Research Article: 2021 Vol: 25 Issue: 5S

Deepening South - South Collaboration: An Analysis of India Trade and Investment with Africa

Ratna Vadra, Institute of Management Technology Ghaziabad

Citation Information: Vadra, R. (2021). Deepening south - south collaboration: an analysis of india trade and investment with africa. Academy of Accounting and Financial Studies Journal, 25(S5), 1-12.

Abstract

In the last few years, the economic ties between India and Africa have followed an upward trend due to the economic and technological boom in India. Apart from the trade relations India investment has substantially increased in African continent as it holds a great potential. This paper presents the merchandise trade between India and Africa and the emergence of investment opportunities in Africa. It also provides a systematic analysis of the current scenario of business of India with Africa along with possible recommendations. The paper is organized as follows. Section 1 is the introduction, Section 2 discusses the literature review and Section 3 discusses the reasons for an increase in trade and Indian investment in Africa followed by Section 4 that discusses the trade scenario of India with Africa. Finally, Section 5 discusses the conclusion. The main objective of the study is to find out the reasons which led to an increase in India’s trade with Africa. The trade between India and Africa as a whole and region wise is analysed from period 2000 to 2018.

Introduction

Since India’s independence, it has supported African national struggles and has a leading role in Nonaligned Movement (NAM). But despite of historical ties and ideological affinity, the African continent was relatively marginal in India’s foreign policy and diplomacy until 1990s. In official rhetoric, India’s relationship with Africa is still based on colonialism. Nevertheless, India’s involvement in Africa is driven first and but in spite of historical ties and ideological affinity, the African continent was relatively marginal in India’s foreign policy and diplomacy until 1990s. In official rhetoric, India’s relationship with Africa is still based on the shared historical experience of colonialism. Nevertheless, India’s involvement in Africa is driven first and foremost by what is seen as its national interests.

In recent years India's economic partnership with African countries has been very strong. It is not only about trade and investment, but about technology transfer, information sharing and skill transfer. The trade ties between India and the African countries are centuries-old and can be traced back when Indian merchants interact with countries along Africa's eastern coastline of Africa.

Owing to linearization movements the basis for socio-political relations between India and the African nations was. These relationships have been founded upon a very active Indian community in the sub-region of Eastern Africa. India's booming economy, the growing spending capacity of its overseas undertakings in the public and private sectors and its leadership in science and technology have together shaped its policy toward Africa. India is focused on deepening the economic and commercial ties and at the same time it also contributes to the development of African countries through cooperation and technical assistance.

Africa provides India with an abundance of chances. Resources of the Indian Ocean is situated around Africa. Most of the Indian investment and trade agreements have attracted African countries bordering the Indian Ocean, mostly South Africa, Mozambique and Tanzania.

Both of these countries had fought during the mid-20th century to overturn European colonialism. After that India-Africa diplomatic relations grew stronger and stronger. East Africa is abundant in minerals such as gold, tantalum, aluminium and diamonds. The area is becoming a major supplier of natural gas, a resource which India desperately needs to keep up with demand for energy.

Literature Review

The availability of studies is even weaker in the case of India this study is aimed at contributing to this gap in the literature. According to Chen et al. (2005), the limited available empirical study along this line on Africa includes the studies by Jenkins & Edwards, (2005) and Stevens & Kennan, (2006). The former combines a disaggregated trade analysis with a framework to assess trade-poverty linkages whereas the latter estimates the impact of China on African countries’ trade balance and draws a tentative list of African ‘losers’ and ‘winners’ from China’s risein the international trade arena. The study by Kaplinsky et al., (2006) is also inconclusive. They summarized the trade, production, and FDI and aid related impact of China and India on Africa against direct (both complementary andcompetitive) and indirect (both complementary and competitive) impacts andnoted that it is difficult to conclude whether the impact is positive or negativeacross countries and sectors (Kaplinsky et al., 2006). Pierluigi et al., (2012) in this article looks at the characteristics and evolution over the last ten years of the commodities trade specialization of China, India, Brazil, and South Africa (CIBS),findings contribute to partial mitigation of the pessimistic view which looks at CIBS as a source of threat to the developed world--with the relevant exception of China--while highlighting a competitiveness threat for developing countries. Santos-Paulino, (2011), in his paper analyses the patterns of export productivity and trade specialization profiles in Brazil, China, India and South Africa, and in other economic groupings and regions. Various measures of trade specialization and a time varying export productivity indicator are estimated using highly disaggregated export data. Kunal, (2009) compares India's employment outcomes with four other countries--Bangladesh, Kenya, South Africa, and Vietnam.

