Research Article: 2019 Vol: 23 Issue: 6

Business Failure: Financial Characterization of the Liquidated Companies in Ecuador, Years 2016 And 2017

Irene Buele, Universidad Politécnica Salesiana

Maida Puwainchir, Universidad Politécnica Salesiana

Santiago Solano, Universidad Politécnica Salesiana

Abstract

Nowadays, some companies have become an essential element of high importance, not only for the growth of a society, but also for the country. If the companies face difficulties, such as situations of failure, they would take to an economic uncertainty in their influence area. This investigation is aimed to identify the financial characteristics of the liquidated companies in Ecuador, which correspond to Wholesale and Retail Trade. This study was made using a database that was elaborated from the published information by the Superintendence of Companies, Values and Insurances of Ecuador. Companies are classified in two groups: healthy and bankrupt. Afterwards, financial ratios are analyzed according to financial statements during the years 2016 and 2017. Finally, in the results, it can be observed that the healthy companies maintained a lower liquidity level in comparison with the ones that went bankrupt. However, the healthy companies have been able to manage, in an efficient way, their cash allowing them to fund their commercial processes, and thus, to keep themselves afloat in the market. The healthy companies present an average liquidity of 2.66 and an average yield of the total active and patrimony of 3.71% and 11.82% respectively. The bankrupt companies showed a liquidity of 3.84 and an average yield of the total active and patrimony of 1.22% and 5.80%. A difference in the yield is also observed; the bankrupt companies presented a 2.59%, whereas the healthy ones reached a 31.15%. Therefore, even the bankrupt companies presented higher levels of liquidity; their profitability is inferior compared to the healthy ones.

Keywords

Financial Analysis, Companies, Business Failure, Financial Indicators.

Introduction

Delfin & Acosta (2016) point out that companies are a fundamental pillar for the economic development of a country because they generate employment, innovation, and social welfare. Additionally, they are dynamic entities that identify, explode, and develop new productive activities. They also highlight the fact that, nowadays, companies have become a priority for the upbringing of a country, transforming themselves in one of the most important factors for the local, national and international economy. Castro (2003) indicates that the companies are important pioneers for the social development; all of this through inclusion and social and labor insertion, into the most vulnerable areas of a country.

Business failure is understood as a situation of companies where they are unable to mobilize the experience and resources necessary to address the old and emerging threats that culminates in a collapse (Amankwah-Amoah et al., 2019) that is, the company stops operating and / or loses its identity due to the inability to respond and adapt in a timely manner to changes in the environment (Amankwah-Amoah, 2016), therefore the business owners close when they obtain returns below their expectations (Sheng & Lan, 2019). Business failure, as mentioned by Lizarazo (2017), has a huge impact in an economy because it generates negative consequences not only for the entrepreneur, but also for the so-called stakeholders; in other words, groups of interest related to the company. Thereby, the companies should be more attentive and try to anticipate to potential situations that would emerge and could generate risks of failure. Romero (2013) indicates that the failure could implicate the deterioration of an entire society or a country, in investment levels, workforce, income distribution, or growth rate of the Gross Domestic Product because the company is considered as a primordial basic unit for the economic development of a country and its inhabitants.

In Ecuador, different companies that expect to grow and remain in the market are formed every day; this fact has become a difficult situation for different circumstances. However, there are not robust answers about the reasons that take a company to success or failure. According to Indacochea (2016), the successful companies have four factors in common, which are:

1. To possess a unique business model.

2. To understand the economy of their business.

3. To be calculators that decidedly takes risks.

4. To dedicate some efforts to be consistent and strategically aligned. Hence, the main task of the authorities is to achieve the creation of a sustainable value; all of this through a good strategy and good execution.

Villalobos (2018) says that to constitute a successful company, some issues like constant training, preparation, planning and above all, a continuous consultancy according to core business are necessary. However, to carry this task out is not easy; several entrepreneurs have constituted a huge number of companies that, for different circumstances have to be settled. Keasey & Watson (1991) point out that the failure of a company does not only depend on the debts or financial insolvency, but also on the power and issues of economic interests of stakeholders; in other words, one of the causes for bankruptcy is for internal deficiencies, such as problems with the people, strategic problems and mainly, operational problems. Therefore, it is emphasized the importance of detecting any kind of difficulties, so the companies are be able to make decisions regarding each case, and on time.

