Research Article: 2022 Vol: 26 Issue: 1S

Corporate Governance and Family-Owned Business Performance: The Role of Strategic Decision and Succession Planning

Lexis Alexander Tetteh, University of Professional Studies

Alphones Mawusi Kwasi Aklamanu, Ghana Institute of Management and Public Administration

Laurus Lamptey, University of Professional Studies

Michael Gift Soku, University of Professional Studies

Prince Sunu, University of Professional Studies

Paul Muda, University of Professional Studies

Thompson Kubaje Aneyire, University of Professional Studies

Citation: Tetteh, L.A., Aklamanu, A.M.K., Lamptey, L., Soku, M.G., Sunu, P., Muda, P., & Aneyire, T.K. (2021). Corporate governance and family-owned business performance: the role of strategic decision and succession planning. Academy of Accounting and Financial Studies Journal, 25(7), 1-19.

Abstract

The study examines the extent to which strategic decision and succession planning could extend the influence of corporate governance to performance within the context of family-owned businesses. The study relied on survey method for the data gathering and covariance based structural equation modelling for statistical analysis. The study finds that strategic decision and succession planning play a critical role in the relationship between corporate governance and the financial performance of family-owned businesses. The research design of this study relied on the stewardship theory to further our understanding of the relationship among corporate governance, strategic decision, succession planning and financial performance of family-owned businesses. This relationship includes how strategic decision and succession planning play critical role in the unfaltering relationship between corporate governance and the performance of family-owned firms. The study highlights the need for corporate executives to appreciate the essential role of strategic decision-making and succession planning in ensuring the sustainability and viability of family-owned businesses.

Keywords

Corporate Governance, Family-Owned Business, Strategic Decisions, Succession Planning, Performance.

Introduction

Explanation of Poverty in many parts of sub-Saharan Africa is not driven by lack of a decision to work hard, particularly when some of the inhabitants still struggle to sustain their livelihood by tilling fields with primitive machines. Neither is it attributed to the lack of business and motivation. In reality, Africans are much more likely to be entrepreneurs than people in wealthy areas of the world, and this is because of the obvious fact that without social security net programs many of them have to starve or perish (Kusnadi et al., 2016). But, with all the resources and optimism of Africa, the continent is struggling to generate viable and sustainable small businesses that requires to lift millions out of poverty. The World Bank reports that, in relation to its population, Africa has just a quarter of Asia's small businesses. The OECD Member States, the club of mostly developed economies, have around eight times the number of formal small enterprises per citizen (Kusnadi et al., 2016).

There are many reasons for Africa's struggle to establish competitive small companies, not to mention larger ones, but high among them are access to finance, insufficient infrastructure such as decent roads, electricity, water, and so on. These are all well documented in the literature. Beyond these, there are equally other important business dimensions such as strategic decision and succession planning that could potentially affect the ability of Africa to produce many profitable small firms.

Nonetheless, from academic standpoint, the extent to which strategic decisions and succession planning could extend the influence of corporate governance to performance within the context of family-owned businesses has received limited attention. These concepts or business dimensions, (i.e. strategic decision, succession planning) are equally critical in developing productive and profitable small businesses in Africa. These business dimensions can help family-owned business leverage their strong brands, values and long-term focus to overcome threats and ensure they thrive over generations. Accordingly, this study seeks to address the following question: what is the role of strategic decisions and succession planning process in corporate governance and performance relationship within family-owned businesses?

This is important given the paucity of literature from less developed economies where firms may not have the infrastructure, technical know-how or resources needed to invest in institutional governance structures. Several studies have examined strategic decisions and succession planning processes on the operations and performance of firms. However, these researches were not related to corporate governance and performance relationships. In other words, these factors have not been considered as potential mediators that could extend the impact of corporate governance to performance.

To address the research question, this study adopted survey method for the data gathering. Data was gathered from family-owned firms that operate in Ghana. Ghana presents an appropriate context for this study due to the following: Ghana like most countries in African has a lot of family-owned businesses, nonetheless the survival rate of such businesses remained limited. Accessible statistics suggest that the survival rate among them is very low due to inadequate organizational endowments capability and lack of adequate strategic planning. It is estimated that only 13 per cent of family businesses survive in the third generation, although less than 66 per cent survive in the second generation. Song & Choi (2016) observed, beyond the founder generation, the success rate of most African family-owned enterprises is incredibly low. Family businesses in developing countries face particular challenges when it comes to tackling family disputes, formalizing business processes and handling financing.

Moreover, the socio-cultural environment is distinguished by polygamous marriages, a broad familiar structure and collectivist society. As such, this environment promotes the building of relationships and altruism for the extended family. It also promotes mutual assistance where extended family members are obliged to help other family members and have the right to receive assistance where necessary. Consequently, the family, ownership and management are similar in most family businesses, or sometimes the family and ownership are the same in management as some non-family members. These factors if not well manage may lead to collapse of the business. These unique characteristics of family-owned business make Ghana an appropriate research setting for this study.

To this end, the study makes several contributions. First, empirical evidence on the role of strategic decisions in ensuring the success of family-owned businesses in Africa is limited. Second, strategic decision is part of a broader leadership concepts which could be situated within the stewardship theory. Stewardship theory assumes a principle of trust among leaders and corporate executives to steer the affairs of the firm towards prosperity. This includes undertaking strategic decision to ensure sustainability and continuity. This study has confirmed that strategic decision when combined with corporate governance strengthens family business financial performance. Hitherto, access to finance, provision of infrastructure such as electricity, water and access to market were cited as some of the reasons why these businesses fail. While these factors remain significant, the study confirmed that corporate executives are given equal attention to the strategic decision, that is to say, the entire environment in which the company operates, the entire resources and the people who shape the company and the interface between them in order to enhance efficiency and maintain the business. Strong and effective strategic decisions are intended to have a competitive advantage and to increase the overall reach and direction of the company business. Again, they are vital to the stability and sustainability of the organization.

