Research Article: 2020 Vol: 24 Issue: 1

Capital Expenditure of Local Governments in Nigeria: A Preferment of Financial Autonomy

Cordelia Onyinyechi Omodero, Covenant University Ota

Kingsley Aderemi Adeyemo, Covenant University Ota

Abstract

The study investigates the effect of local government revenues on its capital expenditure responsibility. Following the local government financial autonomy that is being advocated, this study becomes very imperative to strengthen the move to liberate local governments in Nigeria from financial bondage caused by undue state dominance. The research employs data from 1998 to 2018 and causal research design to determine the effect difference sources of local government revenues have on the capital expenditure. The secondary data used is obtained from the CBN statistical Bulletin and World Bank Economic Indicators. The data are collected on local government capital expenditure which is the dependent variable. The independent variables on which data are equally sourced for include: local governments statutory allocation, state allocation, internally generated revenue, value added tax, grant and other income. The multiple regression analysis results indicate that value added tax, grants and other incomes have a significant adverse effect on capital expenditure. At the same time, the internally generated revenue is insignificant but also negatively affecting capital expenditure. The result also discloses that statutory allocation and state allocation is considered positive in influencing capital expenditure of local governments. The study recommends absolute financial autonomy of local governments as the best way of guaranteeing even rural development in Nigeria.

Keywords

Local Government, Capital Expenditure, Financial Autonomy, Revenue, Statutory Allocation.

JEL Classifications

H70, H71, H72, H77

Introduction

One of the reasons for fiscal federalism in Nigeria is to promote local government autonomy. Local government autonomy includes financial liberation and independence whereby local Government will independently embark on capital projects and complete it at the record time without any form of economic dependence on any other arm of the Government. According to Oates (1972), local governments are located at the heart of the rural areas. They understand the plight of the rural dwellers better than the Government at the centre. However, underdevelopment in Nigeria has been attributed to mismanagement of fund at all levels of Government (Omodero, 2019). The situation intensifies the level of human capital underdevelopment prevalent in the country. According to Omodero (2019), development of human capital is an automatic channel of enlarging a nation’s human capital capacity and skilled workforce, which translates into desired national development. In Nigeria, due to embezzlement and corruption, communities cry for lack of infrastructures, schools, good roads and hospitals especially in the Niger Delta states (Omodero, Ekwe & Ihendinihu, 2018) where leaders are accused of misappropriating public funds. The educational system is low, and universities are always on strike due to unconducive learning environment and inadequate take-home package of lecturers. There are numerous dilapidated school buildings and hospitals without equipment to operate. Several health centres, particularly in the local government areas, are already covered with grasses due to lack of funding.

Some scholars (Enejo & Isa, 2014; Osakade, Ijimakinwa & Adesanya, 2016) believe that local governments’ inability to carry out their financial obligations adequately is due to lack of financial autonomy. Osakade et al. (2016), argued that the state government encroachment on local government finances has been detrimental to the rural dwellers. In other words, the state government usurp the revenues generated within the local governments and even the statutorily allocated funds. The issue of local government lack of independence or what could be referred to as ‘state-bondage’ reached the climax and became very unbearable that the Nigerian Financial Intelligence Unit (NGFIU) had to intervene in 2019 to end the incredible saga. Thus, with effect from June 1 2019, local councils in Nigeria have been mandated to receive their statutory allocation directly from the federation account (Omote, 2019). NGFIU is an agency of the Federal Government of Nigeria assigned to liberate the local Government from 'state-bondage' and to ensure financial autonomy of the 774 local governments in Nigeria.

There are several studies on local governments in Nigeria, but none has examined the extent to which the 774 local governments use their revenues to carry out their capital expenditure tasks. Thus, this present study aims to determine the influence of local government revenues on capital expenditure. This study gives credibility to the financial autonomy that Nigerians clamour for, to bring about even development across the nation’s local government areas. The study also leveraged on lack of clarity of what local Government in Nigeria represents in previous studies. Based on that, the study explains in detail the constitutional backings and revenue sources of local governments in Nigeria.

