Research Article: 2022 Vol: 28 Issue: 4S

Determinants of Voluntary CSR Disclosure: Empirical Evidence from Portugal

Graca Azevedo, University of Aveiro (ISCA-UA)

Rosana Fernandes, University of Aveiro (ISCA-UA)

Maria Fatima Borges, University of Aveiro (ISCA-UA)

Citation Information: Azevedo, G., Oliveira, J.da.S., Fernandes, R., & Borges, M.F. (2022). Determinants of voluntary CSR disclosure: empirical evidence from Portugal. Academy of Entrepreneurship Journal, 28(S4), 1- 22.

Keywords

Corporate Social Responsibility, Global Reporting Initiative, Sustainability Report

JEL Classification

M41

Abstract

The concept of Corporate Social Responsibility (CSR) has been subject to higher levels of disclosure at the corporate and social level. This increase is also seen in Portuguese companies.

In this context, the present study aims to analyze the factors determining the level of CSR disclosure by Portuguese companies, with reports published in the Global Reporting Initiative (GRI), in the period between 2006 and 2014.

For data analysis, non-parametric tests, Chi-square, and Cramer V association tests were performed.

The survey results indicate that between 2006 and 2012 the number of reports added to the GRI database increased, followed by a decrease between 2012 and 2014. The results also showed that there are no differences in disclosure among companies operating in different industry areas. Finally, it was concluded that the level of disclosure is associated with the size of the company, the type of industry, the quotation profile and the type of Audit Company

Introduction

Over the past few years, Corporate Social Responsibility (CSR) has become an increasingly discussed issue in companies and society in general, due to an increased concern about climate change and the importance of adopting sustainable behaviors, in order to save environmental resources that may become scarce.

The concept of CSR has been shaped over time. For most authors, the most common definition describes CSR as a set of behaviors, voluntarily adopted by companies, in order to move towards social and environmental improvement (Guthrie & Farneti, 2008; Juhmani, 2014).

Interest in Corporate Social Responsibility (CSR) has been growing for researchers and practitioners alike. Small and private companies, although with less attention, have begun to devote increasing effort to CSR. However, the CSR of large publicly listed companies is often a focus of public attention (Chi, Wu & Zheng, 2020). Thus, corporate investors and other stakeholders use environmental information in their decision making. According to Alvarez-Gonzalez, et al., (2018) social and environmental information is useful for decision making by investors and other stakeholders. In response to the concerns of investors and other stakeholders about companies' environmental policies, many companies are voluntarily increasing their level of social and environmental disclosure through different sources and media.

In the European context, there has been a growing emphasis on including non-financial information in the management report, with information related to environmental, social and labor issues.

In Portugal, this topic has also gained popularity through the emergence of organizations whose mission is to raise awareness to CSR.

That being said, this study aims to analyze the factors that influence the level of CSR disclosure by Portuguese companies, based on the theory of legitimacy.

The present work is divided into 5 parts. The first part includes the introduction to the study, followed by the literature review. At this point, a theoretical framework will be provided, in which the CSR concept, its evolution and the current situation in Portugal will be addressed, followed by CSR disclosure, which addresses the Sustainability Reports, the Global Reporting Initiative (GRI) and the determinants of information disclosure, as well as the surveys to test the hypotheses. The third section will present the methodology used, addressing aspects related to the definition of the sample, research, data collection and data treatment . The fourth section will provide an analysis of the results obtained in the study. Finally, the last section will present an overview of the study’s conclusions, limitations and future research proposals.

Literature review

In this chapter, a theoretical framework will be proposed, based on some of the main theories that have been used to support studies carried out in this area. An approach to the concept of CSR will also be made, considering its evolution over the past few years, as well as its relevance in Portugal.

This chapter will also cover the dissemination of CSR information and the Global Reporting Initiative, a Non-Governmental Organization (NGO) of great importance with regard to the dissemination of this type of information. Finally, some of the factors that may be associated with CSR disclosure will be addressed and different hypotheses will be discussed.

Theoretical Framework

Over the past few decades there has been a growing interest in social and environmental responsibility, both on the part of companies and the general public. This is due to the increasing dissemination of information related to climate change and the importance of changing society's behavior in order to create sustainable development and, thus, face the scarcity of environmental resources.

According to Faria (2010), the rising popularity of this issue in recent years has led internal and external members of companies to seek more information about the quality of services and products, respect for human rights, consideration for customers, employees working conditions, among others.

The relevance of this issue and its impact on the way companies operate has led to the development of several studies on CSR. These studies have analyzed CSR in several countries, such as India (Bhattacharyya, 2015), Italy (Campopiano & De Massis, 2015), Australia (Chan, Watson & Woodliff, 2014), Brazil (Crisostomo & Oliveira, 2015), Spain ( Otegui Echave & Bhati, 2010; Reverte, 2009), United Kingdom (Friedman & Miles, 2001; Gray, Javad, Power & Sinclair, 2001; Karim, Suh, Carter & Zhang, 2015), Egypt (Hussainey, Elsayed & Razik, 2011), China (Lau, Lu & Liang, 2016; Wang & Li, 2016; Zheng, Luo & Maksimov, 2015), Bangladesh (Sobhani, Amran & Zainuddin, 2009), and Thailand (Suttipun & Stanton , 2012).

In Portugal, several studies on CSR have been carried out, such as: the study by Baptista (2015), in which the author analyzes the adoption of CSR practices by micro, and small and medium-sized companies in the districts of Bragança and Vila Real; the study by Monteiro (2015) which studied the factors that influence the extent and selectivity of CSR information released by Portuguese companies with quoted values; or the study by Faria (2010) in which the author built a CSR disclosure index and analyzed the relationship between the obtained level and economic and financial indicators of 53 companies belonging to the World Business Council for Sustainable Development (WBCSD) in Portugal.

To address this issue, there are several theories used by different authors to explain what motivates companies to voluntarily disclose CSR information, such as agency theory, stakeholder theory, and legitimacy theory, among others.

Agency theory considers that companies maintain business connections in contracts between economic agents operating in efficient markets in an opportunistic manner, using the disclosure of social and environmental information as an advantage for defining contractual changes in accounts, insurance contracts or implicit political insurance (Reverses, 2009).

Jensen & Meckling (1976) defined an agency relationship as a contract under which one person (the principal) hires another person (the agent) to perform tasks on their behalf by giving the agent some authority to make decisions.

In this theory it is considered that the agent, as a manager, is driven by his/her own motivations and interests disregarding the principal's interests, jeopardizing the maximization of the company's value (Ferreira, 2008). Due to conflicts of interest, agency costs arise, such as costs incurred by the principal, monitoring and control costs, and the costs incurred by the agent to inform the principal (Branco & Góis, 2012). Voluntary disclosure of information is a tool used by managers to show shareholders that they are managing their resources well and thus reducing agency costs.

Stakeholder theory considers the impact of the expectations of the various stakeholder groups (employees, shareholders, investors, consumers, public authorities, etc.) on the companies' disclosure policies (Reverte, 2009).

Ferreira (2008) considers that this theory is divided into two branches: the positivist branch, in which the opinion of managers about each of their stakeholders varies depending on the control they have over resources, being more likely that the information disclosed is more directed towards fulfilling the expectations of those stakeholders who are regarded as more powerful or influential.