For the authors Mures et al. (2012), the different contexts that the companies face have led to the elaboration of prediction models for business failure whose main objective is to predict the problems that a company can address. The different studies of business failure contain several definitions and interpretations. For instance, the Dictionary of the Spanish Royal Academy of Language (2014), defines failure as miscarriage or unfavorable result of a company or business. Whereas for Vargas (2014), the definition of business failure is profound because of the influence of several elements that can affect a company unfavorably taking it to a crisis or failure. In the same way, Danilov (2014) indicates that failure is a situation that is produced when the incomes generated by the companies are not enough to pay their liabilities timely. In addition, he stresses that this situation is a symptom of an inadequate capital structure. Conversely, the authors Navarrete & Sansores (2011) define failure from an economic perspective, mentioning that a company fails when the cash flows generated by their activity are not enough to cover their operational costs and their incurred liabilities. Similarly, they highlight that most of the companies that have collapsed is because of mismanagement, such as, the creation of companies for wrong reasons, lack of time, family conflicts, but above all, limited financial responsibility and a clear approach of itself. Amat (201) affirms that “the companies, as well as people, are born, grow, and die; however, just a few of them live longer, and most of the studies situate life expectancy between three and ten years” (p. 23).

Independently from all of these reasons for a company to collapse and put an end to its legal affairs, it has to proceed to its dissolution, and afterwards, to its liquidation. Arroyo (2012) defines dissolution as the prior process; that is, the causes by which a society can terminate its economic activity and become extinguished as legal entity causing losses of 50% or more on social capital for a breach of the period prescribed in the social contract. Whereas liquidation refers to the management that representatives have to make after providing the causes for the dissolution of the society.

According to the Law of Companies of Ecuador (2014), in Section XII. Inactivity, Dissolution, Reactivation, Liquidation and Cancelation, in the articles 359 and 360 respectively, it is mentioned that the Superintendence of Companies, Values and Insurances, upon request of a party or office, will be able to declare inactive the companies that have not operated during two consecutive years. Therefore, once the representative or representatives are notified using any kind of media, and after thirty days, the ultimate authority, in this case, the Superintendent, will declare the company dissolved and order its dissolution. The authors Perez & Campero (2017) define liquidation as a group of operations that a society has to perform in the causal of dissolution working on necessary procedures to conclude with its pending businesses like assets realization, payment of their liabilities, and finally, distribution of the patrimony among its members and stakeholders.

The study of business failure will be applied to Ecuadorian companies dedicated to Wholesale and Retail Trade. According to some data verified by the National Institute of Statistics and Census (2017), in its Entrepreneurial-structural Survey, it is shown that the companies that are mostly dedicated to trade represent a 51.16%, percentage that during the year 2016, contributed with the National Economy in a 37.4% of the total participation regarding national production. In Ecuador, there are about 20 economy sectors that, according to an inform taken from the MarketWatch (2018), Wholesale and Retail Trade is one of the main economy activities performed in the country. In the year 2018, it represented a high growth along with the manufacturing industries; 9.6% and 6.6% respectively.

Diverse studies about business failure are approached to identify the financial variables that lead to bankruptcy in relation to the companies that last. Nava (2009) mentions that the changing environment that the companies face has provoked the need of constant training and knowledge acquisition about some tools that help and improve business management to accomplish with the stated objectives. García (2017) reveals that the financial analysis, day by day, has become a fundamental component for decision-making, allowing the protection of future and present interests of the companies. Also, this process permits the detection of possible errors that lead to an economy risk or liquidation of the company. Villegas (2002) defines financial analysis as a process of tendencies and relations that allow the examination of the financial position and the results of the present and past operations, but above all, it is a method that will contribute to identify the strengths and weaknesses of the company; allowing making the corresponding decisions.

Methodology

This article determines the financial characteristics through financial ratios of Stock and Limited Liability Corporations that have passed through a process of dissolution and liquidation, and then have been compared with the financial ratios of active companies. A descriptive analysis is applied, and it is aimed to explain the properties, features and attributes of people, groups, communities, processes, objects, or any other phenomenon subject of analysis (Hernández et al., 2014).

