Research Article: 2018 Vol: 22 Issue: 1

Corporate Social Responsibility and Customer loyalty in Islamic Banks of Pakistan: A Mediating Role of Brand Image

Muhammad Salman Shabbir, University Utara Malaysia

Mohd Noor Mohd Shariff, University Utara Malaysia

Rabia Salman, University Utara Malaysia

Muhammad Shukri Bin Bakar, University Utara Malaysia

Muhammad Farooq Shabbir, The Islamia University of Bahawalpur

Keywords

Corporate Social Responsibility, Brand Image, Attitudinal Loyalty, Behavioural Loyalty, Islamic Banks, Pakistan.

Introduction

Banks have turned out to be the foundation of economy that assumes as an imperative part for development of business organizations. The current era is referred as information age where customers are highly informed. Moreover, it is imperative for banks to remain competitive in this era of information and competition. Every business needs to retain customer to survive in the competition. The customer’s knowledge with respect to their assets, has constrained the banks to incorporate corporate social responsibility. The organizations are worried about coordinating CSR activities to develop better corporate reputation (Meehan, Meehan & Richards, 2006). Recently, gigantic growth has noticed in Islamic banking industry of Pakistan. More and more commercial banks are offering Islamic financial products which turn into an inevitable intense competition. Customer loyalty is a tool to retain customers specially in competitive environment, it is crucial for business survival (Jacoby & Kyner, 1973). Businesses are concerned to take part in social activities to build a positive image of business in the eyes of customers (Martínez, Pérez & del Bosque, 2014). As asserted by Bravo, Montaner & Pina (2012) customer loyalty is influenced by corporate image of business.

Islamic banking industry is inclined to take part in CSR activities to enhance corporate image of banks. Alamro & Rowley (2011) argued that brand preference is positively influenced by brand image and reputation. Moreover, Ricks (1997) found that businesses take part in social activities build a positive image of business which make customer to become more loyal and proud to be affiliated with such a business. Carroll & Shabana (2010) found that the relationship among corporate social responsibility and customer loyalty is mediated by other factors (Boulstridge & Carrigan, 2000). The role of different mediating variables has been analysed in the framework of CSR and customer loyalty. This study is an effort to explore the missing link of mediating role of corporate image in the relationship of corporate social responsibility and customer loyalty in the context of Islamic banking industry of Pakistan. The study is structured as; second part of the study is to give a brief overview of past literature on corporate social responsibility and customer loyalty. We develop hypotheses on the basis of literature and in methodology section we discuss about instrument for data collection and statistical tool to verify the relationship. In last section we discuss the results and provide recommendations on the basis of results.

Literature Review

Stakeholder theory often referred when explaining the role corporate social responsibility in business economics (Freeman, 1984). The framework of this research has been derived from Stakeholder theory to explain interconnection of CSR with corporate performance where customer loyalty is a proxy of performance. The engagement of firm in social responsibility activities is with the expectation of reward from consumers which ultimately improve performance (Agus & Salas, 2017).

Corporate Social Responsibility

The concept of corporate social responsibility has been in the debate since last six decades. CSR activities are divided into two major classes; one is concerned with stakeholder’s well-being and second is related to social wellbeing (Mohr, 2001). Society is a vital component of business environment as referred by agency theory. The consumer learning and sensitivity towards social wellbeing has pushed organizations to indicate sense of responsibility regarding society (Osman et al., 2015). Interestingly there are a few contentions that CSR does not have a notable effect over buyer conduct which eventually prompts customer loyalty (Marin, Ruiz & Rubio, 2009). Along these lines, the significance of this examination is lifted to unfurl this relationship. Beforehand, a lot of research has been led to clarify the relationship among loyalty of customer and corporate social responsibility (Martínez et al., 2014; Lee, Chang & Lee, 2017). The survival and achievement of business is intensively linked with loyalty of customer. It is evident that corporate social responsibility is a used as marketing tool to influence customer attitude towards loyalty as discussed by Vitaliano (2010) and Sen, Bhattacharya & Korschun (2006). Similarly, a recent study of Liu, Wong, Shi, Chu and Brock (2014) argued that customer brand loyalty can be enhanced through corporate social responsible activates. The customer attitude towards brand loyalty can be manipulated by taking part in CSR initiatives hence a significant positive contribution of CSR is evident by Mandhachitara & Poolthong (2011) and Quazi & Richardson (2012). Moreover, Mattera & Baena (2015) asserted that CSR is a significant tool to gain competitive advantage by retaining and satisfying customers.

