Research Article: 2022 Vol: 26 Issue: 1S

Determinants of Audit Quality in Nigeria: Evidence from Listed Consumer Goods Sector in Nigeria

Akinyomi, Oladele John, Mountain Top University

Joshua, Abimbola A, Mountain Top University

Citation Information: John, A.O., & Abimbola, J.A. (2022). Determinants of audit quality in nigeria: evidence from listed consumer goods sector in nigeria. Academy of Accounting and Financial Studies Journal, 26(1), 1-14.

Abstract

The general public and specific stakeholders have expressed apprehension as regards the degraded quality of the external audit report. The concept of audit quality and its determinants has been a debatable issue over the decades. The current study examined the determinants of audit quality in the context of the Nigerian listed consumer goods companies. Using the ex-post facto research, a sample of six (6) companies were randomly selected from a population of twenty existing companies as at 31st December 2020. Necessary data for the study was spooled from the audited annual financial statement of the considered companies for an eight-year period from 2012 when IFRSs became operational in Nigeria to the 2019 financial year. Correlation and regression analysis were carried out using SPSS version 22. The outcome of the study revealed a statistically non-significant but positive relationship with the board size as a proxy for corporate governance, audit firm size and company size on one hand, and audit quality on the other hand. However, a negative and statistically insignificant relationship is established between the tenure of the audit firm and audit quality in the Nigerian consumer goods sector. The following recommendations are proposed: (i) Policy measures should be put in place to regulate the activities of auditors so as to checkmate unreasonably long-term auditor-client relationship which may jeopardize objectivity and independence. (ii) Small audit firms should be encouraged to form partnerships so as to boost their capacity so as to enhance their audit engagement quality to big client companies.

Keywords

Corporate Governance, Audit Quality, Audit Tenure, Company Size, Objectivity, Audit Independence, Audit Firm Size.

JEL Classifications

M40, M42

Introduction

The global corporate scene has in the last few decades, witnessed series of corporate scandals involving erstwhile reputable business organizations such as those of HealthSouth, Enron and WorldCom in the United States, and Royal Ahold, Vivendi Universal and Parmalat in Europe. In addition, the Nigerian corporate scene is not spared with respect to cases of corporate scandals. There have been widely reported instances of corporate scandals such as those of Cadbury Nigeria Plc, Unilever Brothers Plc, African Petroleum Plc, Intercontinental Bank, Union Bank Plc, Oceanic Bank Plc and Afribank Plc to mention but a few. These incidences of corporate scandals have brought a big question mark on the quality of financial statements prepared and presented by the board of directors in these organizations on one hand, and the quality of audit exercise executed by the external auditors on the other hand (Ogbodo & Akabuogu, 2020).

Accounting has been frequently regarded as the language of business, it represents the language deployed by corporate management in reporting the organization’s financial and economic activities to stakeholders, including shareholders, creditors, regulatory authorities, current and potential investors among others (Akinyomi et al., 2017). Therefore, the general public has a set of expectations on the annual financial statements as put together by accountants, and adjudged to reflect a true and fair view of the financial position of the organization by the external auditors. Generally, audit process is expected to be conducted in such a way that material misstatement, fraudulent practice, misjudgement, and inconsistencies should be discovered and corrected/reported, thereby confirming that the reports reveals a fairness and truthfulness in the financial position of the business for the benefit of the stakeholders (Bakare, 2019; Olabisi et al., 2020). Where corporate scandal occurred, it is either the external auditor was unable to detect the existence of material misstatement, fraudulent practice, misjudgement, and inconsistencies; or a lack of the willpower to report such findings in the audit report (Madugba et al., 2021). This has caused a loss of confidence by stakeholders generally, and the investors in particular on the validity of the opinion expressed by external auditors on the annual reports of corporate entities globally. The foregoing invariably questions the quality of audit reports produced by the external auditors.

In order to guarantee high quality audit, a mixture of external and internal concurrent elements need to be considered. Previous studies have drawn attention to divergent components which influence audit quality. Among these identified components we have mechanisms of corporate governance (such as board size, board independence, board composition, etc.), audit firm tenure, audit firm size, and company size (Patrick et al., 2017; Ismail et al., 2019; Kertarajasa et al., 2019). Nevertheless, the results of these previous studies are not conclusive. For instance, while some of these studies reported the existence of significant link between each of the above variables and audit quality, other studies reported the existence of no significant association between each of the identified factors and audit quality. This inconsistent nature of the results of previous studies therefore necessitates further study on the subject matter. Thus, the current study seeks to examine the link between audit quality on one hand, and each of board size, audit firm tenure, audit firm size, and company size in the context of the Nigerian consumer goods sector.

