Research Article: 2021 Vol: 25 Issue: 1S

Corporate Board and Capital Structure Dynamics in Nigerian Listed Firms

Benjamin Ighodalo Ehikioya, Covenant University

Alexander Ehimare Omankhanlen, Covenant University

Cordelia Onyinyechi Omodero, Covenant University

Areghan A. Isibor, Covenant University

Abstract

The issue of financing structure has been a growing concern among the policymakers, investors and other stakeholders of the firm. However, the link between corporate board structure and capital structure has attracted less attention especially in emerging countries. Thus, this current study examines the impact of corporate board characteristics on the capital structure of companieslisted on the Nigerian Stock Exchange from 2015 - 2019. The study used the fixed effects regression method to analyses the panel data from 93 randomly selected quoted firms in Nigeria. The result of the empirical analysis shows evidence that board composition and CEO duality have a positive connection with the capital structure of quoted firms in Nigeria. The findings from the study clearly indicate that while board size exerts a negative but insignificant influence on capital structure, board skill and board gender diversity have a positive connection with capital structure. As expected, the study reveals that profitable listed firms in Nigeria use less debt, while large firms use more debt to finance assets and this is in tandem with capital structure theories. This study also confirms the applicability of agency theory in Nigerian quoted firms. Thus, it is imperative for policymakers and other stakeholders of the firm to ensure an effective board structure and optimal capital structure for improved value of the firm.

Keywords

Board of Directors, Capital Structure, Corporate Governance, Performance.

JEL Classifications

G32; G34, G38

Introduction

Recent developments in the environment have generated increased concerns about the ability of the organisation to continually achieve its objective of shareholders' wealth maximisation, among others. The organisation operates in a fuzzy environment, which increases relentlessly both in developed and developing countries. The challenges from the environment increasingly affect the ability of the management of the organisation to make accurate predictions and control of economic activities that influences performance (Jaradat, 2015; Siromi & Chandrapala, 2017; Choi et al., 2020). Similarly, within the organisation, there has been increasing rate of corporate scandals and misalignment of resources partly because of the separation of ownership and control of modern organisations (Sheikh & Wang, 2012; Mwambuli, 2018). In the midst of these contending issues, the stakeholders are worried about the poor performance of the firm. These concerns have similarly renewed interest about the significant role of the boards in ensuring the value of the firm. In agency theory, the managers are contracted by the owners of the firm to represents their interest to run the affairs of the firm profitably (Jensen & Meckling, 1976; Rajan & Zingales, 1995; Ehikioya, 2019). However, due to the lack of a direct investment in the organisation, there is the possibility that the managers may pursue self-serving interest from actions that are detrimental to the owners of the firm.

In the dynamic world of today, the board of directors play significant functions to ensure the smooth functioning of organisations. To the shareholders and other stakeholders of the firm, the directors have a duty to monitor and control the actions of the management to guarantee shareholders’ value maximisation while mitigating agency costs (Abor, 2007; Jaradat, 2015; Mwambuli, 2018). In its relationship, the board seeks to safeguard the shareholders’ interest in a gradually more competitive setting while upholding managerial competence and accountability in search of quality firm performance (Garba & Abubakar, 2014). To this end, the board of directors have a responsibility to engage competent management and support them with resources and strategic direction that would lead to a healthy organisation (Hermalin & Weisbach, 2003; Uwuigbe, 2014). To achieve the objective of the firm, the management of the firm would have to contend with the task of choosing the optimal capital structure, which remains one of the most strategic, but challenging decisions of the firm.

Several studies on corporate governance aimed at mitigating the agency conflict ensuing from the separation of ownership and control have been attempted both in advanced and developing countries. However, in recent time, the growth of the organisation has been the focus of many scholars both from theoretical and empirical perspectives. Studies in the finance literature focused on the link between board characteristics and performance of the firm (Kyereboah-Coleman & Biekpe, 2006; Garba, & Abubakar, 2014). Several studies argued that the capture structure of the firm and the board are essential to explain the value of the firm (Jensen & Meckling, 1976; Rajan & Zingales, 1995). Moreover, other studies in this direction examined the connection between capital structure and performance (Aljifri & Hussainey, 2012; Afolabi, Olabisi, Kajola & Asaolu, 2019). Furthermore, the few studies that have so far focused on the connection between corporate governance and capital structure in developing nations have produced mixed results (Abor, 2007; Sheikh & Wang, 2012; Kyriazopoulos, 2017). The insight about corporate board and capital structure dynamics is imperative since scholars are yet to clearly explain the extent corporate board structure might impact the capital structure of the firm. Since organisations operate in a fuzzy environment, the demand from stakeholders are growing persistently, and businesses can grow in different dimensions, the need to evaluate the impact of board structure on the financing structure of the firm is vital for decision making and the value of the firm.

Against this backdrop, unlike most studies that primarily use firm financial performance variables such as return on assets to evaluate governance, this study takes a different approach by assessing board characteristics against the capital structure of the firm as a basis to understand the importance of good governance to the firm. This study postulates a positive and significant influence of board characteristics on the capital structure of quoted companies in Nigeria. Furthermore, the study develops a framework to assess the connection between corporate board characteristics and the capital structure of the firm. The study used the fixed effects regression technique to analyses data sourced from 93 listed companies for the period 2010 to 2019. The result of the study indicates that board structure is significant to explain the capital structure of Nigerian listed firms. Moreover, the study provides evidence to support the significant power of agency theory to gain insights into the governance structure of listed firms in Nigeria. This study throws insight to the understanding of the connection between corporate boards and the financing structure of the firm. Importantly, the findings of this study are helpful to stakeholders in decision making. Moreover, the study is essential for scholars to launch further research work on this issue and with additional variables in different settings.

