Research Article: 2018 Vol: 22 Issue: 3

Determinants Influencing Conditional and Non-Conditional Conservative Accounting

Jaka Isgiyarta, Diponegoro University, Indonesia

Indayani, Syiah Kuala University, Indonesia

Rizqi Yulianto, Sriwijaya University, Indonesia

Abstract

This research investigates the determinants (compensation contracts, debt contracts,litigation, accounting regulations and tax growth) affecting conditional and non-conditional conservatie accounting. The investigation involves panel data for a sample of 80 listed companies in Indonesia Stock Exchange (BEI) for the period of 2010-2014. The results indicated that debt contract has a significant positive effect on conditional conservative accounting.However, accounting regulation factors are not proven to be significant to influence conditional conservative accounting. Findings relating to non-conditional conservative accounting indicate that compensation contracts, debt contracts, litigation, accounting regulations and tax growth are not proven to significantly influence their non-conditional conservatie accounting.

Keywords

Conservative Accounting, Conditional Conservative Accounting, Non-Conditional Conservative Accounting.

Introduction

Watts (2003a) Describes conservative accounting as “one of the oldest accounting principles that has an influence on assessment and the root of the principle of realization. Bliss (1924) defined conservative accounting as “anticipate no profit, but anticipate all losses”, the recognition of profits a company’s financial statements after acquiring a legitimate claim on income that aims to reduce the risk and impact of greater loss. Conservative accounting principles have the advantage of avoiding opportunistic management behavior, reducing agency issues and costs, reducing information asymmetry and moral hazards, and preventing greater loss (Ahmed, Billings, Morton, & Stanford-Harris, 2002; Givoly & Hayn, 2000; Lafond & Roychowdhury, 2008; Zhang, 2008). However, there is a view that conservative accounting holds no benefits since the quality of earnings is lower and less relevant, authorizing managers discretionary to discretionarize accounting to their liking (Feltham & Ohlson, 1995; Ohlson, 1995; Penman & Zhang, 2002; Zhang, 2000). However, Watts (2003a) states that “the advantages of the application of conservative principles in accounting far exceed its drawbacks, so its existence is practically still necessary”.

Beaver & Ryan (2005) distinguish the effects of conservative accounting on financial statements to; conditional conservatism as an immediate impact of the recognition of information bias (bad news-good news) and unconditional conservatism of ‘permanent bias recognition’ due to differences in recognition based on book and market values persistently over a given period, especially the differences in the use of accounting methods (Beaver & Ryan, 2000; Feltham & Ohlson, 1995). Ball & Shivakumar (2005), along with Chan, Lin, & Strong (2009) view the conditional conservative accounting as an ex-post or dependent news forms whereas nonconditional conservative accounting as ex-ante or independent news forms. Chan et al. (2009) assert that “ex-ante and ex-post conservative accounting influence the quality of the presentation of financial statements that leads to conservative earnings, thus affecting the users of the report in predicting the cost of equity capital”.

The benefits of applying conditional and non-conditional conservative accounting have the expected effect. (Beaver & Ryan, 2005) argued that the application of conditional conservative accounting aims at suppressing the bias of profit achievement (corporate profits that tend to be over-reported) through the recording of revenues and expenses and their direct effects on the cash flows and accruals. While the application of non-conditional conservative accounting aims to suppress the growth bias (future growth prospects of the firm which tend to be overstated) through the recording of assets and liabilities where the conditions depend on the accounting method used.

(Beaver & Ryan, 2005) noted that “the conditional and non-conditional conservative accounting relationships are negative but influence each other”. The choice of conditional and non-conditional conservative accounting depends on the shape of the firm's choice strategy, whether oriented toward achieving the firm's profit rate or oriented to growth prospects. High profit-oriented managers tend to capitalize on their assets to generate profits and record higher revenues and lower costs. Thus, to reduce the bias of profit achievement is applied conditional conservative accounting. While growth-oriented managers tend to report lower asset values and higher-value liabilities. Thus to reduce the firm's growth bias is applied non-conditional conservative accounting.

Conservative accounting principles were applied in Indonesia in the early 18th century, or since the Dutch colonial invading VOC company which implemented a double entry book keeping system, this noted was found in the Socyteit Amphioen bookkeeping in Batavia which was a modification of the Venetian-Italian recording system (Prasetya, 2012). In its development, the accounting standards in Indonesia (PSAK) recognized the conservative principle on various options of recording method (ie. PSAK Number 14, using either method, FIFO or weighted average method, PSAK Number 16, regulates the estimated useful lives of a fixed asset. PSAK Number 19 concerning intangible assets related to the amortization method). Changes in local accounting standards into international accounting standards in Indonesia still continue to recognize the principles of conservative accounting (Wardhani, 2010; Zelmiyanti, 2016). The fundamental reason why conservative accounting principles still exist in Indonesia, because the role of accountants who always prioritize the concept of prudence in financial statements.

Many conservative accounting studies in Indonesia as far as the researcher's knowledge is still limited to testing the determinants of whether or not influential effect on conservative accounting. Widya (2005) examined the factors causing conservative accounting through ownership structure, debt agreement (leverage) and political costs. Almilia (2005) managed to reveal the hypothesis of political costs and debt/equity hypotheses can affect conservative accounting. Sari & Adhariani (2009) showed the influence of industrial concentration ratio, capital intensity and firm size able to influence conservative accounting.

There are a number of factors believed to the determinants of conservative accounting based on positive acounting theory, (Watts, 2003a; Watts & Zimmerman, 1990); which include: contracts, shareholder litigation, taxation and accounting regulation. Various determinants have a major influence on conservative accounting regulation, especially regarding the presentation of quality financial statement information. In their research Lara & Mora (2004) along with Brouwer (2009), believe that “compensation contracts, debt contracts, litigation, accounting regulations and tax regulations are considered the determinants of the causes of conservative accounting”. There have been different findings in this study; Qiang (2007) and Lara, Osma & Penalva (2009) suggest that “decisive factors are capable of influencing conditional and unconditional conservative accounting”. Other findings reveal a negative but mutually influential relationship on conditional conservative accounting with non-conditional conservative accounting (Ball & Shivakumar, 2005; Beaver & Ryan, 2005; Chan et al., 2009; Wang, 2009). This shows that the research is still controversial and interesting.

