Research Article: 2022 Vol: 26 Issue: 5S

Determinants of Financial Reporting Quality: Evidence from Listed Industrial Goods Firms in Nigeria

Muideen Adeseye Awodiran, Afe Babalola University

Abiodun Thomas Ogundele, Afe Babalola University

Citation Information: Awodiran, M.A., & Ogundele, A.T. (2022). Determinants of financial reporting quality: evidence from listed industrial goods firms in nigeria. Academy of Accounting and Financial Studies Journal, 26(S5), 1-08.

Abstract

This study investigated the determinants of financial reporting quality among listed industrial goods firms in Nigeria. All the 14 industrial goods firms listed on the Nigerian stock exchange from 2010 to 2019 were included in the study. This study used the descriptive and inferential statistical methods to analysed the data collected through content analysis of the annual report and accounts of the sampled firms. The result of the panel least square regression revealed that firm size and asset tangibility have positive significant effect on financial reporting quality. Profitability and financial distress have negative influence on the quality of financial reporting while firm growth has no statistically significant effect on financial reporting quality. The result of the influence of financial distress suggests that the quality of financial reporting decreases with distress. The study recommended, amongst others, that special attention be paid to the quality of financial information provided by companies that are experiencing financial distress.

Keywords

Financial Reporting Quality, Financial Distress, Firm Size, Asset Tangibility, Profitability, Nigerian Listed Industrial Firms.

Introduction

Financial reporting quality has been an area of interest for owners of firms, regulators, researches and accounting professional bodies. This is due to the fact that financial reports are the main source of providing financial information to outsiders in the business (Johnson et al., 2002). The quality of financial reports is extremely important to any management team, since they are the sole way for outside shareholders and investors to stay updated about the company's performance (Olowokure et al., 2016). The primary goal of financial data is to tell investors about where the company has been, where it is now, and where it is heading (Bushman et al., 2004). As a result, assessing the accounting information quality of businesses has become a hot topic in financial accounting research (Herly, 2015).

Hence, the degree to which the reported accounting information is relevant to the enterprise's capacity to position itself is said to be of significance. Users of financial statements are thus left with questions about whether the yearly reports and accounts are completely devoid of bias, even if they are completely free of mistakes (Olowokure et al., 2016). To be trusted by the public and seen as of high quality, accounting information must be reliable, impartial, timely, relevant, accurate, transparent, comparative, predictive, comprehensible, verifiable, and unambiguous in its whole. However, Johnson (2005) argues that because economic phenomena described in annual reports are usually measured under conditions of ambiguity, yearly reports can never be totally devoid of bias.

Similarly, IASB (2010) stated that; although perfect objectivity is unattainable, a certain amount of accuracy is required for financial reporting data to be decision-relevant. As a result, it is imperative to assess the arguments provided for the various estimates and assumptions presented in the financial reports. Where adequate reasons are supplied for the assumptions and estimations, there is more likelihood that they accurately describe the economic events. Such developments allow investors and other information users gain more control over their economic decisions (Al-Dmour et al., 2018).

Despite the obvious benefits of good quality financial reporting, misleading financial information has continued to be a cankerworm to the integrity financial information needed for making varying economic decisions. In comparison to many modern nations, the quality of financial information in Nigeria remains worrisome (Soyemi & Olawale, 2019). This has slowed the development of efficient stock markets, misled many investors, who frequently claim that, in Nigeria, financial information on firm performance is either inaccessible or unreliable if it is supplied (Shehu, 2013). There are considerably fewer analysts tracking the Nigerian market than in developed markets. As a result, it is believed that the regulatory monitoring of the Nigerian market is less stringent than that of developed markets (Soyemi & Olawale, 2019). The significance of the Nigerian economy in terms of its population and consuming power on African continents, and among all nations, further heightens the need for high quality financial information.

