Research Article: 2018 Vol: 22 Issue: 5

Corporate Restructuring: Case Study in Vietnam

Duong Quynh Nga, Ho Chi Minh City Open University

Dinh Long Pham, Ho Chi Minh City Open University

Cam Linh Nguyen Tran, Ho Chi Minh City Open University

Thu Huong Pham, Ho Chi Minh City Open University

Abstract

Corporate restructuring is the process of significantly changing a company’s business model, management team or financial structure to address challenges and increase shareholder value (ISCI, 2014). Many of studies have examined restructuring activities such as the characteristics of firms that submit restructuring activities, the wealth and performance impacts of restructuring events. In this study, we examine the factors that regularize the delisting of restructuring firms, using a logistic regression analysis. Our point of view is that of a shareholders’ need to both valuate an operational restructuring and forecast its outcome. This study finds that restructuring frequency is significantly correlated positively with the risk delisting of firm.

Keywords

Operational Restructuring, Delisting, Logistic Regression.

Introduction

“Corporate restructuring is the process of significantly changing a company’s business model, management team or financial structure to address challenges and increase shareholder value” (ISCI, 2014). Restructuring is one channel through which business goal might be achieved such as positioning the company to be more competitive, survive a currently adverse economic climate or poise the corporation to move in an entirely new direction.

Many of research of corporate restructuring have examined the characteristics of firms that commit restructuring activities (John et al., 1992), and the wealth and performance effects of restructuring events (Brickley and Van Drunen, 1990, Chaney et al., 2000, Kross et al., 2000, Poon et al., 2001). There is a little evidence that managers do an operational restructuring (Atias et al., 2004; Holder-Webb et al., 2005). Alternatively, operational restructuring may disorder a business, enhance uncertainty earnings and cash flow of firm, and jeopardize its future. Restructuring charges are also a signal of poor performance (Atiase et al., 2004) and the potential for value to be generated more optimally through a takeover than through actions taken by incumbent managers (Jensen, 1987; Maksimovic et al., 2011; Li, 2013) and firms targeted a poorly performing (Bebchuk et al., 2014; Cremers et al., 2009)

The recent empirical findings show that successful operational restructuring may be difficult to achieve in practice. Moreover, the attempt to restructure may be unsuccessful if the problem faced by a firm is deep-rooted. Lin et al. (2006) raise the fundamental question: “How can we design an effective restructuring plan?” They propose a mathematical model to analyze the dynamic of restructuring decision-making over time to construct an optimal restructuring plan. Their model conceptually demonstrates how factors such as the condition of a business, uncertainty in the economy, restructuring frequency, and selected restructuring activities, should be taken into account in the decision-making process concerning restructuring.

Sometimes, the decision making in restructuring and its performance evaluation may be subjective, which muddies the considerations above. However, all restructuring firms share a similar goal: to recover from a bad situation. For example, operational restructurings are often imperative in a depressed economy. Geroski and Gredd (1994); Schivardi (2003); Sill (1998) have shown that corporate restructuring tend to be concentrated within times of economic recession. Additionally, the individual shareholders must bear huge and significant costs to delisting (Shumway, 1997; Shumway and Warther, 1999; Macey et al., 2004). Thus, in this study, we examine corporate that have undertaken operational restructuring during an economic recession (2009), and focus on those that have failed to survive. The aim of this study is to contribute to the literature by providing insights on the factors that are correlated with delisting risk of Vietnamese firms.

This paper focuses on operational restructuring as distinct from financial restructuring, and approaches the problem from an accounting perspective. After collecting and reviewing accounting information, we selected a set of firms that reported operational restructuring charges in 2010 amid the economic recession, to understand the effects of both restructuring and the characteristics of firms that fail to survive. Note that “failure to survive” is defined as delisting from the trading exchange for negative reasons. Being merged or moved to another exchange is not a “failure”, because such an event is not necessarily associated with poor performance or violations of trade exchange guidelines. The empirical analysis is conducted using logit regression estimation. The implications within the results are addressed to provide a guideline for predicting the outcome of restructuring events. The survivability or delisting risk of a firm undergoing restructuring has not been examined in the existing literature. Our results may be used to confirm or strengthen other findings in the fields.

