Research Article: 2022 Vol: 26 Issue: 1

Determinants of Dividend Policy of Manufacturing Companies in Indonesia

A. Razak, Politeknik Negeri Pontianak

Fathihani Fathihani, Universitas Dian Nusantara

Haryo Suparmun, STIE Trisakti

Desty Wana, Politeknik Negeri Pontianak

Selamet Riyadi, Universitas Budi Luhur

Arum Indrasari, Universitas Muhammadiyah Yogyakarta

Endri Endri, Universitas Mercu Buana

Citation Information: Razak, Fatihani, F., Wana, D., Riyadi, S., Suparmun, H., Indrasari, A., & Endri, E. (2022). Determinants of dividend policy of manufacturing companies in indonesia. Academy of Accounting and Financial Studies Journal, 26(1), 1-11.

Abstract

This study aims to estimate and analyze the impact of the company's internal factors on dividend policy in manufacturing companies listed on the Indonesia Stock Exchange (IDX) in 2015-2019. The internal factors that determine dividend policy that tested in this research is Current Ratio (CR), Debt-to-Equity Ratio (DER), Asset Growth (Growth), Collateralizable Assets (COL), and Return on Equity (ROE), while dividend policy is proxied by Dividend Payout Ratio (DPR). The population in this study is 188 manufacturing companies listed on the IDX for the 2015-2019 period. The sampling technique used was purposive sampling, by getting a research sample of 24 companies. The data analysis method uses a panel data regression model based on pairwise testing. The results of this study indicate that CR, DER, and Growth do not affect the DPR. Meanwhile, COL and ROE have a positive effect on dividend policy. The result of this research implies that manufacturing companies in Indonesia tend to pay large dividends to shareholders as long as they achieve high profitability and the availability of large collateralizable assets. The theoretical implication from research findings supports agency theory, that managers can freely increase dividend payments to shareholders. The research contribution both theoretically and empirically is that in the case of manufacturing companies in Indonesia, with high profitability and the availability of assets that can be collateralized in large quantities, the company tends to pay large dividends to shareholders.

Keywords

Dividend Policy, Liquidity, Leverage, Profitability, Asset Growth, Collateralizable Assets.

Introduction

Dividend policy becomes controversial when the company's investment is financed from retained earnings so that the distribution of profits to shareholders is reduced. Manufacturing companies in Indonesia are starting to rise to improve their performance in the future requiring large funds for investment funding, while the company's debt level is already quite large and is required to reduce its debt. In addition, many manufacturing companies have proposed debt restructuring to lenders and this situation has resulted in a decline in other financial performance. Another problem has emerged recently with the tendency of stock prices to decline, investors expect to get dividends rather than capital gains. This phenomenon makes the dividend payment policy controversial so that management and company shareholders in making decisions must prioritize the goal of increasing company value (Endri et al., 2020). Therefore, the investigation of the determinants of dividend policy must be considered in the appropriate decision-making process.

Dividend policy is an important part of the company's financial decisions. Therefore, the decision to pay dividends is inseparable from the achievement of the company's financial performance. Companies with positive financial performance, especially profitability, can provide dividends that are in line with shareholder expectations (Harahap et al., 2020). Previous research has identified the effect of liquidity, activity, leverage, and profitability on the company's dividend payment decisions (eg; Roj, 2019; Yusof & Ismail, 2016; Denis & Osobov, 2008). Therefore, the formulation of the research problem being investigated is whether the ratio of liquidity, activity, leverage, and profitability determines the dividend policy-making process of manufacturing sector companies listed on the Indonesian stock exchange. This study investigates the determinants of dividend policy in manufacturing companies with a focus on estimating financial performance, which consists of; liquidity, leverage, profitability, and activity.

