Research Article: 2018 Vol: 24 Issue: 2

Credit Impact On Performance of Micro and Small Enterprises In Telangana

Keywords

Micro and Small Enterprises-MSEs, Credit Programs, Development and Performance, Micro, Small and Medium Enterprises-MSEs.

Introduction

The Micro, Small and Medium Enterprises (MSME) sector plays a significant role in the Indian economy. The sector is critical in meeting the national objectives of generating employment, reducing poverty and discouraging rural-urban migration. It is an hour to focus more on employment generation as young India needs to direct young graduates and intellectual’s towards nation building. India has grate human resources which are very important to focus by the governments because of his resource miss utilisation can pull back the country and cause for social incongruity. Hence it is more important to provide appropriate employment opportunities to young graduates as well as under graduates in India. To achieve this national objective, widening MSME sector is one of the right choices to the governments (Central and State governments). Because of the sector has already credited with generating one of the highest employment growth and major share of industrial production and exports. This sector helps to build a booming entrepreneurial eco-system, in addition to promoting the use of indigenous technologies. The sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades, but it has done so in a constrained environment often resulting in inefficient resources utilization. In fact there are many challenges slow downing the growth and development of MSMEs in India, inadequate access to financial resources is one of the major bottlenecks that make these enterprises vulnerable, particularly in periods of economic downturn (Mahadeva & Veena, 2014).

As per the latest 4th All India census of MSMEs, the importance of this sector in India as compared to corporate giants with respect to its contribution towards Indian economy can be best understood that they contribute 8% in Gross Domestic Product (GDP), 45% of manufactured output, 40 % of exports, manufacture over 6000 products and provide employment to around 60 million person through 26 million enterprises. MSME is the best vehicle for inclusive growth, to create local demand and consumption. This sector assumes greater importance as the country moves towards a faster and inclusive growth agenda. Mostly, it is the sector which help realize the objective of the proposed National Manufacturing Policy of raising the share of manufacturing sector in GDP from 16 percent at present to 25 percent by the end of 2022 (RBI report of the working group, 2012). Therefore the MSME sector has to be considered as most prioritized sector and focus on its barriers for slowing down the sector growth and eliminate those barriers as quick as possible to reach the expectations on this sector.

This research study particularly concentrating on the micro and small enterprises (MSEs) sector development in the newly formed state Telangana in India. Impact of loans and advances taken by the MSEs on behalf of various credit programs introduced by the government for the development of MSEs and its relevant issues are particularly highlighted in this study. Therefore MSE’s role in the development of Indian economy and industrial development need to study separately. Undoubtedly MSE’s play major role in the development of Indian economies and industrial development as it is the part of MSME sector. There are estimated 26 million micro and small enterprises (MSEs) in the country providing employment to an estimated 60 million people and contributes about 45% of the manufacturing sector output and 40% of the nation’s exports. Timely availability and getting adequate credit at reasonable interest rates are one of the most important problems faced by the MSEs in India. One of the major causes for low availability of bank finance to this sector is the high risk perceptions of the banks in lending to MSEs and consequent insistence on collateral securities which are not easily available with MSEs. However one can observe a significant difference in their growth when compared with medium and large enterprises (MLEs). Providing sufficient financial aids to the MSEs can solve most of the unemployment and economic growth related issues in India. Entrepreneurship development is a significant part of human resource development. To achieve this, government of India has timely introducing different credit programs with different features. This research paper focuses on various credit programs adopted by the micro and small enterprises to investigate various issues like, problems at the time of applying for loans, utilization of sanctioned loans and it repayment issues. This paper tries to provide solution to the loans and advances taken by enterprises have any impact on performance oriented growth of enterprises in Telangana state, India.

Schemes for the Development of MSMEs in India

Government of India has identified importance of MSME sector and came with different varieties of supportive and development schemes. These schemes are developed and regulating by various authorities/ministries of country. There are 18 ministries which are focusing on MSME sector full/partially named Ministry of micro, small and medium enterprises, Ministry of agriculture, Ministry of chemicals and fertilizers, Ministry of commerce and industry, Ministry of communication and information technology, Ministry of corporate affairs, Ministry of culture, Ministry of finance, Ministry of food processing industries, Ministry of housing and urban poverty alleviation, Ministry of rural development, Ministry of science and technology, Ministry of social justice, Ministry of textiles, Ministry of tourism, Ministry of tribal affairs, Ministry of urban development and Ministry of women and children development.

All these ministries are organising and monitoring various schemes to the support and development of MSMEs in India. Ministry of micro, small and medium enterprises has direct instigation to the development and support of MSME sector. The ministry has formulated several schemes with are more popular than the other ministry schemes in the area of micro, small and medium enterprise businesses. These schemes can be divided into four broad categories as SME Division Schemes (Small and Medium scale Enterprises), Development commissioner (DC-MSME) Schemes, NSIC schemes (National Small Industries Corporation) and ARI division schemes (Agriculture and Rural Industries).

In this research study it is only focused on the schemas of Ministry of micro, small and medium enterprises particularly applicable to the MSE sector for avoiding complexity in the research.

Review Of Literature

Theoretical Framework

Various studies that buttress challenges facing MSEs in accessing credit facilities, utilization capacities of sanctioned loans and repayment capacities and its impact on performance oriented growth among micro and small enterprises are considered as literature review for this study as follows:

• Thomas (2017), examined various factors influence on performance of MSEs. Finance and credit are two of the factors examined to study their impact on MSEs performance. The study investigated that the access to finance is one of the most critical factor faced by MSEs and its impact factor is high on MSEs performance. Limited access to finance, high interest rates, bureaucracy in getting finance and low level of financial management skills leads to less production activity less competent due to inability to purchase required technology and limited resources production facility. To overcome these problems, the researcher given several solutions like improving saving culture, search for different mechanisms of financial access, expanding more financial institution and their capacity, finally review of interest rates. The research concluded that finance and credit related issues of MSEs are having high impact and more difficult to resolve it. It is one of the factor took majority of the share for the causes of 50% drop-out.

• Das (2017) studied opportunities, issues and challenges of MSMEs in India. Study noted that flow of institutional credit is one of the challenges to MSMEs in India. The government of India has introduced several major policy initiatives for support and promotion of MSMEs. But flow of credit or availability of finance from banking institutions is a major factor contributing o he growth and success of MSMEs. Available information on flow of credit to this sector indicates a declining trend from 17.34% in 2010 to 10.20% in 2013. One of the key issues identified by the committee is the financial institutions/Banks face challenges in credit risk assessment of MSMEs. One of the conclusions regarding credit is easy and timely access to credit is crucial factor to development and growth of enterprises.

• Chaitra and Al Malliga (2016) studied on growth and performance of MSMEs. The study reveals that inadequate credit facility definitely hinder the competitiveness of Small Scale Industries (SSI). The research also explained that the total bank credit to MSME sector stood at Rs.833 billion in the financial year 2015 ad has grown at compounded average growth rate of 25% to 7.9 trillion in the year 2014. Still there is huge demand for the financial assistance to small enterprise. It is argued that banks are reluctant to bend small units as this segment has high non-performing assets (NPAs). The fact is that NPAs are prevalent across-the-board as between larger and smaller industrial units. The only difference is that there is “glamour” in lending to larger units.

• Joseph (2015), the study found out that credit sources influence the performance of SMEs, credit and performance of SMEs have positive influence. Study concluded that the credit programs which have high interests and terms and conditions have to avoid by the SMEs. Those type of credits leads to negative performance of SMEs. In fact the research totally focused on informal credit but finally proved that the credit has impact on performance of SMEs. The reduced cost of credit and flexibility was found to enhance the access of credit which in turn led to increased business performance.

• Triloknath and Deeksha (2015) complained that the credit acceleration in the sector had significantly noticed absolute growth but proportion of MSE credit in net bank credit has been more or less at same level of 14%, which was way back in year 2000 despite widening the coverage of the MSE sector. The research analysis has indicated that real growth in finance to MSE sector is not adequate in light of significant contribution of the sector in economy such as employment, manufacturing and exports of the country. Low share of MSE credit does not only hamper equitable growth of economy but also fails to banks to fulfil their social commitment to the growing society.

• Anwar (2014), in his research examined the effect of credit disbursement on the performance of MSMEs. The study reveals that credit disbursement and output inputs of the MSMEs have a significant positive effect on the support of MSMEs.

• Biswas (2014) had focused on the access to finance by MSMEs. Research noted that the main constraint that MSMEs face timely access to finance. The researcher tries to analyses the various constraints that MSMEs are facing today with reference to banking sector. Lack of availability of adequate and timely credit, high cost of credit, collateral requirements, etc. are considered various financial constraints faced by MSMEs in the research and also mentioned various problems faced by banks in lending to MSMEs. Major area of research focused on credit guarantee schemes. The credit guarantee scheme has emerged out as one of the most popular schemes for the MSME sector over the last decade. That most of the banks sanction loans through the schemes called ‘Credit Guarantee schemes’. The study also mentioned most of MSMEs work in the unorganized sector, so they do not maintain proper account and balance sheets. Without the presence of proper balance sheets, banks find it really difficulty to lend credit to MSMEs. The research concluded that though banks are catering the needs of the MSME sector through various schemes specifically drafted for the MSMEs, still there is a huge gap between the demands of credit by the MSMEs in India. Economy cannot be overlooked, it’s imperative for the government and RBI to cater the financial needs of MSMEs sector ad helps them being competitive in this globalized economy.

