Research Article: 2023 Vol: 27 Issue: 5

Capital Structure and the Profitability of a Firm: Empirical Evidence from Insurance Industry in Ghana

Dawuda Abudu, Bolgatanga Technical University

Luqman Abudu, Bagabaga College of Education, Ghana-West African

Isaac Luke Agonbire Atugeba, Bolgatanga Technical University

Citation Information: Abudu, D.A., Abudu, L., & Atugeba, I.L.A. (2023). Capital structure and the profitability of a firm: empirical evidence from insurance industry in ghana. Academy of Accounting and Financial Studies Journal, 27(5), 1-15.

Abstract

The purpose of this study was to investigate the firm’s capital structure decision and its impact on profitability. A panel data covering the 2014–2018 audited financial statements of insurance companies under the National Insurance Commission was used in the study. A sample of 24 insurance companies was used due to the availability of financial statements for the period selected. The study revealed that there was a statistically significant negative relationship between capital structure and firms’ profitability. It was also evidenced that growth and asset quality are the key determinants of capital structure. However, board size, age, interest rate and inflation had no influence on the capital structure of a firm. Achieving an optimal capital structure was very challenging for the companies due to the dynamic nature of the determinants. The study, therefore, recommends that corporate leaders always monitor the business environment. This would help them to understand the dynamics of debt and equity instruments, thereby choosing the right capital structure. When a firm plans to increase its return on equity, it should reduce its debt as a source of finance.

Keywords

Financing Decisions, Profitability, Leverage, Equity, Liquidity, Optimal Capital Structure.

Introduction

Business organizations achieve their goals through three major activities: operating, investing, and financing. A company's capital structure is the mix of debt and equity financing for its activities, and it is the responsibility of corporate leaders to decide which option is best for their objectives (Nguyen & Nguyen, 2020; Li et al., 2019; Abdullah & Tursoy, 2021). External sources include long-term debt instruments, trade credit, and bank overdrafts, while internal sources include the issuance of new shares and surplus. According to Ong & Teh (2013), a company's capital structure consists of debt (long- and short-term) and shares (ordinary and preference shares).

Capital structure theory states that managers' decisions about debt and shares affect future liquidity, long-term solvency, and profitability. In a perfect capital market, the firm's value is independent of its capital structure decision. Several theories explain a firm's capital structure, such as the Peck order, static trade-off, and agency cost theories. The trade-off model suggests that firms with high business risks should use less debt than lower-risk firms, while firms with high-quality assets should use more debt. Myers (1977) proposed the pecking order theory, which ranks internal and external financing decisions. Jensen & Meckling (1976) proposed that a firm's gearing level can be used to track managers' efforts to achieve the overall firm's goals. The concept of capital structure is in line with the objectives of the agency theory, which states that for a firm to achieve an optimal capital structure, it should reduce the costs associated with the conflict between the managers and the owners. Capital structure theory states that managers' decisions about debt and shares affect future liquidity, long-term solvency, and profitability. Several theories explain a firm's capital structure, such as the pecking order, static trade-off, and agency cost theories. The trade-off model suggests that firms with high business risks should use less debt than lower-risk firms, while firms with high-quality assets should use more debt. Jensen & Meckling (1976) proposed that a firm's gearing level can be used to track managers' efforts to achieve the overall firm's goals.

Capital structure and firm performance have been talked about in the relevant literature, but there are different opinions about them (Ferdous, 2019). Some studies have established a positive relationship between capital structure and financial performance (Abor, 2005; Margaritis & Psillaki, 2010; Fosu, 2013; Yakubu et al., 2017; Khodavandloo et al., 2017; Yinusa et al., 2019; Ferdous, 2019; Abdullah & Tursoy, 2021). They found that a good capital structure boosts profits and business performance. However, Abbadi & Abu-Rub (2012); Imtiaz et al. (2016); and Alomari & Azzam (2017) found a negative relationship between these variables. To complicate matters further, other researchers have found no significant relationship between the variables and that company debt-equity mix decisions do not affect firm value (El-Sayed Ebaid, 2009). The inconsistency of the research findings created a gap in the body of knowledge, particularly in the field of the insurance industry in an emerging economy like Ghana.

The insurance industry in Ghana has grown significantly over the last few decades, with an increasing number of insurance companies operating in the market (Ghana Insurance Commission, 2019). As the insurance industry grows, it is becoming more important for regulators, investors, and policymakers to understand the factors that affect how well insurance companies perform (Tornyeva, 2013). One of the most important things that affect how well a business does is its capital structure, which is how it gets its money from different sources, like debt and equity. There has been a lot of research on the link between capital structure and firm performance in many fields, but there hasn't been much research on this link in Ghana's insurance industry. The recent global financial crisis has again raised concerns about insurance companies' capital structures, emphasizing the need for a better understanding of the relationship (Khodavandloo et al., 2017). The Ghanaian insurance market has unique risks and legal constraints that may affect its ideal capital structure (Boadi et al., 2013). Therefore, this has drawn the attention of the researchers to undertake this study. The main objective of this study is to examine the capital structure of the insurance companies in Ghana and the profitability of these companies.

This study seeks to achieve the following specific objectives:

1. To determine the relationship between capital structure and firm’s profitability.

2. To examine the factors that influence the capital structure decision of a firm.

3. To establish the optimal capital structure of insurance companies in Ghana.

This study's findings have important implications for regulators, investors, and academics studying the relationship between capital structure and firms’ profitability. For the rest of this study, the format is as follows: Section 2 provides the literature review. Section 3 explains the research methods. The results and discussion are presented in Section 4. Section 5 looks at the conclusion and policy implications of the research.

