Research Article: 2022 Vol: 26 Issue: 2

Cryptocurrencies in the Times of Covid-19 Pandemic

Salih M. Sahi, Wasit University

Citation Information: Sahi, S.M. (2022). Cryptocurrencies in the times of covid-19 pandemic. Academy of Accounting and Financial Studies Journal, 26(2), 1-16.

Abstract

Most countries in the world have experienced the spreading pandemic of COVID-19 in recent months. Different measures have been taken to reduce the death rate, significantly affecting the pure cryptocurrency exchanges across the world. This paper mainly aims to study the impacts of the COVID-19 pandemic on the first 10 cryptocurrencies markets. The research used two major approaches: inductive and deductive. Deductive research moves from general to specific issues. In addition, in the deductive approach, a theoretical and conceptual structure is considered as the basis of the research. This structure is tested and compared with empirical observations. Our findings revealed many fascinating insights that facilitate understanding the effect of the crisis on the investors' behaviors. COVID-19 caused the value of most cryptocurrencies to decrease by roughly 50%, while that of equity lowered only 10%. It is concluded that despite the fast reduction of prices due to the COVID-19, the cryptocurrency markets have preserved their economic efficiency. The first insight is that once a crisis starts, investorstend to depart from traditional markets and enter alternative ones such as cryptocurrencies, at least during the early phases of the crisis.

Keywords

Accounting, Finance, Covid-19, Coronavirus, Cryptocurrencies, Blockchain.

Introduction

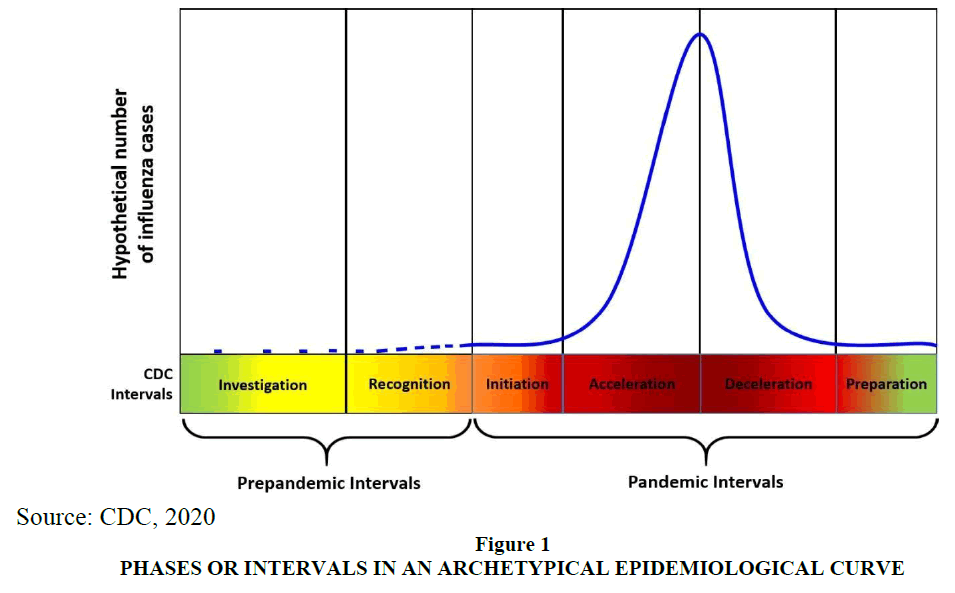

In 2019, there was anxiety over the effect of a trade war between the US and China, Brexit on the World Economy, and the US presidential elections. For these reasons, the IMF had expected to moderate the international growth of 3.4%. However, COVID-19 caused by respiratory disorder-CoV-2, a new strain of coronavirus from the SARS species, unexpectedly modified the outlook (Ozili & Arun, 2020). COVID-2019, an extremely infectious disease, has recently been declared by the WHO as a pandemic. Since then, researchers worldwide try to predict the pandemic progression based on different mathematical models in the future. Figure 1 displays the distribution curve for the hypothetical number of influenza cases during the six intervals of the Center for Disease Control and Prevention (CDC) based on the framework for response to and preparedness for a virus pandemic of new influenza. The first two pre-pandemic intervals from left to right include “recognition and investigation” (In Figure 1, Source: CDC, 2020 the number of new cases per day is plotted against time).

The curve in the “recognition” and “investigation” intervals is flat, which shows no or few hypothetical pandemic influenza cases. The four pandemic intervals, i.e., "acceleration," "deceleration," "preparation, and "initiation," are placed after the "recognition" interval. At intervals of the pandemic, there is a normal distribution of the hypothetical number of influenza cases where most of the cases are located between the “deceleration” and “acceleration” intervals. The hypothetical number of influenza has a considerably increasing distribution curve, which shows that the number of hypothetical influenza cases has increased considerably at the end of the "acceleration” interval. Starting with the “deceleration” and ending with “preparation” the hypothetical number of influenza cases is considerably reduced, making the number of hypothetical influenza cases close to zero. This epidemiological curve, widely applied by public health officials, is not exponential, but it is similar to that in the accelerating phase. The COVID-19, which started in China with the first death on 9 January 2020, and quickly spread medically shocked the economy. Outside China, the first case was confirmed in Thailand on 13 January. The first cases were found in all the G7 economies by the end of the month (except Canada, of which the first case wasfoundon 7 February). All the G7 nations had entered the accelerating stage of their epidemiological curve by early March or the end of February (Italy) (Kraus et al., 2020). The COVID-19 pandemic negatively affected the global economy, which no one could have imagined before. The United Nations declared that this pandemic would reduce global economic output by $8.5 trillion in the next two years, which impoverished more than 34 million people by eradicating almost all gains within the last four years (Tunali, 2020).