Legitimacy theory is based on the concept of legitimacy. According to Suchman (1995), legitimacy is defined as “a generalized perception or assumption that an entity's actions are desirable, adequate or appropriate within a socially constructed system of norms, values, meanings and definitions”.

The lack of legitimacy for not acting in accordance with society's norms and values can lead the organization to failure and to several other consequences, such as subjection to the social pressure exerted to regulate or sanction the activities of the organization, the loss of credibility, difficulty in obtaining financing, customer disinterest, among others (Díez, Blanco & Prado, 2010).

The best way to manage legitimacy is to promote communication between the organization and its stakeholders (Suchman, 1995). Thus, in addition to acting legitimately, that is, in accordance with the norms and values of the society in which they operate, organizations must adopt disclosure practices that can demonstrate to their stakeholders that they are acting in line with those norms and values.

In this sense, according to Juhmani (2014) legitimacy theory suggests a relationship between CSR disclosure and the concerns of the community and companies must act in accordance with society's expectations and changes.

This theory presents a more comprehensive view compared to stakeholder theory, because the latter focuses on the impact that stakeholder groups have on the organization, whilst legitimacy theory covers the whole of society.

Legitimacy theory plays an important role in CSR and is therefore at the base of several studies (Bhattacharyya, 2015; Juhmani, 2014; Reverte, 2009; Friedman & Miles, 2001; Suttipun & Stanton, 2012; Gray et al., 2001). This theory is even regarded by Juhmani (2014); Reverte (2009) as the theory that best explains the results obtained in their studies. Hence, the theory adopted in the present study is legitimacy theory.

Corporate Social Responsibility

The theme of CSR is increasingly present in the daily lives of companies that, in addition to being concerned with their financial performance, have also become concerned with their social and environmental performance, seeking to act in an ethical and transparent manner.

According to Reverte (2009), by acting responsibly in the social, environmental and economic spheres, companies respond to the expectations of different stakeholders, such as employees, investors, consumers, and Non-Governmental Organizations (NGOs). For some companies, the disclosure of environmental and social information is a decisive factor to arouse the interest of their stakeholders and make the company more competitive.

In the book Social Responsibilities of the Businessman, published in 1953, Howard Bowen defined CSR as an obligation on the part of companies to make decisions and follow guidelines and lines of action governed by the goals and values of society, which is one of the first definitions of CSR (Monteiro, 2015).

With the evolution of times itself, the increase in society's awareness of social and environmental issues has led to greater stakeholder interest not only in companies' financial performance, but also in their social and environmental performance. In this sense, the concept of CSR is indispensable, not only at the business level but also at the level of society and our planet (Faria, 2015).

Karim, et al., (2015) define CSR as the company's duty to strive to improve the well-being of society. The authors compared the definition of CSR with our solar system: companies (planets) revolve around society (the sun), companies are subject to societal pressures on environmental and social issues, so managers must take measures to meet the interests of society and thus maintain a “stable orbit”, that is, maintain the company's stability.

CSR in Portugal

Portugal has started showing some concern for the protection of the environment from an early age, as can be seen in Article 66 of the Portuguese Constitution of 1976, which states “Everyone has the right to a human, healthy and ecologically balanced environment and the duty to defend it”.

As a member of the European Union (EU) and the United Nations (UN), Portugal has pledged to motivate companies to have a sustainable economic, environmental and social behavior, through treaties and policies, and other validated documents resulting from the 1992 Earth Summit, such as Agenda 21 (Monteiro, 2015).

However, at the business level, awareness of CSR issues only became visible in 2000. According to Ribeiro (2017), the European Summit in Lisbon, held in March 2000, and the publication of the Green Book in 2001 were essential milestones for a change in attitude on the part of companies that started to adopt CSR practices.

It was also from this date that organizations started dedicating their attention to the issue of CSR and sustainable development began to emerge, such as the Group of Reflection and Support for Corporate Citizenship (GRACE), the Business Council for Sustainable Development (BCSD) and the Portuguese Association of Ethics (APEE).

GRACE is a non-profit association founded in February 2000 by a group of companies (now counting with over 150 companies) whose objective is “to deepen its role in the social development of people and organizations, sharing the mission assumed long ago: reflecting, promoting and developing corporate social responsibility in Portugal” (GRACE, 2018).

BCSD Portugal is a non-profit association of public benefit, founded in October 2001 by companies such as Cimpor, The Navigator Company, and Sonae, with the main objective of promoting sustainable development, seeing itself as “Influential actor inspiring new, competitive, innovative, responsible, sustainable and inclusive business models” (BCSD Portugal, 2018c). BCSD Portugal is part of the global network of the World Business Council for Sustainable Development (WBCSD), and currently has approximately 90 members.

In November 2002, a group of professionals and entrepreneurs formed APEE in order to promote the inclusion of ethical principles in the management practices of companies, in their environment, and consequently contribute to a greater CSR.

Also in 2002, Accounting Directive 29 - Environmental Matters was approved, defining the “criteria for recognition, measurement and disclosure related to environmental expenditures, environmental liabilities and risks and related assets resulting from transactions and events that affect, or are likely to affect, the financial position and results of the reported entity”, as well as the type of environmental information to be disclosed (Commission for Accounting Standardization, 2002). This guideline was scheduled to entry into force on January 1, 2003, however it was only approved in June 2004 and published in Diário da República in April 2005 with mandatory application as of 2006.

In 2004, in collaboration with the ETHOS Institute (a Brazilian organization whose mission is to promote socially responsible management of its businesses together with companies) GRACE published the book First Steps - Guide to Corporate Social Responsibility. This book consists of an adaptation of a document developed by the ETHOS Institute to the reality of the Portuguese business sector and aims to be an instrument to support the reflection on the part of companies about their CSR practices, their role in society and the adoption of management strategies in accordance with CSR values (GRACE, 2004).

After 2004, following the creation of the international standard ISO 26000, each country was asked to develop a response adapted to its reality in order to foster the use of local tools for the definition and application of social responsibility in organizations. Therefore, the Portuguese Quality Institute (IPQ) published NP 4469-1: 2008 whose objective is to encourage and lead organizations towards greater social responsibility and sustainable development (Conde, Vázquez, & Marques, n.d.).

Within this theme, the following standards were published (APEE, 2018):

- NP4469-1: 2008 - Social responsibility management system: part 1: Requirements and guidelines for its use.

- NP4469-2: 2010 - Social responsibility management system part 2: guidance for implementation.

- NP 4460-1: 2007 - Ethics in organizations: Part 1: Guidelines for the process of drafting and implementing codes of ethics in organizations.

- NP 4460-2: 2010 - Ethics in organizations: Part 2: Guidance for the preparation, implementation and operationalization of codes of ethics in organizations.

- NP ISO 26000 - Guide to Social Responsibility.

- NP 4522 - Standard for Family Responsible Organizations.

Last but not least, it seems relevant to mention some of the events promoted by the organizations mentioned above, as they have enhanced the dialogue and debate on issues related to CSR, such as the BCSD Portugal Annual Conferences and the Social Responsibility Weeks organized by APEE, as well as the Portuguese Social Responsibility Forum of Organizations promoted by the Portuguese Industrial Association (AIP).

