Research Article: 2022 Vol: 25 Issue: 3

Development of risk management practices in the electricity sector of the UAE

Ahmed Husain AlMarzooqi, Universiti Teknikal Malaysia

Hyreil Anuar Kasdirin, Universiti Teknikal Malaysia

Nusaibah Mansor, Universiti Teknikal Malaysia

Citation Information: AlMarzooqi, A. H., Kasdirin, H. A., & Mansor, N. (2022). Development of risk management practices in the electricity sector of the UAE. Journal of Management Information and Decision Sciences, 25(3), 1-9.

Abstract

The problem of risk management is relevant for majority of modern business organizations, without dependency on sphere of their operations. This problem is especially relevant for the utilities sector, which plays a significant role for stable economic and social life. This study assessed the methodology of risk management applied in the energy distribution system of the UAE, specifically, the Abu Dhabi Distribution Company (ADDC). It was important to show what methods of risk management are applied in the organization, what factors create barriers for effective mitigation and control of risks. On the basis of the findings, the specific recommendations for future improvement of risk management in the selected organization were developed. The methodology of the study included mixture of quantitative and qualitative research methods, document analysis and survey questionnaire. The results of the study contributed to the identification of the propositions for future improvement of risk management process in the organization.

Keywords

Risk management; Energy distribution system; Decision-making; Risk management culture; Risk.

Introduction

This article considered the main aspects of the earlier performed study on the risk management strategy and methods applied in the electricity distribution system of the UAE. A specific company selected as an object of the study was the Abu Dhabi Distribution Company (ADDC). Being responsible for the delivery of water and electricity resources among households and businesses, ADDC is fairly assessed as one of the strongest players in the utility market of Abu Dhabi. It was sensible to analyze the existing solutions in the sphere of risk management process organization and compare the findings of relevant literature on this issue with the currently applied methodology of risk management in the target organization. This article discussed the following aspects of the previously performed study: the key problem of the study, the methodology of the research, and the main findings of the study.

The Problem of The Study

The problem of the study was related to the critical analysis of the currently applied risk management methods at ADDC and comparison of the findings with the best practices and recommendations stated in the relevant academic literature sources. The focus on the issue of risk management as the main subject of the study is explained by the significant role of risk as a factor of the everyday performance of modern business. The Oxford English Dictionary defined the nature of risk as “hazard, danger; exposure to mischance or peril” (RAIS, 2020). The most interesting position on the nature of risk in modern society and business was presented by Ulrick Beck. Risk became an unavoidable, interconnected sequence of any type of performance in modern society. Due to the active development of new technologies and means of production, “the social production of wealth is systematically accompanied by the social production of risks” (Smart, 1994).

Another aspect of the stated problem’s significance is explained by the high role of the energy distribution system in modern society. A large number of scholars stated that the successful development of modern society is highly dependent on the stable distribution of energy among consumers. Korkovelos et al. (2020) argued that the development of innovations in the UAE and other countries is highly dependent on the stable performance of the electricity distribution system. It was also stated that the development of innovations in any type of activity, including energy distribution, is associated with the generation of new types of risks that should be adequately managed (Vasvari, 2015). Risk and uncertainty are common characteristics of the modern state of the energy distribution system, and the management of companies should be provided with sufficient and reliable solutions that would contribute to the improvement of the quality and effectiveness of risk management process organization.

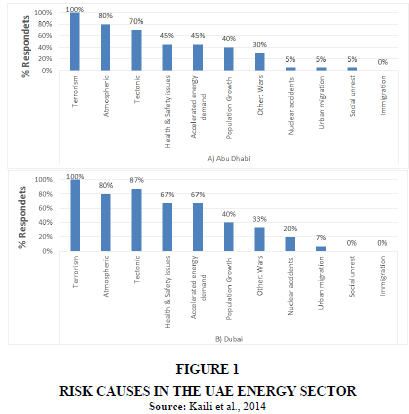

Specific arguments for the significance of the study in the conditions of the UAE included the presence of a unique set of risk factors that required adequate management. A general set of risks common for the majority of players in the energy distribution sector was found to include market risk, credit risk, operational risk, and business risk (Eurelectric, 2007). As for the specific risk factors in the UAE, they were summarized in the study by Kaili et al. (2014) and visualized in Figure 1 of the article. According to the findings of the article, the energy distribution sector in the UAE is vulnerable to the list of risks that are not prevalent in similar companies in different regions of the world. It was sensible to critically analyze the nature of risk management processes in the energy distribution system of the UAE to define the existing limitations and opportunities for further improvement.

