Research Article: 2021 Vol: 25 Issue: 2

Determinants of Internal Auditing Effectiveness in a Public Higher Education Institution

Mvelo Comfort Siyaya, ICT and Society Research Group, Durban University of Technology

Ayogeboh Epizitone, ICT and Society Research Group, Durban University of Technology

Lulu F. Jali, ICT and Society Research Group, Durban University of Technology

Oludayo. O. Olugbara, ICT and Society Research Group, Durban University of Technology

Abstract

The desire to produce an effective internal auditing system to meet the demands of different institutions has caused stiff competition in the auditing market. This has led to a dilemma in effectively deciding on which internal auditing system to implement, whether an in-house system, to outsource services to an external service provider, or even a combination of both services. There are several determinants already identified in literature that could affect the effectiveness of internal auditing to successfully realise its core values. However, little research has been conducted on the validation of these determinants in the context of higher education institutions of learning. Hence, this study seeks to investigate the determinants of internal auditing effectiveness in a public higher education institution using the method of principal component analysis. Consequently, 17 principal components with an eigenvalue of unity were obtained based on the principal component analysis. The study results further afford a significant insight to both suppliers (auditor) of internal auditing services and customers of these services (auditee) regarding the effectiveness of these determinants, extent of internal audit effects, and significant performance indicators in a public higher education institution.

Keywords

Auditing Effectiveness, Higher Education, Internal Auditing, Performance Indicators, Principal Component.

Introduction

Many cooperate institutions around the world have employed internal auditing services rather than relying on external auditing services alone as a way of improving their internal operations. Previous studies on external auditing effectiveness have been carried out with little attention paid to internal auditing effectiveness (Dellai & Omri, 2016). Therefore, this study is driven by this research hiatus to investigate the determinants of internal auditing effectiveness in the context of higher education institutions of learning. Traditionally, internal auditing services were found in corporate industries being driven by high risk on company finances. Expansion of internal audit areas of focus has attracted the necessity for different institutions, including higher education to invest in internal auditing services (Demeke et al., 2020). All institutions are striving towards the achievement of their set strategic objectives.

The academic sector has joined manufacturing, business, and finance enterprises to enjoy the inherent benefits associated with internal auditing services in strengthening their operations and ensuring direct alignment of internal operations with objectives (Demeke et al., 2020). Lenz & Hahn (2015), attested that investment in internal auditing services is associated with the value it adds to strategic objectives, operational objectives, compliance objectives, and financial reporting objectives of an institution. Internal auditors as internal evaluators of institutional processes assume an autonomous examination of different activities of the institution ranging from governance issues, risk management processes, and internal controls (George et al., 2015; Oussii & Boulila Taktak, 2018). In that way, internal auditing services help in governing operations of an institution that relies on internal auditors to give an independent opinion and advisory support on whether internal controls are operating effectively, and that inherent risks are seamlessly managed. The desire to produce an effective internal audit function to meet the demands of different institutions has caused stiff competition in the auditing market.

This has led to a dilemma in effectively deciding on which internal auditing function to implement, whether to implement an in-house internal auditing function or to outsource internal auditing functions to an external service provider, or even use both functions. Accordingly, not all internal auditing functions can help institutions to achieve their objectives, but only those that are effective (Salehi, 2016). The effectiveness of internal auditing has been defined by Dittenhofer (2001), as the potential of the internal auditing function to achieve its set objectives. Also, the effectiveness of internal auditing function has been denoted as an issue of great concern to many researchers, internal auditing professionals and auditing clients (Alzeban & Gwilliam, 2014; Lenz et al., 2017). It is value-driven because it was designed to help its clients to improve internal effectiveness of business operations and it remains a huge challenge when internal auditing functions do not serve their ascribed purpose. There are several determinants already identified in the literature that could affect the effectiveness of internal auditing to successfully realise its intended value. However, little research has been conducted to validate these determinants in the context of higher institutions of learning (Demeke et al., 2020; Oriakhi, 2020). Furthermore, Lenz et al. (2017) advocated for the need to consider the recipients of internal auditing services when measuring internal auditing effectiveness.

This research work has applied the principal component analysis method to identify the determinants of internal auditing effectiveness in a higher learning institution as a unique contribution to the identified hiatus. Data for this study were collected from audit client staff, section managers and senior managers who are often involved in internal auditing in a higher education institution of learning. The management of higher institutions of learning has tried to devise different strategies to help improve their operations with internal auditing being one of them. The prime research question that has guided this study is as follows; “What are the determinants of internal auditing effectiveness in the context of higher education institutions of learning?”

Literature Review

Extant literature review focuses on internal auditing effectiveness on the important determinant as posited by previous pundit. This review provides the theoretical foundation that solidly pivots this study.

Internal Auditing Effectiveness

The concept of internal auditing effectiveness has been considered subjective and less studied in the auditing literature (Dellai & Omri, 2016). This subjectivity can be associated with a lack of unapproved criteria for its measurement. Institutions should examine the internal audit effectiveness to accomplish the primary objectives of internal auditing function (IAF) (Demeke et al., 2020). Prior researchers have perceived internal auditing effectiveness as the ability of the IAF to achieve its objectives and goals (Salehi, 2016). Based on the approved definition of the institute of internal auditors (IIA), the goal of IAF is to add value to and improve the processes of an institution. Therefore, not all IAFs are effective but only those that create value to the processes of the institution (Dellai & Omri, 2016). The most prominent claim that has been observed from the previous studies is that internal auditing aims to add value to an institution by bringing effectiveness on risk management, governance, and internal control processes (Alzeban & Gwilliam, 2014; Lenz et al., 2017). Dellai & Omri (2016) have attested that internal auditing creates a unique value by identifying the weaknesses in institutional processes and providing the necessary recommendations to be implemented by senior management to improve the audited processes.

However, arguments were noted in the literature regarding the appropriateness of the criteria to correctly measure internal auditing effectiveness. The implementation of recommendations by internal auditors, reliance placed by external auditors on the work of internal auditors, international standards for the professional practice of internal auditing, satisfaction of the needs of the auditee, and improvement of auditee performance was among the discussed criteria for measuring internal auditing effectiveness (Alzeban & Gwilliam, 2014; Erasmus & Coetzee, 2018; Salehi, 2016). Barisic & Tusek (2016) have alluded that measurement criteria of internal auditing effectiveness may differ from one institution to the other, which means that there are no common standard criteria of internal auditing effectiveness.

Independence and Objectivity of Internal Auditing

The term ‘independence’ has been stressed for external auditors in the past because these auditors are external to the institution being audited. In recent years, professional bodies and standard setters have emphasised strongly, the importance of the independence of internal auditors (Al-Akra et al., 2016; Oriakhi, 2020). The international standards for the professional practice of internal auditing (ISPPIA) necessitate that an internal auditing unit of an institution should be independent and that internal auditors be objective while performing their internal auditing activities. Standard 1100 recommends that to ensure an appropriate level of independence and objectivity of internal auditors, the head of internal auditing unit should report administratively to senior management and functionally to the audit committee of the board of directors. Internal auditors should have unrestricted access to records, personnel and departments, avoid any conflict of interest, and not perform non-audit activities (Coetzee & Erasmus, 2017; Institute of Internal Auditors, 2017). Furthermore, standard 1111 emphasises that the access of chief audit executive to the board of directors and senior management be unlimited to allow for full independence of the department.