In this study, different measurements were developed as determinants of compensation contracts and tax factors. Based on the opinions of Lara et al., (2009); Qiang (2007) and Lafond & Roychowdhury (2008), we suspect that the extent to which compensation contracts influence conservative accounting is determined by the amount of incentives management received rather than the components of the ownership structure of the firm. In contrast to previous use of NPV (Net Present Value) for equity contracting (Ball & Shivakumar, 2006; Qiang, 2007) and provision (Davila & Penalva, 2006; Lara et al., 2009) to measure compensation contract, this research use the total compensation received by the management who joined the board of directors for a year in the form of currency (Armstrong, Blouin & Larcker, 2012). Concerning tax factors whose existence is replaced by tax growth factors, it aims to better represent the existence of the actual role of tax in financial statements. This provides additional new literature in the conservative accounting study, especially in terms of tax growth factor replacing the role of tax factors.

Furthermore, this paper is structured as follows: part two deals with theories, literature review and hypothesis; part three with research methodology; part four with empirical results and discussion, and the final part with conclusions, limitations, implications, recommendations, and further research agenda.

Theoretical Framework And Hypothesis

Theoretical Framework

Positive Accounting Theory (PAT) (Watts, 2003a, 2003b; Watts & Zimmerman, 1978, 1990) is useful in predicting and identifying the determinants leading to conservative accounting and the benefits of conservative accounting. To predict means conservative accounting can influence financial report (Basu, 1997). To explain means to reveal the major factors that trigger conservative accounting (contracting, litigation, regulation and tax) and the impact created as a determinant of the quality of a company’s financial statements (Watts, 2003a; 2003b).

PAT can be identified in three hypotheses namely Bonus Plan Hypothesis, Debt Covenant Hypothesis and Politic Process Hypothesis (Watts & Zimmerman, 1990), which all recognize the existence of interpersonal relationship to minimize agency costs of contracting parties (Deegan & Unerman, 2006), especially regarding the practice of accounting method selection and how a manager responds to the application of accounting standards (Scott, 2000). Basu (1997) & (Watts, 2003a; 2003b) believe that the existence of conservative accounting has a benefit in practice, since on the basis of such conservative principles, an accountant is required to be extra careful in acting and making decisions.

Conservative accounting on the agency theory framework explains and predicts the impetus of management policy and the demands of stock owners/investors/creditors to implement conservative accounting in the company’s financial statement. The goal is to reduce agency issues, improve the quality of the report and raise the corporate value (Eisenhardt, 1985; Jensen, 1986; Jensen & Meckling, 1976). In the opportunist and efficiency perspective, it is intended to facilitate the explanation and prediction of the relationship of various determinants directed by management in order to make a choice of implementing the conditional or nonconditional conservative accounting (Christie & Zimmerman, 1994; Deegan & Unerman, 2006; Scott, 2000).

Hypotheses

It is Suspected that Contract Compensation Influences Conditional Conservative Accounting (Ha.1a)

Researchers in the field of conservative accounting believe that the existence of contractual agreements is the initial cause of conservative occurrence in financial statements. According to the positive accounting theory (Watts & Zimmerman, 1978, 1990), “the compensation contract is derived from the bonus plan hypothesis or compensation plan hypothesis, in which a manager tends to choose accounting procedure that are considered profitable”. The bonus plan hypothesis is the basis of compensation contract that predicts that a manager tries to plan the amount of compensation he/she receives based on the size of the profit.

Increased compensation contracts are regarded as rewards/stimuli from firm owners to the management to work harder and generate more profits. Nevertheless, increased compensation contracts do not always bring about positive effects on management behavior. They have the potential to promote such opportunistic management behavior by recording higher profit revenues and lowering costs than appropriate, so that the demand for conditional conservative accounting application is higher, with the intention of achieving objective and qualified fixed return gain. On the basis of such, the hypothesis formulation is:

Ha. 1a Compensation contract positively affects conditional conservative accounting.

It is Suspected that Compensation Contract Has Influence on Non-Conditional Accounting (Ha.1b)

The relationship between the tendency to apply either conditional or non-conditional conservative accounting is highly influenced by the condition of the firm. Latridis (2011) in his research confirms the findings of the previous research (Beaver & Ryan, 2005; Chan et al., 2009; Wang, 2009), “which stated that firms that tend to disclose high earnings reports tend to apply conditional conservative accounting, while those with high growth rates of assets tend to apply non-conditional conservative accounting along with weak accounting information that gives a lot of explanation”. Findings by Qiang (2007) and Lara et al., (2009) consistently show that compensation contracts have no effect on non-conditional conservative accounting. An increase in compensation contract that could improve the application of conditional conservative accounting, is not necessarily interpreted as capable of reducing non-conditional conservative accounting. On the basis of the above, the hypothesis is:

Ha 1b Compensation contract negatively affects non-conditional conservative accounting.

It is Suspected that Debt Contracts Has Influence on Conditional Conservative Accounting (Ha.2a)

Watts & Zimmerman (1990) used the basis of PAT to explain the occurrence of debt contract mechanism based on debt covenant hypothesis. The higher the debt-to-equity ratio, the greater the probability of managers using optimistic accounting method in improving the firm’s earnings reports. Debt contract mechanism at least assures the manager to act in the best interest of the owner or to seek compensation of the firm or creditors in accordance with the contractual agreement of the debt. Qiang (2007) and Lara et al., (2009) noted that “managers who seek to increase the firm’s debt contract tend to report higher company’s profitability”. In order to avoid earnings reporting bias, the owners or creditors demand an increase in the application of conditional conservative accounting. On this basis, the following hypothesis is formulated :

Ha 2a Loan contract positively affects conditional conservative accounting.

It is Suspected Debt Contract Has Influence on Non-Conditional Conservative Accounting (Ha.2b)

Beaver & Ryan (2005), Ball & Shivakumar (2006), Chan et al., (2009), Wang (2009), and Latridis (2011) noted that debt contracts negatively affect non-conditional conservative accounting. The management tries to exaggerate its earnings because of the pressure of its debt contract. On the other hand, the firm’s growth is reported to be lower. As a result, loan contract have a negative effect on non-conditional conservative accounting. On that basis, the hypothesis is written down as follows:

Ha 2b Loan contract negatively affects non-conditional conservative accounting.

