Research Article: 2021 Vol: 25 Issue: 6

Do Brand Named Auditors Mitigate Cash Flow Management Post-Sox?

Kyeongmin Jeon, Sungkyunkwan University

Citation Information: Jeon, K. (2021). Do Brand Named Auditors Mitigate Cash Flow Management Post-Sox?. Academy of Accounting and Financial Studies Journal, 25(6), 1-13.

Abstract

This paper examines the relation between named auditors and cash flow management. However, I didn’t find a significant effect of audit firm on cash flow management. It means that brand named auditors, both Big 4 and the second tier public audit firms do not help mitigate cash flow management post-SOX. This is not surprising as auditors alone cannot curb managerial opportunism because other participants such as regulators (i.e., SEC and FASB) have not exerted a concerted effort to provide transparent accounting rules for the SCF model.

Keywords

Auditor, Big4, Cash Flow Management, Post-SOX.

Introduction

Recently the SEC has voiced their concern on the rising cases of restatements due to errors in the statement of cash flows (SCF). In 2009, restatements attributed to errors only amounted to 65 (8.7% of total) but a steady increase during the past five years has led this number to total 174 in 2013 (more than 20% of all restatements). A study commissioned by the Center for Audit Quality listed cash flow statement classification errors as the second most common restatement item after debt-related accounting restatements during 2003 to 2012. The growing rate of cash flow restatements is in stark contrast with the flat rate of zero prior to 2002. The importance of cash flow information has gained currency in accounting literature as well. Wasely & Wu (2006) find that investors and analysts pay more attention to cash flow information due to the heightened concern of potential earnings manipulation after major accounting scandals in the early 2000s. They show that analysts’ forecasts of cash flow during 2000-2003 more than doubled compared to its pre-2000 levels. Call, Chen & Tong (2009) suggest that analysts who publish cash flow forecasts in addition to earnings forecasts aid investors to better understand current period accruals and cash flows for future earnings. As analysts increase their cash flow forecasts, the accruals anomaly appears to decline subsequent to 2002 (Mohanram, 2014; Radhakrishnan & Wu, 2014).

Anecdotal evidence also suggests that analysts and investors are noticing that accounting manipulation is spreading beyond earnings into ‘legal’ massaging of cash flow information with cash flow from operations being the prime target. While earnings are subject to estimation error, this trend in cash flow runs contrary to the common belief that cash flow is immune to managerial manipulation. Firms try to find quick ways to increase cash flow by reducing working capital via selling off inventory, pressuring customers to pay quickly and stalling payments to suppliers to inflate cash. Even some stocks are well received from the market when firms report higher levels of “free cash flow”. In fact, Lee (2012) documents that managers engage in cash flow management when the incentives to do so are strong. She concludes that managers are likely to inflate reported CFO when firms are in (1) financial distress, (2) a long-term credit rating near the investment/noninvestment grade cutoff, (3) the existence of analyst cash flow forecasts, and have a (4) higher association between stock returns and CFO. In response to the growing concern of the SEC regarding increased cases of cash flow restatements, I explore a potentially important research topic - whether brand named auditors help mitigate managerial discretion on cash flow management after the enactment of the Sarbanes-Oxley Act (hereafter “SOX”) following an increased demand for cash flow information by market participants. Despite the growing attention to cash flow information and the increasing role of public accountants, scant research exists that examines the quality of reported cash flow information and whether auditors, who serve at the forefront of financial quality, help mitigate managerial discretion in cash flow management.

SOX implemented dramatic changes to the audit landscape. In particular, SOX transformed the audit profession from a self-regulated industry to one that is now directly overseen by the Public Company Accounting Oversight Board (PCAOB), a quasi-governmental agency that conducts periodic inspections of registered auditors to maintain audit quality and professionalism in its practice (DeFond & Francis, 2005). In addition, the Board has the authority to impose a range of sanctions on auditors including a censure, monetary penalties, and in extreme cases, revocation of a firm’s registration and baring an individual’s association with registered accounting firms (PCOAB). Therefore, SOX has reinstated the role of public accounting as gatekeepers of financial reporting.

Big 4 auditors are known to provide high quality audits. DeAngelo (1981) maintains that audit quality is not independent of firm size and that big audit firms with a large client base has more to lose should they find a breach in their client’s books. This collateral motivates brand named auditors to supply higher quality audits. Brand-named auditors are usually industry specialists who possess the expertise to detect errors that contribute to higher quality audits than nonspecialists (Krishnan, 2003). Comparing Big 6 who are specialists to nonBig 6 auditors, Balsam et al. (2003) also find that clients that hire Big 6 auditors have lower discretionary accruals and higher ERC. Francis & Yu (2009) find that office size of Big 4 bring greater in-house experience in administering audits. Larger offices are more likely to issue going-concern opinions and curb aggressive earnings management behavior thus suggesting that larger offices contribute to higher quality audits. On the other hand, differences in proxies for audit quality can be due to client characteristics which may cause no difference in audit quality between Big 4 and non-Big 4 auditors (Lawrence et al., 2011).