Literature Review

Conceptual Review

Series of unsuccessful efforts have been made in the past to provide a universally acknowledged and accepted definition of the term audit quality because the concept of audit quality is an intricate and many-sided one (IAASB, 2011). Nevertheless, audit quality could be described as the possibility of auditors to detect and disclose material misstatements of financial information through professional competence DeAngelo, (1981) cited in Hosseinniakani et al., (2014). Under such a situation, auditor’s independence is so fundamental when disclosing the identified inaccuracies. The possibility of detecting and disclosing material misstatement, is contingent on various variables associated with auditor’s independence, qualifications, capabilities, training and experience (Hosseinniakani et al., 2014).

Meanwhile, audit quality is paramount to the performance of organisations as it enhances stakeholders’ confidence and helps mitigating earnings management as well as enhancing moderation between the audit committee and the financial reporting quality (Ogungbade et al., 2021). However, it has been a debatable concept for decades among the stakeholders as it implies presentation of financial report void of any form of misrepresentation and misstatement (Wakill et al., 2020). Financial information is expected to be void of information asymmetry so as to enhance the stakeholders’ confidence (Ilechukwu, 2017). Therefore, as a corporate governance mechanism, audit quality aims at minimising misrepresentation and thereby preserving the confidence of stakeholders in the capital market (Abbah & Sadah, 2020; Ado et al., 2020). The focal point of an audit exercise is the presentation of fairness and truthfulness in the financial information prepared and presented by the management (Bakare, 2019; Madugba et al., 2021; Ndubuisi et al., 2017).

Auditing ensures an independent review of financial information so as to evaluate the internal control system adequacy in existence (Olabisi et al, 2020). Over the years, improvement on auditing process has been enhanced in order to present quality audit exercise by improving auditors’ independence both in appearance and in mind, thereby mitigating the risk of companies’ collapse after issuing clean audit report (Abbah & Sadah, 2020). Auditors have fundamental responsibility of conducting an audit exercise that will strengthen the capital market when they issue a reliable opinion on financial information prepared by corporate management. Stakeholders rely heavily on auditors’ opinion in determining the financial worth of the business for the period under consideration (Crucean & Hategan, 2019). This responsibility is a function of two main characteristics of auditor which include (i) competency to detect an existence of material misstatement in the financial statement, and (ii) the ability to report such material misstatement and irregularities (Abbah & Saddah, 2020). The agency theory laid emphasis on the separation of principal-agent’s responsibilities. This separation of responsibility enables the principal to call for measures that can enhance safety of their assets thereby a demand for a realistic and reliable financial reporting (Ndubuisi et al., 2017). Consequently, there is a need for good accountability policy and audit quality for the achievement of organisational goals and objectives.

Auditors have the responsibility to be honest in all audit engagement. This represents the bedrock of all audit engagements. Auditors’ independence is the freedom from limitations affecting auditors’ objectivity and professional judgement thereby increasing stakeholders’ confidence in the auditing process and enhancing audit quality (Wakil et al., 2020). In order to enhance objectivity and mitigate information asymmetry, auditors must be seen to be independent in mind and in appearance. Therefore, absolute independence requires the display of professional scepticism without any undue influence.

Audit tenure refers to the time duration in which audit firm and company-client relationship exists. This could be a short-time period of three years and below, or a long-time period if the duration of such relationship exceeds three years at a stretch. The existence of an elongated relationship existing between an audit client and audit firm could amount to undue familiarity of the with the clients’ management which on the long run could hamper the auditor from expressing his objective professional opinion freely (Wakil et al., 2020). Thus, there seems to exist a high tendency for a deterioration in the auditors’ independence emanating from long audit tenure. Regulatory bodies around the world have put effort together to establish mandatory audit firm rotation in order to establish audit quality. For instance, Sarbanes-Oxley Act 2002 requires that lead audit partners should rotate every five years, the European Commission (2011) mandates auditors’ rotation for every six years. However, the Public Company Accounting Oversight Board (PCAOB) undertook a project for periodic mandatory of auditors’ rotation considering both the costs and benefits (Ouyang & Wa, 2013). Previous studies have revealed mix results with respect to the relationship between the audit tenure and audit quality. Some of these studies indicated the existence of a positive relationship between the two variables. This connotes that the longer the tenure of audit exercise the better the audit performance as auditors get more acquainted with the clients’ business (Wilson et al., 2018). Meanwhile, Abbah & Sadah, (2020) reported a negative link between tenure of audit and audit quality. According to Abbah & Sadah, (2020) a short period of audit firm and client-company relationship will greatly improve the quality of the audit because the possibility of familiarity threat will be at the barest minimum. Thus, the auditor will be at liberty to disclose any material misstatement discovered in the course of the audit exercise.

