Research Article: 2018 Vol: 22 Issue: 1

Corporate Governance and Intellectual Capital: Evidence From Gulf Cooperation Council Countries

Abdalmuttaleb MA Musleh Al-Sartawi, Ahlia University

Keywords

Intellectual Capital, Corporate Governance, Human Capital, Structural Capital, Relational Capital.

Introduction

Decisions-makers and potential investors always seek relevant and accurate information in order to minimize the risks that are associated with their decisions. Accordingly, governments, audit firms and regulatory bodies have started taking steps towards improving their corporate governance structure to assure the public, especially after the financial failure in 2001 and the financial crisis in 2008 (Al-Khadash & Al-Sartawi, 2010; Mousa & Desoky, 2012). The firm’s capability to disclose intellectual capital helps it to enhance its value, gain competitive advantage, improve internal controls, increase asset management capabilities, enrich the characteristics of information disclosed and decrease the decisions associated with risks (Al-Sartawi, 2017; Ranani & Bijani, 2014; Al-Musalli & Ismail, 2012).

Similarly, good corporate governance and fully disclosed information play an important role in reducing the agency problem by representing managements' transparency and accountability in conducting a business (Al-Sartawi, 2016). Moreover, disclosing information about intellectual capital reflects the ability of the firms in managing their assets to create long-term competitive advantage (Ranani & Bijani, 2014) by increasing the percentage of knowledge-based investments. Stewart (1997) defined Intellectual capital as the knowledge that transforms raw materials and makes them more valuable. Moreover, Mavridis (2005) stated that intellectual capital is the way of dealing with assets. In certain developing countries such as the Gulf Council Countries (GCC), disclosing intellectual capital is still not highly used by organizations and has not been formally regulated. Intellectual capital would contribute in enhancing corporate governance level through changing management style toward structuring and formation of relevant strategies and policies to protect investors and users of financial information and reducing the agency problem (Al-Musalli & Ismail, 2012). Nevertheless, there are a limited number of researches focusing on the relationship between corporate governance and intellectual capital, especially in developing countries.

Accordingly, the objective of this study is to highlight the nature of the relationship between the level of corporate governance applied by the GCC listed companies and the level of intellectual capital disclosed by them. The GCC countries, as a part of the developing capital market, have paid a lot of attention to improving its regulations by developing corporate governance policies (Al-Sartawi, 2015), encouraging voluntary disclosure and investing in human resources and information systems. Based on its geographical location, the GCC is considered as the heart of the Middle East, providing quick and efficient access to every market in the region. The GCC always aims at attracting domestic and foreign investors using several incentives, such as having no personal or corporate income tax. It offers a hundred percent foreign ownership of real estate in almost all sectors and business assets. Moreover, the GCC as a financial centre has become an intended destination for a lot of foreign investors (Al-Sartawi et al. 2016). As a result, these investors seek qualified and talented human resources along with developed infrastructure of information systems, to invest in a certain country. This infrastructure of talented human resources and developed information systems is provided through focusing, increasing, educating the society and disclosing about the level and the importance of investing in intellectual capital. Therefore, the research objectives can be developed as a research questions as follows:

1. What is the level of Intellectual Capital (ICL) disclosed by the GCC listed companies?

2. What is the level of corporate governance (CGL) applied by the GCC listed companies?

3. What are the relationship between corporate governance level (CGL) and the level of Intellectual Capital (ICL) disclosed by the GCC listed companies?

Based on the findings of this study, the researcher proposes recommendations that might aid standard setters and regulatory bodies in the GCC to establish strategies that would encourage knowledge-based investment by the listed companies and governments. Furthermore, such research is not only significant for preparers and users of financial information, but will also encourage policy-makers in the GCC Countries to adopt the concept of a knowledge-based economy. Additionally, managers might realize the importance of intellectual capital and adopt better practices in managing their assets. This will result in better provision of information to stakeholders, enhance the characteristics of employers and increase the quality of corporate governance applied in GCC.

Literature Review

In a knowledge-based economy good practices of corporate governance will lead firms towards eliminating information asymmetries and agency problems by preparing and disclosing relevant information to decision-makers. Nevertheless, good corporate governance enhances the firms’ ability to attract talented employees, adopt advanced technological infrastructures and maintain good relationships with suppliers and other stakeholders (Al-Sartawi, 2017; Mousa & Desoky, 2012).