The professional literature also finds that brand named auditors are associated with low quality audits and with AAERs prior to 2002, approximating the demise of Enron and Arthur Anderson. Several studies that model restatements control for Big N auditors but find weak evidence between fewer restatements and Big N auditors (DeFond & Jiambalvo, 1991; DeFond et al., 2012). Zang (2012) finds evidence that Big N auditors are able to constrain AEM but not REM.

The FASB required firms to include the SCF as a part of the full set of financial statements for all firms in 1987 (SFAS No.95). In addition, the FASB requires the indirect method and encourages the direct method. The direct method shows inflows and outflows of cash flow activity which is preferred by investors. The direct method offers some advantages over the indirect method by enabling the reader to compare cash flow categories over time within the same firm and with other firms. However, firms favor using the indirect method that reconciles net income to operating cash flow simply because the FASB requires the indirect method and providing both are too costly. Complicated adjustments made to the indirect method may hinder the user from understanding the SCF which gives managers more discretion to misclassify cash flow to meet managerial ends (Broome, 2004). Since then, FASB has made little progress to revise the SCF model and to provide clear guidance on the interpretation and classification of cash flow activity. In 2006, the SEC offered a one-time opportunity for firms that had misclassification errors in their SCF to correct them without officially restating their SCF. Recently, FASB had announced a new standard to mandate the disclosure of cash flows related to discontinued operation that went into effect in 2014. Considering all prior facts, it is an empirical question of whether brand named public accountants can mitigate cash flow management under the aforementioned conditions.

The heightened regulatory environment ensuing SOX may have made it more difficult for managers to manipulate earnings. However, firms still face great pressure to better present their performance in the presence of investors. Therefore, managers may seek other ways to paint a positive picture of the firm. In fact, Lee (2012) provides evidence that managers inflate reported CFO by classification shifting and timing certain items among the statement of cash flow (i.e., operation, investing and financing activities). Classification shifting means that firms use discretion to shift certain items across the category of operating, investing and financing activities in the statement of cash flows holding earnings and aggregate cash flow constant. Timing of working capital means that companies adjust working capital to inflate reported CFO holding earnings and aggregate cash flow constant. She finds that firms are more likely to classify tax benefits in the operating section when incentives to manage CFO are stronger. Lee (2012) identifies that managers are likely to inflate reported CFO when firms are in (1) financial distress, (2) a long-term credit rating near the investment/noninvestment grade cutoff, (3) the existence of analyst cash flow forecasts, and have a (4) higher association between stock returns and CFO. Cohen et al. (2008) document a gradual increase in accruals-based earnings management (AEM) which accelerates in the period of corporate scandals right before SOX with a significant decrease thereafter. Conversely, real earnings management (REM) decreases before SOX but increases after SOX despite the fact that these are costlier spending decisions than AEM to the firm.

Against this backdrop, I conjecture that managers still face immense pressure from market participants to better present firm performance and have the incentives to find other ways to wield their discretion in managing reported CFO after SOX relative to the period preceding it. At the same time, external auditors face increased regulatory monitoring from the government and from the market to ensure that financial reporting practices accurately reflect the underlying economic reality of the firm. Therefore, it is important to explore how these competing forces among management, external auditors and regulation play out in the market. Hence, I examine two important research topics related to the ongoing impact of SOX on CFO management and on the role of brand-named auditors in curbing managerial discretion on cash flow management, if any. I contribute to the literature in the following ways. First, this study re-evaluates the long-term effects of regulatory reform in financial reporting. SOX enforced stricter reporting rules that appeared to have improved the quality of financial statements. However, it may also have unintended consequences that may affect accounting numbers in a different way. Second, this study corroborates the concerns of the SEC on the growing number of cash flow restatements. If management lacks the incentive to correctly classify cash flow information, then the auditors who have specific accounting knowledge should be the ones that aid managers’ reporting decisions to ensure fair representation of financial statements.

However, external auditors alone may not be able to curb management’s tendency to manage reported cash flow information. One possible reason is that the Financial Accounting Standard Board (FASB) has provided limited guidance in accounting standards so far on how to correctly classify cash flow across operating, investing and financing activities. In February 2006, the SEC offered a one-time opportunity to firms that had incorrect misclassification of cash flow on the SCF to amend them without issuing an official restatement. In 2014, FASB issued a new standard on the disclosure of cash flows arising from discontinued operations. Companies that have business components that meet this standard are required to disclose operating and investing cash flows of discontinued operations. Other than this revision, FASB has not issued other SCF classification guidance which leaves cash flow classification open to managerial judgment. Therefore, this study has implications for regulators and standard setters in providing transparent accounting guidelines as financial reporting quality hinges on such effort. Fourth, this study adds to the scant literature that documents the effect of cash flow misclassification.

