Research Article: 2018 Vol: 22 Issue: 5

Determinants of Saudi Takaful Insurance Companies Profitability

Abdelkrim Ahmed Guendouz, King Faisal University

Saidi Ouassaf, King Faisal University

Abstract

The purpose of this paper is to investigate the main internal factors affecting the profitability of insurance Takaful companies in an Islamic insurance system. We collected the data from the quarterly reports of the six largest Saudi Takaful Insurance companies for the period 2010-2016, which represents more than 60% of the total assets of the Insurance market. Panel data techniques, namely, pooled ordinary least squares, fixed effects and random effects, were used to estimate the relationship between return on policyholders as a proxy of insurance company profitability and company-specific variables such as age, size, loss ratio, the rate of retention, risk level, and the written premium growth rate. The regression results indicate that age, size, written premium growth rate and loss ratio, have significant effects on the profitability of insurance Takaful companies. Many studies were conducted to determine variables affecting insurance Takaful companies profitability, but most of them were concerned with mixed insurance systems, in which conventional and Shariah-compliant companies operate together. A lack in studies dedicated to examining the fully Shariah-compliant system is obvious. Therefore, our study contributes to filling this gap in the literature by exploring the factors affecting the profitability of Takaful insurance companies in a full Shariah-compliant insurance sector.

Keywords

Takaful, Insurance, Profitability, Saudi Arabia, Panel Data.

JEL Codes

G22, C01, C23.

Introduction

During the last two decades, the global Takaful industry has shown a significant growth potential by maintaining its double-digit growth rate (cumulative annual growth rate of 20%). The sector is projected to reach USD 86 billion by 2022, from USD 31 billion in 2012, signifying the massive opportunities the sector harbors (Thomson Reuters, 2017). Saudi Arabia and Malaysia have led the market with a share of 40% and 25% consecutively. The former’s Takaful insurance sector has shown a flourished era during the last few years, with the support of improvement in the regulatory environment and enforcement of the compulsory insurance, as a result of the population growth, increasing number of workers in the private sector, and higher number of vehicles, along with mounting awareness of the insurance’s importance. These changes resulted in an arithmetic growth rate in the insurance sector with 33 listed insurers in the Saudi Stock Market by the end of 2017, which operate at least in one of the three major insurance lines: health insurance, general insurance, and protection and saving insurance (life insurance). It is also expected that with the 2030 vision, in which the government's direction to strengthen the non-oil sector will provide growth opportunities for the insurance sector as a whole. However, the sector is characterized by a huge concentration, in which three companies (Tawuniya, Bupa Arabia, and MedGulf) own 52% of the market share of the insurance industry.

A specific characteristic of the Saudi insurance sector is that all Saudi insurers operate under the Takaful system or Islamic cooperative insurance scheme as it is provided within the article establishment of the National Company for Cooperative Insurance promulgated by Royal Decree M/5 (1984), and in accordance with the principles of Islamic Shariah. According to the requirements of the Monetary Authority (Saudi Arabian Monetary Authority) “10% of the net surplus shall be distributed to the policy holders directly, or in the form of reduction in premiums for the next year. The remaining 90% of the net surplus shall be transferred to the shareholders’ income statement,’. In a Takaful Insurance system, the company’s financial statements shall consist of separate statements of financial position, profit and loss statements and statements of cash flows for both: insurance operations (policy holders) and shareholders. Due to this unique accounting and financial system, the profitability of the industry has always been difficult to be measured as compared with conventional insurance companies and other financial institutions. The core objective of this study is to investigate the firm-specific determinants of profitability of the Takaful insurance companies in Saudi Arabia.

The Takaful insurance industry whether in a fully cooperative system like in Saudi Arabia or in a mixed insurance system like in the United Arab Emirates or Malaysia is confronting many challenges like its relative novelty compared to conventional insurance, financial and regulatory risks and increasing competition. It became very important to determine and define the most important factors affecting the profitability of the Takaful insurance industry to determine the response of this industry towards the said challenges, which predicted the survival of the firm in the industry. Many studies were conducted to determine variables affecting insurance Takaful companies profitability, but most of them were concerned with mixed insurance systems, in which conventional and Shariah-compliant companies operate together. A lack in studies applications on a fully Shariah-compliant system is obvious. Therefore, we hope our study contributes to more comprehension of Takaful insurance profitability in a full Shariah-compliant insurance sector. As all Saudi insurance companies are Takaful insurance, our results are expected to enhance the understanding of internal factors affecting that kind of insurance companies. It may also, help the Saudi Arabian Monetary Authority in establishing guidance requirements especially with the changes and difficulties facing some insurance companies. We expect also that the findings of the study will provide important policy implications for investors, regulators, and other market participants, and enhance the understanding of Takaful insurance system and its performance and profitability motives.

This paper will proceed as follows: in Section 2 we provide a theoretical background on Takaful insurance and the structure of insurance market in Saudi Arabia; Section 3 reviews the available literature on the effects of firm-specific factors on Takaful insurance’ profitability especially empirical works. Section 4 describes the data and statistical approach; Section 5 provides empirical results and discussions. The conclusion and implications are in Section 6.

Theoretical Background

Takaful Vs. Conventional Insurance

Takaful is an Arabic word origin, literally means "mutual obligation" or "solidarity". On an institutional basis, it means a cooperative system of compensation in case of damage, organized as a Shariah1 compliant alternative to conventional insurance, grounded by the principles of donation (Tabarru') (Billah, 2003), which Takaful proponents believe contains forbidden Riba (usury) and Gharar (excessive uncertainty) (Khan, 2013). In this type of insurance, the insurer should operate based on the principles of solidarity and cooperation (El? Gamal, 2007), and members contribute money into a pooling system in order to guarantee each other against loss or damage, with clear segregation between participant and operator (Alamasi, 2010). The purpose of this system is not profits. The principles of Takaful are as follows: policyholders cooperate among themselves for their common good and contribute by donations to the fund, so every policyholder pays his subscription to help those who need assistance. Losses are, then, divided, and liabilities spread according to the community pooling system. This system eliminates Gharar (Uncertainty) as Gharar does not affect donation contracts (Tabarru'2) (Al-Dharir, 1997), and does not derive advantage at the cost of others.

There are several differences between Takaful and conventional insurance. However, the main difference is that the method of dealing with the surplus. In Takaful insurance, the surplus is distributed among policyholders and shareholders based on Mudharaba3, Wakalah4 (Khorshid, 2004; Noordin, 2013), or Waqf (Abdi, 2007).

Why is Conventional Insurance Prohibited in Islamic Law (Shariah)?

There are two main reasons why conventional insurance is prohibited in Islamic Law (Shariah); that are Gharar (Excessive Uncertainty) and Riba (Usury). Gharar is a significant concept in Islamic Economics and can be defined as an element of risk, uncertainty, or hazard that could render a contract void (Al-Saati, 2003). In Islamic finance, Gharar is prohibited in general, as there are strict rules in Islamic finance against transactions that are highly uncertain or that may cause any injustice or deceit against any of the parties. A Gharar-associated contract is one that contains a degree of risk on the part of any of the counterparties in a way that could lead him for losing part or all of some counter value, right, etc. In the conventional financial industry, an insurance contract is basically a contract of exchange, i.e. buying and selling, whereby policy (indemnity) is sold as goods, with the premium as the price. The price must be certain for an exchange contract. Uncertainty (Gharar) in insurance contracts pertains to “deliverability’ of subject matter. That is, there is the uncertainty as to whether the insured will get the compensation, which has been promised by the insurance company, or not, as well as how much the insured will get and when will the compensation be paid. Thus, conventional insurance involves an element of uncertainty in the subject matter of the Insurance Sales Contract, which renders it void under the Islamic law.

Prohibition of Riba (Usury) is a basic principle in Islamic financial ethics and law. Like (Gharar), Riba is an Arabic word origin, which means: increase. In Islamic Jurisprudence, it means "surplus value without counterpart" (Kettell, 2011) or the extra wealth earned without any benefit for gain. In Islam, all contracts and transactions must be free from elements of Riba. Insurance funds are invested in financial instruments, which contain the element of Riba (Treasury Bills, Bonds, Deposits…). There are other elements of conventional insurance prohibition, from which, it is not mutually beneficial, as certain individuals (shareholders) benefit at the expense of others.

Saudi Insurance Sector Structure

The Saudi Insurance consists of three business lines: health insurance, protection and savings insurance, and general insurance. It operates under the Takaful system or Islamic cooperative insurance scheme and considered as the largest insurance market in the Middle East and North Africa region. In 2016, Gross Written Premiums (GWP) reached USD 9.83 Billion, up from USD 7.9 Billion in 2014. This represents an increase of more than 20%. The GWP of health insurance represents 51% of the insurance market, dominating the sector, followed by the GWP of general insurance, which represents 46% of the insurance market. Finally, the GWP of protection & savings (P&S) insurance represents 3% of the insurance market (Albarrak, 2018). The general insurance sector is the largest sector on an activities and products basis. It is characterized by a relatively medium concentration of companies. Tawuniya retains its position as the largest insurer in terms of gross premiums. It captured around 20% of the market. The health insurance captured 48.2% of the total market size with 27 listed insurers. However, the largest companies (Bupa Arabia, Tawuniya, and Medgulf) have continued to dominate the health insurance sector, as they combined generated around 81% of the total market premiums. The other seven largest companies seized only 11.6% of the market share, leaving just 7.4% for the remaining 17 listed insurers. This clearly indicates that most insurers are unable to compete with larger peers in an overcrowded market. The share of protection and savings insurance is the lowest among all other insurance segments, which represents just 3% of overall gross written premiums. The low market share for the protection and savings insurance is attributed to several factors including, the modernity of the Saudi insurance sector, poor savings culture, in addition to religious considerations of many categories of the community towards the protection and savings products as illegal. The protection and savings insurance market consists of 11 insurers. Yet, the top three companies held over 75% of the market by the end of 2016. The remaining eight insurers write only about 25% of the gross premiums in the market. Furthermore, some insurers in this sector are characterized by specialization in specific products but lack the scale to operate successfully in overcrowded and highly competitive markets.

