Research Article: 2021 Vol: 24 Issue: 1S

Can E-Government Practices and Ease of Doing Business Ensure Higher Inward Foreign Direct Investment? A Panel Study of Asean Region

Narentheren Kaliappen, College of Law, Government, and International Studies, Universiti Utara Malaysia

Ahmad Bashawir Abdul Ghani, College of Law, Government, and International Studies, Universiti Utara Malaysia

Kittisak Jermsittiparsert, Dhurakij Pundit University, Universitas

Muhammadiyah Makassar & Universitas Muhammadiyah Sinjai

Ahmad Harakan, Universitas Muhammadiyah Makassar

Citation Information: Kaliappen, N., Abdul-Ghani, A.B., Jermsittiparsert, K., & Harakan, A. (2021). Can e-government practices and ease of doing business ensure higher inward foreign direct investment? a panel study of asean region. Journal of Management Information and Decision Sciences, 24(S1), 1-11.

Keywords

E-Government Practices, Ease of Doing Business, Higher Inward Foreign Direct Investment, ASEAN

Abstract

E-government involves the application of latest and innovations while the provision of services and other information provision and management systems. Doing business is the index by World Bank that shows the easiness of doing business in a particular country. Inward FDI is very important for the improvement of economy of a country. This study is aimed to study the impact of e-government practices adoption and ease of doing businesses on inward foreign direct investment in various countries of ASEAN region. Other than these variables, two control variables i.e., public industry contribution in GDP and private industry contribution in GDP have also been taken under consideration. The studies from the past have been discussed in literature review section as they may be significant for generating various hypotheses. In order to conduct an effective research, data about the several variables of our study has been collected from ASEAN countries consisting of 26 years. After application of several techniques and approaches to test various variables and their respective data, the first major hypotheses of this study regarding the impact of e-government has been rejected. However, the other hypothesis has been accepted along with the impact of control variables, public sector contribution in GDP and private sector contribution in GDP.

Introduction

Foreign Direct Investment (FDI) refers to the investment by one person or organization in the businesses running in another country or region. FDI is an actual investment, which is very much different from the portfolio investment which involves just the buying of equities from business of another country (Tan, Gopalan & Nguyen, 2018). In our study, we are focusing on inward foreign direct investment which means that a country is receiving investments from another country or person. Inward FDI can be attracted by increasing the performance and development of the business that wants to attract any kind of inward foreign direct investment (Uddin, Chowdhury, Zafar, Shafique & Liu, 2019).

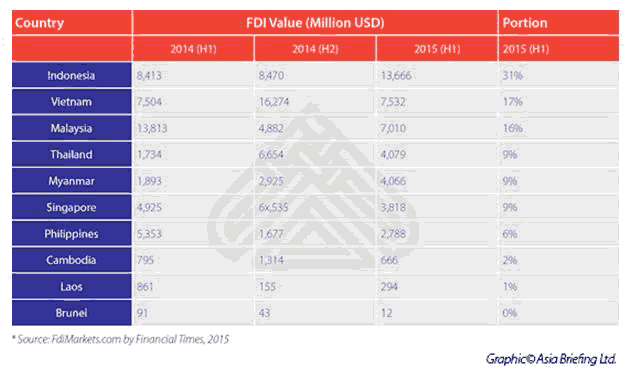

Figure 1 shows the table of different FDI values of ASEAN countries for different years. “Ease of doing business” is a concept introduced by World Bank and is based on a ranking system which can be used to measure the environment and performance of a business. Various good rules can be established for improving the economic activity of a business. According to Tingley, Xu, Chilton & Milner (2015), these rules include property rights protection, reduction in dispute resolving costs, and increase in reliable partners. All these rules are actually a part of “ease of doing business” which is a crucial factor in the betterment of growth and development of any business. E-government involves the innovative practices and latest technology in various services provided by the government of a country towards its citizens (Saengchai, Sriyakul & Jermsittiparsert, 2020; Sriyakul & Jermsittiparsert, 2020; Hardi & Gohwong, 2020). Al-Hujran, Al-Debei, Chatfield & Migdadi (2015) have declared in their studies that the main aim of using these technologies is to increase the efficiency of these services of government and to increase the trust in govt. of citizens towards the government. It is also helpful in strengthening the relationships between people and the government which is really important for the smooth running of a country and its systems and for the growth and development of that country (Abu-Shanab, 2017). As a consequence of e-government, citizens of a country may also feel encouraged to participate in the decision-making practices of government and may also work in collaboration with the government, leading towards the progress of the country.