Reasons of Increase in India’s Trade and Investment with Africa

Indian Diaspora

Multinational corporations tend to invest in countries where they already have a sales or purchasing network because they know the culture, preference, law, market climate and, above all, the business community network. According to a survey carried out by the World Bank, 48% of the business owners surveyed who are of Indian ethnic origin are also African by nationality compared to just 4% of those who are of Indian ethnic origin. The Indian Diaspora 's present strength in African countries is 2,8 million, of which 2,5 million are PIOs and rest 2,20,967 are NRIs.

India 's inherent strength in Africa is its rich and vast Diaspora which has formed close relations with the African continent 's political, economic, and social fabric. In order to formulate a strategy to improve trade & investment between India and Africa, the Indian Diaspora in Africa needs to be further leveraged to ensure the strategy is successful.

Diaspora link as a driver India’s Diaspora is one of the factors of influence in India’s relation with Africa (Ruchita, 2011) and it is the greatest off shore assets resource for development in human and financial capital (Dubey & Aparajita, 2016). India’s cooperation targets mainly African countries rich in resource or Diaspora (Kragelund, 2010).Therefore, it is considered as one of the motivating factors in the relationship (Ansuree, 2013). The Diaspora connexion as a driver of India's Diaspora is one of the driving factors in India 's relationship with Africa (Ruchita, 2011) and is the largest resource for human and financial capital growth offshore assets (Dubey & Aparajita, 2016). India's cooperation targets predominantly resource-rich African countries or the Diaspora (Kragelund, 2010).Thus, it is considered one of the driving factors in the partnership (Ansuree, 2013). The African Diaspora is a significant source of comparative advantage for India (Ksherti, 2013). It is one of the collaborative possible lines (DFID 2005). Motive of global governance and geopolitical factors for improving Africa 's position on World map. Growing importance of Africa is seen in various multilateral institutions (Ruchita, 2011, Amande, et al., 2015). India collaborates with Africa on a set of global issues such as WTO negotiations, climate change, UN Reforms and terrorism is becoming essential aspect of the relationship (CII 2016). India’s investment in Africa has geo-political dynamism and expansion is made in economic relation through various regional economic blocks (Anwar, 2014).

Vast Mineral resources

African countries offer tremendous opportunities for India with the largest land mass in the world, 54 countries, an enormous mineral resource. Africa has a vast abundance of natural resources. The continent contains around 30 per cent of the estimated mineral reserves in the world. These include cobalt, uranium, diamonds and gold, and large reserves of oil and gas.

Growing and a youthful population

Over the past century, Africa's population has risen rapidly and thus saw a strong rise in youth population followed by a low life expectancy in some African countries of less than 50 years. The total population of Africa as of 2017 is estimated at over 1.25 billion, with a growth rate of over 2.5 percent per annum. Nigeria is African country with the most populous population. Nigeria has 191 million inhabitants as of 2017, with an average growth rate of 2.6 per cent. Around 2.2 billion people will be added to the world population by 2050, and more than half of the increase will take place in Africa. With 1.3 billion more inhabitants on the continent, Africa will account for the largest growth spurt.

Increasing consumption patterns

Africa is one of the world's fastest emerging consumer markets. Home consumption has risen much faster in recent years than its gross domestic product (GDP). Consumer spending in Africa has risen at an annual compound rate of 3.9 per cent since 2010, reaching $1.4 trillion in 2015. By 2025, it is expected to hit $2.1 trillion.

The growth of the middle and upper classes

Another significant factor for growth in India's trade with Africa is middle and upper middle class growth. In 2013 the middle and upper classes constitute just 33.90 per cent of the population. It is projected that about 42.69 per cent of the population will be occupied in 2030. Five African power markets are home to two-thirds of the continent's customer class with 219 million people in Egypt, Nigeria, South Africa, Algeria and Maroc.

Regional trade Agreements

Another important factor is regional trade agreements which increase the size of the market and promote FDI inward. In 2003 India signed a BIT with Sudan and announced a US$ 1bn investment in the oil field. India is now Sudan's second-largest exporter, too. India had not been a major investor or trading partner of Sudan prior to 2003. India also has a Bilateral Investment and a Double Tax Avoidance Treaty with Mauritius that could possibly have led to increased FDI inflows into the country. Free trade agreement (FTA) with India and Africa is proposed, or a preferential trade arrangement that could be another way to increase African trade in global market share (Geda, 2002).

India's contribution is likely to lead to Africa's economic development. It gives African countries access to new investment capital, cheap imports, new export markets and leads to price rises on African countries' exports of raw materials. India has proposed to Africa that both sides should work towards a free trade agreement (FTA) or preferential trade agreement (PTA) to enhance and deepen their economic ties in a new global trade order.

Growth of mobile phones and internet

Mobile technology is a fast-growing market in Africa. Sub-Saharan Africa has undergone exponential economic growth, much of which is driven by digital technology. Cell phones and the Internet allow many African nations to engage in domestic and foreign trade, without an existing industrial base.