H1: Corporate social responsibility has a significant positive association with customer loyalty in Islamic banks of Pakistan.

H1a: Corporate social responsibility has a significant positive association with behavioural customer loyalty in Islamic banks of Pakistan.

H1a: Corporate social responsibility has a significant positive association with attitudinal customer loyalty in Islamic banks of Pakistan.

H2: Corporate social responsibility has a significant positive effect on corporate image of Islamic banks of Pakistan.

Corporate Image

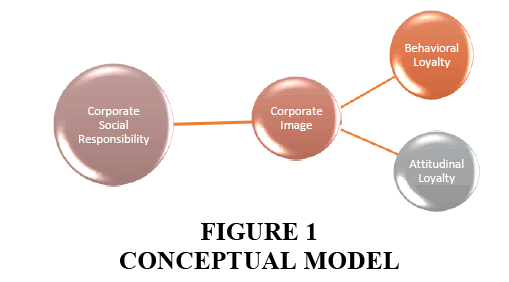

Corporate character is a useful way to portray corporate image of a business. Worcester, (2009) said that the corporate image is an important factor for success and failure of the business. Corporate image is perceived as a competitive advantage in the eyes of Balmer (2009). Matute-Vallejo, Bravo & Pina (2011) argued that to position a financial organization positive corporate image is integral part of the business strategies. Corporate image is a general view that is perceived by customers. Corporate image is the presentation of business’s personality to its stakeholder to get a unique position in the eyes of customer (Schmitt & Pan, 1994; Melewar, 2008). Greve (2014) assert that positive and strong corporate image leads to higher level of customer loyalty. The right image of business influence customer’s attitude towards business hence, their loyalty with the brand becomes persistent (Osman et al., 2015). Ick and Basu (1994) explain the process of loyalty by dividing it into two main parts. The first part of customer loyalty is behavioural loyalty while the other is attitudinal loyalty. A few studies were reported to gauge the influence of attitudinal and behavioural loyalty in Islamic banks (Amin, Isa & Fontaine, 2013; Osman et al., 2015) (Figure 1). Hence it is proposed that:

H3: Corporate image has significant positive influence over attitudinal loyalty and behavioural loyalty of customers of Islamic banks in Pakistan.

H4: Corporate image mediates the relationship of CSR-attitudinal loyalty and CSR-behavioural loyalty of customers of Islamic banks in Pakistan.

Conceptual Model

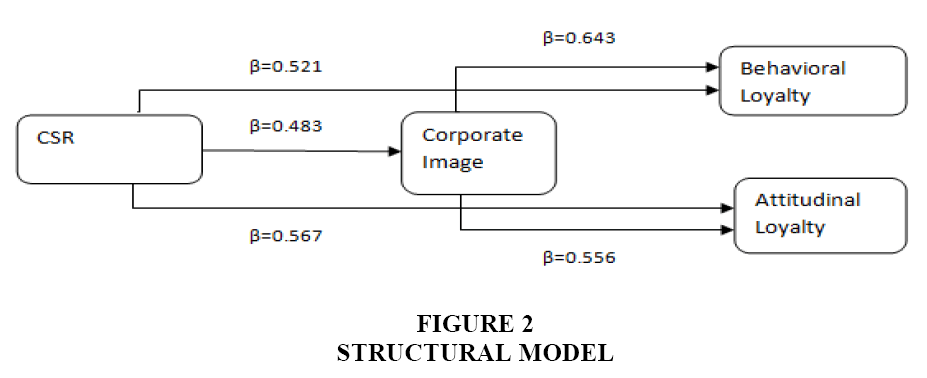

The proposed graphical model of this study is displayed on Figure 2.

