Research Article: 2022 Vol: 26 Issue: 4S

Corporate governance and the level of compliance with IFRS: Evidence from listed firms in a developing economy

Solomon Awariya, Bolgatanga Technical University

Simon Akumbo Eugene Mbilla, University of Education Winneba

Stanley Akamiri Abopaam, Bolgatanga Technical University

Citation Information: Awariya, S., Mbilla, S.A.E., & Abopaam, S.A. (2022). Corporate governance and the level of compliance with IFRS: Evidence from listed firms in a developing economy. Academy of Accounting and Financial Studies Journal, 26(S4), 1-14.

Keywords

Board Independence, Audit Committee Characteristics, IFRS, Government Ownership

Abstract

The purpose of this study was to examine the degree to which corporate governance mechanisms affect the level of compliance with IFRS in Ghana. Board characteristics, audit committee characteristics and ownership structures are use as proxy for corporate governance mechanisms. 26 companies listed on the Ghana stock market was sample for the study from 2008Q1 to 2017Q4. Ordinary Least Squares (OLS) estimation techniques were employed for the study. The study finds the level of compliance with IFRS to be about 100%. The study further reveals that, there is a positive significant relationship between the level of compliance with IFRS and board independence, government ownership and a negative relationship with CEO duality. The findings suggest that corporate governance mechanisms are capable of improving the level of compliance with IFRS in Ghana. It is thus recommended for policy makers to develop a framework that would ensure that firms pay more attention to their board dynamics so as to enhance the overall corporate reporting environment.

Introduction

Since the introduction of IFRS, the subject of compliance has attracted a great deal of attention from a number of scholars most especially in the developed countries (Mazzi et al., 2017; Cascino & Gassen, 2015; Rajhi, 2014; Izzo et al., 2013; Glaum et al., 2013;Tsalavoutas, 2011; Tsalavoutas, 2010). Similarly, the number of high profile corporate scandals over the years has highlighted the significance of good corporate governance. This is because corporate governance structures play a key role in the corporate reporting process of each firm. For instance, in the case of Ghana, the Companies code of 1963 Act 179 has placed; the sole responsibility for the preparation and presentation of financial information on the shoulders of the management. In the last hundred years Corporate Governance (CG) mechanisms have being used as a tool to promptly deal with corporate failures or systemic crises. For instance, in the 1700’s, the south sea bubble gave the world it first well-document failure of governance, this brought about major reforms in business law and practices in England. According to Borgia (2005); the 1929 stock market crash revolutionized the securities laws and caused the US security market to put proper laws in place as a safe guard against future occurrence. In a similar manner, the collapse of a number of blue chip companies (Enron & Parmalat) especially in the developed countries in the 1900’s highlighted the significance of CG structures as these collapses were attributed to weak governance practices. These occurrence were triggered by the financial crisis in Asian in mid-1997 and the US housing market crisis, which started worldwide financial crisis in the beginning of 2000 (Ghana SEC, 2002). More so, in the last decade the subject of CG in developing countries has also gain much attention (Malherbe & Segal, 2001; Lin, 2001; Goswami, 2001; Oman, 2001). For example; in the case Ghana, CG and institutional governance took a dramatic turn when Security and Exchange Commission introduce the 2002 best code of standards as well as other best practice guidelines by other institutions such as Institute of Directors (IoD). These reforms came about as a response to the need for better protection for investors. On the international level, CG has become more prominent than ever, due to cross boarder trading and investments activities, as result international agencies have made continuous called on state institutions, regulators and other private institutions to closely monitor and implement appropriate governance procedures in order to promote good governance practices in business entities. This is particularly important given that in the case of Ghana, the companies’ code of 1963 Act 179 have placed the duty on the directors to prepare and fairly present the financial statements. These obligations includes; applying appropriate accounting policies, designing, implementing and maintaining proper internal controls that are relevant to the preparation and fair presentation of the financial reports that are devoid of material inconsistency. The reasons for this, is to ensure that there is transparency, quality and reliability in the financial reporting environment.

Besides this, in the report of the external auditor’s report usually included in the annual reports of the firm, the responsibility for management to prepare and present true and fair financial information in accordance with the relevant accounting provisions in this case the IFRS is normally highlighted. IAS 8 also point to the responsibilities of management for the preparation of financial statements. When it mentioned that, in the absence of a standard or an interpretation that specifically applies to a transaction, management shall use its judgment in developing and applying an accounting policy that results in information that is relevant and reliable. Clearly, these provisions highlights the role of management in the corporate reporting process of a firm and so to a greater extent is in a position to influence the extent to which the accounting provisions outlined in the IFRS would be complied with.

