Research Article: 2025 Vol: 28 Issue: 4

Board Gender Dynamics & Firm Performance: An Analysis & Empirical Evidence

Prodip Chandra Bishwas Department of Finance and Banking, Jahangirnagar University

Mohammed Sawkat Hossain Department of Finance and Banking, Jahangirnagar University

Citation Information: Bishwas, P.C. & Hossain, M.S. (2024). Board gender dynamics & firm performance: an analysis & empirical evidence. Journal of Management Information and Decision Sciences, 27 (2), 1-14.

Abstract

Corporate governance plays a vital role in exploring firm performance, growth, solvency, stability, and managing risk exposure. As an essential corporate governance constituent, an effective board composition includes diverse abilities, cultures, and perspectives to confirm optimal long-term sustainability choices. In particular, women's involvement in board composition pushes toward greater gender diversity at the succession level. Existing finance literature provides scant empirical evidence about the effect of gender dynamics on corporate performance. Hence, the ongoing debate on whether firm performance is genuinely affected by gender dynamics has become a debatable issue in the relevant literature. So, based on the panel test bed from January 2013 to December 2020, the test results indicate that the presence of women on the board has a major negative impact on the company's financial performance. Consequently, by addressing a fundamental financial issue, the study provides evidence of the effect of female board composition on business performance. Therefore, this study not only significantly subsidizes the extant literature on board gender diversity challenges but also assists in a more profound comprehension of female directors' role in corporate governance and performance.

Keywords

Corporate Governance, Gender Dynamics, Female Directors, System GMM, Firm Performance.

JEL Classifications

C330, G300 G380.

Introduction

Corporate boards of directors are the panel of employees, and shareholders elect to represent equity holders, particularly by fixing corporate policies based on the company's mission and vision. They serve as watchdogs, scrutinizing the acts of corporate officials and administrators. A company's bylaws prescribe a board of directors' duties, responsibilities, structure, composition, and power. A board of directors does not have a defined number or structure; it depends highly on the company. The board of directors has to formulate policies relating to the company's dividend policy, goal, resources, management, and so on. As the board of directors sets different types of policies for the firm, the firm performance might be affected by their decision positively or negatively. The board of directors has significant sway over a company's strategic direction and is responsible for corporate environmental stewardship (Nadeem et al., 2020). Therefore, various corporate board characteristics, like board composition, gender diversity, participation of female directors, board size, and board independence, can affect the firm performance (Romano et al., 2020).

According to existing literature, the composition of a board of directors affects a company's financial success and long-term viability. According to Naciti (2019), environmental performance is enhanced by board diversity and the segregation of the functions of the chair of the board and chief executive officer (CEO). The board's independence negatively impacts social performance. The author also suggests that strong corporate governance can be an effective instrument for resolving agency issues. The impact of board diversity on business performance and the results reveal disparities between internal and external board members (Fernández-Temprano & Tejerina-Gaite, 2020). While age diversity is linked to higher performance in insider and outsider directors, they claim that nationality mix is solely linked to higher productivity in insiders. Based on the findings of extant literature, we find that firms with a larger female-director ratio may successfully address decisions of the board and a firm's operation, boosting corporate supervisory efficacy and performance outcomes (Simionescu et al., 2021; Wang, 2020; Martinez-Ferrero et al., 2020; Chijoke-Mgbame et al., 2020; Al-Jaifi, 2020). However, the previous academic literature makes little effort to investigate the effect of gender diversity on company performance. In contrast, the authors find insignificant evidence that gender diversity influences a company's financial performance.

The effect of female participation on the management board is an interesting aspect of a company's board diversity performance. It is assumed that female representation on board committees leads to meaningful engagement and represents female performance in governance practices that are more inclined to impact the company's overall performance significantly. Women should be rewarded and encouraged based on their education and organizational knowledge, or the performance and wealth maximization of the firm would suffer. However, this critic achieved subsequent forecasts in recent research as women present more ethically and socially strong positions than men. Prior research has demonstrated that women can strengthen decision-making by bringing a fresh viewpoint and inventive ideas to the table, allowing for increased company performance (Atif et al., 2021; Simionescu et al., 2021; Al-Jaifi, 2020).

We review that having more women on the board improves views of the board's credibility and legality, boosting investor trust in the company. The study's primary purpose is to determine whether board gender diversity influences firm performance. We added a few novelties to the existing literature to meet our objectives. In order to reduce the risk of endogeneity, we applied the dynamic panel data estimation approach System-GMM for analysis purposes. We have applied many financial performance and board indicators to a representative sample of eighty-eight enterprises for the eight years from 2013 to 2020 as of the data collection date.

