Research Article: 2018 Vol: 22 Issue: 6

Determinants Influencing the Usage of Balanced Scorecard for Performance Measurement: The Case of Vietnam

Manh Dung Tran, National Economics University, Vietnam

Abstract

This research is conducted for testing the hypothesis of the relationship between contingency variables and the usage of Balanced Score Card (BSC) for performance measurement. Data were collected by receiving 217 questionnaires given to firms in Vietnam using factor analysis, Ordinary Least Square (OLS) regression analysis. The results show that the business strategy, perceived environmental uncertainty, intensity of competition, total quality management have significant positive impacts on the usage of BSC while the organizational structure has no impact. Based on the findings, some implications have been given for promoting the usage of BSC for performance measurement in firms in emerging countries, including Vietnam.

Keywords

Balanced Scorecard, Contingency Variables, Performance Measurement, Vietnam.

Introduction

The fourth industrial revolution is blurring the gap between the real world and the virtual world through advanced technologies and innovation. This revolution brought about opportunities and huge challenges. In order to survive and grow, firms doing business in Vietnam need to adopt advanced management methods. BSC is probably one of the most important recent accounting innovations. It is supposed to enhance organizational performance by allowing top managers to manage their firms’ process resulting in an improved competitive market position and financial performance. The BSC was first introduced by Kaplan and Norton in 1992 as a performance measurement system designed to provide managers with a way of translating strategy into a set of financial and non-financial measures covering different domains of the organization.

Currently in Vietnam, the majority of firms only use financial criteria to evaluate their financial performance. Using these criteria will neither allow firms to assess their potentials for future development, nor assessing their internal strengths which can help them to recognize problems related with business operation. On the other hand, performance indicators do not represent firm strategies, because they lack the connections among departments in the direction to achieve common goals.

Despite the increasing emphasis placed on BSC, many recent papers in management accounting journals have asserted the need for undertaking more studies on both the use and importance of BSC (Ittner et al., 2003; Tanyi, 2011). In addition, a contingency theory framework has been widely used in management accounting research but this stream of research has generally investigated the impact of few contingent variables relating to BSC. Thus, several researchers (Francis and Minchington, 2000; Ittner and Larcker, 2001; Speckbacher et al., 2003; Maltz et al., 2003) suggest the need to undertake more research to examine the impact of several contingent variables on the design and use of BSC. These suggestions provided further insights for studying BSC.

In this study, we examined contingency factors influencing the usage of the BSC by using a survey data. The contingency factors we examined include business strategy, organizational structure, perceived environmental uncertainty, intensity of competition, total quality management. We tested our model and hypotheses by using a sample of 217 firms in Vietnam. Consistent with our predictions, we found that the usage of BSC was significantly related to business strategy, perceived environmental uncertainty, intensity of competition, total quality management. However, we do not find the decision to adopt the BSC to be related to organizational structure, firm culture and market economy institutions even though Vietnam is in the transition process into market based economy.

Our study contributes to the literature in two ways. First, this study provides evidence on the contingency factors influencing the usage of the BSC for performance measurement in firms in Vietnam. Second, most of the BSC studies have been conducted outside Vietnam. With respect to differences in the results across countries, it caught my interest to compare whether the results of this study, particularly the BSC implementation stage, are similar to the results reported in the previous researches.

The remainder of the paper is organized as follows. First, we discussed the theoretical background of our study focusing on the literature of BSC and the contingency variables salient to BSC adoption and offer our research hypotheses. Second, we described the research method approach. Third, we present our results that test our predictions. Finally, we offer a discussion of the research results before concluding.

Balanced Scorecard And Research Hypothesis

Balanced Scorecard

In response to the need to incorporate key non-financial performance measures and integrate financial and non-financial measures, Kaplan and Norton (1992) devised the BSC as a set of performance measures to provide managers with a comprehensive view of the organization, and a reliable feedback for management control purposes and performance evaluation. This approach consists of two types of performance measures. The first is financial measures to describe the past actions. The second is non-financial measures on customer satisfaction, internal business processes, and innovation and improvement activities as drivers of future financial performance. Kaplan and Norton (1996) indicated that the measures of this approach represent a balance between external measures for shareholders and customers, and internal measures for critical business processes, innovation and learning and growth. These measures are balanced between the outcome measures (i.e. the results from past efforts) and the measures that drive future performance.

According to Kaplan and Norton (1992), the BSC approach consists of the following performance perspectives:

(1) Customer perspective: The measures relating to this perspective require managers to translate their general mission statement on customer and market segments into specific measures that reflect the factors that really matter to the customers. Managers should develop performance measures in order to create satisfied and loyal customers in the targeted segments. Customer’s concerns relate to time, quality, service and cost. Therefore, the customer perspective includes different core objectives and measures that relate to the organization’s strategy. Examples include goals and measures relating to increasing market share, customer retention, and customer satisfaction.