Literature Review

Conceptual Review

Local Government is the public administration of towns, cities, counties and districts (Ashley, 2014). Local Government relates directly to the people in a community (Accounting Technicians Scheme West Africa (ATSWA), 2009). It is a government through which the populace conveys their aspirations and grievance to the Federal Government (ATSWA, 2009). Although the Federal Government has control over them, the State Government also determine to some extent the activities of the Local Governments. Nigeria has three tiers of Government which comprise the federal, state and local governments. Local Government is the third tier of Government in Nigeria, and its roles are specified in the Fourth Schedule of the 1999 Constitution. Therefore, based on the vertical revenue allocation formula presently applied in Nigeria, local Government is statutorily entitled to 20.60% of the amount standing to the credit of the Federation Account after deducting 13% derivation allowance given to the Niger Delta States. The provisions of Federation Account Act (FAA) 2002, 1992 No. 106 and S.1.9 specify that the 20.60% allocation to the Local Government should be shared horizontally based on equality (40%), population (30%), Landmass/Terrain (10%), Internal Revenue (10%). The social development is 10% but should be split based on education (4%), health (3%) and water (3%).

Local Government in Nigeria has three sources of revenue which include the statutory sources, permissive sources and unexpected sources of income (ATSWA, 2009). The statutory sources of income of the local governments in Nigeria include statutory allocation, which is the 20.60% allocation from the Federation Account. It also contains 10% of state internally generated revenue and other incomes accruing to the Local Government as a result of its creation, and the Acts of Parliament promulgated from time-to-time (ICAN, 2014). The paragraph 162(7) of the 1999 Constitution enjoins each state of the Federation to pay 10% of its internally generated revenue to an account referred to as Joint Local Government Council Account and after that distribute the money to the local governments in the state based on specific considerations which social development and population.

The local government permissive sources of revenue are contained in the Second Schedule part 11 of the 1999 Constitution of Nigeria. The list comprises shops and kiosks rates, tenement rates, cattle tax, signboard/advertisement permit and others. The unexpected sources consist of grants, loans, incomes from local government investment, incomes from projects and donations made to the Local Government. The local governments also receive a certain amount from Value Added Tax (VAT) which is also part of the federally collected revenue. As it stands, the VAT revenue share to the local governments grew from N10.17 billion in 1998 to N366.29 billion in 2019 (Central Bank of Nigeria Statistical Bulletin, 2019).

Theoretical Framework

Financial Devolution Theory

Theoretically, financial regionalization hypothesis is underpinning this research. This theory was formulated by Oates (1972) and was massively supported by several scholars (Bird, 1993; Bird & Wallich, 1993; Bahl & Linn, 1992; Gramlich, 1993; Oates, 1993) who believe that fiscal decentralization is the key to achieving social, economic development at the grassroots level. Financial regionalization also referred to as transfer of financial supremacy from the central Government to the lower level governments such as local councils, is adjudged to be a reformation measure to heighten public sector productivity, encourage vigorous struggle among states and local governments in the area of public service delivery to increase even national development (Bahl & Linn, 1992; Bird & Wallich 1993). Financial devolution theory supports fiscal decentralization and the financial autonomy of local governments. Financial devolution is an arrangement which allows sharing of monetary responsibilities, functions and resources among the three levels of Government. The key target is to decentralize income generation and disbursement functions thereby improving the efficiency of the public sector, minimize the budget shortfall and stimulate economic growth (Bird, 1993; Bird & Wallich, 1993; Bahl & Linn, 1992; Gramlich, 1993; Oates, 1993). Oates (1972) maintained that local governments are better situated to easily reach the local people in term of public service delivery such as road maintenance, health care services, the building of schools and hospitals.

Thus, financial autonomy that is being advocated in this study will invariably encourage the rural settlers. They may not need to troop to urban areas for health care facilities if the Government at the local level is financially empowered to provide them with ease. According to Oates (1972), the Government at the local level will deliver public goods and services that will match the local preferences and need better than the central Government. Therefore, the financial independence of governments at the local level will indeed enhance the productivity of the rural dwellers. The human capital in the rural areas that would support the national development will not be wasted if adequately developed (Omodero, 2019). The empowerment of Government at the local cadre is very vital for the general nationwide upgrade.