Literature Review

The capital structure of an organization describes its funding sources. Share capital and reserves are funds from shareholders, while long-term debts are gearing, or leverage. The ratio of fixed-interest capital to ordinary share capital shows long-term debt and equity holders' financial risk. Ownership is what sets equity finance apart from debt financing, as investors take on the role of company owners and receive a portion of any earnings. Debt financing also has stringent requirements for making interest and principal payments on time. It is challenging to determine what capital structure is ideal for a company, as equity shareholders' wealth should be maximized, or the value of equity shares should be increased through the capital structure.

Theories of Capital Structure

The 1958 "irrelevance principle" by Modigliani and Miller gave rise to capital structure theory, which needs perfect capital markets, frictionless markets, no arbitrage, no taxes, no transaction costs, no bankruptcy or business disruption costs, and both insiders and outsiders of a company to have the same information. The MM Hypothesis spurred substantial research to disprove those irrelevances. The trade-off, pecking order, and agency theories were proposed because of this principle. Trade-off theory suggests enterprises balance debt financing costs and advantages to determine their capital structure, while dynamic trade-off theory states that enterprises will shift towards their goal capital structure even if they diverge. AbdelJawad et al. (2013) found that firms far from the target and overleveraged enterprises react faster than firms near the target, which is consistent with the dynamic trade-off theory.

Marketing time is another capital structure hypothesis. The market timing hypothesis explains how businesses choose between stock and debt financing. It contrasts with the pecking order hypothesis and the trade-off theory. "Equity market timing" in corporate finance involves issuing shares at higher prices and repurchasing them at lower prices. The goal is to capitalize on brief equity price swings compared to other capital (Baker & Wurgler, 2002). Market timing is sometimes considered behavioural finance because it does not explain why asset mispricing occurs or why firms are better at detecting it than financial markets. Setyawan (2011) found that market leverage is negatively affected by the market-to-book ratio and that firms should proceed with equity financing when their stock prices are high due to profit growth. This implies that a corporation should issue debt when its market price is low and equity when it is high.

Determinants of Firms’ Capital Structure

Capital structure decisions are important for a company, and corporate managers need to know what factors affect a company's position in the capital structure. If a firm fails to achieve the right balance in its capital structure, it may face liquidity and solvency challenges (Modugu, 2013). The empirical literature has identified several factors that affect capital structure, such as profitability, growth, non-debt tax shields, size, tangibility, volatility (or risk), liquidity, uniqueness, cash flow position, interest cover, return on investment, cost of debt, cost of equity, tax rate, floatation cost, control, and regulatory framework (Tornyeva, 2013; Ramli et al., 2019; Khan et al., 2021). Some of the determinants are industry-specific (Li & Islam, 2019). These determinants are important for achieving an optimal capital structure in a competitive and complex business environment. The pecking order theory and trade-off and marketing timing theories suggest that large firms should be highly leveraged as compared to small firms, and there is a positive relationship between leverage and firm size (firms: Antoniou et al., 2008; Bartoloni, 2013; Lemma & Negash, 2014). Jensen & Meckling (1976) argue that if the firm shifts to riskier investments after it has issued debt, then there will be agency conflict between debt holders and equity holders.

Pecking-order theory says that firms will use internal financing first, then move to debt, and finally issue new equity if they need to (Burgstaller & Wagner, 2015; Agyei et al., 2020), while trade-off theory says that firm leverage and profitability will have a positive relationship (Bartoloni, 2013). Hovakimiana et al. (2004) suggest that the positive firm leverage-profitability association may arise for a few reasons, such as higher tax savings from debt, a lower probability of bankruptcy, and potentially higher overinvestment. Risk is one of the determinants of the capital structure, measuring the volatility or fluctuations of cash flows or earning prospects of a firm. Financial theories hypothesize an inverse relationship between volatility in earnings and leverage ratio. Equity shareholders are considered the owners of the company, and they have complete control over it. There is a relationship between the firm's dividend policy and its leverage position. If the dividend payout ratio increases due to an increase in profit, it will favour equity holders, and this will attract more equity holders (Myers, 2001). Equity shareholders are considered the owners of the company, and they have complete control over it. Debt suppliers do not have voting rights, but if a large amount of debt is given, debt holders may put certain terms and conditions on the company.

Therefore, based on the above empirical studies, we hypothized that business growth, assets quality, return on assets, board size, age of a firm, inflation and interest rate influence the capital structure decision of a firm.

Performance Measurement of a Firm

It's normal to check on a company's progress and goals over time. Performance measurement helps the business identify its strengths and weaknesses, as well as external opportunities and threats, to develop strategies to meet its goals. Business strategy includes financial strategy. Business performance is measured by profitability, liquidity, and solvency. It evaluates a company's finances. The financial analysis identifies changes in financial trends to measure an enterprise's progress and draw a logical conclusion about its performance. Performance measurement allows the business to compare its performance over time and with its competitors (Laitinen, 2002). Profitability and financial performance are monetary measures of a firm's policies and operations. Profit is an absolute measure of earning capacity, while profitability is relative (Sarngadharan & Rajitha, 2011). Profitability shows whether profits are constant, improving, or declining and how they can be improved, and managers should prioritize profitability (Bititci et al., 2013). Profitability measurement systems can help the firm grow by providing vital information about current events.