Programmed by Indian Government and BRICS Summit

Since then, South Africa has come a long way, providing BRICS with an enduring and much-needed scope across the African continent. The bloc that was formed in 2009 as a BRIC with four initial members – Brazil, Russia, India and China – extended the acronym to include BRICS after South Africa.

The Government of India launched the "Focus: Africa" programme under EXIM Policy 2002-07 to improve the country's trade with the Sub-Saharan African region. Target countries found during the programme's first step include Mauritius, Kenya and Ethiopia. The Government of India provides financial assistance to various trade promotion organisations, export promotion councils and apex chambers in the form of Market Development Assistance under the “Focus: Africa” programme.

From 26–30 October 2015 the Third India-Africa Forum Summit (IAFS-III) took place in New Delhi, India. The BRICS Summit 2018 is the tenth annual BRICS Summit, an international relations conference attended by Brazil, Russia, India, China and South Africa 's five member states heads of state or government. The summit took place in Johannesburg, South, the second time that South Africa hosted the summit after the summit in 2013. These developments improved India's trade with Africa and enhanced Africa's significance on the world map (Kasahara, 2004).

India Trade with Africa

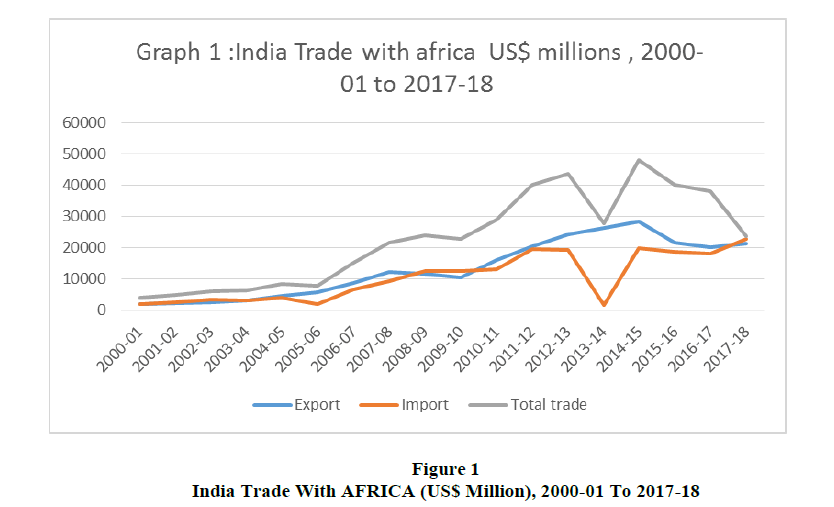

Table 1 and Figure 1 shows the India trade with Africa from period 2000-01 to 2017-18.

| Table 1 India Trade with Africa (US$ Million), 2000-01 To 2017-18 |

||||

| Year | Export | Import | Total trade | Trade balance |

|---|---|---|---|---|

| 2000-01 | 1956.4 | 1996.1 | 3952.5 | -39.7 |

| 2001-02 | 2260.9 | 2502.4 | 4763.3 | -241.5 |

| 2002-03 | 2575.7 | 3348.2 | 5923.9 | -772.5 |

| 2003-04 | 3094.4 | 3103.9 | 6198.3 | -9.5 |

| 2004-05 | 4478.6 | 3930.4 | 8409 | 548.2 |

| 2005-06 | 5699.8 | 1956.4 | 7656.2 | 3743.4 |

| 2006-07 | 8679.5 | 6557.9 | 15237.4 | 2121.6 |

| 2007-08 | 12230.5 | 9338.4 | 21568.9 | 2892.1 |

| 2008-09 | 11576.1 | 12480.5 | 24056.6 | -904.4 |

| 2009-10 | 10417.4 | 12383.1 | 22800.5 | -1965.7 |

| 2010-11 | 15880.4 | 13208 | 29088.4 | 2672.4 |

| 2011-12 | 20501.8 | 19611.3 | 40113.1 | 890.5 |

| 2012-13 | 24395.1 | 19272 | 43667.1 | 5123.1 |

| 2013-14 | 26339.2 | 1499.29 | 27838.49 | 24839.91 |

| 2014-15 | 28380.4 | 19778.5 | 48158.5 | 8601.9 |

| 2015-16 | 21683.5 | 18643.0 | 40326.5 | 3040.5 |

| 2016-17 | 20251.9 | 17976.4 | 38228.3 | 2275.5 |

| 2017-18 | 21472.5 | 22673.0 | 23745.5 | 1200.5 |

Source: RBI handbook of statistics of Indian economy

During the past two decades, Africa's bilateral trade with India has expanded exponentially, steadily rising from US$ 1 billion in 1990 to US$ 3 billion in 2000, then dramatically increasing to US$ 21568.9 million in 2007-08. India's overall trade with Africa in the year 2013-14 was US$ 27838.49 million. The exports are rising but we see sudden dip in imports in year 2013-14. It was US $21472.5 in year 2017-18.

