Research Article: 2022 Vol: 26 Issue: 5

Disclosure of Sustainability Reporting and Their Effect on Shareholders Wealth Maximization of Listed Nigerian Companies

Umeanozie Ogochukwu, University of Nigeria

Ofoegbu Grace, University of Nigeria

Citation Information: Ogochukwu, N.U., & Grace, N.O. (2022). Disclosure of sustainability reporting and their effect on shareholders wealth maximization of listed nigerian companies. Academy of Accounting and Financial Studies Journal, 26(5), 1-12.

Abstract

This study aims to ascertain the extent of disclosure of sustainability reporting and their effect on shareholder’s wealth maximization of listed companies in Nigeria. The study employed environmental performance and governance disclosures as proxies for sustainability reporting; while economic value added was used as proxy for shareholder’s wealth maximization. Data was extracted from the annual reports of eighteen consumer goods companies from 2010 to 2018. The study employed descriptive statistics and panel data estimation regression models to analyze the data. The results revealed that governance was disclosed most by companies and minimal or no disclosure of environmental performance. The findings of the study show a significant relationship exists between governance disclosure and shareholder’s wealth maximization of companies; while there is no significant relationship between environmental performance and shareholder’s wealth maximization of the companies under review. Originality: To the best knowledge of the researchers, limited studies have been carried out on sustainability reporting and maximization of shareholder’s wealth of listed companies in Nigeria. This paper, therefore provides empirical evidence of sustainability reporting and their effect on shareholder’s wealth maximization of Nigerian listed companies.

Keywords

Sustainability, Sustainability Reporting, Shareholders Wealth.

Introduction

The term sustainability has become an interest area in the world at large due to the effect of human activities on the society (Alexander, 2018). Sustainability is based on the principle that future generations should inhabit in a world that the present generation has benefited from without diminishing its future benefits (Clough et al., 2006). In as much as the present generation seeks to exploit the finite resources of the earth, it must be aware of the dangers of compromising the ability of future generations to meet their own needs (Safari, 2019). With the increased global concern as regards the issues of sustainable practices, there is a need to report on the effect of organizational activities on its environment. Global Reporting Initiative defined sustainability reporting as the practice of measuring, disclosing and being accountable for organizational performance while working toward the goal of sustainable development (GRI, 2013). The concept of sustainability reporting was proposed in other to measure and communicate the impact of an organization’s activities beyond the traditional accounting reporting to stakeholders (Atu, 2013). Sustainability has however advanced from concentrating only on environmental issues to focusing on the interdependence of economic, social, environmental and governance factors (Ezeoha & Omkar, 2017).

Disclosure of environmental, economic, social and governance performance of organizations can distinguish an organization from its competitors and also enhance investors’ confidence in the operations of the company (Dhaliwal et al., 2011). Companies are now concentrating on reducing their overall effect on the environment they operate (Andrew, 2017). Measures of corporate governance are also integrated into the dimensions of sustainability performance (Safari, 2019).

Many shareholders have recognized that sustainability is a long term goal of eco-friendly businesses and as such, reporting on sustainability performance of companies has become relevant (Jacob, 2015). Therefore, maximizing shareholders returns usually implies that firms must also satisfy stakeholders such as customers, employees, suppliers, local communities and the environment. As impacts of climate change continue to rise, investors will continue to press for improved disclosure and performance on mitigating these risks (Rob, 2013).

Several researchers have carried out investigation on sustainability reporting, however, previous studies on sustainability reporting in Nigeria aimed at evaluating sustainability reporting and financial performance/profitability of organizations (Asaolu & others, 2011; Ahmad et al., 2017; Ndukwe & Nwakanma, 2018; Nnamani et al., 2017; Asuquo et al., 2018). We observed that there are limited studies on the effect of sustainability reporting in maximizing shareholder’s wealth in Nigeria. Shareholders provide the major funds needed by an organization, thus maximizing shareholders value is often a superior goal of companies. Therefore, the aim of this paper is to provide insights into sustainability reporting and maximization of shareholder’s wealth of listed companies in Nigeria.

To achieve this objective, we hypothesize the following:

H0: There is no relationship between Environmental Performance Disclosure and Shareholders Wealth Maximization of listed companies in Nigeria.

