Research Article: 2019 Vol: 23 Issue: 6

Critical Success Factors for ERP System Implementation to Support Financial Functions

Ayogeboh Epizitone, Durban University of Technology

Oludayo. O. Olugbara, Durban University of Technology

Abstract

Implementation of Enterprise Resource Planning (ERP) systems is a complex technological and organisational business undertaking that requires the knowledge of a process approach to overcome its implementation constraints. The purpose of this study is to determine those factors that are considered critical for successful implementation of an ERP system within the financial system of an organisation. To achieve this, it is necessary to first identify common factors impacting on ERP system implementation and thereafter ascertain whether those identified factors are applicable in different organisation settings with particular emphasis on a financial system. With these factors forming precursor, this study plans a comprehensive exploration of an ERP system implementation that supports financial business process within the context of a financial sector to uncover critical factors for success. In aggregate, 205 Critical Success Factors (CSFs) have been identified from 127 studies from which 20 factors are presented in this paper. The most cited factors are then ranked based on median statistics to select top 6 CSFs that are succinctly discussed within the context of a financial system.

Keywords

Critical Success Factors, Enterprise Resource, Financial System Function/Role, Higher Education.

Introduction

The deployment of Enterprise Resource System (ERP) implementation has been substantively beneficial to organisation however not without constraints such as; inappropriate usage, failed system and real-time challenges. In the ERP environment there has been significant transformation of vast business financial roles with certain financial functions not supported. The purpose of this research is to identify factors of Enterprise Resource system implementation that are crucial and support financial functions in the salary system in the higher education institution (HEI) as an effort to lessen the high failure rate of ERP implementation in developing countries. This study will conduct a comprehensive exploratory literature review of critical success factors of ERP implementation that would support financial functions. To achieve the following key research questions will be addressed in this study. Research question

1. To identify the minimum set of critical factors for ERP implementation that would support financial functions

2. To explore significance of each CSFs in salary sub-system mediated by successful implementation

An exploratory study on journal articles obtain from online database particle those from the web of science will be study. This article will provide contemporary knowledge on critical success factors of ERP implementation that supports financial functions. To holistically understanding these crucial factors, require to mediate a successful ERP implementation. A comprehensive and empirically validated minimum set of CSFs will therefore be identify in these studies. This will provide a basis for additional inquiries from scholars and insight to practitioners for successful ERP system.