Methodology

The data collection instrument for this study is adopted from previous literature. Corporate social responsibility was measured by utilizing Carroll (1999) construct, corporate image was measured by items proposed by Nguyen and Leblanc (2001) and loyalty was measured by items proposed by Jones & Taylor (2007). A self-administrated well-structured questionnaire then distributed among customers of Islamic banks to collect responses on the predetermined construct. Purposive sampling technique was adopted to make sure the significance of sample set. The data was collected from two big cities of Pakistan; Islamabad the capital and Lahore the capital of largest province of Pakistan. These two cities are business hubs and represent a large and diverse ethnic population of Pakistan. A total of 350 responses were collected from Islamic Bank customer in Lahore and Islamabad.

Research Findings and Discussion

First of all validity of construct was determined by applying CFA while internal consistency of construct was determined by Cronbach’s alpha (Fornell & Larcker, 1981; Nunnally, 1978). Table 1 illustrate that all the dimensions of construct are significant as factor loading for all measures is significant and greater then minimum acceptable value 0.6. The value of Cronbach’s alpha for each variable is also greater than standard value 7.0 as said by Nunnally (1978).

| Table 1 Validity and Reliability Results |

|||

| Construct | AVE | CR | Cronbach’s Alpha |

| CSR | 0.724 | 0.911 | 0.937 |

| Corporate Image | 0.889 | 0.831 | 0.873 |

| Behavioural Loyalty | 0.793 | 0.954 | 0.912 |

| Attitudinal Loyalty | 0.810 | 0.843 | 0.823 |

The path diagram with path coefficients is presented in the Figure 2. The regression results shows that CSR has significant impact over customer loyalty (H1), it is worth noting that the impact of CSR over attitudinal loyalty (β=0.567, P<0.00) is greater than behavioural loyalty (β=0.521, P<0.00). As mentioned in figure 2 Brand Image has a significant positive influence over behaviour loyalty (β=0.643, P<0.00) and attitudinal loyalty (β=0.552, P<0.01). Moreover the impact of CSR on corporate image is recorded significant and positive (β=0.483, P<0.00) (Goyal & Chanda, 2017). The mediating effect of corporate image is measured introducing the effect of corporate image in the relationship of CSR-behavioural loyalty and CSR attitudinal loyalty. The finding of this study is in line with the previous studies conducted to gauge the impact of CSR on customer loyalty (Amin, Isa & Fontaine, 2013; Osman et al., 2015; Amin & Isa, 2008). A significant decrease in path variables from 0.567 to 0.264 and 0.521 to 0.143 has been observed which explains that corporate image has a strong mediation effect when introduced with CSR and customer loyalty (Baron & Kenny, 1986).

Conclusion and Limitations

This study is carried to analyse the impact of CSR on customer loyalty. In addition this study tried to explore the link of corporate image in the relationship of CSR and customer loyalty in special context of Islamic banks of Pakistan. The customer loyalty is then divided into two dimension named as attitudinal loyalty and behavioural loyalty (Dick & Basu, 1994). The findings of this study reveal that corporate social responsibility can be utilize to enhance customer behavioural and attitudinal loyalty. Moreover, corporate image found as a strong mediating element in the relationship of corporate social responsibility and customer loyalty. The context of this study is limited to Islamic banking industry of Pakistan. It is important to mention that the socio-culture environment of Pakistan is different. There is a need to apply this model in different social and economic settings.

Recommendations

This study stressed on the role of corporate social responsibility to enhance and build positive image of banks. Hence, the positive image can be utilized to retain and attain customers. To protect and enhance customer loyalty, promotion of brand image through CSR would be an effective approach. Moreover, association of customers with firm having positive brand image will increase customer loyalty. The banks should incorporate social responsibility initiatives to build positive image of banks. In this way banks can retain their customers by portraying positive image of bank.

References

- Agus, H.M. & Salas, J. (2017). Strategic and institutional sustainability: Corporate social responsibility, brand value and interbrand listing. Journal of Product & Brand Management, 26(6), 545-558.

- Alamro, A. & Rowley, J. (2011). Antecedents of brand preference for mobile telecommunications services. Journal of Product & Brand Management, 20(6).

- Amin, M., Isa, Z. & Fontaine, R. (2013). Islamic banks: Contrasting the drivers of customer satisfaction on image, trust and loyalty of Muslim and non-Muslim customers in Malaysia. International Journal of Bank Marketing, 31(2), 79-97.