Indicators of Profitability

The main goal of a business is to make profit, which can be measured by a company's return on assets (ROA) or return on investments (ROI), return on equity (ROE), return on capital employed (ROCE), gross profit ratio (GPR), and net profit ratio (NPR) (Nishanthini & Nimalathasan, 2013). This section looks at the meaning and implications of the indicators. The return on capital investment is the most popular way to measure the profitability of a firm. ROA measures a company’s profitability compared to its total assets. The return on capital employed demonstrates how much profit is generated for every amount of capital invested in the business. This is calculated by dividing net profit before interest and taxes by the capital invested and expressing the quotient as a percentage. Net tangible fixed assets and net current assets are combined to form capital employed. It is also a measure of the earning power of the company's net assets. Indicates the overall profitability of the enterprise. Generating sales from company resources and conserving as much of it as profit.

Capital Structure Indicators

Solvency and the fearing ratio serve as capital structure metrics. The ability to balance an enterprise's overall liabilities with its available assets is referred to as solvency. So, when an organization has enough assets to cover all its liabilities, both now and in the future, when those liabilities are all due for repayment, that organization is solvent. The amount of debt capital a company has raised has an impact on its solvency status. An organization runs a higher risk of default and is more likely to have a weaker solvency position if a larger share of its capital is made up of debt. Manurung et al. (2014) found that the debt ratio, the debt equity ratio, and the long-term debt to total equity ratio were all reliable indicators of capital structure.

Capital Structure and Financial Performance of a Company

Empirical research Ramli et al. (2019) and Nguyen & Nguyen (2020) shows that there is a link between a company's capital structure and how well it does financially. Frank & Goyal (2009) found that organizations with lower leverage ratios have higher returns on assets. This finding was corroborated by Chen et al. (2019) and Chen et al. (2021), who found that enterprises with higher leverage ratios have worse profitability as compared to those firms with a low leverage ratio. Odhiambo & Sam (2015) and Yinusa et al. (2019), however, disagreed with this claim and said that a decrease in debt wouldn't necessarily make a business do better. Myers & Majluf's (1984) pecking order theory suggests that corporations prefer retained earnings to debt or equity issuance. In other studies, capital structure and financial performance are rarely linear (Frank et al., 2020). Ayaz et al. (2021) argued that there is a positive relationship between leverage and firm performance until the debt ratio goes beyond the optimal level before the relationship switches to negative. They also supported the nonlinear relationship between capital structure and firm performance.

It can be concluded from these empirical studies that, the findings on the relationship between capital structure and profitability of a firm have been inconsistent and non-conclusive. Therefore, this study tested the following hypothesis:

H0: There is no relationship between the capital structure of a firm and firm’s profitability

Research Methodology

This study used an explanatory research design, which tries to find a link between a company's capital structure and how well it does (Saunders et al., 2009). The population of the study was 22 life insurance companies, 29 non-life insurance companies, and 3 reinsurers, for a total of 54 insurance companies. The insurance companies with full financial data from 2014 to 2018 were chosen with the help of the purposive sampling method. Based on the availability of annual reports, the study only used secondary data from the annual reports from 2014 to 2018. All insurance companies that had signed up with the National Insurance Commission (NIC) were part of this study. It covers 22 life insurance companies, 29 non-life insurance companies, and 3 reinsurers, for a total of 54 insurance companies. The researchers adopted a purposive sampling method to select the insurance companies with full financial data covering 2014 to 2018. This sampling method had to be used because some companies didn't have all of their financial information. To this end, the insurance companies were selected based on their existence before 2014 and operated continuously for the period 2014–2018, with fully published audited accounts for this period. The study used only secondary data from the annual reports of these companies from 2014 to 2018. The choice of this period was based on the availability of annual reports.

Panel data are more useful than cross-sectional or time-series data because they have more information, more variation, less overlap, and are more efficient (Baltagi, 2001; Kennedy, 2008). The variables used for this study were profitability and leverage (capital structure) ratios. Profitability is the dependent variable, and leverage is the independent variable. Profitability is measured using returns on assets (ROA) and returns on equity (ROE). ROA is used generally to refer to the profit that was generated with the assets of an entity. ROE is also used to indicate the firm’s profits attributed to its equity. These ratios are determined using the following formulas:

In this study, capital structure is measured using leverage or gearing ratio. Even though there are many interpretations of what represents the capital structure, the leverage ratio used is the long-term debt to total capital. This measures the proportion of total capital that represents long-term debt. This is the independent variable in this study

![]()

Model Specification

The relationship between the capital structure and the financial performance of the selected insurance companies is established using panel linear regression. The following regression models are used:

![]()

Where: y is firm profitability proxied by ROA and ROE for firm i in time t; LTDCi,t is long-term debt divided by total capital for firm i in time t; β1 is the coefficient of the independent variable; β0 is the constant; and is the error term.

The model for the determinants of capital structure is as follows:

![]()

Where: C is the debt ratio; β0 is the constant; β1-6 is the coefficients of the independent variables; and ε is the error term. Also, X1= Return on Equity; X2 = Assets Quality; X3 = Growth; X4 = Age of the firm; X5 = Inflation; and X6 = Interest rate.

Results and Discussion

The main objective of this study was to investigate the relationship between the firm's capital structure and its profitability. In the study, panel data covering the period 2014–2018 from audited financial statements of insurance companies under the National Insurance Commission was used. To test for the relationship between firms' capital structure and profitability and the factors that influence the capital structure decision of a firm, regression analysis was used.