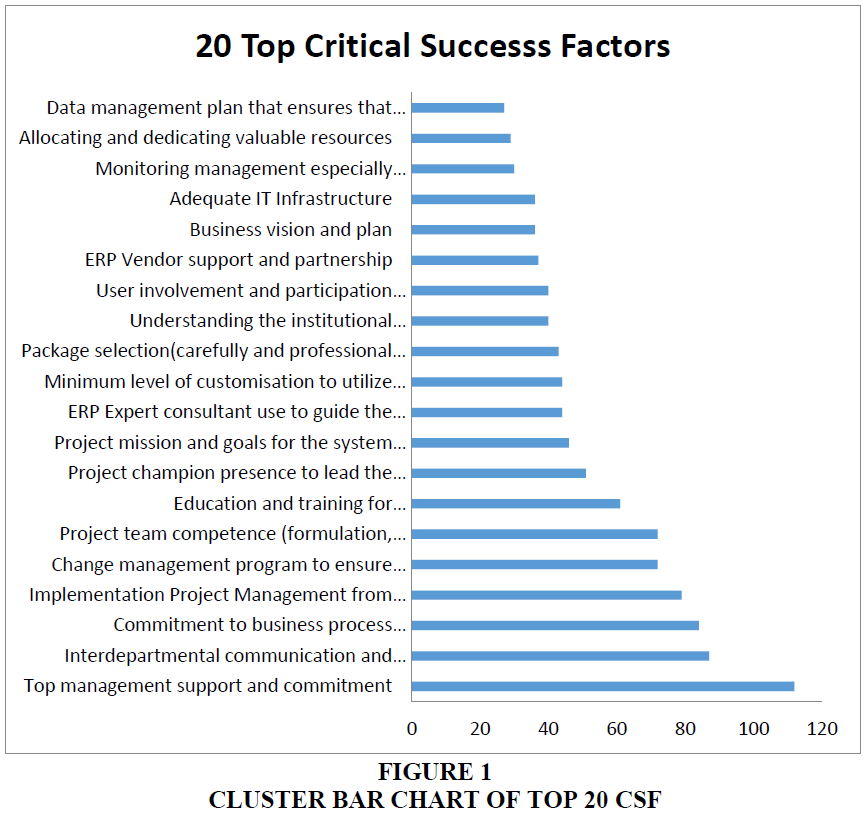

Therefore, with the main objective of this study being to identify critical success factors (CSF) within an enterprise resource planning (ERP) system design to support financial functions. The approaches adopted to conduct this study will be detail in the methodology section with special emphasis on critical success factor. Critical success factors identify from literature are 205 in aggregate from 127 studies, however 20 top CSF has been presented. The most cited will then be rank in the finding and six top CSFs from journal will be discuss within the financial context.

Literature Review

ERP Systems

In today competitive environment enterprise around the globe are facing the need to be reformed to gain competitive advantage and differentiation. Implementing new information system (IS) like the Enterprise Resource Planning (ERP) system is one of the fastest and most effective ways to achieve enterprise reformation. (Chen et al., 2012, Thompson et al., 2018) ERP system is considered by researcher and practitioners as one of the most innovative development in information technology for effective and efficient information management (Ahmad & Cuenca, 2013, Françoise et al., 2009). ERP implementation is essential for building a strong IS infrastructure that unified business functions to automate and integrate core processes across departments (Ghuman & Chaudhary, 2012; Mutongwa & Rabah, 2013).

ERP system as elucidated by Boykin (2001); Chen (2001) and Yen (2002) is said to be a business management system that when successfully implemented, manages and integrate all business functions within an organization. ERP supports efficient operation of business processes by integrating business task relating to sales, marketing, manufacturing, logistics, accounting and staffing. They are an indispensable facet for the efficient operation of organisations (Beatty & Williams 2006; Chen et al., 2012; Antoniadis et al., 2015). However, there has been significantly impact on the role of accountant brought by the implementation of ERP system. Function have been change and consolidated with some functions not supported. Chen et al. (2012) summarise the operations under ERP environment related to accountants’ functions. These functions are data input, General accounting transactions, data compilation and filling, data adjustment and amendment, financial analysis, risk management, enterprise risk assessment, system maintenance, system evaluation, communication and coordination among departments, integration of cost data relating to operation, participation in management decision making, computer auditing and education and training.

ERP involves the combination of various functional information systems. Many organisations apply ERP to specific functional area within the organisations (Kumar & Van Hillegersberg 2000; ALdayel et al. 2011; Erkan, 2011) A phased life cycle is used during implementation of any sub-system. This is followed by a post-implementation phase which incorporates maintenance, upgrades and new integrations to existing sub-systems (Motiwalla & Thompson, 2012). These sub-systems in many organisations are in need of continuous improvement to stay aligned with current technologies and addressing emergent needs.

Despite ERP systems being a very crucial business system providing benefits such as: improving the effectiveness and efficiency of the corporate IT infrastructure and enabling the integration of global business processes (Al-Nafjan & Al-Mudimigh 2011; Karande et al., 2012; Xu & Quaddus, 2013). Nevertheless, there have been failures and dissatisfaction reported by many companies such as; failed ERP system, inappropriate usage, ERP system complexity, overspent budget and delay (Fui-Hoon Nah et al., 2001; Belfo & Trigo 2013; Mushavhanamadi & Mbohwa 2013; Olugbara et al., 2014; Shatat 2015; Tobie et al., 2016).

Resultantly, these phenomenon has been confront by researchers using the taxonomy of previous research (Ngai et al., 2008; Shaul & Tauber, 2013) and identifying these factors that lead to a successful ERP implementation (Maditinos et al., 2011; Ahmad & Cuenca, 2013; Shatat 2015; Thompson et al., 2018). Some Researchers express a shortfall of literature that addresses these challenges in Higher education institutions where failure rate is said to be higher than in other organisation and the lack of contextualisation of ERP implementation in Africa (Abugabah & Sanzogni, 2010; ALdayel et al., 2011; Karande et al., 2012; Olugbara et al., 2014; Thompson et al., 2018).