Empirical Review

Nwosu & Okafor (2014) used co-integration techniques and error correction model to investigate the impact of government revenue on expenditure in Nigeria. The study employed data that covered a period from 1970 to 2011. The result showed a unidirectional relationship between government expenditure and income. Osakede et al. (2016) assessed the financial autonomy of local governments in Nigeria using both primary and secondary data sources. The study focused on Ojo Local Government in Lagos State Nigeria. A total number of 160 staff of the Council were interviewed and a questionnaire administered to them. The study employed the Chi-square method and found that Nigeria Local Governments lacked financial autonomy. The study emphasized that the absence of financial independence had prevented effective and efficient public service delivery of local governments in Nigeria.

Kuntari et al. (2019) examined the impact of local government revenue on capital expenditure. The study covered 35 local governments in the province of Central Java in Indonesia and used secondary data from 2014 to 2016. The findings revealed that locally generated revenue, general allocation fund, special allocation fund, and revenue sharing fund positively and significantly impacted on capital expenditure. The study suggested that economic growth enhancement can be achieved through local government proper management of the funds allocated to them. Orhewere & Ogbeide-Osaretin (2020) examined the effect of oil price variations on capital expenditure in Nigeria. The study spanned from 1970 to 2018 and made use of the Vector Error Correction Model. The findings indicated that capital expenditure negatively responded to oil price shocks.

Nuryani & Firmansyah (2020) investigated the factors determining financial management transparency in local governments. The study spanned from 2013 to 2016 using financial data from selected district/city governments in Java. The findings revealed that financial transparency in the local governments studied was about 24.76% average. The study further revealed that the provincial government expenditure is at the same level as the financial transparency and suggested proper policy formulation to boost regional financial transparency. Omodero (2020) assessed the factors affecting federal government capital investment using macroeconomic variables. The study discovered that real GDP and population insignificantly and negatively impacted on capital investment. Debt servicing was found having a significant negative influence on government capital expenditure. The study also revealed that the exchange rate and total spending had a significant positive impact on capital expenditure. Omodero et al. (2020) argued that Government borrows to finance capital projects that ordinarily should yield returns in the future and reduce consumption cost if the fund is well utilized. The reverse would be the case if the borrowed fund is misused; hence, debt servicing could be devastating on future capital project financing where the expected investment returns are not probable to fill the gap.

Materials and Method

The study investigates the effect of local government revenue on capital expenditure. This study utilized existing data on all revenues accruing to the local governments in Nigeria. The revenues that the 774 local governments in Nigeria enjoy comprise statutory allocation from the federation account, state allocation and internally generated revenue. There are also incomes from VAT, grant and other revenue sources. The study utilized causal research design which allows the examination of the causality effect of one variable on another variable. The study also employed secondary data which were collected from the CBN Statistical Bulletin and World Bank Economic Indicator. The dependent variable used in this study is the Local Government capital expenditure. The independent variables comprise statutory allocation from the federation account, state allocation, internally generated revenue, VAT, Grant and other incomes. The scope of this study is from 1998 to 2018, and it focuses on Public Sector Accounting and Finance. It addresses the issues of local government financial autonomy required to influence adequate capital investment that would boost rural development and fiscal growth of the nation.

Model Specification

The regression model tested in this study, as shown below, is adopted with some modifications from (Kuntari et al., 2019; Omodero, 2020; Nuruyani & Firmansyah, 2020).

CEX = f (FGA, SGA, IGR, VAT, GTO)

The econometric form is stated as:

CEX = β0 + β1FGA + β2SGA + β3IGR + β4VAT + β5GTO + ε

Where

CEX = Capital Expenditure of Local Governments

FGA = Statutory Allocation from the Federation Account (20.60%)

SGA = State Allocation to the Local Governments (10% of state IGR)

IGR = Local Government Internally Generated Revenue

VAT = Value Added Tax

GTO = Grant and other incomes

β0 = Constant; β1-β5 = Regression coefficients; ε = Error term.

On the a priori, we expect; β1 > 0, β2> 0, β3 > 0, β > 0, β3 > 5.