• Shweta (2014) studied profile of MSME’s in Himachal Pradesh and observed that majority of the industries were located in rural areas and sole proprietorship business are more. The state government frames an industrial policy from time to time. It must be guided by the economic and social benefits accrued to MSE.

• Fred and Timothy (2013) studied on effect of credit on MSEs performance in Kitale Town. The study considered value of assets acquired on assessing credit and found that credit available to MSEs does not necessarily lead to addition of assets. The study also focused on the effect of credit availability on expansion of market share and found that the availability of credit does not guarantee a bigger market share. It finally conclude MSEs do not necessarily lead to good performance and the MSEs characteristics like type of business, size of business operations and it expenses, cost of accessing credit and amount of credit should also be well take care of hen accessing credit from lending institutions.

• Ndife (2013) studied to determine the impact of Micro credit institutions in starting up, survival and growth of SMEs as well as the effect. Collateral requirements in obtaining loans from micro credit institutions. The study concluded that there is a significant relationship were observed to exist between microcredit institutions and SMEs development, the small degree of association that exist suggests that capital (Micro Credit) is not the only factor that affect SMEs. The study also found that there is a necessity for micro credit institutions, SMEs and governments to work together for the best interest of development of SMEs. Aiding the Micro credit institutions activities will relax the stress of obtaining loans; thus making prospective entrepreneurs to fully develop into small and medium scale business.

• Ekambaram and Sivasankar (2013) discussed on the socio-economic factors impact on Entrepreneurship development. In this study, socio-economic factors such as the social status of the entrepreneurs, their age at the time of inception, education and family background of the entrepreneurs are considered for measuring impact on development of entrepreneurship development. The study reveals that the social status factor has influenced the entrepreneurs more in starting the units but gender has not influenced. The study also revealed most entrepreneurs are in the age groups between 21 to 40 years non-technical but graduates. The family background has significant impact on entrepreneurship development as well as their prior occupations. The study concluded that the socio-economic factors have significant impact on development of entrepreneurs.

• Report of the Inter-Ministerial Committee for Boosting Exports from MSME Sector under the Chairmanship of Shri R.S. Gujral (Finance Secretary) in 2013 has notes that the major problems for the MSMEs relate to the availability and cost of credit, marketing support, improving productivity, technology/skill up gradation, infrastructure and the institutional framework for the MSMEs.

• Das & Kandarpa (2013) said that the MSES have been considered as a powerful instrument for realizing the twin objectives i.e., accelerating industrial growth and creating productive employment potential in the backward areas. Said that adequate capital is one of the major obstacles in the development of MSES.

• Nagayya (2013) examined credit flow to MSEs for the period of 2004 to 2012. Said that the screening methodology of financing institutions needs to consider non-financial parameters and management competencies while evaluating loan proposals of SME units. The working groups on credit flow to SMEs under the chairmanship of K.C. Chakrabarthy and the prime ministers taskforce on SMEs have suggested a number of measures for sustained development of the SME sector.

• Norhaziah and Shariff (2011) explored the importance of micro financing to the development of micro-enterprises. The paper examines the microfinance programs offer to the MES and concluded that the credit is always become the missing link for micro enterprises. Limited access to credit for both new and growing firms becomes a major barrier for micro entrepreneurs to start and expand their business. Microcredits are seen as an efficient instrument in helping micro-enterprises that faced financial constraints. The credit allows micro-enterprises to acquire assets, start business, finance emergency needs and insure themselves against negative shocks. Finally it has proved that the credit can help micro enterprises to boost up the business.

• Jabir (2011), the idea of attempting poverty reduction through the provision of uncollateralized loans-cum-subsidy to SHG for establishing micro enterprises has gained momentum in the recent decade. The on-going practices in developing micro enterprises through SHG lay much emphasis on provision of credit and subsidy.

• Fennee (2010) studied on a assesses to credit management of micro-enterprises, revealed that about 59 percent micro enterprises not paying their loans on time due to lack of credit management practices. The study concluded that the financial capacity of entrepreneurs have not any significant impact on credit management of micro enterprises.

• Dasanayaka (2009) focused on informal sector of SMEs and said that the sector is lifeline to employment, economy, social stability and regional development. The study also finds that lack of first-hand information is the main obstacle to growth and development of MSEs. The research particularly focused on coherent policies and strategies to develop SMEs to their full potentials to accelerate economic growth and development.

Conceptual Framework

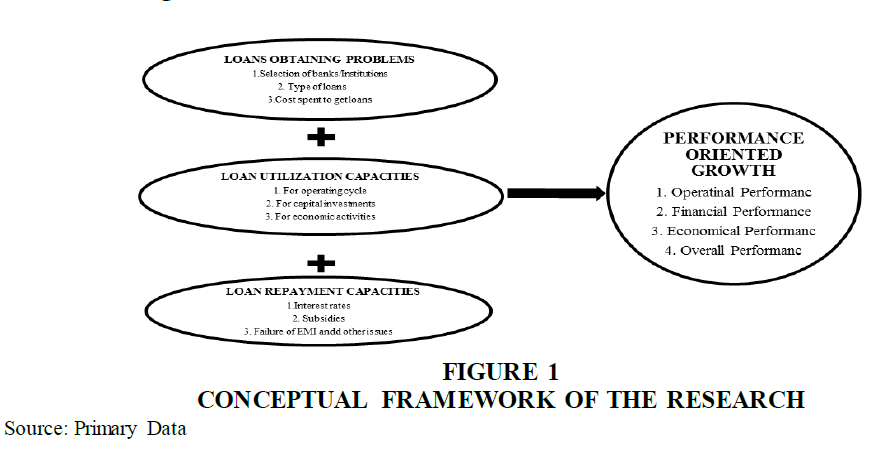

A conceptual frame work is a product of qualitative process of theorization which interlinks concept that together provides a comprehensive understanding of a phenomenon or phenomena (Jabareen, 2009). The concepts that constitute a conceptual frame work support one another, articulate their respective phenomena and establish a frame work- specific philosophy that defines relationship (Gichuki, 2014). The conceptual framework of this research relates to loans taken by the MSE’s and the impact of those loans on performance oriented growth on MSE’s in Telangana State.

As shown in Figure 1, problems faced to obtain loans (pre-loan issues), utilization of loans and loan repayment issues (post-loan issues) are considered as independent variables and performance oriented growth has considered as dependent variable. Variables like, selection of bank or financial institutions to apply loan, issues in apply of loan with selected bank and cost spent to get the loans are kept under the head variable named ‘Loan obtaining problems’. Loan sanctioned amount spent for business operating cycle, capital investment and economic activities are considered as ‘Loan utilization Capacities’. Interest rates, subsidies, failures in EMI payments and its associate penalties are put under the head variable named ‘loan repayment capacities’. Business performance considered by three variables named operational performance, financial performance and economic performance. All the three variables together considered as ‘Overall performance’. The research has two inter related concepts, one is to understand the selected credit based MSEs are similar in independent variables called loan obtaining problems, loan utilization capacities and loan repayment capacities. The second one is to know is there any impact of these loans taken by MSEs on their business performance oriented growth.

Objectives

➢To study the credit impact on operational performances of MSEs in Telangana.

➢ To study the credit impact on financial performances of MSEs in Telangana.

➢To study the credit impact on economic performances of MSEs in Telangana.

➢ To study the credit impact on overall performances of MSEs in Telangana.

Hypotheses

H01 There is no significant impact of credit programs on operational performance of MSEs in Telangana State.

H02 There is no significant impact of credit programs on financial performance of MSEs in Telangana State.

H03 There is no significant impact of credit programs on economic performance of MSEs in Telangana State.

H04 There is no significant impact of credit programs on overall performance of MSEs in Telangana State.

Research Methodology

Research Design

The design of the present research is descriptive and analytical. The research objectives, hypothesis and statistical tools of analysis are made accordingly. The suggestions of the study emerged from the inferences drawn from the sample survey of MSE units in Telangana State.

Study Area

In order to select the sample units the prime task before the researcher was to select the districts which should be representative of highly industrialized area, moderate industrialized areas and also the under developed areas. With this objective the researcher has selected two districts of Ranga Reddy and Nalgonda. While Ranga Reddy district could be termed as the industrially developed district with the availability of infrastructure and other facilities for the establishment of the MSEs, Nalgonda district contains the areas which are termed as industrially developed, developing and backward. Secondly from the data collected for commission rate of MSMEs in Telangana for the period of 2006 to 2015, around 46.39 percent MSEs located in Ranga Reddy district and remaining 53.61 percentages located more or less evenly in other districts of Telangana. In Nalgonda district around 6.24 percentages of MSEs located. Therefore, Ranga Reddy and Nalgonda together are covering around 52.63 percentages which is more than 50 percent of MSEs in Telangana state.

