Research Article: 2023 Vol: 27 Issue: 1S

Corporate Governance Strength and Capital Structure: Empirical Evidence Saudi Arabia

Mohammad Yousef Alghadi, Irbid National University

Ayed Ahmad Khalifah Alzyadat, Irbid National University

Citation Information: Alghadi, M.Y., & Alzyadat, A.A.K.A. (2022). Corporate governance strength and capital structure: empirical evidence Saudi Arabia. Academy of Accounting and Financial Studies Journal, 27(S1), 1-11.

Abstract

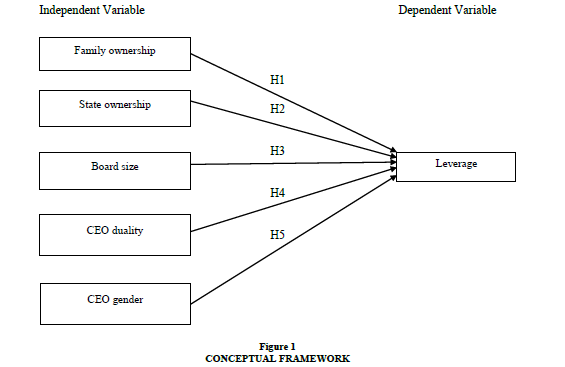

The aim of this study is to investigate the nexus between the mechanisms of corporate governance (family ownership, state ownership, board size, CEO duality and CEO gender) on leverage in Saudi Arabia. Financial data from 100 listed firms at Saudi Stock Exchange (TADAWUL) for the period of 9 years 2011 to 2019 was extrapolated from the companies listed on Saudi Stock Exchange Market (Tadawul), resulting in the final sample of 900 firms-year observations. Moreover, these studies use profitability as control variable. By using generalized least square random-effect (GLS), the multiple regression analysis revealed a negative relationship between family ownership, state ownership and board size on leverage, while CEO duality and CEO gender positive and significant association with level leverage. In addition, family ownership and size of board did not have a direct effect on level leverage in Saudi Arabia. The findings suggest the crucial role of corporate governance in leveraging and minimizing agency conflict. This study also paves the way for further investigations on leverage in the context of other nations that are also facing a dearth of research in this study area. Additionally, there is a prevailing need for developing countries to demonstrate improved compliance with international governance standards

Keywords

Family Ownership, State Ownership, CEO Duality, CEO Gender, Leverage Decisions

Introduction

Capital structure suggests the combination of funding methods maintained by a certain company (Niu, 2008). Gomez et al. (2014) assert that the financing method of a company has to be fitting to the investors, directors and stakeholders. Financing decisions also directly affect the value of a company. Past literatures on financial leverage indicate that capital structure is affected by various factors. In the field of research on corporate finance decision, capital structure represents one of the most prominent topics.

The fundamental goals of companies are the maximization of the wealth of shareholders. According to Black (2000); Rouf (2015) argue that corporate governance mechanisms and firm leverage play a pivotal role in maximizing the wealth of shareholders. Strong corporate governance leads to the enhancement of firm value. Salehi et al. (2020) stated that firms can minimize equity cost by having solid corporate governance in place. Accordingly, Jantadej & Wattanatorn (2020) asserted the crucial role of corporate governance in safeguarding shareholder wealth and reducing asymmetric information between the corporate and external investors inclusive of the debt holder, thus resulting in a decrease in debt financing costs. According to Chatterjee (2020), corporate governance refers to the management of business in an accountable, fair, transparent, and responsible manner. A solid corporate governance safeguards stakeholder interest. Establishing effective governance policies and creating shareholder value corporate governance is designed to minimize agency conflict.

Boards of directors are having full authority over internal control to monitor the top management of companies including the chief executive officer (CEO) (Fama & Jensen, 1983). Under agency theory, the director of boards is one of main corporate governance mechanisms to ensure the managers work for the benefits of shareholders (Allen, 2005). Furthermore, boards of directors can significantly influence business performance improvement via strategic goals and the achievement of the mission and vision statements (Chouaibi et al., 2018). According to Alam et al. (2014), boards of directors elected by shareholders are accountable for ensuring the company’s financial and strategic decisions. Wen et al. (2002) explained that when the board of directors is controlled by an independent director or an outside director, the top managers will face stricter supervisors. This independent board’s presence makes managers’ supervision more active to ensure that their actions do not harm the company. So it is hoped that the presence of an independent director can reduce the CEO’s risk taking in making decisions on using debt. Hambrick (2007) argue that when a company has a weak board of directors, it results in weak monitoring. In this regard, the demographic characteristics of managers will be more reflected in the company’s strategy.