If we see the trade balance in recent years it has been good. We note we have a good trade balance since 2010. It was US $24839.91 in the year 2013-14. India's imports from Africa rose between 2000 and 2009 from US$ 1996.1 million to US$ 112383.1 million, while its exports to the continent rose from US$ 1956.4 million to US$ 10417.4 million over the same period. The total exports to Africa in 2013-14 were US$ 26339.2 and the import amounted to US$ 1499.29 million. Imports increased to US $22673.0 in 2017-18.

India's top export destinations are Nigeria, South Africa, Egypt, Kenya and Tanzania, which together account for over 50% of its overall exports to Africa, but the highest is with South Africa. Indian imports from Africa have seen the biggest growth since 2005. This increase reflects increasing demand for oil and raw materials in India. Indian exports to Africa more than doubled during the same time span. Items produced account for about half of total exports. Currently other major exports include machinery, chemical and pharmaceutical products, transportation equipment, food and livestock etc. India's top 10 African trading partners are South Africa, Nigeria, Egypt, Tanzania, Ghana, Angola, Tunisia, Kenya, Sudan and Morocco. These trade flows are largely driven by economic complementarities (Cheng & Wall, 2005).

India's imports from Africa are mainly crude petroleum, gold, and inorganic chemicals, representing India's high energy resource demand. India is the fifth largest energy user in the world, and this is projected to double in the next 20 years, given the country's rising economy and increasing population. India's petroleum reserves have stagnated at less than 0.5 percent of the world's total, however, which helps to explain the country's high reliance on foreign oil in large part (Paul, 2012).

India is increasingly engaging with African oil-producing countries, namely Nigeria Sudan, Côte d'Ivoire, Equatorial Guinea, Ghana, and Angola, to diversify its energy sources and become less dependent on a global region (currently 75 percent of India's oil is imported from the Middle East). Africa therefore accounts for around 20 per cent of India's overall mineral fuel imports. SouthAfrica, Egypt,Morocco, Tanzania and Tunisia are also main African partners. Besides crude, India's imports from Africa are dominated by gold and other metals (Chakrabarty, 2018).

As the world's largest jewellery manufacturer and lead exporter of diamonds cut and polished, India recognises the opportunities to increase its production and export of finished gold and diamonds in Africa. South Africa is a significant source of gold and diamond imports by India, and is its fourth-largest trading partner. In comparison, India's exports are increasingly diverse, including manufactured goods, machinery, transport equipment, food, and pharmaceutical products (Nayyar & Aggarwal, 2014).

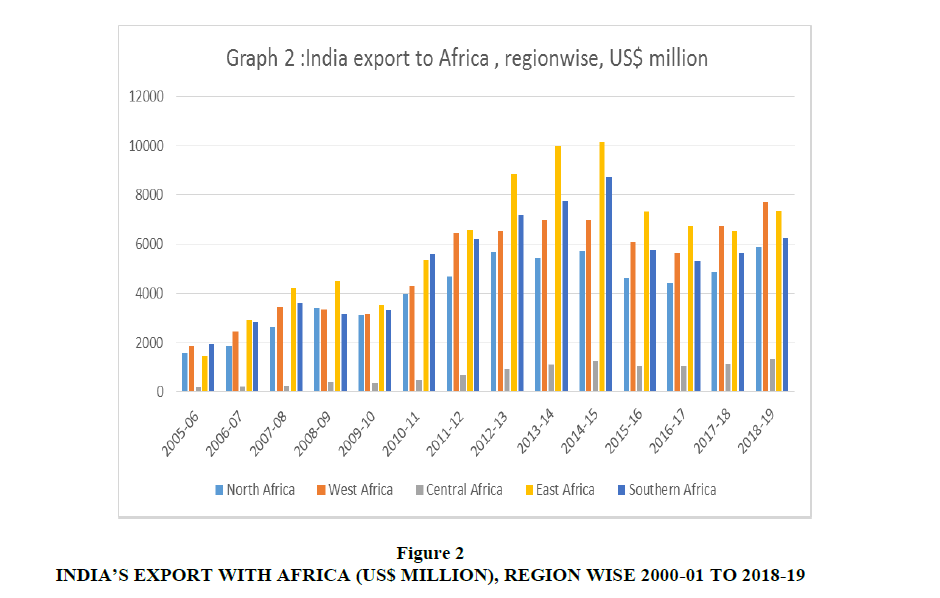

We have also analysed the trade of India with Africa region wise. We have taken North, West, Central, East and Southern Africa in Table 2 and Figure 2.