A decrease in the effectiveness of is evidence from prior studies that found low independence status of internal auditors in the public sector when compared to other factors such as competence of internal auditing unit, size of internal auditing unit, relationship between internal and external auditors, and management support, this factor is considered very crucial for the success of internal audit function (Alzeban & Gwilliam (2014). However, there is a contrast in the current studies that have revealed a higher level of independence of internal auditors (Oriakhi, 2020; Pham & Nguyen, 2021). George et al. (2015) have confirmed this assentation by concluding that independence of internal audit function is the most crucial determinant that contributes to the effectiveness of internal auditing in comparison to other determinants. A lack of independence in internal auditing is a critical hiccup to the satisfactory performance of an internal auditing unit (Salehi, 2016). Ali (2018); Coetzee & Erasmus (2017) have equally attested that independence of internal auditing is the foundation for effective internal auditing processes.

Competence of Internal Auditors

The competence of internal auditors has been highlighted as a strong determinant by almost every study of internal auditing effectiveness. The international standards for the professional practice of internal auditing 1210 (ISPPIA) have pointed out the necessity of internal auditors to possess the necessary knowledge, skill, and competencies to conduct auditing engagements. Competence according to ISPPIA, is the combination of motives, traits, self-concepts, knowledge, and skills. Wu et al. (2017) have suggested that motives, traits, and self-concepts are different from knowledge and skills in that they are essential features of character that are not easy to acquire through training. By contrast, knowledge and skills can be revealed and developed through training intervention. Alzeban & Gwilliam (2014) have associated competence with the level of education, working experience in a field of internal auditing, professional qualifications, and training, all of which assist auditors to add value and improve institutional performance. The general experience of internal auditors relates to the years of experience, skills, knowledge, training, and expertise (Shamki & Alhajri, 2017).

This requirement is consistent with internal auditing standard 1210, which states that “internal auditors must possess high skills, knowledge and competencies to perform their responsibilities” (Institute of Internal Auditors, 2017). Furthermore, Demeke et al. (2020) have associated auditing experience with skills and knowledge that an auditor develops with long practices in the internal auditing field. Prior studies have claimed that the competence of an internal auditor is an important determinant of internal auditing effectiveness (Ali, 2018; Baharud-din et al., 2014; Salehi, 2016). Wu et al. (2017) have shared that competence of internal auditors positively impacts internal auditing effectiveness, based on their problem-solving skills and their dexterity to use auditing software effectively. Consequently, the performance of internal auditors is enhanced through computer skills and abilities to solve practical problems in auditing. Moreover, the results of the study by Ahmet, (2021), have revealed that the competence of internal auditors heavily relies on the management support for internal auditing to hire highly experienced personnel to perform internal audit activities.

Management Support

Management support for internal auditing is vital for the recognition and appreciation of internal audit practices within an institution. Management support is crucial to the operation of internal audit because other determinants strongly depend on it (Ahmet, 2021). International standards of internal auditing state that internal auditors should be supported by the senior management and board of directors to effectively fulfil their responsibilities. “The head of internal audit unit should encourage senior management to be involved in internal audit plan and provide them with a detailed plan of internal audit activities indicating the required resources, including significant interim changes, for senior management to review and approve for further progress with other deciding authorities in the company” (Sobel et al., 2017). Likewise, Alzeban & Gwilliam (2014) have opinionated that management support for internal audit includes the provisioning of sufficient budget for the acquisition of competent human capital and other resources that are needed for the daily operation of the function. Salehi (2016) has observed that a tone of acceptance and appreciation of internal auditing practices can send a crucial message to the entire institution about the importance of internal auditors.

The support can enable internal auditing function to complete its activities and responsibilities. Dellai & Omri (2016) have associated management support as a key precursor that influences the implementation of recommendations made by internal auditors. Management support for effective internal auditing is considered as one of the most significant determinants by almost all studies of internal audit effectiveness. Ahmet (2021) has identified the need of management support for effective functioning of internal auditing function. Whilst Lenz et al., (2017) have consented that interaction between the chief audit executive and senior management is a prime determinant of internal auditing effectiveness. Moreover, Mensah et al. (2020) found a positive correlation between management support and internal auditing effectiveness with the recommendation that more management support for internal audit functions is needed for the acquisition of adequate resources, appropriate skills, experience, consistent development of staff.

Internal Audit Quality

Internal auditors are increasingly expected to cover a variety of responsibilities, including assisting the management to streamline the risk management process. However, quality of internal auditing is of supreme importance in executing those responsibilities. Eulerich et al. (2017). Zaman & Sarens (2013) have associated the quality of internal auditing unit with its interaction with other governance mechanisms such as audit committee, board of directors, and management. Mat Zain et al. (2015) believe that such interaction can result in internal auditors performing their work efficiently, thus reducing external audit fees because a certain amount of work will already have been covered by internal auditors. Recent academic studies that have examined internal audit quality as an independent variable, along with internal audit effectiveness as a dependent variable, found that there is a positive relationship between the two variables (George et al., 2015; Rudhani et al., 2017). Pizzini et al. (2015) are of the view that internal audit quality is principally driven by the proficiency of internal auditing staff. They believe that competent internal audit staff improve the quality of audit work by correctly justifying the internal audit findings, issuing accurate auditing reports, improving their communication with external auditors and achieving internal audit objectives.

Relationship between Internal and External Auditors

Both internal and external auditing standards stress the importance of coordination between internal and external auditors. Internal auditing standards (Standard, 2050) stress the importance of the professional relationship between internal and external auditors. This standard lays out the benefits of coordination between two parties as follows. Coordination of results for the proper coverage of audit work, minimising duplication of effort and reducing external audit costs. External auditing standards (ASA 315) indicate that effective communication between internal and external auditors can create an atmosphere for external auditors in which they are being mutually informed about key matters that have an impact on their work. Moreover, academic studies have proved that coordination between the two parties boosts efficiency, economy, and effectiveness of processes, including a reduction in external auditing hours, external audit effort, audit delay and external audit fees (Pizzini et al., 2015; Wang & Fargher, 2017). Such a coordination allows management to deliver improved services within the public sector (Demeke et al., 2020). Wang & Fargher (2017) have claimed that internal auditing effectiveness is enhanced through coordination with external auditors because it allows internal auditors to access the audit techniques and vocabularies of the external auditors and apply these within the scope of internal auditing. They further stated that coordination sets an operative mechanism to reduce the effect of poor tone at the top on the measured fraud risk by internal auditors. Wang & Fargher (2017) have concluded that the nonexistence of coordination between auditors can result in a high risk of fraud, and they have suggested that internal auditors should use of this coordination as a means of reducing financial fraud risk and enhancing the reliability of financial statements.

