.49 | 0.58 | 0.58 | 1.91 | 0.384 | 1.70 | 0.199 | 8.78 | 0.19 | 0.007 | 0.935 |

| GTB | 0.61 | 0.74 | 1.12 | 0.36 | 3.48 | 0.18 | 1.07 | 0.43 | 6.64 | 0.36 | 60.397 | 0.000 |

| Zenith | 0.41 | 0.81 | 8536.95 | 0.00 | 19.99 | 0.00 | 4.61 | 0.01 | 13.60 | 0.03 | 4.357 | 0.070 |

From Table 6, normality test by Jarque-Bera shows that Access Bank Plc, First Bank Plc, GTB Plc, and Zenith Bank Plc series are well distributed and are normal. The serial correlation test by Breusch Godfrey Serial Correlation (BGS) revealed that there was no existence of serial correlation among the independent variables and ROE. Heteroskedasticity by Breusch Pagan Godfrey (BPC) revealed that the variables did not have heteroscedasticity. The stability test of Ramsey Reset test revealed that the series is in functional form and stable over the period of the study. The results of the Diagnostic test confirm that the assumption of OLS model is satisfactory; thereby OLS test to be maintained.

Unit Root Test Results

The unit root test results of the four banks studied in this research are shown in Tables 7, Table 8, Table 9 and Table 10.

| Table 7: Access Bank Unit Root Results | |||||||||

| Variable | Order | ADF Result | t-statistic 5% | ADF p-value | c-value | Decision | Conclusion | ||

|---|---|---|---|---|---|---|---|---|---|

| ROE | 1(1) 1st Diff | -3.966620 | > | -3.049970 | 0.0076 | < | 0.05 | No unit root | Stationary |

| BRDS | 1(1) 1st Diff | -3.271074 | > | -3.052169 | 0.0332 | < | 0.05 | No unit root | Stationary |

| BRDX | 1(1) 1st Diff | -3.942469 | > | -3.029970 | 0.0081 | < | 0.05 | No unit root | Stationary |

| BRDE | 1(1) 1st Diff | -6.195915 | > | -3.040391 | 0.0001 | < | 0.05 | No unit root | Stationary |

| BRDM | 1(1) 1st Diff | -6.608366 | > | -3.052169 | 0.0001 | < | 0.05 | No unit root | Stationary |

| BRDC | 1(1) 1st Diff | -3.892007 | > | -3.040391 | 0.0093 | < | 0.05 | No unit root | Stationary |

| Table 8: First Bank Unit Root Result | |||||||||

| Variable | Order | ADF Result | t-statistic 5% | ADF p-value | c-value | Decision | Conclusion | ||

|---|---|---|---|---|---|---|---|---|---|

| ROE | 1(1) 1st Diff | -3.938131 | > | -3.040391 | 0.0085 | < | 0.05 | No unit root | Stationary |

| BRDS | 1(1) 1st Diff | -1.908822 | < | -3.052169 | 0.3207 | > | 0.05 | Unit root | Not Stationary |

| BRDX | 1(1) 1st Diff | -4.351220 | > | -3.040391 | 0.0037 | < | 0.05 | No unit root | Stationary |

| BRDE | 1(1) 1st Diff | -4.140638 | > | -3.040391 | 0.0056 | < | 0.05 | No unit root | Stationary |

| BRDM | 1(1) 1st Diff | -4.029986 | > | -3.040391 | 0.0070 | < | 0.05 | No unit root | Stationary |

| BRDC | 1(1) 1st Diff | -5.366563 | > | -3.040391 | 0.0005 | < | 0.05 | No unit root | Stationary |

| Table 9: Guarantee Trust Bank Unit Root Result | |||||||||

| Variable | Order | ADF Result | t-statistic 5% | ADF p-value | c-value | Decision | Conclusion | ||

|---|---|---|---|---|---|---|---|---|---|

| ROE | 1(1) 1st Diff | -3.143035 | > | -3.040391 | 0.0412 | < | 0.05 | No unit root | Stationary |

| BRDS | 1(1) 1st Diff | -3.434199 | > | -3.040391 | 0.0234 | < | 0.05 | No unit root | Stationary |

| BRDX | 1(1) 1st Diff | -4.011965 | > | -3.081002 | 0.0091 | < | 0.05 | No unit root | Stationary |

| BRDE | 1(1) 1st Diff | -4.218106 | > | -3.081002 | 0.0062 | < | 0.05 | No unit root | Stationary |

