Research Article: 2021 Vol: 25 Issue: 5

Determinate main Challenges that Facing Financial Inclusion in Iraq - An Evaluation Study

Dr. Fadi Hassan Jaber, Imam Al Kadhum College

Dr. Mohanad Hameed Yasir, University of Kufa

Citation Information: Jaber, F.H., & Yasir, M.H. (2021). Determinate main challenges that facing financial inclusion in iraq - an evaluation study. Academy of Accounting and Financial Studies Journal, 25(5), 1-16.

Abstract

The research aims to identify the most important challenges and obstacles to achieving an advanced level of financial inclusion (FI) in Iraq and to diagnose these challenges. Global financial indicators have been relied on to diagnose and how to achieve progress in the level of FI in Iraq and also to diagnose which indicator is more important than the rest of the indicators based on analysis and opinions Many academics interested in financial affairs, numbering 130, that the research and using the method of quantitative and qualitative analysis and testing the basic hypothesis, many discussions and recommendations were reached that help in how to face difficulties and work as soon as possible to raise the level of inclusiveness next in Iraq. The study explain barriers and prospects that effect in FI and dissection the vital role of FI in Iraqi financial environment and the international interest in the development of FI. The research concentrate on the current situation of FI in Iraq and what is the procedures to develop it. The researcher use a sample of experts, managers and academics to clarify the capabilities of financial institutions in Iraq to fulfilment FI, The study has reached conclusions regarding the importance of changing financial regulation, review financial slack, enhancing financial education, deploy financial culture and depending on financial innovation. The study set of recommendations, the most important of which is the establishment of a specialized center for FI as important tool to develop our country and training of financial human resources, which helps in building innovation ideas and be the basis for creating FI and Avoid problems that happen to be achieved.

Keywords

Financial Inclusion (FI), Financial Services, Iraq.

Introduction

Studies and reports of international financial institutions confirm that FI is one of the main pillars of today's high finance and represents an essential part in the financial development of any country Abdu et al. (2015), but this goal must be addressed to the obstacles facing it in order to comply with indicators of FI and the characteristics of these indicators that the Iraqi economy is trying to grow After a long period of discontinuation from the world, improvement and development are transmitted through a set of initiatives adopted by one of them is FI, which needs more than following the correct methods in developing a management process for how to limit FI that is mainly reflected in The development of medium and small-sized projects where the study focuses on how to overcome obstacles facing indicators of FI and its proper evaluation, which helps in achieving one of the most important goals of FI by reaching financial services, especially financing, which represents the most important need for the Iraqi environment, and that studying these indicators according to the Iraqi environment What you possess represents a cornerstone in knowing where we are and what we need in order to achieve what we want and what is the best way to reach the best level of FI and at the earliest possible time (Zins & Weill, 2016).

Financial exclusion considered as one of the form of social exclusion means lack of access to labour markets, credit availability and other forms of capital assets. Financial exclusion is an extended form of economic exclusion depriving people of credit, income and utilization of this credit and income to build capital assets further limiting their living opportunities in the mainstream economy. Exclusion from employment or access to credit may lead to economic impoverishment that in turn may deprive others (such as jobless and immigration) (Ambarkhane et al., 2016).

Achieving a well-functioning financial system and attracting the attention of the international environment is a difficult challenge, according to the United Nations report (2006) entitled "Building a comprehensive financial sector for development" that has been able to attract the international community's attention on this phenomenon and FI has been able to receive priority as a policy issue In most countries (GPFI, 2010). The U.N report defines a financial system to be an inclusive one which is able to provide credit to all individuals and enterprises who are bankable; savings, payment & remittance services for all; insurance to insurable people (Akudugu, 2013).

The financial sector leads as a mediator and mediator to achieve economic stability. In Iraq a large part of society is deprived of the use of official financial services that they must rely on because of informal sources of funding, which bear a heavy cost. Experts from the banking sector and government have therefore identified the need for some initiatives and contributions that can be devoted to providing banking services to the economically weaker strata of society (Siddik et al., 2016)

The FI Term

At its most basic level, FI refers to the population's and companies' approaches to financial services, as well as their use by the two groups (GPFI, 2019). "The process of providing adequate financial goods and essential services to all members of society in general, and vulnerable sets in specific, at a reasonable cost in a fair and transparent manner via institutional mass actors," according to a more developed view of FI (Committee, 2015). The Iraqi National Bank has a similar viewpoint. As a result, the Financial Stability Report Pérez et al. (2017) and Al-Alaq (2018) defines FI as the All sectors of consumers and businesses have acceptable assessment to financial services (investments, savings and credit, insurance, and payments). FI encompasses not just the availability of financial services, but also their quality.