In concomitant to the research issue, we systematically investigate if the performance of women-dominated firms outperforms their counterpart peers. This study initially conducts a panel regression analysis for Bangladesh to evaluate the underlying objectives, but the discussion and implications are conducted globally. In several ways, our study contributes to the existing body of knowledge. In addition to presenting evidence of the significance of the association between board gender dynamics (BGD) and financial performance for firms in emerging markets, the current study explores major elements that can affect this relationship. Throughout a newly emerging market, we study how the inclusion of independent directors and board size can strengthen the association between BGD and company performance. Second, our empirical findings offer insight into the contradictory evidence about the relationship between gender diversity and company value for enterprises operating in an emerging market, such as Bangladesh's rising economy. We bring fresh empirical evidence to the governance literature, suggesting that adding female board members negatively impacts a company's financial success. Third, we have also addressed the country-specific control variable to determine the impact of the different country-level variables on the firm's performance relating to the gender dynamics on the board.

The remainder of the study is broken into many consecutive sections, with the literature review analysis presented in the second part. Chapter 3 concentrates on the methodology used in the study, while the fourth part emphasizes the econometric investigation. Section five contains the debate, policy implications, and future directions for study. Conclusions are located in part six. The remainder of the study consists of the bibliography and appendices.

Literature Review and Hypothesis Development

Gender diversity on corporate boards is a vital strategy to boost the performance of corporate boards, and it has become a significant issue in both developed and developing countries. Women's involvement as corporate board members have increased, but these percentages are insignificant. Women's representation on corporate boards and family ownership might differ based on the country, legislative climate, industry, worldwide reach of the firm, phase of growth, and other factors. Recruiting, supervising, retaining, evaluating, and compensating the CEO are probably the essential functions of the board of directors. The agency hypothesis focuses on the board's supervision and oversight of executive actions (Fama & Jensen, 1983). A gender-diverse board reduces agency difficulties among shareholders and executives due to women's inquisitive inclination, making them far more active and demanding monitors than males (Adams & Ferreira, 2009). Hence it is argued that gender diversity promotes high-quality decision-making and improves the financial success of businesses (Martinez-Ferrero et al., 2020). In this respect, Jain (2022) examines that the better representation of women at the owner and managerial levels of the workforce is connected with improved company performance. According to a study by Song et al. (2020), female participation has a significant and favorable effect on corporate profitability, while age diversity has a negligible effect.

Corporate boards make significant decisions, and the board's characteristics influence the effectiveness of these decisions Chen et al. (2017); Chijoke-Mgbame et al. (2020) examined that female board involvement remarkably and positively impacts a company's financial performance. The research also discovered that businesses with two or more female directors experience a greater performance impact from gender diversity, suggesting that having a sufficient number of female members increases a firm financial performance. This conclusion explains why gender-diverse boards are connected with a wide variety of resources such as knowledge, skills, and experience, all of which contribute to more excellent supervision and hence increase the company's overall performance by substituting for Nigeria's poor institutional structure. Another study explored that gender diversity on boards benefits firms' corporate governance but does not affect the banks' social and environmental performance (Al-Jaifi, 2020). This paper's important discovery is that it widens the perspective of the board of directors and the action of social performance. This is because women are more risk-averse and straightforward. In this regard, Tyrowicz et al. (2020) conclude that if a single woman is assigned to a supervisory board instead of a management board, the glass ceiling looks higher, and greater gender equality has nothing to do with the presence of more women in management boards. Maji & Saha (2021) found that having a mix of men and women on staff and boards has a big positive effect on how well an organization does financially. Safiullah et al. (2022) found that firms with more gender diversity on their boards do better in accounting but worse in the market. In the same view, Đặng et al. (2020) also found that having women on a company's board positively and statistically significantly effect a company's return on assets.

Existing literature supports that board gender diversity positively and significantly impacts the firm's financial performance (Arvanitis et al., 2022; Safiullah et al., 2022; Brahma et al., 2021; Simionescu et al., 2021). The study by Arora (2022) shows that the number of women on boards is strongly related to how well a company does. When three or more women are appointed to the board, there is a positive and highly significant correlation with the company's financial performance, in contrast to when two or fewer women are appointed (Brahma et al., 2021; Tleubayev et al., 2020). Researchers added that financial success after the appointment is favorably connected to women's age, education, and whether or not female board members possess executive director posts. Mirza et al. (2020) find that female directors boost investment efficiency in organizations by acting as monitors, disciplining management, reducing agency problems, and improving resource allocation efficiency. Atif et al. (2021) wrote a paper about gender diversity on boards and the use of renewable energy. They found that using renewable energy and having a board with people from different backgrounds helped a business's bottom line (Duppati et al., 2020).

Female board members' inability to strengthen the firm's reputation and relationships with stakeholders, effectively monitor performance, and contribute fresh ideas hinders the firm's performance. Marquez-Cardenas et al.(2022) conclude that in Latin America, board gender diversity has little effect on how well a company does, mostly because there are not as many women on boards as there are men. Naghavi et al. (2021) assert that having women on the board hurts the performance of a company in countries with a high power distance, an individualist, masculine culture, and a low-uncertainty avoidance culture. Pandey et al. (2023) conclude that gender diversity on boards has little effect on a firm's financial performance when considered alone but rather when combined with other board and form factors. Depending on the mix, it is related to more outstanding and lower business financial performance. In addition, authors find that gender diversity on boards mitigates chief executive officer (CEO) duality's adverse effects on a firm's financial performance.

