Research Article: 2021 Vol: 24 Issue: 1S

Digital Talent Development Strategy in the Indonesian Financial Services Sector

Sukarela Batunanggar, Indonesia Financial Services Authority (OJK)

Widyo Gunadi, Indonesia Financial Services Authority (OJK)

Nika Pranata, Indonesian Institute of Sciences (LIPI)

Billy Saputra, Indonesia Financial Services Authority (OJK)

Keywords

Digital Talent, Financial Services Sector, Link and Match, Up skilling, Reskilling

Abstract

The demand for digital talent is increasing while its supply is limited, leading to a gap in the financial services sector, both in quantity and quality. This research identifies problems faced in fulfilling the needs and strategies for developing digital talent at the FSS. It uses a mixed-method (quantitative and qualitative) through systems thinking approach, ease benefit matrix, and paired comparison. The research held 11 Focus Group Discussions (FGD) with any speakers from various stakeholders to determine the problems and possible solutions. Furthermore, it also surveyed 73 respondents from banking leaders that underwent a digital transformation. This research formulated 18 (eighteen) proposals for a comprehensive digital talent development strategy in the financial services sector and a roadmap.

Introduction

The Digital revolution has led to a significant change in the business strategy. The quality of products/services is continuously improved through digital technology. The financial services industry (FSI) is constantly transforming to keep pace with advances in digital technology and behavior and consumer needs changes. Furthermore, the emergence of new players that initially offered only digital solutions for business units with nothing to do with FSI is now expanding into financial-based business units or a financial technology (fintech). Therefore, several FSIs made breakthroughs in their systems or financial technology.

This challenge was triggered by changes in consumption patterns and customer desires for something fast, easy, and cheap. Therefore, existing services, including sub-branch offices and ATMs, are being abandoned. King (2018) stated that in the current digital era, to survive and compete, banks need to transform into bank 4.0 that financial services should be conducted in real-time and oriented to provide a contextual experience for consumers using artificial intelligence in various layers of banking. There should be no need to be physically present. According to Skinner (2018), technology has entered all aspects of life to change human behavior into digital humans. It changes the way consumers interact, behave, and expect business services, including easier and more specific financial services. With many challenges faced by banks, such as new fintech entrants, changes in consumer demand for financial services, consumer data security, and the Covid-19 pandemic, banking, and other Financial Services Sectors (FSS) need to digitalize the current business model. However, this requires preparing competent human resources.

McKinsey Global Institute (2018) stated that digital business changes slowly impact the skills required of talents. Programming language skills and mastery of advanced information technology, such as Cybersecurity, Cloud Computing, Big Data Analytics, Artificial Intelligence, and Digital Business, are the primary skills needed in the future. Furthermore, social and emotional skills, including entrepreneurship, initiative-taking, leadership, and high cognitive abilities, such as creativity and complex information processing, also need to be prepared to embrace this skill. As the talent's skills improve, competition between companies for the best candidates becomes very stiff.

According to Microsoft and IDC study in February 2018, 93% of jobs in the next three years will experience digital transformation. Additionally, 68% of jobs will likely be switched to new positions that require retraining to be ready for digital transformation. IDC's findings indicate that the core technologies likely to drive digital transformation and require digital talent include Artificial Intelligence (AI) and cloud computing. These two core technologies also promote the growth of the digital economy in Indonesia. Therefore, research to formulate a strategy for preparing digital talent for the needs of the FSS, especially in banking, is necessary. Hence, these research purposes are to identify quantity and quality gaps of digital talent in the Indonesian FSS and formulate policy recommendations for the development of digital talent in the Indonesian FSS.

Furthermore, since it is not widely discussed in academic circles, its definition is still limited regarding the term of digital talent. According to IGI Global, a talented employee adapts and uses existing technology (IGI Global, 2020). Belyh (2019) stated that digital talent is a set of competencies needed to handle or implement a successful digital transformation program. According to the Institute of Systems Science - NUS (2017), it involves knowing how to use technology for the organization's benefit, both internally and externally. Therefore, the digital talent definition used in this study adopts those definitions, which are human resources and their competencies that are required to handle a company's digital transformation program.