Literature Review and Hypotheses Development

The steady increase in cash flow restatements in recent years represents an awakening importance of cash flow presentation to market participants. Unlike earnings which involve managerial assumptions that give rise to estimation errors, cash flow is considered to be immune from such abuse. However, anecdotal evidence suggests otherwise. In the early 2000s, a number of high profile accounting failures at public companies revealed abuses in SCF to achieve managerial ends. Tyco International’s alarm business recorded purchases of customer contracts from dealers that amounted to more than $800 million as outflow in investing activities while customer payments to Tyco under these same contracts were recorded in the operating activities section in the SCF. These transactions resulted in inflated cash flow in operations. Further, Tyco had been redirecting investors’ and analysts’ attention to focus on its strong free cash flow rather than on its EPS (Maremont, 2002). Adelphia engaged in aggressive capitalization of labor expenses that approximated $40 million in both 2000 and 2001 which helped boost reported operating cash flow.

In addition to anecdotal evidence, there are some papers that suggest that managers have the proclivity to manage reported CFO. DeFond & Hung (2003) find that markets respond positively to cash flow surprises. McVay (2006) documents that managers move core expenses vertically to special items to opportunistically overstate core earnings (i.e., COGS and SG&A). Relatedly, Fan et al. (2010) concludes that classification shifting is more likely in the fourth quarter than in interim quarters, more prominent when managers are constrained to manipulate accruals and when managers need to meet a range of earnings benchmarks. Call (2008) states that investors put more weight on CFO when analysts provide cash flow forecasts in their stock price evaluation. Hollie et al. (2011) also illustrate that firms generally overstate net cash flows from operations and understate net cash flows from investing activities thereby misrepresenting overall cash flows.

The 2008 financial crisis also magnified the demand for cash flow information. Cash flow from operations provide informational content beyond earnings to predict a firm’s future condition when the economy experiences a significant downturn. Cash flow information is useful to evaluate firms facing financial distress and credit and bankruptcy risks (Beaver, 1966; Ohlson, 1980; DeFond & Hung, 2003; Graham et al., 2005; Lee, 2012), and important to assess the credit ratings of firms by rating agencies (Standard & Poor, 2008). Campello et al. (2010) also find that during the financial crisis period between 2007 and 2009, companies were constrained in liquidity and in credit lines, forcing firms to substitute external financing with internal financing for investment projects. These prodded investors to demand more information about cash flow to see whether firms could fund these investment opportunities internally. Kim et al. (2016) document that socially responsible firms also engage in management of cash flows from operations.

In sum, due to the heightened scrutiny from regulators and investors subsequent to SOX which could have constrained firms to manage earnings, coupled with the current economic downturn, market participants are focusing their attention to CFO subsequent to SOX. Therefore, I predict that firms will find other ways to polish firm performance by increasing their discretion on managing reported CFO. This leads to the first hypothesis:

H1: Managers are more prone to increase their discretion on managing reported cash flow from operations post-SOX.

External auditors provide reasonable assurance that the balance sheet, income statement and SCF are in accordance with GAAP. In today’s environment where business transactions and accounting standards are complex, auditing has the potential to add value (DeFond & Zhang, 2014). SOX ended the self-regulated audit industry which is now externally regulated by the PCOAB to directly oversee the practice of the public audit profession. Registered audit firms with over 100 clients are periodically inspected by the PCOAB to ensure that auditors practice sound judgment in their audits. In case of malpractice, the Board can impose disciplinary action by means of a censure, monetary fines, and in serious cases, delist the accounting firm from conducting public audits. Audit standards require public accounting firms to exercise profession skepticism during their audits post-SOX. Driven by litigation concerns, audit firms have become more discerning in their client retention policies as well. Bugariski & Ward (2012) reports an increased number of withdrawals and dismissals of auditors post-SOX. Therefore, the aforementioned changes in the audit industry should at minimum affect the behavior of public audit firms to maintain independence and efficacies in administering audits.

DeAngelo (1981) maintains that large audit firms provide higher quality audits to maintain their reputation and to earn quasi-rents in fear of losing clients. Brand-named auditors are usually industry specialists who possess the expertise to detect errors that contribute to higher quality audits than nonspecialists (Krishnan, 2003). Compared to interim audits, annual reports are independent audits that are subject to more rigid rules. Therefore, external auditors are more likely to limit opportunistic behavior in the fourth quarter (Brown & Pinello, 2007). Because the client base of brand named auditors are relatively large, these public accountants are subject to greater litigation risk and pressure to succumb to client demands.

