Research Article: 2018 Vol: 22 Issue: 1

Determinants of Implementation of Accounting Standards for Islamic Financial Institutions in Iraq: A Conceptual Framework

Ahmed Maqsad Mohammed, College of Administration and Economics, University of Babylon

Keywords

Islamic Financial institutions, Accounting Standards, Iraq.

Introduction

Islamic financial institutions are developing not only in Muslim countries or the countries with Muslims are the second majority such as India but also getting popular in non-Muslim countries as well. Maurer (2002) argued that during the course of recent decades the Islamic banking system or the PLS has emerged as a global phenomenon which has roots in South Asian, Southeast Asia, Europe and even in the USA. The Islamic financial industry which is based on PLS is worth more than 1.5 trillion and more than 40 percent of market share is capitalized by the non-Muslim countries. The industry is employing more than 500,000 people and growing at the rate of 23 percent per year from 2005.It is projected that by 2020 the Islamic financial industry will cross 2 trillion. It is projected that this will be a $ trillion industries by 2010.

IBs established themselves in the comparatively short period by capturing a good market share from its competitors. The existence of IBs in some Muslim states is 5%, 12% and 30% in Malaysia, KSA and Kuwait respectively. It is expected that in the coming 8 to 10 years IBIs will become a part of at least 40-50%of the total savings of worlds Muslims. Islamic banks are showing emphasis on the domestic markets whereas Western conventional institutions like Merrill ynchaimon a high net value. At present there exist no worldwide competitors for IBIs; moreover, there are no retail Islamic banks (Ibs) in Organization for Economic Cooperation and Development (OECD) countries. Also, Islamic banks lack the in-house expertise to make products compliant with Islamic law and therefore, there a need for financial expertise from the West.

Quran and Elimination of Interest

Allah prohibited charging interest and has directed each person to make sure that his dealing in life is free from the evil of interest whether he is doing any trade or attached to any profession. Some of the Verses from the Holy Quran are quoted below:

“Allah destroys interest and gives increase for Charity. And Allah does not like every sinning disbeliever”. (Al-Quran: 2:276)

The verse 2:276 of the Quran illustrates the Allah act of demolishing of interest and asked to practice the donations.

“O, believers, fears Allah and give up what is still due to you from the interest (usury), if you are true believers”. (Al-Quran: 2:278)

It is clear from the verse that Allah has clearly mentioned a war against those who practice interest and Allah has warned for committing any injustice.

Challenge of Financial Reporting Standards to Islamic Financial System

Though the growth in Islamic banking is tremendous and as discussed earlier that countries around the world are employing this model of financing. Islamic banking system is one of the developing areas in the worldwide financial market, with a huge prospective it is growing very rapidly in all parts of the globe. However, the accounting standards and compliances with the existing accounting reporting standards known as IFRS is practically impossible as the nature of Islamic products is different, so it required a separate accounting standard.

The rise in Islamic financial system and advancement in Islamic financial products the Islamic country Bahrain in 1991 introduced the accounting body for Islamic financial institutions known as Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). The prime duty of AAOIFI is to formulate and interpret the accounting standards for Islamic banking product. Meanwhile, it also organizes debates on current issues and helps in bridging the IFRS and AAOIFI. Currently, 45 countries around the world are members of this body (AAOIFI, 2010).

Islamic Bank in Iraq

The Islamic banking in Iraq was first introduced in 1992 when Iraqi Islamic Bank (JIB) stated their operation in Iraq. The Iraqi Islamic bank is now major Islamic banking driver in Iraq which not only offer guidelines on policy matters but also contributes significantly to economic growth. The CEO of Iraqi Islamic bank once said that “the bank not only has credit to lay down the foundation stone of Islamic banking on country’s map but also contributed and still contributing significantly in the development of the Islamic banking in Iraq”.

