Research Article: 2022 Vol: 26 Issue: 5

Corporate Governance and Financing Decision of Small Growing Firms in a Developing Economy

Sayed Abbas Ahmed, Ajman University

Neimat Abdalla Ibrahim, University of Khartoum

Citation Information: Ahmed, S.A., & Ibrahim, N.A. (2022). Corporate governance and financing decision of small growing firms in a developing economy. Academy of Accounting and Financial Studies Journal, 26(5), 1-19.

Abstract

Corporate governance issue has gained significant attention in management research especially among large listed firms. However, research has seldom been conducted on small and medium sized firms. Therefore, the objective of this paper is to investigate the link between corporate governance and financing decision and its impact on firm performance across a sample of 25 small growing firms operated in Sudan. Specifically, the paper examines how ownership structure and corporate control affect financing decisions through a theoretical framework that links owner profile, financial planning, control characteristics and practice. The empirical findings show that managers are concerned with cash flow and profitability to maintain high internal sourcing of finance, which ultimately, affects financing decisions. The centralization of decision in the hand of the owners gives clear evidence that financing decisions are influenced by their knowledge, experience and typology. The existence of the family at the higher echelon of the hierarchy affects the way in which the business is operated, managed and controlled. These empirical findings provide confirmation that ownership structure and degree of financial control affect financing decisions and have an impact on firm performance.

Keywords

Corporate Governance, Financing Decision, SMEs, Developing.

Introduction

Corporate governance has recently received much attention in corporate finance literature. Abor & Biekpe (2007) define it as the process and structure used to direct and manage the business affairs of the company towards enhancing business prosperity and corporate accountability; with the ultimate objective of realizing long–term shareholder value. Keasey et al. (1997) also defined it as the structures, processes, cultures and systems that engender the successful operation of the organization. According to the Cadbury (1992) corporate governance describes how companies ought to be run, directed and controlled; and also about supervising and holding to account those who direct and control the management.

Corporate governance has been a growing area of management research, especially among large and publicly listed firms. However, less attention has been given to it with respect to small and medium firms (Berger et al., 1997; Ibrahim, 2007).

This study assesses how corporate governance structures influence financing decisions among small growing firms in Sudan. This is an important issue due to the significant role of small firms in the Sudan economy. Over 93% of firms in the Sudanese manufacturing sector are small and medium-sized, according to generally accepted definitions Industrial Survey 2005. The study focuses on food processing firms because they represent 70.4% of manufacturing industries, employ 56.5% of the workforce in the industrial sector and account for 55% of the contribution of industrial sector in the GDP. Their economic and social contributions suggest that corporate governance issues and the financing decisions of the small and medium firms sector is a relevant research area.

Corporate governance arises because of potential conflicts of interest between shareholders and managers, due to the separation between ownership and control of the firm. It has been generally associated with larger companies and the existence of the agency problem. However, many small and medium sized firms have a sole proprietor and manager; they tend to have less pronounced separation of ownership and management. There is an argument that corporate governance would not apply to small and medium sized firms, since the agency problems are less likely to exist (Hart, 1995). However, there is a global concern for the application of corporate governance in small and medium sized firms. It is often argued that guidelines similar to those that apply to listed companies should also apply to small and medium enterprises.

The extant literature addresses the main characteristic of corporate governance to include board size, board composition, Chief Executive Officer (CEO) duality, tenure of the CEO and CEO compensation. However, empirical results on the relationship between corporate governance and capital structure appear to be varied and inconclusive. The results of Wen et al. (2002) show a positive relationship between board size and financial leverage. Abor & Biekpe (2007) conclude that the owner-manager often acts as the chairperson of the board, and that small and medium enterprises have a tendency of employing more debt in order to maintain control. Jensen & Meckling (1976) however argue that introduction of managerial share ownership may reduce these agency problems, thus aligning the interests of managers and shareholders. Empirically Shleifer & Vishny (1986) suggest that concentration of ownership may improve firm performance while argue that it may deteriorate firm performance.

Despite the seminal work of Claessens et al. (2000) who highlighted the role of ownership structure on firm performance in East Asia, none of the recent studies considers the effect of ownership structure on financing and firm performance, and the possible interaction between financing and firm performance. Unlike previous studies; this paper examines how ownership structure affects financing decisions and the link with firm performance. Reid (1999) shows that certain characteristics of the small, medium firms strengthen this link, such as experience, education, and attitude of the entrepreneur; the empirical evidence provides strong support for the role of financial management. Davila (2000) find that the adoption of management control systems is positively associated with the size of the firm.

In the governance literature, the presence of large shareholders may improve corporate governance. Owner control thus may reduce agency conflicts and facilitate access to external finance for investment. Banks as monitoring creditors may exert as much control as large shareholders. In developing economies, ownership is also heavily concentrated (La Porta et al., 1999). Still we have relatively little systematic evidence about the ownership patterns of small growing firms.

Considering agency costs and financing decisions of the firm, Myers (2001) assumes that “The interest of the firms’ financial managers and its shareholders are perfectly aligned, and that financial decisions are in the shareholders’ interest.” However, Jensen & Meckling (1976) argue that corporate managers as "the agents" will act in their own economic interest. They will favor investments which adapt the firms’ assets and operations to the managers’ skills and knowledge and increase their bargaining power against the investors. Shleifer & Vishny (1986) and Kjellman & Hansen (1995) explain that the existence of asymmetric information, as well as corporate control aspects, induce some managers to follow a “pecking order” strategy in raising new funds; their findings indicate that an objective of the financing hierarchy is to avoid control dilution. Therefore, this study examines the hypothesis that the degree of sophistication of corporate control maintained by the firm affects financing decisions and has an impact on firm performance. Our investigation links ownership and corporate governance by answering the question of how small growing firms are affected by ownership structure and quality of institutional environments in their financing decisions.

