Research Article: 2019 Vol: 23 Issue: 1

Corporate Governance Mechanisms and Family Directives: Aggressive or Conservative in Earnings Management?

Mujeeb Saif Mohsen Al-Absy, Universiti Utara Malaysia

Ku Nor Izah Ku Ismail, Universiti Utara Malaysia

Sitraselvi Chandren, Universiti Utara Malaysia

Abstract

Earnings Management (EM) is one of the most important measurements of financial reporting quality which has increased the attention of scholars in recent time. The purpose of this paper is to investigate whether the interaction terms of family directors and Corporate Governance (CG) mechanisms is significantly associated with aggressive or conservative EM, by grouping EM into income-increasing (aggressive) and income-decreasing (conservative) EM. The final sample of the three-year period of 2013, 2014 and 2015 is 864 Malaysian firm-year observations. The findings provide evidence of the entrenchment effect of family directives on managerial decisions as proposed by the type II agency theory. Results show that firms which have engaged in aggressive EM, most of the CG mechanisms with family directors are significantly associated with high aggressive Discretionary Accruals (DA) and Abnormal Real Earnings Management (ABREM). However, in firms which have engaged in conservative EM, the influence of CG mechanisms with family directors shows mixed results on conservative DA, while most of CG mechanisms with family directors are significantly associated with less conservative ABREM. In general, CG mechanisms with family directors are significantly associated with more aggressive and less conservative EM. This study points to policymakers, firms and their stakeholders, as well as researchers to the need for more policies on having family directors on board which common practice in countries such as Malaysia.

Keywords

Discretionary Accrual, Real Earnings Management, Family Ownership, Malaysia.

Introduction

The issue of Earnings Management (EM) is not new. It continues to be a prevalent topic in the field of accounting (Chandren, 2016; Chandren et al., 2017). Basically, management has the responsibility to produce a reliable and true financial report for stakeholders. However, when managers fail to fulfill their obligations or want to mislead stakeholders, they practice EM by exploiting the flexibility of the accounting principles that requires managers’ judgment when they are preparing the financial statements. Hence, EM may hide the firm’s true financial condition. Empirically, researchers have documented many different incentives for EM, including:

1. Capital market expectations and valuation.

2. Contracts written in terms of accounting numbers.

3. Antitrust or other government regulations.

Further, previous studies found that EM has a significant and positive relationship with fraud (Hasnan et al., 2013). It has also been found that increased EM will reduce earnings quality, in particular, and the quality of financial reporting, in general. Consequently, after the failure of several well-known firms, attention and efforts have significantly shifted to Corporate Governance (CG) (Claessens & Fan, 2002). Previous studies have examined the influence of CG on EM. However, the results are not consistent (Inaam & Khamoussi, 2016) and there are several questions concerning CG and EM that could be investigated (Bao & Lewellyn, 2017), particularly in developing countries such as Malaysia. In the Malaysian context, the mechanisms of CG are insufficient in preventing EM, and thus, there is a need to improve CG (Mohammad et al., 2016). Accordingly, there is a moderator variable that may influence the role of CG mechanisms in mitigating EM, which needs further investigation (Mohammad et al., 2016; Wu et al., 2016). In Asian firms, the most important issue in governance is the issue of family ownership/control, in which firms, the conflicts of interest between manager-shareholders have shifted to controlling owners and minority shareholders (Claessens & Fan, 2002). Thus, whether or not family ownership minimizes or creates agency cost, remains an empirical question to be answered (Armstrong et al., 2010). Moreover, the extent of EM remains an open issue (Hamid et al., 2012), especially for Family-controlled/Owned Companies (FOC) (Ferramosca & Allegrini, 2018; Prencipe & Bar-Yosef, 2011). Further, Mansor et al. (2013) and Prencipe & Bar-Yosef (2011) called for more studies on CG and EM in FOC.