These are apparent for financial system where there exists little research. Sammon and Adam (2010) agree that ERP implementation in organisation requires knowledge of process approach, a specific organisation, its environment, and competition and information technology. Though there is significant experience in organisation nevertheless implementation of ERP system in the financial sector requires cognitive and practical studies. Some researcher express that ERP system implementation brings changes to certain organisation processes and nature of the jobs (Chen et al., 2012; Belfo & Trigo 2013; Trigo et al., 2014). Due to the nature of certain jobs in the financial sector being alter before, during and after ERP system implementation and the inadequateness of ERP towards financial functions (Arnold, 2018). Therefore, under these circumstances, ensuring the success of ERP implementation that support financial system function becomes an important undertaking that need to go beyond identifying and proposing taxonomy of Critical success factors (CSF).

Critical Success Factors (CSF)

According to Ziemba and Oblak (2013) CSFs are those areas and activities which be primarily focused on in other to achieve the most satisfying results of the ERP system implementation (Bueno and Salmeron 2008; Amid, Moalagh and Ravasan 2012). Prevalent literature exists on CSFs for ERP implementation for the whole life cycle in organisations. However, there is a shortage of research conducted on the post-implementation and particularly on the financial sub-system on the implementation of ERP system in higher education (Rabaa'i 2009; Abugabah & Sanzogni, 2010). Hence, this study posits a gap in the body of knowledge in this area and endeavours to contribute by establishing a set of critical success factors (CSF) for ERP post-implementation system. At the same time, it extends existing literature in the stream of higher education ERP systems and financial sub-system.

According to Motiwalla & Thompson (2012) the proliferation of Enterprise Resource Planning (ERP) system implementation continues and will continue at a rapid pace with new generations of systems capitalizing on what has already been accomplished. However, there are maintenance, upgrade issues, job consolidation and even high failures rates experienced today by many companies during and after implementation especially in HEI (Abugabah & Sanzogni 2010; Garg 2010; Belfo & Trigo 2013; Mushavhanamadi & Mbohwa 2013; Thompson et al., 2018).

Research on implementation of ERP system is of utmost importance because of its impact on companies around the world undergoing major step in process involving ERP implementation. An iterative process involved in the life cycle of ERP system implementation is maintenance and update (Nah & Delgado 2006). However a large amount of research that has been done on Critical success factors (CSFs) of ERP system focuses predominantly on the implementation phase but lacking on pre and post implementation with findings being repetitive, inconsistent and lacking empirical studies (Esteves & Pastor, 2000; Finney & Corbett, 2007; Hedman, 2010; Matende & Ogao, 2013; Ali & Miller, 2017).

Critical review of literature highlights the need for the dynamic nature of CSFs to be carefully considered because though factors discussed in literature are deem important their relevance varies with time (life-cycle stages) and across stakeholders (Ahmad & Cuenca 2013; Thompson et al., 2018). Finney & Corbett (2007) and Dawson & Owens (2008) indicated the lack of adequate research into significant CSFs consideration. While, Esteves & Pastor (2006) identified success criteria within a single ERP system implementation phase. Yu (2005) supports the call for further examination as many organizations shift their strategies towards improvements or additions to already implemented ERPs. Added to this, Ram et al. (2013) and Ijaz et al. (2014) contend the large differences in success criteria for pre-implementation as opposed to post-implementation of an ERP. Shaul & Tauber (2013) investigation on success criteria in ERP implementation unveiled a serious deficiency of literature on post implementation issues, strategies, and methods to address them. These authors call for more research to investigate the success criteria for the adoption and usage phase of ERP system particularly individual phases in the context of HEI (Rabaa’I, 2009).

Literature also revealed other criticisms such as, studies being vendor specific and minimum focus on other vendor’s product commission by HEI, CFS derived from methods that lack scientific rigour and the need for more innovative research techniques Thompson, Olugbara and Singh (2018). Shortcoming with the majority of studies; emphasized on companies in developed countries with very little work focussing on developing nations like South Africa (Ram et al., 2013; Shaul & Tauber, 2013; Olugbara et al., 2014). Hsueh-Ju Chen et al., 2012 and these authors criticise the majority of existing research for their mainly theoretical literature-based analysis and call for the need for CSF study to account for the continuous technological development.