Selection of Sample Units

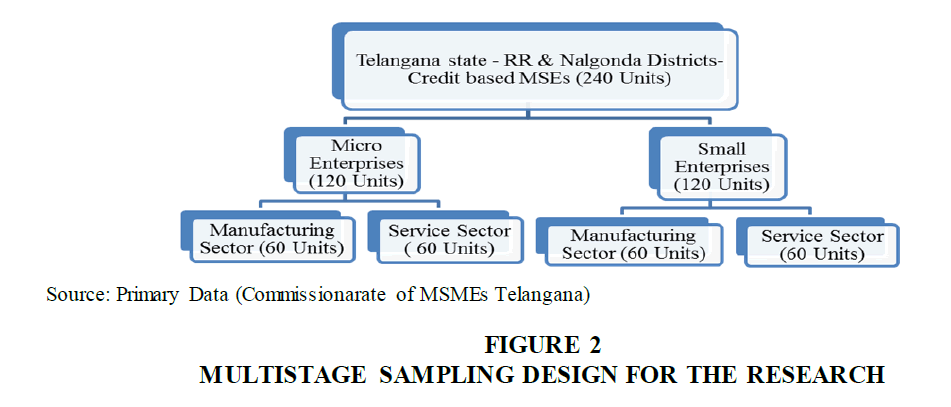

Registered credit based MSEs which are located in Ranga Reddy and Nalgonda districts for the study. For this purpose a list of registered MSEs which availed loans and advances from various financial institutions and banks in Ranga Reddy and Nalgonda district was obtained from Commission rate of MSMEs Telangana State for the period of 2006 to 2015. The selected sample size was 240 units more than 10 percent from both districts during the period from 2006-2007 to 2014-2015 by the Commission rate of MSMEs, Telangana. Period of the study from the year 2010 to 2015, The MSEs whoever availed credit programs in this 5 year period were asked to fill the questionnaire. Out of the total 240 sample size Micro units were 120 and Small units were 120 sector wise from both the districts are covered for the study, as well as the sectors were evenly divided in to 60 units as two groups’ wise service and manufacturing by nature of activity.

Sample Design

In order to have a representative sample from the population of 2362 MSE units spread over Ranga Reddy and Nalgonda districts, multistage simple random sampling technique was adopted. For this purpose, the entire population was divided into three stages. In first stage two district were selected i.e., Ranga Reddy and Nalgonda (Telangana State) constituting a total of 240 sample credit based MSEs to canvass schedule for the purpose of research study by judgmental sampling. In second stage two types of enterprises were selected i.e., Micro and Small Enterprises, so as to constitute 120 sample MSEs from each type of enterprise purposively. And in final stage constitute of 60 samples were selected from each manufacturing and service sector wise by convenience sampling. The Table 1 and Figure 2 below show the size of population and sample design of registered MSE units.

| Table 1: Reliability Statistics | ||

| Reliability Statistics | ||

|---|---|---|

| Cronbach's Alpha | Cronbach's Alpha Based on Standardized Items | No. of Items |

| 0.786 | 0.780 | 35 |

The respondents are owners and top management team of registered MSEs. MSEs are selected randomly from RR district as it has occupied major percentage of MSEs in Telangana (Table 1) as per the data given by commissionarate of MSMEs-Telangana. The reliability of questionnaire was determined by using Cronbach’s co efficient alpha. The information thus collected has been analysed using Statistical Package for Social Sciences (SPSS) version 20.0. In this study the raw data collected are classified, edited and tabulated for analysis. Factor analysis was used to factorise various variables in to required dimensions and multiple linear regression was used to study impact of various factors on MSEs in Telangana.

Data Analysis

In the present research, the reliability of questionnaire was determined by using Cronbach’s coefficient alpha.

As per Table 1, the reliability coefficient indicate that the scale for measuring is quite optimum. An alpha value of 0.7 or above is considered to be the criterion for demonstrating internal consistency of new scale and established scales respectively.

| Table 2: Descriptive Statistics Of Pre-Loan Issues Variables | |||

| Descriptive Statistics | |||

|---|---|---|---|

| Mean | Std. Deviation | Analysis N | |

| Assistance By Financial Institution | 4.05 | 0.832 | 240 |

| No. of Times Visited Financial Institution | 3.60 | 0.954 | 240 |

| Simplicity of loan application process | 3.15 | 1.256 | 240 |

| Reasonability for time taken for process | 3.31 | 1.276 | 240 |

| Time taken for disbursement of loan | 3.44 | 1.137 | 240 |

| No of instalments disbursed loan amount | 3.80 | 1.141 | 240 |

| Reasonability of Processing charges of the loan | 3.11 | 1.253 | 240 |

Factor Analysis

When entrepreneurs decided to avail loans or any credit related schemas form the banks and financial institutions they required to understand the terms and conditions regarding loan with ensuring eligibility. To get avail of loan they have to approach several authorities and convince them to approve that loan. For this entire process entrepreneurs need to spend some valuable resources like time and money. After taking different loans by entrepreneurs, how those loans utilised in business and the loan associated benefits like subsidies, etc. supported for business development were asked in set of variables. Therefore there is a need to reduce these factors by means of factor analysis before testing the hypotheses. Therefore, factor analysis will be used to factor the original large data in to more reasonable factors which helps to use multiple regression analysis. It will be used to ensure those factors having shared variance are grouped together.

In the similar way the dependent variable or performance factors are made up of a number of related variables. Therefore there is a need to reduce these factors by means of factor analysis before testing the hypotheses. Therefore, factor analysis will be used to factor the original large data in to more reasonable factors which helps to use multiple regression analysis. It will be used to ensure those factors having shared variance are grouped together.

In this part of study consider all the variables related to per loan issues, post loan issues and performance related variables were factorized by using factor analysis.

To determine the appropriateness of the factor analysis for the loan utilisation variables Bartlett’s test of Sphericity and the Kaiser-Meyer-Olkin (KMO) measures of sampling adequacy will be performed. For each of these factors scales will be created by adding the response for the item, loading strongly on each factor. Finally, a reliability test which gives a Cronbach alpha value will be performed to make sure that the items incorporated are reliable for use in the testing of the hypotheses.

All the variables were measured by using different items in the survey questionnaire. Respondents were asked to rate this fourteen item related to the loan utilisation derived from engaging their own business enterprises on a 5-point Likert scale, ranging from 1=poor to 5=excellent. All the variable items were factor analysed by means of a principal component factoring, with varimax rotation and the results from this analysis were as follows.

A) Pre-loan Issues-Factor Analysis

i) Descriptive Statistics

The first output of the analysis is a table of descriptive statistics for all the factors under investigation which is represented in Table 2. Typically, the mean, standard deviation and number of respondents (N) who participated in the survey are given. Looking at the mean, we can conclude the assistance provided by financial institutions has most important variable that influences MSEs to attract towards loans. It has the highest mean of 4.05. And on the other side processing charges with less mean of 3.11.

ii) Kaiser-Meyer-Olkin (KMO) and Bartlett’s Test of Pre-Loan Issues Factors

The various indications of the factorability of the dependent variable were excellent and appropriate. Factor analysis of Performance factors revealed that KMO was 0.6.99 and the Bartlett’s test of Sphericity was significant at 0.000 which showed that the analysis was appropriate (Table 3).

| Table 3: Kaiser-Meyer-Olkin (Kmo) And Bartlett’s Test Of Pre-Loan Issues Factors | ||

| KMO and Bartlett's Test | ||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.699 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 844.940 |

| df | 21 | |

| Sig. | 0.000 | |

iii) Communalities of Pre-loan Issues Factors

The above Table 4 of communalities shows how much of variance in the variables has been accounted for by the extracted factors. From the table it is evident that over 87.9% of the variance is accounted for processing charges of the loan is reasonable while 55.7% of the variance is accounted for No. of instalments disbursed loan.

| Table 4: Communalities Of Pre-Loan Issues Factor | ||

| Communalities | ||

|---|---|---|

| Initial | Extraction | |

| Assistance By Financial Institution | 1.000 | 0.680 |

| No. of Times Visited Financial Institution | 1.000 | 0.623 |

| Simplicity of loan application process | 1.000 | 0.715 |

| Reasonability for time taken for process | 1.000 | 0.708 |

| Time taken for disbursement of loan | 1.000 | 0.753 |

| No. of instalments disbursed loan amount | 1.000 | 0.557 |

| Reasonability of Processing charges of the loan | 1.000 | 0.879 |

| Extraction method: Principal Component Analysis | ||

iv) Total Variance Explained of Pre-loan Issues Factors

The following Table 5 shows all the factors extractable from the analysis along with their Eigen values, the percent of variance attributable each factor and the cumulative variance of the factor and the previous factor. Notice that the first factor accounts for 47.470% of the variance and the second factor counts for 22.748%. All the remaining factors are of little significance.