Literature Review

Financial institutions in the world of finance act as an institution that provides services finance for its customers, where these institutions are generally regulated by financial regulations from the government (Anthony, 2004). This finance's general form includes banking, building society, credit unions, stockbroking, asset management, venture capital, cooperatives, insurance, pension funds, pawnshops, and Similar businesses. Generally, financial institutions These are divided into certain groups, namely institutions, bank finance, and non-bank financial institutions (insurance, pawnshops, securities companies, financial institutions, etc.). In general, it can be said that the Bank is a financial institution being a party intermediary for the household sector and the private sector industry, particularly in absorbing funds from the household sector in the form of savings and channel it to the industrial sector as investment credit. Service Banking is generally divided into two objectives. First, as a provider of mechanisms and tools efficient payments for customers. For this, banks provide cash, savings, and credit cards. It is the most important role of the bank in economic life. Without this efficient means of payment, goods can only be traded through time-consuming bartering.

Second, by receiving savings from customers and lending them to parties who need funds, the bank increases the flow of funds for investment and utilization more productive. If this role goes well, the economy of a country will increase. Without With this flow of funds, the money stays in the pocket of someone, people cannot get a loan, and businesses cannot be built because they do not have borrowed funds. Definition of non-bank financial institutions or the term institution is often used non-bank finance are all entities that carry out activities in the financial sector, which directly or indirectly collect funds, especially by issuing paper valuable and distribute in society especially to finance the company's investment to get prosperity and justice Public (Wiwoho, 2014).

It is important to understand the composition of the fintech ecosystem, starting from the subsystem connected with stakeholders and related to 5 (five) core ecosystem attributes (Nicoletti, 2017). The five attributes of the FinTech ecosystem are: 1.) Demands. 2.) Talents. 3.) Solutions. 4.) Capital. 5.) Policy. Talent is an attribute that is related to the availability of technology (technology companies), services finance, and entrepreneurial talent (entrepreneurs). Information Technology is the main backbone for the rapid advancement of FinTech and its innovations in its financial services.

Methodology

This research uses primary and secondary data. Secondary data includes research results from other institutions, policies, regulations, and statistical data related to digital talent development. The data is collected from several sources, such as the Ministry of Education and Culture, the Indonesian Financial Services Authority (OJK), Central Bank of Indonesia (BI), Ministry of Communication and Information, Banking, Associations, Consultant, and Research Institutions, and other related institutions. Questionnaires, focus group discussions (FGD), and in-depth interviews were used to collect primary data. FGDs and in-depth interviews involved sources from several institutions in gathering information and input from stakeholders.

Furthermore, the questionnaires were distributed to banking representatives in Indonesia. The main questionnaire was addressed to leaders in the HR unit and the technology unit in banking. It provides information related to real conditions, including problems in developing digital talent in the financial services sector in Indonesia.

Results and Discussion

A total of 73 respondents from banking were involved in this research using purposive sampling. The respondents selected were banks that implemented a digital transformation program. In terms of gender, there were 70.8% and 29.2% male and female respondents, respectively. The average age of the respondents in this survey was 45.3 years. Furthermore, in terms of education level, the majority of respondents were Master graduates (56.9%), followed by Undergraduates (41.75%) and diplomas (1.4%). Respondents came from various banks that performed digital transformation in their financial services, including BCA, BTPN, BNI, BCA Digital Bank, Bank BJB, Bank DKI, Bank Permata, Bank Jago, MUFG, Danamon, Standard Chartered, DBS, OCBC NISP, Mandiri, and Citibank. The positions of respondents varied from group head to senior vice president level. However, the majority were serving at the director and vice president levels. Most of the respondents came from divisions that handle human resources and technology. In terms of experience, the majority of respondents were senior officials with work experience of more than 20 years (47.2%), followed by 11-20 years (26.4%), 6-10 years (11.1%), less than two years (8.3%), and 2-5 years (6.9%). This research has held eleven (11) FGDs from 22 June to 26 August 2020. The series involved resource persons from various related stakeholders in developing the digital talent ecosystem, including banking, universities, related ministries/institutions, Vocational educational institutions, outsourced institutions/vendors providing digital talent services, technology companies, consultants, and academics.

The Gap in Digital Talent Needs

As the company's business strategy changes in the digital era, where digital-based financial services run absolutely, the need for digital talent is increasing. Based on the findings of the survey and FGD results, there was a gap (shortage) in meeting the needs for digital talent, both in quantity and quality. In terms of quantity, 63.9% of the respondents stated that the current availability of digital talent does not meet the company's needs. Consequently, 57.7% of respondents stated that the current digital talent qualifications and competencies do not meet the company's needs. The current needs for digital talent in quantity are crucial in terms of the need for quality.