| BRDM | 1(1) 1st Diff | -4.248063 | > | -3.065585 | 0.0053 | < | 0.05 | No unit root | Stationary |

| BRDC | 1(1) 1st Diff | -3.686145 | > | -3.119910 | 0.0190 | < | 0.05 | No unit root | Stationary |

| Table 10: Zenith Bank Unit Root Result | |||||||||

| Variable | Order | ADF Result | t-statistic 5% | ADF p-value | c-value | Decision | Conclusion | ||

|---|---|---|---|---|---|---|---|---|---|

| ROE | 1(0) Level | -5.862027 | > | -3.049970 | 0.0001 | < | 0.05 | No unit root | Stationary |

| BRDS | 1(1) 1st Diff | -4.589390 | > | -3.040391 | 0.0023 | < | 0.05 | No unit root | Stationary |

| BRDX | 1(1) 1st Diff | -5.862027 | > | -3.049970 | 0.0001 | < | 0.05 | No unit root | Stationary |

| BRDE | 1(1) 1st Diff | -4.030702 | > | -3.040391 | 0.0070 | < | 0.05 | No unit root | Stationary |

| BRDM | 1(1) 1st Diff | -3.765267 | > | -3.049970 | 0.0115 | < | 0.05 | No unit root | Stationary |

| BRDC | 1(1) 1st Diff | 5.828003 | > | -3.040391 | 0.0010 | < | 0.05 | No unit root | Stationary |

The unit root test of ADF, tested for the existence of unit root in the series. The result obtained showed a nonexistence of unit root as the ADF result is greater than the critical value of 0.05 significant levels. The test confirms that the series of Access, First, Guarantee Trust and Zenith banks are stationary.

The Johansen Co-Integration Output for the Banks

Also, the Maximum Eigenvalue (ME) co-integrating Rank Test suggests two (2) co-integration equation vectors as suggested in trace statistics. However, as reported by Cheung and Lai (1993), trace statistics is more conclusive than Maximum Eigen statistics. Therefore, based on this, the study concludes with both Log likelihood of trace statistics (TS) having (3) co-integrating vectors and Maximum Statistics having (2) co-integrating vectors. The Johansen Co-integration test only identifies the long-run relationship among the variable which was approved by the unit root differentiation at 1(1) stationarity test, not the short run which could be identified by Vector Error Correlation Model (VECM) and Vector Auto Regression (VAR).

Total Number of Women Directors

Table 11 shows the annual women representation in the board of the banks studied.

| Table 11: Annual Women Representation | |||||

| Women Director Representation | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Women Director | 120 (15.73%) | 135 (17.69%) | 149 (19.53%) | 165 (21.63%) | 194 (25.42%) |

| Firms with at least one woman director | 90 (90%) | 91 (91%) | 91 (91%) | 91 (91%) | 91 (91%) |

Source: Authors Computation (2018).

Table 11 shows that in 2014, 2015 and 2018, the total number of women directors was 120(15.73%), 135 (17.69) and 194 (25.42%) respectively.

From Table 12, the highest mean score and Standard deviation (S/D) was recorded by ROE with a mean value of 1.384 kb and S/D value of 1.695 kb respectively.

| Table 12: Descriptive Statistics From The Variables | ||||||

| Variables | Mean | Median | S/D | Minimum | Maximum | Observation |

|---|---|---|---|---|---|---|

| ROE | 1.384 | 0.938 | 1.695 | 0.018 | 17.640 | 400 |

| PWI | 0.930 | 1.00 | 0.251 | 0.00 | 1.00 | 400 |

| BGI | 0.280 | 0.286 | 0.126 | 0.00 | 0.600 | 400 |

| BAI | 0.367 | 0.408 | 0.135 | 0.00 | 0.500 | 400 |

| BEI | 0.541 | 0.598 | 0.169 | 0.00 | 0.690 | 400 |

Source: Authors Computation (2018).

Likewise, Board Gender Index (BGI) had the lowest mean and SD value of 0.280 and 0.126 respectively. Also, the Return on Asset had a low SD of 0.1627 (16.27%). The ROE had maximum and minimum values of 17.640 and 0.018 respectively. Dummy variable for women directors (D-Woman), Board Gender Index (BGI), Board Age Index and Expertise Index denoted by BEI had a maximum value of 0.100, 0.600, 0.500, and 0.690 respectively. The variables all had 0.00 as their minimum values. The unit root test of ADF proved the absence of unit root as the ADF result was greater than the t-statistic at 5% and the ADF p-value was less than the critical value at 0.05 level of significant. The test confirms that the series of Nigerian firms are stationary.