Theoretical Background and Hypothesis Development

Family ownership and leverage: Family-owned company is a business entity that is owned or managed by more than one member of the same family (Astrachan et al., 2002; Warrad et al., 2012). Several authors reported that around the world, it is a common business feature that firms are owned by families (Anderson & Reeb, 2003; Bunkanwanicha et al., 2013; Claessens et al., 2000; Faccio & Lang, 2002; Porta et al., 1999; Shleifer & Vishny, 1986; Villalonga & Amit, 2006). However, there is a considerable debate whether or not such ownership structure creates value to the firms.

The effect of family ownership on leverage is not clear. According to Stulz (1988), family firms utilize more debt to keep control in their hands and hence prevent possible acquisitions from external shareholders. Harijono & George (2004) find that family firms use around twenty percent more debt as compare to non-family firms. Driffield et al. (2007) provided evidence that have significant and negative influence on leverage and argue that firms using higher leverage could reduce the agency problem between majority and minority shareholders. Céspedes et al. (2010) reported that family ownership significantly and positively influence on leverage which suggest that families use debt financing in place of issuing equity to avoid sharing ownership.

In contrast, Anderson & Reeb (2003); Gallo et al. (2004) report that family may be more risk averse and may mitigate firm risk by using less debt in a firm. This might result in leverage being negatively related to family ownership. However, Nadaraja et al. (2011) reported that there is no significant relationship between family ownership and leverage. Therefore, the first hypothesis is developed as follows:

H1: A negative relationship between family ownership and leverage is expected

State ownership and leverage: Agency costs have been confirmed to be related to ownership whether government or state (Wei et al., 2005; Fan et al., 2007). Eng and Mak (2003) stated that companies that are significantly owned by the government possess high agency cost due to the majority and minority shareholders’ contradictory objectives. Meanwhile, Buck, Liu and Skovoroda (2008) asserted that companies that are majorly owned by the state could experience higher agency problems due to the prevalence of lower wages but higher managerial power.

According to Abramov et al. (2017), cost of debt is higher in companies majorly owned by governments as the companies are compelled to fulfill socially- and politically-related investment targets, thus impacting the companies’ performance and value. This would lead to lower profits and higher debt costs, thus exposure to high default risks (Borisova et al., 2012). Hence, government-owned companies typically experience high debt levels.

Meanwhile, the impact of state ownership on leverage remains unclear. Buck et al. (2008) argued that high levels of government ownership may lead to increased moral hazard problems, which in turn could lead to a negative impact on leverage. Su (2010) reported that state ownership significantly and negatively influences leverage. In addition, Vijayakumaran & Vijayakumaran (2019) provided evidence of the significant and negative influence on leverage by suggesting that SOEs could experience lesser constraints in issuing equity and receive preferred treatments when applying for seasoned equity financing, therefore incurring less debt. On the other hand, Hwang & Chien (2009) show that the high degree of government ownership can help enhance the leverage capacity of firms because of the guarantee provided by the government. This could lead that companies with large a proportion of state influence leverage positively. Le & Tannous (2016) examined the effect of state ownership on the financing decision of non-financial companies listed in Vietnam over the period of 2007–2012. The authors concluded that state ownership positively affects corporate leverage. In addition Gul (1999) and Pham & Nguyen, (2019) reported that state ownership significantly and positively influence on leverage. However, Muharam & Putri (2020) stated that there is no significant relationship between state ownership and leverage. Thus, the second hypothesis is developed as follows:

H2: A negative relationship between state ownership and leverage is deemed

Size of board and leverage: Board size can significantly be used to monitor and control managers (Lipton & Lorsch, 1992; Aljaaidi & Hassan, 2020). According to Pfeffer & Selancick (1978); Lipton & Lorsch (1992), board size has a significant association with the financing decision made by the firm. Lipton & Lorsch (1992); Jensen (1993) state small-sized boards have greater efficiency than large-sized boards in tackling agency problems among the board members. In case the board members are excessive, agency problems could increase, as some of directors could tag along as free riders. Jensen (1993) supports small boards due to their efficient decision making, better coordination and less communication problem problems. As suggested by Chaganti et al. (1985), companies that have not faced bankruptcy have larger-sized boards i.e. an indication that company survival is aided by large-sized boards.

The relationship between sizes of board and leverage are mixed. Abor (2007); Saad (2010); Ghosh et al. (2011); Memon & Samo (2019) argue that firms with large board size could have communication difficulties among the directors when they want to take a decision, which could increase the agency problem. Their results show board size is related to higher leverage. Meanwhile, Hasan & Butt (2009) state that larger board size leads to stronger pressure by making managers pursue lower leverage to enhance firm value as high level of leverage might lead to financial distress. In the same line Berger et al. (1997) found that board size has a negative impact on leverage. Their findings suggest that a larger-sized board could put strong pressure on managers to use lower leverage to increase the firm’s performance. Finally, Wiwattanakantang (1999); Vijayakumaran & Vijayakumaran (2019) found that the size of the board is not associated with leverage. Therefore, the third hypothesis is developed as follows:

H3: A negative association between board size and leverage is deemed

CEO duality and leverage: The agency theory asserts the significance of CEO duality in reinforcing the CEO’s power in supporting his personal interest instead of the owner’s interest, and in seizing full board authority hence abating the power of the board (Baatwah et al., 2015). Anderson & Anthony (1986); Dahya et al. (1996) believe that CEO duality can help in improving decision making for achieving the firm’s objective, with minimum board interference. In addition, Rechner & Dalton (1991); Donaldson & Davis (1991) argue that more power held by one person may lead to better decisions.