Effective Audit Committee

The committee of auditors is the foundation of effective governance in many institutions (Shamki & Alhajri, 2017). The success of an audit committee is associated with its expanded scope from financial reporting to key areas that encourage institutional performance, such as risk management, compliance, and effectiveness of internal controls over operation (Institute of Internal Auditors, 2017). Moreover, literature has revealed that the transformed scope of audit committee is only possible with the help of internal auditors. Given its critical position in the institution, internal audit alerts the audit committee by providing insight into the risk facing an institution (Institute of Internal Auditors, 2017). Researchers such as Ali (2018); Dellai & Omri (2016); Erasmus & Coetzee (2018) have argued sternly that effective functioning of an internal audit function relies on the effectiveness of audit committee and that of audit committee relies on effective internal audit function.

Alzeban & Gwilliam (2014) further emphasises that the two parties should have a strong working relationship to assist internal audit to protect institutional value from risk, by providing risk-based assurance, advice, and insight to the institution. It is interesting to note that the study of Alhajri (2017) has found that audit committee effectiveness influences the size of an internal audit unit. The audit committees play an important role in ensuring the unit is financially well-resourced to hire the appropriate number of internal auditors. Moreover, academic studies have shown that enough internal audit staff is positively associated with internal audit effectiveness (Alzeban & Gwilliam, 2014; Salehi, 2016). Further attention has been given to the size of an internal audit unit as one of the determinants that contribute to internal audit effectiveness after the report by Arena & Azzone (2009) who found that “the failure of internal audit performance was the result of a few number of internal auditors in the Malaysian governmental institutions”.

Information Technology Tools

Information technology (IT) is prevalent and significantly impacts the way business is conducted in the emerging world of fourth industrial revolution (4IR). The extensive application of IT in an institution can significantly shorten the time of processing data and support multitasking while working with computing devices. Most IT institutions have decided to adopt multiple information systems to help them with improving efficiency while concomitantly striving to achieve business objectives by harnessing the enormous intrinsic benefits of technology (Dwivedi et al., 2015). Keeping information security controls up to date is a common practice of institutions to ensure information correctness, protection, reliability, and availability (Wu et al., 2017). Providing an assurance that information security controls are adequate and achieving their intended purpose resides heavily on internal auditors (Henderson et al., 2013). Hence, the IIA standard 1210.A3 states that “Internal auditors must have sufficient knowledge of key IT risks, controls and availability technology driven audit techniques to perform the assigned work. However, not all internal auditors are expected to have the expertise of an internal auditor whose primary responsibility is information technology auditing” (Institute of Internal Auditors, 2017).

Furthermore, the institute elaborates that auditors must be able to use computerised auditing tools to evaluate fraud risk, identify risks of material misstatement, and assess audit evidence. Likewise, Abou?El?Sood et al. (2015); Alkebsi & Aziz (2018) have pointed out that computerised assisted auditing tools (CAATs) assist greatly in speeding up the work of internal auditors. Henderson et al. (2013) states that CAAT tools can assist institutions to enhance quality of internal audit processes and make complex audit task more easily manageable.

Methodology

Material

The dataset of this study consists of the determinants that have been measured using the Likert scale survey. The dataset was obtained through the administration of a questionnaire to senior managers, managers and experienced non-managers of the human resources and finance departments of a public higher education institution. This personnel categorised and scored the determinants which are described in Table 1.

| Table 1 Description of Internal Auditing Determinants | ||

| Category | Description | Code |

| Financial performance indicators | Operational cost | ISPF1 |

| Better cash flows | ISPF2 | |

| Effective use of budget | ISPF3 | |

| Consolidated financial index | ISPF4 | |

| Capital spending ratio | ISPF5 | |

| Non-financial indicators | ||

| Customer perspective | Customer satisfaction | ISPC1 |

| Staff rotation rate | ISPC2 | |

| Staff turnover rate | ISPC3 | |

| Student retention rate | ISPC4 | |

| Percentage of students graduating on time | ISPC5 | |

| Learning and innovation | Labour improvement | ISPLI1 |

| Percentage of trainings for staff | ISPLI2 | |

| Qualification index | ISPLI3 | |

| Reduction in customer complains | ISPLI4 | |

| Rewarding system improvement | ISPLI5 | |

| Internal process | Productivity ratio | ISPIP1 |

| Staff rotation | ISPIP2 | |

| Reduction in operating delays | ISPIP3 | |

| Inter-functional cooperation | ISPIP4 | |

| Compliance with internal policies and procedures |

ISPIP5 | |

| Internal Audit Effects | ||

| Automational Effects | Better management of processes increase productivity ratio | AE1 |

| Better management of processes allow for staff rotation |

AE2 | |

| Better management of processes result to labour improvement |

AE3 | |

| Centralisation of operations (such as payments) result to reduced operational cost and labour cost |

AE4 | |

| Centralisation of operations allow for a better cash flow |

AE5 | |

| Centralisation of operations result to an effective use of budget |

AE6 | |

| Encouraging effective use of resources increase return on assets |

AE7 | |

| Encouraging effective use of resources increase the productivity ratio |

AE8 | |

| Efficiency in operations of the business reduces operational delays |

AE9 | |

| Efficiency in business operations reduces operational costs |

AE10 | |

| Efficiency in business operations increases the level of adherence to internal approved policies and procedures |

AE11 | |

| A decreased risk of losing assets decreases capital spending ratio |

AE12 | |

| A decreased risk of losing assets increase return on assets |

AE13 | |

| Informational effects | Reliability of financial information boost stakeholder satisfaction |

IE1 |

| Reliability of financial information results to an increased financial index |

IE2 | |

| Mitigating errors in the process and suggesting ways of improvement reduces the level of operational delays |

IE3 | |

| Mitigating errors in the process and suggesting ways of improvement increases the level student or staff satisfaction |

IE4 | |

| Accuracy of finances according to approved standards increase the level of compliance by the institution |

IE5 | |

| Transformational effects | Cross-functional competences encourages inter- functional cooperation |

TE1 |

| Cross functional competences result to better qualifications index |

TE2 | |

| Revision of process and structures encourages staff rotation in the institution |

TE3 | |

| Discouraging the act of fraud and corruption foster compliance with internal approved policies and procedures |

