Research Article: 2020 Vol: 24 Issue: 1

Constraints of Small and Medium Enterprises Access To Bank Loans: Evidence from Vietnam Manufacturing Firms

Nguyen Viet Hung, National Economics University

To Trung Thanh, National Economics University

Ha Quynh Hoa, National Economics University

Tran Tho Dat, National Economics University

Pham Xuan Nam, National Economics University

Abstract

Keywords

Access to Bank Loans, Financial Constraint, Smes, Probit/Logit Model, Vietnam.

Introduction

After the implementation of the Doi Moi policies in 1986, the Vietnamese government has gradually transformed the model of Vietnam’s economy, from a command to a market economy. Most of the markets in Vietnam have been liberalized, but markets for factors of production, especially capital markets, are still heavily under the control of the government. For many years, the state-owned sector is widely considered the “backbone” of the economy, and therefore has enjoyed the use of most of the country’s resources, including land minerals, credit, policy incentives, etc. These are the main causes that have increased barriers to factors of production, and most of all to capital, for the private sector. In year 2017, Vietnam’s government had stated that the goal was to “develop the private sector to become an essential engine of the market-oriented economy” in Vietnam. This is an important direction in removing constraints of the private sector in the coming period. However, the current situation is that private businesses are being discriminated against when seeking access to markets for the factors of production, particularly to credits from the banking sector.

This paper will focus on evaluating the ability to access commercial banks’ loans of Vietnam SMEs and clarify factors that currently act as barriers to accessibility. The study also proposes some policy implications to improve SMEs’ access to the financial resources from banking sector. To achieve these aims, the rest of the paper is organized as follows. Section 2 presents a literature review. Section 3 employs the probit and logit regression technique to provide empirical evidences regarding determinants of accessibility to bank loans for Vietnam’s SMEs based on firm level financial data and loan information that is collected by our survey in 2017. The final section includes the conclusion and some policy implications to improve access to banking loans for private enterprises.

Literature Review

Empirical studies in Vietnam as well as other countries have pointed out some main factors that affect bank loans accessibility for businesses, especially those in the SMEs. These factors include size of firm, type of ownership, collateral requirements, operational efficiency and other factors regarding institutions and market information.

In terms of firm size, compared to large and state-owned enterprises, SMEs have less access to external financial resources from official markets and are more constrained in their operation and growth (Galindo & Schiantarelli, 2003; Beck & Demirguc-kunt, 2005). Due to the rapid growth and lack of liquidity, these enterprises are always in need of extra capital in their operation (Garcia-Fontes, 2005).

In addition, some studies show that the lack of transparency in accounting and financial management of SME often create information asymmetric or inadequate information regarding the financial capability of firms; while commercial banks base on this information to process their loan applications. Therefore, from the perspective of banks, SMEs are often considered the riskier group of clients. According to Lin (2009), in the case of China, due to low trust in SME, banks often have higher requirements for SMEs in terms of collaterals and other lending conditions compared to larger firms.

Demirgüç-Kunt (2006) implied that an effective information and institutional system would increase responsibilities and performance of loan obligations for enterprises, as well as protect property rights. Thereby, outside investors can effectively control their capital contributions and monitor activities of shareholders or managers of companies to protect their investment. In countries with more developed institutions, enterprises will encounter fewer barriers in accessing loan from the financial intermediaries than in countries with less developed institutions (Kern, 2013).

Beck et al. (2008), based on cross-sectional dataset at firm-level from several countries, have drawn the conclusion that improvements of the protection of copyrights significantly increased external financing of SMEs. Fang (2007) showed that unless government had effective protection on the property right of the private sector, the market would automatically increase the cost of managing loans, and that would be a market imperfection. On the other hand, if government intervention had been strong enough, it could have helped banks’ decisions as means to ensure the stability of financial system.

