Research Article: 2021 Vol: 24 Issue: 4

COVID-19 pandemic and the Nigerian financial market

AYODELE Thomas Duro, Department of Finance, Redeemer’s University

AKINYEDE Oyinlola Morounfoluwa, Department of Finance, Redeemer’s University

OJEDELE Mofoluwaso Iyabode, Department of Accounting, Redeemer’s University

AFOLABI Taofeek Sola, Department of Finance, Redeemer’s University

Citation Information: Ayodele, T. D., Akinyede, O. M., Ojedele, M. I. & Afolabi, T. S. (2021). COVID-19 pandemic and the Nigerian financial market. Journal of Management Information and Decision Sciences, 24(4), 1-10.

Abstract

The study empirically investigated the effect of the Coronavirus (COVID-19) outbreak on the performance and effectiveness of the Nigerian money market, capital market, and foreign exchange market. The study used time-series data for 120 working days after the first COVID-19 confirmed case in Nigeria and used both exploratory and multiple regression analysis to evaluate the effect of COVID-19 outbreak on the Nigerian financial market. Open buy back rate (OBRR), All Share Index Volume (ASIV) and Parallel Foreign Exchange Rate (PFXR) were used as variables for money market, capital market and foreign exchange market, respectively. The data representing these variables were subjected to econometric analysis, including the ADF-Fisher unit root test, Johansen co-integration test and Ordinary Least squares (OLS) regression technique. Results from the analysis show that the number of COVID-19 cases is inversely related to the interbank money market rate and the All Share Index Volume of the capital market but directly related to the foreign exchange rate. The study concludes that COVID-19 pandemic significantly affects the Nigerian financial market. Therefore, it was recommended that the government should take preventive steps against financial challenges resulting from health risk in order to ensure stability in the financial market. In addition, business owners should provide motivations that will allow their staff to work remotely, wherever they are. Furthermore, the government should, by way of policies, encourage domestic production of goods and services

Keywords

COVID-19; Pandemic; Financial market.

Introduction

The contribution of a nation's financial market in mobilizing public and private savings for productive investments cannot be overemphasized. The Nigerian financial market is an institutional framework that facilitates the intermediation of funds in an economy. Intermediation is done through the process of mobilization of financial resources from the surplus unit of the economy to the deficit unit of the economy for productive purposes. According to Ayodele (2014), the economic development of any country depends mainly on the number of investible funds available to the country and the efficiency of her financial intermediaries to mobilize such funds.

In Nigeria, the financial market comprises of the money market, which trades in money at call, certificates of deposit, promising notes, commercial papers and so on; the capital market, which specializes in trading in long term loanable funds and the foreign exchange market, which deals with the determination of the ratio of the local currency to its counterpart foreign currency, especially in fostering international trade and transactions. The performance of the financial market depends mostly on the prevailing condition of the economy within which it operates. Factors such as regulation, speculation, shocks, political instability and other risks will inevitably affect the effectiveness of and performance of the players in the market and the overall intermediation process (Adeusi & Ayodele, 2009).

In recent time, there has been an outbreak of a pandemic disease called Corona Virus (COVID-19), which has caused many deaths globally. The disease was first discovered in China around December 2019. The disease was confirmed in Nigeria on February 27th 2020, by the Virology laboratory of the Lagos University Teaching Hospital (LUTH) in Lagos. Confirmed cases recorded in Nigeria led to the lockdown of many states of the federation through the pronouncement of the Federal Government.

Nigerian banks and other financial institutions have been rendering skeletal services to customers since the 20th of March 2020 because an assembly of more than fifty persons has been prohibited. This decision has also paralyzed the general trading, transportation, educational system, and production sector of the economy. Before the lockdown of the Nigerian economy, the news about the pandemic outbreak in China was assumed to have inflicted negatively on the country’s financial market, especially the foreign exchange segment, before others. This is because the Nigerian economy depends on a large proportion of imported goods from China, the home incubator of the disease. Besides, the world is a global village where information is transmitted in seconds through the usage of the internet. Even labour has become very mobile around the globe. Therefore, any panic or obstruction from any part of the world is likely to affect the effectiveness and efficiency of another independent economy.