Methodology

The substantial rise in challenges in the implementation of ERP system especially in organisational environment demand a better understanding of factors that are critical to its success. Therefore, the need for extensive literature reviews utilizing a systematic conceptual approach. This study involved the analysis of content obtained from the review of existing literature and case study of previous research on CSFs in ERP systems in order to identify CSFs through analysis technique of scope review (Dantes & Hasibuan, 2011; Olugbara et al., 2014).

Preceding the systematic review for a comprehensive literature review the researcher employed utilization of search engines to retrieve related research papers to provide data needed (lugbara & Ojo, 2014, Kalema et al., 2014). Those articles containing reference to ERP system and CSF for ERP implementation were analysed in more depth. For the purpose of providing answer to question “What are the critical factors for successful implementation of an ERP system in the financial system?” These articles were identified through exhaustive search of the more prominent MIS journals and database including, but not limited to those outlined in table 1. In addition, selection of article was from the result of searches that were conducted using keywords and phrase from authors of some of the article identify in a previous literature review. The searches were limited mostly to journals that were scholarly or peer reviewed. Actual selection of article for inclusion in the literature review was dependent on the researcher. After reading the title and abstract then it was possible to determining if article could contain information that is relevant to the success factors for ERP system. The article was then use for further review or otherwise excluded.

| Table 1 Information Sources; Journals, Database and Search Keywords | |

| Journals | Keywords and Phrases |

| Information $ Management | ERP system |

| Journal of management information systems | CSF and ERP system |

| MIS quarterly | Impact of ERPs in Financial |

| The Africa Journal of Information Systems | ERPs Implementation |

| International Journal of Human and Social Sciences | CSF for ERPS in Higher Education institutions |

| Management Sciences | CSF for ERPs implementation and financials |

| Databases | Financial System & ERP system |

| Emerald Insight | Accounting information system |

| ScienceDirect | |

| Proquest | |

| Elsevier Web of science | |

Given that the aim of this study was to gain a depth of understanding of the different CSF for ERP implementation already identify by other researcher content analysis was an appropriate analysis as suggested by Silverman, 2002; Finney & Corbett, 2007.

CFS factors were identify across the six phases involved in the implementation process of ERP and categorise by different researchers as describe Table 1 (Supramaniam & Kuppusamy 2010; Shaul & Tauber, 2013) A number of factors that may affect the implementation of ERP and lead to a successful implementation were identify, validated and categorise in literatures. Among these factors a common CSF identifies in extensive literature are top management commitment and support (Table 2).

| Table 2 Previous Research | ||

| Researchers | CSF identify | Article review |

| Finney and Corbett (2007) | 26 | 70 |

| Shaul and Tauber (2013) | 94 | 341 |

| Dezdar and Sulaiman (2009) | 17 | 95 |

| Rabaa'i (2009) | 12 | 110 |

| Supramaniam and Kuppusamy (2010) | 22 | 36 |

| Ngai, Law and Wat (2008) | 18 | 48 |

| Olugbara, Kalema and Kekwaletswe (2014) | 37 | 49 |

| Thompson, Olugbara and Singh (2018) | 20 | 38 |

A comprehensive study done by Finney and Corbett (2007) identify 26 CSF using content analysis after reviewing 70 articles and considering 45 which contain CSF relevant to their study shown in Table 3. Shaul & Tauber (2013) extensive review of 341 literatures revealed 94 CSF. Furthermore, other method base on case study and literature review identifies 12 CSF that were categorising in to tactical and strategic. Table 2 highlights few previous studies overviews on CSF in ERP implementation.