The World Bank publishes a document on FI, which considers that FI "means individuals and businesses have instant access to and reasonably priced financial services and products that meet their requires - transactions, payments, savings, credit, and insurance services - delivered in a socially and environmentally responsible manner" (the report seems to have two versions, the first in 2011 and the second in 2014; Demirguc-Kunt et al., 2018; The World Bank, 2017). Furthermore, the International Monetary Fund, which has produced six editions of the Financial Access Survey, the most recent in 2016, thinks that FI is defined as "access and usage of official / formal financial services" (Sahay et al., 2015). Finally, we should mention that the phrase "financial inclusion" may refer to anything from" access to and usage of services supplied in a socially and environmentally responsible manner" to "offering inexpensive financial services for low-income sectors of society."

The Issue of FI

Depending on answers to questions such as why certain individuals or businesses do not have access to financial services or get very few calls from them. Low income, a lack of financial intermediaries, or financial intermediary services that are not tailored to demand are among the replies. Despite the fact that there are many research on FI, none of them show a direct link: Economic development is defined as an improvement in living standards (Neaime & Gaysset, 2018). However, there is unquestionably a connection between, on the one hand, economic growth and rising living standards and, on the other side, FI. The more developed an economy is, the better the quality of life becomes, and the greater the need for financial services by individuals and businesses. It is conceivable that increased inhabitant and company financial intermediation will contribute to GDP gains, but if people's incomes and companies are insufficient to consume certain financial services, they will do nothing but avoid them (Soumaré et al., 2016).

Statistics show that progress has been made in regards of FI throughout time, but major problems remain. As a result, certain populations are more financially disadvantaged than others, such as women, the rural poor, and other marginalized groups who have limited access to financial services. In addition, most small companies find it difficult to get financial products. In terms of FI, there is a significant disparity between developed and developing nations. Countries that have made the most progress toward FI have adopted laws and strategies that permit and promote competition, allowing banks and other non-bank financial businesses to innovate and increase financial services access. Nevertheless, in order to guarantee that financial services are provided responsibly, this creative and competitive sector must be supported with regulations and consumer protection measures (Tuesta et al., 2015).

It's also worth noting that digital technology, which has manifested itself in the financial sector (dubbed "FinTech" by the World Bank) and, in specific, the worldwide of mobile phones, has aided in the expansion of access to financial services with low costs and risks for people in remote areas and small businesses. The procedures of establishing an digitizing payments and account are now simpler than ever before thanks to FinTech. Mobile banking-based financial services provide for convenient access even in distant locations, and increased customer data availability allows suppliers to develop digital financial solutions that better meet the requirements of non-banked people. The three-dimensional nature of FI necessitates its measurement Akudugu et al. (2012):

- Financial services using,

- Accessing to financial service.

- Quality of provision and products of these services.

It's worth noting that the indications were updated on a regular basis, with new ones being added as the FI idea evolves. The following databases provide data for the indicators used to measure FI: World Bank Global Survey, World Bank Doing Business, Entrepreneurs Scoreboard and OECD Financing SMEs, FI Surveys and OECD National Financial Literacy OECD, (2019), World Bank Enterprise Surveys, Gallup World Poll, IMF Financial Access Survey, World Bank Global Findex on Protection of Consumer and Financial Literacy, World Bank Financing SMEs and Entrepreneurs Scoreboard (GPFI, 2019).

FI Difficulties

Demirgüc-Kunt et al. (2008) aided the FI's evolution from just giving access to microcredit to integrating insurance products, savings, and remittances into a broader idea. Sarma & Pais (2011) devised a methodology for determining a country's FI level. Three fundamental dimensions were utilized in the research (usage, banking services availability, and banking penetration). Those seeking formal financial services might encounter difficulties. High costs, inappropriate product designs, and inability to meet eligibility criteria, such as bank papers, are just a few of the issues. Generally, mobile banking models rely on a broad variety of unconventional agents to provide cash-in and cash-out services, including shops.

