Research Article: 2019 Vol: 23 Issue: 2

Cryptocurrency: Economic Essence and Features of Accounting

Liudmyla Sokolenko, Sumy National Agrarian University

Tetiana Ostapenko, Poltava State Agrarian Academy

Olga Kubetska, Poltava State Agrarian Academy

Oksana Portna, V. N. Karazin Kharkiv National University

Thuy Tran, Odessa National Polytechnic University

Abstract

The use of cryptocurrencies in international practice suggests that countries are different in its implementation in circulation. This is explained, first of all, by the novelty of this instrument and the lack of a single definition of the “cryptology” category, which would reveal its essence. The positive attitude towards Bitcoins is typical for developed countries, and in developing countries there are some limitations in this area. Also, the emergence of a new product in the market of innovative technologies led to the emergence of a new object of accounting - electronic money. Therefore, countries at the global level should regulate the taxation system for cryptocurrency transactions; introduce a methodology for keeping records of transactions with them for the further development of enterprises and its integration into the global economic environment.

Keywords

Cryptocurrency, Electronic Money, Peering of Virtual Currency, Exchange Rate, Exchange Rate Differences.

JEL Classifications

M21, O16

Introduction

At the beginning of the 21st century, the world entered the third stage of monetary history a period of virtual economy characterized by revolutionary changes in the nature and use of money. The development of the most modern form of money electronic, led to the fact that money began to lose the object-sensory form, became a virtual reality, created by means of technological means.

One of the innovations was the discovery of a special kind of currency, which was called “cryptocurrency”. Today, this phenomenon has become a global phenomenon, known to most people thanks to the crisis of the banking system, the changing exchange rate and other difficulties faced by the business. At the same time, most authors mainly consider the technical aspects of cryptocurrency mining. However, a one-sided research from the position of description of the technical model of functioning does not allow revealing its essence as an economic category, and also prevents the rapid creation of adequate institutional norms, regulatory procedures for the issue and exchange. As a result, there was a certain imbalance - economic innovations ahead of the development of legislation that would regulate the relationship of subjects in the field of cryptocurrency payments.

Review of Previous Studies

The opinions of scientists regarding the attribution of cryptocurrency to electronic money also vary. Drobyazko et al. (2019) on the basis of a detailed analysis of scientific opinions regarding the essence of cryptography came to the conclusion that the definition of cryptocurrency as a “money surrogate” is incorrect. It can be seen as a new form of electronic money, the legal status of which is still in the formation stage.

Juels & Rahman, (2017) came to the conclusion that, in fact, cryptocurrencies are a specific kind of electronic money. Since electronic money in the broadest sense is electronic money held by the issuer, which is at the disposal of the user and which must meet the following criteria: fixed and stored on an electronic medium; issued by the issuer upon receipt of funds from other persons in the amount not less than the issued monetary value; accepted as a means of payment by other persons. On this basis, scientists argue that cryptocurrency corresponds to all the signs of electronic money, and therefore, is a specific kind of electronic money.

Hayes (2017) believes that any cryptocurrency does not have a centralized management, emission and control body, and due to the anonymity of transactions, the absolute impunity of fraud with cryptocurrency is ensured. According to the scientist, this type of currency has no real value and is not guaranteed by any guarantees, and therefore can not be considered a form of electronic money Gainsbury & Blaszczynski, (2017).

On the basis of the analysis of the financial and legal essence of electronic money and cryptocurrencies, Hilorme et al. (2019) expressed the view that cryptocurrencies are the new financial-economic category that has no analogues.

The scientist attributes the following to the significant differences between electronic money and cryptocurrency: technical architecture of electronic money and cryptocurrency; cryptocurrencies do not have an official issuer and are not subscribed to public money, as opposed to electronic money; the circulation of electronic money can be traced (the issuer controls the circulation of electronic money within the limits of its payment system), while the circulation of cryptocurrencies is always anonymous (Drobyazko, 2018).

Methodology

Based on the methods of system analysis, approaches to the definition of the concept of “cryptocurrency” have been investigated. The application of methods of scientific abstraction and comparative analysis, made it possible to determine the features of cryptocurrency as a new economic tool. In the study of the peculiarities of operations with cryptocurrencies, its synthetic and analytical accounting, common scientific methods were used: Induction and deduction, analysis and synthesis, as well as the method of analogy and modeling.

Results and Discussion

The attitude to cryptocurrency is different in the countries of the world. For example, in the United States, bitcoins are considered only as virtual currency, but the attitude to cryptocurrency depends on the state. In the United States bitcoin has been recognized as one type of payment in e-commerce. This country is the most convenient for the cryptocurrency business. ATMs operate here, which enable the exchange of cryptocurrency. Large exchanges, hedge funds and other companies associated with cryptocurrency are also commonplace. Chicago exchanges were the first of the traditional stock exchanges to be able to conduct transactions with financial contracts in bitcoins. In the country, the digital currency is considered simultaneously as an analogue of money, exchange commodity, property and subject to appropriate taxation (Hilorme et al., 2019).