It is Suspected that Litigation Has Influence on Conditional Conservative Accounting (Ha.3a)

Based on political cost hypothesis, Watts & Zimmerman (1990) stated that “the manager of the firm facing a litigation issue tends to choose accounting procedure that can suspend its current-period profit into the future, or try to lower the earnings in order to improve the quality of its financial reports”. Ball, Robin, and Wu (2000) and Francis, Lafond, Olsson & Schipper (2002) reveal that litigation issues are strongly influenced by legal environment of the firm is located. In firms with a strictly legal environment, the application of conservative accounting is higher when compared to firms in a loose legal environment. Litigation affects conditional conservative accounting (Basu (1997); Qiang (2007) and Lara et al., (2009)). The higher litigation faced by the firm, the more conservative its manager is in applying accounting method Watts (2003a). Juanda (2007) asserts that the higher the risk of corporate litigation, the greater the potential for the conflicts it may incur, resulting in a higher demand to apply conditional conservative accounting. On the basis of such, the hypothesis is formulated as follows:

Ha 3a Litigation positively affects conditional conservative accounting.

It is Suspected that Litigation Has Influence on Non-Conditional Conservative Accounting (Ha.3b)

Findings by Qiang (2007) and Lara et al., (2009) explained that a firm’s manager makes every effort to minimize litigation costs. Early recognition of bad news may reduce the possibility of a class action as well as shorten the period of lawsuits. As a firm faces high litigation, management tends to reduce non-conditional conservative accounting to increase the net asset value. The hope is that when profits are reported to decline, the company appears to be growing; thus avoiding the demands from owners and shareholders. Research by Qiang (2007) and Lara et al., (2009) showed that litigation affects the application of non-conditional conservative accounting. From the description above, the hypothesis is that:

Ha 3b Litigation negatively affects non-conditional conservative accounting.

It is Suspected that Accounting Regulation Affects Conditional Conservative Accounting (Ha.4a)

Watts & Zimmerman (1978) stated that “the occurrence of accounting regulations is related to political cost hypothesis”. An accounting regulation problem arises as a result of a conflict of interest between the firm and the regulator regarding the accounting figures in the firm’s financial statements, so the management tries to minimize the profit earned to cut down accounting regulation problems. Watts (2003a) stated that the higher the political cost attributable to accounting regulation, the more likely the firm applies conservative accounting. Widya (2005), Lo (2005), Lara et al., (2009) managed to prove that accounting regulation has a great influence on conditional conservative accounting. Lara et al., (2009) argued that the greater and more complacent the operations of a firm, the more accounting regulations that must be faced; therefore, the management implements a conditional conservative accounting that can reduce the firm’s earning to lower regulatory costs. On the basis of such, the hypothesis is written as follows:

Ha 4a Accounting regulation positively affects conditional conservative accounting.

It is Presumed that Accounting Regulation Affects Non-Conditional Conservative Accounting (Ha.4b)

Accounting regulations have an influence on the application of non-conditional conservative accounting. (Qiang, 2007) explained that large operations tend to gain such big profit that it attracts regulators to impose higher accounting cost responsibility. To avoid this, managers will apply non-conditional conservative accounting by increasing the firm’s growth to decrease profit. Based on this, the hypothesis is formulated as follows:

Ha 4b Accounting regulation negatively affects non-conditional conservative accounting.

It is Suspected that Tax Growth Affects Conditional Conservative Accounting (Ha.5a)

Based on tax PAT theory, tax is a part of political cost hypothesis. Tax growth is expected to replace tax roles as burdens Watts (2003a), tax role representation as incentives (Qiang, 2007), and its tendency to incur burden (Lara et al., 2009) as a single unit of assessment that accommodates not only the influence of owners and investors but also that of the tax authorities. Qiang (2007) and Lara et al. (2009) found that tax factors consistently affect conditional conservative accounting policies in financial reporting. This study assumes that if the growth of taxes increases sharply, the profit of the company also increases and tax payment would also increase, which will reduce its profit. Therefore, the researcher suspects that tax growth factors affect conditional conservative accounting by selecting accounting method that can reduce earnings. On this basis, the hypothesis can be submitted as follows:

Ha 5a Tax growth positively affects conditional conservative accounting.

It is Suspected that Tax Growth Affects Non-Conditional Accounting (Ha.5b)

Tax more dominantly affects non-conditional type of accounting. A firm that chooses to adopt non-conditional conservative accounting regarding tax aims at reducing its book revenue and book income (Qiang, 2007; Shackelford & Shevlin, 2001), by admitting the loss of the previous period, exercising strict control over good and bad news, reducing substantial expenses and conducting income smoothing. Based on the findings by Basu (2005) and Lara et al., (2009) that tax affects non-conditional conservative accounting, the researcher suspects that tax growth also has an influence on non-conditional conservative accounting. Increased corporate tax growth is caused by increased tax payments. Excessive tax payments result in reduced investment opportunities and the addition of the firm’s net asset value; as a result, its assets are reportedly likely to decline. In order to keep asset and investment values reporting up, management tends to reduce the application of non-conditional conservative accounting. On such basis, the hypothesis is formulated as follows:

Ha 5b Tax growth negatively affects non-conditional conservative accounting.

Research Method

Sample Selection

The data collected are gathered from Indonesia Capital Market Directory (ICMD), Annual Report and Financial Statement at Indonesian Stock Echange (BEI) and www.idx.co.id for 2010 -2014. (Ball & Shivakumar, 2005; Basu, 1997; Beaver & Ryan, 2005) state that “the application of conservative principles in the financial statements can be detected after a minimum of 3 years of observation”. This research selected manufacturing industries because they tend to use such higher accrual elements so as to give a picture of the actual conservative accounting. The type of data used is panel data, i.e. a combination of time series and cross section. The sample data of the selected firm amounted to 80 companies a total of 400 observation units.