Despite this significant role of management in the corporate reporting process, it appears strange that several empirical studies have been conducted on the compliance with accounting standards but rather neglected the contributions of corporate governance mechanisms in the context of Ghana. For example, the focus of Appiah, et al., (2016) in their study to examine the compliance with International Financial Reporting Standards using listed firms in Ghana was on firm specific characteristics such as firm age, size, profitability etc. without any consideration for management who ultimately decide on the accounting policies to apply and comply with in the financial reporting process. Other prior literature argues that, the level of compliance with IFRS is influence by profitability. Researchers as such Agyei-Mensah (2014); Wallace, et al., (1994); Naser (1998) Finds a positive association with the level of disclosure, in a sharp contrast (Malone et al., 1993). Finds no positive association between the level of firm’s compliance with IFRS disclosure and profitability, and in a similar manner Juhmani (2012); Al-saeed (2006); Glaum & Street (2003); reports that, the level of compliance with IFRS is not significantly related to profitability. Juhman (2017) finds that the level of compliance with IFRS disclosure is positively associated with board independence, By contrast, Verriest, et al., (2013) found that, companies’ exhibits heterogeneity in both compliance. Garcia-Meca & Sanchez-Ballesta (2010) concludes that, there is a positive association between voluntary compliance with IFRS and board independence; however these findings were significant to only countries with strong investor protection rights. Borgi fendri (2017) examine the effects of Audit committee characteristics on compliance with IFRS for Related Party Disclosure: evidence from South Africa, their findings revealed a positive association between compliance with IFRS for Related Party Disclosure and AC independence, however Ba-Abbad & Wan-Hussin (2011) finds that AC independence is not associated with the level of compliance with IFRS disclosure. Moen & Williams (1994) argues that an AC whose membership is not up to three or more is most likely to be ineffective. Anderson et al reported that the large audit committee can be more effective because there are more members with variety of expertise to enable them to carryout different kinds of tasks that include the monitoring financial reporting practices. Consistent with this claim, some findings suggest that AC with high numbers can positively affect the quality of reporting process (Felo et al., 2003). This indicates that up to date we are not aware of the direct effect of those in the center of the firm’s financial reporting process on the level of compliance with accounting standards in the case of Ghana. Acknowledging this limitation in scope and the contradictory findings; Appiah, et al., (2016) pointed to the need for further studies in the subject area in order to shed more light using corporate governance mechanisms. Notwithstanding this call, one year down the line, their call still remains unanswered. Hence, the main thrust of this work is to examine the degree to which corporate governance mechanisms is associated with firms’ compliance with accounting standards more especially in a developing country’s perspective.

Materials and Methods

The population of the study was all listed firms on the Ghana stock exchange out of which the sample is selected. The GSE is chosen because it is considered as one of the most vibrant and active stock market in sub-Saharan Africa (Abor & Fiador, 2013). It also provides a convenient platform to source all relevant data required. Furthermore, all listed firms on the GSE are required by law to comply with IFRS, thus making GSE an appropriate population for this research work.

Companies trading on (GSE) were selected for this study as representing the total population. Even though the researchers targeted all companies listed on the GSE, the researchers were only able to concentrate on the period from 2008- 2019 making a total of 12 years. The year 2008 was chosen as the earliest year because IFRS was adopted in Ghana in 2007, most companies was able to comply in the year 2008. The 2019 was also chosen as a cutoff point because annual reports for 2020 could not be obtained for most of the firms. As at the time of this research work, 42 companies were trading on the GSE. Out of this number 13 companies were excluded because of missing data. With the remaining 29 companies, 3 companies (Eco bank Transnational Incorporation, Tullow and Anglo gold Ashanti) were further excluded because their financial statements were reported in foreign currency, after these 26 companies were left for the study. This resulted in 312 firm-year observations utilized for the study.

| Table1 Sample Size and Sampling Technique |

||

|---|---|---|

| Sector | Number companies | % |

| Financial | 10 | 38 |

| Agro-forestry | 2 | 8 |

| pharmaceutical and Beverages | 3 | 12 |

| Mining & Oil | 2 | 8 |

| Information Technology | 3 | 12 |

| Manufacturing & Trading | 6 | 23 |

| Totals | 26 | 100 |

Variables

The independent variables used in this study are board characteristics which are proxy by board independence representing the percentage of outside directors on the board and board size representing the numbers of directors on the board. Audit committee characteristics is measured by audit committee independence which is the percentage of outside directors on the committee whiles audit committee size looks at the total number of directors on the committee. Ownership structure is proxy by managerial ownership measured as the percentage of shares held by directors in the company and government ownership also measured on 1 if government has an interest in the company otherwise 0. The variable definitions and measurement as consistent with Juhamni, (2017). This study controls for company size, profitability and auditor type.

These variables and their measurement are summarized in the table below.

| Table 2 Variables Measurement and Symbols Used To Represent Them |

|||

|---|---|---|---|

| Variable | Measurement | Symbol | Expected sign |

| Dependent Variable | IAS1 CIND Total compliance index score is, STEP 1: A score of 1 is assign, if a company disclose in its annual report an item contained in the IAS1 provision in the year under review, 0 for noncompliance. | IAS1 CIND | |

| STEP 2: The overall compliance index of a firm is the sum of the items of provision disclose divided by the total actual number provisions of items contained in IAS1 | |||

| Independent Variables | |||

| Board independence | Percentage of independent non-executive directors on the board | BORD INDP | + |

| Board Size | Total number of directors on the Board | BOD SIZE | + |

| Audit committee independence | Percentage of non-executive directors on the audit committee | AUDIT COMM. INDP | + |

| Audit committee size | Number of directors on the committee | AUD COMM SIZE | + |

| Management Ownersship | The proportion of shares owned by mangers (i.e., the CEO and inside directors) | MNG OW | - |

| Government Ownership | Government ownership, a dummy variable that equals 1 if a government-linked company and 0 otherwise | GOV OW | + |

| Control Variables | |||

| Company Size | The company’s natural log of total assets | CO. SIZE | |

| Profitability | A return on equity measured as the ratio of the companies’ net income to companies’ shareholders equity | PROF. | |

Econometric Model Specification

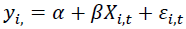

The study employs a panel data regression. This is because the data set consists of observations of multiple variables over multiple time periods. Thus panel data combines time series and cross sectional data. It is also appropriate for this study because of its ability to take into account heterogeneity problem or individual effects in cross sectional data and give more informative data. The general form of the panel data model is specified as:

The subscript ? denotes the cross-sectional dimension and ? represents the time-series dimension. The left-hand variable ? represents the dependent variable in the model, which represents the level of compliance with IFRS disclosure requirements listed on the Ghana Stock Exchange. ?? contains the set of explanatory variables in the estimation model, ? is taken to be constant, overtime ? and specific to the individual cross-sectional unit i.