Convertible virtual currencies, unlike nonconvertible, are divided into two subtypes: centralized and decentralized. Decentralized cryptocurrencies are characterized by the fact that they do not have a central administrator and there is no centralized control or supervision. They are distributed, based on the mathematical principles of peer-to-peer open-source currencies. Examples of decentralized virtual currency are Bitcoin, LiteCoin and Ripple.

The first digital currency is the bitcoin that appeared on the market in 2008. It is considered gold among cryptocurrencies. Coin mining is carried out by mathematical calculations, using the power of graphics processors for computers or special equipment - ASIC. Transactions using coins are anonymous. The main task of the miner is to figure out the block code and get a reward of 12 coins (LeMahieu, 2017).

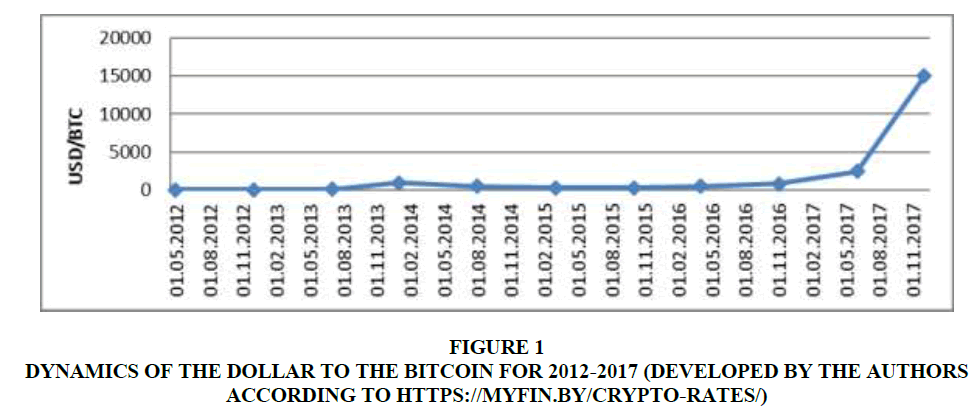

The advantage of Bitcoin is that its maximum quantity is limited, and therefore, they are not threatened by inflation. Also, interest in it creates investment opportunities. The bitcoin exchange rate is not constant and is very volatile, which can be seen in Figure 1.

Figure 1 Dynamics of the Dollar to the Bitcoin for 2012-2017 (Developed by the Authors according to https://myfin.by/crypto-rates/)

Analyzing this graph, we can say that over the past 4 years, the fluctuation of the course is very sharp. Compared to 2012, the bitcoin rate of $ 5.18 increased in 2017 to $ 15033.89 per bitcoin. As a result, the cost of cryptocurrency exceeded the value of an ounce of gold. The main reason for this was the growth of speculative interest in this digital currency.

It should be noted one feature that has been traced in recent years. After an unplanned drop in quotations, another bit of the bitcoin rate is taking place, and it not only reaches the mark from which another recession has begun, but it improves the former value of the cryptocurrency and it hits its own next record. Therefore, those who were able to buy in a timely manner and sell this cryptography on time were able to make big money from small sums.

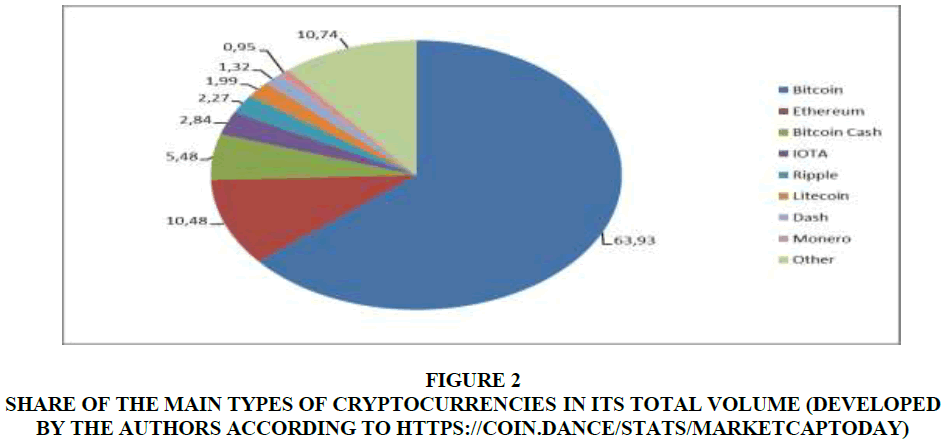

However, cryptocurrency is not limited to one bitcoin that is the most popular in the world and offers the most advanced network infrastructure. The total market capitalization of bitcoin amounted to over $ 250 billion.

Figure 2 shows the share of the main types of cryptocurrencies in its total volume as of 01.01.2018. So, having found out what kinds of cryptocurrency are and what they are different, you can select an object for a property or create an investment project in order to invest in one of the varieties of coins.