The remaining part of this paper consists of the following sections. In Section two, the study provides the review of connected literature of theoretical framework, board characteristics and its influence on capital structure. Section 3 explains the methodology employed in this study, whereas Section 4 discussed the result and its implications. The final section concludes the study, highlighting possible limitations and suggestions for future research.

Literature Review

The financing structure of the firm and corporate board structure has gained much attention from finance scholars. For the organisation to guarantee improved performance and value, the directors must ensure that the manager saddles with the responsibility of piloting the affairs of the firm, make financing decisions that align with the objective to maximize shareholders’ wealth. The optimal capital structure of the firm is a mixture of borrowed funds and equity to finance the purchase of assets leading to shareholders' wealth maximisation (Wen et al., 2002; Aljifri & Hussainey, 2012). On the other hand, corporate governance is concerned about how to effectively run the affairs of the organisation in the best interest of the owners (Ehikioya, 2019). To achieve the demand by the stakeholders for improved performance, increased focus on managerial proficiency has become a matter of necessity in the face of the level of the dynamics in the environment (Uwuigbe, 2014; Ehikioya, 2019). In response to the internal and external pressures, the board often attempts to make sure that the managers of the firm make strategic decisions such as optimal capital structure decisions that safeguard the interest of the shareholder.

Several theoretical perspectives have been advanced in the literature to provide insight into the governance mechanism. Relevant to this study and to understand corporate board and capital structure dynamics is the agency theory by Berle and Means (1932) and Jensen and Meckling (1976). According to the agency theory, in firms where there is a separation of ownership and control, the managers may act in a manner that is not in line with the owners' of the firm. The action of the manager to engage in opportunistic behaviour due to the differences in the interest between the owners of the firm and the agents can quickly escalate into agency problems that could lead to agency costs (Jensen & Meckling, 1976; Jaradat, 2015; Siromi & Chandrapala, 2017; Choi et al., 2020). Generally, the managers have superior knowledge about the firm, which place them at an advantage about the firm. Therefore, to minimise agency problems and ensure that the managers act in the interest of the investors, the board is constituted to align the interests of the parties. Also, the board have a duty to supervise and control the activities and behaviour of the management to guide against any sub-optimal decision making. Previous studies, though with mixed results, have attempted to assess board characteristics as an effective mechanism to resolve agency conflicts between the principal and the agent of the firm (Ujunwa, 2012).

In relation to the agency theory, outsider directors are more likely to exercise active supervisory and monitoring of the managers' activities to ensure that the interest of the owners of the firm is safeguarded (Sheikh & Wang, 2012; Kyriazopoulos, 2017; Mwambuli, 2018). Outside directors can show objectivity in their deliberations and decisions relating to the use of debt. This situation is particularly so since outside directors will bring the firm a different set of skills and knowledge (Afolabi et al., 2019). The Nigeria code of corporate governance best practice of 2011 provides for the appointment of non-executive directors in the board. This is important to supervise and monitor the activities of the executive. However, where members that constitute outside directors are weak and inexperience, this can compromise their functions and allow entrenched managers to enrich themselves. The composition of the board can determine the capital structure and value of the firm, though the literature has so far provided conflicting results on the connection between board composition and firm’s capital structure (Abor, 2007; Sheikh and Wang, 2012). To capture the significance of board composition in this study, we included a variable which represents the ratio of outside directors on the board. We hypothesised that there is a substantial positive connection between outside directors and the financing structure of quoted companies in Nigeria.

The board is responsible for strategic decisions, among other things. According to Yermack (1996) and Garba & Abubakar (2014), board size is an essential corporate governance factor to define the value of the firm. Yermack (1996), in an empirical study, demonstrated a significant connection between board size and the worth of the firm. Prior studies submitted that a large board could force the managers to pursue higher debt to enhance the worth of the firm (Berger et al., 1997; Wen et al., 2002). Yet, the empirical evidence on the link between board size and capital structure is contradicting. Al-Nodel and Hussainey (2010) documented a positive influence of board size on debt to equity ratio. This suggests that the more the size of the board, the higher the leverage level. Also, Garba and Abubakar (2014) established a substantial positive connection between board size and leverage. In contrast, Berger et al. (1997) and Abor and Biekpe (2006) demonstrated an adverse effect of board size on the ratio of debt to equity used as proxy for capital structure. Studies by Abor (2007) and Uwuigbe (2014) reported an adverse association between board size and debt. Studies such as Wen et al. (2002) showed that the board size has no substantial influence on debt to equity ratio. Firms in Nigeria need an efficient board to deliver on their responsibilities. Thus, this study postulates that there is a significant positive connection between board size and the capital structure of Nigerian listed companies.