| Table 3 CSF Sources Author | ||

| 20 Top Critical Success Factors | Frequencies | |

| 1 | Top management support and commitment | 112 |

| 2 | Interdepartmental communication and cooperation throughout the institution | 87 |

| 3 | Commitment to business process reengineering to do away with redundant processes | 84 |

| 4 | Implementation Project Management from initiation to closing | 79 |

| 5 | Change management program to ensure awareness and readiness for any changes that may happen | 72 |

| 6 | Project team competence (formulation, composition and involvement) | 72 |

| 7 | Education and training for stakeholders (end users, technical and IT staffs) | 61 |

| 8 | Project champion presence to lead the implementation (authorized to use internal and external resources to complete implementation) | 51 |

| 9 | Project mission and goals for the system with clear objective agreed upon | 46 |

| 10 | ERP Expert consultant use to guide the implementation process | 44 |

| 11 | Minimum level of customization to utilize ERP functionalities to maximum | 44 |

| 12 | Package selection (carefully and professional selected) | 43 |

| 13 | Understanding the institutional culture (norms, values & beliefs) | 40 |

| 14 | User involvement and participation throughout implementation | 40 |

| 15 | ERP Vendor support and partnership | 37 |

| 16 | Business vision and plan | 36 |

| 17 | Adequate IT Infrastructure | 36 |

| 18 | Monitoring management especially evaluation of performance metrics (fast effects) | 30 |

| 19 | Allocating and dedicating valuable resources | 29 |

| 20 | Data management plan that ensures that data are accurately and efficient migrated to the new system and analyzed properly | 27 |

Discussion and Results

ERP Financial System

The financial subsystem of ERP has been the focal point where industry sectors of enterprises have consistently given careful consideration at all time when implementing ERP systems. This is because an enterprise business performance and efficiency are mirror by financial management which intern targets the capital flow. In an ERP system financial management has always been a core module or function where other module feed it with information or offer services to. Despite the implementation of ERP system being embrace by many organizations especially the HIE for reason such as reformation, globalization, in formalization and modernization there have been unparalleled opportunities and challenges. Literature reports difficulties and challenges being exposed during the implementation of ERP financial subsystem as part of the ERP such as: Unrealised internal functions of financial system, Integration of financial subsystem, Shortage of guidance of modern scientific methods and Constant changes in the topology of an enterprise internal and external (Figure 1).

This study was to determine the requirements for the successful implementation of ERP system within an organisations financial system. More explicitly, to unearth those crucial key factors that impact on the implementation of financial sub-systems. Hence, the main research question devised to realise this aim is: What are the critical factors for successful implementation of an ERP system in the financial sub-system? Exploring Critical success factors for successful ERP implementation in the financial sectors. Special attention paid to ERP system supporting financial functions (accounting and finance) and CSF for ERP system implementation. A minimum unique set of CSFs consisting of 20 top ranks in literature has been presented (Table 3)

The six critical success factors to be discussed in relation to financial system implementation were selected based on the median after preforming descriptive analysis on the identify set of CSFs from literature. These CSFs feature in the top 20 factors above in Table 3. They are, Project Management (79), Interdepartmental communication and cooperation (87), Change management (72), Project team competence (formulation, composition and involvement) (72), Top management support (112) and BPR (84).

Top Management support and commitment is highly relevant in the implementation of an ERP financial system. Given that these factors have been cited by many authors is not a coincidence. The support can range from authorizing, commissioning and making available resource needed for the implementation of a financial system. A success implemented financial system is an asset to top management who rely on most output such as reports to make crucial decisions for that organization. Despite this authors have reported significant inadequately of these system when it comes to reporting hence the need for attention to be given to these are in regards to implementation (Arnold, 2018)

Business Process Reengineering refers to restructuring of business process in an organization. Commitment to business process reengineering to do away with redundant processes is also crucial to financial system implementation that functions have been highly automated. Chen et al. (2012) highlights the massive automation and job consolidation by ERP system. Indicating the new roles that must be shoulder and alignment to the system enforce (Chan et al., 2012; Dezdar & sulaiman, 2009).

Interdepartmental communication and cooperation are also a crucial factor for consideration in the implementation of a financial system. The need for open and fluent communication and cooperation between organization internal stakeholder specifically top management and system user cannot be overlooked. As failure to communicate and cooperate properly are likely the cause of failure and limitation of ERP financial system (Dezdar & Ainin, 2011; Belfo & Trigo, 2013; Trigo et al., 2014).

Project Management entails a broader scope of implementation. For the financial system to successful a good project management has be instituted. To promote the financial system in implementation, build team, deal with conflict and execute objectives of the implementation (Sykes, Venkatesh and Johnson 2014). Given that ERP project can tend to be complex attention need to be given to the implementation of the financial system (Fui-Hoon Nah et al., 2001; Somers & Nelson, 2004).