Several international organizations have estimated the likely impact of the COVID-19 pandemic on the global economy. The United Nation Department of Economics and Social Affairs (UNDESA) forecasted that the world economy is expected to contract by one percent at the end of 2020 as a result of the pandemic. International Labor Organizations (ILO) predicted a surge in the unemployment rate to 24.7millions. Furthermore, the World Trade Organization (WTO) also estimated a decline in the global trade index to values ranging between 13 pecent and 32 percent (Kawamorita et al., 2020). It is on this note that the researchers deemed it fit to investigate the effect (if any) of the COVID-19 pandemic outbreak on the performance of the Nigerian money market, the Nigerian capital market, and the Nigerian foreign exchange market.

The rest of the paper is arranged thus; section two consists of the reviews of relevant literature; section three focuses on the materials and methods for the study, while section four provides the results of the data analysis and discussion of findings. Finally, section five presents the conclusion and policy recommendations.

Literature Review

The first outbreak of the coronavirus (COVID-19) was witnessed in Wuhan, a city in China. This was in December 2019, and since then, the virus has spread worldwide (Mazzoleni et al., 2020). As a result of the spread of the pandemic, the Nigerian government directed the lockdown and movement restrictions in Lagos state, Ogun state and the federal capital territory (Abuja) with effect from Monday, March 30th 2020, starting from 23:00. This scenario paralysed many activities in all sectors of the federation as each state governor also toed the line of the federal government. However, there was an ease in the lockdown from May 2nd 2020. The pandemic, however, did not have a terrible effect on Nigerians thus it may not be unconnected to the fact that people in the tropical region like Nigeria had battled with Ebola and Lassa fever and probably are prepared or immune against some virus and the weather (Domjan, 2020).

Researchers have postulated theories on the relationship between the financial market and changes resulting from economic, social and health factors. The COVID-19 pandemic is a health factor that has changed the global economy due to limitations and restrictions on economic activities. The neoclassical growth theory, postulated by Solow (1957), stated that the financial market's performance depends on exogenous factors such as labour mobility, technological changes, and economic stability (Edame, 2013). The theory suggests that changes in any of these exogenous factors affect the financial market. However, as reported by Gokal and Hanif (2004), the endogenous growth theory argues that policy measures on production process such as economies of scale and increasing returns influence the performance of the financial market. Both the endogenous and exogenous theories provided the theoretical framework for this study.

Salamzadeh and Dana (2020) investigated the effect of COVID-19 pandemic on Iranian startups. The authors identified six significant challenges that the pandemic has brought on Iran's economy. These challenges include financial challenges, market challenges, and crisis management, among others. Zhang, Hu, and Ji (2020) opine that the quick spread of COVID-19 dramatically impacts financial markets by generating an unprecedented level of risk, resulting in significant losses for investors in a short time. The authors utilised daily data to explore the patterns of stock market reactions and ascertained that the pandemic has a strong influence on stock markets. This was done by analysing the potential consequence of policy interventions and accessing the impact of these policies. The longer-term consequences of this pandemic may arise from mass unemployment and business failures. The research concluded that the risk levels of all the countries had increased substantially.

While the exact global economic impacts are not yet clear, financial markets have already responded with unusual movement due to long-term expectations (Gormsen & Koijen, 2020). It is almost certain that emotional factors play essential roles. The market sentiment in response to the outbreak can be quickly amplified through social media, which then stimulate trade activities and cause extreme price movements. The financial markets have seen dramatic movement on an unprecedented scale. The considerable uncertainty of the pandemic and its associated economic losses has caused markets to become highly volatile and unpredictable.

According to Adrian and Natalucci (2020), COVID-19 pandemic has led to an unprecedented crisis in human health. The necessary measures to contain the virus triggered an economic downturn. The financial system has already changed significantly, which could result in global financial stability. Investor sentiment has stabilised in recent weeks, actions aimed at containing the fallout from the pandemic. Emerging markets are at risk of bearing the most massive burden, as so often happens in times of financial distress.

