Research Article: 2021 Vol: 25 Issue: 5

Capital Structure Effect on Firms Value from Specific Industry Perspective: Jordanian Industrial Sector as A Case to Study

Omar Ikbal Tawfik, Dhofar University

Abstract

The paper aims at investigating the Accounting and Finance theories on the best way of financing the firms. On the one hand, the agency theory perspective conflicts with the aggregate of leverage in the firm’s capital structure (CS). While Modigliani and Millers' argued that debt is preferred in some circumstances. Therefore, the effect of equity and debt levels on a firm’s value at a specific Jordanian industrial market is our concern. The study sample includes 34 Jordanian Industrial firms during 2001-2015 listed in Amman Stock Exchange (ASE). The study used multiple stepwise regression models analysis. The study measures the firm value using Earning Per Share (EPS) as a dependent variable. Also, the debt divided by the total assets (DR) and the total liability ratio divided by total equity (DE) isa measurement of the external sources of CS. Furthermore, the total equity ratio divided by total assets (EA) is a measurement of the internal sources of CS. The result of the study indicated a negative effect on capital intensive measured by (DR) and (DE) on firm value in all models. Alternatively, the study found a positive impact on capital intensive measured by (EA) on firm value. Finally, the study established the positive effect of corporate characteristics sales growth, profitability and firms size on firm value in all models under the study. Higher debt is not preferred in Jordan's industrial sector, according to the study. Thus, internal resource in terms of capital intensive equity is better than other resources.

Keywords

Specific Industry Capital Structure, Firms Characteristic, Firms' Value.

Introduction

Many countries and markets faced financial crises in the last decades such as the period 2008-2009, which affected firms' efficiency (Alkhatib et al., 2015). Therefore, firms investigate to find out the best way to achieve highest wealth and rewards to recover such circumstances (Salvatore, 2005). Moreover, investors investigate the earning per share at firms financial statement to achieve best reward on their investment (Hermuningsih, 2013). This leads managers to ask about the best choicetofinancing the firms that affects positively on firms value.

In this regard, theories have different perspectives on the best way of financing firms. Modigliani & Miller (1963) state that higher debt is preferred in some circumstances whereas Jensen (1986) preferred leverage. Alternatively, Myers & Majluf (1984) discuss expectations of debt effect. Thus, most of the debate is about the capital structure (CS), that will help them to transcend and overcome their crises that will be implicit in stock price.

The decision of Financing the firms is one of the most difficult and challenging decisions that can be faced by the firms. The firms need to determine the optimal CS such as internal or external resources to improve their activities and achieve best the wealth and rewards for investment (Weston & Brigham, 1998). In this regard, Chen & Chen (2011) argue that firms should find out the cheapest way to carry out financial needs weather internal or external resources, which leads to improve their values in a long run operation. Internal sources such as retained earnings (earning capital), while external source as level of debt which represent the CS (El-Sayed Ebaid, 2009). Thus, the managers must choose one of the two choices that will achieve the best value of the firms with the concern of benefits and costs.

Another issue that needs to be considered is the conflict among the managers and shareholders that comesdue to different interests. On the one hand, managers acting in the best way to managing firm’s activities but at the same time, don’t get the best return (Jensen & Meckling, 1976) which leads them to tolerate the cost decisions risk as well. Thus, managers usually transfer the benefits to themselves and become less concerned to improve the firms’ value. On the other hand firms having high leverage give a higher opportunity for increasing the managers’ percentage share which mitigate the conflict between the two parts. That was argued by Jensen (1986) who states that the committed firms on the debt lead to less free cash available due to pay the debt and leads to less cash free in managers’ hands and therefore, lower incentive to managers’ behavior. As a result, the level of firms’ debt will play important role on firms’ value. Thus, the above theory limited the discussion to managers and shareholders incentive. However, the discussion here extends to include the firms value which is an important perspective that needs to be highlighted from specific industry perspective.

In this regard, Jensen (1986) predicted that industry with specific characteristics such as new industry in comparative environment needs higher leverage. The debt contract leads to less assets substitution because of having large interests that need to covered and because of the inability to involvement in new investments. Thus, firms in matured industry which have growth opportunities as well as higher cash need higher leverage. However, testing the consequence of higher debt on firm's value and specific industry in developing countries that have unique characteristics have not been tested which requires higher investigation. This kind of industry has a higher incentive to the managers to work on the best value of the firms among other profitability, size growth will effect on the earning per share. Thus, investigating the best doses of financing firms from specific industry perspective and its effect on the firms value will contribute to the current body of literature.

The remaining of this paper is structured as follows: the next section is the study background. Then, a brief summary of related literature and hypotheses development are presented. The third section includes the methodology and the study sample. The fourth section is the study result and dissection. Finally, the conclusion and future research suggestions are outlined.