TE4 | |

| Discouraging the act of fraud and corruption effects capital spending ratio positively | TE5 | |

| Internal Audit effectiveness Determinants |

||

| Competence of Internal Auditors | Internal auditors possess enough experience | CIA1 |

| Required skills to perform internal audits | CIA2 | |

| Relevant qualifications in auditing | CIA3 | |

| Ability to use computerised data tools | CIA4 | |

| Independence of IAF | Free access to departments and workers | IIAF1 |

| Participation in development of processes | IIAF2 | |

| Impartial unbiased attitude | IIAF3 | |

| Non-performance of non-audit services | IIAF4 | |

| Management Support | Support internal audit to perform its services | MS1 |

| Involvement in internal audit plan | MS2 | |

| IAF provide reports to senior management | MS3 | |

| IAF is reasonable funded | MS4 | |

| Internal Audit Quality | Accomplishment of internal audit objectives | IAQ1 |

| Efficiency in internal audit work | IAQ2 | |

| Justification of internal audit findings | IAQ3 | |

| Accuracy of internal audit reports | IAQ4 | |

| Minimised duplication of work among auditors | IAQ5 | |

| Relationship between internal and external auditors |

Support among both parties | RBIEA1 |

| Good attitude towards internal auditors | RBIEA2 | |

| Discussion of plans among both parties | RBIEA3 | |

| Reliance on internal auditor’s work | RBIEA4 | |

| Share of audit working papers | RBIEA5 | |

| Information Technology Tools | Knowledge CAATs to perform audit tasks | ITT1 |

| CAATs speed up audit process | ITT2 | |

| CAATs increase productivity of internal auditors | ITT3 | |

| Effective Audit Committee | Approval of CAE appointment and removal | EAC1 |

| Mutual relationship with internal auditors | EAC2 | |

| Support of good governance | EAC3 | |

| Strengthens management of risk | EAC4 | |

Method

The principal component analysis (PCA) technique has been applied to the dataset to uncover the principal components (PCs) of the determinants of internal auditing effectiveness in a public higher education institution. This technique is not only suitable for the reduction of dimensionality of determinants, but it affords a noble representation of features and has been employed in many studies (Epizitone & Olugbara, 2020). Hence, the selection of this method tally with the intrinsic benefit of revealing the essential determinants in the form of principal components that are likely to mostly influence the effectiveness of internal auditing practices in public HEIs (Bern et al., 2019; Epizitone & Olugbara, 2020). The determinants were coded, and the IBM SPSS statistics version 26 tool was used to carry out the PCA statistical analysis procedures using data with metadata in Table 1. Applying PCA to the coded dataset that consisted of determinants subject to Likert scales and PC value was determined using the eigenvalue of unity. The description of each determinant of internal auditing effectiveness is given in Table 1.

Results and Discussion

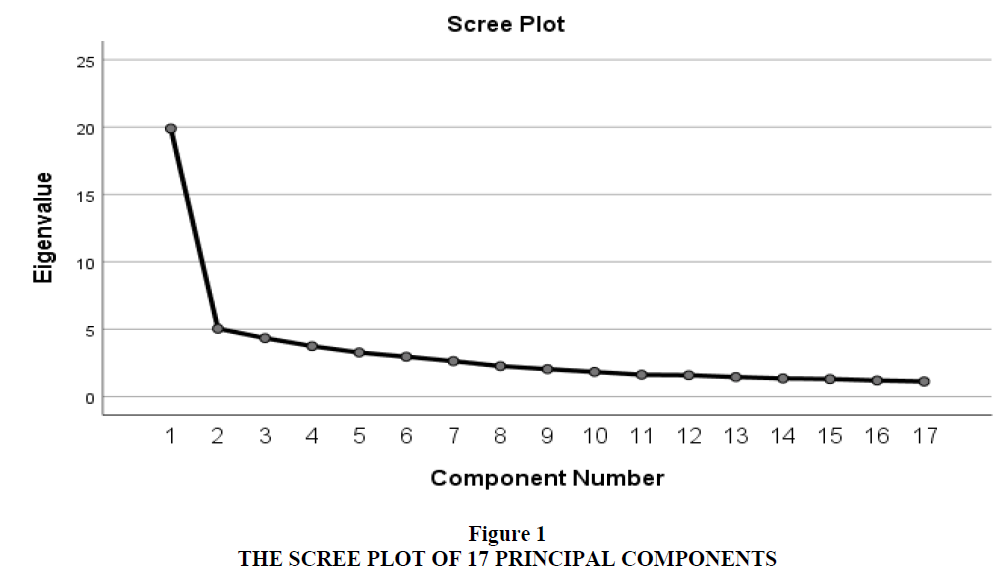

In this study, a total of 17 principal components were obtained that explains the influence of internal auditing determinants on higher education performance with an accumulative variance of 79.9%. Figure 1 shows the scree plot of the identified 17 principal components. The communalities table shows the initial and extraction value for each of the study determinants Table 2. It can be seen from the communalities table that all determinants had an initial loading of 1, but subsequently different extraction loadings that indicate their contribution to the principal components with relatively high values. The PCA distinguishes the various internal auditing determinants with latent influence yielding 17 identified PC that had an eigenvalue of unity and above. The first PC has the highest value of 19.88 and the last PC had the cut off minimal value of 1.16. The PC 1 representing an eigenvalue of 19.8 with a 27.6% variance and PC2 representing an eigenvalue of 5 which accounts for 6.9% of the variance in the analysis. Table 3 shows all the explanation of the variance of the 17 PC. The initial eigenvalue remained unchanged in the extraction sums of square loadings that indicated no absent in the results from latent determinants. Hence, the variability of all determinants is explained in the result.

