Research Article: 2022 Vol: 26 Issue: 4

Determinants of a Bank's Performance in Emerging Markets: Evidence from Egypt

Osama Wagdi, International Academy for Engineering & Media Science – IAEMS

Eman Salman, Helwan University

Citation Information: Wagdi, O., & Salman, E. (2022). Determinants of a bank's performance in emerging markets: Evidence from Egypt. Academy of Accounting and Financial Studies Journal, 26(S4), 1-21.

Keywords

Bank's Performance, Banking Industry, Macroeconomic, Bank's Regulations, Bank's Operations, Bank's Characteristics, Egypt.

JEL Classification

E4; G21; G28.

Abstract

The study investigated determinants of bank's performance in emerging markets, through an analysis of the Egyptian banking industry. According to a quantitative analysis of 12 banks during the period from 2000 to 2019, without 2020 based on the impact of the COVID-19 Pandemic on bank's performance based on cross-sectional analysis, despite the fact that many studies have observed the impact of macroeconomic variables on bank's performance, these studies did not consider other variables as a determinant of bank's performance. As a result, the impact of the bank's regulatory variables and the bank's operations variables, in addition to the bank's maturity, size, style, and ownership as control variables on this performance was investigated in this study. The study found that the most significant determinants of a bank's performance included economic growth rate, interest rate and dollarization as economic variables. Required reserve ratio and capital adequacy requirements as bank's regulations variables. Nonperforming loans ratio, loan to deposit ratio, environmental and social activities as bank's operations variables. Ownership, maturity and style as bank's characteristics. But the other determinants within study have insignificant effect on bank performance included bank efficiency, equity to assets ratio; governance activity and size of a bank; that back to restructuring of banking industry, banking industry concentration, insufficiency of financial inclusion, and informal economic weight in Egypt.

Introduction

Background

Banking Industry is the backbone of the financial system since it serves as a crucial intermediary in mobilizing deposits and as a lender to various sectors of the economy, Because of its position as a conduit for transferring funds between individuals, business units, and governments. Banking industry is source of credit in the emerging economies that may lack sufficient funds to support economic growth and development (Imran & Nishat, 2013; Tariq et al., 2021).

The things that influence banks' performance have continued to draw the attention of the scholarly community. Politicians and policymakers alike have been captivated by the performance. It is vital for the future stability, competitiveness, and efficiency of the whole banking industry (Trujillo-Ponce, 2013; Dietrich & Wanzenried, 2014; Tan, 2016; Buallay et al., 2020; Shair et al., 2021). This after many of financial crises is a major challenge for the banking industry; a plethora of unique financial disasters have occurred across many nations in recent years. The recent financial crises were caused by the subprime mortgages that resulted in the credit crunch and then the financial crises and market volatility in 2008 (Kim et al., 2020).

Many interesting and unexpected connections between economics and finance were discovered in the financial crisis of 2008. These connections led to many bank failures. Financial leverage is thought to have increased bank defaults or failures, having poor liquidity to meet financial obligations, an asymmetry of information, and market volatility (Baba et al., 2009; Prügl 2012; Johnson & Mamun, 2012; Fernando et al., 2012; Dumontaux & Pop., 2013; Gambacorta & Paolo, 2014; Kim & Song 2017; Wiggins & Metrick, 2019).

A lot of attention was thrown on the Basel Committee after the 2008 financial crisis since it is responsible for establishing standards and rules to manage the banking sector. There are many weaknesses related to high level of risk management operations, risk investments, stress tests, assets evaluation, liquidity management, disclosure, transparency, and capital adequacy that have emerged in the Basel II regulations that it do not protect financial institutions around the world and do not provide adequate protection for them against collapse and exposure to losses. Prior flaws in Basel II regulations are major parts of what would become the structure of Basel III norms and regulations in 2010. The new guideline dictates that banks must raise the minimum criteria for equity (Helmy & Wagdi, 2019).

Literatures have noted the importance of banks in financial development and economic growth, especially with regard to bank's performance (Levine, 1997); Bank's performance is determined by many variables. The study is interested in independent and control variables. These variables include: economic growth; dollarization, monetary policy variables; banking regulations and financial indicators of bank units as Independent Variables; Maturity; Size; Style; and Ownership of a bank as Control Variables. Our aim is to explore the way in which these variables influence bank's performance. Therefore, the study presented an investigation into the variables affecting the performance of banks in emerging markets based on studying the state of the Egyptian banking industry through a cross-sectional analysis of banks listed on the Egyptian Exchange (EGX).

Egyptian Banking Industry

Historical Brief

Egyptian banking industry is among the oldest in "the Middle East and North Africa region" and new banking techniques first appeared in 1858. Foreign banks, including "Anglo Egyptian Bank", "Crédit Lyonnais", and "the Ottoman Bank", spearheaded the country's first financial period. This was supported by many Greek, French, and Italian stakeholders. "The National Bank of Egypt (NBE)" was founded in 1898 and given a monopoly to print Egyptian currency, thanks to its British backers. But "Banque Misr", the first bank that was entirely Egyptian, was established in 1920.

Reforming Egyptian Banking Industry

Over the course of many decades, the nationalization process in Egypt led to the creation of four public banks and a few other finance institutions. The Central Bank of Egypt (CBE) took over the responsibilities of regulatory restrictions after the National Bank of Egypt (NBE) was separated, that was the second unit which now functions as a commercial bank that continues to bear the original name.

Law No. 120 of 1975, a new piece of banking law, created three categories of banks: "commercial banks"; "business and investment banks" and "specialized banks". Private sector investment and credit growth was facilitated by a series of directives issued by the CBE throughout the 1990s that had liberalized the lending environment. Despite the bank lending boom that followed, asset quality suffered. At the point when the bad debt burden was high enough, the regulator had to institute substantial change in the industry, which was most visibly seen in the number of banks in Egypt dropping to 38 today.

| Table 1 Transaction of merger in Egyptian banking industry |

||

|---|---|---|

| Date | Banks | |

| 2004 | American Express Bank (Branches in Egypt) Egyptian American Bank |

Egyptian American Bank |

| Banque Misr Misr Exterior Bank |

Banque Misr | |

| 2005 | Credit Lyonnais Branch Credit Agricole Indosuez |

Calyon |

| Misr America International Bank Arab African International Bank |

Arab African International Bank | |

| Mohandes Bank | National Bank of Egypt | |

| Bank of Commerce and Development"Al Tegareyoon" | National Bank of Egypt | |

| 2006 | Nile Bank Islamic International Bankfor Investment and Development United Bank of Egypt |

United Bank of Egypt |

| Egyptian American Bank Calyon |

Credit Agricole Egypt | |

| Misr International Bank National Societe Generale Bank |

National Societe Generale Bank | |

| 2008 | Egyptian Workers Bank the Industrial Development Bank |

Industrial Development & Workers Bank of Egypt |

Source: Prepared by the study based on the reports of the Central Bank of Egypt

The Central Bank of Egypt (CBE) may be able to better deal with the suggestions made by the Basel committee in regards to undertook a variety of initiatives to expand and regulate the banking system by merging institutions that fell below minimal capital requirements, whether by executing voluntary or compulsory mergers and acquisitions operations between banks to meet minimum capital requirements (Helmy & Wagdi, 2019).