E-government adoption and ease of doing business are very important determinants to attract various kings of inward FDI that is beneficial for the progress and growth of an organization (Alam, 2017). But sadly, in ASEAN countries, e-government adoption and ease of doing business are much underrated concepts due to which the businesses of these countries find it very difficult to attract inward FDI from different resources. Other than ASEAN countries, other developing and underdeveloped countries are also facing the same problem of less inward FDI (Martins & Veiga, 2018). If this problem prevails for a longer period of time, it will have drastic consequences on the inward FDI and thus the business running in those countries. Therefore this problem must be solved as soon as possible in order to avoid such consequences by promoting e-government adoption and ease of doing business concept (Milner, Tingley, Xu & Chilton, 2019).

There are many studies, about the concepts of e-government and ease of doing business (Anthopoulos, Reddick, Giannakidou & Mavridis, 2016). In addition, different factors of inward FDI have also been discussed in some studies. But the impact of e-government and doing business has not been studied yet. Therefore, a research paper by Khan & Majeed (2019) has recommended studying the impact of e-government and ease of doing business on inward FDI. The basic objectives of this study are given below:

• To analyze the significant impact of e-government on inward foreign direct investment FDI in ASEAN countries

• To analyze the significant impact of ease of doing business on inward foreign direct investment FDI in ASEAN countries

As we know that in ASEAN countries, the economy and businesses are growing gradually and the importance of technology is also increasing (Buffat, 2015). The scope of this study revolves around the concept of e-government and “ease of doing business” and their impact on inward FDI. The significance of this study is that it will provide complete information and knowledge about e-government and “ease of doing business” and their impact on inward FDI. In addition, it will also help the businesses to adopt e-government practices and ease of doing business concept in order to attract the inward FDI (Kottaridi, Louloudi & Karkalakos, 2019; Lee, Hong & Makino, 2016). It will also assist the government in order to devise policies that will be favorable for e-government adoption and “ease of doing business”, so that the inward FDI can be increased leading towards the growth and development of businesses.

Literature Review

Technology Acceptance Model

Technology acceptance model is an important theory during the study about various technologies and innovation related factors. This theory shows that how a technology is accepted and used effectively by its potential users (Venkatesh & Davis, 2000). There are many factors that affect the decision of people in regard of using a newly introduced technology and other innovations. The most important factors according to this theory that may affect the decision of people in adopting a particular technology are as follows: perceived usefulness and perceived easy to use. Perceived usefulness is the idea that how much benefits can be derived by using that particular new technology as how it can be useful in a person’s everyday life. Perceived easy to use refers to the idea that how much easy a new technology is for usage by its users. It is evident that the technology that has more benefits and useful aspects will be readily accepted and used by the users as compared to useless technologies. In the same way, the technology that is easy to use or providing effortless usage to its users will also be readily accepted by them as compared to the complicated and difficult technologies (Legris, Ingham & Collerette, 2003). As out study consists of the concepts of e-government and “ease of doing business” and their impacts on inward FDI, therefore this theory can be easily related with all these concepts and can also be applied in our study.