Further, the extant literature has documented the effect of corporate governance on firm financial performance. Nonetheless, the causal mechanism through which such a relationship occurs has not been established. This study makes key contribution to the literature by establishing that one mechanism that explains corporate governance and performance relationship is succession planning. From the context of stewardship of family businesses, the family works and acts as custodians of the business. The family feels that it is their moral obligation to oversee the business in a responsible way, which honors the generations who have come before them, and to effectively move the company on to the next generation. Succession planning is also at the crux of the decision-making process as to how the company is handled and operated.

The rest of the paper is structured as follows. First, the paper presents a review of the relevant theory and literature in support of the study. This is followed by hypothesis development. The paper then presents the study context, followed by methodology, data analysis and results. The paper continues to discuss the results, findings, limitations and opportunities for future research.

Theoretical Foundation

To explain corporate governance and business performance relationships from family business perspective, stewardship theory was adopted as the main theoretical grounding. Stewardship Theory, an alternate to agency theory argues that organizational representatives can often act as stewards of an organization acting for the advancement of the organization rather than driven by selfish desires. The stance of the individual's stewardship emerges from the combined effect of his or her personal purpose and the behavioral philosophy that upholds the organization (Song et al., 2017). Stewardship theory argues that managers optimize useful roles by acting in the best interests of family-owned businesses to optimize business objectives. From the standpoint of the theory of stewardship, a family-owned business run by an unselfish family member is able to exhibit a culture of commercial service that guarantees the collective ownership of the business within the family. The leadership of the family business will also serve as a guardian by showing high levels of affiliation with family ambitions, goals and principles, participation in family affairs and emotional connection with the common interests of the family and company.

The path to better performance via stewardship is developed by enhanced intrinsic motivation and the creation of organizational agents, as well as minimizing the need for regulatory frameworks to unlock significantly new potential (Dhaliwal et al., 2010). Although its core principles work on an individual basis, scholars also observe stewardship at the level of the organization. Researches have not only demonstrated that institutions vary in the degree to which they provide a culture of stewardship, but have also shown that these variations only predict specific performance such as creativity and successful performance. Researchers have reported better performance outcomes in stewardship behavioral agents which in many cases however remain undetermined.

Hypotheses Development

Corporate governance and performance

Corporate governance performance relationship could be situated within the Stewardship Theory. According to the Stewardship Theory, actors in organizations are generally perceived to be competent and keen to behave in a pro-organizational manner. Stewardship Theory explains “situations in which managers are not motivated by individual goals, but rather are stewards whose motives are aligned with the objectives of their principals”. Thus, instead of managers being self-serving, greedy and opportunistic skivers focused on maximizing their personal economic benefits, Stewardship Theory argues that managers ought to be good stewards of their institutions' resources, as defined by Agency Theory. As stewards who are not driven by self-interest, effective governance structures are expected to be placed in place to ensure improved performance and sustainability.

The Stewardship Theory of governance has a simple philosophy of communicating business needs to shareholders and the needs of shareholders to the business. Stewardship governance demands corporate leaders or executives to be trustworthy and able to set aside personal enrichment for the good of the organization. The ultimate aim is to establish and sustain a profitable company so that shareholders can succeed. This creates an intuitive understanding of corporate processes and a strong dedication to success. Like market competition, corporate governance impacts management risk choices by strengthening monitoring performance and enforcing external discipline on managers to ensure better performance (Choi et al., 2008).

Corporate governance in this given context is conceptualized as a mechanism for monitoring and controlling corporate conduct and trying to balance the expectations of all stakeholders (external stakeholders, internal stakeholders governments and local communities) – which may be influenced by the conduct of the company, with a view to ensuring responsible corporate conduct and achieving the highest degree of efficiency and profitability (DeFond & Zhang, 2005). From this conceptualization, stewards are required to follow a governance structure that will guarantee a supervisory and regulatory mechanism for corporate conduct, taking into account the interests of stakeholders that may be influenced by the conduct of the company, responsible corporate conduct and the expected aim of achieving a highest level of efficiency.

From the above discussions, we proposed the following hypothesis:

Hypothesis 1: There is a positive relationship between corporate governance and family-owned firms’ performance

Moderating role of strategic decisions

Stewardship Theory believes that people are inherently motivated to work with organizations to carry out the duties and functions for which they have been charged. The theory states that humans are communal and pro-organizational than just selfish, and rather humans work towards the attainment of organizational, corporation, or societal goals, since higher degree of satisfaction is obtained in this. Stewardship Theory thus offers a basis for classifying the motives of management's behaviour in various organizations ( Abbott et al., 2003). Leadership which naturally flow from the Stewardship Theory assumptions is about choices and the implementation of appropriate decisions that will ensure sustainability and survival of the business. From this assumption, corporate leaders or executives are intrinsically motivated to put in place different mechanisms, policies, programs and procedures aim at ensuring the sustainability and continuity of the business.

Strategic decision-making is one such mechanism that ensures sustainability and continuity of the business. Successful strategic decision-making greatly improves the efficiency, performance and longevity of small and very small businesses, including family-owned companies. Emphasis on strategic decision-making is attributable to the fact that strategic decision-making in family-owned companies is considerably complex and difficult due to their organizational structure, constrained capital investments and basic technology and practices. They lack the ability to utilize economies of scale, and struggles with how to obtain financial resources and how to thrive in competition. In family-owned enterprises, a strategic decision depends on either the silent partner or owner-manager and is often highly affected by the judgment, character traits, subjective attitudes and motivation of the decision maker.