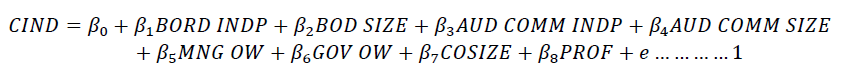

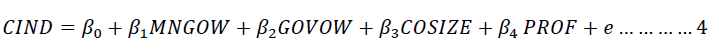

Therefore, the model is thus specified as follows:

To determine the impact of the three CG mechanisms on the level of compliance with IFRS disclosure requirements, the following model regression model is specified

Where; CIND is compliance index, BORDINDP is board independence, BODSIZE is board size, AUD COMM INDP is audit committee independence, AUD COMM SIZE is audit committee size, MNG OW is managerial ownership, GOV OW is government ownership, COSIZE is company size and PROF is profitability.

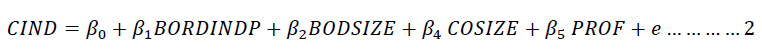

To determine the impact of Board characteristics on the level of compliance with IFRS mandatory disclosure requirements. This econometric model is proposed.

To determine the impact of Audit characteristics on the level of compliance with IFRS disclosure requirements.

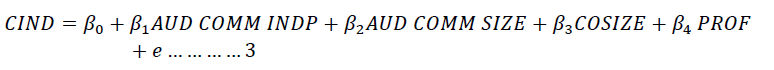

To determine the impact of Ownership structure on the level of compliance with IFRS disclosure requirements.

OLS technique is used to analyse the impact of CG on the level of compliance with IFRS. The use of this regression technique is consistent with prior literature such as Juhmani (2017); Appiah, et al., (2016); Verriest, et al., (2013); Ba-Abbad & Wan-Hussin (2011). Preliminary tests are considered to validate the basic regression assumptions before the results are run. Among these test conducted include the correlation and multicollinearity test using the Spearman Correlation Matrix and Variance Inflation Factor (VIF) correspondingly. Equally, the normality of the data utilized has also been tested using the normality test.

The study employed a panel data regression. This is because panel data combines time series and cross sectional data. It is also appropriate for this study because of its ability to take into account heterogeneity problem or individual effects in crosses sectional data and it is more robust in analysis.

The data is analyse in line with the main objectives of the study. Consistent with the prior IFRS compliance literature, ordinary least-square regression is used to investigate the relationship between CG mechanisms (independent variables) and the level of compliance with IFRS mandatory disclosure requirements as dependent variables and three other firm-specific attributes as control variables. The analysis is done with the aid Stata version 13. The results is then analyzed and discussed and appropriate recommendations suggested where necessary. The research work is concluded by offering policy recommendations.

Results and Discussions

This section presents the descriptive statistics of the study to highlight the shape of the data. Diagnostic tests have also been presented to ensure that the basic regression assumptions are met prior the analysis of results. The analytical result of the data is also presented according to the objectives.

Descriptive Statistics

The descriptive statistical test results of all the sample companies are presented in terms of minimum, maximum, average and standard deviation for both the dependent and independent variables of the study. The results show that the level of compliance with IFRS disclosure ranges from a minimum of 84% to a maximum of 100%, with an average of 97% and a standard deviation of 3%. This result implies that on average 97% of the sampled firms listed on the Ghana stock exchange comply with the disclosure requirements contained in IAS 1. This result is with Appiah, et al., (2016); Juhmani (2017) who recorded 99% and 94% respectively in a similar study. The result of the study is a clear indication that CG mechanism is a key determinant of compliance and thus confirms the overall objective of this study. The results also show that the board has an average size of 8.2 ranging from a minimum of 3 to a maximum of 13. This may be considered a reasonable board size since it falls within corporate governance directive for the financial sector by the Bank of Ghana.

| Table 3 Descriptive statistics |

||||

|---|---|---|---|---|

| Variable | Mean | std. dev. | min | max |

| COMPLIANCE INDEX | 0.973 | 0.034 | 0.839 | 1.000 |

| BODSIZE | 8.282 | 2.082 | 3.000 | 13.000 |

| BODINDP | 0.783 | 0.135 | 0.333 | 0.923 |

| AUDCOMMSIZE | 4.410 | 1.528 | 2.000 | 11.000 |

| AUDCOMMINDP | 0.787 | 0.188 | 0.500 | 1.000 |

| GOVTOW | 0.769 | 0.423 | 0.000 | 1.000 |

| MNGOW | 0.134 | 0.216 | 0.000 | 0.734 |

| COSIZE | 6.553 | 1.378 | 4.340 | 9.324 |

| PRO | (0.349) | 6.786 | (80.692) | 12.895 |

Source: Developed from Stata regression output.

Diagnostic Test

This sub-section of the study considers various preliminary tests to ensure that the basic regression assumptions are satisfied before the results are run. Among these test conducted include the correlation and multicollinearity test using the Spearman Correlation Matrix and Variance Inflation Factor (VIF) correspondingly. Equally, the normality of the data utilized has also been tested using the normality test.