Essential elements of analyzing insurance industry are insurance penetration and insurance density. Insurance penetration equals GWP divided by the total GDP. Over the past five years, insurance penetration has increased at a Compounded Annual Growth Rate (CAGR) of 19%. In 2016, insurance penetration increased to 1.54% up from 1.49% in 2015, due to a decrease in GDP and slightly increase in GWP. Insurance penetration of non-oil GDP is defined as Gross Written Premiums divided by non-oil GDP. In 2016, insurance penetration of non-oil GDP was 2.06%. Insurance penetration of non-oil GDP has increased at an average annual rate of 7% between 2012 and 2016. Insurance density is defined as Gross Written Premiums per Capita. It decreased from USD 316 per Capita in 2015 to USD 309 per capita in 2016, which represents a 2.2% decrease. Expenditures per Capita on insurance products have increased by an average annual rate of 12% between 2012 and 2016. The density of protection and savings insurance remained low in absolute terms, and relative to general and health insurance, at almost USD 1 per capita.

Literature Review

It is well known in the financial literature that profitability is the main goal of any corporation and that is the best measure of success and efficiency (Borlea & Achim, 2010). However, there is no consensus about the best measure of evaluating profitability. This noconsensus shifts to be a serious difficulty when evaluating Takaful insurance companies where there are a unique financial disclosure and financial statements as described in the first section. Some scholars argue that there are three measures that can be considered as a profitability measure for Takaful insurance companies: overall profit, Underwriting Profit, and Investment Income (Rashid & Kemal, 2018).

Conventional Insurance Profitability Determinants

The literature review of profitability in the insurance industry shows that there is some kind of consensus on the effect of some variables on Insurance Profitability. Many studies suggest a positive effect of age (Alomari & Azzam, 2017; Batrinca & Burca, 2014; Kaya, 2015), Size (Almajali et al., 2012; Alomari & Azzam, 2017; Batrinca & Burca, 2014; Bilal et al., 2013; Jibran et al., 2016; Kader et al., 2010; Liargovas & Skandalis, 2010; Malik, 2011; Mehari & Aemiro, 2013; Orty?ski, 2016; Rashid & Kemal, 2018), Capital structure (Malik, 2011), Liquidity (Almajali et al., 2012; Bilal et al., 2013; Boadi et al., 2013).

The previous findings are consistent with the financial and economic logic, as profitability is likely to be increased with the increase in the size and age of the company. That is, as time passes, and size grows, the company becomes more market-driven, gaining more customers, becoming more cost-effective, more economic scale advantage and thus more profitable. However, there is a large dispute on the effect of Leverage, in which some findings suggest a positive effect on profitability (Almajali et al., 2012; Boadi et al., 2013; Mwangi & Murigu, 2015). On the other hand, some studies suggest a negative effect (Batrinca & Burca, 2014).

Another important firm-specific factor, which is in relation with the main role of an insurance company, is the written premium growth rate. While it is generally accepted in the literature of insurance that written premium growth leads to more profits (Akotey et al., 2013; Jibran et al., 2016; Kaya, 2015; Orty?ski, 2016), other results show a negative impact of written premium growth and profitability (Chen & Wong, 2004). In fact, it seems to be logic and justified result by the fact that a large expansion of the actuarial activity leads to self-destruction, as the company may not be able to comply with all insured.

Finally, the factor of loss ratio (Net claims incurred to Net earned premiums) has been found to be negatively associated with the insurance profitability (Kaya, 2015; Mehari & Aemiro, 2013). Companies with a higher loss ratio have a lower profitability ratio and similarly, a lower sales profitability ratio.

Takaful vs. Conventional Insurance Profitability Determinants

If the literature review of insurance companies' profitability determinants shows a diversity in methods used, markets, data, and periods analyzed, there is a scarcity of studies interested in Takaful profitability determinants.

Akhtar, (2018) analyzes the performance of Takaful and conventional insurance companies in Saudi Arabia during the period of 2010-2015 by using the Data Envelopment Analysis (DEA) technique for the whole population of insurance companies. The results of the study reveal that both Takaful and the larger conventional insurance firms in the country need to strengthen their operations more efficiently in order to take advantage of the economies of scale and scope, and that the market share and profitability are important determinants of efficiency.

The paper of (Karbhari et al., 2018) examines the relationship between corporate governance attributes and technical and scale efficiencies of the Takaful Insurance operators in the Middle East North Africa (MENA) and the Southeast East Asian (ASEAN) region. Using alternative estimators for efficiency, the results show that Takaful operators are inefficient suggesting the presence of widespread managerial lethargy and operational inefficiency. Additional analyses indicate that board size, organizational age, regulatory jurisdiction and firm size have a positive relationship with technical efficiency.

Abduh & Zein Isma, (2017) empirically study firm-specific and economic factors affecting solvency of Takaful companies in Malaysia for the period 2008-2012. Equity-to-asset and equity-to-technical reserve ratio are used to measure solvency. Meanwhile, profit rate, Islamic index, company size, risk retention, contribution growth, investment income, Takaful leverage, liquidity and expenses are the independent variables. The determinants that are positively related to Equity-to-Asset Ratio (EAR) of family Takaful include contribution growth, investment income, Takaful leverage, liquidity and Islamic equity index. Company size, risk retention, expenses and profit rate are negatively related to EAR of Takaful. Equity-to-technical reserves ratio (ETR) of Takaful are positively related to risk retention, contribution growth, investment income, Takaful leverage, profit rate and Islamic equity index. The other variables including company size, liquidity, and expenses are negatively related to ETR of Takaful.

Alhassan et al. (2015) examine the impact of the regulatory-driven market structure on firm pricing behavior by testing the Structure-Conduct-Performance (S-C-P) hypothesis for both life and non-life insurance markets in Ghana. Using a panel data on 36 insurers from 2007 to 2011, the authors employed the Herfindahl Hirschman Index and Concentration Ratio as Proxies for the C-R-P hypothesis while efficiency scores were estimated using the data envelopment analysis technique to proxy for the Efficient Structure (ES) hypothesis. The dependent variable, profitability was measured as return on assets while controlling for size, underwriting risk, leverage, GDP growth rate and inflation. The results from the empirical estimation provide ample evidence in support for ES hypothesis for both life and non-life insurance markets, and also point to an increasing level of competition in both life and non-life insurance industry though they still remain concentrated with the life insurance sector having high levels of efficiency compared to the non-life sector.

Al-Amri, (2015) analyses the performance of the Takaful insurance firms in the Gulf Cooperation Council (GCC) countries using Data Envelopment Analysis (DEA) methodology. His findings suggest a highly technical and pure technical efficient of the Takaful insurance industry in GCC but moderately cost efficient with large opportunity for improvement. United Arab Emirates and Qatar score the highest technical efficiency, while Saudi Arabia and UAE are the most cost efficient among the GCC countries.

Kader et al. (2010) examined the cost efficiency of non-life Takaful insurance firms operating in 10 Islamic countries. Their findings suggest positive effects of board size, firm size and product specialization on the cost efficiency of Takaful insurers.

To sum up, there are few papers using quantitative models to analyze the profitability of Insurance Takaful companies. In fact, several factors determine the profitability of an insurance company, however, there is no consensus on which factors are more significant. Furthermore, while most studies emphasize conventional insurance companies, our study examines the profitability determinants of the Takaful insurance companies. Some specific characteristics of our study that make contributions to the current literature are:

1. It deals with a unique insurance sector in which all insurers operate under the Takaful system or Islamic cooperative insurance scheme.

2. The data is collected on a quarterly basis.

Data And Methodology

As the Saudi Takaful insurance market is characterized by a sharp concentration, even though it counts 33 listed companies, we set some criteria to choose our sample: (a) we excluded any insurance company with less than 3.5% share of the total assets of the insurance sector; (b) we excluded companies established before 2009 as our study covers 2010-2016. There are six companies that fit the criteria. Table 1 shows the companies sample, their total assets, market share and their activity starting date.

| Table 1 SAMPLE OF THE STUDY |

||||

| Insurer | Total Assets (106 USD) | Market Share (*) | Starting Date | |

| The Company for Cooperative Insurance (Tawuniya) | TAWU | 2,657 | 25.01% | 1986 |

| The Mediterranean and Gulf Insurance and Reinsurance (MedGulf) | MEDG | 1,496 | 14.08% | 2006 |

| Bupa Arabia for Cooperative Insurance (Bupa Arabia) | BUPA | 739 | 6.96% | 2008 |

| Malath Cooperative Insurance Co. (Malath Insurance) | MALA | 462 | 4.34% | 2008 |

| Allianz Saudi Fransi Cooperative Insurance (Allianz SF) | ALLZ | 394 | 3.70% | 2007 |

| Trade Union Cooperative Insurance (Trade Union) | UNIO | 385 | 3.62% | 2008 |

| Total | 6,133 | ~ 60% | ||

(*) Based on total assets of Insurance Sector.

