Research Article: 2022 Vol: 26 Issue: 3S

Cost Management and Financial Sustainability: Evaluating Its Effect on Liquidity and Solvency of Manufacturing Companies

Adebawojo, Oladipupo Akindehinde, Babcock University

Adegbie Folajimi, Babcock University

Adebawo Owolabi Olutokunbo, Adeleke University

Citation Information: Akindehinde, A.O., Folajimi, A., & Olutokunbo, A.O. (2022). Cost management and financial sustainability: evaluating its effect on liquidity and solvency of manufacturing companies. Academy of Accounting and Financial Studies Journal, 26(S3), 1-21.

Abstract

Manufacturing companies play major roles in national economic development and growth. For this reason, the Sustainability of such firms is a critical factor for consideration in any economy. However, many of these firms have had to contend with rising cost of production in the resent years, coming as threat to their Financial Sustainability. Hence, this study evaluated the Cost Management effect on the liquidity and Solvency of Nigeria Manufacturing firms. The study Adopted an expost-facto research design based on secondary data extracted from the audited and published financial report of selected manufacturing companies. The study population consisted all 33 manufacturing companies in Nigeria as at December 2019 while the sample size comprised of 10 Foods and Beverages companies selected based on Purposive and Judgmental Sampling Techniques. Validity and Reliability of data obtained were based on the statutory audit of the financial reports. An inferential statistics Multiple Regression Model was used to analyze the data with the aid of Stata Computer Statistical Analysis Software. The results found that Cost Management significantly affected the Liquidity and Solvency as measures of Financial Sustainability of Manufacturing Companies: For Liquidity (Current Ratio), Adj R2 = 0.2425, F- statistics (3.96) = 11.57, P-value <0.05, Acid Test Ratio, Adj R2= 0.2905, F- statistics (3.96) =14.51, P-value <0.05 while for Solvency (Debt Ratio) Adj R2 = 0.082, F-statistics (3.96) = 3.93, P-Value <0.05, Gearing Ratio, Adj R2 = 0.1184, F-statistics (3.96) =5.43, P-value < 0.05, Interest Covered, Adj R2 = 0.0986, F-statistics (3.96) =4.61, P-value < 0.05. From the study we concluded that Cost Management significantly affects Liquidity and Solvency Ratios which ultimately impact on the Financial Sustainability of manufacturing companies. The study recommends that Management of Nigeria Manufacturing Companies consistently review production and operational costs of their firms and adopt relevant cost savings technologies in their firms’ operations so as to remain competitive in an inflationary economy.

Keywords

Cost Management, Financial Strength, Financial Sustainability, Liquidity, Quoted Companies, Solvency, Manufacturing Companies.

Introduction

Industrialization is the key to national growth and development. For a nation to achieve formidable national development, the nation’s manufacturing sector must be vibrant. Kayode 1989 as cited in Sola, Obamuyi et al. (2013) described industry particularly the manufacturing one as the heart of economy. Osifo & Omoruyi also regard manufacturing industry being the main provider of employment and industrialization, as the fulcrum on which a nation’s economic growth and development rotates. In support of this fact, Ludovico (2017) stated that industrialization and its associated structural transformation is an engine of economic growth and major source employment.

Furthermore, Yongchun also noted that in the process of industrialization, most countries that are currently considered to be the economic power countries chose the manufacturing industries as the core to drive the development of other industries which would ultimately develop the entire national economy. Hence, Financial Sustainability and survival of Manufacturing Companies is critical to nations’ building in developing country like Nigeria. Financial Sustainability is defined as the ability of firm to generate values for owners and provide continuity of operations in the long term using an optimal combination of investment and sources of financing (Zabolotnyy & Wasilewski, 2019). Thus, prudent management of resources must be observed by all firms including the manufacturing ones in order to achieve financial sustainability. Osazefua (2020) stated that financial sustainability is the ability of a firm to cover both its operational and financial obligations as well as mitigate financial risk while retaining sufficient part of earnings to finance expansion. These definitions imply that a manufacturing company that is not financially sustained may have its profitability and growth threatened, thereby losing its competitive capacity which if not carefully managed could lead to distress and ultimate death of such company.

As a result of Nigeria’s over dependent on oil revenue and the neglect of other viable industries, the country is noted to be low in industrialization (Muhammad et al., 2014). The report of Onuegbu (2016) confirmed that export revenue from oil between 1977 and 1984 was 97% and between then and now it has not been less than 90% of the Nigeria foreign exchange and 70% of the Government revenues. Notwithstanding the importance of manufacturing companies to the development and growth of a nation, the few manufacturing companies in operation within the country are faced with diverse challenges. There is pressure on the environment as a result of the operating activities of the few manufacturing industries that are running within the nation. Thus there are issues of greenhouse gas from continuous gas flaring of multinational oil companies and other manufacturing companies through the discharge of untreated effluents into Nigeria land and water. Furthermore, the Nigeria business environment is not very conducive for operations, this is because business in Nigeria experience multiple tax system, inefficient generation and distribution of power, gross insecurity, poor road network and infrastructure facilities (Anekwe et al., 2019). The effects of these negative economic and environmental factors could translate into significant increase in operating cost of manufacturing companies which may hinder their competitive ability and financial sustainability. Thus there is need for manufacturing firms to manage their operating costs in terms of Cost of Sales, Distribution and Administrative Cost, and Finance Cost in order to achieve continuously low cost of production.

Cost management involves various processes adopted by the management of an organization to achieve consistent low operating cost. It deals with estimated planned or future and past or historical costs (DeltaCPE 2017). The dictionary of Accounting defines cost management as a method of reducing operating or production expenses in order to provide less expensive products or services to consumers (Accounting Dictionary, 2021). This definition implies that, manufacturing companies must achieve consistent low costs in terms of the Raw Materials Cost, Conversion Costs, Administrative Costs and Distribution cost in order to sustain profitability and remain financially sustainable.

There have been many studies on sustainable development on manufacturing industries, however, most of these studies dwell on environmental sustainability of manufacturing industries and also manufacturing performance in terms of contributions to Gross Domestic Product (GDP). Others include cost control or cost reduction and performance of manufacturing (Anekwe et al., 2019; Sola et al., 2013; Muhammad et al., 2014; Pulatovich, 2019; Raymond, John-Akamelu Chigbo, 2016). Thus, there is dearth of studies on cost management and financial sustainability as noted by Zabolotony & Wasilewki (2019) which this study filled by the outcome of this study.

Hence, the objective of this study was to evaluate the effect of Cost Management on the Liquidity and Solvency of quoted manufacturing companies in Nigeria. In pursuance of this objective, we also raised the following research questions to aid our investigation:

1. What effect does cost management have on the liquidity ratio (LR) of quoted manufacturing companies in Nigeria?

2. How will cost management affect the solvency ratio (SR) of quoted manufacturing companies?

Also the following research hypotheses were tested in the study:

H0: Cost Management does not significantly affect the Liquidity Ratio (LR) of quoted manufacturing companies in Nigeria.

H0: Cost Management does not significantly affect the Solvency Ratio (SR) of quoted Manufacturing Companies.