Literature Review

Dividend policy is important for the company because it relates to the company's decision in determining the amount of net income to be distributed as dividends and how much profit will be reinvested into the company in the form of retained earnings. In addition, dividend policy is an important part of the company's long-term funding strategy in responding to environmental dynamics. Therefore, the dividend policy for shareholders is valuable information related to the company's earnings and earnings performance, and thus indirectly acts as a signal for the company's future earnings. In line with the signaling theory that with asymmetric information, dividend policy is used to communicate the company's profitability and prospects (Bhattacharya, 1979). Thus, dividend policy makes investors make decisions to buy, maintain or decide not to buy or sell stocks. If the dividends distributed to shareholders have been maximized, then the step that investors should take is to maintain the company's shares. If the dividend distribution to investors is considered insufficient or not optimal, what investors will do is sell the company's shares in the hope that they will still benefit from capital gains on the capital market (Razak et al., 2020).

Asymmetric information occurs between shareholders and company management where managers hold more information or on time than shareholders (Ullah, 2020). According to agency theory, managers with more complete information can take advantage of the lack of knowledge of shareholders. This is due to the inability of shareholders to control the desired actions of managers. Therefore, it is in the interest of investors to increase cash returns by distributing a larger percentage of profits, whereas managers tend to choose a larger portion of retained earnings to ensure the availability of sufficient funds for investment or expansion purposes. Different interests have the potential to create agency conflicts. Therefore, the company's dividend policy can reduce agency problems can be reduced or reduced through dividend policy. According to Easterbrook (1984), a dividend policy is a mechanism that can reduce agency costs between the agent and the principal.

Current Ratio and Dividend Policy

Liquidity shows the company's ability to meet its short-term obligations (Endri et al., 2020). Liquidity refers to how liquid the current assets are to pay off maturing short-term liabilities (Sharma & Bakshi, 2019). According to Zhang et al. (2020), the current ratio as a proxy for liquidity is one of the measuring tools in determining dividends based on the calculation of current liabilities. Companies with high liquidity can pay dividends to shareholders. If a company has sufficient cash flow, then cash dividend payments can reduce agency costs. Banerjee et al. (2007) highlighted the negative relationship between dividend policy and liquidity and called it the "liquidity hypothesis of dividends''. Baker and Kapoor (2015); Zhiqiang et al. (2015) also disclose the traditional stock dividend liquidity hypothesis with the finding that liquidity has a negative relationship with dividend policy. Conversely, based on signaling theory, there is a positive relationship between liquidity and dividend payments. Amidu and Abor (2006) show a significant positive effect of liquidity on dividend policy, with a note that companies that have good financial conditions (high liquidity) can pay more dividends than companies that experience liquidity problems.

H1: Current ratio (CR) has an impact on dividend policy

Debt-to-Equity Ratio and Dividend Policy

Lintner (1956) argued that debt as a determinant of less influence on dividend policy was stated by Lintner (1956), while Rozeff (1982) found that companies with high leverage tended to have low payout ratios, to reduce transaction costs associated with external financing. Aivazian et al. (2003) and Al-Malkawi (2007) also suggest that companies with high leverage tend to pay fewer dividends. Tahir and Mushtaq (2016), and Arko et al. (2014) identified leverage as the main determinant of dividend policy. Yusof and Ismail (2016) identify debt as a negative determinant of corporate dividend policy. The study of Wahjudi (2020) also proves that leverage has a negative and significant effect on the dividend policy of manufacturing companies in Indonesia. This shows that the higher the leverage, the lower the company's dividend policy. Different findings were revealed by the research of Pattiruhu and Paais (2020) who used the debt to equity ratio (DER) as a proxy for leverage and found that it had a positive impact on dividend policy.

H2: Debt-to-equity ratio (DER) has an impact on dividend policy

Growth and Dividend Policy

Growth is the change in assets owned by the company that is used in operational activities. With high asset growth, it can generate large profits and have an impact on the increased spending required by the company to finance its growth (Sugianto et al., 2020). Therefore, companies must limit dividends and increase retained earnings to support investment decisions. Dempsey et al. (2019) reveal the relationship between asset growth and the company's ability to pay dividends. Research by Fajaria and Isnalita (2018) also found that growth, firm value, and size moderate the company's dividend policy. Wahjudi (2020) proves that net asset growth has a negative and significant effect on dividend policy. This shows that the higher growth of net assets will reduce the dividend policy of manufacturing companies.