H0: There is no relationship between Governance Performance Disclosure and Shareholders Wealth Maximization of listed manufacturing companies in Nigeria.

H0: Disclosure of Sustainability Performance Indicators does not significantly affect Shareholders Wealth Maximization of listed companies in Nigeria across different specialized groups of companies.

Sustainability Reporting and Shareholders Wealth

Sustainability reporting is a concerted effort to integrate environmental, societal and economical aspects of an organization into the evaluation and decision making processes of organizations and communicate to the interested parties (Saminda, 2014). Reporting on the commitment to a sustainable global economy can help organizations measure, understand and communicate their economic, environmental, social and governance performance (Incorp, 2019).

Organizations often operate to fulfill their ultimate objective of maximizing shareholders’ wealth (Saminda, 2014) however, maximizing shareholder value does not need to conflict with maximizing sustainability. Thus, maximizing shareholders returns usually implies that firms must also satisfy stakeholders (Madan, 2013). A study carried out by Innocent & Kenneth (2017) revealed that accountants understand sustainability reporting as taking into consideration social and environmental concern in business operational activities; however, this must be within the context of shareholder’s value maximization.

Legitimacy Theory and Sustainability Reporting

Suchman (1995) defined legitimacy as a generalized perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs and definitions. Legitimacy theory posits that there is a social contract between a company and the society in which it operates. The society has expectations about how organizations should conduct their operations, organizations therefore need to work in line with these expectations in order to survive. Organization’s survival may be threatened if society perceives that the organization has breached its social contract (Deegan, 2002). Societal expectations however change over time (Deegan 2000); therefore, organizations ought to make disclosures that are responsive to the changing environment (James et al., 2006).

Corporate sustainability reporting is one of the strategies used by companies to seek acceptance and approval of their activities from society which they operate (Ndukwe & Nwakanma, 2018). By reporting on economic, social, and environmental issues a company can demonstrate that it fulfills its part of the social contract and that its activities coincide with the value systems of society.

Environmental Sustainability Performance

The environmental dimension of sustainability concerns an organization’s impact on living and non-living natural systems, including ecosystems, land, air, and water (NSE, 2018). Environment is the third bottom line of the company (planet) and is a measure of how environmentally responsible a company has been. Environmental disclosure depicts different ways that companies disclose information about their environmental activities to various users of financial statement (Olayinka & Oluwamayuwa, 2014). Environmental disclosure is a planned statement that depicts company’s environmental burden and environmental efforts including company’s objectives, environmental policies, environmental activities and impacts, reported and published periodically to the public (Ong et al., 2016). Disclosure is necessary because of the importance of environment and the devastating impact of company’s activities on the environment (Ahmad et al., 2017). Companies are now concentrating on reducing their overall effect on the environment (Andrew, 2017). The demand for environmental information indicates that environmental sustainability disclosures influence investment decision making of shareholders and other stakeholders (Villiers & Staden, 2012).

Ahmad et al. (2017) find that disclosure of environmental performance has a positive significant impact on firm performance of cement and brewery companies in Nigeria. Adebimpe et al. (2015) in their research found that environmental information was the least disclosed in the annual reports of companies. Okoye & Ezejiofor (2013) discovered that sustainable environmental accounting has significant impact on corporate productivity in order to enhance corporate growth.

Governance Performance

Corporate governance deals with the system of directing and controlling an organization. It provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined (Albassam, 2014). Sustainability reporting is an essential part of corporate governance; in as much as the present generation seeks to exploit the finite resources of the earth, it must be aware of the dangers of compromising the ability of future generations to meet their own needs. Organizations globally are striving to improve their corporate governance by establishing more robust measures to strengthen their regulatory frameworks in order to promote economic stability, public trust and investor confidence in their reporting. Due to the emphasis on corporate governance, experts have proposed governance policies that enhance the ability of the next generation to meet their needs from exploiting the earth’s resources without damaging it forever. The 2011 Nigerian Code of Corporate Governance emphasized on this under Sustainability Issues (Alhassan & Basariah, 2017). Paragraph 28.3 specifically states that: The Board should report annually on the nature and extent of its social, ethical, safety, health and environmental policies and practices (2011, SEC Code). A key indicator of sustainability integration is clear assignment of accountabilities and responsibilities for environmental, social and economic performance to those charged with governance (NSE, 2018).