| Table 2 Communalities | |||||

| Initial | Extraction | Initial | Extraction | ||

| ISPF1 | 1.000 | 0.780 | IE4 | 1.000 | 0.802 |

| ISPF2 | 1.000 | 0.859 | IE5 | 1.000 | 0.769 |

| ISPF3 | 1.000 | 0.892 | TE1 | 1.000 | 0.791 |

| ISPF4 | 1.000 | 0.833 | TE2 | 1.000 | 0.860 |

| ISPF5 | 1.000 | 0.821 | TE3 | 1.000 | 0.846 |

| ISPC1 | 1.000 | 0.682 | TE4 | 1.000 | 0.771 |

| ISPC2 | 1.000 | 0.823 | TE5 | 1.000 | 0.785 |

| ISPC3 | 1.000 | 0.815 | CIA1 | 1.000 | 0.814 |

| ISPC4 | 1.000 | 0.817 | CIA2 | 1.000 | 0.870 |

| ISPC5 | 1.000 | 0.799 | CIA3 | 1.000 | 0.653 |

| ISPLI1 | 1.000 | 0.782 | CIA4 | 1.000 | 0.820 |

| ISPLI2 | 1.000 | 0.792 | IIAF1 | 1.000 | 0.781 |

| ISPLI3 | 1.000 | 0.780 | IIAF2 | 1.000 | 0.736 |

| ISPLI4 | 1.000 | 0.757 | IIAF3 | 1.000 | 0.273 |

| ISPLI5 | 1.000 | 0.685 | IIAF4 | 1.000 | 0.641 |

| ISPIP1 | 1.000 | 0.713 | MS1 | 1.000 | 0.794 |

| ISPIP2 | 1.000 | 0.745 | MS2 | 1.000 | 0.809 |

| ISPIP3 | 1.000 | 0.701 | MS3 | 1.000 | 0.865 |

| ISPIP4 | 1.000 | 0.872 | MS4 | 1.000 | 0.718 |

| ISPIP5 | 1.000 | 0.804 | IAQ1 | 1.000 | 0.769 |

| AE1 | 1.000 | 0.790 | IAQ2 | 1.000 | 0.857 |

| AE2 | 1.000 | 0.790 | IAQ3 | 1.000 | 0.856 |

| AE3 | 1.000 | 0.881 | IAQ4 | 1.000 | 0.832 |

| AE4 | 1.000 | 0.827 | IAQ5 | 1.000 | 0.794 |

| AE5 | 1.000 | 0.864 | RBIEA1 | 1.000 | 0.726 |

| AE6 | 1.000 | 0.870 | RBIEA2 | 1.000 | 0.871 |

| AE7 | 1.000 | 0.888 | RBIEA3 | 1.000 | 0.836 |

| AE8 | 1.000 | 0.799 | RBIEA4 | 1.000 | 0.870 |

| AE9 | 1.000 | 0.833 | RBIEA5 | 1.000 | 0.912 |

| AE10 | 1.000 | 0.844 | ITT1 | 1.000 | 0.810 |

| AE11 | 1.000 | 0.846 | ITT2 | 1.000 | 0.801 |

| AE12 | 1.000 | 0.867 | ITT3 | 1.000 | 0.826 |

| AE13 | 1.000 | 0.821 | EAC1 | 1.000 | 0.855 |

| IE1 | 1.000 | 0.830 | EAC2 | 1.000 | 0.747 |

| IE2 | 1.000 | 0.814 | EAC3 | 1.000 | 0.888 |

| IE3 | 1.000 | 0.824 | EAC4 | 1.000 | 0.758 |

| Extraction Method: Principal Component Analysis. | |||||

| Table 3 Total Variance Explained | ||||||

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

| Total | % of Variance | Cumulative % |

Total | % of Variance | Cumulative % |

|

| PC1 | 19.888 | 27.622 | 27.622 | 19.888 | 27.622 | 27.622 |

| PC2 | 5.038 | 6.997 | 34.619 | 5.038 | 6.997 | 34.619 |

| PC3 | 4.337 | 6.024 | 40.643 | 4.337 | 6.024 | 40.643 |

| PC4 | 3.739 | 5.193 | 45.836 | 3.739 | 5.193 | 45.836 |

| PC5 | 3.266 | 4.536 | 50.373 | 3.266 | 4.536 | 50.373 |

| PC6 | 2.953 | 4.101 | 54.474 | 2.953 | 4.101 | 54.474 |

| PC7 | 2.626 | 3.647 | 58.121 | 2.626 | 3.647 | 58.121 |

| PC8 | 2.255 | 3.132 | 61.253 | 2.255 | 3.132 | 61.253 |

| PC9 | 2.033 | 2.823 | 64.076 | 2.033 | 2.823 | 64.076 |

| PC10 | 1.824 | 2.533 | 66.610 | 1.824 | 2.533 | 66.610 |

| PC11 | 1.617 | 2.246 | 68.855 | 1.617 | 2.246 | 68.855 |

| PC12 | 1.579 | 2.193 | 71.048 | 1.579 | 2.193 | 71.048 |

| PC13 | 1.445 | 2.007 | 73.055 | 1.445 | 2.007 | 73.055 |

| PC14 | 1.344 | 1.867 | 74.922 | 1.344 | 1.867 | 74.922 |

| PC15 | 1.295 | 1.799 | 76.721 | 1.295 | 1.799 | 76.721 |

| PC16 | 1.193 | 1.657 | 78.377 | 1.193 | 1.657 | 78.377 |

| PC17 | 1.116 | 1.550 | 79.928 | 1.116 | 1.550 | 79.928 |

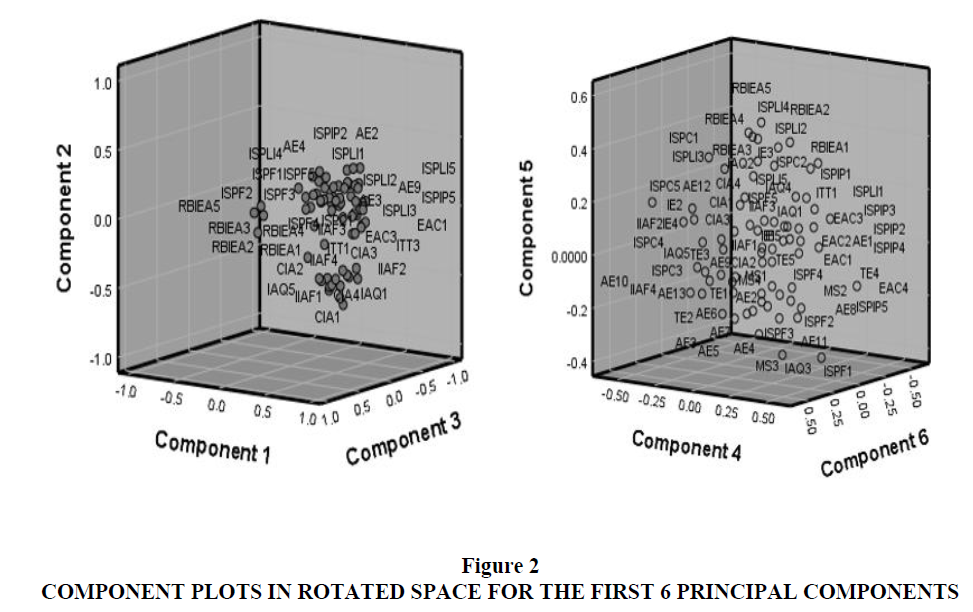

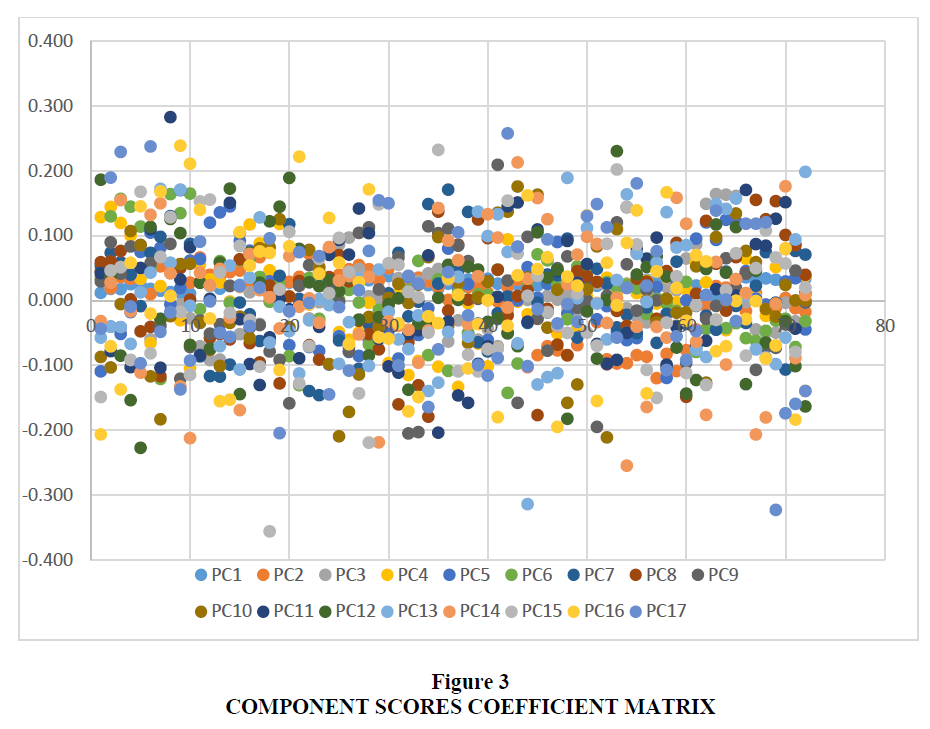

The scree plot confirms the choice of the 17 PC obtained Figure 1. The component plots for the first six components can be seen in the rotated space in Figure 2. The Cronbach alpha values of internal auditing determinants effectiveness examined in this study is 0.825 making it reliable. The distribution of each determinant in the component indicates the contributions to the PC identified as shown in the component scores coefficient matrix of Figure 3. The determinants were coded before PCA with this study aiming to investigate the determinants of internal auditing effectiveness in the context of higher learning institutions. The seven determinants relating to internal auditing effectiveness in a higher education institution are the following. Independence and objectivity, Competence of internal auditors, Management