Abor (2007) found that leverage is positively related to CEO duality, suggesting that leverage could be used to reduce agency problems associated with CEO duality as creditors will monitor the actions of CEO-chairman. Uwuigbe (2014) examined the relationship between CEO duality and leverage using the Nigeria listed firms’ over the period, 2006-2011. The results showed that there is a statistically significant positive effect of CEO duality and leverage. In addition, Memon & Samo (2019); Saad (2010) found a positive relationship between CEO duality and leverage. In contrast, Pham & Nguyen (2019); Hasan & Butt (2009) found that leverage has no significant relationship with CEO duality. Thus, the fourth hypothesis is developed as follows:

H4: There exists a positive and significant relationship between CEO duality and leverage

CEO gender and leverage: With regards to CEO gender, studies in cognitive psychology and management assert that males and females differ in terms of leadership styles, efficacy, communication skills, and degree of conservatism, assertiveness, risk aversion, and decision-making (Byrnes et al., 1999; Eagly & Johnson, 1990). Faccio et al. (2016) stated that gender indirectly reflects one’s self-confidence and penchant for risk aversion. According to Croson & Gneezy (2009); Eckman & Grossman (2008), research evidence shows that women demonstrate higher risk aversion than men. Meanwhile, Beber & Fabbri (2012) showed that male managers have higher confidence than their female counterparts. Therefore, male managers are more willing to speculate.

According to Huang & Kisgen (2013), female CEOs tend to rely less on long-term debt. Faccio et al. (2016) found that female CEOs have a negative effect on leverage. In contrast, Nilmawati et al. (2021) examined the relationship between CEO gender (male) and leverage using 2.264 observations over the period of 2010-2017. The results showed that there is a statistically significant positive effect of CEO gender on leverage. In the same line, Graham, Harvey & Pury (2013); Huang & Kisgen (2013) stated that companies with male managers have high leverage. However, Frank & Goyal (2007); Sitthipongpanich & Polsiri (2012) found that CEO gender is not associated with leverage. Therefore, the fifth hypothesis is developed as follows Figure 1:

H5: There exists a positive and significant relationship between CEO gender and leverage

Methodology

Population and Sampling

The current study investigated the effects of corporate governance specifically family ownership, state ownership, board size, CEO duality and CEO gender on leverage by focusing on the annual reports of a sample of 100 Saudi listed firms covering 13 sectors over the period of 2011-2019. Overall, 900 firm-year observations were made on the non-financial firms. This study had excluded financial firms from banking and insurance sectors due to their distinct features and the various disclosure requirements (Klai & Omri, 2011; Esa & Ghazali, 2012; Alhazaimeh et al., 2014). The study sample entailed 100 out of 170 listed firms on the Saudi Stock Exchange Market (Tadawul).

Model Specification

To examine the influence of corporate governance on leverage, the following regression model is employed.

The measurement of independent and control variables is shown in the Table 1 one.

| Table 1 Measurement Of The Key Variables |

|

|---|---|

| Variables | Operationalization |

| Independent Variables | |

| Leverage (LEV) |

Total debt divided by total assets (Osma, 2008; Belkhir et al., 2014; Anagnostopoulou & Tsekrekos, 2017). |

| Family Ownership (FAWN) | Percentage of shares holds by family divided by the gross number of a firms’ shares. (Villalonga, 2006; Hasnan et al. 2013; Ashwin et al., 2015). |

| State Ownership (STATEOW) | Proportion of total shares held by the state government (Ab Razak et al., 2008; Li et al., 2009; Najid et al. 2011) |

| CEO Duality (CEODU) |

Dummy = 1 if CEO and chairman are the same individual, 0 otherwise. (Joseph et al., 2014; Kusnadi 2011). |

| CEO Gender (CEOGEN) | CEO will be given a 0 if male and one if female (Custodio &Metzger, 2014; Geiler & Renneboog, 2015) |

