Research Article: 2019 Vol: 25 Issue: 3

Capital Structure Determinants and Performance of Startup Firms in Developing Economies: A Conceptual Review

Ezenwakwelu Charity, University of Nigeria

Onyeama Chigozie Austin, University of Nigeria

Osanebi Chimsunum orji, University of Nigeria

Emengini Emeka Steve, University of Nigeria

Abugu James Okechukwu, University of Nigeria

Abstract

Small and medium enterprises in developing economies do not usually utilize the right mix of the various sources of long term funds to finance its capital assets due to ignorance and thus deprived of the benefits accompanied with optimal level of debt and equity mix. This paper examined the determinants for the level of equity and debt in the firm’s capital structure and assessed the extent to which financial leverage affects firm’s financial performance. This study relied on secondary source of information and thus focused on conceptual exploration, review of theories and critical analyses of empirical previous studies. The study presented some practical illustrations and solutions which were derived from the theory provided for the study Table (1) revealed that the more a firm is levered, the higher the rate of return to the equity holders. Levered firms in addition, have the advantage of tax shelter. Table (2) revealed that (when the net operating income is week) unlevered firms will be in a better condition than the levered firms. Table 3 revealed that so long as the net operating income of a firm is strong, the more a firm is levered, the higher the rate of return. The study concluded that the level of debt and equity in a company’s capital structure has risk and return implications. A firm should keep its optimal capital structure in mind when making financing decisions to assure that any increase in debt and preferred equity increase the value of the firm. So long as the net operating income of a firm is strong, the more a firm is levered, the higher the rate of return because interest paid on debt is tax deductible.

Keywords

Financial Leverage, Bond, Preferred Stock, Common Stock, Interest Rate, Capital Structure.

Introduction

Capital structure is the mix of debt and equity which a firm uses for its operation. Manager’s in big and small enterprises utilize substantial time in attempting to find the perfect capital structure in terms of risk/reward for the shareholders. Capital structure involves different sources of long term capital though which an enterprise finances its assets (Kirmi, 2017). Capital structure influences both shareholders’ return and the ability of a firm to survive economic depression (Joshua, 2017).

Mohammad & Jaafer (2012) affirm that firms can use either equity or debt to finance their assets. But where the interest was tax deductible, firms would maximize the value accruable by using more debt. Equity capital refers to shareholders contribution, such as common stock. The debt capital in a firm’s capital structure refers to borrowed monies, such as bonds, loans, debenture, and commercial papers. Capital structure decision becomes relevant to any business enterprise which has the need to maximize shareholders’ return and achieve competitive advantage. The mix/ratio of debt and equity in the company’s mode of financing refers to capital structure. Some organizations prefer more debt while others prefer more equity in financing their assets.

Financial leverage refers to the use of debt to acquire additional assets. Financial leverage means trading on equity which occurs when a firm uses bonds, other debts and preferred stock to increase its earnings on common stock. A firm might use long term debt to purchase assets that are expected to earn more than the interest on the debt. The earnings in excess of the interest expense on the new debt will increase the earnings of the firm’s common stock holders. The increase in earnings indicates that the firm was successful in trading on equity. If the interest expense on the new debt is higher than the earning from the newly purchased assets the earnings of the common stock holders will decrease (www.accountingcoach.com). Capital structure is the mix of various sources of long –term funds used by or an enterprise to finance its capital assets. The long-term sources of financing are mortgage bonds, debentures, preferred stocks, common stock and retained earnings (Ezenwakwelu, 2017). This paper seeks to ascertain the determinants for the level of equity and debt in the firm’s capital structure and also examines the extent to which financial leverage affects firm’s financial performance.

Literature Review

Theoretical Framework

Net income approach: This theory states that an organization can increase its value and reduce the overall cost of capital by increasing the proportion of debt in its capital structure. This approach depends on the assumption that the cost of debt is less than the cost of equity, there are no taxes, and the use of debt does not change the risk perception of investors. The reasons for the assumption that cost of debt is less than cost of equity are that interest charges are usually lower than dividend rates and that, interest charges are tax deductible. (www.shareyouressays.com).