Research Method

A sample of 18 consumer goods manufacturing companies listed on the floor of the Nigerian Stock Exchange (NSE) for the period of nine years (2010-2018) was used to test our hypothesis.

Data was collected from the annual reports of the companies under review (refer to appendix II).

Shareholders Wealth Maximization is the dependent variable in this research work and the Economic Value Added (EVA) will be used as a proxy for Shareholders Wealth. Economic Value Added (EVA) is a value based performance measure that gives importance on value creation by the management for the owners (shareholders). It gives importance on how much economic value is added for the shareholders by the management (Per ways and Mohammed 2012). EVA captures the true economic profit of an enterprise and is the performance measure most directly linked to the creation of shareholder wealth overtime. EVA is based on the concept that a successful firm should earn at least its cost of capital; generating higher returns than the cost of financing would result to increased shareholder’s wealth and vice versa (Madan 2013). EVA is calculated as net operating profit after- tax (NOPAT) minus a capital charge (Perways & Mohammed, 2012).

EVA = NOPAT - Capital Costs = Net operating profit (1-Tax) - Capital employed × Cost of Capital

The independent variables in this research work are - Environmental Performance Disclosure (EvPD) and Governance Performance Disclosure (GoPD). Content analysis was used to measure these variables; content analysis allows the researcher to gather large volumes of data from the annual reports of companies under review.

The Nigerian Stock Exchange Sustainability Disclosure Guidelines was made effective in Nigeria from 1st January, 2019 and the scope of this study is from 2010 to 2018, therefore the study will use the Global Reporting Initiative (GRI) sustainability reporting guidelines for 2010 to 2018.

The Environmental and Governance Disclosure index was calculated based on the number of indicators that were disclosed.

Rating is as follows:

1 = if a company disclosed any indicator

0 = if a company does not disclose any indicator

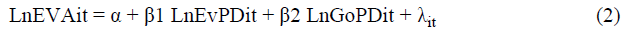

To determine the effect of sustainability reporting on shareholders’ wealth maximization of listed companies under review, this study adopted the model used by Asuquo, Dada and Onyeogaziri (2018). However, the model was adjusted to suit the requirements of this study.

Where:

EVA = Economic value Added represents added Shareholders Wealth in company i at period t.

β=Coefficient of sustainability reporting

α=Unknown parameters to be estimated

X = Sustainability Reporting Performance Indicators

represents the white-noise error.

represents the white-noise error.

For the purpose of linearising the specification above and introducing the independent variables, the predicted and predictor variables are logged. This is given as:

Where:

EVA = Economic Value Added

EvPD = Environmental Performance Disclosure (EvPD)

GoPD = Governance Disclosure

α =Unknown constant to be estimated

λit represents the white-noise error.

β1,β2 Unknown Coefficient of sustainability reporting indicators

Techniques of Data Analysis

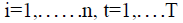

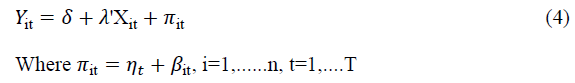

Panel data permits us to apply several econometric techniques in the estimation of our model. We used the Pooled OLS, and the Fixed Effects Model (FEM) or Random Effect Model (REM) to achieve robust estimates. The empirical estimation begins with the benchmark pooled OLS regression model as shown below;

where  for company and time respectively, Yit is the dependent variable, δ is the intercept, λ is the coefficient of the independent variables, are the independent variables and η is the error term

for company and time respectively, Yit is the dependent variable, δ is the intercept, λ is the coefficient of the independent variables, are the independent variables and η is the error term

However, Semykina & Wooldridge (2008) notes that the pooled OLS estimator may be biased, inconsistent and assumes strict homogeneity of the parameters, in which case vital insight offered by panel data may be lost. Following this, we proceed to estimate a Fixed Effect model in the form below;

And  are individual effects under the condition that these effects are unobserved parameters and that

are individual effects under the condition that these effects are unobserved parameters and that  Further, we estimated a Random Effect model as given below;

Further, we estimated a Random Effect model as given below;

Where  and

and

are transformed dependent and set of transformed explanatory variables.

are transformed dependent and set of transformed explanatory variables.

The pooled OLS is estimated for all three groups as well as the whole while the FEM or REM is estimated based on the results of the human specification test for each of these samples.