| Board Size (BSIZE) |

The total number of directors on the board (Sheikh & Kareem, 2014) |

| Profitability (PRO) |

EBIT to total assets. (Iatridis & Kadorinis, 2009; Givoly et al., 2010) |

Empirical Results

Descriptive Statistics

Table 2 shows that a level of significant variation exists among the companies included as samples in this study. Based on Table 2, the values for leverage ranged between 0.00399 and 1.042351, averaging at 0.33144 with a standard deviation of 0.20444. The values for FAWN range between 0 and 0.956188, averaging at 0.14087 with a standard deviation of 0.2199146. The values for STATEOW range between 0 and 0.90603, averaging at 0.088726 with a standard deviation of 0.1804234. Next, the values for BSIZE range between 3 and 16, averaging at 7.873333 with a standard deviation of 2.28881. CEODU shows a maximum value of 1 and minimum value of 0; it acts as a dummy variable, showing the value of 1 if the Chairman and CEO are made up of the same individual and 0 if not. This variable has a mean of 0.64888, indicating that 64% of the sampled firms practice having the same individuals holding the Chairman and CEO positions. Lastly, CEOGEN is another dummy variable, showing the value of 1 if the CEO is female and 0 if it is male. This variable has a maximum value of 1 and minimum value of 0, with a mean of 0.08888. In terms of the control variable, PRO shows a mean value of 0.0299142, a maximum value of 0.68344, a minimum value of -0.47623, and a standard deviation of 0.10929 Table 3.

| Table 2 Descriptive Findings Of The Study |

||||||

|---|---|---|---|---|---|---|

| Variable Names obs | Mean | S.D | Min | Max | Skewnes | Kurtos |

| LEV 900 | 0.331445 | 0.2044469 | 0.0039982 | 1.042351 | 0.8654748 | 3.463133 |

| FAWN 900 | 0.1408707 | 0.2199146 | 0 | 0.956188 | 2.123305 | 7.078181 |

| STATEOW 900 | 0.088726 | 0.1804234 | 0 | 0.9060345 | 2.281374 | 7.681178 |

| BSIZE 900 | 7.873333 | 2.288813 | 3 | 16 | 0.5076862 | 2.666797 |

| CEODU 900 | 0.6488889 | 0.477583 | 0 | 1 | -0.6238567 | 1.389197 |

| CEOGEN 900 | 0.0888889 | 0.2847415 | 0 | 1 | 2.889215 | 9.347561 |

| PRO 900 | 0.0299142 | 0.1092913 | -0.4762397 | 0.6834401 | -0.1636694 | 9.658636 |

| Table 3 Correlation Matrix Results |

||||||

|---|---|---|---|---|---|---|

| Variable | LEV | FAWN | STATEOW BSIZE | CEODU | CEOGEN | PRO |

| LEV | 1 | |||||

| FAWN | -0.0983 | 1 | ||||

| STATEOW | -0.0502 | -0.1118 | 1 | |||

| BSIZE | -0.0755 | -0.0154 | 0.0686 | 1 | ||

| CEODU | 0.4235 | -0.1242 | 0.0614 -0.037 |

1 | ||

| CEOGEN | 0.3604 | 0.0305 | -0.0466 -0.016 |

0.1561 | 1 | |

| PRO | -0.2568 | -0.0343 | 0.0153 0.0572 |

-0.0927 | -0.0681 | 1 |

The correlation matrix measures the strength and direction of the variables’ linear relationships. Practically, the correlation coefficient ranges between -1 and +1, whereby -1 indicates a perfect negative correlation, +1 indicates a perfect positive correlation and 0 a non-correlation.

Multicollinearity Test

The multicollinearity test determines whether a correlation issue exists. A VIF value of 10 and below indicates an acceptable level of multicollinearity (Hair et al., 2013; Pallant, 2013). The VIF values in Table 4 show that there is no significant multicollinearity problem in the model.

| Table 4 Multicollinearity Test |

||

|---|---|---|

| Variables | VIF | 1\VIF |

| FAWN | 1.03 | 0.969847 |

| STATEOW | 1.02 | 0.977764 |

| BSIZE | 1.01 | 0.990656 |

| CEODU | 1.06 | 0.947102 |

| CEOGEN | 1.03 | 0.967874 |

| PRO | 1.02 | 0.983731 |

| Mean VIF | 1.03 | |

The study hypothesized that family ownership is negatively correlated to financial leverage. The results in Table 5 show that both the variables are negatively and insignificantly correlated (β = 0.02178, p= 0.141). This result is in line with the hypothesis and empirical finding of Nadaraja et al. (2011) which states that family ownership and leverage are negatively and insignificantly related. Hence, hypothesis one (H1) is not accepted.