The sector of Wholesale and Retail Trade in the province of Azuay, during the years 2016 and 2017 is chosen as the population for this research (Table 1).

| Table 1 Number of Companies to be Analyzed | ||

| Year | Active Companies | Liquidated Companies |

| 2016 | 57 | 22 |

| 2017 | 621 | 31 |

Subsequently, a database for the companies that have reported their financial statements to the Superintendence of Companies, Values and Insurances in the years mentioned above is elaborated and classified in two groups. The first one refers to bankrupt companies, which are in processes of inactivity, dissolution, liquidation, and cancellation. The second group refers to healthy companies. By using this information, a probability sample is applied as shown in Table 2.

| Table 2 Sample Results | ||||

| Liquidated 2016 |

Liquidated 2017 |

Active 2016 |

Active 2017 |

|

| Z= Confidence level | 1,81 | 1,81 | 1,81 | 1,81 |

| P=Percentage of the population that has the desired attribute | 50% | 50% | 50% | 50% |

| q=Percentage of the population that does not have the desired attribute =1-p | 50% | 50% | 50% | 50% |

| N= Size of the universe | 19 | 33 | 39 | 613 |

| e= Maximum Estimation error accepted | 7% | 7% | 7% | 7% |

| n= Sample size | 17 | 28 | 32 | 132 |

Once the sample is obtained, the values presented in the financial statements are added to the database; the financial ratios shown in Table 3 are applied, and the outlying data is eliminated for its analysis.

| Table 3 Financial Reasons | |||

| Reasons | Definition | Name | Formulation |

| Liquidity reasons | These indicators determine the capacity that the company has to respond to short term liabilities. | ? Liquidity Ratio ? Acid test |

Current Asset/ Current Liability Current Asset - Inventories Current Liability |

| Profitability reasons | They allow the measurement of the capacity of the business to gain an adequate performance about the sales, and total assets invested capital. | ? Gross profit margin ? Net profit margin ? Return on total asset ? Return on capital |

Gross profit/ net sales Net profit / net sales Net profit / Total Assets Net Profit / Patrimony |

| Indebtedness Reasons | These reasons indicate the amount of money of third party that is used to generate profits. | ? Asset Indebtedness ? Short-Term Indebtedness ? Long-Term Indebtedness |

Total Liability / Total Asset Current Liability/Total Liability Total Liability / Patrimony |

The liquidity ratios according to Baena (2014) are used to determine the capacity that the company must cover its short-term liabilities; the higher the current asset, the higher the possibilities to cover short-term debts. The liquidity reasons are classified according to current ration or acid test and the working capital ratio.

Van Horne & Wachowizc (2010) mention two classes of profitability reasons: the first one is the profitability that sales represent, and the second one refers to the investment. They both together demonstrate how efficient a company is to control expenses and costs, and thus to change sales into profits.

The Superintendence of Companies, Values and Insurances (2019) highlights that the Indebtedness reasons determine the way and magnitude that the creditors participate in the company’s financing; that is, the establishment of the risks that the owners and creditors take when getting a new borrowing.

Results

The results are expressed in two sections: the first one corresponds to a descriptive analysis of the active and liquidated companies during the years 2016 and 2017; and the second one analyses the financial statements. All of this through financial ratios with the purpose of determining items that characterize the companies in bankruptcy situations and the healthy ones.