Review Of Literature And Theoretical Framework

Conceptual Review

Cost Management: In the financial report of manufacturing companies, costs are classified and presented as Cost of Sales (Material and Conversion Costs) Distribution and Administrative Costs and Finance Costs Dangote Financial Report, 2020. Cost is the measurement of the sacrifice of economic resources that were already made or that are to be made in the future for the purpose of achieving a specific objective (DeltaCPE, 2017; Lawal, 2017). It is essential that organizations particularly the manufacturing ones manage their various types of cost be it Cost of Sales, Distribution and Administrative Cost, or Finance Cost, in such a way that will ensure quality of products and profitability. Cost management can be classified as actions taken by management to satisfy customers while continuously reducing and controlling costs.

Accounting Dictionary (2021) defines cost management as a method of reducing operating or production expenses in order to provide less expensive products or services to consumers. From Fadare & Adegbie (2020) Cost Management is stated to be the control of actual or forecasted costs incurred by an enterprise or an organization. It helps a business organization to predict impeding expenditures and also avoid over budgeting. In order words, it is the process that is applied by the management to analyze and streamline production or operations processes in a way to keep cost low and manage expenses in the future.

Hansen & Mowen explaining cost management, acknowledged that it is a process much broader than a costing system which is primarily concerned about how much an item or products costs. Cost management deals with information for internal use of managers. Specifically, it identifies, collects, measures, classified and reports information that is useful to managers for determining the product costs, customer’s suppliers and other relevant objects for planning, controlling, making continuous improvement and decision making. Achieving efficient financial management by a business operating in a competitive environment depends largely on adopting cost management practice to enhance cost control and cost reduction (Eneisik, 2021).

Cost of Sales: Cost of goods sold or Cost of Sales as it implies is the aggregate of all Direct Costs involved in acquiring or manufacturing of products which a company sells. It is an essential metric of measuring a company’s Gross Margin or Gross Profit. In business financial reports Gross Profit is measured by deducting the Cost of Sales from the business revenue (Hayes, 2020). Cost of Goods sold include the cost of raw materials consumed in production plus the conversion cost. Conversion cost is a term that describe the costs of converting the raw materials purchased and consumed into finished or semi-finished products. This conversion cost includes; the aggregate of direct wages, direct expenses and absorbed production overheads. Francisca & Christina described cost of sales as a form of cost incurred to produce and sell products in a market as part of business activities. The International Accounting Standard (IAS) 2 recognizes the disclosure of cost of goods sold as a functional expense Deloitte. For a company to have sufficient gross margin that can absorb its Administration and Distribution expenses and Finance Cost, the cost of goods sold must be adequately controlled by adopting strategies that would achieve continuous low cost of raw materials and conversion costs, this is implied in the conclusion of Lawal (2017) otherwise, there could be risks of recurring losses and threat to financial sustainability

Distribution and Administrative Cost

Distribution Costs are all those costs both direct and auxiliary, necessary to secure effective distribution of products thus it is not only related to direct cost of activities for advertising the products, securing orders and shipping products, it also include the cost associated with the functions of general management as long as it has to do with the formulation of policies of marketing, the direction of the work of the sales management and the provision for the control over financial factors of the business Castenhol. In accounting sometimes distribution costs, could be described as marketing and distribution cost or sales and distribution costs. This is because both marketing and distribution cost are usually placed in the same class in cost classification.

All costs incurred by manufacturing firm must be accounted for in its financial statements. Such costs can be categorized into manufacturing costs and non-manufacturing costs. Non-manufacturing cost can be further classified into marketing or Selling costs and Administrative Costs. These classifications are important for manufacturing business because each class of the costs affect different parts of the financial statement. while manufacturing cost affect the statement of cost of goods manufactured, the non-manufacturing cost affect the income statement as current period expenses. Non-manufacturing expenses are selling or distribution and administration expenditures incurred primarily in the current period directly for the benefit of generating revenue. Selling or Distribution Expenses or Administrative expense will usually impact on organizations profit (Oyedokun et al., 2019).

Finance Cost

Business organizations particularly the manufacturing ones usually require huge funding to ensure continuous production and operations. In most cases the business owners are not able to provide these funds and as a result, there is shortage of fund for either operations or expansion. Bazot (2014) described the main function of finance as transferring resources from actors who have surplus those who need it as a result of deficit. This is usually done through the process of financial intermediation. He further explains that financial intermediation pools the risks, provides liquidity and reduces information asymmetries that impede the transfer of funds. Such funds are usually provided with associated costs to compensate the risks of the fund providers.

The International Accounting Standard (IAS) 23 defines finance costs as interest and other costs that an entity incures in connection with borrowing of funds. It is also called borrowing costs. There are different sources of funds by which company’s operations can be financed. The source of finance can be through equity finance or through borrowings or loans, while the equity fund provider wants dividends and capital gains as a reward against the risks of releasing their funds, the loan providers wants interest payments on their funds. The interest cost is the price of obtaining loans and borrowings. Finance cost are interest expense on short-term borrowings like bank overdrafts and note payables interest on long-term borrowings and real estate mortgages However, in broader term finance costs include costs other than just interest expense. It includes Amortization of discounts or premium that are related to the borrowings, amortization of ancillary costs incurred in connection with the borrowings arrangements, finance charges in respect of finance leases, exchange differences arising from foreign currency borrowings to the extent that they are regarded as adjustment to the interest cost (Ready Ratios, 2020).

The International Accounting Standard (IAS) 23 Deloitte provides a standard way of accounting for or treating finance costs in the financial statement by giving two recommendations as follows:

One is to recognize finance cost as an expense in the period in which it is incurred. Whenever this treatment is adopted the entire finance costs will be expensed regardless of how they are applied (Atkinson, 2009).

Alternatively, Finance Cost can be capitalized as part of the cost of a qualifying asset. If the cost is directly attributable to the construction, production or acquisition of such qualifying asset. Capitalization is allowed only if it is probable that there will be future economic benefits that can be reliably measured from the qualifying asset. Also once any part of such qualifying expenditure is put into use the capitalization of interest automatically stops and all finance costs that are subsequently incurred will be fully expensed. Innocent (2017) suggested that reduction of borrowing costs and efficient reduction in lending rates will stimulate financial sustainability. Finance cost is a critical cost could impaired organization’s financial sustainability if not carefully managed. Financing organizations activities with borrowed funds may results in financial leverage effect which creates extra risks for common stock holders Ashmarine.

Sustainable Development and Financial Sustainability

As a result of the harsh economic, political and environmental situations around the world, the survival and sustainability of business particularly the manufacturing ones, has become a matter of concern for business managers. Pulatovich (2019) noted business enterprise as an important component of national economy. Thus, it necessary for contemporary business managers to think and act sustainability in every aspect of their business plans. Sustainable development is described in the context of three pillars of economic sustainability, social sustainability and environmental sustainability Magdalena. Sola et al. (2013), noted that the concept of sustainable development encompasses sustainable manufacturing or production. The United States Environment Protection Agency defines Sustainable. Manufacturing as the creation of manufactured products through economically sound processes that minimize negative environmental impacts while conserving energy and national resources. According to them sustainable manufacturing also enhances the safety of employee, community and products. In a similar way, Sustainable Production can be described as the creation of goods and services by using process and systems that are non-polluting, conserving of energy and material, economically viable, safe and healthy for workers, communities, consumers and socially creatively rewarding for all working people (Sola et al., 2013), citing Lower Centre for Sustainable Production. Sustainable production is critical to nations economic development because sustainable production or manufacturing enhances industrialization and without industrialization there cannot be appreciable economic development. (Uma et al., 2019) confirmed this position stating that every economy considers industrialization policy and the role of the manufacturing subsector as indispensable in harnessing the existing resources of the economy and reposition the state to raise the standard of leaving. They further explained that positive change in economy depends largely on diverse manufacturing of sustainable economic goods and services. Also it will be difficult for any manufacturing organization to thrive and grow within any nation, if the financial resource of such organization is not strong. Thus, manufacturing companies in Nigeria should be financially sustainable to be able to contribute meaningfully to the nation’s economic development.