This development remains a major concern for users of financial information and other stakeholders. Previous studies (Abed et al., 2012; Campa & Camach, 2013) have advanced a number of firm-level characteristics (such as size; profitability; tangibility of assets; firm growth; liquidity; amongst others) as determinants of financial information quality without a consensus; suggesting that the issue is far from being resolved. However, the novelty of this study relates to how bankruptcy or financial distress might affect financial reporting quality. The impact of this factor is largely unexplored in the Nigerian context. Only few studies (such as Agrawal & Chatterjee, 2015; El-Deeb & Ramadan, 2020) in other jurisdictions, especially developed countries, have considered the effect of this factor and reported mixed findings. This provides motivation for conducting this research.

Literature and Hypotheses Development

Firm Size and Financial Reporting Quality

Financial reporting quality is defined as the accuracy of the information conveyed by the process of financial reporting (Martinez-Ferrero et al., 2015). Financial reporting quality can be referred to as the precision with which financial reporting presents information about a firm's operations (Biddle et al., 2009). The size of an organisation has direct relation with the total resources it owns, it could be represented by average total assets, average sale, total assets and number of sales. It has been argued that, the agency problem to be faced by larger company is likely to be higher. Large firms are usually diverse in their business scope, types of products and geographical coverage. A reasonable amount of information is required for the purpose of management and can be generated within the company. Consequently, the marginal cost of disclosing the information publicly is low (Cooke, 1989). Firms which are also large go to the financial market to raise funds more than the small firms.

Chan-Jane et al. (2015) investigated the relationship between attributes of two companies and adequate disclosures, asset size and listing status in the New York Stock Exchange. The outcome depicts that asset size, a measure of the size of the firm has a significant positive effect on financial reporting quality. Similarly, Soyemi & Olawale (2019) found that firm size positively influenced financial reporting quality. Kirubel (2016) revealed that a negative relationship between firm size and financial reporting quality among firms in Addis Ababa. Khanh & Khuong (2018) depicts a negative influence on earnings manipulation among Vietnamese listed firms. Mahboub, (2017) showed that firm size had no much impact on the quality of financial reporting among banks in Lebanon. The study predicts that:

H1: Firm size has no significant effect on financial reporting quality

Firm Growth and Financial Reporting Quality

Firm growth has been identified as one of the factors likely to influence financial reporting quality; it can be determined by the total turnover or sales per year. The firm growth is used to know whether a company has improved or not. It is expected that any growing firm will have less sustainable earnings (Campa & Camach, 2013). Others claim that a growing firm will not like its financial status to change because of this, they may engage in earnings management which will obviously affect the financial reporting quality. Most especially when the firm is not under pressure to meet a particular earnings target, some growing firm may determine to report their declining earnings exactly the way it is because they are aware any attempt to manipulate to portray the firm to be financially stable may affect the firm in the long run (Adewale et al., 2019). It is arguable whether growth, or accruals as a measure of growth affects the earnings persistence (Soyemi & Olawale, 2019).

Rasha (2017) found that firm growth presents managers with opportunity to smooth their earnings. Similarly, Che-Ahmad et al. (2015) found the relation between firm growth and the quality of financial reporting to be positive. Olowokure et al. (2016) found no significant relationship between firm growth and financial reporting quality while Akhgar & Karami (2014) and Khanh & Khuong (2018) found a significant positive influence of firm growth on financial reporting quality of Tehran and Vietnam listed firms, respectively. Therefore, the following hypothesis is stated:

H2: Firm growth has no significant influence on financial reporting quality

Profitability and Financial Reporting Quality

Profitability can be used to explain the difference in disclosure between firms. In line with signaling theory, when profitability is high, management is more willing to disclose detailed information (Rasha, 2017). Firms that are not profitable will be less driven to release more information so as to hide their poor performance. The level of profitability of company could force a firm to engage in accounting manipulation especially when the profit is too low and can discourage potential investors in doing business with such company. At the same time, manager may involve in accounting manipulation in order to increase their benefit (Adewale et al., 2019). Akhgar & Karami (2014) depicts that profitability has a significant positive effect on the quality of financial reporting among listed firms on Tehran. In Vietnam, Khanh & Khuong (2018) reported that profitability has a significant negative influence on earnings manipulation. In null form, the study predict as follows:

H3: Profitability has no significant influence on financial reporting quality

Asset Tangibility and Financial Reporting Quality

Tangibility measures the ratio between noncurrent over total assets a firm has on its statement of financial position. Tangible assets are those that can be seen, touched, felt, and are used in the day-to-day operations of the business to generate income, and been presented as collateral to payables in the unforeseen event of bankruptcy. Asset tangibility has an influence on the financial reporting quality in different ways. One of the ways is when debt of the organization is involved. In the reporting of the financial statements, the debt, capital and assets will be disclosed, thereby showing the true nature of the company, i.e., where the company really stands. Nasution found that asset tangibility has a significant positive influence on financial reporting quality in Indonesia and Ethiopia, respectively. In Nigeria, Soyemi & Olawale (2019) showed that asset tangibility has a significant negative effect on the quality of financial reporting. While Derbali (2014) found no statistically significant relationship. Consequently, it is hypothesised that:

H4: Asset tangibility has no significant effect on financial reporting quality

Financial Distress and Financial Reporting Quality

Financial distress is described as the likelihood of bankruptcy that is dependent on the magnitude of current assets as well as the rate of credit worthiness (Parkinson, 2018). It generally represents the firm’s failure to satisfy its obligations in the short run (El-Deed, 2020). This could be mainly attributed to poor management performance as indicated by Idrees & Qayyum (2018) or due to factors that exceed management control like pandemic, worldwide recession and political troubles (Karugu et al., 2018). In these cases, financial distress can influence the quality of the financial report due to how desperate the management will be when meeting the expectations of the investors or the stakeholders in general. Some sort of earnings management and creative accounting might be the order of the day to create a positive view of the financial statement and this will affect the quality of the financial report.

In Indian, Agrawal & Chatterjee (2015) revealed that earnings management is influenced by financial distress. El-Deeb & Ramadan (2020) depicts that financial distress significantly affect earnings management among Egyptian companies. Ghazali made it clear on the issue of believing that in the early stages of financial distress, management of these companies have been involved in practices that manage earnings upward and accordingly they used all the means to raise the firms' earnings in the previous periods. However, in the later stages of financial distress, there will be no other option than to get involved to decrease the firm's income level. Therefore, in null form, it is hypothesized that:

H5: Financial distress has no significant influence on financial reporting quality

Methodology

The study adopted ex-post factor research design. This was a census study of all the listed industrial goods firms on the Nigerian Stock Exchange during the period 2010-2019. Secondary data were gathered through a content analysis of the annual reports of the sampled firms for the 10-year period. The data were analysed using descriptive (such mean, minimum, maximum and standard deviation) and inferential (static panel regression analysis) statistical methods in testing the stated hypotheses. As a result of the possible firm-level heterogeneity, Hausman test was used carried out to make a choice between the fixed and random-effect models of the panel least square regression.

Model Specification and Variable Description

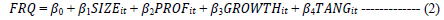

The study adapted the model of Soyemi and Olawale (2019) specified as follows:

FRQ= f (Size, Tangibility, Growth, Profitability) ----------------(1)

In line with the objective, the model is modified by including financial distress as an independent variable as follows:

Where:

FRQ=financial reporting quality, the dependent variable, measured as the residuals of the Dechow & Dichev (2002) model as shown in equation 4, in line with Soyemi et al. (2019);

SIZE=measure of firm size, proxied as the natural logarithm of total assets (Soyemi et al., 2019)

PROF=profitability, measured as the ratio of net income to total assets (Soyemi et al., 2019)

GROWTH=firm growth measured as ratio of market of equity to book value of equity (Soyemi et al., 2019)

TANG=Asset tangibility measured as the proportion of tangible asset to total asset in the firm asset structure (Soyemi et al., 2019)

DIST=financial distress measured using Althman (1968) Z-score model (equation 4) and takes the value of 1 if the company is in distress, and 0 otherwise.

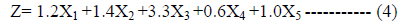

Using Althman (1968) Z-score model specified below;

Where:

X1=working capital (current assets less liabilities)/ total assets. Measures liquid assets in relation to the size of the company.

X2=Retained Earnings/ total assets. Measures profitability that reflects the company’s age and earning power.