| Table 5: Total Variance Explained In Pre-Loan Issues | ||||||||

| Total Variance Explained | ||||||||

|---|---|---|---|---|---|---|---|---|

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | |||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | % of Variance | Cumulative % | |

| 1 | 3.323 | 47.470 | 47.470 | 3.323 | 47.470 | 47.470 | 46.282 | 46.282 |

| 2 | 1.592 | 22.748 | 70.218 | 1.592 | 22.748 | 70.218 | 23.937 | 70.218 |

| 3 | 0.814 | 11.629 | 81.847 | |||||

| 4 | 0.536 | 7.652 | 89.499 | |||||

| 5 | 0.364 | 5.203 | 94.701 | |||||

| 6 | 0.222 | 3.165 | 97.867 | |||||

| 7 | 0.149 | 2.133 | 100.000 | |||||

| Extraction Method: Principal Component Analysis | ||||||||

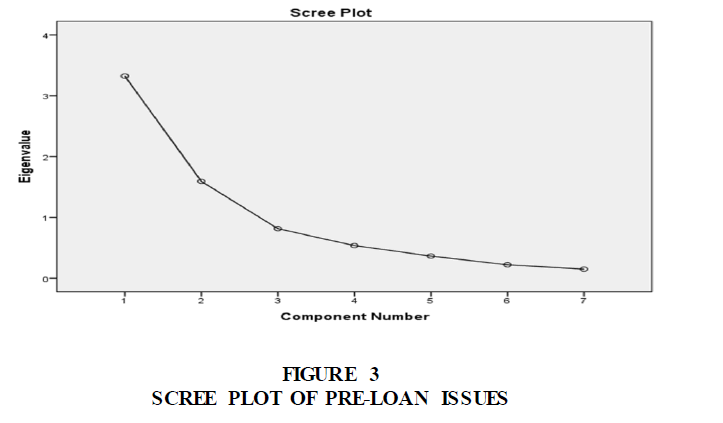

v) Scree Plot of Loan Utilisation Factor

The scree plot in the Figure 2 shows Eigen values and the values greater than 1.0 suggests that only 2 factors are suitable for extraction. These values also represent the amount of variance accounted for each factor. The two factors with Eigen values exceeding 1, explained 47.470 percent and 22.748 percent of the variance respectively of the 70.281 percent of total variance explained by the factors prior to rotation.

vi) Rotated Components Matrix of Loan Utilisation

The SPSS output on the two factors extracted from the measures of pre-loan issue factors are indicated in the rotated component matrix Table (Table 6). The factor analysis reduced the independent variable data in to five factors accumulating related items together. These two factors along with loan utilisation factors (post-loan issues) with their new labels are used as the independent variables in the testing of hypotheses. Factor 1-MSEs side issue and Factor 2-Banker side issues.

| Table 6: Rotated Component Matrixa For Pre-Loan Issues | ||

| Rotated Component Matrixa | ||

|---|---|---|

| Component | ||

| 1 | 2 | |

| Reasonability of Processing charges of the loan | 0.922 | |

| Reasonability for time taken for process | 0.841 | |

| Simplicity of loan application process | 0.824 | |

| Time taken for disbursement of loan | 0.810 | |

| No. of times visited financial institution | 0.782 | |

| Assistance by financial institution | 0.706 | |

| No of instalments disbursed loan amount | 0.391 | |

| Extraction method: Principal Component Analysis. Rotation method: Varimax with Kaiser Normalization. |

||

| a. Rotation converged in 3 iterations | ||

vii) Reliability Test for Loan Utilisation Factor

For easy understanding of the Rotated Component Matrix SPSS output, the factors extracted with their specific variables loading on them have been translated and described below.

Factor 1: This factor was represented by four items and was labelled Pre-loan isuues-1 that accounted for 47.470% of variance. This factor comprised items representing ‘Reasonability of Processing charges of the loan, Reasonability for time taken for process, Simplicity of loan application process, Time taken for disbursement of loan and No of instalments disbursed loan amount’.

Factor 2: This factor was represented by three items and was labelled Pre-loan issues-2 that accounted for 22.748% of variance. This factor comprised items involving ‘No. of Times Visited Financial Institution and Assistance by Financial Institution’.

The factor analysis of the variables has reduced the data to two major factors. Table 7 depicts the mean (M) and standard deviation (SD) for these three factor variables. Pre-loan issues-1 scored the highest mean (16.81) with SD of 4.658. It was followed by pre-loan issues-2 (M=4.11; SD=0.870).On the other hand Cronbach alpha coefficients proved reliable and showed a strong internal consistency among the variable only in case of factor 1 that is 0.860, but the second factor has not reached the minimum acceptable Cronbach alpha value that is 0.7. Therefore the second factor is inappropriate for the testing of the hypothesis, omitted for the further study. Because of there is only one factor considering, it is named as ‘pre-loan issue’ instead of name ‘pre-loan issue-1’.

| Table 7: Reliability Test For Pre-Loan Issue Factors | ||||

| Performance Factors | No. of Variables | Mean | Standard Deviation | Cronbach Alpha Coefficient |

|---|---|---|---|---|

| Factor-1: Pre-loan issues-1 | 5 | 16.81 | 4.658 | 0.825 |

| Factor-2: Pre-loan issues-2 | 2 | 7.65 | 1.551 | 0.667 |

B) Post-Loan Issues/Loan Utilisation-Factor Analysis

i) Descriptive Statistics of Post-Loan Variables

The first output of the analysis is a table of descriptive statistics for all the factors under investigation which is represented in Table 8. Typically, the mean, standard deviation and number of respondents (N) who participated in the survey are given. Looking at the mean, we can conclude the loan supported medium/long term investments of the business is the most important factor that influences utilisation capacities of business. It has the highest mean of 4.2. And on the other side Bank Guidance helped to optimum utilization of loan contributed less in the loan utilisation capacities of the business which has a mean of 3.68.

| Table 8: Descriptive Statistics Of Loan Utilisation Variables | |||

| Descriptive Statistics | |||

|---|---|---|---|

| Mean | Std. Deviation | Analysis N | |

| loan supported day to day operations | 4.18 | 0.564 | 240 |

| loan supported medium/long term investments | 4.2 | 0.935 | 240 |

| loan supported welfare activities | 4.04 | 0.822 | 240 |

| Loan supported For Business Performance | 4.17 | 0.647 | 240 |

| Fully Utilized for Business Purpose only | 3.83 | 0.909 | 240 |

| Loan Utilized only for the purpose of loan taken | 4.18 | 0.896 | 240 |

| Loan utilization Enhanced Business profitability | 4.02 | 0.828 | 240 |

| Bank Guidance helped to optimum utilization of loan | 3.68 | 0.912 | 240 |

| Interest On Loan Amount is Optimum | 3.83 | 0.967 | 240 |

| Comfortability Of Repayment process of loan | 3.79 | 0.936 | 240 |

| Loan Repaid Through Business Profits only | 3.94 | 0.944 | 240 |

| No Failures in loan Repayment Timely | 3.73 | 1.025 | 240 |

| Loan Subsidies Enhanced Business Position | 3.84 | 0.998 | 240 |

| Loan Subsidy Reduced Repayment Burden | 3.76 | 0.964 | 240 |

ii) Kaiser-Meyer-Olkin (KMO) and Bartlett’s Test of Post-Loan Factors

The various indications of the factorability of the dependent variable were excellent and appropriate. Factor analysis of Performance factors revealed that KMO was 0.702 and the Bartlett’s test of Sphericity was significant at 0.000 which showed that the analysis was appropriate (Table 9).

| Table 9: Kaiser-Meyer-Olkin (Kmo) And Bartlett’s Test Of Post-Loan Factors | ||

| KMO and Bartlett's Test | ||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.702 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 1694.847 |

| df | 91 | |

| Sig. | 0.000 | |

iii) Communalities of Post-Loan Factors

The above Table 10 of communalities shows how much of variance in the variables has been accounted for by the extracted factors. From the table it is evident that over 88.5% of the variance is accounted for loan supported medium/long term investments while 54.6% of the variance is accounted for in Loan utilization Enhanced Business profitability.

| Table 10: Communalities Of Loan Utilisation Factor | ||

| Communalities | ||

|---|---|---|

| Initial | Extraction | |

| loan supported day to day operations | 1 | 0.854 |

| loan supported medium/long term investments | 1 | 0.885 |

| loan supported welfare activities | 1 | 0.773 |

| Loan supported For Business Performance | 1 | 0.827 |

| Fully Utilized for Business Purpose only | 1 | 0.732 |

| Loan Utilized only for the purpose of loan taken | 1 | 0.816 |

| Loan utilization Enhanced Business profitability | 1 | 0.546 |

| Bank Guidance helped to optimum utilization of loan | 1 | 0.812 |

| Interest On Loan Amount is Optimum | 1 | 0.779 |

| Comfortability Of Repayment process of loan | 1 | 0.833 |

| Loan Repaid Through Business Profits only | 1 | 0.834 |

| No Failures in loan Repayment Timely | 1 | 0.565 |

| Loan Subsidies Enhanced Business Position | 1 | 0.823 |

| Loan Subsidy Reduced Repayment Burden | 1 | 0.765 |

| Extraction Method: Principal Component Analysis. | ||

iv) Total Variance Explained of Loan Utilisation Factors

The following Table 11 shows all the factors extractable from the analysis along with their Eigen values, the percent of variance attributable each factor and the cumulative variance of the factor and the previous factor. Notice that the first factor accounts for 26.435% of the variance, the second factor counts for 21.098%, the third factor count for 12.605%, the fourth factor counts for 9.329% and the fifth for 7.99%. All the remaining factors are of little significance.