The 1st Annual Conference of BCSD Portugal was held in 2002 and was entitled Social Responsibility in Action. The 1st Portuguese Forum on Social Responsibility of Organizations promoted by AIP was held in 2005, and a year later the First Responsibility Week event was held and organized by APEE.

In addition to the aforementioned conferences, BCSD Portugal also organized, in 2011, in Lisbon, the 1st Certified Training Course on the elaboration of Sustainability Reports according to the GRI guidelines entitled GRI Certified Training Course on GRI Sustainability Reporting Process for Portugal. A second edition took place in 2012, in Porto, with the collaboration of ISEP (Monteiro, 2015).

Currently, BCSD Portugal is involved in the following projects: Meet 2030, Sustainable Development Goals (SDGs), Being or Consuming? and Circular Synergies.

CSR Disclosure

The increasing interest in environmental and social issues has led companies to create various disclosure mechanisms to meet the information needs of stakeholders.

According to Faria (2015), several instruments can be used, such as social marketing, social balance, social indicators and market indexes in the reporting and / or in the production of social responsibility information, and the form of reporting adopted by companies depends mainly on two factors, standardization and the knowledge of experts in dissemination.

Companies may use several ways to disseminate this type of information. These include disclosures through corporate websites, Sustainability Reports, Social Reports and Integrated Reports.

For Reverte (2009), the disclosure of this type of information is usually done through Annual Reports, CSR Reports or Sustainability Reports. In turn, Juhmani (2014) considers that the most used means to disseminate this type of information are the Annual Reports and the companies' websites.

Sustainability Reports

Sustainability Reports are tools used by companies to measure, disseminate and provide clarification to stakeholders on the social and environmental impacts caused by the common activities of companies in order to achieve sustainable development (GRI, 2011).

Although CSR information is very useful to support decision-making, the preparation of these reports is voluntary, which in turn raises a problem: there is no standardization or uniformity about what is disclosed and how disclosure is made. However, despite the absence of a standard, it is necessary to highlight the importance of this issue, since reports may differ in form and content, and thus affect the comparability of information or even become biased because it is directed at a certain group of stakeholders.

In an attempt to fill this gap, several NGOs began to develop models or frameworks to disclose CSR, such as ISO 14001 (Internationally Standards Organization), Word Resources Institute (WRI) and GRI (Reverte, 2009).

To achieve the homogenization of CSR reporting, GRI is regarded as a reference entity because through the creation of guidelines for the preparation of Sustainability Reports, it provides guidance and support to companies wishing to use this form of CSR reporting (Moneva et al., 2006). These guidelines address contents such as the mission statement of the organization's CEO, the profile, executive summary and key indicators, the main Sustainability indicators, vision, strategy and policies, structure and Management Systems (Monteiro, 2015).

According to GRI (2000), these reports can be used for benchmarking and analysis of sustainability performance with respect to laws, standards, codes, performance standards and voluntary initiatives; to demonstrate the influence of sustainable development expectations on the company and how it affects society in this regard; and, to compare, over time, the organization's performance with that of other organizations.

Sustainability Reports carried out in accordance with GRI guidelines are considered credible, even though GRI is not recognized as a regulatory body.

For Roma (2016), to guarantee reliability and increase the credibility of Sustainability Reports, these reports must be submitted for external verification, that is, an audit carried out by a certified entity for this single purpose.

Global Reporting Initiative

The Global Reporting Initiative is an international, independent organization that aims to support companies, governments and other organizations to understand and publicize the impact of their economic activities on critical sustainability issues, such as climate change, human rights and corruption. (GRI, 2016).

GRI was the first organization to develop a structure for the preparation of Sustainability Reports, in which various indicators were defined to help companies disseminate information on environmental and social economic performance.

In 2000, this NGO launched the first version of the guidelines for the dissemination of CSR information (G1). In 2002, the G1 guidelines were improved, resulting in G2, in which new guidelines were developed for the preparation of reports. Later, in 2006, GRI published the G3 Reporting Framework, which allows companies to adopt more flexible disclosures, with the aim of enabling the transparency of the company's activities with regard to its environmental, social and environmental performance. This version was updated and completed in 2011 with the release of G3.1 guideline, which focus on the indicators to be released by companies, such as gender differences, impacts on the local community and human rights. The “Technical Protocol - Applying the principles” was also included in this version to help define the contents of the sustainability report. In May 2013, the G4 version appeared. In relation to previous versions, the following changes stand out (PWC, 2014):

- Materiality: organizations should only disclose relevant topics and the procedure used to determine materiality.

- New requirements for the dissemination of information, at an economic, environmental and social level, management of the supply chain; companies should only disclose information when relevan.

- New requirements for disclosing information on Governance, Compensation, Ethics and Integrity.

- Greater focus on forms of management, in order to standardize its disclosure format.

- Change of Anticorruption and Greenhouse Gas Emissions indicators.

- Replacement of application levels by "essential" and "comprehensive".

- Adding a column for external verification to the new GRI table.

Alongside with the launch of G4, two other supporting documents for companies were also released: the “Principles of standard reporting and information” and “Implementation Manual” (Rome, 2016).

On July 1, 2018, the GRI Standards came into force. The GRI Standards are based on the contents of the G4 guidelines and the G4 Implementation Manual with the main changes and improvements being a new modular structure, a revised format with clear distinctions between requirements, recommendations and guidelines, an explanation of the main concepts and disclosures of the G4 in order to improve the understanding and application of standards, making it more flexible and transparent, and the incorporation of some selected content in other sections to reduce duplication and improve the logical follow-up of standards (GRI, 2018).

Determinants of CSR Disclosure and Hypotheses Survey

GRI has developed a remarkable work regarding the creation of guidelines to assist companies in the construction of Sustainability Reports and in the dissemination of Social Responsibility information.

Consequently, several authors sought to understand the level of application of GRI guidelines and the determining factors for their application (Legendre & Coderre, 2013), and which indicators are frequently disclosed (Roca & Searcy, 2012).

There are several studies that analyze the determining factors for the dissemination of CSR information, such as the size of the company (Gray, Javad, Power & Sinclair, 2001; Crisóstomo & Oliveira, 2015; Aerts & Cormier, 2009; Chiu & Wang, 2015; Otegui & Bhati, 2010; Chan, Watson & Woodliff, 2014; Juhmani, 2014; Reverte, 2009; Hussainey, Elsayed & Razik, 2011), the type of industry (Suttipun & Stanton, 2012; Faria, 2010; Gray et al., 2001; Otegui & Bhati, 2010; Chan et al., 2014; Monteiro, 2015), the presence on the stock exchange (Inchausti, 1997; Moneva & Llena, 2000; Braam, Uit De Weerd, Hauck & Huijbregts, 2016; Monteiro & Aibar -Guzmán, 2010; Hackston & Milne, 2015) and the type of audit firm (Ortiz & Marín, 2014; Miller, 2017; Braam et al., 2016; Juhmani, 2014).

Company Size

The size of the company is considered by several authors to be a determining factor for CSR disclosure. According to Aerts & Cormier (2009), the dimension affects the visibility of the company and tends to generate greater public scrutiny.

Larger companies, due to the significant number of activities they develop, involve a greater number of stakeholders, and have a greater number of shareholders who, in turn, may consider the company's social performance when making investment decisions (Gamerschlag, et al., 2011; Legendre & Coderre, 2013).