Study Background

The debate in the literature about CS and the best way to improve this kind of industry firms value is based on seminal works like (Modigliani & Miller, 1958). Modigliani & Miller (1958) argue that CS does not have an effect on firm’s value where there are no restrictive assumptions such as tax free and transaction cost. The researchers argue that assumptions are difficult to hold and should find out another realization. Then, Jensen (1986) debate that CS plays an important role in affecting the firms' value which supported by (Jensen & Meckling, 1976). Jensen & Meckling (1976) claim that the sum of leverage in CS affect the agency conflict among the principle and agent to best acting in increasing the value of the firms. This suggestion has been followed by several researchers and have mixed results of positive (Lawal, 2014; Abor, 2005; Arbiyan & Safari, 2009) and negative (Salim & Yadav, 2012; Kester, 1986) and with no effect (El-Sayed Ebaid, 2009; Dada & Ghazali, 2016). The mixed results can be due to short sample with different sectors. The specific industry population with longer period gives a more homogenous sample that help decision makers within the firms.

The above issues have been highlighted form researchers in developed countries, but in transition economies such as Jordan and specific characteristic industry will establish a hint in the existing literature to examine the prediction of the theory in developing markets. Jordanian economy is one of the smallest economies in the Middle East region. The country needs higher investigation and more investment to develop the market. On the other hand, the country has suffered from scarce resources which lead the government to rely on reliance form other countries. Furthermore, the country faces several challenges such as unemployment, higher government debt more than other countries as well as budget deficits (Al-Qadi & Lozi, 2017).On other hand, the occurrence of Intifadah in the West Bank and Gaza in 2000 plays important role on Jordanian market. Furthermore, the finance system and credit policy in the market may have an effect on Jordanian market. The Jordanian market is undeveloped and has two Bank System: conventional commercial banks and Islamic banks where firms get funded (Abdul Rahman et al., 2014). Thus, the firms in Jordan rely on banks' fund (short term debt) provided rather than issuing a bond due to inactive market. Also, those banks will not provide long term funds which shake the firm’s CS in such industrial mature firms. Abdul Rahman et al. (2014) study the Islamic bank in Jordan and they found that those banks understand and control the risk as well as have highly skills to predict risks. As a result, this kind of skill will not enter the banks in much funded firms in low growth and unstable market.

A country like Jordan has an important sector such as industry which represents 60% of total country investment needs to be examined. Moreover, this industry highly contributes to Jordanian Dinar (JD) as well as to the exchange rates and helps the Kingdom's official reserves with foreign currency with more than US$ 8.0 billion a year (Jordanian investment commission, 2017). Also, the industrial sector contributes to more than JD 1 billion annually in direct or indirect taxes to the treasury. It also contributes a 10.77% to the Jordanian economy (Jordan: Economy, 2018). On the other hand, the industry has strong competitiveness for investors due to Jordanian location within the Middle East and North Africa (MENA) district. This region is supported by several free trade agreements (FTAs). Therefore, this gives stability and strong expectation for improvement and offering more than 1.5 billion clients over 160 countries. The Jordanian government is committed to some agreements that help the Jordanian products to access international markets such as the agreement between Jordan and the EU with regards to the relaxation of rules of origin. Thus, Jordan and its industrial sector has unique characteristics to investigate in terms of financing firms choices.

The empirical research in Jordan has highlighted several issues regarding firms' value and performance. In this area of research, Alanaty & Alshhed (2017) study the effect of ownership and firm’s characteristic on earning quality at special industry insurance firms in Jordan. The study shows statistical effect of the variables under the study on earning quality. On the other hand, Alsmady (2012) studies the importance of ownership type such as foreign ownership in privatized firms. The study examines the foreign ownership as a main resource of capital specifically in privatized firms. Furthermore, Alsmady (2018) studies the foreign ownership effect on the timeliness of financial reporting. Those studies did not highlight the effect of debt and equity in capital intensive on firms value. In this regard, Zeitun & Tian (2007) study the influence of CS on the Jordanian companies’ performance from 1989 to 2003. The study results approved that CS negatively affects companies’ performance measure by accounting and market bases. Matar & Eneizan (2018) study the factors affecting the Jordanian manufacturing performance. The study found that profitability positively affects companies’ performance. However, studying the internal and external CS effect among other variables on firm’s value has not yet been investigated in Jordanian market. To study that effect will give a big hint to decision makers and investors in Jordanian market and other developing countries.

The literature in Jordan highlights main issues in this area of inquiries. The determinant of CS in small and medium enterprises and banks (Yusuf et al., 2015; Almanaseer, 2019; Al-Smadi, 2019), and the effect of CSfrom long term debt perspective and its effect onfirms' performance in industrial as well as other sectors (Ramadan & Ramadan, 2015; AlAli, 2017; Zeitun & Tian, 2007). The studies about the industrial firms did not test the choice of CS on firms value, rather, they tested the long term borrowing strategy effect on firm performance. However, according to Jensen (1986) this kind of specific sector characteristics and sample gives big opportunityto find new perspectives in choosing an optimal CS to unquiet developing market such as Jordan, which will highly contribute to the current literature.

In sum, the importance of specific industry in a region like Jordan has not been examined by the theories that debate on the possibility of firm’s CS effect on firm’s value for long and enough periods. Thus, the main objective of this study is to test the effect of internal and external sources of capital on firm’s value listed in (ASE) during the period 2001 -2015. The Earning per share measurement is used for firm’s value. Further, the study controls for the growth, profitability and size in affecting the CS on firm’s value.