The remainder of the study is organized as follow: sector 2 reviews the related literature and develops the research hypotheses. Section 3 provides details on the data, regression analysis results and discussion. Finally, Section 4 provides concluding remarks.

Literature Review And Hypotheses

Macey et al. (2004) provide evidence that firms that are delisted from NYSE, had a highly significant costs with percentage spreads tripling, volatility doubling after failing the listing requirements. The similar results have been found out by Panchapagesan and Werner (2004) for firms involuntarily delisted from NASDAQ.

The current literature on business restructuring focuses on environmental and agency theory explanations for the firm’s restructuring decision (Bethel and Liebeskind, 1993; Johnson et al., 1993). This study adds to the literature on delisting by examining whether the restructuring characteristics as proxied by the amount of restructuring costs/total assets and firms characteristics as proxied by debt-to-asset ratio and size are a primary factor being correlated with its ability to survive in the Vietnamese stock exchange (HOSE and HNX).

Restructuring Characteristics and Delisting Risk

Firms that restructure repeatedly may face more adverse conditions and experience different consequences from those that restructure only occasionally. A sequence of restructurings may take place as a firm continues to address pressing financial and operational problems, or as new crises or opportunities emerge. Adut et al. (2003) suggest that repetitive restructuring charges send a negative message, especially in the short term, by studying the effect of restructuring charges on CEO compensation. In particular, in a recessionary economy, repeated restructurings may indicate that the firm is dealing with severe problems, and raise the question of whether the firm can survive long enough to reap the benefits of the restructuring program. We record this relationship formally in the following hypothesis:

H1: Restructuring charges have a positive effect on the probability of corporate delisting risk.

Corporate restructuring often involves refocusing or eliminating non-core business. When the economy slows down, firms are often forced to curtail diversification, so as to concentrate on their core businesses. Previous studies (Berger and Ofek, 1999; Denis et al., 1997; Denis and Kruse, 2000) find that corporate events such as management turnover, changes in the management compensation plan, outside shareholder pressure, or financial distress, frequently precede corporate refocusing programs. This suggests that restructurings, such as refocusing programs, are often initiated to reduce agency conflicts (Jensen, 1986; Jensen and Murphy, 1990; Berger and Ofek, 1995; Land and Stulz, 1994) and to correct past inefficient expansion and diversification. Prior studies show that greater focus is associated with both operating performance increases and higher stock returns (Berger and Ofek, 1999; Comment and Jarrell, 1995; John and Ofek, 1995). Thus, refocusing activities may be one factor that affects survivability.

Cost cutting such as reducing labor costs, production costs, selling and administrative expenses, and R&D and financial costs, is another common measure of corporate restructuring (Denis and Kruse, 2000). Firm need also a necessary strategy to survive amid a recession (Bigelow and Chan, 1992). The effect of cost cutting strategy should be evaluated in light of the efficiency and performance achieved, not by cost savings alone. John et al. (1992) study a set of firms that had experienced performance decrease, yet turned around successfully through restructuring, and find that both the cost of goods sold/sales ratio and labor costs/sales ratio fell significantly for those firms. We therefore consider cost cutting as another factor affecting the probability of survival, and use change in costs to sales ratio, “costsalt” to measure the intensity of cost cutting from year t-1 to year t.

The global financial crisis in 2008-2009 had the basic impact on the economy of Vietnam. Demand power shrinks down, FDI decreases in both quantity and size, the freezing investing activities. In such situation, we choose the year 2010 is the year of restructuring.

For costsalt and assett, we consider their values for both t=2011 and t=2012. This is because restructuring programs initiated in 2010 most likely also involve the following year.