Net operating income approach: This theory was suggested by Durand. The theory states that change in the capital structure of a firm does not affect the market value and the overall cost of capital remains constant despite the method of financing. The theory was supported by the assumption that the market capitalizes the value of the firm as a whole. At every level of debt equity mix, the business risk remains constant (www.shareyouressays.com).

Modigliani and miller approach: This hypothesis resembles the net operating income approach if taxes are ignored. But when taxes exist, the hypothesis will be similar to the net income approach. The M.M hypothesis states that if taxes are ignored, capital structure does not affect the cost of capital. But as financial leverage increases, the cost of equity, the overall cost of capital remains constant. The theory affirms that a firm’s operating income is a determinant of its total value. And that above certain limit of debt, the cost of debt increases, due to increased financial risk but the cost of equity falls. The theory reinstates that where there is tax, the value of the firm increases and the cost of capital decreases on the use of debt. Optimum capital structure is realized by increasing the debt mix in the equity of the firm. Modigliani and Miller (1958) established that the value of a firm is not affected by the capital structure mix of debt and equity in a perfect market.

The pecking order theory: The pecking order theory predicts a hierarchical order for firms financing decision which involves internally generated funds, followed by issuing debt, and thereafter, issuing new equity Myers (1984). The pecking order theory states that investors are likely to undervalue a firm’s new stock due to information asymmetry between the managers of the firm and investors. The theory assumes that for new investment, usually firms prefer to finance it with internal resources, followed by debt and thereafter equity as the last option (Al-Tally, 2014). Thus, pecking order theory does not align with the Modigliani and Miller’s (1958) prediction, since firms under the pecking order theory do not take advantage of the debt tax shields benefits as they prefer internal financing to external financing due to higher risk faced by external financing costs (Fama & French, 1988).

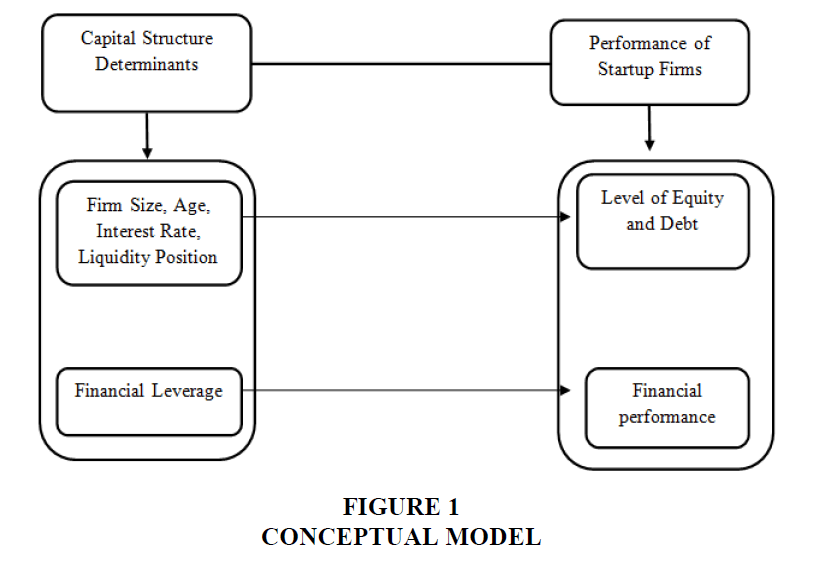

The tradeoff theory: This theory propounds that debt finance is usually used when a firm has more tangible assets while equity finance is usually used by firms that have more intangible assets. Thus, there should be an optimal debt- equity ratio (Al-Tally, 2014). The tradeoff theory states that optimal debt level is realized by comparison of cost of debt financing on the benefits (Aliu, 2010) (Figure 1).

Determinants of capital structure and the level of equity and debt: The ability of a firm in raising adequate funds needed for maximum operation in business depends on the form in which the organization is identified, the duration of business operation and on the size of the business. Corporate organizations can raise more funds through long-term finance sources than a sole proprietorship. The age or duration of business operation determines the firm’s ability to accumulate retained earnings which form part of its capital structure (Ezenwakwelu 2017). Thus, duration of business operation stands as the standard measure of reputation in capital structure models. The longer a firm continues in business, it establishes the capacity to take more on debt (Myers, 1977).