| Table 2 Transaction of acquisition in egyptian banking industry |

||

|---|---|---|

| Date | Banks | |

| 2004 | Misr Exterior Bank | Banque Misr |

| 2005 | Egyptian Commercial Bank | Piraeus |

| Misr International Bank | National Societe Generale Bank | |

| Misr American International Bank | Arab African International Bank | |

| Mohandes Bank | National Bank of Egypt | |

| Misr Romania Bank | Blom Bank | |

| 2006 | Credit Agricole | Egyptian American Bank |

| Commercial international Bank - Egypt (CIB) | A consortium led by Ripplewood Holdings | |

| Cairo Far East Bank | Audi Bank | |

| Misr Iran Development Bank | National Investment Bank | |

| Alexandria Commercial and Maritime Bank | Union National Bank | |

| Delta International Bank | Ahli United Bank | |

| Bank of Alexandria | Intresa San Paolo | |

| 2007 | National Development Bank | Abu Dabi Islamic Bank |

| Banque Misr | Banque du Caire | |

| A consortium led by National Bank of Kuwait | Al Watany Bank of Egypt | |

| 2008 | Port-Said National Bank. | The Société Arabe Internationale De Banque |

| 2012 | BNP Paribas - Egypt | Emirates NBD - Egypt |

| 2013 | National Societe Generale Bank | QNB Alahli |

| 2015 | Piraeus Bank Egypt | Al Ahli Bank of Kuwait - Egypt |

| 2017 | Barclays Bank - Egypt | Attijariwafa bank Egypt |

| 2020 | Union National Bank - Egypt | Abu Dhabi Commercial Bank - Egypt |

Source: Prepared by the study based on the reports of the Central Bank of Egypt

According to of the Central Bank of Egypt (CBE); in 2004; the banking reform unit was established that focused on reforming Egyptian banking industry. The strategy was created to improve the banking industry and make it stronger, so it could more successfully face competition across the world and in its area, helping the economy thrive. The strategy started in 2004 and was concluded in 2008; it had four primary objectives: "Privatization and consolidation within the banking sector”, “Addressing the issue of non-performing loans (NPLs (","Financial and managerial restructuring of state owned banks, “Upgrading CBE banking supervision".

CBE introduced a new strategic plan in January 2009. to prepare for the third and final round of wave of its reform program to 2011, it had primary objectives: "Supervise and monitor of an operational and financial restructuring plan for specialized banks"; "Follow up on restructuring of public banks - National Bank Egypt, Banque Misr and Banque Du Caire -" ; "Adopting an initiative promoting the development and growth of banking activities/services catering for various sectors especially the SME sector"; " Review and enforce the implementation of Governance rules in Egyptian banking industry" and " "Implementation of the Basel II accord by Egyptian banking industry".

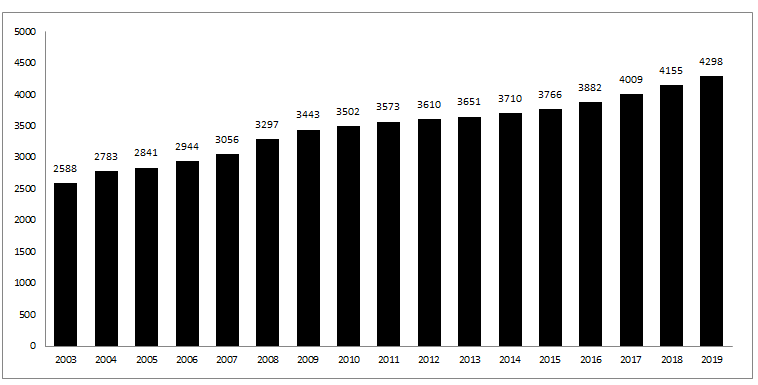

Phase III in 2012; it had primary objectives: "Finalized the fine tuning of the regulations" and "Banks’ preparation for Basel II" ; but Phase IV is Ongoing from 2013; it had primary objectives: "Parallel run of existing regulations on capital adequacy and Basel II", "Finalize the data warehousing framework". Today; the law no. 88 of the year 2003 of the central bank, the banking sector and money promulgated is a legal framework for Egyptian banking industry; this industry includes 38 banks through 4,298 branches until 2019.

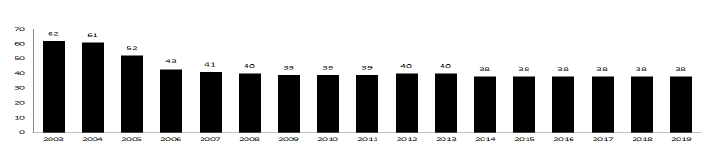

FIGURE 2

NUMBER OF BRANCHES IN EGYPT

Literature review and study design

Literature Review

There is richness in literature that covers banking performance, which makes it important to analyze this within a systematic framework.

Bank's Performance

The banking performance appraisal methodology can be categorized into general approaches and partial indicators. Partial indicators are the most prevalent in academic research. Partial indicators includes returns on assets, returns on equity (Sathye, 2005; Naceur & Kandil, 2009; Saeed, 2014; Helmy & Wagdi, 2019); Tobin Q (Allen & Rai, 1996; Griffith et al., 2002; Jones et al., 2011; Bezawada, 2020; Putri et al., 2021)

Om other hand; general approaches of bank's performance includes CAMEL approach and Balanced Scorecard (BSC) approach; CAMEL - where asset quality (A), while capital adequacy (C), earnings (E), management (M) and liquidity (L), a theory of bank liquidity, incorporates several hazards into the framework, focusing on the balance sheet as a whole with off-site surveillance basis for bank rating (Gilbert et al., 2002; King et al., 2006; Maishanu, 2004; King et al., 2008; Berger et al., 2008; Alber, 2014; Nugroho et al., 2020; Ledhem & Mekidiche, 2020); This approach is usually used by regulatory authorities such as central banks or top management in the bank to evaluate the performance of the bank branches.

But, Balanced Score Card (BSC) is a modern strategy management approach that uses assessment and planning to ensure balanced performance. BSC was created by Kaplan and Norton in 1992. Balanced Score Card is a way to transform a company's overall vision and plans into specific objectives using measures (Hasan & Chyi, 2017; Tuan, 2020; Yadav & Bhojanna, 2020).

Macroeconomic

Many studies such as Saeed (2014); Zhang & Daly (2014); Kiganda (2014); Zampara et al., (2017); Arham et al., (2020) focusing on how macroeconomic effect on bank's performance. According to Guidara et al., (2011) under an investigation to Canadian banking during the period 1982 to 2010; that banks hold more capital buffer in recession than in expansion. So; the study found an impact of economic growth rate on performance of banks.

According to Naceur & Kandil (2013) under an investigation to banking industry in both Egypt, Jordan, Lebanon, Morocco and Tunisia during the period 2000–2004; that Credit growth appears to be more affected by macroeconomic factors. That is agreeing with Albertazzi & Gambacorta (2009) that Bank profitability related to the business cycle; or in other words, the profitability of a bank is related to economic growth.

According to Rashid & Khalid (2017) under an investigation to Pakistan banking during the period 2008-2015; In traditional and Islamic banks, the impact of the volatility of inflation and interest rates are very different on the solvency and performance of each kind of bank. So; the study found an impact of bank's style on their performance. Or in other words, the style of a bank is a control variable for the bank's performance.

According to Khan et al., (2021) under an investigation to banking in Gulf Cooperation Council (GCC) during the period 2007–2015; that Increased trade and financial openness increase the earnings of both traditional and Islamic banks, however Islamic banks are affected differently than traditional banks.

Contrast above, cross application of different analysis direction, Ledhem & Mekidiche (2020) found the impact of Islamic bank's performance on economic according to profitability through Return on Equity (RoE) in all of Malaysia, Indonesia, Brunei, Turkey and Saudi Arabia the period 2014–2014.