Impact of Capital Structure on Profitability

The purpose of every corporate business organization is to generate profit to maximize shareholder value both in the short run and in the long run. However, the business investment activities necessary to generate this profit would have to be financed. This results in a capital structure decision for a firm. This decision is very important in achieving the organizational goals. Based on this, the first objective seeks to examine the impact of capital structure on the profitability of insurance companies. The focus was to determine if there is any relationship and how this relationship is statistically significant enough to cause a change in profitability. To determine the appropriate General Least Square regression method to use, the Hausman Test was performed, and the Randon-effect GLS regression method was then used (P = 0.448 > 0.05). The result of random-effects GLS regression is shown in Table 1 below.

| Table 1 Impact Of Capital Structure On Profitability |

||||

|---|---|---|---|---|

| Dependent Variable: Return on assets (ROA) | ||||

| Method: Panel Least Squares | ||||

| Sample: 2014 -2018 | ||||

| Periods included: 5 | ||||

| Cross-sections included: 24 | ||||

| Total panel (balanced) observations: 120 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| DEBT_EQUITY | -0.099150 | 0.020058 | -4.943130 | 0.0000 |

| C | 12.31294 | 1.358105 | 9.066270 | 0.0000 |

| Root MSE | 4.708468 | R-squared | 0.171549 | |

| Mean dependent var | 5.950750 | Adjusted R-squared | 0.164528 | |

| S.D. dependent var | 5.194735 | S.E. of regression | 4.748202 | |

| Akaike info criterion | 5.969935 | Sum squared resid | 2660.360 | |

| Schwarz criterion | 6.016394 | Log likelihood | -356.1961 | |

| Hannan-Quinn criter. | 5.988802 | F-statistic | 24.43453 | |

| Durbin-Watson stat | 0.811410 | Prob(F-statistic) | 0.000003 | |

It was observed from Table 1 that there was a statistically significant negative relationship between capital structure and firms’ profitability (R2 = 0.171549, F(1,120) = 24.43, P(0.000)<0.05). This evidence means that any increase in the debt-equity ratio would cause the profitability, which was measured in this study as return on assets (ROA), to also decrease (coefficient = -0.099150). This evidence is in line with Bartoloni (2013), Chen et al. (2019), and Chen, et al. (2021), who posited that there is an inverse relationship between the gearing position of a firm and its profitability. The view was that firms with high profitability would have more internal resources and would choose to finance their operations from retained earnings since it would not cause their operating expenses to increase. It is obvious that firms with low profitability levels would not have much internal resources and, consequently, would rely on an external source to finance their activities. With this empirical evidence, this study, therefore, concludes that there is a negative relationship between a firm’s debt ratio and its return on assets. A lowly-geared company pays less in interest as compared to highly geared ones, and hence, operating expenses will reduce, increasing the firm's profit. However, this finding did not support the work of Odhiambo & Sam (2015), Yinusa et al. (2019), and Ayaz et al. (2021). They were of the view that capital structure and profitability are positively correlated. Again, this study did not support the trade-off theory, which points out that highly profitable firms are expected to make use of more and more debt to benefit from the debt-interest tax shield and maximize the value of the firm. The position of the theory is that the cost of debt is tax deductible, while the cost of equity is not tax deductible in determining the profit of a business. This theory fails to recognize that the cost of debt must be settled whether profit is made or not, while dividend payments to equity holders can be postponed. It can, therefore, be deduced that interest payments put more financial pressure on management than dividend payments. Based on this, firms may prefer equity financing to debt financing. It is, however, important for the firm to study its circumstances and examine market forces before taking any capital structure decisions. This is the point of view of market timing theory. Corporate leaders should always monitor the business environment. This would help them to understand the dynamics of debt and equity instruments, thereby choosing the right capital structure. This study also supports the assertion that, when the right capital structure decision is made, it will go a long way toward improving business performance.

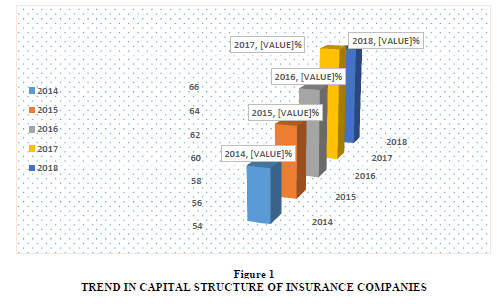

It is important for firms to study their circumstances and examine market forces before taking any capital structure decisions, and to monitor the business environment to understand the dynamics of debt and equity instruments. This study also supports the assertion that when the right capital structure decision is made, it will go a long way toward improving business performance. With respect to the gearing (debt-equity) position of insurance companies in Ghana, the study found an increasing trend. Figure 1 depicts the results.

As seen in the figure above, insurance companies experienced an increasing trend in the debt-equity ratio over the past five years. For instance, the average gearing ratio was 59% in 2014 and this figure marginally increased to 61% and 63% in 2015 and 2016 respectively. The trend continued to 2017 with an average gearing ratio of 66% before marginally declining to 65% in 2018. This trend indicates that insurance companies are highly geared. It is worth to noting that this is not a worrying trend as financial institutions are generally highly geared due to their nature of operations.