The objective of this study, in summary, is to identify the profile of the owners, the business strategies used by the owner/manager and their impact on financing decisions and firm performance. To address the Sudanese experience, the paper is organized as follows:

1. Section I: introduction, which shows the manner in which corporate governance affects firm performance and financing decisions

2. Section II: Methodology

3. Section III: documents the ownership structure and typology of entrepreneur.

4. Section IV: presents evidence on financial control, corporate planning and financing decisions

5. Section V: conclusion and policy implications.

Methodology

Based on the quantitative criteria for identifying small firms; the working definition of a small growing firmf is one which is independently owned, managed and controlled by an owner / part owner, employs between 25-50 employees, and is experienced positive growth in assets, sales and asset turnover. This definition is the established contention in the literature of finance: (Osaze, 1992; Hutchinson, 1989; Ahmed, 1987). The sample of 25 firms satisfies this definition in terms of qualitative criteria and completeness of financial data. The collection of data is based on opinions and descriptions of the financial control systems of the sampled firms. Based on previous empirical research findings on the characteristics of entrepreneurs / business founders Reynolds (1995) aggregate results concerning the determinants of entrepreneurial intentions and behavior, especially Davidson (1996) is used. This concerns economic, psychological and social learning factors. A critical review of the literature on entrepreneurship provides reliable surrogate measures for entrepreneur typology, cultural background, family domination, education, technical experience, occupational experience, and age, which have been used extensively in this study. This study also takes into consideration the degree of interaction between entrepreneurial typology and financial performance as measured by conventional ratios and matrix representation of motivation factors ranked and reported by entrepreneurs.

To examine to what extent the financial control system is maintained, we analyze the internal procedures in relation to the firm’s financial planning and budget. To characterize the financial control system, we follow Hutchinson (1989) and use data on the frequency and type of information produced in the firm.

Corporate Governance, Ownership Structure and profile

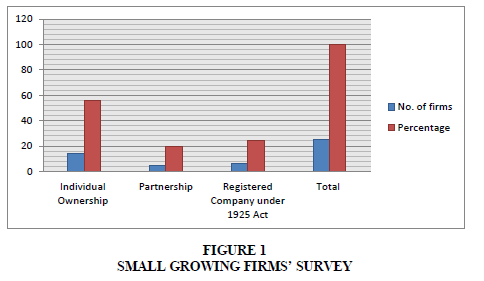

Many recent studies have highlighted the role of corporate governance as reflected in the ownership structure. Sudan is an interesting case to explore how ownership and governance structure affect individual firms' financing decisions. Table 1 shows the distinctive pattern of ownership structure in Sudanese small growing firms, which is dominated by family control over business operations. The survey shows that 56% of small growing firms are individual proprietorships managed by families; 20% registered as partnerships; and 24% as limited companies, under family domination in most cases. Thus, family ownership is predominant form of ownership in Sudan and is closely linked with the presence of trusted associates, tight control and concentrated ownership Figure 1.

| Table 1 Type Of Legal Organization Of The Small Growing Firms |

|||

|---|---|---|---|

| No. of firms | % | ||

| 1. | Individual Ownership | 14 | 56 |

| 2. | Partnership | 5 | 20 |

| 3. | Registered Company under 1925 Act | 6 | 24 |

| Total | 25 | 100 | |

Source: Prepared by Authors; based on Small Growing Firms’ Survey

It is possible to envisage how the dominance of certain individuals or family may affect borrowing. The significant of family ties is reinforced by the practice of inviting other family members to share ownership when setting up new ventures. These help to cement existing business relationships, but may create barriers to entry and extend the dominance of family groups in the corporate sector.

Concentration of ownership is common in developing countries, and there are both pros and cons. The fundamental benefit of concentrated ownership is that it solves the agency problem, since large shareholders are able to easily exert control over a firm and limit management inefficiency and abuse. Indeed except in certain industrial countries, high ownership concentration, including controlling ownership is common (Alba et al., 1998). Ownership concentration is likely to lead to increased risk-taking behavior by firms, in particular when we consider its relation with financial institutions. Family ownership gives rise to greater leverage. The precise link between ownership and leverage is explained by the distinctive feature that in Sudan, entrepreneurial families represent a special class of large shareholders that potentially have unique incentive structures and motives to manage a firm. Families are different from other shareholders in at least two respects, including the family’s interest in the long-term survival and its concern for the firm’s reputation. In addition, banks often develop personal and well-informed relationships with family executives, suggesting that the family’s presence allows this relationship to build over a number of years. This evidence indicates the effect of ownership on firm’s financial structure.

Determinants of Entrepreneurial Profile

Growing firms are firms that have a growth orientation and an intention to expand beyond the state of survival. It has been observed that corporate governance has an impact on value creation in entrepreneurial firms. It has also been asserted that age, level of education, occupational origin, industrial experience and family domination are important determinants of entrepreneur performance.

Based on previous empirical research findings on the characteristics of entrepreneurs/business founders we could establish the Sudanese experience regarding entrepreneur/ownership profile and highlight the relationship between psychological characteristics of entrepreneurs, attitudes, personal background, and entrepreneur behavior and intention. The theory of psychological motivation suggests that entrepreneurs are motivated by three needs; the need for achievement, power, and for affiliation.

Motivation: The impact of the founder individual characteristics on firm would be achieved by assessing the effect of motives underlying the creation of the firm. To our knowledge, the link between motivation factors and firm growth has been scarcely investigated by the literature. However, this view could give a useful interpretative key of the evidence of small growing firms in Sudan. The evaluation of motivations explains the effect of psychological factors such as the need for achievement of personal success and desire of independence are the key factors inducing the firm founder. Bonaccorsi & Giannangeli (2005) adds, “Firms whose creation was not due to profit expectation but rather the founder need to exit unemployment or psychological satisfaction from being entrepreneur, will be less motivated to grow”.