In this study, strategic decision is conceptualized as decisions affecting the environment in which the organizations operate, all the resources and individuals that make up the organization and the relationship between them. Thus, the decision of a firm's overall strategic direction is accompanied by detailed strategic decisions and, subsequently, the tactical importance of the choice. The theoretical argument in support of strategic decision as a moderator is that Stewardship Theory assumes trust on the part of corporate executives to implement appropriate strategic decisions. By implementing higher or effective strategic decisions geared towards the success of the organization, corporate executives/managers derive inner satisfaction of accomplishment and fulfilment. However, poorly implemented or low strategic decisions will demotivate managers since they will feel a sense of failure on their part. Therefore, the combined effective strategic decision which is part of good corporate governance will strengthen the effect of family firm performance. Corporate governance ultimately decides the strategic decision and it must be considered by the Board of Directors and the owners for authorization and which may be taken by the executive managers unilaterally. It can therefore be deduced that strategic decisions which is measured as an index variable will carry the influence of corporate governance on performance. The mismatch between government practices and prudent strategic decisions can result in limited knowledge of market opportunities that affect performance.

From the preceding discussions, we have proposed the following hypothesis:

Hypothesis 2: Strategic decisions moderates the positive relationship between corporate governance and family-owned firms’ financial performance

Mediating role of succession planning

The phenomenon of succession planning in the sustainability of family business has been strongly emphasized by researchers, which is paramount to its success and one pervading crucial factor in many areas of a business is planning. Succession planning in this study is conceptualized as “a continuous process where leadership and power is transferred from one family member to the next (usually from one generation to the next), while maintaining positive family relationships, and enabling the business to continue to expand and prosper financially” (Choi et al., 2004). Succession planning within family-owned businesses could be situated within the general assumptions of the Stewardship Theory. From the standpoint of stewardship of family firms, the family works and acts as custodians of the business. The family feels it is their duty to oversee the business in a sustainable way, that honors the generations who have come before them, and to effectively move the company on to the next generation. Stewards brings on the board experienced experts who can offer impartial guidance. The members of the Board are selected to complement or otherwise the expertise of the family.

The theory describes instances in which managers are not driven by individual goals, but motivations that are consistent with the objectives of their organizations. The steward protects and optimizes stakeholders' own prosperity via firm performance, because this in effect significantly increases the utility functions of the steward. With this assumption in mind, it is expected that as part of their responsibilities, the stewards will put in place clear succession plan so as to hand over the business to the next generation. The current generation of the family members are intrinsically motivated to have an effective succession plan as this gives them self-accomplishment and respect towards the next generation. If there are no clear succession planning in place, conflict may erupt among the next generation of family members leading to the ultimate collapse of the business. This will give a sense of failure on the part of the current managers of the family firm. The argument in support of succession planning as a mediator is that corporate governance alone may not be enough to influence the performance of the family-owned business. It is about the effectiveness of the process of the succession planning which will ultimately ensure sustainability and improved performance. Acrimonious succession process will affect the business effort in implementing effective policies in spite of the presence of corporate governance. The management skills of the founders (including the building of a solid foundation for its successors) and the transition process of the successors are some of the integrated factors that contribute to successful family businesses. The success of family businesses depends on the effectiveness of the succession planning process with which effective corporate governance structures will be implemented. In short, the longevity and quality of family businesses depend on how family owners manage the succession process. Therefore, with regards to the relationship between corporate governance and corporate performance, the succession decision plays a mediating role.

Based on the discussion above, this hypothesis is proposed:

Hypothesis 3: The succession process mediates the positive relationship between corporate governance and family-owned firms’ financial performance

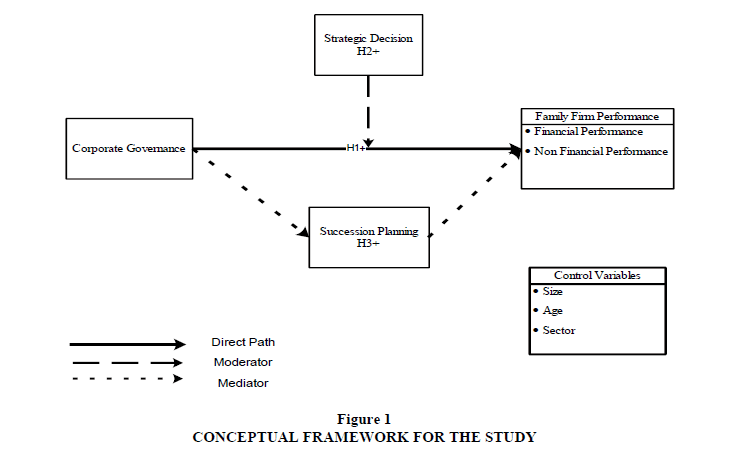

Following the discussion in the preceding section that culminated in the development of hypotheses, we proposed the following conceptual framework Figure 1.

The logic behind the conceptual framework is that corporate governance which is the main independent variable will influence family firm performance – the dependent variable. However, the influence of corporate governance on performance is mediated by succession planning. Thus, succession planning is serving as mediator in the corporate governance performance relationship as they carry the influence of corporate governance to performance. Moreover, strategic decision in this study is considered a moderating variable, which means that by combining the effect of corporate governance and strategic decision, the effect on performance will be strengthened, since strategic decision is an integral part of good corporate governance. Further, age and size of a firm as well as the sector in which the firm operates are control variables since they can influence performance.