(2) Internal business process/operational perspective: The measures within this perspective are related to the critical internal processes for which the organization must excel to implement strategy. The identified processes should stem from the requirements needed to achieve the organization’s customer perspective. Kaplan and Norton identified several generic internal processes, such as operation and postservice sales processes, and stress the need to develop appropriate performance measures relating to these processes such as measures related to time, quality and cost.

(3) Learning and growth/innovation perspective: These types of measures are concerned with building continuous improvement in relation to products or services and processes, and to also create long-term growth. Kaplan and Norton stress that organizations can improve and innovate to achieve the objectives of the scorecard through the ability to launch new products, improve operating efficiencies and create more value for customers.

(4) Financial perspective: Measuring within this perspective is based on financial metrics such as return on investment, and residual income. Kaplan and Norton argued that by incorporating non-financial performance measures in the scorecard, improved financial measures should follow. Moreover, this perspective provides feedback as to whether improved performance in the non-financial perspectives is translated into monetary terms in the financial perspective box.

The BSC enables financial and nonfinancial measures to be part of the information system for employees at all levels of the organization. Front-line employees can understand the financial consequences from their decisions and actions, and senior executives can understand the drivers of long-term financial success. The BSC represents a translation of a business unit’s mission and strategy into tangible objectives and measures. The four perspectives of the scorecard permit a balance:

1. In between short- and long-term objectives.

2. In between external measures- for shareholders and customers-and internal measures of critical business processes, innovation, and learning and growth.

3. In between outcomes desired and the performance drivers of those outcomes.

4. In between hard objective measures and softer, more-subjective measures.

Research Hypothesis

Drawing from Majdy’s (2003) summary and previous research in the area, we examine the importance of contingency variables in explaining the decision for firm usage the BSC. Specifically, we examine business strategy, organizational structure, perceived environmental uncertainty, intensity of competition, total quality management.

Business strategy

The business strategy is a search for a favorable competitive position in an industry (Porter, 1980). There are few empirical studies which support the relationship between business strategy and the use of several management accounting practices such as Activity-Based Costing (ABC) systems and BSC approach (Anderson and Lanen, 1999; Olson and Slater, 2002). Hoque et al. (2001) suggested that there is a need for further investigations of how a set of performance measurements, rather than single measurement, could be useful to organizations operating in varied industries with various competitive strategies. However, past empirical studies (Olson and Slater, 2002; Sohn et al., 2003) have investigated the relationship between business strategy and the usage of BSC perspectives. These studies have shown that prospector firms follow a differentiation orientation place greater emphasis on the usage of non-financial perspectives of the BSC. Accordingly, it can be expected that firms pursuing differentiation strategy are more likely to use the BSC approach than firms that pursuing low cost strategy. Differentiation strategy focusses on providing products or services that customers perceive as being unique. These include superior quality, product flexibility, delivery and product design. Thus, it can be hypothesised that:

Hypothesis 1 (H1): Differentiation strategy has a positive impact on the extent of BSC usage.

Organizational structure

The term organizational structure is considered to be an important internal aspect that influences the design of management accounting system. Structure is defined as the way in which an organization is differentiated and integrated (Lawrence and Lorsch, 1967).

Several researchers argue that organizational structure may influence the adoption and implementation of innovation (Gosselin, 1997, Mooraj et al., 1999). In this context, Braam and Nijssen (2004) argue that the chance of usage of BSC is more likely in high centralized organizations. A centralized organization relies on top down process of instructions and implementation through its hierarchy. Thus, it can be hypothesized that:

Hypothesis 2 (H2): Centralised organization has a positive impact on the extent of BSC usage.

Perceived environmental uncertainty

The environment comprises all the external factors to the organization. Perceived environmental uncertainty is one of the crucial contingent variables that have been widely used in management accounting information characteristic research. The environment of an organization can be characterized by three dimensions of dynamism, heterogeneity, and hostility. The dimension of perceived environmental uncertainty was operationalized in this research as the level of unpredictability and change. Eamples include changing technology, unexpected changes in customers, demands, competitors’ actions. There has been much empirical evidence which has indicated that the increase level of perceived environmental uncertainty leads to a greater need for management accounting information in terms of non-financial performance measurements (Cauvin and Bescos, 2002; Chenhall, 2003). Firms should predict the conditions that will exist during the coming years, and this can be done more accurately under stable environmental conditions than dynamic and changing conditions (Govindarajan, 1984), Based on the results of previous empirical studies it can be hypothesised that:

Hypothesis 3 (H3): Perceived environmental uncertainty has a positive impact on the extent of BSC usage.

Intensity of competition

The intensity of rivalry among competitors in an industry refers to the extent to which firms within an industry put pressure on one another and limit each other’s profit potential. The integration or balance in the performance measurement system is necessary for the organization’s long-term success in today’s competitive environment (Euske et al., 1993). The literature on the BSC approach has revealed that the level of competition is the most important factor that may affect the usage of BSC approach (Hoque and James, 2000; Malmi, 2001). Recently, Maiga and Jacobs (2003) argued that BSC are implemented in response to the competitive environment. Empirically, several studies (Hoque et al., 2001; Banker et al., 2001) found that firms implementing the BSC approach are facing high levels of market competition. Based on the findings of previous empirical studies, it can be expected that firms facing greater competitive pressures are more likely to use the BSC approach. The dimensions of intensity of competition were operationalised in this research as price, new product development, marketing or distribution channels, market share, competitors’ actions and number of competitors. Thus, it can be hypothesised that:

Hypothesis 4 (H4): Intensity of competition has a positive impact on the extent of BSC usage.