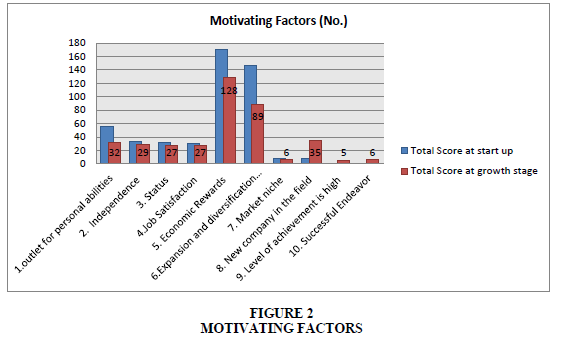

In relation to motivating factors, the analysis of the survey provides an interesting results that the matrix representation of motivation factors ranked and reported by entrepreneurs show that the economic rewards is the most critical factor in forming a business for 80% entrepreneurs. Our result supports Bonaccorsi & Giannangeli (2005) and challenges who fined independence, is one of the most frequently stated reasons for founding a firm. Table 2 also show that family as socio economic factor has been ranked as a second motive for going into business, either to expand family business or meet family demand. This evidence observed in Nigeria and Philippines. Family as motivating factor stems from the fact that 38% of the owners belong to family business. The empirical result also shows that achievement motivation and competitiveness as factors exist but they are not the major determinant of entrepreneurial behavior. This evidence supports (Davidson, 1996; Shaver & Scott, 1992). In Sudan, the current employment status, and change in it is one of the most important situational influence. Although not all studies reach the same conclusion (Reynolds, 1995) some research have indicated a positive relationship between unemployment and firm formation (Davidson, 1996) Figure 2.

| Table 2 Motivated Factors At Start – Up And Growth Stage Of The Firm “Matrix Representation” |

||||||

|---|---|---|---|---|---|---|

| Total Score at start up | Total Score at growth stage | |||||

| Motivating Factors | No | % | Rank | No | % | Rank |

| 1. outlet for personal abilities | 55 | 11 | 3 | 32 | 9 | 4 |

| 2. Independence | 33 | 6.4 | 5 | 29 | 8 | 5 |

| 3. Status | 32 | 6.7 | 4 | 27 | 7.6 | 6 |

| 4. Job Satisfaction | 30 | 6.2 | 6 | 27 | 7.6 | 6 |

| 5. Economic Rewards | 170 | 35 | 1 | 128 | 36 | 1 |

| 6. Expansion and diversification of family business | 147 | 30.6 | 2 | 89 | 24.3 | 2 |

| 7. Market niche | 8 | 2 | 7 | 6 | 2 | 7 |

| 8. New company in the field | 8 | 2 | 8 | 35 | 10 | 3 |

| 9. Level of achievement is high | - | - | - | 5 | 1.4 | 8 |

| 10. Successful Endeavor | - | - | - | 6 | 2 | 7 |

| Total | 481 | 100 | 353 | 100 | ||

Source: Prepared by Authors; based on Small Growing Firms’ Survey

Despite the importance attached to independence by people who farmed their own business not under family umbrella, job satisfaction is also important, in this regards, one of the entrepreneurs in the research sample declared that:

“I entered the field of business to stand by my own, to build my image and reputation out of my business. Moreover, the government job was too narrow to embody my ambition and innovative ability”.

The empirical testing shows that personal abilities, independence, and status and job satisfaction scored 32.5% as entrepreneurial motivating factors in relation to entrepreneurial profile, Shaver & Scott (1992) suggest that there is significant association between personal traits such as age, education and work experience; and the capacity to become an entrepreneur (Gibson & Cassar, 2002). In this part of the study, an attempt is made to give insight and provide a clue for the understanding of the Sudanese entrepreneur as a platform for public policy aiming to develop entrepreneurial activities.

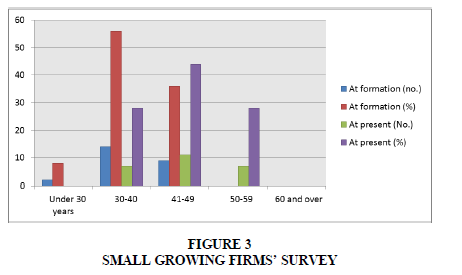

Age Influences Individual Prior Knowledge, Information, and Skills

On one hand, age increases individual ability to exploit opportunities and accumulate experience over life. On the other hand, opportunity cost and therefore reluctant to bear risk increases with age (Bonaccorsi & Giannangeli, 2005). Table 3 shows that at formation of business and at the present growing stage, entrepreneurs have different age groups Figure 3.

| Table 3 Age Distribution Of Small Firm Entrepreneurs At Formation Stage And At Present |

||||

|---|---|---|---|---|

| Range of Age | At formation | At present | ||

| No | % | No | % | |

| Under 30 years | 2 | 8 | 0 | 0 |

| 30-40 | 14 | 56 | 7 | 28 |

| 41-49 | 9 | 36 | 11 | 44 |

| 50-59 | 0 | 0 | 7 | 28 |

| 60 and over | 0 | 0 | 0 | 0 |

Source: Prepared by Authors; based on Small Growing Firms’ Survey

Past Experience

The experience is important factor for survival and growth of small firms. There are two dimensions of experience that matter substantially for entrepreneurship. First, there is learning dimension through which entrepreneur gains practical knowledge for both the identification and the exploitation of opportunities. Second, there is also social network dimension; by which they can build up a network of professional and social contact that is useful for business activities.