Dollarization

The use of a foreign currency is commonly a defensive tactic used by banks to insulate themselves from exposure to exchange rate risk. This approach protects against exchange rate risks, but not against variations in exchange rates; instead, the banks are at more risk because of changes in the value of foreign currency; that is dollarization; according to Kutan et al., (2012) under an investigation to banking industry in 36 countries during the period 1991–2006; that dollarization is one of determinants of bank's performance in emerging markets. That agrees with Vera-Gilces et al., (2020).

Banking Regulations

According to Pasiouras et al., (2009) under an investigation to 74 countries during the period 2000–2004; Banking regulations that improve financial market monitoring and the control of the central bank help banks to be more efficient, additionally, capital requirements become more stringent, but this helps boost cost efficiency, but it reduces profit efficiency. Regulations on banks mean cost efficiency is hurt, while profit efficiency is boosted. But According to Zheng et al., (2017) under an investigation to Bangladeshi during the period 2000-2015; the implementation of Banking regulations from Basel I to Basel II has no appreciable effect on bank profitability and the cost of financial intermediation.

According to Rizwan et al., (2018) under an investigation to banking industry in 15 countries during the period 2000–2015; that default risk is not the same for traditional and Islamic banks, because the effect of banking regulations is different. In regard to Islamic banks, the empirical data shows that rules with have greater impact on Islamic banks rather than traditional banks.

According to Balakrishnan et al., (2021) under an investigation to European central bank that requiring auditor reporting promotes bank market discipline and strengthens the effectiveness of supervisory and monitoring operations. Mandatory auditor reporting, on the other hand, comes at a cost: it lowers future loan growth, risky lending, and profitability, as well as raising audit fees paid by shareholders. This corresponds with (Wheeler, 2019); who referred to banks with insufficient loan loss allowances are more likely to face enforcement proceedings that restrict lending, causing them to lend less during downturns.

In Egyptian banking industry; according to Naceur & Kandil (2009) under an investigation to Egyptian banking during the period 1989-2004; that The new banking regulations have raised the cost of financial intermediation and requirements liquidity on hand; The new banking regulations make an improve in management efficiency on other hand. But according to El-Ansary & Hafez (2015) under an investigation to Egyptian banking during the period 2004-2013; that Egyptian banks might vary in their level of capital adequacy -that an indicator to financial safety- throughout time.

According to Zaky & Soliman (2017) under an investigation to Egypt banking during the period 2013-2016 ; that the common stock prices for banks trading on stock exchange have fallen due to the introduction of Basel III. Additionally, the introduction of Basel III has less impact on banks with a high leverage ratio, as opposed to institutions with a low leverage ratio.

Banking Operations

The many of Literature done on banking industry productivity and efficiency is scarce (Kumbhakar & Sarkar, 2003; Mohan et al., 2005; Rajan & Pandit, 2012). According to Girardone et al., (2004) under an investigation to Italian banking industry during the period 1993 to 1996, that non-performing loan is positively affecting banking inefficiency. According to Pasiouras (2008) under an investigation to Greek commercial banking industry during the period 2000–2004, that the inclusion of the loan loss provision raises banking efficiency. According to Sun & Chang (2011); under an investigation to eight emerging Asian economies; that credit risk is affecting the level and variability of bank efficiency of banks.

In the same context, according to Ozurumba (2016), under investigation to Commercial Banks in Nigeria during the period 2000 to 2013, that Non-performing loan represent a big threat to the commercial banks and are definitely not a trivial matter, with severe consequences for their performance. On other hand; that the relationship positive between corruption and the nonperforming loans (Son et al., 2020).

On the other hand, much of the literature has focused on the relationship between liquidity risk and bank profitability. Some studies have found that liquidity risk does have a significant positive effect on bank profits (Sufian & Habibullah, 2009), but other studies have found that liquidity risk does have a significant negative effect on bank profits (Sufian & Noor Mohamad, 2012). In Egyptian banking industry; according to Wagdi et al. (2019) under investigation during the period 2008 to 2016, there was an impact of the structure of banks' assets and liabilities on their profitability. Therefore, the current study must investigate the structure of assets and liabilities on the performance of banks.

A big bank has lower expenses because of its operations' ability to take advantage of its scale and breadth. Size is often regarded an important factor in bank productivity, as such. Multiple studies have studied and discovered that a positive correlation exists between bank size and bank efficiency in various countries (Delis & Papanikolaou, 2009; Sufian, 2009; Phan et al., 2016).

According to Orazalin & Mahmood (2019) under investigation to Kazakhstan banks during the period 2004 to 2012, there Governance methods resulted in better banking operational performance after the financial crisis. Over time, the better operational performance of the banks is due to improvements in governance mechanisms based on governance codes, board members, board structures and disclosure requirements.

But according to Azmi et al., (2021) under an investigation to banking in 44 emerging economies during the period 2011–2017; that Environmental, Social, and Governance (ESG) activity negatively affects the cost of equity for banks. The current study does not agree with this result, and this can be explained according to the short period of time, as the current study believes that Environmental, Social, and Governance (ESG) activity create value for stakeholders in the long term.

According to Shodiq (2021) under an investigation to Islamic Banking in Indonesia during the period 2017–2019; the sustainability report has a beneficial influence on enhancing banking performance.

According to Bose et al., (2021) under an investigation to Bangladesh banking during the period 2008 to 2014; that improve financial performance of bank may be had by improved performance through the regulatory intervention of more sustainable banks practices. A regulatory green banking effort benefits both competitors and the general public.

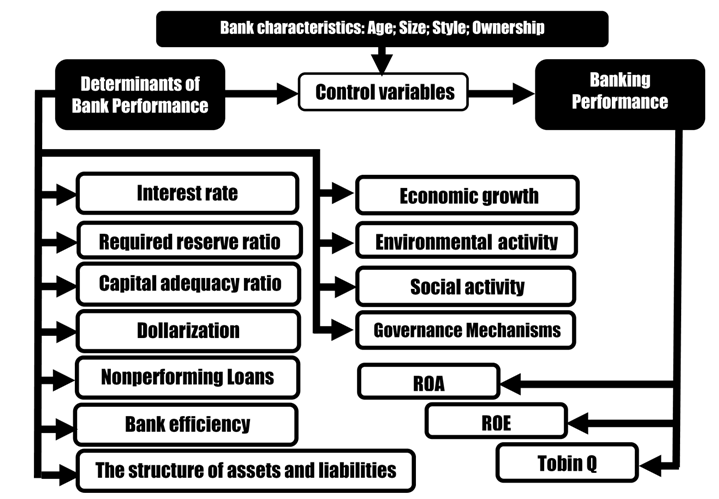

Study Design

Through a literature review, the current study found both economic variables; banking regulations variables and banking operations variables as independent variables. In addition to control variables based on bank characteristics as. Figure (3) shows the study layout.

Through figure NO (3), the study that there are eleven determinants of Bank's performance; that include: economic growth, Interest rate, dollarization, Required reserve ratio, Capital adequacy ratio - as banking regulations variables - Nonperforming Loans, bank efficiency, the structure of banks' assets and liabilities, Environmental, social, and governance (ESG) activity - as banking operations variables -; That under Maturity; Size; Style; and Ownership of a bank as Control Variables. The study investigation into the variables affecting the performance of banks based on return on assets; return on equity and Tobin q ratio of bank unit in Egyptian banking industry through a cross-sectional analysis of banks listed on the Egyptian Exchange (EGX) for 12 banks during the period 2000-2019.

