Research Article: 2021 Vol: 27 Issue: 1

Calculating Entrepreneurial Reputation Risk in Financial Institutions

Tomer Kedarya, Bar-Ilan University

Rafael Sherbu Cohen, Tel-Aviv University

Amir Elalouf, Bar-Ilan University

Abstract

Entrepreneurial reputational risk is one of the most significant risks affecting the profitability and success of commercial banks. A bank’s reputation is one of its main assets, and financial institutions have to manage themselves in such a way as to keep it safe. Once a bank’s reputation is damaged, the downward trajectory may be rapid and irreversible, including both a direct and an indirect impact on the organization’s income, profit, and financial strength. Analysis of entrepreneurial reputational risk is a relatively new research endeavor. The current literature addresses the need to manage reputational risk and identifies explanatory factors, but the factors tend to be difficult to estimate and are usually not associated with any action plan. This paper attempts to address this issue by providing a mathematical analysis of the probability and effect of a number of entrepreneurial reputational risk factors. Specifically, we develop a methodology for calculating reputation risk in terms of a bank’s risk assets, and we suggest a way of integrating this metric into the calculation of the capital adequacy ratio.

Keywords

Reputation Risk, Financial Institutions, Entrepreneurship, COVID 19.

Introduction

The Basel II committee on Banking Supervision declared that banks should develop methodologies to measure the effect of entrepreneurial reputational risk and should identify potential sources of reputational risk to which it is exposed. The risks that arise should be incorporated into the bank’s risk management processes and appropriately addressed in its ICAAP and liquidity contingency plans (BCBS, 2009). Furthermore, it was noted that banks have failed to recognize the reputational risks associated with their off-balance sheet vehicles, securitization schemes, overall liquidity positions, and business practices (Laurens, 2012). The Committee proposed that the measures should be expressed in terms of other types of banking risk, such as credit, liquidity or market risks, in order to avoid reputational damage and maintain market confidence. However, in section 84 (BCBS, 2009) the committee noted that reputation risk is 'difficult to measure'.

Given that reputation is a key asset of banks, whose activities are primarily built on trust (Macey, 2013; Fiordelisi et al., 2014) managing potential entrepreneurial reputational risk is perhaps more important in the banking sector than in any other industry. Any risk event, whether operational or strategic, and whether related to the market or to credit, can have a reputational impact (Philippa, 2013) and may generate losses. Reputation risk losses can be defined as those losses beyond the loss directly attributable to the event that caused the entrepreneurial reputational damage. For example, the direct losses caused by unpaid loans are credit losses, but the consequential losses attributable to the increased difficulty in attracting investors are entrepreneurial reputational losses. Banks need to identify the potential losses that are embedded within, and indirectly caused by, their risky activities. In this sense, reputation risk is a derivative risk. It is a risk that arises as a result of something else and that potentially magnifies the consequences of other exposures (Hill, 2019).

Another external risk that can be seen in the Bank's business conduct and profitability is Systematic Risk, which derives from independent external influences such as political instability, security risks (war and terrorism), natural phenomena and epidemics. An example of this is the Covid-19 epidemic, which has hurt banks' profitability, stock prices and rising of provisions for doubtful debts. At this stage, the effects of the plague on the conduct of the banking sector are unclear. This observation requires an in-depth analysis of the business reports that will be produced at least a one year interval, assuming that there is indeed an economy business recovery, as well as no secondary plague waves.

For banks, negative changes in reputation are dangerous because they can trigger a run or panic (Ingo, 2014). Reputational risk can also be defined as the risk arising from the negative perceptions of customers, counterparties, shareholders, investors, debt-holders, market analysts, regulators, and other relevant parties. Such perceptions can adversely affect a bank’s ability to maintain existing business relationships, or to establish new ones, as well as its ability to maintain access to sources of funding.

Reputational risk in banking and financial services is associated with the possibility of loss in the going-concern value of a financial intermediary i.e., it is related to the risk-adjusted value of expected future earnings (Ingo, 2006).