Otegui & Bhati (2010) stated that large companies are more pressured to disclose information of social responsibility compared to small companies to reduce the pressure of public scrutiny. Therefore, larger companies seek to legitimize their actions by disclosing more information on social responsibility.

Several authors have proven the existence of an association between the size of the companies analyzed and CSR disclosure (Chan et al., 2014; Crisóstomo & Oliveira, 2015; Monteiro, 2015; Reverte, 2009; Van & Vieira, 2014). However, the results are not consensual. Otegui & Bhati (2010) found no association between the disclosure of CSR information and the size of the company. The same results were also obtained by other authors, such as Hussainey, Elsayed & Razik (2011); Juhmani (2014).

On the other hand, Legendre and Coderre (2013) concluded that the size of the company is a determining factor for the adoption of GRI G3 guidelines. However, they found no evidence showing that this factor influences the level of application of these guidelines.

Thus, the following hypothesis is formulated:

H1: The level of disclosure according to GRI guidelines is associated with the size of the company.

Industry Type

The type of industry has been considered by many authors as a potential determinant for the dissemination of CSR information (Gray et al., 2001; Faria, 2010; Otegui & Bhati, 2010; Suttipun & Stanton, 2012; Chan et al., 2014; Van de Burgwal & Vieira, 2014; Hackston & Milne, 2015; Monteiro, 2015).

Legendre & Coderre (2013) consider that companies who belong to high-risk industries, with high consumer visibility or intense competition, are more likely to be under pressure from stakeholders.

Depending on the sector in which they operate, certain companies may face more demanding regulatory environments than others, making it necessary to reassure existing and potential investors who, in turn, want to obtain information about companies' potentially risky activities (Hackston & Milne, 1996).

Some authors (Suttipun & Stanton, 2012; Chan et al., 2014) classify the type of industry as high or low profile, depending on whether they belong to more or less environmentally sensitive sectors, respectively. Thus, they concluded that high profile companies usually disclose more information on CSR.

According to Otegui & Bhati (2010), Telecommunications and Retail companies disclose more information, followed by Utilities and Oil and Gas companies. In turn, Aerts and Cormier (2009) concluded that companies belonging to sectors such as Utilities, Energy, Mining and Resources, whose activities are most likely to affect the environment, release more CSR information.

Legendre & Coderre (2013) found evidence that the type of industry positively influences the level of adoption and application of GRI G3 guidelines.

Thus, the following hypothesis arises:

H2: The level of disclosure according to the GRI guidelines is associated with the type of industry in which the company operates.

Quotation Profile

Companies with securities listed on the stock exchange are generally subject to rules and requirements established by regulatory authorities, related both to the type and the amount of information to be made available to their stakeholders (Monteiro & Aibar-Guzmán, 2010).

Nowadays, investors are increasingly looking to make their decisions not only based on the financial performance of companies, but also on their social and environmental performance. Therefore, it is expected that those companies who have securities listed on the stock exchange disclose CSR information in accordance with GRI guidelines and the level of adoption of the same guidelines.

Monteiro & Aibar-Guzmán (2010) analyzed the determinants of the disclosure of environmental information in Portugal between 2002 and 2004 and concluded that companies with quoted values have higher disclosure levels than companies without quoted values.

Similarly, other authors also found an association between this factor and CSR dissemination (Hackston & Milne, 2015; Inchausti, 1997; Braam, Uit, Hauck & Huijbregts, 2016).

On the other hand, Moneva & Llena (2000) found no evidence that the company’s market quote is a differentiating factor when it comes to disclosing this type of information.

Thus, the following hypothesis is posed:

H3: The level of disclosure according to GRI guidelines is associated with the company's market quote profile.

Audit Firm Type

Organizations have adopted several approaches, such as the implementation of internal control systems, including internal audit functions, as part of the process to manage and disseminate information in order to improve the integrity and credibility of their reports and, thus, to meet the expectations of stakeholders. However, as a complement to internal procedures, GRI recommends the use of an external reliability assurance process for sustainability reports (GRI, 2011).

In this regard, Braam, et al., (2016) stated that, in response to public concerns about the insufficient reliability of sustainability reports, companies can also request third-party verification of sustainability reports, in addition to developing objective measures of environmental performance.

According to Eugénio & Gomes (2013), those responsible for preparing the Sustainability Reports use Statutory Auditors, panels made up of stakeholders and other groups or individuals outside the organization to implement an external verification process.

Consequently, several studies have focused on this theme, namely on the influence of the size of the audit company (Miller, 2017; Ortiz & Marín, 2014; Juhmani, 2014) Braam et al., 2016; Góis et al., 2015).

According to Miller (2017), the external assurance market is currently dominated by the Big Four Audit Company (KPMG, Pricewaterhouse Coopers, Deloitte Touche Tohmatsu and Ernst & Young). This fact goes against the results obtained by Ortiz & Marín (2014) in their study which show that the majority of the analyzed companies, about three quarters, used the assurance services of the main Audit companies.

In addition, Juhmani (2014) concluded that companies audited by large audit firms disclose more social and environmental information than those audited by small audit firms.

Braam, et al., (2016) observed that external assurance plays a significant role in explaining the level and nature of environmental information disclosure. In turn, Góis et al., (2015) found no evidence between being audited by the Big Four and disclosing a greater amount of voluntary information.

Thus, the following hypothesis arises:

H4: The level of disclosure according to the GRI guidelines is associated with the type of audit firm (Big Four or Non-Big Four).

Methodology

In this section we intend to present the sample that was the basis of this study, the method of data collection as well as the method used to analyze them. This chapter will also characterize the variables tested, based on the hypotheses formulated above.

Sample

In the present study, the analyzed population consists of all companies that added their Sustainability Reports or Management and Accounts Reports to the GRI Database between the years 2006 and 2014.

375 observations were obtained, based only on the companies that followed the GRI guidelines (G3 and G3.1), as it is more feasible to compare the disclosure level. However, some observations whose information was not complete were excluded, leaving the final sample initially composed of 358 observations with 91 companies.

Research and Data Collection

The data for this work were taken from the GRI Database for each year. The reports provided by the companies were also collected from this database. However, some companies' websites were also consulted when the report was not available on that database.

Dependent Variable

This study aims to analyze the determinants of the level of CSR disclosure by Portuguese companies with reports published on the GRI database, in the period between 2006 and 2014.

Thus, the “disclosure level” was defined as a dependent variable. This is a dummy variable from which it is possible to study the quality of the information disclosed. For that matter, the variable was measured by assigning the value “0” to the application level “Non-GRI”, value “1” to application levels A and A+, value “2” to the application levels B and B+, value “3” to the application level C and C+, value “4” to the application level “Not Declared”, and value “5” to “None (but quotes the GRI)”.

These classifications were taken from the GRI Database. The “Non-GRI” application level means that the information disclosed does not meet the disclosure requirements of that database. Levels A, A+, B, B+, C, C+ and “Not Declared” are classifications related to the types of disclosure based on G3 and G3.1. The level “Not Declared” means that disclosure is made in accordance with the disclosure requirements, however, it does not fall under any of the previous levels. Finally, the level of disclosure “None” means that although the company refers to GRI guidelines, the information disclosed does not fall under any specific type of disclosure.