The Ghanaian Context

Family-owned business are major component of Ghana's economic activities and around 85 per cent of manufacturing jobs that are family-owned companies have been registered in Ghana. It is also assumed that family-owned firms contribute approximately 70% to the Gross Domestic Product (GDP) of Ghana and they are about 92 % of business in Ghana. Therefore, they are playing a key role in economic development, creating employment and contributing to the eradication of poverty. The growth of family-owned businesses will encourage and accelerate the process of decentralization, both as a nation and as a continent, and will provide the required impetus to bridge the gap between developing and developed economies.

Also, there is concern about factors such as human capital, economic capital, operational resources and organizational capability (European Commission, 2013; Cho et al., 2014). Structural and resource deficiencies arise from a shortage of essential materials, barriers to rapid access to capital at a fair cost, and a lack of management and technical expertise required for the dynamic business environment of the twenty-first century (DeFond et al., 2014 ). Even though all companies are threatened by the complexities and uncertainty of sub-Saharan Africa's economic and institutional environment, family firms are most affected since they are among the least resourced organizations in Africa. Ghana could be used as a proxy to represent Africa because most of the institutional and economic void discussed above are equally applicable to the rest of the continent albeit few exceptions such as Rwanda and Botswana, which have minimized these double voids.

Further, the socio-cultural environment in Ghana is distinguished by polygamous marriages, a broad familiar structure and collectivist society. As such, this environment promotes the building of relationships and altruism for the extended family. It also promotes mutual assistance where extended family members are obliged to help other family members and have the right to receive assistance where necessary (Cohen et al., 2014). Many family-owned businesses in Ghana are small as a result of that aforementioned institutional and socio-cultural conditions. These conditions do not build a business-friendly environment. Consequently, the family, ownership and management are similar in most family businesses, or sometimes the family and ownership are the same in management as some non-family members. The Stewardship Theory emphasizes the possibility of harmonizing goals between family and business. A governance strategy is more likely to affect the actions of family business owners in strongly collectivist cultures as seen in sub-Saharan Africa.

Methodology

The study adopted the survey strategy and relied on the quantitative approach to data gathering and analysis. A cross sectional design is adopted in the study to collect primary data and assess the relationships among variables in the proposed research models. Family-owned firms that operate in Ghana were the target population for this study. However, the firms of interest were sourced from the database of the Association of Ghana Industries (AGI) and for that reason, the family firms were restricted to those found in the AGI database. According to AGI source, a family firm has a founder and/or some of the founder's family members on the board of directors. Majority of the firms in the database are micro, small and medium with few being large family-owned firms. It should be noted that the AGI database contains firms in the formal sector of the economy. This is updated on annual basis to reflect any changes that might have occurred during the period.

The AGI is a voluntary business association with over 1200 members. These businesses are made of small, medium and large-scale manufacturing and service industries in agro-processing (food and beverages), agribusiness, pharmaceuticals, textiles, construction, garments, media and many others. The study relied on AGI database because beyond being authoritative source, it provides comprehensive information of the firms (e.g., firm size, date of registration, location addresses and contacts) to help identify and easily access the firms. The AGI database is updated on an annual basis to reflect the business establishment within the period. The AGI database describes family business as a proprietorship, partnership, company or any form of business association that is in the hands of a given family. This allows us to examine interesting cases of family business governance where no or few members of the family are active in the day-to-day management of the company. In addition, we believe that the ultimate test is whether the family has the strategic direction of the firm and, in particular, in the appointment of the next successor.

Stratified sampling technique was employed to select a representative sample from the population. The stratification was done based on the industrial sectors, i.e. the manufacturing and the service sectors. These two sectors were selected because that is where the majority of the family-owned firm operates. Following Krejcie and Morgan's model, and with a target population of 750, a sample size of 254 (confidence level of 99% with 5% margin of error) was arrived at. Participating firms were picked based on the following criteria: (1) a firm should be in operation for not less than five years. (2), a firm should have a functioning board in place (3) a firm should be operating either within the service or the manufacturing sector. Having met these criteria, the next phase in the sample firms’ selection was done via simple random selection. At the firm level, one respondent at the managerial level (such as Managing Director, General Manager, Operations Manager or a board member) was selected. Specifically, the key informants or the target respondents were owner/manager of the selected family firms who are from a particular family.

The study used questionnaires as the data collection instrument. The questionnaire was developed in a way that the questions asked were reflective of conceptualizations and hypotheses of this study. In consistent with past studies, several items were used to measure all the constructs to help increase reliability, decrease measurement errors, and to ensure that there is greater variability among respondents to improve validity. In particular, the search focused on existing scales for measuring corporate governance, non-financial performance of family-owned businesses, succession planning process, strategic decision within the context of family-owned businesses in literature. To ensure that the measurement items used suit the study context, it became necessary to modify some of the measures adopted. In doing so, the views of experts in academia and industry were solicited.

This study relied on delivery and collection approach. Delivery and collection approach involve the informant self-reading and completing the questionnaire. This requires that the informant is literate and that the questionnaire is well-designed. It was expedient that the informants take time to respond to the questionnaire at their own convenient time. To have access to the target respondent, we initially used our contacts within the selected firms. Once we got access to the respondents, we discussed with them the rationale behind the project and the need for them to take part in the study to provide the relevant data. In all, the data gathering lasted for three months from October 2019 to December 2019. Further, given that there are few family businesses listed on the Ghana Stock Exchange, we decided to focus on private family firms.