H3: Asset Growth has an impact on dividend policy

Collateralizable Asset and Dividend Policy

Assets that can be pledged are guarantees for creditors that do not restrict the company from distributing dividends to shareholders. With the pledged asset value getting bigger, the company can use loan funds freely for company development, while maintaining the company's reputation because it continues to pay dividends consistently. Mollah (2011) argued that companies with high collateralizable assets have a small agency problem between management and creditors because, with high collateralizable assets, creditors are more secure and do not need tighter restrictions on the company's dividend policy so that the company can pay. greater dividends to shareholders. The higher collateralizable assets indirectly show the size of the company. Research conducted by Johari and Hassan (2008) shows that collateralizable assets have a positive effect on cash dividends. On the other hand, Wahjudi (2020) found that collateralizable assets have a negative but insignificant effect on dividend policy. This shows that the high level of collateralizable assets does not affect the dividend policies of manufacturing companies in Indonesia.

H4: Collateralizable assets (COL) have an impact on dividend policy

Return on Equity and Dividend Policy

According to the Pecking order theory, internal financing is the most preferred source for companies, followed by debt and finally equity financing through share issuance (Shahnia et al., 2020; Endri et al., 2020; Fama & French, 2002). Therefore, the dividend payout of the company is small if its profitability increases. The research results of Kuzucu (2015), and Amidu and Abor (2006) state that profitability affects dividend policy negatively and significantly. Conversely, it is under agency theory that an increase in profitability can increase dividend payments to reduce agent conflict with the principle. This argument is supported by research from Danila et al. (2020); Tahir and Mushtaq (2016); Botoc and Pirtea (2014); Al-Najjar (2011); Bokpin (2011); Kim and Gu (2009); Al-Malkawi (2007); Aivazian et al. (2003) who found that profitability has a positive effect on dividend policy. Research by Rodríguez-Pose and Gill (2005) on Malaysian companies found that profitability, as measured by return on equity (ROE), has a significant positive effect on dividend payments.

H5: Return on equity (ROE) has an impact on dividend policy

Methodology

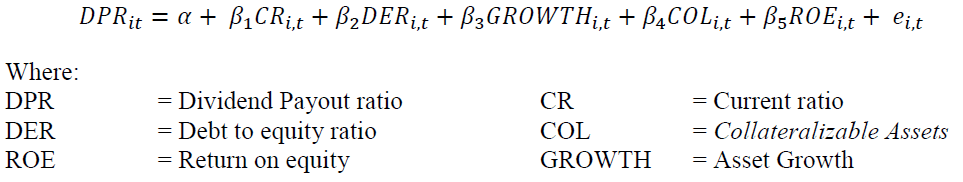

The study population consisted of all manufacturing companies listed on the Indonesia Stock Exchange for the period 2015-2019. The research sample was selected based on the following considerations: listed on the IDX with shares traded during the study period; did not face events that could affect his financial position, such as mergers and acquisitions, restructuring, etc. during the study period; available information about the movements of its shares traded on financial markets during the test period; and financial report data available from the companies that were the research samples. Estimation and analysis of the research model using a panel regression method. The panel regression model in this study can be formulated as follows:

There are three models used in estimating the panel data regression method, namely: random-effect, common-effect, and fixed-effect. The random-effect model can overcome the weaknesses in the fixed-effect model that both use dummy variables so that the model experiences uncertainty. The fixed-effect model can conclude that the variation of the intercept can handle the differences between the intercepts. The common-effect model is the simplest model that combines time series data with cross-sectional data and then calculates the model using Ordinary Least Square.