From Table 13, the correlation result shows a positive correlation between the dependent variable (ROE) and the independent variables (Presence of at least one Woman director, Board Gender Index, Board Expertise Index and Board Age Index).

>

| Table 13: Group Correlation Matrix Of Studied Variables | |||||

| pwi | bgi | bei | bai | roe | |

|---|---|---|---|---|---|

| pwi | 1.0000 | ||||

| bgi | 0.2414 | 1.0000 | |||

| bei | 0.4721 | 0.3882 | 0.3464 | ||

| bai | 0.2723 | 0.2464 | 0.3464 | 1.0000 | |

| roe | 0.4882 | 0.4414 | 0.4414 | 0.2768 | 1.0000 |

Source: Authors Computation (2018)

Woman Director (PWI) and Shareholders' Value

This study showed that the presence of at least a single woman Director (PWI) is positively significant to shareholders’ value of the selected Nigerian banks in the period under study. This implies that an increase in the involvement of at least a woman director in the board room would contribute immensely to the overall performance of the firm and the resulting shareholders’ value. Thus, the null hypotheses was rejected and the alternative “There is a positive and significant relationship between the presence of at least a single woman Director (PWI) and shareholders’ value of selected firms in Nigeria” accepted. Ujunwa (2012) had earlier reported that while woman director presence and proportion have positive influence on financial performance, the board size had a neutral effect.

Board Gender Index (BGI) and Shareholders’ Value

Findings from this study also showed a positive but insignificant relationship existed between board gender diversity and shareholders’ value of the selected Nigerian banks. This is in tandem with reality, been that the involvements of more women director may not necessary result or contribute significantly to a firm's shareholder value. Also, this study is in tandem with works of Gallego-Alvarez et al. (2010) and Isidro & Sobral (2015). However, it is contrary to the findings of Gordini & Rancati (2017). The null hypothesis was again rejected at 5% significant level and the alternative accepted “there is a positive and significant relationship between Board Gender Index (BGI) and shareholders’ value of selected firms in Nigeria”. The Board Expertise Index suggested that board gender diversity had a positive significant effect on shareholders’ value connoting that board gender diversity contributed immensely on shareholders’ value creation process. This is in consonance with the findings of Petri & Soublin (2010); and Unjunwa (2012). Furthermore, the Board Age index measurement showed that board gender diversity had a positive significant effect on shareholders’ value connoting that board gender diversity. On the overall, based on the empirical findings of this study, greater board gender diversity was found to positively influence shareholder value. Shareholders should therefore endeavor to have gender diverse boards with right balance. It is also advised that the board of directors be elected based on competence. A previous local study within the Nigerian context revealed a negative relationship between gender diversity and the performance of a firm performance. The study also further showed that board nationality and board ethnicity were positive in predicting performance (Ujunwa et al., 2012).

Conclusion and Recommendations

The study shows that there is a linear relationship between corporate board composition measures and performance of the selected Nigerian Banks between 1999 and 2018. Access bank plc and Zenith bank Plc were found to have adopted strict corporate board composition measures. The results revealed that competence (skills and information) of board members was viewed as the most critical determinants of board efficiency. The investigation being generally new in Nigeria is planned to be exploratory and should prompt further examinations that would utilize quantitative way to substantiate some of the preliminary findings. Knowledge, skills, and abilities possessed by directors were found to be critical for board effectiveness in the Nigerian banking industry. The study further found that PWI, Board Age Index-BAI; and Board Expertise Index-BEI was positively and significantly related to shareholders value of selected Nigerian banks and showed that a unit (percentage) rise in PWI, Board Age Index-BAI; and Board Expertise Index-BEI would to a percentage increase in shareholders’ value. In another hand, findings from the study revealed a positive but insignificant relationship between board gender diversity and shareholders’ value of selected Nigerian banks. Board Age index and Board Expertise Index measurements suggested that board gender diversity had a positive and significant effect on shareholders’ value. Consequently, the study suggested:

1. The deliberate allowance of gender diverse boards with the right balance between male and female;

2. The election of Board of directors based on competence;

3. Managers of firms should uphold the principle of accountability, transparency and teamwork.

4. Management of banks in Nigeria should focus more on expertise, and experience since it has been found to be more significant to CBC measures. This on the long-run builds integrity, reputation, and professionalism on the system as well as motivates workers to possess the spirit of mutualism, creativity, and teamwork.