According to Chatain et al. (2008), service providers' reach is expanded while service prices remain low. The tremendous success of mobile phone adoption in developing nations has been exploited by utilizing mobile banking models as important conduits to reach new and underserved consumers, according to a research by (Pickens et al., 2009). The Azteca bank example is used by Bruhn (2011) to investigate the impact of banking penetration policies on target low-income people in relation to economic growth. The bank has approximately 600 branches in 2002. According to Beck (2011), those who choose not to use such services (those who requested to be excluded) think they do not require them. In 2009, Morawczynski & Pickens, (2009) said that roughly one billion people using mobile phones did not have banking accounts.

Many researchers Gandhi (2013) and World Bank (2015) measured and emphasized FI indicators by country, including POS, ATM per individual, banking branches per individual, and banking penetration, whereas trying to compare these indexes to those of other countries in the region, and also government and financial sector policies and procedures. Demirguc-Kunt et al. (2018) used World Bank index data on loans and savings, insurances, bank penetrations, and mobile money in 148 countries to assess FI indicators.

According to Chatain et al. (2008), regulatory issues that conform with proposed new regulatory models that incorporate international financial integrity requirements hindered FI efforts in certain countries, particularly mobile banking advancements. Other issues covered by Dittus & Klein (2012) include religious or cultural reasons, as well as a lack of confidence in official financial institutions, such as individuals who have experienced bank collapse or are afraid of becoming fraud victims. Clients who have access to formal financial services, according to Ellison et al. (2010), may leave these institutions. Clients might opt out of formal financial services for a variety of reasons, including high costs, a lack of confidence, bad credit, uncontrollable spending, and poor product design.

Izquierdo & Tuesta (2015) investigated the connection between FI and socioeconomic factors (person characteristics) in Peru and the impact of their association on individual and business adoption of FI. Financial exclusion is exacerbated by poor income, gender, lack of education, and rural location. The banking penetration (access) indicator, as well as other associated variables including branch number, ATMs, branch and ATM dispersion, branch and ATM population coverage, electronic payment cards, POSs, and banking accounts, will be used in this research. Access to total credits, banking accounts, debts, savings, formal financial institutions, and total deposits are all variables examined in the research.

FI ensures that all parts of society, including vulnerable groups including weaker portions and low-income groups, have access to suitable financial goods and services at a reasonable cost, delivered in a fair and transparent way by regulated mainstream institutional actors. Financial literacy is seen as a necessary complement to fostering FI, consumer protection, and, eventually, financial stability. To allow the ordinary man to comprehend the requirements and advantages of the goods and services provided by formal financial institutions, FI and financial literacy must go hand in hand. So, in terms of financial literacy, it basically entails two components: one of access and the other of literacy. There are various variables for FI like affordable credit, coverage of unbanked villages, spreading financial awareness, microcredit, financial advice, etc.

FIEssential

Mahendra is a man of many talents (2006) FI is critical for the poor, farmers, and those living in rural and disadvantaged areas to better their living conditions. Debit cards, stored value cards, computer banking, and Direct deposit, according to King & Levine (1993), may all assist with FI. Sangwan is a Buddhist monk (2008) It was shown that branch density has a positive substantial effect on FI, whereas financial literacy has a negative but significant impact. Chibba (2009) alleviate poverty, promote equitable development, and meet the millennium development objectives, FI provides gradual and balanced solutions.

Mendoza (2009) When there is a disparity in the growth of financial imbalance, financial markets occurs as a consequence of integration. Ramji (2009) Their results indicate that additional work in the areas of financial literacy and marketing is needed to ensure that bank accounts are utilized effectively. BBI (Baseball Batting Ins) (2009) The finding were bolstered by initiatives to boost the productivity of small and marginal farmers, as well as other businesses, so that the financing made accessible might be put to good use. OECD (2019), providing knowledge is just the beginning: the end aim is to enable consumers to take action to enhance their financial well-being.