Total quality management

In today’s global competitive markets, the demand of customers is increasing, as they require improved quality of products and services. A continuous improvement in organization activities with a focus on the customer is the main aspect of quality and its management. An important issue related to quality is Total Quality Management (TQM), which is considered to be one of the most important components of advanced management practices. The association between TQM and non-financial performance measures has been reported in several studies. McAdam and Bannister (2001) argued that business performance is linked to TQM implementation. In their case study they concluded that organizations applying TQM should incorporate financial and non-financial performance measures. Empirically, Malmi (2001) reported in his interviews that one of the important initiatives to encourage the adoption of the BSC is the use of total quality management. Recently, Hoque (2003) recommended using the BSC approach to support the implementation of total quality management initiatives. Based on the above discussion, it can be expected that firms pursuing total quality management are more likely to use the BSC approach. The conceptual definition of total quality management implementation focuses on aspect of quality initiatives. Eamples include quality incentives, quality of processes and continuous quality improvement. Thus, it can be hypothesised that:

Hypothesis 5 (H5): The extent of the use of total quality management has a positive impact on the extent of BSC usage.

In the context of Vietnam, balanced scorecard is still a new instrument for all Vietnameses firms. The number of firms adopting balanced scorecard in designing strategy and performance measurement is still limited, about 7 percent. Only big economic groups apply balanced scorecard such as groups of FPT, Phu Thai, Gami, Kinh Do, Searefico.

Research Methodology

Data Collection

Following the same track of prior studies, current study has also adopted a quantitative research approach and questionnaire survey design is chosen for this study.

For testing the relationship between the contingency variables and the usage of BSC for performance measurement, the target population for this study is all firms in Vietnam irrespective of type (manufacturing, services), nature (textile, automobile cement etc.), ownership (public, private etc.), and location. Sample firms are selected through purposive sampling technique. We sent 320 questionnaires and the feedback of 217, accounting for 68%. In each organization, who can give answer to questions about the usage of BSC and that individual may be CEO, member of board of directors, head of any major department and staffs.

Data for this study were collected using survey questionnaire. The questions in the survey are taken from previous researchers with some slight modifications. Most of the questions used five point Likert scale which is equivalent to “1=strongly disagree”, “2=disagree”, “3=neutral”, “4=agree”, and “5=strongly agree”. Survey questions were created and published on the internet to collect response for the study. Google (a popular survey tool) was used to create the question. The online survey was open for two months from August 1, 2017 to September 30, 2017.

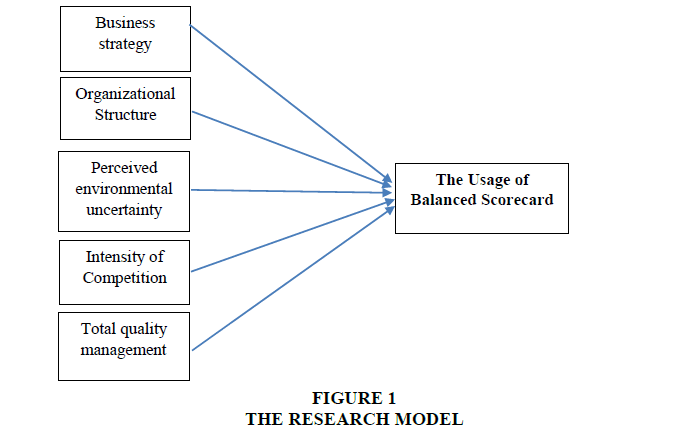

Research Model and Data Processing

Our research model is presented in Figure 1. The figure shows the relationship between two parts of the model. The first part is concerned with six contingency variables. The second part is concerned with the extent of usage of balanced scorecard.

Author has adopted and modified scale from several previous researchers (Table 1). Cronbach’ alpha, factor analysis and item-to-total correlation analysis was used to structure and classify the variables. The different questions were asked pertaining to each of the variables was collapsed into a single variable. Then, OLS regression method was used to analyze the data.