Variable Measurement

Conditional Conservative Accounting. (COND = Y1)

This study uses the conditional conservative accounting measurement model by Ball & Shivakumar (2005), namely Asymmetric Accrual to Cash-Flow. This model is not affected by the increased default risk on the payment of corporate debts so as not to cause a higher upward bias toward conservative accounting. Accrual basis of measurement is to avoid depending on stock return of the firm. The calculation formula is as follows:

ACCit = β0 + β1 DCFOit + β2 CFOit + β3 DCFOit .CFOit + εit (1)

in which;

ACCit =accrual operation, measured by (Δinventory + ΔAccount recievable + Δother current assets)–(ΔDebt + Δother cuurent debt + Depreciation).

DCFOit = dummy cash-flow operation, if 0, CFOit ≥ 0, and if 1, CFOit < 0.

CFOjt = cash flow from operation of company i in year t or Cash Flow for t period.

This study uses dummy to measure conditional conservative accounting for easy comparison with non-conditional one. Determination of dummy variable for conditional conservative accounting is done based on the calculation result using β3*DCFOit.CFOit. If the calculation results a value of zero, the company is considered not to apply the conditional conservative accounting and is noted as dummy 0. However, if the result is negative, the company has applied conservative accounting and is noted as dummy 1.

Non-Conditional Conservative Accounting. (NONCOND = Y2)

Non-conditional conservative accounting is defined as ‘the recognition of permanent bias’ caused by differences in recognition based on book and market values that persist over a certain period. The measurement of non-conditional conservative accounting uses the measurement of Beaver & Ryan (2000). Lara & Mora (2004) and Wang (2009) suggested that this measurement is a better form of measurement and is capable of representing non-conditional conservative accounting. The measurement phase is as follows:

1. Calculating BTM (book to market) and RET (return) ratios using the formula:

BTMit= BVit/ NPit (2)

RETit = (Pit - Pit-1)/ - Pit-1 (3)

In which:

BVit = Book value of equity or net assets for the firm i over t period

MVit= Market value of equity for the firm i (number of shares outstanding x closing price) over t period

Pit= stock prize for the firm i over t period

Pit-1 = stock prize for the firm i over t period

2. Performing regression between BTM and Return for all firms and during the sample period by using the formula:

BTMit = a + β RETit+ e it (4)

3. Calculating the fixed effect coefficient by regulating RET to BTM, using the formula:

In which:

BTM it = book-to-market ratio for the firm i over t period

a = intercept between all companies and all the years

ai = firm-specific persistence bias component of the BTM ratio during sample period

D1 = dummy variable for firm-specific

RETit = stock return including dividend for the firm i over the year t

4. The fixed effect value of each firm is obtained from the regression equation (5) using 5-year panel data for all samples. As a component affecting BTM, the fixed effect measures the conservative level in reverse. The level of conservatism of each firm equation result is then multiplied by –1. The higher the value obtained, the more conservative the firm is considered based on the index value. The final result of fixed effect measurement of each firm can be both positive or negative.

5. This non-conditional conservative accounting measurement uses the dummy variable of the dependent variable. The goal is that the results can be compared with those of conditional conservative accounting measurement. If the final result of the firm’s fixed effect is positive, the firm is considered to have implemented conditional conservative accounting and is marked as dummy 1. Conversely, if the final result of the firm’s fixed effect is negative, the firm does not apply conditional conservative accounting and is marked as dummy 0.

Compensation Contract. (COMP = X1)

The compensation contract is proxied using the natural logarithm of the total compensation value received by the board of directors for a year (Armstrong et al., 2012) in cash (rupiahs) excluding salary. Armstrong et al., (2012) and Irawan & Farahmita (2012) used the total compensation Ln received by the board of directors to measure the compensation contract. The proxy calculation of compensation contract is as follows:

COMP = Ln of Compensation Total Received by the Board of Directors in Cash over Year t (6)

Loan Contract. (LEV = X2)

Qiang (2007) stated that “leverage proxy is capable of functioning as a means to indicate a tendency of a firm to violate its debt contract terms”. The firm with high leverage tends to have a large conflict of interest between shareholders and bondholders, thus eventually affecting contractual demand for increased application of the firm’s conservative accounting. The debt contract is proxied to the leverage ratio of the total debt to total assets.

LEVt = (Total Debt/ Total Asset) (7)

Litigation (LIT = X3)

Litigation is interpreted as a potential inherent loss that affects the financial statements of the firm due to legal problems in relation to outsider parties (stakeholder's). Litigation in this research is proxyed with liquidity ratio. Juanda (2007) and (Johnson, Kasznik, & Nelson, 2001) in their research stated if the firm's financial ratios in the form of liquidity and solvency can be used to proxy litigation. If a firm has a lower level of liquidity ratios, the lower the firm's ability to pay off its current liabilities that impact on increasing legal or litigation issues. Litigation is proxied with liquidity ratio using quick ratio (acid test ratio), in which current assets minus inventory are divided by current liabilities. The lower a firm’s level of liquidity ratio is, the lower its ability to pay off its current liabilities (Johnson et al., 2001; Juanda, 2007).

Quick Ratio = (Current Assets - Inventory) / Current Liabilities (8)

Accounting regulation (REG = X4)

Accounting regulation can be proxied with firm size using sales growth ratio. The larger a firm, the more complex the issues it faces, the more accounting regulatory requirements it must follow, and the more accounting regulation cost it must incur (Scott, 2000; Watts, 2003a; Watts & Zimmerman, 1990). In large companies whose growth ratios are increasing, their accounting regulatory issues are also increasing. (Ahmed et al., 2002) argued that the growth rate of sales of a firm was considered more appropriate to represent the size of the firm and the influence of accounting regulations that cause the cost of regulation. The greater the sales growth of a firm, the more the firm grows. Firm that grows into big course more and more accounting regulations faced. The calculation of sales growth ratio referring to the research by Qiang (2007), Lara et al., (2009) and Lasdi (2009) is:

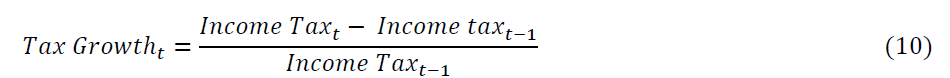

Tax growth (GRWTX = X5)