Conceptual Framework of The Study

The literature review enhanced the deep understanding of the factors that could impact the quality of the risk management processes in the UAE energy distribution sector. The theoretical basis of the study was presented with the enterprise risk management (ERM) theory. This theory provided reliable conceptual basis for the study (Kerraous, 2018; Tasmin et al., 2020). The main theoretical constructs of the ERM theory included risk governance and risk aggregation as the key steps of the risk management process. The risk governance process is aimed at the prevention of management bias, which is characterized by the inability of management to adequately assess the level of risk for the organization and respond to it properly (Jankensgard, 2019). As for the risk aggregation process, it is mainly described as a process of accumulation of the required data for the presentation of risk and means of its mitigation (Jankensgard, 2019). A search of means for the mitigation of management bias and information asymmetry issues formed the basis for this study.

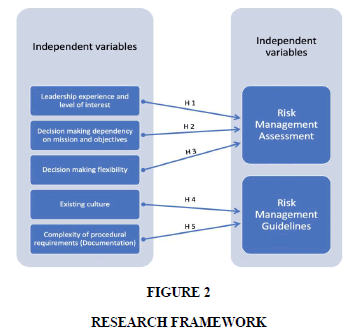

Based on the ERM theory and the literature review outcomes, the conceptual framework of the study was developed. It included the list of dependent and independent variables of the study, together with the set of hypotheses applied to characterize the potential relationship between the variables. The summary of the conceptual framework of the study was visualized in Figure 2. To characterize the relationship between the variables of the study, the following set of hypotheses was identified

H1: The procedure of risk management in the UAE electricity distribution system is performed by experienced managers with a high level of interest and responsibility.

H2: The procedure of risk management in the UAE electricity distribution system is highly dependent on the stated mission and strategic objectives of the organization.

H3: The existing level of flexibility of decision-making in the sphere of risk management in the UAE electricity distribution system can be characterized as low.

H4: The existing risk management culture in the UAE electricity distribution system allows the organization to avoid the most important risks but does not contribute to the realization of the highest potential quality of risk management outcomes.

H5: The current levels of risk appetite and risk attitude in the UAE electricity distribution system are characterized by the decision of the management to avoid any type of risk despite the potential benefits of accepting a risky scenario

Methodology of The Study

To assess the stated hypotheses of the study, a mixture of quantitative and qualitative research designs was applied. The application of the selected research design had to contribute to the understanding of the role of risk management methods and culture in the performance of ADDC (Abutabenjeh & Jaradat, 2018). The main quantitative research method was survey questionnaire analysis, while for the aims of qualitative data collection and analysis the method of document analysis was utilized. The research model was developed based on the post-positivism research philosophy, which contributed to the high objectivity of the research findings and minimization of the subjectivity bias (Kumar, 2019).

The sample population for the quantitative study included ADDC employees and management who could deliver useful information about the risk management procedure applied in the organization. For the aims of the study, a total number of 367 participants was selected using the purposive sampling technique. The total number of participants for the study sample was identified based on Krejcie and Morgan’s sample size determination table (Krejcie & Morgan, 1970). As for the document analysis process, the researcher collected official documents of ADDC that describe different aspects of the risk management process applied in the organization. A total number of 32 documents was collected from the management of the organization on official request.

For the aims of quantitative data collection, an online survey questionnaire was distributed among the participants of the study. Due to the ethical considerations, no personal information of the study participants was collected, processed, or stored during the study. Before the collection of data from the study participants, each respondent was provided with a consent form informing them about the objectives of the research and guarantees of personal interests’ protection.