Generally, disclosure is a very crucial source of information to all internal and external shareholders and stakeholders, as it helps them make appropriate financial decisions (Alhazaimeh et al, 2014). Besides, financial disclosure consists information about intellectual capital that serve as an indicator of a firm’s ability in creating its value by developing and applying proper procedures to manage the assets. Accordingly, implementing effective corporate governance procedures could help firms in maintaining their values by involving employers and decision-makers in the process of developing the firm’s intellectual capital (Madhani, 2014). Therefore, whereas intellectual capital is concerned with value creation processes of an organization; corporate governance plays an important role in maintaining this value.

Consistent with the agency theory, accounting regulation seeks to limit dysfunctional and self-serving managerial behavior. Davis (2005) defined corporate governance as the processes, structures and institutions within and around organizations that assign assets and power control among the participants. It determines the nature of the relationship between management and employees for the equitable distribution of wealth of shareholders (Wahid et al, 2013). Corporate Governance has been recognized as a mechanism for attaining maximum efficiency as well as sustainability, productivity and profitability (Anup & Cooper, 2017; Sanad & Al-Sartawi, 2016). This challenge can be faced by the corporate governors in the knowledge era through getting best out of its intellectual assets and view corporate knowledge as being one of the most sustainable sources of competitive advantage in business. The shift from manufacturing economy to knowledge economy requires corporate governors to maximize value creation from its Intellectual Capital (IC) resources to succeed (Makki & Lodhi, 2014).

In knowledge economy, Intellectual Capital is considered crucial for the competitiveness of companies regardless of the industry. The theory of intellectual capital has been developed through time by different researchers such as Sveiby (1997) and (Edvinsson & Malone, 1997). These researchers established the foundations of the way in which intangible factors determine the success of companies. Their respective models “Intangible Assets Monitor” (IAM) (Sveiby, 1997) and “Skandia Navigator” (Edvinson & Malone, 1997) are representative of the assumptions, principles and foundations of the intellectual capital standard theory. However, later contributions from other academics and specialists have developed and refined the standard theory.

As mentioned by Boudreau & Ramstad, (1997) Intellectual Capital can be defined as business intangible value that includes people, natural relationships and technological infrastructure. Additionally, intellectual capital considered as a tactical component of the real capital which makes the company more attractive and competitiveness (Sharifi & Bijani, 2014). This has resulted in a shift from financial and physical resources to knowledge intensive activities. Therefore, the responsibility of Corporate Governance involves creating, developing and leveraging Intellectual Capital embedded in the people, structures and process of the firm (Keenan & Aggestam, 2001).

Therefore, we can surmise that intellectual capital is a key component for a firm’s future sustainability and successes (Sharifi & Bijani, 2014). Furthermore, intellectual capital can be introduced as the accumulated pool of knowledge regarding recourses and users of these resources which includes physical and intangible assets, management style, internal and external communication lines, human skills and abilities in adding values or solving problems and technological infrastructure (Sharifi & Bijani, 2014; Boudreau & Ramstad, 1997). Makki and Lodhi (2014) argue that Intellectual Capital exists in every firm regardless of the efficiency of governance boards to exploit it. Nonetheless, the researchers further argue that the effectiveness of Intellectual Capital depends upon the best practices of corporate governance, as corporate governance is a performance driver and adds value to a firm. Intellectual resources constitute a strategic asset drive to the successful performance of the company, so that companies need to practice effective corporate governance to protect and retain them (Keenan & Aggestam, 2001).

Intellectual capital can be divided into three parts. The first part is Human Capital, which focuses on the availability of skills, ability, talent and know-how of employees that is necessary to apply the firm’s strategy. The second part is Structural Capital which emphasizes the availability of knowledge applications, databases, information systems, processes and other infrastructure required to support the process of executing strategies. Finally, the third part is the Relational Capital which concentrates on the outside linkage of the company with suppliers and customers that empowers it to secure its merchandising transaction in an easy way (Stewart, 1997).

Investors prefer investing overseas because it provides them with better opportunities and undoubtedly, technology is blurring the borders among countries. Due to the openness of the economies of the GCC countries with the global economy, the huge developments in their technological infrastructures and the variety of external linkages of the company with suppliers and customers, the GCC countries are being more concerned about the attributes that could attract the investors such as clear regulation, corporate governance, transparency and technological infrastructure.