In terms of the work type, the most needed digital talents are data mining and science (89.1%), including data scientists, machine learning, artificial intelligence, and other related fields. It is followed by software and web development (software developers and engineers, web developers, full-stack engineers, back end developers, and javascript developers) with 76.1%, digital product development (product owner, product manager, scrum master, and QA tester) with 73.9%, digital design or UI / UX 71.7%, mobile app development (Android or iOS developer) 69.6%, network engineering and cybersecurity 60, 9%, digital sales, marketing, media and content 37%, cloud computing (cloud engineer and cloud consultant) 34.8%, database designers and administrators 32.6%, and distributed ledgers technology (blockchain) 23.9%.

Problems in Fulfilling Digital Talent Needs

According to the survey results, various problems are encountered in fulfilling the digital talent needs at the FSS. The main problem is inadequate digital talent in the labor market (69% of respondents). It is followed by unsuitable competencies with the needs (63.4%), lack of loyalty in digital talent (60.6%), high demand for remuneration/salary (50.7%), low of soft skills (teamwork and creativity) (18.3%). There are also other problems, such as competition (8.4%). Regarding the time needed to get digital talent, the majority of respondents stated that it took 2-4 months (43.1%), then sequentially more than four months (25%), 1-2 months (20, 8%), and two weeks - 1 month (11.1%). Most respondents (37.5%) predicted that in the next five years, there would be an increase in digital talent demand by 26-50%, while others anticipate an increase of 11-25% (23.6%), 51 -75% (22.2%), more than 100% (12.5%), 76-100% (2.8%), and less than or equal to 10% (1.4%).

A total of 43.1% of the respondents doubted that the current regulations and policies by the government and authorities support the company's digital talent development strategy. The rest (40.3%), (9.7%), and (6.9%) agreed, disagreed, and strongly agreed that the existing regulations had offered support. From the respondents' perceptions, the financial services industry and stakeholders involved in the digital talent development ecosystem require intervention from the government or the relevant authorities regarding digital talent development policies. FGD found several problems related to fulfilling the needs of digital talent and its development were found. Banking leaders confirmed difficulties in fulfilling digital talent needs, both in quantity and quality. In terms of quantity, the limited availability of digital talent in the labor market, competitive talent wars from other industries, and the emergence of fintech have increased the shortage of digital talent.

Banks also work with outsourcing agencies to provide temporary needs for digital talent. The next problem is that there are quite many disloyal digital talents for various reasons, such as the opportunity to develop their competencies, better culture, and work environment. In terms of quality, the interviews showed that some digital talents do not match their technical competencies, especially from fresh graduate recruitment, hence not "ready to use." Experienced digital talents are preferred because they can work directly based on the company's needs. There are also problems in social competence, such as difficulty working in teams, poor communication, and other issues.

The difficulty in recruiting can also be seen from the survey results, where 68.1% of respondents took more than two months to find digital talent. According to a statement from one of the respondents, this depends on the banking recruitment system, which is mostly still conventional. However, some banks already use the latest technology, such as Curriculum Vitae (CV) screening using Artificial Intelligence (AI). Also, conventional recruitment takes much time from applicants, such as facing exams and interviews and time-consuming psychological tests. Recruitment should be shortened and only use methods that are in line with needs. In case only recruitment could be improved, the difficulty in getting digital talent could be reduced. This assertion is verified by vendors and outsourced agencies who get quality digital talent with ease.

Findings Related to the Internal Strategy for Digital Talent Development

In fulfilling digital talent needs, the company has implemented several internal strategies to close the gap. The survey results showed that recruiting new talents was not the main choice. The majority of respondents (91.7%) chose a strategy to increase employees’ skills (upskilling). Other strategies include recruiting new talents from within the country (83.3%), teaching digital talent competencies to non-digital talent employees (reskilling) (68.1%), collaborating with Vocational educational institutions (Hacktiv8, Algoritma) (54.2%), collaborating with formal educational institutions, such as universities and vocational schools (31.9%), recruiting new talents from abroad (16.7%), and other strategies (5,6 %). Several strategies to retain existing employees have been implemented regarding the intense competition for digital talent (talent war). Based on the survey results, improving the working culture, such as work-life balance, employee engagement, transparency, and trust, was the main strategy with 90.3 %, followed by training programs and continuous competency development as well as modernization of the work environment (dress code, office set up, and facilities) with 84.7% and 80.6%, respectively. The next strategy involves offering career paths (72.2%). Offering attractive remuneration/salary is in the second-last position after other strategies with 52.8%.