Of the 33 insurance companies listed on the Tadawul Market (Saudi financial market), and after excluding companies that did not fit the criteria, only six insurance companies are considered in this research. The study is mainly conducted based on secondary data to evaluate the profitability of Takaful insurance companies in Saudi Arabia. It covers seven years period with quarterly data from Q1 2010 to Q4 2016.

Variables and Data

To examine the impact of firm characteristics on profitability as measured by the Return on Assets (ROA), the following variables were chosen based on the existing literature and data availability. Table 2 provides the definitions and measurements of all variables used in this study.

| Table 2 DEFINITION AND MEASUREMENT OF VARIABLES |

||

| Variables | Definition | Measurement |

| Dependent Variable | ||

| Profitability (ROA) | Return on Policyholders Assets. In a Takaful insurance company, the best ratio measuring profitability is the return on Policyholders (Participants) assets. | Net Income (Loss)/Policyholders Assets |

| Independent Variables | ||

| Age of company (AGE) | This variable is measured as the number of years from the date of establishment | |

| Size of company. In this study, we used both: Policyholders and shareholders Assets. | ||

| Assets of Shareholders (SAS) | Shareholders Assets | Natural log of Shareholders Assets |

| Assets of Policyholders (PAS) | Policyholders Assets | Natural log of Policyholders Assets |

| Loss ratio (LOS) | This variable is measured as the ratio of incurred claims to earned premiums. | Loss ratio=Net claims incurred/Net earned premiums |

| Rate of Retention (RTN) | Rate of Retention: Net Premium Earned/Gross Premium Written | |

| Risk Level (RSK) | This ratio reflects the company's ability to meet expected fluctuations in the original risk results covered by the insurance portfolio. The objective is to clarify the amount of premiums subscribed as a liability and the corresponding capital and capital reserves (surplus or total equity). | Net Premium Earned/Net Surplus |

| Underwritings (WPG) | This is the written premium growth rate | (written premium for Q2/ written premium for Q1)-1 |

Like any insurance company, the size of a Takaful insurance company has an important impact on profitability. However, as mentioned earlier, the Takaful insurance company has two balance sheets, one for policyholders, and the other for shareholders. In our study, we considered the return on policyholders as a proxy of the whole company profitability, as the major source of revenue of Takaful Company (Investment income and underwriting income) comes from policyholders' assets.

Methodology

In this research, we rely on the preliminary data analysis tools such as panel unit root test to identify the determinants of profitability of Saudi Arabia's cooperative insurance companies (return on assets).

Findings and Discussions

Descriptive statistics analysis

Table 3 provides a summary of the descriptive statistical analysis for the sample study.

| Table 3 DESCRIPTIVE STATISTICAL ANALYSIS |

|||||||||

| Comp | Variable | ROA | SAS | PAS | Age | EPG | RSK | LOS | RTN |

| TAWU | Mean | 0.0143 | 8.8278 | 7.7764 | 27.625 | 0.2374 | 22.3526 | 0.7559 | 0.7945 |

| St. dev. | 0.01121 | 0.21324 | 0.31135 | 2.05649 | 0.40304 | 32.6095 | 0.09906 | 0.10119 | |

| C.V.% | 78.46 | 2.42 | 4 | 7.44 | 170 | 145.89 | 13.1 | 12.74 | |

| BUPA | Mean | 0.0235 | 10.6948 | 1.6535 | 5.625 | 0.3037 | 52.7051 | 1.0081 | 0.9517 |

| St. dev. | 0.02204 | 3.05402 | 0.40643 | 2.05649 | 0.55536 | 210.81983 | 0.38717 | 0.12871 | |

| C.V.% | 93.84 | 28.56 | 24.58 | 36.6 | 183 | 400 | 38.4 | 13.52 | |

| MEDG | Mean | 0.0137 | 12.1234 | 11.0194 | 6.625 | 0.1739 | 28.6828 | 3.6414 | 0.7451 |

| St. dev. | 0.01349 | 3.2633 | 3.52831 | 2.05649 | 0.30895 | 58.88999 | 2.4999 | 0.13745 | |

| C.V.% | 98.68 | 26.92 | 32.02 | 31 | 178 | 205.31 | 68.7 | 18.45 | |

| MALA | Mean | 0.0182 | 6.9518 | 5.7016 | 6.375 | 0.3197 | 41.7007 | 0.8073 | 0.7793 |

| St. dev. | 0.07675 | 0.48073 | 0.09709 | 2.05649 | 0.62219 | 107.68524 | 0.19453 | 0.1649 | |

| C.V.% | 420.7 | 6.92 | 1.7 | 32.3 | 195 | 258.23 | 24.1 | 21.16 | |

| ALLZ | Mean | 0.0022 | 10.9399 | 9.1507 | 6.375 | 0.1508 | 33.0032 | 0.6064 | 0.5971 |

| St. dev. | 0.00194 | 3.20294 | 3.37184 | 2.05649 | 0.18813 | 35.11727 | 0.1465 | 0.14707 | |

| C.V.% | 87.24 | 29.28 | 36.85 | 32.3 | 125 | 106.41 | 24.2 | 24.63 | |

| UNIO | Mean | 0.0109 | 14.5453 | 13.6766 | 5.375 | 0.2113 | 25.7069 | 0.8063 | 0.6938 |

| St. dev. | 0.01916 | 6.82593 | 6.99698 | 2.05649 | 0.40253 | 43.03697 | 0.14548 | 0.11395 | |

| C.V.% | 176.5 | 46.93 | 51.16 | 38.3 | 191 | 167.41 | 18 | 16.42 | |

Tests for the Stationarity Time Series and Autocorrelations

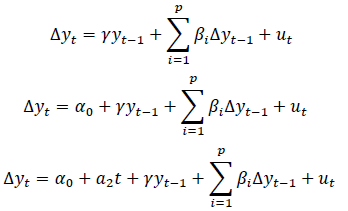

To test the Stationarity time series for ROA and determine autocorrelation by determining whether the time series has the unit root or not, we have used two tests:

Augmented Dickey-Fuller Test

Suggesting an amendment to this test is needed to include additional mutations for the dependent variable in order to eliminate the autocorrelation. The length of the decomposition in the three cases is determined by either the Akaika Information Criterion (AIC) or the Schwartz Bayesian Criterion (SBC) or by Lagrange Multiplier; the three possible cases are given by the following equations:

Phillips-Perron Test

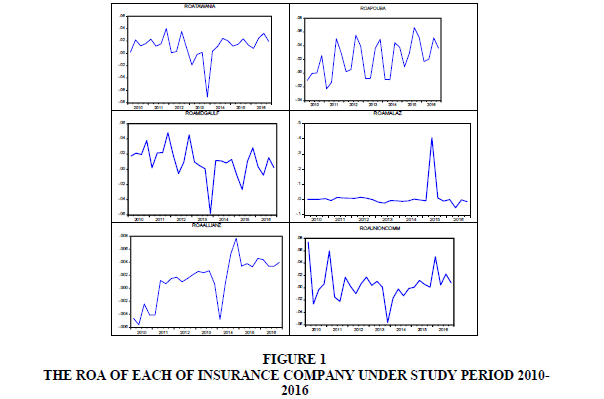

Distribution of the Augmented Dicky-Fuller Test Assumptions that the error limit is statistically independent and contains a constant variation. Therefore, using the Augmented Dicky- Fuller, we must make sure that the error limit is not correlated and that it contains a constant variation. A generalization of the Augmented Dicky-Fuller, Phillips-Perron allows for autocorrelation at the error limit. The method of Philip Peron is to modify the Dicky-Fuller tstatistic to take into account the limitations to the extent of error. The ROA of each insurance company under study was drawn up during the period 2010-2016 as shown in Figure 1.

It is clear that the return on assets of both Bupa and Allianz companies may have an autocorrelation or a general trend. Therefore, test the Stationarity time series for ROA and determine the autocorrelation were used. The results were as follows:

From the Table 4:

| Table 4 RESULTS OF AUGMENTED DICKEY-FULLER TEST AND PHILLIPS-PERRON TEST |

||||

| Company | Augmented Dickey-Fuller test | Phillips-Perron test | ||

| t-Statistic | P-value | t-Statistic | P-value | |

| TAWU | -3.3191 | 0.0018 | -3.286 | 0.0027 |

| BUPA | 0.1898 | 0.7325 | -3.569 | 0.0009 |

| MEDG | -3.7102 | 0.0006 | -3.698 | 0.0006 |

| MALA | -5.013 | 0.0000 | -5.013 | 0.000 |

| ALLZ | -1.9237 | 0.0533 | -1.7882 | 0.0704 |

| UNIO | -6.3315 | 0.0000 | -6.258 | 0.0000 |

1. The calculated values for statistic the Augmented Dickey-Fuller test were all less than the tabulated values at a significant level of 0.05 except for Bupa and Allianz where they reached 0.1898 and -1.9237 which is larger than the value of -1.94. Also, the p-value is less than 0.05 which means rejecting the null hypothesis, and thus there is no autocorrelation (i.e. the time series of return on assets for each of the TAWU, MEDG, MALA, and UNIO is Stationary), while in Bupa and Allianz are greater than 0.05, meaning that they have autocorrelation, i.e. the time series is non- stationarity.