| Table 1 The Constructs Of The Adapted Research Model With Relevant Studies |

||

| Factors | Items | Coding |

| Business strategy- BS (Based on Govindarajan, 1988; Lee and Miller, 1996). |

Product or service quality | BS1 |

| Brand image | BS2 | |

| Product features | BS3 | |

| Organisation Structure-OS (Based on Ramauthy, 1990; Al-Dahiyate, 2003). |

New product introduction decisions are made only at the highest management level | OS1 |

| Apart from minor investments, capital budgeting decisions are usually made only at the top management level | OS2 | |

| Decisions to attempt penetration into new markets generally are made only by top management | OS3 | |

| Decisions on major changes to (including new introduction of) manufacturing processes are made only at the top management level | OS4 | |

| Personnel policy decisions are usually made by top management | OS5 | |

| Pricing policies are set only by top management | OS6 | |

| Perceived environmental uncertainty-PEU (Based on Govindarajan, 1984). |

Manufacturing technology | PEU1 |

| Competitors’ actions | PEU2 | |

| Customers' demand | PEU3 | |

| Product attributes/design | PEU4 | |

| Raw material availability | PEU5 | |

| Raw materials price | PEU6 | |

| Government regulation | PEU7 | |

| Labour unions actions | PEU8 | |

| Intensity of Competition (IC) (Based on Guilding and McManus, 2002). |

Price competition | IC1 |

| Competition for selling and distribution | IC2 | |

| Competition for quality and variety of products | IC3 | |

| Competition for market share | IC4 | |

| Competition relating to customer service | IC5 | |

| Number of competitors in your market segment | IC6 | |

| Competitors’ actions | IC7 | |

| Total Quality Management-TQM (Adopted from Banker et al., 1993, Krumwiede, 1998). |

Workers are rewarded for quality improvement | TQM1 |

| Experiments to improve the quality of processes are frequently conducted | TQM2 | |

| Quality benchmarking with other firms or business units is tracked | TQM3 | |

| Employee teams are functioning and have been effective | TQM4 | |

| Total quality management, whereby most business functions are involved in a process of continuous quality improvement, is an extremely high priority | TQM5 | |

| Balanced Score Card usage-BSC (Based on Tanyi, 2011). |

Do you find financial measures to be more appropriate to present the performance of your organization than non- financial measures | BSC1 |

| In order to exercise your function how often do you use financial or non- financial information | BSC2 | |

| In order to exercise your function do you find qualitative information more than quantitative information | BSC3 | |

Reliability is the overall consistency of a measure in statistics & psychometrics. We conducted a reliability analysis to test the reliability of all measures. Internal consistency reliability can help to assess the consistency of results across items within a test. Corrected itemtotal correlation provides “an indication of the degree to which each item correlates with the total score” (Watson, 2001). The value is defined as Cronbach’s coefficient alpha that is between 0 and 1 in most cases. 0 indicates no internal consistency and reliability, while 1 indicates strong internal consistency and reliability (Bryman and Bell, 2007). A result of less than 0.400, indicates that the item measures something different from the scale as a whole. If the scale Cronbach alpha for an item is less than .600, we may need to consider removing it. A value over 0.700 is validates the internal consistency and reliability of the scale.

In factor analysis, all items measuring same construct loaded on a single factor with high factor loading ranging from 0.600 to 0.900 which establishes convergent validity or convergence of all items to their respective theoretical defined constructs (Hair et al., 2014). Similarly, not a single case is there where cross factor loading is greater than 0.500 and all items loaded on their respective factors and it indicates the existence of discriminant validity.

Multiple regressions are used to examine the relationship between a set of independent variables and one dependent variable. Multiple regression models indicate “how well a set of independent variables predict a particular outcome” (Pallant, 2010). Using linear multiple regressions, we analyze how each independent variable contributes to the model through the indicators from standardized coefficient, t-value and p-value of each hypothesis. The linear multiple regressions also provide two other important values, namely the R2 and ANOVA F value. These two values help to explain how much of the variance in the dependent variable is explained by the model.

Results And Discussion

Results

Descriptive data of user characteristics

Table 2 shows the relative description of users’ characteristics. The specific user characteristics are analyzed as presented below.

| Table 2 Demographics Summary Of Respondents (N=217) |

|||

| Measure | Items | Frequency | Percentage |

| Gender | Female | 110 | 51% |

| Male | 107 | 49% | |

| Age | Below 30 | 50 | 23% |

| 30-40 | 55 | 25% | |

| 41-50 | 100 | 46% | |

| Above 50 | 12 | 6% | |

| Tenure in current position | Less than 5 years | 10 | 5% |

| 5-10 years | 192 | 88% | |

| More than 10 years | 15 | 7% | |

| Current Position | CEO | 4 | 2% |

| Director | 15 | 7% | |

| Head of department | 20 | 9% | |

| Staff | 168 | 77% | |

| Others | 10 | 5% | |

| Firm’s Ownership | State-owned | 3 | 1% |

| Private | 41 | 19% | |

| Limited | 45 | 21% | |

| Joint stock | 105 | 48% | |

| Joint Venture | 2 | 1% | |

| Foreign- Owned | 2 | 1% | |

| Others | 19 | 9% | |

| Firm’s Type | Manufacturing | 44 | 20% |

| Trading | 72 | 33% | |

| Services | 73 | 34% | |

| Others | 28 | 13% | |

| Firm’s Size | Less than 100 employees | 50 | 23% |

| 100-500 employees | 110 | 51% | |

| Above 500 employees | 57 | 26% | |

Reliability Analysis

The reliability analysis results are summarized in Table 3. From the Cronbach’s coefficient alpha result, all values exceed 0.700, showing efficient internal reliability for all measurement items in our survey. The main alpha values of independent variables (BS, OS, PEU, IC, TQM) and dependent variables are all over 0.700, proving very good internal consistency and reliability for the scales in our survey. However, The Corrected Item-total Correlation for item PEU1, PEU2, PEU3, IC6, IC7 were 0.240, 0.280, 0.291, 0.396, 0.293 respectively, indicating unacceptable level of reliability. So, it was decided to exclude them from the analysis before factor analysis.