In the process of quantitative data analysis, the researcher formatted initial responses of the study participants using the Likert scale approach for numerical representation of the specific responses collected from the participants of the study. The target study sample included a diversified structure of participants by the parameters of age, current position in the organization, and previous work experience. To analyze quantitative data, the SPSS software platform was applied. Specific methods of data analysis included the Structural Equation Modelling (SEM) method, Confirmatory Factor Analysis (CFA), and regression analysis. In the process of qualitative data analysis, the researcher applied the following methods: skimming, reading, and interpretation. The findings of document analysis were compared to the key results of the literature review to assess the quality and effectiveness of the risk management documentation organization at ADDC.

Findings of The Study

The findings of the study were based on the results of document and survey questionnaire analysis. The outcomes of analysis for each type of research method were presented separately and summarized as a single set of findings.

Document Analysis

The results of document analysis included a detailed discussion of 32 official risk management documents published by ADDC. As a result of document analysis, it was found that the ADDC management pays close attention to the development of a single risk management policy applicable for a wide range of risk cases. Careful attention is directed to the search of means for the active engagement of stakeholders in the process of risk management. An important advantage of the risk management process organization at ADDC also includes the application of the benchmark analysis instrument for the improvement of the risk management processes in the organization.

It was found that since the beginning of the 2000s’, the ADDC management achieved impressive results in terms of improvement of the risk management processes. The risk management strategy of 2003 demonstrated the strategic priority of the company’s management in the sphere of cost-benefit outcomes maximization in the risk management process. The organization aimed to maximize the benefits and mitigate costs in the risk management process. During the last two decades, the organization made a shift towards the engagement of stakeholders and description of the concrete roles and actors in the risk management procedure.

Based on the document analysis, the following problems in the current structure of risk management documentation were identified: absence of a set of important documents that were found to be useful in the literature review, absence of clear description of the risk management methods applicable at ADDC, absence of the position of the risk manager and the team of risk professionals capable of leading management in the process of risk management. Apart from the identified limitations, the following risk management documents were found to be absent in the organization: risk appetite statement, risk register, and risk training courses. As a result, the management of the company paid scant attention to certain important aspects of the risk management process. Specific recommendations in the sphere of the risk management process optimization through documentation management include producing documents that are currently absent, concrete description of the list of risk management methods that should be applied for concrete scenarios, and forming a team of risk management professionals who would be capable of implementing the required risk management steps in case of need.

Quantitative Data Analysis

As for the quantitative data analysis, frequency and reliability analysis outcomes demonstrated the high quality of the final study sample and the reliability of the primary data collected. The analysis of the specific independent variables of the study about current operations of ADDC demonstrated that the organization employs managers skilled in risk management and provides a certain level of autonomy to employees but demonstrates excessive self-reliance in terms of risk management in the company. From the point of dependency of decision-making on the mission and objectives of the company, it was stated that the organization has a low-risk appetite, and the senior management could create barriers for effective decisions through its position. Altogether, the impact of strategic objectives of the organization on risk management procedures was assessed as moderate for ADDC.

In regards to the parameter of the decision-making flexibility in risk management, it was found that low-risk appetite and lack of readiness for the flexible change of risk management methods create serious barriers to the management of the organization. Even though the organization pays attention to the modification of the risk management solutions, employees usually lack understanding of the role of innovations in this sphere. The parameter of the risk management culture applied at ADDC was found to limit opportunities for the development of innovative risk management solutions. The risk management culture of the company was found to limit opportunities for the timely reporting of risk situations and their innovative resolution. As a result, the respondents stated that the culture of risk management at ADDC should be improved.

The final parameter of the quantitative study was the level of complexity of procedural requirements for the risk management tasks. It was stated that though the organization describes all the procedures in detail, a large share of instructions includes simple formality that should be followed and do not support effective performance. A part of the employees that participated in the study demonstrated a lack of understanding of the significance of the risk management documentation. This is a serious limitation that should be addressed in the future. Additionally, part of the respondents stated that a large volume of risk management documentation still does not allow them to deal effectively with a serious share of risks experienced in their everyday work.