| Table 11: Total Variance Explained In Loan Utilisation | |||||||||

| Component | Initial Eigen values | Loadings | Rotation Sums of Squared Loadings | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 3.701 | 26.435 | 26.435 | 3.701 | 26.435 | 26.435 | 2.855 | 20.393 | 20.393 |

| 2 | 2.954 | 21.098 | 47.533 | 2.954 | 21.098 | 47.533 | 2.328 | 16.628 | 37.021 |

| 3 | 1.765 | 12.605 | 60.139 | 1.765 | 12.605 | 60.139 | 2.035 | 14.537 | 51.558 |

| 4 | 1.306 | 9.329 | 69.468 | 1.306 | 9.329 | 69.468 | 1.891 | 13.504 | 65.062 |

| 5 | 1.119 | 7.990 | 77.458 | 1.119 | 7.990 | 77.458 | 1.735 | 12.396 | 77.458 |

| 6 | 0.684 | 4.888 | 82.346 | ||||||

| 7 | 0.594 | 4.243 | 86.589 | ||||||

| 8 | 0.404 | 2.888 | 89.478 | ||||||

| 9 | 0.386 | 2.761 | 92.238 | ||||||

| 10 | 0.271 | 1.937 | 94.176 | ||||||

| 11 | 0.259 | 1.848 | 96.024 | ||||||

| 12 | 0.236 | 1.687 | 97.711 | ||||||

| 13 | 0.204 | 1.460 | 99.171 | ||||||

| 14 | 0.116 | 0.829 | 100.000 | ||||||

| Extraction method: Principal Component Analysis | |||||||||

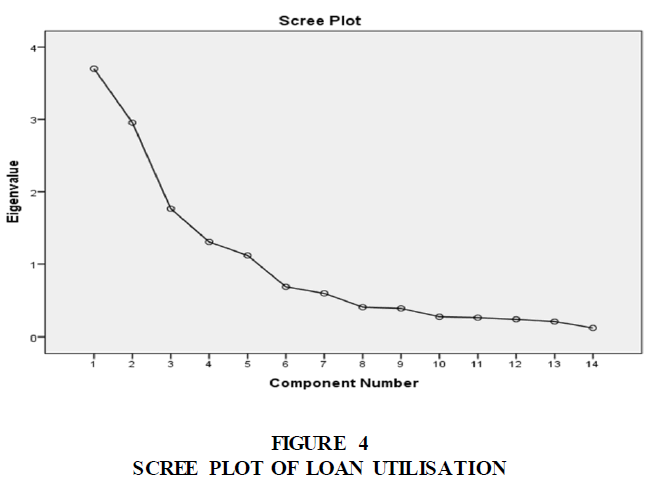

v) Scree Plot of Loan Utilisation Factor

The scree plot in the Figure 3 shows Eigen values and the values greater than 1.0 suggests that only 5 factors are suitable for extraction. These values also represent the amount of variance accounted for each factor. The five factors with Eigen values exceeding 1, explained 26.435 percent, 21.098 percent, 12.605 percent, 9.329 percent and 7.99 percent of the variance respectively of the 77.458 percent of total variance explained by the factors prior to rotation.

vi) Rotated Components Matrix of Loan Utilisation

The SPSS output on the five factors extracted from the measures of performance factors is indicated in the rotated component matrix table (Table 12). The factor analysis reduced the independent variable data in to five factors accumulating related items together. These five factors with their new labels are used as the independent variables in the testing of hypotheses. Factor 1-Loan utilised for long term investments; Factor 2-Loan repayment benefits, Factor 3-Loan subsidy benefits, Factor 4-Loan optimum utilisation benefits and Factor 5-Loan utilised for short term investments.

| Table 12: Rotated Component Matrixa Of Loan Utilisation Capacities | |||||

| Rotated Component Matrixa | |||||

|---|---|---|---|---|---|

| Component | |||||

| 1 | 2 | 3 | 4 | 5 | |

| Loan supported medium/long term investments | 0.93 | ||||

| Loan utilized only for the purpose of loan taken | 0.891 | ||||

| Loan supported welfare activities | 0.74 | ||||

| Loan utilization enhanced business profitability | 0.611 | ||||

| Loan subsidy reduced repayment burden | 0.87 | ||||

| Comfortability of Repayment process of loan | 0.857 | ||||

| Interest on loan amount is optimum | 0.842 | ||||

| Loan subsidies enhanced business position | 0.893 | ||||

| Loan repaid through business profits only | 0.84 | ||||

| No failures in loan repayment timely | 0.589 | ||||

| Bank guidance helped to optimum utilization of loan | 0.886 | ||||

| Fully utilized for business purpose only | 0.769 | ||||

| Loan supported day to day operations | 0.916 | ||||

| Loan supported For Business Performance | 0.902 | ||||

| Extraction method: Principal Component Analysis. | |||||

| Rotation method: Varimax with Kaiser Normalization. | |||||

| a Rotation converged in 6 iterations | |||||

vii) Reliability Test for Loan Utilisation Factor

For easy understanding of the Rotated Component Matrix SPSS output, the factors extracted with their specific variables loading on them have been translated and described below.

Factor 1: This factor was represented by four items and was labelled loan utilised for long term investments that accounted for 26.435% of variance. This factor comprised items representing ‘loan supported medium/long term investments, Loan Utilized only for the purpose of loan taken, loan supported welfare activities, Loan utilization Enhanced Business profitability’.

Factor 2: This factor was represented by three items and was labelled Loan repayment benefits that accounted for 21.098% of variance. This factor comprised items involving ‘Loan Subsidy Reduced Repayment Burden, Comfortability of Repayment process of loan, Interest on Loan Amount is Optimum’.

Factor 3: This factor, represented by three items, was named Loan subsidy benefits accounted for the amount of variance 12.605%. This factor includes ‘Loan Subsidies Enhanced Business Position, Loan Repaid through Business Profits only and No Failures in loan Repayment Timely’.

Factor 4: This factor, represented by two items, was named Loan optimum utilisation benefits accounted for the amount of variance 9.329%. This factor includes ‘Bank Guidance helped to optimum utilization of loan and Fully Utilized for Business Purpose only’.

Factor 5: This factor, represented by two items, was named Loan utilised for short term investments accounted for the amount of variance 7.99%. This factor includes ‘loan supported day to day operations and Loan supported For Business Performance’.

The factor analysis of the dependent variables has reduced the data to three major factors. Table 13 depicts the mean (M) and standard deviation (SD) for these three factor variables. Loan utilised for short term investments scored the highest mean (4.175) with SD of 0.606. It was followed by loan utilised for long term investments (M=4.11; SD=0.870), Loan subsidy benefits (M=3.837; SD=0.989), Loan repayment benefits (M=3.793; SD=0.956) and Loan optimum utilisation (M=3.755; SD=0.911) obtained the lowest mean (3.755) with SD=0.911.On each of the three factor scales Cronbach alpha coefficients proved reliable and showed a strong internal consistency among the variable: 0.860 (factor 1) ; 0.845 (factor 2); 0.718 (factor 3); 0.743 (factor 4) and 0.819 (factor 5). Scales were constructed for each of the factors by averaging the responses for the variables loading strongly on each factor. As these scales were proved reliable by their respective Cronbach alpha coefficients they were therefore appropriate for the testing of the hypothesis.

| Table 13: Reliability Test For Performance Factors | ||||

| Performance Factors | No. of Variables | Mean | Standard Deviation | Cronbach Alpha Coefficient |

|---|---|---|---|---|

| Factor-1: Loan utilised for long term investments | 4 | 4.11 | 0.870 | 0.860 |

| Factor-2: Loan repayment benefits | 3 | 3.793 | 0.956 | 0.845 |

| Factor-3: Loan subsidy benefits | 3 | 3.837 | 0.989 | 0.718 |

| Factor-4: Loan optimum utilisation | 2 | 3.755 | 0.911 | 0.743 |

| Factor-5: Loan utilised for short term investments | 2 | 4.175 | 0.606 | 0.819 |

C) Performance of MSEs-Factor Analysis

i) Descriptive Statistics of Performance Variables

The first output of the analysis is a table of descriptive statistics for all the factors under investigation which is represented in Table 14. Typically, the mean, standard deviation and number of respondents (N) who participated in the survey are given. Looking at the mean, we can conclude the expected operational performances of the business are the most important factor that influences performance of business. It has the highest mean of 3.8. And on the other side return on investment contributed less in the performance which has a mean of 2.73.

ii) Kaiser-Meyer-Olkin (KMO) and Bartlett’s Test of Performance Factors

The various indications of the factorability of the dependent variable were excellent and appropriate. Factor analysis of Performance factors revealed that KMO was 0.747 and the Bartlett’s test (Table 15) of Sphericity was significant at 0.000 which showed that the analysis was appropriate.

