Research Article: 2018 Vol: 22 Issue: 1

Competitive Advantage and Performance: an Analysis of Indian FMCG Industry

Ashok K Sar, Kalinga Institute of Industrial Technology

Keywords

Profit Margin, Asset Turnover, Financial Leverage, Cost Advantage, Differentiation Advantage, Return on Equity.

JEL Classification

M41

Introduction

The profitability of the Indian fast moving consumer goods (FMCG0 industry has be fluctuating widely during the last decade with changes in the competitive landscape, particularly with proliferation of naturals and Ayurveda based personal care categories. During the last decade, the mean, minimum, maximum and standard deviation of return on equity (ROE) has been 25.93%, 2.88%, 105.84% and 26.45 respectively. Till 2012 the Indian FMCG industry was driven by Indian subsidiaries of multinational companies like Unilever (Indian entity- Hindustan Unilever Ltd.), P&G (Indian entity- Procter & Gamble Hygiene & Health Care Ltd.) and Colgate (Colgate-Palmolive (India) Ltd.), with a handful of home-grown companies like Dabur, Godrej and Emami.

The Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homeopathy (AYUSH) movement in India has contributed to growing popularity of Naturals and Ayurveda products in the personal care categories since 2012. Two spiritual organizations, a) one run by Baba Ramdev (Patanjali Ayurveda) and b) other led by Sri Sri Ravi Shankar (Sri Sri Ayurveda) have been key to the AYUSH movement. The two spiritual leaders attract large followings across the country besides other parts in the world. They have been conducting yoga sessions, personally leading mass yoga camps across the country. During the yoga sessions, they would also promote Naturals and Ayurveda based personal care as well as other daily use consumables. In 2014, the Government of India gave a push to the AYUSH movement by establishing the AYUSH ministry and All India Institute of Ayurveda. The government was successful in establishing the International Yoga day (21st June since 2015) with unanimous declaration by the United Nations General Assembly. As per a study by Neilsen India, the contribution of the naturals segment in the Indian personal care industry has increased by about 1 percentage point every year during the last five years. If this trend continues, then the contribution of naturals to the personal care sales will be 50% by 2025.

The changes in the tastes and preference of people towards naturals have resulted in large scale business expansion by the two spiritual organizations mentioned earlier. Acharya Balakrishna, CEO, Patanjali Ayurveda aspires to make his company the number one consumer goods company in India. The current turnover of INR 1000 billion is estimated to double in the next one year. He plans to expand from the current 6 categories to over a dozen categories with head count growing two-fold. The FMCG outfit of Sri Sri Ravishankar, is Sri Sri Tattva. Tej Katpitia, CMO of Sri Sri Tattva, aspires to leverage on the 300 million followers of Sri Sri Ravi Shankar to expand the current portfolio of FMCG products. The traditional FMCG majors have reoriented their strategies to build businesses around naturals and Ayurveda. For example, Hindustan Unilever has launched the master brand “Lever Ayush” which consists of a wide range of products, including tooth paste, soap, hand wash, shampoo and face wash. FMCG companies are strengthening their positions in the entire value chain, from growing raw materials, to establishing spa and panchakarmas that will use these offerings. For example, Dabur, plans to become the largest bulk grower or rare medicinal herbs un India, by more than doubling its area under cultivation 4,500 acres from 2,000 acres at the end of fiscal year 2017.

Literature Review

The structure-conduct-performance (SCP) framework articulated by the modern industrial organization economists, argues that industry structure determined the behaviour or conduct of the firms, whose joint conduct then determine the collective performance of firms in the market place (Porter, 1986). The work of Porter in particular gave rise to the concept of industry analysis and emergence of the positioning school of strategy (Mintzberg & Lampel, 1999). Further work by Porter saw the emergence of competitive advantage through generic strategies as a means of creating superior profit (Porter, 2008).