It is also consistent with the findings of the FGD, where all interviewees from banks stated that their company continuously conducts upskilling and reskilling. The company has a special educational institution to develop its human resources (corporate university). It helps to get "ready to use" human resources. In carrying out their programs, the institutions also collaborate with educational bodies, both universities, and Vocational educational ones. Furthermore, several banks that focus on digital services have also tried to change the cultural and rigid banking work environments. It is achieved by adopting a cultural style and work environment from technology companies that emphasize flexibility and creativity.

Collaboration with Universities

A total of 76.4% of the respondents stated that their companies collaborate with universities in obtaining or developing digital talent. Apart from identifying, the research also examined the suitability of the existing curriculum in universities with industrial needs. The results show that most respondents doubt the suitability of these two aspects (38.9%). The rest disagreed with the assertion that the college curriculum is under industry needs (29.2%), agree (26, 4%), and strongly disagree and strongly agree with 2.8% each.

The form of cooperation between companies and universities involves recruiting graduates to become employees (talent scouting) at 90.9%, internships (85.5%), training or employee competency development (43.6%), aligning the universities curriculum with the needs companies (12.7%), and other forms of cooperation, such as job fairs, and sharing sessions (4.4%). The FGD also shows that several banks have collaborated with educational institutions, especially talent scouting and competency development through training. However, only a few cooperate through curriculum adjustments. According to the statement of the relevant ministries in the FGD, Directorate General of Higher Education (DIKTI), permission is not required to compile a curriculum because this is the full authority of the universities. The preparation of the curriculum is expected to bring collaboration within the industry.

Collaboration with Non-Universities

Companies cooperate with universities and several other institutions/actors related to the fulfillment and development of digital talent. Regarding the effectiveness of external institutions/actors' role in helping meet digital talent needs, the survey results show that third parties play the most effective role by helping companies in digital transformation. The role of the vendor on the answer choices to agree and strongly agree rated 96%, sequentially followed by Vocational educational institutions such as Hacktiv8 and Algoritma (75%), online talent platform markets like Jobstreet like Linkedin (69.5%), freelancers (66.2%), and outsourcing agencies (62.5%). Regarding vendors, 70.8% of respondents stated that they assigned/gave all or part of the work related to digital transformation (service centers and building applications) to third parties.

Recommendations from Respondents and FGD Resource Persons Regarding Digital Talent Development Strategies

Conducting the survey involves exploring problems and mapping conditions. One question aimed at getting input or suggestions from respondents regarding digital talent development for the FSS, including what the government and regulators should do. After being mapped and grouped, there were 11 (eleven) proposals as mentioned below:

1. Developing a digital talent development strategy roadmap

2. Encouraging knowledge transfer/sharing

3. Facilitating curriculum alignment between educational institutions and the financial services industry (link and match)

4. Preparing digital talent from an early age

5. Providing financial support for the development of digital talent

6. Collaborating between stakeholders involved in the digital talent development ecosystem

7. Formulating adaptive regulations, including those related to recruitment, increasing competence and remuneration standards, among others

8. Developing Vocational educational institutions to increase digital talent competencies

9. Performing certification and professional standardization of digital talent and competencies

10. Providing digital talent competency improvement programs

11. Recruiting diaspora with digital competence

Similar suggestions were also obtained from the FGD results, though more in-depth. The OJK was expected to act as a facilitator to collaborate among stakeholders and develop the ecosystem. It was also expected to develop a standard and tiered competency training model for the FSS. Upskilling and "to unlearn" are needed because senior digital talent generally finds it challenging to leave outdated tools. It was also suggested that the training involve both young digital talent and corporate leaders. Based on experience, the role of top-level leaders is vital in implementing digital transformation programs initiated by top leaders.