There are several empirical studies on the relationship between Intellectual Capital and Corporate Governance (Faisal et al, 2016; Makki & Lodhi, 2014; Wahid et al 2013). However, in the GCC countries empirical studies are still at an early stage and quite negligible (Al-Musalli & Ismail, 2012). On the other hand, a study that was conducted in Bahrain by Sarea and Alansari (2016) revealed that investing in intellectual capital will decrease earning management practices because of the existence of talented employees and the style of management applied will lead the company to be more interested in real revenues rather than manipulating the numbers.

Additionally, a study conducted by Al-Musalli & Ismail (2012) examined the relationship between board of directors’ characteristics (educational level diversity, nationality diversity, board interlocking, board size and number of independent directors) and intellectual capital performance in a sample of 147 banks in Gulf Cooperation council (GCC) countries for the period 2008-2010 revealing that IC performance of GCC listed banks is low because of the negative relationship with the independent directors in GCC listed banks.

Therefore, this study would be an important contribution in filling the gap in the current literature by determining the level of intellectual capital disclosed by the companies that are listed in the GCC Bourse, in particular the relationship between Corporate Governance and Intellectual Capital.

Methodology

Sample Selection

The empirical study of the current research depends on a sample which includes all the listed companies in the GCC Bourses for the year 2015. However, the required data for calculating ICL and CGL were gathered from 274 companies out of 285 companies listed under the financial sector. Table (1) shows the sample distribution according to country and industry type (Banking, Insurance and Investment) as the structure of the financial sectors and their regulations in the GCC are similar. Moreover, the financial sector is the largest sector due to the size of funds invested in it.

| Table 1: Sample Distribution According To Country And Industry | ||||||||||||||||

| GCC Countries | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| KSA | UAE | OMA | QAT | BAH | KUW | TOTAL | ||||||||||

| Industry | IN | EX | IN | EX | IN | EX | IN | EX | IN | EX | IN | EX | IN | EX | *Sample | % |

| Banks | 12 | 0 | 36 | 0 | 8 | 0 | 8 | 0 | 7 | 0 | 9 | 0 | 80 | 0 | 80 | 29% |

| Insurance | 35 | 1 | 35 | 0 | 5 | 0 | 5 | 0 | 5 | 0 | 7 | 0 | 92 | 1 | 91 | 33% |

| Investment | 7 | 1 | 21 | 0 | 13 | 0 | 4 | 0 | 11 | 2 | 57 | 7 | 113 | 10 | 103 | 38% |

| Total | 54 | 2 | 92 | 0 | 26 | 0 | 17 | 0 | 23 | 2 | 73 | 7 | 285 | 11 | ||

| *Per country | 52 | 92 | 26 | 17 | 21 | 66 | 274 | 100% | ||||||||

*Included?Excluded

The researcher used the companies’ websites, GCC Bourses’ websites and financial reports to gather the data required for this study. Some of the companies were excluded from the study because their websites were not functioning and some of them were excluded because they did not have published financial reports on their websites. In addition, a few companies were suspended from trading in the bourses. Table (2) shows the reasons for excluding companies from the selected sample.

| Table 2: Reasons Of Excluded Companies | ||

| Item | Number | Percentage |

|---|---|---|

| Listed companies in GCC Bourses under financial sector | 285 | 100% |

| Suspended from GCC Bourses | (5) | (2%) |

| Company's website was not working | (1) | (0.4%) |

| The company has no website | (1) | (0.4%) |

| No published financial reports on website | (2) | (0.7%) |

| Closed companies | (2) | (0.7%) |

| Total companies included in the sample | 274 | 96% |

Measuring the level of CG and the level of IC Disclosure

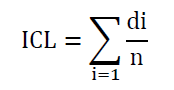

The current study has adopted ICL index used by Al-Sartawi (2017), Ho et al., (2012), Bukh et al., (2005) and Rimmel et al., 2009 consisting of 78 items. The ICL index is binary-based, that is, if a company reported an item which was included in the checklist it received a score of 1 and if the company did not report an item, a score of 0 was allocated. Consequently, the Index for each company was calculated by dividing the total earned scores of the company by the total maximum possible scores appropriate for the company. The formula below shows the way of calculating the ICL index:

Where:

di: Disclosed item equal to 1 if the company met the checklist item and 0 otherwise.

n: Equals the maximum score each company can obtain.