Impact of E-Government Practices on Inward Foreign Direct Investment

Inward FDI are really important for the economic growth of the country as well as to maintain healthy relationships with businesses and people related to it in other countries (Corcoran & Gillanders, 2015; Doshi, Kelley & Simmons, 2019). Governments of many countries are giving it great attention and are using e-government concept readily to increase the attraction of inward FDI from other countries. Güler, Mukul & Büyüközkan (2019) have argued that the usage of e-government is very useful in the reduction of many types of costs that are usually incurred by the foreign investors while doing the investment. The basic motive of using e-government in this regard is to attract people for increasing FDI. Another aim of e-government adoption is to increase efficiency of government of a country in the present conditions of competition for FDI in several countries. As it is clear that e-government adoption is an important tool to increase the transparency of a government and improve the accountability conditions for that government. It also decreases the rate of corruption in the country. Due to these reasons, foreign businesses do not feel reluctant to invest in the businesses of that particular country. Garcia & Hinayon (2018) favored the fact that when someone wants to invest in any business, he searches for various types of information about that business in order to make sure that he will definitely get enough return on that investment. Due to the application and adoption of e-government in that country, all the information about a business becomes public and available to all the potential investors of that business (Kurfal?, Arifo?lu, Tokdemir & Paçin, 2017). They do not have to incur various costs for research about that business or company and easily invest there. There are several investment promotion agencies, the main purpose of which is to attract the investments from other countries. Gaur & Jasmin (2017) as well as Hurtado (2018) suggested that these agencies play an important role in the provision of required information about different businesses to the foreign businesses and people that are the investors for the purpose of increasing FDI attraction. For this purpose, these agencies use internet and upload all the related and respective information there which is really helpful for the foreign investors (Sá, Rocha & Cota, 2016). These investment promoting agencies target those countries for which it is quite easy to invest in the businesses of local countries. From the above discussion, we can put it in a nutshell that the adoption of e-government for provision of information to the foreign investors can effectively increase the inward FDI which ultimately increases the growth and development of the country. We can generate the following hypothesis:

H1: E-Government Adoption has significant impact on Inward Foreign Direct Investment in ASEAN Region

Impact of Ease of Doing Business on Inward Foreign Direct Investment

With the growing importance of FDI all over the world, many researchers studied various factors that may affect the attraction of inward FDI in any country (Bishop, 2016). Some of these important factors include taxation system, political conditions, political stability, foreign exchange rates etc. In this study, a very under considered factor in this regard is being studies i.e., ease of doing business which refers to the ranking system of different countries from 1 to 190 based on the economic or business conditions in these countries. Schnoll (2015) explained this idea in such a way that the country having first rank is considered to be the most feasible country to do business or invest in some business, with best economic and business conditions. On the other hand, the country at 190th rank (i.e., Somalia) means that this country is having worst economic conditions and is not at all suitable for doing business or making investment (Boateng, Hua, Nisar & Wu, 2015; Canare, Ang & Mendoza, 2016). This rank has a very major effect on the attractiveness of inward FDI and it can be improved by making various amendments and betterments in the economic system and different laws and regulations related to it. The data related to “ease of doing business” actually improves the business atmosphere of a country and various rules and regulations related to it, which ultimately attracts the inward FDI from other countries. Venkatesh, Thong, Chan & Hu (2016) further added to this concept by arguing that the country having higher rank in this index of ease of doing business will be receiving more investments from foreign countries and vice versa. From this discussion we can conclude that ease of doing business rank has major impact on inward FDI all over the world. We can generate the following hypothesis:

H 2: “Ease of Doing Business” has significant impact on Inward Foreign Direct Investment in ASEAN Region

Research Methodology

Data

For conducting research in this study, data has been collected about the several variables used in this study. The independent variables are e-government adoption and ease of doing business. The impact of these two variables is supposed to be studied on the dependent variable, inward FDI. Along with these independent and dependent variables, two control variables have also been used in this study. These include public sector contribution of GDP and private sector contribution of GDP. The impact of these two control variables is also supposed to be studied. Therefore, the data about these variables has been collected from the various countries of SEAN region. 26 years data has been collected in this regard. To ensure the accuracy of the research, it was made sure that data must be collected from authentic and verified sources. Therefore E-government Development Index and World Bank were selected for the gathering of data.