X3=Earnings Before interest and taxes/ Total assets. Measures operating efficiency apart from taxes and leveraging factors.

X4=Market value of Equity/ Book value of total Liabilities. Adds market dimension that can show up security price fluctuation as a possible red flag.

X5=Sales/ Total Assets. Standard measure for total asset turnover (varies greatly from industry to industry).

Results and Discussions

The statistical features of the variables in the study are presented in descriptive statistics in Table 1. The average value of financial reporting quality and firms' size were 0.2503 and 10.1671, respectively. Firm growth and Profitability averaged 0.6434 and 0.4174, respectively. The mean values asset tangibility and distress were 0.3992 and 0.3467 correspondingly during the period under review. The minimum and maximum values recorded in the period are as displayed in the Table 1.

| Table 1 Descriptive Statistics |

||||

|---|---|---|---|---|

| Variable | Mean | Std. dev. | Minimum | Maximum |

| FRQ | 0.2503 | 0.2507 | 0.1130 | 0.8733 |

| SIZE | 10.1671 | 0.95513 | 0.9551 | 12.62400 |

| PROF | 0.4174 | 3.5804 | 0.0003 | 42.2971 |

| GROWTH | 0.6434 | 6.06566 | -0.9990 | 68.60646 |

| TANG | 0.3992 | 0.22973 | 0.0139 | 0.86897 |

| DIST | 0.3467 | 0.3563 | 0 | 1 |

Presented in Table 2 above is the result of correlation among the expandatory variables of the study. The results indicate that the relationship between pairs of variables used as predictors is low and weak. The relatively strongest relationship between the variables was that of SIZE and DIST i.e., 43%. According to Baltagi (2005), multicollinearity exists if there is high correlation (ranging from 50% - 80%) among the independent variables in a model, which is a serious violation of least squares regression technique. Hence it can be concluded that there is no multicollinearity among the independent variables in the model estimated.

| Table 2 Correlation Matrix (Multicollinearity Test) |

|||||

|---|---|---|---|---|---|

| SIZE | PROF | GROWTH | TANG | DIST | |

| SIZE | 1.000000 | ||||

| PROF | 0.168574 | 1.000000 | |||

| GROWTH | 0.350831 | 0.078766 | 1.000000 | ||

| TANG | -0.169810 | -0.120918 | 0.387148 | 1.000000 | |

| DIST | 0.431519 | 0.252879 | 0.170139 | -0.251917 | 1.000000 |

Table 3 presented the result of Hausman specification test to make a choice between random and fixed effect models. The null hypothesis for the Hausman test is that random effect model (REM) is appropriate. With the P-value of 0.4071 which is statistically insignificant; the null hypothesis is hereby accepted. Therefore, fixed effect model is considered inappropriate and random effect model is preferred and thus adopted for this study.

| Table 3 Hausman Specification Test |

||

|---|---|---|

| Test Summary | Chi.Sq. Stat. | Prob |

| Cross-section random | 2.901453 | 0.4071 |

The result of the determinants of financial reporting quality are presented in Table 4. The coefficients of firm size (SIZE), and tangibility of asset (TANG) were positive and significant in the regression models. However, financial distress (DIST) and profitability (PROF) have a negative significant influence on financial reporting quality. This suggests the firm size, tangibility of asset, financial distress, and profitability are significant determinants of financial reporting quality among listed industrial goods firms in Nigeria. The coefficient of the firm growth (GROWTH) was not statistically significant, implying that growth of the firm is not a significant determinant of financial reporting quality. The findings of this study on firm size, asset tangibility and financial distress are in line with the outcome of Soyemi et al. (2019), Yükse & Kartal (2020), and Campa (2015), respectively. Similarly, the finding of this study on influence of profitability on financial reporting quality is in tandem with that of (Mahboub, 2017). Overall, the joint significance of all the variables in the model is brought to light by the F-statistic of 721.29. Based on this, the null hypothesis that the predictor variables are not jointly significant can be rejected at 1% level of significance. Therefore, it can be concluded that firm size, profitability, growth, asset tangibility, and distress are significant factors affecting financial reporting quality of listed industrial goods firms in Nigeria.

