Research Article: 2022 Vol: 25 Issue: 3S

Corporate governance and financial performance: the mediating effect of corporate social responsibility

Arzizeh Tiesieh Tapang, Michael Okpara University of Agriculture Umudike

Ashishie Peter Uklala, University of Calabar

Geraldine Banku Mbu-Ogar, University of Calabar

Ekpenyong Bassey Obo, University of Calabar

Eme Joel Efiong, University of Calabar

Abosede Abimbola Usoro, University of Calabar

Monica Peter Lebo, University of Calabar

Roland Agwenjang Anyingang, University of Buea

Citation Information: Tapang, A.T., Uklala, A.P., Mbu-Ogar, G.B., Obo, E.B., Efiong, E.J., Usoro, A.A., Lebo, M.P., & Anyingang, R.A. (2022). Corporate governance and financial performance: the mediating effect of corporate social responsibility. Journal of Management Information and Decision Sciences, 25(S3), 1-8.

Abstract

The study looked at the role of corporate social responsibility in mediating the link between corporate governance and financial performance. Data obtained from secondary sources were analyzed using the partial least square techniques employing an ex-post facto research approach. The structural equation modeling approach was adopted and the results revealed that corporate social responsibility has an insignificant effect on corporate governance. It also revealed that corporate social responsibility has a significant effect on financial performance. Additionally, the results showed that corporate governance has a significant effect on financial performance. Furthermore, the research found that corporate social responsibility has no role in mediating the relationship between corporate governance and financial performance. Conclusively, the study suggests that corporate social responsibility does not play any role in mediating the link between corporate governance and financial performance. The study suggests that a unified corporate organization be established with the purpose of collecting and compiling corporate governance-related data and developing relevant indices to aid corporate governance investigation in Nigeria. Corporate social responsibility initiatives should be recognized using acceptable methods. Banks should plan carefully in order to fulfill their corporate responsibility obligations, ensuring that their lending and investment strategies do not encourage environmentally perilous business activity or waste pollution. Banks financial performance does not improve solely as a result of corporate governance and corporate social responsibility. There is still a slew of other things to keep an eye on. As a result, if the banks wish to increase their financial performance, other techniques such as sustainability modernization and incessant enhancement must be implemented.

Keywords

Banks; Corporate governance; Corporate social responsibility; Financial performance; Mediation.

Introduction

The financial sector is becoming increasingly receptive to new products and services as globalization and technology improvements accelerate. On the other side, financial regulators throughout the world are trying to analyze the situation and handle the chaos ( Uwuigbe & Fakile, 2012). Corporate governance has been prioritized across the Nigerian economy. The Peterside Committee on Corporate Governance in Public Companies, for example, was founded by the Securities and Exchange Commission. The Bankers' Committee has formed a corporate governance sub-committee for banks and other financial organizations in Nigeria. This emphasizes the significance of corporate governance in determining whether or not a firm succeeds (Ogbechie, 2006). Thus, corporate governance refers to the processes and structures that direct and manage an institution's operations and affairs in order to generate long-term shareholder value by increasing corporate performance and accountability while also taking other stakeholders' interests into account (Jenkinson & Mayer, 1992). Corporate governance entails establishing trust, assuring openness and accountability, and maintaining an effective channel of information disclosure to promote successful firm performance. It is therefore critical to underline that for more than a decade, the notion of bank and very large firm corporate governance has been a top legislative goal in developed market economies. Furthermore, the concept is slowly gaining support as a priority across the African continent.

Corporate social responsibility is based on the concept of stewardship accounting. This principle is the bedrock of financial reporting. The concept of stewardship accounting provides the link that connects financial accounting and social responsibility accounting in a continuous line of historical development. As a result, this word should be interpreted to mean that CEOs have a social responsibility as caretakers of the social assets entrusted to them. Social stewardship requires revealing information to enable informed decisions on the quality of social asset management, which we might define as asset management for the benefit of society.