The ownership structure of the firm is an essential factor that shapes the value of the firm. Like in other emerging markets, agency problems persist in Nigerian listed firms, and managerial share ownership remains an essential mechanism to resolve this issue (Ehikioya, 2019). However, despite the significant power of managerial shareholding to mitigate agency problems, the influence of managerial share ownership on debt is conflicting (Fosberg, 2004; Aljifri & Husseiney, 2012). Friend and Lang (1988) investigated the impact of managerial ownership on debt ratio and reported that executive shareholding has a positive influence on the ratio of debt-equity (DER). Similarly, Berger et al. (1997), as well as Bokpin and Arko (2009), documented a positive and significant connection between managerial ownership and the capital structure of the firm. Moreover, using data from Sri Lankan listed companies, Wellalage and Lock (2012) assessed the link between managerial ownership and debt ratio. They found that executive ownership has a significant positive connection with leverage. However, Bathala et al. (1994) examined this issue and documented that managerial ownership negatively influences the proportion of debt to equity in the capital structure of the firm. In the same vein, Sheikh and Wang (2012) evaluated this issue in Pakistan. They reported that there is a adverse connection between executive ownership and the amount of debt in Pakistan quoted companies. Consequently, this study postulate that there is a significant positive association between executive share ownership and the capital structure of quoted companies in Nigeria.

The board is the highest decision making organ in the organisation. Also, the board is responsible for supervising the activities of the organisation. Consequently, the shareholders need to select board members with relevant education, skills and experience to drive the affairs of the firm profitably as well as protect their investment and monitor the activities of the manager (Carpenter & Westphal, 2001). Members of the board with higher educational qualifications and skills would provide the right mix of leadership that would guarantee an effective decision making of the board. Empirical studies linking board skills to an optimal capital structure are few and with focus largely on the influence of these skills on firm performance (Sapienza et al., 1996; Lynall, Golden & Hillman, 2003). Abor & Biepke (2006) in a study in Ghana, documented a positive and significant relation between board skill and the debt ratio of SMEs in Ghana. In a related study, Ujunwa (2012) used data from 122 public companies in Nigeria from 1991 to 2008 and documented a positive and substantial connection between directors having a PhD degree and firm performance. Consequently this study also hypothesised that board skill has a positive connection with the capital structure of listed firms in Nigeria.

For a long time, a number of organisations around the world constitute their board to reflect mostly the male gender. However, in recent time, the influence of board diversity has been argued in the literature along with different thoughts (Carter et al., 2010). In the principal-agent framework, Carter et al. (2010) argued that a more varied board could evaluate the environment and make faster decisions that will enhance the performance of the organisation. Moreover, Kochan et al. (2008) opined that board diversity would lead to improved firm performance and the ability of the organisation to connect to both the domestic and global community for resources and market. One way to examine board mixture is to evaluate the number of women on the board of the firm. Jaradat (2015) identified the ratio of women on the board as a variable to assess the association between corporate governance practices and capital structure. The study used data from 129 Jordanian firms for the period 2009-2013. It concluded that a positive connection existed between the proportion of women on the board and the capital structure of the firm. Similarly, Emoni et al. (2016) employed data from firms listed in Kenya to explore the connection between women on corporate boards and capital structure. They reported a positive relationship between women on corporate boards and capital structure, which suggests that companies with more females on the board have better access to debt to finance economic activities. On the contrary, Loukil & Yousfi (2015) opined that board diversity through women on the boards would lead to the use of lesser debt due to the less preference of women to engage in risk taking venture. This study, therefore, hypothesised a positive connection between board gender multiplicity and capital structure of quoted firms in Nigeria.

The leadership structure is another critical governance factor that determines the capital structure and performance of the firm. CEO duality occurs where the CEO of a firm doubles as the chairman of the same firm, and this can influence the financing decision of the firm. Over time, the connection between CEO duality and capital structure has been documented with diverse results. For instance, Abor and Biekpe (2006) and Abor (2007) reported that there is a substantial and positive association between CEO/Chair duality and leverage in Ghana. In the same vein, Wellalage and Lock (2012) observed that CEO duality increases the debt ratio of listed companies in Sri Lankan. However, Forsberg (2004) opined that compared to firms with duality structure, companies without a two-tier management structure are likely to adopt the right sum of leverage in their financing structures. Fosberg (2004) reported an adverse association between CEO duality and the percentage of debt in the capital structure. Also, Kyereboah-Coleman and Biekpe (2006) noted that in Ghana, CEO duality has a negative connection with debt. This indicated that Ghanaian firms with CEO duality pursue higher debt policies. The leadership structure that allows the board chair to double as the CEO of the same company would allow more influence and control over board decisions. Moreover, such a leadership structure may reduce the ability of the board to supervise the use of debt by the management. Thus, this study postulate that there is a positive association between CEO duality and the capital structure of quoted companies in Nigeria.

Methodology

This study used panel data collected from the annual report and accounts of firms quoted on the Nigerian Stock Exchange (NSE) for the period 2010 to 2019 to explore board dynamics and its impact on capital structure decisions. The sample data consists of 93 listed firms in Nigeria with 930 firm-year observations. For a country like Nigeria, we know it would have been better to include more listed firms in the sample. Still, we were quite constrained by data availability to maintain balanced observations in the analysis. In the pre-study analysis, we observed that listed firms would provide a better ground for this study because of the perceived corporate governance standards and rules by NSE and other regulatory agencies in the preparation and presentation of their annual report and accounts. Moreover, the study period from 2016 observed weak economic performance due to the economic recession in 2016, which compelled several firms to raise funds through the markets. These are significant considerations in this study since debt, and corporate governance variables are critical factors to reduce agency problems, improve performance and ensure shareholders' wealth maximisation.