Descriptive Analysis

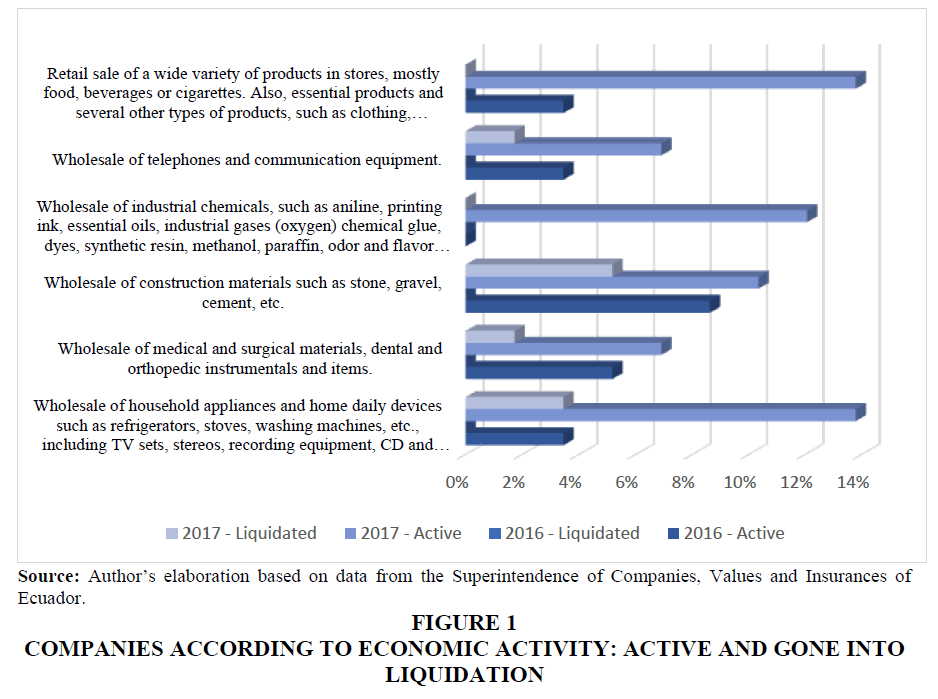

Figure 1 shows the most representative economic activities during the years of study. In 2016, the active companies dedicated to the wholesale trade of construction materials such as stone, sand, gravel, cement, etc., which reached a 9% of active companies in the province of Azuay. By 2017, retail business activities of a wide variety of products in stores reached a highly significant percentage of 14%, together with 14% of companies engaged in wholesale trade of household appliances and common home devices. As for the liquidated companies, in 2017 a 5% made wholesale sales of construction materials such as stone, sand, gravel, cement, etc., followed by 3% for wholesale of household appliances and common home devices. For the year 2016, no predominant economic activity was presented within the liquidated companies.

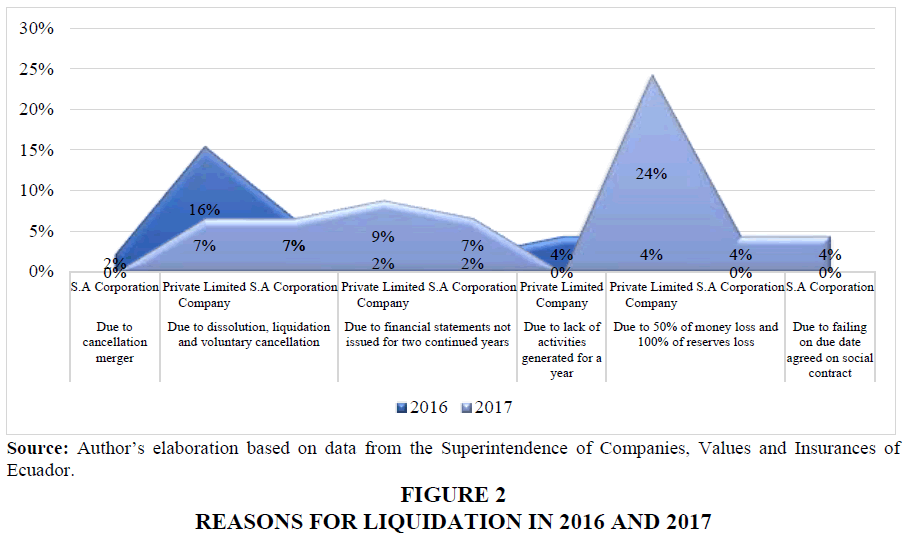

As seen on Figure 2, in 2016 the main reason for ending economic activities was due to dissolution, liquidation and volunteer cancelation in a 16%. In 2017, the highest percentage of liquidated companies 24% corresponds to companies limited by losses of 50% or more of the capital and all its reserves. The Company Law (2014) in its article 361 on paragraph 6 and in agreement with article 198 of the same legal body, states that when companies happen to lose a fifty percent or more of the subscribed capital and the total of their reserves then the companies will necessarily be put into liquidation. This takes place as long as the shareholders do not proceed to reintegrate it or limit the social fund to the existing capital so that it survives.

The second reason why companies were closed in 2017 is related to the non-presentation of the financial statements. The Company Law (2014), in its article 359, states that the Superintendence of Companies, by request of a party or ex officio, can declare inactive companies subject to its control even if they have not operated for two consecutive years.