Study Variables

The analysis includes three classifications of variables, the Tables 3 to 5 present those variables with previous studies relevant.

| Table 3 Study independent variables |

||

|---|---|---|

| Variables | Symbol | Previous studies |

| Economic Growth Rate | EG | Pasiouras et al., (2009)., Guidara et al., (2011); Naceur & Kandil (2013); Zheng et al., (2017); Manish & O’Reilly (2019); Helmy & Wagdi (2019); Ledhem & Mekidiche (2020); Ijaz et al., (2020). |

| Interest Rate | IR | Naceur & Kandil (2013); Rashid & Khalid (2017); Helmy & Wagdi (2019). |

| Dollarization | D | Kutan et al., (2012); Vera-Gilces et al., (2020). |

| Required Reserve Ratio | RRR | Gilbert & Peterson (1975); Xi et al., (2005); Naceur & Kandil (2009); MacCarthy (2016); Helmy & Wagdi (2019). |

| Capital Adequacy Requirements | CAR | Pasiouras et al., (2009), Naceur & Kandil (2009); Zheng et al., (2017); Zaky & Soliman (2017); Rizwan et al., (2018); Helmy & Wagdi (2019); Gopalan (2021). |

| Nonperforming Loans | NPL | Lu et al., (2005); Abid et al., (2014); Adebisi & Matthew (2015); Ozurumba (2016); Kingu et al., (2018); Nugraha et al., (2021). |

| Bank Efficiency | BE | Girardone et al., (2004); Pasiouras (2008); Delis & Papanikolaou, (2009); Hays et al., (2009); Sun & Chang (2011); Arora (2014); Phan et al., (2016) |

| The Structure of Banks' Assets and Liabilities | LDR (loan to deposit ratio) |

Sufian & Habibullah (2009); Sufian & Noor Mohamad (2012); Wagdi et al., (2019) |

| EAR (equity to assets ratio) |

||

| Environmental, Social, and Governance (ESG) Activity | EA | Griffith et al., (2002); Liang et al., (2013); Srivastav et al., (2017); Bushman et al., (2018); Orazalin & Mahmood (2019); Bezawada (2020); Azmi et al., (2021) |

| SA | ||

| GM | ||

| Table 4 Study control variables |

||

|---|---|---|

| Variables | Symbol | Previous studies |

| Maturity of a bank | MB | Tariq et al., (2021) |

| Size of a bank | SIZE | Delis & Papanikolaou (2009); Sufian (2009); Rizwan et al., (2018); Alber (2014); Phan et al., (2016) |

| Style of a bank | STYLE | Rashid & Khalid (2017); Rizwan et al., (2018); Khan et al., (2021) |

| Ownership of a bank (According to free float) |

OWN | Griffith et al., (2002); Sathye (2005); Arora (2014); Rizwan et al., (2018) |

| Table 5 Study dependent variables |

||

|---|---|---|

| Variables | Symbol | Previous studies |

| Returns on assets | ROA | Sathye (2005); Naceur & Kandil (2009); Saeed (2014); Helmy & Wagdi (2019) |

| Returns on equity | ROE | Naceur & Kandil (2009); Saeed (2014); Helmy & Wagdi (2019) |

| Tobin Q | TQ | Allen & Rai (1996); Griffith et al., (2002); Jones et al., (2011); Bezawada (2020) Putri et al., (2021) |

Sample and hypotheses testing

Study Sample

The study sampled 12 banks, all of which are listed on the Egyptian Exchange (EGX). The relevant banks are shown in table (2).

| Table 6 Study sample |

|||

|---|---|---|---|

| Style of a bank | Name of bank | Reuters code | Listing Date |

| Traditional Banks | Société Arabe Internationale De Banque (SAIB) | SAIB.CA | 29-11-1980 |

| Suez Canal Bank | CANA.CA | 15-09-1982 | |

| Egyptian Gulf Bank | EGBE.CA | 17-11-1983 | |

| National Bank of Kuwait- Egypt- NBK | NBKE.CA | 12-09-1994 | |

| Commercial International Bank (Egypt) | COMI.CA | 02-02-1995 | |

| Qatar National Bank Alahly | QNBA.CA | 03-07-1996 | |

| Credit Agricole Egypt | CIEB.CA | 03-07-1996 | |

| Specialized Banks | Housing & Development Bank | HDBK.CA | 13-09-1983 |

| Export Development Bank of Egypt (EDBE) | EXPA.CA | 14-12-1995 | |

| Islamic Banks | Al Baraka Bank Egypt | SAUD.CA | 25-12-1984 |

| Faisal Islamic Bank of Egypt | FAIT.CA | 07-06-1995 | |

| Abu Dhabi Islamic Bank- Egypt | ADIB.CA | 19-06-1996 | |

Source: The Egyptian Exchange

Stationary of Data

The assumption of stationary (constant variance) exists in many time series methods. One of the defining characteristics of a stationary process is that "the mean", "variance", and "autocorrelation values" do not vary over time; The study exam the data stationary to ensure that the mean and variance were invariant according to a unit root test, the stationarity of the time series of the basic independent and dependent indicators at level zero was evaluated according to the constant level. This was done through the "Augmented Dickey–Fuller (ADF)", "Philips–Perron (PP)", "Im, Pesaran and Shin W-stat (IPSW)", "Levin, and Lin and Chu t (LLC)" tests at a significance level of less than 0.05. In addition to the "Tau-statistic", the "Z-statistic" criteria were at a significance level of less than 0.05.

Study Models

The study used the fixed-effect model initially to investigated determinants of bank's performance in emerging markets. The study removed the outliers using winsorization at 1% for the continuous variables.

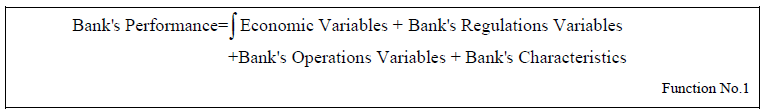

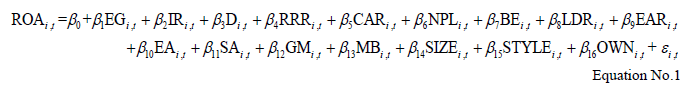

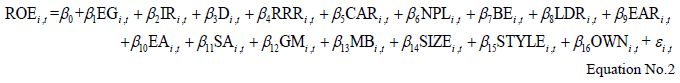

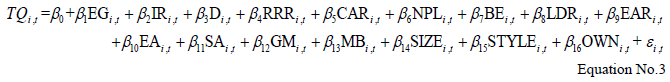

The first function is drafted to explain the proposed framework for the bank's performance through four groups of economic, organizational, and operational variables, in addition to the bank's characteristics. The study uses three measures to estimate the bank’s performance based on returns on assets, returns on equity and Tobin Q. So, the study presents an independent model for each measure that is examined through the cross-sectional data method.

The study tested three hypotheses, and Equations (1), (2), and (3) were drafted to test these hypotheses. Where (i) represent the bank and (t) represents time. In equation (1), ROA represents returns on assets as a dependent variable, but in equation (2), ROE represents returns on equity as a dependent variable, and finally, in equation (3), TQ represents the Tobin Q measure as a dependent variable.

On other hand; Equations (1), (2) and (3) Maturity of a bank: MB, Size of a bank: SIZE; Style of a bank: STYLE and Ownership of a bank (According to free float): OWN are used as a proxy of bank stability as control variables but β0 is a constant term.