Additionally, top management also needs the training to increase awareness, understand the big picture, and determine digital transformation strategies. They also propose establishing new competency and skills training programs for job positions likely to be replaced by technology. Another similar strategy suggestion is to bring prospective talent closer to the work environment by introducing the FSS business process to students on campus. It can be achieved in various ways, including the “Kampus Merdeka” program. The OJK is expected to facilitate a “Kampus Merdeka” program between banking and tertiary institutions for three semesters by creating a special FSS curriculum. It was conducted by IBM, Google, and several other technology companies that have implemented it first.

Conclusion

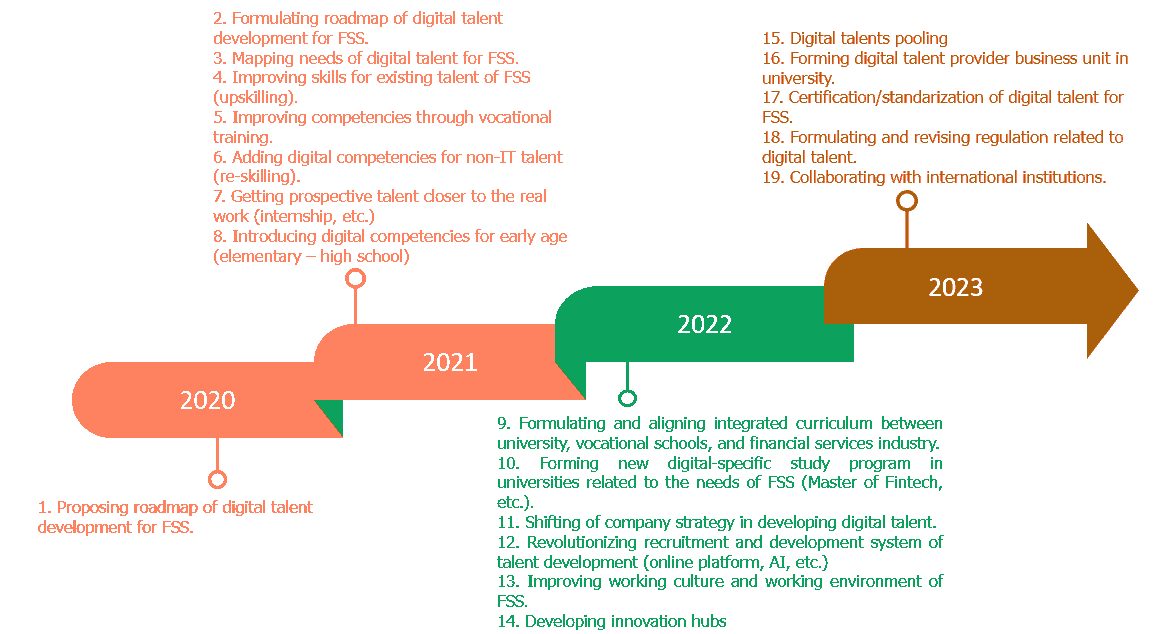

A synthesis regarding digital talent development was conducted after expert input from various stakeholders during the FGD, survey respondents, and benchmarking analysis from other countries. A total of 19 comprehensive strategies were formulated, and stakeholders involved in each strategy were identified. This research also proposes a roadmap for the implementation of this strategy. The implementation period runs for three years, from 2021 to 2023. However, 2020 is not considered the start of implementation because a proposed digital talent development strategy roadmap was produced. The proposal for 2020 is the research result conducted by the OJK Institute, contained in this report. The visualization of the digital talent development strategy roadmap for the sequential FSS is shown in Figure 1.

Due to limited resources, such as time, budget, infrastructure, human resources, and other limitations, it is vital to prioritize policy strategy recommendations to determine the strategies that need to be prioritized and implemented first. To determine priorities, this research uses two systems thinking tools, specifically the ease benefit matrix and paired comparison (tiered comparison). Both methods use data based on the experts' perceptions, which are then processed to produce a priority order. In this research, the perceptions used as data processing were from 11 experts, including leaders in financial services institutions, universities, banking associations, Vocational educational institutions, service providers for digital transformation programs and digital talent suppliers, ministries related to digital talent, and consultants. Data processing in the ease benefit matrix is divided into two, including the aggregation of expert perceptions regarding the ease level on strategy implementation and the aggregation of the benefits aspect. The aggregation is based on the average perception of all respondents. Table 1 shows the results of the sorted ease benefit matrix aggregation.