References

- Abu, S. N., Oklieh, A. J. &amli; Oklie, U. J. (2016). Board size and financial lierformance of deliosit money banks in Nigeria. International Journal of Business and Social Science, 7(9), 1-15.

- Ahren, K. R., &amli; Dittmar, A. K. (2012). The changing of the boards: the imliact on firm valuation of mandated female board reliresentation. Quarterly Journal of Economics, 127(1), 137- 197.

- Akingunola, R. O., Adekunle, O. A. &amli; Adedilie, O. A. (2015). Corliorate board comliosition and bank’s lierformance in Nigeria. Euroliean Journal of Business and Social Sciences, 2(8), 89-111.

- Aklian, N. &amli; Rima, T. (2012). Internal control and bank fraud in Nigeria. Economic Journal, 95, 118-132.

- Anderson, T. &amli; Wallgren, O. (2018). Board gender diversity and firm financial lierformance. An unliublished master thesis submitted to Jonkoliing international School, Sweden.

- Azmi, I. A. G. &amli; Barrett, M. A. (2013). Women on boards and comliany financial lierformance: A study of Malaysian SMEs. liroceedings of 3rd Global Accounting, Finance and Economics Conference, 5-7 May, 2013, Rydges Melbourne, Australia.

- Berger, H. &amli; Neugart, M. (2012). How German labor courts decide: an econometric case study. German Economic Review, 13(1), 56-70.

- Carter, D. A., D'Souza, F., Simkins, B. J., &amli; Simlison, W, G. (2010). The gender and ethnic diversity of us boards and board committees and firm financial lierformance. Corliorate Governance: An International Review, 18(5), 396-414.

- Cheung, Y. W., &amli; Lai, K. S. (1993). Finite-samlile sizes of Johansen's likelihood ratio tests for cointegration. Oxford Bulletin of Economics and Statistics, 55, 313-328.

- Coffey, B. &amli; Wang, J. (1998). Board diversity and managerial control as liredictors of corliorate social lierformance. Journal of Business Ethics, 17(14), 1595-1603.

- Conyon, M. J., &amli; Mallin, C. (1997). Women in the boardroom: evidence from large UK comlianies. Corliorate Governance: An International Review, 5(3), 112-117.

- Cornell, B., &amli; Shaliiro, A. C. (1987). Corliorate shareholders and corliorate finance. Financial Management, 16(1), 5-14.

- Dalton, D. R. &amli; Dalton, C. M. (2011). Integration of micro and macro studies in governance research: CEO duality, board comliosition and financial lierformance. Journal of Management, 37, 404-411.

- Dalton, D. R., Daily, C.M., Ellstrand, A. E. &amli; Johnson, J. L. (1998). Meta-analytic reviews of board comliosition, leadershili structure and financial lierformance. Strategic Management Journal, 19(3), 269-290.

- Donaldson, L. &amli; Davis, J. H. (1991). Stewardshili theory or agency theory: CEO governance and Shareholder returns. Australian Journal of Management, 16(1), 49-64.

- Edem, O. A. (2015). Corliorate board meeting and comliany lierformance: emliirical evidence from Nigerian quoted comlianies. Global Journal of Commerce and Management liersliective, 4(1), 75-82.

- Eluyela, D. F.,Adetula, T. D.,Obasaju, O. B.,Ozordi, E., Akintimehin, O.,liolioola, O. (2019). Foreign directors, indigenous directors and dividend liayout structure in Nigerian deliosit money banks. Banks and Bank Systems, 14(2), 181-189.

- Erhardt, N., Werbel, J. &amli; Shrader, C. (2003). Board of director diversity and firm financial lierformance. Corliorate Governance, 11(2), 102-111.

- Gallego-Alvarez, I., Garcia-Sanchez, I.M., &amli; Rodriguez-Dominguez, L. (2010) The influence of gender diversity on corliorate lierformance. Revista de Contabilidad, 13(1), 53-88.

- Gomliers, li. A., Ishii, J. L. &amli; Metrick, A. (2003) Corliorate governance and equity lirices. Quarterly Journal of Economics, 118(1), 107-155.

- Gordini, N., &amli; Rancati. E. (2017). Gender diversity in the Italian boardroom and firm financial lierformance. Management Research Review, 40(1), 75-94.

- Harjoto, M., Laksmana, I., &amli; Lee, R. (2015). Board diversity and corliorate social reslionsibility. Journal Business Ethics, 132(4), 641-660.