Examining the Impact of Economic Variables; Banking Regulations Variables and Banking Operations Variables on Returns on Assets of Banks:

| Table 7 Examining the determinants of returns on assets |

|||||

|---|---|---|---|---|---|

| Coefficient | Std. Error | t-ratio | p-value | ||

|

Const. |

-10.1583 | 2.43967 | -4.164 | <0.0001 | *** |

|

EG |

6.07297 | 0.864817 | 7.022 | <0.0001 | *** |

|

IR |

-0.00180347 | 0.0221232 | -0.08152 | 0.9351 | |

|

RRR |

5.35311 | 1.24656 | 4.294 | <0.0001 | *** |

|

CAR |

0.0789968 | 1.43068 | 0.05522 | 0.9560 | |

|

D |

-6.91542 | 1.54563 | -4.474 | <0.0001 | *** |

|

NPL |

-1.59874 | 0.273646 | 5.842 | <0.0001 | *** |

|

BE |

-0.0115430 | 0.00844366 | -1.367 | 0.1731 | |

|

LDR |

3.21793 | 1.26360 | 2.547 | 0.0116 | ** |

|

EAR |

-1.13880 | 1.31331 | -0.8671 | 0.3869 | |

|

EA |

-0.0365065 | 0.00774771 | -4.712 | <0.0001 | *** |

|

SE |

-7.24114 | 1.21093 | -5.980 | <0.0001 | *** |

|

MB |

-1.01409e-06 | 0.000436424 | -0.002324 | 0.9981 | |

|

SIZE |

-0.000432327 | 0.000515417 | -0.8388 | 0.4025 | |

|

STYLE |

-0.0112621 | 0.0188959 | -0.5960 | 0.5518 | |

|

OWN |

-0.0934093 | 0.0225034 | -4.151 | <0.0001 | *** |

| Mean dependent var | 1.643535 | S.D. dependent var | 0.443959 | ||

| Sum squared resid | 0.611916 | S.E. of regression | 0.053725 | ||

| LSDV R-squared | 0.986955 | Within R-squared | 0.986841 | ||

| LSDV F(26, 212) | 616.9217 | P-value(F) | 1.3e-184 | ||

| Log-likelihood | 374.0048 | Akaike criterion | -694.0095 | ||

| Schwarz criterion | -600.1450 | Hannan-Quinn | -656.1847 | ||

| Rho | -0.108490 | Durbin-Watson | 2.159016 | ||

|

Model 1: Fixed-effects, using 239 observations |

|||||

Source: Gnu Regression, Econometrics and Time-series Library

The statistical results showed that there was an impact of economic variables; banking regulations variables and banking operations variables on returns on assets of banks under bank characteristics, and this was significant at the 0.01 level. Economic variables; banking regulations variables and banking operations variables on returns on assets of banks under bank characteristics affected (98.68%) of the returns on assets.

Examining the Impact of Economic Variables; Banking Regulations Variables and Banking Operations Variables on Returns on Equity of Banks

| Table 8 Examining the determinants of returns on equity |

||||||

|---|---|---|---|---|---|---|

| Coefficient | Std. Error | t-ratio | p-value | |||

|

Const. |

203.541 | 94.0223 | 2.165 | 0.0315 | ** | |

|

EG |

52.5407 | 33.3292 | 1.576 | 0.1164 | ||

|

IR |

-2.48228 | 0.852604 | -2.911 | 0.0040 | *** | |

|

RRR |

-12.3388 | 48.0411 | -0.2568 | 0.7976 | ||

|

CAR |

-74.5238 | 55.1370 | -1.352 | 0.1779 | ||

|

D |

125.803 | 59.5671 | 2.112 | 0.0359 | ** | |

|

NPL |

-9.01985 | 10.5460 | -0.8553 | 0.3934 | ||

|

BE |

0.314345 | 0.325410 | 0.9660 | 0.3351 | ||

|

LDR |

-65.5778 | 48.6977 | -1.347 | 0.1795 | ||

|

EAR |

-73.2924 | 50.6137 | -1.448 | 0.1491 | ||

|

EA |

-1.75589 | 0.298589 | -5.881 | <0.0001 | *** | |

|

SE |

62.2737 | 46.6681 | 1.334 | 0.1835 | ||

|

AGE |

-0.0616836 | 0.0168193 | -3.667 | 0.0003 | *** | |

|

SIZE |

-0.00163669 | 0.0198637 | -0.08240 | 0.9344 | ||

|

STYLE |

1.93159 | 0.728227 | 2.652 | 0.0086 | *** | |

|

OWN |

-0.470861 | 0.867260 | -0.5429 | 0.5877 | ||

|

Mean dependent var |

13.88772 |

S.D. dependent var |

4.643905 | |||

|

Sum squared resid |

908.8507 |

S.E. of regression |

2.070515 | |||

|

LSDV R-squared |

0.822928 |

Within R-squared |

0.822077 | |||

|

LSDV F(26, 212) |

37.89445 | P-value(F) | 1.70e-65 | |||

|

Log-likelihood |

-498.7445 |

Akaike criterion |

1051.489 | |||

|

Schwarz criterion |

1145.354 |

Hannan-Quinn |

1089.314 | |||

|

Rho |

-0.055561 |

Durbin-Watson |

1.245627 | |||

|

Model 2: Fixed-effects, using 239 observations |

||||||

Source: Gnu Regression, Econometrics and Time-series Library

The statistical results showed that there was an impact of economic variables; and banking operations variables on returns on equity of banks under bank characteristics, and this was significant at the 0.01 level. Economic variables; and banking operations variables on returns on equity of banks under bank characteristics affected (82.2%) of the returns on equity.

Examining the Impact of Economic Variables; Banking Regulations Variables and Banking Operations Variables on Tobin Q of Banks

| Table 9 Examining the determinants of Tobin Q |

||||||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Std. Error | t-ratio | p-value | |||||

| const | -0.555991 | 0.245798 | -2.262 | 0.0247 | ** | |||

| EG | -0.0506366 | 0.0871310 | -0.5812 | 0.5618 | ||||

| IR | -0.00708086 | 0.00222893 | -3.177 | 0.0017 | *** | |||

| RRR | 0.517049 | 0.125592 | 4.117 | <0.0001 | *** | |||

| CAR | -0.415663 | 0.144142 | -2.884 | 0.0043 | *** | |||

| D | -0.452932 | 0.155724 | -2.909 | 0.0040 | *** | |||

| NPL | -1.73473 | 0.0275701 | 62.92 | <0.0001 | *** | |||

| BE | -0.000273879 | 0.000850706 | -0.3219 | 0.7478 | ||||

| LDR | -0.0372275 | 0.127308 | -0.2924 | 0.7703 | ||||

| EAR | -0.241674 | 0.132317 | -1.826 | 0.0692 | * | |||

| EA | -2.16041e-06 | 0.000780588 | -0.002768 | 0.9978 | ||||

| SE | -0.0470437 | 0.122003 | -0.3856 | 0.7002 | ||||

| AGE | 5.27979e-05 | 4.39701e-05 | 1.201 | 0.2312 | ||||

| SIZE | -5.29138e-05 | 5.19287e-05 | -1.019 | 0.3094 | ||||

| STYLE | -0.000249522 | 0.00190377 | -0.1311 | 0.8958 | ||||

| OWN | 0.00623300 | 0.00226724 | 2.749 | 0.0065 | *** | |||

| Mean dependent v | 20.79136 | S.D. dependent var | 6.324819 | |||||

| Sum squared resid | 0.006211 | S.E. of regression | 0.005413 | |||||

| LSDV R-squared | 0.919999 | Within R-squared | 0.901999 | |||||

| LSDV F(26, 212) | 12498161 | P-value(F) | 0.000000 | |||||

| Log-likelihood | 922.5347 | Akaike criterion | -1791.069 | |||||

| Schwarz criterion | -1697.205 | Hannan-Quinn | -1753.245 | |||||

| rho | -0.042024 | Durbin-Watson | 2.028416 | |||||

|

Model 3: Fixed-effects, using 239 observations |

||||||||

Source: Gnu Regression, Econometrics and Time-series Library

The statistical results showed that there was an impact of economic variables; banking regulations variables and banking operations variables on Tobin Q of banks under bank characteristics, and this was significant at the 0.01 level. Economic variables; banking regulations variables and banking operations variables on Tobin Q of banks under bank characteristics affected (90.19%) of Tobin Q.