The International Labour Organization [ILO], 2020 declared the effect of the COVID-19 pandemic on 2.7 billion employees, which represented about 81% of labor worldwide. In addition, different enterprises, particularly small ones, faced considerable difficulties. It is predicted that the global GDP growth will generally drop to 2.4% every year in 2020, from 2.9%, which is already weak in 2019. China has markedly revised its prospects with growth reduced to below 5% this year, before it is recovered to more than 6% in 2021, with the gradual return of the output to the levels projected before the outbreak (Organisation for Economic Co-operation and Development (OECD, 2020). It seemed that global stock markets enjoyed some stability level in early 2020 when the positive trends were disrupted due to the emergence of Covid-19, which as a “black swan” has affected the world stock marketsand endangered the global economic stability. Black swans in the financial markets are described as highly disruptive and rare events.

On the contrary, the COVID-19 unexpected shocked the cryptocurrency markets as the unexplored and relatively new financial assets. For one decade, Bitcoin has experienced high volatility before without susceptibility to any main systematic crisis. Morales & Andreosso- O’Callaghan (2020) introduced an important case and argued that the theory of “black swan” explains that three main characteristics are found in the "black swan” events: i. A black swan has substantially influenced the related things and events; ii.A black swan is regarded as an outlier event, which is unexpected or unprecedented; iii. People have oversimplified explanations to rationalize the event of the black swan. As financial assets, cryptocurrencies have not yet demonstrated that they have haven properties under the major economic crisis and recession. The early evidence shows that Bitcoin could not show hedging opportunities and flight to safety properties under the COVID-19 pandemic. This finding shows the black swan effect of COVID-19 on cryptocurrency leading to behavioral anomalies. 5500 cryptocurrencies that had an impressively total market capitalization of $258 billion for this recently created market segment were listed through the price-tracking service for cryptoassets Coinmarketcap on 25 May 2020.Despite the domination of Bitcoin over this market with a share of 66.5%, this market, which as a universe, cannot be overseen due to the growing number of new currencies (Alt, 2020). From an economic viewpoint, the coronavirus pandemic is a global symmetric shock in the first instance, showing that cryptocurrencies can protect investors against the uncertainty raised by COVID-19. The economics research conducted so far has not shown the economic relevance of cryptocurrencies a lot. In addition, there is very little economic literature regarding the effects of the COVID-19 pandemic on cryptocurrency. This paper proposes a framework used by researchers to analyze the same cases. The aim of this paper is to analyze the effects of the COVID-19 pandemic on the market of the top ten cryptocurrencies. The remaining part of the paper is organized as follows. In Section 2, the background of blockchain technology and cryptocurrencies is shown. In Section 3, the data and methodology are explained. In Section 4, the results are shown, and the last section concludes the paper.

Theoretical Background

Definitions

Blockchain technology and cryptocurrencies have attracted much attentionfor years. Although two of them are often mentioned in the same sentence and are interrelated, we should not confuse one with the other. It was proved that cryptocurrencies were very successfully used for blockchain technology. As a subset of virtual currencies, cryptocurrencies use a new method to process virtual transactions, called distributed ledger technology (DLT) or, more specifically, “blockchain”. Satoshi Nakamato could have created a private digital currency for the first time in the long history of money in whichusers empower a decentralized peer-to-peer payment network withoutintermediaries or central authority (Nakamato, 2009). A type of unregulated digital money is the cryptocurrency accepted and used by a specific virtual community's members and usually issued and controlled by its developers (European Central Bank, 2012). The Greek term "Crypto" means hidden or secret. The name implies thata cryptographic mechanism is used incryptocurrency, storing all data about the balance sheet and transaction (Adiyatma & Maharani, 2020). Perkins, (2020) states that payments are validated by a system users' decentralized network and cryptographic protocols rather than by a centralized intermediary such as a bank in an electronic payment system where cryptocurrency is digital money. A cryptocurrency (also referred to as virtual currency or digital currency) typically refers to digital entries in a distributed ledger or database maintained in a network of nodes or computers (Kulkarni et al., 2019). In addition, the EU Parliament published definition as a compromise solution which considers cryptocurrencies as digitally representing a value intended to make up a peer-to-peer (P2P) alternative to legal tender issued by the government, secured by a mechanism, i.e., cryptography, used as an exchange general medium independent of any central bank, and changed into legal tender and vice versa (Katarzyna, 2019). Like Bitcoin, cryptocurrencies verify and document the payments made in a non-centralized ledger knownas blockchain (Prybila et al., 2020). As a concept, blockchain technology was first coined by Satoshi Nakamoto in the Bitcoin white paper in 2009 (Nakamato, 2009). The term ‘blockchain’ means how to store the data. One can record transactions in time-stamped “blocks" each connected to the previous blocks, which form a chain of transactions (Ramachandran & Rehermann, 2017).

A clear line should be drawn between cryptocurrencies and these applications, as one specific usage of the blockchain technology. Blockchain forms the backbone of the crypto- market as a type of DLT. This technology is behind various types of cryptocurrencies currently circulatin (Houben & Snyers, 2018). DLT means a new and fast-growing approach to sharing and recording data among several data stores (ledgers), each having the exact records of the same data, which are collectively kept and controlled by a computer server's distributed network known as nodes (World Bank Group, 2017). Initial coin offerings (ICOs) mechanisms sell coins or tokens to raise funds using blockchain technology to support a new virtual currency or a product launch. Crowdfunding and blockchain are combined to form ICOs (Allen et al., 2021). It can be said that cryptocurrencies are first known for their application to attract attention toward blockchain technology, but Blockchain technology nowadays has grown faster than the cryptocurrency context, which can be used in different sectors such as commerce, healthcare, trade, and governance.