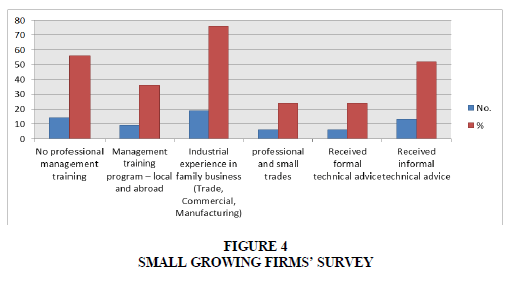

Training material is a source of information used to inform the creation of integrated model on starting or growing small business. However, Table 4 indicates that 56% of the sample has no management training and only 36% of entrepreneurs have management training of which 20% have local training and 16% abroad. While the previous entrepreneurship research shows the positive influence of education on intention and entrepreneur behavior that is people with more education have better chances for success and attainment of personal goals. Our empirical study provides little input concerning managers with management degree and business education (8%). Managerial background and industrial experience are important determinants of entrepreneurial knowledge, profile, and the way the business runs. Specific professional experiences endow founders with different degrees of ability in exploiting opportunities. Entrepreneurs having some professional experience in the same industry possess a better knowledge of both the market and the production process that are very likely positively affect the survival and growing chances of newly established firms. Previous industrial experience of the founders conveys to the new firm a better understanding on how to meet demand conditions in the market place Figure 4.

| Table 4 Entrepreneurs Sample With Past Experience |

|||

|---|---|---|---|

| No. | % | ||

| 1. | No professional management training | 14 | 56 |

| 2. | Management training program – local and abroad | 9 | 36 |

| 3. | Industrial experience in family business (Trade, Commercial, Manufacturing) | 19 | 76 |

| 4. | professional and small trades | 6 | 24 |

| 5. | Received formal technical advice | 6 | 24 |

| 6. | Received informal technical advice | 13 | 52 |

Source: Prepared by Authors; based on Small Growing Firms’ Survey

The empirical analysis shows the extent to which this argument hold true for Sudanese entrepreneurs. 76% of small growing firms’ entrepreneurs had an industrial experience in working in family business, while professional and small trades’ employees maintain the remaining 24%. The survey shows insignificant existence of professional management and supports the existence of positive relationship between firm success and founders’ pre-history in industry. Therefore, family tradition in entrepreneurship is powerful source of vicarious learning for new entrepreneurs. In addition, family ties offer great advantages for networking. The family name and reputation may open door for suppliers, customers, and bankers. Furthermore, being a family with business experience also help in establishing social ties that create economic opportunities, which in turn, affect firm performance in terms of survival and growth, as well as access to finance. The importance of family experience in Sudanese small growing firms provides strong support to the literature (Reynolds, 1995).

The survey shows that 56% of entrepreneurs had managerial experience as a chief executive or assistant managers in family business before establishing their own business. So they are more likely to run their business with a preceding managerial experience and they are expected to be better in organizing inputs, resources, and prepared to deal with a wide range of problems concerning the business. However, technical skills are required for entrepreneurs to establish and manage their business. In response to the question of whether, there was any technical assistant or advice received, the respondents reported that; “They received technical advice and assistance form friend and relatives in the concerned field of industry on informal basis”. 52% of small growing firm's entrepreneurs receive technical advice from friends and relatives on personal ground and only 24% of the sample received formal training either from local or foreign specialist body. This result reflects the introduction of family members usually at higher echelons in the hierarchy and indicates the traditional way of establishing industrial firms in Sudan, which in turn has an implication on the way the business is handled, managed and controlled.

In considering responsibilities and functional activities of small growing firms; start with the establishment of a mission of the company and individual goals, from this observation, the business plan is constructed. Practical issues of business forms, premises and associated decision making, financial, marketing and human resource management matters follow.

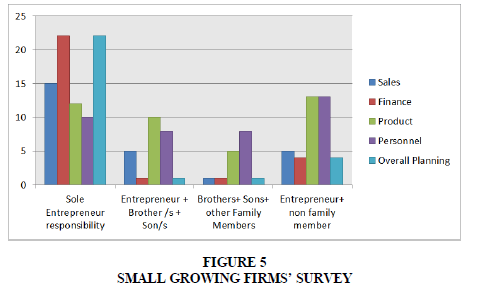

The attention then turns to controlling the business and includes sales and marketing, employment and financial management. Support for this notion, Table 5 illustrates that Sudanese entrepreneurs tend to keep all decisions on sales (60%); finance (88%); and over all planning (88%) under their responsibility. This finding provides some guidance in understanding the personality and typological factors of entrepreneur with a financial gain as a prominent objective. The centralization of financing decision and any transaction with direct monetary connotation in the hand of entrepreneur provides an empirical examination of the research analytical framework and gives clear evidence that small growing firms’ financing decision influenced among a number of variables by typology, profile, and attitude of an entrepreneur Figure 5.

| Table 5 Responsibilities Of Functional Activities In Small Growing Firms |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Functions | Sales | Finance | Production | Personnel | Overall planning | |||||

| No | % | No | % | No. | % | No | % | No | % | |

| Sole Entrepreneur responsibility | 15 | 60 | 22 | 88 | 12 | 48 | 10 | 40 | 22 | 88 |

| Entrepreneur + Brother /s + Son/s | 5 | 20 | 1 | 4 | 10 | 40 | 8 | 32 | 1 | 4 |

| Brothers+ Sons+ other Family Members | 1 | 4 | 1 | 4 | 5 | 20 | 8 | 32 | 1 | 4 |

| Entrepreneur+ non family member | 5 | 20 | 4 | 16 | 13 | 52 | 13 | 52 | 4 | 16 |

Source: Prepared by Authors; based on Small Growing Firms’ Survey

The centralization of power and decision-making on financial issues on entrepreneur, questioned the management knowledge of an entrepreneur, entrepreneurial competence in handling financial management issues of business at critical stage of growth and development. Therefore, the empirical finding is that the degree of involvement of the owner/entrepreneurs in management correlates positively with access to finance and hence capital structure. The interesting finding is that in small growing firms 52% of entrepreneurs delegate the responsibility of production and personnel functions to outsiders. In Sudan small growing firms managed and controlled in personalized way with confined sharing power of family members. This notion provides significant evidence of the relationship between entrepreneur, financing, and financial control.