Alternatively, prior literature finds that brand named auditors are associated with AAERs prior to 2002 and were excoriate for providing low quality audits after the Enron/Arthur Anderson debacle. Several studies that model restatements control for Big N auditors but find weak evidence between fewer restatements and Big N auditors (DeFond & Jiambalvo, 1991; DeFond et al., 2012). Zang (2012) finds evidence that Big N auditors are able to constrain AEM but not REM.

Public accountants are not the only ones to blame. Since FASB issued SFAS No.95, Statement of Cash Flows, in 1987 the Board has not made any significant revisions to cash flow reporting models except for the new standard that mandates the disclosure of cash flows arising from discontinued operations in 2014. Prior to this new standard, the SEC allowed firms a one-time opportunity to correct misclassified items on the statement of cash flow without issuing an official restatement. Other than this revision, FASB has not issued other guidance on the SCF which gives rise to misinterpretation and misclassification open to managerial judgment. SFAS No.95 encourages the use of the direct method but a vast majority of firms use the indirect method. Investors and analyst prefer the direct method which shows major cash inflows and outflows. Broome (2014) states that a major advantage of using the direct method is that investors can compare cash flow categories over time and compare these numbers with other competitors. However, corporations use the indirect method that reconciles net income to operating cash flow primarily because FASB requires the indirect method and firms state that providing both schedules are too costly. The complicated adjustments using the indirect method obfuscates readers from observing changes in the balance sheet accounts from the previous year to the current one, leaving readers to understand only the magnitude of the difference of net income and operating cash flow. This gives more leeway to managers to manipulate the SCF.

On balance, it is an empirical question of whether brand named auditors can mitigate cash flow management after SOX due to the aforementioned intricacies. Therefore, I state my hypothesis in the null form which leads to my second hypothesis:

H2: Brand named auditors do not help mitigate CFO management post-SOX.

Methodology

Sample Selection

Table 1 describes the sample selection. I use Compustat and CRSP to collect financial and auditor data available for all firms from the period 1992 to 2013. I exclude all non-financial firms that are regulated and use Fama and French 48 Industrial Classification to calculate change in the conversion cycle (?CC). For each industry, I require at least 15 observations. Then I eliminate all observations without sufficient information to compute either control variables or to compute the change in CC. The final sample consist of 18,795 firm year observations from 1992-2013 due to only including sample data that uses managerial ownership. I define the post-SOX period from fiscal years 2002 to 2013. All variables are winsorized at the extreme 1 percent.

| Table 1 Sample Selection | |

| Sample selection criteria | Firm-years |

| Total number of firm-years between 1992 and 2013 that have distribution code on Compustat | 131,574 |

| (-) Firms without control variables ROA, MKTCAP, MB | 17,577 |

| (-) Firms with missing data to compute ALTMAN Z-SCORE | 3,337 |

| (-) Firms with missing data to compute CFO-WEIGHT based on a 5 year rolling regression return in CRSP on Earnings and Cash Flows | 32.989 |

| (-) Firms with missing quarterly data to compute ?CC | 32,444 |

| TOTAL FULL SAMPLE | 45,227 |

| (-) Firms with missing information for managerial ownership | 26,434 |

| FINAL SAMPLE | 18,793 |

Research Model

I adopt methodologies and proxies from prior research. In particular, I follow Lee (2012) to estimate unexpected levels of CFO management and the change in industry-adjusted cash conversion cycle that measures the days a firm collects cash in the fourth quarter of the fiscal year end and delays cash payments in the first quarter of the next year to alter reported CFO.

I rerun the same analyses including the second-tier public auditors such as BDO, Crowe Horwath (CH), McGladrey (McG) and Grant Thornton (GT) with Big 4 auditors (as BIG8) as audit quality between the Big 4 and nonBig 4 could be due to client characteristics and the perception that Big 4 provides higher quality audits (Lawrence et al. 2011; Boone et al. 2010). In addition, PCOAB includes BDO and CH in their annual inspection list and the second tier public auditors generally include McG and GT as market share of these auditors are growing rapidly. Next, I discuss the research design for calculating the dependent and independent variables.

Unexpected Cash Flow from Operations

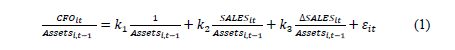

First, I estimate unexpected CFO that is the dependent variable. I follow Dechow et al. (1998)’s model to estimate the following cross-sectional regression for each industry and year:

Where, for fiscal year t and firm i:

CFO_it = CFO is the operating cash flows (from continuing operations) taken from the statement of cash flows (annual Compustat data item “oancf” - annual Compustat data item “xidoc”); Assets_(i,t-1) = total assets (annual Compustat data item “at”); SALES_it = total sales (annual Compustat data item “sale”); ΔSALES_it = change in sales (annual Compustat data item “sale”) from the preceding year;