Hannig, & Jansen (2011), A bigger FI means more opportunities to improve financial stability. Sharma & Pais (2010) found that human development and FI in a given nation progress in lockstep.

Literature Review

Understanding FI as a critical component of long-term economic growth. The quest for FI shows that community efforts and donations to FI are required to enhance the financial position of economically disadvantaged sectors of society. It encompasses a broad variety of activities, including savings, insurance, and credit (Dev, 2006). Furthermore, a research found that providing low-margin financial services to a large number of individuals may result in significant profit. It is critical for banks to reconsider their existing business practices in order to encourage financial integration amongst low-income populations. In order to accomplish the objective of financial integration, all available resources, including technology, must be used.

Leeladhar (2006) Absence of work, low literacy, and low income levels were identified as the major reasons of poor financial achievement (Sriram & Sundaram, 2015). Furthermore, some crucial information was disclosed. However, the research revealed that bank accounts have not been created under the FI program, but rather under a program, and that there was an investigation that addressed the need to improve financial literacy among the rural people (Ramji, 2009). While the primary emphasis was on FI, the first objective in a cross-country research was achieved using two additional principles/approaches. The authors discovered a significant link between the degree of FI and the level of long-term human growth. The author found that per capita income had been a significant variable in understanding levels of FI when utilizing the Sarma index for the suggested FI. As a result, additional indicators were discovered, including adult literacy, urbanization, and economic disparity (Sharma & Beyas, 2011).

The term "financial inclusion" (FI) refers to the loss of some kinds of society's access to essential, low-cost, fair, and secure financial goods and services from major service providers. As a result, the core of FI is to guarantee that all people have access to a variety of suitable financial services and that they are able to comprehend and provide these services. Regardless of the usual form of financial intermediation, a fundamental bank account without payments to obtain and receive payments, a suitable savings product for the poverty money flow pattern, non-life insurance, life, overdraft for personal and, money transfering facilities, microcredit and other uses, and so on. On the demand side, low awareness, low income, poverty, and illiteracy are the most common causes of financial exclusion; on the staff attitudes, language, inappropriate products, cumbersome procedures, documentation, branch timing, branch distance, and supply side are the most common causes of financial exclusion. People believe that taking money from informal credit sources is simpler since all these procedural wranglings, but this leads to dangers, greater prices, increased exposure to unethical and disorganized service providers, and vulnerability to unsecured hazards. To save, open a bank account, but this requires banks to raise knowledge about financial products, literacy, and guidance on money management and debt management, among other things. Every community must guarantee that public goods are easily accessible. As a result, banking services must strive to be a universal instrument for delivering services to the broader public.

On a large scale, it has been said that FI is the process of providing banking services at a reasonable cost, thus improving their living conditions. (Sharma and Beyas, 2011)

The Prospect of FI

Importance of FI

The response is that if impoverished people do not have access to our official financial system, they will not be able to develop and progress, and as the nation improves, they will stay poor and unable to meet their fundamental needs. Second, due of the financial system's lack of maturity, people may be duped into fraud activities and robbed. They are oblivious to the importance of investing and are putting their children's futures at danger. This is why FI strives for long-term growth.

"FI" is characterized as "the process of guaranteeing the delivery and supply of sufficient and timely financial and credit services once required by vulnerable groups including the most vulnerable and low-income populations at a fair cost," according to the (Rangarajan, 2008). In general, financial inclusion (FI) refers to the provision of low-cost banking services to significant segments of the poor and low-income population. For an open and functioning society, unrestricted accessing to public goods and services is a need. Because banking is in the best interests of society, it is essential that the policy's primary goal be to provide financial services and payment to all segments of society without discrimination (Sarkar, 2010).

The banking sector's effort to involve various sectors of society, geography, gender, and income, as well as encourage the public to embrace banking traditions, may help FI accomplish its goals. Furthermore, the Central Bank of Iraq, as a key regulatory agency, contributes to the development of FI via a variety of legislations, financial literacy engines, and technological applications, among other things (Evans & Adeoye, 2017).

The following is a summary of the significance of FI: If a customer is financially educated, he will be able to make better financial decisions, such as which financial products would best suit his or her specific requirements. Will contribute to the overall development of a sustainable future (Chithra & Selvam, 2013).