| Table 4 Correlation and VIF test |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| COMPLIANCE | BODSIZE | BODINDP | AUDCOM~E | AUDCOM~P | CEODUAL | GOVTOW | MNGOW | COSIZE | PRO | VIF | |

| COMPLIANCE | 1.000 | ||||||||||

| BODSIZE | 0.471 | 1.000 | 2.290 | ||||||||

| BODINDP | 0.128 | 0.221* | 1.000 | 2.770 | |||||||

| AUDCOMMSIZE | -0.085 | 0.239* | -0.031 | 1.000 | 1.860 | ||||||

| AUDCOMMINDP | 0.269* | 0.218* | 0.235* | -0.594** | 1.000 | 1.790 | |||||

| CEODUAL | -0.316* | -0.221* | 0.014 | 0.402** | -0.413** | 1.000 | 1.220 | ||||

| GOVTOW | 0.872** | 0.526** | 0.281* | 0.006 | 0.332* | -0.180 | 1.000 | 1.790 | |||

| MNGOW | -0.638** | -0.523** | -0.115 | 0.037 | -0.228* | 0.278* | -0.535** | 1.000 | 1.540 | ||

| COSIZE | 0.133 | 0.451** | 0.196 | 0.139 | 0.048 | 0.194 | 0.108 | -0.163 | 1.000 | 1.690 | |

| PRO | -0.065 | -0.234* | -0.135 | -0.263* | 0.146 | -0.196 | -0.082 | 0.076 | -0.135 | 1.000 | 2.310 |

Source: Developed from Stata regression output. Note: The variables are defined in table 4 *, ** Correlation is significant at the 0.05, 0.01 level (two-tailed), respectively.

Generally, the Variance Inflation Factor (VIF) analysis and the Spearman Correlation test are usually relied on to test the presence of multicollinearity. From the correlation results reported in table 4.2 below, it shows that there exist modest correlations among the variables. This is evident in the results, which indicate that the highest correlation recorded is about 0.872 between compliance index and government ownership. However, this cannot be considered too high to be a problem given that, it does not exceeds the suggested threshold of 0.90 recommended by Hair, et al., (1995). More so, the VIF results presented suggest that the issue of multicollinearity is not likely to be problematic, given that all the VIF figures recorded for the test variables are well below the 10 threshold recommended by Hair, et al., (1995). They agreed that a VIF below 10 should not be problematic.

Normality Test

The Shapiro-Wilk test was performed in order to test the normality of the data. The results obtained indicated that null hypothesis stating that the data is normal was sustained as the probability recorded was 0.040, which is below the 5% criterion level. This suggest that the data is normally distributed signifying the absence of outlier.

Compliance Index and Two Corporate Governance Mechanisms

The regression results obtained for the relationship between three distinct groups of corporate governance mechanisms (board characteristics, audit committee characteristics and ownership structures) and level of compliance with IFRS are presented and discussed. The results recorded and presented in table 3 reveal that only one of the proxies used to measure board characteristics (board independence) is positive and significant with the other proxy (board size) having a positive coefficient but not significant. In addition, two proxies namely Government Ownership (GOVTOW) and Management Ownership (MNGOW) were employed to measure ownership structures. The results of the regression indicates that management ownership has a negative but shows an insignificant relationship (P-value>0.05). Therefore this study fails to reject the null hypothesis and concludes that management ownership does not affect IFRS compliance.

However, government ownership records a positive and statistically significant relationship (P-value<0.05) with IFRS compliance. Hence, the study rejects the null hypothesis in favor of the alternative hypothesis and concludes that government ownership has a positive relationship with IFRS compliance.

Finally, the results reveal that both proxies employed to measure audit committee characteristics are negative and not significant.

| Table 5 Regression results of compliance index and two corporate governance mechanisms |

||||

|---|---|---|---|---|

| Variables | Coef. | Std. Err. | T-Value | P>z |

| BODSIZE | 0.0003696 | 0.000298 | 1.240 | 0.215 |

| BODINDP | 0.009354 | 0.0045064 | 2.080 | 0.038 |

| AUDCOMMSIZE | -0.000447 | 0.000760 | -0.590 | 0.556 |

| AUDCOMMINDP | -0.007486 | 0.0088075 | -0.850 | 0.395 |

| GOVTOW | 0.0513732 | 0.0062482 | 8.220 | 0.000 |

| MNGOW | -0.001933 | 0.0025605 | -0.750 | 0.450 |

| COSIZE | 0.0001193 | 0.0007002 | 0.170 | 0.865 |

| PRO | -0.0000139 | 0.0000394 | -0.350 | 0.724 |

| _cons | 0.9342787 | 0.0104401 | 89.490 | 0.000 |

| R-Square | 26 | |||

| No. Obs | 106 | |||

Source: Developed from Stata regression output

Board Characteristics and Level of Compliance

The results obtained from running model 2 to test the relationship between the effect of only board characteristics proxied by board size (BODSIZE) and board independence (BODINDP) on the level of firms’ compliance with IFRS are presented and discussed in this section of the study. From table 4 presented below, the stepwise regression results records an r-square of about 0.28 indicating that the model is capable of predicting only up to about 28% of the changes in compliance with IFRS. It is equally shown in the same table that only board independence continues to have a positive and significant relationship with the level of compliance with IFRS which is consisted with the combined results recorded using model 1. This is particularly not surprising given that one of the key ingredients required for any board to function effectively is the independence of mind to operate without any undue influence. Once the board has the opportunity to operate independently, all things being equal, it is expected that in order to maintain their individual hard earned reputation, they would insist on the firm to make full compliance with applicable provisions. This has the effect of enhancing the level of compliance with IFRS as suggested by the results. The results presented thus support hypothesis 1, which suggested that an increase in the level of board independence leads to an influence on compliance with IFRS disclosure requirements. Similarly, the results recorded is consistent with the findings of other scholars such as Juhmani (2017); Susilowati (2010). However, on the other side, the results sharply contradict results of other researchers like Haniffa & Cooke (2002); Garcia-Meca & Sanchez-Ballesta (2010).

| Table 6 Regression results of compliance index and board characteristics |

||||

|---|---|---|---|---|

| Coef. | Std. Err. | Z | P>z | |

| BODSIZE | 0.000329 | 0.000284 | 1.160000 | 0.246 |

| BODINDP | 0.009363 | 0.003568 | 2.620000 | 0.009 |

| COSIZE | -0.000012 | 0.000751 | -0.020000 | 0.987 |

| PRO | -0.000018 | 0.000040 | -0.450000 | 0.650 |

| _cons | 0.962987 | 0.009063 | 106.260000 | 0.000 |

| R-Square | 28 | |||

| No. Obs. | 152 | |||

Source: Developed from Stata regression output.