Results

Descriptive Statistics

Descriptive statistics are used to provide an overview or description of the variables contained in this study. Descriptive statistics are only concerned with describing or providing information about a data or situation or phenomenon in tabulated form so that it is easy to understand and interpret. Table 1 shows that N = 120 means the amount of data processed in this study is as many as 120 samples consisting of 24 companies sampled for five years consisting of variable data Dividend Payout Ratio (DPR), Current Ratio (CR), Debt to Equity Ratio (DER), Growth, Collateralizable Assets, and Return on Equity (ROE).

| Table 1 Descriptive Statistics Test Results | ||||||

| DPR | CR | DER | GROWTH | COL | ROE | |

| Mean | 0.406826 | 2.858542 | 0.934968 | 0.120467 | 0.298016 | 0.237033 |

| Median | 0.382674 | 2.142393 | 0.642726 | 0.097032 | 0.277396 | 0.150216 |

| Maximum | 1.536772 | 15.16460 | 5.152418 | 0.802730 | 0.602647 | 1.435333 |

| Minimum | 0.007308 | 0.513906 | 0.124837 | -0.148089 | 0.033865 | 0.022265 |

| Std. Dev | 0.252413 | 2.450499 | 0.923099 | 2.256604 | 0.132767 | 0.304256 |

Panel Data Regression Estimation Model

Chow test is used to determine whether the panel data regression technique with the fixed-effect method is better than the regression of the panel data model without dummy variables or the common-effect method. If the calculated F probability value is greater than the predetermined significance level, the null hypothesis is rejected, which means that the correct model for panel data regression is the fixed-effect model. And conversely, if the calculated F probability value is smaller than the specified level of significance, the null hypothesis is accepted, which means that the right model for panel data regression is the common-effect model.

The test results of the Chow model presented in Table 2 show that the probability value of Cross-section F is 0.0000. This probability value is smaller than the predetermined significance level of 0.05. Based on the explanation previously described, it can be concluded that the null hypothesis is rejected and the alternative hypothesis is accepted, which means that panel data regression with a fixed-effect model is better used in this study. Hausman test has developed a test to determine whether the fixed-effect method and the random-effect method are better than the common-effect method. If the Hausman statistical value is greater than the critical value of Chi-Squares, the null hypothesis is rejected, which means that the correct model for panel data regression is the fixed-effect model. On the other hand, if the Hausman statistical value is less than the critical value of Chi-Squares, the null hypothesis is accepted, which means that the appropriate model for panel data regression is the random-effect model. The following are the results of testing the panel data regression selection with the Hausman model:

| Table 2 Panel Data Regression Estimation Testing Results: Chow Model | |||

| Effects Test | Statistic | d.f. | Prob. |

| Cross-section F | 4.120171 | (23,91) | 0.0000 |

| Cross-section Chi-square | 85.634061 | 23 | 0.0000 |

From the test results of the Hausman model presented in the Table 3 above, it is known that the probability value of a random cross-section is 0.0008. This probability value is smaller than the predetermined significance level of 0.05. Based on the explanation previously described, it can be concluded that the null hypothesis is rejected and the alternative hypothesis is accepted, which means that panel data regression with a fixed-effect model is better used in this study. To find out whether the random-effect model is better than the common-effect model, the Lagrange Multiplier (LM) is used. If the calculated LM value is greater than the critical value of Chi-Squares or if the probability value is smaller than the significance level, the null hypothesis is rejected, which means that the appropriate model for panel data regression is the random-effect model. And conversely, if the calculated LM value is less than the critical value of Chi-Squares or the probability value is greater than the significance level, the null hypothesis is accepted, which means that the right model for panel data regression is the common-effect model. The following are the results of testing the panel data regression selection with the Lagrange multiplier model:

| Table 3 Panel Data Regression Estimation Testing Results: Hausman Model | |||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

| Cross-section random | 21.077301 | 5 | 0.0008 |

The test results of the LM model presented in Table 4 show that the probability value of Breusch Pagan: one-side cross-section is 0.0000. This probability value is smaller than the predetermined significance level of 0.05. Based on the explanation previously described, it can be concluded that the null hypothesis is rejected and the alternative hypothesis is accepted, which means that panel data regression with the random effect model is better used in this study.