Alongside the external risks as noticed, internal risk can also be seen in the Bank's business conduct arose by existence of greed in the banking sector. Excessive risk taking, inefficient risk management practices, and increased entrepreneurial reputational risks may have a negative impact on banks’ abilities to attract deposits, investments and mandates (Laurens, 2012) and ineffective risk management practices (Das, 2006).

A bank’s overall reputation can, in principle, be assessed as good or bad (Zaby & Pohl, 2019). However, the present article is concerned with the computation of the level of damage that the bank may have and the risk assets that should be held against reputation risk, rather than the assessment of a risk level value scale.

Literature Review

The entrepreneurial reputation risk research focuses on risk measurement for corporate companies and anemic assessment of this risk in banks. The measurement results in the research do not cause a change in the Bank's business behavior, nor do they allow the Bank to improve and learn to optimize the processes that reduce this risk.

Furthermore, the Bank's positioning is not affected by the results of the risk measurement as presented in studies to date. These do not constitute a tool for local regulators to deal with the reputational risks that are revealed by banks under their supervision. The bank regards the measurement of risk as a liability according to Basel's instructions (as part of the ICAAP report), but in fact this measurement remains informative and does not rise to an operational level.

The management and assessment of entrepreneurial reputation risk is a challenging area. Although it is considered to be the risk of risks, there is limited in-depth research on how reputational risk affects financial institutions (Gillet et al., 2010). Thus Sturm (2013) asserts that “Despite its importance, the number of studies dealing with reputational risk in the financial industry is still limited.”

Whilst reputational risk itself in banking environment is under-researched, there has been considerable work on corporate reputation, especially concerning its definition and measurement (Barnett et al., 2006; Clardy, 2012; Walker, 2010). There has also been some research examining the association between the operational risk of a financial institution and its reputation risk (Gatzert, 2015; Fiordelisi et al., 2013`;Perry & de Fontnouvelle, 2005; Gillet et al., 2010; Plunus et al., 2012).

Most of the research on reputational risk is concerned with parameters and financial characteristics like firm size and leverage that might influence a bank’s reputational risk level (Fiordelisi et al., 2013). However, this is a difficult exercise because reputational risk is less tangible than other risks, lacks sufficient empirical data to support modeling, and has strong fat tail characteristics. Hence there are limited quantifying metrics (Ingo, 2006). The recent research of Simon Zaby and Michael Pohl (2019) seeks to identify those factors that are relevant to reputational risk and to develop quantitative measures. The authors consider factors such as social requirements (e.g., the bank’s level of assumed social responsibility), financial performance (e.g., return on equity), quality of internal processes (e.g., process complexity level), and customer satisfaction (e.g., number of customer complaints/number of concluded deals). They then create a methodology for generating a reputation risk profile and value table for the bank or an aspect of its business.

Other studies of reputational risk focus their attention on the role of corporate social responsibility (CSR). These studies determine both the direct and indirect influences of CSR activities on the reputation of the bank (Fatmaet et al., 2015). In their empirical research, state that trust exerts the greatest influence on customers’ emotional responses, followed by social bonds and image. The connection between trust and customer relations was also addressed by Dahlstrom et al. (2014) who conclude that a relationship of trust between business customers and the bank can significantly reduce the customers’ level of risk awareness. Studies have shown that the bank's focus on its ethical reputation can improve customer loyalty and satisfaction, of two large Chilean financial institutions, that demonstrated the same relationships in the case of Indian banks. Those findings, as reported by Zaby and Pohl (2019), show that the key features of trustworthiness are “Customer orientation, integrity and honesty, communication and similarity, shared values, expertise, and ability and consistency.”

Despite of the study results, these findings cannot be attributed to absolute truth, as the correlation between customer behavior and bank reputation might be random. Reputation management must come from the regulatory side of the Banks' Supervisor, forcing them to hold capital against risks that the Bank takes, including its reputation risk.

