Research Article: 2021 Vol: 25 Issue: 1

Digitalization of Transfer Pricing As An Element of The Management Accounting System In The Company

Marek Garbowski, University of Warmia and Mazury in Olsztyn, Poland

Svitlana Tiutiunnyk, Poltava State Agrarian Academy

Yurii Tiutiunnyk, Poltava State Agrarian Academy

Nelia Kondukotsova, Open International Human Development University "Ukraine"

Olha Karpenko, Open International Human Development University "Ukraine"

Abstract

Systems of digitalization of transfer pricing operations should especially ensure the implementation of the functions of processing and transmission of accounting information. Providing such information requires a certain analytical grouping and detailing. In addition, transfer pricing in the management accounting system uses a large amount of primary data and the lack of an automated system leads to spending a significant amount of time for their processing. The introduction of an integrated effective system of digitization of transfer pricing accounting operations is a complex process, in which the following interconnected and complex stages can be distinguished: definition of the goals of digitalization of transfer pricing; development of the technical task; choice of digital system; introduction of a digital product. The success of the company is largely determined by the effectiveness of decisions, which must take into account various factors and the dynamics of their development. It is management accounting that should provide users with the information necessary to make informed decisions to reduce or expand certain areas of activity, focusing on the most promising segments. To perform these functions, the effective work with the information which is allowed by digital data processing systems is required.

Keywords

Transfer Pricing, Accounting Information, Digitization of Accounting Operations, Management System, Digital Product.

JEL Classifications

M5, Q2

Introduction

Recent trends in global commodity and stock markets, fluctuations in the hryvnia exchange rate, and the introduction of measures by the world governments to prevent the spread of COVID-19 are becoming a challenge for global business.

Small and medium-sized businesses are most exposed to the current conditions, then the wave affects large companies. Among big business, it is companies with high fixed costs that will be most sensitive to possible instability in the economy. Such industries, first of all, include industrial production.

The current macroeconomic conditions will also affect distributors of international corporations. At first glance, it seems that these companies do not have significant fixed costs. However, this is not quite true.

To justify the marketability of import prices, most distributors position themselves as limited risk distributors. According to the concept of transfer pricing (TP), such companies should not bear currency and credit risks, the risk of changes in market prices and other commercial risks. This allows them to receive a small but guaranteed income. Thus, it is extremely difficult for limited risk distributors to justify their losses. An example of such a company can be an importer of home appliances.

Review of Previous Studies

Transfer pricing, in particular, is a tool for assessing the quality of management of subsidiaries (divisions, branches, structural units) by meeting the performance criteria for each structural unit that is part of the enterprise.

It can serve as a basis for determining the volume of domestic sales, profits, and profitability, and also focuses the attention of senior managers on such issues as coordination of the activities of the parent company and its management policy, the reasonableness of the distribution of costs and assets between units, including volume of mutual deliveries, correctness of distribution of expenses at storage of stocks, need of improvement of indicators of the financial reporting and improvement of applied cost accounting systems (Rossing et al. 2017; Sikka, 2017).

Transfer pricing as a management accounting tool raises the question for the accountant-analyst (Klassen et al. 2017): should the produced product be sold to other structural units of the enterprise at special prices (Clempner & Poznyak, 2017; Rikhardsson & Yigitbasioglu (2018). And if so, to what extent it will be intended for sale in domestic and foreign markets and what will be the transfer price at each stage of transfer.

The transfer pricing system arises with a positive answer to the first question and is differentiated depending on the applied methods and models of transfer pricing (Davies et al., 2018).