As the turbulence in the external environment increased post the liberalisation era in the early 1990s, the significance of industry forces on profitability was on a decline (McGahan & Porter, 1997). It was established that nearly 80% of intra-industry variation in profit was not explained by the industry factors. This lead to the focus of scholars and managers to the internal firm specific factors as drivers of profitability. This in turn led to the resource based view (RBV) of firms (Barney, 1991). There has been a growing interest in the role of resource-based capabilities as sources of profitability (Collis & Montgomery, 2008). Resource-based theory of competitive advantage became a popular basis for strategy formulation (Grant, 1991). Unique resources-based capabilities which are valuable, rare, imperfectly tradable and imperfectly inimitable become the basis of superior profit (Kraatz & Zajac, 2001). Successful product market diversification has also largely based relatedness with reference to resource-based capabilities (Markides & Williamson, 1994).

The profitability of firms can therefore be said to be driven partly by the conditions in the industry, termed as the industry effect and partly by the firm’s resources and capabilities, termed as the positioning effect. The positioning effect is aligned to a firm’s competitive advantage. A firm is said to have a competitive advantage, when it is pursuing a strategy not currently being pursues by another firm that facilitates the reduction of cost or raise customer willingness to pay (Barney, 1991). Competitive advantage has therefore been a significant determinant of firm performance with declining significance of industry effect. Brandenburger and Stuart (2005) gave an objective meaning to the concept of competitive advantage through the measure of added value. Thus the generic strategies of cost leadership and differentiation articulated by Porter and the resultant competitive advantage can be determined using financial data.

The disaggregation of firm performance measured by return on equity (ROE) into asset turnover (AT), profit margin (PM) and leverage (LEV) in the DuPont analysis can be aligned to the competitive advantage to performance linkage. A higher profit margin is a reflection of premium position of offerings of firm, which can be used as a measure of differentiation advantage. Similarly, asset turnover is a reflection of the efficiency of the firm, which can be used as a measure of cost advantage. Thus by analysing the impact of profit margin and asset turnover on ROE, one can assess the impact of competitive advantage on firm performance. Leverage or the equity multiplier is often referred to as a measure of risk, as a higher ratio means the firm is relying more on debt to finance its assets. Risk can become an important driver of performance considering the uncertainties associated with strategy formulation and execution.

Data and Research Methodology

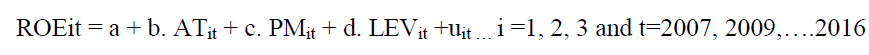

The analysis considers balanced panel data of twenty-five major FMCG companies over ten years (2007- 2016). The data is collected from CMIE–PROWESS database. The analysis intends to estimate one regression equations as specified below through panel data analysis. Return on Equity (ROEit) has been taken as dependent variable and Asset Turnover (ATit), Profit Margin (PMit) along with Leverage (LEVit) have been taken as independent variables. If any statistically significant association is found between the dependent and the independent variables as specified, then it might be concluded that competitive advantage has significant impact on firm performance.

The regression equation to be estimated is:

In the above equation, ‘a’ is the constant terms, b, c and d, are the coefficients of ATit, PMit, and LEVit and uit is the stochastic error term.

Variables of Study and Hypothesis Development

DuPont analysis provides a means of disaggregating a firm’s ROE into asset turnover, profit margin and leverage components (Stowe, Robinson, Pinto & Mcleavey, 2002). The three financial aspects, a) asset turnover, b) profit margin and c) leverage have been derived from established theory as independent variables (Correia, Flynn, Uliana & Wormald, 2015). ROE is taken as the dependent variable in the study. The basis of choosing these variables in the study are explained in the following section. Since the study is aimed at understanding the impact of competitive advantage on firm performance, asset turnover and profit margin are considered for the analysis. Asset turnover is taken as the indictor for cost advantage and profit is taken as the indicator for differentiation advantage.