Figure 2 Share of the main types of Cryptocurrencies in its total volume (Developed by the Authors according to https://coin.dance/stats/marketcaptoday)

In this article, we conducted a certain analogy between cryptocurrency and foreign currency. Undeniably, there is a big difference between these categories. However, we believe that certain features of accounting for foreign exchange operations are also typical for accounting for cryptocurrency transactions. In this case (use of cryptocurrency as a means of payment) cryptocurrency is part of the monetary articles. Therefore, in accounting for cryptocurrencies, subject to control by the central bank of the country, the concepts of “exchange rate” and “exchange rate differences” may well be applied. We will consider these concepts in such an interpretation: the exchange rate - the currency exchange rate established by the central bank to the cryptocurrency unit; exchange rate difference is the difference between estimates of the same number of units of cryptocurrency at different exchange rates.

Transactions in cryptocurrency in the initial recognition will be reflected in the reporting currency, that is, in hryvnia, by converting the amount in cryptocurrency using the exchange rate at the beginning of the day, the transaction date.

The amount of the prepayment in cryptocurrency, provided to other persons on account of payments for the acquisition of assets, the receipt of works and services, when included in the value of these assets (works, services) will be transferred to the reporting currency using the exchange rate at the beginning of the day of advance payment date. In the case of advance payments in the cryptocurrency to the supplier parts and receipt of parts from the supplier of non-monetary assets, works, services, the value of the assets received (works, services) will be determined by the amount of advance payments using the exchange rates, based on the sequence of advance payments.

The amount of advance in the cryptocurrency, received on account of payments for the supply of products, other assets, works and services, when included in the income of the reporting period, will be converted into the reporting currency using the exchange rate at the beginning of the day of advance receipt. In case of receipt from the buyer of advance payments in the cryptocurrency of parts and shipment of parts to the buyer of assets (works, services) income will be recognized by the amount of advance payments using foreign exchange rates, based on the sequence of receipt of advance payments.

Recommendations

The definition of exchange rate differences on monetary items in the cryptocurrency is recommended at the balance sheet date as well as on the transaction date. In order to determine the differences on the balance date, it is recommended to apply the exchange rate at the end of the day of the balance sheet date. In determining the differences on the transaction date, the rate will be applied to the beginning of the transaction date. An enterprise may recalculate the balance at the end of the day on monetary items in the cryptocurrency, for which, during the day, operations using the exchange rate, established at the end of this day, were carried out. Exchange rate differences from the conversion of monetary items on operating, investment and financial activities will be reflected in other operating income (expenses).

Conclusion

Attributing cryptocurrency to electronic money is inappropriate, since there are significant differences between these concepts: Decentralized nature, mining method of extraction, anonymity, etc. Cryptocurrency has its advantages and disadvantages in comparison with physical and electronic money. All this makes it an entirely new asset, a new economic category.

There are two main types of virtual currencies: Convertible and non-convertible. Nonconvertible cryptocurrencies are centralized. Convertible are divided into two subtypes: centralized and decentralized. The market of cryptocurrencies is very saturated, based on Bitcoin other currencies are created: Ethereum, Bitcoin Cash, Namecoin, Litecoin, PPCoin, Novacoin, Dash, Monero, Zcash, Ripple. The course of cryptocurrencies is not constant and is very volatile.

Lack of effective legal provision causes significant difficulties in reflecting cryptocurrency transactions in financial accounting. We have determined that cryptocurrency is not a form of electronic money, but certain features of accounting for foreign exchange operations are also typical for accounting for cybercurrency transactions. In the case of use of the digital currency as a means of payment, cryptocurrency is part of the monetary articles. Accordingly, in the accounting of cybercurrencies, subject to control by the central bank, the concepts of “exchange rate” and “exchange rate differences” may well be applied.

References

- Gainsbury, S.M., & Blaszczynski, A. (2017). How blockchain and cryptocurrency technology could revolutionize online gambling. Gaming Law Review, 21(7), 482-492.

- Garbowski ?., Drobyazko S., Matveeva V., Kyiashko O., & Dmytrovska V. (2019). Financial accounting of E-business enterprises. Academy of Accounting and Financial Studies Journal, 23(SI 2), 2019.

- Drobyazko, S. (2018). Accounting management of enterprises’ own of in the conditions of legislative changes. Economics and Finance. Scientific Journal Economics and Finance, 10, 4-11.

- Drobyazko, S., Hryhoruk, I., Pavlova, H., Volchanska, L., & Sergiychuk, S. (2019). Entrepreneurship Innovation Model for Telecommunications Enterprises. Journal of Entrepreneurship Education, 22(2).

- Hayes, A.S. (2017). Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics, 34(7), 1308-1321.

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22(1S).

- Hilorme, T., Zamazii, O., Judina, O., Korolenko, R., & Melnikova, Yu. (2019). Formation of risk mitigating strategies for the implementation of projects of energy saving technologies. Academy of Strategic Management Journal, 18(3).

- Juels, A., & Rahman, F. (2017). U.S. Patent Application No. 15/337, 481. Retrieved from https://www.uspto.gov/patents-application-process/search-patents

- LeMahieu, C. (2017). RaiBlocks: A feeless distributed cryptocurrency network. Retrieved from https://raiblocks. net/media/RaiBlocks_Whitepaper__English. pdf.