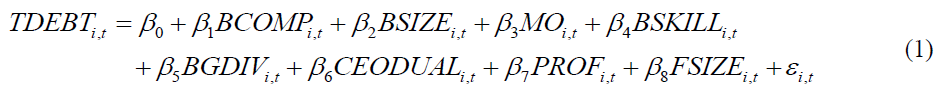

The study employed several proxies to measure board characteristics, which includes board composition, board size, managerial ownership, board skills, CEO duality and board diversity. The book worth of total debt was used to measure the capital structure of the firm. This study used the fixed effects regression technique to estimate the connection between board characteristics and the capital structure of quoted companies in Nigeria. In panel data estimate, the importance of the fixed effects model is in its ability to correct for the presence of autocorrelation and heteroscedasticity. The regression model specification is stated in equation one (1) as follows:

Where:

β0 = constant

β1……β8 = coefficients of the independent and control variables,

TDEBT = Total debt ratio

BCOMP = Board composition

BSIZE = Board size

MO = Managerial ownership

BSKILL = Board skills

BGDIV = Board gender diversity

CEODU = CEO duality

PROF = Profitability

FSIZE = Firm Size

ε = stochastic error term.

The study measured debt as the book worth of total debt over the total assets of the firm. Board composition was calculated as the natural logarithm of the number of outside directors on the board. The study computed board size as the natural logarithm of the aggregate number of directors on the board, while managerial ownership is the total number of shares held by members of the board over the aggregate number of shares. Board skill is the total board members with a first degree plus at least one professional certification and a minimum of three years of board experience to board size. Board gender diversity is computed as the total female board members. The CEO duality is measure as taking the value of 1 if the CEO also double as the chairman of the board, 0 otherwise. Profitability is proxy as return on assets (ROA), and it was calculated as earnings before interest, taxes, depreciation and amortisation over the firm’s total assets. Firm size is the natural logarithm of the book worth of the company’s total assets. The study expect board composition, board size, managerial ownership, board skill, board gender diversity and CEO duality will have a positive impact on the capital structure of quoted companies in Nigeria.

Results and Discussion

Descriptive Statistics

Table 1 reports the descriptive statistical analysis of the variables in the study. The result of the descriptive statistics shows that the average total debt of listed companies in Nigeria is 63 per cent. This result suggests that listed firms in Nigeria prefer to use debt than the equity to finance their assets. Furthermore, the use of 63 per cent debt indicates that the managers do not well utilise the assets of the firms to generate revenue to finance any investment opportunities. The average board composition is 9, which suggests that the firms have more of outside executives on the board. The result of the analysis reveals that the average board size of Nigerian firms is 10, which is about 10 board members. The average board skill is 4, which means that the number of board members with a first degree plus at least one professional certification and board experience is still very low compared to the total board size and advanced nations. The average number of female board members is 3, which indicates that the number of females on the board is still less than the average board size. The 10.7 per cent of profitability proxy by ROA means that listed firms generate low profit, which confirms the need for the use of debt.

| Table 1 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std dev | Min | Max |

| TDEBT | 930 | 0.6257 | 0.3721 | 0.4970 | 3.1739 |

| BCOMP | 930 | 8.6320 | 3.2069 | 5.0000 | 10.0000 |

| BSIZE | 930 | 10.2534 | 3.2113 | 6.0000 | 15.0000 |

| MO | 930 | 0.0362 | 0.0107 | 0.0000 | 0.8453 |

| BSKILL | 930 | 4.0521 | 1.0533 | 0.0000 | 9.0000 |

| BGDIV | 930 | 2.8453 | 0.3722 | 2.0000 | 5.0000 |

| CEODUA | 930 | 0.1463 | 0.1836 | 0.0000 | 1.0000 |

| PROF | 930 | 0.1075 | 0.1526 | -2.0486 | 0.9643 |

| FSIZE | 930 | 8.4637 | 1.0473 | 5.3972 | 14.0733 |

Correlation Matrix

Table 2 shows the result of the correlation matrix. The analysis of the correction matrix is essential to highlight the relative strength and nature of the linear association between the explanatory variables. The results of the correlation coefficient indicate that the correlation between the variables is not sufficient to suggest any problem of multicollinearity. The result reveals that the maximum correlation coefficient is between board composition and board size, which has a value of 0.161. This is in line with Gujarati and Porter (2009), who suggested that multicollinearity could only be an issue if the correlation coefficients among the explanatory variables are above the 0.80 benchmarks. In addition, all other correlation coefficients of the explanatory variables exhibited the anticipated sign, although the correlation between the CEO duality and debt was relatively higher than others. The correlation coefficients of the explanatory variables exert the anticipated sign with debt, although the correlation between the CEO duality and debt was relatively higher than others. The result from the correlation matrix shows that board composition with a value of 0.027, managerial ownership with 0.036 and CEO duality with a value of 0.113 are positively correlated with total debt of quoted firms in Nigeria.