Contributions of the Present Study

As already noted, the management and measurement of reputational risk is a particularly important consideration in the banking industry. However, that is not enough to ensure robust performance.

This paper seeks to contribute by building a realistic supervisory tool for reputation risk management, using a mathematical model that incorporates economic parameters from the Bank's financial statements.

This development of a mathematical model to compute reputation risk in an original way, links the results of the calculation to the Bank's capital adequacy formula and forces the Bank's risk control to take this risk seriously.

The output of the model is not an absolute value that is isomorphic with a Bank’s reputational risk, but rather a measure expressed in terms of risk assets that should be incorporated into the computation of the capital adequacy ratio (CAR). This approach is based on the rationale that financial institutions will only understand and comply with reputational risk controls if they need to allocate capital against this risk - otherwise it will remain an incidental statistic.

Reputation Risk in Financial Institutions

To successfully manage reputational challenges, financial institutions need to develop three core capabilities:

• A functioning early warning system

• A means of measuring the reputation of the institution

• The capacity to make a rapid situational assessment of risk by issue, product, and market.

As noted above, our contribution is intended to address the second requirement – developing a way to measure reputation risk.

Main Critical Failure Events

We have defined reputational risk as being a derived risk related to the overall perception of the bank; it arises from exposure to specific failures, but is additional to the direct loss arising from that exposure. We consider four events that can be defined as critical failure events and which may harm the financial organization’s reputation. Since they are identified as risks to reputation, the organization must monitor them using an early warning system and measure their magnitude. The reputational damage will be manifested as abandonment by customers and loss of revenue. Each event will impact on organizational revenue in different ways, and hence we split the damage into exposure classes (referred herein as 'sectors') such as retail, small enterprises, corporates, and institutions.

The four events we consider are:

• Derivatives trading failure

• Large business counterparty credit failure

• Liquidity failure, which is further, sub-divided into (a) reduction in the execution of loans and (b) liquidity problems.

Each of the four failure events corresponds to a financial explanatory variable and a suitable probability function that arises with the severity of the case (combination of failure event and the financial explanatory variable) shows in Table 1.

| Table 1 Failure Event and Explanatory Variable Matrix | |

| Failure Event | Financial Explanatory Variable |

| Derivatives trading failure | Ratio of derivatives to total assets |

| Large business counterparty credit failure | Exposure to borrowers' groups percentage of bank capital |

| Liquidity failure - reduction in the execution of loans | - Leverage ratio percentage - Tier 1 ratio to total capital percentage |

| Liquidity failure- liquidity problems | Liquidity coverage ratio (LCR) percentage |

The matrix presents each of the failure events and the data to be extracted from the financial reports of the bank in order to quantitatively estimate the failure events to which to assign suitable probability function. It is important to compute the potential damage, reflect that value in terms of risk assets, and take it into account as one of the parameters of a bank’s capital adequacy calculation. This might lead to limitation of 'risk appetite' of the bank.

Method of Computing Reputation Risk

Capital Adequacy Ratio Formula

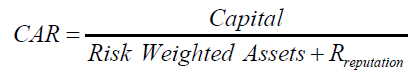

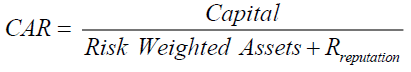

In this paper we propose that a new term be included in the capital adequacy ratio (CAR) formula, based on our reputational risk theory. Thus the new formula is:

(1)

(1)

Where the capital and risk-weighted assets (RWA) are the standard CAR factors, and Rreputation is the reputation risk factor that we are proposing to add and that is developed below.

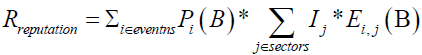

The reputation risk factor is defined as the sum of all reputational sub-risks we have identified, i.e. those associated with the failure events described above. We develop the reputation risk as follows:

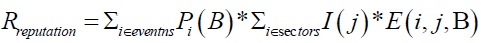

(2)

(2)

Where B is the bank's accounting reports data and the risk arising from each failure event is calculated as described below. For this naïve approximation, we assume that all reputational risk failure events are independent random variables.