Methodology

In practice, there are three methods of transfer pricing in management accounting and the corresponding three types of transfer pricing, as well as their various modifications that companies can use when transferring goods, performing work, and providing services (Table 1).

| Table 1 Methods of Transfer Pricing in Management Accounting | ||||

| Approaches to determining the transfer price | positive | based on market prices |

prices are set on the basis of list prices for the same or similar goods or services; in other words, it is the actual price at which the supplier sells products to external consumers or it is the price offered by a competitor in the relevant market | |

| normative | based on production cost | at marginal costs | marginal costs are equal to short-term variable costs, which consist of direct variable costs and variable indirect costs | |

| at regulatory costs | scientifically substantiated value of costs of economic resources for production in the period | |||

| at full costs | setting transfer prices based on the total cost of all resources spent on a product or service in the short term | |||

| at double the rate | different transfer prices are set to two cooperating organizations (supplier and buyer) | |||

| based on contract prices |

transfer prices on the basis of negotiations are considered as the prices, which are established as a result of the agreement of the parties - the party 1 (the enterprise) delivering production (the goods, works, and services), and the party 2 (the enterprise) carrying out acceptance of the given production, and defined as the sum of the general costs and marginal revenue per unit of output in the form of lost profits of the supplier-enterprise | |||

According to some studies (Appelbaum et al., 2017; Bhimani, 2020; Möller et al., 2020), the cost-based transfer pricing methods are more common. Moreover, the methods based on full and regulatory costs are the most common. Next, in terms of prevalence, there are methods based on market prices and based on negotiations.

Turning to the study of transfer pricing models (Table 2), it should be noted that the nature of these models is economic and mathematical. In other words, the application of economic and mathematical models in management accounting aims to diagnose internal processes and with the help of logical schemes and mathematical methods, such as linear programming, to develop the most profitable production program for the enterprise and financial flow chart.

| Table 2 Models of Transfer Pricing in Management Accounting | |

| Transfer pricing model | Essence and features |

| Hirschleifer model | the search for the optimal transfer price with the output parameter, which maximizes profit (the transfer price was equal to the marginal costs) by constructing curves of marginal income and marginal costs; |

| Schillinglov model | the search for the optimal volume of sales to domestic firms and the foreign market under the condition of equality of marginal income and marginal costs by plotting the dependence of marginal income on production volumes; |

| Ecclesia model | the search for the transfer pricing method based on the company's vertical integration differentiation matrix and diversification from the quadrant of methods |

| Spicer model | the search for the appropriate transfer pricing method based on the matrix of differentiation of the level of trade between units and the degree of transactional specificity of investments from the quadrant of methods |

Behavioral models of transfer pricing are of particular interest. In a model that takes into account the behavioral aspects of management accounting, the company is presented as an association of participants with opposing interests.

Results and Discussion

The spread of management accounting has increased the role of transfer pricing systems within the enterprise. Large business structures, carrying out reorganization during the next stage of rapid growth, are faced with the question of which functions should be left inside the company and which are cheaper and easier to put aside.

The reason for this question is the fact that the company may have a large number of cost centers (transport department, procurement department, economic department, etc) and only one revenue center (sales department), as well as the fact that there is no convenient tool for assessing the contribution of each unit to the end result.

This fact gives rise to numerous conflicts and disputes at the meeting of heads of departments over who "made the greatest contribution to the profits of enterprises" and "who is more important for efficient operation." In this case, when erecting separate budgets of responsibility centers in a single format of the operating budget of the industrial enterprise, the system acquires the need to use transfer pricing tools.

Transfer prices should be set so that for each of the centers it is possible to determine not only the real value of costs but also profits, which in the future will allow to form a comprehensive information system of objective evaluation of efficiency and identification of "bottlenecks". Considering the scope of transfer pricing, it should be noted that transfer prices can be set not only for goods, products, and services in the manufacturing sector but also on interest rates, discount on bonds and promissory notes, the value of property rights to which securities, royalties, etc are transferred.

Transfer prices act here as the price of providing capital. This fact expands the scope of transfer pricing to banking and other financial institutions, leasing, insurance companies, and financial and industrial groups.

With the introduction of transfer pricing, the amount of information that the management accounting service must identify, record, analyze, process, and transmit for decision-making increases significantly. This is due to the growth of accounting information in terms of differentiated reflection of transactions at transfer prices, emerging financial flows, and changes in costs and results of structural units within the company.

Systems of digitalization of transfer pricing operations should especially ensure the implementation of the functions of processing and transmission of accounting information. Providing such information requires a certain analytical grouping and detailing. In addition, transfer pricing in the management accounting system uses a large amount of primary data and the lack of the automated system leads to significant time for their processing.