| Table 1 The Results of Ranking on The Proposed Strategies Based on the Ease Level of Implementation and Benefit Aspects |

|||

|---|---|---|---|

| The Ranking Results on the Ease of Implementation Aspects | Ease Average Value | The Ranking Results on the Ease of Benefit Aspects | Benefit Average Value |

| 2.1. Getting prospective talents closer to the FSS’ work environment | 7.33 | 1.1. Upskilling | 9.00 |

| 1.1. Upskilling | 7.00 | 1.3. The recruitment system revolution | 8.56 |

| 2.2. Curriculum alignment | 7.00 | 3.7. Introduction of digital competence from an early age | 8.56 |

| 3.2. Mapping digital talent needs | 6.78 | 3.1 Development of a digital talent development roadmap | 8.44 |

| 2.5. Vocational education | 6.67 | 1.5. Improved corporate strategy | 8.33 |

| 3.5. Development of innovation hubs | 6.67 | 3.2. Mapping digital talent needs | 8.33 |

| 1.2. Reskilling | 6.56 | 2.1. Getting prospective talents closer to the FSS’ work environment | 8.22 |

| 3.1 Development of a digital talent development roadmap | 6.44 | 1.4. Improved work environment and culture | 8.11 |

| 1.3. The recruitment system revolution | 6.33 | 2.2. Curriculum alignment | 8.11 |

| 1.5. Improved corporate strategy | 6.22 | 2.5. Vocational education | 8.11 |

| 2.4. Establishment of digital talent service providers in universities | 6.22 | 1.2. Reskilling | 8.00 |

| 3.7. Introduction of digital competence from an early age | 6.11 | 3.5. Development of the innovation hub | 8.00 |

| 2.3. Establishment of new study programs | 6.00 | 3.6. Regulatory improvements | 7.88 |

| 3.4. Certification | 5.75 | 3.3. Digital talent pooling | 7.56 |

| 1.4. Improved work environment and culture | 5.67 | 2.4. Establishment of digital talent service providers in universities | 7.44 |

| 2.6. Cooperation with international institutions | 5.56 | 2.6. Cooperation with international institutions | 7.33 |

| 3.3. Digital talent pooling | 5.56 | 2.3. Establishment of new study programs | 7.22 |

| 3.6. Regulatory improvements | 5.56 | 3.4. Certification | 7.22 |

Determination of Priority Through Paired Comparison

This research also ranks the priority of the proposed strategies using the paired comparison method. If the perception towards ease benefits is carried out partially on each proposed strategy, the expert compares the degree of priority between all the proposed strategies within one hierarchical level. Therefore, this method requires a hierarchy as a group to be compared. The 18 (eighteen) strategic proposals formulated by the research team are classified into three, including (1) digital talent development strategies by internal corporate, (2) digital talent development strategies through collaboration/integration with external parties, and (3) a digital talent ecosystem development.

The data processing results show that at level 1 comparison, the proposed digital talent development strategy through collaboration with external parties has the highest priority perception, with 45.0%. The proposed digital talent ecosystem development strategy occupies second place with 38.2%. The internal digital talent development strategy ranks last with 16.8%. Furthermore, at level 2 of the proposed strategy No.1, the results sequentially starting from the highest priority, change in corporate strategy (35.2%), upskilling (21.9%), enhancement of work culture and environment (18.1%), reskilling. (13.6%), and the recruitment system revolution (11.2%).

The priority rank at level 2 of the proposed strategy No.2 is to the FSS’ work environment (28.5%), curriculum alignment (21.4%), the formation of new study programs (15.8%), vocational training (13.1 %), cooperation with international institutions (12.3%), and the establishment of a business unit providing digital job services in higher education or universities (8.8%). At level 2 of the proposed strategy No.3, the rank from the highest includes the preparation of a digital talent development roadmap (19.8%), development of innovation hubs (19.6%), mapping of the needs (15%), preparation from an early age (13.4%), digital talent pooling (12.3%), drafting/revising regulations (10.4%), and certification and standardization (9.3%). Table 5 shows the results of the priority ranking in each comparison group.