| Table 2 India Export to Africa Region wise, US$ Million |

||||||||||||||

| REGION | 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| North Africa | 1593.21 | 1861.99 | 2652.26 | 3422.61 | 3125.18 | 3985.85 | 4693.63 | 5681.84 | 5441.63 | 5711.68 | 4594.98 | 4407.33 | 4874.34 | 5,888.58 |

| West Africa | 1857.6 | 2446.76 | 3461.93 | 3357.08 | 3136.98 | 4296.61 | 6460.45 | 6523.39 | 6993.33 | 6980.27 | 6108.29 | 5651.72 | 6718.96 | 7698.24 |

| Central Africa | 165.27 | 203.54 | 257.7 | 384.87 | 349.63 | 465.03 | 707.8 | 931 | 1092.19 | 1251.51 | 1051.51 | 1044.9 | 1142.83 | 1342 |

| East Africa | 1437.42 | 2942.22 | 4214.15 | 4509.79 | 3512.18 | 5346.87 | 6594.24 | 8839.29 | 9975.47 | 10152.26 | 7311.88 | 6728.80 | 6532.53 | 7377.5 |

| Southern Africa | 1940.02 | 2814.93 | 3605.74 | 3139.07 | 3308.94 | 5619.11 | 6217.96 | 7166.98 | 7723.58 | 8746.46 | 5772.34 | 5296.59 | 5635.29 | 6233.95 |

source: http://commerce.nic.in/eidb/ergn.asp)

As can be seen from the Table 3 and Figure 3 Indian exports to Africa have been showing an upward trend since the inception of programme “Focus Africa” in year 2002-03. With around 30% share of total exports to Africa, East Africa has been a major importer followed by Southern Africa and North Africa in the year 2018-19.

| Table 3 India’s Import from Africa Region wise (US$ Million) |

||||||||||||||

| REGION | 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-2018 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| North Africa | 837.17 | 3353.47 | 5,542.93 | 5,823.96 | 4,899.66 | 5,894.40 | 7,405.84 | 6,723.32 | 5108.57 | 4065.83 | 2892.76 | 2929.21 | 4026.50 | 5728.13 |

| West Africa | 1,161.99 | 8,178.06 | 9,726.27 | 11,179.37 | 9,864.24 | 12,862.57 | 17,850.58 | 16,264.44 | 17236.80 | 20034.56 | 16740.61 | 13024.96 | 16833.18 | 20083.90 |

| Central Africa | 19.36 | 29.05 | 49.24 | 153.06 | 270.43 | 45.74 | 85.63 | 230.12 | 108.20 | 265.82 | 530.75 | 368.70 | 479.31 | 554.26 |

| East Africa | 223.73 | 234.42 | 321.14 | 353.43 | 388.49 | 579.73 | 542.87 | 1054.6 | 1034.02 | 1441.99 | 1326.99 | 1319.11 | 1403.77 | 1550.26 |

| Southern Africa | 2,636.31 | 2,921.23 | 4,831.33 | 7,218.48 | 10,191.94 | 12,573.98 | 17,980.70 | 16,838.20 | 13139.33 | 12826.66 | 10176.34 | 11202.75 | 15046.88 | 13198.18 |

source: http://commerce.nic.in/eidb/ergn.asp)

East African countries have strong trade ties with India and that is why Indian products are the largest market. Refined petroleum products, pharmaceuticals, industrial machinery, iron and steel and sugar products are among the major export items to East Africa region. Ethiopia, a less developed country in the region, has proven to be a major trading partner for Indian exporters investing mainly in the agricultural and mining sectors.

Southern Africa, which accounted for about 24.6 per cent of India's total exports to Africa in 2012-13, saw a significant increase in India's exports. Southern African countries imported from Indian companies refined petroleum products, vehicles, pharmaceuticals, electric and construction machinery (Alemayehu, 2006).

North Africa has also picked up momentum when it comes to imports from India, following the Eastern and Southern equivalents. Egypt has proved to be the biggest market for Indian products in the northern region. Automobiles, electrical equipment, and bovine meat are the main import products. The major projects undertaken by Indian companies in the Maghreb area include turnkey projects, refining facilities, gas pipeline, transmission line, and water supply projects (Roy, 2013).

With about 22 percent of total Indian exports to Africa, the imports from India for the West African region mainly include pharmaceuticals, electrical machinery and vehicles. Nigeria is the region's biggest economy and the largest market for India. Thus export to East Africa is largest and to Central Africa it is lowest from period 2005-06 to 2018-19.