Literature Review and Hypotheses Development

Capital Structure Effect on Firms Value

There are many debates regarding the CS and firms value in accounting and finance research. The theory of CS was first proposed by Modigliani & Miller (1958), which establishes very restrictive assumptions that are implicit in perfect markets. Tax free, no transaction cost, risk free debt among others are common expectations by investors that are difficult to handle in real world. Then, they suggested that the CS is unrelated in determining the value of the firms whereas the real assets are more determinant factors. On the other hand, Modigliani & Miller (1963) then argued that when firms pay higher taxes, debt is preferred by tax-shield. Moreover, the firms will benefit from the debt by reducing the agency cost throughout the consequences that managers will face if the firms have a liquidation problem. Therefore, Modigliani & Miller (1963) suggested that increasing the debt in CS may maximize the value of the firms. Moreover, Jensen & Meckling (1976) debate that agency cost comes from the skirmish of interest between the managers and shareholders as well as debt holders and equity holders. The conflict between managers and shareholders is attributable to the fact that managers hold less percentage of the residual claim of the assets. The managers do high effort in improving the firm’s activities but capture lower gain. Furthermore, the managers handle the cost consequences of those activities. Also, the managers have the power to transfer the firm’s resources to their benefits which leads them to follow these desires rather than to improve the firms value. The other conflict comes from the debt contract transfer risk from the equity holders to the debt holders. The debt contract gives the equity holders the most gain and reward if soled before the face value. However, if the investment fails due to limited responsibility and liability of the equity holders the debt holders, they will tolerate the cost consequences.

On the other hand, pecking order theory established by Myers & Majluf (1984) argued that investors have less information than current insiders about firm’s resources and possible investment occasions. In this case, the firm’s equity will be priced incorrectly because the information asymmetry is relative to the value if the information is revealed in the market. Therefore, the outside investors will gain less than net present value expected from the new project. Thus, the shareholders will capture a net loss because the project is rejected. In this case, the managers of the firm can avoid the problem by using internal sources such as retained earnings or by using securities with less severe value by the market. Thus, agreeing to pecking order theory, the firm having a great profit is expected to have less debt in the CS (El-Sayed Ebaid, 2009). Furthermore, the firms desire in financing the firm has an essential role in the CS. In this regard, Jensen (1986) argues that firms with great investment opportunity will have less debt in the CS compared to unhurried growth firms. Thus, the debt has two side effects in the benefits and the costs. On the one hand, the benefits are such as tax-shields, threat of bankruptcy, and less free cash flow that control the managers (Jensen & Meckling, 1976). In contrast, when the firms have high debt level, they will have a higher cost of capital and will have a negative result on firm’s value (Zeitun & Tian, 2007) supported by policy maker of conservative (Hermuningsih, 2013). Also, Zeitun & Tian (2007) argued that Sis fundamental factor effect on firms’ value. However, the firms should carefully consider the tax-shield benefits by substitution of debt for equity less than the bankruptcy cost.

Thus, if the firms have high retained earnings, they should not rely on the debt which, therefore is expected to have negative relationship between the debt and firms value (El-Sayed Ebaid, 2009). The above discussion about the theory of CS has been supported by many empirical pieces of research. In this regard, some researchers found positive (Lawal, 2014; Abor, 2005; Arbiyan & Safari, 2009) and other negative (Salim & Yadav, 2012; Kester, 1986) and with no effect (El-Sayed Ebaid, 2009; Dada & Ghazali, 2016) of the CS.

In this regard, Lawal (2014) studies the commercial banks in Nigerian market and found that debt has an essential role in increasing the banks' value whereas the equity structure in the banks sector partially affected banks' value. Abor (2005) studies the effect of CS on firm’s value in Ghanaian firms and found a positive relationship. The same result was found by Arbiyan & Safari (2009) in Iranian firms. On the other hand, Salim & Yadav (2012) study the CSin term of long, short, and total debt on firm’s value measured by the Earning Per Share for 237 listed companies in Malaysia. The study adds the company growth to the model and firm size control variable when it runs the regression. The study found that CS by all the measurement has a negative effect on the Earning Per Share. Moreover, the study found a positive result on the firms growth in EPS. Kester (1986) studies the effect of CS and firm’s value in United States and Japan firms and found a negative relationship.

Also, El-Sayed Ebaid (2009) studies the influence of CS (debt level) on firm’s value in Egyptian market. The study found that the CS has weak outcome on firm’s value. More specific, the short-term debt to total assets and total debt to total assets have adverseresult on return on assets. Further, the study found all debt measures have no effect on gross profit to sales. Another study by Dada & Ghazali (2016) study the CS effect on accounting and market measure performance on non-financial listed firms in Nigeria market. The study found no statistical effect between the CS (leverage ratio) and companies’ value of accounting and market measurement respectively. Chandra et al. (2019) using path analysis and several endogenous and exogenous variables in compass index 100 in 2016. The study found that profitability and firm's size has positive outcome on stock returns. But the CS variables have no influence on the firm’s value. Therefore, testing the internal and external resources of capital effect in specific industry can be the missing issue in the literature. Thus, the discussion above leads to the following hypotheses:

H1: Capital Structure has an effect on firms' value.

H1a: Debt level has negative effect on firms' value.