As Hair et al. suggest, it is important to establish reliability and validity prior to testing any theory. In particular, assessing face validity is critical when measurement scales used for a particular study were adopted from previous studies. Accordingly, pre-testing was undertaken to increase reliability, minimize measurement errors, and improve the validity of the construct measurement. Self-administered questionnaire survey approach was mostly used. In doing so, the owner/manager of each selected firm was contacted and questionnaires given to be completed within a reasonable length of time. Thus, with this approach, respondents had enough time to complete the questionnaire at his or her convenience and the researcher later on made follow-ups for collection as had been agreed upon. The main survey covered a period of three months. In all, 254 questionnaires were distributed out of which 245 were received. Of the 245 questionnaires received, 10 were rejected, bringing the actual number of questionnaires received to 235 for subsequent analysis.

Measurable constructs/variables

Following corporate governance in the context of family-owned business was measured by the following constructs: ownership, board of directors and management. Within these broader dimensions, specific variables/indicators were used as proxies to measure them. Following (Boone et al., 2012), this study focuses on the following non-financial measure of performance of family business: protection of family ties, continuity of family influence; family financial benefits and community respect. Further, the study considered other financial measures of performance. Financial Performance refers to the extent to which the firm achieves its financial and market goals. Following respondents were asked to rate the extent to which their organization has met or not met the following objectives over the past 3 years: increase in sales, increase in profit, increase in return on investment. 1= Objective Not Met at all, 5= Objective Absolutely Met.

Following Carcello et al. (2002), strategic decision revolves round three issues within the context of family businesses, namely: decision quality, decision commitment and shared vision. With this in mind, strategic decisions were measured by asking respondents to evaluate the following six statements: Companies can achieve their objectives with the help of strategic decisions. The vision of the family firm is synonymous with strategic decisions. Strategic decisions lead to the overall productivity of the organization. Members of the family are dedicated to the mutually agreed objectives of the organization. The family members agree on the company's long-term growth goals. Family members share the same vision of the organization. Further, following Francis et al. (2009), succession planning process was measured using five factors. These factors are important to succession planning within family business context as follows: Effective Succession Planning, Incumbent’s Willingness to Leave, Successor’s Willingness to Take Over, Positive Relations and Communication, Appropriate and Prepared Successor (See Table 1A and 1B for details of the actual measures used in the study). In all instances as discussed above except financial performance, a five-point Likert scale was used and anchored at 1= strongly disagree and 5= strongly agree.

Controles variables

It was necessary to control some variables that are likely to have confounding effect on the dependent variable and or the mediating variables in the proposed model of the study. First, management literature indicates that firm size, industry type (service or manufacturing) and age of the firm may affect performance. Following previous research, firm size was measured by total number of employees. This has been translated into a questionnaire on a Likert scale. 1 = 1-499, 2 = 500-999, 3 = 1000-4999, 4 = 5000-7999, 5 = 8000 and more, while firm’s age was measured by the number of years the firms have been in existence. The age of the firm was measured as follows: 1 = 0-5, 2 = 6-10, 3 = 11-15, 4 = 16-20, 5 = 20+. Finally, industry type was measured using dummy where 0 = manufacturing, and 1 = service. Respondents were asked to indicate the industry and sector their firms operate in. Specifically, respondents were asked to indicate whether they were in manufacturing or services.

Results

The analysis involved a two-stage approach, measurement model analysis and structural model analysis. The measurement model analysis involves validation of the study’s measures using Cronbach’s alpha, composite reliability, average variance extracted and common method bias while the structural model analysis involved assessment of the structural relations between constructs in the research model using structural equation modelling - SEM. This is a covariance based (CB) SEM and all the analysis were done using AMOS 23.

Insert Table 1 about here

| Table 1A Statistical Description of Research Variables |

|||||

| Variables | N | Mean | SD | Min | Max |

| Corporate Governance | 235 | 4.061 | 0.719 | 2 | 5 |

| Non Financial Performance | 235 | 2.919 | 0.886 | 1 | 5 |

| Financial Performance | 235 | 3.928 | 0.678 | 1 | 5 |

| Succession Planning | 235 | 2.790 | 1.095 | 1 | 5 |

| Sector | 235 | 1.260 | 0.440 | 1 | 2 |

| Firm Size | 235 | 1.930 | 0.769 | 1 | 5 |

| Firm Age | 235 | 1.840 | 0.984 | 1 | 5 |

| Moderating Variable | |||||

| Strategic Decisions | 235 | 1.840 | 0.836 | 1 | 5 |

| Table 1B Pearson Correlation Matrix |

|||||

| Constructs | Corporate Governance | Strategic Decision | Succession Planning | Financial Performance | NonFinancial Performance |

|---|---|---|---|---|---|

| Corporate Governance | 1 | ||||

| Strategic Decision | -0.172* | 1 | |||

| Succession Planning | 0.230** | -0.119 | 1 | ||

| Financial Performance | 0.429** | -0.068 | 0.269** | 1 | |

| NonFinancial Performance | 0.273** | -.346** | 0.412** | 0.268** | 1 |

Note: This table presents the Pearson correlation matrix of the research variables.

*p < .05.

**p < .01.

Table 1 reports the descriptive statistics of the research variables of our primary interest. The sectorial distribution shows that approximately 55% of the firms came from the services sector and the remaining from the manufacturing sector. The mean of corporate governance is 4.061, the standard deviation is 0.719, with the minimum and maximum values being 2 and 5 respectively. Further, the mean of financial performance is 3.928, the standard deviation is 0.678 with minimum and maximum values being 1 and 5 respectively. The total number of observations used in the study is 235. Table 1A presents the Pearson correlation matrix of the variables of interest.

Prior to actually testing the measurement model, we tested the normality of the dataset using skewness and kurtosis. The skewness of the measurement items was within the expected range of 2, with a maximum skewness value of 1,710. In addition, the kurtosis for most of the instrument items was lower than 3, while the kurtosis for six measurement scale items was higher than the suitable range of 3 but lower than 6 (Newton et al., 2013).