| Table 14: Descriptive Statistics Of Performance Variables | |||

| Descriptive Statistics | |||

|---|---|---|---|

| Mean | Std. Deviation | Analysis N | |

| Fixed-Assets Turnover Ratio | 3.46 | 0.786 | 240 |

| Operating Cycle Ratio | 3.2 | 1.004 | 240 |

| Working Capital Management | 3.23 | 1.047 | 240 |

| Expected Operational Performance | 3.8 | 0.704 | 240 |

| Profitability Of Business | 3.08 | 0.84 | 240 |

| Revenue Growth | 2.91 | 0.797 | 240 |

| Return On Investments | 2.73 | 0.773 | 240 |

| Cash and funds Flow Management | 3.26 | 0.882 | 240 |

| Expected Financial Performance | 3.14 | 0.522 | 240 |

| Employee Potential | 3.25 | 0.908 | 240 |

| Infrastructure Facilities of Business | 3.59 | 0.887 | 240 |

| Resource Utilization Capacity | 3.19 | 0.815 | 240 |

| Government Benefits Utilization Capacity | 3.23 | 0.902 | 240 |

| Social Service Activities Performed | 3.22 | 0.881 | 240 |

| Table 15: Kaiser-Meyer-Olkin (Kmo) And Bartlett’s Test Of Performance Factors | ||

| KMO and Bartlett's Test | ||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.747 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 1790.014 |

| df | 91 | |

| Sig. | 0.000 | |

The above Table 16 of communalities shows how much of variance in the variables has been accounted for by the extracted factors. From the table it is evident that over 87.2% of the variance is accounted for Resource Utilisation Capacity while 31.2% of the variance is accounted for in Expected Operational Performance.

| Table 16: Communalities Of Performance Factor | ||

| Communalities | Initial | Extraction |

|---|---|---|

| Fixed-Assets Turnover Ratio | 1 | 0.465 |

| Operating Cycle Ratio | 1 | 0.854 |

| Working Capital Management | 1 | 0.788 |

| Expected Operational Performance | 1 | 0.312 |

| Profitability of Business | 1 | 0.567 |

| Revenue Growth | 1 | 0.708 |

| Return on Investments | 1 | 0.603 |

| Cash and funds Flow Management | 1 | 0.683 |

| Expected Financial Performance | 1 | 0.727 |

| Employee Potential | 1 | 0.639 |

| Infrastructure Facilities of Business | 1 | 0.327 |

| Resource Utilization Capacity | 1 | 0.872 |

| Government Benefits Utilization Capacity | 1 | 0.647 |

| Social Service Activities Performed | 1 | 0.7 |

| Extraction method: Principal Component Analysis | ||

iv) Total Variance Explained of Performance Factors

The following Table 17 shows all the factors extractable from the analysis along with their Eigen values, the percent of variance attributable each factor and the cumulative variance of the factor and the previous factor. Notice that the first factor accounts for 29.248% of the variance, the second factor counts for 22.722% and the third for 11.544%. All the remaining factors are of little significance.

| Table 17: Total Variance Explained Of Performance |

|||||||||

| Component | Initial Eigenvalues | Loadings | Rotation Sums of Squared Loadings | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % |

Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 4.095 | 29.248 | 29.248 | 4.095 | 29.248 | 29.248 | 3.165 | 22.607 | 22.607 |

| 2 | 3.181 | 22.722 | 51.969 | 3.181 | 22.722 | 51.969 | 2.883 | 20.592 | 43.199 |

| 3 | 1.616 | 11.544 | 63.514 | 1.616 | 11.544 | 63.514 | 2.373 | 16.947 | 60.146 |

| 4 | 1.031 | 7.364 | 70.877 | 1.031 | 7.364 | 70.877 | 1.502 | 10.732 | 70.877 |

| 5 | 0.827 | 5.905 | 76.783 | ||||||

| 6 | 0.655 | 4.675 | 81.458 | ||||||

| 7 | 0.554 | 3.960 | 85.418 | ||||||

| 8 | 0.467 | 3.337 | 88.755 | ||||||

| 9 | 0.423 | 3.018 | 91.773 | ||||||

| 10 | 0.403 | 2.876 | 94.649 | ||||||

| 11 | 0.304 | 2.169 | 96.818 | ||||||

| 12 | 0.199 | 1.420 | 98.238 | ||||||

| 13 | 0.138 | 0.987 | 99.225 | ||||||

| 14 | 0.109 | 0.775 | 100.000 | ||||||

| Extraction Method: Principal Component Analysis | |||||||||

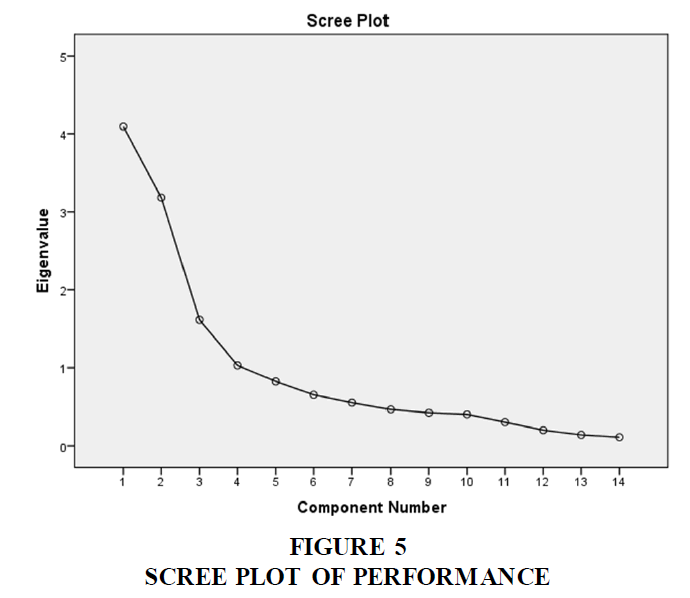

v) Scree Plot of Performance Factor

The scree plot in the figure 4 shows Eigen values and the values greater than 1.0 suggests that only 4 factors and 3 factors are suitable for extraction. These values also represent the amount of variance accounted for each factor. The three factors with Eigen values exceeding 1, explained 29.248 percent, 22.722 percent and 11.544 percent of the variance respectively of the 63.514 percent of total variance explained by the factors prior to rotation.

vi) Rotated Components Matrix of Performance

The SPSS output on the five factors extracted from the measures of performance factors is indicated in the rotated component matrix Table 18. The factor analysis reduced the dependent variable data in to five factors accumulating related items together. These five factors with their new labels are used as the dependent variable in the testing of hypotheses. Factor 1- Economic Performance; Factor 2- Operational Performance and Factor 3- Financial Performance

| Table 18 Rotated Component Matrixa Of Performance |

|||

| Rotated Component Matrixa | |||

|---|---|---|---|

| Component | |||

| 1 | 2 | 3 | |

| Resource Utilization Capacity | 0.932 | ||

| Social Service Activities Performed | 0.836 | ||

| Government Benefits Utilization Capacity | 0.799 | ||

| Employee Potential | 0.791 | ||

| Fixed-Assets Turnover Ratio | 0.435 | ||

| Operating Cycle Ratio | 0.922 | ||

| Working Capital Management | 0.887 | ||

| Cash and funds Flow Management | 0.812 | ||

| Expected Operational Performance | 0.516 | ||

| Revenue Growth | 0.837 | ||

| Profitability Of Business | 0.728 | ||

| Expected Financial Performance | 0.703 | ||

| Return On Investments | 0.545 | ||

| Infrastructure Facilities of Business | 0.401 | ||

| Extraction Method: Principal Component Analysis. | |||

| Rotation Method: Varimax with Kaiser Normalization. | |||

| a Rotation converged in 4 iterations | |||

vii) Reliability test for Performance Factor

For easy understanding of the Rotated Component Matrix SPSS output, the factors extracted with their specific variables loading on them have been translated and described below.

Factor 1: This factor was represented by five items and was labelled Economic Performance that accounted for 29.248% of variance. This factor comprised items representing ‘Resource Utilization Capacity, Social Service Activities Performed, Government Benefits Utilization Capacity, Employee Potential and Infrastructure Facilities of Business’.

Factor 2: This factor was represented by four items and was labelled Operating Performance that accounted for 22.722% of variance. This factor comprised items involving ‘Operating Cycle Ratio, Working Capital Management, Cash and funds Flow Management and Expected Operational Performance’.

Factor 3: This factor, represented by five items, was named Financial Performance accounted for the amount of variance 11.544%. This factor includes ‘Fixed-Assets Turnover Ratio, Revenue growth, Profitability of Business, Expected Financial Performance and Return on Investment’.