Financial Planning, Control Characteristics and Practice

Corporate governance – “the battle for corporate control” this battle’s trend line clearly establishes the firm’s hand by which management holds the rein. However the magnitude of corporate control by management does not always lead to out comes in the best interest of the shareholders (Dalton, 1989). Prior studies show how the availability of personal quality is important for owner manager to flourish the economy. The skills that emerge from these studies are: having a purpose “strategic vision”, innovation and creativity, activity planning and management decision making, division of activities and delegation.

The impact of both planning and control on firm performance is implicit in academic discussion. Although some studies have examined the relationship between planning sophistication and performance has been no empirical investigation of both planning and control processes and their impact upon the performance and financing decision of small growing firms in developing countries. So this study examines specifically, management practices of the owner-managers in relation to internal and external environmental is.

A number of studies including concluding that in developing economies accounting practice was very poor. Financial accounting has taken the form of more technical recording rather than being adjunct to planning and control functions. Parker & Tay (1990) rightly added that: “Deficiencies in developing country financial accounting and reporting practices are varied … The potential use of management accounting information for analysis and decision making in both the macro and micro sectors in developing economies has often been neglected”.

A general view of accounting information system development in small and medium enterprises would take as its starting point the stage of growth or life cycle position of small and medium enterprise (Reid, 1999). Based on the argument that as business developed, information needs is rise to cope with complexity and dynamic; Osaze (1992) find that growth has an influence on the financial control practice of small firms.

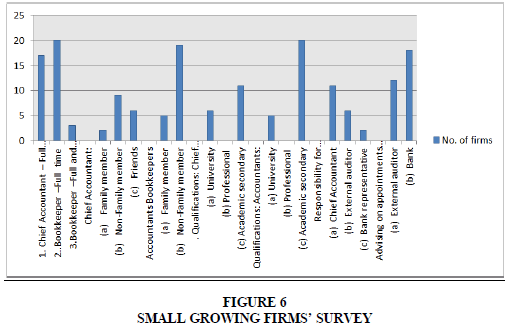

Growth requires an accounting information system appropriate to its features. The three levels of information complexity identified are statutory information which is appropriate to governmental bodies “taxation authorities”; statutory information plus budgeted operation and capital formation; and additional accounting information such as cash flow statement and break even analysis. Table 6 provides empirical evidence that 68% of the sample tends to retain a full time chief accountant with technical advice and 52% of them with managerial experience. Whereas, 80% of small growing firms retained book keepers on full time basis with a low percentage of family members and friend involvement (24%). As far as qualification and accounting knowledge and training is concerned, the evidence indicates that 67% of chief accountants and 80% of book- keepers have no accounting education and have received less management education and training (36%). This evidence indicates that small growing firms experienced accounting problems. Further, the analysis shows that the financial information is largely prepared by chief accountants, this result relates the level of information to educational attainment in the sense that the more education, the more likely to be the existence of both statutory and budgeted information. The Table 6 also illustrates that under Musharaka financing the bank is involved in the maintenance of accounting records, and recruitment and selection of bookkeeper; the same as external auditor. Thus, the bank involvement in the management has an influence on the status of accountant in term of qualification Figure 6.

| Table 6 Position And Status Of Accountant And Bookkeepers In Small Growing Firms |

||

|---|---|---|

| No. of Firms | % | |

| 1. Chief Accountant – Full time | 17 | 68 |

| 2..Bookkeeper –Full time | 20 | 80 |

| 3.Bookkeeper –Full and part time | 3 | 12 |

| Chief Accountant - Family member - Non-Family member - Friends |

2 9 6 |

12 36 24 |

| Accountants Bookkeepers - Family member - Non-Family member |

5 19 |

20 76 |

| . Qualifications: Chief Accountants: University Professional Academic secondary |

6 0 11 |

24 0 44 |

| Qualifications: Accountants: University Professional Academic secondary |

5 0 20 |

20 0 80 |

| Responsibility for preparation of financial statements Chief Accountant External auditor Bank representative |

11 6 2 |

44 24 8 |

| Advising on appointments of Accountants: External auditor Bank |

12 18 |

48 72 |

Source: Prepared by Authors; based on Small Growing Firms’ Survey

In response to the question of the role of accounting and accountants in financing decisions; 40% of sample reported that the role of accountant in raising finance is limited to preparation of documentations; one of the accountants points out that:

“It is a general practice in the Sudan, that the owner is taking the whole responsibility in raising finance and controlling cash resources. In small firms, management is not capable to identify and specify the accounting information needed, and this is mainly attributed to the fact that many of them have little knowledge of accounting.”

The research findings on entrepreneur attitude towards accountants and the accounting role, explained the phenomenon why small businessmen attempt to run a firm without adequate and complete accounting system. “Many owners of small businesses are horrified by accounts. The terminology of the accountant is precise and meaningful to profession, but it is frequently obscure and misleading to the layman, and many owners of small business are simply overawed”. However, the accounting problem experienced by small growing firms raises the question of financial control profile of small firms.

Financial Control Characteristics

A recent work on the issue of financial control of small growing firms is the guidance of financial management in small firms. Stanworth & Curran (1991) focus on how small firms manage their cash flow and measure performance. Sound financial management is crucial to the survival of small enterprises of all types.