Asset Turnover

Asset turnover is calculated by dividing the sales with total asset. Asset turnover is often used as an indicator of efficiency with which a firm is deploying its assets in generating revenue. It can be seen as a reflection of relative position of firms with reference to unit cost and low cost positioning. Firms implementing low cost strategy tend to be associated with superior asset turnover. A study of US companies with one digit as well as two digit SIC codes established that the changes in return on fixed assets had a significant impact on profitability (Fairfield & Yohn, 2001). An empirical analysis carried out on a sample of 65,783 firm-year observations, with data sets for period 1991-2009, revealed significant positive impact of asset turnover on return on invested capital (Bauman, 2014). Jansen, Ramnath, & Yohn (2012) analysed the impact of changes in asset turnover on firm earnings taking 46,522 firm-year observations during the period 1971-2005 and concluded that there is a high explanatory power of asset turnover ratio on earning management. To validate the impact of asset turnover on profitability, the following hypothesis is proposed:

Hypothesis 1: Assets turnover significantly impacts ROE.

Profit Margin

Profit margin is calculated by dividing the net income by sales. It can be seen as a reflection of relative position of firms with reference to unit price and premium positioning. Firms implementing differentiation strategy tend to be associated with superior profit margin. Fairfield & Yohn (Fairfield & Yohn, 2001) analysed data from the Compustat Annual Tape for the years 1977-1996 (excluding SIC codes from 6000-6999, since separation of financial and operating activities were artificial) and concluded that changes in profit margin is a good predictor of future profitbility. Soliman (2007) studied 38,716 firm-year observations covering the time period, 1984-2002 and concluded that changes in profit margin has strong impact on the change in ROE. In a study of the Indonesian automotive industry, Heikal et al., (2016) found profit margin having significant impact on income growth. Soliman (2008) analysed financial data from three sources: I/B/E/S, CRSP and Compustat and concluded that changes in profit margin has positive explanatory power for future changes in ROE. Bauman (Bauman, 2014) analysed profitability drivers in a sample of 65,783 farm-years over observations over the period 1999-2009 and concluded that the direction in the change in the profit margin can be used to significantly improve forecasts of ROE. To validate the impact of asset turnover on profitability, the following hypothesis is proposed:

Hypothesis 2: Profit margin significantly impacts ROE.

Results and Analysis

Since the mentioned regression refers to a multiple regression, hence, initially a multi-collinearity test has been performed. Then Considering the panel structure of the data under consideration and considerable heterogeneity among districts, the heteroskedasticity, autocorrelation and cross sectional dependence in the residuals have been checked. The choice among pooled regression, with panel corrected standard errors, fixed and random effects models has been made following the necessary tests as explained in the next section.

As illustrated in Table 1, according to the variance inflation factors (vif) value there is no multicollinearity. Again, Wooldridge test for first order autocorrelation that works robust even under heteroscedasticity (Wooldridge, 2003), idiosyncratic error terms are serially correlated for the panel data model. Modified Wald test for group-wise heteroskedasticity in fixed effects (within) regression model refutes the presence of heteroskedasticity in the fixed effects (within) regression model. Pesaran test (Pesaran, 2004) for contemporaneous correlation declares no presence of cross sectional dependence either in the fixed or random effects regression models. F statistics for pool ability rejects the presence of fixed unit effects. For the choice between pooled OLS regression model and unit random effects model, presence of autocorrelation rules out the use of Breusch and Pagan Lagrange Multiplier test and Honda’s version of the same. However, Bera, Sosa-Escudero and Yoon modified Lagrange Multiplier test for random effects (two and one tail) that is robust under autocorrelation (Sosa-Escudero & Bera, 2008) cannot reject the null hypothesis of no random effects for the regression equation. On the other hand Bera, Sosa-Escudero and Yoon modified Lagrange Multiplier Test for autocorrelation that works unbiased even under random effects (Bera, Sosa-Escudero & Yoon, 2001) and Baltagi and Li joint test for serial correlation and random effects have not found autocorrelation in random effects models. At this juncture it is confirmed that a pooled OLS regression is a better option than FE or RE models but dilemma hovers around the autocorrelation part. Wooldridge test for autocorrelation has confirmed the presence of the same but Bera, Sosa-Escudero and Yoon modified Lagrange Multiplier Test for autocorrelation along with Baltagi and Li joint test for serial correlation and random effects have refuted the presence of autocorrelation. Wooldridge test for autocorrelation should only be considered for a reasonably sized sample (Drukker, 2003).