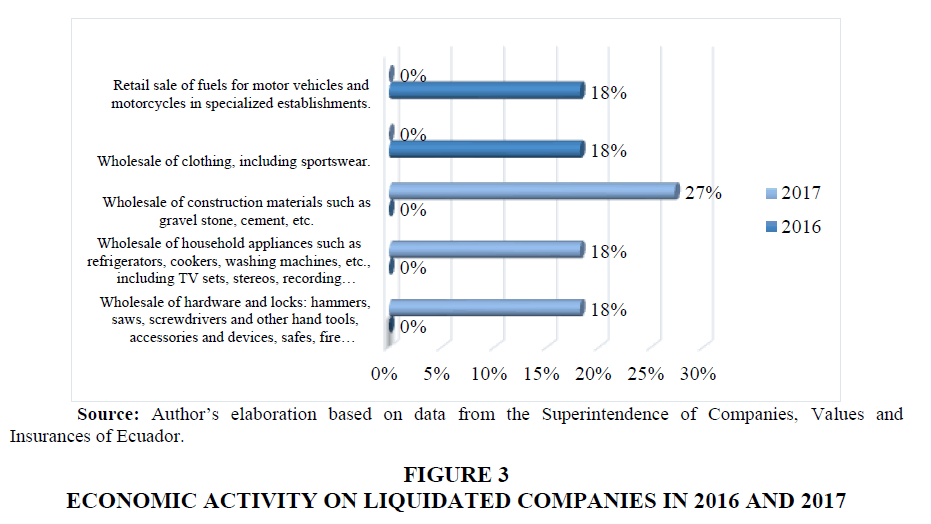

By 2016, an 18% of the liquidated companies were engaged in retail trade of fuels for motor vehicles and motorcycles in specialized establishments. Another 18% represented the wholesale sale of clothing, including sportswear. By 2017, 27% of the liquidated companies carried out economic activities such as the wholesale of construction materials: stone, sand, gravel, cement, etc. Followed with 18% to the wholesale of household appliances and common home devices at home, as well as the wholesale of hardware and locks (Table 4 & Figure 3).

| Table 4 Financial Ratios of the Commerce Sector on Wholesale and Retail | |||||

| Financial Ratio | Formula | Liquidated 2016 | Liquidated 2017 | Active 2016 |

Active 2017 |

| Current Ratio | Current Assets / Current Liabilities |

3.20 | 4.48 | 2.78 | 2.54 |

| Quick Ratio | Total Current Assets - Inventory Current Liabilities |

3.05 | 4.17 | 2.06 | 1.95 |

| Gross Profit Margin | Gross Income / Sales | 47.07% | 44.86% | 47.20% | 48.70% |

| Net Profit Margin | Net Income / Sales | 0.00% | 5.17% | 5.11% | 57.19% |

| (Total) Return on Assets | Net Income / Total Assets | 0.76% | 1.69% | 1.45% | 5.97% |

| Return on Equity | Net Income /Shareholders’ equity | 0.80% | 10.81% | 3.80% | 19.85% |

| Total Debt to Asset | Total Debt / Total Assets | 90.84% | 88.61% | 60.85% | 77.04% |

| Short-term Debt | Current Liabilities /Long-term debt | 74.62% | 71.72% | 78.21% | 77.43% |

| Long-term Debt | Long-term Debt / Total Assets | 78.91% | 65.02% | 67.37% | 60.12% |

Analysis of Financial Ratios

The companies liquidated in 2016 and 2017 presented an average current ratio of 3.84, in relation to the active companies that reached 2.66. It is observed that the liquidated companies did have enough liquidity to cover their short-term obligations; therefore, this would not seem to be a cause of their failure.

Regarding the aforementioned, Rubio (2007) states that a lack of liquidity may mean that the company could be unable to take advantage of investment opportunities. This might lead to an impediment to expand, which is, a poor liquidity would imply a lower autonomy of choice and less maneuverability, a situation that does not happen with liquidated and active companies.

Gitman (2003) mentions that the most advisable scenario is the quick ratio to be 1 or greater, although this would depend on the economic activity in which the company operates. During the years 2016 and 2017, with regard to both, liquidated and active companies, they presented on average the following values in this financial ratio 3.61 and 2.00 correspondingly. These figures show that companies did not need to use their inventories in order to cover their obligations in the short term. This means that active companies were able to remain liquid with no dependence on their inventories to remain financially stable and pay their debts. In the two years evaluated, a 39% of the liquidated companies presented outliers because they had no liabilities.

On the other hand, the liquidated and active wholesale and retail trade companies have a gross profit margin during 2016 and 2017, on average, a 45.97% and a 47.95% correspondingly. The net margin reflected on average values of a 2.59% for liquidated companies and a 31.15% for active ones. These results show that both, liquidated and the active companies obtained acceptable profitability, but this time active companies show the best results. Baena (2014), mentions that in order to improve the gross or net profit margin, the cost of production (manufacturing companies) or the cost of sales (commercial companies) must be considered; most of all, costs of manufacturing or marketing of a product or service. It is also stated that maintaining a good margin depends on strategies such as increasing production, maintaining the quality and price of the product or service.