| Table 3 The Result Of The Reliability Test And Factor Analysis |

||||

| Factors | Items | Cronbach’s alpha | Corrected item-total Correlation | Factor loading |

| BS | BS1 | 0.819 | 0.688 | 0.826 |

| BS2 | 0.717 | 0.877 | ||

| BS3 | 0.614 | 0.756 | ||

| OS | OS1 | 0.904 | 0.718 | 0.804 |

| OS2 | 0.757 | 0.816 | ||

| OS3 | 0.703 | 0.796 | ||

| OS4 | 0.780 | 0.834 | ||

| OS5 | 0.692 | 0.783 | ||

| OS6 | 0.771 | 0.845 | ||

| PEU | PEU1 | 0.747 | 0.240* | - |

| PEU2 | 0.280* | - | ||

| PEU3 | 0.291* | - | ||

| PEU4 | 0.542 | 0.725 | ||

| PEU5 | 0.614 | 0.809 | ||

| PEU6 | 0.498 | 0.721 | ||

| PEU7 | 0.595 | 0.811 | ||

| PEU8 | 0.576 | 0.769 | ||

| IC | IC1 | 0.857 | 0.792 | 0.832 |

| IC2 | 0.785 | 0.867 | ||

| IC3 | 0.736 | 0.791 | ||

| IC4 | 0.720 | 0.758 | ||

| IC5 | 0.689 | 0.691 | ||

| IC6 | 0.396* | - | ||

| IC7 | 0.293* | - | ||

| TQM | TQM1 | 0.771 | 0.534 | 0.756 |

| TQM2 | 0.460 | 0.691 | ||

| TQM3 | 0.543 | 0.747 | ||

| TQM4 | 0.583 | 0.484 | ||

| TQM5 | 0.602 | 0.555 | ||

| BSC | BSC1 | 0.850 | 0.628 | 0.852 |

| BSC2 | 0.648 | 0.853 | ||

| BSC3 | 0.691 | 0.877 | ||

Note: The number with*was excluded from the model.

Factor Analysis

In this study, two factors analyses were conducted using the principal extraction method and varimax rotation of 3 items of the dependent variables group and 24 items of the independent variables group. The Kaiser-Meyer-Olkin measure of sampling adequacy was 0.709 for the group of dependent variables and 0.871 for the group of independent variables. This value was significant. Similarly, Bartlett’s test of Sphericity was significant (p<0.000), indicating sufficient correlation between the variables. Hence, KMO and Bartlett’s test proved the suitability of current data for factor analyses. The high values of item-to-total correlation are also supporting the convergence validity and internal consistency of constructs. The factors analysis results are summarized in Table 3.

Impact Levels of Determinants on the Usage of BSC and Hypothesis Testing

In order to examine the relationship between the usage of BSC and all independent factors, correlation and regression analyses are used.

Table 4 illustrates that usage of BSC is significantly correlated and has positive relationship with business strategy (differentiation strategy) (r=0.516, p<0.01), perceived environmental uncertainty (r=0.630, p<0.01), intensity of competition (r=0.666, p<0.01) and TQM (r=0.414, p<0.01). The relationship of usage of BSC is significant and has negative relationship with organizational structure (r=-0.216, p<0.01). The regression estimates help to determine the intensity of influencing each factors may offer. The adjusted R2 indicates that the regression model explains 58.8% of the variance in BSC usage. R2 is influenced by the number of independent variables relative to sample size (Hair et al., 2014). The high value of F=62.613 with p<0.00 approves the significance of the model i.e. these predictors have influence on usage of BSC.

| Table 4 Correlation Matrix |

||||||||||

| Variables | N | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | |

| 1 | BS | 217 | 3.1091 | 0.98543 | 1 | |||||

| 2 | OS | 217 | 3.0484 | 1.17111 | -0.197** | 1 | ||||

| 3 | PEU | 217 | 3.6995 | 0.90761 | 0.299** | -0.205** | 1 | |||

| 4 | IC | 217 | 3.5779 | 0.95601 | 0.425** | -0.304** | 0.594** | 1 | ||

| 5 | TQM | 217 | 3.6025 | 0.79176 | 0.183** | 0.067 | 0.360** | 0.417** | 1 | |

| 6 | BSC | 217 | 3.5653 | 0.94606 | 0.516** | -0.216** | 0.630** | 0.666** | 0.414** | 1 |

| Note: **Correlation is significant at the 0.01 level (2-tailed). | ||||||||||

Table 5 indicates the degree of relationship of predictors have with usage of BSC. The factor that had the strongest effect on usage of BSC was perceived environmental uncertainty (β=0.322, p=0.000), these values support the H3 that perceived environmental uncertainty has a positive impact on the extent of BSC usage. These positive effects of PEU dimensions are consistent with Chenhall and Morris (1986), Tanyi (2011) empirical findings indicate that increasing levels of perceived environmental uncertainty lead to a greater need for management accounting information in terms of non-financial performance measurements. The results are also consistent with Chow et al. (1997), Majdy (2005) theoretical argument that the usage of the BSC has been mostly reported in organizations facing turbulent environment.