Furthermore, the researcher used a checklist consisting of 12 items (8 items regarding the board of directors’ characteristics and 4 items regarding the audit committee characteristics) to measure the level of corporate governance. Therefore to aggregate the results of the level of corporate governance, the variables are defined binary digits, that is, if a company achieved an item which was included in the checklist it received a score of 1 and if the company did not achieve an item, a score of 0 was allocated. Accordingly, the level for each company was calculated by dividing the total earned scores of the company by the total maximum possible scours appropriate for the company.

Hypothesis Development

Several studies have been conducted regarding the association between the level of intellectual capital and the board of director’s characteristics including CEO duality, board size, board composition, frequency of board meetings and director’s ownership (Faisal et al, 2016; Muttakin et al, 2015; Makki & Lodhi, 2014; Al-Musalli & Ismail, 2012). Negligible research has been undertaken to investigate the relationship between the level of intellectual capital and the overall level of corporate governance. Consequently, this research hypothesizes the following:

H1: There is a positive relationship between CGL and ICL disclosed by the companies listed in GCC Bourses.

Regression Model

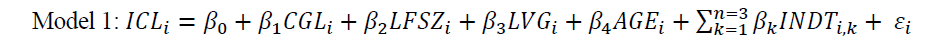

To test the hypothesis the following regression model was developed using intellectual capital as a dependent variable and control variables such as company age, size; industry type and financial leverage.

Where:

Data Analysis

Descriptive Statistics

As mentioned earlier, the level of intellectual capital is measured by dividing the total score of every company by the maximum probable scores. The maximum score of IC level is 78 points. The results shown in Table 3 report that the level of intellectual capital disclosed differed between GCC Countries and also between industry types. The highest level was 80% by Qatari companies and the lowest was 69% by Saudi companies. In addition, with regards to industry type, the banks achieved the lowest level which was 72% compared with the two other industry types. The results, moreover, show that the overall level was 73% which considered as a good level of disclosure by the GCC companies. On the other hand, the results show that the overall level of corporate governance applied by the GCC listed companies was 78% and it is considered as a good level.

| Model 1: Regression Model | ||

| Code | Variable Name | Operationalization |

|---|---|---|

| Dependent variable | ||

| ICL | Intellectual Capital Level | Total scored items by the company/Total maximum scores |

| Independent Variables?Corporate Governance Level: | ||

| CGL | Internet financial reporting % | Total scored items by the company/Total maximum scores |

| Control Variables: | ||

| LFSZ | Firm size | Natural logarithm of Total Assets |

| LVG | Leverage | Total liabilities/Total Assets |

| AGE | Firm Age | The difference between the establishing date of the firm and the report date (2015) |

| INDT | Industry Type | |

| Banks | This is a binary Wherein 1 means that the company is Banks and 0 otherwise | |

| Insurance | This is a binary Wherein 1 means that the company is Insurance and 0 otherwise | |

| Investment | This is a binary Wherein 1 means that the company is Investment and 0 otherwise | |

| ei | Error | |

Additionally, the descriptive statistics for control variables (Table 4) show that the mean of firm size, i.e., Total Assets, was 1.20 million, with a minimum of 2.837 million and a maximum 168.1 million. The normality distributions of Total Assets were skewed. Hence, natural logarithm was used in the regression analysis to reduce skewness and bring the distribution of the variables nearer to normality.

| Table 4: Descriptive Statistics For Dependent And Control Variables | |||||

| Variable | N. | Min. | Max | Mean | S.D |

|---|---|---|---|---|---|

| Assets | 274 | 20297 | 1681844040 | 1.20E8 | 2.837E8 |

| Leverage | 274 | 0.12 | 0.96 | 0.6345 | 0.21114 |

| Age | 274 | 2 | 61 | 22.56 | 15.158 |

Moreover, the mean leverage of the firms was approximately 63.5% with a minimum 0.12%, indicating firms with somewhat high debts and a maximum of 96 %, signifying very high debts. Firm age ranges from 2 to 61 with a mean of 22.6.