| Table 1: Econometric Test Results | ||

| ROEit (Dependent variable) | ATit, PMit and LEVit (Independent variables) |

|

|---|---|---|

| Group (unit) Effect | ||

| Stat | Prob | |

| Variance inflation factors (vif) | 1.13<10 | NA |

| Wooldridge test for autocorrelation | 166.97 | 0 |

| Modified Wald test for Heteroskedasticity | 0.97 | 0 |

| Pesaran test for Contemporaneous correlation | -0.415 (FE) | 0.6784 (FE) 0.3233 (RE) |

| -0.988 (RE) | ||

| Average correlation across the units | 0.514 (FE) | 0.509 (RE) |

| F statistics for poolability | 27.99 | 0 |

| Bera, Sosa-Escudero and Yoon modified Lagrange Multiplier Test for random effects (two tail) | 40.15 | 0 |

| Bera, Sosa-Escudero and Yoon modified Lagrange Multiplier Test for random effects (one tail) | 6.34 | 0 |

| Bera, Sosa-Escudero and Yoon modified adjusted Lagrange Multiplier Test for serial correlation | 11.74 | 0.0006 |

| Baltagi-Li joint test for serial correlation and random effects Sargan-Hansen test statistics for fixed vs. random effects |

132.26 17.087 |

0 0.0007 |

The regression coefficient for asset turnover is 21.081 and significant at 0.01 levels. Hence I accept Hypothesis 1 – asset turnover significantly impacts ROE. This would mean companies need to focus on efficiency as they are investing heavily in the entire value chain to capture the opportunities arising out of the emergence of naturals and Ayurveda based product categories. Success will depend on strengthening positions both in upstream- growing own naturals and Ayurveda inputs and downstream- own distribution and points of sale, besides manufacturing. Since the regression coefficient is highest for asset turnover, managing efficiency would be the 1st priority for companies.

The regression coefficient for profit margin is 4.361, significant at 0.01 levels. Hence I also accept Hypothesis 2 – profit margin significantly impacts ROE. Profit margin being an indicator of differentiation advantage, it can be estimated than a superior differentiation is required to earn higher ROE. However, with a growing trend of demand and relatively lower regression coefficient, the significance of differentiation is relatively low. Hence companies need to trade-off awareness and attitude building when promoting their products. Too much of promotions to build brand may not be justifies as it will adversely impact efficiency and not significant for raising ROE.

The leverage is also significant with regression coefficient of 9.110. This means, companies have been funding their investments through debt as opposed to equity, which implies a higher level of risk. While there is nothing so adverse on a higher level of risk, as long as it is aligned with the risk appetite of the company. Moreover, with interest rates at its lowest in the last five years, growth supported with debt may not be a bad idea. However, companies need to closely monitor the emerging growth opportunities and capturing the same.

Hindustan Unilever, through its Lever Ayush umbrella brand, while promoting the brand aggressively, has ramped up the inbound and outbound logistics to enhance efficiency and maintain quality (“HUL makes new game plan, forms crack teams to knock the wind out of Patanjali’s sails,” n.d.). The logistics network comprising of carrying and forwarding agents, redistribution stockists, wholesalers, urban retailers and rural retailers have been upgraded to meet new standards of efficiency and maintain quality. The major threat to Hindustan Unilever has been Patanjali, which has been growing at the cost of the entrenched FMCG majors. It has carved out 15 teams within the organisation for each category with separate targets in sales and innovations in an effort to be more agile as it looks to fight nimbler rivals and mop up higher sales in a fast changing consumer environment. Each team called Country Category Business Teams or CCBTs have representatives from all functions including R&D, sales and marketing, supply chain and finance and run as independent groups with an entrepreneurial mind set, something that attributes as one of the key reason for bucking the slowdown trend (“HUL makes new game plan, forms crack teams to knock the wind out of Patanjali’s sails,” n.d.). These teams are said to have the autonomy to break away from the conventional logic and build strategies meeting the emergent challenges.