Importantly, studies have investigated the moderating role of family ownership in the relationship between a few mechanisms of CG, such as board independent directors (Adiguzel, 2013; Jaggi et al., 2009; Mansor et al., 2013; Prencipe & Bar-Yosef, 2011; Wu et al., 2016); Audit Committee (AC) independent directors (Adiguzel, 2013; Mansor et al., 2013); and women on board and AC (Abdullah & Ku Ismail, 2016; Ku Ismail & Abdullah, 2013) and EM. However, the issue has not been explored well (Wu et al., 2016). Further, previous studies have ignored the signed value of EM, income-increasing (aggressive) and income-decreasing (conservative) EM, or gathering income-increasing and income-decreasing EM in one regression. Accordingly, the current study followed Mitra et al. (2009) and Zalata et al. (2018), among others, by separating the signed value of DA into aggressive DA (DA+) and conservative DA (DA-). Similarly, for ABREM, the study separated the ABREM into aggressive ABREM (ABREM+) and conservative ABREM (ABREM-). Importantly, the current study multiplied the value of DA- and ABREM- by (-1) to be consistent with DA+ and ABREM+. Consequently, separate regressions were run for each group to determine whether CG mechanisms with family directors are more aggressive or more conservative EM. Thus, the positive result of the regression reflects the highly aggressive or conservative EM and the negative result in the regression reflects the low aggressive or conservative EM. Generally, this study provides evidence that CG mechanisms with family directors are more aggressive in firm which have engaged in aggressive EM, while they are less conservative in firms which have engaged in conservative EM.

The contribution of this study can be seen from different points of view. Firstly, it enriches the literature by adding empirical evidence, based on the agency theory, on the influence of having family directors on the monitoring role of extensive variables of CG mechanisms toward aggressive and conservative EM practices. Especially for those mechanisms where there is no study has focused on, such as the chairman’s tenure, board ethnic diversity, AC chairman’s accounting expertise and multiple directorships. Thus, applying the agency theory to investigate the influence of the interaction term of family directors and those mechanisms on EM will add a new contribution to the agency theory. Secondly, it contributes to the literature by focusing on both types of EM (DA and ABREM) where the majority of previous studies, especially in Malaysia, have used only DA. Thus, focusing on ABREM alongside DA is a worthwhile contribution to the literature to examine whether or not firms are engaging in both types of EM. Importantly, DA and ABREM have been grouped into; income-increasing (aggressive), and income-decreasing (conservative) because the DA and ABREM have been practised based on the firm’s financial situation. By doing this, the study could draw an accurate relationship of the interaction term of family directors and CG mechanisms on each group, where the previous studies have not separately investigated that relationship. Thirdly, it extends the literature by selecting firms with the lowest positive earnings (measured by ROA), where managers are likely to be more motivated to avoid reporting annual losses. Lastly, it helps the policymakers and stakeholders for improving the role of CG, especially in firms with family directors. Perhaps, policymakers might need to formulate specific criteria and effectively oversee the implementation of CG mechanisms in firms which have family directors on the board. Further, the independence of the nomination committee must be strengthened which may reduce the dominant role of family directors in the director nomination process.

Literature Review And Hypotheses Development

After the serious financial scandals, efforts have been taken globally to develop and implement appropriate CG mechanisms. The agency and resource dependence theories have explained the role of CG mechanisms in monitoring and supporting the management to improve a firm’s performance and having high-quality reporting, particularly financial reporting. In this regard, the appropriate CG code helps to achieve high standards of governance processes; enhance the confidence of foreign investors; protect the rights of the stakeholders, reduce the problem of “asymmetry information” and improve reporting quality. However, in emerging markets, some studies have documented the presence of a larger shareholder, which holds a direct controlling interest in the equity capital of firms (Claessens & Yurtoglu, 2013). Therefore, family or controlling shareholders often seeks to either reduce the presence of independent directors (Hasan et al., 2014; Leung et al., 2014); or appoint external directors who are independent only in name (Wu et al., 2016) but do not improve the CG practices (Park & Shin, 2004), especially, when the chief executive officer, who in most cases is a family member, is present in the nominating committee. This is because dominant families may view independent directors as unnecessary interference in the decision-making processes and a potential risk to their power (Leung et al., 2014). Jaggi & Leung (2007) found that family directors significantly reduce the efficiency of the AC. Hence, it is not wise to expect good governance in firms with a family-based culture in the corporate sector (Hasan et al., 2014), as the interference by family members reduces the effectiveness of CG mechanisms in mitigating EM (Mansor et al., 2013). Many studies have shown that when firms become highly controlled by families or individuals, deviances in the control of cash flow rights encourage controlling shareholders to push the confiscation of wealth by seeking personal advantage at the expense of minority shareholders (Claessens et al., 2002).