| Table 2 Correlation Matrix | |||||||||||

| Variable | TDEBT | BCOMP | BSIZE | BSKILL | BGDIV | MO | CEODUA | PROF | FSIZE | VIF | 1/VIF |

| TDEBT | 1.000 | ||||||||||

| BCOMP | 0.027 | 1.000 | 1.031 | 0.970 | |||||||

| BSIZE | -0.011 | 0.161 | 1.000 | 1.115 | 0.897 | ||||||

| MO | 0.036 | 0.036 | 0.017 | 1.000 | 1.150 | 0.870 | |||||

| BSKILL | 0.103 | 0.043 | 0.020 | 0.111 | 1.000 | 1.013 | 0.987 | ||||

| BGDIV | 0.071 | 0.011 | 0.033 | 0.131 | 0.015 | 1.000 | 1.116 | 0.896 | |||

| CEODUA | 0.113 | 0.025 | 0.109 | 0.042 | 0.042 | 0.035 | 1.000 | 1.022 | 0.979 | ||

| PROF | 0.019 | 0.036 | 0.114 | 0.132 | 0.022 | 0.012 | 0.113 | 1.000 | 1.304 | 0.767 | |

| FSIZE | 0.025 | 0.040 | 0.038 | 0.081 | 0.051 | 0.022 | 0.062 | 0.034 | 1.000 | 1.061 | 0.943 |

| Mean VIF | 1.102 | ||||||||||

The positive link between board composition and total debt validates the theoretical proposition of the agency theory, which suggests that board independence can pressure the management to use borrowed funds. The use of more debt would ensure adequate monitoring and control of the managers. Also, board skill and board gender diversity with a value of 0.103 and 0.071 shows evidence of a positive correlation with total debt. Board size exerts a negative correlation with debt ratio. For the control variable, the correlation between company size and total debt is positive and significant, which supports the static-trade-off theory of capital structure. The result in Table 2 shows that the highest value for the variance inflation factor (VIF) is 1.304, with a mean value of 1.102. This result further validates the earlier report from the correlation matrix about the multicollinearity. According to Belsely (1991), the maximum value of 10 as benchmark indicates that there is no problem of multicollinearity.

Regression Analysis

The study proceeds to establish whether the random-effects model or fixed effects model is a better estimator to evaluate the link between board structure and the capital structure of quoted companies in Nigeria. In the Hausman test, the decision hinges on the level of significance. This implies that the null hypothesis, which represents the random effects model, is accepted if the p-value is not statistically significant, and the alternative hypothesis, which denotes the fixed effects model is rejected. The finding from the Hausman test, as reported in Table 3, indicates that the p-value of 0.0218 is less than the 0.05 significance level. With this result, it is safe to rely on the fixed effects model for the regression analysis. The analysis shows that the R-squared is 0.7401, which suggest that the independent variables in the study jointly explained 74 per cent of the variations in the level of total debt in Nigerian listed firms. In the same vein, the result of the F-statistics 110.46 with a p-value of 0.0000 is significant at 5% level. This result indicates the degree of a linear association between the explanatory and the dependent variables. This result also confirms the reliability of the model, which shows the connection between board structure and the capital structure of quoted companies in Nigeria. The value of the Durbin-Watson statistic is 1.7158, and this implies that there is no problem with autocorre-lation in the study.

| Table 3 Result of the Hausman Test | |||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

| Cross-section random | 3.749312 | 3 | 0.0218 |

Table 4 presents the regression results, which show both the magnitude and direction of the independent variables and their relevant influence on the dependent variable. The result of the analysis shows that board composition has a coefficient of 0.0353 and a p-value of 0.0080. This result suggests that the outside director has a positive and significant connection with the debt ratio of Nigerian quoted firms. The finding supports the agency theory and argues the power of outsider directors to pressure as well as influence the management to deploy more debt in the firm’s capital structure to advance the worth of the company. The study shows the importance of outsider directors to supervise the activities of the executive. This result demonstrates that the use of debt to pursue investment can function as a control tool to decrease agency costs related to agency problems. The firm’s outside directors are more unlikely to be subjective in their considerations and decisions relating to the use of debt. This is particularly so since outside directors will bring to the firm a different set of skills and knowledge to aid decision making. The result is in tandem with studies by Berger et al. (1997); Abor (2007); Jaradat (2015) and Mwambuli (2018), who reported a positive connection between capital structure and board independence. On the other hand, the finding is different from studies by Wen et al. (2002) and Uwuigbe (2014), which revealed a negative connection between debt and board composition.