Change Management crosses through diverse aspect in the implementation of an ERP system. Change spans a great length ranging from cultural, organisational and structural. A stable and successful setting is requiring for a successful implementation (Finney & Corbett, 2007; Moon, 2007; Dezdar & Sulaiman, 2009; Shaul & Tauber, 2013).

Project team play a vital role in the implementation indicating that the formation, participation, skills and involvement is highly relevant for the success of a financial system implementation (Finney & Corbett, 2007; Moon 2007; Dezdar & Sulaiman 2009; Shaul & Tauber, 2013; Saade & Nijher, 2016).

Conclusion and Future Research

The success and failure of ERP system can be address by identifying CSF that significantly impact the implementation of ERP system. However, the good practices use in implementation ERP system identifies in literature needs verification and adjustment to their specific conditions that support financial function. Taking into consideration the roles, regulations and nature of functions in the financial sector. There are major differences between business organisation processes and financial functions which imply that the existing successful solutions do not apply to financial system. ERP system design for organisation do not account for specific financial regulations.

Though it has been stated in literature that CSF vary across the life cycle of ERP implementation. More study in to CSF was done on the entire ERP life cycle with very little on a single phase (Shaul & Tauber 2013). Some authors stress the absence of proper analytical study to identify CSF for ERP implementation that established the interrelation of CSF dependency (Supramaniam & Kuppusamy, 2010; Olugbara et al., 2014; Thompson et al., 2018).

Hence, the findings of this research highlight the need for research that looks at CSF for ERP implementation for a specific sector not the entire ERP system as postulated in existing literature trends. Furthermore, the need for CSF for ERP implementation research in the financial sector as there is little research that has been conducted in this sector. It is expected that the (CSFs) discovered during this study will contribute towards the underserved area of ERP implementation, pragmatically aiding in the improvement of a process area that is in desperate need of re-engineering to support significant financial functions in organisations It is hoped that in achieving the aims of this study, the requirements for ERP implementation in the financial system are demystified. This may then serve as a springboard to improved implementation of ERP systems in specific sector in an organisation and in the context of financial system implementation in developing nation.

A general recommendation to management for the successful implementation of ERP that support financial functions these critical factor should be given special consideration. Research Gap for future work in the effects and roles of each the following aspects listed below on ERP system.

1. Real-time challenges. Continuous technological development especial as the data are quickly becoming redundant and obsolete

2. csf in the past liteture looks at the entire ERP system and the business as a whole.

3. IT and Regulated profession

4. Vendor and business process; vendors oppinion varies vastly from organisation oppinion and user as these can be seen on th eimpact on job roles

5. HEI – Highest failure rate may be due to the complex nature and diversity of organisation process.

6. Effective and reliability of IT applications

7. Determination of CSFs in the financial domain can be an effective strategy to reduce ERP system failure and related challenges.

8. System that support financial functions enhancing ICT, analytical ability and familiarization of work processes in organisation current situation

9. Factor identify as critical are not actually critical as they vary across function and modules implemented.

Acknowledgement

The authors would like to thank DUT for their support and assistance.

References

- Abugabah, A., & Sanzogni, L. (2010). Enterprise resource planning (ERP) system in higher education: A literature review and implications. International Journal of Human and Social Sciences, 5(6), 395-399.

- Ahmad, M.M., & Cuenca, R.P. (2013). Critical success factors for ERP implementation in SMEs. Robotics and computer-integrated manufacturing, 29(3), 104-111.

- Al-Nafjan, A.N., & Al-Mudimigh, A.S. (2011). THE impact of change management in ERP system: A case study of madar. Journal of Theoretical & Applied Information Technology, 23(2).

- ALdayel, A.I., Aldayel, M.S., & Al-Mudimigh, A.S. (2011). The critical success factors of ERP implementation in higher education in Saudi Arabia: A case study. Journal of Information Technology and Economic Development, 2(2),1.

- Ali, M., & Miller, L. (2017). ERP system implementation in large enterprises: A systematic literature review. Journal of Enterprise Information Management, 30(4), 666-692.

