Research Article: 2019 Vol: 23 Issue: 2

Development and Introduction of Banking Products: Accounting Aspect

Andriy Melikhov, Pryazovskyi State Technical University

Mykhailo Yukhnenko, Donetsk State University of Management

Oksana Bieliakova, Azov Maritime Institute of the National University

"Odessa Maritime Academy"

Dmytro Adamov, Donetsk State University of Management

Olena Suzdalieva, Donetsk State University of Management

Abstract

The discussed approach to the definition of banking engineering allowed us to describe its progress taking into account the features of the formation of the cost of an innovative banking product. So, we determined the main stages of banking engineering (collection and processing of information, development, legal protection, implementation, evaluation of results). In accordance with the developed scheme for each of the listed stages of banking engineering, except for the last and partial second last, the bank bears the costs that form the cost of the innovative banking product. At the implementation stage, when the product is essentially implemented, the bank is actively resorting to marketing measures, the main of which is the conduct of promotional actions. These costs are already recognized as expenses of the period. In addition, at the stage of evaluation of the results, the actual cost of this product is already formed, so the costs incurred in this time interval should already be included in the cost of the reporting period and be taken into account when determining the financial result.

Keywords

Banking Product, Innovation, Accounting and Analytical Support, Banking Engineering, Management Mechanism

JEL Classifications

M21, O16

Introduction

The development and improvement of banking products is a dominant area of innovation activity of banks, which has been named banking engineering. Indeed, during the creation and introduction of an innovative banking product in the market, various costs may be incurred, in particular, design costs, development of documentation for the implementation of innovations, information security costs, advertising of a new banking product, personnel training costs for the presentation of new banking products, costs for the acquisition of the necessary support (technical, software) for the implementation of innovations.

The importance of description of the stages of banking engineering is also due to the fact that depending on the stage of the innovative product development, the costs of its appearance and the results from its use are distinguished. The diagnostics of a stage and its time interval allows us to suppose a different effect from introduction. Moreover, at a particular stage, it can be negative.

Literature Review

Considering the process of development and introduction of innovative banking products, the authors in the vast majority distinguish four of its stages (Al-Habil et al., 2017): collection and processing of information on the state of the market, analysis of data on the potential needs of new banking products; development of the innovative strategy of the credit institution, the concept of a new product and the technology of its introduction into the banking services market (preparation of documents, development of technology of banking operations, training of employees, determination of methods for introduction of a product (services) into the market, testing product quality among customers); organization of promotion of an innovative product (service), its sale to customers; evaluation of the results of the implementation of innovative products (services) and analysis of the chosen innovation strategy.

Muda & Putra (2018) specified the logical sequence of actions at the presented stages of development of a new product: studying the needs of clients, finding ideas, selection of ideas, designing a product according to an idea, development of a marketing strategy, analysis of operational and sales opportunities, development of a product, development of a prototype, study and introduction of a product in the market.

Another feature of the banking engineering sequence was proposed by Abbas et al. (2018) is the definition of the need for a business proposal - a document that includes the necessary and sufficient description of the new product to decide on its development and implementation. We believe that the development of such a document is an important, but not an obligatory step. Each bank, when developing a separate innovation project, may decide on the appropriateness of drafting such a document.

Methodology

During the study, general scientific and special methods of knowledge of phenomena and processes were used. The method of theoretical generalization, dialectic method, analysis, synthesis, abstraction are taken as the basis for improvement of the organizational and methodological provisions of accounting and economic analysis of operations for the creation and implementation of innovative banking products. Graphical method is used for visual representation of the obtained data.