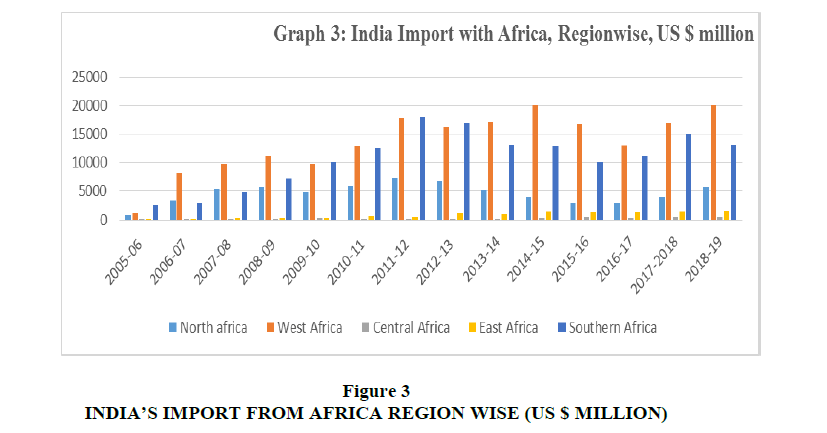

From Table 4 and Figure 3 we can see that Imports from Africa are dominated by South Africa, the largest economy of Africa.

| Table 4 India’s Investment in African Countries in 2010-2017, $ Billion |

||||||||

| Years | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|

| India’s investment to Africa | 11.89 | 16.38 | 23.64 | 13.82 | 15.10 | 18.18 | 11.58 | 13.31 |

| India’s investment to the world | 71.32 | 78.54 | 93.41 | 90.16 | 89.01 | 90.78 | 72.51 | 81.35 |

| Share of investment to Africa in total India’s investment to the world | 16.67 | 20.86 | 25.31 | 15.33 | 16.97 | 20.02 | 15.97 | 16.36 |

Source: Source: International Monetary Fund [IMF] (n.d.)

The country is an important exporter to India and exports mainly gold and coal. India has also been importing iron and steel, inorganic chemicals and mineral ores from the world besides meeting the demand of its large consumer base of gold. West Africa's exports to India have seen an upward trend with a share of about 40 per cent. India is an important importer of the region's crude oil. In addition to oil, significant import items include edible fruits and nuts, especially shelled cashews. North Africa has also begun establishing trade ties with India following the footsteps of Southern and Western Africa. One could see Egypt, Algeria and Morocco as major trading partners. The import items from North Africa mainly include fertilizers, inorganic chemicals and mineral fuel. Apart from above, India has also been importing edible nuts, vegetables, iron and steel, coffee and inorganic chemicals from East Africa and crude oil from Central Africa. Imports are highest from South Africa and lowest from Central Africa (2005-06-2018-19).

India Investment in Africa

Foreign direct investment in sub-Saharan Africa is rising day by day, as opposed to other regions, Africa has become the most attractive region. Africa has advanced from third from last place in 2011 to become the second most desirable investment destination in the world.

Indian companies entering Africa are primarily finding market and capital. Indian FDI to Africa is largely focused on the primary commodity market in oil, gas, and mining. A domination of the automotive and pharmaceutical industries can be seen in the manufacturing sector (Anusree, 2012).

Some of the major sectors in which Indian firms have made substantial investments include healthcare and pharmaceuticals, IT, automotive industry and finance. Leading Indian companies that have invested in South Africa are Wipro, Coal India, Cipla, HCL Technologies, Tata Motors, Zomato and Mahindra and Mahindra. Indian investment in Africa is led by the private sector, with most investments in the service and manufacturing sectors (Vadra, 2012, 2016, 2019).

One explanation for this is that India has large reserves of foreign currency, and the government has relaxed restrictions and controls to allow companies to move internationally. It has also excluded Indian companies from the $100 million limit on foreign investment. Big Indian companies like Tatas, Essar, Vedanta and Kirloskar have invested in Africa. The TataGroup has invested around US$ 100 million over the next three years, and plans to triple that number. The Group claims to have employed700 people in Africa.19 Indian companies are also actively involved to explore commercial farming in various African countries.

Both state-owned companies and Indian private sector operators derive significant support from India's Export-Import Bank through its credit lines programme. The credit lines are seen as enhancing and increasing export trade between the respective regions and India through deferred payment terms. Examples of projects sponsored by Indian companies are: pharmaceutical supply (Uganda, Ghana); transmission line building (Kenya); telecommunications projects (Malawi); railway development project (Tanzania); sugar plant construction (Nigeria); and sewerage research (Ethiopia).

Indian companies have worked in the infrastructure sector in Africa, with government-owned engineering companies such as IRCON (a construction company owned by the Ministry of Railways); and Rail India Technical and Economic Services (RITES), a consulting organisation in the transport, infrastructure and related technology sectors, playing a major role in the construction of roads and railways in countries like Kenya, Mozambique, Algeria, Niger, Sudan.