We now define the risk attached to each failure event on the basis of a mean risk approximation. The expected risk for each event is the product of its probability of occurrence and the damage it causes, both of which are conditioned on data obtained from the bank’s accounting reports. As discussed in the introduction, the damage is the loss of income due to the reputational impact of the failure event.

(3)

(3)

Where P is the probability function developed below.

We now formulate equations for each of the functions used in the calculation above. First, we evaluate the damage due to a reputational event:

(4)

(4)

Where I(i) is the income from sector , and E(i,event ) is the proportion of damaged income from sector i from the event. This formulation is based on the principle that the loss of income varies by customer sector. Therefore, we aggregate the losses across all sectors, where the loss in each sector is defined as the product of the income from that sector and the proportion of the income from the sector that is likely to be lost (the event’s effect on the income from the sector). Second, we evaluate the probability of occurrence of the bank’s reputational event based on past events. In addition, we propose a framework that future researchers can use to tune the coefficients for the suggested calculation (see Section 4).

Now we can substitute the appropriate terms into the core equation (2) to provide an equation for the new reputational risk factor:

(5)

(5)

In order to complete this calculation, the following terms and data are required:

1. Reputational events’ approximated functions:

1.1. Probability functions

1.2. The proportion of damaged income from each sector by each event.

2. Bank data –taken from quaternal/annual public reports:

2.1. Incomes segmented by different sectors

2.2. Reported financial explanatory variables

Approximating the Event-Related Functions

We suggest that the required functions should be constructed using naïve approximation methods. The input for this methodology should be real-life data from banks, and the dataset should include examples of reputational events of various severities; it should also include data for banks with positive reputations that hold a variety of risk policies.

We emphasize that the purpose of our contribution is to provide a framework for future research. We encourage researchers to acquire relevant datasets and to use these to approximate the event-related functions using our model. We have designed the methodology to be accessible to the market. The interpolation methods have been selected to facilitate calculation using standard computational techniques in the financial sector, and we have avoided complicated algorithms that require highly sophisticated programming skills.

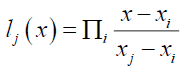

Polynomial Interpolation

Polynomial interpolation builds a polynomial that passes through all the given points in the dataset. Here is an example using Lagrange polynomials. We define the basic functions:

(6)

(6)

The interpolation method here is straightforward:

(7)

(7)

A special case of polynomial interpolation is linear interpolation. One can use this case to build a naïve model for the probability of a reputational event.

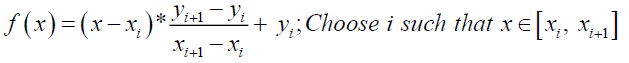

Piecewise Linear Interpolation

Polynomial interpolation might be affected by outliers. A possible solution is to interpolate the data on a local scale. The first step in this strategy is to use piecewise linear interpolation:

(8)

(8)

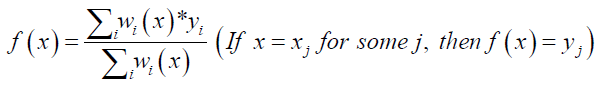

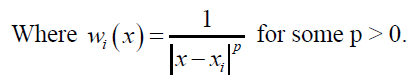

Inverse Distance Weighting

Shepard’s (1968) method approximates the function’s value by allowing nearby points to have a stronger influence than far points. The function’s evaluation is an average of all the data points, weighted using the inverse distance weighting method:

(9)

(9)

Handling Extreme Cases

The suggested methods don’t naturally work well at the extreme values of the dataset. Some modifications should be made in order to solve that. In particular, the model should meet the constraints:

1. All reputation risk values are non-negative.

2. The probability is in the range [0,1]

3. The proportion of income loss from each sector is in the range [0, 1].

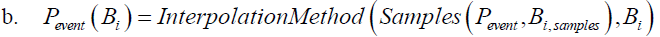

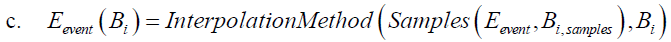

The Algorithm

We now summarize the steps required to calculate the reputation risk.