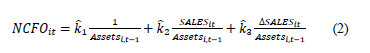

To obtain the unexpected cash flow from operations (UCFO) I deduct the actual CFO from the normal level of CFO using the estimated parameters in equation (1) in equation (2) as following:

Cash Conversion Cycle

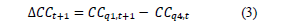

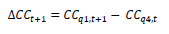

The cash conversion cycle measures how long it takes the firm to accelerate cash collection from customers after the firm pays cash for its inventory, and stalls payments to suppliers. For calculating the cash conversion cycle, I follow Lee (2012)’s model:

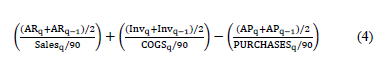

Where, Cqi,t represents the cash conversion cycle in quarter i of year t. CC is calculate as follows:

Where AR is accounts receivable, Inv is inventory, AP is accounts payable, COGS is cost of goods sold, and PURCHASES= Inv_q+COGS_q- Inv_(q-1). In order to control for industry-specific factors that affect quarterly changes in the cash conversion cycle, I adjust ΔCC to reflect deviations from the industry means in a given year. In every quarter, I compute the industry mean ΔCC using all firms available in the Compustat quarterly database. For each firm-quarter, I subtract the industry mean ΔCC for that year from the firm’s ΔCC. The industry classification follows Fama and French (1997).

Research Model

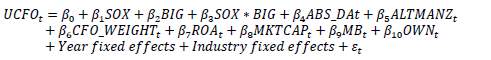

To test the first and second hypotheses of CFO management post-SOX, I first use the following model to examine relations with UCFOt

UCFOt = defined as actual CFO minus the normal level of CFO

SOX= a dummy variable that is equal to 1 for the years 2002 onward, and 0 otherwise (represents the post SOX period);

ABS_DAt= defines as absolute value of Discretionary Accruals;

ALTMANZt = output of a credit strength test that gauges a publicly traded manufacturing company's likelihood of bankruptcy, that is computed as (1.2*(act lct)/at + 1.4*re/at + 3.3*(ebit)/at+0.6*csho*prcc_f/lt + 0.999*sale/at);

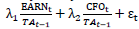

CFO_WEIGHTt = weight on CFO given by λ2 from the regression estimated for every firm year over a rolling five year period: where RETURNt= λ0 +  CRSP buy and hold stock return (including dividends) minus the CRSP value weighted market index (including dividends) over the fiscal year,

CRSP buy and hold stock return (including dividends) minus the CRSP value weighted market index (including dividends) over the fiscal year,  = earnings scaled by the beginning of period total assets, and

= earnings scaled by the beginning of period total assets, and  = cash flow from operations scaled by the beginning of period total assets.

= cash flow from operations scaled by the beginning of period total assets.

ROAt= return on assets;

MKTVALt= market value of equity (“prcc_f * csho”);

MBt = market to book ratio;

BIGt = a dummy variable equal to 1 if the auditor is a Big 5 audit firm (or their successors)

OWNt = defined as managerial ownership in firm;

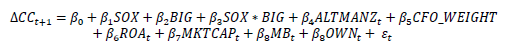

I expect to find a positive sign on β1 that indicates that the magnitude of unexpected cash flow has increased after SOX, as a possible sign that managers have the incentive to manage CFO. I do not make a prediction for BIG as I stated my hypothesis in the null form. Another model I use to examine cash flow management is as follows (Lee 2012);

Where, ΔCCt+1 qi,t represents the change in the cash conversion cycle in quarter i of year t.

Firms will try to shorten the cash conversion cycle in the 4th quarter but this will likely reverse in the first quarter of the next fiscal period. Next, I review the empirical results of the models.

Data Analysis and Results

Descriptive Statistics and Univariate Analysis

Table 2 presents the descriptive statistics for variables that are used in the analysis. As shown in Table 2, the size of the sample varies across the variables. I limit my analysis using ownership data as managerial incentives play an important factor in managing cash flow. SOX is a dichotomous variable set to 1 for years after 2002 and onward which represents the post-SOX period, and 0 otherwise. A mean (median) of 55.4 percent (100 percent) of firms are defined after SOX. BIG represents firms that hire Big 4 auditors which comprise a mean (median) of about 82.1 percent (100 percent) of the sample. The dependent variables are changes in cash conversion cycles (?CC) and unexpected cash flow from operations (UCFO) which are explained later in main research model. The control variables are the absolute value of discretionary accruals (ABS_DA), the probability of bankruptcy (AltmanZ), the incremental measure that investors put on CFO (CFO_WEIGHT), return on assets (ROA), firm size (MKTCAP), market-to-book ratio (MB) that represents growth prospects and managerial ownership percentage (OWN).