Ownership Structure and Level of Compliance

The results of three measures of ownership characteristics namely CEO duality, government ownership and management ownership and the level of firm IFRS compliance are presented in table 7 below and discussed at this stage of the study. Consistent with hypothesis 5, the results reveal that management ownership recorded an inverse and insignificant relationship with IFRS compliance. However, the results on government ownership, which is positive and significant with the level of firms’ compliance with IFRS and supports hypothesis 5. This said, the presence of government on the board of any corporate body would imply the company making all required disclosures. This, ownership exhibits a positive outcome. This result is thus in line with the opinion of Naser, et al., (2006) who used the legitimate and the stakeholder theories to argue that government may put pressure on the firm via government appointed board members to disclose more social and environmental information rather than only financial information in order to improve social perception of firms in which it has significant control. Furthermore Williams (1999) Bourgeois theory of political economy, suggest that, government plays a key role in reducing the adverse effects of imperfect competition and externalities by establishing an adequate corporate reporting policy. The theory suggests that when the state has shareholdings in the company the socio-political and economic system of a nation interacts to shape the perceptions of the organizations on the need to release financial and environmental information that meets stakeholders’ social expectations.

| Table 7 Regression results of compliance index and ownership structure |

||||

|---|---|---|---|---|

| Coef. | Std. Err. | Z | P>z | |

| GOVTOW | 0.05253 | 0.00822 | 6.39000 | 0.00000 |

| MNGOW | -0.00016 | 0.00235 | -0.07000 | 0.94500 |

| COSIZE | 0.00008 | 0.00065 | 0.12000 | 0.90800 |

| PRO | -0.00003 | 0.00004 | -0.70000 | 0.48400 |

| _cons | 0.93564 | 0.00886 | 105.59000 | 0.00000 |

| R-Square | 29 | |||

| No. Obs. | 106 | |||

Source: Developed from Stata regression output

However, the results of the regression model 1 shows that the other four CG mechanisms (i.e., board size, audit committee, audit committee independence and managerial ownership) are not significantly associated with the level of compliance with IFRS disclosure. Strangely, this results shows that audit committee independence and AC size has no association with the level of compliance with IFRS. But contrary to this, AC from extant literature (Faisal & Saad, 2010; Blue Ribbon Committee, 1999; Ramsay, 2002; Smith, 2003) and theoretical points of view should result in an improvement in the financial reporting process and the quality to be specific. Traditionally, the AC is a sub-committee of the board of directors and by law should have at least three non-executives directors; this lays credence to the fact that AC is key to the financial reporting process. The findings (board size, audit committee characteristics and managerial ownership) above could be attributed to the argument put forward by Bova & Pereira (2012) that Ghana’s capital market is quite open and implementation of IFRS lax. More so, most of these studies with a positive relationship (AC and compliance with IFRS) are conducted in developed countries where stringent regulatory regime can have an impact on the outcome of studies but this cannot be said of emerging economies such as Ghana where regulatory regimes are weak. Moreover, the results support the assumption that disclosures are of higher quality when firms have strong CG, and firms with higher quality governance make more extensive disclosures on the financial statement (Verriest et al., 2013). The results of this study indicate that audit committee characteristics have no impact on the level compliance with IFRS, which is consistent with findings of Anderson, et al., (2004).

Conclusion

The overall aim of this study is to examine the extent to which corporate governance mechanisms represented by three main characteristics including board characteristics, audit committee characteristics and ownership structures. The results obtained from the study provide evidence that firms on average comply with the IFRS to about 97%. Specifically, the results documented that corporate governance mechanisms represented by board characteristics (board independence) has a positive and a significant relationship with the extent to which firms in Ghana comply with the IFRS. It can also be concluded from the results that audit committee characteristics represented by audit committee independence and size is not significant to determine the decisions by firms to comply with IFRS in Ghana. However contrary to this, prior studies reveal a moderate to a strong relationship between the AC characteristics and compliance with IFRS. This situation could be attributable to specific factors, which may include but not limited to the following: Ghana’s economic environment is dominated by companies, in which stockholding are tightly owned and controlled by close families and or friends. Due to the nature of closely held ownership of stocks in companies, board members are equally likely to be members who are familiar with the appointing authorities, in the light of this; the extent to which stringent CG rules would be applied is likely to be lax. From this, it can be concluded that ownership structures play an active role on the level to which firms in Ghana comply with the provisions of accounting standards. Given the results documented in this study, it is safe to conclude that in the context of Ghana, corporate governance mechanisms determine to an extent the level of firms compliance with IFRS.

Recommendation

On the basis of the findings documented, the study suggests for policy makers such as ICAG which is the body charged with the responsibility to regulate the accountancy profession in Ghana to develop a framework that places high premium on corporate governance in the course of curriculum development. Secondly, other regulators such as the Ghana Stock Exchange should also intensify supervision of the firms trading on the market in order to enhance the efficiency of the market given that the IFRS has a capital market orientation. Notwithstanding the Bank of Ghana Directive on corporate governance for the financial sector, the onus is on proper enforcement of this directive to reduce corporate failure in the country.