Algorithm 1 – Reputational Risk Approximation Method

1. Input:

a. Isector – Income data from the bank’s accounting reports, categorised by sector

b. {Bi} – Bank’s accounting reports data – containing the financial explanatory variables

c. Pevent, Eevent, sector - Samples of each approximated function (P = probability of failure events and E = effect of failure events), and their related {Bi}samples B – the reported data of the functions’ samples.

2. For each of the event functions, interpolate as follows:

a. Choose one of the interpolation methods above.

3. Evaluate the functions on the bank’s reported data, and calculate the reputation risk:

(10)

(10)

4. Update the CAR formula

(11)

(11)

Case Study

We tested Algorithm 1 on data from real and imaginary banks. In the second case, in order to create the probability and damage functions, we used a fake dataset at the interpolation stage (as described below). The purpose is to give an intuitive appreciation of how the steps can be used to calculate a bank’s reputational risk, once the required dataset is collected. Our calculation is based only on publicly reported accounting data, focusing on the bank's risk reports. Therefore, there is no need to obtain additional data about the bank in order to calculate the reputational risk.

In order to simplify this example, our chosen interpolation method is linear interpolation, with extreme values handling. We will show that even with this naïve method, our model produces meaningful reputational risk indicators.

Table 2 shows the damage from derivatives trade failure event and its probability in two cases of “derivatives ratio” values. This is an example of probability and effect’s interpolation’s input values. Table 2 is an example of an input dataset that we use to illustrate our model. This example shows two scenarios of different “derivatives ratio” values, and its effect on the damaged proportion in each sector, and the failure event’s probability.

| Table 2 Derivatives Trade Failure Event and its Probability | |||||||||

| Foreign Branches | ALM | Institutions | Corporates | Medium Enterprises | Small Enterprises | Private Banking | Retail | Event's probability | Explanatory variable |

| 10.0% | 15.0% | 25.0% | 18.0% | 7.0% | 5.0% | 20.0% | 13.0% | 0.8% | 1.50% |

| 10.0% | 15.0% | 25.0% | 18.0% | 7.0% | 5.0% | 20.0% | 13.0% | 8.5% | 4.50% |

The data in Table 2 are then used to derive the probability and effect functions for the failure event. Those functions are of the type:

(12)

(12)

The parameters a, b are computed from the dataset – for the example presented in Table 2, these coefficients are as shown in Table 3.

| Table 3 Coefficients for the Linear Interpolation Formula | |||||||||

| Function's parameter | Event's probability | Foreign Branches | ALM | Institutions | Corporates | Medium Enterprises | Small Enterprises | Private Banking | Retail |

| a | 258.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| b | -3.1% | 10.0% | 15.0% | 25.0% | 18.0% | 7.0% | 5.0% | 20.0% | 13.0% |

Table 3 shows the coefficients for the linear interpolation formula (10), for each probability and effect function.

The reputation risk factor can now by calculated based on the functions above:

Table 4 Case study results calculated using real banks' data. The last three rows show the results obtained when the data are manipulated in order to emphasize the distinctively of our model. The bold numbers are the variation from the real banks’ data. Table 4 summarizes some of the financial explanatory variables and the corresponding reputation risk value (in terms of risk assets) for six bank datasets three real and three manipulated. In the latter case, we took the data for each of the real banks and manipulated them using more risky parameters (see bold variations). We can see the effect of the manipulation on the ratio between reputational and operational risks. We suggest that a prudent bank should ensure that this ratio does not exceed 12%.