Additionally, Wicker et al. (2020) x-rays that gender diversity on boards significantly decreases human resource and budgetary issues. According to a study, having a diverse board of directors decreases human resource and financial issues, which supports the information perspective. It also implies that it adds value to the firm due to the diversity of resource availability, human and social capital, and better decision-making efficiency. In an emerging economy such as Bangladesh, there is no correlation between board gender diversity and long-term performance. Male-dominated boards, women directors appointed based on family relations, a lack of education and knowledge, and other factors may obscure gender diversity's direct impact on sustainable performance (Fakir & Jusoh, 2020). Mustafa et al. (2020) said that putting women on boards positively affects both the economy and society. Gender-diverse boards lead to more robust company performance. Simionescu et al. (2021) x-rays that the participation of women on the board positively influences the return on assets and shows how gender diversity can improve board supervision, give the board more legitimacy, improve management teamwork and mentoring, and boost stakeholder relationships. Adding female directors makes generating better financial statements easier, reducing the incidence of financial market standards violations and lessening disappointing news hoarding.

Gender diversity on boards strongly correlates positively with environmental innovation (Nadeem et al., 2020). Shakil et al. (2020) examine the correlation between board gender diversity and environmental, social, and governmental (ESG) efficiency and the moderating effects of ESG disputes on this correlation. This research significantly contributes to the study of corporate sustainability and governance. The positive results of the participation of women on the board are pretty groundbreaking. Gender diversity promotes high-quality decision-making and improves the financial success of businesses (Martinez-Ferrero et al., 2020). Brahma et al. (2021) say that a company's performance will be better if there is more than one female director. They conclude that attributes such as age, education level, multiple directorships, prominence, or if female board members also hold executive positions have any impact on corporate performance.

In the last few decades, politicians, regulators, and academics worldwide have paid much attention to the link between the number of women on corporate boards and how well the companies do financially. There is a growing agreement that talented women directors can add a lot to how boards make decisions. So, more and more people see gender diversity as a way to add value and set themselves apart. According to prior research, gender diversity has a major impact on the success of businesses. Including female board members has both beneficial and negative effects on the company's performance. Therefore, we propose a testable hypothesis based on the above debates and inconclusive findings -: 'Board gender diversity has a significant impact on firm performance.

Research Methodology

Participation of female directors on the board enhances the firm financial performance, supporting resource dependency theory and social categorization theory, implying that female directors are valuable resources to the firm and have unique attributes that tend to promote firm performance.

Population and Sample

This study's population is all of the companies listed on the Dhaka Stock Exchange (DSE) in Bangladesh, so the effects of board gender diversity on financial performance in a developing country can be examined. The data and resource constraints make it hard to look at all the firms. Hence, the study focuses on a selected sample of 88 firms from various industry distributions. The cement industry, ceramics industry, food & allied sector, jute industry, paper & printing sector, tannery industries, engineering sector, and textile sector are considered for this study. Eighty-eight firms are sampled among one hundred and forty-eight firms, which seems that 59.46 percent of firms are finally being sampled Table 1.

| Table 1 Sample Breakdown of the Study | |||

| Industry | Total Firms | Selected Firms | Sample Percentage |

| Cement | 7 | 7 | 100.00% |

| Ceramics | 5 | 5 | 100.00% |

| Food & Allied | 21 | 12 | 57.14% |

| Jute | 3 | 2 | 66.67% |

| Paper & Printing | 6 | 5 | 83.33% |

| Tannery Industries | 6 | 5 | 83.33% |

| Engineering | 42 | 8 | 19.05% |

| Textile | 58 | 44 | 75.86% |

| Total | 148 | 88 | 59.46% |

Variable Measurement

Independent Variables

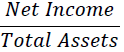

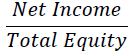

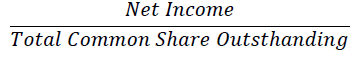

Different types of variables are being counted for this study. According to the previous literature, firms' financial performance can be measured by return on equity (ROE), return on assets (ROA), and earnings per share (EPS). Therefore, this study counts ROA, ROE, and EPS as the dependent variable and a proxy for the firm's financial performance. Divide the company's net income by the number of common shares to get the return on equity. On the other hand, ROA is calculated by dividing the company's net income by the value of all its assets. EPS shows how much of a company's income goes to each share of common stock that is still outstanding.

Focus Variable

The focus variable is the dummy variable for the number of female directors (FD Dummy) on the board. If there are female directors on the board, the value is 1, and if there are not, the value is 0. The number of women on the board of directors has also been an important part of the full analysis.