In addition, in examining constraints to external capital accessibility of firms, some studies focus on internal problems of firms that are most likely to be hindered when accessing their bank loan. For examples, age and level of education of owners/managers have positive impact on credit accessibility (Kasseeah & Thoplan, 2012; Rand & Tarp, 2007; Yaldiz et al., 2011), however, this is not the case for that of Vietnamese research, education level has negative impact (Khanh Nguyet, 2014; Nhung et al., 2016) or even having no impact on credit accessibility (Vo et al. 2011) due to the lack of economic and management knowledge (Manh- Trung, 2014); the age of firm has positive impact to access to official financial sources (Akoten et al., 2006; Beck & Demirguc-kunt, 2005; Oliner & Rudebusch, 1992); businesses that have state’s ownership have advantage in accessing external finance (Harrison et al., 2004; Laeven, 2003); businesses in urban areas or close to a commercial bank’s branch have easier access to bank loans (Gine, 2011; Yaldiz et al., 2011).

It can be seen that for SMEs, constraints to external credit are not only include internal factors of the business but also include others, such as the institutional and information system of the country. Depending on exsiting data, the empirical model for each country uses different sets of independent variables and measures proxy for access to bank loan. Through literature review, there are two limitations of empirical studies about contrains of firm’s acess to bank loans: (1) measuring the extent of access to debt financing through bank loans to SMEs without considering other sources of finance available to them; (2) lack of theoretical linkages which explain the findings and discussions.

In order to overcome these obstacles of previous studies, this paper focus on evaluating and estimating the impact for some of the determinants of commercial banks’ loans accessibility by using the probit and logit regression methods in which variables are specified base on credit rationing theory and pecking order theory.

Data and Methodology

The purpose of this paper is to evaluate the factors determining SMEs’ access to bank loans. Therefore, this section will analyze the impact of some factors on the ability to access commercial bank loans through a quantitative model.

Variables using in the model are specified based on Credit Rationing Theory. This theory explains why some SMEs can access to debt finance, whilst others fail. Nevertheless, some specific oriented variables, affiliated to the situation prevalent in Vietnam, have been added to make this study more precise and concise. Beside, credit rationing theory, this paper also adopted pecking order theory to build the ceptual framework of the access to bank loans. The pecking order theory was developed by Modigliani in 1985 and Miller in 1963. Refering to this theory, adverse selection leads firms to choose internal in peference to external finance. For instance, when firms undergo financial shortage from outside fund, they are more in favor of debt than equity since debt issues do not bear as much information costs than that of equity. Overall, SMEs are favor in sustaining control and maintaining managerial independence.

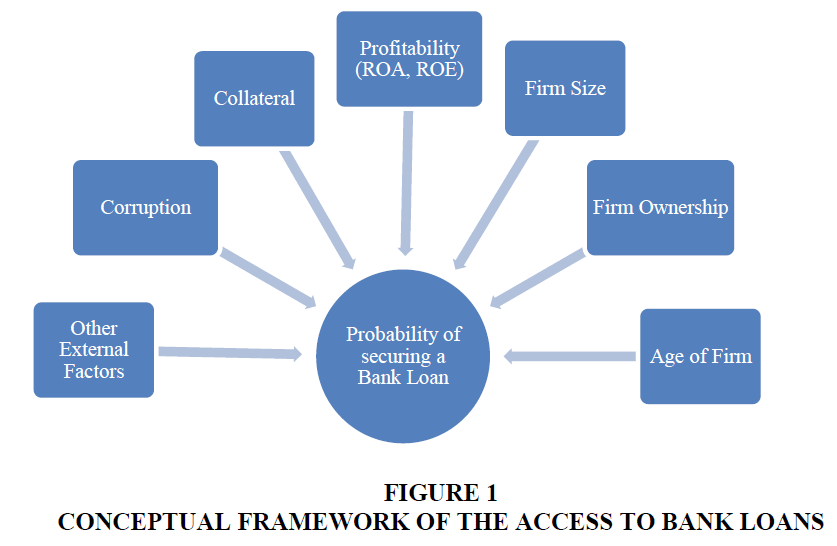

Figure 1 presents factors, which will be considered in the following empirical study, likely to impact on banks process of loan applications (businesses might gain access to official credit sources). They include characteristics of the firm (firm size, type of ownership, age of firm); performance of the firm (revenue growth rate, ROE, ROA); characteristics of the loans (collateral requirements); and other external factors such as location of firm and stock market.

Data Description

The dataset employed in this study is based on our survey using structured questionnaires in December 2017. The sample included of 695 firms in Manufacturing Sector of Vietnam.