Regarding EM, a few studies have investigated the moderating influence of family ownership or controlling family on the association between CG mechanisms and EM. For example, Mansor et al. (2013) divided firms into FOC and Non-Family Owned Companies (NFOC). For the FOC, only the number of board meetings is found to be significant and negatively related to EM. Compared to NFOC, more CG mechanisms seem to be effective in constraining EM, such as board independence, non-duality, AC independence, AC size and qualified audit firms. Prencipe & Bar-Yosef (2011) found that the proportion of independent directors on the board in FOC has a weaker influence in mitigating EM compared to NFOC. Jaggi et al. (2009) found that higher board independence in NFOC effectively mitigates EM than in FOC. Wu et al. (2016) found that controlling shareholders significantly suppress the influence of the relationship between independent directors and EM. Jaggi & Leung (2007) found that the presence of family members on the board significantly reduces the efficiency of the AC, particularly when family members control the board. In the context of Malaysia, Ku Ismail & Abdullah (2013) found that women, either on the board or in the AC, are less likely to monitor EM in FOC than in NFOC. However, Abdullah & Ku Ismail (2016) found that the interactive effect of women directors on the board or the AC and family ownership is not significant in mitigating EM. Thus, according to the type II agency problem and the above discussion, the hypothesis is stated as follows:

H1: Corporate governance mechanisms with family directors are more aggressive in earnings management.

H2: Corporate governance mechanisms with family directors are more conservative in earnings management.

Research Design

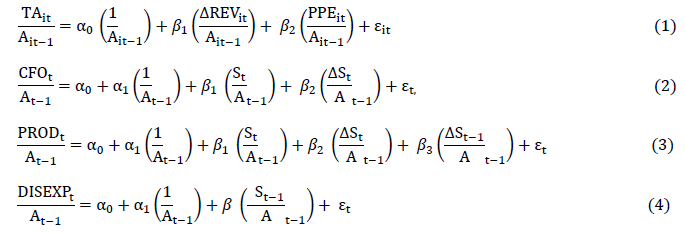

This study covers 300 Malaysian firms with the lowest positive average of Return On Assets (ROA) by following two steps: first, any firm with negative earnings in one or more years was excluded; and second, the firm’s average ROA, calculated by the sum of the ROA for 2013, 2014 and 2015, was divided by three (number of years). However, during data collection, 12 firms were excluded. Therefore, the final sample is 864 firm-year observations. This study applied the Jones Model and the aggregate value of the three proxies introduced by Roy chowdhury’s models to measure DA and ABREM. To calculating DA, the study uses equation 1. The Abnormal levels of Cash Flow from Operations (ABCFO) use equation 2. While abnormal levels of production costs (ABPROD) uses equation 3 and Abnormal levels of Discretionary Expenses (ABDISX) is for equation 4. Further, the cross-sectional analysis using OLS was run for three years using seven sectors with specific industry and year effect to estimate the coefficient values of each model, from equations 1 to 4 respectively:

Where, TA is the total accruals (net income minus cash flows from operation),  is total assets in the past year,

is total assets in the past year,  is the change in revenues, PPE is gross property, plant and equipment, CFOt is cash flow from operations, St is the sales, PRODt is the sum of the cost of goods sold and change in inventory,

is the change in revenues, PPE is gross property, plant and equipment, CFOt is cash flow from operations, St is the sales, PRODt is the sum of the cost of goods sold and change in inventory,  is the lag of change in sales,

is the lag of change in sales,  is the sales of the last period,

is the sales of the last period,  is the sum of R&D, advertising and selling and general and administrative costs and