Empirical Results and Discussion of Findings

To ascertain the impact of Disclosure of Sustainability Performance Indicators by listed companies in Nigeria on Maximization of Shareholders Wealth, the study employed a panel regression analysis. To perform the panel regression analysis, the augmented dickey fuller fisher-type panel unit root test with drift, without trend and with trend was employed to check for stability in the variables in Tables 1-3.

| Table 1 Pair Wise Correlation Among The Disclosure Performance Indicators And Economic Value Added |

|||

|---|---|---|---|

| Environmental Performance Disclosure | Governance Disclosure | Economic Value Added | |

| Environmental Performance | 1.0000 | ||

| Governance Disclosure | 0.6599**(0.0000) | 1.0000 | |

| Economic Value Added | 0.7294***(0.0000) | 0.4996***(0.0000) | 1.0000 |

Note: *,**,***Implies significance at 10%, 5% and 1% significant levels respectively

| Table 2 Fisher Type Unit Root Tests |

|||

|---|---|---|---|

| Variables | Fisher Adf Statistics (Prob. Values) | ||

| With drift | Without trend | With trend | |

| Environmental Performance | 0.000*** | 1.0000 | 0.9931 |

| Governance Disclosure | 0.000*** | 1.0000 | 1.0000 |

| Economic Value Added | 0.9562 | 0.0086*** | 0.000*** |

Note: *,**,*** Denote that variables are stationary at 10%, 5% and 1% significance level respectively

| Table 3 Impact Of Sustainability Performance Disclosure Indicators On Shareholders Wealth |

||

|---|---|---|

| Variables | All companies | |

| Pooled OLS | Random Effects | |

| Environmental Performance Disclosure | 9.714961 (0.021) ** |

-1.880718 (0.563) |

| Governance Disclosure | 7.829233 (0.002) *** |

5.5683 (0.009) *** |

| Constant | 13.36942 (0.000)*** |

12.98434 (0.000)*** |

| Within R2 | ||

| Between R2 | 0.1488 | |

| Overall R2 | 0.2788 | 0.2494 |

| Prob chi2 | 0.0000 | 0.0000 |

| Hausman | 149.55 (0.2700) |

|

Note: *, **, *** Implies significance at 10%, 5% and 1% significant levels respectively. Probability value in Parenthesis.

Results from these tests presented above suggest that the variables in our models are stationary at levels with drifts for environmental performance disclosure indicator. Meanwhile, the economic value added that was used to proxy shareholder’s wealth is stationary at level with and without trend at 1% level of significance.

After having established stationarity at levels for all variables, the study employed the human specification test and the probability value was 0.27 which suggests that it is not significant at 5% level of significance and so the random effect model be preferred over the fixed effect. Other diagnostics such as probability chi square shows that the overall model is significant. Meanwhile, the within range R square of 72.52% shows a very strong relationship between the independent variables and the dependent variable – economic value added, though the other R square indicators are relatively low and could be attributed to the cross-sectional identities of the panel model. Also, the pooled regression was employed as a robustness check.

Analysis of Hypothesis One

There is no relationship between Environmental Performance Disclosure (EvPD) and Shareholders Wealth Maximization of listed companies in Nigeria.

The results of the random effect model (see Table III) posit that Environmental Performance Disclosure has a negative and insignificant effect shareholder’s wealth maximization given that the probability value of environmental performance disclosure when regressed on Economic Value Added is 0.563 and hence insignificant at 1% significant level because it is not less than 0.01.

Therefore, implying that 1% change in environmental performance decreases economic value added by 1.8807. Though the pooled regression also show that Environmental Performance Disclosure is significant at 5% level which is not the case with the main model we are employing.

Based on the evidence provided in this result, we accept the null hypothesis and conclude that there is no significant relationship between Environmental Performance Disclosure and Shareholders Wealth Maximization of listed companies in Nigeria.

Analysis of Hypothesis Two

There is no relationship between Governance Performance Disclosure and Shareholders Wealth Maximization of listed companies in Nigeria.

The results of the random effect model (see Table III) posit that governance disclosure indicator significantly impacts shareholder’s wealth given that the probability value of governance disclosure when regressed on economic value added is 0.009 and hence significant at 1% significant level because it is less than 0.01. Therefore, a unit increase in governance disclosure increases economic value added by 5.563. The result of the random effect is very much similar to that of the pooled regression that also shows that governance disclosure is significant at 1% significant level.