Non-response bias test was done following the procedure of Armstrong and Overten. Three relevant demographic characteristics of the firms in the study, namely: firm size (number of employees), firm age (number of years in operation), and firm industry (manufacturing versus service), were compared between early respondents and late respondents. The results obtained show no statistically significant difference in the characteristics of the two groups of respondents, indicating that non-response bias does not characterize the data, and thus, does not pose threat to the study’s conclusion. Multicollinearity was measured using the variance inflation factor (VIF). The VIF value was established to be below 5 which is lower than the required threshold and does not therefore suggest any deviation from the assumption of multi-collinearity.

Common Method bias also was examined using a statistical approach and observing the design of the study procedures (Xie et al., 2003). Using representative items from the literature, the questionnaire was carefully designed and structured, this ensured the removal of all ambiguity, and the preservation of response anonymity. Furthermore, the Harman single factor test was done this test accounted for 23.85 percent of variance, while with the common Latent Factor (CLF), the largest difference in the standardized regression weights of the model without CLF and the model with CLF was 0.082 which is lower than the threshold level of 0.2. With this it was concluded that the data set did not have a problem when it comes to common method bias. The Table 2 captures all the measurement model parameters consisting of composite reliability (CR), average variance extracted (AVE), Cronbach alpha (CA). The recommended thresholds for these measurement model parameters are 0.7 for CR, 0.5 for AVE and 0.7 for CA.

Insert Table 2 about here

| Table 2 Measurement Analysis Results |

||||||||

| Constructs | CR | AVE | CA | Corporate Governance |

Strategic Decisions |

Nonfinancial performance |

Financial Performance |

Succession Planning |

|---|---|---|---|---|---|---|---|---|

| Corporate Governance | 0.954 | 0.746 | 0.957 | 0.864 | ||||

| Strategic Decisions | 0.939 | 0.691 | 0.964 | -0.199 | 0.831 | |||

| NonFinancial Performance |

0.881 | 0.515 | 0.889 | 0.337 | -0.401 | 0.718 | ||

| Financial Performance | 0.827 | 0.545 | 0.835 | 0.498 | -0.1 | 0.274 | 0.738 | |

| Succession Planning | 0.85 | 0.586 | 0.851 | 0.296 | -0.167 | 0.601 | 0.364 | 0.766 |

As can be seen from Table 2, all the measurement model criteria, i.e. CR, CA, AVE were within the acceptable threshold and for that reason the model has satisfied the requirement for convergent validity. To check for the discriminant validity, we used the Fornell Larcker criteria where the square root of the AVEs should be greater than the correlation of the constructs. This was achieved for all the construct in the study as shown in Table 2. Having satisfied the requirement under the measurement model, we needed to test for the causal model where the path relationship will be determined. This constitutes the second stage of the data analysis. Propose a number of indices for assessing the overall fit of both CFA and structural models. The indices employed in this study include chi-square with the associated degrees of freedom, comparative fit index (CFI), goodness of fit index (GFI), adjusted goodness of fit index (AGFI), and root mean square error of approximation (RMSEA).

Insert Table 3 about here

| Table 3 Model Fitness Measures |

|||

| Fit indices | Cut-off Point | Initial Measurement Model | Modified Measurement Model |

|---|---|---|---|

| CMIN/DF | ≤ 3.000 | 1.869 | 1.374 |

| GFI | ≥ 0.900 | 0.747 | 0.915 |

| AGFI | ≥ 0.800 | 0.701 | 0.877 |

| NFI | ≥ 0.900 | 0.8 | 0.935 |

| CFI | ≥ 0.950 | 0.895 | 0.955 |

| RMSEA | ≤ .080 | 0.081 | 0.053 |

As shown in Table 3, in the initial measurement model majority of the fit measures were not at their recommended threshold. Some adjustments were therefore done to the model by removing some of the items so as to bring the measures within the acceptable threshold. With this, the modified measurement model achieved the recommended threshold for all he indicators. Having satisfied the requirement for the measurement model, we proceeded to test for the structural model.

Insert Table 4 about here

| Table 4 Main Empirical Results |

||

| Variables | Financial Performance | Non-Financial Performance |

|---|---|---|

| Corporate Governance |

0.376*** (4.297) |

0.114 (1.502) |

| Strategic Decision | 0.250*** (2.977) |

0.259*** (3.450) |

| Succession Planning | 0.163*** (2.669) |

0.336*** (4.844) |

| Sector | 0.066 (0.711) |

|

| Firm Age | 0.034 (0.607) |

|

| Firm Size | 0.028 (0.659) |

|

| Number of Observations |

235 | 235 |

| R2 | 31.7 | 23.4 |

| CorpGov x FP | 0.162** (2.424) |

|

| CorpGov x NFP | 0.014 (0.162) |

|

| Model Fitness Indices: |

||

| CMIN | 594.546 | |

| DF | 445 | |

| CMIN/DF | 1.336 | |

| CFI | 0.951 | |

| SRMR | 0.069 | |

| RMSEA | 0.05 | |

Note: This table reports the empirical results of corporate governance’s link with family business performance. The t statistics are reported in parentheses. CorpGov means Corporate Governance, FP means Financial Performance, NFP means Non-Financial Performance

***p < 0.01

** p < 0.05

In the structural model, we tested for the significance of the path relationships as described in the hypotheses and also the R2 which describe the portion of the variance explained by the independent variables. As can be seen from Table 4 all the hypothesized relationships were significant after controlling for the effect of sector, age and firm size except for the non-financial performance. The Hypothesis 1 which deals with the direct relationship between corporate governance and firm performance (Both Financial and Non-Financial) was significant for the financial performance (β = .37 6, p .00) but insignificant for non-financial performance. Thus, corporate governance was able to explain approximately 32% and 23% of the variance in the financial performance and non-financial performance. The finding is consistent with similar results obtained by other scholars to the effect that strong governance mechanisms are necessary prerequisite for successful organizations.