Business size determines the extent of raising funds in an organization. People subscribe to a firm's share capital if they know the size of the business and prospects of its success. The larger the firm, the more possible it can issue debt and lower the risk of bankruptcy (Titman and Wessels, 1988).

Warner (1977) posits that a large firm would have lower transactions costs of external financing than a small firm, making it difficult for the small firms to acquire debt and preventing them from utilizing external financing. Generally, big firms have diversified business strategy, which enables them to have stable earnings that reduce the risk of bankruptcy and contribute in meeting their debt obligations (Warner, 1977; Marsh, 1982).

Firms raise debt at cheaper rates if they have large amount of fixed assets. Such firms have an incentive to obtain loans at cheaper rate. Firms with large amount of fixed assets would secure higher level of debt. Thus, when debt is secured on assets, creditors would have an assurance for repayment (Titman & Wessels, 1988; Harris & Raviv, 1991).

Interest rates determine the ability of a firm to raise new funds through the issue of debenture or common stocks [equity shares]. If interest rates rise, companies would prefer to raise funds through the issue of common stock [by subscribing for shares]. But when interest rates fall, companies raise funds through debenture issue. Therefore, interest is the payment that is made for using someone else's money or capital.

The liquidity position of a firm is necessary for determining its capital structure. Corporate organizations consider their liquidity position before embarking on the issue of debenture [debt issue]. This prevents bankruptcy or being unable to pay debts.

A firm is said to be liquid when it has the ability to produce cash required in servicing its debt obligations.

Cost of capital is considered by firms when raising funds. Experience gathered by firms proved that the cost of debt is lower than the cost of equity capital because firms usually borrow capital less than it earns. Also, interest charges for borrowing funds are tax deductible. An increase in debt ratio results in increased variability in income.

The desire of a firm to have control of the organization may determine the finance source the firm may use. Thus, the firm may prefer debt issues and preferred stock [which have no voting rights] to common stock (Ezenwakwelu, 2017).

Financial Leverage and Financial Performance

Financial leverage refers to trading on equity which occur when a firm uses bonds, other debts and preferred stock to increase its earnings on common stock (Ezenwakwelu, 2017).

Financial leverage refers to use of more debt in the firm’s capital structure. The leverage occurs like fixed financial expense on the firm which bears a fixed interest payment (Adenugba et al., 2016).

Financial leverage is a debt incurred by a firm from financial institutions with the intention that such investment will earn more than the cost of interest charged on the debt (Abubakar, 2015). Additionally, financial leverage employed by a firm is motivated by the intention of earning higher returns on debt than the cost (Enekwe et al., 2014). The possible outcomes with the use of fianacial leverage can be profit maximization or minimization. Thus, the high debt level which should be paid at a cost exposes the firm to risk (Al-Otaibi, 2013).

Financial performance analysis deals with the following items: capital employed, asset base, sales turnover, dividend growth (Omondi & Muturi, 2013). Financial performance is expressed with regards to increase in stock prices, sales and dividend (Maghanga & Kalio, 2012). Moghadam & Jafari, (2015) examined the role of leverage on firm’s performance. The finding revealed that leverage had a significant positive relationship with firm’s performance. The study concluded that the higher the debt level, the more the profitability of the firm.

Researchers conducted in the Small Medium Enterprises(SMEs) field are consistent and revealed a negative relationship between debt ratios and profitability (e.g. Michaelas et al., 1999; Hall et al., 2000; Esperança et al., 2003; Mira & Garcia, 2003; Cabaço, 2010; Vieira & Novo, 2010).

Mira & Garcia (2003) studying the SMEs in Spain found a negative relationship between cash flow and debt as companies have a preference for financing their investments with internal generated funds instead of accessing external debt.

Methodology

This study relied on secondary source of information and thus focused on conceptual exploration, review of theories and critical analyses of empirical previous studies. The research questions were discussed in the literature review. The study made critical review of the previous works that were related to this study. The study presented some practical illustrations and solutions which were derived from the theory provided for the study. The practical illustrations and the solutions will benefit startup firms. The data were collected through books, journals and internet.

Illustrations on Net Operating Income Theory Approach to Capital Structure, Having Considered the Determinants for Capital Structure.