Results and Discussions

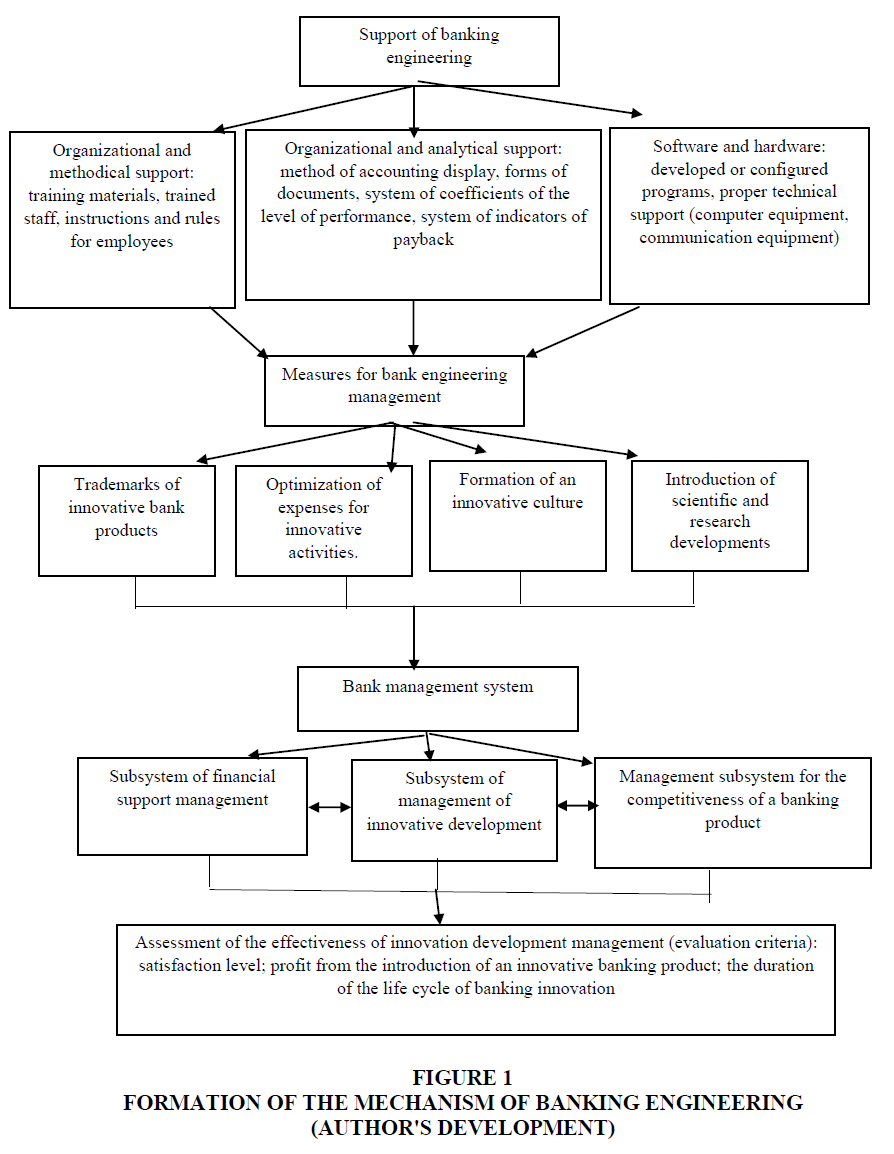

The mechanism of management of banking engineering can be represented as a set of processes and actions for the creation, maintenance, functioning and improvement of the system of economic relations between the subjects and objects of this process, which is carried out in order to increase the efficiency of all activities of the bank and innovation activities, in particular. This mechanism should include the following components:

1. Organizational and methodological, accounting and analytical, software, technical and marketing tools for the achievement of banking engineering goals;

2. strategy of innovative development of the bank, which defines the respective goals as the planned result of the introduction of banking engineering;

3. subsystems of bank management, which have a determining influence on conduction of banking engineering;

4. Objects of management - units of the bank and market environment of banking products (Figure1).

5. Among the management activities of innovative bank engineering, it should be noted:

6. Approval of the trademark image of the bank. In today's conditions of economic development, a significant number of banks cooperate with subjects (insurance, travel companies, and real estate agencies) that do not belong to the banking sector. As a result of their cooperation, new products may be provided under the already familiar trademark;

7. Optimization of expenses for innovative activities. Considering that market research, the search for and the development of new ideas require the attraction of a significant amount of cash, one of the main measures of banking engineering is aimed at obtaining the optimal balance between the costs incurred and the result obtained;

8. Formation of an innovative culture. The high level of development of modern technologies requires the bank employees not only to perform their duties (which is actually achieved through the active use of the latest technical developments and software), but requires creative ideas, which is the key to the continuous development of the bank;

9. Introduction of scientific and research developments.

The banking engineering, the result of which is the creation of a product that has a beneficial effect, also involves the active implementation of the results in practical activities.

Indicators of efficiency of management of innovative development should serve as the basis for making managerial decisions on introduction of innovative banking product. However, it should be noted that the efficiency of banking engineering is difficult to quantify.