In our opinion, the digital pricing system of transfer pricing is an element of digitization of the general management accounting system in the company and can be implemented as a functional unit in the complex automation program or as a specialized program integrated with the automation program of general management accounting functions.

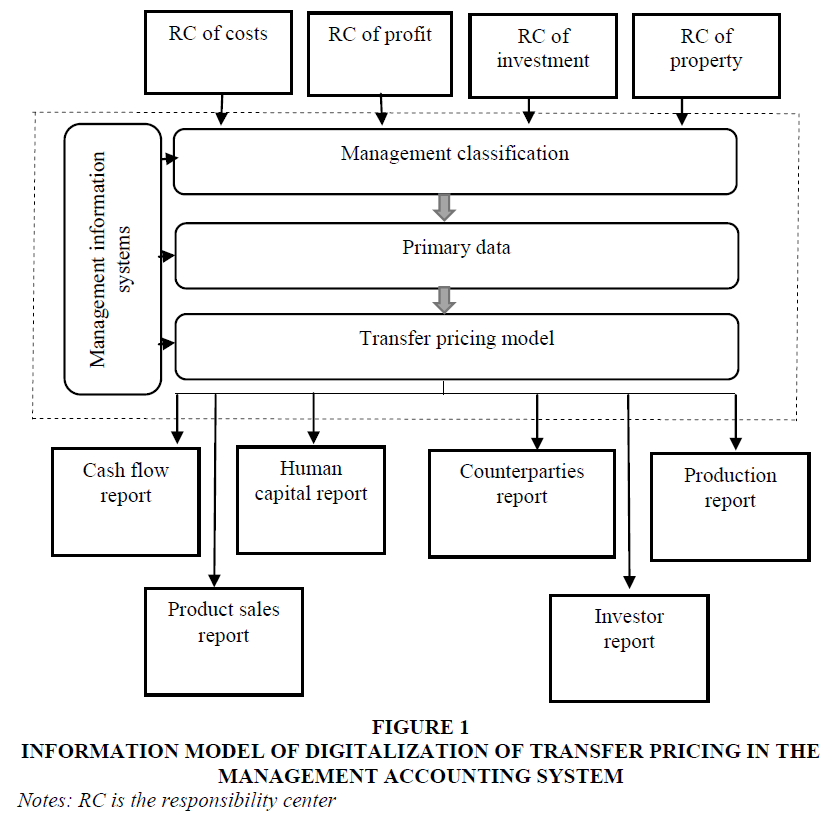

Taking into account the above requirements, it is advisable to develop a model of transfer pricing automation (Figure 1).

Figure 1 Information Model of Digitalization of Transfer Pricing in the Management Accounting System

Notes: RC is the responsibility center

According to the constructed model, primary data arrive in the automated system from the responsibility centers, thus for processing they are entered according to certain rules of the administrative account according to the established analytical directories.

The automated system performs grouping and analytical processing of primary data, as a result of which the necessary management reports are generated at the output. In addition, the existing model of transfer pricing on the basis of target accounting indicators ("mandatory tasks") consists of management registers at actual and recommended transfer prices in the section of each type of product.

Setting up the transfer pricing automation is a rather long process, which applies to almost all structural units that are part of the company. Only small structural units have the ability to keep management records in a separate system, which is not related to the financial accounting system, while for large and medium-sized structural units such a mechanism will be ineffective, as there is a need to maintain data in two independent databases. Therefore, to automate transfer pricing in such cases, as a rule, a single information database of primary data of financial and management accounting is used.

Transfer pricing digitalization methods depend on many factors - this is the specifics of activities and strategic goals of the organization but, in any case, the purpose of digitalization is to obtain operational and reliable indicators, management reports needed for management decisions.

The most significant advantage of OLAP-based systems is that they work with existing and, as a rule, debugged financial accounting automation systems, which speeds up the implementation process.