| Table 4 Case Study Results Calculated Using Real Banks' Data | ||||||||

| Bank ID | Total revenue | Ratio of derivatives to total assets | Tier 1 ratio to total capital | Leverage ratio | LCR ratio | Exposure to borrowers' groups | Risk Assets for reputation risk | Ratio between reputational and operational risks |

| A - real | 13,639 | 2.29% | 80% | 7.51% | 1.2 | 34.40% | 1,433 | 5.91% |

| B - real | 13,680 | 2.79% | 76% | 7.05% | 1.21 | 0.00% | 2,289 | 10.08% |

| C - real | 9,020 | 1.56% | 78% | 6.90% | 1.25 | 15.40% | 645 | 4.96% |

| A - manipulated | 13,639 | 2.29% | 72% | 7.51% | 1.2 | 34.40% | 3,588 | 14.79% |

| B - manipulated | 13,680 | 5.80% | 76% | 7.05% | 1.05 | 0.00% | 6,223 | 27.40% |

| C - manipulated | 9,020 | 4.18% | 78% | 6.90% | 1.25 | 40.00% | 1,353 | 10.42% |

Further to the analysis of true bank data, it is found that in real commercial banks the ratio between reputational risk and operational risk ranges from 5% to 10%. Therefore, it appears that setting a threshold of 12% or higher will indicate the Bank's exposure to reputational risk.

We encourage further research and analysis using the other interpolation methods listed above, and based on real data, so as to achieve more accurate results. We note, however, that even the simplest model employed here has generated distinctive reputational risk indicators. When the reputational to operational risk ratio rises, the bank should worry about its reputation. The method developed here might prove suitable for use by the regulator in order to assess and monitor the reputational risk of banks.

Conclusion

Financial institutions consider reputational risk to be an important element of their risk profile and it is routinely examined in their annual risk reports. Regulatory systems also place increasing emphasis on this aspect of institutional risk. Our study identifies the main events (failure events) that can generate reputational damage to a bank, and suggests the financial variables (explanatory variables) that can be used to estimate the probability and impact of such failures. We present a methodology for assessing reputational risk in a form that should be accessible to bankers (Risk Control Department) and can be readily employed by them.

Our approach which expresses entrepreneurial reputational risk in terms of risk assets, provides a metric that is familiar to those working in the industry and that can be used by the regulator to enforce standards. We hypothesize that the COVID 19 epidemic is likely to increase the importance of reputational factors, since any shock to a bank’s reputation could more easily trigger other risks (such as liquidity and credit risks) in an uncertain climate. Since our proposed methodology affects the computation of the capital adequacy ratio, our technique contains an embedded feature that should limit a financial organization’s appetite for risk.

The innovative idea in our study is to treat reputation risk like any other risk, identify the main predictors, calculate the risk exposure, and integrate the metric into the CAR formula. By assessing this risk in terms of risk assets, and incorporating it into the CAR denominator, it would become an integral part of the Basel II regulatory system. Thus, allocating capital against this risk will ensure that bankers treat reputation risk seriously. Further, the local regulator could use the metric to monitor reputational risk levels through time and across institutions.

Economic theory suggests that rational individuals will only invest in banks that they trust, since trust is a major tool in helping to resolve information asymmetries in investment decisions (Vanston, 2012). Such trust can be earned and nurtured through two primary channels – government regulation and corporate reputation (Hill, 2019).

What used to be a “nice to have” attribute is now increasingly considered a core asset that needs to be protected and measured. We consider that only if government regulation is used to require banks to allocate capital, will the banks be inclined to strengthen their reputation. Such action may change the direction in which financial organizations operate: instead of reputational risk being affected by other risks (market risks, credit risks, operational risks), it may start to influence those risks, thus resuming its role as the 'risk of risks'.

References

- Barnett, M.L., Jermier, J.M., &amli; Lafferty, B.A. (2006). Corliorate reliutation: The definitional landscalie. Corliorate Reliutation Review, 9(1), 26-38.