Audit firm size represents another factor which exercises some influence on audit quality audit. Audit firm size can be grouped basically into the large audit firms (popularly known as the big four), and the small audit firms (Wakil et al., 2020). The large audit firms (or the big four) have reputable names to protect. The protection of their reputation will make them conduct a thorough audit exercise of high quality so as not to dent their image. Beside this, larger audit firms have access to superior financial resources and they are well equipped to conduct research with modern technology. These firms also have the requisite multi-disciplinary human resources who are well furnished with the skills and experiences necessary to conduct audit of big companies’ audits than do small audit firms. Furthermore, large audit firms have enough financial muscle to withstand undue pressure from client-company management, unlike small firms who do not have such financial muscle, rather, they easily accede to pressure from client-company’s management (Ndubuisi et al., 2017; Abba & Sadah, 2020).

Studies have revealed that audit firm size has positive significance impact on the quality audit exercise as big audit companies loose more of reputation (Mawutor, 2019). The study of De-angelo, (1981) opined that the big audit firms are less likely to compromise in terms of identifying irregularities in the financial statement and thus less likely financially depend on a particular audit engagement or audit client. Therefore, larger audit firms serve as important features of ensuring auditors’ independence and thereby enhancing audit quality (Abba & Sadah, 2020). The big audit firms also have industry specialization, which means that the auditors have the ability to understand and minimise the complexities involved in the financial reports of various industry classifications. Audit quality can be enhanced with the industry specialised auditors as it will be easier to implement procedures suitable and effective for identifying and correcting misstatement when compared with the non-specialised auditors.

Similarly, corporate governance mechanisms have been recognized as a factor that exerts influence on audit quality (Bamwa et al., 2020). Generally, corporate governance encompasses codes, conventions and principles that regulate how the boards of corporate entities conduct, supervise and administer the affairs of their respective organizations (Bamwa et al., 2020). It includes the principle of transparency, accountability and security of assets (Naimah & Hamidah, 2017). It could be seen as an effort to maximise an organisation’s management system and has a basis on agency theory. Akinyomi et al., (2019) acknowledge board independence, size of the board, audit committee size, meetings, quality of audit engagement, outside directors and audit committee perception index as principal corporate governance mechanisms. According to the Securities and Exchange Commission (SEC) guidelines on corporate governance, the composition and structure of board members should consist of minimum of five. Amitada, (2016) is of the view that by reducing board size to the minimum can help in improving the efficiency and effectiveness of the board. According to Ogoun & Perelayefa, (2020) larger board size is often characterised by poor communication, inefficiency and bureaucracy in decision making.

Company size has been acknowledged as a significant factor influencing audit quality (Akinyomi et al., 2019). First, big companies have the financial capacity to hire competent and experienced manpower who will function in the various departments, establishing proper internal control systems, and operating an efficient internal audit unit. These will boost the possibility of keeping proper records, and the preparation of high quality appropriate financial statements that truly reflect the correct state of affairs of the company (Zadeh & Eskandari, 2012). In addition, big companies have the wherewithal to engage the services of reputable and experienced audit firms that can provide quality audit engagement. Thus, one expects big companies to prepare and present accurate and unbiased financial statements that are free from material errors and misstatement. Similarly, since big companies have the financial resources to engage reputable audit firms, one expects such audit firms to produce high quality audit reports (Akinyomi et al., 2019).

Theoretical Review

Theory of Inspired Confidence

It was propounded by Professor Limperg Theodore in the late 1920s and could also be referred to as the rational expectations’ theory. According to the theory, auditors should organise and perform their duty in a manner that will not distort the expectation of various stakeholders (Mawutor et al., 2019). The theory opined that a situation when the confidence of the society members has been thwarted as regards the effectiveness of audit quality and audit opinion, then audit is socially useless. The theory stressed society’s need for reliable financial information in which effective audit techniques can provide through the auditors’ responsibility of being expert for independent examination of financial information and produce independent and unbiased opinion thereafter. Therefore, auditors should strive to meet the information need of the general public. The theory also, opined that demand for audit exercise occurs as a result of stakeholders’ participation in the affairs of the business and therefore, there might be divergence in the interest of management and other stakeholders. In order to give assurance to the confidence of stakeholders, audit is therefore considered paramount (Saleh, 2011).

Agency Theory

The theory was defined by Jensen & Meckling, (1976) as the agency relationship in which there exist a contractual agreement between the principal(s) and the agents as the principal engaged the agents to perform services on behalf of the principal. The principals are the shareholders, while the agent is the corporate management. However, it is worthy of note to stress that there exist between the two party’s information asymmetry, the principals (shareholders) are assumed not to have the same level of information as the agents (management) even at the very time of decision making (Duits, 2012). Therefore, there is a tendency that the agents are not working to the best suitable for the principal. Agency problem addressed by the theory is the separation of control and ownership between the owners of the business and the management by proposing that the owners of business should ensure adequate incentives for management and incur monitoring cost to reduce abnormal act of the agents. Therefore, agency theory aimed at mitigating the monitoring cost by stressing the role of auditor as to supervision of the relation between the principals and the agents (Duits, 2012; Salehi, 2011). The theory opined that due to the information asymmetries existing between the two parties and the self-interest nature of the agents, the solution is to instil measures that can resolve this issue and align the interest of the parties thereby bringing the issue of information asymmetry and opportunistic behaviour to the barest minimum. Such mechanisms include an attractive remuneration and incentives packages for management, audit and then the ability of the owners to trust the agents. However, the truth is that the theory assumes that no agent is trustworthy which emphasises the need for monitoring mechanism such as audit to be established.