Cryptocurrencies: A New Economy

Blockchain technology was created to proliferate digital coins, commonly called cryptocurrencies, as the main variations of Bitcoin with additional functionality (Harvard.edu, 2020). Is this technology broadly relevant for corporate finance and economics, beyond the new efficient book-keeping and interesting crypto-assets? Despite the increasing attention to the endogenous economic role of technology in academic groups, any economic change is regarded as an entropic system involved in an ecological environment. Even the article "Endogenous Technological Change’ (1990) by Paul M. Romer, which is one of the most cited papers in this field, seeks to find the equilibrium state in a technological change (Bheemaiah, 2017). Hence, the rise of cryptocurrencies emphasizes what is not present in fiat currencies: the necessity of peer- to-peer payment services that are fast, cheap, guaranteed, and secure. Remember that the performance of cryptocurrency as money is dependent on its performance as (i). a unit of account; (ii). a medium of exchange; and (iii). a store of value. Cryptocurrency has several characteristics preventing it from performing these three interconnected functions in the United States and other countries (Perkins, 2020).Most basically, cryptocurrency - virtual currency or digital currency is an exchange medium working like money to be exchanged for services and goods. Unlike traditional currency, it is independent of the central banks, national borders, sovereigns, or fiats. If the governments do not interfere, there will be no price stability in the cryptocurrencies, making them risky to invest in and hold. Bitcoin has fluctuated strongly in the past few years. Cryptocurrencies have emerged for about ten years, but they received significant attention worldwide not until 2017when Bitcoin price rose to about $20,000 (Laboure & Reid, 2020). Since 2014, the total capitalization of the cryptocurrency market has dramatically grown 1000 fold within six years. It reached only below 1 trillion Euros by the end of 2019, with a similar magnitude to the total circulating currency in the third three months of 2019, which was 1.2 trillion Euros (Gerba & Rubio, 2019). Laboure & Reid (2020) stated that the unique survey of 3,600 customers in the USA, France, China, Italy, Germany, and the UK found that millennials envisioned a purely digital currency. More than one-third of the millennials believe that cryptocurrencies are a substitute for cash. Apart from the fact that cryptocurrency prices are not stable, regulators are concerned about criminals increasingly using cryptocurrencies for trading without official channels such as manipulation, fraud, tax evasion, money laundering, hacking, and funding for terrorist activities. There are no bans or restrains on the market manipulations with rates of cryptocurrency ("pump and dump" technique), and financial intermediaries pass through various prohibitions using cryptocurrencies for financing illegal activities, tax evasion, and other illegal actions. There have been more frequent cyber attacks. The cryptocurrency exchange Coincheck in Tokyo reported in January 2018 that hackers robbed 400 million GBP. Despite the public nature of transactions for many cryptocurrencies, nameless accounts of all 523 million stolen coins were ended (Laboure & Reid, 2020). Other prominent platforms and crypto assets help create the tokens, which are new digital assets. For example, in the Ethereum platform, a necessary input for creating ‘smart contracts’ is the Ethereum coin using the functions of the Ethereum platform. In this platform, several firms can raise financing in exchange for the 'token rights,' which are known as initial coin offerings (ICOs). ICOs raised the total capital, which was only $16 million in two deals in 2014 and $6.1 million in three deals in 2015 but increased sharplywith the exponential trend in the next two years. Until mid-2018, EOS priced the biggest ICO, which rose to $4.1 billion (Allen et al., 2021).

How Does Blockchain Work ?

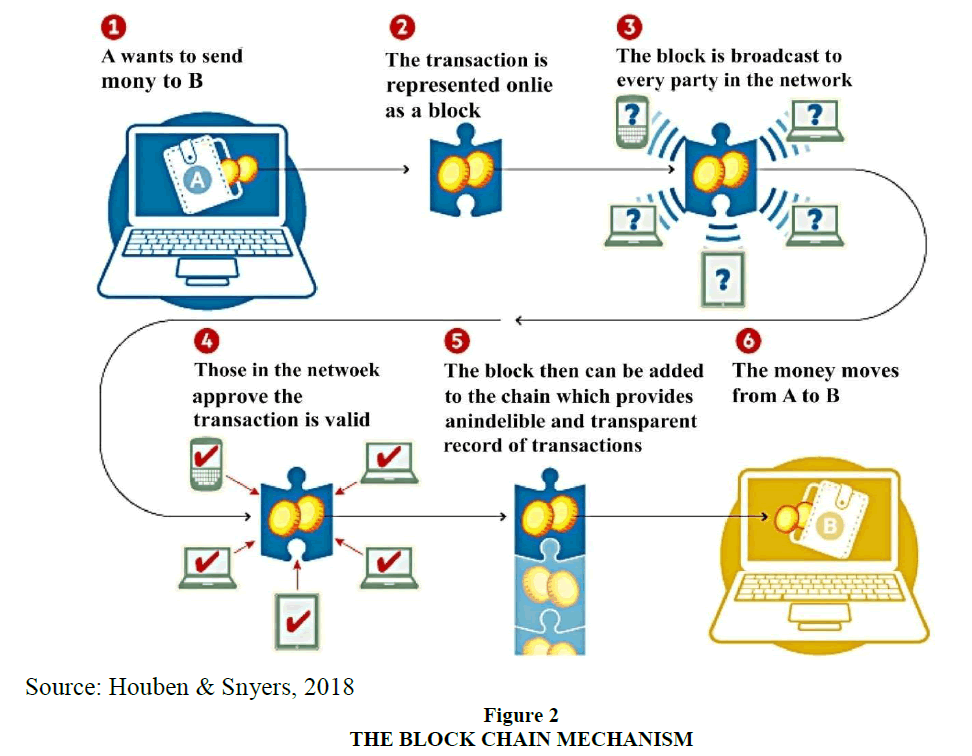

While cryptocurrencies are growing rapidly, the blockchain has attracted much attention as an underlying technology. Blockchain as an emerging technology enables the re-engineering of economic models and creates products and markets which were previously unprofitable or unavailable among the emerging markets (Miller et al., 2019). Transaction data are recorded and tracked using block chain as an open and distributed registry. The security and verifiability of these transactions are due to cryptography principles. Using this registry, the double-spending problem is solved, and the risk of digital files which are shared and copied infinitely is eliminated. Block chain technology was first applied significantly in the crypto-finance and coin or token trading. More than 3,000 ICOs and 200 crypto-exchanges launched to date due to crypto asset market capitalization of approximately $300 billion when the public officials and leading market participants decided (Casey et al., 2018). Companies in Western Europe can use blockchain technology to save about $450 billion as logistical costs by distributing and controlling their data immediately and safely (Tunali, 2020). This technology, which is primarily used with digital currency, is widely applied, beyond the economic and financial realm, including trade, government services, supply chain management, and health. PwC's analysis shows the potential of blockchain technology to increase global GDP by $1.76 trillion in the next decade. This report assessed how to use the technology currently used and explore the impact of blockchain on the global economy (Helpnetsecurity.com, 2020). However, the far-reaching and most important blockchains are based on Satoshi’s bitcoin model Figure 2.