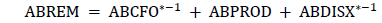

is the sum of R&D, advertising and selling and general and administrative costs and  is error term. Therefore, the residuals value of DA, ABCFO, ABPROD and ABDISX were calculated by using the new option which is available at STATA program “statistics=>post-estimation=>predictions, residuals, etc.=> residuals (equation-level scores)” (Brennan, 2010) after running equations 1-4, respectively. Importantly, by following the previous studies, the current study combined the value of ABCFO, ABPROD and ABDISX to reflect the total value of ABREM as per the following equation:

is error term. Therefore, the residuals value of DA, ABCFO, ABPROD and ABDISX were calculated by using the new option which is available at STATA program “statistics=>post-estimation=>predictions, residuals, etc.=> residuals (equation-level scores)” (Brennan, 2010) after running equations 1-4, respectively. Importantly, by following the previous studies, the current study combined the value of ABCFO, ABPROD and ABDISX to reflect the total value of ABREM as per the following equation:

(5)

(5)

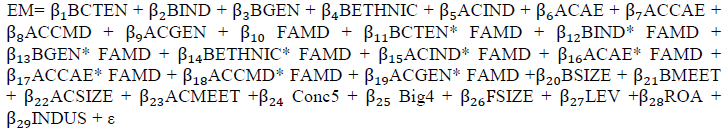

It is known that the value of DA and ABREM can either be negative (income-decrease) or positive (income-increase). Consequently, separate regressions were conducted for each group. Regarding other variables, this study used the proportion of family directors on the board (FAMD) to measure the influence of family directors in a firm. The board’s mechanisms are: chairman’s tenure (BCTEN), independent directors (BIND), gender diversity (BGEN) and ethnic diversity (BETHNIC). Further, the mechanisms of the AC are: independent directors (ACIND), accounting expertise (ACAE), chairman’s accounting expertise (ACCAE), chairman’s multiple directorships (ACCMD) and gender diversity (ACGEN). To reduce the endogeneity and misspecification of the model, more control variables were included (Prencipe & Bar-Yosef, 2011). These control variables are: board size (BSIZE), board meetings (BMEET), AC size (ACSIZE), AC meeting (ACMEET), ownership concentration (Conc5), Big4 audit firms (Big4), firm size (FSIZE), leverage (LEV), return on assets (ROA) and industry dummy (INDUS). Hence, the following regression was separately used for DA+, DA-, ABREM+ and ABREM- to conclude the result of Hypotheses:

Empirical Results

The descriptive statistics show that firms without family directors display a significantly higher mean regarding BIND, BETHNIC, BMEET, ACSIZE, ACMEET, Conc5 and FSIZE. Also, other variables, including the proportion of ACGEN and Big4 are significantly higher in firms without family directors over those with family directors on the board. However, in firms with family directors, the means of other variables, like BCTEN and ACIND, are significantly higher than in those firms without family directors. The higher mean of BCTEN may indicate that those firms may attempt to dominate the board by retaining a longer chairman’s tenure. Also, other variables, including the proportion of BGEN and INDUS are significantly higher in firms with family directors over those without family directors. The study tested the fitness of the sample data with the statistical assumptions before running the regression analysis. Variables used in the study have no outlier’s problem, except for DA, ABREM, ACMEET and BMEET where they winsorized by using 1% at the top and bottom. However, the study used 5% for BMEET because of the high outlier problem in this variable. Consequently, the dataset of variables has no severe violation of the normality assumption, where the Skewness and Kurtosis values are not higher than the threshold of ± 3 and ± 10, respectively. Moreover, based on the correlation matrix and the Variance Inflation Factor (VIF) tests, there is no evidence of multicollinearity problems. However, the data suffers from heteroscedasticity problem but not from autocorrelations problem. Thus, this study used the Feasible Generalized Least Squares (FGLS) estimator as it is asymptotically more efficient than any other estimators, and its asymptotic variance estimator takes the usual form (Wooldridge, 2010).