support, Internal audit quality, Relationship between internal and external auditors, Effective Audit Committee, Information Technology tools. However, for the attributes of these determinants to be clearly examined, it was important to first define and measure the institution performance indicator (IPI), which consisted of financial, customers, learning, innovation and internal process and their significance were obtained. After the IPI significance were obtained the effects of the internal audit on the performance indicators (PI) was obtained. This involved the automation effects, informational effects, and transformational effects. Subsequently, the determinants of internal auditing effectiveness on the HEIs PI were obtained and measured.

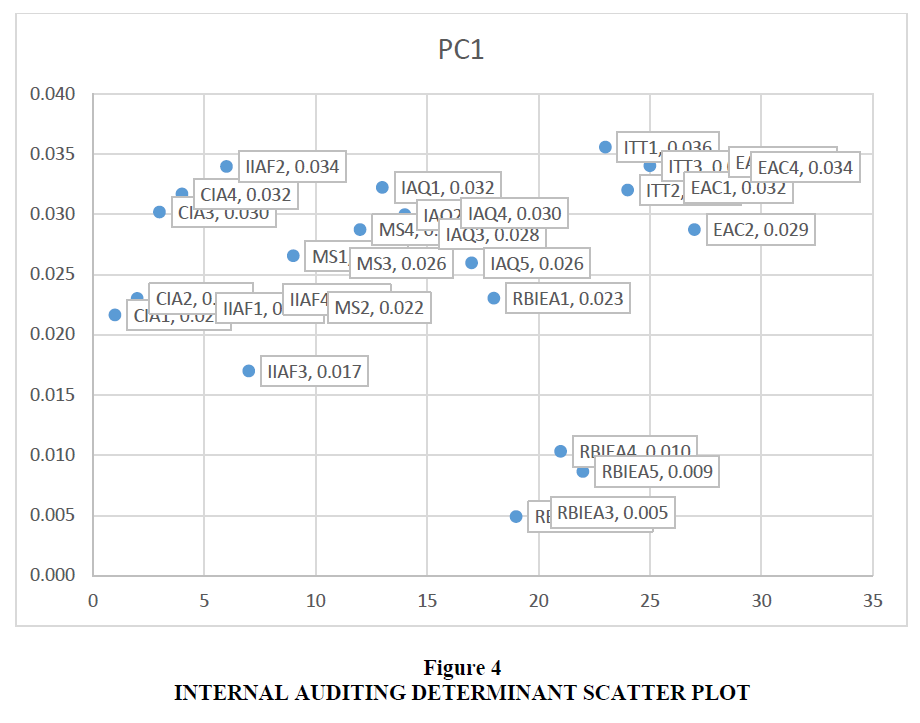

These determinants are the competence of internal auditors, internal auditing independence, management support, internal audit quality, relationship between internal and external auditors, information technology tools, and effective audit committee contributions can be seen in the PC identified. The component coefficient matrix shows their distribution weightings in the 17 identified determinants. PC represents the vital contributions of the determinants of internal auditing effectiveness in HEIs. In PC 1 the highest coefficient scores of 0.036, 0.032 and 0.034 were obtained for information technology tools used in the institution. The information technology tools had a high communalities value of 0.8 for the three variations presented. Implying that the effectiveness of this determinant in the institution is reliance on the knowledge of internal auditors on available technology-based audit techniques needed to perform their task (0.036 ITT1). Furthermore, the nature of the audit tools to speed up the internal audit process and increase an internal auditor level of productivity was also significant with values of 0.032 and 0.034 is seen to contributes to this determinant effectiveness within the institution (ITT2 and ITT3). The competency of internal auditors can be seen to be strongly present. Highlighting the strong effects of internal audits executed with modern technology that incorporate computerised data tools (CIA4) with a coefficient score of 0.032. The appropriate and relevant education that allows internal auditors to audit all system within the institution presented a high score of 0.030 (CIA3). The experience of internal auditors about the institution system and skills match against internal operations of the institution scores 0.023 and 0.020. A coefficient score of 0.034 was obtained for two attributes relating to the determinant of “effective audit committee”. These are for an effective audit committee that supports good governance in the institution and strengthens the risk management and internal controls throughout the internal audit (EAC3 and EAC4).

A score of 0.032 was obtained for the appointment and removal of audit firm handle by the auditing committee (EAC1) while a score of 0.029 was obtained for the mutual relationship between the audit committee and internal auditors within the institution. The internal audit quality is presented with a score that ranges from 0.028 to 0.032. Features of this determinant that aid the effectiveness of internal audit within the institution can be seen in the accomplished established objectives of internal audit (0.032, IAQ1), efficient performance of the audit work (0.030, IAQ2), and accuracy of the audit reports (0.030, IAQ4). The justification of the audit finding and communication of results between internal and external auditors present a low score in this determinant (0.028, IAQ3 and 0.026, IAQ5). There is a low coefficient score obtained for the determinants group management support (MS) and independent internal audit functions (IIAF) in the PC 1. A score within the minimum of 0.017 was presented in this group. This likely suggests that the effectiveness of these two internal auditing determinants is less substantial in the institution.