2. The results of the Phillips-Perron test indicate that the time series of the return on the assets of the insurance companies is stable except for Allianz only since the significance of the test has 0.0704 that is greater than 0.05, which means that there is an existence of autocorrelation.

From the above, we can count on the results of Phillips-Perron that stationary time series of the return on assets of all insurance companies except Allianz, which needs to conduct a test of auto-correlation and partial auto-correlation to identify the type of differences, so that the time series can be stationary. The results were as shown in Table 5.

| Table 5 THE RESULTS OF THE AUTOCORRELATION TEST AND PARTIAL AUTOCORRELATION OF ALLIANZ'S ROA |

||||||

| Autocorrelation | Partial Correlation | AC | PAC | Q-Stat | Prob. | |

| . |*****| | . |*****| | 1 | 0.673 | 0.673 | 14.104 | 0.000 |

| . |*** | | .*|.| | 2 | 0.362 | -0.168 | 18.331 | 0.000 |

| . |**.| | . |*.| | 3 | 0.259 | 0.164 | 20.579 | 0.000 |

| . |*.| | . |.| | 4 | 0.211 | -0.005 | 22.137 | 0.000 |

| . |* . | | . | . | | 5 | 0.135 | -0.033 | 22.804 | 0.000 |

| . |* . | | . |* . | | 6 | 0.119 | 0.085 | 23.343 | 0.001 |

| . | . | | . *| . | | 7 | 0.048 | -0.141 | 23.434 | 0.001 |

| . | . | | . | . | | 8 | 0.007 | 0.059 | 23.436 | 0.003 |

| . | . | | . *| . | | 9 | -0.032 | -0.090 | 23.482 | 0.005 |

| . *| . | | . | . | | 10 | -0.079 | -0.049 | 23.770 | 0.008 |

| . *| . | | . | . | | 11 | -0.076 | 0.052 | 24.058 | 0.012 |

| . |* . | | . |**. | | 12 | 0.083 | 0.238 | 24.420 | 0.018 |

Table 5 shows that the values of autocorrelation decrease over time while the partial autocorrelation values fade after the initial period, meaning that their model is autocorrelation from the first order AR (1). The study of statistical hypothesis is "There are no significant differences between the average return on assets among insurance companies".

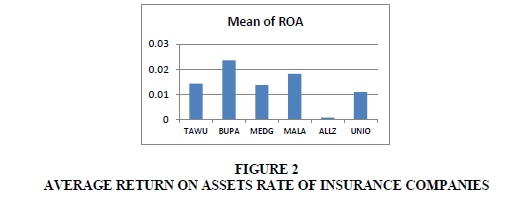

The average return on assets rate of insurance companies under study are can be represented by Table 6 and Figure 2:

| Table 6 THE AVERAGE RETURN ON ASSETS RATE OF INSURANCE COMPANIES |

||||||

| Company | TAWU | BUPA | MEDG | MALA | ALLZ | UNIO |

| Mean of ROA | 0.0143 | 0.0235 | 0.0137 | 0.0182 | 0.000 | 0.0109 |

The average return on assets during the study period is 0.0022. To verify this, a t-test was conducted to determine whether there are significant differences between the two groups, first the five insurance companies (TAWU, MEDG, BUPA, MALA, and UNIO) and second Allianz Company in average of return on assets:

The significance of the t-test is 0.000, which is less than 0.05; therefore, we reject the null hypothesis and accept the alternative: there are significant differences between the average rate of return on assets of Allianz and the average rate of return on assets for the rest of the insurance companies under study (Table 7).

| Table 7 THE RESULTS OF TESTING THE AVERAGE RATE OF RETURN ON ASSETS AMONG INSURERS |

|||||||

| Company | no. | mean | St. dev. | t | sig | Levene's Test for Equality of Variances | |

| group I | 140 | 0.02 | 0.0373 | 4.27 | 0.000 | F | sig |

| Allianz | 28 | 0 | 0.0019 | 5.42 | 0.021 | ||

To test of homogeneity, we use Levene's Test for Equality of Variances, which significance is 0.021, which is less than 0.05 indicating that there is heterogeneity between the two groups.

Which means that we deal with the five companies in a way and deal with Allianz in another way when estimating the rate of Return on Assets.

The Correlation between ROA and the Variables of the Study

Table 8 shows the results of analyzing the correlation between the rate of return on assets and the other variables in the study for each insurance company:

| Table 8 THE CORRELATION COEFFICIENT MATRIX BETWEEN ROA AND OTHER VARIABLES |

||||||||

| Company | SAS | PAS | AGE | WPG | RSK | LOS | RTN | |

| TAWU | value | 0.109 | 0.246 | 0.141 | 0.17 | -0.470-* | -0.606-** | 0.118 |

| sig. | 0.579 | 0.208 | 0.475 | 0.38 | 0.012 | 0.001 | 0.551 | |

| BUPA | value | -0.232 | 0.461* | 0.453* | -0.3 | -0.229 | 0.458* | 0.307 |

| sig. | 0.235 | 0.014 | 0.015 | 0.12 | 0.241 | 0.014 | 0.112 | |

| MEDG | value | 0.31 | 0.329 | -0.429-* | -0.27 | -0.313 | 0.193 | -0.454-* |

| sig. | 0.109 | 0.087 | 0.023 | 0.17 | 0.104 | 0.326 | 0.015 | |

| MALA | value | 0.154 | -0.04 | 0.152 | -0.11 | -0.084 | -0.009 | 0.085 |

| sig. | 0.434 | 0.858 | 0.44 | 0.56 | 0.67 | 0.963 | 0.666 | |

| UNIO | value | 0.066 | 0.099 | -0.169 | .479** | -0.156 | -0.609-** | -0.236 |

| sig. | 0.739 | 0.616 | 0.39 | 0.01 | 0.428 | 0.001 | 0.227 | |

| ALLZ | value | -0.634-** | -0.654-** | 0.746** | -0.04 | -0.274 | -0.026 | 0.611** |

| sig. | 0 | 0 | 0 | 0.84 | 0.158 | 0.896 | 0.001 | |

*Significant at 5% level; **significant at 1% level

1. In TAWU, there is an inverse correlation between ROA and both risk and loss ratio.

2. BUPA, there is a direct correlation between the size of the company and its assets and age and the rate of loss.

3. MEDG, an inverse correlation with age and retention.

4. MALA, there is no correlation between any variable.

5. UNIO, there is a direct correlation with underwriting while an inverse correlation with the loss rate.

6. ALLZ, there is a strong correlation with age and retention while there is an inverse correlation with assets of shareholders and assets of policyholders.

Estimation ROA for Group I companies (TAWU, MEDG, BUPA, MALA, and UNIO)

Dependent on Panel Data Models or combining Time series and cross-sectional data models. Here, we can compare many models that differ according to their respective assumptions to be as follows:

Model I: All slope coefficients are common without intercept.

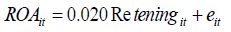

The results as shown in Appendix 1 indicate that the value of the F test is 27.383 with sig. 0.000 is less than 0.05 indicating the significance of the model as:

Where R-square is 0.165 which means the retention can interpret 16.5% of the variation in ROA.

Model II: All slope coefficients are common with intercept.

The results, as shown in Appendix 2, indicate that the value of the F test is 0.413 with a sig. 0.893, which is greater than 0.05 indicating that the model is not significant.

Model III: All slope coefficients are common with intercept vary over cross sections.

The results, as shown in Appendix 3, indicate that the value of the F test is 0.37509 with sig. of 0.9636, which is greater than 0.05 indicating that the model is not significant.

Model IV: All coefficients vary over cross sections.

We can indicate which the model is fixed effect or random effect model. Therefore, we constructed a test and got the following results:

The significance of the test is 0.0001, which is less than 0.05, indicating that the random effect model is rejected and that the alternative assumption is that the model is a fixed effect model (Table 9).

| Table 9 TEST CROSS-SECTION FIXED EFFECTS |

|||

| Effects Test | Statistic | df. | Prob. |

| Cross-section F | 6.607919 | (4, 100) | 0.0001 |

We can depend on two methods for estimating its parameters Pooled GLS (cross section weights) and Pooled GLS (cross section SUR). Therefore, we can represent Model IV by two models:

Model IV (a): Pooled GLS (cross-section weights).

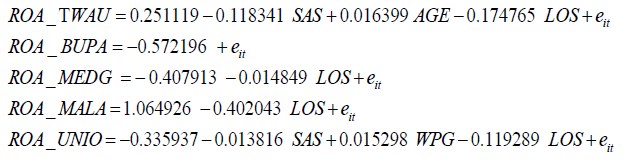

The results as shown in Appendix 4a indicate that the value of the F test is 4.026988 with sig. 0.000 which is less than 0.05 indicating the significance of the model as:

Where, the value of the R-square is 0.61097 indicating that this model can interpret 61.097% of the change in the value of the ROA. The Durbin-Watson test statistic was 2.19246, which means that it falls within the null hypothesis acceptance area, i.e. there is no autocorrelation.