Validity

With regards to the validity test, the data was checked for multicollinearity which involved conducting the Variance Inflation Factor (VIF). The VIF scores are reported in Table 5, indicating that no score exceeds 10 for any variable in the model. It was, therefore, concluded that no problems were found with regards to collinearity.

| Table 5. Collinearity Statistics Test | ||

| Model | Tolerance | VIF |

|---|---|---|

| CGL | 0.899 | 1.112 |

| Size | 0.759 | 1.317 |

| Leverage | 0.887 | 1.127 |

| Age | 0.901 | 1.110 |

| Industry type | 0.788 | 1.269 |

Additionally, as reported in table 6, the Durbin Watson (D-W) value of the study model was (1.748). Accordingly, we can conclude that there is appositive autocorrelation founded in the model because the (D-W) value was beyond the d-statistic range which is less than the minimal range. In order to overcome this problem, (Lag 1) has to be considered when testing the model of the study.

| Table 6. Autocorrelation Test | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

|---|---|---|---|---|---|

| 1 | 0.216 | 0.089 | 0.047 | 124485 | 1.748 |

Testing Hypothesis

Table 7 reports the findings of the regression analysis. These findings show that F-ratio for the model was 2.725 with 0.006 of probability level, which indicates that the model was reflecting the relationship between the variables in a statistically appropriate way.

| Table 7. Regression Analysis Models | ||||||||||

| CGL | Size | Lev. | Age | In. type | R-Square | Adjusted R-Square | F-statistics | Prob. (F) | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Beta | -0.059 | 0.039 | 0.045 | 0.007 | 0.102 | 0.089 | 0.047 | 2.725 | .006 | |

| t-statistics | -0.922 | 0.563 | 0.697 | 0.113 | 2.486 | |||||

| Sig. | 0.357 | 0.574 | 0.486 | 0.910 | 0.093* | |||||

| *P<0.1 level | ||||||||||

The hypothesis of the study states that there is a positive relationship between CGL and ICL disclosed by the companies listed in GCC Bourses. The results indicate that there is a weak negative relationship between CGL and ICL. Therefore, this hypothesis is not widely supported.

This result is consist with Faisal et al. (2016); Alizadeh (2014) and Al-Musalli & Ismail (2012) who are clearly mentioned that some aspects of corporate governance such as board of directors characteristics and audit committee have negative impacts on the level of intellectual capital disclosed. Furthermore, the findings revealed a positive and significant relationship between industry type and intellectual capital.

Moreover, the results reported that there is a no significant relationship between the firm size, leverage and age. The findings support the belief that increasing corporate governance practices in any firm will affect the agency cost which will in turn affect the intellectual capital disclosure negatively (Faisal et al. 2016). Another reason for this could be that in GCC countries, corporate governance practices are still in there early stage and therefore they are not fully applying strict governance mechanisms. On the other hand, the GCC counters’ economies are not directed towards knowledge based economies.

Conclusion and Recommendations

Corporate governance is considered as a management mechanism tool which enhances the ability of firms in disclosing relevant information for decision makers. Subsequently, good corporate governance enriches financial statements by reporting information regarding intellectual capital which indicates the ability of firms in managing their own assets and reflecting their value (Ranani & Bijani, 2014). Accordingly, the current research focuses on the relationship of corporate governance with intellectual capital disclosure in the GCC Countries. A regression model was developed to measure the relationship between the variables. The results showed that the total level of intellectual capital was 73% and the level of corporate governance applied by the GCC firms was 78%. Moreover, the findings indicate that there is a weak negative relationship between CGL and ICL. The current research extended the previous studies conducted in the GCC Countries by using a wider checklist, using a larger sample (274) and conducting a comparison study among the all GCC countries. As a result, this paper is important as it seeks to contribute empirical evidence to the literature regarding the intellectual capital and corporate governance in developing countries, particularly in the GCC Countries.