The findings of the quantitative data analysis demonstrated a high level of the imperfectness of the risk management processes arranged at ADDC. Despite serious progress achieved in the organization during the last 20 years, certain aspects of the risk management process still require serious improvement. Unless the organization pays proper attention to these aspects of the problem, it is likely to face serious risks in the future. The findings of the quantitative and qualitative data analysis formed the basis for the definition of the key implications and recommendations for the study.

Study Results

The results of the study formed a reliable contribution both in theoretical and practical aspects of the stated research issue. It is important to present the main findings of the research from the point of potential contribution to theoretical knowledge in the field of risk management in the UAE, the industry of electric energy distribution, and the operations of policymakers in the UAE. In addition, opportunities for further study were summarized to determine the perspectives of further research on the study problem.

Contribution towards Knowledge

The contribution of the study to the sphere of knowledge was related to the outcomes of the academic literature review and the complex study of the processes of risk management taking place in the energy distribution system of the UAE. The outcomes of the literature review contributed to the improved understanding of risk and risk management phenomena. It was stated that risk should be considered not only as a source of losses for an organization or individual but also as a source of opportunities. The role of management’s subjectivity in the definition of the means of risk management was identified. The discussion of the problems of risk appetite and flexibility in decision-making as the key factors for risk management activities was provided. The findings of the literature review contributed to the definition of the single mechanism of risk management applicable in any type of organization, the key methods of risk management, and the factors that could contribute to the realization of the risk management activity in modern organizations.

From the point of the target study object, the main sources of risk for the UAE energy distribution sector were summarized. In addition, the main characteristics of the existing format of risk management applied at ADDC were summarized based on the analysis of both primary and secondary information. This knowledge could be useful not only for the theorists but also for the practitioners interested in the search of solutions for the future improvement of the risk management processes in the target industry. Altogether, the accumulated knowledge of the performance of the energy distribution sector in the UAE and risk management could be useful in the further study of a variety of questions.

Contribution towards Industry

The practical contribution of the study is mainly related to the definition of the concrete recommendations that could be applied by ADDC to form the improved model of the risk management process in the future. The analysis of the relevant risk management documentation allowed the researcher to define opportunities for further development of the specific documentation that would support the risk management activity at ADDC and similar organizations operating in the UAE. It was found that the organization did not manage to demonstrate the significance of the risk management activity and specific methods in this sphere to the target population of employees. To address this problem, it was recommended to develop a set of additional risk management documents: risk appetite statement, risk register, and risk training courses. Moreover, it was found sensible to provide a full and detailed description of all types of risk management methods that could be applied for different cases in the UAE energy distribution sector. While the management of ADDC produced a diversified structure of risk management documents, the absence of the list of applicable risk management methods could serve as a limitation for effective practice in the future.

From the point of the contribution of the quantitative research outcomes, it was stated that all the hypotheses of the study were supported, and the management of the independent variables of the study could be considered as a source of improvements in the risk management quality and effectiveness at ADDC. Based on these findings, specific recommendations for further research could be developed.

Contribution towards Policymakers

The results of the study also formed the basis for the definition of the specific practical contribution towards policymakers in the UAE. Policymakers are interested in the stable operations of the energy distribution sector as a factor of social stability and innovative development of the state. One of the main aspects that could be targeted by policymakers is related to the arrangement of the risk management documentation in the energy distribution companies. Due to the differences in the approach to documentation arrangement in different companies, it is sensible to develop a single set of regulatory guidelines for companies to follow in the sphere of documentation development. Such a solution could send the user message to the companies, guaranteeing proper arrangement of the risk management process.

Opportunities for Further Study

The results of the study also included the definition of the set of research questions that could be raised in the future. Analysis of these specific questions could lead to the improved quality of risk management at ADDC and other organizations operating in a similar field in the UAE. After the discussion of the specifics of other industries, it might be found that the management of other economic sectors might also be interested in the resolution of the stated research questions.