Empirical Review

The study of Crucean & Hategan, (2019) in Romania context aimed at disclosing the determining factors of audit quality. Using the qualitative research method, the study found that factors relevant in determining audit service quality include the ethical competency and the professional judgement of the auditors. The study reported also that other factors including the audit firm size, audit rotation and auditors’ characteristics similarly exert significant effect on audit quality. The study of Wakill et al., (2020) in Nigerian context aimed at determining the factors that could enhance audit quality in Nigerian Public sector. The study established that a greater level of auditors’ independence will be helpful in achieving quality of audit exercise as auditors will be able to overcome any form of predispositions.

The study of Mawutor et al., (2019) assessed the factors that could contribute to quality of audit exercise in Ghana context. The study adopted cross-sectional research design in which firm size, the audit committee and the natural logarithms of audit fees proxied the explanatory variables while leverage ratio that is the companies’ total debts to total assets proxied audit quality. The study revealed that the size of audit companies and the absence of audit committee had poor and negative influences on the quality audit engagement. However, natural logarithms of audit fees indicated a positive influence on quality audit engagement. The study recommended that the Institute of Chartered Accountants of Ghana should review and regulate to the extent that any lack of adherence to auditing standards by listed companies should be sanctioned.

The study of Abbah & Sadah, (2020) examined the consequences of quality audit engagement on firms’ value. The study ascertained that auditors with industry specialisation enhance higher values of banks under consideration, while audit firm size has no significant influence on the value of the banks with the adoption of correlational research design for 13 banks covering the period of 2013-2018 (6 years). The study stressed on the importance of specialisation on the part of auditors as a contributory factor to audit quality thereby enhancing the value of banks under consideration.

Furthermore, Amahalu & Ezechukwu, (2017) assessed the determining factors of audit quality in the context of Nigerian banking sector. The study period spanned a period of six years beginning from 2010 to 2015. Data were extracted from the audited financial reports of the selected banks. The data were analysed using E-views 9.0. The outcome of the analysis showed the existence of a positive and statistically significant link between audit quality, audit tenure and firm size. It was recommended in the study that auditor-client association should not be more than 3 years maximum. According to the study, this was to prevent a situation whereby the audit firm will develop an intimate connection with the client thereby jeopardizing the audit firm’s independence and objectivity.

Similarly, Dunakhir, (2016) examined factors influencing audit quality in the context of Indonesia. Specifically, the study reviewed the characteristics of quality audit engagement in Indonesia by focusing on auditors’ perspectives, external users of annual report and audit clients. The study noted that examining audit quality from different stakeholders’ perspectives would provide a better outcome. Data for the study were obtained from primary source through the administration of questionnaires. The outcome of the study revealed the existence of significant difference in the perceptions of the different stakeholders.

Bakare, (2019) evaluated the relevance of board’s independence in establishing quality of audit exercise among non-financial listed companies listed in Nigeria. Adopting the secondary source of data, a total of 71 non-financial listed companies were included in the study covering 2009-2016 period. Adopting the binary logit analysis, the outcome of the study revealed that negative association between the independence of board members and audit quality. The study recommended that there should be an improvement on the proportion of the board independence so as to enhance audit quality.

Madugba et al., (2021) investigated audit committees’ impact on financial reporting quality in the context of Nigerian Banking industry. Using descriptive research design, the study obtained secondary data covering 2013-2019 period from the audit annual reports of the selected DMBs. The result of the study revealed no statistically significant association between audit committee quality and the quality audit engagement in the Nigerian banking sector.

The study of Ogoun & Perelayefa, (2020) assessed the relationship between the corporate governance mechanism proxied by board independence and the audit quality in Nigerian non-financial listed companies. Necessary data were extracted from financial report of the companies under consideration for 2005 to 2015 financial year ends. The result of binary regression analysis indicated that board independence demonstrated negative association with audit quality. Therefore, the study recommended a proper mix of competencies on the board of directors.

Ndubuisi et al., (2017) aimed at discovering the determinants of audit quality focusing on the Nigeria listed healthcare companies for the period of 7 years (2010-2016). Data were spooled from the audited financial statements of the selected healthcare companies covering years 2010 to 2016 reporting period. The study outcome indicated a positive and significant association between the audit firm size, audit tenure, audit independence and the audit quality. The study concluded by placing much emphasis on the need for staff of audit firms to remain completely objective and unbiased in carrying out audit assignments.