Firm Characteristics and Delisting Risk

Restructuring is an ongoing process. Managers adjust their restructuring strategy as the firm’s operating performance evolves. Several studies find that firms undergoing restructuring and that are financially weak prior to or during the restructuring year, are fundamentally different from those that are in a healthy financial condition (e.g., Atiase et al., 2004; Chaney et al., 2000; Gombola and Tsetsekos, 1992). A restructuring made by financially weak firm may indicate that it is having difficulties generating enough demand for its products, staying cost–competitive in the market and/or maintaining its profitability. A depressed economy presents a greater challenge for financially weak firms to manage business cycles, in particular to come through the down cycles. It is to be expected that firms that are financially health are more likely to survive a bad economy than firms that are in an unfavorable financial condition. Therefore, we include firm profitability during the year of restructuring as a factor that affects company survival.

Capital structure theory states that the optimal capital structure is determined by weighing the advantages of debts such as shielding tax and reducing agency costs against the increased likelihood of incurring debt-related financial distress/bankruptcy costs (Modigliani and Miller, 1958: 1963; Myers, 1984; Jensen and Meckling, 1976; Grossman and Hart, 1982). Empirical studies on capital structure show that debt level is a function of company size, bankruptcy risk, profitability and asset composition, among other factors (Marsh, 1982). Previous studies also show that restructuring firms respond to poor operating performance by quickly cutting debt (John et al., 1992). These studies suggest that there is a positive association between firm failure and high level of debt. Furthermore, the cost of debt tends to be higher during a recessionary economy, making it more difficult for firms with a high level of debt to survive. Therefore, we examine the effect of debt-to-assets ratio on listed firm. We record this relationship formally in the following hypothesis:

H2: Debt-to-asset ratio has a negative effect on of corporate delisting risk.

H3: Firm size has a negative effect on the corporate delisting risk.

We calculate the change of debt to total asset ratio,dedt from year t-1 to year t, to measure the change in a firm’s financing policy due to the restructuring action in year t. again, debtt is observed for both t=2011 and t=2012 following the reasoning addressed in section 2.1.We use SIZE to proxy the resources that a firm has accumulated to withstand either adverse market conditions or to recover from past investment mistakes.

Logit Model Estimation

The dependent variable P (DELIST) used in this study is an indicator variable representing delisted firm, which equals 1 if the company was delisted by 2014, and 0 otherwise. Those firms that failed were delisted from trading due to poor performance and inability to maintain the minimum requirements for continued listing on the exchange.

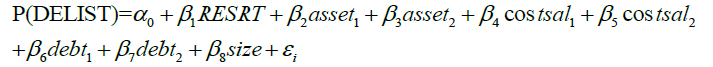

Our objective is to explore factors that are significantly correlated with the delisting risk of a firm undergoing restructuring activities. Based on the discussion in the previous two sections, we estimate the following logit regression model:

Where P (DELIST) is the indicator variable of delisting and is a binary variable that equals on for delisted firms and zero for control firms. The independent variables are defined as follows:

Restructuring characteristics

REST: The absolute amount of restructuring costs/total assets in the year of restructuring 2011.

asset1:Percentage of annual change in total assets from year 2010 to year 2011.

asset2 :Percentage of annual change in total assets from year 2011 to 2012.

costsal1: Percentage of annual change in the ratio of costs of goods to net sales from year 2010 to year 2011

costsal1: Percentage of annual change in the ratio of costs of goods to net sales from year 2011 to 2012.

Firm Characteristics

dedt1: Percentage of annual change in debt to total asset ratio from year 2010 to year 2011

dedt2: Percentage of annual change in debt to total asset ratio from year 2011 to 2012.

Size: The log of total assets at the beginning of year 2011

Note that subscripts 01 and 02 refer to year 2011 and 2012.

Data And Empirical Results

Data

We start with all firm-year observations between fiscal years 2010 and 2012 that have restructuring data available in Hanoi stock exchange and Hochiminh stock exchange. According to Denis and Kruse (2000) and Kang and Shivdasani (1997), the effectiveness of a restructuring event is usually apparent within the three years following a restructuring. Thus, we set out observations period to the three years subsequent, from 2010 to 2012.

We deleted firms that have missing values. The final sample consists of 642 firms of which 624 continued trading after 2014 and 18 delisted from the stock exchanges by 2014.