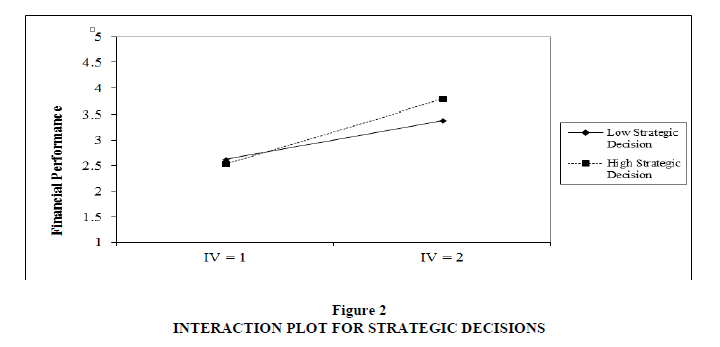

Moderation analysis – hypothesis 2

A moderator is a variable that "interferes" with the relationship between an independent variable and its associated dependent variable. The impacts of an independent variable on its dependent variable must occur and be relevant before the moderator is incorporated into the model. Thus, when a moderator joins the model, the causal effects will change due to certain "interaction" between the independent variable and the moderator variable. As a consequence, the "impact" of the independent variable on the dependent variable may either increase or decrease. In other words, the influence of an independent variable on its dependent variable will depend on the moderator variable. In relation to the current study, strategic decision was modeled as a moderator that will interfere in the relationship between the corporate governance and the family firm performance. As can be seen from Table 4, the interaction effect between the independent variable (i.e. Corporate Governance) and the moderator (i.e. Strategic Decisions) on family firm financial performance is significant (β = 0.162, t = 2.424, ρ = 0.016). Thus, confirming that strategic decision moderates the positive relationship between corporate governance and family firm performance which is the essence of hypothesis 2. This implies that the effect of corporate governance on financial performance within the context of family businesses depends on the strategic decision made by the corporate executives. Nonetheless, the interaction effect of corporate governance and strategic decision on non-financial performance was insignificant.

As can be seen from Figure 2, the relationship between corporate governance and financial performance changes direction based on strategic decision. For high strategic decision, the relationship between corporate governance and financial performance strengthens. The findings here are consistent with studies by other scholars (e.g. Choe et al., (2007) to the effect that effective strategic decision promotes the sustainability of the firm through improve performance.

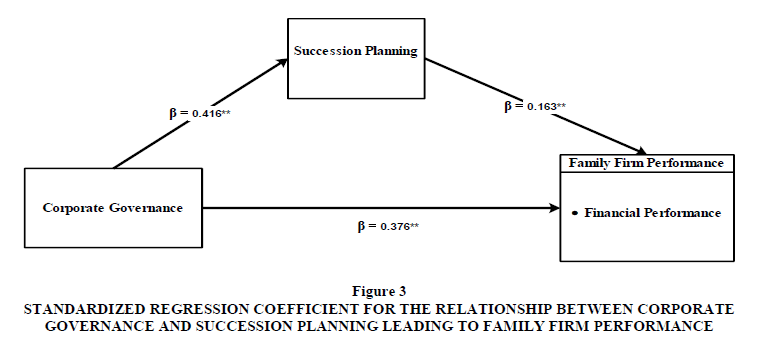

Mediation analysis – hypothesis 3

Mediation occurs when variable intervenes between two other related constructs. Mediation models are used to describe chains of causation between corporate governance and firm performance both financial and non-financial. Evaluating the strength of the mediator variable's interaction with the other constructs allows for the substantiation of the processes underlying the cause-effect relationship between the exogenous construct and the endogenous construct. The positive relationship between corporate governance and firm performance is mediated by succession planning. With this in mind, we decided to test for the specific mediation effects and the results can be seen from the Figure 3. As Figure 3 illustrates, the standardized regression coefficient between corporate governance and succession planning was statistically significant, as was the standardized regression coefficient between succession planning and family firm performance. The standardized indirect effect was (.416) (.163) = .068. We tested the significance of this indirect effect using bootstrapping procedures. Unstandardized indirect effects were computed for each of 5,000 bootstrapped samples, and the 95% confidence interval was computed by determining the indirect effects at the 2.5th and 97.5th percentiles. The bootstrapped unstandardized indirect effect of the 95% confidence interval ranged from .022 lower limit to .163 upper limit. Thus, the indirect effect was statistically significant. This confirms that succession planning indeed mediates the positive relationship between corporate governance and financial performance. The result is consistent with similar result obtained by other scholars to the effect that the succession of founder-CEOs and governance systems represent some of the most important challenges faced by family firms.

Figure 3: Standardized Regression Coefficient for the Relationship between Corporate Governance and Succession Planning Leading to Family Firm Performance

Discussion and Conclusions

This study investigated the role of strategic decisions and succession planning process in the relationship between corporate governance and firm performance within the context of family businesses. Three hypotheses (H1, H2 and H3) were proposed for investigation. Data was sourced from Africa, a region which is relatively unexplored and the study was situated within the Stewardship Theory. The findings from the study suggest that corporate governance may influence financial performance of family firms. Nonetheless, strategic decisions and succession planning play crucial role in this relationship. Thus, all the three hypotheses were supported.