| Table 2 Descriptive Statistics | |||||

| Variables | Mean | Std. Dev. | Median | 1Q | 3Q |

| ?CC | 12.733 | 117.743 | 3.857 | -25.030 | 51.310 |

| UCFO | 0.026 | 0.170 | 0.041 | -0.030 | 0.110 |

| SOX | 0.554 | 0.497 | 1.000 | 0.000 | 1.000 |

| BIG | 0.821 | 0.383 | 1.000 | 1.000 | 1.000 |

| ABS_DA | 0.093 | 0.107 | 0.059 | 0.030 | 0.120 |

| ALTMANZ | -4.252 | 5.995 | -3.364 | -5.500 | -1.990 |

| CFO_WEIGHT | 1.021 | 7.421 | 0.669 | -2.040 | 3.830 |

| ROA | 0.858 | 11.828 | 0.817 | -2.100 | 4.100 |

| MKTCAP | 2,467 | 6,831 | 252.509 | 49.630 | 1,257 |

| MB | 2.729 | 5.088 | 1.929 | 1.140 | 3.310 |

| OWN | 4.063 | 7.431 | 1.122 | 0.400 | 3.610 |

Table 3 presents both Pearson and Spearman correlations among variables. UCFO is positively correlated with SOX, BIG, CFO_WEIGHT, MKTCAP and MB and is negatively correlated with ABS_DA, AltmanZ, ROA and OWN under the Spearman correlation. However, the signs of SOX, ROA and OWN with UCFO are opposite under the Pearson correlation.

| Table 3 Correlations Matrix | |||||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

| (1)?CC | 1.000 | -0.008 | 0.014 | -0.008 | -0.017 | 0.020 | 0.001 | 0.006 | 0.006 | -0.006 | -0.009 |

| (2)UCFO | 0.000 | 1.000 | -0.001 | 0.099 | -0.166 | -0.325- | 0.027 | 0.003 | 0.164 | 0.040 | 0.036 |

| (3)SOX | 0.020 | 0.019 | 1.000 | -0.132 | -0.016 | 0.067 | 0.017 | -0.061 | 0.125 | 0.003 | -0.084 |

| (4)BIG | -0.007 | 0.092 | -0.132 | 1.000 | -0.141 | -0.057 | 0.006 | -0.024 | 0.150 | 0.036 | -0.107 |

| (5)ABS_DA | 0.008 | -0.082 | -0.016 | -0.124 | 1.000 | 0.101 | -0.024 | 0.007 | -0.093 | 0.023 | 0.013 |

| (6)ALTMANZ | 0.043 | -0.365 | 0.048 | -0.058 | 0.080 | 1.000 | -0.006 | 0.001 | -0.072 | -0.217 | -0.128 |

| (7)CFO_WEIGHT | 0.002 | 0.034 | 0.014 | 0.013 | -0.019 | -0.034 | 1.000 | -0.395 | -0.003 | 0.001 | 0.035 |

| (8)ROA | 0.007 | -0.012 | -0.090 | -0.032 | 0.016 | 0.019 | -0.422 | 1.000 | -0.041 | -0.027 | 0.012 |

| (9)MKTCAP | -0.001 | 0.321 | 0.247 | 0.376 | -0.214 | -0.260 | 0.019 | -0.121 | 1.000 | 0.124 | -0.154 |

| (10)MB | -0.018 | 0.238 | 0.042 | 0.106 | 0.001 | -0.378 | -0.006 | -0.073 | 0.448 | 1.000 | -0.005 |

| (11)OWN | -0.014 | -0.007 | -0.023 | -0.122 | 0.038 | -0.122 | 0.038 | 0.043 | -0.390 | -0.089 | 1.000 |

Empirical Results

Table 4 presents the results for both hypotheses focusing on Big 4 auditors. H1 states that managers are more prone to increase their discretion on managing reported cash flow from operations post-SOX. H2 states that brand named auditors do not help mitigate CFO management post-SOX. Contrary to my prediction, the results of the association with UCFO and with SOX are negative and insignificant. In addition, the association with BIG4 and with the interaction term of SOX*BIG4 is positive and insignificant. In addition, the results of the association between ?CC and SOX are positive and insignificant. The association between ?CC and BIG4 is positive but insignificant. The association with ?CC and the interaction term of SOX*BIG4 is negative and insignificant as well. In sum, I do not find evidence to support my hypotheses that managers have the proclivity to manage UCFO and to manage ?CC post-SOX.