The lives of the impoverished are improved when they have accessing to financial services and low-cost banking. FI is a long-term plan, but in order to accomplish its goals, we must keep in mind the main areas that must be addressed:

- Accessing basic financial services including banking services, etc. must be providing

- The using of financial services should be meeting the requirements of the poor.

- The financial product should be at low costs.

- The services and products quality should be enhanced.

For the following reasons, recent trends have demonstrated that technology has a significant effect on enhancing FI:

- Helps decrease product cost.

- Reduces the cost of procedures.

- Product quality development.

- Helps increase diversity and flexibility for customers.

All of the above has contributed to the increased utility of financial services. Figures 1-5 illustrates the most effective factors in FI (Ambarkhane et al., 2016; Kaur et al., 2017).

Requirement of FI in Iraq

Since it fosters a culture of saving across various groups or the rural population, FI assists improve the financial system's resource base in Iraq. Furthermore, by offering competitively priced financial services, they are able to preserve and utilize their financial riches in any situation. Vulnerable groups in society will be protected from misleading finances if they have easy access to official credit. The following are the FI's major goals in Iraq:

- Developing a platform for planting that saves money: this is a critical component for the development of the state's financial system. By attempting to integrate Mali, the central bank hopes to expand the country's financial resource base by encouraging everyone to open a banking account and therefore securitize their savings (Singh & Singh, 2016).

- Provision of formal banking resources: To fulfill their financial requirements, a significant section of the impoverished population increasingly relies on direct access to loans from family, friends, and lenders. Individuals from low-income groups will be able to stabilize their livelihoods and enhance their living conditions via formal banking channels.

- Subsidy and social assistance program direct benefits: One of the most pressing issues confronting the government is that funds given to the rural population under various plans do not reach them. If every organization in rural areas has a banking account, it is utilized for professional and convenient money distribution As a result, the central banking has chosen direct transfers to recipients.

The United Nations has highlighted access to a variety of financial services including remittances, insurance, credit, savings, and other bank payment services to all families and banking institutions at a fair cost as one of the primary goals of comprehensive finance. The benefits of financial integration can be seen all around the globe. Much of the research on banking communication focuses on the effect of evidence collected during the nation. In a survey performed by the World Bank in rural Iraq, it was shown that approximately 25% of families had bank accounts, 30% have outstanding loans, and just 10% have any insurance. (Report of Iraq Central 2019). The FI began with financial literacy and progressed to financial stability.

Barriers of FI

Banking Density

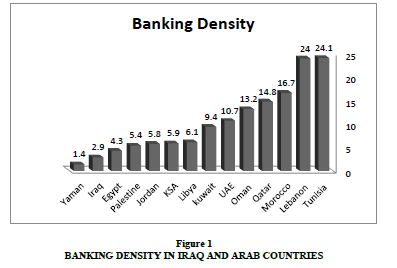

The banking sector suffers from a decline in banking density, which currently stands at the limit of one bank branch per 35,000 people, which is low compared to the global standard of one bank per 10000 people due to the lack of mechanisms and techniques in the banking sector. In the most densely populated population in Iraq. Iraqi is unranked in economic stability index. And Figure 1 explains the Banking Density in Iraq and compare with other Arab countries.

Sources: Report of Iraq Central Bank www.cbi.iq

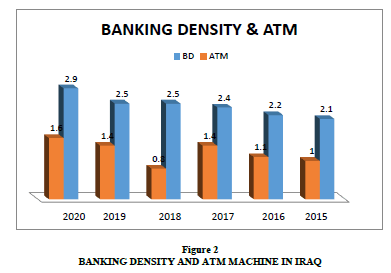

Also Figure 2 will explain the Banking Density and ATM machine in Iraq that consider one of best method to improve banking density in Iraq for years (2015-2020).

Sources: Report of Iraq Central Bank www.cbi.iq

All of the above Figures 3 & 4 and clarifying the form shows the need to increase the banking density to achieve financial coverage, in addition to that the increase must be quality and influential and has advanced technology in the delivery of services to customers, the spread of banks should be according to a specific geographical plan and that there are conditions on banks Help achieve FI or the problem will continue.