| Table 5 Regression Analysis |

|||||||

| B | SD | β (Beta) | T | Sig. | Collinearity Statistics | ||

| Tolerance | VIF | ||||||

| (Constant) | -0.049 | 0.275 | - | -0.178 | 0.859 | - | - |

| BS | 0.253 | 0.047 | 0.264 | 5.444 | 0.000 | 0.811 | 1.232 |

| OS | -0.010 | 0.038 | -0.012 | -0.264 | 0.792 | 0.853 | 1.173 |

| PEU | 0.336 | 0.058 | 0.322 | 5.836 | 0.000 | 0.626 | 1.597 |

| IC | 0.305 | 0.061 | 0.308 | 5.017 | 0.000 | 0.507 | 1.974 |

| TQM | 0.146 | 0.060 | 0.122 | 2.438 | 0.016 | 0.763 | 1.310 |

| Adjusted R square | 0.588 | ||||||

| F | 62.643 | ||||||

| Sig | 0.000 | ||||||

Intensity of competition had the second strongest effect (β=0.308, p=0.000), these values support the H4 that intensity of competition has a positive impact on the extent of BSC usage. The literature on BSC concurs with the above result. In this context, Kaplan and Norton (1992) argued that the BSC is a more appropriate approach when the level of market competition is high. This result is also consistent with the empirical work by Banker et al. (2001) who found that firms implementing the BSC operate in competitive markets and face high competitive pressure.

Differentiation strategy ranked third (β=0.264, p=0.000), these values support the H1 that differentiation strategy has a positive impact on the extent of BSC usage. It was argued in the literature that the increasing use of non-financial performance measures is relatively high in differentiator firms. Therefore, it can be concluded that adopting this type of strategy is related to the extent of BSC usage in firms in Vietnam. The results are consistent with the findings of previous studies. In this vein, Abemethy and Lillis (1995) argued that the choice of performance measurements is dependent on business strategy, and the nature of performance measurements is different according to business strategy (Cauvin and Bescos, 2002).

The factor that had the least effect was TQM (β =0.122, p=0.016), these values support the H5 that the extent of the use of total quality management has a positive impact on the extent of BSC usage. The literature on the BSC supports the above result in which the use of total quality management has a positive impact on the extent of BSC usage. It has been argued that today’s firm environment can be characterised by intensified competition, market changes and high customer demand. These conditions require an enterprise to concentrate more on continuously improving quality and the aspects of total quality management (Johnson and Kaplan, 1987). The TQM concept and implications are consistent with the increasing use of nonfinancial performance measurements (Banker et al., 1993; Perera et al., 1997). Thus, it can be expected that firms that pursue TQM are more likely to use the BSC approach. Empirical work by Malmi (2001) supported the proposition that one of the important initiatives that encourage the adoption of the BSC is the use of TQM.

The relationship was not found between organizational structure and the usage of BSC (β=-0.102, p=0.792), providing no support the H2 that centralised organization has a positive impact on the extent of BSC usage. Centralisation refers to the hierarchical level that has the authority to make decisions. Therefore, it can be concluded that firms with centralised decisionmaking has no impact on the extent of BSC usage. The negative and non-significant effect of centralisation on the extent of BSC usage contradicts with the argument presented by Braam and Nijseen (2004) in which they argue that the chance of BSC adoption is more likely in high centralised firms. A possible explanation for the non- significant relationship is that almost all of firms in Vietnam is a small and medium-size in term of registered capital, only top managers make decisions and provide direction for the company. Small and medium-size firms have not abilities and capabilities to deal with management accounting innovation. They require less elaborate performance evaluation techniques because the strategy setters are more likely to be directly assessing the extent to which strategy is being achieved.

All VIF-scores in the regression analysis were below 1.8 confirming that multicollinearity was not a problem.

Besides, according to descriptive statistics, this study has provided a lot of important and meaningful information. When respondents were asked if they had encountered any difficulties when applying the BSC model, 16.1% of the respondent did report the problem of “No clear strategy”. Only 5.1% of respondents said that “Lack of leadership support” is the most difficult barrier, while 38.2% indicated the “Lack of demand for BSC usage”. While in some firms in Vietnam, boards of management are increasingly aware of the importance of adopting a new governance model such as BSC. This deemed to be a fundamental factor to facilitate the promotion of BSC usage. The result of the research also showed many other statistical indices such as the periodicity of indicator measurement, the level of technology usage in the BSC implementation, the extent of BSC usage in businesses and the deploy of consultancy in BSC implementation. This result further explains the correlation between the factors that influence the usage of BSC; while at the same time, it provides important information for managers to make their decisions when deploying the BSC model.