Tax growth is expected to replace the role of taxes as an expense Watts (2003a). Representation of tax role as incentive (Qiang, 2007), tax as pressure (Lara et al, 2009b), accomodated through tax growth. In addition, through tax growth, it is expected that the incentives and tax pressure of the scope will be more broadly influenced by the firm, not only influenced by the owners or investors, but the fiscal role is also taken into account in providing incentives and pressure to the firm. The use of tax growth factors will be seen as a single unit of assessment in place of the tax factor and is not seen separately as an expense, incentive or pressure on taxes. Tax growth is a new factor developed in research to represent the actual taxation position. The tax growth relates to corporate income tax, and it can be defined as the percentage of change in income tax payment a firm currently incurs compared to the previous year’s corporate income tax payment based on its tax rate using the formula:

Hypothesis testing

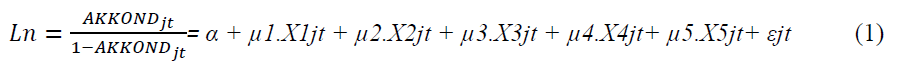

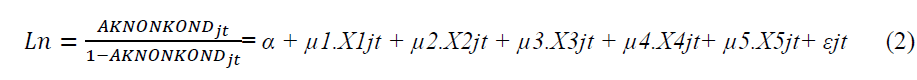

This research uses logistic test model with two equation models:

1. Testing the first group hypothesis about the various determinants associated with conditional conservative accounting (Ha.1a – Ha.5a). The equation model (1) used is:

2. Testing the alternative hypothesis of the second group on various determinants relating to non-conditional conservative accounting (Ha.1b – Ha.5b). The equation model (2) can be presented as follows:

Logistic regression model testing is conducted because the numeric value of conditional and non-conditional conservative accounting as the dependent variables is dummy (Dummy 1 = The firm implements conditional and/or non-conditional conservative accounting; Dummy 2 = The firm does not implement conditional and non-conditional conservative accounting) when used to test alternative hypotheses. The replacement of actual numeric value resulting from the calculations of conditional and non-conditional conservative accounting into dummy variable is intended to facilitate the comparison.

Empirical Result And Discussions

First Group Alternative Hypothesis Testing. (Ha.1a; Ha.2a; Ha.3a; Ha.4a and Ha.5a)

Table 1 shows the feasibility test result of equation model (1). In general, it is declared feasible and its measurement model is adequate (model fit). The likelihood test showed a test of 2 -2LogL Beginning Block (block 0) of 408,500 and the second block (block 1) of 369,318, so - 2LogL Block 0> -2LogL Block 1, and a decrease of 39.182. Based on these finding, the second block testing model is better for predicting the likelihood of differences between firms that apply conditional conservative accounting and those that do not. On that basis, the -2LogL ratio reinforces the precision testing of preceding classification predictions. The Nagelkerke R Square test shows the determination coefficient R2 of 0,146. Hosmer & Lemeshow's Goodness of Fit test shows a value of 12.635 with significance of 0.125.

| Table 1: Goodness Of Fit Model First Group |

||

|---|---|---|

| Classification Table | Block 0 : Beginning Block 79,30% | -2 LLB 0 > -2 LLB 1 |

| Block 1 : Method Enter 79% | ||

| Overall percentage correct : | ||

| -2 log likehood block 0 | 408.500 | |

| -2 log likehood block 1 | 369.318 | |

| Selisih Perbandingan | 39.182 | |

| Cox & Snell’s R Square Test | 0.093 | Var. Independent vs Var. Dependent = 9,3 % |

| The other var. Outside model = 90,7% | ||

| Nagelkerke R Square | 0.146 | Var. Independent vs Var. Dependent = 14,6 % |

| The other var. Outside model = 85,4% | ||

| Hosmer & Lemeshow’s | 12.635 (sig 0.125) | Sig 0.125 > Sig standard 0.05 |

| Goodness of Fit | ||

Table 2 reports the results of wald test and the Omnibus Test of the first group of various determinants relating to the conditional conservative accounting (Ha.1a; Ha.2a; Ha.3a; Ha.4a and Ha.5a). The results show negative and significant coefficients on the effect of COMP on the COND (wald = 4.128, β = -0.207, p = 0.042); thus, Ha.1a is rejected; although the results are significant, the direction is negative. The negative influence can be interpreted as that when the firm cut down the value of its compensation contract; it is a form of pressure (punishment) to the management to improve the quality of financial reporting or to increase profits. These results support the compensation plan hypothesis in which compensation affects conditional conservative accounting. By decreasing compensation contract, a firm’s owner requires an improvement in the conditional conservative accounting where financial statements are neither biased nor opportunistic.

| Table 2: Wald Test And Omnibus Test First Group |

||||||

| Wald Test : | ||||||

|---|---|---|---|---|---|---|

| Variable | B | S.E. | Wald | df | Sig. | Exp (B) |

| COMP | -0.207 | 0.102 | 4.128 | 1 | 0.042 | 0.813 |

| LEV | 1.083 | 0.521 | 4.313 | 1 | 0.038 | 2.953 |

| LIT | -0.457 | 0.203 | 5.082 | 1 | 0.024 | 0.633 |

| REG | 0.504 | 0.362 | 1.943 | 1 | 0.163 | 1.656 |

| GRWTX | -0.222 | 0.098 | 5.115 | 1 | 0.024 | 0.801 |

| Constant | 3.173 | 2.396 | 1.754 | 1 | 0.185 | 23.89 |

| Omnibus Test of Coefficiensts : | Chi-Square=39.182 | |||||

| Simultan test | Sig 0,000 < Sig Std. 0.05 | |||||

Table 2 shows the result of Ha.2a hypothesis testing, yielding positive and significant results (wald = 4.313, β = 1.083, p = 0.038); therefore Ha.2a Accepted. LEV has the highest exponential value of 2.953, thus LEV has a highest chance of affecting the COND. The acceptance of Ha.2a has supported the debt covenant hypothesis based on positive accounting hypothesis (Watts, 2003a; Watts & Zimmerman, 1990) and agency theory (Jensen & Meckling, 1976), which states that the application of conservative accounting is necessary in case of debt contracts to limit opportunistic management behavior. In the opportunistic and efficiency perspective of Christie & Zimmerman (1994), this finding suggests that debt contract affects management policy in high profit reporting, making conditional conservative a means to cut down opportunistic management behavior and raise corporate value. The findings of Ha.2a hypothesis have supported the findings by Qiang (2007) and Lara et al., (2009). In Indonesian context, these findings is different from those of Widya (2005) which previously suggest that debt contract has a positive but insignificant effects on (conditional) conservative accounting.