| Table 4 Random Effects Model Estimation Results |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -0.377423 | 0.043863 | -8.604587 | 0.0000 |

| SIZE | 0.000682 | 0.000328 | 2.0792268 | 0.0390 |

| PROF | -8.90452 | 3.096825 | -2.875372 | 0.0000 |

| GROWTH | 0.000405 | 0.000766 | 0.528720 | 0.5983 |

| TANG | 0.631382 | 0.033060 | 19.09806 | 0.0000 |

| DIST | -0.002008 | 0.000295 | -6.80678 | 0.0000 |

| R-squared | 0.959047 | |||

| F-statistic | 721.2865 | Durbin-Watson stat | 2.550641 | |

| Prob(F-statistic) | 0.000000 | |||

Conclusion

This study examined the determinants of financial reporting quality among the listed industrial goods firms in Nigeria. Data were gathered through a content analysis from annual reports and accounts of the sampled firms for the period 2010-2019. In term of joint significance of the model, the study found that firm size, profitability, growth, asset tangibility, and financial distress were to be significant determinants of financial reporting quality among listed industrial goods firms in Nigeria. As regards the specific variables, firm size and asset tangibility have positive influence while profitability and financial distress showed negative influence on financial reporting quality. Firm growth has no significant influence on financial reporting quality.

The study marks a conceptual contribution by bridging the literature gap on the effect of financial distress on financial reporting quality in the Nigerian context. Future studies could include larger sample by extending the work to other sectors of the Nigerian economy.

References

Abed, S., Al-Attar, A., & Suwaidan, M. (2012). Corporate governance and earnings management: Jordanian evidence. International Business Research,5(1), 216-236.

Indexed at, Google Scholar, Cross Ref

Adewale, A.K., Muhammad, M.I., & Hanga, B.Y. (2019). Effect of Firm Attributes on Financial Reporting Quality: Evidence from Listed Consumer Goods Companies in Nigeria. Indian Journal of Commerce and Management Studies,10(1), 55-64.

Indexed at, Google Scholar, Cross Ref

Agrawal, K., & Chatterjee, C. (2015). Earnings management and financial distress: Evidence from India. Global Business Review, 16(5), 140-154.

Indexed at, Google Scholar, Cross Ref

Akhgar, M.O., & Karami, A. (2014). Firm characteristics and financial reporting quality of quoted listed companies in Tehran Stock Exchange . Accounting Review, 1(4), 1-22.

Al-Dmour, A.H., Abbod, M., & Al Qadi, N.S. (2018). The impact of the quality of financial reporting on non-financial business performance and the role of orgnaisation demographic attributes (type, size, and experience) . Academy of Accounting and Financial Studies, 22(1), 1-18.

Althman, E. (1968). Financial ratios, discriminants analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589-609.

Indexed at, Google Scholar, Cross Ref

Baltagi, B.H. (2005).Econometric Analysis of Panel Data. Springer Nature.

Biddle, G.C., Hilary, G., & Verdi, R.S. (2009). How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics,48(2-3), 112-131.

Indexed at, Google Scholar, Cross Ref

Bushman, R., Chen, Q., Engel, E., & Smith, A. (2004). Financial accounting information, organisation complexity and corporate governance systems . Journal of Accounting and Economics, 37(2), 167-201.

Indexed at, Google Scholar, Cross Ref

Campa, D., & Camacho-Miñano, M.D.M. (2014). Earnings management among bankrupt non-listed firms: evidence from Spain. Spanish Journal of Finance and Accounting/Revista Espanola de Financiacion y Contabilidad,43(1), 3-20.

Indexed at, Google Scholar, Cross Ref

Chan-Jane, L., Tawei, W., & Chae-Jung, P. (2015). Financial reporting quality and investment decisions for family firms. Asia Pacific Journal of Management, 22(3), 1-34.

Indexed at, Google Scholar, Cross Ref

Che-Ahmad, A., Osazuwa, N.P., & Mgbame, C.O. (2015). Environmental accounting and firm profitability in Nigeria: Do firm-specific effects matter? IUP Journal of Accounting Research & Audit Practices,14(1).