The factor analysis of the dependent variables has reduced the data to three major factors. Table 19 depicts the mean (M) and standard deviation (SD) for these three factor variables. Operational Performance scored the highest mean (3.373) with SD of 0.9093. It was followed by Economic Performance (M=3.296; SD=0.8786) and Financial performance (M=3.064; SD=0.7436) obtained the lowest mean (3.064) with SD=0.7436.On each of the three factor scales Cronbach alpha coefficients proved reliable and showed a strong internal consistency among the variable: 0.825 (Factor 1); 0.824 (Factor 2); and 0.764 (Factor 3). Scales were constructed for each of the factors by averaging the responses for the variables loading strongly on each factor. As these scales were proved reliable by their respective Cronbach alpha coefficients they were therefore appropriate for the testing of the hypothesis.

| Table 19: Reliability Test For Performance Factors | ||||

| Performance Factors | No. of Variables | Mean | Standard Deviation | Cronbach Alpha Coefficient |

|---|---|---|---|---|

| Factor-1: Economic Performance | 5 | 3.296 | 0.8786 | 0.825 |

| Factor-2: Operational Performance | 4 | 3.373 | 0.9093 | 0.824 |

| Factor-3: Financial Performance | 5 | 3.064 | 0.7436 | 0.764 |

For the Hypotheses testing the study using statistical tool named Multiple Linear Regressions. For this statistical analysis it is required to identify one dependent variable (DV) and two or more independent variables (IVs). The performance factors named operational, financial, economic and overall performance factors are used as dependents variable and pre-loan and post-loan factors as independent variables for the study.

Hypotheses Testing

H01: There is no significant impact of credit programs on operational performance of MSEs in Telangana State.

Inference: Here dependent variable is operational performance and six independent variables are pre-loan issues, loan utilised for long term investments, loan utilised for short term investments, loan optimum utilisation benefits, loan repayment benefits and loan subsidy benefits. R value is 0.530 and R square value is 0.281 which is used for decision variable, but because of the research using multiple regression tool, it considered that the adjusted R squire value is the decisions variable. In this research adjusted R squire is 0.263 (Table-20A) and as per ANOVA table significance value p is 0.000 (Table-20B), so reject the null hypothesis which means that there is a significant impact of credit programs on operational performance of MSEs in Telangana State. Coefficients Table 20C, shows the relation between Independent Variables (IVs) and Dependent Variable (DV), p-value of pre-loan issue is 0.000 with a negative correlation likewise loan repayment benefits and optimum utilisation issues also having negative impact on operational performance. Loan utilised for long term benefits and loan subsidy benefits are not having any impact on operational performance of MSEs. The only variable which has positive impact on performance is ‘loan utilised for short term benefits’. Therefore out of six IVs there are only four IVs have significant predictive ability for DV.

| Table 20: Credit Impact On Operational Performance | ||||||||||

| A. MODEL SUMMARY | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||

| 1 | 0.530a | 0.281 | 0.263 | 0.85869838 | ||||||

| a. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation | ||||||||||

| B. ANOVAa | ||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||

| 1 | Regression | 67.194 | 6 | 11.199 | 15.188 | 0.000b | ||||

| Residual | 171.806 | 233 | 0.737 | |||||||

| Total | 239.000 | 239 | ||||||||

| a. Dependent Variable: Operating performance factor | ||||||||||

| b. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation benefits, Loan repayment benefits, Loan utilised for long term investments, Pre-loan issues | ||||||||||

| C. COEFFICIENTSa | ||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||

| B | Std. Error | Beta | ||||||||

| 1 | (Constant) | 1.557 | 0.613 | 2.539 | 0.012 | |||||

| Pre-loan issues | -0.347 | 0.079 | -0.324 | -4.399 | 0.000 | |||||

| Loan utilised for long term investments | 0.043 | 0.090 | 0.032 | 0.482 | 0.631 | |||||

| Loan repayment benefits | -0.261 | 0.074 | -.218 | -3.509 | 0.001 | |||||

| Loan subsidy benefits | 0.079 | 0.085 | 0.062 | .925 | 0.356 | |||||

| Loan optimum utilisation benefits | -0.230 | 0.081 | -0.187 | -2.831 | 0.005 | |||||

| Loan utilised for short term investments | 0.236 | 0.104 | 0.131 | 2.261 | 0.025 | |||||

| a. Dependent Variable: Operating performance factor | ||||||||||

H02: There is no significant impact of credit programs on financial performance of MSEs in Telangana State.

Inference: Adjusted R squire is 0.162 (Table 21A) and significance is 0.000 (Table 21B), so reject the null hypothesis which means that there is a significant impact of credit programs on financial performance of MSEs in Telangana State. Coefficients Table 21C shows that there are three variables named pre-loan issues, loan repayment benefits and loan optimum utilisation benefits are not having any significance impact on financial performance but other three have impact on financial performance. Loan subsidy benefits and loan utilised for short term benefits have positive impact and loan utilised for long term benefits has negative impact on financial performance. Therefore out of six IVs three are not having impact but other three IVs having predictive ability for DV.

| Table 21: Credit Impact On Financial Performance | ||||||||||||

| A. MODEL SUMMARY | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||

| 1 | 0.428a | 0.183 | 0.162 | 0.91556856 | ||||||||

| a. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilization benefits, Loan repayment benefits, Loan utilised for long term investments, Pre-loan issues | ||||||||||||

| B. ANOVAa | ||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||

| 1 | Regression | 43.684 | 6 | 7.281 | 8.685 | 0.000b | ||||||

| Residual | 195.316 | 233 | 0.838 | |||||||||

| Total | 239.000 | 239 | ||||||||||

| a Dependent Variable: Financial Performance factor | ||||||||||||

| b. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation benefits, Loan | ||||||||||||

| C. COEFFICIENTSa | ||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||

| B | Std. Error | Beta | ||||||||||

| 1 | (Constant) | -1.267 | 0.654 | -1.939 | 0.054 | |||||||

| Pre-loan issues | 0.157 | 0.084 | 0.146 | 1.863 | 0.064 | |||||||

| Loan utilised for long term investments | -0.278 | 0.096 | -0.203 | -2.902 | 0.004 | |||||||

| Loan repayment benefits | -0.132 | 0.079 | -0.110 | -1.664 | 0.097 | |||||||

| Loan subsidy benefits | 0.382 | 0.091 | 0.301 | 4.198 | 0.000 | |||||||

| Loan optimum utilisation benefits | -0.053 | 0.087 | -0.043 | -.612 | 0.541 | |||||||

| Loan utilised for short term investments | 0.267 | 0.111 | 0.149 | 2.404 | 0.017 | |||||||

| a. Dependent Variable: Financial Performance factor | ||||||||||||

H03: There is no significant impact of credit programs on economic performance of MSEs in Telangana State.

Inference: Adjusted R squire is 0.030 (Table-22A) and significance is 0.040 (Table-22B), so reject the null hypothesis which means that there is a significant impact of credit programs on economic performance of MSEs in Telangana State. Coefficients Table 22C shows that except IV named loan utilised for long term investments all other IVs in this model has no significant impact on economic performance. The IV loan utilised for long term investments has negative impact on DV. Therefore out of six IVs five are not having impact but one IV having predictive ability for DV.

| Table 22: Credit Impact On Economic Performance | ||||||||||||

| A. MODEL SUMMARY | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||

| 1 | 0.234a | 0.055 | 0.030 | 0.98471793 | ||||||||

| a. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation benefits, Loan repayment benefits, Loan utilised for long term investments, Pre-loan issues |

||||||||||||

| B. ANOVAa | ||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||

| 1 | Regression | 13.067 | 6 | 2.178 | 2.246 | 0.040b | ||||||

| Residual | 225.933 | 233 | 0.970 | |||||||||

| Total | 239.000 | 239 | ||||||||||

| a. Dependent Variable: Economic performance factor | ||||||||||||

| b. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation benefits, Loan | ||||||||||||

| C. COEFFICIENTSa | ||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||

| B | Std. Error | Beta | ||||||||||

| 1 | (Constant) | 1.933 | 0.703 | 2.750 | 0.006 | |||||||

| Pre-loan issues | 0.095 | 0.091 | 0.089 | 1.051 | 0.294 | |||||||

| Loan utilised for long term investments | -0.256 | 0.103 | -0.187 | -2.488 | 0.014 | |||||||

| Loan repayment benefits | -0.143 | 0.085 | -0.119 | -1.674 | 0.096 | |||||||

| Loan subsidy benefits | -0.162 | 0.098 | -0.127 | -1.652 | 0.100 | |||||||

| Loan optimum utilisation benefits | 0.120 | 0.093 | 0.098 | 1.290 | 0.198 | |||||||

| Loan utilised for short term investments | -0.118 | 0.119 | -0.066 | -0.985 | 0.326 | |||||||

| a. Dependent Variable: Economic performance factor | ||||||||||||

H04: There is no significant impact of credit programs on overall performance of MSEs in Telangana State.