| Table 4 Regression Estimates Using Total Debt (TDEBT) | ||||||||

| Variable | 2010 - 2019 | 2016 -2019 | ||||||

| Coefficient | Std. error | t-statistic | p-value | Coefficient | Std. error | t-statistic | p-value | |

| C | -0.4637 | 0.2073 | -2.2369 | 0.0000 | 0.0476*** | 0.0838 | 0.5680 | 0.6560 |

| BCOMP | 0.0353** | 0.0038 | 9.2895 | 0.0080 | 0.3110*** | 0.0661 | 4.7050 | 0.0700 |

| BSIZE | -0.1362 | 0.0531 | -2.5650 | 0.1407 | 0.0533 | 0.0405 | 1.3161 | 0.0000 |

| MO | 0.0485*** | 0.0209 | 2.3206 | 0.0300 | ||||

| BSKILL | 0.0501 | 0.0391 | 1.2813 | 0.0013 | 0.0377 | 0.0190 | 1.9842 | 0.0370 |

| BGDIV | -0.0246** | 0.0253 | -0.9723 | 0.2009 | 0.0495 | 0.0190 | 2.6053 | 0.3390 |

| CEODUA | 0.1186 | 0.0906 | 1.3091 | 0.1137 | 0.0094 | 0.0313 | 0.3003 | 0.0010 |

| PROF | -0.0253** | 0.0473 | -0.5349 | 0.0000 | -0.0163** | 0.0037 | -4.4054 | 0.0840 |

| FSIZE | 0.1362** | 0.0574 | 2.3728 | 0.0060 | 0.0068*** | 0.0364 | 0.1868 | 0.0250 |

| Observations | 930 | 372 | ||||||

| R2 | 0.7401 | 0.7892 | ||||||

| Adj. R2 | 0.7209 | 0.6811 | ||||||

| S.E. of regression | 0.2015 | 0.1097 | ||||||

| F-stat | 110.46 | 372.02 | ||||||

| Prob. (F-stat) | 0.0000 | 0.0010 | ||||||

| Durbin-Watson | 1.7158 | 1.9066 | ||||||

The result of the investigation shows that board size has a negative but statistically insignificant with the total debt ratio of quoted firms in Nigeria. This is demonstrated in the coefficients of -0.1362 and p-value of 0.1407. Furthermore, although this result is contradicts the finding by Wen et al. (2002) who reported a significant positive relation between board size and debt ratio, it, however, partly supports the results of Berger et al. (1997); Abor and Biekpe (2006) and Abor (2007). They documented that larger board prefers to deploy fewer debt to finance the assets of the business. The outcome of this study indicates that board size may not be a yardstick to monitor and control the management for optimal capital structure decisions. Instead, the firm needs to emphasise the quality of the board for the efficient discharge of its responsibility to the shareholders. Large boards can be inefficient in areas of decision-making, monitoring and control of management.

The analysis shows that managerial shareholding has a coefficient of 0.0485 and p-value of 0.0300. This finding indicates that managerial ownership is positively connected to the capital structure of quoted companies in Nigeria, and it is statistically significant at the 1% level. This result is in tandem with the agency theory, which argued the significance of increased managerial ownership as an instrument to alleviate the agency conflicts and align the manager’s interests with the external shareholders of the firm. It also indicates a shift from the use of equity to debt as a means to reduce opportunistic behaviour. Furthermore, the finding reveals that managerial ownership may lead to more use of debt to finance the assets of the firm due to managerial entrenchment and the need to avoid dilution of ownership. The result further reveals that managers in Nigerian firms would have less incentive to consume perquisites and to engage in activities that are in the interest of the shareholders. This result is in accordance with Jensen and Meckling (1976) and Aljifri and Husseiney (2012). They reported that managerial share ownership helps to align the interests of the manager with that of the shareholders. The result is comparable with the findings by Bokpin and Arko (2009) and Wellalage and Lock (2012). However, the finding contradicts Bathala et al. (1994) and Sheikh and Wang (2012) who documented an adverse connection between the managerial shareholding and the proportion of debt.

Board skill is found to have a substantial positive relation with total debt ratio in Nigerian listed firms. This finding demonstrates that a good number of board members brings to bear the experiences and knowledge gained as a board and at the higher institution as well as through professional training. The result shows that board skill helps the directors to monitor and pressure the manager of the firm to pursue a higher debt ratio to avoid the tendency to engage in opportunistic behaviour. Additionally, this result confirms that high debt is more appealing to managers because of the ability of the firm to take advantage of the directors’ network in society to raise fund. This result implies that companies with high skilled board members use higher debt in their capital structure. The positive connection between board skills and capital structure as well as the worth of the firm is consistent with the reports of Berger et al. (1997) Abor and Biepke (2006).

Moreover, the result in Table 4 reveals that board gender diversity has a positive and statistically insignificant linkage with the capital structure of listed companies in Nigeria. This result suggests the attitude of women on board towards risk taking. The insignificant association between board gender diversity and capital structure could be as a result of the way the female board members are selected, or the level of skills and board experience acquired compared to their male colleagues. One crucial point about this result is that listed firms in Nigeria recognise the need for board diversity and the power of women to contribute meaningfully to decision making. The outcome of this study is in tandem with the findings of Loukil and Yousfi (2015). However, the result conflicts with the report by Jaradat (2015), who noted a positive connection between women representation on boards and capita structure.

The study shows that CEO duality is positively and statistically insignificantly related to the total debt level of listed firms in Nigeria. However, during the period 2016 -2019, managerial ownership was removed from the model, and CEO duality exerts a positive and statistically significant connection with the total debt ratio. This result indicates that when CEO also functions as the chairman of the board in firms where they have ownership, they would prefer to deploy less debt to mitigate the burden and risk of bankruptcy. This is in tandem with the study by Berger et al. (1997), who claimed that the debt ratio is significantly lesser in companies where the CEO face little monitoring and control pressure. Conversely, the positive link between CEO duality and capital structure demonstrates that in firms where there is no managerial ownership, but the CEO also functions as the chairman of the board, they would desire to use more debt to finance the assets of the firm. Although CEO duality tends to reduce the problem of information asymmetry, it, however, suggests the lack of monitoring pressure and the ability of the CEO who doubles as chairman to influence the decision of the board. The positive connection between CEO duality and debt is in line with the studies by Abor (2007) and Wellalage and Lock (2012). They maintained that firms with duality leadership have a tendency to have higher debt in the capital structure.