Illustration 1

The illustration on three firms: O, P and Z, each capitalized at N4 million. The shares of each of the companies are selling at NI.00 par value and net operating income for each of the companies is ₦400, 000. If the firm O is not levered, while firm P has ₦500, 000 at 5% debenture in its capital structure and firm Z has ₦900, 000 at 5% debenture in its capital structure. With a tax rate of 30%, what is the rate of return for these firms?

Table (1) reveals that the more a firm is levered, the higher the rate of return to the equity holders. Levered firms in addition, have the advantage of tax shelter to the extent of the leverage. This was shown in the illustration where firm, 'O' paid a tax of ₦120,000 while firm ‘P’ paid tax of ₦112,500 and firm 'Z' paid ₦I06,500. Firm Z has a higher rate of return because it was more levered. Startup firms should learn that liquidity position of a firm and interest rate on capital are considered before going in for debt. Table 1 showed that the net operating income was strong and that the interest rate for borrowing fund was not high. This reveals an increase in the rate of return to equity holders.

| Table 1: Solutions For Illustration 1 | |||

| Options | O | P | Z |

|---|---|---|---|

| Earnings before Interest and Taxes | N 400,000 |

N 400,000 |

N 400,000 |

| Interest on debt at 5% | - | 25, 000 | 45, 000 |

| Earnings before Taxes | 400,000 | 375,000 | 355,000 |

| Tax 30% | 120,000 | 112500 | 106,500 |

| Available to Equity Holders | 280,000 | 262,500 | 248,500 |

| Rate of Return | 7% | 7.5% | 8% |

Illustration II

The illustration on three firms: X Y and Z, each capitalized at N4 million. The shares of each of the companies are selling at ₦l.00 par value and net operating income for each of the companies is ₦100, 000. If the firm X is not levered and firm Y acquired ₦500, 000 at 6%debenture in its capital structure while firm Z acquired N1 million at 6% debenture in its capital structure; with a tax-rate of 20%, what is the rate of return for the three firms?

Table (2) shows that (when the net operating income is week) unlevered firms will be in a better condition than the levered firms. Thus, in the illustration above, firm Z had the lowest rate of return followed by firm Y. Startup firms will learn that a firm which its net operating income (earnings before interest and tax) is weak has no need of debt issue. Such a firm would raise funds by subscribing for shares (equity stocks) so as to build enough retained earnings and reserves which can support debt issue in future.

| Table 2: Solutions For Illustration Ii | |||

| Options | X | Y | Z |

|---|---|---|---|

| Earnings before Interest and Taxes | ₦ 100,000 |

₦ 100,000 |

₦ 100,000 |

| Interest on Debt at 6% | - | 30,000 | 60,000 |

| Earnings before Taxes | 100,000 | 70,000 | 40,000 |

| Tax 20% | 20,000 | 14,000 | 8000 |

| Available to Equity holders | 30,000 | 56,000 | 32000 |

| Rate of Return | 2% | 1.6% | 1.1% |

Illustration III

The illustration on three firms: Sharp, Sony and Toshiba, each capitalized at N5 million. Sharp's capital structure is made up of only equity stocks. Sony has ₦l.2 million at 10% debenture in its capital structure while Toshiba has ₦l.5 million at 10% debenture in its capital structure. If the net operating income of each of the firms is ₦I million and the tax is 40%. Determine the rate of return for each firm. Table 3 shows that so long as the net operating income of a firm is strong, the more a firm is levered, the higher the rate of return. Interest paid on debt is tax deductible.

| Table 3: Solutions For Illustration III | |||

| Options | SHARP | SONY | TOSHIBA |

|---|---|---|---|

| EBIT | ₦1,000,000 | ₦1,000,000 | ₦1,000,000 |

| Interest on Debt (10%) | - | 120, 000 | 150,000 |

| Earnings before Tax | 1,000,000 | 880, 000 | 850,000 |

| Tax 40% | 400,000 | 352,000 | 340, 000 |

| Available to Equity Holders | 600,000 | 528, 000 | 510000 |

| Rate of Return | 12% | 13.89% | 14.57% |

Illustration IV

The illustration on three firms: Sharp, Sony and Toshiba, each capitalized at ₦4 million. Sharp's capital structure is made up of only equity stocks. Sony has ₦l million at 15% debenture in its capital structure while Toshiba has ₦l.5 million at 15% debenture in its capital structure. If the net operating income of each of the firms is ₦500000 and the tax is 40%. Determine the rate of return for each firm.