Enrico Onali (2020) investigated the impact of COVID-19 cases and related deaths in the U.S. with the stock market and suggested that the number of reported deaths in Italy and France negatively impacted the stock market returns. Baldwin and Weder di Mauro (2020) utilized an exogenous shock to examine the role of uncertainty in selecting locations for informed and uninformed traders on the financial markets. This also helps us capture market share dynamics, dark pool volume as the business volatility generated by COVID-19 grows, and eventually analyze the case's business-quality implications.

Materials and Methods

The study focused on the Short-term effect of the COVID-19 pandemic on the Nigerian financial market by exploring time-series data for 120 working days after the first confirmed case in the country. The 120 working days are combinations of lockdown periods and post lockdown periods in Nigeria. The study utilised exploratory analysis and linear multiple regression analysis to evaluate the effect of COVID-19 (proxy by the number of confirmed cases) on the Nigerian financial market (money market, capital market and foreign exchange market).

Quantitative data were used in this study. The money market data were sourced and extracted from the central bank of Nigeria Inter-Bank daily Rates website (https://www.cbn.gov.ng/rates/interbankrates.asp), the capital market data were sourced and extracted from the Nigerian stock exchange website (https://ng.investing.com/indices/nse-all-share- historical-data), while the foreign exchange market data were sourced and extracted from the Nigerian parallel market website (https://www.exchangerates.org.uk/USD-NGN-exchange-rate- history.html) Table 1.

| Table 1 Variable Measurement | ||

| VARIABLES | TYPE | PROXY |

| Money Market (OBBR) | Dependent | OBBR- Open Buy Back Rate (OBBR), are rates on discountable securities traded in the Nigerian Inter-Bank financial market |

| Capital Market (ASIV) | Dependent | ASIV- All-share index volume |

| Foreign Exchange Market (PFXM) | Dependent | PFXM- U.S. Dollar to Nigerian Naira rate at the parallel market |

| Covid-19 (Cvd) | Independent | CvD-Total number of Confirmed Covid-19 cases |

| Lockdown (LDS) | Control | LDS - Lockdown Status (introduced as a control variable, with 0 representing lockdown and 1 representing lockdown) |

Operational Measures of Variables

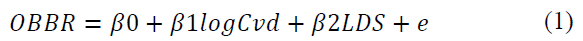

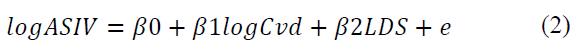

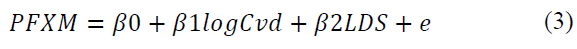

Model SpecificationThe multiple regression models for the hypothesized variables are specified below;

Where,

β0 = constant or intercept

β0 to β2 = regression coefficients

e = error term

Estimation TechniquesThe time-series data representing the variables in the model were subjected to the unit root test and the co-integration test in order to determine if they are stationary. The Ordinary Least Squares (OLS) technique was further used to estimate the parameters of the regression models.

Results and Discusson

Unit Root Test

The results of the ADF-Fisher unit root test reveal that all the variables are stationary. The variables OBBR, logASIV and logCvd are stationary at both their level form and after their 1st difference, with t-statistics which are significant at the 5% level (p < 0.05). However, PFXM is only stationary after the 1st diff., as revealed by the p-value of its t-statistic, which is significant at the 5% level. Based on these results, we can therefore conclude that all the variables are suitable for a regression model (Table 2).

| Table 2 Augmented Dickey Fuller (ADF) Unit Root Rest Result | ||||

| Variables | Method | Statistics | p-value | Order |

| OBBR | ADF-Fisher | -5.9253 | 0.0000* | I(0) |

| ADF-Fisher | -8.5637 | 0.0000* | I(1) | |

| LogASIV | ADF-Fisher | -4.9717 | 0.0001* | I(0) |

| ADF-Fisher | -14.5489 | 0.0000* | I(1) | |

| LogCvD | ADF-Fisher | -9.1037 | 0.0000* | I(0) |

| ADF-Fisher | -3.6089 | 0.0071* | I(1) | |

| PFXM | ADF-Fisher | -2.5547 | 0.1055 | I(0) |

| ADF-Fisher | -11.6452 | 0.0000* | I(1) | |

The Johansen co-integration test has a null hypothesis which says “no co-integrating equations”. The results of the Trace test and Max-Eigen test in Tables 3 and 4 reveal p-values which are significant at the 5% statistical level. These confirm that there exists at least one co-integrating equation among the variables, thus making them fit for the regression models.