Table 1 shows that SMEs amounted to about 56.7% of all firms included in the sample. 58.4% of firms in the sample had a loan application (of which 48.3% were from SMEs and 51.7% were from large enterprises). The ratio of being approved for disbursement for SMEs with loan application was only 47.3%.

| Table 1 Summary Statistics of Sample Data | |||

| No. | Indicator | SME | Large Firms |

| 1 | Whole sample | 56.7 | 43.3 |

| State-owned enterprises | 23.3 | 76.7 | |

| Non-State-owned enterprises | 58.9 | 41.1 | |

| 2 | Enterprise with loan application | 48.3 | 51.7 |

| State-owned enterprises | 10.7 | 89.3 | |

| Non-State-owned enterprises | 51.1 | 48.9 | |

| 3 | Enterprise with approved application | 47.3 | 52.7 |

| State-owned enterprises | 10.7 | 89.3 | |

| Non-State-owned enterprises | 50.1 | 49.9 | |

| 4 | The age of the enterprises (average) | 9.25 | 12.81 |

| State-owned enterprises | 20 | 25.6 | |

| Non-State-owned enterprises | 8.97 | 11.23 | |

Source: Author’s calculation from the dataset

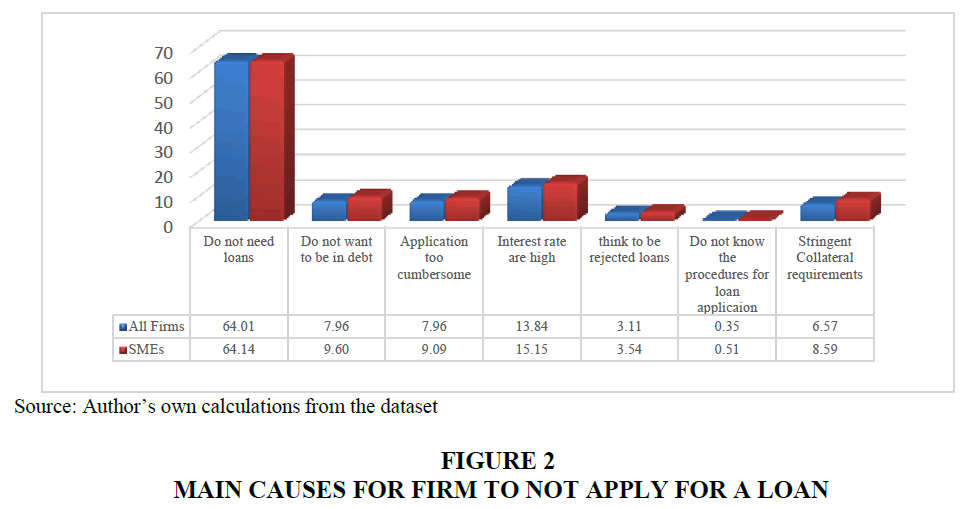

In Figure 2, except for firms that “do not need loans” and “do not want to be in debt”, others do not apply for a loan because of some reasons, some of which are “interest rate are high”, “application too cumbersome” and “stringent collateral requirements”.

Table 1 also shows that average number of years that an enterprise had been in operation until the time of the survey was 10.8 year. Of which, the proportion of SMEs with less than 5 years in operation was 31.2% and less than 10 years in operation was 66.5%. In theory, firms which had been in the market for longer were expected to have easier access to resources in the financial markets. In practice, however, most firms in Vietnam, especially those in the SME sector, had a relatively young age. This factor could also be considered one of the main constraints to financial accessibility for private enterprises.

Key Variables

In order to understand SMEs’ financing constraints in Vietnam, this section has conducted econometric analysis by probit and logits regression models. The dependent variable (Y) is equal to 1 if the firm has applied for a bank loan and loan application was approved. On the other hand, if the loan application was rejected, Y equals zero.