The Ha.3a hypothesis suggests that litigation (LIT) positively affects conditional conservative accounting (COND). However, the results are inconsistent with the hypothesis; that is, litigation negatively and significantly affects conditional conservative accounting (β = -0.457, p = 0.024), meaning that Ha.3a is rejected. The litigation factor is still relevant to PAT theory, despite obtaining different policy directions. The findings can be interpreted as that the negative value of litigation proxied by quick ratio indicates the firm low ability to pay its current liabilities (Johnson et al., 2001; Juanda, 2007), or that the firm is facing such a critical litigation issue that “the management raises its conditional conservative accounting to decrease the corporate profit. Basu (1997) stated that the management and owners try to defend the interest of their company when dealing with external parties, thus causing litigation to affect the company’s policies regarding conditional conservative accounting”. Litigation issues force the management to work carefully in reporting the company’s profit. To produce a quality financial report, it is necessary to apply conservative accounting Watts (2003a). These findings are inconsistent with those found by Qiang (2007), Lara et al., (2009), Widya (2005) and Lasdi (2009).

Wald Test results for REG variable is 1.943, with REG variable coefficient value of 0.504 and Symp. Sig = 0.163 > Std. Sig = 0.05. That is, Ha.4a is rejected; even though the direction is positive, the results are not significant. This is inconsistent with the PAT theory, which states that accounting regulation believed to be part of political hypothesis is one of the major factors causing conservative accounting. The main cause for the unsignificant results lies in the use of proxy sales growth that is considered less relevant to represent regulation factors. The average value of sales growth for manufacturing companies in Indonesia is very small bellow the middle of the ratio between the highest and lowest sales growth, so it does not affect the testing significantly. The results of this study are consistent with the findings of Lasdi (2009) that indicate that the proportion of sales growth is irrelevant in representing the existence of accounting regulations, especially for manufacturing companies in Indonesia.

Ha.5a hypothesis is related to tax growth factor as a new factor that emerges as one of the causes of the occurrence of conditional conservative accounting. Its role replaces the tax factor. However, Ha.5a is denied because even though it is significant, the direction is negative (β= - 0.222 p = 0.024). However, while having a negative effect, tax growth factor has a significant effect on conditional conservative accounting. This supports the theory that tax growth factor derived from tax factor is part of political hypothesis in PAT. Agency issues occur due to the conflict of interests either between a firm and tax authorities, but do not rule out the conflict between management and owners caused by the large tax payment. Conservative accounting is necessary based on agency theory of Jensen & Meckling (1976) to reduce agency conflicts and cut down the risk of greater loss Watts (2003a). This finding is consistent with Lara et al., (2009) who proved that tax factor has a significant effect on conditional conservative accounting. This study views that tax growth capable of accommodating any interpretation of the important of taxes for a firm, and the results prove that tax growth factor affects conditional conservative accounting. The negative effect shows that an increasing tax growth impacted on the decline in the quality of corporate profits. As a result, the management tries to cut down the amount of tax by shifting tax burden to the next period in order to avoid fiscal pressure and investor or owner pressure due to excessive tax payment. At least, through the application of conditional conservative accounting the profit can be lowered so as to reduce tax payment as well as minimizing the impact of tax growth.

Omnibus test (simultaneous test) results in Chi-Square value of 39.182 with significant 0,000 < Sig Std. 0.05. That is, the various determinants (COMP, LEV, LIT, REG, GRWTX) all have a significant affect simultaneously on the application of conditional conservative accounting (COND). The result of Omnibus test supports the previous Wald Test.

Testing of Second Group Alternative Hypotheses (Ha.1b; Ha.2b; Ha.3b; Ha.4b and Ha.5b)

Table 3 shows the test results of Goodness of Fit Model equation (2) as a whole are considered feasible and the measurement model is considered fit. The observational prediction accuracy value of 60.30% is still more than the average and declared feasible. Likelihood Test - 2LogL Block 0> -2LogL Block (1) means that the second regression model is better to predict the likelihood of differences between firms that apply non-conditional conservative accounting and those who do not. Coefficient of determination R2is 0,004. Nagelkerke's R Square of 0.005 indicates that non-conditional conservative accounting can only be influenced by various determinants of 0.5%. Hosmer & Lemeshow’s Goodness of Fit shows Chi-Square 13,997 Sig 0.082> Sig standard 0.05; it means that logistic regression model used is able to predict the observation value and the null hypothesis can not be rejected.

| Table 3: Goodness Of Fit Model Second Group |

||

|---|---|---|

| Classification Table | Block 0 : Beginning Block 60% |

|

| Block 1 : Method Enter 60.30% |

||

| Overall percentage correct : | ||

| -2 log likehood block 0 | 538.409 | -2 LLB 0 > -2 LLB 1 |

| -2 log likehood block 1 | 536.985 | |

| Selisih Perbandingan | 1.424 | |

| Cox & Snell’s R Square Test | 0.004 | Var. Independent vs Var. Dependent = 0,4 % |

| The other var. Outside model = 99,6% | ||

| Nagelkerke R Square | 0.005 | Var. Independent vs Var. Dependent = 0,5 % |

| The other var. Outside model = 99,5% | ||

| Hosmer & Lemeshow’s | 13.997 (sig 0.082) | Sig 0.082 > Sig standard 0.05 |

| Goodness of Fit | ||

Table 4 shows the results of COMP have positive and insignificant effect on NONCOND (wald = 0.061, p = 0.445), so, Ha.1b is rejected. These findings rejected earlier predictions that estimate compensation contracts are negatively and significantly related to non-conditional conservative accounting. These findings mean that an increase in the compensation contract does not necessarily have a direct impact on the growth of the firm, thus not affecting the increasing demand for the non-conditional conservative accounting by management. In line with (Beaver & Ryan, 2005) assertion that a company is unlikely in a period of high profit-oriented accompanied by high growth prospects (assets), so managers must make choices, and the compensation contract does not support the application of non-conditional conservative accounting on the case of manufacturing companies in Indonesia. These results are in line with Qiang (2007) and Lara et al., (2009) studies which reveal that the compensation contract has no significant effect on nonconditional conservative accounting.