Independent Variables

Similarly, to the data collected for the measurement of the dependent variable, the data for the measurement of the independent variables were also taken from GRI database, with the exception of the type of Audit Company. Due to the fact that some information could not be directly obtained from the database, including some of the reports, there was a need to consult the companies' websites to obtain the missing information.

Company Size

GRI characterizes companies in terms of size as small and medium-sized companies (SMEs), large companies and multinationals. The same characterization was used in this study, with the following values being assigned: “1” for large companies, “2” for multinational companies and “3” for SMEs.

Type of Industry

The “Type of Industry” was characterized according to the level of risk, based on the classifications of Hackston & Milne (1996); Legendre & Coderre (2013). Thus, based on the information found on the GRI Database regarding each company’s business sector, we have created the following categories, shown in Table 1.

| Table 1 Classification of sectors according to level of risk |

|

|---|---|

| High Risk Sectors | Low Risk Sectors |

| Automobile | Water |

| Aviation | Conglomerates |

| Energy | Construction |

| Media | Electricity |

| Forest Products and Paper | Equipment |

| Chemicals | Railroad |

| Telecommunications | Waste Management |

| Real Estate | |

| Logistics | |

| Construction Materials | |

| Other | |

| Food products and beverages | |

| Domestic and Personal Products | |

| Retail | |

| Non-Profit / Services | |

| Commercial services | |

| Health Services | |

| Financial Services | |

| Technology and Hardware | |

| Textiles and clothing | |

| Tourism and Laser | |

| University | |

To measure this variable, the same procedure was used: the value “0” was assigned when the company belonged to an industrial sector considered to be of low risk and “1” for high risk companies.

Quotation Profile

The “Quotation Profile” variable was measured according to the method used by Monteiro & Aibar-Guzmán, (2010). Thus, “0” was assigned to companies without listed values and “1” to companies with values listed on the Portuguese securities exchange - Euronext Lisbon.

Type of Audit Firm

To measure the variable “Type of audit firm”, the methodology used by Góis et al. (2015) was followed. Thus, the value “1” was assigned when the audit companies belonged to the Big Four and “0” when the same did not occur. To this end, KPMG, Pricewaterhouse Coopers, Deloitte Touche Tohmatsu and Ernst & Young were considered as part of the Big Four.

Data Processing Techniques

For the treatment of data, the program SPSS (Statistical Package for Social Sciences) was used. Descriptive analysis was initially used as an analysis technique to characterize the variables under study.

Then, non-parametric hypothesis tests were performed, namely the Mann-Whitney U test and the Kruskal-Wallis test, in order to verify whether there are differences in disclosure for each independent variable. The Mann-Whitney U test is used for variables that are divided into two groups. It compares the location center of two independent samples allowing you to find the differences between the two groups belonging to a given variable. According to Pestana & Gageiro (2003), the aforementioned test allows you “to verify the equality of behavior in two case groups or the existence of differences in the post-test scores between two experimental conditions”.

The Kruskal-Wallis test makes it possible to generalize the Mann-Whitney U test for variables with more than two groups. Thus, the Mann-Whitney U test was applied to the variables “Type of audit firm”, “Quotation Profile” and “Type of Industry”, while the Kruskal-Wallis test was applied to the variable “Company size.”

Finally, the Chi-Square independence test was used to verify whether the variables are related to each other and Cramer's V measure of association to assess the intensity of the relationship between the variables and, thus, test the hypotheses mentioned above.

Analysis of Results

This section includes the analysis of the results obtained after applying the methodology previously explained.

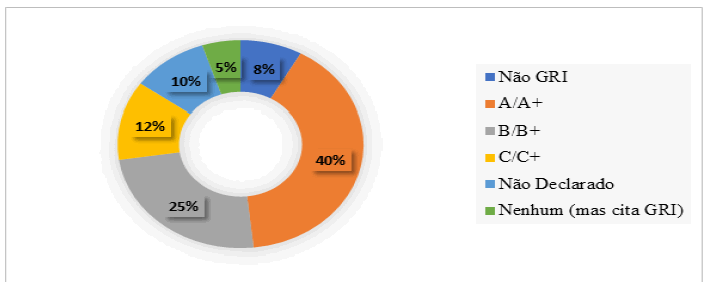

In Table 2 it is possible to observe that in 358 observations, 29 have a “Non-GRI” disclosure level, 144 correspond to an “A / A +” disclosure level, 87 to “B / B +” disclosure level, 44 to “C / C +” disclosure level, 36 to the “Not Declared” level, and 18 to “None” level (but quotes GRI).

| Table 2 Descriptive analysis by disclosure level |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level of disclosure | Year | Total | ||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

| Non GRI | 2 | 4 | 1 | 0 | 0 | 2 | 7 | 5 | 8 | 29 |

| A/A+ | 0 | 4 | 9 | 12 | 20 | 23 | 28 | 29 | 19 | 144 |

| B/B+ | 1 | 3 | 9 | 15 | 11 | 16 | 16 | 10 | 6 | 87 |

| C/C+ | 0 | 4 | 12 | 10 | 11 | 5 | 1 | 1 | 0 | 44 |

| Undeclared | 2 | 3 | 5 | 7 | 5 | 5 | 2 | 4 | 3 | 36 |

| None (but quotes GRI) | 0 | 0 | 0 | 2 | 1 | 2 | 6 | 4 | 3 | 18 |

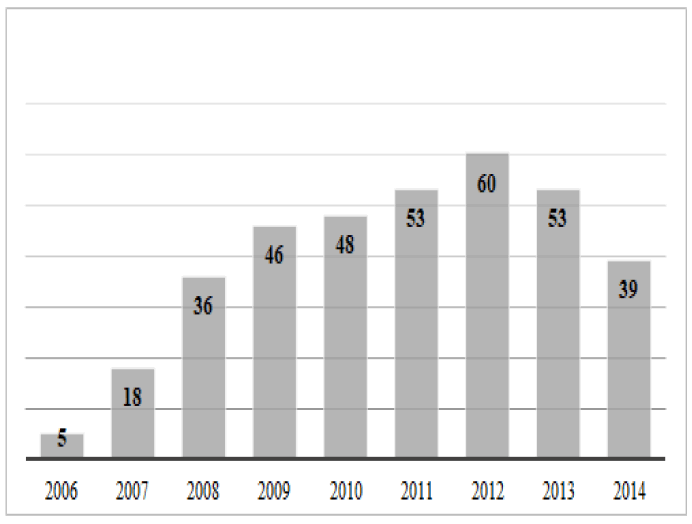

| Total | 5 | 18 | 36 | 46 | 48 | 53 | 60 | 53 | 39 | 358 |

These values are represented in percentage terms in Figure 1, which shows that approximately 40% of the analyzed reports have the highest level of disclosure (A / A +), 24% the second best level of disclosure “B / B +”, followed by disclosure level “C / C +” with a percentage of 12%. This Figure also shows that 10% of the reports disclosed are in accordance with GRI G3 / G3.1; however, their level of disclosure does not fall within the aforementioned levels (reporting level “Not Declared”). 8% of the reports analyzed do not disclose information in accordance with the GRI guidelines (“Non-GRI” disclosure level), and 5% quote the GRI guidelines but do not fall within any specific type of disclosure (None).