Financial sustainability is defined as the capacity of organization to cover all of its expenses by its revenue and to generate a margin to finance its growth (Ayayi & Sene, 2010). This definition was made from the point of view of profit. However, financial sustainability can also be defined from the point of view of value creation, as the ability to create value for owners and provide continuity of operations in the long-term, using an optimal combination of investments and sources of financing. For better understanding the concept of continuity in the definition refers to the going concern concepts (Zabolotnyy & Wasilewski, 2019).

Explaining this definition further, Zabolotnyy and Wasilewski liken financial sustainability in this context to the concept of risk return model of investment theory. Risk-return model proposes higher return for higher risk. This implies that taking additional risk expressed by volatility of the price of a financial instrument increases the probability of receiving higher profit. They also noted that continuous or progressively worse relationship between value and continuity may lead an entity into financial distress or bankruptcy. Conversely, to ensure entity’s continuity managers usually maximize solvency and liquidity which may lead to reduction of business profitability. Thus for a firm or organization, managers must decide whether to maximize the return from investment and increase financial leverage or avoid a risk and maintain solvency and liquidity. Hence it is manager’s responsibility to strike a comfortable balance between risk and return.

There are several variables that can be adopted for measuring financial sustainability of firm including manufacturing companies. These include; short term profit, efficiency ratio, liquidity ratio and solvency ratio, Asset turn-over ratio. Debt to asset ratio, Ratio of Interest Expense to Earnings before Interest and Taxes, Retained Earning to Revenue Ratio and Price Book Value Ratio (Ayayi & Sene, 2010; Zabolotnyy & Wasilewski, 2019; Osazefua, 2020).

Liquidity Ratios

Liquidity describes how much funds are available to immediately meet the current obligations and the day today running of a business organization. Liquidity is having enough money inform of cash that will meet either business or individual commitments. It is the ability of a business entity to convert assets into cash quickly and cheaply (Priya & Nimalathasan, 2013; Hayes, 2020; Elsharif 2016). It involves adequate management, planning and controlling of both current assets and current liabilities in other to avoid danger of insolvency or insufficient funds to meet due commitments (Priya & Nimelathasan, 2013). Liquidity ratios are major financial metrics that are used in measuring the level of liquidity of companies or business organization. Liquidity ratios measure the relationship between current assets and current liabilities of a company. It measures the ability of a firm to meet its short term maturing obligation. The major liquidity ratios include:

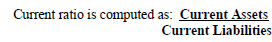

Current ratio: This measures the extent of coverage of short-term creditors by assets that are convertible to cash within one year. Thus a high current ratio implies a high margin of safety for short-term creditors. Conventionally a current ratio of 2:1 is considered to be a normal industry average.

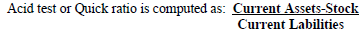

Acid test or quick ratio: This is a more precise guide to measuring liquidity. It measures the extent to which the cash and the near cash assets available can meet the demands of short-term creditors. In this regard stock or inventory is considered to be an illiquid asset and thus, not included in the computation of Quick ratio, conventionally a good industry average for Acid test or Quick ratio is considered to be ratio 1:1.

Other ratios for assessment of business liquidity include Debtors Turnover, Average collection period, Creditors Payment Periods, Stock Turnover and Stock Turnover Period. Liquidity ratios are very essential in assessing and evaluating the short term solvency of business. Hence, it may likely impact on financial sustainability of a business organization.

Solvency ratios: While Liquidity is the ability of business or an organization to meet its short-term financial commitments, Solvency is the ability of organization to meet its long-term financial commitment or obligation. Thus it is an essential measure of the financial health of organizations because it reveals organization ability to operate into a foreseeable future without financial stress. A quick assessment of company’s solvency status can be checked by comparing its total assets with its total liabilities. The difference in total assets and total liabilities should equal the shareholder’s equity. However, the difference may sometimes result in negative shareholder’s equity for some companies which is an indication of insolvency. The implication of negative shareholder’s equity is that, in the event of immediate call for liquidation or involuntary liquidation, the owners of the business may be at risks of personal losses if such business is not covered by limited liability (Hayes & Young, 2020).

Aside from this quick way to check organizations solvency, there are important financial ratios that could be computed for deep analysis of company’s solvency as presented in financial literatures; This includes Fixed Interest Cover, Fixed Charge coverage, Cashflow Interest coverage, Fixed Dividend Cover, Total Debt to Shareholder Funds, Proprietary Ratio, Gearing or Financial Ratio, Debt Ratio and Equity Multiplier. A good solvency ratio for a company would be a good indication that a company is able to sustain its operations financially into a foreseeable future because of the indications that such company is able to meet its financial obligations without any financial stress.

Theoretical Framework

Signaling theory: This was anchored on Signaling Theory was developed by Michael Spence in 1973 to reduce the challenge of information asymmetry between two parties. Information Asymmetry occurs when one party has access to better information for decision making than the other party.

Signaling Theory was adopted in sustainability research by Bae et al. (2018) while studying Corporate Governance and Corporate Sustainability. They stressed that the theory centers on management’s intention to share information and receive signals from the markets, stakeholders and society. They further explained that information asymmetry results in potential conflicts between management and agents in the organization environment. It is the signals that reduces the gap by sending relevant and quality information to the different parties. They also noted that the concept of signaling theory identified four elements of the theory as: Signaler, Signals Receiver, and Feedback. This is similar to a basic communication flow. Relating this four element to business, Bae, Musad and Kim considered Executive, Directors or Managers who are the insiders to work as signaler while the signals are regarded to be the flow information like the stock price news, dividends, environmental financing, corporate social responsibility (CSR) investment. On the other hand, the receivers are outsiders like individuals, investors, and employees. They are not aware of the insiders’ information while the feedback is the reflection of interaction between signaler and receiver.

Following the same line of thought, this study emphasized that management as the Signaler has the responsibility for efficient cost management process that would improve profitability. The signal of profitability is sent to other parties like investors, employees, local communities, and customers who are the receivers. The receivers at the same time will send positive feedback in terms of their committed patronage as a result of positive profitability signals. Hence, the receivers’ continuous committed patronage is expected to strengthen the organizations’ financial sustainability. Roy also adopted signaling theory in his study of Determinants of External Assurance on Sustainability Reports.