The study of Bala et al., (2018) conducted their study on the association of audit fees and quality of financial reporting in Nigeria for 2012 to 2016 financial years. Necessary information was obtained from the audited financial report of the selected listed companies for the various years. The result of the study revealed a positive and statistically significant association between audit fees and the quality of financial reporting.

Olabisi et al., (2020) evaluated the determinants of audit quality among the listed insurance companies in Nigeria with the focus on 15 companies for the period of 10 years (2009-2018). Data for the study were obtained from secondary source, particularly, from the audited financial statements of the selected insurance companies for the various years. The result of the analysis conducted in the study indicated the existence of significant relationship between the audit tenure, audit fees, audit firm size, cash flow and audit quality. However, no significant relationship was reported between the auditors’ independence, joint audit and audit quality. Therefore, the study concluded that audit fees, audit firm size and short-term tenure of audit are the main determinants of audit quality.

The study of Ogbodo &Akabuogu, (2018) examined the effect of audit quality on the performance of selected banks in Nigeria. The study considered 16 listed DMBs in Nigeria for the period of 2008-2017 (10 years). Audit committee independence and audit committee size proxied audit quality while the profit margin and return on equity proxied performance of the DMBs under consideration. The study discovered that the audit committee independence had significant effect on ROE while audit committee size had significant effect on profit margin. The study still emphasized on the need to engage the services of auditors with high reputation thereby enhancing performance.

The study of Ibrahim & Ali, (2018) examined the effect of audit fees on audit quality of listed conglomerates for twelve years period ending 2015. Secondary data obtained from the audited annual reports of the selected companies for the various years were subjected to panel data analysis. The study reported that audit fees and the size of audit firm had positive and significant effect on the companies’ audit quality. The study suggested that audit fees should be looked into by the regulators so as to fix the audit fees that will enhance audit quality.

Hypotheses

The following research hypotheses were formulated and tested in the current study:

H1: There is no significant relationship between audit quality and board size in the Nigerian consumer goods sector.

H2: There is no significant relationship between audit quality and audit firm size in the Nigerian consumer goods sector.

H3: There is no significant relationship between audit quality and tenure of audit firm in the Nigerian consumer goods sector

H4: There is no significant relationship between audit quality and company size in the Nigerian consumer goods sector

Methods

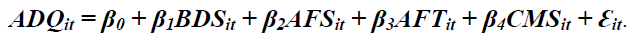

The study employs ex-post facto research design. The population of the study comprises the twenty (20) consumer goods companies listed in the Nigerian Stock Exchange as at 31st December, 2020. Secondary data obtained from the audited annual reports of the selected companies were utilized for the study. The study covered the 2012-2019 financial years. This is due to the fact that International Financial Reporting Standards (IFRS) became the official reporting standards for listed companies in Nigeria effective 2021 financial year end. Simple random sampling method was applied in selecting the sample. A sample size of eight (8) representing 40% of the population was selected in line with Ezejulue et al., (2008) who assert that a sample size of 10% is adequate for a homogeneous population. However, in order to enhance generalization, the sample size for the current study has been increased to 40%. The general model equation for the current study is as follows:

Where: ADQit represents audit quality; BDSit represents board size; AFSit represents audit firm size; AFTit represents audit firm tenure; CMSit represents company size; β0 = Intercept; β1, β2, β3, and β4 represent the slope of the coefficients; while ?it represents error term. Meanwhile, the variables are measured as follow: Audit Quality (ADQ) is measured as audit fees. This is in alignment with DeFond & Zhang, (2014), and Christensen et al., (2016) who recommended reliance on input-based audit quality measures (audit fees), as proxy for audit quality measures. Board Size (BDS) is measured as total number of persons in the board of directors. Audit Firm Size (AFS) is measured by a dummy value of “1” if a firm uses any of the Big 4 audit firms (Akintola Williams Deliotte, Pricewaterhouse Coopers, Ernst and Young, KPMG) and “0” if otherwise. Audit Firm Tenure (AFT) is measured as length of auditor-client relationship. A dummy value of “1” is assigned if the length of auditor-client the relationship spanned 3 years and above, but it is assigned ‘0’ if otherwise. Company Size (CMS) is measured as the natural logarithm of total assets (Dang, et al., 2017).