Independent variables: those variables that stated the firm as being a SME (SME), a stateowned enterprise (STATE), the age of the firm (AGE), ROE, ROA, the availability of collateral (collateral), the loan-related unofficial cost for bribes and gifts (corruption), the firm was listed on the stock market (stockmarket) and other interactive terms. Table 2 summarizes the variables employed in empirical models.

| Table 2 Definitions of Variables in the Regression Models | |||

| No. | Name | Description | Definitions of variables |

| 1 | SME | Small and Medium enterprise | SME =1 if a firm had less than 200 employees, less than 100 billion dongs in capital and less than 300 billion dongs in revenue, otherwise SME =0 |

| 2 | STATE | State ownership | STATE =1 if more than 50% of the firm’s capital was state ownership, otherwise STATE =0 |

| 3 | AGE | Age of the firm | Age of firm were calculated from a firm officially registered for business |

| 4 | ROE | Profitability | After tax profit over equity |

| 5 | ROA | Profit over total assets | |

| 6 | collateral | Collateral | collateral =1 if a firm had adequate collateral available, otherwise collateral =0 |

| 7 | corruption | Loan-related unofficial cost for bribes and gifts | corruption =1 if a firm did spend money on bribe and gift to receive bank loans. |

| 8 | stockmarket | Listed in the stock market | stockmarket =1 if a firm was listed on the stock market, otherwise Stockmarket =0 |

| 9 | collateralsme | Interactive term | collateralsme = collateral × SME |

| 10 | corruptionsme | Interactive term | corruptionsme = corruption × SME |

Model Specifications

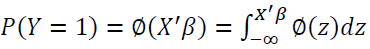

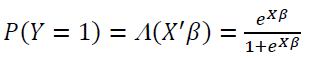

This research employed the probit and logit regression approach to estimate the impact of various factors on the probability of the loan application from the SMEs being approved for disbursement by banks. In probit and logit models, the probability of loan application from the SMEs being approved for disbursement by banks are expressed as a non-linear function of a set of regressor X, which can be written as:

(1)

(1)

(2)

(2)

Where, P(Y=1) is the probability of loan application from the SMEs being approved for disbursement by banks; is a set of selected independent variables; φ(X'β) is the cumulative distribution function of the standard distribution; ∧(X'β) is the cumulative distribution function of logistic distribution.

Equation (1) and (2) are probit and logit formula for conditional probability that a loan application is approved by the bank, are the function of the set of factors that had impact on the likelihood of the decision to loan of the banks or other financial institutions (X). The set of variables X included: SME, STATE, AGE, ROE, ROA, collateral, corruption, stockmarket and the interactive terms collateralsme, corruptionsme.

Results and Discussion

Regression Results

In the linear probability model, the magnitude of the coefficient for each independent variable gives the size of the effect that variable is having on dependent variable, and the sign on the coefficient (positive or negative) gives the direction of the effect. The slope coefficient measures the marginal effect of the independent/explanatory variable, which is not the case with the probit/logit model. The magnitude cannot be interpreted using the coefficient because different models have different scales of coefficients. However, signs of coefficients in the probit/logit model have the same meaning as in the linear probability (i.e. OLS) model. In this paper, the impact of independent variable to dependent probability will be explained through using of the average marginal effect (AME). The estimation results from the probit and logit regressions are summarized in Table 3.

For the variable SME (Table 3), estimation results from the probit model showed that the probability for the loan application being approved would decrease by 32 percentage points if the applied enterprise was SME. The respective figure in the logit model was 34 percentage points.

| Table 3 Probit and Logit Estimation Results | ||||

| Probit regression | Logit Regression | |||

| Coef. | AME | Coef. | AME | |

| sme | -0.848*** | -0.320*** | -1.463*** | -0.340*** |

| (0.02) | (0.01) | (0.06) | (0.01) | |

| state | 0.141*** | 0.055*** | 0.223*** | 0.054*** |

| (0.02) | (0.01) | (0.03) | (0.01) | |

| age | 0.016*** | 0.006*** | 0.028*** | 0.007*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| ROE | 0.020*** | 0.008*** | 0.035*** | 0.009*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| ROA | 0.537 | 0.211 | 1.714* | 0.420* |