| Table 3 Johansen Co- Integration Test Results (Trace) | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob. |

| None * | 0.229347 | 77.47228 | 47.85613 | 0.0000 |

| At most 1 * | 0.175105 | 47.51279 | 29.79707 | 0.0002 |

| At most 2 * | 0.140130 | 25.37546 | 15.49471 | 0.0012 |

| At most 3 * | 0.067310 | 8.013459 | 3.841466 | 0.0046 |

| Table 4 Johansen Co-Integration Test Results (Max-Eigen) | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | Prob. |

| None * | 0.229347 | 29.95949 | 27.58434 | 0.0243 |

| At most 1 * | 0.175105 | 22.13734 | 21.13162 | 0.0360 |

| At most 2 * | 0.140130 | 17.36200 | 14.26460 | 0.0157 |

| At most 3 * | 0.067310 | 8.013459 | 3.841466 | 0.0046 |

Parameter Estimates of Regression Models

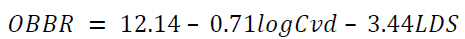

Impact of Covid-19 on the money market

From Table 5, the t-statistics (t = -1.7210) of the estimate of the co-efficient of COVID-19 (Cvd) is not statistically significant at the 5% level (p = 0.088). The co-efficient is negative (β1 = - 0.71) suggesting an inverse relationship between COVID-19 and OBBR. This implies that a percentage change in cases of covid-19 results in 71percent change in interbank money market rate. Similarly, the t-statistics (t = -2.2648) of the estimate of the lockdown status (LDS) is significant at the 5% level (p = 0.025). This is a control variable and as expected, the number of covid-19 cases affect the decision on the lockdown status by the Nigerian government.

| Table 5 Estimates of the Multiple Regression Model Involving OBBR, CVD and LDS | ||||

| Dependent Variable: OBBR | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| logCvd | -0.707058 | 0.410823 | -1.721076 | 0.0879 |

| LDS | -3.435413 | 1.516842 | -2.264846 | 0.0254 |

| C | 12.13835 | 1.581789 | 7.673811 | 0.0000 |

| R-squared | 0.054241 | Durbin-Watson statistics | 0.970253 | |

| F-statistic | 3.355051 | Prob. (F-statistics) | 0.038298 | |

Further results from Table 5 show an R-squared value of 0.0542, suggesting that 5.42percent of the variations in the dependent variable (OBBR) are explained by the independent variables (Cvd & LDS). The F-statistics (F =3.35 & p = 0.038) is statistically significant at the 5% level, suggesting that the independent variables jointly and significantly explain the variations in the model. The estimated Durbin-Watson statistics (0.97) is less than 2, indicating the absence of autocorrelation in the time series data.

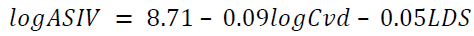

Impact of Covid-19 on the capital market

Looking at the result from Table 6, the t-statistics (t = -8.5616) of the estimate of the co- efficient of COVID-19 (Cvd) is statistically significant at the 5% level (p = 0.00). The co-efficient is negative (β1 = -0.09) suggesting an inverse relationship between COVID-19 and ASIV. This implies that a percentage change in the number of cases of covid-19 produces 9percent change in the All- Share Index value of the capital market.

| Table 6 Estimates of the Multiple Regression Model Involving ASIV, CVD and LDS | ||||

| Dependent Variable: LOGASIV | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| logCvd | -0.086483 | 0.010101 | -8.561626 | 0.0000 |

| LDS | -0.046773 | 0.037296 | -1.254114 | 0.2123 |

| C | 8.712021 | 0.038893 | 224.0004 | 0.0000 |

| R-squared | 0.386462 | Durbin-Watson stat | 1.113572 | |

| F-statistic | 36.84858 | Prob. (F-statistic) | 0.0000 | |

Further results also show an R-squared value of 0.386, suggesting that the independent variables (COVID-19 & lockdown status) are responsible for 38.6percent movement or variations in the capital market variable. In addition, the F-statistics (F =36.84 & p = 0.00) is statistically significant at the 5% level, suggesting that the independent variables jointly and significantly explain the variations in the model. The estimated Durbin-Watson statistics (1.11) is less than 2, confirming the absence of autocorrelation in the time series data.