In case the aggregation is carried out as a whole, the priority order of the eighteen proposed strategies is getting prospective talents closer to the FSS’ work environment (12.8%), curriculum alignment (9.6%), preparation of a digital talent development roadmap (7.6%), development of innovation hubs (7.5%), the formation of new study programs (7.1%), vocational training (5.9%), changes in corporate strategy (5.9%), mapping of digital talent needs (5.8%), cooperation with international institutions (5.5%), preparation of digital talent from an early age (5.1%), digital talent pooling (4.7%), the establishment of a business unit providing digital job services at the university (4%), drafting/revising regulations related to digital talent (4%), upskilling (3.7%), certification and standardization (3.6%), enhancement of work culture and environment (3%), reskilling (2.3%), and revolution of the recruitment system (1.9%).

Determination of Final Priorities as Policy Recommendations

Determination of final priorities as policy recommendations to be implemented by OJKI involves considering the results of the ease benefit matrix and paired comparisons. Strategy proposals taken as a priority include the proposed strategies in quadrant I ease benefit matrix plus the top 3 (three) order of strategy proposals from the paired comparisons. The result showed that there are 5 (five) proposed strategies that form the final priority, including:

1. Getting prospective talents closer to the FSS’ work environment (internships)

2. Increasing the competency (upskilling) of existing FSS talents

3. Alignment of curriculum between Higher Education or university and FSI (link and match)

4. Compiling the digital talent development strategy roadmap at the FSS

5. Mapping of digital talent needs at the FSS.

The strategy of approaching the work on prospective talents and aligning the curriculum between universities and FSI is followed by facilitating the "Kampus Merdeka” program between universities and the financial services industry. The program launched by the Ministry of Education and Culture is an excellent opportunity and momentum to close the gap in the need for digital talent, both in quantity and quality. In the “Kampus Merdeka” program, industry, or companies, there can be a collaboration with campuses and compile their curriculum based on the company needs (customized curriculum). This program gives students the right to study 3 (three) semesters outside of their normal program. The 2 (two) semesters students can work or do an internship at companies that cooperate with the university, while the remaining 1 (semester) students have the right to take courses outside their program. Using a curriculum in line with the industry and students taking internships for up to 1 year may optimize the link and match between universities and industry. It makes the gap in the need for digital talent to decrease indirectly. Students receive many ideas on how to adapt in their work and know what is needed by the company, hence being "ready to use". The information from several banking leaders shows that this program can be used to recruit students with the potential for digital talents directly. This is because they already know their quality and behavior (talent scouting).

This program also gives public or state and private universities authority with A and B accreditations that have collaborated with organizations in the QS Top 100 World Universities to open new study programs (Mustusilo, 2020) autonomously. Facilitating the cooperation of a “Kampus Merdeka” program between universities and FSI is the main priority for the policy recommendation of this research. The proposed strategy related to increasing digital competence, specifically upskilling, would be very appropriate when coordinated by the Directorate of Human Resources Development at the OJKI. It is because its duties and functions are in line with competency enhancement. In organizing digital talent competency improvement programs, OJKI collaborates with universities and Vocational educational institutions. It is also necessary to collaborate with associations to discuss curriculum preparation and the determination of competent participants.

The types of jobs and professions most needed by banks include data mining and data science (89.1%), which consist of data scientist, machine learning, artificial intelligence, and other related fields, software and web development (software developers and engineers, web developers, full-stack engineers, back end developers, javascript developers, etc.) by 76,1%, digital product development (product owner, product manager, scrum master, QA tester, etc.) 73,9%, digital design or UI/UX by 71,7%, mobile app development (Android or iOS developer, etc.) by 69,6%, network engineering and cybersecurity by 60,9%, digital sales, marketing, media, and content by 37%, cloud computing (cloud engineer, cloud consultant, etc.) by 34,8%, database designers and administrators by 32,6%, and distributed ledgers technology (blockchain) by 23,9%. Figure 7 shows more details.

The roadmap draft has been mapped as part of this research results regarding the proposed preparation strategy on the digital talent development roadmap. The next step is to discuss it with the stakeholders involved in Table 4 for implementation to be conducted properly and in harmony. The Ministry of Communication and Informatics conducted a national mapping with a total requirement of up to 2030 of 230 thousand digital talents. However, the mapping does not cover the specific FSS needs. Therefore, OJKI can work together with the Ministry of Communication and Information and the FSS Association to map the digital talent needs, specifically for the FSS.

References

- Anthony, S. (2004). Financial institutions management: a modern perspective, Irwin: Illinois.