| (0.33) | (0.13) | (0.85) | (0.21) | |

| collateral | 1.582*** | 0.571*** | 2.730*** | 0.593*** |

| (0.06) | (0.02) | (0.13) | (0.02) | |

| corruption | 0.116* | 0.045* | 0.538*** | 0.125*** |

| (0.05) | (0.02) | (0.01) | (0.00) | |

| Stockmarket | 0.073** | 0.028** | 0.036 | 0.009 |

| (0.03) | (0.01) | (0.04) | (0.01) | |

| corruptionsme | 0.657*** | 0.230*** | 0.907*** | 0.198*** |

| (0.07) | (0.02) | (0.03) | (0.00) | |

| collateralsme | 0.477*** | 0.182*** | 0.808*** | 0.191*** |

| (0.04) | (0.02) | (0.09) | (0.02) | |

| Intercept | -0.199*** | -0.360*** | ||

| (0.04) | (0.08) | |||

| regional | yes | yes | ||

Source: estimation results of the model

In terms of firms’ characteristics (such as the state-owned dummy STATE and the age of the firm AGE), estimation results from the probit and logit model showed that the probability of being approved will increase respectively by 5.5 and 5.4 percent points if a firm is state-owned enterprise. Therefore, it could be observed that state ownership still directly affected enterprises’ credit accessibility. The number of years that a firm had been in the market also had a positive impact on credit accessibility. The coefficient on age of firm is positive and has statistically significant impacts on probability of loan application approval. It means that if the age of firm increased by 1 year, the approved probability would also increase by 0.6-0.7 percentage points. This result was supported by theoretical framework that firms with higher number of years in operation would have better credit history and therefore had easier access to resources from financial institutions in general and commercial banks.

In terms of firms’ performance (ROA and ROE), the coefficient of return on asset and return on equity implied that the approved probability increased when these variables increased. In logit model, if ROA increased by 1%, the approved probability would increase by 42 percentage point. Probit model also showed similar sign of impact the coefficient of ROA but not statistically significant. The coefficient of ROE variable showed that impact was indeed positive as expected and statistically significant. However, the magnitude of impact was rather small, from 0.8 to 0.9 percentage points. This result indicated that the more efficient the firm managed its assets, the better the probability of the loan application being approved.

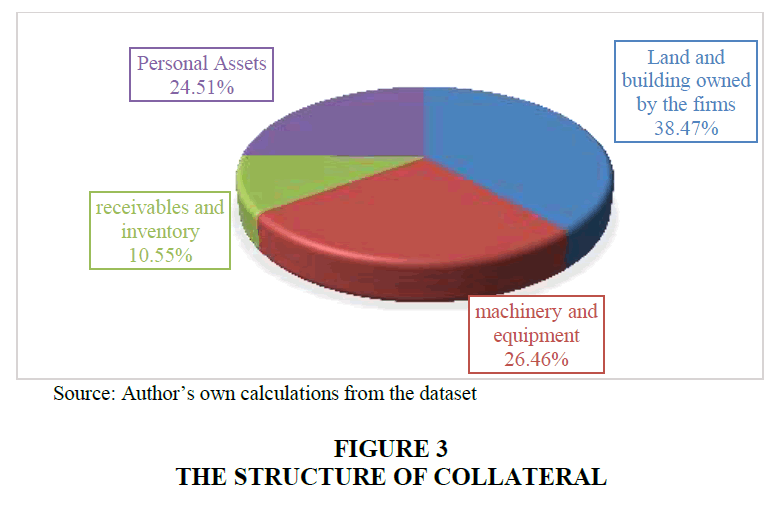

For the variable represented collateral requirements of loans (collateral), the coefficient of collateral requirements of the loans that was estimated from the two models showed that the availability of collateral has significant positive impact to the decision to loan of banks. In Table 3, being able to post collateral is associated with 57 percentage point’s increase in the probability of loan approval in probit model and 59.3 percentage points in the logit model. To better observe the negative impact of this constraint to the credit accessibility of firm, the research investigated the structure of collateral requirements in the loan applications.

Figure 3 shows that the most popular form of collateral was land and building owned by the firms (with a 38.47% share), machines and equipment had a 36.46% share, personal assets accounted for 24.51% and the rest are account receivable and inventory (10.55%). This result helped to show why private enterprises (which largely comprised of SMEs) could hardly ever meet collateral requirements from the financial institutions. For these firms, most of them with rented land, building and machines.

For the variable representing unofficial facilitating cost (such as bribes and giftscorruption), estimation results from both models had expected signs and significance level at 10% and 1%. These results implied that the approved probability did increase when the firm paid unofficial costs. The logit model showed that the probability increased by about 12.5 percentage points. Thus, unofficial cost was still a constraint to firms’ credit accessibility, especially for those from the SME sector.