Like other countries, the religion Islam plays a significant role in the development of Islamic banking in Iraq. Hin, Wei, Bohari, Adam and Zainol (2011) stated that principles of Islamic Sharia are the one of the most imperative factors in picking an Islamic bank. The second significant factor was the return rate, which is committed to the principles of Islamic law. The subsequent selection criteria, according to the researchers, for the selection of IBIs were recommendations from family and friends, followed by the easy access to the bank site. According to the Hin et al. (2011) study, the client consideration towards the presence of Shariah was the strong reason for selecting the Islamic banks. However, during their findings, they measured the reputation of the bank as the most important factor that influences the choice of customers while selecting a bank. They placed religion influence as a second important factor affecting the customer’s decisions towards Islamic Banking.

The studies of Yusoff and Shamsuddin (2001) studied the behavior of Iraqi people regarding interest-free banking. They have analysed that religion factor was not found as the main factor for selecting an IBIs, but there were some other criteria’s of selection including the profitability level and the returns on the investments of the customers. In Iraq there is no or little work has been done on this issue.

Determinants in Implementation of Accounting Standards for Islamic Financial Institutions in Iraq

There are many factors which affect the adoption of accounting reporting standards in any country. They are broadly categorized into two factors internal factors and external factors. Many prior studies (Cooke & Wallace, 1990; El Khatib & Nizami, 2015) argued that the legal system, political system, tax, reporting system, the legal system and globalization have a significant impact on the adoption of accounting reporting standards. Iraq which is not only an Islamic country but also among pioneers in Islamic banking system has adopted this mode of financing only considering its Islamic value. However, around the world, the Islamic mode of financing was being accepted as an alternative to the traditional banking system and was being considered as a system which cures the ills of the conventional financial system (Wagenhofer, 2011).

Though AAOIFI is working diligently to promote and develop the accounting standers for IFIs. However, till to date, IFIs are striving for uniform accounting standers (Abidin, Bakar & Haseeb, 2014 & 2015; Abidin & Haseeb, 2015; Sarea & Hanefah, 2013; Wan Abdullah, Percy & Stewart, 2011) Even the studies on the issue of compliance level with AAOIFI broached an interesting or may be said an alarming situation that the compliance rate of IFIs with AAOIFI is declining by 5 percent. Though the share of Islamic banking is increasing significantly in Iraq. However, little or no intention has been given to explore the determinants of accounting standers adoption by IFIs in Iraq.

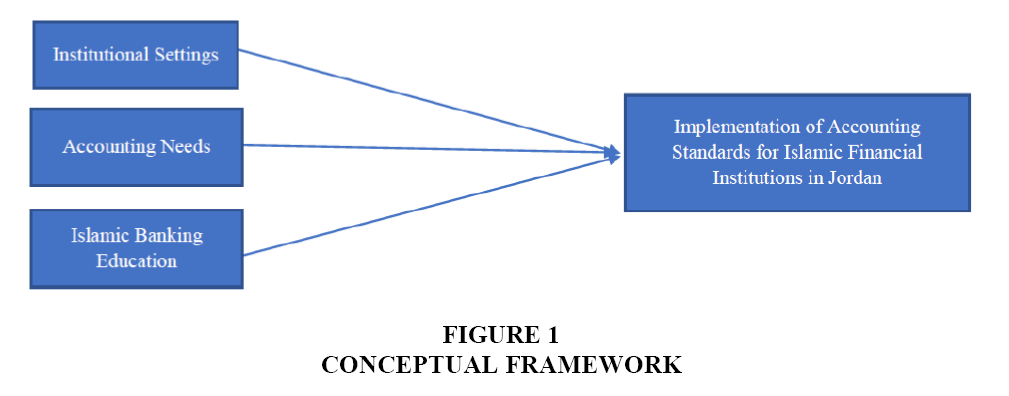

After critically reviewing the empirical review of literature and reports, we have proposed that the institutional settings, lack of Islamic banking education and accounting needs are the three most important determinants of Implementation of Accounting Standards for Islamic Financial Institutions in Iraq (Figure 1).