Based on the evidence provided in this result, we reject the null hypothesis and accept the alternative hypothesis and conclude that there is a significant relationship between Governance Disclosure and Shareholders Wealth Maximization of listed companies in Nigeria.

Analysis of Hypothesis Three

Disclosure of Sustainability Performance Indicators does not significantly affect Shareholders Wealth Maximization of listed companies in Nigeria across different specialized groups of companies.

Eighteen companies were redistributed into three groups as follows: Breweries (Nigerian Breweries, Guinness, Champion Breweries and International Breweries), Food (Nestle, Mcnichols, Unilever, Cadbury, Dangote flour mills, Dangote sugar, Honeywells, National salt company of Nigeria, Flour mills of Nigeria, Northern Nigeria flour mills, Union Dicon Salt) and Non-food (PZ Cussons, Vita foam and Nigerian enamelware) in Table 4.

| Table 4 Impact Of Sustainability Performance Disclosure Indicators On Shareholders Wealth Across Different Groups Of Companies |

||||||

|---|---|---|---|---|---|---|

| Variable | Breweries | Non-food | Food | |||

| Pooled OLS | Fixed Effects |

Pooled OLS | Random Effects | Pooled OLS | Random Effects | |

| Environmental Performance Disclosure | 1.350582 (0.826) | -9.1792(0.124) | -98.17554 (0.001) *** | -98.17554 (0.000)*** | 2.633941(0.621) | .4106974(0.918) |

| Governance Disclosure | 16.7856 (0.003)*** | 8.480904 (0.039)** | 2.626937 (0.802) | 2.626937 (0.800) | 10.10219 (0.000)*** | 3.015468 (0.035) ** |

| Constant | 7.3244 (0.000)*** |

11.2712 (0.000)*** | -4.98491 (0.060)* |

18.09669(0.000)*** | 12.17558 (0.000)** | 3.15804 (0.000)*** |

| Within R2 | 0.2999 | 0.4123 | 0.0733 | |||

| Between R2 | 0.4447 | 0.9991 | 0.3677 | |||

| Overall R2 | 0.5780 | 0.2866 | 0.7924 | 0.7924 | 0.9367 | 0.2601 |

| Prob chi2 | 0.0000 | 0.0637 | 0.0000 | 0.0000 | 0.0000 | 0.1231 |

| Hausman | 430.72 (0.0000) *** | 0.68 (0.8773) | 6.53 (0.1631) | |||

Note: *,**,*** Implies significance at 10%, 5% and 1% significant levels respectively. Probability value in Parenthesis.

The human specification test was employed to test for the right model to use besides the pooled regression that was employed as a robustness check. The results of the human are as outlined in Table IV and suggest that we employ the fixed effects for the breweries group and the random effects for the other two groups. The R square values are relatively low, but it is expected whenever cross-sectional indicators are involved.

The regression results when the companies are disaggregated into specialized groups are similar to the whole in two of the three groups. The results for the breweries group and the food group show that governance disclosure is a significant determinant of economic value added at 5% significant level given that their probability values are less than 0.05. These results are very similar to that of the pooled regression which equally has only one significant determinant at 5% significant level. The results show that for an increase in governance disclosure by one-unit, economic value-added increases significantly by 8.48 for the breweries group and 3.015 for the food group of companies.

On the other hand, the results for the non-food group differs from the other in that the regression results suggests that it is the environmental performance disclosure that has a significant and negative relationship with the economic value added that represents shareholder’s wealth. In fact, a unit increase in the environmental performance disclosure reduces the economic value added for non-food companies by 98.18. Again, the pooled regression results agree with that of the random effect regression.

Discussion of Findings

The study investigates the impact of Disclosure of Sustainability Performance Indicators by listed companies in Nigeria on Shareholders Wealth Maximization. Environmental Performance Disclosure and Governance Disclosure were used as proxies for Sustainability Performance Indicators; while Economic Value Added is used as proxy for Shareholders Wealth. From the test of hypotheses of this study, the following are the findings:

Environmental performance disclosure has a negative (-1.8807) but insignificant (0.563) effect on shareholder’s wealth maximization (-1.8807). This means that increase in environmental disclosure brings about a decrease in economic value added, while decrease in environmental disclosure brings about an increase in economic value added. This implies that disclosure of environmental performance of organizations does not have a significant effect on the maximization of shareholder’s wealth. This result could be as result of concentration on one sector of the economy.