A study by Ernst & Young found that India had invested in 237 new projects on the African continent in the period from 2007 to 2012, beating China's 152. In fact, in this respect, three Western countries — the United States, the United Kingdom and France — were the only ones to surpass India. The dollar prices tell a different storey; last year, India's $27.3 billion FDI into Africa did not equal China's $119.7 billion. Ernst & Young projects that by 2015, capital flowing to Africa would hit $150 billion, generating 350,000 new jobs per year. Manufacturing, infrastructure and services sectors in Africa have seen especially strong inflows (Vadra, 2019).

The number of FDI projects in Africa has more than doubled to 857 last year from 339 in 2003, While the US and UK are the top investors in Africa, India and China are also aggressively seeking business opportunities on the continent.

Rising India's investment in Africa has contributed to several factors. Factors such as socio-cultural policies, host country policies, regional cooperation agreements, bilateral investment treaties and development of the gross domestic product encourage Indian investors to invest in Africa. India's investment in the year 2010 was $11.89 billion, and in 2017 rose to $13.31 billion Table 4. Despite this rise, India's share of global investment in African countries decreased marginally to 16.36 per cent in 2017, from 16.67 per cent in 2010 Table 6). In 2016-17, Indian FDI in Africa was even smaller at $14 billion than it was at $16 billion in 2011-12, according to the World Investment Report for 2018, except of the 2015 figures, which jumped due to a single investment of $2.6 billion by ONGC Videsh (OVL) for a stake in the Rovuma gas field of Mozambique in 2014. Thus we find Indian investment in Africa has been steadily decreasing year on year since 2014 (Montalbano & Nenci, 2012).

India's top ten investment destination in Africa is Mauritius, with investments of more than $102 billion in 2010-2017, led by Zambia and South Africa. Egypt was on number ten Table 5. Mauritius' share of India's total investment in Africa is 83%. Others have a comparatively smaller share of India's investment in the region (Vadra, 2012).

| Table 5 India’s Investment in Top-Ten African Countries in 2010-2017, $ Million |

||

| No | Country | Investment volume |

|---|---|---|

| 1 | Mauritius | 102,834.94 |

| 2 | Zambia | 10,428.37 |

| 3 | South Africa | 2,665.43 |

| 4 | Libya | 1,651.03 |

| 5 | Nigeria | 1,649.46 |

| 6 | Gabon | 901.52 |

| 7 | Mozambique | 830.53 |

| 8 | Morroco | 812.48 |

| 9 | Ghana | 460.60 |

| 10 | Egypt | 272.52 |

Source: Authors’ development based on IMF (n.d.)

In recent years, besides China, India has also become one of the largest investors in Africa. Most of the Indian investors are investing in different sectors like FMGC, telecommunications, energy, computer services, power, automobile, infrastructure. According to figures given by Confederation of Indian Industry (CII) cumulative investments from India to Africa amounted to 54 billion US dollars between the 10-year period of April 1996 and March 2016. If we see amongst, African nations, Mauritius is the major country in terms of receiving the highest FDI (foreign direct investment) inflows from India followed by Mozambique, Sudan, Egypt and South Africa Table 6.

| Table 6 Indian Green Field investment in Africa |

|

| Year | Capex ($ Billion) |

|---|---|

| 2008 | 4.3 |

| 2009 | 2.8 |

| 2010 | 4.5 |

| 2011 | 7.7 |

| 2012 | 7.8 |

| 2013 | 5.1 |

| 2014 | 1.1 |

| 2015 | 1 |

| 2016 | 1.2 |

| 2017 | 1.1 |

| Total | 36.6 |

Source: Exim Bank of India

Conclusion

In 2017, Africa emerged as India’s third-largest export destination. If we see The composition of commodities of two countries, India and Africa, Africa’s exports to India is mainly crude oil and primary commodities, while India’s export to Africa include manufactured and technological products.

If we see India is Africa’s fourth-largest trading partner after the European Union, US and China. According to the figures issued by India's Department of Commerce, the total trade between India and Africa increased almost five-fold between 2005-06 and 2015-16, and was 52 billion US dollars. (March 2016-17). IN 2012-13 India-Africa trade recorded its touching a figure of 68.5 billion US dollars.

In year 2013-14 total trade of India with Africa was US $27838.49 million. The exports are rising since then but we see sudden decline in imports in year 2013-14. It was US $21472.5 in year 2017-18. South Africa remains India’s leading export destination in Africa with total exports valued at 3.5 billion US dollars accounting for around 15.4 percent of India’s total exports to Africa (2016-17). If we see the trade balance of India and Africa it positive in recent years. If we see country wise, Nigeria is the largest economy of the region and the largest market for India. If we see region wise, export to East Africa is largest and to Central Africa it is lowest from period 2005-06 to 2018-19. Imports are highest from South Africa and lowest from Central Africa (2005-06-2018-19).