Control Variables

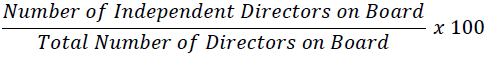

One of the firm-specific control variables is the firm's age (FAGE), which is the difference between the year the firm was founded and the year the sample was taken. Board size (BSIZE) refers to the overall number of board members. On the other hand, board independence (BIND) is the ratio of independent board members to the total number of board members. The firm's debt-to-equity ratio measures leverage (LEV). Firm size (FSIZE) refers to the firm's total assets. The country-specific control variables are the gross domestic product (GDP), which shows the annual growth rate of the GDP, and inflation (INF), which shows the annual inflation rate for the country.

Model Specification

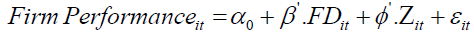

The following model has been made to determine how having women on a board affects how well a business does for the selected sampled firms:

i represent the ith firm, and the t (2013, ....., 2020) reflects the period for each firm. Return on assets (ROA), return on equity (ROE), and earnings per share (EPS) are performance indicators for the company. The vectors in the FD column indicate the gender diversity dummy. In addition, the proportion of female board members is included in the robustness check. Zcolumn vectors represent the firm-specific and country-specific control variables influencing the firm performance. The coefficient column vectors of board gender diversity are represented by β while firm-specific and country-specific control factors affecting firm performance are expressed by ϕ.

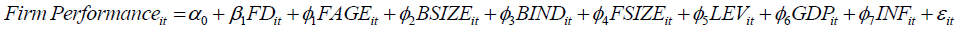

Here, The regression coefficient β1 shows the impact of board gender diversity. Finally, the influence of the firm-specific and the country-specific control variable on the firm performance is represented by the regression coefficients ϕ1, ϕ2, ϕ3, ϕ4, ϕ5, ϕ6, and ϕ7. The study uses Stata to do a generalized system method of moments (GMM) regression analysis to examine how the number of women on a board affects how well a company does. While sophisticated GMM estimators are required for complex estimation problems, it is unlikely that GMM will provide convincing improvements over ordinary least squares and two-stage least squares- the most common modeling approaches in econometrics- in the situations that researchers are most likely to encounter (Wooldridge, 2001). Sargan J-statistic is utilized in the GMM system for testing over detecting constraints (Roodman, 2009).

Test Results and Analysis

In this section, we will concentrate on the different test outcomes from the study. We look at the link between the number of women on a board and how well the company does financially. We also think about the academic and practical importance of the study's results in light of the most recent changes in the state.

Table 2 provides an overview of the descriptive statistics for the dependent, independent, firm- and country-specific control variables. It shows that sampled firms have an average return on assets is 5.4 percent with a maximum of 7.6 percent. The average return on equity is 7.5 percent, whereas the average earnings per share are 5.334. Table 2 also shows that the total observation for the study is 645, and the minimum and maximum value of FD Dummy is 0 and 1, respectively, as we create a dummy variable for the board gender diversity. Firms have an average age of 26 years. The sampled firms have an average of 7 boards of directors on their corporate boards, where only 25 percent of directors are independent. The average leverage of the firms is 3.24 percent. Furthermore, the firms are BDT 5863.87 million in size on average.

| Table 2 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| ROA | 645 | 0.054 | 0.197 | -4.053 | 0.76 |

| ROE | 645 | 0.075 | 0.555 | -12.835 | 4 |

| EPS | 645 | 5.334 | 17.808 | -173.3 | 166.87 |

| FD Dummy | 646 | 0.723 | 0.448 | 0 | 1 |

| FAGE | 646 | 3.093 | 0.584 | 0.02 | 4.7 |

| BSIZE | 646 | 6.924 | 2.145 | 3 | 19 |

| BIND | 646 | 0.252 | 0.133 | 0 | 1 |

| FSIZE | 645 | 7.96 | 1.281 | 4.559 | 11.122 |

| LEV | 645 | 3.24 | 21.012 | 0 | 463.362 |

| GDP | 704 | 0.064 | 0.013 | 0.035 | 0.079 |

| INF | 704 | 0.061 | 0.007 | 0.055 | 0.075 |

Table 3 displays the correlation between the dependent, independent, and control variables. Return on equity, earnings per share, and assets are all lower when more women are on a board (FD Dummy). Except for board size, every firm-specific control variable positively correlates with the FD dummy. The country-specific control variables, gross domestic products and inflation, negatively correlate with the board gender diversity. Based on the correlation analysis, there is no problem with the independent variables in our testbed, meaning there is no multicollinearity issue.

| Table 3 Pairwise Correlations | |||||||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