Therefore, the research recommends that the GCC Bourses have to develop a formal guideline for intellectual capital disclosure to create harmony in disclosing information and to reduce the agency costs through improving the practices of corporate governance mechanisms.

research was conducted using the financial sector in the GCC Countries, thus, the sample size is small when compared to the total companies listed. Furthermore, while some companies did not have a website, others did not have published financial reports on their websites. Therefore, the study findings cannot be generalized.

| Appendix: Intellectual Capital Level (Icl) Index | |||

| 1 | Staff breakdown by age | 40 | Market share, breakdown by country/segment/product |

| 2 | Staff breakdown by seniority | 41 | Repurchase |

| 3 | Staff breakdown by gender | 42 | Description of and reason for investment in IT |

| 4 | Staff breakdown by nationality | 43 | IT systems |

| 5 | Staff breakdown by department | 44 | Software assets |

| 6 | Staff breakdown by job function | 45 | Description of IT facilities |

| 7 | Staff breakdown by level of education | 46 | IT expenses |

| 8 | Rate of staff turnover | 47 | Efforts related to the working environment |

| 9 | Comments on changes in number of employees | 48 | Information and communication within the company |

| 10 | Staff health and safety | 49 | Working from home |

| 11 | Education and training expenses/number of employees | 50 | Internal sharing of knowledge and information |

| 12 | Staff interview | 51 | Measures of internal or external failure |

| 13 | Policy statements on competence development | 52 | External sharing of knowledge and information |

| 14 | Description of competence development program and activities | 53 | Fringe benefits and company social programs |

| 15 | Educating and training expenses | 54 | Environmental approvals and statements/policies |

| 16 | Absentee rates | 55 | Statements of policies, strategies and/or objectives related to R&D activities |

| 17 | Employee expenses/number of employees | 56 | R&D expenses |

| 18 | Recruitment policies | 57 | R&D expenses/sales |

| 19 | HRM department, division or function | 58 | R&D invested in basic research |

| 20 | Job rotation opportunities | 59 | R&D invested in product design/development |

| 21 | Career opportunities | 60 | Future prospects regarding R&D |

| 22 | Remuneration and incentive systems | 61 | Details of company patents |

| 23 | Pensions | 62 | Number of patents and licenses, etc. |

| 24 | Insurance policies | 63 | Patents pending |

| 25 | Statements of dependence on key personnel | 64 | Description of new production technology |

| 26 | Revenues/employee | 65 | Statements of corporate quality performance |

| 27 | Value added/employee | 66 | Strategic alliances |

| 28 | Number of customers | 67 | Objectives and reasons for strategic alliances |

| 29 | Sales breakdown by customer | 68 | Comments on the effects of the strategic alliances |

| 30 | Annual sales per segment or product | 69 | Description of the network of suppliers and distributors |

| 31 | Average customer size | 70 | Image and brand statements |

| 32 | Dependence on key customers | 71 | Corporate culture statements |

| 33 | Description of customer involvement | 72 | Best practices |

| 34 | Description of customer relations | 73 | Organizational structure |

| 35 | Education/training of customers | 74 | Utilization of energy, raw materials and other input goods |

| 36 | Customers/employees | 75 | Investment in the environment |

| 37 | Value added per customer or segment | 76 | Description of community involvement |

| 38 | Market share percentage | 77 | Information on corporate social responsibility strategies and objectives |

| 39 | Relative market share | 78 | Description of employee contracts/contractual issues |

References

- Abdulsalam,F., Al-Qaheri, H. & Al-Khayyat, R. (2011). The intellectual capital performance of Kuwaiti banks: An application of VAICTM1 model. I Business, 3, 88-96.

- Alhazaimeh, A., Palaniappan, R. & Almsafir, M. (2014). The impact of corporate governance and ownership structure on voluntary disclosure in annual reports among listed jordanian companies. Procedia Social and Behavioral Sciences, 129, 341-348.

- Alizadeh, R., Chashmi, S.A.N. & Bahnamiri, A.J. (2014). Corporate governance and intellectual capital. Management Science Letters, 4(1), 181-186.

- Al-Khadash., Aldeen, H. & Al-Sartawi, A. (2010). The Capability of sarbanes-oxley act in enhancing the independence of the jordanian certified public accountant and its impact on reducing the audit expectation gap. An empirical investigation from the perspectives of auditors and institutional investors. Jordan Journal of Business Administration, 6(3), 294-315.

- Al-Musalli, Mahfoudh A.K. & Ku N. I., Ku Ismail. (2012). Intellectual capital performance and board characteristics of GCC banks. Procedia Economics and Finance, 2, 219-226.