Model Specification

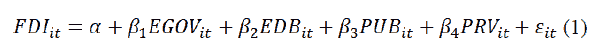

As it is clear that the impact of two independent variables i.e., e-government adoption and ease of doing business is supposed to be studied in this research in the occurrence of two control variables, public sector contribution of GDP and private sector contribution of GDP. Therefore in order to proceed in this research, the relative data of all the above mentioned variables will be collected effectively. The measurement unit of all these variables will be defined here. Firstly, the independent variable, E-Government (EGOV) is measured in terms of percentage of individuals using and adopting e-government concept. Then there is the other independent variable, Ease of Doing Business (EDB) which can be measured by and index given by World Bank called as doing business index. The dependent variable, inward FDI (FDI) can be measured in the form of amount of money or currency. In the last, control variables, public sector contribution of GDP (PUB) and private sector contribution of GDP (PRV) can both be measured by per capita GDP contribution of both the sectors respectively. All these units of measurements are very specific to each variable and effectively used in this study. By using all these variables, a regression equation can be produced, which is given as follows:

Where, FDI is inward foreign direct investment, EGOV is e-government adoption, EDB is ease of doing business, PUB is public sector contribution of GDP, PRV is private sector contribution of GDP, α is used to denote constant and εit is a term that represents the error.

Estimation Procedure

In the research process, after data collection procedure, the next basic and most important concept that is employed in this research is to utilize and analyze that collected data for various purposes. The most important purpose of this analysis is that it assists the author to identify that which hypothesis is accepted and which hypothesis is rejected after the completion of research process. Various results and interpretations can be derived from the results of various tests used for the research process. In this particular study, the author has used the following tests in order to fulfill the above-mentioned consequences; unit root test, cointegration test, coefficient estimation test etc. Various methods and techniques of using and applying these tests will be argued in the following section.

Panel Unit Root Test

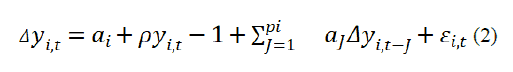

The first and foremost test that is used in the study of panel data is panel unit root test. This test is really important as it provides more accurate and reliable results in research process as compared to the other old and conventional methods used for the same purpose. This benefit of more accuracy and reliability is because of the fact that variations in the collected data increases the power of unit root tests more as compared to the traditional ones. Another point of importance in this regard is that the panel unit root tests have the ability to provide a standard normal distribution of collected data. There are two different tests that come under the one basic category of unit root test i.e., Levin Lin Chu and Im Pesaran Shin. These two tests can be differentiated with the help of the fact that IPS give heterogeneous results while LLC gives homogeneous results in case of study of cross-sectional data just as explained by Pedroni (1999). The most important benefit of applying these techniques in this study is that it will provide a standard normal distribution of the data which author has collected for the research purpose. These tests will also give the information about the status of stationary or non-stationary state of the data involved in this study. The integration level or status can also be effectively seen through these tests. All these points show the importance and benefits of Dickey-Fuller extension tests of unit root. In this study the author has used IPS approach of unit root test and its general equation is given below:

Panel Cointegration Test

After the application of unit root tests and the identification of stationary and non-stationary condition of data as well as the integration among various variables, the next aspect is usually to identify the cointegrated variables of the study. In order to serve this purpose, Pedroni and Kao tests are generally used. One of the common things of Pedroni and IPS unit root test is due to the reason that both of them give heterogeneous results for autoregressive nature of cross-sectional data. These two tests i.e., (Pedroni, 2001) and Kao cointegration tests are actually derived from Engle-Granger tests. These tests use two different approaches simultaneously which are named as within dimension and between dimension. These two can be differentiated by the fact that within dimension uses four types of statistics while between dimension uses only three types of statistics. The statistics included in within dimension are “panel v statistic”, “panel rho statistic”, “panel PP statistic (non-parametric)” and “panel ADF statistic (parametric)”. On the other hand, the statistics used in between dimension include “group rho statistic, “group PP statistic (nonparametric)” and “group ADF statistic (parametric)”. Among Kao and Pedroni, the author will use the Kao cointegration test, whose equation that is generally used is given as follows,