Model IV (b): Pooled GLS (cross section SUR)

The results as shown in Appendix 4b indicate that the value of the F test is 4.6887 with sig. 0.000 which is less than 0.05 indicating the significance of the model.

Where, the value of the R-square is 0.6464 indicating that this model can interpret 64.64% of the change in the value of the ROA. The Durbin-Watson test statistic was 2.2667, which means that it falls within the null hypothesis acceptance area, i.e. there is no autocorrelation.

Model V: Stepwise- Multiple Regression Model For each individual

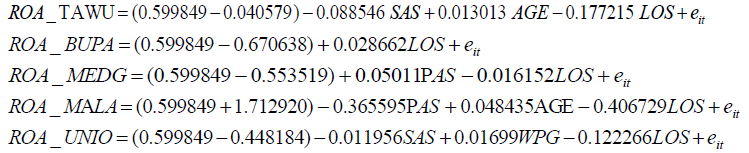

TAWU: The results indicate that the value of the F test is 11.100 with sig. 0.000, which is less than 0.05 indicating the significance of the model.

Where, the value of the R-square is 0.659 indicating that this model can interpret 65.9% of the change in the value of the ROA in Tawuniya Company.

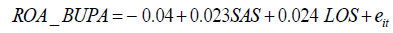

BUPA : The results show that the value of the F test is 8.11 with sig. 0.002, which is less than 0.05 indicating the significance of the model

The R-square is 0.393, indicating that this model accounts for 39.3% of the change in BUPA's return on assets.

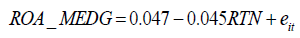

MEDG: The results indicate that the value of the F test is 6.743 with sig. 0.015 which is less than 0.05 indicating the significance of the model.

The R-square is 0.206, indicating that this model accounts for 20.6% of the change in the return on assets of MedGulf Insurance.

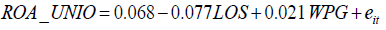

UNIO: The results indicate that the value of the F test is 16.577 with sig. 0.000, which is less than 0.05 indicating the significance of the model.

R-square is 0.57, indicating that this model accounts for 57% of the change in the value of the rate of return on assets in the Union Cooperative Insurance (Trade Union) Company.

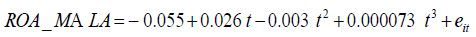

MALA: When applying the multiple regression models, there was no model where all the independent variables of the model were excluded. Therefore, the nonlinear regression model was used to express the relationship between the rate of return on assets in MALA and time as quadratic, cubical, exponential, logarithmic and other relationships. The best model is the Cubic model as:

The results show that the value of the F test is 6.968 with sig. 0.002, which is less than 0.05, indicating the significance of the model, and the value of the R-square 0.466, indicating that this model accounts for 46.6% of the change in the value of the return on assets.

Comparison of the predictive performance of ROA models

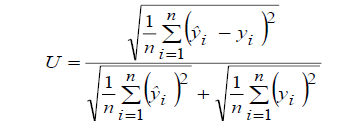

The comparison of ROA models to insurance companies in Saudi Arabia has been relied on in many ways, but the accuracy of the forecast is different according to the equations used in calculating them. Accuracy measures are always known based on forecasting errors.

Forecasting error is  where yi is the observed value and

where yi is the observed value and  is the predicted value. One of the most commonly used accuracy measures is the following:

is the predicted value. One of the most commonly used accuracy measures is the following:

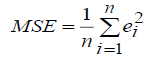

1. Mean Squared Error (MSE)

2. Mean Squared Percent Error (MSPE)

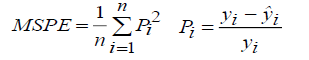

3. The il Statistic for predictive performance

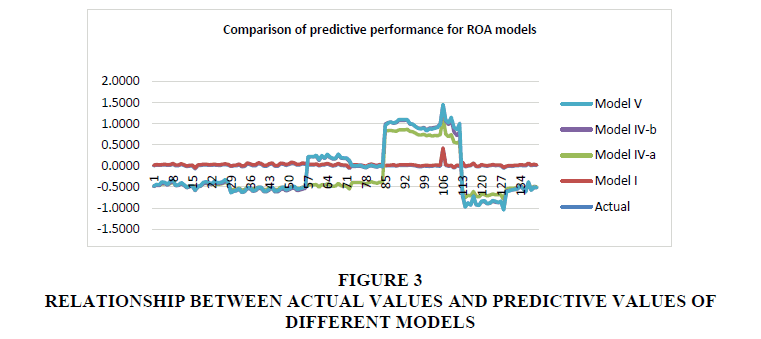

It is clear from the previous Table 10 that the best model is the fifth model. As illustrated by the following figure of the relationship between actual values and predictive values of different models.

| Table 10 THE RESULTS OF PREDICTIVE PERFORMANCE FOR ROA MODELS |

||||

| Measures | Model I | Model IV-a | Model IV-b | Model V |

| MSE | 0.001642 | 0.353036 | 0.073696 | 0.002158 |

| MSPE | 52.49631 | 84030.15 | 9365.481 | 275.5754 |

| Theil | 0.694336 | 0.943098 | 0.85572 | 0.639093 |

It is clear from the previous Figure 3 that the fifth model (Model V) of the most models corresponds to the actual values.

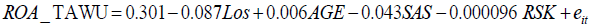

To find a model to predict the rate of return on assets of Allianz

The results showed that there was an autocorrelation in Allianz's ROA values with AR (1). The results, as shown in Appendix 5, indicate that the value of the F test is 52.060 with sig. of 0.000 being less than 0.05, the significance of the model.

The R-square is 0.806, indicating that this model accounts for 80.6% of the change in Allianz's rate of return on assets.

Conclusion And Practical Implications

The article uses the return on Shareholders assets as a measure of profitability of the Takaful Insurance Companies, and analyses the profitability of sample of Saudi Takaful Insurance companies representing more than 60% of the total assets of Saudi insurance sector. The comparison of ROA models to insurance companies in Saudi Arabia has been relied on in many ways, but the accuracy of the forecast is different according to the equations used in calculating them. The profitability is explained by firm-specific variables. The models are designed for both pooled and panel data and estimated by several methods. The results show that the age of Takaful insurance contribute positively to the profitability of BUPA and Allianz and negatively to the profitability of Med Gulf. Both Insurance Assets and Assets of shareholders contribute positively to BUPA and negatively to Allianz profitability. The findings indicate also a negative relation between loss ratio and profitability of TAWUNIA and Union Commercial, a negative relation between the Rate of Retention and Midgulf Profitability, and a positive contribution of the written premium growth rate into Union Commercial Profitability. Finally, the Risk Level, which is a measure that reflects the company's ability to meet expected fluctuations in the original risk results covered by the insurance portfolio, has a negative impact on TAWUNIA Profitability.

In an insurance sector, in which many companies are facing difficulties like the accumulation of losses and the risk of going bankrupt, the policy implications of this study for the stakeholders of the Takaful insurance industry are very important. For instance, Takaful insurance companies inside and outside Saudi Arabia are very interested in identifying the causes of profits and losses and therefore factors affecting their profitability. In addition, Saudi Arabia's central bank (SAMA) is preparing tougher rules for insurance companies as part of a drive to create a smaller number of stronger market players operating in the country; so the results can help to decide which companies have to be acquired by big ones and companies to merge with stronger ones.

End Note

1. Sharia (also known as (Shariah) or (Shari'a) is the Islamic religious law that governs all Muslim aspects (religious rituals, day-to-day life, financial transactions...).

2. Tabarru' (donation) are contracts effected based on benevolence and do not involve the exchange of counter values and for that reason, Gharar (Uncertainty) does not affect donation contracts. Donation contracts include; Qard (loan), Hibah (gift), I’arah/Ariyah (asset lending), Waqf (endowment), and Ibra’ (rebate).

3. Mudarabah is a form of partnership where one party provides the funds while the other party provides expertise. The party who brings in money is "Rab-ul-Maal" while the management and work is an exclusive responsibility of the "Mudarib". The profit sharing ratio is determined at the time of entering into the Mudarabah agreement whereas in case of loss it is borne by the Rab-ul-Mal only. In case of this type of insurance, policyholders are "Rabb-ul-Maal" and the insurer is Mudarib.

4. Wakalah or agency agreement. In Takaful company, the shareholder has no rights to the money credited to or remained in this account apart from their stipulated proportion of Wakala charges, and in some cases may also include performance fees.

Acknowledgments

The authors gratefully acknowledge the financial support from King Faisal University. The present work was done under Project Number 160116.