- Baron, R.M. & Kenny, D.A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

- Boulstridge, E. & Carrigan, M. (2000). Do consumers really care about corporate responsibility? Highlighting the attitude-behaviour gap. Journal of Communication Management, 4(4), 355-368.

- Bravo, R., Montaner, T. & Pina, J.M. (2012). Corporate brand image of financial institutions: A consumer approach. Journal of Product & Brand Management, 21(4), 232-245.

- Carroll, A.B. (1999). Corporate social responsibility: Evolution of a definitional construct. Business and Society, 38(3), 268-295.

- Dick, A.S. & Basu, K. (1994). Customer loyalty: Toward an integrated conceptual framework. Journal of the Academy of Marketing Science, 22(2), 99-113.

- Fornell, C. & Larcker, D.F. (1981). Structural equation models with unobservable variables and measurement error: Algebra and statistics. Journal of Marketing Research, 18(3), 382.

- Freeman, R.E. (1984). Strategic management: A stakeholder approach, (Analysis Vol. 1). Cambridge University Press.

- Goyal, P. & Chanda, U. (2017). A bayesian network model on the association between CSR, perceived service quality and customer loyalty in Indian Banking Industry. Sustainable Production and Consumption, 10, 50-65.

- Greve, G. (2014). The moderating effect of customer engagement on the brand image-brand loyalty relationship. Procedia-Social and Behavioural Sciences, 148, 203-210.

- Jacoby, J. & Kyner, D.B. (1973). Brand loyalty vs. repeat purchasing behaviour. Journal of Marketing Research, 10(1), 1.

- Jones, T. & Taylor, S.F. (2007). The conceptual domain of service loyalty: How many dimensions? Journal of Services Marketing, 21(1), 36-51.

- Ricks, J.M. (1997). An assessment of strategic corporate philanthropy on perceptions of brand equity variables. Journal of Consumer Marketing, 22(3), 121-134.

- Lee, C.Y., Chang, W.C. & Lee, H.C. (2017). Corporate reputation and customer loyalty-Evidence from Mandhachitara, R. & Poolthong, Y. (2011). A model of customer loyalty and corporate social responsibility. Journal of Services Marketing, 25(2), 122-133.

- Marin, L., Ruiz, S. & Rubio, A. (2009). The role of identity salience in the effects of corporate social responsibility on consumer behaviour. Journal of Business Ethics, 84(1), 65-78.

- Martínez, P., Pérez, A. & del Bosque, I.R. (2014). CSR influence on hotel brand image and loyalty. Academia Revista Latinoamericana de Administración, 27(2), 267-283.

- Mattera, M. & Baena, V. (2015). The key to carving out a high corporate reputation based on innovation: Corporate social responsibility. Social Responsibility Journal, 11(2), 221-241.

- Melewar, T.C. (2008). Facets of corporate identity, communication and reputation. Facets of Corporate Identity, Communication and Reputation. Taylor & Francis Group.

- Mohr, L.A. & Webb, D.J. (2005). The effects of corporate social responsibility and price on consumer responses. Journal of Consumer Affairs, 39(1), 121-147.

- Nunnally, J. (1978). Psychometric Theory. New York: McGraw-Hill.

- Osman, I., Alwi, S.F.S., Mokhtar, I., Ali, H., Setapa, F., Muda, R. & Rahim, A.R.A. (2015). Integrating institutional theory in determining corporate image of islamic banks. Procedia-Social and Behavioural Sciences, 211, 560-567.

- Quazi, A. & Richardson, A. (2012). Sources of variation in linking corporate social responsibility and financial performance. Social Responsibility Journal, 8(2), 242-256.

- Schmitt, B.H. & Pan, Y. (1994). Managing corporate and brand identities in the Asia-Pacific region. California Management Review, 36(4), 32-48.

- Tingchi, Liu, M., Wong, A.I., Shi, G., Chu, R. & Brock, J.L. (2014). The impact of corporate social responsibility (CSR) performance and perceived brand quality on customer-based brand preference. Journal of Services Marketing, 28(3), 181-194.

- Vitaliano, D.F. (2010). Corporate social responsibility and labor turnover. Corporate Governance: The International Journal of Business in Society, 10(5), 563-573.