H1b: Equity level has positive effect on firms' value.

Firms Growth

The firm’s characteristics set withCSand theinfluence on the firm’s value is firm’s growth. In this regards, the pecking order theory suggested that firms are likely to use the internal resource rather than the external due to information asymmetry (Myers & Majluf, 1984). Moreover, the firms expected to growth and have more operation activities tend to issue more stock in the market (Hermuningsh, 2013). Also, Shyu (2013) argues that the firms with high growth need more fund which firm affiliation helps for better value. The study model includes the CS and the growth variables, which concluded a positive result of the firm’s value. Alternatively, the tradeoff model that supported the firms to have more tax should benefit from deb interest and reducing the agency cost (Modigliani & Miller, 1963). However, the optimal CS in the firms needs to balance between the cost and the benefits that will be generated by the level of debt. In this regard, Hermuningsh, (2013) maintains that when the debt cost exceeds the financial desire cost, the high debt level will effect negatively on the firm’s value.The discussion above leads to the following hypothesis:

H2: Firms growth has positive effect on firm’s value.

Firms Profitability

The pecking order theory suggested that firms with great operating income reduce the firms level of debt (Myers & Majluf, 1984). Furthermore, the firms with internal resources and high cost of debt such as developing market may help the firms to minimize the agency cost and improve the firms' value. Chen & Chen (2011) debate that the higher value of the firm is expected in firms with higher profit which supported by the study result of positive influences of profitability on the firm’s value. Also, a study conducted for Taiwanese listed companies in 2005 to 2009 developed a model constructed on the pecking order theory which supported the argument of firms having higher profit will not over depend on the external funds. Furthermore, when the debt level increases the agency cost and bankruptcy, it will affect negatively on the firm’s value. Shyu (2013) supported the same result of positive effect of profitability on firm’s value. The discussion above leads to the following hypothesis:

H3: Firms profitability has positive effect on firm’s value.

Firms Size

Dada & Ghazali (2016) argue that large firms are more established in the market and have more relationship with other profitable firms. Furthermore, large firms have more capacity and resources and therefore the study found positive association between the firm’s size and companies’ value. Shyu (2013) studies the CS effect on firm’s value using the Taiwan Economic data from 1999 to 2007. The study used two-stage least squares regression to examine the effect of internal and external share effect on firm’s value. The result indicate that the debt capital (total liability) affect positively on firm’s value. Alternatively, the insider shares (Number of insider shares/number of outstanding shares) has negative effect on firm’s value. The discussion above leads to the following hypothesis:

H4: Firms size has positive effect on firm’s value.

Methodology and Study Sample

As we argued above specific industry may give a higher light to investigate. Thus, the study selects Jordanian market which is a special market to study in the middle east countries discussed above (Jordan: Economy, 2018) Also, the study chooses industrial companies listed in (ASE) from 2001 to 2015 that highly contributes to Jordanian economy. The full population sample which was chosen is 63 firms in that time period. Then, the study excluded 29 companies because of missing variables data for that period. The responses include some years of data that are not available and some firms which have been liquidated for the selected period. Thus, there are 34 firms over the period of the study with a total of 510 observations which are shown in Table 1 below.

| Table 1 Study Sample and Population | |||||

| No. of Sectors | The Sectors Types | No. of Firms in each Sectors | Sample Selected | Percentage (%) of Sample | No. of Excluded Firms |

| 1 | Chemical Industries | 11 | 6 | 55% | 5 |

| 2 | Electrical Industries | 6 | 3 | 50% | 3 |

| 3 | Engineering and Construction | 10 | 4 | 40% | 6 |

| 4 | Food and Beverages | 13 | 9 | 69% | 4 |

| 5 | Glass and Ceramic Industries | 2 | 0 | 0% | 2 |

| 6 | Paper and Cardboard Industries | 3 | 3 | 100% | 0 |

| 7 | Pharmaceutical and Medical Industries | 7 | 3 | 43% | 4 |

| 8 | Printing and Packaging | 2 | 1 | 50% | 1 |

| 9 | Textiles, Leathers and Clothing | 7 | 3 | 43% | 4 |

| 10 | Tobacco and Cigarettes | 2 | 2 | 100% | 0 |

| Total | 63 | 34 | 54% | 29 | |

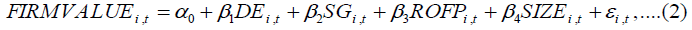

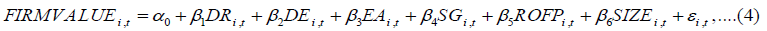

The firms consider the capital cost and try to have an optimal CS to increase their activities and values. The firms may have debt level higher than what they should have (Harris & Raviv, 1991), which may affect negatively on firm’s value. Therefore, the study developed the following models with stepwise multiple regression models to investigate the level of debt that is a proxy for CS. The study developed the models based on the above discussed theories and previous empirical literature. The intercept term, E (ut)=0; homoscedasticity, var(ut) = σ2<∞ where included. There is another control variable that is set in the models to investigate the hypotheses as follow;