According to Suteja et al. (2017), the financial system cannot be chosen at random as a research framework. The banking industry is currently undergoing tremendous expansion (Suteja et al., 2017), and CSR problems in social accounting and corporate governance have become increasingly important. Banking organizations' operations, such as lending and investment strategies, can be considered similarly ecologically sensitive when contrasted to the direct impact of polluting enterprises. Banks can declare what they're doing to ensure that their lending and investment policies don't encourage environmentally harmful industrial practices, according to Branco & Rodrigues (2006). Financial institutions, on the other hand, consume a lot of resources like paper and electricity, as well as generate a lot of waste. As a result, policies governing how businesses contribute to energy management, natural resource management, and recycling operations are key components of their corporate social responsibility efforts (Khoiruman & Haryanto, 2017).

Statement of the Problem

The banking sector, like other sectors in developing nations, has experienced a number of failures. As a result, a number of events, both in developed and developing countries have heightened interest in corporate governance. Following a series of high-profile firm failures, corporate governance has risen from relative obscurity into the global business spotlight. Enron, the Houston-based energy behemoth, and WorldCom, the telecoms behemoth, surprised the business world with the scope and age of their unethical and criminal operations. These groups appeared to be the tip of an iceberg that may be devastating. Banks and other financial intermediaries are at the center of the global financial crisis. The deterioration of their asset portfolios, which was partly attributed to their inadequate credit management, was one of the primary structural origins of the crisis. Inadequate corporate governance in Nigerian financial firms is mostly to blame for this problem. Only a few empirical studies look at the role of corporate social responsibility as a mediating factor in the relationship between corporate governance and financial performance, but the majority of empirical studies look at the effects of corporate social responsibility or corporate governance on financial performance. This points to a fascinating gap in previous research.

Objectives of the Study

The study's major goal is to see how corporate social responsibility mediates the relationship between corporate governance and bank financial performance.

The precise goals are to:

1. Examine the effect of corporate governance on corporate social responsibility. 2. Ascertain the effect of corporate social responsibility on financial performance. 3. Find out how corporate social responsibility mediates the relationship between corporate governance and financial performance.

Research Questions

The following are the research questions:

1. What is the effect of corporate governance on corporate social responsibility? 2. How does corporate social responsibility affect financial performance? 3. How corporate social responsibility does mediate the relationship between corporate governance and financial performance?

Research Hypotheses

The following are the research hypotheses in null form:

H1: Corporate governance has no significant effect on corporate social responsibility.

H2: Corporate social responsibility has no significant effect on financial performance.

H3: Corporate social responsibility significantly mediates the relationship between corporate governance and financial performance.

Literature Review

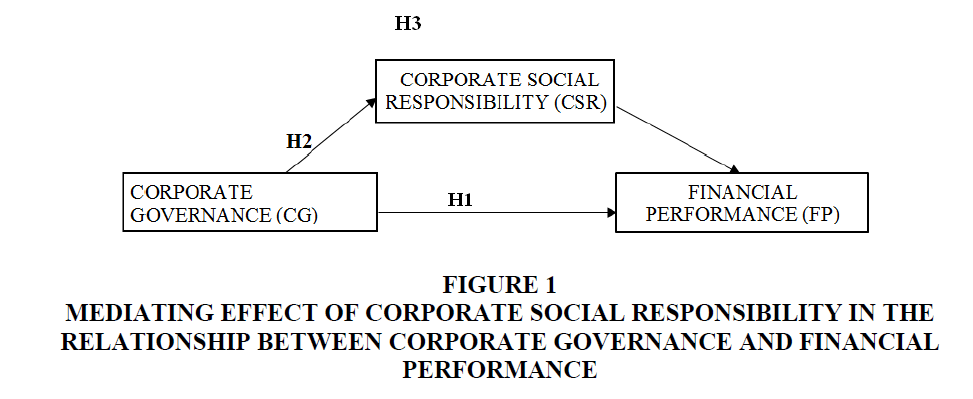

Conceptual Model

Conceptual model of the research and the hypothesis generation has been illustrated in Figure 1.

Figure 1: Mediating Effect Of Corporate Social Responsibility In The Relationship Between Corporate Governance And Financial Performance.

Theoretical Framework

Agency theory: The agency relationship is formed when management operates as an agent and the owner acts as the principle (Jensen & Meckling, 1976). Management has more information than the shareholder, who is the owner, as an agent. This raises the possibility that agents care more about their own interests than the interests of shareholders. According to agency theory, company management is considered as an agent for shareholders who will act in their own best interests rather than as a reasonable and fair party to the interests of shareholders (Suprayitno et al., 2005). Corporate social responsibility reflects the major agent interaction between senior management and shareholders (Barnea & Rubin, 2010). At the expense of shareholders, top management should be worried about investing in social responsibility and participating in activities that will assist the company by developing a reputation as ethical and socially responsible people (Tapang et al., 2020, Uklala et al., 2021; Bessong & Tapang, 2012).