Descriptive Statistics

Table 1 presents descriptive statistics. The average value of REST is 3.98. The average of asset1 and asset2 are 120.2355 and 106.3879, respectively. The average of costsale1 and costsale 2 are 122.4449 and 110.1046, respectively. The average of size is 11.63

| Table 1 DESCRIPTIVE STATISTICS |

||||

| Variable | Mean | Std. Dev. | Min | Max |

| delist | 0.0212014 | 0.1443104 | 0 | 1 |

| REST | 3.987018 | 3.865284 | -9.560907 | 12.38058 |

| asset1 | 120.2355 | 56.83415 | 43.00672 | 799.7028 |

| asset2 | 106.3879 | 31.03248 | 32.5779 | 470.6371 |

| costsale1 | 122.4449 | 150.4578 | .8583888 | 1198.236 |

| costsale2 | 110.1046 | 87.17358 | -54.02002 | 1011.339 |

| debt1 | 117.0314 | 105.1968 | 18.36857 | 1600.479 |

| size | 11.63145 | 0.6197332 | 9.893289 | 13.50088 |

Table 2 Summary statistics and correlations. This table provides information about the distribution of the variables that are used in our regressions.

| Table 2 CORRELATION MATRIX |

||||||||

| REST | asset1 | asset2 | costsale1 | costsale2 | debt1 | Debt2 | size | |

| REST | 1 | |||||||

| asset1 | -0.0632 | 1 | ||||||

| asset2 | 0.0432 | 0.0306 | 1 | |||||

| costsale1 | 0.0306 | -0.0232 | 0.0990 | 1 | ||||

| costsale2 | -0.0482 | 0.4392 | -0.0146 | -0.0867 | 1 | |||

| debt1 | 0.0173 | -0.1282 | 0.3474 | 0.2929 | -0.1291 | 1 | ||

| Debt2 | 0.0173 | -0.1282 | 0.3474 | 0.2929 | -0.1291 | -0.2006 | 1 | |

| size | 0.0835 | -0.1919 | -0.0299 | -0.0615 | -0.2029 | -0.0945 | 0.1576 | 1 |

The correlation coefficients among explanatory variables show that the correlations between two sets of downsizing variables might cause collinearity concerns: costsale2 vs. asset1 (0.439). Multicollinearity diagnostics show that the variance inflation factors are well below the threshold value of 10, indicating insignificant collinear influence on regression estimations. Therefore, multicollinearity should not present a serious threat to the estimation of the logit model.

Results of Logit Regression

This section presents logit regression analysis results from tests investigating the relation between the restructuring activities, assets ratio, debt-to-asset ratio, size with the likelihood of delisting from Hochiminh Stock Exchange and Hanoi Stock Exchange.

Table 3 presents the results of a logit regression analysis, which show the effect of restructuring characteristics and firm characteristics on firm survival. The coefficient on REST is positive and statistically significant, showing that there is direct positively correlation between the magnitude of restructuring and firm survival.

| Table 3 RESULT OF LOGIT REGRESSION |

||||

| Estimate | Std. Error | z value | Pr(>|z|) | |

| (Intercept) | 11.00885 | 9.496456 | 1.16 | 0.246 |

| REST | 0.1926157 | 0.1115667 | -1.73 | 0.084* |

| asset1 | -0.0501853 | 0.0195616 | -2.57 | 0.010*** |

| asset2 | -0.0868145 | 0.0450277 | -1.93 | 0.054** |

| costsale1 | -0.0023248 | 0.002795 | -0.83 | 0.406 |

| costsale2 | -0.002171 | 0.0121121 | -0.18 | 0.858 |

| debt1 | 0.0038231 | 0.0017735 | 2.16 | 0.031** |

| Debt2 | 0.0470158 | 0.0175532 | 2.68 | 0.007*** |

| size | -0.399080 | 0.226828 | -1.759 | 0.0785* |

| Wald chi2(9) = 6.15 | ||||

| Prob > chi2 = 0.0638 Pseudo R2 = 0.2634 |

||||

Signif. codes: ‘***’ 0.001; ‘**’ 0.01; ‘*’ 0.05;