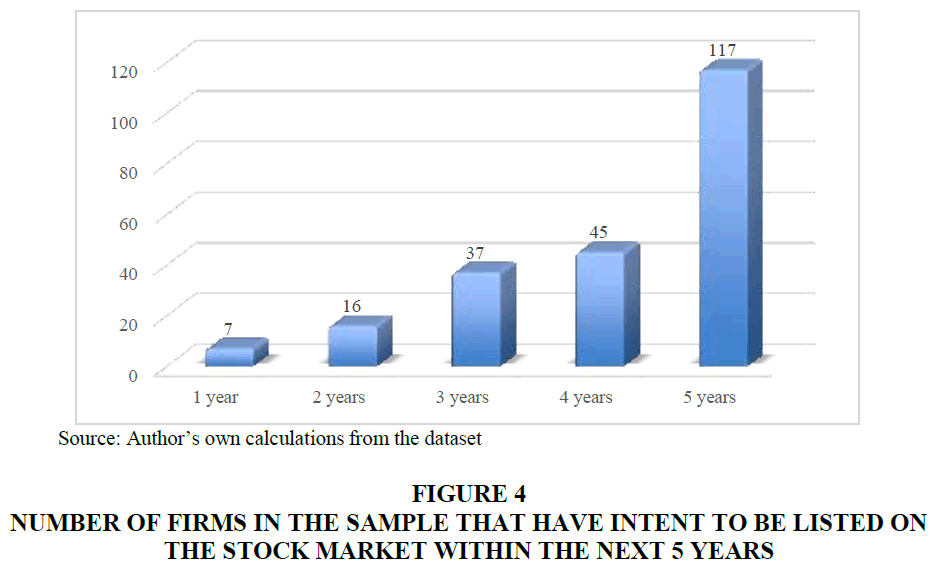

The variable of stockmarket, which represented the development of capital markets, had positive sign and was statistically significant. The AME of this variable showed that approved probability was only at about 2.8 percentage points. Development of capital markets require firms to be more transparent in financial performance, as well as more standard in accounting activities which, in turns, help firms to access financial resources more easily. Firms in the survey appeared to be aware of that issue. Figure 4 shows the number of firms that displayed an intent to be listed on stock market significantly increasing with the timeframe, 117 firms wanted to be listed in the next 5 years, compared to 7 firms wanted to do so in the next year.

Figure 4 Number of Firms in the Sample that have Intent to be Listed on the Stock Market Within the Next 5 Years

Coefficients of interaction terms between the variable SME and the control variable collateral and corruption had positive sign and were statistically significant at 1% level of significance. These results showed that there were differences in the treatment of financial institutions between SMEs and larger firms regarding collateral availability and unofficial costs during the loan application approval process. The coefficients of interaction term showed that the approved probability for an SME willing to pay for bribes and gifts was higher than a larger firm with the same characteristics by 20 to 23 percentage points. Similarly, among the firms with adequate collateral, the approved probability for an SME was 18.2 to 19.1 percentage points higher than a larger firm with same characteristics.