| Table 4: Wald Test And Omnibus Test Second Group |

||||||

|---|---|---|---|---|---|---|

| Wald Test : | ||||||

| Variable | B | S.E. | Wald | df | Sig. | Exp(B) |

| COMP | 0.061 | 0.080 | 0.583 | 1 | 0.445 | 1.063 |

| LEV | 0.167 | 0.421 | 0.158 | 1 | 0.691 | 1.182 |

| LIT | -0.034 | 0.098 | 0.119 | 1 | 0.730 | 0.967 |

| REG | 0.101 | 0.308 | 0.108 | 1 | 0.743 | 1.106 |

| GRWTX | -0.024 | 0.076 | 0.099 | 1 | 0.753 | 0.976 |

| Constant | -1.020 | 1.890 | 0.291 | 1 | 0.589 | 0.361 |

| Omnibus Test of Coefficiensts : | Chi Square=1.424 | |||||

| Sig 0,992 > Sig Std. 0.05 | ||||||

Hypothesis testing Ha.2b reported positive and insignificant results (β = 0.167, p = 0.691), so Ha.2b is Rejected. LEV has the highest exponential value; thus, LEV has a big chance to influence NONCOND. The results show that the increase in debt contracts only has a direct relationship to the increase in corporate profits, but not directly related to the growth of the company. On such basis, management does not consider the need to apply non-conditional conservative accounting in order to increase the growth of the company. The results of this study are still in line with Qiang (2007) and Lara et al. ,(2009) studies, but unlike Lasdi (2009) who reported debt contracts are negatively related to non-conditional conservative accounting in the case of Indonesia. Lasdi (2009) used negative accruals proxies from the Givoly & Hayn (2000) models. Differences in the use of proxies appear to represent different outcomes.

The value of wald for LIT variable is 0.119, with coefficient value of -0.034, Symp. Sig = 0.730> Std. Sig = 0.05, that is, Ha.3b is rejected (negative and not significant). This is due to the weakness that occurs due to the influence of using fixed effect as a proxy of measurement of non-conditional conservative accounting is very small and weak, so the results are insignificant. This finding is apparently different from the findings of Qiang (2007) and Lara et al., (2009) studies which show that litigation factors have a significant negative effect on non-conditional conservative accounting.

Ha.4b submission formulating that REG has a negative effect on NONCOND is unacceptable because the results showed positive and insignificant influence; that is the value of coefficient of 0.101 and Symp. Sig = 0.743> Std. Sig = 0.05. The fundamental problem causing the insignificant results is the improper use of proxies. The proxy of accounting regulation through sales growth is not a relevant form of proxy and fixed effect measurement cannot represent the proxy of non-conditional conservative accounting, thus breaking the opinion of Beaver & Ryan (2005). The researcher argues that the accounting regulation problem in companies in Indonesia is not caused by the low level of sales growth alone, so it does not have a big effect on management policy choice in applying non-conditional conservative accounting.

Ha.5b test showed that GRWTX influence is negative and not significant (β = -0.024, p = 0.753), so Ha.5b is rejected. This shows the growth in taxes on the part of taxes perceived as burdens Watts (2003a), the form of pressure on firms (Qiang, 2007; Shackelford & Shevlin, 2001) and the form of pressure and incentives to firms (Lara et al., 2009) is still not able to affect the application of non-conditional conservative accounting or is influential on corporate growth. The role of tax growth that emerged as a new factor in the study has not reached the expected pattern of relationships, but at least has provided additional information that the existence of tax growth is able to give a negative effect, although not significant to non-conditional conservative accounting. Omnibus test shows Chi-Square value of 1442 with significant 0.922>Sig Std. 0.05. This means that various conservative accounting factors (COMP, LEV, LIT, REG, GRWTX) do not have a significant effect simultaneously on non-conditional conservative accounting (NONCOND).

Conclusion

The main purpose of this study was to examine the influence of various determinants such as compensation contracts, debt contracts, litigation, accounting regulations and tax growth on conditional and non-conditional conservative accounting. The implementation of conservative accounting policy in manufacturing companies in Indonesia is still low. The condition can be identified that manufacturing companies apply conditional conservative accounting are 20.8% of the total observed companies, while those that apply non-conditional conservative accounting are 60%. As a result, the quality of the financial statements is low and the information generated is often biased and doesn’t fully illustrate the actual condition of the company.

The findings in this study do not fully support positive accounting theory and agency theory. The general findings in this study proves that contracting factors (compensation contracts and debt contracts), litigation and tax growth have a significant effect on conditional conservative accounting, while accounting regulation factor does not. While the findings of the test on how much all the determinants influence non-conditional conservative accounting yielded insignificant results. This finding suggested the management must consider the application of conservative accounting in the preparation of financial statements to support its longterm oriented business strategy, so that the company’s performance becomes better in the future.

The limitation of this research is the amount of research data for the sample observation is too small because almost half of the data is not eligible or incomplete. The future research alternative is important to consider using other companies. The small influence of determinants on non-conditional conservative accounting causes the overall result that is insignificant. It is likely that a market to book ratio proxy is less able to fully represent non-conditional conservative accounting. On the basis of such, there is a need to consider the use of another better proxy. The role of tax growth that emerges as a new factor in the study has not reached the expected pattern of relationships. On the basis of this, it is important to consider and conduct more in-depth research on the existence of tax growth factors in conservative accounting research. The sales growth proxies are considered to be less relevant to represent the regulation factor because the average value of sales growth of manufacturing companies in Indonesia is so small that it does not have a great impact in the testing.

References

- Ahmed, A.S., Billings, B.K., Morton, R.M. & M. Stanford-Harris (2002). The role of accounting conservatism in mitigating bondholder-shareholder conflicts over dividend policy and in reducing debt costs. The Accounting Review, 77(4), 867-890.

- Almilia, L.S. (2005). Testing size hypothesis and debt/equity Hypothesis affecting the level of Conservatism of corporate financial statements With multinomial logit analysis techniques. Jurnal Bisnis dan Akuntansi, 7(1), 1-9.

- Armstrong, C.S., Blouin, J.L. & D.F. Larcker (2012). The incentives for tax planning. Journal of Accounting and Economics, 53(1-2), 391-411.