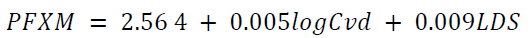

Impact of Covid-19 on the foreign exchange market

From Table 7, the t-statistics (t = 19.7699) of the estimate of the co-efficient of COVID-19 (Cvd) is statistically significant at the 5% level (p = 0.00). The co-efficient is positive (β1 = 0.01) suggesting a direct relationship between COVID-19 and PFXM, such that a percentage change in the number of cases of covid-19 produces results in 1percent corresponding change in exchange rates in the foreign exchange market. Similarly, the t-statistics (t = 8.4953) of the estimate of the lockdown status (LDS) is also significant at the 5% level (p = 0.00), suggesting that changes in the lockdown status significantly influences changes in exchange rates in the country.

| Table 7 Estimates of the Multiple Regression Model Involving PFXM, CVD and LDS | ||||

| Dependent Variable: PFXM | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| logCvd | 0.005445 | 0.000275 | 19.76988 | 0.0000 |

| LDS | 0.008639 | 0.001017 | 8.495387 | 0.0000 |

| C | 2.564070 | 0.001060 | 2417.972 | 0.0000 |

| R-squared | 0.777655 | Durbin-Watson stat | 0.781510 | |

| F-statistic | 204.6052 | Prob(F-statistic) | 0.0000 | |

In addition, the R-squared value of 0.777, shows that the independent variables (COVID-19 & lockdown status) are responsible for 77.7percent movement or variations in the foreign exchange variable. The F-statistics (F = 204.6 & p = 0.00) is statistically significant at the 5% level, also suggesting that the independent variables jointly and significantly explain the variations in the model. The estimated Durbin-Watson statistics (0.78) is less than 2, indicating the absence of autocorrelation in the time series data.

Implications of the FindingsResults of the analysis has revealed an inverse but insignificant relationship between COVID-19 and the Nigerian money market. This implies that as the number of cases of COVID-19 increases, the country’s interbank money market rate (OBBR) decreases, although the effect is not significant. The decrease in OBBR may be attributed to the limited activities by the commercial banks in Nigeria during the study period. These findings are in line with the Study of Zhang (2020), who opines the quick spread of coronavirus has dramatic impacts on the financial markets.

Furthermore, results from the analysis established a significant and inverse relationship between COVID-19 and the Nigerian capital market. This implies that as the number of COVID-19 cases increase, the All-Share Index value of the Nigerian Stock Exchange, decreases. This suggests that government’s restriction on business activities, as a result of the pandemic, significantly reduces performances of the shares of the companies listed on the stock exchange market. This result agrees with the findings of Onali (2020) in Italy and France, who reported that the number of COVID-19 has a negative impact on stock market returns.

Lastly, the outcomes of the analysis showed a significant and direct relationship between COVID-19 and the Nigerian foreign exchange market. This implies that as the number of cases of COVID-19 increases, the Parallel Exchange Rate (PFXM) in the country also increase. Nigeria is still an import-based economy with majority of her citizens relying on imported goods. However, global restrictions as a result of the pandemic, has led to an increase in foreign exchange rate in the country. These findings are in tandem with the work of Zhang (2020), but disagree with those of Akinyede, Iriobe, Afolabi and Eniola (2017) who postulate that social factors do not have significant effect on foreign exchange rates in Nigeria.

Conclusion and Recommendations

This study investigated the effect of the Covid-19 pandemic on the Nigerian financial markets. Findings from the study have established an inverse relationship between the number of cases of COVID-19 and Nigerian money market; an inverse relationship between the number of cases of COVID-19 and Nigerian capital market; and a direct relationship between the number of cases of COVID-19 and Nigerian foreign exchange, during the study periods. Therefore, the study concludes that the coronavirus pandemic influences performance of the Nigerian financial market.