Conclusion and recommendations

Determinants of the bank's performance are projected to increase as they evolve in the current business environment, creating new obstacles for banks in emerging markets. The bank's performance will be difficult to maintain while complying with Basel III, based on the poor economic conditions in many emerging markets, where growing capital costs and liquidity costs will have a negative impact on profit margins for the majority of banking.

The study investigated the determinants of bank's performance in emerging markets, through an analysis of the Egyptian banking industry. According to a quantitative analysis of 12 banks during the period from 2000 to 2019, without 2020 based on the impact of covid-19 Pandemic on bank's performance; the study included economic variables, regulations variables and operations variables as independent variables. In addition to Maturity, size, style, and ownership of bank as control variables.

According to statistical analysis, there was a significant impact of the economic growth rate, dollarization, required reserve ratio, nonperforming loans ratio, loan to deposit ratio, environmental activities, and social activities on returns on assets of banks under their ownership as control variables, and this was significant at the 0.01 level. That affected (98.68%) of the returns on assets.

On the other hand, there was a significant impact of dollarization, interest rate, and environmental activities on bank's returns on equity when bank's maturity and style were used as control variables, and this was significant at the 0.01 level. That affected (82.2%) of the returns of equity of banks.

In addition that; there was a significant impact of interest rate, dollarization, required reserve ratio, capital adequacy requirements, nonperforming loans ratio and equity to assets ratio on under their ownership as control variables, and this was significant at the 0.01 level. So; economic variables, banking regulations, and banking operations Variables on returns on assets of banks under bank's characteristics affected (90.19%) of Tobin Q.

But the other determinants within study have insignificant effect with regard to bank performance, which backed to restructuring of banking industry, banking industry concentration, insufficiency of financial inclusion, and informal economic weight in Egypt.

There was a significant impact of economic variables on bank's performance; that agrees with Cole et al., (2008); Pasiouras et al., (2009); Chang et al., (2010); Guidara et al., (2011); Kutan et al., (2012); Naceur & Kandil (2013); Rashid & Khalid (2017); Zheng et al., (2017); Manish & O’Reilly (2019); Vera-Gilces et al., (2020); Ledhem & Mekidiche (2020).

There was a significant impact of banking regulations variables on bank's performance; that agrees with Gilbert & Peterson (1975); Xi et al., (2005); Naceur & Kandil (2009); Pasiouras et al., (2009), Olszak (2014); MacCarthy (2016); Zheng et al., (2017); Zaky & Soliman (2017); Rizwan et al., (2018).

There was a significant impact of banking operations variables on bank's performance; that agrees with Lu et al., (2005); Abid et al., (2014); Adebisi & Matthew(2015); Ozurumba (2016); Kingu et al., (2018), Nugraha et al., (2021).

There was a significant impact of bank's characteristics on bank's performance ; that agrees with Griffith et al., (2002); Sathye (2005); Delis & Papanikolaou (2009); Sufian (2009); Arora (2014); Alber (2014); Phan et al., (2016), Rashid & Khalid (2017); Rizwan et al., (2018); Khan et al., (2021),

Finally, the study can summarize the determinants of banks' performance as shown in the Table 10.

| Table 10 Determinants of a bank's performance |

|||

|---|---|---|---|

| Economic Variables | Bank's RegulationsVariables | Bank's Operations Variables | Bank's Characteristics |

|

|

|

|

The study recommends the bank's top management have a comprehensive vision of the determinants of bank's performance, which includes four variables (see table No. 8), while the researchers recommend that future research include an extensive test of the proposed model (see figure No.1) through a cross-sectional analysis of several countries.

References

Abid, L., Ouertani, M.N., & Zouari-Ghorbel, S. (2014). Macroeconomic and bank-specific determinants of household's non-performing loans in Tunisia: A dynamic panel data. Procedia Economics and Finance, 13, 58-68.

Indexed at, Crossref, GoogleScholar

Adebisi, J.F., & Matthew, O.B. (2015). The impact of non-performing loans on firm profitability: A focus on the Nigerian banking industry. American Research Journal of Business and Management, 1(4), 1-7.

Alber, N. (2014). Size effect, seasonality, attitude to risk and performance of Egyptian Banks. International Business Research, 7(1), 82-93.

Albertazzi, U., & Gambacorta, L. (2009). Bank profitability and the business cycle. Journal of Financial Stability, 5(4), 393-409.

Indexed at, Crossref, GoogleScholar

Allen, L., & Rai, A. (1996). Bank charter values and capital levels: An international comparison. Journal of Economics and Business, 48(3), 269-284.

Indexed at, Crossref, GoogleScholar

Arham, N., Salisi, M.S., Mohammed, R.U., & Tuyon, J. (2020). Impact of macroeconomic cyclical indicators and country governance on bank non-performing loans in Emerging Asia. Eurasian Economic Review, 10(4), 707-726.

Arora, P. (2014). Reforms, ownership and determinants of efficiency: An empirical study of commercial banks in India. Journal of Emerging Market Finance, 13, 103-138.

Indexed at, Crossref, GoogleScholar

Azmi, W., Hassan, M.K., Houston, R., & Karim, M.S. (2021). ESG activities and banking performance: International evidence from emerging economies. Journal of International Financial Markets, Institutions and Money, 70, 101277.

Indexed at, Crossref, GoogleScholar

Baba, N., & Packer, F., (2009). From turmoil to crisis: Dislocations in the FX swap market before and after the failure of Lehman Brothers. Journal of International Money and Finance, 28(8), 1350-1374.

Indexed at, Crossref, GoogleScholar

Balakrishnan, K., De George, E.T., Ertan, A., & Scobie, H. (2021). Economic consequences of mandatory auditor reporting to bank regulators. Journal of Accounting and Economics, 101431.

Indexed at, Crossref, GoogleScholar

Berger, A., DeYoung, R., Flannery, M., Lee, D., & Öztekin, Ö. (2008). How do large banking organizations manage their capital ratios? Journal of Financial Services Research, 34, 123–149.

Bezawada, B. (2020). Corporate governance practices and bank performance: Evidence from Indian Banks. Indian Journal of Finance and Banking, 4(1), 33-41.

Indexed at, Crossref, GoogleScholar

Bose, S., Khan, H.Z., & Monem, R.M. (2021). Does green banking performance pay off? Evidence from a unique regulatory setting in Bangladesh. Corporate Governance: An International Review, 29(2), 162-187.

Indexed at, Crossref, GoogleScholar

Buallay, A., Fadel, S.M., Alajmi, J., & Saudagaran, S. (2020). Sustainability reporting and bank performance after financial crisis: Evidence from developed and developing countries. Competitiveness Review, 31(4), 747-770.

Indexed at, Crossref, GoogleScholar

Bushman, R.M., Davidson, R.H., Dey, A., & Smith, A. (2018). Bank CEO Materialism: Risk controls, culture and tail risk. Journal of Accounting and Economics, 65(1), 191-220.

Indexed at, Crossref, GoogleScholar

Chang, P.C., Jia, C., & Wang, Z. (2010). Bank fund reallocation and economic growth: Evidence from China. Journal of Banking & Finance, 34(11), 2753-2766.