However, the independent internal audit function that entails internal audit participation in the development of the institution processes has stood out with a 0.034 coefficient score (IIAF2). Hence supported by a high extraction value of 0.736. Regardless of the high extraction value for the determinant, the relationship between an internal and external auditor (RBIEA) are seen to be less presented in this component because it falls below the 0.015 coefficient score. Only one feature can be seen in the upper quadrant, which highlights the effectiveness base on the sharing of working papers (0.023 RBIEA5). It can be ascertained from the PC1 that these determinants; information technology tools (ITT), competency of internal auditors (CIA), effective audit committee (AEC) and internal audit quality (IAQ) are the top influential determinants of internal audit effectiveness within the institution. The other determinants like management support (MS), independent internal audit functions and the relationship between internal and external auditors are relevant, but their effectiveness is minimal in the institution as shown in Figure 4.

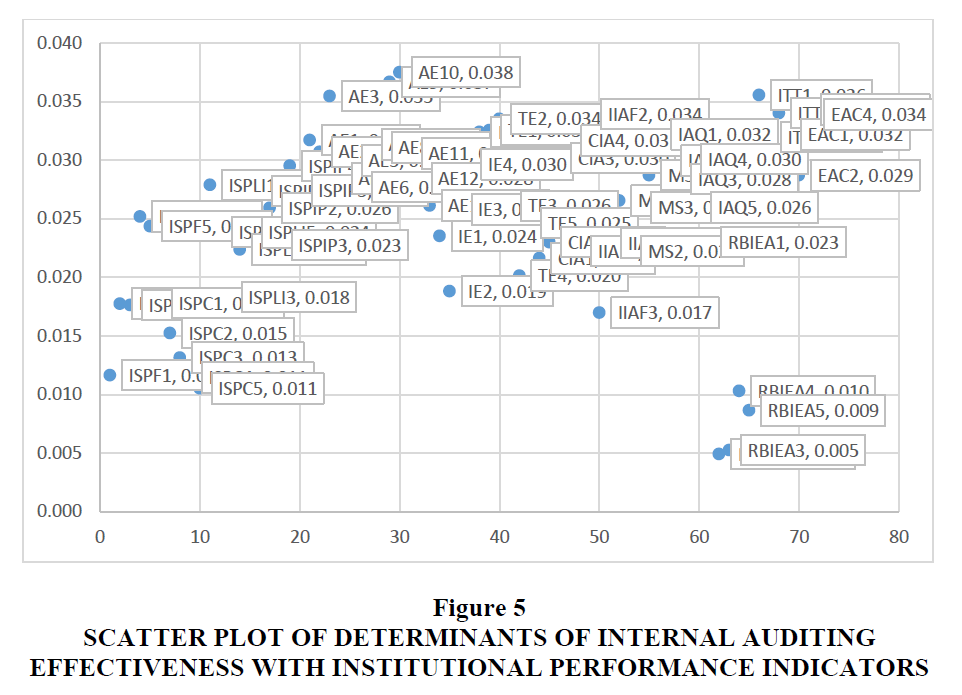

In addition, it is important to note that the institutional performance indicator and effects of internal audit present few support to the internal audit determinants of effectiveness in the form of internal process inter-functional cooperation (ISPIP4,0.030), automation effects related to better management processes that increase productivity ratio (AE1), staff rotation(AE2, 0.031), labour improvement(AE3, 0.035), centralised operations related to operational cost(AE4, 0.028), better cash flow(AE5, 0.030), effective utilisation of budget(AE6, 0.028), effective use of resources related to returns (AE7, 0.031), productivity ratio (AE8, 0.031), financial, operational and compliance improvement status related to processes that reduce operational delay (AE9, 0.037), reduce operational cost (AE10, 0.038) and increase adherence level of internal approved policies and procedures (AE11, 0.031), decrease risk of losing assets that decreases capital spending ratio (AE12, 0.028). The information effects that mitigate process error while procuring ways to increase the level of student and staff satisfaction (1E4, 0.030) and accuracy of finances (IE5, 0.032). The transformation effects that involve cross-functional competencies that encourage interfunctional cooperation (TE1, 0.033) and better qualification index (TE2, 0.034). The scatter plot shows the coefficient score for the determinants with the institution performance indicator and determinants of internal auditor effects on the indicator PC1 as shown in Figure 5.

Figure 5 Scatter Plot of Determinants of Internal Auditing Effectiveness with Institutional Performance Indicators

The validation of determinants for various functions in organisations has been alluded in the previous studies (D'onza et al., 2020; Epizitone & Olugbara, 2020; Ahmet, 2021). Similar studies have employed PCA method to validate the determinants of the maturity of internal auditing function (D'onza et al., 2020) and effectiveness (Ahmet, 2021). However, the results highlighted in their studies are the least influential determinants that have been identified in our study. In our study, information technology tools, competency of internal auditors, effective audit committee and internal audit quality were found to be the top influential determinants of internal audit effectiveness within the institution. The least influential determinants were management support, independent internal audit functions and relationship between internal and external auditors despite their relevant. These less influential determinants were identified in a similar study as the most influential (Ahmet, 2021). This differential indicates that the determinants of internal auditing effectives vary across diverse organisational settings. Our principal result mainly highlights the determinants for internal auditing effectives within the higher institution structure.

Conclusion

The research question of this study is what are the determinants of internal auditing effectiveness in the context of higher education institutions of learning? The riposte to this question was consummated through distinct phases that included the identification of internal audit measures of their effectiveness through the review of extant literature, identification of measures of performance in a public higher education institution and linking of internal auditing effects to the performance of a public higher education institution. The results obtained using the PCA identified 17 principal components that influence internal auditing effectiveness in a public higher education institution. The results also offer significant insight to both suppliers (auditor) of internal auditing services and customers of these services (auditee) regarding the significant determinants of internal audit effectiveness, the extent of internal audit effects, and significant performance indicators in a public higher education institution. By utilising the findings of this study, senior management (auditee) will be better positioned to understand the effects of internal auditing on their operations and be able to identify if these effects are weak or strong or and or absent as perceived by managers in dayto-day operations of the business.

The most influential determinants of internal auditing effectiveness can serve as a useful barometer to identify weaknesses and strengths of internal auditing function or outsourced auditing firm. This can enable an auditee to identify the extent to which value can be added to the local and global performance of an institution through automation, information, and transformation effects. Incorporating the effects of internal auditing on the performance of public higher education in this study shows the significance of having operations being internally audited. Moreover, the results of this study afford a yardstick for the management of the institutional unit audited to help identify and test the degree of significance of their performance indicators. In addition, while our primary result aligns concretely with the prior studies, it reveals distinctively the variance of internal audit effectiveness in different organisational platforms.

References

- Abou?El?Sood, H., Kotb, A., & Allam, A. (2015). Exploring auditors' perceptions of the usage and importance of audit information technology. International Journal of Auditing, 19(3), 252-266.

- Ahmet, O. (2021). Factors affecting the internal audit effectiveness: A research of the Turkish private sector organizations. Ege Academic Review, 21(1), 1-15.