For firm characteristics variables, the results show that the probability of delisting decreases with asset1, asset2, costsale1,costsale2 and size but only asset1, asset2 and debt1, Debt2 and size variables are statistically and significant. We don’t see the significant coefficient of the costsale1 and costsale2 that suggest that cost cutting is not significant predictors of delisting. The coefficient of size is negative and significant (p<0.07), indicating that larger firms have a smaller delisting risk. The variable debt1 and Debt2 has a positive coefficient and is significant at 0.03 and 0.007, it means that delisting firms tend to have a spike in their debt load before delisting. Moreover, the cost of liabilities is typically higher in a tough economy, making it more troublesome for firms with huge debts to survive.

Conclusion

We used the logit regression on the static relationship between delisting risk and restructuring strategies, firm’s characteristics at the time of restructuring, and not take note an event occurring in between. Restructuring strategy is considered as the crucial strategy during an economic recession. We present empirical evidence that delisting risk is negatively associated with high restructuring risk, large-scale asset downsizing, and large firm size. Moreover, high level of liabilities also affects delisting risk. We identify key factors that are statistically significant in predicting the survival of restructuring firms for manager and decision makers in planning effective restructuring strategies. The size of delisted firm is still small and the stock exchange is still young. Other models can be applied such as Cox model and event- history analysis, using longitudinal data.

References

- Adut D., Cready, W.H., & Lopez, T.J. (2003). Restructuring charges and CEO cash compensation: A reexamination. The Accounting Review, 78(1), 169-192.

- Atiase, R.K., Platt, D.E., & Tse, S.Y. (2004). Operating Restructuring Charges and Post-Restructuring Performance. Contemporary Accounting Research, 21(3), 493-522.

- Berger, P.G., & Ofek, E. (1995). Diversification's effect on firm value. Journal of Financial Economics, 37, 39-65.

- Berger, P.G., & Ofek, E. (1999). Causes and effects of corporate refocusing programs. The Review of Financial Studies, 12(2), 311-345.

- Bethel, J., & Liebeskind, J. (1993). The effects of ownership structure on corporate restructuring. Strategic Management Journal, 14, 15-31.

- Bigelow, R., & Chan, P. (1992). Managing in difficult times, lesions from the most recent recession. Management Decision, 30(8), 34-41.

- Brickley, J.A., & Van Drunen, L.D. (1990). Internal corporate restructuring an empirical analysis. Journal of Accounting and Economics, 12, 251-280.

- Chaney, P.K., Hogan, C.E., & Jeter, D.C. (2000). The information content of restructuring charges. A Contextual Analysis. Working Paper, Vanderbilt University.

- Chalos, P., & Chen, C.J.P. (2002). Employee downsizing strategies, market reaction and post announcement financial performance. Journal of Business Finance and Accounting, 29(5-6), 847-870.

- Chen, P., Mehrotra V., Sivakumar, R., & Yu, W.W. (2001). Layoffs, Shareholders' Wealth, and Corporate Performance. Journal of Empirical Finance, 8(2), 171-199.

- Chen, K.C.W., & Schoderbek, M.P. (1999). The role of accounting information in security exchange delisting. Journal of Accounting and Public Policy, 18, 31-57.

- Comment, R., & Jarrell, G.A. (1995). Corporate focus and stock returns. Journal of Financial Economics, 37, 67-87.

- Denis, D.J., Denis, D.K., & Sarin, A. (1997). Agency problems, equity ownership, and corporate diversification. Journal of Finance, 52, 135-160.

- Denis, D.J., & Kruse T.A. (2000). Managerial discipline and corporate restructuring following performance declines. Journal of Financial Economics, 55, 391-424.

- Elayan, F.A., Swales, G.S., Maris, B.A., & Scott, J.R. (1998). Market reactions, characteristics, and the effectiveness of corporate layoffs. Journal of Business Finance and Accounting, 25(3-4), 329-351.

- Geroski, P., & Gregg, P. (1994). Corporate restructuring in the UK during the recession. Business Strategy Review, 5(2), 1-19.