The current study also hypothesized that state ownership is negatively correlated to financial leverage. The results in Table 5 show that state ownership and leverage are negatively and significantly correlated (β=-0.0905018, p=0.000). This finding is in line with that of Su (2010); Vijayakumaran & Vijayakumaran (2019) which state that state ownership and leverage are negatively related. This suggests that SOEs experience less constraints in issuing equity and receive preferred treatments when applying for seasoned equity financing, hence incurring less debts (Vijayakumaran & Vijayakumaran, 2019). Therefore, hypothesis two (H2) is accepted.

| TABLE 5 Regression Results (N=900) |

||||||

|---|---|---|---|---|---|---|

| Fixed-effect | Round-effect | GLS | ||||

| Variable | Coefficient | Prob. | Coefficient | Prob. | Coefficient | Prob. |

| FAWN | -0.0783802 | 0.011 | -0.0805894 | 0.005 | -0.0217832 | 0.141 |

| STATEOW | -0.0903763 | 0.146 | -0.0800645 | 0.113 | -0.0905018 | ***0.000 |

| BSIZE | -0.0010102 | 0.512 | -0.0011124 | 0.468 | -0.000497 | 0.680 |

| CEODU | 0.0800872 | 0.000 | 0.0855065 | 0.000 | 0.1589918 | ***0.000 |

| CEOGEN | 0.1627181 | 0.000 | 0.1688032 | 0.000 | 0.1923633 | ***0.000 |

| PRO | -0.2514525 | 0.000 | -0.262855 | 0.000 | -0.2831037 | ***0.000 |

| VIF | 1.03 | |||||

| R2 | 0.2377 | |||||

| F - Stat | Prob-f | 0.0000 | ||||

| Hausman | chi2 = | 0.0056 | ||||

| Homo | No Hetero | |||||

Note: LEV = Leverage, FAWN = family ownership, STATEOW = state ownership, BSIZE = board size, CEODU = CEO duality, CEOGEN = CEO gender, PRO = Profitability.

This study predicted a negative association between board size and leverage. Table 4 shows that the direction of the relationship between board size and leverage is negative and insignificant (β = - .000497, p= .680). This finding is in line with the current study’s hypothesis and the empirical findings of Vijayakumaran & Vijayakumaran (2019) which state that board size is negatively and insignificantly correlated to leverage. Hence, hypothesis three (H3) is not accepted.

The current study hypothesized that CEO duality is positively correlated to leverage. The results in Table 5 show that CEO duality is positively and significantly correlated to leverage (β =0.1589918, p=0.000). This means that CEO duality has a positive effect on leverage, which is in line with the findings of Uwuigbe (2014), Memon and Samo (2019); Saad (2010) who found that leverage positively influences CEO duality. Abor (2007) suggesting that leverage could be used to reduce agency problems associated with CEO duality as creditors will monitor the actions of CEO-chairman. Hence, hypothesis four (H4) is accepted.

CEO gender is expected to be positively associated with leverage. Table 5 shows that there is a significant positive relationship between CEO gender and leverage (β =0.1923633, p=0.000). This result is in line with that of Graham et al. (2013); Huang & Kisgen (2013); Nilmawati et al. (2021) who found that CEO gender is significantly related with leverage. Their findings suggest that men are too confident (overconfidence) and tolerant of risk, while women are more conservative and less risk-taking. Companies with male CEOs are more willing to take risks; in this case, use more debt. Hence, hypothesis five (H5) is accepted.

Conclusion

Optimal level leverage and good corporate governance strength are crucial for increasing the value of the firm and maximizing the wealth of shareholders. However, prior literature suggests that the governance characteristics and leverage structures change at various life cycles of the firm. Therefore, in this study has addressed 100 companies in the non-financial firms at Saudi Stock Exchange (TADAWUL) for the period of 9 years 2011 to 2019, using generalized least square random-effect (GLS) regression model to study the effect ownership structure (family and state ownership) and CEO characteristics (size of board, CEO duality and CEO gender) on the leverage of a firm.

The results of this study indicate several factors affecting the level of leverage. The results show that state ownership is significantly and negatively correlated to profitability, whilst CEO duality and CEO gender are positively and significantly linked to leverage in the context of Saudi Arabia. Meanwhile, family ownership, board size and firm complexity are shown to be non-significantly correlated to leverage.

These outcomes suggest that state ownership should be encouraged in listed firms to make up for the lack of corporate governance in other aspects. The findings of this study are beneficial for regulators and policymakers. The robust findings offer valuable insights concerning the factors determining leverage including managerial ownership, ownership concentration and board independence. The findings also notify the Saudi government to develop its corporate governance codes and tighten the penalties for firms that do not comply with international governance standards.

References

Ab Razak, N.H., Ahmad, R., & Aliahmed, H.J. (2008). Government Ownership and Performance: An Analysis of Listed Companies in Malaysia. Corporate Ownership Control, 6(2), 434-442.

Indexed at, Google Scholar, Cross Ref

Abor, J. (2007). Corporate governance and financing decisions of Ghanaian listed firms. Corporate Governance, 7(1), 83-92.

Indexed at, Google Scholar, Cross Ref

Abramov, A., Radygin, A., Entov, R., & Chernova, M. (2017). State ownership and efficiency characteristics. Russian Journal of Economics, 3(2), 129-157.

Indexed at, Google Scholar, Cross Ref

Alam, Z.S., Chen, M.A., Ciccotello, C.S., & Ryan, H.E. (2014). Does the location of directors matter? Information acquisition and board decisions. Journal of Financial and Quantitative Analysis, 49(1), 131-164.