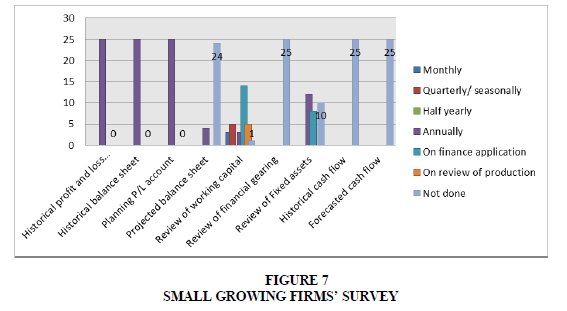

Based on Hutchinson (1999); the financial control system profile in small growing firms describes the frequency and type of information produced in the firm. The survey shows that 72% of small growing firms prepare informal and formal reporting of key financial variables with annual and half-yearly reporting of historical financial statements, with informal reporting of forecast financial information. 28% of firms tend to maintain informal and ad hoc reporting of a key financial variable. The result confirms that, the accounting system is merely within the boundary of producing historical profit and loss account and balance sheet as an end product for taxation and rising of finance.

In building a relationship between financing pattern and financial control, the evidence shows that small growing firms with a relatively adequate financial control system were successful in obtaining institutional finance. Further, there is a positive correlation between the level of education of an entrepreneur with management and accounting knowledge and the degree of financial control. The evidence also indicates 36% of small growing firms managed by educated persons with some sort of management knowledge and has reactively adequate financial control. In relation to external financial resources needed; the more educated entrepreneur will suffer less credit constraints and better resorting outside collateral. His personality, values, convictions, education and experiences overwhelmingly influence the information, policy and financing decision. This finding supports the contention in the body of knowledge that better-educated people are expected to become an entrepreneur and found firm with high growth expectancy.

Frequency of Information Production

A recent work on the issue of control of small firms is the guidance of financial management in small firms. Stanworth & Curran (1991) focus on how small firms manage cash flow and measure performance. The survey shows that none of the sample adopted formal planning and control system. The informality prevails and control is maintained through operational involvement in the small growing firms. There was found to be a lack of concern with formal systems among small growing firms. However traditional financial accounting for taxation and official revenue purposes featured heavily, as well as, importance of production of historical balance sheet and profit and loss accounts annually. By contrast, at growth stage small growing firms have to develop a more strategic approach for planning and control.

Table 7 indicates that small firms have no idea of the importance and significance of forecasting financial information including statement of cash flow and forecasted cash flow. Given the growth perspective it seems clear that information both determines and determined by growth. The specific form this information takes has explained, where they emphasize information use within a planning and control perspectives. Although budgeting improves coordination, communication and control, it is not popular in small and medium firms. There is short range planning cash flow and budget were not used, as well as, non-existence of sources and uses of fund statement This misconception indicates a lack of accounting knowledge in small growing firm under the dominant ascendancy of the owner. Therefore, the education and management training for entrepreneur are of great importance to make them aware of accounting knowledge and techniques.

| Table 7 Type And Frequency Of Information Produced By Small Firms |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Subject | Monthly | Quarterly/ seasonally | Half yearly | Annually | On finance application | On review of production | Not done | |||||||

| No. | % | No. | % | No. | % | No. | % | No. | % | No. | % | No. | % | |

| Historical profit and loss account | 0 | 0 | 0 | 0 | 0 | 0 | 25 | 100 | 0 | 0 | 0 | 0 | 0 | 0 |

| Historical balance sheet | 0 | 0 | 0 | 0 | 0 | 0 | 25 | 100 | 0 | 0 | 0 | 0 | 0 | 0 |

| Planning P/L account | 0 | 0 | 0 | 0 | 0 | 0 | 25 | 100 | 0 | 0 | 0 | 0 | 0 | 0 |

| Projected balance sheet | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 16 | 0 | 0 | 0 | 0 | 24 | 96 |

| Review of working capital | 3 | 12 | 5 | 20 | 0 | 0 | 3 | 12 | 14 | 56 | 5 | 20 | 1 | 4 |

| Review of financial gearing | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 25 | 100 |

| Review of Fixed assets | 0 | 0 | 0 | 0 | 0 | 0 | 12 | 48 | 8 | 32 | 0 | 0 | 10 | 40 |

| Historical cash flow | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 25 | 100 |

| Forecasted cash flow | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 25 | 100 |

Source: Prepared by Authors based on Small Growing Firms’ Survey.

Working capital practices have received a considerable attention from researchers. The survey shows that none of small growing firms use cash management practices. The review of working capital is built around row material, which depends on private or institutional source of finance. The most common financing instrument used by banks in providing funds is Murabaha financing which is highly associated with goods and raw materials, in this regards 56% of small growing firms, which depend highly on external finance; review their working capital as documentation on finance application. This evidence reflects the effect of institutional financing on financial control practice and confirms that 56 % of the firm sample holds a large amount of current assets in relation to total assets. Inventory constitutes 44% in assets structure; and 98% of current liabilities on average Figure 7.

Similarly, the valuation of fixed assets shows that small growing firms depend on external financing to meet the growth in fixed asset or capacity expansion. Revaluation fixed assets is needed under guarantee and higher value security as well as for determination of capital sharing under Musharaka financing. Thus, the institutional finance influences entrepreneur awareness of the importance of financial control.