Empirical Review

Liquidity, solvency and financial sustainability: Liquidity is the measure of an organization’s ability to meet its current financial commitment or obligations as they fall due without any interruption to the normal operations of the organization. It is determined by the ratio of current asset to current liability (Gichuki, 2014). While the ratio of current assets to current liabilities provides a quick measure of company’s liquidity, there other measures of liquidity according to Owolabi & Obida (2012) that are used to assess the extent of liquidity or lack of liquidity these include Debtors collection period (DCP), creditor payment period (CPP) cashflow ratio (CFR) and cash conversion circle (CCD). Akinleye & Ogunleye (2019) and Khan & safinddium noted that liquidity measures the ability of a firm to meet its maturing obligation in a short-term within one year.

The relationship between liquidity and financial sustainability of firms including manufacturing companies could be established from the work of previous researchers on liquidity. According to Owolabi & Obida (2012) profitability is considered a major factor of assessment of business going concern thus, managers should strive to ensure a reasonable level of profitability in order to maximize the shareholder’s wealth. Their work confirmed a significant impact of liquidity management on profitability of manufacturing firm. Maina (2018) established that liquidity management strategies positively and significantly influence sustainability of table banking industry. In this study Maina considered Asset Value, Working Capital and Operating Surplus as variables in operating surplus as variables in measuring sustainability (dependent variables) thus he further strengthens the taught that liquidity impacts on organizations financial sustainability(Kuruppu et al., 2003).

The findings of Akinleye & Ogunleye (2019) was intandem with that of Owolabi & Obida (2012) by concluding that financial liquidity has helped to improve financial performance of selected manufacturing firm in Nigeria. Although, they noted that there is no long run relationship between liquidity and profitability. This further confirms that liquidity measure companies’ financial stability in the short-term. Conversely, the work of Egbide et al. (2013) confirmed in insignificant relationship between liquidity and profitability. They however, noted in their conclusion that the controversy on the relationship between liquidity and profitability and the impact of one on the other is yet to be resolve because of the existence of divergent findings. However, Adegbie & Adesanmi (2020) concluded in their study of liquidity management and corporate sustainability of Nigeria quoted Oil and Gas Companies that liquidity management significantly affects corporate sustainability(Meher & Getaneh, 2019).

Furthermore, solvency unlike liquidity measures the financial stability of a firm in long-term (Zorn et al., 2018). It measures the financial stability of a firm to repay all its debts if all of the assets were to be sold. Variables that can be used in measuring solvency include Debts to Assets ratio, Equity to Assets ratio or Debt to Equity ratio (Gichuki, 2014). The work of Zorn et al. (2018) further explained that solvency indicates the viability of a firm after a financial adversity. That is, the ability to continue firm operations. This by extension to manufacturing companies would imply the viability of a manufacturing company after a financial disorder. That is, the ability of manufacturing company to continue operations. It is however noted that many of the research works on financial sustainability had measured financial sustainability in form of profitability and liquidity which are more or less measuring sustainability in the short-term. Thus Zabolotnyy & Wasilewki (2019) noted that there is a limited research on financial sustainability. Hence, this is one of the gaps that this study intends to fill. Notwithstanding this fact, Dahiyat et al. (2021) confirmed from their study that solvency, significantly and negatively affected financial performance of Jordanian manufacturing companies. Also, Kishor & Henok noted that solvency risk negatively and significantly affected financial sustainability of Ethiopians Commercial Banks(Huang et al., 2020).

In support of this Ajibola et al. (2018) study on capital structure and financial performance of listed manufacturing firms in Nigeria confirmed from their findings that both long-term debt ratio and total debt ratio which are measures of solvency have significant positive relationship with the return on equity which is one of the variable that measures profitability. They also confirmed positive but insignificant relationship between short-term debt ratio and return on equity. Thus their study concluded that capital structure which is the combination of debt and equity used by a firm to finance its operations has a positive effect on companies’ financial performance. Also Ng’ang’a & Kibati (2016) in their study of determinants of financial sustainability concluded that capital structure was highly important to enhance financial sustainability of college. Hence, the conclusion of their study was in consonance with the view that the solvency of a firm would likely impact on her financial sustainability. In support of this Ashmarina et al. (2016) confirmed in their study that financial Leverage influences capital structure and also has great impact on financial sustainability of organization. In Russia, Wanguu & Kipkirui in their own study further confirmed that leverage has significant and positive relationship with profitability of cement manufacturing company in Kenya. Thus this submission implies that Leverage will have impact on financial sustainability. Its direct impact on profitability may affect financial sustainability on the long-run(Ebieri, 2018)..

Cost Management, Cost Reduction and Financial Sustainability

Cost Management is described as a process. It is a process of planning and controlling the budget of a project, or of entire business. Cost Management includes activities like planning, estimating, budgeting, Financing, funding, managing and controlling costs in order to ensure completion of project within approved budget Cleopatra Enterprise July 22, 2020. Thus, by extension Cost Management in manufacturing companies can be described as the planning, estimating, budgeting, financing, or funding, managing and controlling costs in order to ensure that products are manufactured within approved production budget. Cost Management covers the full life cycle of a project, product or entire business. It is a continuous process that takes place during the project to determine and control the resources required to perform activities or create assets(Franscisca & Christine, 2019; Oluwagbemiga et al., 2014).

According to Egbide et al. (2019), cost reduction is a planned approach to reduce expenditure, it is a continuous process of critical review of all elements of cost and all aspects of the business with a view to improving business efficiency. It is a process of cutting down on organization operating cost for the purpose of making profit. While cost reduction is a corrective and a reactive process, cost management is a proactive and it is an enlarged process that encompasses cost reduction and cost controlling activities. Cost management includes the process of monitoring costs beginning from the product planning stage all through the production, distribution and delivery of products to consumers (Connelly et al., 2011).

Effective Management of cost in its terms of cost of sales (which include the cost of materials consumed in production and the conversion cost), Distribution and Administrative expenses, and finance cost of manufacturing companies is expected to enhance their efficiency and profitability which will in turn affect their financial sustainability. From the study of Oyadonghan & Ramond (2014) on the effect of quality cost management on firm’s profitability it was discovered that the profitability of a firm can be affected by the firm’s quality cost management practices. This is intandem with the findings of Oyerogba on cost management practices and firm’s performance of manufacturing organizations which also shows that cost management is significantly positively related to performance of manufacturing organization.

Furthermore, the study of Siyanbola & Raji (2013) on cost control in manufacturing companies revealed positive impact of cost control on profitability of manufacturing company. In addition, Egbide et al. (2019) on cost reduction strategies also confirmed a positive significant relationship between cost reduction strategies and growth of manufacturing companies in Nigeria. The implications of the findings of all these researchers are that cost management process or its related components will significantly impact on the profitability of manufacturing companies. Hence the financial sustainability of these companies will also be affected since profitability is one of the key variables that measures financial sustainability either in short-term or long-term. The outcome of the study of Mutya (2018) corroborated the findings of these researchers by pointing out that cost control greatly impacts organizations performance.

Methodology

This empirical study adopts an Ex-Post Facto research design. The study population consisted of all the 33 Nigeria manufacturing companies that were listed in both the Consumer Goods and Industrial Goods Sectors of Nigeria stock exchange as at December 2019. 20 out of the 33 companies listed as Consumer Goods Manufacturing formed the sample frame for this study. Using Purposive and Judgmental Sampling Techniques, all 17 listed Foods and Beverages Manufacturing Companies that were within the sample frame were selected to be the sample size. The remaining three (3) of the twenty (20) companies within the sample frame were not Foods and Beverages manufacturing companies hence, they were not selected. Thus, these seventeen companies were the representatives of the population of the study. The Seventeen Companies (Sample size) were further reduced to ten (10) because we observed that seven out of the seventeen companies did not have complete set of published Financial Report for the ten years under consideration 2010-2019. Consequently, the ten companies were taken to be the effective sample size for this study (Chen, 2015; Wanguu & kipkirui, 2015).