Innovation in FI

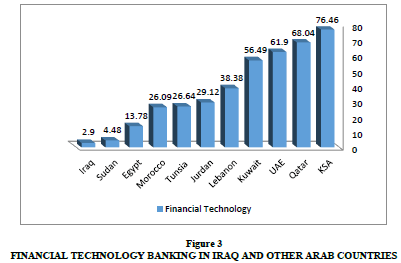

Technology is important in developing FI efforts. Mobile technology is a good model. Strong technological innovation in financial services requires a presence through a strong business strategy. A Table 1 showing the existence of electronic financial accounts, which are indicators of lack of interest in the creative aspects of the achievement financial services and pursuit of the deployment of banking density with creative specifications and Figure 5 shows the level of use of financial innovation in Iraq compared to Arab countries which is last place, so must work more strategically and changing this situation that need a lot of hard work.

| Table 1 Existence Of Electronic Financial Accounts |

||||

| Years | Adulds (10000) | ATM | Q card | 1/2 |

|---|---|---|---|---|

| Above 15 years | ||||

| 2014 | 19929 | 467 | 50000 | 2.3 |

| 2015 | 20569 | 467 | 50000 | 2.2 |

| 2016 | 21227 | 647 | 30000 | 3.1 |

| 2017 | 21926 | 337 | 30000 | 1.5 |

| 2018 | 22082 | 580 | 30000 | 2.6 |

| 2019 | 22654 | 660 | 30000 | 2.9 |

Sources: Report of Iraq Central Bank www.cbi.iq

Figure 3 also explain Financial Technology Banking in Iraq and other Arab countries that depending on to increase financial inclusion the data for 2019.

Iraq is still a modern user country of financial technology and this is certainly reflected in the applications of FI, which represents financial innovation is a key element, and the use of financial creativity includes many of the tools and financial expertise and technology that can be obtained from the experiences of other countries, and attempts today to use ATM in Iraq is still in a very late stage of the rest of the countries, in addition to the lack of a financial culture and the desire to use the products of financial creativity by the community and here should be a center of FI helps in achieving these requirements.

Financial Literacy

A thorough examination of banking and mobile banking advances may easily demonstrate that improved technology and offerings are insufficient. Customers should have a basic understanding of money and how to utilize technology (imagine that if a customer does not know how to utilize a mobile phones, he will be interested in financial services utilizing a mobile phone). It is essential to be able to understand and write fundamental financial instruments. The consumer must understand why investing are essential to their family for several years.

How could we guarantee that low-income people's fundamental needs, such as access to services and increased financial literacy, are met? The organizer comes into action at this point. Many empirical studies show that population density has a detrimental effect on deposit penetration. The findings suggest that deposit accounts have enhanced over time. Iraq ranks 105th out of 144 nations in terms of financial literacy, depending on the Global Financial Literacy Index. This metric should be researched and strategies made to decrease Iraq's degree of financial literacy (Global financial literacy ranking, 2020).

Poverty Rates

Empirically, Park & Mercado (2018), examine the existence of FI in reducing poverty rates, as well as various indicators in developing countries in Asia. With increased FI, poverty rates must be reduced because large numbers of community members can use financial services to streamline their consumption and join productive processes. Studies show that there is a positive correlation between poverty rates and FI. They found that FI drastically reduces poverty rates, as well as reducing inequality in the income of individuals and contributing to poverty reduction not only financially, but also in economic development. Growth is necessary but not enough to eradicate poverty. Sustainable economic development is possible to solve poverty. There is a general consensus among economists that financial development stimulates economic growth (Sharma et al., 2014). Sharma et al. (2014) show that economic growth is necessary for sustainable development and equitable distribution of wealth and well-being. The success of poverty alleviation programs can be achieved in the real sense, when the average man is also part of growth. While some empirical concepts and evidence support the argument that FI reduces poverty rates, those suggest that there is still inconsistency results in FI and poverty research. Some empirical research supported the concepts and arguments that FI, The Table 2 shows indicators of poverty ratio, which is high and as previous studies have confirmed the interactive relationship between high poverty and FI.