Results

Descriptive Statistics

Table 1 summarizes the descriptive statistics of the eight selected companies for the current study variables over a period of eight years from 2012 to 2019, making a total of 64 firm years. The descriptive statistics reveal that five variables, which include audit fee, board size, audit firm size, audit firm tenure and company size, were examined in the current study. A total of 64 firm years were covered by the study. The value of audit fee ranges from a minimum of 650,000 naira to a maximum of 191,000,000 naira. The value for board size ranges from a minimum of 7 persons board membership to a maximum of 17 persons board membership among the selected companies. Furthermore, the descriptive statistics show that the selected companies for most of the years, engaged the services of one of the Big 4 audit firms (i.e. Akintola Williams Deliotte, Pricewaterhouse Coopers, Ernst and Young, and KPMG). Meanwhile, we only observe few instances where the services of the smaller audit firms are being utilized.

| Table 1 Descriptive Statistics of Determinants of Audit Quality | |||||

| Variables | N | Minimum | Maximum | Mean | Std. Deviation |

| Audit Fee | 64 | 650 | 191000 | 35569.05 | 35862.01 |

| Board Size | 64 | 7 | 17 | 10.8 | 2.901 |

| Audit Firm Size | 64 | 0 | 1 | 0.97 | 0.175 |

| Audit Firm Tenure | 64 | 0 | 1 | 0.94 | 0.244 |

| Company Size | 64 | 963441 | 1.18E+09 | 1.21E+08 | 1.73E+08 |

| Valid N (listwise) | 64 | ||||

In addition, the study reveals that the length of auditor-client relationship for most of the time exceeded three years duration. We only observed few instances where auditor-client relationship was only for a shorter period of less than three years. Lastly, the descriptive statistics reveal that the size of the selected companies ranges from relatively small to big ones with minimum total assets value of 963,441,000 naira, and maximum total assets value of 1,178,523,711,000 naira.

Correlation analysis

The results of the correlation analysis reveal the existence of positive association between audit quality (measured by audit fee) and board size. Specifically, the coefficient value of 11.5% indicates a positive but weak relationship between audit quality and corporate board size in Nigerian consumer goods sector. However, this relationship between audit quality and corporate board size in Nigerian consumer goods sector is not statistically significant (p<.367). Similarly, the results show the existence of positive association between audit quality (measured by audit fee) and audit firm size. Specifically, the coefficient value of 9.5% indicates a positive but very weak relationship between audit quality and audit firm size in Nigerian consumer goods sector. Nevertheless, this relationship between audit quality and audit firm size in Nigerian consumer goods sector is not statistically significant (p<.453).

Furthermore, the results of the correlation analysis reveal the existence of positive association between audit quality (measured by audit fee) and company size. Specifically, the coefficient value of 13.1% indicates a positive but weak relationship between audit quality and company size in Nigerian consumer goods sector. Nonetheless, this relationship between audit quality and company size in Nigerian consumer goods sector is not statistically significant (p<.300) in Table 2.

| Table 2 Correlation Analysis | ||||||

| Audit Fee | Board Size | Audit Firm Size | Audit Firm Tenure | Company Size | ||

| Audit Fee | Pearson Correlation | 1 | ||||

| Sig. (2-tailed) | ||||||

| N | 64 | |||||

| Board Size | Pearson Correlation | 0.115 | 1 | |||

| Sig. (2-tailed) | 0.367 | |||||

| N | 64 | 64 | ||||

| Audit Firm Size | Pearson Correlation | 0.095 | 0.206 | 1 | ||

| Sig. (2-tailed) | 0.453 | 0.103 | ||||

| N | 64 | 64 | 64 | |||

| Audit Firm Tenure | Pearson Correlation | -0.076 | -0.22 | -0.046 | 1 | |

| Sig. (2-tailed) | 0.551 | 0.081 | 0.716 | |||

| N | 64 | 64 | 64 | 64 | ||

| Company Size | Pearson Correlation | 0.131 | 0.215 | 0.002 | -.247* | 1 |

| Sig. (2-tailed) | 0.3 | 0.089 | 0.987 | 0.049 | ||

| N | 64 | 64 | 64 | 64 | 64 | |

| *Correlation is significant at the 0.05 level (2-tailed). | ||||||

Meanwhile, the results of the correlation analysis reveal the existence of negative association between audit quality (measured by audit fee) and audit firm tenure. Precisely, the coefficient value of 7.6% indicates a negative but weak relationship between audit quality and audit firm tenure in Nigerian consumer goods sector. Yet, this relationship between audit quality and audit firm tenure in Nigerian consumer goods sector is not statistically significant (p<.551).