Statement of Hypotheses

The following null hypotheses were tested in this study:

H01: FGA does not have a significant influence on CEX

H02: SGA does not have a considerable impact on CEX

H03: IGR does not have a substantial effect on CEX

H04: VAT does not materially affect CEX

H05: GTO does not have a remarkable impact on CEX

Data Analysis and Interpretation

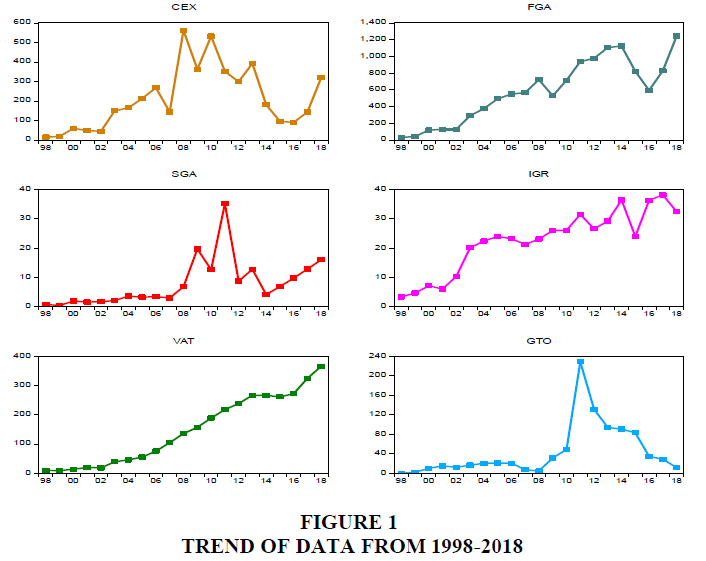

Trend Analysis

Figure 1 above shows the trend of Local Government revenue sources and capital expenditure from 1998 to 2018. The capital expenditure was too low in 1998 but reached a peak in 2003. The drop in 2015-2016 is very pathetic, although there was a significant rise in 2018 but not as expected. The state allocation of 10% of internally derived income was very discouraging at the initial stage but increased tremendously 2010-2011before the sharp drop in 2012. The distribution from VAT and federation account maintained a steady rise, grant and other income was very high in 2012. The whole idea of allowing local Government to enjoy certain revenues is to ensure adequate public capital investment in the rural areas of the nation. The capital expenditure, as shown in Figure 1, is not indicating that the incomes allocated to the local governments are sufficiently invested in capital projects. It brings attention to the actualization local government financial autonomy as the tool to break the chain of state slavery of local governments in Nigeria. The realization of local government financial autonomy will give room for even development of rural areas and freedom of spending responsibilities, especially on capital projects. The struggle is encouraged and supported with the understanding that those at the hemp of affairs in the Nigerian local governments will not misuse the public fund but will ensure sufficient investment in infrastructures.

Table 1 is the model summary of the regression analysis carried out in this study. The relationship between capital expenditure and the revenue sources of local governments in Nigeria is very strong as represented by R, which is 83%. The coefficient of determination (R Square) is 69%. The implication is that revenues sources of local governments in Nigeria determine about 69% of the variations in the capital expenditure. In comparison, 31% is attributable to other sources that are not indicated in the model. The Durbin-Watson of 2 reveals the absence of autocorrelation.

| Table 1 Model Summary | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | 0.830 | 0.690 | 0.586 | 103.89590 | 2.225 |

| Predictors: (Constant), GTO, IGR, SGA, VAT, FGA | |||||

| Dependent Variable: CEX | |||||

Table 2 shows the fitness of the model applied in this study using the F-statistic result. The F-Statistic is 6.665 and the p-value is 0.00 < 0.05. The result shows that the model is fit for the study and is statistically significant. All the revenue sources identified in this study collectively affected the capital expenditure of 774 local governments in Nigeria.

| Table 2 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 359742.083 | 5 | 71948.417 | 6.665 | .002 |

| Residual | 161915.364 | 15 | 10794.358 | |||

| Total | 521657.447 | 20 | ||||

| Dependent Variable: CEX | ||||||

| Predictors: (Constant), GTO, IGR, SGA, VAT, FGA | ||||||

CEX = β0 + β1FGA + β2SGA + β3IGR + β4VAT + β5GTO + ε

Based on the result in Table 3, the multiple linear regression can be stated as follows:

| Table 3 Coefficients | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | 11.938 | 60.557 | 0.197 | 0.846 | |||

| FGA | 0.686 | 0.176 | 1.592 | 3.903 | 0.001 | 0.124 | 8.040 | |

| SGA | 14.122 | 4.524 | 0.727 | 3.121 | 0.007 | 0.381 | 2.622 | |

| IGR | -0.119 | 4.656 | -0.008 | -0.026 | 0.980 | 0.221 | 4.535 | |

| VAT | -1.653 | 0.528 | -1.206 | -3.130 | 0.007 | 0.139 | 7.172 | |

| GTO | -1.582 | 0.662 | -0.543 | -2.391 | 0.030 | 0.401 | 2.493 | |

| Dependent Variable: CEX | ||||||||

Y = 11.938 + 0.686X1 + 14.122X2 – 0.119X3 – 1.653X4 – 1.582X5 + ε

The result in Table 3 shows that the Variance Inflation Factor (VIF) of each predictor variable is below the value of 10, which is the benchmark. This result is a shred of evidence that there is no multi-collinearity.