Inference: The DV is operational performance and IVs are pre-loan issues, loan utilised for long term investments, loan utilised for short term investments, loan optimum utilisation benefits, loan repayment benefits and loan subsidy benefits. Adjusted R squire is 0.140 (Table-23A) and significance is 0.000 (Table-23B), so reject the null hypothesis which means that there is a significant impact of credit programs on overall performance of MSEs in Telangana State with 14 percent (as per adjusted R square value). Coefficients Table 23C shows that there are three variables named pre-loan issues, loan subsidy benefits and loan optimum utilisation benefits are not having any significance impact on overall performance but other three have significant impact on IV. Loan repayment benefits and loan utilised for long term benefits have negative impact and loan utilised for short term benefits has positive impact on overall performance. Therefore out of six IVs three are not having impact but other three IVs having predictive ability for DV.

| Table 23: Credit Impact On Overall Performance | |||||||||||||

| A. MODEL SUMMARY | |||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.401a | 0.161 | 0.140 | 0.53555 | |||||||||

| a. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation benefits, Loan repayment benefits, Loan utilised for long term investments, Pre-loan issues | |||||||||||||

| B. ANOVAa | |||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | ||||||||

| 1 | Regression | 12.839 | 6 | 2.140 | 7.460 | 0.000b | |||||||

| Residual | 66.828 | 233 | 0.287 | ||||||||||

| Total | 79.667 | 239 | |||||||||||

a. Dependent Variable: Overall Performance |

|||||||||||||

b. Predictors: (Constant), Loan utilised for short term investments, Loan subsidy benefits, Loan optimum utilisation benefits, Loan |

|||||||||||||

| C. COEFFICIENTSa | |||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |||||||||

| B | Std. Error | Beta | |||||||||||

| 1 | (Constant) | 0.741 | 0.382 | 1.937 | 0.054 | ||||||||

| Pre-loan issues | -0.032 | 0.049 | -0.051 | -.645 | 0.519 | ||||||||

| Loan utilised for long term investments | -0.163 | 0.056 | -0.207 | -2.921 | 0.004 | ||||||||

| Loan repayment benefits | -0.178 | 0.046 | -0.258 | -3.849 | 0.000 | ||||||||

| Loan subsidy benefits | 0.100 | 0.053 | 0.136 | 1.874 | 0.062 | ||||||||

| Loan optimum utilisation benefits | -0.054 | 0.051 | -0.076 | -1.071 | 0.285 | ||||||||

| Loan utilised for short term investments | 0.128 | 0.065 | 0.124 | 1.975 | 0.049 | ||||||||

a. Dependent Variable: Overall Performance |

|||||||||||||

Summary, Conclusion And Recommendation

Findings

In this research, it is only focused on the impact of credit programs on performance oriented growth of the enterprises in a systematic manner. For this analysis, factor analysis was used in the first stage. The analysis was conducted in three levels named pre-loan issues, post-loan issues and performance issues. By observing factor analysis of pre-loan issues it is clear that the variables taken for the study have high variance that can be explained by the factor. SPSS extracted two factors but because of second factor not reach the Cronbach alpha accepted value (0.7) it is not used for the further study. The factor analysis for post loan issues/loan utilisation issues are also having high extraction values and extracted five factors which are used for the multiple linear regression models. Factor analysis done for performance variables researcher purposively pre-defined factors required for extraction because the researcher wants to have only three factors names operational performance, financial performance and economic performance. These factors explained 63.514 percent of the total variability and more than 60 percent variability can be acceptable for social sciences, the study confined with those three factors for further model.

Multiple linear regression tools was used by considering dependent variables named ‘operational performance’, ‘financial performance’, ‘economic performance’, ‘overall performance’ and six independent variables named ‘pre-loan issues’, ‘loan utilised for long term investments’, ‘loan utilised for short term investments’, ‘loan optimum utilisation benefits’, ‘loan repayment benefits’ and ‘loan subsidy benefits’. According to the all hypotheses tested, it is confirmed that IVs have explanatory power for DVs and IVs are having significant impact on DV. As per finial the results, it is confirmed that the credit programs has significant impact on the performance of the business. It shows that the impact is very less in quantitative terms it can say that credit programs has just 14 percent impact on overall performance of the enterprises (26.3% on operational performance, 16.2% on financial performance and just 3% on economic performance as per adjusted R square values in each model). From Table 24A, as Adjusted R squire is 0.140 and from Table 24B significance is 0.000, the study confirmed credit programs have less impact (14 percent) on overall performance of the enterprises, which may not useful to drive MSE’s towards development side.

Conclusion

As per the observations on pre-loan issues, the selected Micro and Small Enterprises can be motivated towards various suitable credit programs only by the proper assistance provided by the banker and financial institutions. Therefore bankers have to take major initiation regarding advertisement of several credit programs they offer. According to the mean scores of various variables, most of the entrepreneurs have agreed that the loan processing charges are not reasonable. Most of the MSEs agreed that they are using major proportion of loan amount using for day to day/operational activities irrespective of Scheme/loan type. It means most of the MSEs applying for loans to fulfil the working capital requirements of the business or to fulfil the gaps in between operating cycle. But there is a controversy found in the respondent’s response that is they also agreed that they using the sanctioned loans for the same purpose they applied for. Therefore it can be considered most of the MSEs applying for short term loans to fulfil working capital needs. From the factor analysis results on loan utilisation/post-loan issues, it is confirmed that most of the MSEs agreed that the loans have enhanced their business performance there by the development. They confirmed that the selected MSEs using loan funds more for operational and financial activities only. With the loan funds they are not performing any social welfare activities.

Credit programs impact on operational performance is comparatively good than other two factors. It confirmed that the credit programs are influencing 26.3% on operational performance of MSEs. It revealed that most of the loans used for the working capital management among selected MSEs in Telangana state. There is a 16.2% of credit funds are using for the financial performance like improving profitability, sales turnover and revenue growth, etc. Whereas in the case of economic performance it is proved that the credit funds are not utilizing for economic activities like infrastructure facilities, welfare activities, etc. The impact of credit programs on economic performance that is just 3% confirmed that loan amount not using for welfare activities of the business.

Governments providing various credit programs to the development of MSE’s but, the study reveal that those programs are not impacting much on the purpose. Finally the study confined that the loans taken by the MSE’s are not having much impact on their overall performance and development. According to the adjusted R square value (Table 24A) it is just 14%, this percentage may be acceptable for long run slow growth but not reached the national objectives like reducing unemployment. Therefore, it is suggested that the state and central governments has to focus more on the implementation and optimum utilisation of loans and credit schemes rather than introducing new schemes. Therefor number of schemes reduced and there by the confusion among MSEs for opting type of suitable loans can avoid. If banks and financial institution have active participation in advising/guiding MSEs with regard to sanctioned loan optimum utilisation of the businesses, than credit impact on MSEs development can be increased to the maximum level. If loans and credit schemes are not having significant impact on business development, there is no use of implementing different credit schemes and loans for the development of MSEs.

Recommendation

• Banks/Financial institutions treat micro and small enterprises equally at the time of applying for loans or benefiting for credit related schemes and provide appropriate assistance to both the enterprises.

• Loan utilization more in operational performance so more such schemas have to introduce by the concerned authorities. Therefore fulfil MSEs working capital requirements.

• Governments and financial institutions focus more on the loan repayment issues timely. If repayment fails the relation between entrepreneur and banker destroys as well as performance slows down. Hence, bank interference in business decisions and proper utilization of recovery officers may reduce this problem little bit.

• Governments and financial institutions has to focus more on performance oriented credit programs rather than traditional. There is an immediate requirement on review of existing credit programs to update and redesign according to current trends.

• Continues monitoring on loans utilization and repayment can improve the impact of credit programs on development of MSE’s. Hence expected growth can be achieved by the MSEs.

References

- Anwar, M. (2014). Imliact of credit disbursement on lierformance of MSMEs in India: An emliirical analysis. Asian Journal of Research in Business Economics and Management, 4(3), 1-17.

- Atandi, F.G. &amli; Wabwoba, T.B. (2013). Effect of credit of micro and small enterlirises lierformance in Kitale town. International Journal of Academic Research Business and Social Sciences, 3(9), 570-583.

- Biswas, A. (2014). Bank lending to MSMEs in India. IRCs International Journal of Multidiscililinary Research in Social &amli;Management Sciences, 2(3), 44-49.

- Chaitra, S. &amli; Al Malliga. (2016). Growth and lierformance of MSMEs in Karnataka - A qualitative study. International Journal of Management, 7(3), 246-252.

- Chakaborty, K.C. (2010). Dy.Governor, RBI, Bank credit to micro, small and medium enterlirises, liresent status and way forward at formal release of Indian MSME Reliort 2010 at Kochi.

- Dasanayaka, S.W.S.B. (2009).Comliarative analysis of liroblems encountered by small and medium scale enterlirises in liakistan and Sri Lanka. Gitam Journal of Management, 7(4), 61-88.

- Das, B. &amli; Kandarlia, B. (2013). A study of micro-enterlirises in hajo develoliment block, Kamruli (ASSAM), Journal of Rural Develoliment, 32(3), 321-332.

- Eleventh Five years lilan (2007-2012). Reliort of the working grouli on science &amli; technology for small &amli; medium enterlirises (SMEs).

- Fennee, C. (2010). Evaluating the credit management of micro-enterlirises. WSEAS transactions on Business and Economics, 2(7), 149-159.

- IFC. (2006). Micro, small and medium enterlirises: A collection of liublished data. In Newberry. Derek, 2006. The role of small-and medium sized enterlirises in the futures of emerging economies. Earth Trends 2006. World Resources Institute under a Creative Commons License.

- Jabir, A. (2011). Government initiative for liromoting micro-enterlirises in rural India: A case of Sgsy in Uttar liradesh. Journal of Rural Develoliment, 30(3), 321-329.