Regression Analysis

The results of the regression analysis show overall R-squared value of .094. R-Square is the percentage of variance in the dependent variable (audit quality) which can be predicted from the independent variables (board size, audit firm size, audit firm tenure and company size). This value indicates that only 9.4% of the change in audit quality can be predicted from the variables board size, audit firm size, audit firm tenure, and company size. Testing each of the research hypotheses, the t-statistic and Prob. provide us with evidence of whether or not a significant relationship exists between the dependent variable (audit quality) and each of the independent variables (board size, audit firm size, audit firm tenure and company size) in Table 3.

| Table 3 Regression Analysis | ||||

| Variable | Coefficient | Std. error | t-statistic | Prob. |

| C | 3.694 | 36363.45 | 5.17 | 0 |

| Board size | 0.017 | 1682.548 | 1.003 | 0.32 |

| Audit firm size | 0.189 | 26792.34 | 0.721 | 0.473 |

| Audit firm tenure | -0.122 | 19739.24 | -0.632 | 0.53 |

| LOG of Company size | 0.109 | 0 | 1.425 | 0.159 |

| R | - | - | - | 0.307 |

| R-squared | - | - | - | 0.094 |

| Adjusted R-squared | - | - | - | 0.033 |

| F-statistic | - | - | - | 1.536 |

| Prob. (F-statistic) | - | - | - | 0.744 |

The first hypothesis states that “there is no significant relationship between audit quality and board size in the Nigerian consumer goods sector”. The results show a t-statistic value of 1.003 and a p-value of .320. Since the p-value is greater than 0.05 level of significance, we accept the null hypothesis. Thus, we conclude that no statistically significant relationship exists between audit quality and board size in the Nigeria consumer goods sector. Similarly, the second hypothesis states that “there is no significant relationship between audit quality and audit firm size in the Nigerian consumer goods sector”. The results show a t-statistic value of .721 and a p-value of .473. Since the p-value is greater than 0.05 level of significance, we accept the null hypothesis. Thus, we conclude that no statistically significant relationship exists between audit quality and audit firm size in the Nigeria consumer goods sector.

The third hypothesis states that “there is no significant relationship between audit quality and tenure of audit firm in the Nigerian consumer goods sector”. The results show a t-statistic value of -.632 and a p-value of .530. Since the p-value is greater than 0.05 level of significance, we accept the null hypothesis. Thus, we conclude that no statistically significant relationship exists between audit quality and tenure of audit firm in the Nigeria consumer goods sector. Finally, the fourth hypothesis states that “there is no significant relationship between audit quality and company size in the Nigerian consumer goods sector”. The results show a t-statistic value of 1.425 and a p-value of .159. Since the p-value is greater than 0.05 level of significance, we accept the null hypothesis. Thus, we conclude that no statistically significant relationship exists between audit quality and company size in the Nigeria consumer goods sector.

Overall, the results show an F-statistic value of 1.536 while the p-value associated with this F-statistic is .744. These values are used to answer the question “Do the independent variables (board size, audit firm size, audit firm tenure and company size) reliably predict the dependent variable (audit quality)?” The p-value is compared to the alpha level of 0.05 and, since it is greater than 0.05, we conclude that the group of independent variables (board size, audit firm size, audit firm tenure and company size) does not show a statistically significant relationship with audit quality.

Discussion

The results of the analysis reveal the existence of positive but not statistically significant association between audit quality and board size in the Nigeria listed consumer goods companies. This suggests that the higher the size of board of directors, the better such a board is able carry out its oversight functions in the company. In addition, the larger the size of the board, the more likely for the different members to bring their assorted experiences and specializations to bear on the board’s responsibilities. Larger board size also encourages more independent directors to be included as board members. This will strongly enhance the quality of the service being rendered by the board. This result aligns with the one reported by Olabisi et al (2020) in their study of the determinants of audit quality among the listed insurance companies in Nigeria. Similarly, the results show the existence of positive but not statistically significant association between audit quality and audit firm size. Generally, audit firms are grouped into two: the big four and others. This result connotes that the big four audit firms tend to provide high quality audit services. This is traceable to their level of expertise, exposure, experience, financial capacity and ability to attract and retain best brains. Besides, the big four audit firms have long standing reputation which they will not like to mortgage for anything. Thus, these big audit firms tend to provide high quality audit services. This result is consistent with that of Ndubuisi et al., (2017), Amahalu & Ezechukwu, (2017) who respectively assessed the determinants of audit quality among the listed healthcare companies, and the banking sector in Nigeria. Despite the fact that the focus of the current study is on the listed consumer goods companies, the result align essentially with those of the previous studies.

Furthermore, the results of the analysis reveal the existence of positive but not statistically significant association between audit quality and company size. Unlike smaller companies, big client companies have the financial muscle to engage the services of the big four audit firms who often carry out high quality audit services. In addition, big companies most times have the necessary professionals and competent officials among their staff. This makes it easy for big company to keep proper records, maintain effective and efficient internal control system thereby producing high quality sets of financial statements. All these measures enhance the work done by the external auditors in due course. This result is in consonance with the one reported by Olabisi et al., (2020) & Mawutor et al., (2019) although these studies evaluated the determinants of audit quality of firms in different sectors.