This result contradicts the findings of Ahmad, Simom & Mohammad (2017) which revealed that environmental disclosure has a positive significant impact on firm performance of cement and brewery companies.

Governance performance disclosure has a positive and significant effect on shareholder’s wealth maximization. That is, a unit increase in governance disclosure significantly increases economic value added by 5.563. This implies that increase in governance performance disclosure would bring about an increase in economic value added, while decrease in governance performance disclosure would bring about a decrease in economic value added. Therefore, disclosure of information on governance activities of organizations enhances the maximization of shareholder’s wealth.

Empirical evidence does not portray several works using governance disclosure as one of the performance indicators except for Adebimpe, Ekubiat & Bokime (2015) who revealed in his study that governance information was the most disclosed of the selected indicators employed.

The results for the breweries group and the food group show that governance disclosure is a significant determinant of economic value added. That is a unit increase in governance disclosure increases economic value-added significantly for the breweries group and the food group of companies; while the environmental performance disclosure has a significant and negative relationship with the economic value added.

Conclusion

Sustainability reporting is currently a significant issue in our society today, investors and other stakeholders demand information that will enable them to make effective investment and other decisions. Increasing number of shareholders require greater insights into how companies manage risks and opportunities related to environmental, economic and social performance. Motivated by the relevance of sustainable reporting and how it affects shareholder’s wealth maximization of companies in Nigeria, the study employed data for 18 companies from 2010 and 2018 to ascertain the extent of disclosure of sustainability performance indicators and their effect on shareholder’s wealth maximization of listed companies in Nigeria. The study employed descriptive statistics and panel data estimation regression models to analyze the data. The results revealed that there is no significant relationship between environmental performance disclosure and shareholder’s wealth maximization; while governance performance disclosure has a positive and significant effect on shareholder’s wealth maximization. The results further show that when all companies are taken into consideration as well as when it is only food and brewery companies, governance disclosure is the only significant determinant of economic value added while the environmental performance disclosure alone significantly impact on economic value added for non-food sampled companies.

The study therefore recommends that Sustainability reporting framework in line with global best practices be sustained in the Nigerian private sector and that more emphasis could be made on the three components of the triple bottom line model – environmental, economic, and social so that it can equally be significant in wealth maximization of shareholders. Regulatory authorities such as the Securities and Exchange Commission (SEC) should enact measures to ensure that companies disclose information regarding their activities as it affects the triple bottom line. It is not enough for the Nigerian Stock Exchange to establish guidelines on sustainability reporting; procedures should also be put in place to make certain that companies in Nigeria comply with the established guidelines. Some of these companies may however lack full understanding of the application of the guidelines in disclosing their sustainability performance, therefore company’s representatives should be trained so as to have better grasp on the sustainability disclosure guidelines and their application; this would enhance the disclosures made by companies. In addition, disclosures on sustainability performance should be made mandatory for all companies listed on the floor of the Nigerian Stock Exchange as this would ensure that firms report relevant sustainability information to the shareholders.

Future research could examine sustainability reporting and shareholders’ value in other sectors of the economy.

Appendix A

Sampled Consumer Goods Manufacturing Companies Listed in the Nigerian Stock Exchange:

1. Cadbury Nigeria Plc

2. Champion Breweries Plc

3. Dangote Flour Mills Plc

4. Dangote Sugar RefineryPlc

5. Flour Mills Nigeria Plc

6. Guiness Nigeria Plc

7. Honeywell Flour Mill Plc

8. International Breweries Plc

9. McNichols Plc

10. Nascon Allied Industries Plc

11. Nestle Nigeria Plc

12. Nigerian Breweries Plc

13. Nigerian Enamelware Plc

14. Northern Nigeria Flour Mills Plc

15. PZ Cussons Nigeria Plc

16. Unilever Nigeria Plc

17. Union Dicon Salt Plc

18. Vitafoam Nigeria Plc

References

Ahmad, A.A., Simon, M., & Mohammad, B.I. (2017). Impact of environmental disclosure on performance of cement and brewery companies in Nigeria. Civil and Environmental Research, 9(10), 40-46.