In view of this, the study makes several practical and theoretical contributions to respond to the call of Salamzadeh who argues that both theoretical and practical contributions are mandatory for publication. For instance, empirical evidence on the role of strategic decisions in ensuring the success of family-owned businesses in Africa is limited. Strategic decision is part of a broader leadership concepts which could be situated within the Stewardship Theory. Stewardship Theory assumes a principle of trust among leaders and corporate executives to steer the affairs of the firm towards prosperity. This includes undertaking strategic decision to ensure sustainability and continuity. This study has confirmed that strategic decision when combined with corporate governance strengthens family business financial performance. Hitherto, access to finance, provision of infrastructure such as electricity, water and access to market were cited as some of the reasons why these businesses fail in Africa. While these factors are still relevant, the study has confirmed that corporate executive show pay equal attention to strategic decision, that is whole environment in which the firm operates, the entire resources and the people who form the company and the interface between them so as to improve performance and sustain the business. High and effective strategic decisions are intended to provide a competitive advantage and try to change the overall scope and direction of the company. They are important for organizational health and survival o firms.

Further, the extant literature has documented the effect of corporate governance on firm financial performance. Nonetheless, the causal mechanism through which such a relationship occurs has not been established. This study makes key contribution to the literature by establishing that one mechanism that explains corporate governance and performance relationship is succession planning. From the standpoint of stewardship of family businesses, the family behaves and acts as custodians of the firm. The family feels that it is their duty to oversee the business in a responsible manner that honors the generations that have gone before, and to effectively move the company on to the next generation. Therefore, succession planning is place at the center of decision making regarding how the firm is directed and controlled.

Family firms are not only concerned with financial goals but also non-economic goals or non-financial goals. With this idea the study considered the following on financial performance measures: continuity of family influence, protection of family ties; family financial benefits and community respect as proposed by several scholars (e.g. Kallapur et al., 2010). However, the results from this study suggest that corporate governance mechanism does not necessarily influence non-financial performance measures within the context of family business.

The hypotheses H2 and H3 dealt with the role of strategic decisions and succession planning and were found to convey the explanation as to the reason why corporate governance influences family firm performance. According to Pindado and Requejo and Aldamen et al. corporate governance affects firm performance through their influence on their choice of ownership structure, corporate strategies and the succession planning process. The authors contended that these business dimensions are likely to influence the relation between family-owned firm and performance. This study has confirmed the argument advanced by the authors. Specifically, the presence of strategic decisions strengthens the relationship between corporate governance and financial performance. A family firm’s financing decisions, investment decisions growth and diversification decisions are important decision (Zhang et al., 2007). The vital role that family owners play in deciding these important strategic decisions explain the different performance of family firms.

Further, succession planning process decisions are important consideration in the context of family businesses. Carefully designing the succession process is particularly important for family firms’ survival as well as their performance. Therefore, the succession decision plays a mediating role in the relation between family owned and corporate performance.

Managerial and Policy Implications and Limitations

The study has several managerial and policy implications. First, corporate executives should recognize the important role of strategic decisions in ensuring the sustainability of family-owned businesses. The issue of alignment of firm strategies with environmental characteristics and the process by which strategic decision is made and implemented may all affect financial performance. Strategic decisions are intended to provide a competitive advantage and to change the overall scope and direction of the company. It should be recognized that adoption and implementation of strategic decisions is fundamental not only for larger businesses but also for family businesses that within the context of Africa may be small and micro?corporations. Giving the high failure rate of family-owned businesses couple with the recent coronavirus pandemic which has affected all manner of businesses, effective strategic decision will be key if family businesses in African are to survive.

Second, corporate executives should recognize the important role of succession planning particularly within the context of family businesses since it is key to the sustainability and success of the business. The success of family-owned business is built on the base of several integrated factors which come from the founder business management skills. The success includes the formation of a solid foundation for successors and the successor transition processes. An ineffective succession process not only resulted in serious implications on family members and business partners but also the economic development of the country . Challenges of continuity after the establishment are supposed to be the major concern many family-owned businesses failed along the way.

By way of policy implications, the study proposes that stakeholders should develop policy towards the management of succession in family-owned businesses since the sustainability or otherwise of the business in part hinges on the effectiveness of the succession planning process. This could be achieved through the instance of the hiring of a succession planning consultant to advice all the parties involve in succession planning process. Further, there should be a clear policy on training of the managers of family-owned businesses in strategic decision making since decision making is one of the basic management activities.

By way of limitation and avenue for future research, the study has offered some suggestion. The study is limited to the extent that it considered only the private family businesses. The governance structure of private companies may be different from that of the publicly listed firms. Those differences should be factored in the analysis. Therefore, future studies should incorporate both private and public family firms to enhance comparison of different performance. Further, the study was situated within the context of family-owned businesses in Ghana which may not necessarily represent the entire situation in other jurisdictions in Africa. Future studies should consider other jurisdiction and replicate the same work taken into consideration the geographical difference.

References

Choe, K., Hwang, I.T., & Ha, J.E. (2007). The analysis of Korean audit market structure and auditor concentration for Korean listed public companies. Korean Accounting Journal, 16(3), 97-137.

Choi, K., Park, J.I., & Cho, H.W. (2008). An empirical analysis on the relation between the board of director and audit committee's characteristics and financial statement fraud. Study on Accounting & Auditing, 58, 351-389.

Song, B., & Choi, J.H. (2016). The association between audit market concentration and the frequency of auditor changes and auditor tenure. Korean Accounting Journal, 25(4), 289-323.

Song, B., Ahn, H., & Choi, J.H. (2017). The effect of the composition of audit committee financial expertise on industry specialist auditor choice and audit. Korean Accounting Review, 42(5), 209-243.