Stakeholder theory: Stakeholder theory combines social and organizational theories. Stakeholders are any organization or people who can affect or be influenced by the achievement of company objectives. The goal of stakeholder theory is to deal with appropriate stakeholder groups that need managerial attention (Sundaram & Inkpen, 2004). Stakeholder support is essential for a company's existence, and stakeholders can influence how information is published in financial statements. Stakeholder theory is based on balancing stakeholder interests, and it goes beyond only describing or forecasting causality (Donaldson & Preston, 1995). Investors react negatively to stakeholder pressure, regulatory punishments, colleague defection, activist boycotts, and negative media coverage (Prior et al., 2008; Tapang et al., 2021; Tapang et al., 2020; Tapang & Ibiam, 2019).

Empirical Review

Taleatu et al. (2020) study on Moderating Effect Of Governance Quality On The Relationship Between CFOs' Narcissism and Corporate Earnings Management in Nigeria Our findings revealed high CFOs' narcissism (Mean=3.6961, SD=1.03428, Min=1, Max=5), upward earnings management (Mean=3.8137, SD=1.00472, Min=1, Max=5) and moderate corporate governance quality (Mean=3.2353, SD=1.25299, Min=1, Max=5). The study also revealed a significant positive relationship between earnings management and CFOs' narcissistic trait (beta=0.636, t-value=21.628, P<.05, Sig.=0.000). A significant negative relationship was observed between corporate governance quality and earnings management (beta=-.360, t-value=-12.251, P< 0.05, Sig.=0.000). However, further finding revealed that corporate governance quality has a significant moderating effect on the relationship between CFOs' narcissistic trait and corporate earnings management (beta=0.145, t-value=9.582, P< 0.05, Sig.=0.000).

Machdar (2019) found that (a) corporate governance has no impact on corporate social responsibility disclosure in Indonesia, (b) corporate governance has an impact on corporate financial performance in Indonesia, and (c) corporate governance has no impact on corporate financial performance in Indonesia in his study titled "Corporate social responsibility disclosure mediates the relationship between corporate governance and corporate financial performance in Indonesia." As a result, corporate social responsibility disclosure does not mediate the relationship between corporate governance and financial success in Indonesia.

Salamzadeh et al. (2019) study on corporate entrepreneurship in University of Tehran: does human resources management matter? with aim to examine whether human resource management affects the development of corporate entrepreneurship in University of Tehran, or not. This research is applied in term of purpose and descriptive-correlational in terms of quantitative approach. As the topic was strategic in University of Tehran, the statistical population consists of 200 directors and deputies of the university, among whom 132 were randomly selected. To analyse the information structural equation modelling (SEM) and Smart PLS software were used. Their results indicated that if more attention is paid to human resources management practices in University of Tehran, corporate entrepreneurship will be improved accordingly.

Doshmanli et al. (2018) study on Development of SMEs in an emerging economy: does corporate social responsibility matter? Focus on investigating the correlation between CSR and development of SMEs to find a way to develop SMEs in a more responsible manner. This study followed a survey research design, and the statistical population of the study included 720 owners/managers of SMEs. The results indicated that there was a significantly positive correlation between all four dimensions of economic, legal, ethical and discretionary social responsibility and development of SMEs.

Suteja et al. (2017), in their study on “Does Corporate Social Responsibility Shape the Relationship between Corporate Governance and Financial Performance?” show that corporate governance has a positive impact on a company's financial performance. Financial performance has a favorable link with aspects of corporate governance such as audit committees and the number of board meetings, but there is no such relationship with the independent board of commissioners. Furthermore, CSR can only bolster the positive correlation between the number of board of commissioners meetings and the company's financial performance.

Salamzadeh et al. (2013) work on social entrepreneurship education in higher education: insights from a developing country. Their result revealed a significant rate of intention towards and awareness of the concept among respondents, but a lack of sufficient attention to contextual elements and adequate support. Investigating social entrepreneurship intention and education is lacking in Iran’s higher education and this study is one of the first in the country.