Table 4 Unexpected CFO(UCFO) and Change in the Cash Conversion(CC) Post-SOX(BIG4) |

||||

| UCFO Estimate P-value |

?CC Estimate P-value |

|||

| Intercept | 0.008 | 0.679 | 5.385 | 0.649 |

| SOX | -0.011 | 0.636 | 14.633 | 0.235 |

| BIG4 | 0.002 | 0.936 | 13.206 | 0.264 |

| SOX*BIG4 | 0.017 | 0.454 | -15.699 | 0.207 |

| ABS_DA | 0.002 | 0.940 | -23.262 | 0.053 |

| ALTMANZ | -0.008 | <0.001 | 0.723 | <0.001 |

| CFO WEIGHT | 0.000 | 0.843 | -0.069 | 0.519 |

| ROA | 0.000 | 0.021 | 0.018 | 0.742 |

| MKTCAP | 0.000 | <0.001 | 0.000 | 0.539 |

| MB | 0.002 | <0.001 | -0.389 | 0.091 |

| OWN | 0.000 | 0.352 | -0.042 | 0.734 |

| Year | Yes | Yes | ||

| Industries | Yes | Yes | ||

| Adj. R-square | 0.179 | 0.002 | ||

| Obs. | 18,795 | 18,795 | ||

Table 5 presents the results for both hypotheses including the second tier public accounting firms and Big 4 auditors (as BIG8) in the analyses. The results of the association with UCFO and SOX are negative and significant. The association with UCFO and BIG8 and with the interaction term SOX*BIG8 both show a positive and significant association. It appears that the Big 8 auditors are not able to mitigate cash flow management post-SOX. However, reviewing the relation between ?CC and SOX, the relation between ?CC and BIG8 and the interaction term of SOX*BIG8 are not significant. In sum, I show some evidence that brand audit firms may not be able to deter cash flow management post-SOX.

| Table 5 Unexpected CFO(UCFO) and Change in the Cash Conversion(CC) Post-SOX(BIG4) | ||||

| UCFO Estimate P-value |

?CC Estimate P-value |

|||

| Intercept | -0.007 | 0.396 | 17.818 | 0.000 |

| SOX | -0.026 | 0.005 | 3.894 | 0.497 |

| BIG4 | 0.006 | 0.005 | -3.440 | 0.487 |

| SOX*BIG4 | 0.030 | 0.001 | -1.428 | 0.807 |

| ABS_DA | -0.183 | <0.001 | -21.486 | 0.003 |

| ALTMANZ | -0.009 | <0.001 | 0.407 | 0.003 |

| CFO WEIGHT | 0.001 | <0.001 | 0.058 | 0.502 |

| ROA | 0.000 | <0.001 | 0.078 | 0.118 |

| MKTCAP | 0.000 | <0.001 | 0.000 | 0.344 |

| MB | -0.001 | 0.001 | -0.036 | 0.833 |

| OWN | 0.000 | 0.343 | -0.059 | 0.628 |

| Year | Yes | Yes | ||

| Industries | Yes | Yes | ||

| Adj. R-square | 0.179 | 0.002 | ||

| Obs. | 18,795 | 18,795 | ||

Conclusion and Discussion

Due to the heightened scrutiny from regulators and investors subsequent to SOX which could have constrained firms to manage earnings, coupled with the current economic downturn, market participants are focusing their attention to CFO subsequent to SOX. Therefore, I examines the relation between named auditors (Big4 or Big8) and cash flow management. However, I didn’t find a significant effect of audit firm on cash flow management. It appears that brand named auditors, both Big 4 and the second tier public audit firms do not help mitigate cash flow management post-SOX. This is not surprising as auditors alone cannot curb managerial opportunism because other participants such as regulators (i.e., SEC and FASB) have not exerted a concerted effort to provide transparent accounting rules for the SCF model.

As mentioned in Lee (2012), the limitation of the change in the cash flow cycle has very low explanatory power. Future research may attempt to improve the specification of this model as misclassification in SCF is on the rise and is a timely research topic.

References

- Balsam, S., Krishnan, J., & Yang, J.S. (2003). Auditor industry specialization and earnings quality. Auditing: A Journal of Practice and Theory, 22(2), 71–97.

- Beaver, W. (1966). Financial ratios as predictors of failure. Journal of Accounting Research, 4(Supplement), 71-111.

- Boone, J.P., Khurana, I.K., & Raman, K.K. (2010). Do the Big 4 and the Second-tier firms provide audits of similar quality? Journal of Accounting and Public Policy, 29(4), 330–352.

- Broome, O.W. (2004). Statement of Cash Flows: Time for Change! Financial Analysts Journal, March/April

- Brown, L.D., & Pinello, A.S. (2007). To What Extent Does the Financial Reporting Process Curb Earnings Surprise Games? Journal of Accounting Research, 45(5), 947-981.

- Bugariski, O., & Ward. T.J. (2012). Auditor Resignations before and after the Sarbanes-Oxley Act. Journal of Finance and Accountancy, 9.

- Call, A. (2008). The implications of Cash Flow Forecasts for Investors’ Pricing and Managers’ Reporting of Earnings. Working paper. The University of Georgia.