- Ball, R., Robin, A. & J.S. Wu (2000). Incentives versus standards: properties of Accounting income in four East Asian countries, and implications for Acceptance of IAS.

- Ball, R. & L. Shivakumar (2005). Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics, 39(1), 83-128.

- Ball, R. & L. Shivakumar (2006). The role of accruals in asymmetrically timely gain and loss recognition. Journal of Accounting Research, 44(2), 207-242.

- Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings 1. Journal of Accounting and Economics, 24(1), 3-37.

- Basu, S. (2005). Discussion of conditional and unconditional conservatism: Concepts and modeling. Review of Accounting Studies, 10(2-3), 311-321.

- Beaver, W.H. & S.G. Ryan (2000). Biases and lags in book value and their effects on the ability of the book-to-market ratio to predict book return on equity. Journal of Accounting Research, 38(1), 127-148.

- Beaver, W.H. & S.G. Ryan (2005). Conditional and unconditional conservatism: Concepts and modeling. Review of Accounting Studies, 10(2-3), 269-309.

- Brouwer, R. (2009). Accounting conservatism in Europe.

- Chan, A.L.C., Lin, S.W.J. & N. Strong (2009). Accounting conservatism and the cost of equity capital: UK evidence. Managerial Finance, 35(4), 325-345.

- Christie, A.A. & J.L. Zimmerman (1994). Efficient and opportunistic choices of accounting procedures: Corporate control contests. Accounting review, 69(4), 539-566.

- Davila, A. & F. Penalva (2006). Governance structure and the weighting of performance measures in CEO compensation. Review of Accounting Studies, 11(4), 463-493.

- Deegan, C. & J. Unerman (2006). Financial Accounting Theory (European edition) Mc-Graw Hill Education.

- Eisenhardt, K.M. (1985). Control: Organizational and economic approaches. Management science, 31(2), 134-149.

- Feltham, G.A. & J.A. Ohlson (1995). Valuation and clean surplus accounting for operating and financial activities. Contemporary Accounting Research, 11(2), 689-731.

- Francis, J., Lafond, R., Olsson, P. & K. Schipper (2002). The market pricing of earnings quality.

- Givoly, D. & C. Hayn (2000). The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative? Journal of Accounting and Economics, 29(3), 287-320.

- Irawan, H.P. & A. Farahmita (2012). The influence of management compensation and corporate governance on corporate tax management. Simposium Nasional Akuntansi XV, 1-31.

- Jensen, M.C. (1986). Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. The American Economic Review, 76(2), 323-329.

- Jensen, M.C. & W.H. Meckling (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305-360.

- Johnson, M.F., Kasznik, R. & K.K. Nelson (2001). The impact of securities litigation reform on the disclosure of Forward Looking information by high technology firms. Journal of Accounting Research, 39(2), 297-327.

- Juanda, A. (2007). The Influence Of Litigation Risk And The Type Of Strategy To The Relationship Between Conflicts Of Interest And Conservatism Accounting. Makalah SNA X, Makasar.

- Lafond, R. & S. Roychowdhury (2008). Managerial ownership and accounting conservatism. Journal of Accounting Research, 46(1), 101-135.

- Lara, J.M.G. & A. Mora (2004). Balance sheet versus earnings conservatism in Europe. European Accounting Review, 13(2), 261-292.

- Lara, J.M.G., Osma, B.G. & F. Penalva (2009). The economic determinants of conditional conservatism. Journal of Business Finance & Accounting, 36(3-4), 336-372.

- Lasdi, L. (2009). Testing Determinant Accounting Conservatism. Jurnal Akuntansi Kontemporer, 1(1).

- Latridis, G.E. (2011). Accounting disclosures, accounting quality and conditional and unconditional conservatism. International Review of Financial Analysis, 20(2), 88-102.

- Ohlson, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11(2), 661-687.

- Penman, S.H. & X.J. Zhang (2002). Accounting conservatism, the quality of earnings, and stock returns. The Accounting Review, 77(2), 237-264.

- Prasetya, F.D. (2012). The development of financial accounting standards in Indonesia. Scientific Journal of Accounting Students, 1(4), 113-117.

- Qiang, X. (2007). The effects of contracting, litigation, regulation, and tax costs on conditional and unconditional conservatism: cross-sectional evidence at the firm level. The Accounting Review, 82(3), 759-796.

- Sari, C. & D. Adhariani (2009). Conservative Companies in Indonesia and Its Affecting Factors. Seminar Nasional Akuntansi XII, 1-26.

- Scott, W.R. (2000). Financial Accounting Theory (Second Edition). Prentice Hall Canada Inc.

- Shackelford, D.A. & T. Shevlin (2001). Empirical tax research in accounting. Journal of Accounting and Economics, 31, 321-387.

- Wang, Z.R. (2009). Accounting conservatism: Victoria University of Wllington.

- Wardhani, R. (2010). The effect Of Degree Convergence to IFRS and Governance System To accounting Conservatism: Evidence From Asia. Paper presented at the National Symposium on Accounting XIII Th, Purwokerto, Indonesia.

- Watts, R.L. (2003). Conservatism in accounting part I: Explanations and implications. Accounting Horizons, 17(3), 207-221.

- Watts, R.L. (2003). Conservatism in accounting part II: Evidence and research opportunities. Accounting Horizons, 17(4), 287-301.

- Watts, R.L. & J.L. Zimmerman (1978). Towards a positive theory of the determination of accounting standards. Accounting review, 53(1), 112-134.

- Watts, R.L. & J.L. Zimmerman (1990). Positive accounting theory: a ten year perspective. Accounting review, 65(1), 131-156.

- Widya, W. (2005). Analysis of Factors Affecting the Company's Choice of Conservative Accounting. The Indonesian Journal of Accounting Research, 8(2).

- Zelmiyanti, R. (2016). Development of Application of Conservatism Principles in Accounting. JRAK: Journal of Accounting Research & Computerized Accounting, 5(1), 50-55.

- Zhang, X.J. (2008). The contracting benefits of accounting conservatism to lenders and borrowers. Journal of Accounting and Economics, 45(1), 27-54.

- Zhang, X.J. (2000). Conservative accounting and equity valuation. Journal of Accounting and Economics, 29(1), 125-149.