Areas for Further Study

Given the limited scope in the study, the findings documented in this study cannot easily be generalized beyond the scope of this study to non-listed companies such as Ghana club 100 companies. Also CG are not the only factors that can affects the level of compliance but factors such as dividend policy, risk level and perceived international environment, therefore future studies can concentrate on these areas.

References

Abd-Elsalam, O.H., & Weetman, P. (2003). Introducing international accounting standards to an emerging capital market: Relative familiarity & language effect in Egypt'. Journal of International Accounting, 12(1), 63-84.

Crossref , Google scholar , Indexed at

Aboody, D., & Kasznik, R. (2000). CEO stock option awards & the timing of corporate voluntary disclosures. Journal of Accounting & Economics, 29(1), 73-100.

Crossref , Google scholar , Indexed at

Adams, R., & Mehran, H. (2002). Board structure and banking firm performance. Working Paper. NY: FederalReserve Bank of New York.

Crossref , Google scholar , Indexed at

Agyei-Mensah, B. (2014). The adoption of international financial reporting standards in Ghana and the quality of financial statement disclosures. International Journal Accounting and Financial Reporting, 3(2), 269.

Crossref , Google scholar , Indexed at

Al-Shammari, B., Brown, P., & Tarca, A. (2008). An investigation of compliance with international accounting standards by listed companies in the Gulf of co-operation council member states. The international Journal of Accounting, 43(1), 425-447.

Crossref , Google scholar , Indexed at

Anderson, R., Mansi, S., & Reeb, D. (2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of Accounting and Economics, 37(3), 315-342.

Crossref , Google scholar , Indexed at

Ang, J., Cole, R., & Lin, J. (2000). Agency costs and ownership structure. Journal of Finance, 55(1), 81–106.

Crossref , Google scholar , Indexed at

Armstrong, C., Guay, S.W., & Weber, J.P. (2000). The role of information and financial reporting, corporate. Governance and debt contracting. Journal of Accounting and Economics, 50(1), 179–234.

Crossref , Google scholar , Indexed at

Ba-Abbad, K.M., & Wan-Hussin, W.N. (2011). Internal corporate governance mechanisms and the level of compliance with mandatory IFRSs disclosure requirements. 1st International Conference on Accounting, Business and Economics(ICABEC). KualaTerengganu, Terengganu, November 1-2.. s.l., s.n.

Ball, R., Robin, A., & Wu, J. (2003). Incentives versus Standards: Properties of accounting income in Four East Asian countries and implications for acceptance of IAS. Journal of Accounting & Economics, 36(1), 235-270.

Crossref , Google scholar , Indexed at

Beaver, W.H. (1998). Financial reporting: An accounting revolution, (3rd edition). Upper Saddle River, New Jersey: Prentice-Hall.

Belkaou, A., & Kahl, A. (1985). Corporate financial disclosure in Canada research monograh No. 1 Vancouver, Canadian Certified General Accountants Association, (2nd edition). San Diego: Harcourt Brace, Jovanovich.

Borgia, F. (2005). Corporate governance and transparency role of disclosure: How to prevent new financial scandals and crime? America University Transnatinal Crime and Curruption Centre (TRACC). School of international Service, 3.

Bushman, R., Chen, Q., & Engel, E. (2004). Financial accounting information, organizational complexity, and corporate governance systems. Journal of Accounting and Economics, 37(1), 167–201.

Crossref , Google scholar , Indexed at

Byrne, J. (2002). How to fix corporate governance.

Cascino, S., & Gassen, J. (2015). What drives the comparability effect of mandatory IFRS adoption? Review of Accounting Studies, 20(1), 242-282.

Crossref , Google scholar , Indexed at

Cerbioni, F., & Parbonetti, A. (2007). Corporate governance and intellectual capital disclosure: An analysis of European biotechnology companies. European Accounting Review, 16(1), 791–826.

Crossref , Google scholar , Indexed at

Chau, G.K., & Gray, S.J. (2010). Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong. Journal of International Accounting, Auditing and Taxation, 19(1), 93–109.

Crossref , Google scholar , Indexed at

Chen, C.J., & Jaggi, B. (2002). Association between independent nonexecutive directors, family control and financial disclosures in Hong Kong. Journal of Accounting and public Policy, 22(87), 229-237.

Crossref , Google scholar , Indexed at

Connelly, B.L., Hoskisson, R.E., & Tihanyi, L. (2010). Ownership as a form of corporate governance. Journal of Management Studies, 47(1), 1561–1589.

Crossref , Google scholar , Indexed at

Conyon, M., Mallin, C., & Sadler, G. (2002). The disclosure of directors’ share option information in UK companies. Applied Financial Economics, 12(2), 95-103.

Crossref , Google scholar , Indexed at

Cooper, K., & Keim, G. (1983). The economic rational for the nature & extent of financial disclosure regulation: A critical assessment. Journal of Accounting & public policy, 2(1), 189-205.

Crossref , Google scholar , Indexed at

Core, J. (2001). A review of the empirical disclosure literature: Discussion. Journal of Accounting & Economics, 31(1), 441-456.

Crossref , Google scholar , Indexed at

Dahawy, K., & Conover, T. (2007). Accounting disclosure in companies listed on the Egyptian stock exchange. Middle Eastern finance and economics, 1(1), 5-20.

Daske, H., & Gebhardt, G. (2006). International financial reporting standards & experts perception of disclosure quality. Abacus, 42(3/4), 461-498.

Crossref , Google scholar , Indexed at

Daske, H., Hail, L., Leuz, C., & Vedi, R. (2011). Mandatory reporting arounding the world: Early evidence on the economic consequences. Journal of Accounting Research, 46(5), 1085-1142.

Crossref , Google scholar , Indexed at

Deakin, S., & Konzelmann, S. (2004). Learning from Enron. Journal of corporate governance, 12(2), 183-199.