Hypotheses Testing

H01: FGA does not have a significant influence on CEX

The study earlier hypothesized that statutory allocation (FGA) does not significantly impact on capital expenditure (CEX) of local governments in Nigeria. The result in Table 3 confirms that FGA t-statistic is 3.903, and the p-value is 0.00 < 0.05. The result implies that the statutory revenue allocation to the Local Government impact significantly on capital expenditure. Thus, the H01 is at this moment, overruled, and the alternative is acknowledged.

H02: SGA does not have a significant impact on CEX

The H02 provides a suggestion that state allocation does not have a significant impact on capital expenditure of local governments in Nigeria. This suggestion has been tested, and the result in Table 3 shows that SGA t-statistic is 3.121, and the p-value is 0.01 < 0.05. The result gives the impression that state allocation has a significant impact on capital expenditure of local governments in Nigeria. Therefore, the H02 is rejected, and the alternative suggestion is accepted.

H03: IGR does not have a substantial effect on CEX

The study has initially suggested that internally generated revenue (IGR) of local governments does not have a considerable effect on CEX. The result in Table 3 indicates that IGR t-statistic is -0.026, and the p-value is 0.980. This result implies that IGR has an insignificant negative impact on capital expenditure of local governments. So, the H03 is believed, and the alternative declined.

H04: VAT does not materially affect CEX

The H04 suggests that VAT does not have a material influence on CEX. This suggestion is not refuted by the result on Table 3 which reveals that VAT is having significant negative impact (t-statistic = -3.130; p-value = 0.00 <0.05) on CEX. The result implies that the VAT share of the local governments is not materially contributing to capital expenditure fiscal function of local governments in Nigeria. This H04 is recognized and alternative rebutted.

H05: GTO does not have a remarkable impact on CEX

In this study, there is an earlier suggestion that grant and other incomes do not have a remarkable impact on CEX. This suggestion is hereby tested and the result shows that GTO has substantial negative impact (t-statistic = -2.391; p-value = 0.03 < 0.05) on CEX. The result contradicts the alternative opinion while H05 is adjudged accurate.

Conclusion and Proposals

In line with local government financial autonomy struggle in Nigeria, this study examined the impact of local government revenues on its capital expenditure. Capital project financing is paramount in rural areas to ensure a good standard of living for rural dwellers. This opportunity cannot be accessed except local governments have the financial liberation to carry out the significant capital project. In Nigeria, it has been a pathetic situation where health centres and schools in rural areas are covered with grasses with dilapidated buildings. The Joint Local Government Council Account as specified in paragraph 162(7) of the 1999 Constitution from which state governments distribute 10% to local governments have been wrongly applied for many years. The state uses this clause to enslaved local governments in Nigeria. The State governments have acted ultra vires by hiding under this statutory provision to undermine local government resources practically. Many local governments have been impoverished due to corrupt leadership prevailing in the country. The result in table 3 suggests the local Government IGR could not finance capital expenditure. This is because the state government exceeds its boundary by exploiting most revenue sources belong to the Local Government. The result also indicates that statutory and state allocation are very beneficial in capital project execution in the rural areas. This is no doubt if only financial autonomy will be upheld. It will lead to better improvement of the local councils, and many abandoned projects will be revived.

The study concludes that the financial autonomy of local governments will guarantee proper development in the rural quarters of the country. The study recommends that Nigerian Financial Intelligence Unit (NGFIU) and all other relevant agencies charged with this responsibility should put in their best to ensure that the 774 local governments in Nigeria receive and adequately manage the revenues they are entitled to utilize. Financial liberation struggle should not cease until Nigerian rural environments and dwellers see the future of their dream. The Central Government should ensure the provision of rural electricity, water, good roads and other amenities to make life comfortable for rural inhabitants. The VAT allocation, grant and other incomes should also be enhanced for better execution of rural capital projects.