Table 1 shows that firms which have engaged in income-increasing DA (aggressive DA+), the most of CG mechanisms are negatively associated with aggressive DA, where it is significant for BCTEN, BGEN and ACAE and insignificant for BETHNIC and ACCMD. However, with the influence of family directors, those mechanisms become significantly associated with high aggressive DA which is in line with the entrenchment effect of family directives as proposed by the type II agency theory. In contrast, results show that only BIND and ACIND are significantly related to low aggressive DA in firms with family directors which suggested that independent directors are not easily to influenced by the family directive; however, they effectively monitoring the aggressive DA. Further, Table 1 shows that in firms which have engaged in income-increasing ABREM (aggressive ABREM+), the most of CG mechanisms, namely, BETHNIC, ACAE, ACCMD and ACGEN are significantly associated with low aggressive ABREM which is in line with agency theory that CG mechanisms reduce the conflict of interest between managers and shareholders. However, with the influence of family directors, those mechanisms become significantly associated with high aggressive ABREM which is in line with the entrenchment effect of family directives as proposed by the type II agency theory. In contrast, only BGEN is significantly related to low aggressive ABREM in firms with family directors which is inconsistent with the entrenchment effect agreement. In general, CG mechanisms with family directors are more aggressive in EM, which suggests that hypothesis 1 is supported. These results confirm the existence of the type II agency problem. The interference of family directive significantly weakens the monitoring role of CG in mitigating the aggressive DA and ABREM, which leads to expropriating minority interests (Claessens et al., 2002) as there is a conflict of interest between controlling and monitory shareholders (Claessens & Fan, 2002). As family or controlling shareholders are more likely to reduce the number of independent directors (Hasan et al., 2014; Leung et al., 2014); or appoint external directors who belongs to them as a family member and is loyal to them (Jaggi & Leung, 2007; Wu et al., 2016), the opportunity of engaging in aggressive DA and ABREM becomes higher.

Table 1 also shows that firms which have engaged in income-decreasing DA (conservative DA-), the influence of CG mechanisms shows mixed results. Some of CG mechanisms, namely, BCTEN, ACIND and ACGEN are significantly associated with low conservative DA as in line with agency theory. However, with the influence of family directors, those mechanisms become significantly associated with high conservative DA which is in line with the entrenchment effect of family directives as proposed by the type II agency theory. In contrast, BETHNIC, ACAE and ACCMD are significantly related to low conservative DA in firms with family directors against the significant relationship with high conservative DA found in the direct relationship, without the influence of family directors. Further, Table 1 shows that firms which have engaged in income-decreasing ABREM (conservative ABREM-), some of CG mechanisms, namely, BCTEN, ACCAE and ACGEN are significantly associated with high conservative ABREM. However, with the influence of family directors, those mechanisms and other such as BETHNIC become significantly associated with low conservative ABREM which is inconsistent with the entrenchment effect argument. In overall, CG mechanisms with family directors are less conservative in EM which contradicted hypothesis 2. The explanatory reasons of less engaging in conservative EM in the current study, which includes only firms with lowest earnings, are that family directors may likely prefer to report high earnings to maintain their position on board and receiving high compensations but not for improving the financial reporting quality.

| Table 1 FGLS REGRESSION BY GROUPING EM INTO INCOME-INCREASING (AGGRESSIVE) AND INCOME-DECREASING (CONSERVATIVE) EM |

||||||||

| VARIABLES | Income-increasing (aggressive) EM | Income-decreasing (conservative) EM | ||||||