Indexed at, Google Scholar, Cross Ref

Alhazaimeh, A., Palaniappan, R., & Almsafir, M. (2014). The impact of corporate governance and ownership structure on voluntary disclosure in annual reports among listed Jordanian companies.Procedia-Social and Behavioral Sciences,129, 341-348.

Indexed at, Google Scholar, Cross Ref

Aljaaidi, K.S., & Hassan, W.K. (2020). Energy industry performance in Saudi Arabia: Empirical evidence. International Journal of Energy Economics and Policy, 10(4), 271-277.

Indexed at, Google Scholar, Cross Ref

Allen, F. (2005). Corporate governance in emerging economies. Oxford Review of Economic Policy, 21(2), 164-177.

Indexed at, Google Scholar, Cross Ref

Anagnostopoulou, S.C., & Tsekrekos, A.E. (2017). The effect of financial leverage on real and accrual-based earnings management. Accounting and Business Research, 47(2), 191-236.

Indexed at, Google Scholar, Cross Ref

Anderson, C.A., & Anthony, R.N. (1986). The new corporate directors, New York: John Wiley and Sons.

Ashwin, A.S., Krishnan, R.T., & George, R. (2015). Family firms in India: Family involvement, innovation and agency and stewardship behaviors.Asia Pacific Journal of Management, 32(4), 869-900.

Indexed at, Google Scholar, Cross Ref

Baatwah Saeed, R., Salleh, Z., & Ahmad, N. (2015). CEO characteristics and audit report timeliness: do CEO tenure and financial expertise matter? Managerial Auditing Journal, 30(8/9), 998-1022.

Indexed at, Google Scholar, Cross Ref

Beber, A., & Fabbri, D. (2012). Who times the foreign exchange market? Corporate speculation and CEO characteristics. Journal of Corporate Finance, 18(5), 1065-1087.

Indexed at, Google Scholar, Cross Ref

Belkhir, M., Boubaker, S., & Derouiche, I. (2014). Control–ownership wedge, board of directors, and the value of excess cash.Economic Modelling, 110-122.

Indexed at, Google Scholar, Cross Ref

Berger, G. P., Ofek, E., & Yermack, L. D. (1997). Managerial entrenchment and capital structure decisions. The Journal of Finance, 52(4), 1411-1438.

Indexed at, Google Scholar, Cross Ref

Borisova, G., Fotak, V., Holland, K., & Megginson, W.L. (2012). Government ownership and the cost of debt: Evidence from government investments in publicly traded firms.

Indexed at, Google Scholar, Cross Ref

Buck, T., Liu, X., & Skovoroda, R. (2008). Top executive pay and firm performance in China. Journal of International Business Studies, 39(5), 833-850.

Indexed at, Google Scholar, Cross Ref

Byrnes, J.P., Miller, D.C., & Schafer, W.D. (1999). Gender differences in risk taking: A metaanalysis. Psychological Bulletin, 125, 367-383.

Chaganti, R.S., Mahajan, V., & Sharma, S. (1985). Corporate board size, composition and corporate failures in the retailing industry. Journal of Management Studies, 22(4), 400-417.

Indexed at, Google Scholar, Cross Ref

Chatterjee, C. (2020). Board quality and earnings management: Evidence from India. Global Business Review, 21(5), 1-23.

Indexed at, Google Scholar, Cross Ref

Chouaibi, J., Harres, M., & Brahim, N.B. (2018). The Effect of board director’s characteristics on real earnings management: Tunisian-listed firms. Journal of the Knowledge Economy, 9(3), 999-1013.

Indexed at, Google Scholar, Cross Ref

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 1-27.

Indexed at, Google Scholar, Cross Ref

Dahya, J., Lonie, A.A., & Power, D.M. (1996). The case for separating the roles of chairman and CEO: An analysis of stock market and accounting data. Corporate Governance: An International Review, 4(2), 71-77.

Indexed at, Google Scholar, Cross Ref

Donaldson, L., & Davis, J.H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16, 49-64.

Indexed at, Google Scholar, Cross Ref

Eagly, A.H., & Johnson, B.T. (1990). Gender and leadership styles: A meta-analysis.

Indexed at, Google Scholar, Cross Ref

Eng, L., & Mak, Y. (2003). Corporate governance and voluntary disclosure. Journal of Accounting and Public Policy, 22(4), 325-345.

Indexed at, Google Scholar, Cross Ref

Esa, E., & Ghazali, N.A.M. (2012). Corporate social responsibility and corporate governance in Malaysian government?linked companies.Corporate Governance: The international journal of business in society.

Indexed at, Google Scholar, Cross Ref

Faccio, M., Marchica, M. T., & Mura, R. (2016). CEO gender, corporate risk-taking, and the efficiency of capital allocation. Journal of Corporate Finance, 39, 193-209.