The study further carried out Pedroni Residual Cointegration Test to find if the relationship established between capital structure and profitability can stay for a long period. The test was performed using within-dimension statistics to test for a common set of AR coefficients and between-dimension statistics to test for individual AR coefficients. The evidence is depicted in Table 2 below.

| Table 2 Debt-Equity And Profitability Cointegration |

|||||

|---|---|---|---|---|---|

| Alternative hypothesis: common AR coefs. (within-dimension) | |||||

| Weighted | |||||

| Statistic | Prob. | Statistic | Prob. | ||

| Panel v-Statistic | 0.222758 | 0.4119 | -0.426794 | 0.6652 | |

| Panel rho-Statistic | 0.316796 | 0.6243 | -0.037704 | 0.4850 | |

| Panel PP-Statistic | -3.526021 | 0.0002 | -5.820178 | 0.0000 | |

| Panel ADF-Statistic | -3.520949 | 0.0002 | -5.634528 | 0.0000 | |

| Alternative hypothesis: individual AR coefs. (between-dimension) | |||||

| Statistic | Prob. | ||||

| Group rho-Statistic | 2.613903 | 0.9955 | |||

| Group PP-Statistic | -6.123856 | 0.0000 | |||

| Group ADF-Statistic | -4.726569 | 0.0000 | |||

From Table 2, the within-dimension statistics show that the panel PP-Statistic and Panel ADF-Statistic have calculated test statistics of -3.526021 and -3.520949, respectively, both of which are less than the critical value of -2.52 at a 1% significance level, indicating that there is a long run association between capital structure and profitability. Again, the between dimension Group PP-Statistic, Group rho-Statistic, and Group ADF-Statistic provided strong evidence of cointegration between capital structure and profitability. It was also observed that the majority (15) representing 62.5% of the observed insurance companies would experience a negative association between their capital structure and profitability. Since these two variables are cointegrated for a long period, it is important for corporate decision-makers to establish the right capital structure that would maximize shareholder value. If a firm fails to determine the right capital structure, its profitability will suffer. The decision of capital structure is not a matter of choice but rather key in firm’s survival.

Determinants of Capital Structure

Capital structure decision is very important and therefore, companies should be concerned with the factors that influence this decision. Both external and internal factors formed part of the regression model of this study. A multicollinearity was first performed to ensure that there was no correlation between the factors as shown Table 3 below.

| Table 3 Multicollinearity Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| ROE | ROA | Growth | Assets Quality |

No of BOD | Age | Inflation Rate | Monetary Policy |

|

| Tolerance | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| VIF | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

The tolerance and VIF statistics indicate that there is no significant multicollinearity between the independent variables in the model.

Further test was performed to examine the model parameter and the standardardized coefficient and the findings are displayed in Table 4a and Table 4b below.

| Table 4a Model Paramters |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Value | Standard Error | t | Pr>?t? | Lower Bound | Upper Bound | P-values Significat |

| Intercept | 0.000 | ||||||

| ROE | 0.000 | 0.000 | |||||

| ROA | 0.000 | 0.000 | |||||

| Growth | 0.221 | 0.070 | 3.175 | 0.002 | 0.083 | 0.359 | ** |

| Assets Quality | 0.736 | 0.036 | 22.307 | <0.0001 | 0.670 | 0.801 | *** |

| No of BOD | 0.000 | 0.000 | |||||

| Age | 0.000 | 0.000 | |||||

| Inflation Rate | 0.000 | 0.000 | |||||

| Monetary Policy | 0.000 | 0.000 | |||||

| Signification Codes: 0 < *** < ** < 0.01 < * < 0.05 < . < 0.1 < º < 1 | |||||||

| Table 4b Standardized Coefficient |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Value | Standard Error | t | Pr>?t? | Lower Bound | Upper Bound | P-values Significat |

| ROE | 0.000 | 0.000 | |||||

| ROA | 0.000 | 0.000 | |||||

| Growth | 0.123 | 0.039 | 3.175 | 0.002 | 0.046 | 0.200 | |

| Assets Quality | 0.864 | 0.039 | 22.307 | <0.0001 | 0.787 | 0.941 | ** |

| No of BOD | 0.000 | 0.000 | |||||

| Age | 0.000 | 0.000 | |||||

| Inflation Rate | 0.000 | 0.000 | |||||

| Monetary Policy | 0.000 | 0.000 | |||||

| Signification Codes: 0 < *** < 0.001 < ** < 0.01 < * < 0.01 <0.05 < . < 0.1 < º < 1 | |||||||

Equation of the model (Debt-Equity):

Debt-Equity = 0.22083546702013*Growth+0.735612325069922*Assets Quality

Goodness of fit statistics (Debt-Equity):

Observations: 120

Sum of weights: 120

DF: 118

R2: 0.914

Adjusted R2: 0.912

MSE: 402.521

RMSE: 20.063

MAPE: 31.639

DW: 0.704

Cp: 34.805

AIC: 721.713

SBC: 727.288

PC: 0.089

The regression analysis reveals that the best model is a linear combination of Growth and Assets Quality. The goodness of fit statistics (R-squared, Adjusted R-squared, MSE, RMSE, MAPE, DW, Cp, AIC, SBC, and PC) indicates that the model explains 91.4% of the variation in the capital structure decision. The analysis of variance shows that the model is statistically significant (F=624.361, p<0.0001).

The model parameters reveal that only Growth and Assets Quality are statistically significant predictors of Debt-Equity. The equation of the model indicates that debt-equity increases by 0.2208 for every unit increase in Growth, and it increases by 0.7356 for every unit increase in assets quality. The standardized coefficients show that assets quality has a higher impact on debt-equity than growth.

This evidence suggests that when a firm is experiencing growth and it wants to maintain it, the best source of finance is the debt instrument. It can also be deduced from this angle that lenders will be more willing to grant credit facilities to companies experiencing growth at a reduced cost debt due to the confidence level in terms of the default rate they have in such companies as compared to companies experiencing contraction. A firm should take the advantage of its growth or size to finance its activities through debt instruments at a competitive interest rate to enable it to sustain its growth Small firms.