Where FIRMVALUE is the firms' value measure by Earnings Per Share = net income divide by average outstanding common shares (Chien et al., 2008). The DR is a proxy for CS measured by the ratio of the debt divided by the total assets (El-Sayed, 2009). Also, the DE is another proxy for CS measured by the ratio of the total liability divided by the total equity (El-Sayed, 2009). Further, the EA is the last proxy for CS measured by the ratio of the total equity divided by total assets (El-Sayed, 2009). Also, the study adds the following control variables in all models under the study such as: SG which is the sales growth measured by =(sales(t)- sales(t-1))divide by sales (t-1) (Chadha & Sharma, 2015(. Moreover, the ROFP is the profitability of firms measured by return on assets = net profit / the total assets (Yang et al., 2010). Finally, the firmsSIZE measured by log total assets (El-Sayed, 2009). Where is α is the constant included in the models and it is firms and years; ε is the error term. These variables are shortened in the subsequent Table 2.

| Table 2 The Measurement of the Variables | |

| Variables | Definition |

| Panel-A: Independent | |

| capital structure (CS); | |

| Debt Ratio (DR) | Measured by the ratio of the debt divided by the total assets. |

| Debt to equity ratio (DE) | Measured by the ratio of the total liability divided by total equity. |

| Equity to assets ratio (EA) | Measured by the ratio of the total equity divided by total assets. |

| Corporate Characteristics; | |

| Sales Growth (SG) | =(sales(t)- sales(t-1))divide by sales (t-1) |

| Size (SIZE) | Log Total Assets. |

| Profitability (ROFP) | Return on Assets = net profit divided by the total assets. |

| Panel-B: Dependent | |

| Firm value (EPS) | Earnings Per Share = Net income divide by Average outstanding common shares |

The Study Results

Descriptive Statistics and Analysis Assumptions

The study started with the descriptive analysis of the independent variables and dependent variable under the study that are shown in Table 3. Descriptive analysis presented in Table 3 gives an important indicator. First, the mean of firm value (EPS) are.08 and (SG) sales growth .07. These results propose that Jordanian listed industrial companies have quite poor firm value, this can be due to the fact that most of listed companies in Jordan faced a Global Crises, increased amounts of obsolete fixed resources, absence of managerial assistances and surplus number of employees. Moreover, the tax payment will reduce the net income after tax as well as the bank system are in lower and unstable market such as Jordan (Abdul Rahman et al., 2014). These difficulties may affect negatively on firms' value. Second, as shown in Table 3 the mean value of (DE) is 0.67. This result suggests that about 67 percent of Jordanian industrial listed firms are financed by external debt. Also, the mean of debt to total assets ratio (DR) and (EA) are .35 and .64, respectively. Thus, this gives an important indicator to investigate the internal resource effect on firms' value. Zeitun & Tian, (2007( result is consistent with this study which is about 36%. On the other hand, a different result is found by Matar & Eneian )2018) that debt with mean value of 1.157%. Also found mean value corporate characteristics such as (SG), (PROF) and (SIZE) are .07, 2.32 and 7.17, respectively. On the other hand, the sample has some values that effect on the kurtosis such as 239.21 and 10.95 respectively. The data kurtosis effected is due to the financial crisis of 2009. Then, the study splits the sample and runs the descriptive analysis after 2009 from 2010 to 2015 for the same variables. The results of the same variables show 118.11 and 10.43, respectively, which do not make differences in running the data analysis. In sum, the descriptive analysis shows the variables that were analyzed to have a normal range of skewness and kurtosis that meets the assumption of disturbances that are normally distributed, ut ~ N (0, σ2).

| Table 3 Descriptive Statistics | ||||||

| Variables | Minimum | Maximum | Mean | Std. Deviation | Skewness | Kurtosis |

| DR | 0.00 | 2.28 | 0.35 | 0.26 | 1.95 | 9.07 |

| DE | -65.75 | 19.72 | 0.67 | 3.57 | -12.15 | 239.21 |

| EA | -1.28 | 1.00 | 0.64 | 0.26 | -1.94 | 8.99 |

| SG | -1.00 | 6.30 | 0.07 | 0.50 | 5.96 | 63.84 |

| PROF | -58.67 | 32.27 | 2.32 | 8.67 | -1.95 | 10.96 |

| Size | 5.86 | 8.09 | 7.17 | 0.44 | -0.24 | 0.12 |

| EPS | -0.64 | 1.25 | 0.08 | 0.23 | 1.03 | 4.76 |

| Obs. | 510 | 510 | 510 | 510 | 510 | 510 |

On the other hand, one of the regression analysis assumptions is that no auto-correlation cov, (ui , uj ) = 0; non-stochastic of independent variables cov, (ui , xt ) = 0;. Thus, the Table 4 shows the correlations test was employed to test the assumption. The results indicate that there was associationamong some variables such as the highest negative correlation between independent variables value was (-.999**) where (EA) and (DR). On the other hand, the lowest correlation between independent variables value was (0.038) which was between (SG) and (DR). Also, the relationship between (EPS) and (DR) was (-.375**). Moreover, the results indicated that a significant relationship between some independent variables and dependent variable such as the highest correlation between explanatory variables and response variables value has stretch to to (.757**) which was between (ROFP) and (EPS).