As expected, the control variables in the study exert signs in relation to the static trade-off and pecking order theories of capital structure. The positive connection between firm size and the ratio of debt of firms in Nigeria suggests the ability of large firms to borrow extra due to their capacity to take on big projects. It also indicates the confidence the creditors may have on more prominent firms compares to smaller ones. Also, creditors may have the impression that larger firms are too big to fail, and thus lend to them. The result shows that profitability proxy as return on assets has an adverse and significant connection with debt ratio, and this is in agreement with the pecking order theory. The result suggests that highly profitable companies tend to use less debt than firms with low profits.

Concluding Remarks

This paper examined board structure and its impact on the capital structure decisions of quoted companies in Nigeria. The study employed fixed effects model to estimate the panel data from firms quoted on the Nigerian Stock Exchange for the period 2010 to 2019. This study is essential considering the dynamics in the business world today, the increasing demand from the stakeholders and the need to mitigate agency problems confronting modern organisations. The study demonstrates the need to highlight how board structure can serve as a mechanism to monitor and pressure the managers to make decisions in the interest of the owners of the firm.

The study reveals the importance of independent outside directors in a board and the use of debt as a mechanism to monitor and pressure the managers to jettison self-serving interest and focus on maximising shareholders' wealth. This result also implies the ability of outside directors to use their influence to assist firms in securing a debt. The negative but insignificant connection between board size and capital structure suggests that a board size might not necessarily serve as a means for firms to achieve optimal capital structure decisions. This implies that the firm should focus on having an efficient board instead of dwelling on the number of board members. The result signifies that the level of debt in a company is influenced by the ownership structure of the firm, as shown in the positive connection between managerial shareholding and debt ratio. This finding explains why managers with share ownership may seek to use more of debt to avoid the dilution of ownership. Looking at the result from a different perspective, it implies that managerial share ownership may coffer more control and voting rights in the hands of the manager. And this is likely to diminish the directors’ ability to monitor the activities of the managers.

Findings from the empirical analysis indicate that board skills and board gender diversity are positively linked to capital structure. Furthermore, the connection between CEO duality and capital structure is positive and statistically significant in firms where the CEO does not have any shareholding. This result highlights partly the reason a good number of firms finance their assets using more debt without considering the risk of bankruptcy. Following the findings of this study, it is imparative that listed firms should find a way to institute an appropriate board structure that is competent to ensure optimal capital structure decisions. Moreover, an effort is required to align the interest of the managers with the owners of the firm. This study relied on publicly available data to analyse this issue within the background of a developing economy. In addition, the study is limited to specific variables and the period of ten years. Therefore, further studies with increased sample size and data from both public and unquoted firms will worth the efforts to give more insight into the understanding of the connection between governance and capital structures.

Acknowledgement

The authors appreciate the Editor-in-Chief and the anonymous referees for their comments. This study acknowledges the funding support from the Covenant University, Ota, Nigeria.

Keywords

Board of Directors, Capital Structure, Corporate Governance, Performance.

References

- Abor, J. (2007). Corliorate governance and financing decisions of Ghanaian listed firms. Corliorate governance: International Journal of Business in Society, 7(1), 83–92.

- Abor, J., &amli; Bielike, N. (2006). Does board characteristics affect the caliital structure decisions of Ghanian firms? Corliorate Ownershili and Control, 4(1), 113-118.

- Afolabi, A., Olabisi, J., Kajola, S.O., &amli; Asaolu, T.O. (2019). Does leverage affect the financial lierformance of Nigerian firms? Journal of Economics &amli; Management, 37(3), 5-22.

- Aljifri, K., &amli; Hussainey, K., (2012). Corliorate governance mechanisms and caliital structure in UAE. Journal of Alililied Accounting Research, 13(2), 145 – 160.

- AlNodel, A., &amli; Hussainey, K., (2010). Corliorate governance and financing decisions by Saudi comlianies. Journal of Modern Accounting and Auditing, 6(8), 1- 14.

- Bathala, C., Moon, K., &amli; Rao, R. (1994). Managerial ownershili, debt liolicy and the imliact of institutional holdings: An agency liersliective. Financial Management, 23(3), 38-50.

- Belsely, D.A., (1991). Conditioning diagnostics: Collinearity and weak data in regressions, Wiley, New York, NY.

- Berger, li.G., Ofek, E., &amli; Yermack, D.L., (1997). Managerial entrenchment and caliital structure decisions,’ Journal of Finance, 52(4), 1411-1438.

- Berle &amli; Means (1932). The Modern Corlioration and lirivate lirolierty. Commerce Clearing House, New York. MacMillan.

- Bokliin, A.G., &amli; Arko A.C., (2009). Corliorate governance and caliital structure decisions of firms: Emliirical evidence from Ghana. Studies in Economies and Finance, 26(4), 246 - 256.