| Table 4 Panel Data Regression Estimation Testing Results: Lagrange Multiplier Model | |||

| Null (no rand. effect) | Cross-section | Period | Both |

| Alternative | One-sided | One-sided | |

| Breusch-Pagan | 16.99008 | 2.047938 | 19.03802 |

| (0.0000) | (0.1524) | (0.0000) | |

Hypothesis Test

The t statistic test shows how far the influence of one independent variable is individually in explaining the dependent variable. The t-test can be done by looking at the probability value of the significance of t of each variable contained in the output of panel data regression using Eviews 10. If the probability value is <0.05, then H0 is rejected, meaning that there is a significant influence between one independent variable on the dependent variable. Conversely, if the significance value of t> 0.05, then H0 is accepted, meaning that there is no significant effect between one independent variable on the dependent variable. The following is the result of partial testing between the independent variable and the dependent variable:

From the results of partial hypothesis testing presented in Table 5, it is known that the probability value of the Current Ratio (CR) variable is 0.8706 with a t-statistic value of 0.163377, the probability value of the Debt-to-Equity Ratio (DER) variable is 0.0721 with a t-value statistic is 1.819969, the probability value of the Growth variable (GROWTH) is 0.0624 with a t-statistic value of -1.886397. The probability value of the Collateralizable Assets (COL) variable is 0.0200 with a t-statistic value of 2.368685 and the probability value of the Return-on-Equity (ROE) variable of 0.0473 with a t-statistic value of 2.011212. The following are the results of panel data regression testing used in this study:

| Table 5 Estimated Determinants of Dividend Policy | ||||

| Var. | Coeff. | SD | t-Stat. | Prob. |

| C | 0.002277 | 0.140495 | 0.016207 | 0.9871 |

| CR | 0.002779 | 0.017009 | 0.163377 | 0.8706 |

| DER | 0.107929 | 0.059303 | 1.819969 | 0.0721 |

| GROWTH | -0.230874 | 0.122389 | -1.886397 | 0.0624 |

| COL | 0.747152 | 0.031543 | 2.368685 | 0.0200 |

| ROE | 0.425443 | 0.211536 | 2.011212 | 0.0473 |

| R2 | 0.760217 | Mean dep. var | 0.138241 | |

| Adjusted R2 | 0.686438 | S.D. dep. var | 0.110969 | |

| S.E. of regression | 0.141343 | SS resid | 1.290634 | |

| F-stat. | 9.784929 | D-W stat | 1.128056 | |

| Prob(F-stat.) | 0.000001 | |||

DPR = 0.002277 + 0.002779*CR + 0.107929*DER - 0.230874*GROWTH + 0.747152*COL + 0.425443*ROE

The coefficient of determination (R2) in essence measures how far the model is capable of explaining the variation in the dependent variable. The coefficient of determination is zero and one. The small value of R2 means that the ability of the independent variables to explain the variation in the dependent variable is very limited. A value close to one means that the independent variable provides almost all the information needed to predict the variation in the dependent variable. From the test results of the regression coefficient presented in Table 5, it is known that the coefficient of determination (R-squared) is 0.760217 or 76.02%. From these results, it can be explained that the variables Current Ratio, Debt-to-Equity Ratio, Growth, Collateralizable Assets and Return on Equity have an effect of 76.02% on the company's Dividend Payout Ratio, while the remaining 23.98% is influenced by other factors, not examined in this study.

Discussion

The results of this study indicate that the Current Ratio (CR) does not affect the dividend policy of manufacturing companies in Indonesia, which means that short-term financial decisions do not interfere with company dividend payments. The argument that can be drawn from this finding is that a high CR, it means that the company has large cash reserves which may not be used efficiently, on the other hand, cash dividend payments are not a concern of management. However, a high CR indicates that it is smooth to meet the company's short-term obligations. The results of this study are in line with (Pattiruhu & Paais, 2020; Sharma & Baksh, 2019; Mehta, 2012), whose findings were that the Current Ratio did not affect the Dividend Payout Ratio. Different findings were revealed by Wahjudi (2020) that proves that liquidity has a positive and significant effect on dividend policy.