- Gibbs, P.A. (1993). Determinants of corporate restructuring, the relative importance of corporate governance:Takeover threat, and free cash flow. Strategic Management Journal, 14, 51-68

- Gombola, M.J., & Tsetsekos, G.P. (1992). Plant closings for financially weak and financially strong firms. Quarterly Journal of Business and Economics, 31(3), 69-83.

- Grossman, S.J., & Hart, O., (1982). Corporate Financial Structure and Managerial Incentive, In J. Mccall (Editor), The Economics of Information and Uncertainty, University Of Chicago Press, 107-137.

- Hahn, T., & Reyes, M. (2004). On the estimation of stock-market reaction to corporate layoff announcements. Review of Financial Economics, 13(4), 357-370.

- Holder-Webb, L., Lopez, T.J., & Regier, P.R. (2005). The performance consequences of operational restructurings. Review of Quantitative Finance and Accounting, 25(4), 319-339.

- Jensen, M.C., & Meckling, W. (1976). Theory of the firm, managerial behavior, agency costs, and capital structure. Journal of Financial Economics, 3(4), 305-360.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76, 323-330.

- Jensen, M.C., & Murphy, K.J. (1990). Performance pay and top-management incentives. The Journal of Political Economy, 98, 225-264.

- John, K., Lang, L.H.P., & Netter, J. (1990). The voluntary restructuring of large firms in response to performance decline. Journal of Finance, 47(3), 891-917.

- John, K., & Ofek E. (1995). Asset sales and increase in focus. Journal of Financial Economics, 37, 105-126.

- Johnson, R.A., Hoskisson, R.E., & Hitt, M.A. (1993). Board of director involvement in restructuring: the effects of boards versus managerial controls and characteristics. Strategic Management Journal, 14, 33-50.

- Kang, J., & Shivdasani, A. (1997). Corporate restructuring during performance declines in Japan. Journal of Financial Economics, 46(1), 29-66.

- Lang, L., & Stulz, R. (1994). Tobin's Q, corporate diversification and firm performance. Journal of Political Economy, 102, 1248-1280.

- Lin, B., Lee, Z., & Peterson, R. (2006). An analytical approach for making management decisions concerning corporate restructuring. Managerial and Decision Economics, 27(5), 655-666.

- Lin, B., & Lee Z.H., (2007). Will firms survive restructuring? Key factors and issues. International Journal of Business Strategy, 7(2).

- Marsh, P. (1982). The choice between equity and debt, an empirical study, Journal of Finance, 37(1), 121-144.

- Modigliani, F.F., & Miller, M.H. (1958). The cost of capital, corporate finance, and the theory of investment. American Economic Review, 48(3), 261-297.

- Modigliani, F.F., & Miller, M.H. (1963). Corporate income taxes and the cost of capital, a correction. American Economic Review, 53(3), 433-443.

- Myers, S.C. (1984). The capital structure puzzle. Journal of Finance, 39(3), 575-592.

- Palmon, O., Sun, H., & Tang, A.P. (1997). Layoff announcements, stock market impact and financial performance. Financial Management, 26, 54-58.

- Shumway, T. (1997). The delisting bias in CRSP data. Journal of Finance, 52, 327-340.

- Shumway, T., & Warther, V. (1999). The delisting bias in CRSP’s Nasdaq data and its implications for the size effect. Journal of Finance, 54, 2351-2379

- Schivardi, F. (2003). Reallocation and Learning over the Business Cycle. European Economic Review, 47(1), 95-111.

- Sill, K. (1998). Restructuring during recessions, a silver lining in the cloud? Business Review (Federal Reserve Bank of Philadelphia) (May/Jun), 15-31.

- Worrell, D., Davidson III, W., & Sharma, V.M. (1991). Layoff announcements and stockholder wealth. Academy of Management Journal, 34(3), 662-278.

- World Bank (2010). How deep was the impact of the economic crisis in Vietnam? A focus on the informal sector in Hanoi and HO Chi Minh City, Washington DC, 2010.