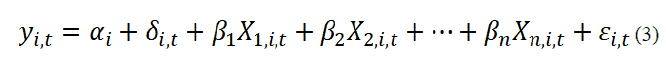

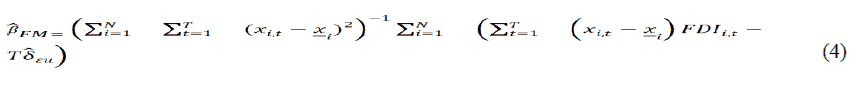

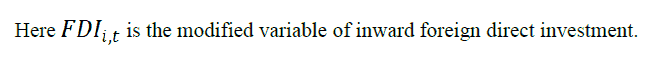

Coefficient Estimation Test

The next step in our research or study is to check the liaison between different variables of the study. The hypotheses made in the literature review section are also supposed to be confirmed through this coefficient estimation test. In order to serve this purpose, two coefficient estimation techniques are generally in use as discussed by Pedroni (2004). These techniques include FMOLS and DOLS, which are basically derived from OLS, the original test which does not provide correct or reliable results. Therefore, FMOLS and DOLS are used in its place for the same purpose. These two tests can be discriminated in such a way that FMOLS is a non-parametric technique while DOLS is a parametric technique and both of them deal with the issue of serial correlation. In this regard, the author has used DOLS test of coefficient estimation and its equation is also given below:

Research Result

Results of Unit Root Test

The stationary state as well as the integration of different variables included in this study i.e., foreign direct inward investment, e-government adoption, ease of doing business, public sector contribution of GDP and private contribution of GDP can be checked by using the unit root test. The results of unit root test can be evidently shown through the table 1. This table clearly depicts that the “null hypothesis” of panel unit root test in the level portion of the series data must be accepted. So, for this portion i.e., level data, it can be concluded that all the data of the variables of our study is stationary. Other than that, we also have the first difference section of the table. When we observe the first difference section of table 1, it can be viewed that the null hypothesis of all the data of that section will be clearly rejected with different significance levels i.e., five and one percent significance levels. This rejection clearly shows that the data in this portion is nonstationary. The rejection of null hypothesis of zero integration means that the variables of our study are integrated of one order. We can conclude from the above discussion that the data in level section of the table is stationary while the data at the first difference section of the table is nonstationary.

| Table 1 Panel Unit Root Test |

||

|---|---|---|

| Variable | Level | First Difference |

| FDI | -2.82624 (0.6831) | -2.81638** (0.0012) |

| EGOV | -1.72368 (0.8163) | -0.00176858 |

| EDB | -1.28642(0.5278) | -2.17638**(0.0643) |

| PUB | -2.82633(0.1379) | -0.085373002 |

| PRV | -1.03771 (0.2578) | -0.82738** (0.0036) |

Results of Panel Cointegration Test

In various steps of research in this research, after the identification of incorporation among various variables involved in our study, the next step is to identify the cointegration of these variables of our study. This is one aspect of this research. Another aspect of this test is that it will provide the information about the steady and non-steady state of the variables. The results of this cointegration test about all the variables included in our study are shown in the table 2. This table shows the statistics and p values of both within and between dimension approaches. In this table it is can be seen that in “within dimension” approach; panel rho statistic has rejected the “null hypothesis” with the significance level of one percent and panel ADF statistic has rejected the “null hypothesis” with the significance level of five percent. On the other hand, in “between dimension” approach, group PP statistic has rejected the “null hypothesis” with one percent and group ADF statistic has rejected the “null hypothesis” by five percent. So overall, four out of seven statistics have shown the rejection of null hypothesis by one and five percent significance levels. As it is clear that non-parametric and parametric statistics are very important in this regard, so it can be said that all the variables of our study are in cointegration with each other.

| Table 2 Panel Cointegration Test |

|||

|---|---|---|---|

| Dimension | Tests | Statistics | T-Value |

| Within Dimension | Panel v statistic | -0.51786 | -0.78269 |

| Panel rho statistic | -0.18745* | -2.93854 | |

| Panel PP statistic | -1.81568 | -1.25784 | |

| Panel ADF statistic | -2.57841** | -3.86432 | |

| Group rho statistic | -1.18745* | -2.36768 | |

| Between Dimension | Group PP statistic | -0.81557* | -1.35676 |

| Group ADF statistic | -3.87958** | -3.88647 | |

| Note: *, ** and *** are used to show the rejection of non-cointegrated variables at 1, 5 and 10% significance. | |||