Indexed at, Google Scholar, Cross Ref

Fama, E.F., & Jensen, M.C. (1983). Agency problems and residual claims. The Journal of Law Economics, 26(2), 327-349.

Indexed at, Google Scholar, Cross Ref

Fan, P.H.J., Wong, T.J., & Zhang, T. (2007). Politically-connected CEOs, corporate governance and post-IPO performance of China’s partially privatized firms. Journal of Financial Economics, 84(2), 330-357.

Indexed at, Google Scholar, Cross Ref

Frank, M.Z., & Goyal, V.K. (2007). Corporate leverage: how much do managers really matter? In: SSRN Electronic Journal.

Indexed at, Google Scholar, Cross Ref

Geiler, P., & Renneboog, L. (2015). Are female top managers really paid less? Journal of Corporate Finance, 35, 345-369.

Indexed at, Google Scholar, Cross Ref

Ghosh, C., Giambona, E., Harding, J.P., & Sirmans, C.F. (2011). How entrenchment, incentives and governance influence REIT capital structure. The Journal of Real Estate Finance and Economics, 43(1-2), 39-72.

Indexed at, Google Scholar, Cross Ref

Givoly, D., Hayn, C.K., & Katz, S.P. (2010). Does public ownership of equity improve earnings quality. The accounting review, 85(1), 195-225.

Indexed at, Google Scholar, Cross Ref

Graham, J.R., Harvey, C.R., & Puri, M. (2013). Managerial attitudes and corporate actions. Journal of Financial Economics, 109(1), 103-121.

Indexed at, Google Scholar, Cross Ref

Hambrick, C.D. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334-343.

Indexed at, Google Scholar, Cross Ref

Hasan, A., & Butt, S.A. (2009). Impact of ownership structure and corporate governance on capital structure of Pakistani listed companies. International Journal of Business and management, 4(2), 50-57.

Indexed at, Google Scholar, Cross Ref

Hasnan, S., Rahman, R.A., & Mahenthiran, S. (2013). Management motive, weak governance, earnings management, and fraudulent financial reporting: Malaysian evidence. Journal of International Accounting Research, 12(1), 1-27.

Indexed at, Google Scholar, Cross Ref

Huang, J., & Kisgen, J.D. (2013). Gender and corporate finance: Are male executives overconfident relative for female executives. Journal of Financial Economics, 108(3), 822-839.

Indexed at, Google Scholar, Cross Ref

Iatridis, G., & Kadorinis, G. (2009). Earnings management and firm financial motives: A financial investigation of UK listed firms. International Review of Financial Analysis, 18(4), 164-173.

Indexed at, Google Scholar, Cross Ref

Jantadej, K., & Wattanatorn, W. (2020). The effect of corporate governance on the cost of debt: Evidence from Thailand.The Journal of Asian Finance, Economics, and Business,7(9), 283-291.

Indexed at, Google Scholar, Cross Ref

Jensen, M. (1993). The modern industrial revolution, exit and the failure of internal control systems. Journal of Finance, 48(3), 831880.

Indexed at, Google Scholar, Cross Ref

Joseph, J., Ocasio, W., & McDonnell, M.H. (2014). The structural elaboration of board independence: executive power, institutional logics, and the adoption of CEO-only board structures in US corporate governance. Academy of Management Journal, 57(6), 1834-1858.

Indexed at, Google Scholar, Cross Ref

Klai, N., & Omri, A. (2011). Corporate governance and financial reporting quality: The case of Tunisian firms.International business research,4(1), 158-166.

Indexed at, Google Scholar, Cross Ref

Kusnadi, Y. (2011). Do corporate governance mechanisms matter for cash holdings and firm value. Pacific-Basin Finance Journal, 19(5), 554-570.

Indexed at, Google Scholar, Cross Ref

Le, T.P.V., & Tannous, K. (2016). Ownership structure and capital structure: A study of Vietnamese listed firms. Australian Economic Papers, 55(4), 319-344.

Indexed at, Google Scholar, Cross Ref

Li, K., Yue, H., & Zhao, L. (2009). Ownership, institutions, and capital structure: Evidence from China. Journal of Comparative Economics, 37, 471-490.

Indexed at, Google Scholar, Cross Ref

Lipton, M., & Lorsch, J.W. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 48(1), 59-77.

Indexed at, Google Scholar, Cross Ref

Memon, Z.A., & Samo, Y.C.A.A. (2019). Corporate governance, firm age, and leverage: Empirical evidence from China.Corporate Governance,10(2).

Indexed at, Google Scholar, Cross Ref

Muharam, H., & Putri, G.K. (2020). The effect of ownership structure on leverage with credit rating as a moderating variable. Diponegoro International Journal of Business, 3(2), 80-87.