The first research question that was raised due to the outcomes of the current study included the analysis of means for the effective engagement of stakeholders in the process of risk management for companies. The management of ADDC declared an intention to intensify the engagement of stakeholders for effective risk management. The findings of the literature review demonstrated the opportunities related to such a solution. Nevertheless, a limited number of relevant sources presented information about concrete measures that could be taken in this sphere to reach the desired outcomes. It is sensible to pay closer attention to this issue in the further study.

Another question to be considered in the further study was related to the definition of means for the reliable assessment of the risk appetite level. In addition, there is a need to further examine the question about the definition of means for the development of flexible decision-making skills in the field of risk management among the employees of modern companies. The resolution of both of these questions could contribute to the serious improvement of the risk management quality and effectiveness. Their resolution still requires the application of reliable data and significant scholarly resources.

Conclusion

This article served as the summary of the main elements of the previously performed study on the energy distribution sector in the UAE. It was important to define the main factors that impact the realization of the risk management procedure at ADDC, identify issues and opportunities, and provide practical recommendations. The results of the study demonstrated that despite serious efforts to reach high effectiveness of the risk management process at ADDC, the leadership team did not pay sufficient attention to certain aspects of the process. Specific improvement should be made in terms of risk management documentation, risk management culture, engagement of employees, and the decision-making autonomy and flexibility among the staff. The findings of the study should also form the basis for the further study of the research problem in the context of other questions and fields. The findings of the study could be useful not only for the companies operating in the energy sector of the UAE but also for businesses in other industries.

References

Abutabenjeh, S., & Jaradat, R. (2018). Clarification of research design, research methods, and research methodology: a guide for public administration researchers and practitioners. Teaching Public Administration, 36(3), 237-258.

Indexed at, Google Scholar, Cross Ref

Eurelectric. ( 2007). Risk management in the electricity industry – White paper I – Overall perspective. Yumpu.

Jankensgard, H. (2019). A theory of enterprise risk management. Corporate Governance International Journal of Business in Society, 19(3), 565-579.

Indexed at, Google Scholar, Cross Ref

Kaili, K., Pathirage, C., & Amaratunga, D. (2014). Vulnerability of the Emirati Energy Sector for Disaster: A Critical Review. Procedia Economics and Finance, 18, 701-709.

Indexed at, Google Scholar, Cross Ref

Kerraous, E. (2018). Enterprise risk management and value creation: a literature review. Revue du Contrôle de la Comptabilité et de l’Audit. 280-296.

Korkovelos, A., Zerriffi, H., Howells, M.; Bazilian, M.; Rogner, H.-H.; Fuso Nerini, F. (2020). A Retrospective Analysis of Energy Access with a Focus on the Role of Mini-Grids. Sustainability, 12(5), 1793.

Indexed at, Google Scholar, Cross Ref

Krejcie, R. V., & Morgan, D. W. (1970). Determining Sample Size for Research Activities.Educational and Psychological Measurement,30(3), 607-610.

Indexed at, Google Scholar, Cross Ref

Kumar, R. (2019).Research methodology: a step-by-step guide for beginners. Thousand Oaks: Sage Publications.

RAIS. (2020). The Risk Assessment Information System. RAIS: what is risk assessment.

Smart, B. (1994). Reviews : Ulrich Beck, Risk Society: Towards a New Modernity (London and New York, Sage, 1992).Thesis Eleven,37(1), 160–165.

Indexed at, Google Scholar, Cross Ref

Tasmin, R., Muazu, M.H., Nor Aziati, A.H., & Zohadi, N.L. (2020). The mediating effect of enterprise risk management implementation on operational excellence in the Malaysian oil and gas sector: a conceptual framework. Future Business Journal, 6(7), 1-6.

Indexed at, Google Scholar, Cross Ref

Vasvari, T. (2015). Risk, risk Perception, risk management - a review of the literature. Public Finance Quarterly LX(1), 29-48.

Received: 31-Jan-2022, Manuscript No. JMIDS-22-11038; Editor assigned: 31-Jan-2022, PreQC No. JMIDS-22-11038(PQ); Reviewed: 16-Feb-2022, QC No. JMIDS-22-11038; Revised: 18-Feb-2022, Manuscript No. JMIDS-22-11038(R); Published: 21-Feb-2022