Methods

The study adopted the ex-post facto research design. All banking companies registered on the Nigerian Stock Exchange (NSE) as at year 2020 were included in this study's population. In this study, samples were collected using a non-probability sampling strategy and a purposive sampling method. The sample was chosen based on the fact that the listed banks continuously issued audited financial statements from 2011 to 2020 and included CSR in their annual reports and also has been in existence within the sampled period. Thirteen banks were chosen based on this criterion.

Model Specification

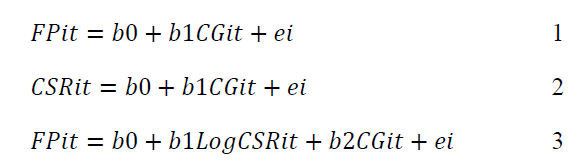

The study made use of a mediation panel regression model using SMART-PLS 3.3.3. The mediation is tested using the causal step approach as follows

Where,

FP =Financial Performance CG =Corporate Governance CSR =Corporate Social Responsibility Ei =Error Term it =i implies Cross Section while the t =Time

Results and Discussion

In order to test the mediation effect of corporate social responsibility (CSR) on the nexus between corporate governance (CG) and financial performance (FP), a series of steps were followed. First, corporate governance (CG) was regressed against financial performance (FP) and the relationship was found to be significant H1: b=0.088, t-value=2.453, p-value=0.015. Next, corporate governance (CG) also regressed against corporate social responsibility (CSR) and the relationship was found to be insignificant H2: b=0.855, t-value=1.368, p-value=0.224. The mediator variable corporate social responsibility (CSR), was added to the model and the result was found to be insignificant H3, b=0.045, t value=1.047, p-value=0.235 (Table 1). This result is in accordance with the findings of Machdar (2019). The findings also corroborated with that of Suteja et al. (2017).

| Table 1 Mediating Effect Of Corporate Social Responsibility In The Relationship Between Corporate Governance And Financial Performance |

|||||

|---|---|---|---|---|---|

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | |

| CG -> FP | 0.088 | 0.093 | 0.036 | 2.453 | 0.015 |

| CSR -> FP | 0.862 | 0.857 | 0.026 | 33.600 | 0.000 |

| CG -> CSR | 0.855 | 0.518 | 0.625 | 1.368 | 0.224 |

| CG -> CSR -> FP | 0.045 | 0.049 | 0.043 | 1.047 | 0.235 |

Source: Smart PLS 3.3.3

Conclusion

The study concludes that corporate social responsibility plays no role in mediating the relationship between corporate governance and financial performance. According to the report, a unified corporate organization should be developed with the goal of collecting and combining corporate governance-related data and producing relevant indices to facilitate corporate governance investigations in Nigeria. Acceptable approaches for recognizing corporate social responsibility initiatives should be used. Banks should carefully plan to meet their corporate responsibility duties, making sure that their lending and investment strategies do not support environmentally hazardous company activity or waste pollution. Corporate governance and corporate social responsibility do not improve a bank's financial performance alone. There are a plethora of other things to be aware of. Due to this, various strategies such as sustainability modernization and continuous improvement must be applied if banks want to improve their financial performance.

References

Barnea, A., & Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. Journal of Business Ethics, 97(1), 71-86.

Indexed at, Google Scholar, Cross Ref

Bessong, P.K., & Tapang, A.T. (2012). Social responsibility cost and its influence on the profitability of Nigerian banks. International Journal of Financial Research, 3(4), 33.

Indexed at, Google Scholar, Cross Ref

Branco, M.C., & Rodrigues, L.L. (2006). Corporate social responsibility and resource-based perspectives. Journal of business Ethics, 69(2), 111-132.

Indexed at, Google Scholar, Cross Ref

Donaldson, T., & Preston, L.E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications. Academy of management Review, 20(1), 65-91.

Indexed at, Google Scholar, Cross Ref

Doshmanli, M., Salamzadeh, Y., & Salamzadeh, A. (2018). Development of SMEs in an emerging economy: does corporate social responsibility matter?. International Journal of Management and Enterprise Development, 17(2), 168-191.

Indexed at, Google Scholar, Cross Ref

Jenkinson, T., & Mayer, C. (1992). The assessment: corporate governance and corporate control. Oxford Review of Economic Policy, 8(3), 1-10.