Cooke, T.E. (1989). Voluntary corporate disclosure by Swedish companies .Journal of International Financial Management & Accounting,1(2), 171-195.

Indexed at, Google Scholar, Cross Ref

Dechow, P.M., & Dichev, L.D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 7(supp.), 35-59.

Indexed at, Google Scholar, Cross Ref

Derbali, A. (2014). “Determinants of performance of insurance companies in Tunisia: The case of life insurance” , International Journal of Innovation and Applied Studies, 6(1), 90-96.

El-Deeb, M.S., & Ramadan, M. (2020). Audit quality on earnings’ management evidence from companies listed in Egyptian Stock Exchange. Alexandria Journal of Accounting Research, 4(3), 1-48.

Herly, M. (2015). Empirical studies of Earnings Quality . Published thesis Ph.D,. Aarhus University Denmark: Department of Economics and Business.

Idrees, S., & Qayyum, A. (2018). The impact of financial distress risk on equity returns: A case study of non-financial firms of Pakistan Stock Exchange. Munich Personal RePEc Archive, 12, 16-23.

Indexed at, Google Scholar, Cross Ref

International Accounting Standards Board (IASB). (2010). Road Map Final Report (online). Retrieved from http:/www.iasc.org.uk

Johnson, V.E., Khurana, I.K., & Reynolds, J.K. (2002). Audit?firm tenure and the quality of financial reports. Contemporary Accounting Research,19(4), 637-660.

Indexed at, Google Scholar, Cross Ref

Karugu, C., Achoki, G., & Kiriri, P. (2018). Capital adequacy ratio as predictors of financial distress in Kenyan commercial banks . Journal of Financial Risk Management,7, 278-289.

Indexed at, Google Scholar, Cross Ref

Khanh, H.T.M., & Khuong, N. (2018). Audit quality, firm characteristics and real earnings management: The case listed Vietnamese companies . International Journal of Economics and Financial Issues, 8(4), 243-249.

Kirubel, A. (2016). Determinants of financial reporting quality: Evidence from large manufacturing share companies of Addis Ababa . European Journal of Business and Strategic Management, 2(2), 52-70.

Mahboub, R.M. (2017). Main determinants of financial reporting quality in the Lebanese banking sector .

Indexed at, Google Scholar, Cross Ref

Martinez-Ferrero, J., Garcia-Sanchez, I.M., & Cuadrado-Ballesteros, B. (2015). Effect of financial reporting quality on sustainability information disclosure. Corporate Social Responsibility and Environmental Management,22(1), 45-64.

Indexed at, Google Scholar, Cross Ref

Olowokure, O., Tanko, M., & Nyor, T. (2016). Firm Structural Characteristics and Financial Reporting Quality of Listed Deposit Money Banks in Nigeria. International Business Research, 9(1), 106-122.

Indexed at, Google Scholar, Cross Ref

Parkinson, M.M. (2018). Financial Distress, Insolvency and Business Rescue. InCorporate Governance in Transition(pp. 43-64). Palgrave Macmillan, Cham.

Indexed at, Google Scholar, Cross Ref

Rasha, B. (2017). Main Determinants of Financial Reporting Quality in the Lebanese Banking Sector. European Research Studies Journal, 20(4b), 706-726.

Indexed at, Google Scholar, Cross Ref

Shehu, H., & Bello, A. (2013). Firm Characteristics and Financial Reporting Quality of Quoted Manufacturing Firms in Nigeria. International Journal of Accounting, Banking and Management, 3(6), 47-63.

Soyemi, K.A., & Olawale, L.S. (2019). Firm Characteristics and Financial Reporting Quality: Evidence from Non-Financial Firms in Nigeria.International Journal of Economics, Management and Accounting,27(2), 445-472.

Received: 20-Sep-2021, Manuscript No. AAFSJ-21-8275; Editor assigned: 22-Sep-2021, PreQC No. AAFSJ-21-8275(PQ); Reviewed: 06-Oct-2021, QC No. AAFSJ-21-8275; Revised: 15-Mar-2022, Manuscript No. AAFSJ-21-8275(R); Published: 22-Mar-2022