Accounting Needs

The literature shares a common understanding that Iraqi is more likely to adopt international accounting standards due to its accounting needs that are derived from the economic needs. Haddad, Sbeiti and Qasim (2017) argued that amount of accounting information required to disclose and set of regulation required to comply by to disclose that information varies from country to country. Meanwhile, they have argued that the need for an accounting system significantly affects the accounting reform process and its implementation process. They continued and argued that though the institutional setting in Iraq is the biggest hurdle in a way to implement any accounting standards in Iraq. However, the increasing globalization and rapidly expanding Iraqi economy revealed the fact that Iraq is acute need of accounting reforms. The central bank of Iraq has realized that there is need of separate accounting for IFIs in Iraq. And the emphasis is being placed to satisfy this need. So, undoubtedly the accounting need is an important determinant of implementation of accounting standards for Islamic financial institutions in Iraq.

Accounting Needs

The literature shares a common understanding that Iraqi financial institutions are more likely to adopt international accounting standards due to its accounting needs that are derived from the economic needs. Haddad et al. (2017) argued that amount of accounting information required to disclose and set of regulation required to comply by to disclose that information varies from country to country. Meanwhile, they have argued that the need for an accounting system significantly affects the accounting reform process and its implementation process. They continued and argued that though the institutional setting in Iraq is the biggest hurdle in a way to implement any accounting standards in Iraq. However, the increasing globalization and rapidly expanding Iraqi economy revealed the fact that Iraq is acute need of accounting reforms. The central bank of Iraq has realized that there is need of separate accounting for IFIs in Iraq. And the emphasis is being placed to satisfy this need. So, undoubtedly the accounting need is an important determinant of implementation of accounting standards for Islamic financial institutions in Iraq.

Islamic Banking Education

It is being increased realized that the Islamic banking education is a significant determinant of Islamic banking development (Kaabachi & Obeid, 2016; Tarman, 2010; Tarman & Chigisheva, 2017). Financial literacy plays a significant role in the development of the financial sector of any country. Islamic banking which is relatively a new subject is facing an issue of qualified Islamic banking professionals (Abdullah & Alex, 2015; Abidin, Haseeb, Azam & Islam, 2015; Abidin, Haseeb & Islam, 2016; Abidina, Haseeb & Jantan, 2016). Similarly, the Islamic accounting system is a new area and need unique and subject-specific teaching methodology. There is a limited number of universities which are offering Ph.D. in Islamic Accounting. In Iraq only, a limited number of universities are offering Islamic Banking and finance and among them, no one is offering a specialized Islamic accounting degree. So, the lack of Islamic accounting qualified professionals is one of the determinants of implementation of accounting standards for Islamic financial institutions in Iraq.

Conclusion

The current study has presented a conceptual framework of determinants in the implementation of accounting standards for Islamic financial institutions in Iraq. Islamic financial institutions are developing not only in Muslim countries or the countries with Muslims are the second majority such as India but also getting popular in non-Muslim countries as well. At present there exist no worldwide competitors for IBIs, moreover, there are no retail Ibs in Organization of Economic Cooperation and Development (OECD) countries. The Islamic banking in Iraq was first introduced in 1992 when Iraq Islamic Bank (ISB). The Iraq Islamic bank is now major Islamic banking driver in Iraq which not only offer guidelines on policy matters but also contributes significantly to economic growth. Like other countries, the religion Islam plays a significant role in the development of Islamic banking in Iraq. Islamic banking system is one of the developing areas in the worldwide financial market, with a huge prospective it is growing very rapidly in all parts of the globe. However, the accounting standards and compliances with the existing accounting reporting standards known as IFRS is practically impossible as the nature of Islamic products is different, so it required a separate accounting standard. After reviewing the existing literature, we found that institutional setting; accounting need and Islamic accounting education are important determinants of implementation of accounting standards for Islamic financial institutions in Iraq.

Endnote

1. Al Quran: The Quran (English Meanings) published by Abul Qasim Publishing House 1997, Saudi Al-Muntada Al-Islamic, 2004

References

- AAOIFI. (2010). Auditing and Governance Standards for Islamic financial institutions: Bahrain. Retrived from: http://aaoifi.com/standard/accounting-standards/?lang=en

- Abdullah, M.A. & Alex, A. (2015). Islamic financial literacy among bankers in Kuala Lumpur. Journal of Emerging Economies and Islamic Research, 3(2), 1-16.