Indexed at, Google Scholar, Cross Ref

Andrew, B. (2017). The Three pillars of Corporate Sustainability.

Asaolu, T.O., Agboola, A.A., Ayoola, T.J., & Salawu, M.K. (2011). Sustainability Reporting in the Nigerian Oil and Gas Sector. Proceedings of the Environmental Management Conference, Federal University of Agriculture, Abeokuta, Nigeria.

Asuquo, A.I., Dada, E.T., & Onyeogaziri, U.R. (2018). The effect of sustainability reporting on corporate performance of selected quoted brewery firms in Nigeria. International Journal of Business & Law Research, 6(3), 1-10.

Atu, O.E.O.K. (2013). Triple bottom line accounting: A conceptual expose. IOSR Journal of Business and Management, 13(4), 30-36.

Indexed at, Google Scholar, Cross Ref

Deegan, C. (2000). Financial Accounting Theory. McGraw Hill Book Company, Sydney.

Indexed at, Google Scholar, Cross Ref

Ezeoha, B.A., & Omkar, D. (2017). Sustainability Practices as Determinants of Financial Performance: A Case of Malaysian Corporations. Journal of Asian Finance, Economics and Business, 4(2), 55-68.

Indexed at, Google Scholar, Cross Ref

Global Reporting Initiative – GRI. (2013). G3.1 and G3 Sustainability Reporting Guidelines.

InCorp. (2019). Why Sustainability Reporting is Important for Businesses in Singapore.

Innocent, O., & Kenneth. A. (2017). Sustainability Reporting and the Professional Accountant in Nigeria.

Jacob, A. (2015). The Importance of Sustainability Reporting.

James, G.C., Suresh, & Leanne, W. (2006). Legitimacy Theory: A Story of Reporting Social and Environmental Matters within the Australian Food and Beverage Industry.

Madan, L.B., (2013). Economic Value Added and Shareholders’ Wealth Creation: Evidence from Developing Country. International Journal of Finance and Accounting 2(4), 185-198.

Ndukwe, O.D., & Nwakanma, G.N. (2018). Sustainable Development Practices and Corporate Financial Performance: A Survey of Selected Quoted Companies in Nigeria. Asian Journal of Economics, Business and Accounting, 7(1), 1-13.

Nigerian Stock Exchange (NSE). (2018). Sustainability Disclosure Guidelines.

Nnamani, J.N., Onyekwelu, U.L., & Ugwu, O.K. (2017). Effect of sustainability accounting and reporting on financial performance of firms in Nigeria brewery sector. European Journal of Business and Innovation Research, 5(1), 1-15.

Olayinka, A.O., & Oluwamuyowa, I.O. (2014). Corporate Environmental Disclosure. The Management Review, 5(3), 171-184.

Perways, A., & Mohammed, M. (2012). Performance Measures of Shareholders Wealth: An Application of Economic Value Added. International Journal of Applied Financial Management Perspectives, 1, 2.

Safari. (2019). The Corporate Governance Dimension of Sustainability.

Indexed at, Google Scholar, Cross Ref

Safari. (2019). What is Sustainability Reporting?

Saminda, N.H. (2014). Sustainability Reporting in Stakeholder Value Creation: A Framework. Reshaping Management and Economic Thinking through Integrating Eco-Friendly and Ethical Practices. Proceedings of the 3rd International Conference on Management and Economics, Faculty of Management and Finance, University of Ruhuna, Sri Lanka.

The Nigerian Stock Exchange (NSE). (2018). Sustainability Disclosure Guidelines.

Villiers, D.C., & Staden, V.C. (2012). New Zealand Shareholder Attitudes towards Corporate Environmental Disclosure. Pacific Accounting Review, 24(2), 186-210.

Indexed at, Google Scholar, Cross Ref

Received: 09-Sep-2021, Manuscript No. AAFSJ-21-7911; Editor assigned: 13-Sep-2021, PreQC No. AAFSJ-21-7911(PQ); Reviewed: 27-Sep-2021, QC No. AAFSJ-21-7911; Revised: 05-Aug-2022, Manuscript No. AAFSJ-21-7911(R); Published: 12-Aug-2022