In Table 3, it is possible to verify that 283 of the observations come from large companies, 20 belong to multinational companies and 55 to small and medium sized companies.

| Table 3 Descriptive analysis by company size |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Company size | Year | Total | ||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

| Large | 5 | 15 | 32 | 39 | 40 | 39 | 45 | 41 | 27 | 283 |

| Multinational | 0 | 0 | 1 | 2 | 4 | 2 | 4 | 3 | 4 | 20 |

| SMES | 0 | 3 | 3 | 5 | 4 | 12 | 11 | 9 | 8 | 55 |

| Total | 5 | 18 | 36 | 46 | 48 | 53 | 60 | 53 | 39 | 358 |

Thus, it is possible to conclude that the sample is composed mainly of large companies (79% of observations), followed by small and medium-sized companies (15% of observations) and, finally, by multinational companies (6% of observations).

Regarding the variable “Type of Industry”, when analyzing Table 4, it appears that the sample is essentially composed of observations belonging to industries considered to be of low risk, since 279 of the 358 total observations belong to low risk industries, which corresponds to 78% of observations, while 79 observations comprise industries considered to be of high risk, making up the remaining 22%.

| Table 4 Descriptive analysis by type of industry |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Type of Industry | Year | Total | ||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

| Low risk | 4 | 13 | 31 | 39 | 37 | 40 | 46 | 42 | 27 | 279 |

| High risk | 1 | 5 | 5 | 7 | 11 | 13 | 14 | 11 | 12 | 79 |

| Total | 5 | 18 | 36 | 46 | 48 | 53 | 60 | 53 | 39 | 358 |

The descriptive analysis of the variable “Quotation Profile” is shown in Table 5. Through the results presented in this table it can be concluded that the number of observations belonging to companies without quoted values (222 observations) is higher than the number of observations whose companies have quoted values (136 observations). In percentage terms, 62% of the observations correspond to companies without quoted values, while 38% belong to companies with quoted values.

| Table 5 Descriptive analysis by market quotation profile |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Quotation profile | Year | Total | ||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

| Unquoted | 4 | 10 | 23 | 30 | 30 | 34 | 37 | 33 | 21 | 222 |

| Quoted | 1 | 8 | 13 | 16 | 18 | 19 | 23 | 20 | 18 | 136 |

| Total | 5 | 18 | 36 | 46 | 48 | 53 | 60 | 53 | 39 | 358 |

Regarding the type of Audit Company, it can be seen in Table 6 that from the 358 observations that make up the sample, 228 belong to reports verified by “Non Big4” companies and 130 to companies audited by Big4. Thus, it can be seen that 64% of the observations correspond to companies that do not use any of the Big4 companies to perform their audit, against 36% that use one of those companies.

| Table 6 Descriptive analysis by type of audit company |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Type of Audit Company | Year | Total | ||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

| Non Big4 | 4 | 13 | 22 | 30 | 29 | 33 | 38 | 34 | 25 | 228 |

| Big4 | 1 | 5 | 14 | 16 | 19 | 20 | 22 | 19 | 14 | 130 |

| Total | 5 | 18 | 36 | 46 | 48 | 53 | 60 | 53 | 39 | 358 |

In the descriptive analysis, it should also be noted that the number of observations increased between 2006 and 2012, from 5 observations in 2006, to 60 observations in 2012, and then it decreased again until 2014, with 39 observations (Figure 2).

Table 7 shows the results of the Kruskal-Wallis test for the variable Company Size. A test value of 7.19 was obtained with an associated significance value of 0.03, so it can be concluded that, for the total sample, there are disclosure differences in the variable “Company Size” (for large companies, multinationals or SMEs), with a type I error of 0.01.

| Table 7 Kurskal-Wallis test to the variable company size |

|||||

|---|---|---|---|---|---|

| Company size | Kurskal-Wallis Test | P-value | |||

| Large | Multinational | SMES | |||

| Average Rank (total sample) | 174.86 | 236.03 | 182.80 | 7.19 | 0.03 |

| Average Rank (per year) | |||||

| 2006 | 3.00 | -- | -- | -- | -- |

| 2007 | 8.47 | 14.67 | -- | 3.51 | 0.06 |

| 2008 | 18.03 | 24.67 | 15.00 | 1.29 | 0.52 |

| 2009 | 22.96 | 24.00 | 32.75 | 1.09 | 0.58 |

| 2010 | 23.09 | 26.88 | 36.25 | 3.70 | 0.16 |

| 2011 | 25.24 | 30.04 | 43.00 | 3.50 | 0.17 |

| 2012 | 29.03 | 33.18 | 39.63 | 1.90 | 0.39 |

| 2013 | 27.07 | 24.33 | 34.00 | 1.07 | 0.59 |

| 2014 | 19.70 | 21.13 | 19.75 | 0.11 | 0.95 |

Table 8 shows the results obtained by applying the Mann-Whitney U test to the Industry Type variable, obtaining a value of 9 903 with an associated significance of 0.2. Thus, it can be concluded that, in the total sample, there are no disclosure differences in the Industry Type variable (for low or high risk industries), with a type I error of 0.01.

| Table 8 Mann-Whitney u test applied to the industry type variable |

||||

|---|---|---|---|---|

| Type of industry | Mann-Whitney U Test | P-value | ||

| Low risk | High risk | |||

| Average Rank (total sample) | 175.49 | 191.54 | 9,903.00 | 0.20 |

| Average Rank (per year) | ||||

| 2006 | 2.63 | 4.50 | 0.50 | 0.40 |

| 2007 | 9.31 | 10.00 | 30.00 | 0.85 |

| 2008 | 19.03 | 15.20 | 61.00 | 0.48 |

| 2009 | 23.21 | 25.14 | 125.00 | 0.74 |

| 2010 | 24.41 | 24.82 | 200.00 | 0.93 |

| 2011 | 24.93 | 33.38 | 177.00 | 0.07 |

| 2012 | 29.04 | 35.29 | 255.00 | 0.21 |

| 2013 | 26.87 | 27.50 | 225.50 | 0.89 |

| 2014 | 19.04 | 20.64 | 136.00 | 0.70 |

The results of the Mann-Whitney U test applied to the Quotation Profile variable are shown in Table 9. With this test, the value of 13054.5 was obtained with an associated significance of 0.02. Thus, it is possible to conclude that, for this variable, considering the total sample, there are disclosure differences (companies with or without quoted values), with a type I error of 0.01.

| Table 9 Mann-Whitney u test applied to the quotation profile variable |

||||

|---|---|---|---|---|

| Quotation profile | Mann-Whitney U Test | P-value | ||

| Non Listed | Listed | |||

| Average Rank (total sample) | 188.70 | 164.49 | 13,054.50 | 0.02 |

| Average Rank (per year) | ||||

| 2006 | 3.00 | 3.00 | 2.00 | 1.00 |

| 2007 | 9.15 | 9.94 | 36.50 | 0.76 |

| 2008 | 20.91 | 14.23 | 94.00 | 0.07 |

| 2009 | 23.40 | 23.69 | 237.00 | 0.94 |

| 2010 | 26.67 | 20.89 | 205.00 | 0.15 |

| 2011 | 29.29 | 22.89 | 245.00 | 0.13 |

| 2012 | 30.39 | 30.67 | 421.50 | 0.95 |

| 2013 | 29.33 | 23.15 | 253.00 | 0.12 |

| 2014 | 21.62 | 18.11 | 155.00 | 0.35 |

Finally, regarding the analysis of the disclosure differences between the independent variables, Table 10 presents the results of the Mann-Whitney U test to the variable Type of Audit Company. Therefore, it can be seen that the test score btained was 9074.5 with an associated significance of 0. Thus, it can be concluded that, in the total sample, there are disclosure differences for this variable (Big4 and non-Big4 companies), with a type I error of 0.01.