We recommend that government and stakeholders should regularly embark on preventive measures in order to guide against financial challenges resulting from health risk. This can be done by taking proactive action against diseases that may affect the country’s financial system in order to ensure stability in the performance of the financial market. In addition, owners of businesses should wake up to the ‘new normal’ in terms of business activities in the country, where workers are encouraged and motivated to work remotely from wherever they are. Furthermore, policy makers in the country should encourage domestic production of goods, in order to prevent over reliance on importations.

References

- Adeusi S. O., & Ayodele T. D. (2009). Effects of Financial Liberation on Commercial Banks Performance. Sahel Analyst journal of Faculty of Management Sciences, University of Maiduguri, 11(2), 234 -244.

- Adrian, T., & Natalucci, F. (2020). COVID-19 Crisis Poses Threat to Financial Stability. Retrieved from https://www.google.com/search?q=Acccording+to+Tobias+Adrian+and+Fabio+Natalucci&oq=chrome.69i 57j33.18674j0j4&sourceid=chrome&ie=UTF-8

- Akinyede, O. M., Iriobe, G. O., Afolabi, T. S., & Eniola, O. A. (2017). Impacts of Environmental Factors on Foreign Exchange Fluctuations in Nigeria. International Journal of Economics and Financial Research, 3(4), 39-43.

- Amassoma, D. (2016). The Nexus between Exchange Rate Variation and Economic Growth in Nigeria. Journal of Entrepreneurship, Business and Economics, 5(1), 1-40.

- Ayodele, T. D. (2014). The Impact of Credit Policy on the Performance of Nigerian Commercial Banks. Journal of International Finance and Banking, 1(2), 40 - 50.

- Baldwin, R. B., & Weder, Di Mauro (2020), Mitigating the COVID economic crisis: Act fast and do whatever it takes,A VoxEU.org eBook, CEPR press.

- Domjan, P. (2020). Covid-19: The Emerging Markets best-placed to withstand the pandemic. Published by Tellimer.

- Edame, G. E. (2013). An Analysis of the Nigerian Capita Market Performance and Economic Growth in Nigeria. Journal of Poverty, Investment and Development, 1(1), 57-64.

- Farzad, F. S., Salamzadeh, Y., Amran, A. B., & Hafezalkotob, A. (2020). Social Innovation: Towards a Better Life after COVID-19 Crisis: What to Concentrate On. Journal of Entrepreneurship, Business and Economics, 8(1), 89 - 120.

- Gokal, G., & Hanif, I. (2004). Fundamental Share Price and Aggregate Real Output. European Economic review, 132-136.

- Gormsen, N. J., & Koijen, R. S. (2020). Coronavirus: Impact on stock prices and growth expectations. University of Chicago, Becker Friedman Institute for Economics Working Paper, (2020-22).

- Islam, A., Jerin, I., Hafiz, N., Nimfa, D. T., & Wahab, S. A. (2021). Configuring a Blueprint for Malaysian SMEs to Survive through the COVID-19 Crisis: The Reinforcement of Quadruple Helix Innovation Model. Journal of Entrepreneurship, Business and Economics, 9(1), 32-81.

- Kawamorita, H., Salamzadeh, A., Demiryurek, K., & Ghajarzadeh, M. (2020). Entrepreneurial Universities in Times of Crisis: Case of COVID-19 Pandemic. Journal of Entrepreneurship, Business and Economics, 8(1), 77-88.

- Mazzoleni, S., Turchetti, G., & Ambrosino, N. (2020). The COVID-19 Outbreak: From “Black Swan” to Global Challenges and Opportunities. Pulmonology, 26(3), 117.

- Nwosa, P. I. (2017). External Reserve on Economic Growth in Nigeria. Journal of Entrepreneurship, Business and Economics, 5(2), 110-126.

- Onali, E. (2020). Covid-19 and Stock Market Volatility. Available at SSRN 3571453.

- Salamzadeh, A., & Dana, L. P. (2020). The Coronavirus (COVID-19) Pandemic: Challenges among Iranian Startups. Journal of Small Business & Entrepreneurship, 1821158.