Appendices

| Appendix 1 ALL SLOPE COEFFICIENTS ARE COMMON WITHOUT INTERCEPT |

|||||||||||

| Model Summary | |||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson | ||||||

| 1 | 0.406a | 0.165 | 0.159 | 0.03713 | 1.721 | ||||||

| a.Dependent Variable: RoA | |||||||||||

| ANOVAb | |||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | ||||||

| 1 | Regression | 0.038 | 1 | 0.038 | 27.383 | 0.000c | |||||

| Residual | 0.192 | 139 | 0.001 | ||||||||

| Total | 0.229 | 140 | |||||||||

| b. Dependent Variable: RoA c. Predictors: (Constant), Retening, Risk, Age, Underwr, Loss_ratio, Ln_assets, St_assests |

|||||||||||

| Coefficientsa,b | |||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |||||||

| B | Std. Error | Beta | |||||||||

| 1 | Retening | 0.020 | 0.004 | 0.406 | 5.233 | 0.000 | |||||

| a.Dependent Variable: RoA | |||||||||||

| b. Predictors: (Constant), Retening, Risk, Age, Underwr, Loss_ratio, Ln_assets, St_assests | |||||||||||

| Excluded Variables | |||||||||||

| Model | Beta In | t | Sig. | Partial Correlation | Collinearity Statistics | ||||||

| Tolerance | |||||||||||

| 1 | Ln_assets | 0.007 | 0.044 | 0.965 | 0.004 | 0.219 | |||||

| St_assests | -0.014- | -0.118- | 0.906 | -0.010- | 0.430 | ||||||

| Age | -0.019- | -0.157- | 0.875 | -0.013- | 0.433 | ||||||

| Underwr | -0.062- | -0.702- | 0.484 | -0.060- | 0.776 | ||||||

| Risk | -0.092- | -1.142- | 0.255 | -0.097- | 0.916 | ||||||

| Loss_ratio | 0.023 | 0.225 | 0.823 | 0.019 | 0.603 | ||||||

| Appendix 2 ALL SLOPE COEFFICIENTS ARE COMMON WITHOUT INTERCEPT |

||||||||

| Model Summaryb | ||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson | |||

| 1 | 0.146a | 0.021 | -0.030- | 0.03783 | 1.758 | |||

| a. Predictors: (Constant), Retening, Risk, Age, Underwr, Loss_ratio, Ln_assets, St_assests | ||||||||

| b. Dependent Variable: RoA | ||||||||

| ANOVAa | ||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||

| 1 | Regression | 0.004 | 7 | 0.001 | 0.413 | 0.893b | ||

| Residual | 0.189 | 132 | 0.001 | |||||

| Total | 0.193 | 139 | ||||||

| a. Dependent Variable: RoA | ||||||||

| b. Predictors: (Constant), Retening, Risk, Age, Underwr, Loss_ratio, Ln_assets, St_assests | ||||||||

| Appendix 3 ALL SLOPE COEFFICIENTS ARE COMMON WITH INTERCEPT VARY OVER CROSS SECTIONS |

||||||

| Dependent Variable: ROA? | ||||||

| Method: Pooled Least Squares | ||||||

| Sample: 2010Q1 2016Q4 | ||||||

| Included observations: 28 | ||||||

| Cross-sections included: 5 | ||||||

| Total pool (balanced) observations: 140 | ||||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. | ||

| C | -0.009082 | 0.036508 | -0.248775 | 0.8039 | ||

| LN_ASSETS? | -0.001579 | 0.002496 | -0.632448 | 0.5282 | ||

| ST_ASSETS? | 0.002133 | 0.002490 | 0.856852 | 0.3931 | ||

| AGE? | 0.001346 | 0.002281 | 0.589815 | 0.5564 | ||

| UNDERWR? | -0.004455 | 0.005998 | -0.742799 | 0.4590 | ||

| RISK? | 2.41E-06 | 2.20E-05 | 0.109290 | 0.9131 | ||

| LOSS_RATIO? | 0.000807 | 0.003528 | 0.228810 | 0.8194 | ||

| RETENING? | 0.007526 | 0.029942 | 0.251343 | 0.8020 | ||

| Fixed Effects (Cross) | ||||||

| TAWANIA--C | -0.025931 | |||||

| POUBA--C | 0.028053 | |||||

| MIDGAULF--C | -0.002889 | |||||

| MALAZ--C | 0.005798 | |||||

| UNIONCOMM--C | -0.005031 | |||||

| Effects Specification | ||||||

| Cross-section fixed (dummy variables) | ||||||

| R-squared | 0.031228 | Mean dependent var | 0.011794 | |||

| Adjusted R-squared | -0.052026 | S.D. dependent var | 0.040669 | |||

| S.E. of regression | 0.041713 | Akaike info criterion | -3.434191 | |||

| Sum squared resid | 0.222717 | Schwarz criterion | -3.182051 | |||

| Log likelihood | 252.3934 | Hannan-Quinn criter. | -3.331729 | |||

| F-statistic | 0.375096 | Durbin-Watson stat | 2.016361 | |||

| Prob(F-statistic) | 0.963625 | |||||

| Appendix 4a ALL COEFFICIENT VARY OVER CROSS SECTIONS |

||||

| Dependent Variable: ROA? | ||||

| Method: Pooled EGLS (Cross-section weights) | ||||

| Date: 11/25/17 Time: 18:32 | ||||

| Sample: 2010Q1 2016Q4 | ||||

| Included observations: 28 | ||||

| Cross-sections included: 5 | ||||

| Total pool (balanced) observations: 140 | ||||

| Linear estimation after one-step weighting matrix | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 0.490135 | 0.297225 | 1.649034 | 0.1023 |