- Amid, A., Moalagh, M., & Ravasan, A.Z. (2012). Identification and classification of ERP critical failure factors in Iranian industries. Information Systems, 37(3), 227-237.

- Antoniadis, I., Tsiakiris, T., & Tsopogloy, S. (2015). Business intelligence during times of crisis: Adoption and usage of ERP systems by SMEs. Procedia-Social and Behavioral Sciences, 175, 299-307.

- Arnold, V. (2018). The changing technological environment and the future of behavioural research in accounting. Accounting & Finance, 58(2), 315-339.

- Beatty, R.C., & Williams, C.D. (2006). ERP II: Best practices for successfully implementing an ERP upgrade. Communications of the ACM, 49(3), 105-109.

- Belfo, F., & Trigo, A. (2013). Accounting information systems: Tradition and future directions. Procedia Technology, 9, 536-546.

- Boykin, R.F. (2001). Enterprise resource planning software: A solution to the return material authorization problem. Computers in industry, 45(1), 99-109.

- Bueno, S., & Salmeron, J.L. (2008). TAM-based success modeling in ERP. Interacting with Computers, 20(6), 515-523.

- Chen, H.J., Yan Huang, S., Chiu, A.A., & Pai, F.C. (2012). The ERP system impact on the role of accountants. Industrial Management & Data Systems, 112(1), 83-101.

- Chen, I.J. (2001). Planning for ERP systems: Analysis and future trend. Business process management journal, 7(5), 374-386.

- Dantes, G.R., & Hasibuan, Z.A. (2011). Enterprise resource planning implementation framework based on key success factors (KSFs). UK Academy for Information System, 11-13.

- Dawson, J., & Owens, J. (2008). Critical success factors in the chartering phase: A case study of an ERP implementation. International Journal of Enterprise Information Systems, 4(3), 9.

- Dezdar, S., & Ainin, S. (2011). The influence of organizational factors on successful ERP implementation. Management Decision, 49(6), 911-926.

- Dezdar, S., & Sulaiman, A. (2009). Successful enterprise resource planning implementation: Taxonomy of critical factors. Industrial Management & Data Systems, 109(8), 1037-1052.

- Erkan, T.E. (2011). Enterprise resource planning implementation differences within the same methodology: Case study from west Europe and Turkey.In: Proceedings of Proceedings of the International Conference on Information Management & Evaluation, 181-186.

- Esteves, J., & Pastor, J. (2000). Towards the unification of critical success factors for ERP implementations.In: Proceedings of 10th Annual BIT Conference, Manchester, UK.

- Esteves, J., & Pastor, J.A. (2006). Organizational and technological critical success factors behavior along the ERP implementation phases. In: Enterprise information systems VI. Springer, 63-71.

- Finney, S., & Corbett, M. (2007). ERP implementation: A compilation and analysis of critical success factors. Business process management journal, 13(3), 329-347.

- Fui-Hoon Nah, F., Lee-Shang Lau, J., & Kuang, J. (2001). Critical factors for successful implementation of enterprise systems. Business process management journal, 7(3), 285-296.

- Garg, P. (2010). Critical success factors for enterprise resource planning implementation in Indian retail industry: An exploratory study. arXiv preprint arXiv:1006.5749,

- Hedman, J. (2010). ERP systems: critical factors in theory and practice. C Center for Applied ICT (CAICT), CBS, Frederiksberg,

- Ijaz, A., Malik, R., Lodhi, R.N., Habiba, U., & Irfan, S.M. (2014). A qualitative study of the critical success factors of ERP system: A case study approach.In: Proceedings of 2014 Conference on Industrial Engineering and Operations Management Bali, Indonesia,

- Karande, S.H., Jain, V., & Ghatule, A.P. (2012). ERP implementation: Critical success factors for indian universities and higher educational institutions. Pragyaan Journal of Information Technology, 10(2), 24-29.

- Kumar, K., & Van Hillegersberg, J. (2000). ERP experiences and evolution. Communications of the ACM, 43(4), 22-22.

- Maditinos, D., Chatzoudes, D., & Tsairidis, C. (2011). Factors affecting ERP system implementation effectiveness. Journal of Enterprise Information Management, 25(1), 60-78.