- Call, A., Chen, S., & Tong, Y. (2009). Are analysts’ earnings forecasts more accurate when accompanied by cash flow forecasts? Review of Accounting Studies, 14(2–3), 358–91.

- Campello, E., Graham, J., & Harvey, C. (2010). The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics, 97, 470–487.

- Chang J., Molina, J.J., & Lee, Y.G. (2016). Management of Cash Flows from Operations in the Pre-and Post- Sarbanes-Oxley Periods. Working paper, Sungkyunkwan University.

- Coates, J.C., & Srinivasan, S. (2014). SOX after Ten Years: A Multidisciplinary Review (Commentary). Accounting Horizons, 28(3), 627-671.

- Cohen, D., Dey, A., & Lys, T. (2008). Real and Accrual-Based Earnings Management in the Pre- and Post-Sarbanes –Oxley Periods. The Accounting Review, 83(3), 757-787.

- DeAngelo, L. (1981). Auditor independence, “low-balling” and disclosure regulation. Journal of Accounting and Economics, 3, 113–127.

- Dechow S., Kothari, P., & Watts, R. (1998). The relation between earnings and cash flows. Journal of Accounting and Economics, 25, 133-168.

- DeFond, M.L., & Francis, J.R. (2005). Audit research after Sarbanes–Oxley, Auditing: A Journal of Practice & Theory, 24, 5–30.

- DeFond, M., & Hung, M. (2003). An empirical analysis of analysts’ cash flow forecasts. Journal of Accounting and Economics, 35(1), 73–100.

- DeFond, M.L., & Jiambalvo, J. (1991). Incidence and circumstances of accounting errors. The Accounting Review, 66(3), 643–655.

- DeFond, M., Lim, C.Y., & Zang, Y. (2012). Client conservatism and auditor – client contracting. Workingpaper, University of Southern California and Singapore Management University.

- DeFond, M., & Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58, 275–326

- Fama, E., & French, K. (1997). Industry costs of equity. Journal of Financial Economics, 43(2), 153–193.

- Fan, Y., Barua, A., Cready, W., & Thomas, W. (2010). Managing earnings using classification shifting: Evidence from quarterly special items. The Accounting Review, 85(4), 1303-1323.

- Francis, J.R., & Yu, M.D. (2009). Big 4 office size and audit quality. The Accounting Review, 84(5), 1521–1552.

- Graham, J., Harvey, C., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40(1-3), 3–73.

- Heller, M. (2014). SEC Official Urges Closer Look at Cash Flow Statements. CFO

- Henry, D. (2004). Fuzzy Numbers. Business Week (October 4).

- Hollie, D., Nicholls, C., & Zhao, Q. (2011). Effects of cash flow statement reclassifications pursuant to the SEC’s one-time allowance. Journal of Accounting and Public Policy, 30, 570–588.

- Kim H.P., Kim, J.B., & Lee, Y.G. (2016). Corporate Social Responsibility and Operating Cash Flows Management. Working paper, Sungkyunkwan University and University of Waterloo.

- Krishnan, G.V. (2003). Audit quality and the pricing of discretionary accruals. Auditing: A Journal of Practice and Theory, 22(1), 109–126.

- Lawrence, A., Minutti-Meza, M., & Zhang, P. (2011). Can Big 4 versus non Big4 differences in audit-quality proxies be attributed to client characteristics? The Accounting Review, 86(1), 259–286.

- Lee, L. (2012). Incentives to Inflate Reported Cash from Operations Using Classification and Timing. The Accounting Review, 87(1), 1-33.

- Maremont, M. (2002). “Cash Flow? It Isn’t Always What It Seems.” Wall Street Journal (8 May): C1, C3.

- McVay, S. (2006). Earnings management using classification shifting: An examination of core earnings and special items. The Accounting Review, 81(3), 501-531.

- Mohanram P. (2014). Analyts´ Cash Flow Forecats and the decline of the Accruals Anomaly. Contemporary Accounting Research, 31(4), 1143-1170.

- Ohlson, J. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18(1), 109–131.

- Radhakrishnan, S., & Wu, S. (2014). Analysts' Cash Flow Forecasts and Accrual Mispricing. Contemporary Accounting Research, 31(4), 1191–1219.

- Scholz, S. (2008). The Changing Nature and Consequences of Public Company Financial Restatements 1997-2006. The Department of the Treasury(April).

- Tanona, D., Usvyatsky, O., & Whalen, D. (2014). Financial Restatements: A fourteen Year Comparison. Audit Analytics(April).

- Wasley, C., & Wu, J. (2006). Why do managers voluntarily issue cash flow forecasts? Journal of Accounting Research, 44(2), 389–429.

- Zang, A.Y. (2012). Evidence on the Trade-Off between Real Activities Manipulation and Accrual-Based Earnings Management. The Accounting Review, 87(2), 675-703.