| (1) EPS | 1.00 | ||||||||||

| (2) ROA | 0.14 | 1.00 | |||||||||

| (3) ROE | 0.13 | 0.78 | 1.00 | ||||||||

| (4) FD Dummy | -0.04 | -0.03 | -0.03 | 1.00 | |||||||

| (5) FAGE | 0.32 | -0.01 | 0.04 | 0.05 | 1.00 | ||||||

| (6) BSIZE | 0.12 | 0.02 | 0.04 | -0.01 | 0.07 | 1.00 | |||||

| (7) BIND | -0.01 | -0.05 | 0.02 | 0.04 | 0.14 | -0.17 | 1.00 | ||||

| (8) FSIZE | 0.24 | 0.14 | 0.04 | 0.01 | 0.05 | 0.29 | -0.02 | 1.00 | |||

| (9) LEV | -0.08 | -0.04 | 0.10 | 0.03 | 0.03 | 0.01 | -0.05 | -0.09 | 1.00 | ||

| (10) GDP | 0.01 | -0.05 | -0.03 | -0.03 | -0.04 | -0.02 | 0.01 | -0.02 | -0.06 | 1.00 | |

| (11) INF | 0.04 | 0.06 | 0.07 | -0.02 | -0.12 | 0.01 | -0.05 | -0.09 | -0.01 | -0.20 | 1.00 |

Table 4 expresses the regression output with the generalized method of moments (GMM) approach. Model 1 indicates that the presence of female directors (FD Dummy) has a significant negative impact on firms' return on assets. Models 2 and 3 also show that having female directors (FD Dummy) negatively affects a company's return on equity and earnings per share. ROA and ROE are both hurt by the age of a company, but age has a big positive effect on earnings per share. Board size has a significant negative impact on return on assets and returns on equity, except for earnings per share. Board independence and firm size also significantly impact returns on equity and earnings per share.

| Table 4 Regression Results (System Gmm Approach) | |||

– where the ROA, ROE, and EPS are used as the company's financial performance. If female directors are on the Board, FD Dummy = 1, and ε is the error term. Systems-generalized methods of moments (System GMM) are used to estimate the model. – where the ROA, ROE, and EPS are used as the company's financial performance. If female directors are on the Board, FD Dummy = 1, and ε is the error term. Systems-generalized methods of moments (System GMM) are used to estimate the model. |

|||

| Variable | Corporate Financial Performance Measures | ||

| Model 1 | Model 2 | Model 3 | |

| Return on asset | Return on equity | Earnings per share | |

| FD Dummy | -0.066 (0.000) *** |

-0.055 (0.000) *** |

-6.795 (0.000) *** |

| FAGE | -0.009 (0. 734) |

-0.026 (0. 332) |

20.415 (0.000) *** |

| BSIZE | -0.007 (0.000) *** |

-0.062 (0.000) *** |

1.16 (0.000) *** |

| BIND | -0.062 (0.236) |

-0.832 (0.000) *** |

-41.155 (0.000) *** |

| FSIZE | -0.001 (0. 921) |

-0.025 (0.000) *** |

-2.727 (0.000) *** |

| LEV | 0.0004 (0. 047) ** |

0.004 (0.000) *** |

-.002 (0.398) *** |

| GDP | -0.523 (0.038) ** |

-0.934 (0.003) *** |

21.048 (0.003) *** |

| INF | 1.226 (0.000) *** |

1.947 (0.008) *** |

151.264 (0.000) *** |

| Constant | 0.149 (0.042) ** |

0.948 (0.000) *** |

-42.078 (0.000) *** |

| Observation | 550 | 550 | 550 |

| No. Of instruments | 36 | 36 | 36 |

| No. Of groups | 88 | 88 | 88 |

| Arellano-Bond: AR (1) | 0.3048 | 0.2926 | 0.1437 |

| Arellano-Bond: AR (2) | 0.2687 | 0.3292 | 0.6071 |

| Sargan test (p-val) | 0.1192 | 0.2282 | 0.1146 |

| Significant differences are denoted by ***p <.01 at the 1% level, **p <.05 at the 5% level, and *p <.10 at the 10% level. According to the Sargan test's null hypothesis, the instruments are all exogenous. As a result, a p-value greater than 10% indicates good results. Furthermore, AR (1) and AR (2) indicate that the results are free of autocorrelation issues. | |||

In contrast, they have an insignificant negative impact on return on assets. Also, leverage has a large positive effect on returns on assets and returns on equity but a large negative effect on earnings per share. Gross domestic product and inflation, which are country-specific control variables, greatly affect how well businesses do financially. GDP strongly hurts the return on assets and equity, but earnings per share are helped by it in a big way.

On the other hand, inflation has a big positive effect on the ROA, ROE, and EPS. The pvalue of the Sargan J-statistic for model 1, model 2, and model 3 are 11.92 percent, 22.82 percent, and 1.46 percent, respectively, which means that all the models provide satisfactory results without the econometric issue of heteroskedasticity for the study. Moreover, AR (1), and AR (2) tell us that variables and results are free of autocorrelation issues.

Robustness Check

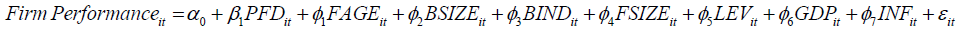

We use the same regression method with a different dependent variable to check the reliability of the test result. To review the influence of board gender diversity on firms' financial performance, we use the proportion of female directors to the total number of directors on the board (PFD) as our focus variable.