A necessary condition for this is to work on the unification of classifiers and accounts of existing programs. Thus, for the digitalization of transfer pricing, it is necessary to unify the accounting of settlement operations within the company, to unify the analytical directories of direct and indirect costs, directories of products, which are manufactured and consumed. For this purpose the combined system of the normative and reference information containing directories of the analytical account, information on plans of accounts is applied. All changes to the unified regulatory information system are strictly regulated as they must occur simultaneously throughout the company.

When using OLAP-system management accounting for digitization, it is necessary that a unique number is assigned to each posting in this system, otherwise the same information can be exported several times from the accounting system, for example, with a unique number, the corporate data warehouse can distinguish edited posting from newly entered one.

On the basis of the source of costs and on the basis of the supplier, the analytical system in the process of data processing will be able to determine whether the data export operation is internal and already in accordance with the established algorithm will be able to group information and prepare consolidated management reports.

The only accounting and analytical system of transfer pricing. The only accounting and analytical system of transfer pricing is based on the ERP system such as SAP R/3, Oracle Applications, etc. ERP systems are based on the creation of a single data warehouse, which must be simultaneously accessed by a number of employees with the appropriate authority.

A significant advantage of ERP systems is that both financial and management reporting are based on the same primary information; information enters the system and is processed in real time, contributes to the transparency of the company and the growth of employee discipline, while the internal information flows are reduced.

Despite all the advantages, the ERP systems have certain disadvantages. Thus, it is necessary to unify the method of accounting in all structural units, to transfer all data into a single integrated system, as a rule, it takes more than a year, while having to keep management records in parallel with the help of former information tools.

Thus, the introduction of the integrated effective system of digitization of transfer pricing accounting operations is a complex process in which the following interrelated and complex stages can be distinguished.

Stage 1. Determination of the goals of digitalization of transfer pricing. In the context of digitalization of management accounting, it is necessary to be aware of your needs, opportunities, requirements, and preferences. It is necessary to define the company's development strategy as the digitalization system must grow and develop together with the company.

Stage 2. Development of the terms of reference. At the stage of development of the terms of reference, the formation of the terms of reference, introduction and adjustment of the software product for automation of process of transfer pricing are carried out. At this stage, the corporate policy of transfer pricing is determined: an analysis of the current system of management accounting, analysis of the applicable chart of accounts of management accounting; standard postings, which are used to reflect transactions; directories and analytics on management accounting accounts; distribution of functions in management accounting; used management reporting.

When it is determined what it is necessary to change in the current system of transfer pricing, the terms of reference (task statement) is made, which determines what information and in what context will be entered into the system, which registers and management reports should be received at the output.

The terms of reference define the basic principles of the accounting process; working plan of accounts of management accounting; accounting methodology, including standard postings; classifier of fixed and variable, direct and indirect costs; rules for allocation of indirect costs; modeling and principles of transfer price formation; the required level of detailing of the information; methods of consolidation of management reporting; frequency of submission and composition of management reporting; reporting forms; internal control system.

Step 3. Selection of the digital system. To select the specific system, it is necessary to define the requirements for it, that is, it is necessary to determine what resources and, accordingly, what information will be required for management. Thus, in the process of transfer pricing, it is necessary that the selected system allows for management accounting not of a single structural unit but of the company. The management accounting must determine certain priorities regarding the reliability and efficiency of accounting.

Stage 4. Implementation of the digital product. The company can implement the software product on its own, which is possible only if it has a strong automation department and an enough large staff of experienced programmers. However, as a rule, most prefer to involve third-party organizations with experience in digitizing management accounting. This increases the cost of automation but at the same time allows significantly reducing the time of implementation of the software product and avoiding the typical mistakes and problems faced by employees who do not have sufficient experience in digitizing accounting procedures.

Recommendations

To substantiate that the import prices at which this importer buys the equipment are market ones, the net profit method is used. According to this method, if the company's net profitability (ie the ratio of profit to financial expenses and taxation to revenue) is not lower than the profitability of similar distributors in the market, then import prices correspond to the market level. In this case, it will not lead to additional surcharges on income tax.

Adhering to this approach, it seems that no difficulties with justification should be expected. After all, the negative margin that will be received by the importer of home appliances will be compared with the profitability of comparable companies, which will be at about the same level.