Coefficient Estimation Test

After the identification of cointegration between different variables of this study i.e., foreign direct inward investment, e-government adoption, ease of doing business, public sector contribution of GDP and private contribution of GDP, now the author will estimate the coefficients of various variables included in this study. For this purpose, FMOLS technique has been selected among the two techniques i.e., FMOLS and DOLS. The results of this FMOLS test have been shown in the table 3. The coefficients of our first independent variable are 0.537 and 1.583 for pooled and grouped variables respectively. As there is no significance sign shown in the table, it is clear that the impact of e-government adoption on inward FDI is not significant. The next independent variable ease of doing business shows the coefficient values 1.374 and 1.746 for pooled and grouped versions respectively. In addition, this result is also significant which gives the result that ease of doing business has significant impact on inward FDI. There are two control variables in this study, public sector contribution in GDP and private sector contribution in GDP. The impact of both these control variables is significant in the results presented in the table given below:

| Table 3 Coefficient Estimation Test |

||

|---|---|---|

| Variables | Pooled | Grouped |

| EGOV | 0.537(0.634) | 1.583(0.527) |

| EDB | 1.374**(2.276) | 1.746*(2.864) |

| PUB | 0.175*(2.032) | -0.073**(-2.032) |

| PRV | -1.597(-2.163) | 1.563*(2.165) |

| R-Squared Adj. | 0.747 | 0.829 |

| Note: *, ** and *** are the significance levels of the variables at one, five and ten%, respectively. | ||

Discussion and Conclusion

Discussion

This study is aimed to find out the impact of two independent variables of this study i.e., e-government adoption and ease of doing government on the dependent government i.e., “inward foreign direct investment”. All the hypotheses of this study will be discussed one by one along with the status of their acceptance or rejection. The first hypothesis of this study was that e-government adoption has significant impact on inward FDI. By applying various techniques and approaches, this hypothesis was tested and evaluated effectively and finally it was rejected as a result of these tests. A past study by Banerjee & Chau (2004) also has shown the same result of rejection, in regard of e-government impact on private sector contribution in GDP. E-government may be useful for a small portion of country but has no major impact in inward FDI. Next hypothesis of this study was that “ease of doing business” has significant impact on inward FDI in ASEAN regions. After testing and evaluating, this hypothesis was accepted. Ease of doing business increases the trust of investors in various sectors of the country and thus FDI increases. Another research of Dreze & Sen (1999) has also accepted the same result. Public sector contribution in GDP was used as a control variable in this study and its impact has been accepted as significant by several tests, which has also been accepted by another researcher (Moran, 2012). Public sector contribution in GDP increases the growth and performance of the public sectors resulting in increase in inward FDI. The last variable, Private sector contribution in GDP is a control variable used in this study and its significant impact on private sector contribution in GDP has also been accepted by several tests. The same result has also been shown in an earlier study by Jayasuriya (2011). Private sector contribution of GDP increases the attraction of FDI.

Conclusion

E-government refers to the concept of new technology usage in various government services and information management aspects to increase efficiency and effectiveness of these services. Ease of doing business is and index of World Bank in which various countries are given ranks according to the degree of “ease of doing business” in these countries. Inward FDI are the investments coming from people or businesses from the foreign countries. The motive of this study is to find out the impact of e-government adoption and ease of doing business on inward FDI. For this purpose, data was collected from ASEAN countries consisting of 26 years and several techniques and approaches were applied on the collected data. After that, by using the results of these approaches, several hypotheses of the study were accepted or rejected according to the results.