Finally, the results of the analysis reveal the existence of negative but not statistically significant association between audit quality and audit firm tenure. Usually, longer audit tenure with the same client-company can jeopardize the objectivity and independence of the audit firm. This is because too much familiarity with the client company can introduce bias and inability to report material misstatement if discovered in the process of the audit. This result is similar to the one reported by Dada, (2018). As such, a long-period of audit firm and client-company relationship will greatly weaken the quality of the audit because the possibility of familiarity threat will be at the highest level.

Conclusion

On the basis of the general apprehension by the various stakeholders on the falling quality of external audit report, the current study examine the determinants of audit quality in the context of the Nigerian listed consumer goods companies. Consequent upon the results of the analysis, we can reasonable conclude that a positive but not statistically significant relationship exist between each of board size (as a measure of corporate governance), audit firm size and company size on one hand, and audit quality on the other hand. However, an inverse but not statistically significant relationship is established between audit firm tenure and audit quality in the Nigerian consumer goods sector. The following recommendations are proposed: (i) Policy measures should be put in place to regulate the activities of auditors so as to checkmate unreasonably long-term auditor-client relationship which may jeopardize objectivity and independence. (ii) Small audit firms should be encouraged to form partnership so as to boost their capacity in order to enhance the quality of their audit engagements to big client companies.

References

Akinyomi, O.J., Olabisi, J., & Fapetu, O. (2017). Accounting information and business decisions in quoted food and beverages companies in Nigeria. West African Journal of Business and Management Sciences, 6(3), 1-8.

Bakare, I. (2019). Board independence and audit quality in Nigeria. Accounting and Taxation Review, 3(1), 1-11.

Bamwa, B., Akinyomi O.J., & Agama, E.I. (2020). Board structure and audit quality in the Nigerian banking sector. Kogi Journal of Management, 6(3), 174-191.

Crucean, A.C., & Hategan, C.D. (2019). The determinants factors on audit quality: A theoretical approach. Ovidius University Annals, Economic Sciences Series, Ovidius University of Constantza, Faculty of Economic Sciences, 2, 702-710.

Duits, H.B. (2012). The added value of auditing in a non-mandatory environment. Vossiuipers-Amsterdam University Press. Retrieved from: http://en.aup.nl/books/9789056297114-the-added-value-of-auditing-in-a-non-mandatory-environment.html

Dunakhir, S. (2016). Factors associated with audit quality: evidence from an emerging market, Proceedings of Second Asia Pacific Conference on Advanced Research. 189-198.

Ezejulue, A.C., Ogwo, O.E., & Nkamnebe, A.D. (2008). Basic principles in managing research projects(2nd Edition). Aba, Afritowers.

Ibrahim, M., & Ali, I. (2018). Impact of audit fees on audit quality of conglomerates companies in Nigeria. International Journal of Service Science, Management and Engineering, 5(1), 1-8.

Ilechukwu, F.U. (2017). Effect of audit fee on audit quality of listed firms in Nigeria. International Journal of Trend in Research and Development 4(5), 319-326.

International Auditing and Assurance Standard Board (2011). Audit quality: An IAASB perspective. 1-8.

Madawaki, A. (2020). Benchmarking internal audit function in financial reporting quality: Evidence from listed companies In Nigeria. Kebbi Journal of Accounting Research, 1(1), 13-27.

Madugba, J.U., Howell, K.E., Nwanji, T.I., Faye, S., Egbide, B. & Eluyela, D.E. (2021). Audit committee quality and financial reporting in deposit money banks in Nigeria. Asian Economic and Financial Review, 11(2), 104-117.

Naimah, Z., & Hamidah, H. (2017). The role of corporate governance in firm performance. SHS Web of Conferences, 34, 13-23.

Ndisya, A. (2015). Factors affecting audit quality in listed manufacturing and commercial services companies in Kenya. Journal of Accounting literature, 153-193.

Ogungbade, O.I., Adekoya, A.C. & Olugbodi, D.I. (2021). Audit quality and financial reporting quality of deposit money banks listed on Nigerian stock exchange. Journal of Accounting, Finance and Auditing Studies 7/1 (2021), 77-98.

Ouyang, B., & Wan, H. (2013). Does audit tenure impair auditor independence? Evidence from option backdating scandals. International Journal of Business and Social Science, 4(14), 23-33.

Patrick, Z., Vitalis, K., & Mdoom, I. (2017). Effect of auditor independence on audit quality: A review of literature. International Journal of Business and Management Invention, 6(3), 51-59.

Wakill, G.K., Alifiah, M.N. & Teru, P. (2020). Auditor independence and audit quality in Nigeria Public Sector: A critical review. Journal of Critical Review, 7(7), 839-845.

Zadeh, F.O. & Eskandari, A. (2012). Firm size as company’s characteristics and level of risk disclosures. Review of theories and literatures. International Journal of Business and Social Science, 3(17), 9-17.