| Table 4 Correlations Matrix | |||||||

| DR | DE | EA | SG | ROFP | Size | EPS | |

| DR | 1. | ||||||

| DE | .090** (0.04) |

1 | |||||

| EA | -.999*** (0.00) |

-.091** (0.04) |

1. | ||||

| SG | 0.04 (0.39) |

0.05 (0.28) |

-0.04 (0.43) |

1. | |||

| ROFP | -.367*** (0.00) |

-0.03 (0.57) |

.373*** (0.00) |

.168*** (0.00) |

1. | ||

| Size | .095** (0.03) |

-0.01 (0.83) |

-.103** (0.02) |

0.02 (0.59) |

.209*** (0.00) |

1. | |

| EPS | -.375*** (0.00) |

-0.07 (0.14) |

.375*** (0.00) |

.166*** (0.00) |

.757*** (0.00) |

.312*** (0.00) |

1. |

| Note: The table shows the Correlations results between CS and Corporate characteristic’s and Firm value, where FV is the firm value by Earnings per share (EPS); CS measured by the (DR) is Debt Ratio, (DE) Debt to equity ratio, and (EA) Equity to assets ratio, and Corporate characteristic’s represented b (SG) sales growth, (ROFP) Return on Assets (ROA) ,(SIZE) log of total assets, Here, Figures between parentheses are t-statistics. Significance at the 10%, 5%, and 1% levels is denoted by *, ** and ***, respectively. | |||||||

Regression Analysis

Table 5 shows the results of the four models under the study. Firstly, model (1) shows the regression test results for the effect of CS measured by debt ratio and firms characteristics on firms' value. The coefficient value of debt ratio has negative effect on the firms' value at 1% level. Also, the coefficient value of SG, ROFPand firm SIZE variable being positive and statistically significant at 5% and 1% level, respectively. This result differs from Yu-Shu et al. (2010); Lawal (2014) which shows a significant positive effect with the firm value, but agrees with Salim & Yadav (2012) and Kester (1986) who found negative influence of debt level on firms' value.

| Table 5 Dependent: FV (EPS) |

||||

| Independent | Model(1) | Model(2) | Model(3) | Model(4) |

| DR | -.156*** (-5.157) |

-1.442** ( -2.199 ) |

||

| DE | -.048* ( -1.692 ) |

-.037 ( -1.339 ) |

||

| EA | .154*** ( 5.057 ) |

-1.296** ( -1.968 ) |

||

| SG | .059** ( 2.086 ) |

.045 ( 1.564 ) |

.058** ( 2.063 ) |

.063** ( 2.233 ) |

| ROFP | .650*** ( 20.806 ) |

.714*** ( 24.495 ) |

.650*** ( 20.703 ) |

.662*** ( 20.857 ) |

| Size | .190*** ( 6.634 ) |

.161*** ( 5.617 ) |

.191*** ( 6.651 ) |

.175*** ( 5.965 ) |

| N | 510 | 510 | 510 | 510 |

| Adjusted R2 | .616 | .598 | .615 | .619 |

| F-Statistic | 205.209*** | 190.413*** | 204.575*** | 138.706*** |

| (Constant) | ( -5.942 ) *** | ( -5.322 ) *** | ( -6.877 ) *** | ( .945 ) *** |

| Note: The table shows the regression Models (1,2,3,4) results that set up above, FV is the firm value of the firm represented by Earnings per share (EPS) which measured by net income divided by average outstanding common shares. TheCS measured by different proxy such the Debt Ratio(DR); debt divided by the total assets, (DE) measured by total liability divided by total Equity and (EA) measured bytotal equity divided by total liability and equity. Also, the corporate characteristic’s measured by the (SG) sales growth= (sales (t) -sales (t-1)) divide sales (t-1), (ROFP) Return on Assets measured by the ratio of the net profit divided by the total assets, SIZE log of total assets. The N indicated the number of observations. The numbers in the parentheses are t-statistics. Finally, the significance at the 10%, 5%, and 1% levels is denoted by *, ** and ***, respectively. | ||||

Then, the study runs model (2) which shows the regression test results for the effect of CS measured by debt to equity ratio and firms characteristic on firms' value. The coefficient value of DEhas a negative effect on firms' value at 10% level. Moreover, the coefficient value of ROFPand firm SIZE variables being positive and statistically significant at 1% level. This result differs from Walaa, (2007) which shows a no significant impact with firm value but agrees with Salim & Yadav's (2012) CS variables having effect on the firm’s value measured by the Earning Per Share in Malaysia.

After that, the study runs model (3) which shows the regression test results for the effect of CS measured by EA ratio and firms characteristic on firms' value. The coefficient of EA has a positive effect on firms' value at 1% level. Furthermore, the coefficient of SG, ROFP and firm SIZE variable being positive and statistically significant at 5% and 1% level, respectively. This result agrees with Lawal (2014); Abor (2005) who show positive effects of contribution capital on firms' value.

Finally, the study runs model (4) which shows the regression test results for the effect of CS by all measurements on firm value. The debt ratios DE, and EA represent the total debt, external debt, and internal, respectively. The result confirms the previous models with negative effect of debt ratios both DE and EA at 5% level. Alternatively, the coefficient of SG, ROFP and firm SIZE positively effect on firms' value at 5% level and 1% level, respectively.