The asset quality also has positive impact on capital structure decision of a firm. The study uses the proportion of investment assets ratio to measure assets quality. This ratio is calculated as total investments divided by total asset. It is a useful measure of the quality of assets on the insurer’s balance sheet. This positive correlation gives an indication that, a firm with more quality assets can borrow more than a firm with less quality assets. Assets with quality value can be used as collateral for credit facilities.

However, no empirical evidence supports the influence of board size, age of business, inflation, and interest rate on the capital structure decisions of the insurance companies. Even though old firms would have an advantage over new firms when it comes to securing debt, it does not necessarily mean that they would go for external first if the internal source is available. However, if a firm has a long history of debt repayment without default, there is a high probability that it can borrow more, and debt financing will become a cheaper source of finance.

Inflation and interest rate are external variables that affect business operations. To this end, the study sought to find out if inflation and interest rate could determine the capital structure of a firm. It was established they had no influence on capital structure.

Optimal Capital Structure for Insurance Companies in Ghana

An optimal capital structure is the combination of equity and debt that maximizes profit and creates value for shareholders. The inappropriate capital structure could affect business and therefore, this study sought to explore an optimal capital structure among insurance companies in Ghana and this was determined by a threshold regression analysis using return on equity and debt-to-equity as shown in Table 5.

| Table 5 Optimal Capital Structure For Insurance Companies In Ghana |

|||

|---|---|---|---|

| Multiple threshold tests | |||

| Bai-Perron tests of L+1 vs. L sequentially determined thresholds | |||

| Sample: 1 24 | |||

| Included observations: 24 | |||

| Threshold variable: RESID | |||

| Threshold varying variables: DEBT_EQUITY C | |||

| Threshold test options: Trimming 0.15, Max. thresholds 5, Sig. | |||

| level 0.05 | |||

| Sequential F-statistic determined thresholds: | 1 | ||

| Scaled | Critical | ||

| Threshold Test | F-statistic | F-statistic | Value** |

| 0 vs. 1 * | 34.82968 | 69.65937 | 11.47 |

| 1 vs. 2 | 5.935217 | 11.87043 | 12.95 |

| * Significant at the 0.05 level. | |||

| ** Bai-Perron (Econometric Journal, 2003) critical values. | |||

The empirical evidence suggests that the optimal capital structure for insurance companies in Ghana varies across the industry ranging from 34.8% to 69.7% at 0.05 significance level. Even though the companies are in the same industry, each company has unique way of responding to the various factors that influence the capital and hence, different optimal capital structure. This confirms the trade-off theory of capital structure, which states that managers choose the mix of debt and equity that achieves a balance between the tax advantages of the debt and the various costs of using financial leverage. To achieve an optimal capital structure, the marginal benefits must be equal to the marginal cost of debt. The following steps should be taken when determining a firm's optimal capital structure: (i) estimate the interest rate the firm will pay; (ii) estimate the cost of equity; (iii) estimate the weighted average cost of capital; (iv) estimate the free cash flows and their present value, which is the value of the firm and (v) deduct the value of the debt to find the shareholders’ wealth, which is to be maximized.

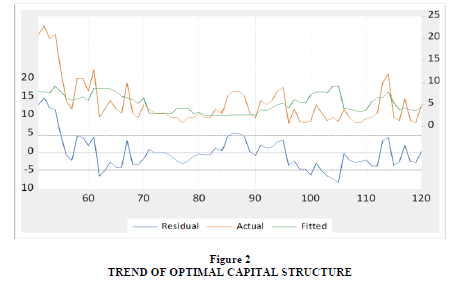

It is also worth to note that optimal capital of a firm changes from one period to another and differs from one company to another. The residual graph of the capital structure threshold showing this trend is depicted in Figure 2 below.

From the Figure 2 above, it can be observed that the optimal capital structure of the insurance companies varies, and its impact on profitability also varies accordingly. This means that there is no fixed optimal capital structure for a firm. For this reason, firms should also analyze its business operations and objectives before deciding on the appropriate capital structure. The evidence suggests that it is a challenging task for corporate managers to determine the optimal capital structure for a company in the process of maximizing shareholder. This is attributed to the dynamic nature of the factors that influence the firm’s capital structure. New loans and share issues are usually raised in “lumpy” amounts, making it almost impossible for a company to remain at an optimal capital structure

Conclusion and Recommendations

This study investigated the impact of capital structure decisions on profitability among insurance companies in Ghana. The findings of the study reveal that capital structure decision has a significant impact on profitability, with a positive relationship between the debt-to-equity ratio and profitability. The study also found that companies in the insurance industry are highly geared. The best source of finance for a firm experiencing growth with quality assets is debt instrument. Thus, for a firm to achieve an optimal capital structure, the marginal benefits must be equal to the marginal cost of debt. The research established that there is no fixed optimal capital structure in the insurance industry.

Based on the findings of the study, it is recommended that insurance companies should prioritize maintaining an optimal capital structure that balances the benefits of debt financing and equity financing, with a focus on maximizing profitability. Also, insurance companies should regularly monitor and adjust their capital structure to respond to changing market conditions and business needs. Further research is recommended to study the role of corporate governance practices in the relationship between capital structure decisions and profitability among insurance companies in Ghana. This will provide insights into the effectiveness of different corporate governance practices in managing the impact of capital structure decisions on profitability.