Table (4) reveals that the rate of return for Sony and Toshiba fell because of higher interest charge on debt (15%). The rate of return for Sharp rises because with rise in the interest rate, it is better to subscribe for shares.

| Table 4: Solutions For Illustration V | |||

| Options | SHARP | SONY | TOSHIBA |

| EBIT | ₦500,000 | ₦ 500,000 | ₦500,000 |

| Interest on Debt (15%) | - | 150,000 | 225,000 |

| Earnings before Tax | 500,000 | 350,000 | 275,000 |

| Tax 40% | 200,000 | 140,000 | 110000 |

| Available to Equity Holders | 300,000 | 210000 | 165000 |

| Rate of Return | 7.5% | 7% | 6.6% |

Results And Discussion

Fosu (2013) conducted a study to examine the relationship between capital structure and firm’s performance in South Africa. The objective of the study was to ascertain the extent to which financial leverage affects firm’s performance. Fosu used 257 firms listed on the stock exchange. The finding revealed that financial leverage had a significant positive effect on the firm’s performance.

Saeed, et al. (2013) studied the impact of capital structure on performance of Pakistani banks. The objective was to assess the nature of relationship between determinants of capital structure and performance of the banking industry. Saeed et al. used data of banks listed on Karachi stock exchange for the period of 2007-2011. Performance was measured by return of equity, return on assets and earnings per share while determinants of capital structure involve: long term debt to capital ratio, short–term debt to capital ratio and total debt to capital ratio. Finding revealed that there was a positive relationship between determinants of capital structure and performance of the banking industry.

Adesina, et al. (2015) studied capital structure and financial performance in Nigeria. The objective was to ascertain the nature of the relationship between firm’s capital structure and bank’s financial performance. Data for the study were analysed using ordinary least square (OLS). The result revealed that capital structure (debt and equity) positively related with bank’s financial performance.

Conclusion

The level of debt and equity in a company’s capital structure has risk and return implications. Financial leverage is the degree to which a firm uses debt and preferred equity. The more a firm uses debt financing, the higher its financial leverage. The higher the financial leverage, the higher the interest payments which negatively affect the firm’s earnings per share. Increased level of financial leverage may result to increase in the firm’s profits which ultimately cause the firm’s stock price to rise and fall frequently. However increase in the stock price means that the firm will pay higher interest to shareholders. A firm should keep its optimal capital structure in mind when making financing decisions to assure that any increase in debt and preferred equity increase the value of the firm. So long as the net operating income of a firm is strong, the more a firm is levered, the higher the rate of return because interest paid on debt is tax deductible.

Limitations

The research has limitations because it has focused on theoretical and conceptual review. The research questions were discussed in the literature review, no primary data were collected. Future researchers can conduct empirical studies and thus, collect both primary data and secondary data.

References

- Abubakar, A. (2015). Relationshili between financial leverage and financial lierformance of deliosit money banks in Nigeria. International Journal of Economics, Commerce and Management, 3(10), 759-778.

- Adenugba, A.A., Ige, A.A., &amli; Kesinro, O.R. (2016) Finacial leverage and firms? value. A study of selected firms in Nigeria. Euroliean Journal of Research and Reflection in Management Sciences, 4(1), 14-32.

- Aliu, N.O. (2010). Effect of caliital structure on the lierformance of quoted manufacturing firms in Nigeria, ABU, Zaria.

- Al-Otaibi, R. (2015). Imliact of financial leverage on the comliany?s financial lierformance, Saudi Arabia.

- Al-Tally, H.A. (2014). An investigation of the effect of financial leverage on firm?s financial lierformance in Saud Arabia?s liublic listed comlianies, University of Melbourne, Australia.

- Adesina, J.B., Nwidobie, M., &amli; Adesina, O.O. (2015). Caliital structure and financial lierformance in Nigeria. International Journal of Business and Social Research, 5(2), 21-31.

- Cabašo, D. (2010). The caliital structure of SMEs in liortugale Sliain. Master Thesis in Management, UE.