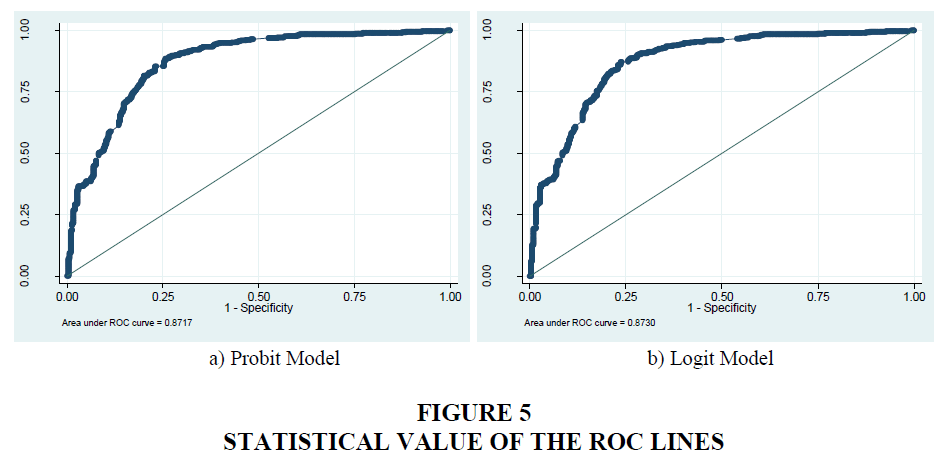

Goodness of Fit Testing

Pseudo R2 uses the likelihood function to measure the fit of the model but this value tends to be smaller than R-square (OLS). The Pseudo R2 values ranged from a minimum of 0.262 (Aldrich and Nelson, 1984) to a maximum of 0.489 (Veall and Zimmermann, 1994). Thus, the results of probit and logit regression model have Pseudo R2 values of 0.3668 and 0.3652 that are considered highly satisfactory.

In addition, if the dependent variable Yi=1 and the predicted probability was higher than 50% or if the dependent variable Yi=0 and the predicted probability was lower than 50% then Yi would be correctly predicted. Otherwise, Yi would be a failure prediction or incorrectly predicted (Stock and Watson, 2010)

In Table 4, the probit model predicts correctly 31.37% of rejected loan application and 50.64% of approved loan application. Thus, the total correctly predicted percentage of probit model is 82.01%. The logit model also correctly predicts 31.37% of rejected loan application and 50.79% of approved loan application. Therefore, the total correctly predicted percentage of logit model is 82.16%.

| Table 4 Correctly Predicted by Probit/Logit Model | ||||||

| Actual | Predicted by Probit model | Predicted by Logit model | ||||

| approval | rejection | Total | approval | rejection | Total | |

| Firm’s loan application is approved | 352 | 86 | 438 | 353 | 86 | 439 |

| Firm’s loan application is rejected | 39 | 218 | 257 | 38 | 218 | 256 |

| Total | 391 | 304 | 695 | 391 | 304 | 695 |

The ROC test statistics also indicated confirming results. The value of the estimated ROC line from the probit model was 0.8717 and from the logit model was 0.8730. These tests showed that estimation results from both models were reliable. Both models are fitted to the data (Figure 5).

Conclusions

The probit and the logit estimation results showed that: (i) the size of firm is the important factor that determine accessibility to bank loans. (ii) collateral is the main constraint to credit accessibility, especially for SMEs which still hired most of their production premises and equipment. (iii) Discrimination is still available in approving loan application between SMEs and larger firm. Additionally, efficiency in operation and assets management as well as the development of capital markets are also factoring that have positive impacts that help firms have easier access to capital resources.

Based on the study’s results, the paper gives out some policy implications to improve credit accessibility of firms in general and SMEs in particular, which are:

Improving the legal framework and the information infrastructure which reduce transaction costs, creating a more equal and fairer competitive environment for all kinds of business to access financial resources from commercial banks.

Encouraging the development of non-bank system to meet the demand for loans of SMEs. Through which, the competitiveness in the financial system will be enhanced and firms can reduce dependence on the commercial bank system. However, the economy will face some challenges for regulators, namely: (i) Access to capital resources from unofficial financial institutions will create risks and instability which results from booming loan activities. This, in turn, could badly damage the performance of SMEs. In order to mitigate these threats, the Government should introduce regulations that regulate strictly the behaviors of non-bank financial institutions through the development and improvement of a monitoring and supervising system. These should be based on existing regulations for the formal financial system. (ii) Develop corporate bond market to reduce the burden on the banking sector. Gradually allow firms to access bond market. At first, larger firms should be encouraged to use the corporate bond market to finance projects then expand to selected groups of SMEs.

Limitations of the Study

The limitations of the study are on limited sources of available data in Vietnam. Analysis in our paper only takes into account the presence of discrimination in the final step of approving a bank loan, and do not capture other discrimination in different steps of the lending process. In addtion, cross-sectional data cannot analyze firms’ behavior over time, thus future studies should use panel data.