In considering the most important items for small growing firms to control, the Sudanese experience shows limited use of financial reports by the owner manager. Concerning the use of accounting information in managerial decision-making, none of the respondents reports the use of some form of financial statement analysis and interpretation. They did not appear to understand the meaning of debt/ equity ratio, and its value to their firms. Regarding the importance of formal and most frequent financial reporting, the respondents were asked about which three items in the balance sheet they considered as most important to control. Table 8 shows that sale is the most important profit and loss item to be controlled by all firms. Sale as cash inflow item is under direct supervision and responsibility of owner-entrepreneur. This practice stemmed from the fact that small firms often emphasize on the volume of sale as indicator of success. The owner managers also are concerning with the production process in terms of row material and operational cost; they scored 72% and 40%of the sample respectively. The evidence provides that sales, row material and operational cost are integrated into management control system of small growing firms. This result supports (Ahmed, 1987). However, only 12% of small growing firms regard bank cost of finance as most important item to control. This observation indicates the non-accessibility of external source of finance. Furthermore, the most important balance sheet items perceived by entrepreneurs to control and reflect the financing pattern are:

| Table 8 Most Important Items To Control For Small Growing Firms |

||

|---|---|---|

| No. of firms | % | |

| Profit and loss items: Sales (Cash inflow item) |

25 | 100 |

| Raw – material costs (Cash out flow item) | 18 | 72 |

| Net profit of the year (performance factor) | 9 | 36 |

| Overhead expenses (operational cost ) | 10 | 40 |

| Factory expenses(variable cost) | 2 | 8 |

| Bank cost of finance | 3 | 12 |

| Balance sheet Items: Cash and bank balances |

20 | 80 |

| Bank as a creditor | 13 | 52 |

| Suppliers as trade creditors | 19 | 76 |

| Inventory | 18 | 70 |

| Debtors | 15 | 60 |

| Fixed assets | 10 | 40 |

Source: Prepared by Authors; based on Small Growing Firms’ Survey.

Cash and bank balance, in the sense that 80% of small growing firms give the higher priority to cash control and rely on it as internal source of finance. However, the lack of any sort of planning on cash flow questioned cash management in small firms and capability of the owner manager to manage cash properly. The second important item to control is suppliers and trade creditor, which score 76% of sample. In responding to the question of whether the small growing firms follow up the debtors and creditors, 92% of the firms tend to keep a follow system. Standard costing, project appraisal techniques in firm valuation and controlling operation and performance are not used. This reflects poor accounting knowledge and low level of sophistication.

Planning Practice in Small Growing Firms

Although a few studies have examined the nature of both planning and control processes in relation to different aspects of enterprise growth; none of them have focused on the sophistication of those processes suggested that small firms’ growth is constrained by failure to prepare and implement a sophisticated planning and control system. Similarly pointed out that “The basic tendency of small business is to shy away from planning, the struggle for day to day survival saps the amount of attention which can be devoted to planning. Another tendency of small business planning is that it concerns with the short-run”.

The most sophisticated form of planning which has been discussed widely in the management literature is “strategic planning”. Based on the examination of what type of planning and control process are used and how they influence the performance; the empirical finding provides confirmation of the documented literature that financial planning in the small firms is very poor and limited to informal and short-term period. While formal planning and control systems are important elements in management of growing firms a lack of concern with formal systems typically is found in small growing firms in Sudan. In considering the relationship between planning and control process and financial performance; budgeting and budgetary control processes practice has been questioned based on the presence and absence of simple budgets and detailed budgets, measured in term of change in sales or sales growth. The survey shows that 56% of small growing firms experience very short budgeting practice, of which 28% their forecast and budgeting around the production and manufacturing needs with a complete non existence of detailed budget and budgetary control. However, 44% of small growing firms using simple budgets were able to increase significantly or slightly their sales. Thus this result indicates that high level of planning leads to great increase in sales and affects firm performance. This situation is consistent with findings in developing countries (Wijewardena et al., 2004). However the reasons reported by some entrepreneurs for not practicing and producing budgeting system could be summarized as: they did not need it; lack of ideas and lack of understanding of its significant and importance; and lack of qualified accountants.

As far as long term planning is concerned, the survey shows that 52% of small growing firms tend to keep informal thinking and formal written proposals for business plan, either as an application for finance or merely as a feasibility study. Overall entrepreneurs use an emergent approach associated with growth and there is no formality in setting objective reviewing performance against objective.

The empirical investigation adds another dimension that the typology of entrepreneur affects planning and controls in the sense that low level of education of an entrepreneur, and lack of management skills has an influence on the degree of informality of planning.

Responding to the question of the level of profitability; liquidity and financial gearing they maintained, none of them reported specific objective, and they set a general objective, which reflected in profit generation, expansion and business survival.

Lack of qualified staff and specialist in small firms as well as the attitude and entrepreneurial knowledge gap are in part reasons behind planning deficiency. The study supports the argument that entrepreneurship education should concentrate on the process rather than the content.

Conclusion

This paper investigates the relationship between ownership structure, financing decision and performance of small growing firms in Sudan. The empirical evidence provides confirmation of the research hypothesis that the degree of sophistication of corporate control maintained by the firm affects the financing decision and has impact on firm performance. By using accounting data for positive managerial control and profitability, we find that:

Majority of the owners have cited economic rewards and financial gains as the main motive for going into business. Managers concern about cash flow, sales and operational cost to increase profitability and maintain high internal source of finance, which is ultimately affects the financing decision. Although the financial resources are a key condition for growth, small growing firms are not concerned about controlling cost of financing. This result indicates their inaccessibility to long-term external finance.

The existence of the family at the higher echelon of the hierarchy indicates the traditional way of establishing and running a business with respect to industrial, managerial, and technical advice. The importance of the family entrepreneur and its effect on performance and access to finance provides strong support.

Moreover, the centralization of decision making concerning sale, finance, and overall planning in the hand of owners gives clear evidence that financing decision of small growing firms is affected by typology and attitudes of entrepreneur. These empirical findings provide confirmation to our hypothesis, based on the relation between corporate control and financing decision.

The financial control system maintained by small growing firms is informal and based on poor and short-term business plan and traditional accounting reports rather than forecasting financial information. However, the frequency of the review of working capital and revaluation of fixed assets, as well as the level of inventory maintained to satisfy banks requirements under Murabaha financing, provide empirical evidence in support of our hypothesis

The policy implication is a practical step that should fill the deficiency in financial control practice. Entrepreneurs and management profile are the focal point in policy implications. At a level of macro strategies, policies are directed towards entrepreneur development as an agent of change for economic growth.