Cole, R.A., Moshirian, F., & Wu, Q. (2008). Bank stock returns and economic growth. Journal of Banking & Finance, 32(6), 995-1007.

Dietrich, A., & Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of international financial markets, institutions and money, 21(3), 307-327.

Indexed at, Crossref, GoogleScholar

Dumontaux, N., & Pop, A., (2013). Understanding the market reaction to shockwaves: Evidence from the failure of Lehman Brothers. Journal of Financial Stability, 9(3), 269-286.

Indexed at, Crossref, GoogleScholar

El-Ansary, O., & Hafez, H.M., (2015). Determinants of capital adequacy ratio: An empirical study on Egyptian banks. Corporate Ownership & Control, 13(1), Continued, 13(1-10), 1166-1176.

Indexed at, Crossref, GoogleScholar

Fernando, C.S., May, A.D., & Megginson, W.L, (2012). The value of investment banking relationships: Evidence from the collapse of Lehman Brothers. The Journal of Finance, 67(1), 235-270.

Gambacorta, L., & Paolo E.M. (2014). Bank heterogeneity and interest rate setting: What lessons have we learned since Lehman Brothers? Journal of Money, Credit and Banking, 46(4), 753-778.

Gilbert, G.G., & Peterson, M.O. (1975). The impact of changes in Federal Reserve membership on commercial bank performance. The Journal of Finance, 30(3), 713-719.

Gilbert, R., Meyer, A., & Vaughan, M. (2002). Could a CAMELS downgrade model improve off-site surveillance? Federal Reserve Bank of St. Louis Review, 84(1), 47–63.

Indexed at, Crossref, GoogleScholar

Girardone, C., Molyneux, P., & Gardener, E.P.M. (2004). Analysing the determinants of bank efficiency: The case of Italian banks. Applied Economics, 36, 215-227.

ProQuest, Crossref, GoogleScholar

Gopalan, Y. (2021). The effects of ratings disclosure by bank regulators. Journal of Accounting and Economics, 101438.

Indexed at, Crossref, GoogleScholar

Griffith, J.M., Fogelberg, L., & Weeks, H.S. (2002). CEO ownership, corporate control, and bank performance. Journal of Economics and Finance, 26(2), 170-183.

Guidara, A., Lai, V., & Soumaré, I. (2011). Banks’ capital buffer, risk and performance in different business and regulation cycles: Evidence from Canadian sector. In The 44th Annual Conference of the Canadian Economic Association, Quebec City.

Hays, F.H., De Lurgio, S.A., & Gilbert, A.H. (2009). Efficiency ratios and community bank performance. Journal of Finance and Accountancy, 1(1), 1-15.

Helmy, A., & Wagdi, O. (2019). Three-dimensional analysis of bank profit with the development of regulatory restrictions: Evidence from Egypt. International Journal of Economics and Finance, 11(3), 12-31.

Ijaz, S., Hassan, A., Tarazi, A., & Fraz, A. (2020). Linking bank competition, financial stability, and economic growth. Journal of Business Economics and Management, 21(1), 200-221.

Imran, K., & Nishat, M. (2013). Determinants of bank credit in Pakistan: A supply side approach. Economic Modelling, 35, 384–390.

Indexed at, Crossref, GoogleScholar

Johnson, M.A., & Mamun, A. (2012). The failure of Lehman brothers and its impact on other financial institutions. Applied Financial Economics, 22(5), 375-385.

Jones, J.S., Miller, S.A., & Yeager, T.J. (2011). Charter value, Tobin's Q and bank risk during the subprime financial crisis. Journal of Economics and Business, 63(5), 372-391.

Khan, A., Hassan, M.K., Paltrinieri, A., & Bahoo, S. (2021). Trade, financial openness and dual banking economies: Evidence from GCC Region. Journal of Multinational Financial Management, 100693.

Kiganda, E.O. (2014). Effect of macroeconomic factors on commercial banks profitability in Kenya: Case of equity bank limited. Journal of Economics and Sustainable development, 5(2), 46-56.

Kim, D., & Song, C.Y. (2017). Bankruptcy of Lehman brothers: Determinants of cross-country impacts on stock market volatility. International Journal of Economics and Financial Issues, 7(3), 210-219.

Kim, H., Batten, J.A., & Ryu, D. (2020). Financial crisis, bank diversification, and financial stability: OECD countries. International Review of Economics & Finance, 65, 94-104.

Indexed at, Crossref, GoogleScholar

King, T., Nuxoll, D., & Yeager, T. (2006). Are the causes of bank distress changing? Can researchers keep up? Federal Reserve Bank of St. Louis Review, 88(1), 57–80.

Indexed at, Crossref, GoogleScholar

Kingu, P.S., Macha, S., & Gwahula, R. (2018). Impact of non-performing loans on bank’s profitability: Empirical evidence from commercial banks in Tanzania. International Journal of Scientific Research and Management, 6(1), 71-79.

Indexed at, Crossref, GoogleScholar

Kumbhakar, S.C., & Sarkar, S. (2003). Deregulation, ownership, and productivity growth in the banking Industry?: Evidence from India. Journal of Money, Credit, and Banking, 35, 403-424.

Kutan, A.M., Ozsoz, E., & Rengifo, E.W. (2012). Cross-sectional determinants of bank performance under deposit dollarization in emerging markets. Emerging Markets Review, 13(4), 478-492.

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of economic literature, 35(2), 688-726.

Liang, Q., Xu, P., & Jiraporn, P. (2013). Board characteristics and Chinese bank performance. Journal of Banking & Finance, 37(8), 2953-2968.

Indexed at, Crossref, GoogleScholar

Lu, D., Thangavelu, S.M., & Hu, Q. (2005). Biased lending and non-performing loans in China's banking sector. Journal of Development Studies, 41(6), 1071-1091.

MacCarthy, J. (2016). The effect of Cash Reserve Ratio (CRR) on the financial performance ofcommercial banks and their engagement in csr In Ghana. Research Journal of Finance, 4(3), 23-45.

Maishanu, M. (2004). A univariate approach to predicting failure in the commercial banking sub-sector in Nigerian. Journal of Accounting Research, 1(1).

Manish, G.P., & O’Reilly, C. (2019). Banking regulation, regulatory capture and inequality. Public Choice, 180(1), 145-164.

Indexed at, Crossref, GoogleScholar

Mohan, R., Khan, M.S., & Janjua, M.A. (2005). Reforms, productivity, and efficiency in banking: The Indian experience. Pakistan Development Review, 44, 505-538.

Naceur, S.B., & Kandil, M. (2009). The impact of capital requirements on banks’ cost of intermediation and performance: The case of Egypt. Journal of Economics and Business, 61(1), 70-89.

Indexed at, Crossref, GoogleScholar

Naceur, S.B., & Kandil, M. (2013). Has the basel capital requirement caused credit crunch in the Mena region? Middle East Development Journal, 5(02).

Indexed at, Crossref, GoogleScholar

Nugraha, N.M., Yahya, A., Nariswari, T.N., Salsabila, F., & Octaviantika, I.Y. (2021). Impact of non-performing loans, loan to deposit ratio and education diverstiy on firm performance of Indonesia banking sectors. Review of International Geographical Education Online, 11(3), 85-96.

Nugroho, M., Halik, A., & Arif, D. (2020). Effect of camel’s ratio on Indonesia banking share prices. The Journal of Asian Finance, Economics, and Business, 7(11), 101-106.

Indexed at, Crossref, GoogleScholar

Olszak M. (2014). The role of capital regulation and risk-taking by banks in monetary policy. The Copernican economy, 5(1).