Acknowledgement

The authors sincerely thank Covenant University Ota, Ogun State, Nigeria, for supporting open access of this paper.

References

- Ashley, D. (2014). What Is Local Government? - Definition, Responsibilities & Challenges. Retrieved on November 10, 2020, from https://study.com/academy/lesson/what-is-local-government-definition-responsibilities-challenges.html.

- ATSWA (2009). Public Sector Accounting. Accounting Technicians Scheme (West Africa). Second Edition. ABWA Publishers.

- Bahl, R.W., & Linn, J. (1992). Urban public finance in developing countries. Oxford University Press, New York.

- Bird, R.M. (1993). Threading the fiscal labyrinth: some issues in fiscal decentralization. National Tax Journal, 46(2), 207-227.

- Bird, R.M., & Wallich, C. (1993). Fiscal decentralization and intergovernmental relations in Transition economies: towards a systematic framework of Analysis. Country Economics Department working paper, World Bank, Washington D.C..

- Constitution of the Federal Republic of Nigeria (1999). Second Schedule. Part 1: Exclusive List. Part 11: Concurrent Legislative List. Part 111 Supplemental and Interpretation.

- Central Bank of Nigeria (2019). Summary of local governments finances. CBN Statistical Bulletin, 2019 edition.

- Enejo, W., & Isa, A. (2014). The imperative of local government autonomy and intergovernmental Relations in Nigeria. International Journal of Public Administration and Management Research, 2(3), 74-83.

- Gramlich, E.M. (1993). A policy-maker’s guide to fiscal decentralization. National Tax Journal, 46(2), 229-235.

- Institute of Chartered Accountants Nigeria – ICAN (2014). Skills Level: Public Sector Accounting And Finance. Published by ICAN.

- Kuntari, Y., Chariri, A., & Prabowo, T.J.W. (2019). Capital expenditure of local governments. Academy of Accounting and Financial Studies Journal, 23(1), 1-13.

- Nuryani, N., & Firmansyah, A. (2020). Determinants of transparency in financial management on Local government websites: Evidence from Indonesia. Humanities and Social Science Letters, 8(2), 145-155.

- Nwosu, D.C., & Okafor, H.O. (2014). Government revenue and expenditure in Nigeria: A Disaggregated analysis. Asian Economic and Financial Review, 4(7), 877-892.

- Oates, W.E. (1972). Fiscal federalism. New York: Harcourt Brace Jovanovich.

- Oates, W.E. (1993). Fiscal decentralization and economic development. National Tax Journal XLVI (2), 237-243

- Omodero, C.O., Ekwe, M.C., & Ihendinihu, J.U. (2018). Derivation funds management and economic development of nigeria: evidence from Niger Delta States of Nigeria. International Journal of Financial Research, 9(2), 165-171.

- Omodero, C.O. (2019). Government general spending and human development: A case study of Nigeria. Academic Journal of Interdisciplinary Studies, 8(1), 51-59.

- Omodero, C.O. (2019). Effect of apportioned federal revenue on economic growth: The Nigerian Experience. International Journal of Financial Research, 10(4), 172-180.

- Omodero, C.O. (2020). Analysis of factors influencing public capital investment in Nigeria. Journal of Educational and Social Research, 10(1), 62-72.

- Omodero, C.O., Egbide, B., Madugba, J.U., & Ehikioya, B.I. (2020). A mismatch between external debt finances and consumption cost in Nigeria. Journal of Open Innovation: Technology, Market, and Complexity, 6(58), 1-13.

- Omote, R. (2019). NGFIU, Local Government autonomy and legal quagmire. Retrieved from: https://guardian.ng/ features/ngfiu-local-government-autonomy-and-legal-quagmire/.

- Orhewere, B., & Ogbeide-Osaretin, E.N. (2020). Oil price shocks and their impact on Capital expenditure in Nigeria. Acta Universitatis Danubius Œconomica, 16(2), 227-238.

- Osakede, K.O., Ijimakinwa, S.O., & Adesanya, T.O. (2016). Local government financial autonomy in Nigeria: An empirical analysis. Kuwait Chapter of Arabian Journal of Business and Management Review, 5(11), 24-37.