Theoretical Implications

The study contributes to the existing knowledge base on competitive advantage by bringing in the insights concerning a major change in the where-to-play and how-to-win perspective. On where-to-play, the arena has expanded to naturals necessitating a reconfiguration of the key elements like, geographic territories, product categories, consumer segments, channels and vertical stages of value creation. On how-to-win, this paper particularly helps to gain insights into reconfiguration of value propositions and competitive advantage.

Managerial Implications

The study contributes to the current debate about the nature and process of creating and sustaining competitive advantage. The study provides substantial support for the claim that with changes in the competitive landscape and drivers of customer value, there is a need to break away from the conventional logic and take a zero-base approach to strategy formulation and execution. The priorities have shifted from innovation and customer responsiveness (which would continue to be relevant) to efficiency and quality.

Conclusion

With the onset of new entries in the FMCG industry in India, consequent to proliferation of naturals and Ayurveda products, companies need to reorient their strategies to achieve cost advantage by maintaining differentiation proximity. The strategic apex as well as the middle line management in these companies need to question the conventional wisdom of focusing on branding and giving lower priority to efficiency and quality. The reflections from the data presented in table 2 are indictors of the desired strategy orientations. Since asset turnover has the greatest impact on ROE, cost leadership strategy becomes the desired strategic orientation. Any effort on reducing cost structure is expected raise the ROE. The focus of the companies would be to identify the drivers of cost in the value chain and control them without compromising on quality and identity. The old guards like Hindustan Unilever and P&G need to also understand barriers to achieving cost advantage driven by legacy issues. Beyond controlling cost drivers, companies need to reconfigure value chain with a view to achieve greater cost advantage over rivals. In the process of controlling cost drivers, reconfiguring the value chain and maintain close control over the value chain, companies need to develop partners both in the upstream and in the downstream for sustaining the cost advantage.

| Table 2: Pooled Regression Results (Dependent Variable Roeit) | |||||||

| List of independent variable | Coefficient | t statistics | Probability | R2 | Adjusted R2 | F Statistics (3,247) |

Probability |

|---|---|---|---|---|---|---|---|

| LEVit | 9.110 | 6.952 | 0.000 | ||||

| PMit | 4.361 | 17.398 | 0.000 | 0.580 | 0.575 | 114.954 | 0.000 |

| ATit | 21.081 | 8.154 | 0.000 | ||||

| Constant | -66.885 | -9.861 | 0.000 | ||||

Endnote

1. It is believed that the saint lived around the second century BCE and also wrote significant works on Ayurveda (the ancient Indian system of medicine) and Sanskrit grammar, making him something of a Renaissance man.

2. It is said to be the ultimate mind-body healing experience for detoxifying the body, strengthening the immune system and restoring balance and well-being. It is one the most effective healing modality in Ayurveda Medicine. It promotes Detoxification and Rejuvenation.

3. Database of the Centre for Monitoring Indian Economy.

References

- Barney, J. (1991). Firm resources and sustained competitive advantage, 17(1), 99-120. http://doi.org/10.1177/014920639101700108

- Bauman, M.P. (2014). Forecasting operating profitability with DuPont analysis Further evidence. Review of Accounting and Finance, 13(2), 191-205. http://doi.org/10.1108/RAF-11-2012-0115

- Bera, A.K., Sosa-Escudero, W. & Yoon, M. (2001). Tests for the error component model in the presence of local misspecification. Journal of Econometrics, 101(1),1-23. http://doi.org/10.1016/S0304-4076(00)00071-3

- Brandenburger, A.M. & Stuart, H.W. (2005). Value-based business strategy. Journal of Economics & Management Strategy, 5(1), 5-24. http://doi.org/10.1111/j.1430-9134.1996.00005.x

- Collis, D.J. & Montgomery, C.A. (2008). Competing on resources. Harvard Business Reiew, (July-August).