Thus, the study results confirms that internal sources of CS in low growth markets such as industrial firms in Jordan is better than higher debt. The result is consistent with Jensen & Meckling (1976) who state that when firms have high debt level, they will have higher cost of capital and will have negative effect on firms value. Furthermore, Myers & Majluf (1984) stated that the investors will gain less than the expected value return. Thus, higher debt is preferred where there is a high growth opportunity in satiable market which leads to reducing the agency cost (Modigliani & Miller, 1963).

Conclusion

Firms face many challenges such as financing its operating activities in markets where there is new implementing industry and unstable markets. Thus, the firms need to choose the best way for that purpose. The study comes to give a big light for Jordanian and other markets having the same characteristics. The theory argues that industry with specific characteristics such as new industry in comparative environment with higher leverage needs to be investigated (Jensen, 1986). Hence, the study tests the theory in industrial Jordanian firms and found matching results with previous research and theories. Jensen (1986) argues that debt leads to less available free cash due to paying the debt and having lower incentive for sharking behavior of managers which effect significantly on the firms' value. Models (1), (2), (4) show negative effect of level debt on the firm’s value measured by EPS. The results support the argument that the firms with high investment opportunity will have lower debt in the CS. However, Jordanian industrial firms have high level of debt which effect negatively on firm’s value. Alternatively, the firms having high level of debt will have higher cost of capital which effect negatively on the firm’s value which is consistent with (Zeitun & Tian 2007). Jensen (1986) argues that increasing debt will give benefits to the firms such as tax-shields but policy makers (Hermuningih, 2013) and the firms should carefully consider the tax-shields' benefits by substitution of debt for equity which is less than the bankruptcy cost. Thus, the study result in Model (3) is that the CS in terms of liabilities to the equity. The pecking order theory argues that when the investors have less information than insiders, then, the outsiders will gain less than expected net present value. In this case, using internal resources such as contribution of capital and decreasing the level of debt can help to avoid the information asymmetry problem. Thus, the result in Model (3) shows that (EA) effect positively on the firm’s value at 1% level. Moreover, when the type of CS is mixed in Model (4), the results still give a negative effect on the firm’s value. Therefore, such Jordanian industrial firms should lower the level of debt and improve the internal resources to improve and financing there operating activities. Moreover, when the firms are established in the market and have higher profitability in the future, then, they can use the debts level carefully in financing their activities.

The study does not study other industries which may give other instances of the results. Moreover, there are many variables that may affect the CS of the firms which gives other results of affecting the CS of the firm’s value. Thus, for future research, conducting a study on the mediating and moderating role of CS on firm’s value will be useful and valid. The cross countries' sample also gives a higher picture for testing the theories in the future.

References

- Rahman, R. A., Alsmady, A., Ibrahim, Z., & Muhammad, A. D. (2014). Risk management practices in Islamic banking institutions: A comparative study between Malaysia and Jordan. Journal of Applied Business Research (JABR), 30(5), 1295-1304.

- Abor, J. (2005). The effect of capital structure on profitability: an empirical analysis of listed firms in Ghana. The Journal of Risk Finance, 6, 438-47.

- Al-Qadi, N., & Lozi, B. (2017). The Impact of Middle East Conflict on the Jordanian Economy. International Journal of Academic Research in Business and Social Sciences, 7(7), 345-355.

- AlAli, S.M. (2017). The Impact of Capital Structure on the Financial Performance of the Jordanian Industrial Companies Listed on the Amman Stock Exchange for the Period 2012-2015. Asian Journal of Finance & Accounting, 9(2). 369- 386.

- Almanaseer, S.R. (2019). Determinants of Capital Structure: Evidence from Jordan. Accounting and Finance Research, 8(4), 186-198.

- Alkhatib, H., Sharabati, A., Alhorani, A., Tabieh, M., Qtaisht, T., & Obeidat, Z. (2015). The Impact of the Global Financial Crisis on the Jordanian GDP, Global Advanced Research Journal of Management and Business Studies, 4(9), 398-406.

- Alanaty, R.M., & Alshhed, R.M. (2017). The Impact of Ownership Structure and Companies’ Characteristics on Earnings Quality: Empirical Study on Jordanian Insurance Companies, Zarqa. Journal for Research and Studies in Humanities, 17(1).

- Al-Smadi, M. O. (2019). A study of capital structure decisions by SMEs: Empirical evidence from Jordan. Academy of Accounting and Financial Studies Journal, 23(1), 1-9.

- Faris, A. S. (2010). Determinants of capital structure choice: A case study of Jordanian Industrial Companies. 24(8), 2458-2494.

- Alsmady, A. A. (2018). The effect of board of directors’ characteristics and ownership type on the timeliness of financial reports. International Journal of Business and Management, 13(6), 276-287.

- Alsmady, A. A., Mohd-Saleh, N., & Ibrahim, I. (2012). Corporate Governance Mechanisms, Privatization Method and the Performance of Privatized Companies in Jordan. Asian Journal of Accounting and Governance, 4, 31-50.

- Arbabiyan, A.A., & Safari, M. (2009). The effects of capital structure and profitability in the listed firms in Tehran Stock Exchange. Journal of Management Perspective, 33(12), 159-175.