| DA+ | ABREM+ | DA- | ABREM- | |||||

| Coef. | Z-value | Coef. | Z-value | Coef. | Z-value | Coef. | Z-value | |

| BCTEN | -0.00171*** | -8.86 | 1.88e-06 | 0.00 | -0.00101*** | -7.42 | 0.00252*** | 5.41 |

| BIND | -0.00332 | -0.25 | 0.0181 | 0.59 | 0.0295** | 2.27 | 0.183*** | 4.29 |

| BGEN | -0.0229*** | -5.82 | -0.00464 | -0.59 | -0.00153 | -0.41 | 0.000194 | 0.01 |

| BETHNIC | -0.00947 | -1.54 | -0.0406*** | -2.88 | 0.0140*** | 2.79 | -0.0320* | -1.85 |

| ACIND | 0.0540*** | 5.46 | 0.0590** | 2.11 | -0.0346*** | -3.53 | -0.110*** | -3.51 |

| ACAE | -0.0186** | -2.17 | -0.0355** | -2.30 | 0.0417*** | 5.56 | 0.0689*** | 3.44 |

| ACCAE | -0.00258 | -0.74 | 0.0227*** | 2.84 | 0.00128 | 0.38 | 0.0315*** | 3.35 |

| ACCMD | -1.68e-05 | -0.01 | -0.0184** | -2.49 | 0.00591** | 2.13 | -0.0151* | -1.89 |

| ACGEN | -0.000327 | -0.10 | -0.0138** | -2.17 | -0.00976*** | -3.26 | 0.0499*** | 4.86 |

| FAMD | -0.0483 | -1.47 | -0.0964 | -1.36 | -0.0457 | -1.59 | 0.291*** | 3.01 |

| BCTEN*FAMD | 0.00289*** | 5.89 | -0.00130 | -0.99 | 0.00190*** | 4.18 | -0.00511*** | -3.46 |

| BIND*FAMD | -0.0707* | -1.86 | -0.0295 | -0.30 | 0.0535 | 1.48 | -0.0825 | -0.54 |

| BGEN*FAMD | 0.0203** | 2.39 | -0.0607*** | -2.78 | -0.0144 | -1.27 | -0.0238 | -0.75 |

| BETHNIC*FAMD | 0.0520*** | 2.76 | 0.129*** | 2.64 | -0.0444*** | -2.78 | -0.147** | -2.24 |

| ACIND*FAMD | -0.0470* | -1.90 | -0.0674 | -0.88 | 0.0855*** | 2.85 | -0.104 | -1.03 |

| ACAE*FAMD | 0.0439* | 1.92 | 0.132*** | 2.77 | -0.0884*** | -4.51 | -0.104 | -1.56 |

| ACCAE*FAMD | 0.0142 | 1.54 | -0.00766 | -0.35 | -0.00466 | -0.49 | -0.0843** | -2.47 |

| ACCMD*FAMD | 0.0254*** | 3.66 | 0.118*** | 5.44 | -0.0256*** | -3.29 | 0.0381 | 1.50 |

| ACGEN*FAMD | -0.00694 | -0.85 | 0.0367* | 1.75 | 0.0206* | 1.91 | -0.110*** | -3.67 |

| BSIZE | -0.00260*** | -4.34 | -0.00108 | -0.78 | 0.00143** | 2.36 | 0.00121 | 0.51 |

| BMEET | 0.00340*** | 4.17 | 0.00152 | 0.87 | 0.00129** | 2.18 | 0.00619** | 2.50 |

| ACSIZE | -0.00194 | -0.98 | -0.00105 | -0.24 | -0.00768*** | -4.27 | -0.0151** | -2.36 |

| ACMEET | -0.00358*** | -4.78 | -0.00648*** | -3.78 | -0.000254 | -0.30 | -0.000694 | -0.28 |

| Conc5 | -0.0221*** | -4.34 | 0.0629*** | 4.18 | -0.00988* | -1.93 | 0.0606*** | 3.73 |

| Big4 | -0.00417** | -2.15 | 0.00932* | 1.74 | -0.00235 | -1.55 | -0.00903 | -1.33 |

| FSIZE | -0.000537 | -0.68 | -0.0111*** | -6.43 | -0.00234*** | -4.15 | -0.0187*** | -6.53 |

| LEV | 0.000458*** | 7.77 | 0.000968*** | 6.52 | -9.70e-05 | -1.63 | 0.000280 | 1.29 |