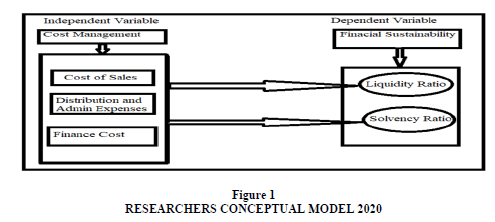

Researcher’s Conceptual Model

The Figure 1, in this study is the researcher’s conceptual model showing how Cost of Sales, Distribution and Administrative Cost, and Finance Cost as variables of Cost Managements (independent Variable) affects the Liquidity Ratio and Solvency Ratio as measures of Financial Sustainability. The relationship implies that if there is inefficiency in the management of any of the items of Cost like Cost of Sale, Distribution and Administrative Cost and Finance Cost this will impact negatively on the liquidity and solvency of manufacturing firms. Hence, the Financial Sustainability of the will be impaired(Ben-Caleb et al., 2013).

Model Specification

Model 1

Y1 = LR = βo + β1 log CS +β2 log DA + β3 log FC+ u = For Liquidity Ratio

Model 2

Y2 = SR = βo + β1 log CS +β2 log DA + β3 log FC+ u = For Solvency Ratio

LR = Liquidity Ratio

SR= Solvency Ratio

u = Error Level

CS= Cost of Sales

DA= Distribution and Administrative Cost

FC= Finance Cost

Results and Discussions

Test of Hypothesis One

Effect of Cost Management on the Liquidity Ratio of Quoted Manufacturing Companies in Nigeria

Objective one: To examine the effect of Cost Management on the Liquidity ratio (LR) of the quoted manufacturing companies in Nigeria?

Research question one: To what extent does Cost Management affect the Liquidity Ratio (LR) of quoted manufacturing companies in Nigeria?

Research Hypothesis one: Cost Management does not significantly affect the Liquidity Ratio (LR) of quoted manufacturing companies.

We achieved the research objectives one by providing answer to the research question one. The research question one was answered by testing the Research Hypothesis one with the use of multiple regression analysis of which the results were presented in tables.

1A and 1B and also tables 2A and 2B showing the effect on both current ratio and Acid Test Ratio.

The Regression Model for hypothesis one was stated as follows:

y5 = βo +β1 logCS + β2 logDA +β3 logFC +μ

Where: y = Liquidity Ratio

CS = Cost of Sales

DA = Distribution and Administrative Expenses

FC = Finance Cost

μ = Error Term

β = coefficient of the variables

log = Logarithm of values to base 10

The results presented in Tables 1 and 2 show the effect of Cost Management on the Liquidity Ratio measured by Current Ratio and Acid Test Ratio of manufacturing firms in Nigeria. From table 1 it shows that Cost Management have significant effect on Current Ratio of manufacturing companies at F-Statistics = 11.57, p-value = 0.000, and the Adjusted R- squared = 0.2425. In a similar manner, Table 1B also presented that Cost Management, significantly affects the Liquidity of manufacturing companies in terms of Acid Test Ratio at F-Statistics = 14.51, p-value = 0.000, and Adjusted R-Squared = 0.2905.

| Table 1 Regression Table For Effect Of Cost Management On Liquidity Ratio (Current Ratio) |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Sum of Square (SS) | DF | Mean Square (MS) | F -Ratio | Sig | R-Squired | Adjusted R-Squired |

| Model | 11.0915591 | 3 | 3.69717971 | 11.57 | 0.000 | 0.2655 | 0.2425 |

| Residual | 30.6842437 | 6 | 0.319627539 | ||||

| Total | 41.7757829 | 9 | |||||

Source: The Researcher’s Results 2020

The Adjusted R-Squared of 0.2425 in Table 1 of current ratio shows that the composition of cost management variables in current ratio as measure of liquidity is 24.25% while the remaining balance of 75.75% is represented by other factors not considered in this model. Also the Adjusted R-Squared of 0.2905 in Table 2 for Acid Test Ratio shows that the composition of Cost Management variables in the Acid Test Ratio as measure of liquidity is 29.05%. This means the remaining 70.95% is explained by other factors that are not considered in this model.

Decision

| Table 2 The Regression Table For Effect Of Cost Management On Acid Test Ratio |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Sum of Square (SS) | F | Mean Square (MS) | F- Ratio | Sig | R Squire | Adjusted R-Squared |

| Model | 13.1943817 | 6 | 4.39812724 | 14.51 | 0.000 | 0.3120 | 0.2905 |

| Residual | 29.1002074 | 9 | 0.30312716 | ||||

| Total | 42.2945891 | ||||||

At an adopted significant level of 0.05 the F-statistics is 11.57 while the p-value of the F-Statistics is 0.000 for Current Ratio in Table 1. Also for Acid Test Ratio in Table 2 the F-statistics is 14.51 while the p-value is 0.000 showing that both p-value for Current Ratio and Acid Test Ratio were less than the adopted p-value of 0.05. Hence the study rejected the Null Hypothesis. This confirmed that Cost Management has significant effect on Liquidity Ratio measured by Current Ratio and Acid Test Ratio as proxies for Financial Sustainability of quoted manufacturing companies in Nigeria.

Table 3 and 4 shows the relative contributions of Cost Management to Liquidity Ratio in terms of Current Ratio and Acid Test Ratio as proxies of Financial Sustainability in Nigeria manufacturing companies. From Table 3 for Current Ratio, the results show the Beta values for Cost of Sales (CS), Distribution and Administrative expenses (DA) and Finance Cost (FC). The coefficient of Cost of Sales (CS) is 0.8544887. This shows that a change of 1% in Cost of Sales (CS) will lead to an increase in Current Ratio by 85.45% which is significant at p-value of 0.000 and t-Statistics at 4.99. The Distribution and Administrative cost with a coefficient of -0.4748863 shows that a change of 1% in Distribution and Administrative Cost will lead to a reduction at in 47.49% in liquidity Ratio in terms of Current Ration which is significant at p-value of 0.005 and t-Statistics of -2.85 while for Finance Cost (FC), the coefficient of -0.1338856 shows that a change of 1% in Finance Cost will lead to 13.39% reduction in current Ratio which is significant at P-Value of 0.001 and t-Value of -3.33. Hence for Liquidity Measured in terms of Current Ratio, the Regression Model can be restated by Inserting Coefficient of Cost Management Variables as follows:

| Table 3 Parameter Of Estimate Of Relative Contributions Of Cost Management To Liquidity In Terms Of Current Ratio |

||||

|---|---|---|---|---|

| Current Ratio | Beta coefficient | Standard Error | T. value | Sig |

| Cost of Sales | 0.8544887 | 0.1710951 | 4.99 | 0.000 |

| Distribution and Administrative Expenses | -0.4748863 | 0.1665775 | -2.85 | 0.005 |

| Finance Cost | -0.1338856 | 0.0401926 | -3.33 | 0.001 |

| Constant | -1.334079 | 0.7046385 | -1.89 | 0.061 |

Source Researcher’s Result (2020).

| Table 4 Parameter Of Estimate Of Relative Contributions Of Cost Management To Liquidity In Terms Of Acid Test Ratio |

||||

|---|---|---|---|---|

| Acid Test | Beta coefficient | Standard Error | T. value | Sig |

| Cost of Sales | 0.8351249 | 0.166203 | 5.01 | 0.000 |

| Distribution and Admin Expenses | -0.5830679 | 0.1621624 | - 3.60 | 0.001 |

| Finance Cost | -0.1666277 | 0.0391414 | -4.26 | 0.000 |

| Constant | -0.4964443 | 0.6862095 | -0.72 | 0.471 |

Source Researcher’s Result (2020).