- Chadha, S., & Sharma, A.K. (2015). Capital structure and firm performance: Empirical evidence from India. Vision, 19(4), 295-302.

- Chandra, T., Junaedi, A.T., Wijaya, E., Suharti, S., Mimelientesa, I., & Ng, M. (2019). The effect of capital structure on profitability and stock returns: Empirical analysis of firms listed in Kompas 100. Journal of Chinese Economic and Foreign Trade Studies.

- Chien-Chung N., Hwey-Yun Y., & Wen-Chien L. (2008). Investigation of Target CS for Electronic Lsted Firms in Taiwan, Emerging Markets Finance & Trade, 44(4), 75-87.

- Dada, A.O., & Ghazali, ZB. (2016). The Impact of Capital Structure on Firm Performance: Empirical Evidence from Nigeria, IOSR Journal of Economics and Finance, 7(4), 23-30.

- El?Sayed, E.I. (2009). The Impact of Capital?Structure Choice on Firm Performance: Empirical Evidence from Egypt, The Journal of Risk Finance, 10(5), 477-487.

- Feng-Li, L. (2010). A Panel Threshold Model of Institutional Ownership and Firm Value in Taiwan, International Research Journal of Finance and Economics, 42, 54-62.

- Harris, M., & Raviv, A. (1991). The Theory of Capital Structure, Journal of Finance, 46, 297-356.

- Hermuningsih, S. (2013). Pengaruh Profitabilitas, Growth Opportunity, Sruktur Modal Terhadap Nilai Perusahaan Pada Perusahaan Publik Di Indonesia.Yogyakarta: University of Sarjanawiyata Taman Siswa Yogyakarta.

- Jensen, M.C. (1986). Agency Costs of Free Cash Flow, Corporate Finance and Takeovers, American Economic Review, 76, 323-339.

- Jensen, C.M., & Meckling, W.H. (1976). Theory of Firm: Managerial Behaviour, Agency Cost and Ownership Structure. Journal of Finance and Economics, 305-360.

- Kester, W. (1986). Capital and Ownership Structure: A Comparison of United States and Japanese Manufacturing Corporations, Financial Management, 15, 5-16.

- Lawal, A.I. (2014). Capital Structure and the Value of the Firm: Evidence from the Nigeria Banking Industry, Journal of Accounting and Management, 4(1).

- Matar, A., & Eneizan, B.M. (2018). Determinants of Financial Performance in the Industrial Firms: Evidence from Jordan, Asian Journal of Agricultural Extension, Economics & Sociology, 22(1), 1-10.

- Modigliani, F., & Miller, M. (1958). The Cost of Capital, Corporation and Theory of Investment. American Economic Review, 18, 261-361.

- Modigliani, F., & Miller, M. (1963). Corporate Income Taxes and the Cost of Capital: A Correction, American Economic Review, 53, 443-53.

- Myers, S.C. (1977). Determinants of Corporate Borrowing. The American Economic Review, 5(2), 147-75.

- Myers, S., & Majluf, N. (1984). Corporate Financing and Investment Decisions when Firms have Information that Investors do not Have, Journal of Financial Economics, 13, 187-221.

- Salim, M., & Yadav, R. (2012). Capital Structure and Firm Performance: Evidence from Malaysian Listed Companies, International Congress on Interdisciplinary Business and Social Science, 65, 156-166.

- Salvatore, D. (2005). Ekonomi Manajerial dalam Perekonomian Global. Salemba Empat: Jakarta.

- Shyu, J. (2013). Ownership Structure, Capital Structure, and Performance of Group Affiliation Evidence from Taiwanese Group-Affiliated Firms, Managerial Finance, 39(4), 404-420.

- Tsangyaao, C., Kuei-Chiu, L., Yao-Men, Y., & Chia-Hao, L. (2009), Does Capital Structureaffect Operating Performances of Credit Cooperatives in Taiwan—Application of Panel Threshold Method, International Research Journal of Finance and Economics, 32, 18-30.

- Walaa, W. (2007), Financial Structure and Firm Value: Empirical Evidence From the United Arab Emirates, International Journal of Business Research.

- Weston, J., Freddan, B., (1998). Dasar- Dasar Manajemen Keuangan; Edisi Kesembilan, Jilid 2.

- Yang, C.C., Lee, C.F., Gu, Y.X., & Lee, Y.W. (2010). Co-determination of Capital Structure and Stock Returns – A Lisrel Approach: An Empirical Test of Taiwan stock Market, The Quarterly Review of Economics and Finance, 50, 222-233.

- Yu-Shu, C., Yi-Pei, L., & Chu-Yang, C. (2010). Capital Structure and Firm Value in China: A panel Threshold Regression Analysis, African Journal of Business Management, 4(12), 2500-2507.

- Yusuf, A.N., Al-Attar, A.M., & Al-Shattarat, H.H. (2015). Empirical Evidence on Capital Structure Determinants in Jordan. International Journal of Business and Management, 10(5). 134- 152.

- Zeitun, R., & Tian, G.G. (2007). Capital Structure and corporate performance: evidence from Jordan. Australasian Accounting, Business and Finance Journal, 1(4), 40-61.