Implications

Different results and conclusions of this study provide various theoretical, practical and policy making benefits to various people. Firstly, it will provide complete information and knowledge about e-government adoption and “ease of doing business” and their impact on inward foreign direct investment. In addition to that, this study will also provide assistance to government and businesses of a country to adopt e-government and improve the conditions of doing business, so that more and more inward “foreign direct investment” can be attracted. Moreover, this study will also provide assistance to the government to make policies that are helpful in the usefulness of e-government and make it easy to do business activities for the people, so that a handsome amount of inward FDI can be attracted and used effectively for the economic development of the country. Strong networking with competent foreign intermediaries can provide an adequate competitive advantage and enable them to penetrate foreign markets and overcome the complexities and eventually manage their foreign business (Basah, 2019).

Limitations and Future Indications

There exist various loopholes of this study. The most important limitations include smaller size of sample, focus only on ASEAN countries, using only few selected tests and techniques for research purpose, focus only on few variables etc. The future researchers can increase the size of the samples for conducting an effective and reliable research. In addition, they can also focus on some other region or set of countries of the world in data collection process. In future researches, authors can use more tests other than unit root test, panel cointegration test, coefficient estimation test and Granger casualty test etc. In the last, future researchers can also use variables other than those used in this study.

Acknowledgement

Kittisak Jermsittiparsert, Professor of Dhurakij Pundit University, Thailand and Adjunct Professor of Universitas Muhammadiyah Makassar & Universitas Muhammadiyah Sinjai, Indonesia is the corresponding author.

References

- Abu-Shanab, E. (2017). E-government familiarity influence on Jordanians’ perceptions. Telematics and Informatics, 34(1), 103-113.

- Al-Hujran, O., Al-Debei, M., Chatfield, A., & Migdadi, M. (2015). The imperative of influencing citizen attitude toward e-government adoption and use. Computers in Human Behavior, 53, 189-203.

- Alam, M. (2017). e-Government in India. In M. Sabharwal & E. Berman (editions.). Public Administration in South Asia, 173-192. London: Routledge.

- Anthopoulos, L., Reddick, C., Giannakidou, I., & Mavridis, N. (2016). Why e-government projects fail? An analysis of the Healthcare. gov website. Government Information Quarterly, 33(1), 161-173.

- Banerjee, P., & Chau, P. (2004). An evaluative framework for analysing e-government convergence capability in developing countries. Electronic Government, an International Journal, 1(1), 29-48.

- Basah, N. (2019). Factors that influence the quality of relationship between exporters and foreign intermediaries in relation to SMEs’ export performance. Journal of International Studie, 15, 87-103.

- Bishop, G. (2016). A rule of reason for inward FDI: Integrating Canadian foreign investment review and competition policy. SPP Research Paper, 9(34).

- Boateng, A., Hua, X., Nisar, S., & Wu, J. (2015). Examining the determinants of inward FDI: Evidence from Norway. Economic Modelling, 47, 118-127.

- Buffat, A. (2015). Street-level bureaucracy and e-government. Public Management Review, 17(1), 149-161.

- Canare, T., Ang, A., & Mendoza, R. (2016). Ease of doing business: International policy experience and evidence.

- Corcoran, A., & Gillanders, R. (2015). Foreign direct investment and the ease of doing business. Review of World Economics, 151(1), 103-126.

- Doshi, R., Kelley, J., & Simmons, B. (2019). The power of ranking: The ease of doing business indicator and global regulatory behavior. International Organization, Forthcoming, 73(3), 611-643.

- Dreze, J., & Sen, A. (1999). India: Economic development and social opportunity. Oxford: Clarendon Press.

- Garcia, C., & Hinayon, D. (2018). Components of ease of doing business inferred from macroeconomic performance indicators. Journal of Educational and Human Resource Development, 6, 161-171.

- Gaur, A., & Jasmin, P. (2017). Ease of doing business in India: Challenges & road ahead. Paper presented at the International Conference on technology and Business Management, Dubai, United Arab Emirates.

Güler, M., Mukul, E., & Büyüközkan, G. (2019). Analysis of e-government strategies with hesitant fuzzy linguistic multi-criteria decision making techniques. Paper presented at the international conference on intelligent and fuzzy systems, Istanbul, Turkey.