- Al-Sartawi., Abdalmuttaleb., Fatema, A. & Zakeya, S. (2016). Corporate governance and the level of compliance with international accounting standards (IAS-1): Evidence from Bahrain Bourse. International Research Journal of Finance and Economics, 157, 110-122.

- Al-Sartawi. & Abdalmuttaleb. (2015). The effect of corporate governance on the performance of the listed companies in the gulf cooperation council countries. Jordan Journal of Business Administration, 11(3), 705-725.

- Al-Sartawi. & Abdalmuttaleb. (2016). Measuring the level of online financial disclosure in the Gulf Cooperation Council Countries, Corporate Ownership and Control, 14(1), 547-558

- Al-Sartawi. & Abdalmuttaleb. (2017). The level of disclosing intellectual capital in the gulf cooperation council countries. International Research Journal of Finance and Economics, 159.

- Anup, A. & Cooper, T. (2017).Corporate governance consequences of accounting scandals: Evidence from Top Management, CFO and Auditor Turnover. Quarterly Journal of Finance, 7(1), 1-41.

- Boudreau, J. & Ramstad, P. (1997). Measuring intellectual capital: Learning from financial history. Cornell University ILR school.

- Bukh, P.N., Nielsen, C., Gormsen, P. & Mouritsen, J. (2005). Disclosure of information on intellectual capital in Danish IPO prospectuses. Accounting, Auditing and Accountability Journal, 186,713-732.

- Edvinsson, L. & Malone, M.S. (1997). Intellectual Capital. Harper Business.

- Faisal, M., Hassan, M., Shahid, M. Rizwan, M. & Quershi, Z. (2016). Impact of corporate governance on intellectual capital efficiency: Evidence from Kse Listed Commercial Banks. Science International-Lahore, 28(4), 353-361.

- Ho, H., Kin, C. & Pauline, C. (2012). Intellectual capital disclosure and initial public offerings: Evidence from Hong Kong. Journal of Applied Economics and Business Research,2(2), 56-68.

- Keenan, J. & Aggestam, M. (2001). Corporate governance and intellectual capital: Some conceptualizations. Corporate Governance: An International Review, 9(4), 259-275.

- Madhani, P.M. (2014). Corporate governance and disclosure practices in India: Domestic firms versus cross-listed firms. IUP Journal of Corporate Governance, 13(4), 24-51.

- Makki, M. & Lodhi, S. (2014). Impact of Corporate Governance on Intellectual Capital Efficiency and Financial Performance. Pakistan Journal of Commerce and Social Sciences. 8(2), 305-330.

- Mavridis, D. (2005). Intellectual capital performance drivers in the Greek banking sector. Management Research News, 28(5), 43-62.

- Mousa, G.A. & Abdelmohsen M. D. (2012). The association between internal governance mechanisms and corporate value: Evidence from Bahrain. Asian Academy of Management Journal of Accounting and Finance, 8(1), 67-92.

- Muttakin, M., Khan, A. & Belal, A. (2015) Intellectual capital disclosures and corporate governance: An empirical examination. Advances in Accounting, Incorporating Advances in International Accounting, 31, 219-227.

- Ranani, H. S. & Zivar B. (2014). The impact of intellectual capital on the financial performance of listed companies in tehran stock exchange. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(1), 130-146.

- Rimmel, G., Nielsen, C., Yosano, T. 2009. Intellectual capital disclosures in Japanese IPO prospectuses. Journal of Human Resource Costing & Accounting, 134, 316-337.

- Sanad., Zakeya., Al-Sartawi. & Abdalmuttaleb. (2016). Investigating the relationship between corporate governance and internet financial reporting (IFR): Evidence from Bahrain Bourse. Jordan Journal of Business Administration, 12(1), 239-269.

- Sarea, A. & Shaima, A. (2016). The relationship between intellectual capital and earnings quality: Evidence from listed firms in Bahrain Bourse. International Journal of Learning and Intellectual Capital, 13(4), 302-315.

- Sveiby, K.E. (1997). The new organisational wealth, San Francisco, Berett-Koehler.

- Wahid, A., Abu, N., Latif, W. & Smith, M. (2013). Corporate governance and intellectual capital: Evidence from public and private universities. Higher Education Studies, 3(1), 63-78.