Originality of the Study

Capital structure decisions plays out differently in the insurance industry in Ghana compared to other sectors due to industry-specific factors such as regulatory requirements, risk profiles, and business models. A study focusing on this industry would contribute original findings to the existing literature.

References

Abbadi, M.S., & Abu-Rub, N. (2012). The Effect of Capital Structure on the Performance of Palestinian Financial Institutions. British Journal of Economics Finance and Management Sciences, 3(2), 92-101.

AbdelJawad, I., Nor, F., Ibrahim, I., & Abdul-Rahim, R. (2013). Dynamic Capital Structure Trade-off Theory: Evidence from Malaysia. International Review of Business Papers, 9(1), 102-110.

Abdullah, H., & Tursoy, T. (2021). Capital structure and firm performance: evidence of Germany under IFRS adoption. Review of Managerial Science, 15(2), 379-398.

Indexed at, Google Scholar, Cross Ref

Abor, J. (2005). Debt policy and performance of SMEs: Evidence from Ghanaian and South African firms. The Journal of Risk Finance Incorporating Balance Sheet, 8(2), 364-379.

Indexed at, Google Scholar, Cross Ref

Agyei, J., Sun, S., & Abrokwah, E. (2020). Trade-off theory versus pecking order theory: Ghanaian evidence. SAGE Open, 10(3), 2158244020940987.

Indexed at, Google Scholar, Cross Ref

Alomari, M.W. (2019). Effect of the Micro and Macro Factors on the Performance of the Listed Jordanian Insurance Companies. Journal of Emerging Issues in Economics, Finance, and Banking, 8(1).

Antoniou, A., Guney, Y., & Paudyal, K. (2008). The Determinants of Capital Structure: Capital Market-Oriented Versus Bank-Oriented Institutions. Journal of Financial and Quantitative Analysis, 1-19.

Indexed at, Google Scholar, Cross Ref

Ayaz, M., Mohamed Zabri, S., & Ahmad, K. (2021). An empirical investigation on the impact of capital structure on firm performance: Evidence from Malaysia. Managerial Finance, 47(8), 1107-1127.

Indexed at, Google Scholar, Cross Ref

Baker, M., & Wurgler, J. (2002). Market Timing and Capital Structure. The Journal of Finance, 57(1), 1-31.

Baltagi, B. (2001). Econometric Analysis of Panel Data (2nd ed). John Wiley and Sons, Chichester.

Indexed at, Google Scholar, Cross Ref

Bartoloni, E. (2013). Capital structure and innovation: causality and determinants. Empirica, 40(1), 111-151.

Bititci, U., Firat, S.U.O., & Garengo, P. (2013). How to compare performances of firms operating in different sectors? Production Planning and Control, 24(12), 1-18.

Indexed at, Google Scholar, Cross Ref

Boadi, E.K., Antwi, S., & Lartey, V.C. (2013). Determinants of Profitability of Insurance Firms in Ghana. International Journal of Business and Social Research, 3, 43-50.

Indexed at, Google Scholar, Cross Ref

Burgstaller, J., & Wagner, E. (2015). How do family ownership and founder management affect capital structure decisions and adjustment of SMEs? Evidence from a bank-based economy. The Journal of Risk Finance, 16(1), 73-101.

Indexed at, Google Scholar, Cross Ref

Chen, Y., Sensini, L., & Vazquez, M. (2021). Determinants of leverage in emerging markets: empirical evidence. International Journal of Economics and Financial Issues, 11(2), 40.

Indexed at, Google Scholar, Cross Ref

Chen, Z., Harford, J., & Kamara, A. (2019). Operating leverage, profitability, and capital structure. Journal of Financial and Quantitative Analysis, 54(1), 369-392.

Indexed at, Google Scholar, Cross Ref

El?Sayed Ebaid, I. (2009). "The impact of capital?structure choice on firm performance: empirical evidence from Egypt", Journal of Risk Finance, 10(5), 477-487.

Indexed at, Google Scholar, Cross Ref

Ferdous, L.T. (2019). Capital structure theories in finance research: A historical review. Australian Finance & Banking Review, 3(1), 11-19.

Indexed at, Google Scholar, Cross Ref

Fosu, S. (2013). Capital structure, product market competition and firm performance: Evidence from South Africa. The Quarterly Reviews of Economics and Finance, 53(2), 140-151.

Indexed at, Google Scholar, Cross Ref

Frank, M., Goyal, V., & Shen, T. (2020). The Pecking Order Theory of Capital Structure: Where Do We Stand? Oxford Research Encyclopedia of Economics and Finance.

Frank, M.Z., & Goyal, K.V. (2009). Capital Structure Decisions: Which Factors Are Reliably Important? Financial Management, 38(1), 1-37.

Indexed at, Google Scholar, Cross Ref

Hovakimiana, A., Hovakimian, G., & Tehranian, H. (2004). Determinants of target capital structure: The case of dual debt and equity issues. Journal of Financial Economics, 71(2004), 517–540.

Indexed at, Google Scholar, Cross Ref

Imtiaz, F., Mahmud, K., & Mallik, A. (2016). Determinants of Capital Structure and Testing of Applicable Theories: Evidence from Pharmaceutical Firms of Bangladesh. International Journal of Economics and Finance, 8(3), 24-32.

Indexed at, Google Scholar, Cross Ref

Islam, M.R., Liu, S., Biddle, R., Razzak, I., Wang, X., Tilocca, P., & Xu, G. (2021). Discovering dynamic adverse behavior of policyholders in the life insurance industry. Technological Forecasting and Social Change, 163, 120486.