Conclusion And Implications

This study is an attempt to provide a better understanding of how firms in Vietnam dealing with the BSC concept. In addition, this study has utilised the contingency theory theoretical framework to examine the contingent relationships between BS, OS, PEU, IC, TQM and the extent of usage of BSC. The results indicated that BS, PEU, IC, TQM had a positive significant impact on the extent of usage of BSC while OS had no impact. Operating in high level of competition and perceived environmental uncertainty, firms in Vietnam needing to be innovative, as opposed to solely being efficient, are more likely to adopt a BSC. For differentiation strategy, the usage of a BSC is a critical management choice that facilitates the alignment of the array of decisions made to best match strategic and tactical decisions and activities with environmental requirements. Managers in Vietnam, faced with external environmental uncertainty, are constantly on the lookout for business systems and tools that would allow them to better coordinate efforts and achieve certainty in results. Firms in Vietnam can achieve better performance when TQM philosophy is in place. Such improved performance can be seen as aggregated improvement in quality of work, external customer satisfaction, safety, market share, effectiveness of planning, labor efficiency, competency in management human resources, risk control and manager’s competency. The coordination and stabilizing nature of the BSC are likely key factors in the increasing usage and satisfaction with the BSC some implications have been given basing on the findings as:

1. For researchers: The summaries and findings of this study addressed significant issues for the researchers. On the basis of contingency theory, there were many controversies in the measurement of variables. This study indicated that variables such as BS, OS, PEU, IC, TQM are multidimensional variables. The IC variable is approached on different aspects such as market competition, product competition, etc. Therefore, detailed evaluation of the influence of every aspect of independent variables is of great significance.

2. For business executives: BSC is a powerful instrument in strategic management, to progress measurement and effective communication. It has been proven by real business cases in many countries around the world. However, in conditions and circumstances of firms in Vietnam when deploying BSC usage, it is necessary to take prudent steps. Research results are very important for the consideration of decision-making of executives. Based on the results of our research, we would like to make some suggestions as follows:

a. It is necessary to consider and evaluate the influencing factors before deciding to apply the BSC model.

b. Focus on evaluating and improving obstacles and difficulties in applying BSC model in performance evaluation.

3. For state agencies: In order to promote the effective usage of the BSC model in Vietnam, in addition to the efforts of firms, Government should consider and promulgate appropriate macro policies to support and accelerate the BSC usage. Based on the result of this study, we have several recommendations:

a. The State should have specific guidelines, policies and action programs to popularize and enhance knowledge on BSC model for firms.

b. The State should have policies to support and encourage firms in Vietnam to apply modern governance model in general and BSC model in particular.

c. The State should consider introducing the BSC model to non- profiting organizations and administrative bodies to increase performance efficiency and create a premise and motive force for firms in Vietnam to apply this model as soon as possible.

References

- Abemethy, M., & Lillis, A. (1995). The impact of manufacturing flexibility on management control system design. AccountingOrganizations and Society, 20(4), 241-258.

- Al-Dahiyat, M. (2003). Towards an effective design of management control systems: A contingency approach. Unpublished PhD Thesis (University of Huddersfield).

- Anderson, S., & Lanen, W. (1999). Economic transition, strategy and the evolution of management accounting practices: the case of India. Accounting, Organizations and Society, 24(5), 379-412.

- Banker, R.?Potter, G., & Schroeder, R. (1993). Reporting manufacturing performance measures to workers: An empirical study. Journal of Management Accounting Research, 5, 34-55.

- Braam, G., & Nijssen, E. (2004). Exploring determinants of balanced scorecard adoption. The 27th Annual Congress of the European Accounting Association (Prague-Czech Republic).

- Bryman, A., & Cramer, D. (2001). Quantitative data analysis with SPSS release 10 for windows. Routledge

- Bryman, A., & Bell, E., (2007). Business research methods, (Second Edition).Great Clarendon: Oxford University Press.

- Cauvin, E., & Bescos, P. (2002). Performance measurement practices: Comparing French start-ups to French and American traditional firms. The 25th Annual Congress of the European Accounting Association (Copenhagan-Denmark).

- Chenhall, R. (2003). Management control systems design within its organizational context: Findings from contingency-based research and directions for the future. Accounting, Organizations and Society?28 (2/3), 127-168.

- Chenhall, R., & Morris, D. (1986). The impact of structure, environment and interdependence on perceived usefulness of management accounting systems. The Accounting Review, 61(1), 16-35.

- Chow, C.?Haddad, K., & Williamson, J. (1997). Applying the balanced scorecard to small companies. Management Accounting (USA), 79(2), 21-27.

- Euske, K., Lebas, M., & McNair, C. (1993). Performance management in an international setting. Management Accounting Research, 4(4), 275-299.