The Block Chain Mechanism

This is translated into the following example on the Bitcoin blockchain. Assume that Sophia wants to send Adam 100 Bitcoins, and then she first has to sign this transaction digitally using her private key, which only she knows. She will have to send the transaction to Adam’s public key, which is Adam’s address on the Bitcoin network. Then, the transaction combined as a “transaction block” will be verified by the Bitcoin network nodes. Here, Sophia verifies her signature using the public key. If Sophia’s signature is valid, the transaction will be processed by the network, adding the block to the chain and transferring 100 Bitcoins from Sophia to Adam. The characteristics of blockchain are persistency, decentralization, anonymity, and auditability. Decentralization means that each transaction should be validated, but the validation process is not performed through a central trusted agency such as a central bank (Ertz & Boily, 2019). The cryptocoins' owners are entitled to use and own blockchain technology and such payment system due to its belonging to all network participants, such as the decentralization principle. In this case, a single network user can not supervise its regulation, development, maintenance, etc. Cryptocurrencies or coins entitle the owners to dispose of and own the virtual values circulating in the network based on blockchain technology. So, the blockchain represents a network consensus for every transaction which has occurred as a distributed ledger. Like the World Wide Web of information, the World Wide Ledger of value, a distributed ledger, can be downloaded by everyone and run on their personal computer (Tapscott & Tapscott, 2016).

Econometrics Considerations

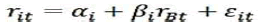

Expression indicates the linear regression model employed in estimating the beta coefficient and estimating portfolio return dependency on Bitcoin 1.

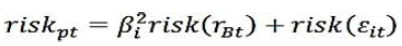

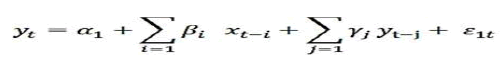

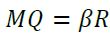

If βi stands for covariance between cryptocurrency returns (portfolio) i and Bitcoin returns, rBt represents Bitcoin cryptocurrency returns for period t and ������ is the residual deviations from pitch (portfolio return not clarified by the Bitcoin return), rit stands for crypto-monetary return (portfolio) i for period t, αi represents cryptocurrency return component (portfolio) i that isn't explanted by Bitcoin.Tomic (2020) points out that total portfolio variances may be broken up into two components. This is a non-systemic component that constitutes a particular investment risk, and that is an absence from the regressive functional relationship. In the cryptocurrency market, the assumption that the dependent variable will be the returns of the portfolio and Bitcoin may be used to identify the influence of the systemic component. Therefore, the complete risk of the portfolio can be stated (2). Initiated the standard Granger Causality Test (Granger, 1969) with two stationary variables in two distinct equations:

(1)

(1)

(2)

(2)

If we suppose yt is a dependent variable, where xt is an independent, yt -reduced variable. This Article showed the results of the unidirectional causality as the work aimed to discover if Covid-19 caused the explanatory variables. A bivariate method allows for consideration of all three possibilities is the model of the frequency domain. In Wuhan, China, the first test scenario was described as the first instances in Covid-19. The second scenario evaluated the influence Italy and the third scenario was having on global insecurity (Morales & Andreosso-O'Callaghan, 2020).

(3)

(3)

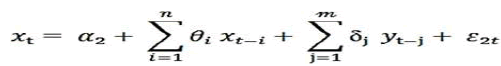

This empirical section uses the idea of fractality theory in order to determine the presence of herding performance and to estimate the inefficiency of cryptocurrency markets after and before the pandemic of COVID-19 (Mnif et al., 2020). Cryptocurrencies' daily returns are defined as:

(4)

(4)

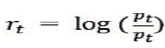

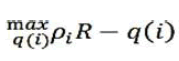

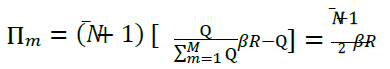

If rt is on the date t of cryptocurrencyreturn, and Pt on the date t is the cryptocurrency price. Miners do one expensive computational operation with a random rate of success, q, which is measured in actual crypto-currency balance. M miners also compete in subperiods �� = 0, … , �� with all subperiod 0 transactions for updating a blockchain (Chiu & Koeppl, 2018). In each subperiod, we assume that mining companies have a linear value of actual balance. The Bitcoin protocol also provides the likelihood that the power of miner i will win a mining game if the computer power of miner i in a subperiod is q(i), as follows:

(5)

(5)

(6)

(6)

By appealing the contest in any sub-period, a miner can modernize the blockchain and get a prize R in real balance (e.g. add the nth block to the blockchain).This reward is paid by the miners after the period by β-time preferences. The mining games are separate during sub- periods. Therefore i solve in any miner sub-period:

(7)

(7)

(8)

(8)

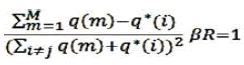

So that, Where he selected all miners m ≠ i as provided. Impressive symmetry, q(m) = Q for all m, as a mining game's Nash equilibrium (Chiu & Koeppl, 2018) ,we get this:

(9)

(9)

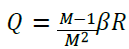

Accordingly, in any sub-period the entire cost of mining is:

(10)

(10)

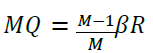

This is the estimated miner for equilibriummine over the single transaction period:

(11)

(11)

We permit �� → ∞ to get to the following lemma, so as to stop the fact that mining is very competitive and open to new participants Lemma 1. As for �� → ∞, the likely rate of miners is zero and the computer power of miners eliminates any mining benefits:

(12)

(12)

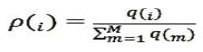

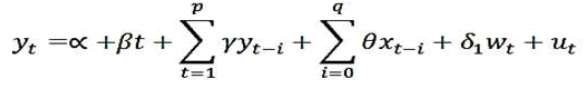

The most efficient model is ARDL, as the series is not stationary in the second order, based upon the unit root test. In addition to distributed lags, the ARDL model contains a series of autoregressive lags and explains the short and long term connections (if series are integrated together) (Demir et al., 2020). The ARDL model is demonstrated:

(13)

(13)

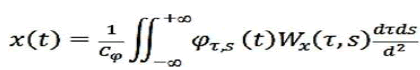

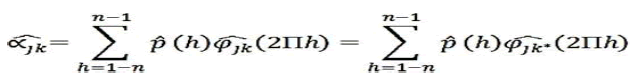

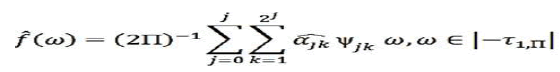

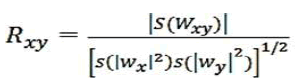

Where p is the number of delays in dependence variables, and q is the number of lags of different variables. x is the variable independent and y is the variable dependent. We are the end of the error. Akaike Criteria Information (AIC) order the ARDL models (Demir et al., 2020). A statistical approach that analyzes the time and frequency axis using the rescaled series is the wavelet frequency analysis. In geophysics and numerous other technical industries, Wavelet analysis is frequently used (Massel, 2001), moreover, it is also employed in finance and economics in the latest years (Sharif et al., 2020). Cryptocurrency investigations are widely employ wavelet analysis method (Demir et al., 2020):

(14)

(14)

With the help of some projections, the wavelet analysis can convert series into continuous signals or waves as follows:

(15)

(15)

In Eq. 14, data generation process, a reconstruction is begun. During this reconstruction, the series is transformed into synthetic data. The series is then transformed to the signal in Eqs. 15 and 16 via a wavelet transformation. The consistency check of the wavelet is shown in Eq. 17.

(16)

(16)

(17)

(17)

Methodology

The research used two major approaches, i.e., inductive approach and the deductive approach. Deductive research moves from general to specific issues. In addition, in the deductive approach, a theoretical and conceptual structure is considered as the basis of the research. On the other hand, there is a difference between the deductive approach and the inductive approach. The inductive approach moves from the specific to the general issues and is almost used in interpretivism, presenting the inductive logic using the known theories to reach new conclusions. The qualitative analysis is based on quantitative extrapolation. There are weekly, daily, and monthly log-returns of the top ten cryptocurrencies, which are ranked by market capitalization in our data set. The order of these ten cryptocurrencies was from the highest to lowest based on the market capitalization, including Ripple (XRP), Bitcoin (BTC), Tether (USDT), Ethereum (ETH), Bitcoin_sv (BSV), Bitcoin_cash (BCH), Litecoin (LTC), Binance_coin (BNB) EOS, and Tezos (XTZ). The Coinmarketcap.com website can be referred to provide the data (Tables 1& 2). On 7 March 2020, these top ten cryptocurrencies, which were studied, averagely represented more than 92% of the cryptocurrency market capitalization, and Bitcoin represented about 66% of dominance in this market.An analysis of the ten cryptocurrencies with the highest market capitalization will classify cryptocurrencies that will be regarded as a benchmark in this research and verify the adequacy of the upcoming and existing analytical framework.Data from January 26, 2015,to September 15,2020, are available in the sample. We use World Corona Deaths (WCD) and World Corona Cases (WCC). Table 3 shows descriptive statistics of the variables.Finally, this paper has applied the well-known literature on the research fields of the COVID-19 pandemic and cryptocurrencies. In this literature, the methodological standpoints considered in research are presented.

| Table 1 Top 10 Cryptocurrencies in Market Capitalization | ||||||

| Name | Market Cap (Billions) | Price | Volume (24h- Billions) | Circulating Supply | Change (24 h) | Starting Date |