For this purpose (Drobyazko, 2018), it is advisable to take into account not only economic indicators (which fully characterize the absolute and relative results of the use of innovative banking products), but also indicators of social efficiency. After all, as already mentioned above, the new banking products developed should best meet the needs of clients, moreover the clients of different social classes. The examples of such products can be lending to projects aimed at improvement of language skills, improvement of the production environment, provision of preferential conditions for lending to certain segments of the population. The presentation of such "social" products can attract more clients and improve the image of the bank on the market (Drobyazko et al., 2019).

Despite the fact that the introduction of innovation processes in the activities of banks is a complex process, their competitiveness depends, to a great extent, on the introduction of innovations. It is banking innovations that help accelerate and improve the quality of client service, and allow you to better organize the bank's internal work.

The results of our study are confirmed by the following studies. The process of banking engineering is more detailed in a paper by Tetiana et al., (2018) and Hilorme et al., (2019). Authors distinguished six stages: emergence of ideas or systematization of ideas; selection and formulation of the idea of an innovative product based on the analysis of opportunities; development of a business process for the implementation of an innovative product; technical training and software development; training of bank employees; preparation and implementation of marketing support.

Recommendations

We think it is reasonable to base the classification of innovative banking products used in accounting and analysis practices on such features that determine the characteristics of their accounting reflection and analysis. We propose that such features include the following with the indication of the appropriate types of innovative banking products: indication in the balance sheet (balance sheet, off-balance sheet); mechanism of development (developed by the bank, with the involvement of third-party developers); the degree of novelty (newly created, borrowed); degree of completion (completed, incomplete); a form of protection (which trademark is registered; which are the subject of copyright; which are commercial secrets, for which no method of protection was used); effectiveness (implemented, partially implemented, not implemented). The proposed classification of innovative banking products allows us to structure the concept of "innovative banking product", choose the optimal strategy for innovation development, and ensure the proper organization of accounting and analytical support for the management of the innovation process.

Conclusion

So, banking engineering, being a relatively new area of research, is not sufficiently theoretically grounded. In the course of the study, the feasibility of using the concept of banking engineering as a process of development and introduction of banking innovative products that meet the needs of clients and own interests of banks, which is caused by changes in the external and internal environment of their functioning, has been proved. The basic stages of banking engineering were determined; the list of expenses arising on each of them was disclosed.

The procedure of formation of the cost of innovative banking product and features of the accounting reflection of expenses during banking engineering was described.

The description of the aforementioned theoretical principles allowed us to determine the areas of improvement of accounting and analytical support for operations with banking products in the conditions of an innovative economy. Further research should be aimed at determination of the optimal structure of the account plan in terms of registration information for the development, implementation and use of innovative banking products; substantiation of analytical sections, which will allow to form the selection of indicators in the formation of reporting on banking innovations in accordance with the information needs of users; determination of approaches to the building of internal reporting that characterises the process of formation of an innovative banking product; development of a methodology for analytical substantiation of managerial decisions aimed at ensuring the development of effective banking products, and methods for evaluation of their effectiveness.

References

- Abbas, S.K., Hassan, H.A., Iftikhar, S., & Waris, A. (2018). Assimilation of TTF and UTAUT for Mobile Banking Usage. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3170641.

- Al-Habil, W.I., Al-Hila, A.A., Al Shobaki, M.J., Abu Amuna, Y., & Abu Naser, S.S. (2017). The impact of the quality of banking services on improving the marketing performance of banks in Gaza governorates from the point of view of their employees. International Journal of Engineering and Information Systems (IJEAIS), 1(7), 197-217.

- Drobyazko, S. (2018). Accounting management of enterprises’ own of in the conditions of legislative changes. Economics and Finance, 10, 4-11.

- Drobyazko, S., Hryhoruk, I., Pavlova, H., Volchanska, L., & Sergiychuk, S. (2019). Entrepreneurship Innovation Model for Telecommunications Enterprises. Journal of Entrepreneurship Education. 22(2).

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education. 22(Special Issue), 1-6.

- Muda, I., & Putra, A.S. (2018). Institutional fishermen economic development models and banking support in the development of the innovation system of fisheries and marine area in north Sumatera. In IOP Conference Series: Materials Science and Engineering, 288(1), 12-82.

- Tetiana, H., Karpenko, L., Fedoruk, O., Shevchenko, I., & Drobyazko, S. (2018). Innovative methods of performance evaluation of energy efficiency project. Academy of Strategic Management Journal, 17(2), 112-110. AAFSJ-19-119