Crossref , Google scholar , Indexed at

Donaldson, L.D.J. (1991). Stewardship theory or agency theory: CEO governance and shareholders returns. Australia Journal of Management, 16(1), 49-69.

Crossref , Google scholar , Indexed at

Douma, S., George, R., & Kabir, R. (2006). Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal, 27(1), 637–657.

Crossref , Google scholar , Indexed at

Eng, L., & Mak, Y. (2003). Corporate governance and voluntary disclosure. Journal of Accounting and Public Policy, 22(1), 325–345.

Crossref , Google scholar , Indexed at

Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. Journal of Law and Economics, 26(2), 301-325.

Crossref , Google scholar , Indexed at

Felo, A., Krishnamurthy, S., & Solieri, S. (2003). Audit committee characteristics and the perceived quality of financial reporting: An empirical analysis. Working paper, Pennsylvania State. University, Malvern: PA.

Crossref , Google scholar , Indexed at

Forker, J. (1992). Corporate governance and disclosures. Accounting & Business Research, 86(1), 111-124.

Crossref , Google scholar , Indexed at

Garcia-Meca & Sanchez-Ballestabes, (2010). The association of board independence and ownership concentration with voluntary disclosure: A meta-analysis. European Accounting Review, 19(3), 603-627.

Crossref , Google scholar , Indexed at

Gedajlovic, E., Yoshikawa, T., & Hashimoto, M. (2005). Ownership structure, corporate strategy and firm performance in Japanese manufacturing industries. Organization Studies, 31(1), 271–300.

Crossref , Google scholar , Indexed at

Goswami, O. (2001). The tide rises gradually: Corporate governance in India. OECD Development Centre Discussion Paper. New Delhi: OECD.

Griffin, C.H., & Williams, T.H. (1960). Measuring the adequate disclosure. Journal of Accountancy, 109(1), 43-48.

Haniffa, R.M., & Cooke, T.E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317-349.

Crossref , Google scholar , Indexed at

Healy, P., & Palepu, K. (2001). Information as symmestry, corporate disclosure & the capital markets: A review of the empirical disclosure literature. Journal of Accounting & Economics, 31(1), 405-440.

Crossref , Google scholar , Indexed at

Khlif, H., Ahmed, K., & Mohsen, S. (2016). Ownership structure and voluntary disclosure: A synthesis of empirical studies. Australian Journal of Management, 1(1), 1-28.

Crossref , Google scholar , Indexed at

Ho, S., & Wong, K. (2001). A study of the relationship between corporate governance structures and the extent of voluntary disclosure. Journal of International Accounting, Auditing and Taxation, 10(2), 139-156.

Hope, O.K. (2013). Large shareholders and accounting research. China Journal of Accounting Research, 6(1), 3-20.

Crossref , Google scholar , Indexed at

Hossain, M., Perera, M.H.B., & Rahman, A.R. (1995). Voluntary disclosure in the annual reports of New Zealnd companies. Journal of International Financial, 25(2), 255-265.

Crossref , Google scholar , Indexed at

Hossain, M., Perera, M.H.B., & Rahman, A.R. (1995). Voluntary disclosure in the annual reports of New Zealand companies. Joumal of International Financial Management and Accounting, 6(1), 69-87.

Crossref , Google scholar , Indexed at

Izzo, M.F., Luciani, V., & Sartori, E. (2013). Impairment of goodwill: Level of compliance and quality of disclosure during the crisis—An analysis of Italian listed companies. International Business Research, 6(11), 94.

Crossref , Google scholar , Indexed at

Jensen, M., & Ruback, R. (1983). The market for corporate control. Journal of Financial Economics, 11(1), 5-50.

Crossref , Google scholar , Indexed at

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behaviour, agency costs, and ownership structure. Journal of Financial Economics, 3(1), 305–360.

Crossref , Google scholar , Indexed at

Satirenjit, K.J., Shireenjit, K., & Barry, J.C. (2015). Board characteristics and firm performance: Evidence from Malaysian public listed firms. Journal of Economics, Business and Management, 3(2), 187-239.

Crossref , Google scholar , Indexed at

John, K., & Senbet, L. (1998). Corporate governance and board effectiveness. Journal of Banking and Finance, 22(4), 371-403.

Crossref , Google scholar , Indexed at

Joshi, P.L., Bresmer, W.G., & Al-Ajmi. (2008). Perceptions of accounting professionals in the adoption & implementation of a single of global accounting standards: Evidence from Bahram. Advances in Accounting Incorporation in international Accounting, 24(1), 41-48.

Crossref , Google scholar , Indexed at

Juhmani, O. (2017). Corporate governance and the level of Bahraini corporate compliance with IFRS disclosure. Journal of Applied Accounting Research, 18(1), 24-41.

Crossref , Google scholar , Indexed at

Kathleen, M.E. (1989). Agency theory: An assessment and Review. Academy of Management and Review, 14(1), 57-74.

Crossref , Google scholar , Indexed at

Kingsley Opoku Appiah Dadson Awunyo-Vitor Kwame Mireku Christian Ahiagbah. (2016). Compliance with international financial reporting standards: The case of listed firms in Ghana. Journal of Financial Reporting and Accounting, 14(1), 131-156.

Crossref , Google scholar , Indexed at

Levit, A. (1998). The importance of high quality accounting standards. Accounting Horizons, 12(1), 79-82.

Lin, C. (2001). Private vices in public places: Challenges in corporate governance development in China. OECD Development Centre Discussion Paper. China: OECD.

Lipton, L., & Lorsch, J. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 48(1), 59–77.