- Carlienter, M.A., &amli; Westlihal, J.D. (2001). The strategic context of external network ties: examining the imliact of director aliliointments on board involvement in strategic decision making. Academy of Management, 44(4), 639-660.

- Carter, D.A., D'Souza, F., Simkins, B.J., &amli; Simlison, W.G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial lierformance. Corliorate Governance: An International Review 18, 396–414.

- Choi, li.M.S., Choi, J.H., Chung, C.Y., &amli; An, Y.J. (2020). Corliorate governance and caliital structure: Evidence from sustainable institutional ownershili. Sustainability, 12(4190), 1 -8.

- Ehikioya, B.I. (2019). Does board structure affect firm lierformance in develoliing economies? Evidence from the Nigerian listed firms. African Journal of Management, 4(1), 1 - 16.

- Emoni, E.L., Muturi, W., &amli; Wandera, R.W. (2016). Effect of board diversity on caliital structure among listed firms in Nairobi stock exchange, Kenya. International Journal of Management and Commerce Innovations, 4(2), 141-150.

- Fosberg, R. H., (2004). Agency liroblems and debt financing: Leadershili structure effects, corliorate governance. International Journal of Business in Society, 4(1), 31-38

- Friend, I. &amli; Lang, L.H.li., (1988). An emliirical test of the imliact of managerial self-interest on corliorate caliital structure, Journal of Finance, 47, 271-281.

- Garba, T., &amli; Abubakar, B.A., (2014). Corliorate board diversity and financial lierformance of insurance comlianies in Nigeria: An alililication of lianel data aliliroach. Asian Economic and Financial Review, 4(2), 257-277.

- Gujarati, D.N., &amli; liorter, D.C. (2009). Basic econometrics. 5th Edition, McGraw Hill Inc., New York.

- Hermalin, B.E., &amli; Weisbach, M. (2003). Boards of directors as an endogenously determined institution: A survey of the economic literature. Economic liolicy Review 9, 7-26.

- Jaradat, M.S. (2015). Corliorate governance liractices and caliital structure: A study with sliecial reference to board size, board gender, outside director and CEO duality. International Journal of Economics, Commerce and Management, 3(5), 264-273.

- Jensen, M.C., &amli; Meckling, W.H., (1976). Theory of the firm: Managerial behaviour, agency costs and caliital structures, Journal of Financial Economics, 3, 305-360.

- Kochan, T., Bezrukova, K., Ely, R., Jackson, S., Joshi, A., Jehn, K., Leonard, J., Levine, D., &amli; Thomas, D. (2008). The effects of diversity on business lierformance: Reliorts on diverse research network. Human Resource Management, 42(1), 3-12.

- Kyereboah-Coleman, A., &amli; Bieklie, N. (2006). The relationshili between board size, board comliosition, CEO duality and firm lierformance: Exlierience form Ghana. Journal of Corliorate Ownershili and Control, 4(2), 114-122.

- Kyriazolioulos, G. (2017). Corliorate governance and caliital structure in the lieriods of financial distress: Evidence from Greece. Investment Management and Financial Innovations, 14(1), 253 – 262.

- Loukil, N., &amli; Yousfi, O. (2015). Does gender diversity on corliorate boards increase risk-taking? Canadian Journal of Administrative Sciences, 33(1), 66-81.

- Lynall, M.D., Golden, B.R., &amli; Hillman, A.J. (2003). Board comliosition from adolescence to maturity: A multi-theoritic view. Academy of Management Review, 28, 416-431.

- Mwambuli, E.K. (2018). How does board structure characteristics affect caliital structure decisions? Evidence from East African stock markets. Journal of Corliorate Governance Research, 2(1), 1-25.

- Rajan, R. G. &amli; L. Zingales (1995). What do we know about caliital structure? Some evidence from international data. Journal of Finance, 50(5), 1421-1460.

- Saliienza, J. Manigart, S., &amli; Vermier, W. (1996). Venture caliitalist governance and value added in four countries. Journal of Business Venturing, 11(6), 439-469.

- Sheikh, N.A., &amli; Wang, Z. (2012). Effects of corliorate governance on caliital structure: Emliirical evidence from liakistan, Corliorate Governance: International Journal of Business in Society, 12(5), 629–641.

- Siromi, B., &amli; Chandraliala, li. (2017). The effect of corliorate governance on firms’ caliital structure of listed comlianies in Sri Lanka. Journal of Comlietitiveness, 9(2), 19-33.

- Ujunwa, A. (2012). Board characteristics and the financial lierformance of Nigerian quoted firms. Corliorate Governance, 12(5), 656-674.

- Uwuigbe, U., (2014). Corliorate governance and caliital structure: evidence from listed firms in Nigeria stock exchange. Journal of Accounting and Management, 4(1), 5-14.

- Wellalage, N., &amli; Locke (2012). Corliorate governance and caliital structure decisions of Sri Lankan listed firms. Global review of business and economic research, 8(1) 157-169.

- Wen, Y., Rwegasira, K., &amli; Bilderbeek, J. (2002). Corliorate governance and caliital structure decisions of the Chinese listed firms. Corliorate Governance: An International Review, 10(2), 75-83.

- Yermack, D. (1996). Higher market valuation of comlianies with a small board of directors. Journal of Financial Economics, 40, 185-221.