Current Ratio (LR) = -1.334079 + 0.8544887 CS -0.4748863DA – 0.1338856 FC.

Furthermore, from Table 2B for liquidity measured in terms of Acid Test Ratio, the coefficient of Cost of Sales is 0.8351249. This means that a change of 1% in Cost of Sales will result in increase of liquidity in terms of Acid Test Ratio by 83.51% which is significant at p-value of 0.000 and t-Statistics of 5.01. Also the coefficient of -0.5830679 for Distribution and Administrative Cost (DA) shows that a change of 1% in Distribution and Administrative Cost will lead to reduction in Liquidity in terms of Acid Test by 58.31% which is significant at p-value of 0.001 and t-Statistics of -3.60. For Finance Cost (FC), the coefficient is -0.1666277 this shows that a change of 1% in Finance Cost will lead to a reduction in liquidity in terms of Acid Test Ratio by 16.66% which is also significant at p-value of 0.000 and t-Statistics of -4.26. Thus for Liquidity Measured in terms of Acid Test the Regression Model can be restated by substituting the coefficient of Cost Management variables in the model as follows:

LR (Acid Test) = 0.4964443 + 0.8351249 CS + -0.5830679 DA – 0.1666277 FC.

These findings were in line with the findings of Maina (2018) who confirmed that liquidity management strategies positively and significantly influence sustainability of a Table Banking Industry. The findings of Owolabi & Obida (2012) were also in tandem with the findings of this study by affirming that liquidity management significantly impacts profitability which is also one of the proxies of financial sustainability in this study. Akinleye and Ogunleye (2019) further strengthen the findings by concluding that financial liquidity has helped to improve financial performance of selected manufacturing firms in Nigeria. Supporting the position of this study Adegbie and Adesanmi (2020) in their study of liquidity management and corporate sustainability concluded that, liquidity management significantly affects corporate sustainability.

Test of Hypothesis Two

Effect of cost management of solvency of quoted manufacturing companies in Nigeria.

Objective two: To Ascertain the effect of Cost Management on the Solvency of quoted manufacturing companies in Nigeria.

Research question two: To what extent does Cost Management affect the Solvency ratio (SR) of quoted manufacturing companies in Nigeria?

Research hypothesis two: Cost Management does not significantly affect the solvency of quoted manufacturing companies in Nigeria.

The objective two of this study was achieved by providing answers to the research question two. The research question two was answered by testing the research hypothesis two with the use of Multiple Regression Analysis of which the results were presented in the Tables 3A, 3B and 3C showing the effect of Cost Management on solvency ratio measured by Debt Ratio, Gearing and Interest covered respectively.

The Regression Model for hypothesis six was stated as follows:

Y2 = βo +β1 logCS + β2 logDA+β3logFC + μ

Where Y2 = Solvency Ratio

CS=Cost of Sales

DA = Distribution and Administrative Expenses

FC = Finance Cost

μ = Error Term

β = Coefficient of the variables of Cost Management

log = Logarithm of values to base 10

All the results presented in Tables 5, 6 & 7 show that the effect of Cost Management on the Solvency of quoted manufacturing companies in Nigeria is highly significant. From the Table 5, Cost Management have significant effect on solvency measured by Debt Ratio of manufacturing companies at F - Statistics = 3.93, P-values = 0.0108, and Adjusted R2 = 0.0815. Also from the Table 3B, Cost Management reveals significant effect on solvency measured by Gearing of manufacturing companies at F-Statistics=5.43, P= 0.0017 and Adjusted R-squared = 0.1184. Similarly, the results from table 3C shows that cost management significantly affect solvency ratio measured by Interest Covered at F –Statistics = 4.61 and p= 0.0047 and Adjusted R-squared = 0.0986.

The Adjusted R-Squared of 0.0815 in Table 5 representing solvency measured by Debt Ratio shows that the composition of the Cost Management variables in Debt Ratio is 8.15% while the balance of 91.85% is represented by other factors not considered in this Model. Furthermore, the Adjusted R-Squared in Table 6 representing solvency measured by Gearing shows that the composition of Cost Management variables in Gearing Ratio is 11.84%. While balance of 88.16% is accounted for by other factors not considered in this model.

Also for solvency measured by Interest Covered as presented in Table 3C, The Adjusted R-Squared of 0.0986 shows that the composition of Cost Management variables in Interest Covered is 9.86%. This is an indication that the balance of 90.14% is explained by other factors that are not considered in this model.

Decision

At an Adopted significant level of 0.05, the F-Statistics is 3.93 and p-value of the F-Statistics is 0.0108 for solvency as measured by Debt Ratio as stated in Table 5. Also for solvency measured by Gearing Ratio, the F-Statistics is 5.43 with the p-value for the F-Statistics of 0.0017 as stated in Table 3B, while for Solvency Ratio measured by Interest Covered, the F-Statistics is 4.61 with p-value of the F-Statistics of 0.0047 as stated in Table 3C. This shows that all the P-Values are less than the adopted p-value of 0.05. Hence, the study rejected the Null Hypothesis, thus confirming that Cost Management has effect on Solvency of Manufacturing Companies.

From Table 8, for Solvency Measured by Debt Ratio, the coefficient, Cost of Sales (CS) is 0.08477 which shows that a change of 1% in Cost of Sales (CS) will result into a reduction in solvency as measured by Debit Ratio by 8.5%. This is not significant at P-Value of 0.266 and T-Statistics of -1.12. The Distribution and Administrative Cost (DA) coefficient is -0.0196879. This shows that a change of 1% in Distribution and Administrative Cost will lead to a reduction of 1.07% in solvency as measured by Debt Ratio which is also not significant at P-Value of 0.790, and t-Statics of -0.27.

However, the coefficient of Finance Cost is 0.0583838. This shows that a change of 1% in Finance Cost (FC) will lead to an increase in solvency in terms of Debit Ratio by 5.84% which is significant at P-Value of 0.001 and t-Statistics of 3.28. Thus for solvency in terms of Debit Ratio, the Regression Model can be restated by inserting the coefficient of the Cost Management variables in the Model as follows:

Debit Ratio (SR) = 1.027172 – 0.084.77CS – 0.0196879 DA + 0.0583838FC.

Also from Table 4B Solvency measured by Gearing, the coefficient of Cost of Sales is -11.9087 which shows that a change of 1% in cost of sales will result into reduction in Solvency in forms of Gearing which is not significant at p-value of 0.104 and t-Statistics of 1.64.