Table 5 expresses the regression output with the generalized method of moments (GMM) approach as a robust check. Models 1, 2, and 3 show that the percentage of women on a board of directors (PFD) negatively affects a company's return on assets, equity, and earnings per share. Model 1 says that the size and age of the board have a big and negative effect on the return on assets. On the other hand, firm size and leverage affect the return on assets in a positive but not very important way. The findings of model 2 express that board size, board independence, and firm size significantly impact return on equity.

| Table 5 Regression Results (PFD) | |||

– where ROA, ROE, and EPS are used to measure a company's financial success. PFD denotes the proportion of female board directors relative to the total number of board directors, and ε is the error term. Based on generalized system methods of moments (System GMM), we estimate the model. – where ROA, ROE, and EPS are used to measure a company's financial success. PFD denotes the proportion of female board directors relative to the total number of board directors, and ε is the error term. Based on generalized system methods of moments (System GMM), we estimate the model. |

|||

| Variable | Corporate Financial Performance Measures | ||

| Model 1 | Model 2 | Model 3 | |

| Return on asset | Return on equity | Earnings per share | |

| PFD | -0.064 (0.035) ** |

-0.416 (0.000) *** |

-21.573 (0.000) *** |

| FAGE | -0.039 (0.043) ** |

-0.037 (0.151) |

19.774 (0.000) *** |

| BSIZE | -0.006 (0.000) *** |

-0.065 (0.000) *** |

1.006 (0.000) *** |

| BIND | -0.051 (0. 278) |

-0.795 (0.000) *** |

-38.917 (0.000) *** |

| FSIZE | 0.003 (0.458) |

-0.017 (0.002) *** |

-3.194 (0.000) *** |

| LEV | 0.0002 (0.416) |

0.004 (0.000) *** |

-0.005 (0.053) * |

| GDP | -0.351 (0.118) |

-0.992 (0.001) *** |

20.819 (0.002) *** |

| INF | 1.138 (0.000) *** |

1.789 (0.016) ** |

142.581 (0.000) *** |

| Constant | 0.165 (0.007) *** |

0.998 (0.000) *** |

-36.162 (0.000) *** |

| Observation | 550 | 550 | 550 |

| No. of instruments | 36 | 36 | 36 |

| No. of groups | 88 | 88 | 88 |

| Arellano-Bond: AR (1) | 0.3042 | 0.2926 | 0.1467 |

| Arellano-Bond: AR (2) | 0.3066 | 0.3064 | 0.5855 |

| Sargan test (p-val) | 0.1564 | 0.1758 | 0.0223 |

In contrast, leverage positively and significantly impacts return on equity. Along with these, model 3 also shows that firm age and board size significantly positively impact earnings per share. In contrast, board independence, firm size, and leverage negatively impact earnings per share. Among the country-specific variables, inflation strongly affects a corporation's financial performance, while the gross domestic product harms return on assets and equity. Nonetheless, it has a substantial beneficial effect on earnings per share. The P-value of the Sargan J-statistic for model 1, model 2, and model 3 are 15.64 percent, 17.58 percent, and 2.23 percent, respectively, which means that all the models provide good results for the study. Moreover, AR (1), and AR (2) tell us that variables and results are free of autocorrelation issues. Further, as a part of the robustness, we rechecked the findings of fixed effect and random effect along with the Hausman test and concluded that the Hausman test results support random effect.

Discussion, Implications, and Future Directions

Corporate governance plays a principal role in enhancing the firm's operating and financial performance. So, the corporate board is a key issue for maximizing the company's performance and its shareholders' wealth. Therefore, a diversified board can be a blessing for the firm. Literature shows that the more the board is diversified, the better the firm's performance. This study has been done to explore the relationship between board gender diversity and firm performance. Politicians, regulators, and academics worldwide have paid significant attention to the association between board gender diversity and financial performance in recent years. Gender diversity enhances high-quality decision-making and boosts the financial performance of firms. In emerging economies, there is little link between the number of women on a board and how well the company does financially. Male-dominated boards and female directors selected based on family links, a lack of education, experience, and knowledge, and other factors may mask gender diversity's significant impact on long-term performance. Consequently, it might be stated that female board members have both favorable and unfavorable effects on the firms' performance.

Over the past decade, there has been a global trend of growing female representation on boards of directors, supported by companies with female CEOs making sound decisions for their shareholders. Female representation makes the working environment more fascinating, and also, this is undoubtedly a refreshing inspiration for women out there. Establishing a vast inclusion of female representation improves firm financial performance. The entire debate indicates that there may be variation in the extent to which ethical and logical judgment can be applied to firm decision-making by corporate boards with female members, with implications for overall economic and financial objectives.

Model 1, Model 2, and Model 3 all state that the presence of female directors on the board negatively influences the organization's financial performance. Also, these models show how firm performance is linked to controlling factors unique to the firm and the country. Firm age, firm size, board independence, and board size significantly negatively impact both returns on assets and equity. On the other hand, the firm's use of debt greatly affects all performance measures, such as return on assets, equity, and earnings per share. All the control variables, including the focus variable (presence of female directors on the board), significantly impact the firm's earnings per share, where firm age and board size are positive, and the rest hurt earnings per share. The study's models also reveal that the country-specific control variables, i.e., gross domestic product and inflation, significantly impact the firm's financial performance. In summary, the presence of female directors on boards in the emerging economy significantly impacts the firms' corporate financial performance.