The results about the average return on total assets and equity are of a 1.22% and a 3.71% correspondingly. It is convenient that companies remaining in the market consider the implementation of strategies aiming to improve this indicator. Baena (2014) also mentions some strategies, such as the management of costs, expenses, taxes, fees and levies, in terms of net income. About assets, aspects such as the working capital, customers, inventories should be considered, especially the infrastructure and installed capacity of the property, plant and equipment. Regarding the equity return, the liquidated and active companies, obtained an average return on the investment of the shareholders or partners an equivalent to a 5.80% and a 11.82% on the two periods of study correspondingly.

Companies liquidated in 2016 and 2017 show an average level of debt of assets of an 89.72%, a figure that suggests a more dependence on suppliers and creditors rather than on their own owners. Meanwhile, active companies have an average of 68.94%, a decrease in relation to the liquidated ones is evident here. Apparently, owners are taking more participation in their companies. López (2013) points out that there is no standard measure of the debt ratio that works well for all companies. In other words, there are companies that manage to keep stable returns and could have a high level of debt and remain comfortable while there are others seemingly under pressure. However, according to Baena (2012), the ideal scenario for companies is to maintain the 1:1 debt level, which means it is convenient to stay below 50%. On the contrary, if the indebtedness is greater than 0.6, the company would be losing financial autonomy on third parties, which compromises financing capacity.

About short-term debt, the average of the liquidated companies showed a 73.17%. On the other hand, active companies showed an average of 77.82%, these values mean that both liquidated and active companies maintained a debts concentration higher than 70% with respect to total liabilities. On the other hand, the debt or long-term financing of the companies of wholesale and retail trade, showed in average the following results: 71.97% for the liquidated companies, and 63.75% for the active ones, which means that their assets were funded mostly by long-term resources.

Conclusion

In each of the periods analyzed we can clearly see that stable companies were mostly engaged in two economic activities; the first one related to retail sale of a wide variety of products in stores such as food products, drinks or cigarettes, essential products and several other types of products. The second is related to wholesale of household appliances and common home devices such as fridges, stoves, washing machines, etc. On the other hand, most of the failed companies were engaged in the activity of the wholesale of construction materials such as stone, sand, gravel, cement, etc., followed by the wholesale sale of household appliances and common home devices like refrigerators, stoves, washing machines, etc.

On the other hand, the main cause of the cessation of commercial activities in Azuay in the Field of wholesale and retail trade was due to the reasons that follow:

1. Losses of fifty percent or more of the capital and all its reserves (year 2017).

2. Due to dissolution, liquidation and voluntary cancellation (year 2016).

3. Due to omissions during the presentation of the financial statements (year 2017). These causes mostly affected limited liability companies.

Regarding commercial activity of the liquidated companies, in both analyzed periods, these were mostly dedicated to the wholesale of construction materials such stone, sand, gravel, cement, etc., with a highly meaningful percentage of a 27%. On the other hand, both in 2016 and 2017 an 18% of the liquidated companies kept the following four most outstanding economic activities. Those are retail sale of fuels for motor vehicles and motorcycles in specialized establishments, the wholesale of clothing including sportswear, wholesale of household appliances and common home devices such as refrigerators, stoves, washing machines, etc., and the wholesale of hardware and locks.

Regarding the analysis of the financial reasons, during the years 2016 and 2017 both the liquidated and the active companies, it is shown in all cases that determined levels indebtedness were high; such results, were certainly unusual considering the high rates reported due to liquidity ratios. These results got our attention, since the liquidated companies even when being able to meet their short and long-term obligations and considering their liquidity, preferred to keep high levels of debt, which probably ended up suffocating the companies and causing their failure. As a conclusion, it is not possible to confirm that liquidity levels of the liquidated companies were a determining variable for the cessation of activities in a company. Therefore, for future research purposes, it is suggested to study the causes of business failure from the analysis of administrative, business and marketing strategies and practices.