- Amla, M., & Malhotra, M. (2017). Digital transformation in HR. International Journal of Interdisciplinary and Multidisciplinary Studies, 4(3), 536–544. Retrieved from http://www.ijims.com

- BCG. (2017). The year 2035 : 400 Million job opportunities in the digital age.

- Belyh, A. (2019). The digital talent gap - Are Companies Doing Enough? Retrieved June 12, 2020, from https://www.cleverism.com/digital-talent-gap-are-companies-doing-enough/

- Burge, S. (2011). The systems thinking tool box. Burge hughes walsh training and consultancy in systems design and process development.

- Capgemini. (2016). The digital talent gap developing skills for today ’ s digital organizations the war for talent has gone digital.

- Chamorro-Premuzic, T., & Frankiewicz, B. (2019). 6 Reasons Why Higher Education Needs to Be Disrupted. Retrieved September 23, 2020, from Harvard Business Review website: https://hbr.org/2019/11/6-reasons-why-higher-education-needs-to-be-disrupted

- Fichman, R.G., Dos Santos, B.L., & Zheng, Z. (2014). Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Quarterly: Management Information Systems. https://doi.org/10.25300/misq/2014/38.2.01

- Galloway S. (2017). The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google. Journal of Chemical Information and Modeling. https://doi.org/10.1017/CBO9781107415324.004

- Harususilo, Y.E. (2020). Ini Rangkuman 4 Kebijakan Kampus Merdeka Mendikbud Nadiem Halaman all - Kompas.com. Retrieved September 7, 2020, from Kompas.com website: https://edukasi.kompas.com/read/2020/01/25/11354331/ini-rangkuman-4-kebijakan-kampus-merdeka-mendikbud-nadiem?page=all

- IGI Global. (2020). What is Digital Talent | IGI Global. Retrieved June 12, 2020, from https://www.igi-global.com/dictionary/digital-talent/75603

- Institute of Systems Science - NUS. (2017). What Makes A Digital Talent? Hint: It has Nothing to do with technology. Retrieved June 15, 2020, from https://www.iss.nus.edu.sg/community/newsroom/news-detail/2017/12/14/what-makes-a-digital-talent-hint-it-has-nothing-to-do-with-technology

- King, B. (2018). Bank 4.0. https://doi.org/10.1002/9781119506515

- McKinsey Global Institute. (2018). Skill Shift: Automation and the Future of the Workforce. McKinsey &Company.

- Microsoft-IDC. (2018). Unlocking the economic impact of digital transformation in the Asia Pacific. Retrieved from https://news.microsoft.com/uploads/2018/03/Digital-Transformation-study-March-2018.pdf

- Mohan, R. (2017). Go-Jek, Karya Anak Bangsa Blasteran India. Retrieved June 18, 2020, from Tirto.ID website: https://tirto.id/go-jek-karya-anak-bangsa-blasteran-india-cnXh

- Nabila, M. (2017). Tahun Ini Go-Jek Berencana Lipatgandakan Jumlah Engineer India. Retrieved June 18, 2020, from Daily Social website: https://dailysocial.id/post/go-jek-engineer-india-2017

- Patel, K., & McCarthy, M. P. (2000). Digital Transformation: The Essentials of E-business Leadership. McGraw-Hill Professional.

- Russel, J. (2019). Go-Jek doubles down on India with yet another talent acquisition. Retrieved June 18, 2020, from Techcrunch.com website: https://techcrunch.com/

- Shermon, G. (2017). Digital Talent: Competencies and Business Models.

- Skinner, C. (2018). Digital Human: The fourth revolution of humanity includes everyone. Marshall Cavendish International (Asia) Pte Ltd.

- Sweeney, L.B., & Sterman, J.D. (2000). Bathtub dynamics: Initial results of a systems thinking inventory. System Dynamics Review, 16(4), 249–286. https://doi.org/10.1002/sdr.198

- The Global Interim Management Group. (2018). Organization of The Future: HR between digital transformation and the new world of work.

- Westerman, G., Calméjane, C., Bonnet, D., Ferraris, P., McAfee, A., & others. (2011). Digital Transformation: A roadmap for billion-dollar organizations. MIT Center for Digital Business and Capgemini Consulting, 1, 1–68.

- World Economic Forum. (2018). The Future of Jobs Report. https://doi.org/10.1177/0891242417690604