The results of this study indicate that the Debt-to-Equity Ratio does not affect dividend policy, which means that changes in corporate debt policy do not interfere with dividend payments for manufacturing companies in Indonesia. The argument that can be expressed is that with a low level of leverage, the debt burden does not interfere with dividend payments. The results of this study are consistent with the findings of Nurhayati and Endri (2020); Alzomaia and Al-Khadhiri (2013); Sharma and Bakshi (2019); Singla and Samanta (2018), which conclude that financial leverage does not determine the company's dividend policy. Different results are revealed in the research of Tahir and Mushtaq (2020); Wahjudi (2020); Basri (2010); Yusuf & Ismail (2016); Deshmukh et al. (2013); Aivazian et al. (2003); Lie (2005) who prove that financial leverage has a negative effect on dividend policy.

The results of this study indicate that asset growth does not affect dividend policy, which means that changes in assets owned by the company are not a consideration in determining dividend payments. The allocation of additional assets is prioritized to support the company's business operations so that the company's assets are held at a high level and do not affect dividend policy. With a high level of company growth, it requires company investment financing needs. Profits obtained by the company are prioritized to finance the expansion or growth of the company rather than dividend payments. The results of the study are in line with the findings of Alzomaia and Al Khadhiri (2013), which prove that asset growth does not determine dividend policy. The results of the study differ from the findings of Wahjudi (2020), and Sharma and Baksh (2019), which reveal that net asset growth has a negative and significant effect on dividend policy.

The results of this study indicate that Collateralizable Assets (COL) has a positive effect on dividend policy, which indicates that an increase in COL provides an opportunity for company management to increase dividend payments to shareholders. In addition, high COL can also reduce agency conflicts, where creditors give the company management the freedom to distribute dividends to stock investors. The results of the study are supported by the findings of Mauris and Rizal (2021). The results of the study are different from the findings of Wahjudi (2020), which proves that collateralizable assets have a negative but insignificant effect on dividend policy. Basri (2019) also concluded that COL has no significant effect on dividend policy.

The results of this study indicate that Return on Equity has a positive effect on the dividend policy of Indonesian manufacturing companies. This shows that with increasing profitability, dividend payments will tend to increase. By agency theory, shareholders enjoy an increase in dividend payments, while the need for funds for company management for business operations and investment activities easily and profitably from external sources. The results of this research on profitability and dividend payments are in line with the empirical research of (Endri et al., 2020c; Tahir & Mushtaq, 2020; Basri, 2019; Amidu & Abor, 2006; Aivazian et al., 2003; Kim & Gu, 2009). Different research results were presented by Wahyudi (2020); Sharma & Baksh (2019), who concluded that profitability does not affect dividend policy.

Conclusion

The research aims to identify the influence of the company's internal factors, which consist of; Current Ratio (CR), Debt-to-Equity Ratio (DER), Asset Growth (Growth), Collateralizable Assets (COL), and Return on Equity (ROE) on dividend policy (DPR) in manufacturing companies listed on the Indonesia Stock Exchange (IDX) 2015-2019. The panel data regression model was applied to the 24 companies selected as the research sample. Empirical findings prove that only the COL and ROE variables have a positive effect on dividend policy, while the CR, DER, and Growth ratios do not affect. An interesting finding of this study which makes an important contribution to the theory of dividend policy is that with large profitability and the availability of assets that can be collateralized in large quantities, companies tend to distribute large dividends to shareholders. This empirical evidence also supports agency theory, that company managers with shareholder approval can pay larger dividends. For investors who are interested in buying a manufacturing company in Indonesia, information related to COL and ROE factors is important to consider in making investment decisions.

References

Alzomaia, T.S.F., & Al-Khadhiri, A. (2013). Determination of Dividend Policy: The Evidence from Saudi Arabia. International Journal of Business and Social Science, 4(1), 181-192.

Baker, H.K., & Kapoor, S. (2015). Dividend policy in India: new survey evidence. Managerial Finance, 41(2), 182-204.

Basri, H. (2019). Assessing determinants of dividend policy of the government-owned companies in Indonesia. International Journal of Law and Management, 61(5/6), 530-541.