Based on the previous conclusion, it is essential to mention that both the liquidated and active companies reported significantly high current liquidity rates: 3.84 and 2.66 correspondingly. It is even usual that the acid test on liquidated companies reports an index of 3.61; which is obtained by active companies. These results suggest that liquidity problems were not the cause of failure of liquidated companies, but their uses and application. For Garcia et al. (2019), insolvency failure refers to the voluntary liquidation of a business due to poor performance. Or either by owners’ decisions of ceasing their entrepreneurship, as determined by the second cause of business closure in 2016. Regarding results of the gross profit margin, on average, for both liquidated and active companies, it was a 45.97% and a 47.95% correspondingly. Values also show that in both cases an average net return of a 31.15% was obtained for the active companies and a 2.59% for the liquidated ones. In this occasion, active companies show better results. However, indebtedness on average, place liquidated companies in disadvantage with an 89.72%, about a 68.94% obtained by active companies. These results suggest that the owners of the liquidated companies were not conservative enough against their participation and that of their creditors. Regarding short-term average debt, the liquidated companies reached an index of a 73.17%, lower than a 77.82% of active companies. Conversely, the long-term debt ratio is better in active companies with a 63.75% compared to a 71.97% of liquidated companies.

These data are interesting considering that the indicators that capture deteriorating financial conditions are also used to detect fraud, since companies experiencing financial difficulties are precisely the most likely to manipulate the financial statements (Serrano-Cinca et al., 2019) According to the results found, the business sector of wholesale and retail sales must pay special attention to the financial performance of the indicators of indebtedness of assets and profitability, these indicators were critical when differentiating an active company from a liquidated one. For this sector the liquidity indicator did not indicate major problems for the survival of companies.

References

- Amankwah-Amoah, J. (2016). An integrative process model of organizational failure. Journal of Business Research, 69(9), 3388-3397.

- Amankwah-Amoah, J., Hinson, R., Honyenuga, B., & Lu, Y. (2019). Accounting for the transitions after entrepreneurial business failure: An emerging market perspective. Structural Change and Economic Dynamics (50), 148-158.

- Amat, O. (2010). Comprehensive business analysis: keys to a complete check: from qualitative analysis to balance sheet analysis with case studies solved (Primera ed.). México: Alfaomega - PROFIT.

- Arroyo Chacón, J.I. (2012). The life cycle. Electronic Journal of the Faculty of Law, ULACIT - Costa Rica (2), 39-58. Retrieved from http://www.ulacit.ac.cr/files/revista/articulos/esp/resumen/52_08jenniferisabel arroyo chacon5.pdf

- Baena Toro, D. (2012). Financial analysis: Financial approach and projections (First ed.). Bogotá, Colombia: Eco Editions.

- Baena Toro, D. (2014). Financial analysis: Approach and projections (Second ed.). Bogotá, Colombia: Eco Ediciones.

- Castro Sanz, M. (2003). The Social Economy as an economic agent: need for participation in the dialogue. Revista de Economía (47), 41-57. Retrieved from https://www.redalyc.org/articulo.oa?id=17404707

- Danilov, K.A. (2014). Corporate bankruptcy: Assessment, analysis and prediction of financial distress, insolvency, and failure. 90. Retrieved from http://dx.doi.org/10.2139/ssrn.2467580

- Delfín Pozos, F.L., & Acosta Márquez, M.P. (2016). Importance and analysis of business development. Pensamiento & Gestión, 40, 184-202. Retrieved from http://dx.doi.org/10.14482/pege.40.8810

- Garcia, M., Zouaghi, F., García, T., & Robinson, C. (2019). What drives business failure? Exploring the role of internal and external knowledge capabilities during the global financial crisis. Journal of Business Research (98), 441-449.

- García Segura, C. (2017). eumed.net. Retrieved from http://www.eumed.net/libros-gratis/actas/2017/desarrollo-empresarial/49-importancia-del-analisis-financiero-en-una-empresa-fletera.pdf

- Gitman, L.J. (2003). Principles of Financial Administration (Tenth ed.). México: Pearson Educación.

- Hernández Sampieri, R., Fernández Collado, C., & Baptista Lucio, M. (2014). Metodología de la investigación (Sexta ed.). México: McGraw-Hill Interamericana. Retrieved from https://bibliotecas.ups.edu.ec:2708

- Indacochea Cáceda, A. (2016). Strategy for business success: The business prospect. Beyond strategic planning (O. Martinéz, Ed.). México: Cengage Learning.

- INEC. (2017). National Institute of Statistics and Censuses. Retrieved from http://www.ecuadorencifras.gob.ec/ /directoriodeempresas/

- Keasey, K., & Watson, R. (1991). Financial distress prediction models: A review of their usefulness. British Journal of Management, 2(2), 89-102.