Conclusion

To make any business sustainable, the impact of a board member is notable because the board confirms all the decisions of any organization regarding possible strategies. Gender diversity on corporate boards is an effective strategy to enhance the competitive market, and Both developed and developing nations now consider it a serious problem. A growing body of research indicates that female executives can improve boardroom performance by adding value. In Bangladeshi organizations, where most organizations are male-dominated, women are not taken seriously and are mostly ignored by the dominating male field. A few female members are picked only for their family connections. They get lower positions on the board than their male counterparts. Getting more women into boardrooms will help with long-term, sustainable change in the workplace, good governance, and competition worldwide. With that end in view, this study examines the relationship between board gender dynamics and firm performance. Overall, the test results show that the presence of female directors on the board significantly impacts the firm's financial performance Appendix I.

This study gives some insights into corporate governance relating to board dynamics to the corporate governance policymakers. The study findings can help investors think twice about which institutions they want to invest in and which they should not. Investors should make the investment decision carefully as the board's gender dynamics significantly impact the firms' performance. The test results show that having women on the board has a negative and significant effect on all measures of financial performance, such as return on assets, equity, and earnings per share. There are also some limitations to this study. Firstly, it includes only eighty-eight firms from 8 different industry sectors. It should consider all the pharmaceuticals and financial sectors to conclude a more accurate and precise conclusion. Secondly, the dataset includes the data up to 2020, and the firm-specific control variable is only six; future research should be done with more variables, i.e., industry average, CEO characteristics, demographic information of female directors, etc. Finally, this study does not consider the firm's market-based performance, which could be addressed in future research in the global context.

| Appendix I Variable Measurement |

||

| Notation | Variable Name | Measurement |

| Dependent Variables | ||

| ROA | Return on Assets |  |

| ROE | Return on Equity |  |

| EPS | Earnings Per Share |  |

| Independent Variable | ||

| FD | Dummy Variable of Female Director | Presence of female director on the Board = 1, otherwise 0. |

| Firm-Specific Control Variables | ||

| FAGE | Firm Age | Log of firm age. |

| BSIZE | Board Size | Total Number of Directions onf Board |

| BIND | Board Independence |  |

| FSIZE | Firm Size | Total assets of the firm. |

| LEV | Leverage | |

References

Adams, R.B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of financial economics, 94(2), 291-309.

Indexed at, Google Scholar, Cross Ref

Al-Jaifi, H.A. (2020). Board gender diversity and environmental, social and corporate governance performance: evidence from ASEAN banks. Asia-Pacific Journal of Business Administration, 12(3/4), 269-281.

Indexed at, Google Scholar, Cross Ref

Arora, A. (2022). Gender diversity in boardroom and its impact on firm performance. Journal of Management and Governance, 26(3), 735-755.

Arvanitis, S.E., Varouchas, E.G., & Agiomirgianakis, G.M. (2022). Does board gender diversity really improve firm performance? Evidence from Greek listed firms. Journal of Risk and Financial Management, 15(7), 306.

Indexed at, Google Scholar, Cross Ref

Atif, M., Hossain, M., Alam, M.S., & Goergen, M. (2021). Does board gender diversity affect renewable energy consumption?. Journal of Corporate Finance, 66, 101665.

Brahma, S., Nwafor, C., & Boateng, A. (2021). Board gender diversity and firm performance: The UK evidence. International Journal of Finance & Economics, 26(4), 5704-5719.

Indexed at, Google Scholar, Cross Ref

Chen, J., Leung, W. S., & Goergen, M. (2017). The impact of board gender composition on dividend payouts. Journal of Corporate finance, 43, 86-105.

Indexed at, Google Scholar, Cross Ref

Chijoke-Mgbame, A.M., Boateng, A., & Mgbame, C.O. (2020). Board gender diversity, audit committee and financial performance: evidence from Nigeria. In Accounting Forum (Vol. 44, No. 3, pp. 262-286). Routledge.

Đặng, R., Houanti, L.H., Reddy, K., & Simioni, M. (2020). Does board gender diversity influence firm profitability? A control function approach. Economic Modelling, 90, 168-181.

Indexed at, Google Scholar, Cross Ref

Duppati, G., Rao, N. V., Matlani, N., Scrimgeour, F., & Patnaik, D. (2020). Gender diversity and firm performance: evidence from India and Singapore. Applied Economics, 52(14), 1553-1565.

Fakir, A. N. M., & Jusoh, R. (2020). Board gender diversity and corporate sustainability performance: Mediating role of enterprise risk management. The Journal of Asian Finance, Economics and Business, 7(6), 351-363.

Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. The journal of law and Economics, 26(2), 301-325.

Indexed at, Google Scholar, Cross Ref

Fernández-Temprano, M.A., & Tejerina-Gaite, F. (2020). Types of director, board diversity and firm performance. Corporate Governance: The International Journal of Business in Society, 20(2), 324-342.