For policy makers and educators seeking to assist small firms; attention should be given to the development of strategic thinking skills, planning skills and formal education programs in business management needs of the small firm sector.

References

Abor, J., & Biekpe, N. (2007). Does Corporate Governance affect Capital Structure Decisions of Ghanaian SMEs? University of Stellenbosch Business School, South Africa.

Indexed at, Google Scholar, Cross Ref

Ahmed, E.S.A. (1987). An empirical study of the financing of small enterprise development in Sudan. University of Bath (United Kingdom).

Alba, P., Claessens, S., & Djankov, S. (1998). Thailand's corporate financing and governance structures. World Bank Publications.

Berger, P.G., Ofek, E., & Yermack, D.L. (1997). Managerial entrenchment and capital structure decisions. The Journal of Finance, 52(4), 1411-1438.

Indexed at, Google Scholar, Cross Ref

Bonaccorsi, A., & Giannangeli, S. (2005). Why new firms never get large? Evidence on post-entry growth of Italian new firms.Economic Policy Magazine,95(1), 137-180.

Cadbury, A. (1992). Report on the financial aspects of Corporate Governance, Gee Publishing, London.

Claessens, S., Djankov, S., & Lang, L.H. (2000). The separation of ownership and control in East Asian corporations.Journal of Financial Economics,58(1-2), 81-112.

Indexed at, Google Scholar, Cross Ref

Dalton, D.R. (1989). Corporate governance: who is in control here? Business Horizons,32(4), 2-11.

Davidson, P. (1996). Determinants of Entrepreneurial Intentions. Jonkoping International Business School (JIBS), Sweden.

Davila, T. (2000). An empirical study on the drivers of management control systems' design in new product development.Accounting, Organizations and Society,25(4-5), 383-409.

Indexed at, Google Scholar, Cross Ref

Gibson, B., & Cassar, G. (2002). Planning behavior variables in small firms.Journal of Small Business Management,40(3), 171-186.

Indexed at, Google Scholar, Cross Ref

Hart, O. (1995). Corporate governance: some theory and implications.The Economic Journal,105(430), 678-689.

Indexed at, Google Scholar, Cross Ref

Hutchinson P.J. (1989). The Financial Profile of Small Firms in Australia” Accounting Research Study No. 10, Department of Accounting and Financial Management, University of New England, Armidale, New South Wales.

Hutchinson, P. (1999). Small enterprise: finance, ownership and control.International Journal of Management Reviews,1(3), 343-365.

Indexed at, Google Scholar, Cross Ref

Ibrahim, N.A. (2007). Capital Structure Puzzles of Small Growing Firms in the Sudan - An Empirical Study. Unpublished PhD Thesis. Faculty of Economics and Rural Development, University of Gezira, Sudan.

Jensen, M.C., & Meckling, W.H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs, and ownership Structure.Journal of Financial Economics, 3(4), 305-360.

Indexed at, Google Scholar, Cross Ref

Keasey, K., Thompson, S., & Wright, M. (1997). Introduction: the corporate governance problem–competing diagnoses and solutions.Corporate governance: Economic and Financial Issues,2.

Kjellman, A., & Hansén, S. (1995). Determinants of capital structure: Theory vs. practice.Scandinavian Journal of Management,11(2), 91-102.

Indexed at, Google Scholar, Cross Ref

La Porta, R., Lopez?de?Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world.The Journal of Finance,54(2), 471-517.

Indexed at, Google Scholar, Cross Ref

Myers, S.C. (2001). Capital structure.Journal of Economic Perspectives,15(2), 81-102.

Osaze, B.E. (1992). (Financing Small Rapid Growth Firms) Unpublished paper, logos, Nigeria.

Parker, J., & Tay, R.H. (1990). Measuring International Harmonization and Standardization. Abacus, 26(1), 71-88.

Indexed at, Google Scholar, Cross Ref

Reid, G.C. (1999).Information and the small firm. University of St. Andrews, Centre for Research into Industry, Enterprise, and the Firm.

Reynolds, P.D. (1995). Who starts new firms? Linear additive versus interaction based models.Frontiers of Entrepreneurship Research, 32-46.

Shaver, K.G., & Scott, L.R. (1992). Person, process, choice: The psychology of new venture creation.Entrepreneurship Theory and Practice,16(2), 23-46.

Indexed at, Google Scholar, Cross Ref

Shleifer, A., & Vishny, R.W. (1986). Large shareholders and corporate control.Journal of Political Economy,94(1), 461-488.

Stanworth, J., & Curran, J. (1991). Growth and the small firm, in J. Curran, J. Stanworth, and D. Watkins (eds.) The Survival of the Small Firm. 2: Employment, Growth, Technology and Politics, Gower Publishing, Aldershot, England, 77-99.

Wen, Y., Rwegasira, K., & Bilderbeek, J. (2002). Corporate governance and capital structure decisions of the Chinese listed firms.Corporate Governance: An International Review,10(2), 75-83.

Indexed at, Google Scholar, Cross Ref

Wijewardena, H., De Zoysa, A., Fonseka, T., & Perera, B. (2004). The impact of planning and control sophistication on performance of small and medium?sized enterprises: Evidence from Sri Lanka.Journal of Small Business Management,42(2), 209-217.

Received: 19-Apr-2022, Manuscript No. AAFSJ-22-11800; Editor assigned: 21-Apr-2022, PreQC No. AAFSJ-22-11800(PQ); Reviewed: 05-May-2022, QC No. AAFSJ-22-11800; Revised: 08-June-2022, Manuscript No. AAFSJ-22-11800(R); Published: 15-June-2022