- Francis, G., & Minchington, C. (2000). Value-based management in practice. Management Accounting (UK), 78(2), 46-47.

- Gosselin, L. (1997). The effects of strategy and organizational structure on the adoption and implementation of activity-based costing. Accounting, Organizations and Society, 22(2), 105-122.

- Govindarajan, V. (1984). Appropriateness of accounting data in performance evaluation: An empirical examination of environmental uncertainty as an intervening variable. Accounting, Organizations and Society, 9(2), 125-135.

- Govindarajan, V. (1988). A contingency approach to strategy implementation at the business-unit level: Integrating administrative mechanisms with strategy. Academy of Management Journal, 31(4), 828-853.

- Govindarajan, V., & Fisher, J, (1990). Strategy, control systems and resource sharing: Effects on business unit performance. Academy of Management Journal, 33(2), 259-285.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2014). Multivariate data analysis. Pearson Education Limited, Harlow.

- Hoque, Z. (2003). Total quality management and the balanced scorecard approach: A critical analysis of their potential relationships and directions for research. Critical Perspectives on Accounting, 14(5), 553-566.

- Hoque, Z., & James, W. (2000). Linking balanced scorecard measures to size and market factors: Impact on organizational performance. Journal of Management Accounting Research, 12, 1-17.

- Hoque, Z., Mia, L., & Alam, M. (2001). Market competition, computer-aided manufacturing and use of multiple performance measures: An empirical study. British Accounting Review, 33(1), 23-45.

- Ittner, C., & Larcker, D. (2001). Assessing empirical research in managerial accounting: A value-based management perspective. Journal of Accounting and Economics, 32(1/3), 349-410.

- Ittner, C.?Larcker, D., & Meyer, M. (2001). The anatomy of a balanced scorecard bonus plan. Unpublished Working paper, (University of Pennsylvania).

- Johnson, H., & Kaplan, R. (1987). Relevance lost: the rise and fall of management accounting. Boston, MA: Harvard Business School Press.

- Kaplan, R., & Norton, D. (1992). The balanced scorecard measures that drive performance. Harvard Business Review, 70(1), 71-79.

- Kaplan, R., & Norton, D. (1996). Using the balanced scorecard as a strategic management system. Harvard Business Review, 74(1), 75-85.

- Krumwiede, K. (1998). The implementation stages of activity-based costing and the impact of contextual and organizational factors. Journal of Management Accounting Research, 10, 239-277.

- Lawrence, P., & Lorsch, J. (1967). Organization and Environment. Boston: Harvard Business School, Division of Research.

- Lee, J., & Miller, D. (1996). Strategy, environment and performance in two technological contexts: Contingency theory in Korea. Organization Studies, 17(5), 729-750.

- Malmi, T. (2001). Balanced scorecards in Finnish companies: A research note. Management Accounting Research, 12(2), 207-220.

- Maltz, A., Shenhar, A., & Reilly, R. (2003). Beyond the balanced scorecard: Refining the search for organizational success measures. Long Range Planning, 36(2), 187-204.

- Majdy, Z. (2005). Performance measurement systems: An examination of influence of contextual factors and their impact on performance with specific emphasis on the Balanced Scorecard approach. Unpublished PhD Thesis (University of Huddersfield).

- Olson, E., & Slater, S. (2002). The balanced scorecard, competitive strategy, and performance. Business Horizons, 45(3), 11-16.

- Otley, D. (2001). Extending the boundaries of management accounting research: Developing systems for performance management. British Accounting Review, 33(3), 243261.

- Otley, D., & Wilkinson, C. (1988). Organizational behavior: Strategy, structure, environment and technology. Behavioral Accounting Research: A Critical Analysis, 147-170

- Pallant, J. (2001). SPSS Survival manual: A step by step guide to data analysis using SPSS for windows. Versions 10 and 77, (Open University Press).

- Perera, S., Harrison, G., & Poole, M. (1997). Customer-focused manufacturing strategy and the use of operation-based non-financial performance measures: A research note. Accounting, Organizations and Society, 22(6), 557-572.

- Porter, M. (1980). Competitive strategy techniques for analyzing industries and competitors. New York: Free Press.

- Sohn, M.?You, T., Lee, S., & Lee, H. (2003). Corporate strategies, environmental forces, and performance measures: a weighting decision support system using the k-nearest neighbor technique. Expert Systems with Applications, 25(3), 279-292.

- Speckbacher, G.?Bischof, J., & Pfeiffer, T. (2003). A descriptive analysis on the implementation of balanced scorecards in German-speaking countries. Management Accounting Research, 14(4), 361-387.

- Tanyi, E. (2011). Factors influencing the use of balanced scorecard. MAS Thesis, Hanken School of Economics.

- Watson, R. (2001). SPSS survival manual. Open University Press, Buckingham

- Wang, Y.S., Wang, Y.M., Lin, H.H., & Tang, T.I. (2003). Determinants of user acceptance of Internet banking: an empirical study. International Journal of Service Industry Management, 14(5), 500-519.