This will lead to the fact that this importer will have to add income tax and the group will face double taxation (as the supplier of the product will not be able to account for the tax paid by the importer against his obligations).

In practice, there are two baseline scenarios that can allow the group to avoid double taxation and the importer to minimize additional income tax surcharges. The first scenario is to use tools to improve the distributor's financial performance. The second is to change the transfer pricing method used by the distributor to analyze transfer pricing.

The use of the credit note allows, on the one hand, to increase the profitability of the Ukrainian company and, on the other, to reduce the profitability of the supplier. Accordingly, the use of the credit note will avoid double taxation on supply transactions.

To use the credit note, the supply contract between the supplier and the distributor must contain provisions on the possibility, conditions, and forms of issuing the credit note.

However, the use of the credit note may carry certain VAT risks. For example, the tax authorities may consider a credit note as the provision of marketing services for the benefit of a non-resident and add VAT liabilities. To minimize this risk, it is necessary not only to draw up the credit note correctly but also to correctly reflect it in the company's financial statements.

Conclusions

Given the choice of methods and models for determining the transfer prices with a change in management approaches, taking into account the factor of strategic development, it is advisable to use optimization models for transfer prices based on the concept, which is widely used in modern business structures, namely the system of key performance indicators, which is the operational controlling tool. Information and management support of the process of determining transfer prices on the basis of the optimization model of income maximization are key performance indicators in the structure of the balanced scorecard.

To make effective decisions on transfer prices, information that characterizes the impact on their changes in previous reporting periods is needed. The top management of the company should clearly present the functioning of the transfer pricing system, know the economic effect of its functioning in the company. In addition, directly to determine transfer prices, it is necessary to determine the cost estimate of the influence of transfer pricing factors on the formation of transfer prices.

Thus, the success of the company is largely determined by the effectiveness of decisions, which must take into account various factors and the dynamics of their development. It is management accounting that should provide users with the information necessary to make informed decisions to reduce or expand certain areas of activity, to focus on the most promising segments. To perform these functions, the efficient work with the information, which is allowed by the digital data processing systems, is required.

References

- Appelbaum D., Kogan A., Vasarhelyi M., & Yan Z. (2017). Impact of business analytics and enterprise systems on managerial accounting. International Journal of Accounting Information Systems. 25, 29–44.

- Bhimani, A. (2020). Digital data and management accounting: why we need to rethink research methods. J Manag Control, 31, 9–23.

- Clempner, J.B., & Poznyak, A.S. (2017). Negotiating transfer pricing using the Nash bargaining solution. International Journal of Applied Mathematics and Computer Science, 27(4), 853-864.

- Davies, R.B., Martin, J., Parenti, M., & Toubal, F. (2018). Knocking on tax haven’s door: Multinational firms and transfer pricing. Review of Economics and Statistics, 100(1), 120-134.

- Deloitte, (2020). Finance in a digital world: It’s crunch time for CFO’s! https://www2.deloitte.com/nl/nl/pages/strategy-analytics-and-ma/articles/finance-in-a-digital-world-crunch-time-for-cfo.html. Accessed 26 Mar 2020.

- Klassen, K.J., Lisowsky, P., & Mescall, D. (2017). Transfer pricing: Strategies, practices, and tax minimization. Contemporary Accounting Research, 34(1), 455-493.

- y. (2018). Memo to the CFO: Get in front of digital finance—or get left back. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/memo-to-the-cfo-get-in-front-of-digital-finance-or-get-left-back. Accessed 26 March 2020.

- Möller, K., Schäffer, U., & Verbeeten, F. (2020). Digitalization in management accounting and control: An editorial. J Manag Control, 31, 1–8.

- Rikhardsson P., & Yigitbasioglu O. (2018). Business intelligence and analytics in management accounting research: Status and future focus. International Journal of Accounting Information Systems; 29, 37–58.

- Rossing, C.P., Cools, M., & Rohde, C. (2017). International transfer pricing in multinational enterprises. Journal of Accounting Education, 39, 55-67.

- Sikka, P. (2017, December). Accounting and taxation: Conjoined twins or separate siblings?. In Accounting forum, 41(4), 390-405.