Hardi, R., & Gohwong, S. (2020). E-Government based urban governance on the smart city program in makassar, Indonesia. Journal of Contemporary Governance and Public Policy, 1(1), 12-17. - Hurtado, J. (2018). Country patterns and effects on the ease of doing business and competitiveness: A global study. International Journal of Competitiveness, 1(3), 206-220.

- Jayasuriya, D. (2011). Improvements in the world bank's ease of doing business rankings: Do they translate into greater foreign direct investment inflows? Washington, D.C.: The World Bank.

- Khan, F., & Majeed, M. (2019). ICT and e-government as the sources of economic growth in information age: Empirical evidence from south Asian economies. South Asian Studies, 34(1), 227-249.

- Kottaridi, C., Louloudi, K., & Karkalakos, S. (2019). Human capital, skills and competencies: Varying effects on inward FDI in the EU context. International Business Review, 28(2), 375-390.

- Kurfal?, M., Arifo?lu, A., Tokdemir, G., & Paçin, Y. (2017). Adoption of e-government services in Turkey. Computers in Human Behavior, 66, 168-178.

- Lee, I., Hong, E., & Makino, S. (2016). Location decisions of inward FDI in sub-national regions of a host country: Service versus manufacturing industries. Asia Pacific Journal of Management, 33(2), 343-370.

- Legris, P., Ingham, J., & Collerette, P. (2003). Why do people use information technology? A critical review of the technology acceptance model. Information & management, 40(3), 191-204.

- Martins, J., & Veiga, L. (2018). Electronic government and the ease of doing business. In Proceedings of the 11th International Conference on Theory and Practice of Electronic Governance, 584-587. New York: Association for computing machinery.

- Milner, H., Tingley, D., Xu, C., & Chilton, A. (2019). The political economy of inward FDI: Opposition to Chinese mergers and acquisitions. Chinese Journal of International Politics, 8(1), 27-57.

- Moran, T. (2012). Foreign direct investment and development. The Wiley?Blackwell Encyclopedia of Globalization.

- Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and statistics, 61(S1), 653-670.

- Pedroni, P. (2001). Purchasing power parity tests in cointegrated panels. Review of Economics and Statistics, 83(4), 727-731.

- Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric theory, 20(3), 597-625.

- Sá, F., Rocha, Á., & Cota, M. (2016). Potential dimensions for a local e-Government services quality model. Telematics and Informatics, 33(2), 270-276.

- Saengchai, S., Sriyakul, T., & Jermsittiparsert, K. (2020). The impact of citizen trust, citizen disposition and favourable social characteristics on the adoption of e-government: Mediating roles of perceived behavioural control. International Journal of Innovation, Creativity and Change, 12(11), 375-393.

- Schnoll, H. (2015). E-Government: Information, technology, and transformation: Information, Technology, and Transformation. New York: Routledge.

- Sriyakul, T., & Jermsittiparsert, K. (2020). Role of e-government and open data to enhance transparency in ASEAN region: A panel data analysis. Journal of Security and Sustainability Issues, 10(O), 337-347.

- Tan, K., Gopalan, S., & Nguyen, W. (2018). Measuring ease of doing business in India’s sub-national economies: A novel index. South Asian Journal of Business Studies, 7(3), 242-264.

- Tingley, D., Xu, C., Chilton, A., & Milner, H. (2015). The political economy of inward FDI: Opposition to Chinese mergers and acquisitions. The Chinese Journal of International Politics, 8(1), 27-57.

- Uddin, M., Chowdhury, A., Zafar, S., Shafique, S., & Liu, J. (2019). Institutional determinants of inward FDI: Evidence from Pakistan. International Business Review, 28(2), 344-358.

- Venkatesh, V., & Davis, F. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management science, 46(2), 186-204.

- Venkatesh, V., Thong, J., Chan, F., & Hu, P. (2016). Managing citizens’ uncertainty in e-government services: The mediating and moderating roles of transparency and trust. Information Systems Research, 27(1), 87-111.