Indexed at, Google Scholar, Cross Ref

Jeannine, M., Gregory, S.N. & Silas, O. (2016). Effect of Capital Structure on Financial Performance of Firms Listed on The Rwanda Stock Exchange. European Journal of Business, Economics and Accountancy, 4(4), 1-11.

Jensen, M.C., & Meckling, W.H. (1976). Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305-360.

Indexed at, Google Scholar, Cross Ref

Jong, A., Kabir, R., & Nguyen, T. (2008). Capital Structure around the World: The Roles of Firm- and Country-Specific Determinants. Journal of Banking & Finance, 32(1), 1954-1969.

Indexed at, Google Scholar, Cross Ref

Kennedy, P. (2008). A Guide to Econometrics (6th ed). Malden, MA: Blackwell Publishing.

Khalid, A., Khursheed, A., & Mouh-i-din, S. (2013). Impact of capital Structure on profitability of listed companies’ evidence from India. International Journal of Management and Social Science Research, 2(8), 55-61.

Khan, S., Bashir, U., & Islam, M.S. (2021). Determinants of capital structure of banks: evidence from the Kingdom of Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management, 14(2), 268-285.

Indexed at, Google Scholar, Cross Ref

Khodavandloo, M., Zakaria, Z., & Nassir, A. M. (2017). Capital structure and firm performance during global financial crisis. International Journal of Economics and Financial Issues, 7(4), 498-506.

Laitinen, E.K. (2002). A Dynamic Performance Measurement System: Evidence from Small Finnish Technology Companies. Scandinavian Journal of Management, 18(1), 65-99.

Indexed at, Google Scholar, Cross Ref

Lemma, T., & Negash, M. (2014). Determinants of the adjustment speed of capital structure: Evidence from developing economies. Journal of Applied Accounting Research, 15(1), 64-99.

Li, K., Niskanen, J., & Niskanen, M. (2019). Capital structure and firm performance in European SMEs: does credit risk make a Difference? Managerial Finance, 45(5), 582-601.

Manurung, D.S., Suhadak, Nuzula, F.N. (2014). The influence of Capital Structure on Profitability and Firm Value. Journal Administration Business, 7(2), 1-8.

Margaritis, D.& Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of Banking and Finance, 34(3), 621-632.

Indexed at, Google Scholar, Cross Ref

Modigliani, F., & Miller, M.H. (1958). The Cost of Capital, Corporation Finance, and Theory of Investment. The American Economic Review, 48(3), 261-297.

Modugu, K.P. (2013). Capital structure decision: An overview. Journal of Finance and Bank Management, 1(1), 14-27.

Myers, C.S. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147-175.

Indexed at, Google Scholar, Cross Ref

Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

Nazir, A., Azam, M., & Khalid, M.U. (2021). Debt financing and firm performance: empirical evidence from the Pakistan Stock Exchange. Asian Journal of Accounting Research.

Indexed at, Google Scholar, Cross Ref

Nguyen, T., & Nguyen, H. (2020). Capital structure and firm performance of non-financial listed companies: Cross-sector empirical evidence from Vietnam. Accounting, 6(2), 137-150.

Indexed at, Google Scholar, Cross Ref

Nishanthini A., & Nimalathasan, B. (2013). Determinants of profitability: A case study of listed manufacturing companies in Sri Lanka. Merit Research Journal of Art, Social Science and Humanities, 1(1), 1-6.

Indexed at, Google Scholar, Cross Ref

Odhiambo, L.O., & Sam, N. (2015). The Relationship between Capital Structure and Financial Performance of Firms Listed on the Nairobi Securities Exchange. Corporate Ownership & Control, 13(1), 296-314.

Indexed at, Google Scholar, Cross Ref

Ong T.S., Teh B.H. (2013). Factors affecting the profitability of Malaysian commercial banks. African Journal of Business Management, 7(8), 649-660.

Ramli, N.A., Latan, H., & Solovida, G.T. (2019). Determinants of capital structure and firm financial performance—A PLS-SEM approach: Evidence from Malaysia and Indonesia. The Quarterly Review of Economics and Finance, 71, 148-160.

Indexed at, Google Scholar, Cross Ref

Sarngadharan, M., & Rajitha, K.S. (2011). Financial Analysis of Management Decision. New Delhi: PHI Learning Private Limited.

Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students. Pearson education.

Setyawan, I. (2011). An Empirical Study on Market Timing Theory of Capital Structure. International Research Journal of Business Studies, 4(1), 103-119.

Tornyeva, K. (2013). Determinants of Capital Structure of Insurance Companies in Ghana. Research Journal of Finance and Accounting, 4(13), 52-60.

Yakubu, I., Dinye, R. Buor, D., & Iddrisu, W. A. (2017). Discriminant Analysis of Demand-Side Roadblocks to Financial Inclusion in Northern Ghana. Journal of Financial Mathematics, 7(3), 718-733.

Indexed at, Google Scholar, Cross Ref

Yinusa, O.G., Ismail, A., Yulia, R., & Olawale, L.S. (2019). Capital Structure and Firm Performance in Nigeria. Africa Journal of Economics Review, 7(1).

Indexed at, Google Scholar, Cross Ref

Received: 04-Jun-2023 Manuscript No. AAFSJ-23-13658; Editor assigned: 06-Jun-2023, PreQC No. AAFSJ-23-13658(PQ); Reviewed: 20-Jun-2023, QC No. AAFSJ-23-13658; Revised: 13-Jul-2023, Manuscript No. AAFSJ-23-13658(R); Published: 20-Jul-2023