| TAWANIA--LN_ASSETSTAWANIA | -0.118341 | 0.036536 | -3.239022 | 0.0016 |

| POUBA--LN_ASSETSPOUBA | 0.002165 | 0.002707 | 0.799933 | 0.4256 |

| MIDGAULF--LN_ASSETSMIDGAULF | -0.051296 | 0.030905 | -1.659807 | 0.1001 |

| MALAZ--LN_ASSETSMALAZ | 0.007365 | 0.081310 | 0.090574 | 0.9280 |

| UNIONCOMM--LN_ASSETSUNIONCOMM | -0.013816 | 0.006907 | -2.000150 | 0.0482 |

| TAWANIA--ST_ASSETSTAWANIA | 0.006566 | 0.011226 | 0.584956 | 0.5599 |

| POUBA--ST_ASSETSPOUBA | 0.050662 | 0.099246 | 0.510471 | 0.6108 |

| MIDGAULF--ST_ASSETSMIDGAULF | 0.057233 | 0.029177 | 1.961573 | 0.0526 |

| MALAZ--ST_ASSETSMALAZ | -0.284193 | 0.215253 | -1.320277 | 0.1898 |

| UNIONCOMM--ST_ASSETSUNIONCOMM | 0.012079 | 0.007004 | 1.724633 | 0.0877 |

| TAWANIA--AGETAWANIA | 0.016399 | 0.004377 | 3.746639 | 0.0003 |

| POUBA--AGEPOUBA | -0.000966 | 0.019391 | -0.049840 | 0.9603 |

| MIDGAULF--AGEMIDGAULF | -0.002475 | 0.004454 | -0.555657 | 0.5797 |

| MALAZ--AGEMALAZ | 0.037025 | 0.026717 | 1.385821 | 0.1689 |

| UNIONCOMM--AGEUNIONCOMM | -0.001972 | 0.003219 | -0.612623 | 0.5415 |

| TAWANIA--UNDERWRTAWANIA | -0.004614 | 0.005934 | -0.777487 | 0.4387 |

| POUBA--UNDERWRPOUBA | -0.000975 | 0.007983 | -0.122166 | 0.9030 |

| MIDGAULF--UNDERWRMIDGAULF | 0.000482 | 0.009238 | 0.052158 | 0.9585 |

| MALAZ--UNDERWRMALAZ | -0.027925 | 0.022058 | -1.265939 | 0.2085 |

| UNIONCOMM--UNDERWRUNIONCOMM | 0.015298 | 0.005843 | 2.618196 | 0.0102 |

| TAWANIA--RISKTAWANIA | 1.38E-05 | 7.21E-05 | 0.191546 | 0.8485 |

| POUBA--RISKPOUBA | -2.00E-06 | 1.31E-05 | -0.152612 | 0.8790 |

| MIDGAULF--RISKMIDGAULF | 5.35E-05 | 6.29E-05 | 0.850996 | 0.3968 |

| MALAZ--RISKMALAZ | -2.54E-05 | 0.000131 | -0.193606 | 0.8469 |

| UNIONCOMM--RISKUNIONCOMM | 2.70E-05 | 5.06E-05 | 0.534034 | 0.5945 |

| TAWANIA--LOSS_RATIOTAWANIA | -0.174765 | 0.033363 | -5.238367 | 0.0000 |

| POUBA--LOSS_RATIOPOUBA | 0.029347 | 0.015231 | 1.926774 | 0.0568 |

| MIDGAULF--LOSS_RATIOMIDGAULF | -0.014849 | 0.007283 | -2.038699 | 0.0441 |

| MALAZ--LOSS_RATIOMALAZ | -0.402043 | 0.185237 | -2.170422 | 0.0323 |

| UNIONCOMM--LOSS_RATIOUNIONCOMM | -0.119289 | 0.019459 | -6.130131 | 0.0000 |

| TAWANIA--RETENINGTAWANIA | -0.072158 | 0.044247 | -1.630802 | 0.1061 |

| POUBA--RETENINGPOUBA | -0.029736 | 0.064055 | -0.464233 | 0.6435 |

| MIDGAULF--RETENINGMIDGAULF | -0.016139 | 0.027960 | -0.577207 | 0.5651 |

| MALAZ--RETENINGMALAZ | 0.152835 | 0.111712 | 1.368111 | 0.1743 |

| UNIONCOMM--RETENINGUNIONCOMM | -0.011506 | 0.032363 | -0.355541 | 0.7229 |

| Fixed Effects (Cross) | ||||

| TAWANIA--C | 0.251119 | |||

| POUBA--C | -0.572196 | |||

| MIDGAULF--C | -0.407913 | |||

| MALAZ--C | 1.064926 | |||

| UNIONCOMM--C | -0.335937 | |||

| Effects Specification | ||||

| Cross-section fixed (dummy variables) | ||||

| Weighted Statistics | ||||

| R-squared | 0.610974 | Mean dependent var | 0.021472 | |

| Adjusted R-squared | 0.459255 | S.D. dependent var | 0.052516 | |

| S.E. of regression | 0.038582 | Sum squared resid | 0.148859 | |

| F-statistic | 4.026988 | Durbin-Watson stat | 2.192461 | |

| Prob(F-statistic) | 0.000000 | |||

| Unweighted Statistics | ||||

| R-squared | 0.352496 | Mean dependent var | 0.011794 | |

| Sum squared resid | 0.148859 | Durbin-Watson stat | 2.576153 | |

| Appendix 4b ALL COEFFICIENT VARY OVER CROSS SECTIONS |

||||

| Dependent Variable: ROA? | ||||

| Method: Pooled EGLS (Cross-section SUR) | ||||

| Sample: 2010Q1 2016Q4 | ||||

| Included observations: 28 | ||||

| Cross-sections included: 5 | ||||

| Total pool (balanced) observations: 140 | ||||

| Linear estimation after one-step weighting matrix | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 0.599849 | 0.234179 | 2.561495 | 0.0119 |

| TAWANIA--LN_ASSETSTAWANIA | -0.088846 | 0.027976 | -3.175823 | 0.0020 |

| POUBA--LN_ASSETSPOUBA | 0.002146 | 0.002243 | 0.956954 | 0.3409 |

| MIDGAULF--LN_ASSETSMIDGAULF | -0.042054 | 0.023006 | -1.827955 | 0.0705 |

| MALAZ--LN_ASSETSMALAZ | -0.044041 | 0.063192 | -0.696939 | 0.4875 |

| UNIONCOMM--LN_ASSETSUNIONCOMM | -0.011956 | 0.005651 | -2.115711 | 0.0369 |

| TAWANIA--ST_ASSETSTAWANIA | 0.006122 | 0.008495 | 0.720668 | 0.4728 |

| POUBA--ST_ASSETSPOUBA | 0.048874 | 0.080587 | 0.606483 | 0.5456 |

| MIDGAULF--ST_ASSETSMIDGAULF | 0.050111 | 0.021737 | 2.305272 | 0.0232 |

| MALAZ--ST_ASSETSMALAZ | -0.365595 | 0.169630 | -2.155253 | 0.0335 |

| UNIONCOMM--ST_ASSETSUNIONCOMM | 0.010176 | 0.005728 | 1.776597 | 0.0787 |

| TAWANIA--AGETAWANIA | 0.013013 | 0.003359 | 3.873518 | 0.0002 |

| POUBA--AGEPOUBA | -0.000298 | 0.015772 | -0.018885 | 0.9850 |

| MIDGAULF--AGEMIDGAULF | -0.002019 | 0.003407 | -0.592511 | 0.5548 |

| MALAZ--AGEMALAZ | 0.048435 | 0.020463 | 2.367002 | 0.0199 |

| UNIONCOMM--AGEUNIONCOMM | -0.002484 | 0.002668 | -0.931085 | 0.3541 |

| TAWANIA--UNDERWRTAWANIA | -0.004322 | 0.004727 | -0.914131 | 0.3628 |

| POUBA--UNDERWRPOUBA | -0.001695 | 0.006488 | -0.261277 | 0.7944 |

| MIDGAULF--UNDERWRMIDGAULF | 0.001452 | 0.006667 | 0.217828 | 0.8280 |

| MALAZ--UNDERWRMALAZ | -0.017701 | 0.016690 | -1.060557 | 0.2914 |

| UNIONCOMM--UNDERWRUNIONCOMM | 0.016990 | 0.004770 | 3.561472 | 0.0006 |

| TAWANIA--RISKTAWANIA | 2.37E-05 | 5.48E-05 | 0.432169 | 0.6665 |

| POUBA--RISKPOUBA | -1.58E-06 | 1.02E-05 | -0.154965 | 0.8772 |

| MIDGAULF--RISKMIDGAULF | 2.57E-05 | 4.17E-05 | 0.616376 | 0.5390 |

| MALAZ--RISKMALAZ | -1.67E-05 | 0.000100 | -0.166210 | 0.8683 |

| UNIONCOMM--RISKUNIONCOMM | 1.52E-05 | 4.12E-05 | 0.369834 | 0.7123 |

| TAWANIA--LOSS_RATIOTAWANIA | -0.177215 | 0.026429 | -6.705385 | 0.0000 |

| POUBA--LOSS_RATIOPOUBA | 0.028662 | 0.012390 | 2.313342 | 0.0228 |

| MIDGAULF--LOSS_RATIOMIDGAULF | -0.016152 | 0.005023 | -3.215537 | 0.0018 |

| MALAZ--LOSS_RATIOMALAZ | -0.406729 | 0.140195 | -2.901173 | 0.0046 |

| UNIONCOMM--LOSS_RATIOUNIONCOMM | -0.122266 | 0.015916 | -7.681821 | 0.0000 |

| TAWANIA--RETENINGTAWANIA | -0.046673 | 0.034369 | -1.358001 | 0.1775 |

| POUBA--RETENINGPOUBA | -0.041389 | 0.050828 | -0.814299 | 0.4174 |

| MIDGAULF--RETENINGMIDGAULF | -0.009745 | 0.020178 | -0.482937 | 0.6302 |

| MALAZ--RETENINGMALAZ | 0.144316 | 0.084975 | 1.698340 | 0.0926 |

| UNIONCOMM--RETENINGUNIONCOMM | -0.001802 | 0.026336 | -0.068409 | 0.9456 |

| Fixed Effects (Cross) | ||||

| TAWANIA--C | -0.040579 | |||

| POUBA--C | -0.670638 | |||

| MIDGAULF--C | -0.553519 | |||

| MALAZ--C | 1.712920 | |||

| UNIONCOMM--C | -0.448184 | |||

| Effects Specification | ||||

| Cross-section fixed (dummy variables) | ||||

| Weighted Statistics | ||||

| R-squared | 0.646467 | Mean dependent var | 0.514195 | |

| Adjusted R-squared | 0.508590 | S.D. dependent var | 1.695222 | |

| S.E. of regression | 1.160330 | Sum squared resid | 134.6366 | |

| F-statistic | 4.688701 | Durbin-Watson stat | 2.266710 | |

| Prob(F-statistic) | 0.000000 | |||

| Unweighted Statistics | ||||

| R-squared | 0.334758 | Mean dependent var | 0.011794 | |

| Sum squared resid | 0.152936 | Durbin-Watson stat | 2.484896 | |

| Appendix 5 MODEL TO PREDICT THE RATE OF RETURN ON ASSETS OF ALLIANZ |

||||||||||||||||||||||||||||

| Variables Entered/Removeda,b | ||||||||||||||||||||||||||||

| Model | Variables Entered | Variables Removed | Method | |||||||||||||||||||||||||

| 1 | Roa_1 | . | Stepwise (Criteria: Probability-of-F-to-enter <= 0.050, Probability-of-F-to-remove >= 0.100). | |||||||||||||||||||||||||

| 2 | Age | . | Stepwise (Criteria: Probability-of-F-to-enter <= 0.050, Probability-of-F-to-remove >= 0.100). | |||||||||||||||||||||||||

| a. Dependent Variable: RoA | ||||||||||||||||||||||||||||

| b. Linear Regression through the Origin | ||||||||||||||||||||||||||||

| Model Summary | ||||||||||||||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson | |||||||||||||||||||||||

| 1 | 0.877a | 0.770 | 0.761 | 0.00141 | ||||||||||||||||||||||||

| 2 | 0.898 | 0.806 | 0.791 | 0.00132 | 1.634 | |||||||||||||||||||||||

| a. Dependent Variable: RoA | ||||||||||||||||||||||||||||

| ANOVAa | ||||||||||||||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||||||||||||||

| 2 | Regression | 0.000 | 2 | 0.000 | 52.060 | 0.000b | ||||||||||||||||||||||

| Residual | 0.000 | 25 | 0.000 | |||||||||||||||||||||||||

| Total | 0.000 | 27 | ||||||||||||||||||||||||||

| a. Dependent Variable: RoA b. Predictors: (Constant), Retening, Risk, Age, Underwr, Loss_ratio, Ln_assets, St_assests |

||||||||||||||||||||||||||||

| Coefficients | ||||||||||||||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||||||||||||||

| B | Std. Error | Beta | ||||||||||||||||||||||||||

| 2 | Roa_1 | 0.513 | 0.176 | 0.531 | 2.911 | 0.007 | ||||||||||||||||||||||

| Age | 0.000174 | 0.000 | 0.395 | 2.167 | 0.040 | |||||||||||||||||||||||

| Excluded Variablesa,b | ||||||||||||||||||||||||||||

| Model | Beta In | t | Sig. | Partial Correlation | Collinearity Statistics | |||||||||||||||||||||||