| Bitcoin | $166,743,993,933 $106,591,196,069 |

$8887.80 $5830.25 |

$47,868,579,352 $40,099,664,740 |

18,238,800 BTC 18,282,425 BTC |

- 0.21% -5.73% |

01/26/2015 |

| Ethereum | $26,966,016,878 $13,590,860,527 |

$237.32 $123.32 |

$25,206,666,119 $12,497,707,224 |

109,863,231 ETH 110,207,055 ETH |

2.07% -7.05% |

03/10/2016 |

| Ripple | $10,688,702,708 $6,585,765,149 |

$0.23624 $0.150214 |

$3,252,412,868 $1,864,979,798 |

43,749,413,421 XRP 43,842,625,397 XRP |

-0.88% -5.02% |

01/26/2015 |

| Bitcoin_Cash | $6,364,459,307 $3,736,418,941 (5) |

$330.77 $203.67 |

$6,617,099,625 $4,015,953,536 |

18,300,000 BCH 18,345,250 BCH |

-0.25% -7.47% |

08/03/2017 |

| Tether | $4,641,437,047 $4,637,871,717 (4) |

$1.0047 $0.99903 |

$66,519,050,406 $49,036,623,749 |

4,642,367,414 USDT 4,642,367,414 USDT |

0.16% -0.21% |

04/15/2017 |

| Bitcoin_SV | $4,439,960,724 $2,894,145,363 |

$233.95 $157.78 |

$3,344,789,290 $3,365,019,330 |

18,297,290 BSV 18,342,440 BSV |

-1.66% - 6.35% |

11/19/2018 |

| Litecoin | $4,072,866,599 $2,292,391,578 |

$60.45 $35.63 |

$6,342,837,357 $3,148,219,029 |

64,168,987 LTC 64,342,318 LTC |

-0.77% -7.34% |

08/24/2016 |

| EOS | $3,526,893,934 $1,965,191,547 |

$3.64 $2.13 |

$6,064,573,978 $2,921,411,201 |

920,452,308 EOS 921,045,767 EOS |

-0.47% -6.45% |

07/02/2017 |

| Binance Coin | $3.292,877,236 $1,735,514,181 |

$20.24 $11.16 |

$427,799,971 $308,670,064 |

155,536,713 BNB 155,536,713 BNB |

-1.68% -7.48% |

11/09/2017 |

| Tezos | $2,250,710,445 $1,038,511,561 |

$2.98 $1.47 |

$317,321,520 $113,589,399 |

702,028,555 XTZ 704,565,511 |

-0.04% - 11.11% |

02/02/2018 |

| Table 2 Top 10 Cryptocurrencies in Market Capitalizationon 15 Sep 2020 | |||||

| Change (24 h) |

Circulating Supply | Volume (24h- Billions) |

Price | Market Cap (Billions |

Name |

| 1.68% | 18,490,056 BTC | $32,520,804,894 | $10,861.15 | $200,823,249,816 | Bitcoin |

| -2.93% | 112,611,778 ETH | $17,215,863,793 | $365.73 | $41,186,024,605 | Ethereum |

| -0.05% | 14,709,331,641 USDT * | $57,539,368,164 | $1.00 | $14,722,660,529 | Tether |

| -0.48% | 45,042,338,912 XRP * | $1,959,248,629 | $0.244193 | $10,999,025,685 | XRP |

| 4.29% | 18,518,519 BCH | $3,589,926,583 | $236.15 | $4,373,191,758 | Bitcoin_Cash |

| -11.28% | 144,406,560 BNB * | $1,308,357,648 | $27.46 | $3,965,018,025 | Binance Coin |

| -0.27% | 65,461,995 LTC | $2,011,295,470 | $48.81 | $3,195,450,248 | Litecoin |

| 0.38% | 18,516,746 BSV | $1,130,821,344 | $164.51 | $3,046,107,528 | Bitcoin_SV |

| -1.40% | 936,077,078 EOS * | $2,759,810,960 | $2.71 | $2,540,744,451 | EOS |

| -4.11% | 743,309,698 XTZ * | $217,172,064 | $2.55 | $1,893,737,936 | Tezos |

| Table 3 Correlations Between Cryptocurrencies and Covid-19 Cases And Deaths | ||

| COVID-19 deaths | COVID-19 cases | Cryptocurrencies |

| 0.1021 | 0.1061 | Bitcoin (BTC) |

| 0.0735 | 0.1062 | Ethereum (ETH) |

| 0.0616 | 0.1207 | Ripple (XRP) |

| 0.0927 | 0.1484 | Litecoin (LTC) |

Result and Discussion

The cryptocurrency monitoring highly relies on the public data aggregated from third parties. The aggregated informationis almostavailable on public websites. The examples are indicators for market capitalization estimates, volumes of trade, blockchain networks, prices, and funds collected in initial coin offerings (ICOs). There are varying sources based on the used methodologies, access to, and coverage of basic source information. The innovations which are generated in the payment system help users get access to them. Technological developments affect modifying the payment systems pattern. All types of transaction recording which were previously physical have changed to electronic forms, increasing the speed of the transaction process and reducing the operational errors. Adiyatma & Maharani (2020) state that several indicators are used to measure itas follows: a. movement of user value: there will be more offers and requests for more users against the movement of its value.There are different cryptocurrency users in each country. Therefore, judging the movement of the number of users in a country indicates that cryptocurrency in that country can be legalized in governmental regulation. b. The number of cryptocurrency transactions: there are different transactions within each country. There is consistency between the number of transactions in a country and the number of users, so it can be stated that increasing the number of users will enhance the number of transactions.c. cryptocurrencytrading: cryptocurrency acceptance in a country cannot be separated from the high cryptocurrency trading, a cryptocurrency exchange activity in return for domestic currencies or vice versa. These activities are performed in the cryptocurrency market in which cryptocurrency is exchanged with fiat money or other cryptocurrencies. d.cryptocurrency prices: values of prices were easily changed in a cryptocurrency exchange market. Market acceptance and supply logically influence the price. The cryptocurrency price is paid to take one unit of cryptocurrency.Thiswillfocus on the ten Altcoins with the highest market capitalization (see Table 1). We have made this choice, not only due to the current popularity of these Altcoins in the “crypto-community" but also due to their different features.

Some of them are based on a whole new platform or ecosystem, while they are based on Bitcoin’s original open-source protocol. Our first sample starts from 26 January 2015 to 7 March 2020, yielding 267 weekly, 1868 daily, and 61 monthly data observations. The total cryptocurrency market capitalization reached about $400 billion in December 2018, based on Coincodex.com (2018). The starting point of some cryptocurrencies in terms of price and this period ended exactly before the cryptocurrency market was sold massively on 8 March 2020, and the stock market fell suddenly on 9 March 2020 due to COVID-19. Due to this massive selloff, $21 billion market capitalization was lost in the cryptocurrency market within 24 hours from Saturday, 7 March 2020 to Sunday, 8 March 2020, i.e., from $251.5 billion to $230.8 billion. CoinMarketCap.com (2020) reports show that there are currently more than 21000 markets and more than 5000 cryptocurrencies globally, where these digital currencies match with the standard reference currencies, dominated by the US dollar. Averagely, total market capitalization represents about $250 billion, and the dominance or market share of the most significant cryptocurrencies over the total market capitalization is presented in the following Table to show how Bitcoin forms almost 64% of the total value. CoinMarketCap.com (2020) emphasized that the cryptocurrencies had total market capitalization from March 07, 2020, to March 22, 2020, reaching $251.5 billion or $167.1 billion. More than $84 billion was lost in the cryptocurrency market on 22 March 2020 due to COVID-19, which decreased to a total of $167.1 billion. It is necessary to note that although cryptocurrency market capitalization considerably falls, Bitcoin still dominates over this market by 65.1% on 22 March 2020. These top ten cryptocurrencies were not available simultaneously. Column 7 of Table 1 shows the date each cryptocurrency starts. Thus, Bitcoin_sv and Tezos, which are the newest cryptocurrencies, will provide less data every month for the empirical analysis.