However, Finance Cost (FC) has a coefficient of 9.42036. This means a change of 1% in Finance Cost will lead to positive increase in Solvency as measured by Gearing. This is marginally significant at p-value of 0.059 and t-Statistics of 1.91. Hence the Regression model can be restated by inserting the coefficients of Cost management variables in the models as follows:

Gearing (SR)-149.6406 – 11.9087 + 33.50994 DA + 9.420367FC.

Furthermore, from table 4C for solvency measured in terms of Interest Covered, the coefficient of Cost of Sales (CS) is 2416.082. This means that a change of 1% in Cost of Sales will lead to increase in Solvency in terms of Interest Covered by 2416.08. This is significant at p-value of 0.009 and t-Statistics of 2.67. The Distribution and Administrative Cost (DA) has a coefficient of -1778.473 which shows that a change of 1% in DA will lead to a reduction or negative growth in Solvency in terms of Interest Covered by -1778.47 which is significant at p-value of 0.046 and T-Statistics of -2.02.

The Finance Cost (FC) has a coefficient of -520.8393 which shows that 1% change in Finance Cost will lead to a reduction of -520.84 in solvency in terms of Interest Covered. This is significant at p-value of 0.016 and t-Statistics of -2.45. Hence, Regression model for solvency can be restated by inserting the coefficient of Cost Management Variables in the Model as follows:

Interest Covered (SR)= -2707.84 + 2416.082 CS – 1778.473 DA – 520.8393 FC.

Solvency measure the long term financial stability of a firm. It is an indication of viability of a firm or its ability to continue operations after going through a financial disorder or stress. (Zorn et al., 2018). Thus, the manufacturing companies in Nigeria must be strategically reposition for effective management and control of their Cost of Sales, Distribution and Administrative Cost and Finance Cost particularly at this period when high cost of operations occasioned by the effect of the current coronavirus pandemic and unprecedented high exchange rate is being experienced by business organizations. Although Zabolotnyy and Wasilewski (2019) noted there is a limited research on financial sustainability, Ajibola, Wisdom and Qudus (2018) from their study on Capital Structure and Financial Performance of listed manufacturing firms in Nigeria, supported the findings of this study by confirming that both long term debt ratio and total debt ratio which are measured of Solvency have, significant positive relationship with return on equity which is also measure of profitability and one of the proxies of Financial sustainability.

The findings of Kishor and Henok corroborated the results of this study by noting that solvency risk negatively and significantly affects financial sustainability of Ethiopians Commercial Banks. This submission is in tandem with that of Dahiyat et al. (2021) who confirmed from their study that solvency significantly and negatively affected financial performance of Jordanian manufacturing companies. In consonance with the findings of this study, Ashmarina et al. (2016) confirmed that Financial Leverage influences capital structure and has great impact on Financial Sustainability of organization. Furthermore, the conclusion of the studies of Ng’ang’a & Kibati (2016); Russia, Wangua and Kipkirui were all in support of this study.

Conclusion and Recommedation

In consideration of the empirical findings of this study and the results of the two hypotheses tested in the study, we concluded that Cost Management in terms of efficient and effective management of Cost of Sales, Distribution and Administrative Cost, and Finance Cost has significant effect on the liquidity and solvency of manufacturing firms which significantly impacts on or contributes to the Financial Sustainability of manufacturing firms. Hence, we recommend that Management of manufacturing companies consistently review their costs and adopt better cost savings technologies in their companies’ operations. This will help in reducing cost of operations and also improves organizational liquidity to ensure financial strength. Also, management of Manufacturing Companies must consistently maintain optimal combination of Equity and Debt Finance in order to ensure low finance cost and improve the solvency of the companies.

Contribution to Knowledge

This study has contributed to knowledge by expanding academic discourse and also bridging the gaps in literature in the area of Cost Management and Financial Sustainability. It shows how Cost Management affects liquidity and solvency and its ultimate effect on Financial Sustainability of manufacturing companies.

References

Adegbie, F.F., & Adesanmi, T. (2020). Liquidity management and corporate sustainability of listed oil and gas companies: Empirical evidence from Nigeria. European Journal of Accounting, Auditing ad Finance, 8(8) 30-72.

Ajibola, A., Wisdom, O., & Qudus, O.L. (2018). Capital Structure and Financial Performance of listed manufacturing firms in Nigeria. Journal of Research in International Business and Management , 5(1), 88-89.

Indexed at, Google Scholar, Cross Ref

Akinleye, G.T., & Ogunleye, J.S. (2019). Liquidity and the profitability of manufacturing firms in Nigeria. Applied Finance and Accounting, 5(2), 68-73.

Indexed at, Google Scholar, Cross Ref

Anekwe, R.I., Ndubusi-Okolo, P., & Uzoezie, C. (2019). Sustainability in the Nigeria business environment: Problems and Prospects. International Journal of Academic Management Science Research, 3, 72-80.

Ashmarina, S., Zotova, A., & Smolina, E. (2016). Implementation of financial sustainability in organizations through valuation of financial leverage effect in Russian practice of financial management. International Journal of Environmental & Science Education, 11(10), 3775-3782.

Atkinson, G. (2009). Going concerns, futurity and reasonable value. Journal of Economic Issues, 43(2), 433-440.

Indexed at, Google Scholar, Cross Ref

Ayayi, A.G., & Sene, M. (2010). What drives microfinance institution's financial sustainability. The Journal of Developing Areas, 303-324.

Indexed at, Google Scholar, Cross Ref

Bae, S.M., Masud, M., Kaium, A., & Kim, J.D. (2018). A cross-country investigation of corporate governance and corporate sustainability disclosure: A signaling theory perspective. Sustainability, 10(8), 2611.

Indexed at, Google Scholar, Cross Ref

Bazot, G. (2014). Financial Consumption and the cost of finance: Measuring financial efficiency in Europe 1950-2007. Journal of the European Economic Association, 16(1), 123-160.

Indexed at, Google Scholar, Cross Ref

Ben-Caleb, E., Olubukunola, U., & Uwuigbe, U. (2013). Liquidity management and profitability of manufacturing companies in Nigeria. IOSR Journal of Business and Management, 9(1), 13-21.

Indexed at, Google Scholar, Cross Ref

Chen, L. (2015). Sustainability and company performance: Evidence from the manufacturing industry. Linköping University Electronic Press.

Indexed at, Google Scholar, Cross Ref

Connelly, B.L., Certo, S.T., Ireland, R.D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39-67.

Indexed at, Google Scholar, Cross Ref

Dahiyat, A.A., Weshah, S.R., & Aldahiyat, M. (2021). Liquidity and Solvency Management and its Impact on Financial Performance: Empirical Evidence from Jordan. The Journal of Asian Finance, Economics and Business, 8(5), 135-141.

Indexed at, Google Scholar, Cross Ref

Ebieri, J. (2018). Effect of sustainability costs accounting on networth of listed firms on Nigeria stock exchange. International Journal of Economics and Business Management, 4(7), 59-76.

Egbide, B.C., Adegbola, O., Rasak, B., Sunday, A., Olufemi, O., & Ruth, E. (2019). Cost reduction strategies and the growth of selected manufacturing companies in Nigeria. International Journal of Mechanical Engineering and Technology, 10(3).

Elsharif, T.A. (2016). The impact of liquidity management on profitability. Graduate School of Social Sciences 1-11.