Indexed at, Crossref, GoogleScholar

Orazalin, N., & Mahmood, M. (2019). The financial crisis as a wake-up call: Corporate governance and bank performance in an emerging economy. Corporate Governance, 19(1), 80-101.

Indexed at, Crossref, GoogleScholar

Ozurumba, B.A. (2016). Impact of non-performing loans on the performance of selected commercial banks in Nigeria. Research journal of Finance and Accounting, 7(16), 95-109.

Pasiouras, F. (2008). Estimating the technical and scale efficiency of Greek commercial banks: The impact of credit risk, off-balance sheet activities, and international operations. Research in International Business and Finance, 22, 301-318.

Indexed at, Crossref, GoogleScholar

Pasiouras, F., Tanna, S., & Zopounidis, C. (2009). The impact of banking regulations on banks' cost and profit efficiency: Cross-country evidence. International Review of Financial Analysis, 18(5), 294-302.

Indexed at, Crossref, GoogleScholar

Phan, H.T.M., Daly, K., & Akhter, S. (2016). Bank efficiency in emerging Asian countries. Research in International Business and Finance, 38, 517-530.

Prügl, E. (2012). If Lehman brothers had been Lehman sisters...: Gender and myth in the aftermath of the financial crisis. International Political Sociology, 6(1), 21-35.

Indexed at, Crossref, GoogleScholar

Rajan, S.S., & Pandit, V. (2012). Efficiency and productivity growth in Indian banking. Margin, 6, 467-486.

Rashid, D., & Khalid, S., (2017). Impacts of inflation and interest rate uncertainty on performance and solvency of conventional and Islamic banks in Pakistan. Journal of Islamic Business and Management, 7(2), 156-177.

Indexed at, Crossref, GoogleScholar

Rizwan, M.S., Moinuddin, M., L’Huillier, B., & Ashraf, D. (2018). Does a one-size-fits-all approach to financial regulations alleviate default risk? The case of dual banking systems. Journal of Regulatory Economics, 53(1), 37-74.

Indexed at, Crossref, GoogleScholar

Saeed, M.S. (2014). Bank-related, industry-related and macroeconomic factors affecting bank profitability: A case of the United Kingdom. Research Journal of Finance and Accounting, 5(2).

Sathye, M. (2005). Privatization, performance, and efficiency: A study of Indian banks. Vikalpa, 30(1), 7-16.

Shair, F., Shaorong, S., Kamran, H.W., Hussain, M.S., Nawaz, M.A., & Nguyen, V.C. (2021). Assessing the efficiency and total factor productivity growth of the banking industry: Do environmental concerns matters?. Environmental Science and Pollution Research, 28(16), 20822-20838.

Shodiq, M.J. (2021). The influence of sustainability report on Islamic banking performance in Indonesia. In conference on complex, intelligent, and software intensive systems, 590-597. Springer, Cham.

Son, T.H., Liem, N.T., & Khuong, N.V. (2020). Corruption, nonperforming loans, and economic growth: International evidence. Cogent Business & Management, 7(1), 1735691.

Indexed at, Crossref, GoogleScholar

Srivastav, A., Keasey, K., Mollah, S., & Vallascas, F. (2017). CEO turnover in large banks: Does tail risk matter?. Journal of Accounting and Economics, 64(1), 37-55.

Sufian, F. (2009). Determinants of bank profitability in a developing economy: Empirical evidence from the China banking sector. Journal of Asia-Pacific Business, 10, 281-307.

Indexed at, Crossref, GoogleScholar

Sufian, F., & Habibullah, M.S. (2009). Bank specific and macroeconomic determinants of bank profitability: Empirical evidence from the China banking sector. Frontiers of Economics in China, 4, 274-291.

Sufian, F., & Noor Mohamad, M.A. (2012). Determinants of bank performance in a developing economy: Does bank origins matters?. Global Business Review, 13, 1-23.

Sun, L., & Chang, T.P. (2011). A comprehensive analysis of the effects of risk measures on bank efficiency: Evidence from emerging Asian countries. Journal of Banking and Finance, 35, 1727-1735.

Indexed at, Crossref, GoogleScholar

Tan, Y. (2016). The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money, 40, 85-110.

Indexed at, Crossref, GoogleScholar

Tariq, W., Usman, M., Tariq, A., Rashid, R., Yin, J., Memon, M.A., & Ashfaq, M. (2021). Bank maturity, income diversification, and bank stability. Journal of Business Economics and Management, 22(6), 1492-1511.

Indexed at, Crossref, GoogleScholar

Trujillo?Ponce, A. (2013). What determines the profitability of banks? Evidence from Spain. Accounting & Finance, 53(2), 561-586.

Indexed at, Crossref, GoogleScholar

Tuan, T.T. (2020). The impact of balanced scorecard on performance: The case of Vietnamese commercial banks. The Journal of Asian Finance, Economics and Business, 7(1), 71-79.

Indexed at, Crossref, GoogleScholar

Vera-Gilces, P., Camino-Mogro, S., Ordeñana-Rodríguez, X., & Cornejo-Marcos, G. (2020). A look inside banking profitability: Evidence from a dollarized emerging country. The Quarterly Review of Economics and Finance, 75, 147-166.

Indexed at, Crossref, GoogleScholar

Wagdi, O., Hasaneen, A., & Abouzeid, W. (2019). The impact of bank's asset and liability structure on their profitability regardless of monetary policy and size: A panel analysis. Asian Journal of Finance & Accounting, 11(2), 186-206.

Wheeler, P.B. (2019). Loan loss accounting and procyclical bank lending: The role of direct regulatory actions. Journal of Accounting and Economics, 67(2-3), 463-495.

Indexed at, Crossref, GoogleScholar

Wiggins, R.Z., & Metrick, A. (2019). The Lehman brothers bankruptcy h: The global contagion. Journal of Financial Crises, 1(1), 172-199.

Indexed at, Crossref, GoogleScholar

Xi, N., Ding, N., & Wang, Y. (2005). How required reserve ratio affects distribution and velocity of money. Physica A: Statistical mechanics and its applications, 357(3-4), 543-555.

Indexed at, Crossref, GoogleScholar

Yadav, R.A., & Bhojanna, U. (2020). Evaluation methods for bank performance using balanced scorecard–A qualitative study In Bangalore city. Aut Aut Research Journal, 11(9), 173-186.

Zaky, A.H.M., & Soliman, M.M., (2017). The impact of announcement of Basel III on the banking system performance: An empirical research on Egyptian Banking Sector. The Business & Management Review, 9(2), 165-174.

Zampara, K., Giannopoulos, M., & Koufopoulos, D.N. (2017). Macroeconomic and industry-specific determinants of Greek bank profitability. International Journal of Business and Economic Sciences Applied Research, 10(1), 3-22.

Zhang, X., & Daly, K. (2014). The impact of bank-specific and macroeconomic factors on China’s bank performance ok. Chinese Economy, 47(5-6), 5-28.

Zheng, C., Rahman, M.M., Begum, M., & Ashraf, B.N., (2017). Capital regulation, the cost of financial intermediation and bank profitability: Evidence from Bangladesh. Journal of Risk and Financial Management, 10(2).

Indexed at, Crossref, GoogleScholar

Received: 20-Nov-2021, Manuscript No. AAFSJ-21-8760 ; Editor assigned: 23- Nov -2021, PreQC No.AAFSJ-21-8760 (PQ); Reviewed: 08-Dec-2021, QC No. AAFSJ-21-8760; Revised: 20-Dec-2021, Manuscript No. AAFSJ-21-8760 (R); Published: 03-Jan-2022