Indexed at, Google Scholar, Cross Ref

Najid, Afzan, N., & Abdul Rahman, R. (2011). Government ownership and performance of Malaysian, government-linked companies. International Research Journal of Finance and Economics, 61, 42-5

Nilmawati, N., Untoro, W., Hadinugroho, B., & Atmaji, A. (2021). The relationship between CEO characteristics and leverage: The role of independent commissioners.The Journal of Asian Finance, Economics and Business,8(4), 787-796.

Indexed at, Google Scholar, Cross Ref

Niu, X. (2008). Theoretical and practical review of capital structure and its determinants. International Journal of Business and Management, 3(3), 133-139.

Indexed at, Google Scholar, Cross Ref

Osma, B.G. (2008). Board independence and real earnings management: The case of R&D expenditure. Corporate Governance: An International Review, 16(2), 116-131.

Indexed at, Google Scholar, Cross Ref

Pallant, J. (2013). SPSS survival manual: A step by step guide to data analysis using IBM spss (5th ed.). New Jersey: McGraw-Hill Education.

Indexed at, Google Scholar, Cross Ref

Pfeffer, J., & Salancik, G.R. (1978). The external of organisations: A resource dependence perspectives. New York, NY: Harper & Row, 25-32.

Pham, H.S.T., & Nguyen, D.T. (2019). The effects of corporate governance mechanisms on the financial leverage-profitability relation. Management Research Review. Psychological Bulletin, 108, 233-256.

Indexed at, Google Scholar, Cross Ref

Rechner, P.L., & Dalton, D.R. (1991). CEO duality and organizational performance: A longitudinal analysis. Strategic Management Journal, 12(2), 155-161.

Indexed at, Google Scholar, Cross Ref

Rouf, D., & Abdur, M. (2015). Capital structure and firm performance of listed non-financial companies in Bangladesh.The International Journal of Applied Economics and Finance,9(1), 25-32.

Indexed at, Google Scholar, Cross Ref

Saad, N.M. (2010). Corporate governance compliance and the effects to capital structure in Malaysia. International Journal of Economics and Finance, 2(1), 105-114.

Indexed at, Google Scholar, Cross Ref

Salehi, M., Arianpoor, A., & Dalwai, T. (2020). Corporate governance and cost of equity: Evidence from Tehran stock exchange. The Journal of Asian Finance, Economics, and Business, 7(7), 149-158.

Indexed at, Google Scholar, Cross Ref

Sheikh, N.A., & Kareem, S. (2014). The impact of board structure, ownership concentration, and CEO remuneration on perfor-mance of Islamic commercial banks in Pakistan. Pakistan Journal of Islamic Research, 15, 49-59.

Siregar, S.V., & Utama, S. (2008). Type of earnings management and the effect of ownership structure, firm size, and corporate governance practices: Evidence from Indonesia. International Journal of Accounting, 43(1), 1-27.

Indexed at, Google Scholar, Cross Ref

Sitthipongpanich, T., & Polsiri, P. (2015). CEO characteristics and corporate financing in Thailand. International Research Journal of Finance and Economics, 102, 56-69.

Su, L.D. (2010). Ownership structure, corporate diversification and capital structure: Evidence from China's publicly listed firms. Management Decision, 48(2), 314-339.

Indexed at, Google Scholar, Cross Ref

Uwuigbe, U. (2014). Corporate governance and capital structure: evidence from listed firms in Nigeria stock exchange. Journal of Accounting and Management, 4(1), 5-14.

Vijayakumaran, R., & Vijayakumaran, S. (2019). Corporate governance and capital structure decisions: Evidence from Chinese listed companies. Journal of Asian Finance, Economics and Business, 6(3), 67-79.

Indexed at, Google Scholar, Cross Ref

Villalonga, B., & Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80(2), 385-417.

Indexed at, Google Scholar, Cross Ref

Wei, Z., Xie, F., & Zhang, S. (2005). Ownership structure and firm value in China’s privatized firms. Journal of Financial Quantitative Analysis, 40(1), 87-108.

Indexed at, Google Scholar, Cross Ref

Wen, Y., Rwegasira, K., & Bilderbeek, J. (2002). Corporate governance and capital structure decisions of Chinese listed firms. Corporate Governance: An International Review, 10(2), 75-83.

Indexed at, Google Scholar, Cross Ref

Wiwattanakantang, Y. (1999). An empirical study on the determinants of the capital structure of Thai firms. Pacific-Basin Finance Journal, 7(3-4), 371-403.

Indexed at, Google Scholar, Cross Ref

Received: 25-Dec-2021, Manuscript No. AAFSJ-22-10623; Editor assigned: 28-Dec-2021, PreQC No. AAFSJ-22-10623(PQ); Reviewed: 12-Jan-2022, QC No. AAFSJ-22-10623; Revised: 22-Nov-2022, Manuscript No. AAFSJ-22-10623(R); Published: 29-Nov-2022