- Correia, C., Flynn, D., Uliana, E. & Wormald, M. (2015). Financial Management.

- Drukker, D.M. (2003). Testing for serial correlation in linear panel-data models. Stata Journal, 3(2), 168-177.

- Fairfield, P.M. & Yohn, T. (2001). Using asset turnover and profit margin to forecast changes in profitability. Review of Accounting Studies, 6(4), 371-385.

- Grant, R.M. (1991). The Resource-based theory of competitive advantage: Implications for strategy formulation, 33(3), 114-135. http://doi.org/10.2307/41166664

- Heikal, M., Malikussaleh, U., Khaddafi, M. & Malikussaleh, U. (2016). Influence Analysis of Return on Assets ( ROA ), Return on Equity ( ROE ), Net Profit Margin ( NPM ), Debt To Equity Ratio ( DER Influence Analysis of Return on Assets ( ROA ), Return on Equity ( ROE ), Net Profit Margin ( NPM ), Debt To Equity Ratio (December 2014). http://doi.org/10.6007/IJARBSS/v4-i12/1331

- HUL makes new game plan, forms crack teams to knock the wind out of Patanjali’s sails. (n.d.). Retrieved December 14, 2017, from https://economictimes.indiatimes.com/industry/cons-products/fmcg/hul-carves-out-15-teams-to-buck-slowdown-trend-beat-rivals-like-patanjali/articleshow/58741320.cms

- JANSEN, I.V.O.P.H., RAMNATH, S. & YOHN, T.L. (2012). A Diagnostic for Earnings Management Using Changes in Asset Turnover and Profit Margin. Diagnostic de La Gestion Du Résultat Au Moyen de L’évolution de La Rotation Des Actifs et de La Marge Bénéficiaire., 29(1), 221-251.

- Kraatz, M. S. & Zajac, E.J. (2001). How organizational resources affect strategic change and performance in turbulent environments: Theory and evidence. Organization Science, 12(5), 632-657. http://doi.org/10.1287/orsc.12.5.632.10088

- Markides, C.C. & Williamson, P.J. (1994). Related diversification, core competences and corporate performance. Strategic Management Journal, 15, 149-165.

- McGahan, A.M. & Porter, M.E. (1997). How much does industry matter, really? Strategic Management Journal, 18, 15-30.

- Mintzberg, H. & Lampel, J. (1999). Reflecting on the strategy process. Sloan Management Review, 40(3), 21-30. http://doi.org/10.1128/JVI.78.19.10303-10309.2004

- Pesaran, M.H. (2004). General diagnostic tests for cross section dependence in panels (No. CWPE 0435).

- Porter, M.E. (1986). The contributions of industrial organization to strategic management. Academy of Management Review, 6(4), 609-620. http://doi.org/10.5465/AMR.1981.4285706

- Porter, M. E. (2008). The five competitive forces that shape strategy. Harvard Business Reiew, (January).

- Soliman, M.T. (2007). The use of dupont analysis by market participants * The Use of DuPont analysis by market participants.

- Soliman, M.T. (2008). The use of DuPont analysis by market participants. Accounting Review, 83(3), 823-853.

- Sosa-Escudero, W. & Bera, A.K. (2008). Tests for unbalanced error-components models under local misspecification. Stata Journal, 8(1), 68-78.

- Stowe, J.D., Robinson, T.R., Pinto, J.E. & Mcleavey, D.W. (2002). Equity Asset Valuation.

- Wooldridge, J.M. (2003). Cluster-Sample Methods in Applied Econometrics. American Economic Review, 93(2), 133-138.