- Al-Akra, M., Abdel-Qader, W., & Billah, M. (2016). Internal auditing in the Middle East and North Africa: A literature review. Journal of International Accounting, Auditing and Taxation, 26, 13-27.

- Alhajri, M.O. (2017). Factors associated with the size of internal audit functions: evidence from Kuwait. Managerial Auditing Journal, 32(1), 75-89.

- Ali, B.O. (2018). Factors influencing the effectiveness of internal audit on organizational performance. International Journal of Advanced Engineering, Management and Science, 4(4), 219-226.

- Alkebsi, M., & Aziz, K.A. (2018). Information technology usage, top management support and internal audit effectiveness. Asian Journal of Accounting and Governance, 8, 123-132.

- Alzeban, A., & Gwilliam, D. (2014). Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. Journal of International Accounting, Auditing and Taxation, 23(2), 74-86.

- Arena, M., & Azzone, G. (2009). Identifying organizational drivers of internal audit effectiveness. International Journal of Auditing, 13(1), 43-60.

- Epizitone, A., & Olugbara, O. (2020). Principal component analysis on morphological variability of critical success factors for enterprise resource planning. International Journal of Advanced Computer Science and Applications (IJACSA), 11(5).

- Baharud-din, Z., Shokiyah, A., & Ibrahim, M.S. (2014). Factors that contribute to the effectiveness of internal audit in public sector. International Proceedings of Economics Development and Research, 70, 126.

- Barisic, I., & Tusek, B. (2016). The importance of the supportive control environment for internal audit effectiveness - the case of Croatian companies. Economic Research-Ekonomska Istrazivanja, 29(1), 1021-1037.

- Coetzee, P., & Erasmus, L.J. (2017). What drives and measures public sector internal audit effectiveness? Dependent and independent variables. International Journal of Auditing, 21(3), 237-248.

- Bern, C. R., Walton-Day, K., & Naftz, D.L. (2019). Improved enrichment factor calculations through principal component analysis: Examples from soils near breccia pipe uranium mines, Arizona, USA, Environmental pollution, 248, 90-100.

- Dellai, H., & Omri, M.A.B. (2016). Factors affecting the internal audit effectiveness in Tunisian organizations Research Journal of Finance and Accounting, 7(16), 208-221.

- Demeke, T., Kaur, J., & Kansal, R. (2020). The practices and effectiveness of internal auditing among public higher education institutions, Ethiopia. American Journal of Industrial and Business Management, 10(07), 1291.

- Dittenhofer, M. (2001). Internal audit effectiveness: An expansion of present methods, Managerial Auditing Journal, 16(8), 443?50.

- Dwivedi, Y.K., Wastell, D., Laumer, S., Henriksen, H.Z., Myers, M.D., Bunker, D., & Srivastava, S.C. (2015). Research on information systems failures and successes: status update and future directions. Information Systems Frontiers, 17(1), 143-157.

- Erasmus, L., & Coetzee, P. (2018). Drivers of stakeholders’ view of internal audit effectiveness: management versus audit committee. Managerial Auditing Journal, 33(1), 90-114.

- Eulerich, M., Henseler, J., & Köhler, A.G. (2017). The internal audit dilemma – the impact of executive directors versus audit committees on internal auditing work. Managerial Auditing Journal, 32(9), 854-878.

- George, D., Theofanis, K., & Konstantinos, A. (2015). Factors associated with internal audit effectiveness: evidence from Greece. Journal of Accounting and Taxation, 7(7), 113-122.

- Henderson, D.L., Davis, J.M., & Lapke, M.S. (2013). The effect of internal auditors’ information technology knowledge on integrated internal audits. International Business Research 6(4), 1-17.

- Institute of Internal Auditors. (2017). The international professional practices framework, Institute of Internal Auditors. In Altermonte

- Springs, Fl. Lenz, R., & Hahn, U. (2015). A synthesis of empirical internal audit effectiveness literature pointing to new research opportunities. Managerial Auditing Journal, 30(1), 5-33.

- Lenz, R., Sarens, G., & Hoos, F. (2017). Internal audit effectiveness: Multiple case study research involving chief audit executives and senior management. EDPACS, 55(1), 1-17.

- Mat Zain, M., Zaman, M., & Mohamed, Z. (2015). The effect of internal audit function quality and internal audit contribution to external audit on audit fees. International Journal of Auditing, 19(3), 134-147.

- Mensah, O.A., Ngwenya, B., & Pelser, T. (2020). Investigating the impact of antecedents of internal audit function effectiveness at a private university in Ghana. Acta Commercii, 20(1), 1-11.

- D'onza, G., Sarens, G., & DeSimone, S. (2020). Factors that influence the internal audit function's maturity. Accounting Horizons, 34(4), 57-74.

- Oriakhi, S. (2020). Determinants of internal auditing effectiveness in tertiary institutions. Indonesian Journal of Contemporary Accounting Research, 2(1).

- Oussii, A.A., & Boulila, N.T. (2018). The impact of internal audit function characteristics on internal control quality. Managerial Auditing Journal, 33(5), 450-469.

- Pham, D.C., & Nguyen, T.T. (2021). Factors affecting the internal audit effectiveness of steel enterprises in Vietnam. The Journal of Asian Finance, Economics, and Business, 8(1), 271-283.

- Pizzini, M., Lin, S., & Ziegenfuss, D.E. (2015). The impact of internal audit function quality and contribution on audit delay. Auditing: A Journal of Practice & Theory, 34(1), 25-58.

- Rudhani, L.H., Vokshi, N.B., & Hashani, S. (2017). Factors contributing to the effectiveness of internal audit: Case study of internal audit in the public sector in Kosovo. Journal of Accounting, Finance and Auditing Studies, 3(4), 91-108.

- Salehi, T. (2016). Investigation factors affecting the effectiveness of internal auditors in the company: Case study Iran. Review of European Studies, 8(2), 224-235.

- Shamki, D., & Alhajri, T.A. (2017). Factors influence internal audit effectiveness. International Journal of Business and Management, 12(10), 143-153.

- Sobel, P.J., Anderson, U.L., Head, M.J., Ramamoorti, S., Salamasick, M., & Riddle, C. (2017). Internal auditing: Assurance & advisory services (4th edition ed.): Institute of Internal Auditors, The IIA Research Foundation.

- Wang, I.Z., & Fargher, N. (2017). The effects of tone at the top and coordination with external auditors on internal auditors’ fraud risk assessments. Accounting & Finance, 57(4), 1177-1202.

- Wu, T.H., Huang, S.M., Huang, S.Y., & Yen, D.C. (2017). The effect of competencies, team problem-solving ability, and computer audit activity on internal audit performance. Information Systems Frontiers, 19(5), 1133-1148.

- Zaman, M., & Sarens, G. (2013). Informal interactions between audit committees and internal audit functions: Exploratory evidence and directions for future research. Managerial Auditing Journal, 28(6), 495-515.