| ROA | 0.000970*** | 3.59 | -0.00159*** | -2.75 | -8.51e-06 | -0.02 | 0.00569*** | 5.84 |

| INDUS | 0.00544*** | 3.01 | 0.0217*** | 5.13 | 0.00482*** | 2.83 | 0.0127** | 2.16 |

| Constant | 0.0717*** | 5.08 | 0.206*** | 5.73 | 0.0910*** | 8.25 | 0.269*** | 5.82 |

| Wald Chi2 | 2633.44 | 1427.72 | 1018.64 | 8033.85 | ||||

| P value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||

| R2 | 0.189 | 0.155 | 0.082 | 0.174 | ||||

| Observations | 409 | 460 | 455 | 404 | ||||

Note: ***p<0.01, **p<0.05, * p<0.1.

R2 calculated by OLS regression. DA+ ABREM+ represent firms which have engaged in income-increasing DA and ABREM, respectively. DA- and ABREM- represent firms which have engaged in income-decreasing DA and ABREM, respectively. BCTEN is the period which the board chairman serves on the board. BIND is the proportion of board independence. BGEN is “1” if the board has at least two women directors, and “0”, otherwise”. BEHNIC is the Bumiputra (Malay) directors’ ratio. ACIND is the proportion of AC’s independent directors. ACAE is the proportion of AC directors with accounting expertise. ACCAE is “1” if the AC chairman has accounting expertise. ACCMD is “1” if AC chairman is a director in other firms, and “0”, otherwise. ACGEN is “1” if the AC has a female director, and “0” otherwise. FAMD is the proportion of family members on the board. BSIZE is the total number of directors. BMEET is the frequency of board meetings. ACSIZE is the number of AC directors. ACMEET is the frequency of AC meetings. Conc5 is the total percentage of outstanding shares held by the largest five shareholders. Big4 is “1” if firms were audited by Big4 firms, and “0”, otherwise”. FSIZE is the natural log of total assets. LEV is the total debt to total assets. ROA is the ratio of net income to total assets. INDUS is “1” for an observation in the manufacturing industry, and “0”, otherwise”.

Conclusion

Findings reveal that CG mechanisms with family directors are more aggressive in EM, either DA or ABREM, in those firms that have engaged in income-increasing. This indicates that family directors influence the CG mechanisms to aggressively engages in income-increasing to defend their controlling position and report positive earnings. For those firms that engaged in income-decreasing EM, CG mechanisms with family directors, in general, are less conservative EM, either DA or ABREM. It seems that family directors do not prefer to highly engage in income-decreasing as this may affect the controlling shareholders’ position, especially, in firms selected in this study (the lowest ROA). The researchers, therefore, recommend to regulators to focus more on enhancing the governance role in family firms. Further, more studies need to conducted by increasing the sample size and using a longer period for generalizing the results.

Acknowledgements

We wish to thanks University Utara Malaysia for funding this research.

References

- Abdullah, S.N., & Ku Ismail, K.N.I. (2016). Women directors, family ownership and earnings management in Malaysia. Asian Review of Accounting, 24(4), 525-550.

- Adiguzel, H. (2013). Corporate governance, family ownership and earnings management: Emerging market evidence. Accounting and Finance Research, 2(4), 17-33.

- Armstrong, C.S., Guay, W.R., & Weber, J.P. (2010). The role of information and financial reporting in corporate governance and debt contracting. Journal of Accounting and Economics, 50(2), 179-234.

- Bao, S.R., & Lewellyn, K.B. (2017). Ownership structure and earnings management in emerging markets: An institutionalized agency perspective. International Business Review, 26(5), 828-838.

- Brennan, J.S. (2010). "Stata Companion", Statistical methods in molecular biology. Methods in Molecular Biology, 620, 599-526.

- Chandren, S. (2016). Review on the double side of earnings management. Pertanika Journal of Social Sciences & Humanities, 24(4), 1253-1265.

- Chandren, S., Ahmad, Z., & Ali, R. (2017). The impact of accretive share buyback on long-term firm performance. International Journal of Economics and Management, 11(1), 49-66.