- Enekwe, C.I., Agu, C.I., &amli; Eziedo, K.N. (2014). The effect of financial leverage on financial lierformance: Evidence from quoted liharmaceutical comlianies in Nigeria. Journal of Economics and Finance, 5(3), 17-25.

- Eslieranša, J., Gama, A.M., &amli; Azzim, M. (2003). Corliorate debt liolicy of small firms: An emliirical (re)examination. Journal of Small Business and Enterlirise Develoliment, 10, 62-80.

- Ezenwakwelu, C.A. (2017). International business management (Second Edition).&nbsli; Enugu: Immaculate liublications Ltd.

- Fama, E. F., &amli; French, K.R. (1988). Taxes, financing decisions and firm value. The Journal of Finance, 53(2), 819-844.

- Fosu, S. (2013). Caliital structure, liroduct market, comlietition and firm?s lierformance: Evidence from South Africa University of Leicester, UK Working lialier.

- Hall, G., Hutchinson, li.J., &amli; Michaelas, N. (2000). Industry effects on the determinants of unquoted SMEs' caliital structure. International Journal of the Economics of Business, 7, 297-312.

- Harris, M., &amli; Raviv, A. (1991). The theory of caliital structure. Journal of Finance, 46, 297?355.

- Joshua, K. (2017). An introduction to caliital structure: Why caliital structure matters to your investments. Retrieved from httli://www.the balance.com/an-introduction to caliital-structure-357496.html.

- Kirmi, li.N. (2017). Relationshili between caliital structure and lirofitability, evidence from listed energy and lietroleum comlianies listed in Nairobi Securities Exchange, Journal of Investment and Management, 6(5), 97?102.

- Martin, J.D., lietty, W.J., Koewn, A.J., &amli; Scott, D.F. (1991). Basic financial management. New Jersey: lirentice Hall Inc.

- Maghanga, E.N., &amli; Kalio, A.M. (2012). Effects of leverage on the financial lierformance of liarastatals: A case study of Kenya liower. International journal of Science and Research, 3(10), 990-991.

- Marsh, li. (1982). The choice between equity and debt: An emliirical study. Journal of Finance, 37, 121-144.

- Michaelas, N., Chittenden, F., &amli; lioutziouris, li. (1999). Financial liolicy and caliital structure choice in UK SMEs: emliirical evidence from comliany lianel data. Small Business Economics, 12, 113-130.

- Mira, F., &amli; Garcia, J. (2003). liecking order versus trade-off: an emliirical aliliroach to the small and medium enterlirise caliital structure. IVIE Working lialier, Universidad Cardenal Herrera.

- Modigliani, F., &amli; Miller, M.H. (1958). The cost of caliital, corliorate finance, and the theory of investment. American Economic Review, 48(3), 261-275.

- Mohammed, F.S., &amli; Jaafer, M. (2012). The relationshili between caliital structure and lirofitability: International Journal of Business and Social Science, 3(16).

- Myers, S.C. (1977). Determinants of corliorate borrowing. Journal of Financial economics, 5, 147 -175.

- Myers, S.C. (1984). The caliital structure liuzzle. The Journal of Finance, 39(3), 575-583.

- Omondi, O.M., &amli; Muturi, W. (2013). Factors affecting the financial lierformance of listed comlianies at the Nairobi Securities Exchange in Kenya. Research Journal of Finance and accounting, 4(15), 99-104.

- Saeed, M.M., Gull, A.A., &amli; Rasheed, M.Y (2013). Imliact of caliital structure on banking lierformance: A case study of liakistan. Interdiscililinary Journal of Contemliorary Research in Business, 4(10), 393?403.

- Titman, S., &amli; Wessels, R. (1988). The determinants of caliital structure choice. Journal of Finance, 43, 1-19.

- Vieira, E., &amli; Novo, A. (2010). &nbsli;The caliital structure of SMEs: Evidence from the liortuguese Market, ISCA Studies, Series, 4(2), 25-32.

- Warner, J.B. (1977). Bankrulitcy costs: some evidence. Journal of Finance, 32, 337-347. www.shareyouressays.com, Retrieved 10/ 01/2019. www.accountingcoach.com, Retrieved 10/ 01/2019.