Acknowledgement

1. This research is funded by National Economics University, Hanoi, Vietnam [grant number 154/QÐ-ÐHKTQD].

2. Corresponding author: Nguyen Viet Hung, Faculty of Economics, National Economics University, Hanoi, Vietnam. Email: hungnv@neu.edu.vn

References

- Akoten, J.E., Sawada, Y., & Otsuka, K. (2006). The determinants of credit access and its impacts on micro and small enterprises: The case of garment producers in Kenya. Economic Development and Cultural Change, 54(4), 927-944.

- Aldrich, J.H. & Nelson, F.D. (1984). Linear probability, logit, and probit models. Beverly Hills, CA: Sage.

- Beck, T. & Demirguc-kunt, A. (2006). Small and medium-size enterprises: Finance as a growth constraints. Journal of Banking & Finance, 30, 2931-2943.

- Beck, T., Demirguc-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: Are small firms different? Retrieved from https://econpapers.repec.org/RePEc:tiu:tiutis:7078f1cc-51a6-4556-b193-df23609ebe10

- Demirgüç-Kunt, A. (2006). Finance and economic development: Policy choices for developing countries (Google eBook). Retrieved March 24, 2019, from http://books.google.com/books?id=4o_v5jLH4KUC&pgis=1

- Fang, J. (2007). Ownership, Institutional Environment and Capital Allocation. (in Chinese. with English Summary). Jingji Yanjiu/Economic Research Journal, 42(12), 82-92.

- Galindo, A. & Schiantarelli, F. (2003). Credit Constraints and Investment in Latin America. Washington, DC: Inter-American Development Bank.

- Garcia-Fontes, W. (2005). Small and medium enterprises financing in China. Central Bank of Malaysia Working Paper, 1–13. Retrieved from http://www.bnm.gov.my/microsites/rcicc/papers/s6.garciafontes.pdf

- Gine, X. (2011). Access to capital in rural Thailand: an estimated model of formal vs. informal credit. Journal of Development Economics, 96(1), 16-29.

- Harrison, A.E., Love, I., & McMillan, M.S. (2004). Global capital flows and financing constraints. Journal of Development Economics, 75(1), 269-301.

- Kasseeah, H., & Thoplan, R. (2012). Access to financing in a small island economy: Evidence from Mauritius. Journal of African Business, 13(3), 221-231.

- Kern, A. (2013). Finance in development course lecture. Washington, DC: Georgetown University.

- Khanh Nguyet, C.T. (2014). Why do small and medium enterprises need to access informal credit? The case of Vietnam. International Finance and Banking, 1(2), 1-17.

- Laeven, L. (2003). Does financial liberalization reduce financing constraints? Financial Management, 32(1), 5-34.

- Lin, X. (2009). Survey on SME Financing in Dongping County (In Chinese), Qi Lu Forum, January 2009.

- Manh-Trung, V.H. (2014) Training SME owners: Current status and solution. Ministry of Finance, 6(596), 74-75.

- Nhung N.T., Gan, C., & Hu, B. (2016). An empirical analysis of credit accessibility of small and medium sized enterprises in Vietnam. MPRA Paper No. 81911, Posted 18 October 2017 13:17 UTC, (74203). Retrieved from https://mpra.ub.uni-muenchen.de/81911/

- Oliner, S.D. & Rudebusch, G.D. (1992). Sources of the financing hierarchy for business investment. The Review of Economics and Statistics, 74(4), 643-654.

- Rand, J., & Tarp, F. (2007). Characteristics of the Vietnamese business environment: Evidence from a SME Survey in 2005. A Study Prepared under Component 5.

- Stock, J.H. & M.W. Watson (2010). Introduction to Econometrics (3rd ed). Boston, MA. Pearson Press.

- Veall, M.R. & Zimmermann, K.F. (1994). Evaluating pseudo-R2’s for binary probit models. Quality and Quantity, 28(2), 151-164.

- Vo, T.T., Tran, T.C., Bui, V.D., & Trinh, D.C. (2011). Small and Medium Enterprises Access to Finance in Vietnam, in Harvie, C., Oum, S. & Narjoko, D. (eds.), Small and Medium Enterprises (SMEs) Access to Finance in Selected East Asian Economies. ERIA Research Project Report 2010-14, Jakarta: ERIA. pp.151-192.

- Yaldiz, E., Altunbas, Y., & Bazzana, F. (2011). Determinants of informal credit use: A Cross Country Study. SSRN, (September).