- Claessens, S., & Fan, J.P. (2002). Corporate governance in Asia: A survey. International Review of Finance, 3(2), 71-103.

- Claessens, S., & Yurtoglu, B.B. (2013). Corporate governance in emerging markets: A survey. Emerging Markets Review, 15, 1-33.

- Claessens, S., Djankov, S., Fan, J.P., & Lang, L.H. (2002). Disentangling the incentive and entrenchment effects of large shareholdings. The Journal of Finance, 57(6), 2741-2771.

- Ferramosca, S., & Allegrini, M. (2018). The complex role of family involvement in earnings management. Journal of Family Business Strategy, 9(2), 128-141.

- Hamid, F., Hashim, H.A., & Salleh, Z. (2012). Motivation for earnings management among auditors in Malaysia. Procedia-Social and Behavioral Sciences, 65, 239-246.

- Hasan, M.S., Rahman, R.A., & Hossain, S.Z. (2014). Monitoring family performance: family ownership and corporate governance structure in Bangladesh. Procedia-Social and Behavioral Sciences, 145, 103-109.

- Hasnan, S., Abdul-Rahman, R., & Mahenthiran, S. (2013). Management motive, weak governance, earnings management, and fraudulent financial reporting: Malaysian evidence. Journal of International Accounting Research, 12(1), 1-27.

- Inaam, Z., & Khamoussi, H. (2016). Audit committee effectiveness, audit quality and earnings management: a meta-analysis. International Journal of Law and Management, 58(2), 179-196.

- Jaggi, B., & Leung, S. (2007). Impact of family dominance on monitoring of earnings management by audit committees: Evidence from Hong Kong. Journal of International Accounting, Auditing and Taxation, 16(1), 27-50.

- Jaggi, B., Leung, S., & Gul, F. (2009). Family control, board independence and earnings management: Evidence based on Hong Kong firms. Journal of Accounting and Public Policy, 28(4), 281-300.

- Ku Ismail, K.N.I., & Abdullah, S.N. (2013). Does women representation on boards and audit committees restrict earnings management? The impact of family ownership in Malaysian firms. Proceedings of the First AARESOC International Conference on Business and Management, 12-18.

- Leung, S., Richardson, G., & Jaggi, B. (2014). Corporate board and board committee independence, firm performance, and family ownership concentration: An analysis based on Hong Kong firms. Journal of Contemporary Accounting & Economics, 10(1), 16-31.

- Mansor, N., Che-Ahmad, A., Ahmad-Zaluki, N., & Osman, A. (2013). Corporate governance and earnings management: A study on the Malaysian family and non-family owned PLCs. Procedia Economics and Finance, 7, 221-229.

- Mitra, S., Deis, D.R., & Hossain, M. (2009). The association between audit fees and reported earnings quality in pre-and post-Sarbanes-Oxley regimes. Review of Accounting and Finance, 8(3), 232-252.

- Mohammad, W.M.W., Wasiuzzaman, S., & Salleh, N.M.Z.N. (2016). Board and audit committee effectiveness, ethnic diversification and earnings management: A study of the Malaysian manufacturing sector. Corporate Governance, 16(4), 726-746.

- Park, Y.W., & Shin, H.H. (2004). Board composition and earnings management in Canada. Journal of Corporate Finance, 10(3), 431-457.

- Prencipe, A., & Bar-Yosef, S. (2011). Corporate governance and earnings management in family-controlled companies. Journal of Accounting, Auditing & Finance, 26(2), 199-227.

- Wooldridge, J.M. (2010). Econometric analysis of cross section and panel data. MIT press.

- Wu, S., Chen, C.M., & Lee, P.C. (2016). Independent directors and earnings management: The moderating effects of controlling shareholders and the divergence of cash-flow and control rights. The North American Journal of Economics and Finance, 35, 153-165.

- Zalata, A.M., Tauringana, V., & Tingbani, I. (2018). Audit committee financial expertise, gender, and earnings management: Does gender of the financial expert matter? International Review of Financial Analysis, 55, 170-183.