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360.

Indexed at, Google Scholar, Cross Ref

Khoiruman, M., & Haryanto, A.T. (2017). Green purchasing behavior analysis of government policy about paid plastic bags. Indonesian Journal of Sustainability Accounting and Management, 1(1), 31-39.

Indexed at, Google Scholar, Cross Ref

Machdar, N.M. (2019). Corporate social responsibility disclosure mediates the relationship between corporate governance, and corporate financial performance in Indonesia. Academy of Accounting and Financial Studies Journal, 23(3), 1-14.

Ogbechie, C. (2006). Corporate governance: challenges for banks in Nigeria. Economic and Policy Review, 12(2).

Indexed at, Google Scholar, Cross Ref

Prior, D., Surroca, J., & Tribó, J.A. (2008). Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corporate governance: An international review, 16(3), 160-177.

Indexed at, Google Scholar, Cross Ref

Salamzadeh, A., Azimi, M.A., & Kirby, D.A. (2013). Social entrepreneurship education in higher education: insights from a developing country. International Journal of Entrepreneurship and Small Business, 20(1), 17-34.

Indexed at, Google Scholar, Cross Ref

Salamzadeh, A., Tajpour, M., & Hosseini, E. (2019). Corporate entrepreneurship in University of Tehran: does human resources management matter? International Journal of Knowledge-based Development, 10(3), 276-292.

Indexed at, Google Scholar, Cross Ref

Sundaram, A.K., & Inkpen, A.C. (2004). Stakeholder theory and “The corporate objective revisited”: A reply. Organization science, 15(3), 370-371.

Indexed at, Google Scholar, Cross Ref

Suprayitno, G., & Khomsiyah, Y.S., Darmawati, D., dan Susanty, A. (2005). Internalisasi Good Corporate Governance dalam Proses Bisnis. The Indonesian Institute.

Suteja, J., Gunardi, A., & Auristi, R.J. (2017). Does Corporate Social Responsibility Shape the Relationship between Corporate Governance and Financial Performance? Indonesian Journal of Sustainability Accounting and Management, 1(2), 59-68.

Indexed at, Google Scholar, Cross Ref

Taleatu, T.A., Adetula, D.T., & Iyoha, F. O. (2020). Moderating Effect of Governance Quality on the Relationship between CFOs' Narcissism and Corporate Earnings Management in Nigeria. Journal of Management Information & Decision Sciences, 23(S1), 477-490.

Tapang, A.T., Effiong, C., Efiong, E.J., Oti, P.A., Uklala, A.P., & Bessong, P.K. (2020). Corporate Governance Characteristics and Financial Performance of Listed Pharmaceutical Companies in Nigeria. Test Engineering & Management. 83(7-8),3244-3251.

Tapang, A.T., Uklala, A.P., Bassey, B.E., Ezuwore-Obodoekwe, C.N., Onyeanu, E.O., Ozoji, A.P., & Obo, E.B. (2021). Mediating Effect of Firm Size on Corporate Social Responsibility Cost and Financial Performance of Listed Non-Financial Companies in Nigeria. Academy Of Accounting and Financial Studies Journal, 25(3).

Tapang, A.T., & Ibiam, O. (2019). Internal Audit and Financial Performance of Micro Finance Banks in Nigeria. International Journal of Social Sciences and Management Research,5(4),95-107.

Uklala, A.P., Bessong, P.K., Oti, P.A., Tapang, A.T., & Inah, E.U. (2021). Empirical Analysis of Public Accounts Committee and Accountability of Funds in Nigeria. Academy of Accounting and Financial Studies Journal, 25(4), 1-12.

Uwuigbe, O.R., & Fakile, A.S. (2012). The effects of board size on financial performance of banks: A study of listed banks in Nigeria. International Journal of Economics and Finance, 4(2), 260-267.

Indexed at, Google Scholar, Cross Ref

Received: 17-Jan-2022, Manuscript No. jmids-22-10918; Editor assigned: 20-Jan-2021, PreQC No. jmids-22-10918(PQ); Reviewed: 24-Jan-2022, QC No. jmids-22-10918; Revised: 27-Jan-2022, Manuscript No. jmids-22-10918(R); Published: 31-Jan-2022