| Tolerance | ||||||||||||||||||||||||||||

| 1 | Ln_assets | 0.108c | 0.895 | 0.379 | 0.176 | 0.618 | ||||||||||||||||||||||

| St_assests | 0.094c | 0.817 | 0.422 | 0.161 | 0.674 | |||||||||||||||||||||||

| Age | 0.395c | 2.167 | 0.040 | 0.398 | 0.233 | |||||||||||||||||||||||

| Underwr | 0.042c | 0.396 | 0.696 | 0.079 | 0.814 | |||||||||||||||||||||||

| Risk | -0.031-c | -0.281- | 0.781 | -0.056- | 0.771 | |||||||||||||||||||||||

| Loss_ratio | 0.133c | 0.909 | 0.372 | 0.179 | 0.419 | |||||||||||||||||||||||

| Retening | 0.289c | 1.666 | 0.108 | 0.316 | 0.275 | |||||||||||||||||||||||

| 2 | Ln_assets | -0.283-d | -1.472- | 0.154 | -0.288- | 0.201 | ||||||||||||||||||||||

| St_assests | -0.253-d | -1.449- | 0.160 | -0.284- | 0.244 | |||||||||||||||||||||||

| Underwr | -0.104-d | -0.887- | 0.384 | -0.178- | 0.574 | |||||||||||||||||||||||

| Risk | -0.187-d | -1.667- | 0.109 | -0.322- | 0.577 | |||||||||||||||||||||||

| Loss_ratio | -0.294-d | -1.304- | 0.205 | -0.257- | 0.148 | |||||||||||||||||||||||

| Retening | -0.168-d | -0.448- | 0.658 | -0.091- | 0.057 | |||||||||||||||||||||||

| a. Dependent Variable: RoA | ||||||||||||||||||||||||||||

| b. Linear Regression through the Origin | ||||||||||||||||||||||||||||

| c. Predictors in the Model: Roa_1 | ||||||||||||||||||||||||||||

| d. Predictors in the Model: Roa_1, Age | ||||||||||||||||||||||||||||

| Residuals Statistics | ||||||||||||||||||||||||||||

| Minimum | Maximum | Mean | Std. Deviation | N | ||||||||||||||||||||||||

| Predicted Value | 0.0005 | 0.0053 | 0.0023 | 0.00126 | 27 | |||||||||||||||||||||||

| Residual | -0.00318- | 0.00461 | -0.00011- | 0.00129 | 27 | |||||||||||||||||||||||

| Std. Predicted Value | -1.385- | 2.367 | 0.000 | 1.000 | 27 | |||||||||||||||||||||||

| Std. Residual | -2.416- | 3.502 | -0.086- | 0.977 | 27 | |||||||||||||||||||||||

References

- Abdi, S. (2007). Taking takaful to the next level: How the industry can create demand for its services. In S. Jaffer (Ed.), Islamic insurance: Trends, opportunities and the future of takaful (22-33). Euromoney.

- Abduh, M., & Zein Isma, S.N. (2017). Economic and market predictors of solvency of family takaful in malaysia. Journal of Islamic Accounting and Business Research, 8(3), 334-344.

- Akhtar, M.H. (2018). Performance analysis of takaful and conventional insurance companies in saudi arabia. Benchmarking: An International Journal, 25(2), 677-695.

- Akotey, J.O., Sackey, F., Amoah, L., & Manso, R.F. (2013). The financial performance of life insurance companies in ghana. The Journal of Risk Finance, 14(3), 286-302.

- Alamasi, A. (2010). Surveying developments in takaful industry: Prospects and challenges. Review of Islamic Economics: International Association for Islamic Economics, 13(2), 195-210.

- Al-Amri, K. (2015). Takaful insurance efficiency in the GCC countries. Humanomics, 31(3), 344-353.

- Albarrak, H. (2018). Saudi insurance sector 2017. Riyadh: AlBilad Capital. Retrieved from http://www.albilad-capital.com/Research_EnglishReport/InsuranceSectorQ417EN.pdf

- Al-Dharir, S. (Ed.). (1997). Al-gharar in the contracts and its effects on contemporary transactions (1st ed.). Jeddah: Islamic Research and Training Institute.

- Alhassan, A.L., Addisson, G.K., & Asamoah, M.E. (2015). Market structure, efficiency and profitability of insurance companies in ghana. International Journal of Emerging Markets, 10(4), 648-669.

- Almajali, A., Alamro, S., & Al-Soub, Y. (2012). Factors affecting the financial performance of jordanian insurance companies listed at amman stock exchange. Journal of Management Research, 4(2), 266-289.

- Alomari, M., & Azzam, I. (2017). Effect of the micro and macro factors on the performance of the listed jordanian insurance companies. International Journal of Business and Social Science, 8(2), 66-73.

- Al-Saati, A. (2003). The permissible gharar (risk) in classical islamic jurisprudence. Journal of King Abdulaziz University: Islamic Economics, 16(2), 3-19.

- Batrinca, G., & Burca, A. (2014). The determinants of financial performance in romanian insurance market. International Journal of Academic Research in Accounting, Finance, and Management Sciences, 4(1), 299-308.

- Bilal, S., Javaria, K., Tufail, S., & Najm-ul-Sehae. (2013). Determinants of profitability panel data: Evidence from insurance sector of pakistan. Management and Administrative Sciences Review, 2(1), 10-22.

- Billah, M.M. (Ed.). (2003). Islamic and modern insurance : Principles and practices (1st ed.). Selangor, Malaysia: Ilmiah Publishers.

- Boadi, E.K., Antwi, S., & Lartey, V.C. (2013). Determinants of profitability of insurance firms in ghana. International Journal of Business and Social Research, 3(3), 43-50.

- Borlea, S.N., & Achim, M.V. (2010). Business performances: Between profitability, return and growth. Annals of University of Craiova-Economic Sciences Series, 2(38).

- Chen, R., & Wong, K.A. (2004). The determinants of financial health of asian insurance companies. The Journal of Risk and Insurance, 71(3), 469-499.

- El?Gamal, M.A. (2007). Mutuality as an antidote to rent?seeking shariah arbitrage in islamic finance. Thunderbird International Business Review, 49(2), 187-202.

- Jan, S., Iqbal, K., & Rahman, S. (2014). Determinants of profitability of islamic and conventional insurance companies in pakistan: An internal evaluation. Abasyn Journal of Social Sciences, 7(1), 57-63.

- Jibran, Q.M.A., Sameen, M., Kashif, A., & Nouman, K. (2016). Determinants that affect the profitability of non-life insurance companies: Evidence from Pakistan. Research Journal of Recent Sciences, 5(4), 6-11.

- Kader, H.A., Adams, M., & Hardwick, P. (2010). The cost efficiency of takaful insurance companies. The Geneva Papers on Risk and Insurance.Issues and Practice, 35(1), 161-181.

- Karbhari, Y., Muye, I., Hassan, A.F.S., & Elnahass, M. (2018). Governance mechanisms and efficiency: Evidence from an alternative insurance (takaful) market. Journal of International Financial Markets, Institutions and Money, doi:10.1016/j.intfin.2018.02.017

- Kaya, E.Ö. (2015). The effects of firm-specific factors on the profitability of non-life insurance companies in turkey. International Journal of Financial Studies, 3(4), 510-529.

- Kettell, B. (Ed.). (2011). The islamic banking and finance workbook, wiley finance (First Edition). Wiltshire: John Wiley & Sons.

- Khan, M.A. (2013). What is wrong with islamic economics? analysing the present state and future agenda. Northampton: USA: Edward Elgar Publishing.

- Khorshid, A. (2004). Islamic insurance: A modern approach to islamic banking (1st ed.). Richmond: Routledge Ltd.

- Liargovas, P.G., & Skandalis, K.S. (2010). Factors affecting firms' performance: The case of Greece. Global Business and Management Research: An International Journal, 2(2-3), 184.

- Malik, H. (2011). Determinants of insurance companies profitability: An analysis of insurance sector of pakistan. Academic Research International, 1(3), 315-321.

- Mehari, D., & Aemiro, T. (2013). Firm specific factors that determine insurance companies' performance in ethiopia. European Scientific Journal, 9(10), 245-255.

- Mwangi, M., & Murigu, J.W. (2015). The determinants of financial performance in general insurance companies in kenya. European Scientific Journal, 11(1), 288-297.

- Noordin, K. (2013). The implementation of tabarru and Taawun contracts in the takaful models. In A. R. Asmak, W. A. Wan Marhaini & M. Shamsiah (Eds.), Islamic economics, banking and finance: Concepts and critical issues (91-112). Kuala Lumpur: Pearson Malaysia.

- Orty?ski, K. (2016). Determinants of profitability of general insurance companies performance in poland. Central European Review of Economics & Finance, 12(2), 53-66.

- Rashid, A., & Kemal, M.U. (2018). Impact of internal (micro) and external (macro) factors on profitability of insurance companies. Journal of Economic Policy Researches, 5(1), 35-57.

- Thomson Reuters. (2017). ICD-THOMSON REUTERS ISLAMIC FINANCE DEVELOPMENT report 2017: Towards sustainability. (No. IFDI2017). Jeddah: Thomson Reuters.