| Table 10 Mann-Whitney u test applied to the variable type of audit company |

||||

|---|---|---|---|---|

| Type of audit company | Mann-Whitney U Test | P-value | ||

| Non Big4 | Big4 | |||

| Average Rank (total sample) | 204.70 | 135.30 | 9,074.50 | 0.00 |

| Average Rank (per year) | ||||

| 2006 | 2.63 | 4.50 | 0.50 | 0.40 |

| 2007 | 9.58 | 9.30 | 31.50 | 0.92 |

| 2008 | 22.30 | 12.54 | 70.50 | 0.01 |

| 2009 | 28.97 | 13.25 | 76.00 | 0.00 |

| 2010 | 31.53 | 13.76 | 71.50 | 0.00 |

| 2011 | 32.52 | 17.90 | 148.00 | 0.00 |

| 2012 | 33.39 | 25.50 | 308.00 | 0.07 |

| 2013 | 29.76 | 22.05 | 229.00 | 0.06 |

| 2014 | 20.62 | 18.89 | 159.50 | 0.65 |

Table 11 shows the value of the chi-square test for the variable Company size, namely 32.443. When consulting the Chi-square table with 2 degrees of freedom and α = 0.01, the critical region is found [9,21.; + ∞ [. Thus, since the test value is included in this range, it can be concluded that there is a relationship between the level of disclosure and the size of the company. However, since the Crámer V value (0.212) is very close to 0, this association is considered to be weak. This confirms H1, that is, the level of disclosure is associated with the size of the company despite the fact that this is not a strong association.

| Table 11 Association tests for the company size variable |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Level of disclosure | Company size | Chi-Square Statistics | Symmetry Measures | ||||||

| Big | Multinational | SMES | Pearson Chi-Square | Likelihood Ratio | Linear-by-Linear Association | Phi | Cramer's V | Contingency Coefficient | |

| Non GRI | 24 | 4 | 1 | 32.443*** | 35.809*** | 0.744 | 0.301*** | 0.212*** | 0.288*** |

| A/A+ | 120 | 0 | 24 | ||||||

| B/B+ | 64 | 5 | 18 | ||||||

| C/C+ | 37 | 2 | 5 | ||||||

| Undeclared | 25 | 5 | 6 | ||||||

| None (but quotes GRI) | 13 | 4 | 1 | ||||||

| Statistically significant values: ***0.01, **0.05 e *0.1 | |||||||||

Table 12 shows the results of the chi-square association test for the Industry Type variable. Once again, consulting the Chi-square table for 1 degree of freedom and α = 0.01, the following critical region is obtained [6,635; + ∞ [. As the test value (23,682) falls within that range, it is concluded that there is a relationship between the type of company and the level of disclosure. However, as Cramer's V value is very close to 0, this association is considered weak. Thus, similar to the previous variable, H2 can be confirmed, that is, the level of disclosure variable is associated with the type of industry variable; however, this association is considered weak.

| Table 12 |

|---|

References

Aerts, W., & Cormier, D. (2009). Media legitimacy and corporate environmental communication. Accounting, Organizations and Society, 34(1), 1–27.

Alvarez-Gonzalez, L., Garcia-Rodriguez, N., & Sanzo-Perez, M.J. (2018). Online voluntary transparency in spanish retail firms. Measurement Index and CSR-Related Factors as Determinants. Sustainability, 10, 3542, 1–20.

APEE. (2018). Normas Publicadas.

Aupperle, K.E., Carroll, A.B., & Hatfield, J.D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28(2), 446–463.

Baptista, H.C. (2015). Adocao da responsabilidade social por parte das micro e pequenas empresas portuguesas: uma analise a entidades dos distritos de Braganca e Vila Real. (Adoption of social responsibility by Portuguese micro and small companies: an analysis of entities in the districts of Braganca and Vila Real).

BCSD Portugal. (2018a). Meet 2030.

BCSD Portugal. (2018b). Objetivos de Desenvolvimento Sustentavel– ODS.

BCSD Portugal. (2018c). Quem somos.

Bhattacharyya, A. (2015). Corporate social and environmental responsibility in an emerging economy: Through the lens of legitimacy theory. Australasian Accounting, Business and Finance Journal, 9(2), 79–92.

Braam, G.J.M., Uit De Weerd, L., Hauck, M., & Huijbregts, M.A.J. (2016). Determinants of corporate environmental reporting: The importance of environmental performance and assurance. Journal of Cleaner Production, 129, 724–734.

Branco, L.P.S., & Gois, C.G. (2012). Relato Financeiro – A Importancia E Os Determinantes Da Divulgacao Voluntaria . Analise Da Divulgacao Voluntaria Nas Empresas Em Portugal. (Financial Reporting – The Importance and Determinants of Voluntary Disclosure . Analysis of Voluntary Disclosure in Companies in Portugal).

Campopiano, G., & De Massis, A. (2015). Corporate social responsibility reporting: A content analysis in family and non-family firms. Journal of Business Ethics, 129(3), 511–534.

Chan, M.C.C., Watson, J., & Woodliff, D. (2014). Corporate governance quality and CSR disclosures. Journal of Business Ethics, 125(1), 59–73.

Chi, W., Wub, S.-J., & Zhengc, Z. (2020). Determinants and consequences of voluntary corporate social responsibility disclosure: Evidence from private firms. The British Accounting Review, 52, 100939.

Chiu, T.K., & Wang, Y.H. (2015). Determinants of social disclosure quality in Taiwan: An application of stakeholder theory. Journal of Business Ethics, 129(2), 379–398.

Cochran, P.L., & Wood, R.A. (1984). Corporate social responsibility and financial performance. Academy of Manegement Journal, 27(1), 42–56.

Accounting Standardization Commission. (2002). Accounting Guideline No. 29 - Environmental matters, 29.

Conde, M.de.F., Vazquez, D.G., & Marques, M.da.C. da C. (n.d.). Evolucao da Responsabilidade docial Empresarial na Peninsula Iberica. (Evolution of corporate social responsibility in the Iberian Peninsula).

Crisostomo, V.L., & Oliveira, M. R. (2015). An analysis of the determinants of corporate social responsibilty of Brazilian firms. SSRN, 72–93.

Diez Martin, F., Blanco Gonzalez, A., & Prado Roman, C. (2010). Legitimidad como factor clave del exito organizativo. Investigaciones Europeas de Direccion y Economia de La Empresa, 16(3), 127–143.

Drucker, P.F. (1984). The new meaning of corporate social responsibility. California Management Review, 26(2), 53–63.