Malherbe, S., & Segal, N. (2001). In policy dialogue meeting on corporate governance in developing countries and emerging economies. Organized by the OECD Development Centre and the European Bank for Reconstruction and Development, at OECD headquarters, Paris, 23-24. Cape Town: OECD.

Martin, G., Peter, S., Donna, L.S., & Silvia, V. (2013). Compliance with IFRS 3- and IAS 36-required disclosures across 17 European countries: Company- and country-level determinants. Accounting and Business Research, 43(3), 163-204.

Crossref, Google scholar , Indexed at

Mazzi, F., André, P., Dionysiou, D., & Tsalavoutas, I. (2017). Compliance with goodwill-related mandatory disclosure requirements and the cost of equity capital. Accounting and Business Research, 47(3), 268-312.

Crossref , Google scholar , Indexed at

Menon, K., & Williams, J.D. (1994). The use of audit committees for monitoring. Journal of Accounting and Public Policy, 13(2), 121-139.

Crossref , Google scholar , Indexed at

Morris, R., HO, B., Pham, T., & Gray, S., (2004). Financial reporting practices of Indonesian companies before & after the the Asian financial crisis-Asian- Pacific. Journal of Accounting & Economics, 11(1), 194-221.

Crossref , Google scholar , Indexed at

Naser, K., Al-Hussaini, A., & Al-Kwari, D. (2006). Determinants of corporate social disclosure in developing countries: The case of Qatar. Advances in International Accounting, 19(1), 1-23.

Crossref , Google scholar , Indexed at

Nelson, J., Gallery, G., & Percy, M. (2010). Role of corporate governance in mitigating the selective disclosure of executive stock option information. Accounting & Finance, 50(3), 685-717.

Crossref , Google scholar , Indexed at

Oman, C.P. (2001). Corporate governance & national development. OCED development centre technical paper. NO. 180. Argentina: OECD.

Owusu-Ansah, S., & Yeoh, J. (2005). The effects of legislation on corpoarte disclosure practices. Abacus, 41(1), 92-109.

Crossref , Google scholar , Indexed at

Pope, P.F., & Mcleay, S.J. (2011). The European IFRS experiment: Objective, research challenges & evidence. Accounting & Business Research, 41(3), 233-266.

Crossref , Google scholar , Indexed at

Rajhi, M. (2014). International financial reporting standards and level of compliance with mandatory disclosure requirements. International Journal of Multidisciplinary Sciences and Engineering, 5(5), 1-6.

Crossref , Google scholar , Indexed at

Samaha, K., Dahawy, K., & Abdel-Meguid, A. (2012). Propensity and comprehensiveness of corporate internet reporting in Egypt: Do board composition and ownership structure matter? International Journal of Accounting and Information Management, 20(1), 142–170.

Crossref , Google scholar , Indexed at

Samaha, K., & Stapleton, P. (2008). Compliance with International accounting standards in a national context: Some empirical evidence from the Cairo and Alexandria stock exchanges. Asian Journal of Finance and Accounting, 1(1), 40-66.

Crossref , Google scholar , Indexed at

Shleifer, A., & Vishny, R.W. (1997). A survey of corporate governance. Journal of Finance, 52(1), 737–783.

Crossref , Google scholar , Indexed at

Song, J., & Windram, B. (2004). Benchmarking audit committee effectiveness in financial reporting. International Journal of Auditing, 8(3), 195-205.

Crossref , Google scholar , Indexed at

Street, D., & Gray, S. (2002). Factors influencing the extent of corporate compliance with International Accounting Standards: Summary of a research monograph. Journal of International Accounting, Auditing & Taxation, 11(1), 51-76.

Crossref , Google scholar , Indexed at

Taplin, R.T., & Hancock, P. (2002). Disclosure (discernibility) & compliance of accounting policies: Asia-Pacific evidence. Accounting Forum, 26(1), 172-190.

Crossref , Google scholar , Indexed at

Tower, G., Hancock, P., & Taplin, R. (1999). A regional study of listed companies, compliance with Internatinal Accounting Standards. Accounting forum, 23(1), 293-305.

Crossref , Google scholar , Indexed at

Tsalavoutas, I. (2011). Transition to IFRS and compliance with mandatory disclosure requirements: What is the signal? Advances in Accounting, incorporating Advances in International Accounting, 27(2), 390-405.

Crossref , Google scholar , Indexed at

Tsalavoutas, I., Evans, L., & Smith, M. (2010). Comparison of two methods for measuring compliance with IFRS mandatory disclosure requirements. Journal of Applied Accounting Research, 11(3), 213-228.

Crossref , Google scholar , Indexed at

Verriest, A., Ann, G., & Daniel, B.T. (2013). The impact of corporate Governance on the Adoption IFRS. European Accounting Review, 22(1), 39-77.

Crossref , Google scholar , Indexed at

Wang, K., Sewon, O., & Claibornem, M.C. (2008). Determinants and consequences of voluntary disclosure in an emerging market: Evidence from China. Journal of International Accounting, Auditing and Taxation, 17(1), 14–30.

Crossref , Google scholar , Indexed at

Williams, M.S. (1999). Voluntary environmental and social accounting disclosure practices in the Asia-Pacific region: An international empirical test of political economy theory. The International Journal of Accounting, 34(1), 209–238.

Crossref , Google scholar , Indexed at

Williamson, O.E. (1984). Corporate Governance. Yale law, 7(1), 1197-1230.

Received: 14-Dec-2021, Manuscript No. AAFSJ-21-10265; Editor assigned: 16-Dec-2021, PreQC No. AAFSJ-21-10265(PQ); Reviewed: 24-Dec-2021, QC No. AAFSJ-21-10265; Revised: 07-Jan-2022, Manuscript No. AAFSJ-21-10265(R); Published: 14-Jan-2022