The virtual currencies market size has increased considerably in the last years. There was about $12.6 billion of total market capitalization by the end of 2016 (Ciaian et al., 2017). In this study, these top ten cryptocurrencies averagely represent more than 92% of the cryptocurrency market capitalization. 37% of the cryptocurrency market was the Bitcoin capitalization on 1 May 2018 while Bitcoin market share is now about 66% on 7 March 2020, which is exactly two years later (González et al., 2020).

González et al., 2020highlight the time evolution of daily prices of the cryptocurrencies until the end of March 2020, so incorporating the COVID-19 event on 8 March 2020. As a result, the top ten cryptocurrencies analyzed in this paper had sharply decreased market capitalization on March 8, from 53.8% for Tezos to 38.3% for Ripple. On the other hand, Bitcoinsustained a lower loss of 36% even though it was not as low as 34.7% for Bitcoin_sv. It is interesting that Tether is an outlier that experiences a very modest loss of 0.065% in one day. Table 1 also shows the reduction of the total cryptocurrency market capitalization two weeks after the COVID-19 event by about 40%, from $251.5 billion to $167.1 billion. The value of these top ten cryptocurrencies had decreased by 32% and 50%, but such decrease is only 0.5% for Tether. Table 2 shows the top ten cryptocurrencies, which we discuss in this section. In this Table, the market capitalization is reviewed as the size measure, circulating supply, and 24-hour trading volume as indicators of ten top cryptocurrencies liquidity on 15 Sep 2020. Bitcoin, with a market capitalization of nearly $201 billion and with a 24-hour trading volume of more than $32 billion, dominated the remaining of our sample in terms of liquidity and size on Sep 15, 2020. On the other hand, Tezos with the smallest market capitalization has the least liquidity with a 24- hour trading volume of more than $217million and a market capitalization of below $2 billion. On 15 Sep 2020, the total market capitalization of cryptocurrencies reached about $348 billion as shown by (CoinMarketCap.com, 2020).

González et al., 2020 pointed out that non-annualized daily stock returns were sometimes above 5% and, more than 10% losses occurred during this elevated uncertainty period. On March 12, 2020, most of the cryptocurrencies lost about one-half of their value while losing their equity by a little more than 10%. Although there is a strong rebound, there was a higher catastrophic loss the next day on Monday, March 16, where most of the cryptocurrencies lost their value by 10% and equities by 13%. Considering such wild gyrations in the financial markets, we interestingly indicate whether we can add a cryptocurrency to a cash portfolio to reduce the risk of investment in cash assets.

Deflation has deterrent effects primarily because we cannot usually have negative nominal interest rates. They have zero borders sincea zero rate of return is always provided by the currency. Interest rate caps can be canceled in the world of digital currency. Anyway, it seems that the deflation problem is partially solved, which leads to the growth of the digital currency amount with the economy. However, the digital currency amount cannot move up and down based on seasonal demand and have a partial response to COVID-19 shocks of the economy. It would be more realistic for the economy to use digital currency partially. The business cycle can be softened by the central bank, and the inflation rate can be controlled in the currency, though there is less accuracy. According to ( Wajdi et al., 2020). Bitcoin is dynamically correlated with the selected set of cryptocurrencies to show three patterns. First, it indicates that Bitcoin is highly conditionally correlated with the litecoin. Second, it suggests that Bitcoin is moderately correlated with the other cryptocurrencies. Third, the different vulnerability of currencies is reflected. The decreasing and increasing links between Bitcoin and other cryptocurrencies imply an increasing benefit of portfolio diversification due to the lower effect of systematic risk on holding a portfolio with diverse currencies. For this reason, traders should modify their portfolios frequently based on the cryptocurrency type and market condition.

The nexus between financial assets and COVID-19 patients and deaths has some outcomes which should undoubtedly be also regarded based on the sign of their relation. It means that whether commodities, stock indices, and cryptocurrencies are negatively or positively associated with cases and deaths due to the coronavirus should be thoroughly examined (see Table 3).

It is also necessary to note that there is a positive association between all four main cryptocurrencies under scrutiny and the cases and deaths during the pandemic. This supports that the main cryptocurrencies have not been regarded as risky assets as in the past due to the higher maturity of their markets than before. It has been argued that there are some common characteristics between Bitcoin and other cryptocurrencies and gold, but they are not very similar to the latter. They believe that the safety abilities of cryptocurrencies under the crisis are regarded as one of their new features. As a result, there is a positive relationship between the market values of Bitcoin and other cryptocurrencies following Bitcoin due to high herding behaviour levels in cryptocurrency markets and the coronavirus spreading higher levels.

To analyze the cryptocurrencies results, it can be found that all four are more affected by announcements of the new COVID-19 cases than those of deaths by the latter. In this case, cryptocurrencies have highly volatile assets preferred by speculators. As a result, their volatility and returns are easily affected by bad news even if they do not contain fatal data. Due to the increasing popularity of cryptocurrencies among investors since 2017, even the announcement of new patients rather than deaths causes considerable changes in the returns for their holders and alters their overall assets. ARDL model estimatesthat the short-run dynamics of each cryptocurrency shows the effect of the lags of World Corona Cases (WCC) on the BTC, but there is a difference between the second lag direction and the first and third lags, which is negative. The ETH has similar signs of the coefficients to BTC. Our finding shows that WCC positively affects and the WCC first lag negatively affects XRP. Using the World Corona Deaths World Corona Deaths (WCD) as the independent variable, there remain similar results (Demir et al., 2020). COVID-19 increased Bitcoin prices after April 5, 2020. Other cryptocurrencies and Bitcoin have similar interactions while the interactions are weaker than those of Bitcoin. It shows the hedging role of cryptocurrencies under the uncertainty due to COVID-19. They were priced first like the traditional assets but with a hedging effect of COVID-19.