- Abidin, I.S.Z., Bakar, N.A.A. & Haseeb, M. (2014). An empirical analysis of exports between Malaysia and TPP member countries: Evidence from a panel cointegration (FMOLS) model. Modern Applied Science, 8(6), 238.

- Abidin, I.S.Z., Bakar, N.A.A. & Haseeb, M. (2015). Exploring trade relationship between Malaysia and the OIC member countries: A panel cointegration approach (1995-2012). Asian Journal of Scientific Research, 8(1), 107.

- Abidin, I.S.Z. & Haseeb, M. (2015). Investigating Exports Performance between Malaysia and OIC Member Countries from 1997-2012. Asian Social Science, 11(7), 11.

- Abidin, I.S.Z., Haseeb, M., Azam, M. & Islam, R. (2015). Foreign direct investment, financial Development, international trade and energy consumption: Panel data evidence from selected ASEAN Countries. International Journal of Energy Economics and Policy, 5(3).

- Abidin, I.S.Z., Haseeb, M. & Islam, R. (2016). Regional integration of the association of Southeast Asian Nations Economic Community: An analysis of Malaysia-Association of Southeast Asian Nations Exports. International Journal of Economics and Financial Issues, 6(2).

- Abidina, I.S.Z., Haseeb, M. & Jantan, M.D. (2016). Trans-Pacific Partnership (TPP) agreement: Comparative trade and economic analysis for Malaysia. The Social Sciences, 11(13), 3375-3380.

- Cooke, T.E. & Wallace, R.O. (1990). Financial disclosure regulation and its environment: A review and further analysis. Journal of Accounting and Public Policy, 9(2), 79-110.

- El Khatib, A.S. & Nizami, F.A. (2015). Accounting standards for islamic financial institutions in United Kingdom and Indonesia. Paper presented at the USR XV Congresso Sao Paulo.

- Haddad, A.E., Sbeiti, W.M. & Qasim, A. (2017). Accounting legislation, corporate governance codes and disclosure in Jordan: A review. International Journal of Law and Management, 59(1), 147-176.

- Hin, C.W., Wei, C.C., Bohari, A.M., Adam, A. & Zainol, M. (2011). Bank selection criteria and service quality of Islamic banking: A comparison between Muslim and non-Muslim students and its effect on student's satisfaction. Bank selection criteria and service quality of islamic banking: A comparison between Muslim and Non-Muslim Students and its effect on student's satisfaction.

- Kaabachi, S. & Obeid, H. (2016). Determinants of Islamic banking adoption in Tunisia: Empirical analysis. International Journal of Bank Marketing, 34(7), 1069-1091.

- Maurer, B. (2002). Anthropological and accounting knowledge in Islamic banking and finance: Rethinking critical accounts. Journal of the Royal Anthropological Institute, 8(4), 645-667.

- Sarea, A.M. & Hanefah, M.M. (2013). Adoption of AAOIFI accounting standards by Islamic banks of Bahrain. Journal of Financial Reporting and Accounting, 11(2), 131-142.

- Tarman, B. (2010). Social studies education and a new social studies movement. Journal of Social Studies Education Research, 1(1).

- Tarman, B. & Chigisheva, O. (2017). Editorial for special issue: Transformation of educational policy, theory and practice in post-soviet social studies education. Journal of Social Studies Education Research, 8(2), 1-4.

- Wagenhofer, A. (2011). Towards a theory of accounting regulation: A discussion of the politics of disclosure regulation along the economic cycle. Journal of Accounting and Economics, 52(2-3), 228-234.

- Wan Abdullah, W., Percy, M. & Stewart, J. (2011). Corporate social responsibility in Islamic banks: A study of Shari’ah supervisory board disclosures and zakat disclosures in Malaysian and Indonesian Islamic banks. Paper presented at the AFAANZ Conference.

- Yusoff, M.E. & Shamsuddin, A.S. (2001). Muslim consumers attitude toward Islamic Finance products in a Non-Muslim country. Jurnal Kemanusiaan, 94-103.