- Ley de Compañías. (2014). Superintendence of Companies, Securities and Insurance. Retrieved from http://portal.supercias.gob.ec/wps/portal/Inicio/Inicio/SectorSocietario/Normativa/LeyCompanias

- Lizarazo Barrero, E.F. (2017). Financial variables of small and medium-sized Colombian companies that fail compared to those that survive. Maestría thesis, Universidad Nacional de Colombia - Sede Bogotá. Retrieved from http://bdigital.unal.edu.co/64384/2/EdgarF.LizarazoBarrero2018.pdf

- Lopéz Dumrauf, G. (2013). Corporate Finance: A Latin American approach (Third ed.). Buenos Aires, Argentina: Alfaomega Grupo Editor Argentino.

- Market Watch Ecuador. (2018). Market Watch Ecuador. Retrieved from http://marketwatch.com.ec/category/ reportes/

- Mures Quintana, M.J., García Gallego, A., & Vallejo Pascual, M.E. (2012). Analysis of business failure by sectors: differentiating factors = Cross-industry analysis of business failure: differential factors. Pecvnia: Journal of the Faculty of Economic and Business Sciences, Universidad de León, 52-83. Retrieved from http://dx.doi.org/10.18002/pec.v0i2012.1107

- Nava Rosillón, M.A. (2009). Financial analysis: a key tool for efficient financial management. Revista Venezolana de Gerencia, 14(48), 606-628. Retrieved from https://www.redalyc.org/articulo.oa?id=29012059009

- Navarrete Marneou, E., & Sansores Guerrero, E. (2011). Fracaso de las micro, pequeñas y medianas empresas: un análisis multivariable. Revista International Administración & Finanzas, 4(3), 13. Retrieved from https://ssrn.com/abstract=1884519

- Pérez Chávez, J., & Campero Guerrero, E. (2017). Liquidación de sociedades (Segunda ed.). México: Tax Editores Unidos. Retrieved from https://bibliotecas.ups.edu.ec:2708

- RAE. (2014). Real Academia Española (vigésimatercera ed). Retrieved from http://dle.rae.es/?id=ILxbAAO

- Romero Espinosa, F. (2013). Variables financieras determinantes del fracaso empresarial para la pequeña y mediana empresa en Colombia: análisis bajo modelo Logit. Pensamiento & Gestión(34), 235-277. Retrieved from http://www.scielo.org.co/scielo.php?pid=S1657-62762013000100012&script=sci_abstract&tlng=es

- Rubio Dominguez, P. (2007). eumed.net. Retrieved from http://www.eumed.net/libros-gratis/2007a/255/indice.htm

- Serrano-Cinca, C., Gutiérrez-Nieto, B., & Bernate-Valbuena, M. (2019). El uso de indicadores de anomalías contables para predecir el fracaso empresarial. Revista Europea de Gestión, 37(3), 353-375.

- Sheng, J., & Lan, H. (2019). El fracaso empresarial y los medios de comunicación: análisis de una exposición a los medios en el contexto del caso de exclusión. Revista de investigación empresarial (97), 316-323.

- Superintendencia de Compañías, Valores y Seguros. (2019). Superintendencia de Compañias, Valores y Seguros. Retrieved from http://reporteria.supercias.gob.ec/portal/samples/images/docs/tabla_indicadores.pdf

- Van Horne, J.C., & Wachowicz Jr, J.M. (2010). Fundamentos de administración financiera (Décimotercera ed.). México: Pearson Educación.

- Vargas Charpentier, J.A. (2014). Models of beaver, ohlson and altman: are really able to predict the bankruptcy in the costa rican business sector? TEC Empresarial, 8(3), 29-40.

- Vargas Charpentier, J.A., Barrett Gómez, M., & Cordero Rojas, J.M. (2013). Models for company bankruptcy prevention used by the Costa Rican business sector). TEC Empresarial, 7(3), 43-49.

- Villalobos, G. (2018). Mondaq Connecting Knowledge & Peolple. Retrieved from http://www.mondaq.com/x/ 718516/Shareholders/Causas+De+Disolucin+De+Compaas

- Villegas Valladares, E. (2002). Financial analysis in agribusiness. Mexican Journal of Agribusiness, 6(10). Retrieved from https://www.redalyc.org/articulo.oa?id=14101003