| Table 2 Poverty Ratio In Iraq |

||||

| Years | POVERTY ERADICATION / Kurdistan region | POVERTY Gap | Joblessrate | Banking Density |

|---|---|---|---|---|

| 2016 | 30% | 6.60% | 12.70% | 1047 |

| 2017 | 31% | 6.6%. | 12.70% | 854 |

| 2018 | 31% | 6.60% | 12.70% | 866 |

| 2019 | 25% | 6.60% | 12.70% | 859 |

| 2020 | 30.50% | 6.60% | 19% | 859 |

Sources: Report of Iraq Central Bank www.cbi.iq

Regulation Issues

Determines the rules of financial work in Iraq. In branchless banking, regulation can play a key role in improving customer satisfaction and ensuring basic financial service to end users, creating an environment that must be a satisfactory center for both business entities and customers. The following are some key notes about regulation in unaffiliated banks that are implemented all over the world:

- Regulatory bodies should be used for experience, learning and implementation.

- It should promote public-private partnership.

- Focus on customer security and protection

There is a large segment of the Iraqi people on the sidelines of the Iraqi financial systems. In addition to individual savings in this class may be very low, the large group means that their combined savings will be very large. If facilitate their entry into the formal financial and banking sector, these savings can be directed to take advantage careers in achieving comprehensive development with the proper distribution and equality. Thus structuring risk-saving products that reflect their essential needs as soon as they become part of the financial system.

The United Kingdom is one of the first industrialized nations to realize the significance of FI. Approximately 8percent of families do not have any kind of deposit account. People under the age of 20 and those beyond the age of 80 have a lower calculation. Exclusionary factors include a poor credit score, laws prohibiting the use of bank accounts for "money laundering" a lack of public confidence, the bank's terms and conditions, physical access issues, and others. Unregistered people are less common in Australia than in other industrialized nations, with just 3percent of individuals believed to be without a banking account. Nevertheless, the "lack of financing" for individuals is causing increasing worry (Uddin, 2017).

FI is a long-term goal: it is an effective and significant initiative and contribution that will evolve and grow by itself over time. Stakeholders who participate are the government, regulatory bodies, public and private entities and the country's people in general. To promote the FI Initiative, all shareholders must work together to create a better, more effective and viable business model and strategy that not only serves the needs and fundamentals of the current economy but also builds and establishes the basis for future FI plans. Thus, creativity plays a vital role. Can reduce the costs of transitions, and develop advanced customer access products at favorable prices (Dangi, 2012).

Methodology Of Study

Objectives of Study

Through this paper, an attempt was made to gain insight into the various Features of FI with a major focus on the state of FI in Iraq. The research aims to determine the factors and effects facing the application of FI in Iraq, and determine the level of importance of each indicator and how to develop procedures to overcome it to achieve advanced ratios in the applications of FI.

Problem of Study

The research examines the problems and issues that facing FI and identifies the most important barriers and factors that affect in FI.

Hypotheses of Study

The main Hypotheses is Determining the most importance factors (barriers) have an impact on the application of FI

Data of Study

The study is a descriptive diagnosis in nature. The secondary data available from reports issued by the CBI, the Ministry of Finance and the World Bank have been widely used for the study and sample of academies and CEOs working in Iraqi institutions. Various news articles, books, and approved Internet resources have been used to record and record. The simple percentage method for secondary data analysis was used to show the direction and condition of FI in Iraq.

Characteristics of the Sample

This section presents demographic information about the participants. 42academic and CEO participated in the study in total. The demographic distributions of the research questionnaires and their profiles are given in Table 3.

| Table 3 Research Sample Characteristics |

|||||||

| Specifications | N | % | Specifications | N | % | ||

|---|---|---|---|---|---|---|---|

| Gender | Male | 30 | 74 | education | Bachelor | 15 | 39 |

| Female | 12 | 26 | |||||

| Total | 42 | 100 | Master | 6 | 11 | ||

| Age | 36-45 | 5 | 20 | PhD | 11 | 50 | |

| 46-55 | 26 | 53 | Total | 42 | 100 | ||

| 56 | 11 | 27 | Service period | 6--10 | 5 | 12 | |

| Total | 42 | 100 | 11--15 | 18 | 35 | ||

| 21 and above | 19 | 53 | |||||