Jain, R. (2022). Gender diversity, gender norms and firm performance: Evidence from India. Economic Systems, 46(4), 101006.

Indexed at, Google Scholar, Cross Ref

Maji, S.G., & Saha, R. (2021). Gender diversity and financial performance in an emerging economy: Empirical evidencefrom India. Management Research Review, 44(12), 1660-1683.

Marquez-Cardenas, V., Gonzalez-Ruiz, J.D., & Duque-Grisales, E. (2022). Board gender diversity and firm performance: Evidence from Latin America. Journal of Sustainable Finance & Investment, 12(3), 785-808.

Martinez-Ferrero, J., Eryilmaz, M., & Colakoglu, N. (2020). How does board gender diversity influence the likelihood of becoming a UN Global Compact signatory? The mediating effect of the CSR committee. Sustainability, 12(10), 4329.

Indexed at, Google Scholar, Cross Ref

Mirza, S.S., Majeed, M.A., & Ahsan, T. (2020). Board gender diversity, competitive pressure and investment efficiency in Chinese private firms. Eurasian Business Review, 10, 417-440.

Mustafa, A., Saeed, A., Awais, M., & Aziz, S. (2020). Board-Gender diversity, family ownership, and dividend announcement: Evidence from Asian emerging economies. Journal of Risk and Financial Management, 13(4), 62.

Indexed at, Google Scholar, Cross Ref

Naciti, V. (2019). Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. Journal of Cleaner Production, 237, 117727.

Nadeem, M., Bahadar, S., Gull, A. A., & Iqbal, U. (2020). Are women eco‐friendly? Board gender diversity and environmental innovation. Business Strategy and the Environment, 29(8), 3146-3161.

Naghavi, N., Pahlevan Sharif, S., & Iqbal Hussain, H. B. (2021). The role of national culture in the impact of board gender diversity on firm performance: evidence from a multi-country study. Equality, Diversity and Inclusion: An International Journal, 40(5), 631-650.

Indexed at, Google Scholar, Cross Ref

Pandey, N., Kumar, S., Post, C., Goodell, J. W., & García-Ramos, R. (2023). Board gender diversity and firm performance: A complexity theory perspective. Asia Pacific Journal of Management, 40(3), 1289-1320.

Romano, M., Cirillo, A., Favino, C., & Netti, A. (2020). ESG (Environmental, Social and Governance) performance and board gender diversity: The moderating role of CEO duality. Sustainability, 12(21), 9298.

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and statistics, 71(1), 135-158.

Safiullah, M., Akhter, T., Saona, P., & Azad, M. A. K. (2022). Gender diversity on corporate boards, firm performance, and risk-taking: New evidence from Spain. Journal of Behavioral and Experimental Finance, 35, 100721.

Indexed at, Google Scholar, Cross Ref

Shakil, M.H., Tasnia, M., & Mostafiz, M.I. (2021). Board gender diversity and environmental, social and governance performance of US banks: Moderating role of environmental, social and corporate governance controversies. International Journal of Bank Marketing, 39(4), 661-677.

Indexed at, Google Scholar, Cross Ref

Simionescu, L.N., Gherghina, Ş.C., Tawil, H., & Sheikha, Z. (2021). Does board gender diversity affect firm performance? Empirical evidence from Standard & Poor’s 500 Information Technology Sector. Financial Innovation, 7(1), 1-45.

Indexed at, Google Scholar, Cross Ref

Song, H. J., Yoon, Y. N., & Kang, K. H. (2020). The relationship between board diversity and firm performance in the lodging industry: The moderating role of internationalization. International Journal of Hospitality Management, 86, 102461.

Tleubayev, A., Bobojonov, I., Gagalyuk, T., & Glauben, T. (2020). Board gender diversity and firm performance: evidence from the Russian agri-food industry. International Food and Agribusiness Management Review, 23(1), 35-53.

Tyrowicz, J., Terjesen, S., & Mazurek, J. (2020). All on board? New evidence on board gender diversity from a large panel of European firms. European Management Journal, 38(4), 634-645.

Indexed at, Google Scholar, Cross Ref

Wang, Y. H. (2020). Does board gender diversity bring better financial and governance performances? An empirical investigation of cases in Taiwan. Sustainability, 12(8), 3205.

Indexed at, Google Scholar, Cross Ref

Wicker, P., Feiler, S., & Breuer, C. (2020). Board gender diversity, critical masses, and organizational problems of non-profit sport clubs. European Sport Management Quarterly, 1-21.

Wooldridge, J. M. (2001). Applications of generalized method of moments estimation. Journal of Economic perspectives, 15(4), 87-100.

Indexed at, Google Scholar, Cross Ref

Received: 10-Jan -2024, Manuscript No. jmids-24-14367; Editor assigned: 12-Jan -2024, Pre QC No. jmids-24-14367(PQ); Reviewed: 23- Jan-2024, QC No. jmids-24-14367; Published: 25-Jan-2024