Dempsey, M., Gunasekarage, A., & Truong, T.T. (2019). The association between dividend payout and firm growth: Australian evidence. Accounting & Finance, 59(4), 2345-2376.

Deshmukh, S., Goel, A.M., & Howe, K.M. (2013). CEO overconfidence and dividend policy. Journal of Financial Intermediation, 22(3), 440-463.

Endri, E., Sumarno, A., & Saragi, H. (2020). Analysis of Financial Performance: Evidence from Food and Beverage Companies in Indonesia. International Journal of Advanced Science and Technology, 29(5), 4199-4208.

Fama, E., & French, K. (2002). Testing trade-off and pecking order predictions about dividends and debt. The Review of Financial Studies, 15(1), 1-33.

Harahap, I.M., Septiania, I., & Endri, E. (2020). Effect of financial performance on firms’ value of cable companies in Indonesia. Accounting, 6(6), 1103-1110.

Johari, N., & Hassan, M. (2008). The influence of board independence, competency, and ownership on earning management in Malaysia. International Journal of Economics and Management, 2(2), 281-306.

Kuzucu, N. (2015). Determinants of dividend policy: a panel data analysis for Turkish listed Firms. International Journal of Business and Management, 10(11), 149-160.

Lintner, J. (1956). Distribution of incomes of corporations among dividends retained earnings and taxes. American Economic Review, 46(2), 97-113.

Mauris, F.I., & Rizal, N.A. (2021). The Effect of Collaterallizable Assets, Growth in Net Assets, Liquidity, Leverage and Profitability on Dividend Policy (Case Studies on Non-Financial Services Sector Companies Listed on the Indonesia Stock Exchange for the 2016-2019 Period). Budapest International Research and Critics Institute-Journal, 4(1), 937-950.

Nurhayati, I., & Endri, E. (2020). A New Measure of Asset Pricing: Friction-Adjusted Three-Factor Model. Journal of Asian Finance, Economics, and Business, 7(12), 605-613

Razak, A., Nurfitriana, F.V., Wana, D., Ramli, R., Umar, I., & Endri, E. (2020). The Effects of Financial Performance on Stock Returns Evidence of Machine and Heavy Equipment Companies in Indonesia. Research in World Economy, 11(6), 131-138.

Roj, J. (2019). The Determinants of Corporate Dividend Policy in Poland. Ekonomika, 98, 96-110.

Shahnia, C., Purnamasari, E.P., Hakim, L., & Endri, E. (2020). The determinant of profitability: Evidence from trading, service, and investment companies in Indonesia. Accounting, 6(5), 787-794.

Sharma, R.K., & Bakshi, A. (2019). An evident prescience of determinants of dividend policy of Indian real estate companies: An empirical analysis using co-integration regression and generalized method of moments. Journal of Financial Management of Property and Construction, 24(3), 358-384.

Tahir, M., & Mushtaq, M. (2016). Determinants of Dividend Payout: Evidence from listed Oil and Gas Companies of Pakistan. Journal of Asian Finance, Economics, and Business, 3(4), 25–37.

Wahjudi, E. (2020). Factors affecting dividend policy in manufacturing companies in Indonesia Stock Exchange. Journal of Management Development, 39(1), 4-17.

Zhang, Y., Uchida, K., & Dong, L. (2020). External financing and earnings management: Evidence from international data. Research in International Business and Finance, 54, 101275.

Mehta, A. (2012). An empirical analysis of determinants of dividend policy-evidence from the UAE companies. Global Review Of Accounting And Finance, 3(1), 18-31.

Yusuf, S., & Ismail, K. (2016). Availability, affordability, and consumption of fruits and vegetables in 18 countries across income levels: findings from the Prospective Urban Rural Epidemiology (PURE) study. The Lancet Global Health, 4(10), e695-e703.

Wahyudi, S. (2020). Asset allocation and strategies on investment portfolio performance: A study on the implementation of employee pension fund in Indonesia. Accounting, 6(5), 839-850.