Conclusion

Recent decades have seen the worst recessionof the global economy due to the COVID- 19 pandemic, and associated measures have been taken to control it gradually. Our findings indicate many interesting insights that can help understand how the crisis affects the investors' behavior. This paper concludes that the world economy has become more vulnerable to a global recession every day due to a global epidemic (COVID-19) that cannot be controlled. The reason is that stock markets and cryptocurrency exchanges are interconnected through sophisticated ICT, mainly due to their inherent volatility, namely their inelastic supply limiting their extensive adoption as a medium of exchange and as a unit of account.COVID-19 caused an $84 billion loss in the cryptocurrency market, dropping to a total of $167.1 billion. It is noteworthy that although cryptocurrency market capitalization has dropped significantly, Bitcoin still dominants this market by 65.1%. In this paper, cryptocurrencies were shown to fulfill the three major functions of money, i.e., performing a medium of exchange, as a unit of account, and a store of value, and they were still more similar to the speculative assets than money was.This elevated uncertainty period resulted in non-annualized daily stock returns of above 5% and losses of above 10%. The one-half value of most cryptocurrencies was lost, while 10% of the equity was lost due to COVID-19. It is concluded that despite the fast reduction of prices due to the COVID-19, the cryptocurrency markets have preserved their economic efficiency.The first insight is that once a crisis starts, investors tend to depart from traditional markets and enter alternative ones such as cryptocurrencies, at least during the early phases of the crisis.

Although cryptocurrency prices are not stable, regulators are concerned about illegitimate use and illegal activity. Furthermore, the Funds Transfer Regulation scope should be extended in the cryptocurrency exchanges to ensure that there are related data about cryptocurrency transactions, allowing terrorist financing checks and adequate money laundering. The innovative blockchain technology ecosystem may also deal with challenges of anonymity and scalability in the future, supporting the case of the permissionless blockchain and decreasing the permissioned blockchains incremental value. More specialized parts of the world’s financial systems should be studied more due to the higher connection of cryptocurrencies to daily social life. For example, we should study the integration of cryptocurrencies into the complex payment system of the home, auto, and investment loans, while loans of fiat currencies are provided with cryptocurrencies used as collateral.

References

Adiyatma, S. E., Maharani, D. F. (2020). Cryptocurrency’s control in the misuse of money laundering acts as an effort to maintain the resilience and security of the state, LESREV (Lex Scientia Law Review), 4(1), 75-88.

Alt, R. (2020). Electronic markets on blockchain markets, Springer.

Chiu, J., & Koeppl, T. V. (2018). The Economics of Cryptocurrencies-Bitcoin and Beyond.

Coincodex.com (2018). Retrieved from https://coincodex.com

CoinMarketCap.com (2020). Today's Cryptocurrency Prices by Market Cap.

Demir, E., Bilgin, M. H., Karabulut, G., & Doker, A. C., (2020). The relationship between cryptocurrencies and COVID‑19 pandemic, Eurasian Economic Review, 10, 349-360.

European Central Bank (2012). Virtual currency schemes”. European Central Bank, Frankfurt amMain. Retrieved from https://www.ecb.europa.eu/pub/pdf/other/virtualcurrencyschemes201210en.pdf

Granger, C.W.J. (1969). Investigating causal relations by econometric models and cross-spectral methods.

Econometrica, 37, 424-438.

Helpnetsecurity.com (2020). Retrieved fromhttps://img2.helpnetsecurity.com/posts2020/blockchain-pwc.jpg Houben, R., & Snyers, A. (2018). Crypto-currencies and blockchain, Legal context and implications for financial

crime, money laundering and tax evasion, European Parliament.

Katarzyna, C. (2019). Cryptocurrencies:opportunities, risks and challenges for anti-corruption compliance system, Kraus, S. et al. (2020). The economics of COVID-19: initial empirical evidence on how family firms in five

Kyriazis, Ν. A. (2020). Effects of the COVID-19 pandemic on worldwide financial markets and opportunities for increasing wealth levels.

Laboure, M., & Reid, J. (2020). Digital currencies: The ultimate hard power tool, part III, Deutsche Bank Research. Massel, S.R. (2001). Wavelet analysis for processing of ocean surface wave records. Ocean Engineering, 28(8),

Miller, D. et al. (2019). Blockchain: opportunities for private enterprises in emerging markets, second and Expanded Edition, Washington, D.C, International Finance Corporation, World Bank Group. Retrieved fromhttps://www.ifc.org/wps/wcm/connect/publications_ext_content/ifc_external_publication_site/publicat ions_listing_page/blockchain+report

Mnif, E., Jarboui, A., & Mouakha, K. (2020). How the cryptocurrency market has performed during COVID 19? A multifractal analysis, Finance Research Letters, 36, 101647.

Morales, L., & Andreosso-O’Callaghan, B. (2020). Covid-19 - Global Stock Markets “Black Swan”. Critical Letters in Economics & Finance, 1(1).

Nakamato, S. (2009). Bitcoin White paper. Retrieved from http://bitcoin.org

OECD (2020). Coronavirus: The Economy at Risk. Organization for Economic Cooperation and Development. Retrieved fromhttps://www.oecd.org/berlin/publikationen/Interim-Economic-Assessment-2-March- 2020.pdf

Ozili, P. K.& Arun T. (2020). Spillover of COVID-19: impact on the global economy.

Prybila, C., Schulte, S., Hochreiner, C., & Weber, I. (2020). Runtime verification for business processes utilizing the Bitcoin blockchain, future generation computer systems, 107, 816-831.

Tapscott, D., & Tapscot, A. (2016). Blockchain revolution: How the technology behind Bitcoin is changing money, business and the world, Penguin Random House LLC. Retrieved from https://www.penguinrandomhouse.com/books/531126/blockchain-revolution-by-don-tapscott-and-alex- tapscott