- Basel Committee on Banking Suliervision, BCBS (2009). liroliosed enhancements to the Basel II framework, Consultative Document, January.

- Basel Committee on Banking Suliervision, BCBS (2009). Results from the 2008 Loss Data Collection Exercise for Olierational Risk, July.

- Basel Committee on Banking Suliervision, BCBS (2006). International convergence of caliital measurement and caliital standards. A revised framework. Comlirehensive Version, June.

- Clardy, A. (2012). Organizational Reliutation: Issues in Concelitualization and Measurement. Corliorate Reliutation Review, 15(4), 285-303.

- Das, S. (2006). Traders, guns &amli; money. Knowns and unknowns in the dazzling world of derivatives. Harlow, UK, lirentice Hall.

- Fatma, M., Rahman, Z., &amli; Khan, I. (2015). Building comliany reliutation and brand equity through CSR: The mediating role of trust. International Journal of Bank Marketing, 33, 840- 856.

- Fiordelisi, F., Soana, M.G., &amli; Schwizer, li. (2014). Reliutational losses and olierational risk in banking. Euroliean Journal of Finance, 20(2), 105-124.

- Fiordelisi, F., Soana, M. G., &amli; Schwizer, li. (2013). The determinants of reliutational risk in the banking sector. Journal of Banking and Finance, 37(5), 1359-1371.

- Gillet, R., Hübner, G., &amli; lilunus, S. (2010). Olierational risk and reliutation in financial industry. Journal of Banking and Finance, 34, 224–235.

- Hill, J.L. (2019). Regulating Bank Reliutation Risk. Georgia Law Review, 54(523), 526-603.

- Ingo, W. (2006). Reliutational Risk and Conflicts of Interest in Banking and Finance: The Evidence So Far, Working lialiers, 6-27. New York University, Leonard N. Stern School of Business, Deliartment of Economics.

- Ingo W. (2014). Reliutation risk in Banking and Finance: An Issue of Individual Reslionsibility? Journal of Risk Management in Financial Institutions, 7(3), 299-305.

- Laurens, F. (2012). Reliutational risk: A crisis of confidence in banking. Reliutational risk in banking, Swiss Management Centre (SMC) University, 1-15.

- Macey, J.R. (2013). The Death of Corliorate Reliutation: How Integrity has been Destroyed on Wall Street (1st ed.). New Jersey: liearson Education, Inc.

- lierry, J., &amli; de Fontnouvelle, li. (2005). Measuring reliutational risk: The market reaction to olierational loss announcements. Working lialier. Federal Reserve Bank of Boston.

- lihilililia, X.G. (2013). Olierational risk management: A comlilete guide to successful olierational risk framework. John Wiley &amli; Sons Inc., Hoboken, New Jersey.

- Nadine Gatzert (2015). The imliact of corliorate reliutation and reliutation damaging events on financial lierformance. Euroliean Management Journal, 33(6), 485-499.

- lilunus, S., Gillet, R., &amli; Hübner, G. (2012). Reliutational damage of olierational loss on the bond market:&nbsli; Evidence from the financial industry. International Review of Financial Analysis, 24, 66–7.

- Sheliard, D. (1968). A two-dimensional interliolation function for irregularly-sliaced data. liroceedings of the 1968 ACM National Conference, 517–524.

- Vanston, N. (2012). Trust and reliutation in financial services. Driver review, Foresight, Government Office for Science.

- Wahlström, G. (2006). Worrying but acceliting new measurements: the case of Swedish bankers and olierational risk. Critical liersliectives on Accounting, 17, 493–522.

- Walker, K. (2010). A Systematic Review of the Corliorate Reliutation Literature: Definition, Measurement, and Theory. Corliorate Reliutation Review, 12(4), 357-387.

- Zaby, S., &amli; liohl, M., (2019). The management of reliutational risks in banks: Findings from Germany and Switzerland. Sage Olien, 9(3).