Indian companies have made investments in many sectors like healthcare and pharmaceuticals, IT, automobile industry and finance. Most of the top Indian companies that have invested in South Africa are Wipro, Coal India, Cipla, HCL Technologies, Tata Motors, Zomato and Mahindra and Mahindra.

Bilateral trade and investment between India and Africa increased until 2014, and it begins to decline afterwards. For India and Africa, this is not a positive indication, since both have tremendous potential to contribute. One of Africa's significant advantages is that it has abundant natural resources and workable human resources but lacks capital and technical know-how.

We notice an emerging trade-investment partnership between India and Africa in our analysis. While Africa's outward investment in India has increased in recent years, potential obstacles may dampen this upward trend. In realising the opportunities in Africa, the Indian Government has extended support measures to promote trade and investment between them in comparison with China, Indiais still a relatively smaller trading partner for African countries, but its contribution to African international trade is still substantial. Thus, with growing economic engagement, we find that future relations between India and Africa will rely not only on contingent factors such as trade and investment, but also on a policy which would persuade the African people that economic engagement with India would be mutually beneficial.

References

- Alemayehu, G. (2006). The Impact of China and India on African Manufacturing: Review of the Relevant Literature. Addis Ababa University, Department of Economics and African Economic Research Consortium, Nairobi (Mimeo).

- Chakrabarty, M. (2018). Indian investments in Africa: Scale, trends, and policy recommendations. Observer Research Foundation (ORF), 1-66.

- Cheng, I. H., & Wall, H. (2005). Controlling for Heterogeneity in GravityModels of Trade and Integration, Federal Reserve Bank of St. LouisReview, 87(1), 49–63.

- Dubey, A.K., & Biswas, A. (2016). Introduction: A Long-Standing Relationship. In India and Africa's Partnership (pp. 1-9). Springer, New Delhi.

- Ernst & Young Report

- Geda, A. (2002). Finance and trade in Africa: Macroeconomic response in the world economy context. Springer.

- Government of India. (n.d.). Directorate General of Commercial Intelligence and Statistics. Retrieved from http://dgciskol.gov.in\.

- International Monetary Fund. (n.d.). Coordinated Direct Investment Survey. Retrieved from http://data.imf.org/site_moved.html

- Jenkins, R., & Edwards, C. (2005). The effect of China and India’s growth and trade liberalisation on poverty in Africa. Dept for International Development, DCP, 70.

- Kaplinsky, P.D., McCormic., & Morris, M. (2006), The Impact of Chinaon Sub Saharan Africa’ (DFID China Office, DFID, UK).

- Kasahara, S. (2004). The Flying Geese Paradigm: A Critical Study ofits Application to East Asian Regional Development, United Nations Conference on Trade and Development, 169, 1–34.

- Montalbano, P., & Nenci, S. (2012). The Trade Specialization of China, India, Brazil, and South Africa: A Threat to Whom?. The International Trade Journal, 26(5), 363-384.

- Nayyar, R., & Aggarwal, P. (2014). Africa-India’s New Trade and Investment Partner. Retrieved October 1, 2019, from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2757798.

- Paul, A. (2012), Indian Foreign Direct Investment in Africa, CUTS CCIER Working Paper No. 1/2012

- Roy, S. (2013). India and Africa Ties: Challenges and Opportunities. Retrieved October 1, 2019, from https://blogs.lse.ac.uk/africaatlse/2013/07/03/india-and-africa-ties-challenges-and-opportunities/.

- Santos-Paulino, A.U. (2011). Trade specialization, export productivity and growth in Brazil, China, India, South Africa, and a cross section of countries. Economic change and restructuring, 44(1), 75-97.

- Sen, K. (2009). International trade and manufacturing employment: Is India following the footsteps of Asia or Africa?. Review of development economics, 13(4), 765-777.

- Stevens, C., & Kennan, J. (2005). Opening the Package: The Asian Drivers and poor-country trade. Institute of Development Studies University of Sussex, Brighton.

- Vadra, R. (2012). Africa: an emerging markets frontier. African J. Economic and Sustainable Development, 1(2).

- Vadra, R. (2012). Shifting FDIs scenario: a case of an African safari. International Journal of Indian Culture and Business Management, 5(4), 367-384.

- Vadra, R. (2016), Creeping Tiger: India’s presence in Africa, African J. Economic and Sustainable Development, 5(1).

- Vadra, R. (2019). India and South Africa: The new buoyance in trade. Asian-African Journal of Economics and Econometrics, 19.