- Matende, S., & Ogao, P. (2013). Enterprise resource planning (ERP) system implementation: a case for user participation. Procedia Technology, 9, 518-526.

- Moon, Y.B. (2007). Enterprise resource planning (ERP): A review of the literature. International journal of management and enterprise development, 4(3), 235-264.

- Motiwalla, L.F., & Thompson, J. (2012). Enterprise systems for management. Pearson Education Upper Saddle River, NJ.

- Mushavhanamadi, K., & Mbohwa, C. (2013). The impact of enterprise resource planning system (ERP) in a South African company. International Journal of Economics and Management Engineering, 7(11), 2903-2907.

- Nah, F.F.H., & Delgado, S. (2006). Critical success factors for enterprise resource planning implementation and upgrade. Journal of Computer Information Systems, 46(5), 99-113.

- Ngai, E.W., Law, C.C., & Wat, F.K. (2008). Examining the critical success factors in the adoption of enterprise resource planning. Computers in industry, 59(6), 548-564.

- Olugbara, O.O., Kalema, B.M., & Kekwaletswe, R.M. (2014). Identifying critical success factors: the case of ERP systems in higher education. The African Journal of Information Systems, 6(3), 65-84.

- Rabaa'i, A.A. (2009). Identifying critical success factors of ERP Systems at the higher education sector. In: ISIICT 2009 : Third International Symposium on Innovation in Information & Communication Technology, 15 - 17 December, 2009, Philadelphia University, Amman, Jordan.

- Ram, J., Corkindale, D., & Wu, M.L. (2013). Implementation critical success factors (CSFs) for ERP: Do they contribute to implementation success and post-implementation performance? International Journal of Production Economics, 144(1), 157-174.

- Saade, R.G., & Nijher, H. (2016). Critical success factors in enterprise resource planning implementation: A review of case studies. Journal of Enterprise Information Management, 29(1), 72-96.

- Sammon, D., & Adam, F. (2010). Project preparedness and the emergence of implementation problems in ERP projects. Information & Management, 47(1), 1-8.

- Shatat, A.S. (2015). Critical success factors in enterprise resource planning (ERP) system implementation: An exploratory study in Oman. Electronic Journal of Information Systems Evaluation, 18(1), 36-45.

- Shaul, L., & Tauber, D. (2013). Critical success factors in enterprise resource planning systems: Review of the last decade. ACM Computing Surveys (CSUR), 45(4), 55.

- Somers, T.M., & Nelson, K.G. (2004). A taxonomy of players and activities across the ERP project life cycle. Information & Management, 41(3), 257-278.

- Supramaniam, M., & Kuppusamy, M. (2010). ERP system implementation: A Malaysian perspective. Journal of Information Technology Management, 21(1), 35-48.

- Sykes, T.A., Venkatesh, V., & Johnson, J.L. (2014). Enterprise system implementation and employee job performance: Understanding the role of advice networks. Mis Quarterly, 38(1).

- Thompson, R.C., Olugbara, O.O., & Singh, A. (2018). Deriving critical success factors for implementation of enterprise resource planning systems in higher education institution. African Journal of Information Systems, 10(1).

- Tobie, A.M., Etoundi, R.A., & Zoa, J. (2016). A literature review of ERP implementation within African countries. EJISDC: The Electronic Journal on Information Systems in Developing Countries, (76), 4.

- Trigo, A., Belfo, F., & Estébanez, R.P. (2014). Accounting information systems: The challenge of the real-time reporting. Procedia Technology, 16,118-127.

- Xu, J., & Quaddus, M. (2013). Using information systems for enhancing internal operation: enterprise resource planning systems. In: Managing Information Systems. Springer, 109-119.

- Yen, D.C., Chou, D.C., & Chang, J. (2002). A synergic analysis for Web-based enterprise resources planning systems. Computer Standards & Interfaces, 24(4), 337-346.

- Yu, C.S. (2005). Causes influencing the effectiveness of the post-implementation ERP system. Industrial Management & Data Systems, 105(1), 115-132.

- Ziemba, E., & Oblak, I. (2013). Critical success factors for ERP systems implementation in public administration.In: Proceedings of Proceedings of the Informing Science and Information Technology Education Conference. Informing Science Institute, 1-19.