Eneisik, G.E. (2021). Cost management and financial performance of listed deposit money banks in Nigeria. Journal of Accounting and Financial Management, 7(2).

Fadare, T.V., & Adegbie, F.F. (2020). Cost Management and Financial Performance of consumer goods companies quoted in Nigeria. International Journal of Scientific and research Publication, 10(8).

Franscisca, S.G., & Christine, C.W. (2019). Significance effect cost of goods sold and inventory on sales pt. Nippon Indoscari and corpindo tbk. Advances in Economics, Business and Management Research, 120.

Indexed at, Google Scholar, Cross Ref

Gichuki, C.W. (2014). Effect of cost management strategies on the financial performance of manufacturing companies listed on the Nairobi securities exchange (Doctoral dissertation, University of Nairobi).

Hayes, A. (2020, August 19). What are Liquidity ratios. Investopedia. Retrieved from:http https://www.investopedia.com/terms/l/liquidityratios.asp. September 29, 2020.

Hayes, A.S., & Young, J. (2020, August 15). Solvency. Investopedia. Retrieved from: https://www.investopedia.com/terms/s/solvency.asp. September 29, 2020

Huang, Y., Chen, C., Su, D., & Wu, S. (2020). Comparison of leading?industrialisation and crossing?industrialisation economic growth patterns in the context of sustainable development: Lessons from China and India. Sustainable Development, 28(5), 1077-1085.

Indexed at, Google Scholar, Cross Ref

Innocent, B. (2017). Financing structure and Financial Sustainability: Evidence from selected Southern African Development Community Microfinance Institutions. Doctoral Degree Dissertation, University of Stellenbosch.

Kuruppu, N., Laswad, F., & Oyelere, P. (2003). The efficacy of liquidation and bankruptcy prediction models for assessing going concern. Managerial Auditing Journal.

Indexed at, Google Scholar, Cross Ref

Lawal, B.A. (2017). Effect of Cost Control and Cost reduction techniques in organizational performance. International Business Management, 14(3), 19-26.

Indexed at, Google Scholar, Cross Ref

Ludovico, A. (2017). Industrialization, Employment and the sustainable Development agenda. Society for International Development, 58(4).

Indexed at, Google Scholar, Cross Ref

Maina, K.E. (2018). Effect of Liquidity Management Strategies on Sustainability of Table Banking Groups in Uasin Gishu Country, Kenya. International Journal of Finance Accounting and Economics (IJFAE), 1(1).

Meher, K., & Getaneh, H. (2019). Impact of determinants of the financial distress on financial sustainability of Ethiopian commercial banks. Banks and Bank Systems, 14(3), 187.

Indexed at, Google Scholar, Cross Ref

Muhammad, S.A., Adamu, M., & Alege S.O. (2014). Industrial and sustainable development in Nigeria. The International Journal of social sciences and Humanities Invention, 1(3), 142-154.

Mutya, T. (2018). Cost control: A fundamental tool towards organisation performance. Journal of Accounting & Marketing, 7(3), 1-11.

Indexed at, Google Scholar, Cross Ref

Ng’ang’a, A.N., & Kibati, P. (2016). Determinants of Financial Sustainability in Private Middle Level Colleges in Nakuru County. International Journal of Economics, Commerce and Management, 4(10), 356-380.

Oluwagbemiga, O.E., Olugbenga, O.M., & Zaccheaus, S.A. (2014). Cost management practices and firm’s performance of manufacturing organizations. International Journal of Economics and Finance, 6(6), 234.

Indexed at, Google Scholar, Cross Ref

Onuegbu, H.C. (2016). Evolution, challenges and prospects of oil and gas industry in Nigeria. 3rd Annual Industrial Relations, Carrier and Financial Management Training, 1-46.

Osazefua Imhanzenobe, J. (2020). Managers’ financial practices and financial sustainability of Nigerian manufacturing companies: Which ratios matter most?. Cogent Economics & Finance, 8(1), 1724241.

Indexed at, Google Scholar, Cross Ref

Owolabi, S.A., & Obida, S.S. (2012). Liquidity management and corporate profitability: Case study of selected manufacturing companies listed on the Nigerian stock exchange. Business Management Dynamics, 2(2), 10-25.

Oyadongha, K.J., & Ramond, L. (2014). The effect of quality cost management on firm’s profitability. British Journal of Marketing Studies, 2(1), 12-26.

Oyedokun, G.E., Tomomewo, A.O., & Owolabi, S.A. (2019). Cost Control and Profitability of Selected Manufacturing Companies in Nigeria. Journal of Accounting and Strategic Finance, 2(1), 14-33.

Indexed at, Google Scholar, Cross Ref

Priya, K., & Nimalathasan, B. (2013). Liquidity management and profitability: A case study of listed manufacturing companies in Sri Lanka. International Journal of Technological Exploration and Learning, 2(4), 161-165.

Pulatovich, E.M. (2019). Impact of financial sustainability on enterprise value expansion. International Journal of Engineering and Advanced Technology, 9(1), 4640-4645.

Indexed at, Google Scholar, Cross Ref

Raymond, A.E., John-Akamela, R.C& Chigbo, B.E. (2016). Effect of Sustainability Environmental Cost Accounting on Financial performance of Nigeria Corporate Organizations. International Journal of scientific Research and Management, 4536-4549.

Indexed at, Google Scholar, Cross Ref

Siyanbola, T.T., & Raji, G.M. (2013). The Impact of Cost Control on Manufacturing Industries’ Profitability. International Journal of Management and Social Sciences Research, 2(4), 1-7.

Sola, O., Obamuyi, T.M., Adekunjo, F.O., & Ogunleye, E.O. (2013). Manufacturing performance in Nigeria: Implication for sustainable development. Asian Economics & Financial Review, 3(9); 1195-1213.

Uma, K.E., Obidike, P.C., Chukwu, C.O., Kanu, C., Ogbuagu, R.A., Osunkwo, F.O., & Ndubuisi, P. (2019). Revamping the Nigerian manufacturing sub-sector as a panacea for economic progress: lessons from South Korea. Mediterranean Journal of Social Sciences, 10(4), 111-111.

Indexed at, Google Scholar, Cross Ref

Wanguu, K.C., & kipkirui S.E. (2015). The effect of working capital management on profitability of cement manufacturing companies in Kenya. I0SR Journal of Economics and Finance (I0SR-JEF), 66, 53-61.

Zabolotnyy, S., & Wasilewski, M. (2019). The concept of financial sustainability measurement: A case of food companies from Northern Europe. Sustainability, 11(18), 5139.

Indexed at, Google Scholar, Cross Ref

Zorn, A., Esteves, M., Baur, I., & Lips, M. (2018). Financial ratios as indicators of economic sustainability: A quantitative analysis for Swiss dairy farms. Sustainability, 10(8), 2942.

Indexed at, Google Scholar, Cross Ref

Received: 25-Nov-2021, Manuscript No. AAFSJ-21-10014; Editor assigned: 27-Nov-2021, PreQC No. AAFSJ-21-10014(PQ); Reviewed: 13-Dec-2021, QC No. AAFSJ-21-10014; Revised: 13-Jan-2022, Manuscript No. AAFSJ-21-10014(R); Published: 20-Jan-2022