Eugenio, T., & Gomes, S. (2013). Verificacao aos Relatorios de Sustentabilidade Um desafio para os Revisores Oficiais de Contas. Revisores e Auditores, 36–44.

Faria, F.M. (2010). “ Um indice de Responsabilidade Social Empresarial para a Realidade Portuguesa .”

Faria, M.J.da.S. (2015). Responsabilidade Social Empresarial- Relato e analise economica e financeira. (Corporate social responsibility - economic and financial reporting and analysis) (S. Vida Economica- Editorial, Ed.).

Ferreira, A.L.de.P. (2008). A divulgacao de informacao sobre capital intelectual em Portugal- Uma analise exploratoria. (The dissemination of information on intellectual capital in Portugal - An exploratory analysis).

Gamerschlag, R., Moller, K., & Verbeeten, F. (2011). Determinants of voluntary CSR disclosure: empirical evidence from Germany. Review of Managerial Science, 5, 233–262.

Gois, A.D., De Luca, M.M.M., & Vasconcelos, A.C. (2015). Determinantes da divulgacao dos indicadores de desempenho da GRI nas empresas do Brasil e da Espanha, (Determinants of disclosure of two GRI performance indicators in companies in Brazil and Spain), 7.

GRACE. (2004). Primeiros Passos - Guia para a Responsabilidade Social das Empresas (First Steps - Guide to Corporate Social Responsibility).

GRACE. (2018). O GRACE - Grupo de Reflexao e Apoio a Cidadania Empresarial (O GRACE - Corporate Citizenship Reflection and Support Group).

Gray, R., Javad, M., Power, D.M., & Sinclair, C.D. (2001). Social and environmental disclosure and corporate characteristics: A research note and extension. Journal of Business Finance and Accounting, 28(3–4), 327–356.

GRI. (2000). Global Reporting Initiative. Directrizes para a Elaboracao de Relatorios de Sustentabilidade.

GRI. (2011). Sustainability Reporting Guidelines.

GRI. (2016). Global Reportig Iniciative. Retrieved October 31, 2016, from https://www.globalreporting.org

GRI. (2018). Questions about transitioning from G4 to GRI Standards.

Guthrie, J., & Farneti, F. (2008). GRI sustainability reporting by Australian public sector organisations. Public Money and Management, 28(6), 361-366

Hackston, D., & Milne, M.J. (1996). Some determinants of social and environmental disclosures in New Zealand companies.

Hussainey, K., Mohamed, A.O., & Marwa, A.R. (2011). Factors affecting corporate social responsibility disclosure in Egypt. Corporate Ownership and Control, (July).

Inchausti, B. G. (1997). The influence of company characteristics and accounting regulation on information disclosed by Spanish firms. European Accounting Review, 6(1), 45–68.

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 4, 305–360. Retrieved from http://ssrn.com/abstract=94043http://hupress.harvard.edu/catalog/JENTHF.html

Juhmani, O. (2014). Determinants of corporate social and environmental disclosure on websites: The case of Bahrain. Universal Journal of Accounting and Finance, 2(4), 77–87.

Karim, K., Suh, S., Carter, C., & Zhang, M. (2015). Corporate social responsability: Evidence from the United Kingdom. Journal of international business research,14(1), 85–101.

Lau, C.M., Lu, Y., & Liang, Q. (2016). Corporate social responsibility in China: A corporate governance approach. Journal of Business Ethics, 136(1), 73–87.

Legendre, S., & Coderre, F. (2013). Determinants of GRI G3 application levels: The case of the fortune global 500. Corporate Social Responsibility and Environmental Management, 20(3), 182–192.

Miller, K. C. (2017). Current trends and future expectations in external assurance for integrated corporate sustainability reporting. Journal of Legal, 20(1), 1–18.

Moneva, J.M., & Llena, F. (2000). Environmental disclosures in the annual reports of large companies in Spain. The European Accounting Review, 9(1), 7–29.

Moneva, M., Archel, P., & Correa, C. (2006). GRI and the camouflaging of corporate unsustainability. Accounting Forum, 30, 121–137.

Monteiro, P. (2015). Determinantes da Extensao e Seletividades da sobre Responsabilidade Social : Divulgacao evidencia nas empresas cotadas Portuguesas. Universidade de Aveiro (Determinants of extension and selection of social responsibility: Disclosure of evidence in limited Portuguese companies. University of Aveiro).

Monteiro, S., & Aibar-Guzman, B. (2010). Determinants of environmental disclosure in the annual reports of large companies operating in Portugal. Corporate Social Responsibility and Environmental Management, 17(4), 185–204.

Ortiz, E., & Marin, S. (2014). Global Reporting Initiative (GRI) as recognized guidelines for sustainability reporting by spanish companies on the IBEX 35: Homogeneity in their framework and added value in the relationship with financial entities. Intangible Capital, 10(5), 855–872.

Otegui E.J., & Bhati, S.S. (2010). Determinants of social and environmental disclosures by Spanish Companies. GSMI Third Annual International Business Conference, 55–68.

Pestana, M.H., & Gageiro, J.N. (2003). Analise de Dados para Ciencias Sociais- A Complementariedade do SPSS (3a Edicao). Edicoes Silabo (Data analysis for social sciences- A complementarity of SPSS (3rd Edition). Edicoes Silabo.).

Reverte, C. (2009). Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. Journal of Business Ethics, 88, 351–366.

Ribeiro, L. (2017). Responsabilidade Social – Importancia para as empresas e para o consumidor (Social Responsibility – Importance for companies and for the consumer).

Roca, L.C., & Searcy, C. (2012). An analysis of indicators disclosed in corporate sustainability reports. Journal of Cleaner Production, 20(1), 103–118.

Roma, P. (2016). Relatorios de Sustentabilidade - comparacao de divulgacao 2008 vs 2013. Instituto Politecnico de Lisboa- Instituto Superior de Contabilidade e Administracao de Lisboa (Sustainability reports - disclosure comparison 2008 vs 2013. Lisbon Polytechnic Institute - Lisbon Accounting and Administration Higher Institute).

Suchman, M.C. (1995). Managing legitimacy: Strategic and institutional approaches. The Academy of Management Review, 20(3), 571–610.

Suttipun, M., & Stanton, P. (2012). The differences in corporate environmental disclosures on websites and in annual reports : A case study of companies listed in Thailand. International Journal of Business and Management, 7(14), 18–31.

Van de, B.D., & Vieira, R.J.O. (2014). Environmental disclosure determinants in Dutch listed companies. Revista Contabilidade & Financas - USP, 25(64), 60–78.

Wang, K.T., & Li, D. (2016). Market reactions to the first-time disclosure of corporate social responsibility reports: Evidence from China. Journal of Business Ethics, 138(4), 661–682.

Zheng, Q., Luo, Y., & Maksimov, V. (2015). Achieving legitimacy through corporate social responsibility: The case of emerging economy firms. Journal of World Business, 50(3), 389–403.

Received: 03-Jan-2022, Manuscript No. AEJ-22-10812; Editor assigned: 05- Jan -2022, PreQC No. AEJ-22-10812 (PQ); Reviewed: 19- Jan-2022, QC No. AEJ-22-10812; Revised: 26-Jan-2022, Manuscript No. AEJ-22-10812 (R); Published: 07-Feb-2022