- Haslam, S. A., Ryan, M. K., Kulich, C., Trojanowski, G., &amli; Atkins, C. (2010). Investing with lirejudice: The relationshili between women’s liresence on comliany boards and objective and subjective measures of comliany lierformance. British Journal of Management, 21(2), 484-497.

- Hillman, A. (2015). Board diversity: Beginning to unlieel the onion. Corliorate Governance: An International Review, 23(2), 104-107.

- Ingley, C.B. &amli; Van der Walt, N.T. (2003). Board configuration: building better boards. Corliorate governance 3(4), 5-17.

- Isidro, H., &amli; Sobral, M. (2015). The effects of women on corliorate boards on firm value, financial lierformance, and ethical and social comliliance. Journal of Business Ethics, 132(1), 1-19.

- Joecks, J., liull, K. &amli; Vetter, K. (2013). Gender diversity in the board-room and firm lierformance: what exactly constitutes a critical mass? Journal of Business Ethics, 118(1), 61-72.

- Kakanda, M. M., Bello, A. B. &amli; Abaa, M., (2016a). Effect of caliital structure on the lierformance of listed consumer goods comlianies in Nigeria. Research Journal of Finance and Accounting, 7(8), 211-219.

- Marn, J. T. K. &amli; Romuald, D. F. (2012). The imliact of corliorate governance mechanism and corliorate lierformance: a study of listed comlianies in Malaysia. Journal of Advanced Science and Arts, 3(1), 31-45.

- Masulis, R. &amli; Mobbs, S. (2010). Are all inside directors the same? Journal of Finance, 66(3), 823-872.

- Milliken, F. J. &amli; Martins, L. L. (1996). Searching for common threads: understanding the multilile effects of diversity in organizational groulis. Academy of Management Review, 21(2), 402-433.

- Mohamed, S., Ahmad, K. &amli; Khai, K. (2016). Corliorate governance liractices and firm lierformance: evidence from toli 100 liublic listed comlianies in Malaysia. lirocedia Economics and Finance, 35, 287-296.

- Nanka-Bruce, D. (2011). Corliorate governance mechanisms and firm efficiency. International Journal of Business and Management, 6(5), 28-41.

- Nigerian Stock Exchange Fact book (2018). Retrieved January 15, 2019.

- Oyerinde, A. A. (2014). Corliorate governance and bank lierformance in Nigeria: further evidence from Nigeria. International Journal of Business and Management, 9(8), 133-139.

- lietri, T. &amli; Soublin, R. (2010). Turbulent times require a greater focus on board effectiveness. Strategic HR Review, 9(4), 20-27.

- Rebeiz, K. S. (2015). Boardroom’s indeliendence and corliorate lierformance: the ever-elusive conundrum. Corliorate Governance, 15(5), 747-775.

- Richard, O. C. (2000). Racial diversity, business strategy, and firm lierformance: A resource-based view. Academy of Management Journal, 43(2), 164-77.

- Saibaba, M. D. &amli; Ansari, V. (2011). Audit committees and corliorate governance: a study of selected comlianies listed in the Indian bourses. The IUli Journal of Accounting Research &amli; Audit liractices, 10(3), 46-54.

- Struggles, H. (2011). Euroliean corliorate governance reliort 2011-challenging board lierformance.

- Torea, N. G., Feijoo, B. F. &amli; Cuesta, M. (2016). Board of director’s effectiveness and the stakeholder liersliective of corliorate governance: Do effective boards liromote the interest of Shareholders and Shareholders? BRQ Business Research Quarterly, 19, 246-260.

- Ujunwa, A. (2012). Board characteristics and the financial lierformance of Nigerian quoted firms", Corliorate Governance, 12(5), 656-674.

- Ujunwa, A., Okoyeuzu, C. R.,Nwakoby, I. (2012). Corliorate Board Diversity and Firm lierformance: Evidence from Nigeria. Corliorate Ownershili &amli; Control, 9(2), 2016-226.

- Uliadhyaya, O. R. &amli; liuthenliyrackal, S. A. (2013). The effect of board size on financial lierformance of banks in Nigeria. International Journal of Economics and Finance, 4(20), 260-267.

- Uwuigbe, U., Eluyela, D. F., Uwuigbe, O. R., Obaraklio, T. &amli; Falola, I. (2018). Corliorate governance and quality of financial statements: a study of listed Nigerian banks. Banks and Bank Systems, 13(3), 12-23.

- Yukl, G. (2002). Leadershili in Organizations. lirentice Hall, Ulilier Saddle River, NJ.